Case Study: Integrating SMART Decision Making Attributes to

Improve the Selecting Subcontractor Strategy

Theofilus Purnama Putra and Sudarso Kaderi Wiryono

School of Business and Management, Institut Teknologi Bandung, Bandung, Indonesia

Keywords: Subcontractor, Construction Value Chain, Financial Ratio, Capacity Planning, Project Funding, Strategic

Improvement, Subcontract Performance.

Abstract: PT McDermott Indonesia is subsidiary of McDermott International Incorporated. In its working practice,

McDermott cooperate with other contractors so called subcontractors to complete specific work on a project.

This research was conducted using lessons learned from the non-conformance made by one of the

subcontractor on the project of Qatar Gas North Field. The objective of this business research is to ascertain

the elements where this problematic subcontractor error occurs. An integrated framework is developed

incorporate attributes of : construction value chain, financial ratio, capacity planning and project funding. The

study uses analysis methods to identify the potential problem, interviews among related parties and simulation

methods to formulate an improvement plan. This research concludes that the analysed attributes have an

important role and should be included in the key for subcontractor selection by using the proposed SMART

decision making method. This new strategy expected can help PT McDermott Indonesia to improve the

assessment of each subcontractor competency prior to contract awards.

1 INTRODUCTION

1.1 Subcontractor

According to Eccles (1981) and Costantino et al.,

(2001) the contractor will not carry out all the works

but sublet specialist works, such as building

services works, to subcontractors specialized in the

respective work disciplines. Hughes et al. (1997)

and Yik et al. (2006) describes specialist work as

those that involve the use of special methods,

delivery of proprietary products, or works that can

only be performed by registered or licensed

companies or persons.

PT McDermott Indonesia divides the rules in

this subcontracting into four parts, the purpose of

this division is to maintain the effectiveness of the

process, consisting of Pre-Subcontract Planning,

Sourcing, Management and Vessels (see flowchart

on Figure 1).

The process of subcontracting itself are divided

by (a) Identification of the work scope to be

subcontracted (b) Preparation of the relevant

package for the identified scope of work to be

subcontracted (c) Selection of qualified

subcontractor from whom quotes/bids are to be

obtained for the specified work and (d) Evaluation

of the respective bids from the Subcontractor(s) and

subsequent selection of the Subcontractor based on

technical capability, cost, quality and schedule for

the execution of the specific scope of work.

Figure 1: Subcontracting.

1.2 Problem Statement

PT McDermott Indonesia was started the

fabrication of Qatar Gas North Field project since

2019. One part of the fabrication scope of work for

the piping contract of this project is to fabricate

cladded pipes which is subcontracted.

184

Purnama Putra, T. and Kaderi Wiryono, S.

Case Study: Integrating SMART Decision Making Attributes to Improve the Selecting Subcontractor Strategy.

DOI: 10.5220/0010861300003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 184-189

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The subcontractor was considered having a

product delivery problem. This case almost causes

delays in the delivery of the whole project module

plan which can cause a loss of reputation of PT

McDermott Indonesia. The management assumed

that: (a) This problem was caused by

subcontractor's financial problems with the

possibility of non-smooth cash flow conditions. (2)

On the other hand, there may also be problems

related to production aspects, insufficient

machinery and equipment as well as the supply of

raw materials. (3) Other possibilities also arise such

as technical skills, procedures for financing the

projects or constraints in the administrative area.

2 LITERATURE REVIEW

2.1 SMART Analysis Method

The Simple Multi Attribute Rating Technique

(SMART) decision-making technique has been

used to explore how decision analysis can be used

to support decision makers who have multiple

objectives. According to Paul Goodwin and

George Wright (2004) when decision problems

involve a number of objectives unaided decision

makers tend to avoid making trade-offs between

these objectives. This can lead to the selection of

options that perform well on only one objective, or

the rejection of relatively attractive options

because their good performance on several

objectives is not allowed to compensate for poor

performance elsewhere.

