The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax

Amnesty Policies on Tax Compliance of Taxpayers in Batam City

Viska Martina and Afriyanti Hasanah

Department of Business Management, Politeknik Negeri Batam, Ahmad Yani Street, Batam, Indonesia

Keywords: Tax Awareness, Tax Moral, Tax Sanctions, Tax Amnesty Policy, Taxpayer Compliance

Abstract: This study aims to determine the effect of tax awareness, tax morale, tax sanctions and tax amnesty policies

on taxpayer compliance in Batam City, especially those registered at the North Batam Pratama Tax Office.

Data collection was carried out by the non-probability sampling method with convenience sampling

technique. The sample of this study with a total of 100 samples. Statistical test methods and data processing

using component based-Structural Equation Modeling (SEM) or Partial Least Square (PLS) using SmartPLS

Version 3. The research findings show that: 1) tax awareness has no significant effect on tax compliance, 2)

tax morale positive and significant effect on tax compliance variable, 3) tax sanctions have no significant

effect on tax compliance, 4) tax amnesty policy (tax amnesty) has a positive and significant effect on tax

compliance.

1 INTRODUCTION

The 1945 Constitution is the guideline for the

Unitary State of the Republic of Indonesia (NKRI)

which controls the implementation of national

development aimed at the welfare of the people, this

is stated in the goal of the founding of the Republic

of Indonesia on Pancasila, namely the realization of

a just and prosperous society. One source of funding

that plays an important role in the implementation

of national development is taxes. Payment is a form

of community obligation to collect development

funds for a country, which aims to benefit the

people through improving public services

(Pattasiana, Noch, Rumukaun, Temalagi, &

Anakota, 2020). Tax contributions to the state

budget in 2019 accounted for 82.5% of total state

revenue. In collecting taxes, the government must

have implemented an integrated system to make it

easier for taxpayers to calculate, report and deposit

their tax obligations, the system is the Self-

Assessment System. There is a consequence that

arises from taxes, namely acts of disobedience or

non-compliance. This unresolved problem may be

caused by the Self-Assessment System feature,

namely the transfer of tasks in calculating taxes

(Saad, 2014). The parameter to determine the level

of tax compliance is using the Tax Ratio. In 2017,

Indonesia's tax ratio was 10.82%, which means it is

still below the standard applied to developing

countries (lower middle income) which should have

a tax ratio of 19%. Causes that affect compliance

include tax awareness, tax morale, tax sanctions, as

well as tax amnesty policies. The government in

Indonesia takes several ways to motivate taxpayers,

one of which is a tax amnesty where the

government provides an opportunity for taxpayers

to pay taxes owed within a certain period without

any fines (Asih, Adi, 2020).

This research refers to Ghani, Hamid, Sanusi, &

Shamsuddin (2020). The thing that distinguishes this

research from previous research is that it is located

in the place or region as well as the variables, where

the reference research takes the title The Effect of

Tax Knowledge, Compliance Costs, Complexity and

Morale Towards Tax Compliance Among Self-

Employed in Malaysia. Based on the gaps in the

description that has been outlined in the

introduction, the researcher is interested in taking

the title "INFLUENCE OF TAX AWARENESS,

TAX MORAL, TAX SANCTIONS, AND TAX

FORGIVENESS POLICY ON TAX

COMPLIANCE WITH TAXPAYER IN BATAM

CITY".

140

Martina, V. and Hasanah, A.

The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax Amnesty Policies on Tax Compliance of Taxpayers in Batam City.

DOI: 10.5220/0010862500003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 140-148

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 RESEARCH METHODS

2.1 Data Types and Sources

The model used is a quantitative method based on a

research method that has been determined, namely

the measurement of objective results using statistical

analysis. Data collection techniques using survey

methods and distributing questionnaires to

individual taxpayers in the Batam City area. This

study uses a quantitative approach because it is

theoretical and conducts testing through variable

measurement with objective results using statistical

procedures.

2.2 Research Instruments

Research variables will be measured using a Likert

scale, where the Likert scale is a non-comparative

and unidimensional (measured only one trait)

scaling technique. Researchers use a 5-point Likert

Scale to calculate taxpayer awareness, tax morale,

tax sanctions and tax amnesty with the details:

1) Strongly Agree (SS), score 5

2) Agree (S), score 4

3) Neutral (N), score 3

4) Disagree (TS), score 2

5) Strongly Disagree (STS), score 1.

2.3 Research Location and Object

The location of the research was carried out,

especially in (KPP) the North Batam Pratama Tax

Service Office, Jalan Kuda Laut No. 1 Batu Ampar,

29423, Batam City. The object of this research is to

individuals who are registered and have a Taxpayer

Identification Number (NPWP).

