Effect of Financial Ratios on Financial Distress of Retail Trade

Companies Listed on the Indonesia Stock Exchange

Sinarti

1

, Maresyah Handayani

1

and Nguyen Thi Hoang Oanh

2

1

Department of Managerial Accounting, Politeknik Negeri Batam, Jl. A. Yani, Batam, Indonesia

2

Thai Nguyen University of Technology, Thành phố Thái Nguyê, Vietnam

Keywords: Financial Ratios, Return on Equity, Debt to Equity Ratio, Current Ratio, Financial Distress, Z-Score.

Abstract: This study aims to examine the effect of financial ratios on financial distress in retail trade sub-sector

companies in Indonesia. Profitability is measured by Return on Equity (ROE), leverage as measured by

Debt-to-Equity Ratio, Liquidity is measured by Current Ratio (CR), and Financial distress is measured by

Z-Score. This study uses secondary data with data collection techniques using financial statements of retail

trade sub-sector companies listed on the Indonesia Stock Exchange for the period 2014-2018. The sampling

technique used the purposive sampling method, obtained several 14 companies that fulfill the criteria with a

total population of 26 companies, the total observation for five years was 70 samples. The test method in

this study uses panel data regression analysis with Eviews 9. This study found that the Return on Equity has

a significant positive impact on Financial Distress in the retail trade sub-sector. This study also found that

the Debt Equity Ratio has a significant negative effect on Financial Distress on retail trade sub-sector and

Current Ratio has an insignificant negative effect on Financial Distress on retail trade sub-sector.

1 INTRODUCTION

Indonesia is the fourth country with 269 million

people, or around 3.39% of the total world

population (Worldometers, 2019). The increasing

population can affect the level of community needs

ranging from personal, family, and group needs will

continue to increase so that it becomes a potential

market for producers to develop their businesses in

Indonesia. The retail trade business can be a solution

for people's needs so that people do not need to buy

directly from producers because of retail sales

(retail). This makes it easier for people to shop for

their needs.

Retail trade is a business sub-sector that is

important in distributing goods to its users and

becomes the last chain in the distribution process

(Soliha, 2008). This business sector involves the

activity of selling products and services directly to

the final consumer. In general, the products

marketed are household needs, including basic

needs. Businesses in this sector have great potential

to continue to grow. Indonesia experienced an

increase in retail sales growth with the highest value

of 10.1% in March 2019 (Ceicdata, 2019). This is

result of the increasing population and purchasing

power of the people and the public's need for

consumer products.

Retail trade business competition tends to be

increasingly unhealthy due to modern retail

businesses that can kill traditional markets because

they take advantage of the purchasing power of the

upper middle-class people who prefer neater and

cleaner facilities (Soliha, 2008). This increase in the

competition encourages retail business actors to be

more careful and careful in dealing with and making

decisions concerning their companies. Assessment

of company performance can be analyzed using one

of the essential sources of information, namely

financial statements that contain information related

to financial position, profit and loss, and company

performance that serves to make company decisions.

According to Ramadhan & Syarfan (2016),

Financial statement analysis can be used as a

policymaker and consideration for related parties

such as managers, company owners, and investors to

project financial aspects in the future to prevent

bankruptcy. Bankruptcy results from financial

difficulties that occur continuously and are getting

worse (Platt & Platt, 2002). According to Nugroho

(2018) financial distress is the company's inability to

manage profits in its operational activities, resulting

in a decrease. Before bankruptcy, management

needs to predict financial distress by analyzing

financial statements, which are an essential source of

information.

Sinarti, ., Handayani, M. and Thi Hoang Oanh, N.

Effect of Financial Ratios on Financial Distress of Retail Trade Companies Listed on the Indonesia Stock Exchange.

DOI: 10.5220/0010861500003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 109-116

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

109

Financial statements are a benchmark in

measuring financial ratios to predict financial

distress. Financial ratios are the most significant

indicator in predicting financial distress (Andre,

2013). Financial ratios that can be used are liquidity

ratios, leverage ratios, profitability ratios, activity

ratios, and growth ratios. Financial distress can be

analyzed with various models. One of them uses the

z-score model, which is a bankruptcy prediction tool

made in 1968 by Altman (Hikmah & Afridola,

2019). This model uses specific financial ratios and

has a relatively reliable level of accuracy and

precision.

Fauzan & Sutiono (2017) compares bankruptcy

prediction models using several models, namely

Altman Z-Score and Zmijewski. The study shows

that the Altman Z-Score method has a high accuracy

rate of 86% in the period one or a year before the

company is issued from the stock exchange and

100% in the one or two year period before the

company is published from the stock exchange. It

also proves that the Altman Z-Score model is more

accurate.