So this is the based to use SMART method on

this research, this method also based on a linear

additive model. This means that an overall value of

a given alternative is calculated as the total sum of

the performance score (value) of each criterion

(attribute) multiplied with the weight of that

criterion.

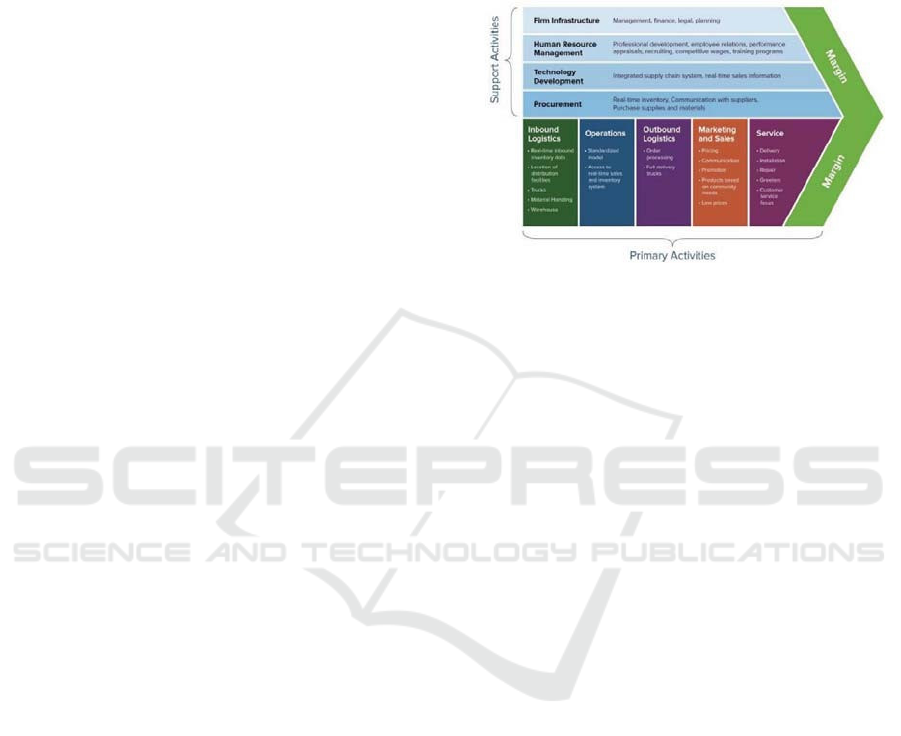

2.2 Construction Value Chain

According to Porter (1985: 12). The idea of the

value chain is based on the process view of

organizations, the idea of seeing a manufacturing

(or service) organization as a system, made up of

subsystems each with inputs, transformation

processes and outputs. Inputs, transformation

processes, and outputs involve the acquisition and

consumption of resources – money, labour,

materials, equipment, buildings, land,

administration and management. How value chain

activities are carried out determines costs and

affects profits. The Inbound Logistics, Operations,

Outbound Logistics, Marketing and Sales, and

Service are categorized as primary activities, while

the other included on secondary activities (see

Figure 2).

Figure.2. Construction Value Chain

2.3

Financial Ratio Analysis

According to Gropelli (2000: 433) a financial ratio

or accounting ratio is a relative magnitude of two

selected numerical values taken from an

enterprise's financial statements. Often used in

accounting, there are many standard ratios used to

try to evaluate the overall financial condition of a

corporation or other organization. Financial ratios

may be used by managers within a firm, by current

and potential shareholders (owners) of a firm, and

by a firm's creditors. Financial analysts use

financial ratios to compare the strengths and

weaknesses in various companies. In this research,

the financial ratios of the problematic

subcontractor are detailed and checked.

2.4 Capacity Planning

According The North Carolina State University on

the book "Terms and Definitions - Supply Chain

Management", Capacity planning describes as the

process of determining the production capacity

needed by an organization to meet changing

demands for its products. The strategy which is

broadly used worldwide are:

Lead strategy, it is the strategy by adding

capacity in anticipation of an increase in demand.