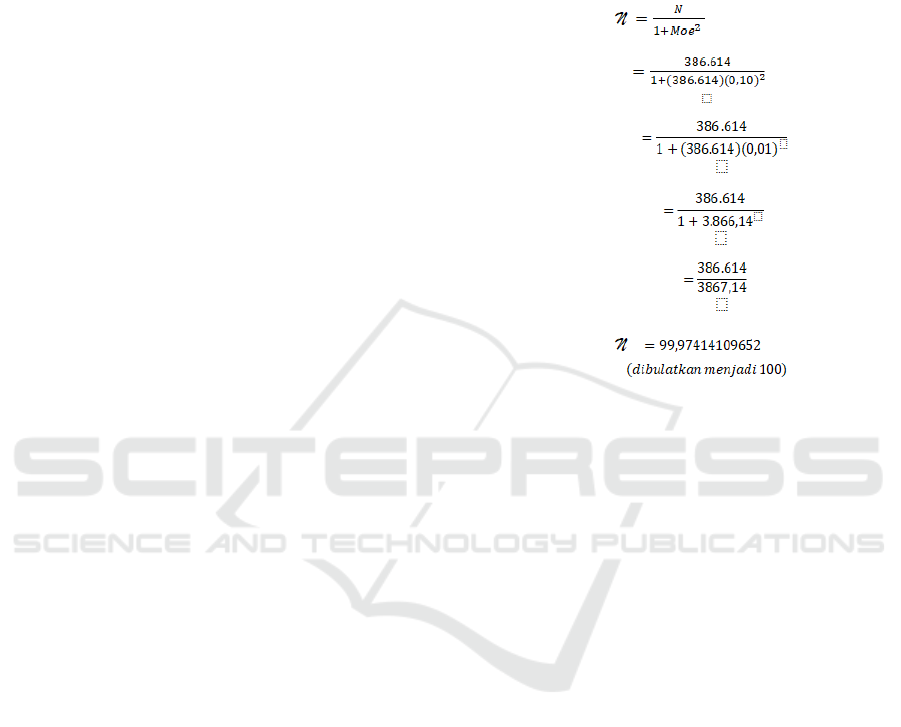

2.4 Sample Quantity Determination

Technique

The total community or population is Individual Tax

Payer totaling 386,614 active taxpayers registered at

the North Batam KPP from 2016-2020. The large

population in this study, the method for sampling is

the convenience method.

2.5 Sampling Technique

The non-probability sampling method was used by

researchers to calculate the sampling and was carried

out using a convenience sampling technique. Where

the technique is a combination of information from

population elements that makes it easy for

researchers to obtain it. The use of this method is

appropriate for use in this type of quantitative

research. Respondents used 386,614 Individual Tax

Payer who are active tax subjects in the KPP, the

following is the slovin formula to determine the

number of samples:

Information :

N = Total Sample

N = Total Population

Moe = maximum margin of error (tolerable error

rate (10%))

2.6 Data Collection Technique

Data collection is only on the category of registered

tax subjects with the sample criteria being taxpayers

for 2016-2020 at KPP Pratama Batam Utara. Before

the questionnaire is distributed to the real

respondents, the questionnaire will first be tested

using a pilot test to 30 respondents.

2.7 Data Analysis Technique

The data is calculated and processed using the

smartPLS version 3 software to produce calculations

that show the effect of the dependent variable and

the independent variable. Analysis of the data

obtained from the questionnaire survey was carried

out using component based-Structural Equation

Modeling (SEM) or Partial Least Square (PLS). PLS

(Partial Least Square) has the advantage of

calculating measurement error for variables that

cannot be measured directly (Hair Jr, Black, Babin,

& Anderson, 2002).

The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax Amnesty Policies on Tax Compliance of Taxpayers in Batam City

141

2.7.1 Descriptive Statistics Test

Descriptive statistics is a data analysis technique that

provides an overview or description of the data of

the object under study in terms of the average value,

standard deviation, maximum, minimum and range

of Ghozali (2016).

2.7.2 The Measurement Model (Outer

Model)

The data is calculated and processed using the

SmartPLS version 3 software to produce

calculations that show the effect of the dependent

variable and the independent variable using the

Partial Least Square (PLS) approach, which is a

component- or variant-based Structural Equation

Modeling (SEM) equation model by testing

Convergent Validity and Discriminant validity. In

addition, to measure the reliability of a construct,

there are 2 ways, namely Cronbach's Alpha and

Composite Reliability.

2.7.3 Convergent Validity Test

The value of convergent validity is said to be valid if

it has a correlation of more than 0.70 with the

construct to be measured. However, according to

Chin (1998) cited by Ghozali (2011) for research in

the early stages of developing a loading factor

measurement scale of 0.50 – 0.60 is considered

sufficient to meet convergent validity.

2.7.4 Construct Reliability Test

The reliability test was carried out to prove the level

of accuracy, consistency and determination of the

instrument in measuring the construct. By using the

smartPLS version 3 program in PLS-SEM, it is done

in 2 ways, namely Composite Reliability and

Cronbach's Alpha. Each is said to be reliable if it has

a value above 0.70.

2.7.5 Structural Model Test (Inner Model)

Evaluation of the structural model on SEM with PLS

is carried out by testing R-squared (R²) and testing

significance through path coefficience (Ghozali,

2018). Changes in the value of R-square are used to

assess the substantive effect of the independent

latent variable on the dependent latent variable.

Hypothesis testing was carried out using the SEM

PLS method through a bootstrapping process which

was processed with the smartPLS version 3

software. If the t-statistical value is greater than the

t-table value (1.96), then there is a significant effect

between a variable and other variables and if the t-

statistical value is less than the t-table value (1.96), it

can be stated that there is no significant effect.

