The Effect of Liquidity, Profitability, and Solvency to the Financial

Distress in Agricultural Sector Companies Listed on the Indonesia

Stock Exchange (IDX)

Egi Lolita Sukma

1

, Ria ANggraini

1

and Hanna Tiurma Tinambunan

2

1

Managerial Accounting, Politeknik Negeri Batam, Jl Ahmad Yani, Batam, Indonesia

2

Department of Business Administration, Illinois University, Illinois, U.S.A.

Keywords: Financial Distress, Financial Ratios, Liquidity, Profitability, Solvability, Z-Score

Abstract: This study aims to analyse financial ratios, namely liquidity ratios, profitability ratios, and solvency ratios

that affect financial distress conditions. This study uses quantitative research methods. The data used is on

agricultural companies on the Indonesia Stock Exchange (IDX) in 2015-2019, with 75 samples. The

dependent variable of financial distress was measured using the Altman analysis model (Z-Score). The

independent variables were measured using financial ratio indicators, namely liquidity ratios, profitability

ratios, and solvency ratios. This study uses secondary data with database collection techniques and uses a

non-probability sampling technique, purposive sampling. The data used is panel data regression, using the

EViews 9 application. This study shows that the liquidity ratio with the working capital and current ratio to

total assets proxies affects financial distress conditions. Profitability ratios with Return on Equity and return

on assets proxies affect financial distress conditions. The solvency ratio as measured by debt to total assets

affects financial distress conditions. While the solvency ratio analysed by debt to total Equity and time interest

earned does not affect the financial Ratio.

1 INTRODUCTION

Indonesia is an agricultural country. According to the

BPS, in 2019, Indonesian agricultural products

contributed to the gross domestic product (GDP)

value of 13.57% in the second quarter. Thus, one of

the keys to strengthening the national economy still

relies on the agriculture sector. In Indonesia's

economic structure in 2019, the agricultural industry

has provided 12.72% of business fields which are the

third-largest contributor (Central Statistics Agency,

2020). Of course, it is not only the duty of the

government, but companies are also trying to improve

performance in the agricultural sector jointly.

Because if it is optimized, the agricultural industry

may become the most significant contributor to the

country's economy.

This continuous (real) price GDP is useful for

showing each sector's annual economic growth rate.

For example, based on the graph above, it can be seen

that from 2015 to 2019, GDP, which is calculated at

constant prices by the business sector, increased.

Thus, the development every year shows an increase

which indicates an increase in the performance of the

agricultural industry.

Figure 1: GDP on a constant price basis by business field.

Indonesia, as a developing country, constantly

strives to promote stable economic growth. For this

reason, companies in Indonesia in various sectors can

help realize this by maintaining and improving

company performance, including financial

performance. Various external factors can affect the

Company's actual performance. Companies that are

constantly experiencing decreasing in their

1.171.445,8

1.210.955,5

1.258.375,7

1.307.373,9

1.354.957,3

2015 2016 2017 2018 2019

miliyar rupiah

Source : bps.go.id

Sukma, E., Anggraini, R. and Tinambunan, H.

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock Exchange (IDX).

DOI: 10.5220/0010860200003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 97-108

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

97

businesses may be feared to experience financial

distress conditions (Khaliq, 2014).

In 2015 there was an unfavourable situation for

the Indonesian economy. There was a weakening of

the rupiah caused by the prolonged crisis in Greece,

the economic recovery in the United States, and the

occurrence of political dynamics during our reign

(Zakaria, 2020). In September 2018, Indonesia again

experienced a weakening of the rupiah, which is due

to the current account deficit, the escalation of the war

in trading between America and China, emerging

market crises such as in Turkey, Iran, Argentina, and

South Africa and the strengthening of the United

States economy (Fauziah & Khoerulloh, 2020).

Quoted from the Greenpeace organization, the

agricultural sector is most affected by the fires from

2015 to 2019. Of the 4.4 million land areas of 1.3

million hectares are oil palm and pulp land.

According to the World Bank, these forest fires have

created negative perceptions of palm oil products, one

of Indonesia's primary export commodities. These

things are external factors of declining performance

so that they can affect business continuity.

As a result of this unfavorable economy,

companies in Indonesia can experience financial

distress, which also impacts company obligations that

have matured. Based on IDX data during 2015-2019,

21 companies have been delisted. It is necessary to

analyze the condition of financial distress as the

concerning of the declining financial condition of a

company. According to Kasmir (2012), companies

are expected to take decisions and actions quickly and

accurately to not cause company failure to

bankruptcy. Some companies in the agricultural

sector experienced a decline in profits to operational

losses.