Lead strategy is an aggressive strategy with the

goal of luring customers away from the company's

competitors by improving the service level and

reducing lead time. It is also a strategy aimed at

reducing stock out costs. A large capacity does not

necessarily imply high inventory levels, but it can

Case Study: Integrating SMART Decision Making Attributes to Improve the Selecting Subcontractor Strategy

185

imply higher cycle stock costs. Excess capacity can

also be rented to other companies.

Lag strategy describe as the strategy by adding

capacity only after the organization is running at

full capacity or beyond due to increase in demand

(North Carolina State University, 2006). This is a

more conservative strategy and opposite of a lead

capacity strategy. It decreases the risk of waste, but

it may result in the loss of possible customers either

by stock out or low service levels. Three clear

advantages of this strategy are a reduced risk of

overbuilding, greater productivity due to higher

utilization levels, and the ability to put off large

investments as long as possible. Organization that

follow this strategy often provide mature, cost-

sensitive products or services.

Match strategy, It is by adding capacity in small

amounts in response to changing demand in the

market. This is a more moderate strategy.

Adjustment strategy, with method of adding or

reducing capacity in small or large amounts due to

consumer's demand, or, due to major changes to

product or system architecture.

2.5 Project Funding

Funding is the act of providing resources to finance

a need, program, or project. While this is usually in

the form of money, it can also take the form of

effort or time from an organization or company.

Generally, this word is used when a firm uses

its internal reserves to satisfy its necessity for cash,

while the term financing is used when the firm

acquires capital from external sources. Sources of

funding include credit, venture capital, donations,

grants, savings, subsidies, and taxes.

3 METHODOLOGY

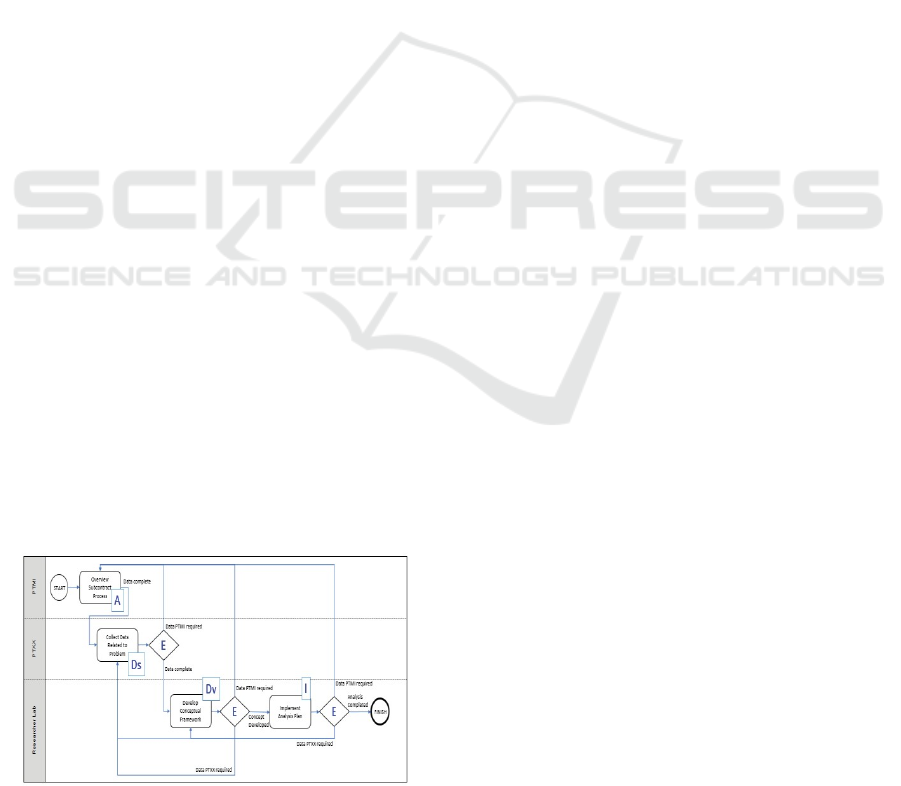

3.1 Methodology Flowchart

Figure.3: ADDIE Methodology.