3 RESULTS AND ANALYSIS

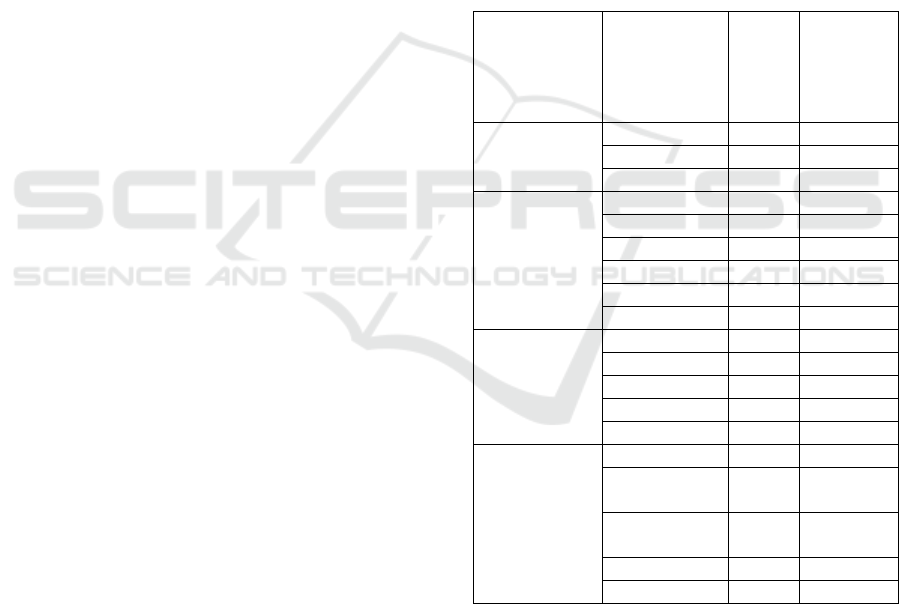

3.1 Characteristics of Respondents

Data collection is only on the category of registered

tax subjects with the sample criteria being taxpayers

for 2016-2020 at KPP Pratama Batam Utara.

Questionnaires were given and filled out by 100

respondents which were then tabulated. Of the 100

respondents in the study can be described as follows:

Table 1. Characteristics of Respondents

Characteristi

cs

Category

N

u

m

ber of

Resp

onde

nts

Percenta

ge (%)

Gende

r

Woman 60 60%

Man 40 40%

Total 100 100%

Age 18-24 yo 61 61%

25-31

y

o 23 23%

32-38

y

o 4 4%

39-45 yo 11 11%

>53

y

o1 1%

Total 100 100%

Level of

Education

SMA/SMK 45 45%

D3 17 17%

D4 14 14%

S1 24 24%

Total 100 100%

Profession Enterpreneu

r

11 11%

Private

Emplo

y

ees

62 62%

Government

Emplo

y

ees

3 3%

Other Jobs 24 24%

Total 100 100%

Source: Processed Primary Data Processing, 2021.

3.2 Descriptive Statictical Analysis

The data that has been collected from the results of

the answers to the questionnaire is then tabulated

and processed using the smartPLS version 3

program. So that the resulting variable statistical

descriptions are as follows:

ICAESS 2021 - The International Conference on Applied Economics and Social Science

142

Table 2. Descriptive Statistics

Variable N Mean Medi

an

Min Max Std.

Dev

Tax

Awarene

ss

10

0

3.85 4.00 3.00 5.00 0.726

Tax

Moral

10

0

4.16 4.00 3.00 5.00 0.657

Tax

Sanstion

s

10

0

3.70 4.00 3.00 5.00 1.051

Tax

Amnesty

10

0

3.73 4.00 1.00 5.00 0.929

Tax

Complia

nce

10

0

4.18 4.00 3.00 5.00 0.672

Source: Processed Primary Data Processing, 2021.

3.3 Instrument Testing

3.3.1 Validity Test with Outer Loading

Outer loadings (measurement model) or convergent

validity were used to test the unidimensionality of

each construct. According to Chin (1998) the

indicator value is greater than or equal to 0.5 then it

is said to be valid. Validity testing was conducted on

30 respondents.

3.3.2 Convergent Validity Test

According to Chin (1998) cited by Ghozali (2011)

for the early stage research of developing a loading

factor measurement scale of 0.50 – 0.60 is

considered sufficient to meet convergent validity.

The following are the results of the convergent

validity test in this study:

Table 3. Convergent Validity Test Results

Indicator Tax

Compli

ance

Tax

Awaren

ess

Tax

Morale

Tax

Sanct

ions

Tax

AMnest

y

Kep1 0.834

Kep2 0.805

Kep3 0.772

Kep4 0.777

Kep5 0.803

Kep6 0.777

Kep7 0.784

Kep 8 0.859

Kep 9 0.861

Kep 10 0.799

Kep 11 0.857

Kes1 0.766

Kes2 0.794

Kes3 0.756

Kes4 0.834

Mp1 0.730

Mp2 0.897

Mp3 0.714

Mp4 0.503

Mp5 0.746

Mp6 0.782

Mp7 0.739

Mp8 0.706

Mp9 0.467

Sp1 0.759

Sp2 0.740

Sp3 0.733

Sp4 0.711

Sp5 0.839

Sp6 0.983

Sp7 0.959

Ap2 0.625

Ap3 0.751

Ap4 0.587

Ap5 0.763

AP6 0.796

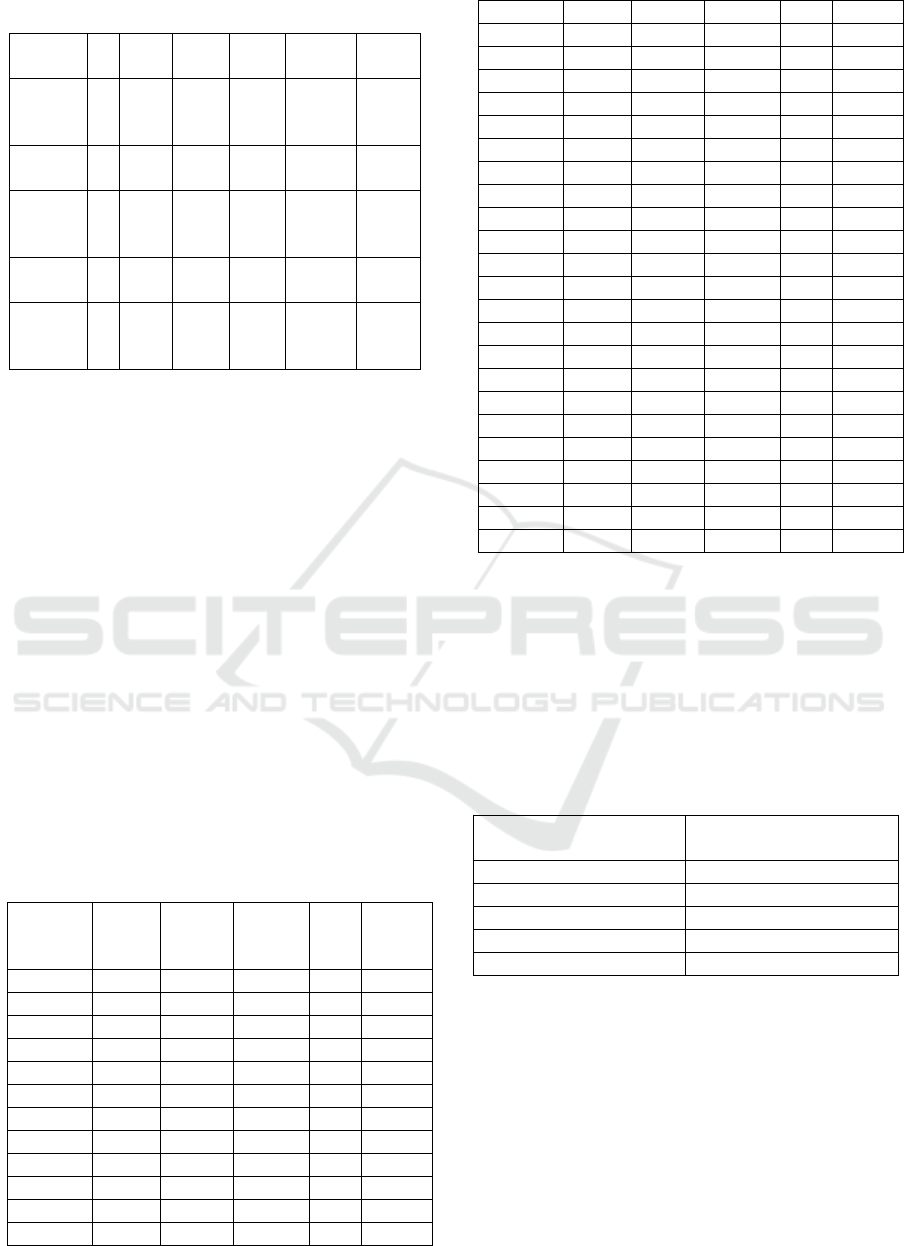

Source: SmartPLS Data Processing, 2021.

All variable indicator values > 0.5 are declared valid

for the convergent validity test. It can be stated that

all measuring instruments of each variable are the

right tools to measure the variables. The right

measuring instrument means that the respondent

feels that the indicators used are important to

measure these variables.

Table 4. Average Variance Extracted (AVE) Value

Variable Average Variance

Extracted (AVE) Value

Tax Awareness 0.675

Tax Morale 0.623

Tax Sanctions 0.680

Tax Amnest

y

0.701

Tax Compliance 0.725

Source: SmartPLS Data Processing, 2021.

Looking at the results from table 4.5 the AVE value

of all variables is > 0.5 so this shows that each

indicator that has been measured can reflect each

variable validly.

3.3.3 Discriminant Validity Test

The discriminant validity test can be seen from the

correlation value between the variable value and the

variable itself and compares the variable value with

The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax Amnesty Policies on Tax Compliance of Taxpayers in Batam City

143

other variables, namely > 0.70. The following is the

presentation of the correlation value between

variables:

Table 5. Correlation Values between Variables

Tax

amn

esty

Tax

comp

lianc

e

Tax

awarene

ss

Tax

moral

e

Tax

sanction

s

Tax

amne

sty

0.83

7

Tax

compl

iance

0.30

7

0.851

Tax

aware

ness

0.22

1

0.272 0.821

Tax

moral

e

-

0.05

2

0.494 0.176 0.789

Tax

sancti

ons

0.28

8

-

0.196

-0.133 -0.012 0.824

Source: SmartPLS Data Processing, 2021

Besides being able to be seen from the comparison

of correlation values, discriminant validity can also

be seen from the value of Cross Loading which is

presented in the following table.