2 THEORETICAL STUDY

2.1 Signaling Theory

According to Spence (1973), a sign is a movement

taken with the aid of using the agency's to control to

offer commands for traders approximately how

control perspectives of the agency's prospects. This

principle additionally indicates the significance of

statistics issued with the aid of using the agency to

funding decisions. The Information posted as a

statement will offer a sign for traders in making

funding decisions.

2.2 Trade-off Theory

Trade-Off Theory demonstrates that the most

appropriate capital shape may be decided through

balancing the advantages of the use of debt; with

monetary fees and company problems (Modigliani

& Miller, 1963).

2.3 Literature Review

Several researchers on the impact of financial ratios

on financial distress includes Islami & Rio (2019),

which examines the opportunity of financial distress

in property and real estate companies listed on the

Indonesia Stock Exchange for 2012-2016. The

financial ratios used are debt ratio, current ratio,

return on equity ratio, and capitalization ratio. The

consequences display that the current ratio, debt

ratio, and return on equity ratio can measure the

opportunity of financial distress.

Desiyanti et al. (2019) examined the impact of

financial ratios on financial distress using of the

Altman Z-Score method on real estate companies

indexed at the Indonesia Stock Exchange for 2014-

2018. The variables used are return on equity, debt

to equity ratio, current ratio, working capital ratio,

and Z-Score. The effects of this take a look at

implying that the return on equity and working

capital ratio has a significant positive effect on

financial distress. In contrast, the debt to equity ratio

has a significant negative effect on financial distress.

Subsequent research by Erayanti (2019) tested the

impact of profitability, liquidity, and leverage on

financial distress in transportation, infrastructure and

utilities zone groups indexed at the Indonesia Stock

Exchange for the period 2012-2016. The effects

show that return on investment has a significant

effect on financial distress, while the current ratio,

quick ratio, return on equity, debt to equity ratio and

debt to asset ratio have no effect on financial

distress.

Research conducted by Widati & Pratama

(2014) examines the effect of the current ratio, debt

to equity ratio, and return on equity on financial

distress in 192 manufacturing companies listed on

the Indonesia Stock Exchange. The results show that

the current ratio has no significant negative effect on

financial distress and debt to equity ratio and return

on equity has a significant positive effect on

financial distress. Sinarti & Sembiring (2015)

research aims to determine the health level of metal

and manufacturing companies listed on the

Indonesia Stock Exchange and to find out whether

there are significant differences between the three

models used, namely Z-score, Springate, and

Zmijewski. The results show that there is no

significant difference in the z-score prediction model

with springate, but there is a significant difference

between the z-score prediction model with

zmijewski and springate with zmijewski.

2.3 Hypothesis Development

2.3.1 Effect of Return on Equity on

Financial Distress

Return on equity is a ratio that could degree how a

lot the company's cap potential to apply its personal

capital in producing income for all shareholders

ICAESS 2021 - The International Conference on Applied Economics and Social Science

110

(Sujarweni, 2017). If this ratio is higher, then the

company is taken into consideration to be more

effective and efficient in dealing with sources so that

the opportunity of financial distress is also getting

smaller. In Islami & Rio (2019) return on equity can

are expecting the prevalence of financial distress due

to the fact if the enterprise isn't capable of

generateing income for investors, then it can cause

company funds to also decrease along with reduced

investor interest in investing in companies, but in

Erayanti (2019) shows that return on equity does

now no longer affect on the prediction of financial

distress because the increase in return on equity is

not always given a good deal interest in making

choices associated with investing in companies.

Based on the explanation above, the hypotheses to

be tested are:

𝐇

𝟏

= Return on equity has a significant positive

on financial distress.

2.3.2 Effect of Debt-to-Equity-Ratio on

Financial Distress

Widati & Pratama (2014) research shows that the

debt to equity ratio has a positive and significant

effect on financial distress, while Erayanti (2019)

shows that the debt to equity ratio has no significant

effect on financial distress. Based on the explanation

above, the hypotheses to be tested are:

𝐇

𝟐

= Debt to equity ratio has a significant

negative on financial distress.

2.3.3 Effect of Current Ratio on Financial

Distress

In Islami & Rio (2019), it shows that the current

ratio can predict financial distress because if current

assets do not pay the company's short-term

obligations, it can trigger the possibility of financial

distress affecting the company's operations, while in

Erayanti (2019), the current ratio has no effect. On

the prediction of financial distress. Based on the

explanation above, the hypotheses to be tested are:

𝐇

𝟑

= Current Ratio has a significant positive on

financial distress.