This research used ADDIE model which consists of

five stages: Analysis, Design, Development ,

Implementation and Evaluation (see Figure 3). Stage

Evaluate in this methodology is iteration process which

aims to review again, add improvements if there are still

deficiencies, as well as the process of sharpening the

process results.

4 ANALYSIS

4.1 Analysis 1, the Construction Value

Chain of the Subcontractor

The Porter’s Value Chain describe the importance

of each activities, both activities are involved and

support each other. First step is checking five

Primary Activities (see Appendix.1), these are

essential in adding value and creating a competitive

advantage of the subcontractor.

From the first analysis, it was found that there

were no issues related to five primary activities at

the subcontractor area, but subcontractor could

harness a competitive advantage at any one of

activities in the value chain. For example, by

creating inbound logistics that are highly efficient

or by reducing a company's operation costs, it

allows to either realize more profits or pass the

savings to the consumer by way of lower prices.

The Support Activities is using to helps make

primary activities more effective. Increasing any of

the four support activities helps at least one

primary activity to work more efficiently (see

Appendix.2).

From this Value Chain analysis result, found

several areas need to have improvement:

Operations, Human Resources Management and

Technological Development. From those three

activities that need improvement, only one is the

primary activity, the finding which is also a minor

finding in the form of improving dimensional

inspection forms, training matrix and one more

finding which has not been resolved. In this case it

can be concluded that in general the condition of

the construction value chain of subcontractor is in

good condition.

There are four red dots which are finding in the

construction value check above, the finding part is

then used as a basic measure of risk checking,

which is called the Key Risk Indicator (KRI) and

transformed to ranking table (see Appendix.3)

The table shows that technological

development shall give first attention, the use of

tools and materials without a certificate is very

ICAESS 2021 - The International Conference on Applied Economics and Social Science

186

risky, especially when testing pipes in a shop is in

progress. The next critical item is in both the

operations and human resources areas, this also

shows that the technical work in operations is also

influenced by the completeness of tools possessed

by the human resources department.

4.2 Analysis 2, the Financial Ratio of

the Subcontractor

Financial Ratio will determine the Company

performance. Company performance showing the

company capability to generate profit. In

connection with the selection of a subcontractor,

company performance will make it easier for

McDermott to choose a subcontractor from one of

the important considerations, called Financial

Health.

Financial performance is measured from three

important aspects: Liquidity Ratio, Solvability

Ratio and Profitability ratio from the Statement of

Financial Position report from subcontractor for

2018 and 2019 (see Appendix.4).

The table conclude that from the twelve ratios

that were checked in relation to the financial

performance of subcontractor, eleven are dropping

from year 2018 to 2019.

4.3 Analysis 3, Project Funding of the

Subcontractor

A company will be said to be an unhealthy

company not only from the quality of its human

resources or from the value of its sales. However,

it can be measured from an internal financial

perspective. One way to do this is by measuring the

Debt to Equity Ratio (DER).

Debt to Equity Ratio or DER is the ratio of debt

to equity or financial ratio that compares the amount

of debt to equity. Equity and the amount of debt is

used for the operational needs of the company,

which must be proportional to the amount. In

addition, this Debt to Equity Ratio is also

commonly called the leverage ratio, where this ratio

is used to measure an investment in the company.

The formula for calculating DER is as follows:

From the financial report of subcontractor, in

2018 the total long-term liabilities is IDR

36,074,010,000,000 with total owner's equity is

IDR 3,975,872,000,000, from the two data

obtained DER = 9.07, while in 2019 the total long

term liabilities is IDR 34,478,745,000,000 with

total owner's equity is IDR 6,071,641,000,000,

DER is obtained from both data is = 5.68

According to Finance Minister Regulation No.

PER-25/PJ/2017 (article 2), the reference for DER

is that a company can be said to be healthy with a

maximum ratio of : 4 liabilities and 1 equity. So the

smaller this ratio, the better the company.