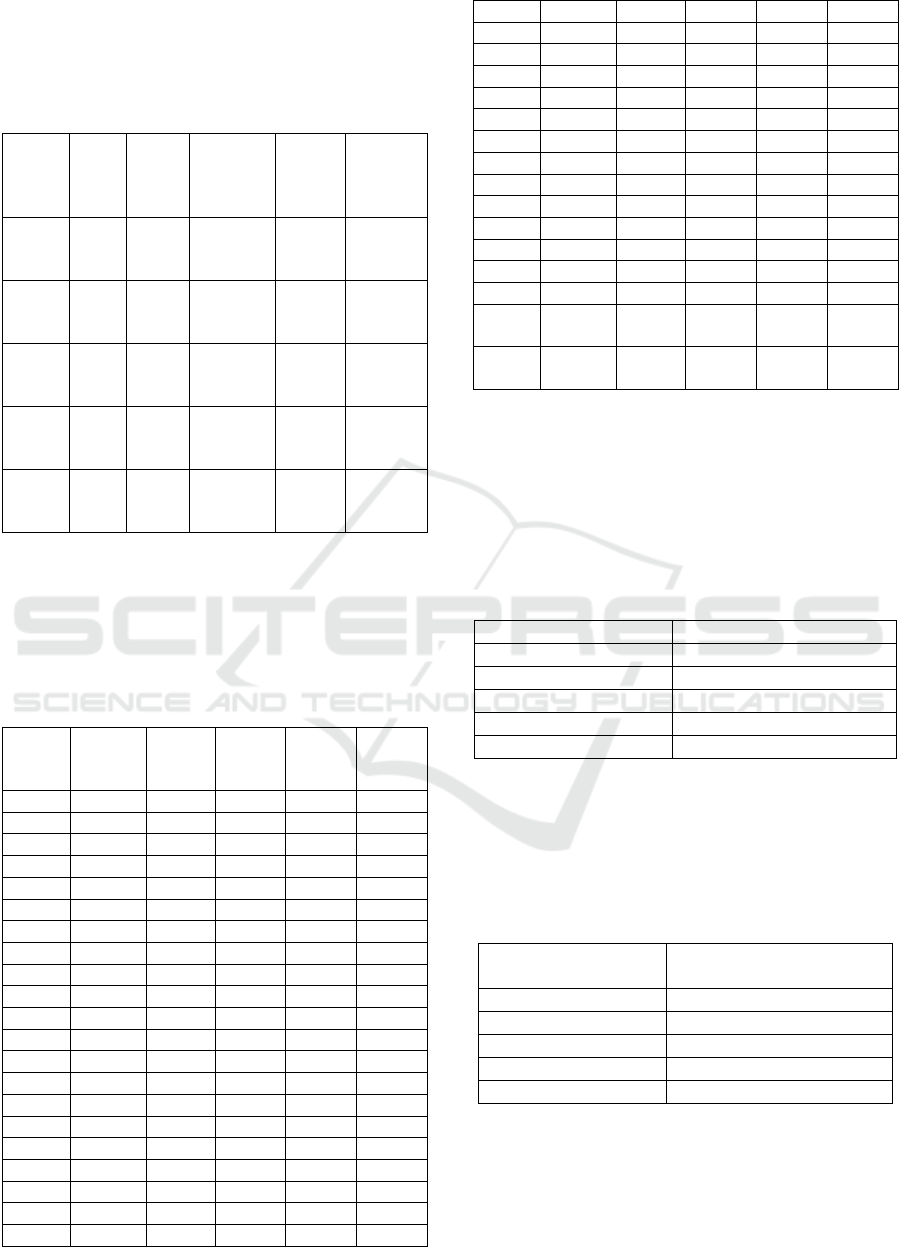

Table 6. Cross Loading Value

Tax

awaren

ess

Tax

moral

e

Tax

sancti

ons

Tax

amnes

ty

Tax

Compl

iance

Kes1 0.902 0.045 -0.029 0.258 0.283

Kes2 0.852 0.253 -0.254 0.123 0.212

Kes3 0.741 0.198 -0.062 0.135 0.145

Kes4 0.782 0.092 0.004 0.034 -0.009

Mp1 0.275 0.825 -0.116 0.066 0.538

Mp2 0.123 0.841 -0.076 -0.077 0.485

Mp3 0.177 0.729 0.333 -0.151 0.203

MP4 0.182 0.739 0.216 -0.124 0.302

M

p

5 0.142 0.743 0.104 0.091 0.446

M

p

6 0.239 0.773 -0.100 -0.040 0.345

Mp7 0.054 0.718 -0.060 -0.191 0.102

Mp8 -0.039 0.882 -0.070 -0.057 0.377

Mp9 0.019 0.838 -0.126 -0.135 0.334

S

p

1 0.067 0.288 0.759 0.225 -0.066

S

p

2 -0.086 0.014 0.740 0.363 -0.028

Sp3 -0.063 -0.125 0.733 0.307 -0.038

Sp4 0.116 -0.017 0.711 0.348 0.073

Sp5 -0.030 -0.037 0.839 0.388 0.010

S

p

6 -0.111 -0.057 0.983 0.279 -0.194

S

p

7 -0.130 -0.063 0.959 0.305 -0.158

A

p

1 0.102 -0.119 0.486 0.817 0.150

A

p

2 0.144 -0.024 0.443 0.816 0.208

Ap3 0.247 -0.060 0.094 0.887 0.333

Ap4 0.176 0.072 0.223 0.931 0.371

A

p

5 0.232 -0.060 0.187 0.777 0.143

A

p

6 0.205 -0.238 0.195 0.786 0.148

Ke

p

1 0.220 0.439 -0.109 0.361 0.896

Kep2 0.235 0.382 -0.104 0.527 0.851

Kep3 0.308 0.307 -0.233 0.548 0.830

Kep4 0.267 0.363 -0.165 0.242 0.801

Ke

p

5 0.156 0.517 -0.172 0.326 0.881

Ke

p

6 0.207 0.273 -0.268 0.243 0.795

Ke

p

7 0.192 0.291 -0.335 -0.025 0.827

Kep8 0.185 0.410 -0.094 0.136 0.883

Kep9 0.311 0.566 -0.057 0.054 0.833

Kep1

0

0.196 0.486 -0.094 0.144 0.897

Kep1

1

0.254 0.559 -0.246 0.023 0.864

Source: SmartPLS Data Processing, 2021

3.3.4 Construct Reliability Test

The reliability test can be seen from the value of

composite reliability and Cronbach's alpha where the

assessment method is that both values must be above

0.7 then this is a satisfactory or reliable result.

Table 7. Cronbach's Alpha value

Variable Cronbach's Alpha Value

Tax Awareness 0.857

Tax Moral 0.926

Tax Sanctions 0.944

Tax Amnesty 0.918

Tax Compliance 0.962

Source: SmartPLS Data Processing, 2021

If the Cronbach's Alpha value of all variables is

above 0.70, the latent variable in this study is

accurate, consistent and precise and has good

reliability.