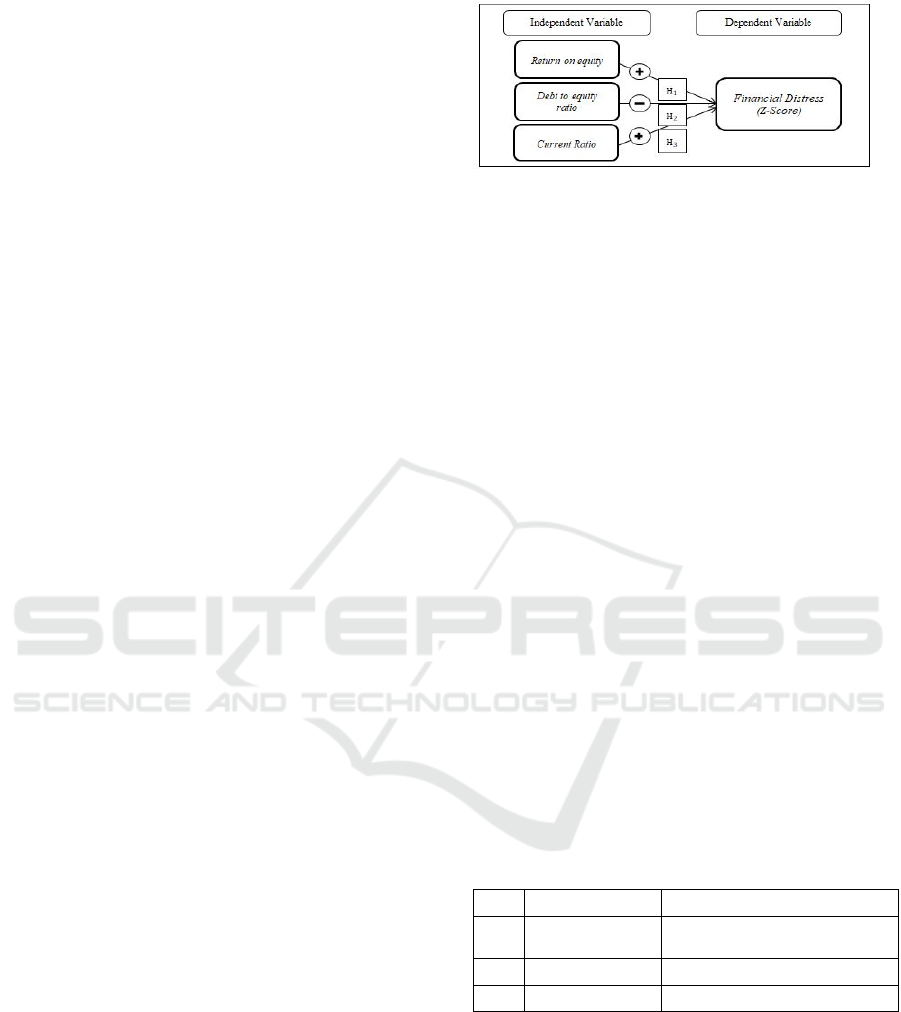

Based on the description of the theoretical study,

literature review, and hypothesis development which

have been defined previously, the research model

may be visible in Figure 1:

Figure 1: Research Model

3 RESEARCH METHOD

The research method used in this study is a

quantitative approach which is a specific, clear, and

detailed type of research to display the connection

between the independent variable and the dependent

variable.

3.1 Operational Variable and Indicator

3.1.1 Dependent Variable

The dependent variable used in this study is

financial distress. As for a researcher named Edward

I Altman, who introduced a z-score analysis model.

The ratio is calculated by the following formula:

𝒁 = 𝟑. 𝟐𝟓 + 𝟔. 𝟓𝟔𝑿

𝟏

+ 𝟑. 𝟐𝟔𝑿

𝟐

+ 𝟔. 𝟕𝟐𝑿

𝟑

+ 𝟏. 𝟎𝟓𝑿

𝟒

Source: (Altman & Hotchkiss, 2006)

Description:

𝑋

: working capital/total assets

𝑋

: retained earnings/total assets

𝑋

: earnings before interest and taxes/total assets

𝑋

: book value of equity/book value of total debt

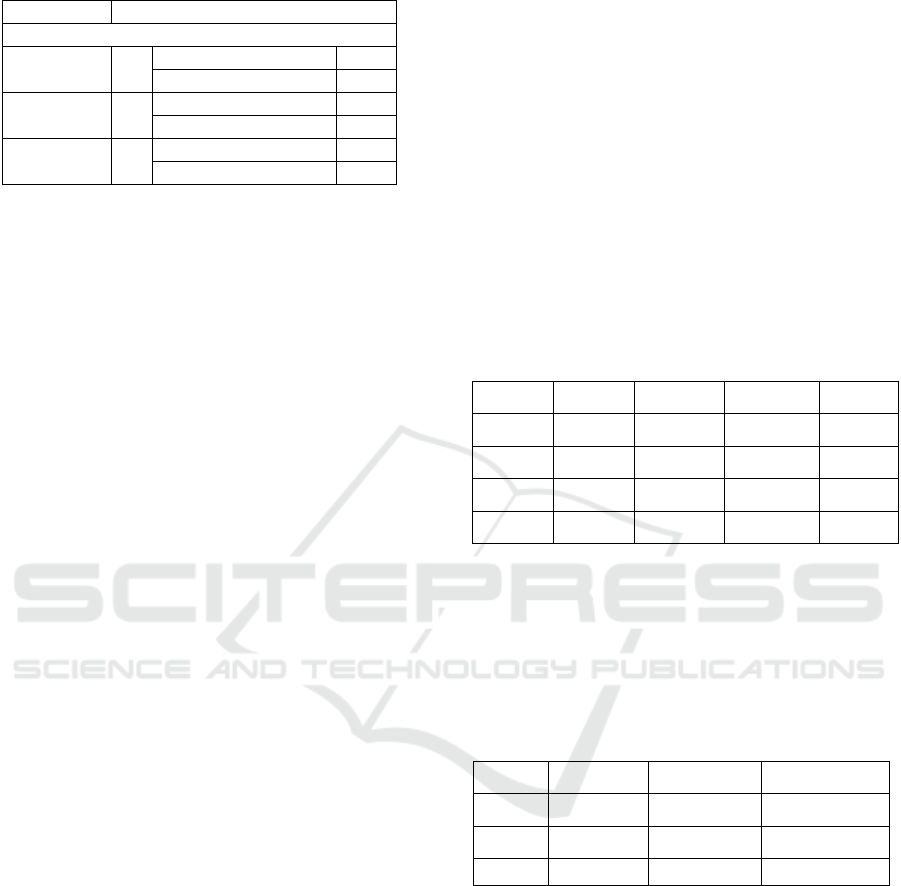

Table 1: The Altman Model Parameter Index

No. Z-Score Classification

1 >2.60

The company in good

condition

2 1.10<Z<2.60

The company in grey zone

3 <1.10

The company in bankrupt

Source: (Altman &Hotchkiss, 2006)

3.1.2 Independent Variable

The independent variables used in this study are

return on equity, debt to equity ratio, and current

ratio. Operational variables and their indicators can

be seen in table 1:

Effect of Financial Ratios on Financial Distress of Retail Trade Companies Listed on the Indonesia Stock Exchange

111

Table 2: Independent Variables and Indicator

Variable Indicator

Independent Variable

ROE = Net Income After Tax

Total Equity

DER = Total Liabilities

Total Equity

CR = Current Assets

Current Liabilities

The object of research used in this study is a

retail trade company that publishes its financial

statements and is listed on the Indonesia Stock

Exchange. The sample taken is a sample decided on

the usage of predetermined criteria. Twenty-six

corporations are indexed as populace corporations at

the Indonesia Stock Exchange, because this study

uses purposive sampling where the sample must be

based on specific predetermined criteria. There are

12 companies that do not meet the criteria of the

research sample. Then, the researchers found 14

companies that match the research criteria to be used

as research samples. Next, 14 companies are

multiplied by five years, so the total sample is 70

samples.

3.2 Data Analysis Technique

The data analysis technique in this study uses panel

data regression analysis which is a combination of

time series data and cross section data.

3.2.1 Descriptive Statistics

Descriptive statistical analysis is an analytical

method used to collect and present quantitative data

so as to produce useful information. Descriptive

reports in the form of data in general in the

frequency distribution table include the average

value (mean), minimum value, maximum value and

standard deviation.

3.2.2 Classic Assumption Test

The classical assumption test is a test carried out to

see the significant effect between each variable, both

the independent variable and the dependent variable.

The classical assumption test consists of

Heteroscedasticity Test and Multicollinearity Test.

3.3 Panel Data Regression Analysis

According to Winarno (2017) the panel data

regression model has three approaches, namely fixed

effect model, random effect model and common

effect model. To choose the most appropriate model

in managing panel data, there are several tests that

can be done, namely chow test, hausman test and

lagrange multiplier test.