Subcontractor's DER in 2018 is 9.07 And in the

year 2019 is 5.68, This higher DER indicates that

more creditor financing is used than equity

financing. Movement of DER ratio tends to

decrease from 9.07 to 5.68 and it indicates that

company moving to better condition.

4.4 Analysis 4, Capacity Planning of

the Subcontractor

This research uses project data carried out by

subcontractor from January 2019 to March 2021.

Data obtained from the Project Reference List

consists of two weld overlay (WOL) activities,

pipes is measured in length (meters) and fittings is

measured by quantity.

From the Project reference list data, it is found

that the accumulated changes in load are

summarized from the each month load on

Appendix.5 (a) and (b).

The existing monthly capacity of Subcontractor

is 650 meters for pipe welding overlay (WOL) and

650 ea. for fittings per month. This calculation is

an average calculation because the capacity will

depend on the diameter and thickness of the pipes

and fittings, for example a material with a size of

16 inches and above will require 2 times the

processing time than the small material. Besides

that, it also depends on the requirements of the

client regarding the overlay material and the

thickness it requires, each overlay material has its

own difficulties in the process.

Capacity utilization rate used to measure of

how close the firm is to its best possible operating

level, the formula for calculating the Capacity

Utilization rate is:

From the Subcontractor data, the best operating

level is 650 meters and 650 ea. There are several

monthly loads that exceed the capacity, it is shown

on Appendix.5 (c).

The summary table explained that there are six

months overloaded for pipe cladding project and

eight months for the fittings. Some of the load gap

Case Study: Integrating SMART Decision Making Attributes to Improve the Selecting Subcontractor Strategy

187

even too big, especially on the piping part, while

on fitting part, there are extravagant gap found on

March 2020, in this condition Subcontractor gets

support for the requirement of project fabrication

machine from the facility branches in Rio De

Janeiro, Brazil and Dammam Saudi Arabia. In this

case, actually the capacity of Subcontractor Batam

still has limitations which can be increased by

adding new machines and experts. However, this

will require a fairly long consideration given the

continuity of projects and loads that vary widely.

4.5 Proposed Improvement for

Subcontractor

From the four analysis that have been carried out,

in general we can see better regarding the condition

of subcontractor, the results of this research can be

used as a basis for proposals to subcontractor and

also as input for improvement in the subcontractor

selection method at McDermott.

In the Construction Value Chain analysis, from

the Deployment Table for Target and Profile Risk,

there are twelve key risk indicators which are a

combination of the risk of their primary and

supporting activities. The unique thing is that the

risks between these parts are interconnected, for

example: risk in the area of supporting activities,

called Technological Development, which is all

included in Extreme Risk, if it is not immediately

followed up, it will affect risk in the Operations

area. Risk in the Technological Development area

which includes material, tools and instrument

certification is critical, so it must be handled

quickly, and after the problem is resolved,

monitoring tools must be created immediately to

avoid the same case occurring in the future.

In the Financial Ratio analysis, with exception

of DER analysis, from the 2018 and 2019 financial

reports, there was a declining trend for almost all

of the ratios studied, Liquidity Ratio, Solvability

Ratio and Profitability ratio. This indicates that the

company is in a state of decline or can be said to be

unhealthy.

In the Project Funding area, using the same data

from Financial Ratio data, DER which is the

determinant of project funding for the two (2) years

of data studied, 2018 and 2019, got a value of 9.07

for 2018 and 5.68 for 2019. These two conditions

are not good enough seen from the minimum

standard of DER which should be below the

number 4, however there is a tendency that

improvements are taking place within the

company's financial institutions.

Analysis for the Capacity Planning resulting

subcontractor's line of business is classified as a

business whose load cannot be planned, in other

words, the load varies greatly, for example: there

are circumstances where in one month the

company only gets orders for only four pcs of

fittings to work on, but there are times within one

month it get orders of 8635 pcs of fittings, a very

unequal number. By looking at this situation,

Capacity Planning can only be predicted in general

terms, mitigation at the time of overload has also

been made, i.e. by borrowing fabrication machines

from subcontractor headquarters or branches.