Table 8. Composite Reliability Value

Variable Composite Reliability

Value

Tax Awareness 0.892

Tax Moral 0.937

Tax Sanctions 0.936

Tax Amnesty 0.933

Tax Compliance 0.967

Source: SmartPLS Data Processing, 2021

It can be concluded that the data on the variables of

tax awareness, tax morale, tax sanctions, tax

amnesty (Tax Amnesty) are reliable, accurate,

consistent and appropriate so that they can be used

to test the hypothesis.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

144

3.4 Evaluation of the Structural (Inner

Model)

Evaluation of the structural model or inner model

and evaluated using R-Square for the dependent

variable. Changes in the value of R-Square show the

value of the influence of how much the independent

variable affects the dependent variable.

Table 9. R-Square Value

Construc

t

R-Square

(Y) Tax

Compliance

0.447

Source: SmartPLS Data Processing, 2021

The value of the tax compliance variable is 0.447 or

47%. This indicates that the tax compliance

construct is influenced only by 47% by tax

awareness, tax morale, tax sanctions, and tax

amnesty policies (tax amnesty), where the remaining

53% may be influenced by constructs not found in

this study.

3.5 Hypothesis Test

Inner model can be evaluated using t test through

bootstrapping procedure. The significance level used

is 95% (α = 0.05) with a t-table of 1.96. Seeing the

value of t-statistic > t table, if the value of t-statistic

< than 1.96 then the hypothesis is rejected. It can be

seen in table 4.9 the results of path coefficience

(rho) and t-statistics.

Table 10. Hypothesis Test Results

Hypothesis T-

Statistic

T-

Table

Results

H1 Tax

awareness

has a

positive

and

significant

effect on

taxpayer

compliance

0.272 1.96 Rejecte

d

H2 Tax morale

has a

positive

and

significant

effect on

taxpayer

compliance

3.155 1.96 Accep

t

ed

H3 Tax 1.146 1.96 Rejecte

sanctions

have a

positive

and

significant

effect on

taxpayer

compliance

d

H4 Tax

amnesty

has a

positive

and

significant

effect on

taxpayer

compliance

2.061 1.96 Accep

t

ed

Source: SmartPLS Data Processing, 2021

3.6 Data Analysis

3.6.1 The Effect of Tax Awareness on Tax

Compliance

Tax awareness has no significant effect on tax

compliance. In this case it can be concluded that the

awareness of taxpayers in the city of Batam does not

affect the level of taxpayer compliance in paying

taxes. Therefore, it indicates that tax awareness has

not affected taxpayer compliance in carrying out

their tax obligations. According to the researcher,

the government is expected to continue to increase

tax awareness through socialization and providing

transparent information about taxation, but there are

still many taxpayers who do not understand the

rules, systems and tax reporting. In addition, the

government needs to carry out special strategies to

overcome these problems so as to increase taxpayer

compliance. When it comes to attribution theory,

which explains the internal understanding and the

influence of the social environment to the tax agency

will have an impact on the tax assessment, does not

apply to the tax awareness variable. The results of

the study have the same results as research

conducted by Nugroho, Andini & Raharjo (2016)

and Primasari & Hilmi (2016) which shows that tax

awareness has no effect on taxpayer obligations.

However, this study is not in line with the research

of Suyanto & Trisnawati (2016) where the results

obtained are that there is a positive influence

between awareness and fulfillment of taxpayers.

Andini & Raharjo (2016) and Primasari & Hilmi

(2016) which show that tax awareness has no effect

on taxpayer obligations. However, this study is not

in line with the research of Suyanto & Trisnawati

The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax Amnesty Policies on Tax Compliance of Taxpayers in Batam City

145

(2016) where the results obtained are that there is a

positive influence between awareness and

fulfillment of taxpayers. Andini & Raharjo (2016)

and Primasari & Hilmi (2016) which show that tax

awareness has no effect on taxpayer obligations.

However, this study is not in line with the research

of Suyanto & Trisnawati (2016) where the results

obtained are that there is a positive influence

between awareness and fulfillment of taxpayers.

3.6.2 The Effect of Tax Morals on Tax

Compliance

The results of the bootstrapping model analysis

show that H2 is accepted, which states that tax

morale has a significant effect on taxpayer

compliance and has a positive direction. This means

that the higher the tax morale, the higher the tax

compliance of taxpayers in the city of Batam. The

researcher argues that taxpayers in Batam already

have intrinsic motivation and have awareness of the

taxes that have been paid and understand

contributions as citizens through taxes. The results

of this study are related to compliance theory, which

shows that taxpayer compliance in registering,

compliance in reporting tax returns (SPT),

compliance in calculating and carrying out tax

obligations are considered good. The results of the

study support the research that has been carried out

by Asih & Adi (2020), Sriniyanti (2020) and Torgler

(2004) who stated that tax morale had a significant

effect on tax compliance. This is in contrast to the

research conducted by Ramadhan (2017) which

states that tax morale has no effect on tax

compliance of Siola SMEs.

3.6.3 The Effect of Tax Sanctions on Tax

Compliance

The effect of tax sanctions on tax compliance,

judging from the results of bootstrapping testing, it

can be concluded that tax sanctions have no

significant effect on tax compliance. According to

the results of this study, tax subjects have not been

too affected by applicable sanctions, this can also be

caused by a lack of understanding of the tax system

regulations regarding existing tax sanctions because

taxpayers still often repeat the same mistakes when

carrying out tax obligations. In this case the

applicable witness cannot affect the level of taxpayer

compliance and does not provide a deterrent effect.