4 RESULT AND DISCUSSION

4.1 Descriptive Statistical Analysis

Based at the monetary document statistics studied,

the subsequent is a descriptive statistical table for

the independent variables ROE, DER, CR and the

dependent variable Z-Score:

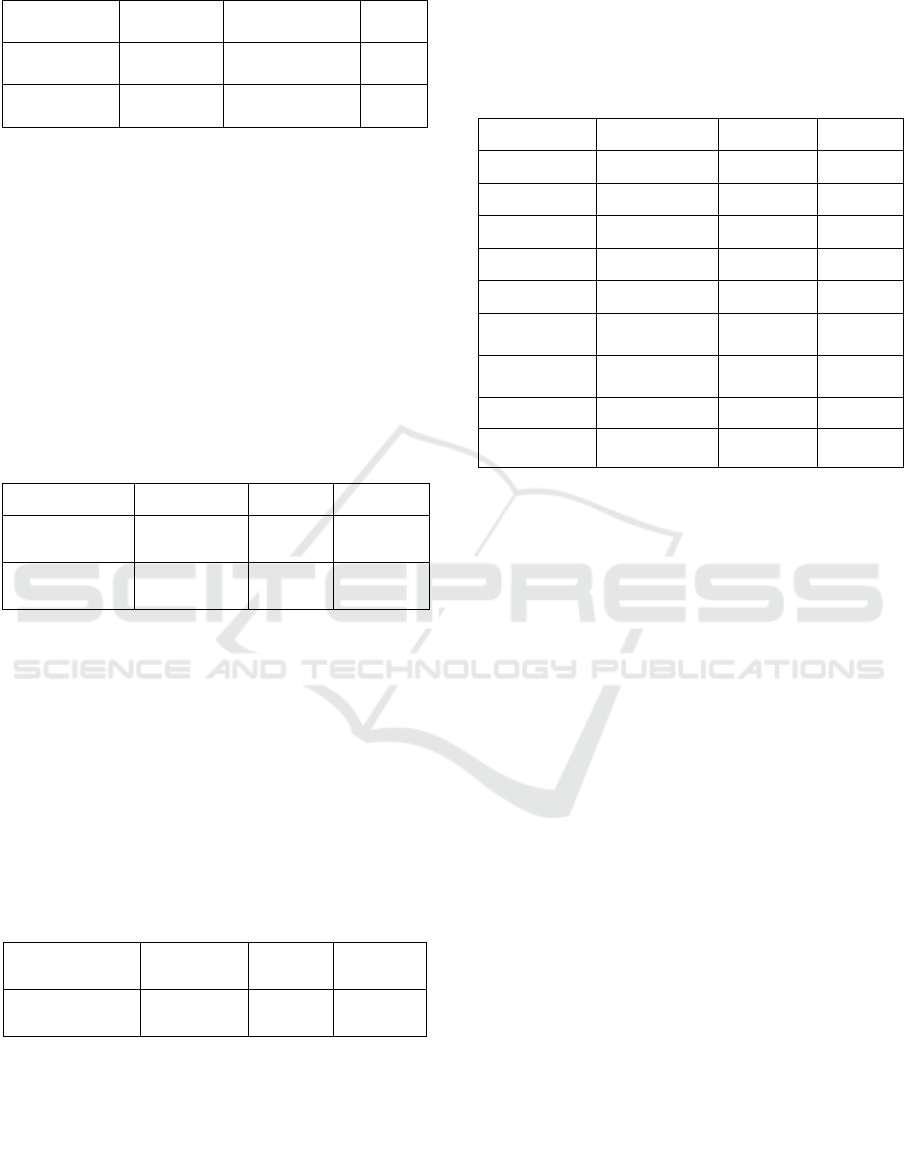

Table 3: Descriptive Statistical

Variable Mean Max Min Std.Dev

Z-Score

7.457411 21.31383 -0.151235 3.984879

ROE 0.236643 7.991000 -0.781600 0.981138

DER 0.020286 0.181900 0.000900 0.024601

CR 0.020442 0.122023 0.006413 0.019655

4.2 Classis Assumption Test

4.2.1 Multicollinearity Test

The results of the multicollinearity test can be seen

in table 4:

Table 4: Multicollinearity Test

ROE DER CR

ROE 1.000000 0.751720 -0.068611

DER 0.751720 1.000000 -0.359267

CR -0.068611 -0.359267 1.000000

Based on table 4, the correlation coefficient

between variables has a value of less than 0.8. This

suggests that the information on this take a look at

does now no longer contain multicollinearity

disorders (Ghozali, 2016).

4.2.3 Heteroscedasticity Test

The output results of the Breusch-Pagan-Godfrey

test are shown in table 5:

ICAESS 2021 - The International Conference on Applied Economics and Social Science

112

Table 5: Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 0.643964 Prob. F(4,80) 0.589

5

Obs*R-

s

q

uare

d

1.990705 Prob.Chi-

S

q

uare

(

4

)

0.574

3

Scaled

explained SS

9.818901 Prob.Chi-

Square(4)

0.020

2

The results of Table 5 shows that the probability

value is 0.5743, which is more significant than 0.05.

This indicates that the data does not experience

heteroscedasticity problems.

4.3 Model Selection

4.3.1 Chow Test

The Chow test is used to decide the maximum

suitable version among the fixed-effect model or the

common effect model.

Table 6: Chow Test

Effects Test Statistic d.f. Prob.