Table on Appendix.6 showing the improvement

proposals that can be used by Subcontractor to

improve the health of its company.

5 RESULTS AND DISCUSSSION

5.1 Integrating SMART Decision

Making Attributes to Improve the

Selecting Subcontractor Strategy

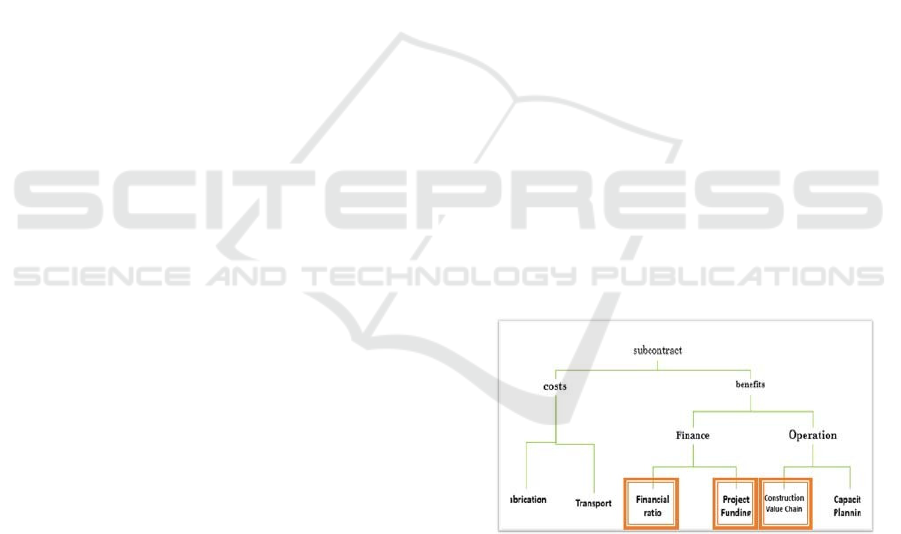

The default for the subcontractor selection method

is from two main parts: Cost and Operations, the

cost in this case is represented by fabrication and

transport, while in the operation area it only

focuses on checking the capacity of the

subcontractor, even this checking is not done in

detail.

Figure 4: Subcontract Attributes.

From the research that has been done, it was

found three items which turned out to be important

to check as well and have an overall effect on

company performance, they are Financial Ratio and

Project Funding plan, as well as checking the

Construction value chain. These three items must

be registered into attributes which will be used as

the basis for the next decision making process (see

Figure.4).