In the opinion of the researcher, currently tax

sanctions are only considered as legality by

taxpayers in tax regulations, therefore the

government is expected to take action on violations

committed. The results of this study support the

research conducted by Basri et al (2014) and Wati

(2016) that tax sanctions have no significant effect

on taxpayer compliance. In addition, this is in stark

contrast to the research that has been done by

Muliari & Setiawan (2009) and Perdana &

Dwirandra (2020) which in the results of their

research analysis concluded that tax sanctions on tax

compliance have a positive and significant effect on

segmental tax compliance.

3.6.4 The Effect of Tax Amnesty Policy on

Tax Compliance

The results of the bootstrapping model analysis

show that H4 is accepted, there is a significant effect

between tax amnesty policy and taxpayer

compliance (tax amnesty). Then the relationship

between tax amnesty variables on tax compliance

leads to a positive relationship. The researcher

argues, meaning that the existence of a tax amnesty

policy is considered a good policy because the

government has the opportunity to be more honest in

disclosing assets owned by taxpayers and provides

forgiveness for violations committed. In addition,

taxpayers are given the opportunity to correct data or

assets that have not been submitted because they are

not subject to fines by the government for the delay.

With regard to the theory of obedience which is

defined as an act of fulfilling what is ordered by

others, In this study it is proven that taxpayers have

implemented tax amnesty in accordance with what

has been instructed by the government. In line with

the research conducted by Fitria, Abdillah, Prasetyo,

Cahyo, & Burhanudin (2019), Wirawan & Noviari

(2017) and Sriniyanti (2020) the results show that

there is a positive influence between tax amnesty

and tax compliance.

4 CONCLUSIONS

From the results of the analysis that has been carried

out, the following conclusions can be drawn: 1) The

tax awareness variable does not affect the tax

compliance variable of individual taxpayers in

Batam City. 2) The tax moral variable has a

significant effect on the tax compliance variable of

individual taxpayers in Batam City and has a

positive relationship direction. This means that tax

morale is able to increase taxpayer compliance in

fulfilling their tax obligations. 3) The variable of tax

ICAESS 2021 - The International Conference on Applied Economics and Social Science

146

sanctions has no effect on the tax compliance

variable of individual taxpayers in Batam City. This

means that the existing sanctions have not been able

to provide a deterrent effect so that they cannot

increase taxpayer compliance. 4) The variable of tax

amnesty policy (tax amnesty) has a significant effect

on the tax compliance variable of individual

taxpayers in Batam City and has a positive

relationship direction. This shows that taxpayers are

given the trust to disclose their assets and without

being subject to fines so that this can improve

taxpayer compliance. 5) The adjusted coefficient of

determination (Adjusted R-Square) of 0.447 means

that 47% of the level of taxpayer compliance can be

explained by the variables of tax awareness, tax

morale, tax sanctions, and tax amnesty policies.

While the remaining 53% are explained and

influenced by constructs that are not found in this

study. This shows that taxpayers are given the trust

to disclose their assets and without being subject to

fines so that this can improve taxpayer compliance.

5) The adjusted coefficient of determination

(Adjusted R-Square) of 0.447 means that 47% of the

level of taxpayer compliance can be explained by

the variables of tax awareness, tax morale, tax

sanctions, and tax amnesty policies. While the

remaining 53% are explained and influenced by

constructs that are not found in this study. This

shows that taxpayers are given the trust to disclose

their assets and without being subject to fines so that

this can improve taxpayer compliance.

REFERENCES

Asih, K. S., & Adi, I. Y. (2020, Juni). Pengaruh Moral

Pajak, Budaya Pajak, dan Tarif Pajak Terhadap

Kepatuhan Wajib Pajak Badan di KPP Pratama

Bandung Utara. Journal Research Accounting

(JARAC), 1(2), 181-189.

Basri, Y.M, Surya, R.A.S, Fitriasari, R, Novryan, R,

Tania, T.S. 2014. Studi Ketidakpatuhan Pajak : Faktor

yang Mempengaruhinya (Kasus Pada Wajib Pajak

Orang Pribadi yang Terdaftar di KPP Pratama Tampan

Pekanbaru).

sna.akuntansi.unikal.ac.id/makalah/088 PPJK- 19.pdf

Chan, C. W., Troutman, C.S And O’Bryan, D. (2000), An

Expanded Model of Taxpayer Compliance: Empirical

Evidence from the US and Hong Kong, Journal of

International Accounting Auditing and Taxation, 9

(2):83-103

Chin, W. W. (1998). The Partial Least Squares Approach

to Structural Equation Modeling. Lodon: Lawrance

Erlbaum Associates Publisher.

Fisher, R. C., Goddeeris, J. H., & Young, J. C. (1989).

Participation in Tax Amnesties: The Individual

Income Tax. National Tax Journal, 42(1), 15- 27.

Fitria, D., Abdillah, A., Prasetyo, H., Cahyo, I. D., &

Burhanudin. (2019). The Difference of Enterprises

Taxpayers Compliance after Tax Amnesty. Journal of

Economics and Policy, 12(1), 86-99.

Ghani, H. H., Hamid, N. A., Sanusi, S., & Shamsuddin, R.

(2020). The Effect of Tax Knowledge, Compliance

Costs, Complexity and Morale Towards Tax

Compliance Among Self- Employed in Malaysia.

Global Business and Management Research: An

International Journal, 12(1), 18-32.

Ghozali, I. (2011). Aplikasi Analisis Multivariate Dengan

Program SPSS. Semarang: Badan Penerbit Universitas

Diponegoro.

Ghozali, I. (2016). Aplikasi Analisis Multivariete Dengan

Program IBM SPSS 23 (Edisi 8 ed). Semarang: Badan

Penerbit Universitas Diponegoro.