Cross-section

F

3.356469 (13,53) 0.0009

Cross-section

Chi-square

42.044777 13 0.0001

Table 6 shows that the chi-square cross-section

probability of 0.0001 is smaller than the alpha level

(5%). The outcomes of the Chow test indicate that it

is more appropriate to use the fixed effect model

than the common effect model.

4.3.2 Hausman Test

The Hausman test is a test to determine the correct

version among the fixed effect model or the random

effect model.

Table 7: Hausman Test

Test

Summar

y

Chi-Sq.

Statistic

Chi-Sq.

d.f.

Prob.

Cross-section

rando

m

24.393209 3 0.0000

Table 7 above shows the probability value of a

random cross-section of 0.0000. The random cross-

section probability value is smaller than the alpha

level (5%), so the Hausman take a look at effects to

display that the fixed effect model is extra suitable

than the random effect model.

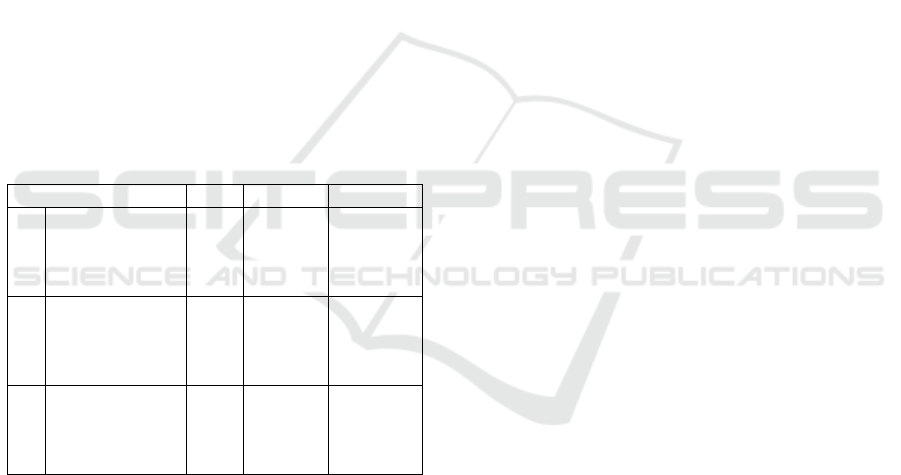

4.4 Panel Data Regression Analysis

The results of panel data regression using the fixed-

effect model can be seen in Table 8 below.

Table 8: Fixed Effect Model

Variable Coefficient t-Statistic Prob.

C 8.910100 27.560690 0.0000

ROE 1.738537 10.684850 0.0000

DER -71.61540 11.0665 0.0000

CR -20.12152 -1.253855 0.2154

R-squared 0.987406

Adjusted

R-s

q

uare

d

0.983605

Prob(F-

statistic)

0.000000

N 70

Model Result Fixed

From the results of the panel data regression, the

following equation can be obtained:

Z-Score

t

=8.910100+

1.738537ROE

t

-71.61540DER

t

-20.12152CR

t

4.5 Hypothesis Test Results

4.5.1 Test Result of H

1

Hypothesis 1 states that Return on Equity (ROE) has

a significant positive effect on financial distress.

Table 8 shows that ROE has a significant effect on

financial distress because the probability value is

0.0000, which is smaller than 0.05. The coefficient

value of 1.738537 indicates a positive direction,

meaning that if the ROE increases by 1 with the

assumption that other variables are fixed, there will

be an increase in the z-score of 7.874606. The

conclusion that can be drawn from the description

above shows that hypothesis 1 is supported.

4.5.2 Test Result of H

2

Hypothesis 2 states that the Debt to Equity Ratio

(DER) has a significant negative effect on financial

distress. Table 8 shows that DER has a significant

effect on financial distress because the probability

value is 0.0000, which is smaller than 0.05. The

coefficient value of -71.61540 indicates a negative

Effect of Financial Ratios on Financial Distress of Retail Trade Companies Listed on the Indonesia Stock Exchange

113

direction, meaning that if the z-score increases by 1

with the assumption that other variables are fixed,

there will be a decrease of -71.61540. The

conclusion that can be drawn from the description

above shows that hypothesis 2 is supported.

4.5.3 Test Result of H

3

Hypothesis 3 states that the current ratio (CR) has a

significant positive effect on financial distress. Table

8 shows that CR has no significant effect on

financial distress because the probability value is

0.2154, which is more significant than 0.05. The

coefficient value of -20.12152 indicates a negative

direction, meaning that if the z-score increases by 1

with the assumption that other variables are

constant, there will be a decrease of -20.12152. The

conclusion that can be drawn from the description

above shows that hypothesis 3 is not supported.