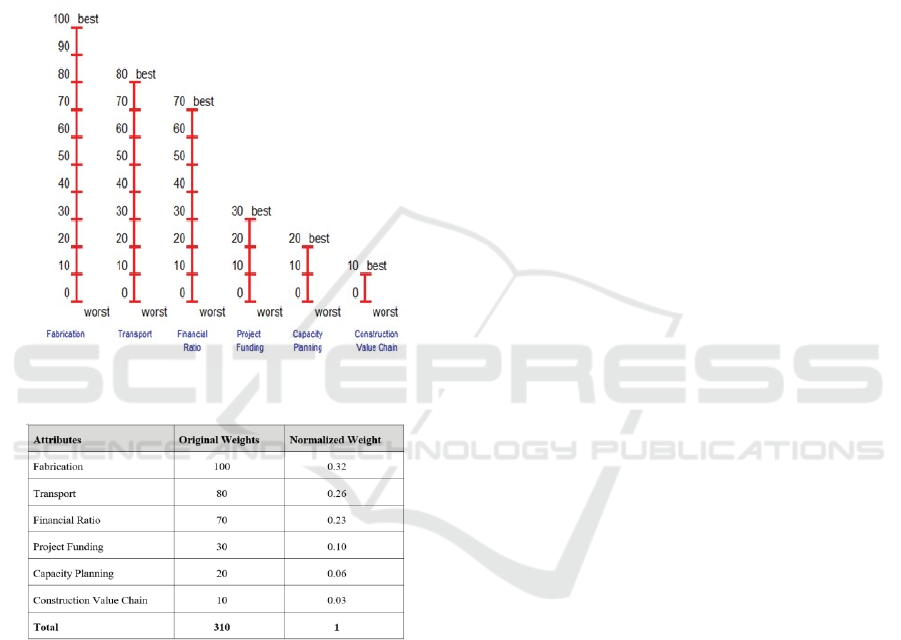

To determine the weight of attributes, a

ICAESS 2021 - The International Conference on Applied Economics and Social Science

188

discussion of three parties who is involved with

this activity, including: Project Engineer,

Subcontracting Coor- dinator and Completion

Coordinator. From the discussion, the results

showed that cost still gets the highest ranking,

followed by finance and operations (see Figure.5

and Table.1).

This normalized weight then can be used for

calculating of aggregate of weighted value for each

subcontractor with the purpose to make the

calculation more details.

Figure 5: Attributes Weight.

Figure 6: Original and Normalized Weight.

6 CONCLUSION

As assumed earlier, the problem that occurs is due

to the method of selecting subcontractors which

seems to ignore several important items. As

evidenced by the four analyses: Construction

Value Chain, Financial Ratio Analysis, Project

Funding and Capacity Planning in subcontractor

area, found deficiencies that indicate the company

is not healthy.

In Construction Value Chain area, the

Technological Development area which includes

material, tools and instrument certification is

critical, so it must be handled quickly, and after the

problem is resolved, monitoring tools must be

created immediately to avoid the same case

occurring in the future. In Financial Area,

improvement need to be done as the company is in

a state of decline or can be said to be unhealthy. In

Project Funding plan, even there is a tendency that

improvements are taking place within the

company's financial institutions, improvement still

need to be done. In Capacity Planning area,

improvement need to be done to make the load

uniform so will be easier to make capacity

planning.

Seeing from these results, we can conclude that

the attributes studied are items that are important in

relation to the decision making in selecting the

subcontractor, therefore it needs to be included in

the existing attributes.

REFERENCES

Eccles, R.G., 1981. Bureaucratic versus Craft

Administration: The Relationship of Market

Structure to the Construction Firm, Administrative

Science Quarterly, Vol.26, pp.449-469.

Constantino, N., Pietroforte, R. and Hamill, P., 2001,

Subcontracting in commercial and residential

construction: an empirical investigation,

Construction Management and Economics, Vol. 19,

pp. 439-447.

Goodwin, P and Wright, G. 2004. Decision Analysis for

Management Judgment, Third Edition, John Wiley

& Sons Ltd, West Sussex, England. pp. 27

Porter, Michael E., 1985. Competitive Advantage:

Creating and Sustaining Superior Performance. New

York.: Simon and Schuster. ISBN 9781416595847.

Retrieved 9 September 2013. pp. 12, 37.

Gropelli, A. A., & Ehsan, N., 2000, Finance (4th Edn.).

New York: Baron’s Educational Series, Inc. pp. 433

North Carolina State University., 2006, Terms &

Definitions - Supply Chain Management. Retrieved

2008-10-26.

Greener, Sue. & Martelli, J. 2015, An Introduction to

Business Research Methods. bookboon.com

Direktorat Jenderal Pajak. 2017, Peraturan Direktur

Jenderal Pajak Nomor: PER-25/PJ/2017. Jakarta

Management Team, 2015, Management System Manual

- Global. LinQ, McDermott.

Management Team. (2006) Subcontract Procedure for

Subcontract Bid Solicitation, Evaluation and Award.

LinQ, McDermott.

Management Team. (2020) Pre-Subcontract Planning.

Unifi, McDermott

Management Team. (2020) Supply Chain Management

Policy. Unifi, McDermott

Case Study: Integrating SMART Decision Making Attributes to Improve the Selecting Subcontractor Strategy

189