Ghozali, I. (2018). Aplikasi Analisis Multivariete Dengan

Program IBM SPSS 25. Semarang: Badan Penerbit

Universitas Diponegoro.\

Hair, Jr., Black, W., Babin, B., & Anderson, R (2002).

Multivariate Data Analysis. New Jersey: McGraw

Hill.

Kartini, U. (2018). Pengaruh Tax Amnesty dan Sanksi

Perpajakan Terhadap Kepatuhan Wajib Pajak Orang

Pribadi di Kantor Pelayanan Pajak Pratama Kabupaten

Purworejo Pada Tahun 2016. ePrints@UNY, 1-178.

Luttumer, E. F., & Singhal, M. (2014). Tax Morale.

Journal of Economic Perpectives, 28(4), 149-168.

Muliari, N. K., & Setiawan, P. E. (2009). Pengaruh

Persepsi Tentang Sanksi Perpajakan dan Kesadaran

Wajib Pajak Pada Kepatuhan Pelaporan Wajib Pajak

Orang Pribadi di Kantor Pelayanan Pajak Pratama

Denpasar Timur. Jurnal Akuntansi, 1-23.

Nugroho, A., Andini, R., & Raharjo, K. (2016). Pengaruh

Kesadaran Wajib Pajak Dan Pengetahuan Perpajakan

Wajib Pajak Terhadap Kepatuhan Wajib Pajak Dalam

Membayar Pajak Penghasilan. Journal of Accounting,

2(2), 1-13.

Palil, M. R., Md Akir, M. R., & Wan Ahmad, W. B.

(2013). Ther Perception of Tax Payers on Tax

Knowledge and Tax Education with Level of Tax

Compliance : A Study the Influences of Religiosity.

ASEAN Journal of Economics, Magement and

Accounting, 1(1), 118-129.

Pattiasina, V., Noch, M. Y., Rumasukun, M. R., Temalagi,

S., & Anakotta, F. M. (2020, March). Determinants of

Taxpayer Compliance Level : Empirical Study in East

Indonesia. The Journal of Research on the

Lepidoptera, 51(1), 339-351.

Perdana, E. S., & Dwirandra, A. N. (2020, Juni). Pengaruh

Kesadaran Wajib Pajak, Pengetahuan Perpajakan, dan

Sanksi Perpajakan Pada Kepatuhan Wajib Pajak

UMKM. E-Journal Akuntansi, 30(6), 1458-1469.

Pradnyani, N. N., & Utthavi, W. H. (2020). The

effectiveness of tax volunteers in increasing taxpayer

compliance. International Journal of Research in

Business and Social Science, 9(5), 281-284.

The Effect of Tax Awareness, Tax Morale, Tax Sanctions, and Tax Amnesty Policies on Tax Compliance of Taxpayers in Batam City

147

Primasari, & Hilmi, N. (2016, Oktober). Faktor-faktor

yang mempengaruhi wajib pajak orang pribadi yang

melakukan pekerjaan bebas. Jurnal Akuntansi dan

Keuangan, 5(2).

Rahayu, Y. N. (2019, November). Tax Amnesty : Why Is

It Behavior Compliance ? Journal of Applied

Management (JAM), 17(3), 442-450.

Ramadhan, L. Y. (2017). Pengaruh Kesadaran, Moralitas,

dan Budaya Pajak Terhadap Kepatuhan Pajak (Studi

Pada UKM Siola Kota Surabaya). E- Journal

Akuntansi, 3(2), 16-33.

Saad, N. (2009). Fairness perceptions and compliance

behavior: The case of salaried taxpayers in Malaysia

after implementation of the self- assessment system. e-

Journal Tax Research, 8(1), 32-63.

Saad, N. (2014). Tax Knowledge, Tax Complexity and

Tax Compliance : Taypayer's View. Procedia- Social

and Behavioral Sciences, 109, 1069-1075.

Sriniyanti. (2020, July). Pengaruh Moral Pajak, Sanksi

Pajak, dan Kebijakan Pengampunan Pajak Terhadap

Kepatuhan Pajak Wajib Pajak Orang Pribadi. Jurnal

Akuntansi, Ekonomi dan Manajemen Bisnis, 8(1), 14-

23.

Suyanto, & Trisnawati, E. (2016, Juni). The Influence of

Tax Awareness Toward Tax Compliance of

Enterpreneurial Taxpayers and Celengan Padjeg

Program As A Moderating Variable : A Case Study At

The Pratama Tax Office of Wonosari Town. Jurnal

Penelitian Sosial Keagamaan, 10(1), 47-68.

Torgler, B. (2004). Tax Morale in Asian Countries. Center

for Research in Economics, Management and the Arts,

1-34.

Wahl, I., Kastlunger, B., & Kirchler, E. (2010). Trust in

Authorities and Power to Enforce Tax Compliance :

An Empirical Analysis of the "Slippery Slope

Framework". Law & Policy, 32(4), 383-406.

Wati, R. E. 2016. Pengaruh Pengetahuan, Modernisasi

Strategi Direktorat Jenderal Pajak, Sanksi Perpajakan,

Kualitas Pelayanan Fiskus dan Religiusitas yan

Dipersepsikan terhadap Kepatuhan Perpajakan.

Skripsi. Fakultas Ekonomi dan Bisnis Universitas

Muhammadiyah Surakarta

Wirawan, I. B. N. A. P., dan N. Noviari. 2017. Pengaruh

Penerapan Kebijakan Tax Amnesty dan Sanksi

Perpajakan Terhadap Kepatuhan Wajib Pajak. E-

Jurnal Akuntansi Universitas Udayana, Vol. 21 No. 3,

pp. 2165-2194.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

148