4.6 Data Analysis

The following is a summary table of test results from

this study:

Table 9: Summary of Test Result

Hypothesis Prob. Coeff. Result

H

1

ROE has a

significantly

positive effect on

Financial Distress

0.0000 1.738537 Supported

H

2

DER has a

significantly

negative effect on

Financial Distress

0.0000 -71.61540 Supported

H

3

CR has a

significantly

positive effect on

Financial Distress

0.2154 -20.12152 Not

Supported

4.6.1 Effect of Return on Equity on

Financial Distress

Based on the H

1

test in table 8, suggests that the

profitability ratio as measured by ROE has a

significant positive effect on financial distress. This

indicate that ROE can expect the incidence of

financial distress. If the ROE is higher, the agency is

taken into consideration to be getting better and is

capable of manipulating to manage its resources

greater effectively and efficiently. The better the

agency, the higher the z-score, so the agency is

much less possibly to reveal in financial distress.

The results of this study are following the

research of Desiyanti et al. (2019) and Widati &

Pratama (2014), which state that ROE has a

significant positive effect on financial distress. If the

ROE percentage is high, the company is said to be

far from financial distress. This ratio is essential for

the business enterprise because it could take degree

to earn earnings with the equity owned by the

company. A low ROE can illustrate that the

company cannot use equity to generate profits and

makes it more incredible hard for the company's

finances in inner investment reasserts for

investment, so that the company's increase will

become much less trues and financial distress The

company's growth that is not good will give a signal

(signal theory) or information to shareholders that

the company is less able to maintain survival and is

less able to develop. High company growth will

indicate that the company is in good health and not

under pressure.

4.6.2 Effect of Debt to Equity Ratio on

Financial Distress

Based on the H

2

test table 8, indicates that the

leverage ratio measured by the use of DER has a

significant negative effect on financial distress. This

shows that DER can expect the incidence of

financial distress. If the DER is lower, the company

is taken into consideration able to paying off its

responsibilities without sacrificing the interests of

the owners of too much capital so that the possibility

of financial distress is also getting smaller with a

higher z-score.

The outcomes of this observation are according

with the results of studies with the aid of using by

Desiyanti et al. (2019) which states that DER has a

significant negative effect on financial distress. The

outcomes of this observation also are in keeping

with the studies of Masdupi et al. (2018), which

states that if the company manages debt well, the

company is capable of boom income and company

cost to keep away from financial distress. The

outcomes of this observation are according with the

trade-off theory, which states that debt will increase

the value of the company to reduce financial

distress, so it can be concluded that the use of debt

in the retail trade sector affects financial distress.

4.6.3 Effect of Current Ratio on Financial

Distress

Based on the H

3

test in table 8, it suggests that the

liquidity ratio as measured by CR has no significant

negative effect on financial distress. It can be

ICAESS 2021 - The International Conference on Applied Economics and Social Science

114

concluded that CR cannot are expecting the

prevalence of financial distress. The consequences

of this has a examine contradict the impact of Islami

& Rio (2019) research which states that the current

ratio can expect financial distress. The distinction

withinside the consequences of this have a take a

follow can be because of variations withinside the

pattern and the studies period, at the same time as

the results of this have a take a observe are

according with the consequences of studies with the

aid of using Widati & Pratama (2014) which states

that the current ratio has no significant negative

effect on financial distress.

CR is not the principle element that impact

financial distress in retail trade sub-sector companies

because it does not have a significant effect. One of

them is due to the fact the agency has a reasonably

excessive short-time period responsibility, after

which the agency is not able to pay its short-time

period duties till adulthood so that debt that turned

into at first classified as short-time period debt will

become long-time period debt. From the outline

above, it may be concluded that companies with

high CR values will not necessarily avoid financial

distress, and companies with the lowest CR values

do not always experience financial distress.

5 CONCLUSIONS

Based on the consequences of the studies conducted,

it becomes located that Return on equity (ROE) had

a significant positive effect on financial distress.

From the implications of the study, the higher the

ROE, the more effective and efficient the company

is in dealing with sources so that the opportunity of

financial distress is smaller and the z-score is higher.

The Debt to equity ratio (DER) has a significant

negative effect on financial distress. From the

consequences of the study, the decrease the DER,

the company is taken into consideration capable of

repaying its duties without sacrificing the hobbies of

the proprietors of capital so that the opportunity of

financial distress is smaller and the z-score is higher.

Current ratio (CR) has no significant negative effect

on financial distress. From the results of the study, a

high CR value does not necessarily guarantee that

the company can pay its maturing debts, so

companies with a high CR value will not necessarily

avoid financial distress.

REFERENCES

Altman, E. I., & Hotchkiss, E. (2005). Corporate Financial

Distress and Bankruptcy. Corporate Financial

Distress and Bankruptcy.

https://doi.org/10.1002/9781118267806

Andre, O. (2013). Pengaruh Profitabilitas, Likuiditas dan

Leverage Dalam Memprediksi Financial Distress.

Ejournal UNP, 1–17.

Ceicdata. (2019). Indonesia Retail Sales Growth.

Ceicdata.Com.

https://www.ceicdata.com/en/indicator/indonesia/retail

-sales-growth

Desiyanti, O., Soedarmo, W., Chandra, K., & Kusnadi, K.

(2019). The Effect Of Financial Ratios To Financial

Distress Using Altman Z-Score Method In Real Estate

Companies Listed In Indonesia Stock Exchange

Period 2014 - 2018. Business and Entrepreneurial

Review, 19(2), 119.

https://doi.org/10.25105/ber.v19i2.5699

Erayanti, R. (2019). Pengaruh Likuiditas, Profitabilitas

dan Leverage terhadap Prediksi Financial Distress.

Jurnal Riset Akuntansi & Perpajakan (JRAP), 6(01),

38–51. https://doi.org/10.35838/jrap.v6i01.393

Fauzan, H., & Sutiono, F. (2017). Perbandingan Model

Altman Z-Score, Zmijewski, Springate, Dan Grover

Dalam Memprediksi Kebangkrutan Perusahaan

Perbankan (Studi Kasus Pada BEI Tahun 2011-2015).

Jurnal Online Insan Akuntan, Vol 2 No 1(1), 49–60.

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan

Program IBM SPSS. Badan Penerbit Universitas

Diponegoro.

Hikmah, & Afridola, S. (2019). Pengaruh Rasio Keuangan

Altman Z-score Terhadap Financial Distress pada PT

Citra Tubindo Tbk. Junal Institusi Politeknik Ganesha

Medan, 2(1), 1–14.

Islami, I. N., & Rio, W. (2019). Financial Ratio Analysis

to Predict Financial Distress on Property and Real

Estate Company listed in Indonesia Stock Exchange.

JAAF (Journal of Applied Accounting and Finance),

2(2), 125. https://doi.org/10.33021/jaaf.v2i2.550

Masdupi, E., Tasman, A., & Davista, A. (2018). The

Influence of Liquidity, Leverage and Profitability on

Financial Distress of Listed Manufacturing

Companies in Indonesia. 57(Piceeba), 223–228.

https://doi.org/10.2991/piceeba-18.2018.51

Modigliani, F., & Miller, M. (1963). Corporate Income

Taxes and the Cost of Capital: A Correction. American

Economic Review, 433–443.

Nugroho, A. (2018). MODEL ANALISIS Z SCORE

TERHADAP PREDIKSI KEBANGKRUTAN ( Studi

pada PT Garuda Indonesia,Tbk tahun 2015-2017). J-

MACC: Journal of Management and Acoounting, 1(2),

124–138.

Platt, H. D., & Platt, M. B. (2002). Predicting corporate

financial distress: Reflections on choice-based sample

bias.

Journal of Economics and Finance, 26(2), 184–

199. https://doi.org/10.1007/bf02755985

Ramadhan, K. D., & Syarfan, L. O. (2016). Analisis

Laporan Keuangan Dalam Mengukur Kinerja

Effect of Financial Ratios on Financial Distress of Retail Trade Companies Listed on the Indonesia Stock Exchange

115

Perusahan Pada Pt. Ricky Kurniawan Kertapersada

(Makin Group) Jambi. Jurnal Valuta, 2(2), 190–207.

Sinarti, & Sembiring, T. M. (2015). Bankruptcy prediction

analysis of manufacturing companies listed in

Indonesia stock exchange. International Journal of

Economics and Financial Issues, 5, 354–359.

Soliha, E. (2008). Analisis Industri Ritel di Indonesia.

Analisis Industri Ritel Di Indonesia, 15(2), 128–142.

Spence, M. (1973). Job Market Signaling. Quarterly

Journal of Economics, 87, 355–374.

https://doi.org/10.1055/s-2004-820924

Sujarweni, V. (2017). Manajemen Aplikasi Teori,

Aplikasi, dan Hasil Penelitian. Pustaka Baru Press.

Widati, L. W., & Pratama, B. A. (2014). Pengaruh Current

Ratio, Debt To Equity, Dan Return On Equity, Untuk

Memprediksi Kondisi Financial Distress. Prosiding

Seminar Nasional Multi Displin Ilmu & Call For

Papers Unisbank, 978–979.

Winarno, W. . (2017). Analisis Ekonometrika dan

Statistika dengan Eviews. UPP STIM YKPN.

Worldometers. (2019). Indonesian Population.

Worldometers. https://www.worldometers.info/world-

population/indonesia-population/

ICAESS 2021 - The International Conference on Applied Economics and Social Science

116