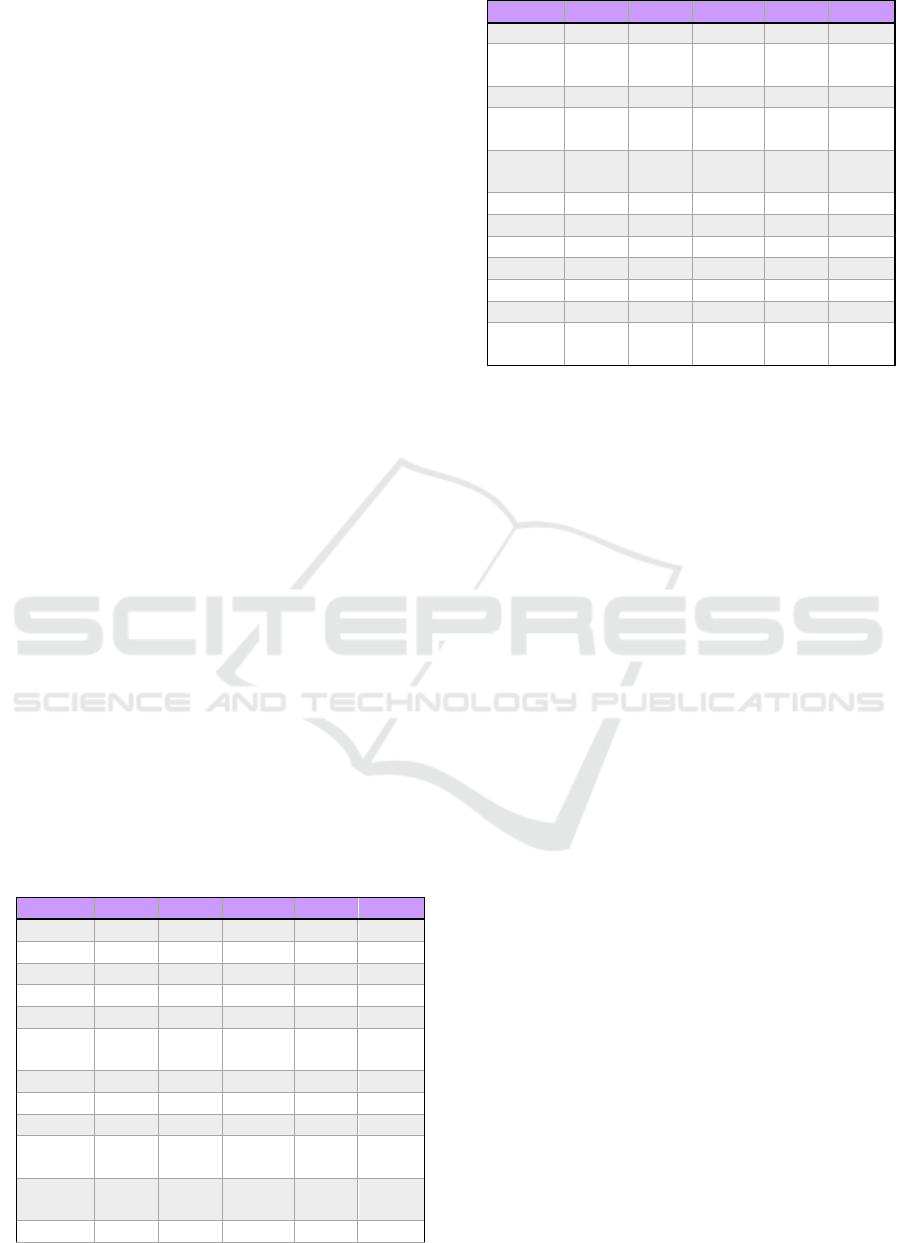

Table 1: Operating profit of agriculture sector companies.

Emiten 2015 2016 2017 2018 2019

AALI 14,19 18,83 17,63 12,19 5,50

ANDI 14,72 31,36 8,73 17,28 12,53

ANJT 17,04 12,13 44,57 4,69 -5,58

BEEF 4,81 5,17 7,36 10,01 9,46

BISI 22,33 23,79 21,67 21,98 17,61

BWPT 8,75 9,63 13,45 5,85

-

23,37

CSRA

20,40 30,81 20,91 17,42

DSFI 4,12 2,38 2,77 2,63 3,80

DSNG 16,62 10,69 22,69 18,99 12,34

GOLL

-

18,68

12,22 -6,89

-

80,26

-

GZCO 2,53

-

41,14

-5,48

-

35,69

-

90,60

JAWA 11,64 0,70 0,26 -7,24 -6,75

Emiten 2015 2016 2017 2018 2019

LSIP 19,95 21,07 20,23 8,45 5,41

MAGP -0,72

-

83,87

-25,25

-

19,59

-

82,04

MGRO 6,41 6,38 4,19 7,66 3,51

PALM 19,31 21,43 9,93

-

19,41

-

13,09

PGUN

-

236,62

-

69,94

18,79

PNGO 12,43 7,06 7,45

PSGO -7,77 4,78 -4,11 -3,70

SGRO 16,96 15,34 18,02 10,95 9,43

SIMP 11,80 14,11 11,48 6,86 4,78

SMAR 2,81 4,86 4,44 4,23 2,97

SSMS 37,33 32,87 36,63 16,65 69,83

UNSP 4,23 3,68 10,07 -7,88

-

15,89

It can be seen from the table above that several

companies such as Astra Agro Lestari Tbk, Andira

Agro Tbk, BISI International Tbk, PP London

Sumatra Indonesia Tbk, Sampoerna Agro Tbk, Sawit

Sourcemas Sarana Tbk experienced a decline in

financial performance. Several companies even

suffered losses, such as Austindo Nusantara Jaya Tbk,

Gozco Plantations Tbk, Provident Agro Tbk, Eagle

High Plantations Tbk, Jaya Agra Wattie Tbk, Multi

Agro Gemilang Plantation Tbk, Palma Serasih Tbk,

Bakrie Sumatra Plantations Tbk.

According to the IDX, one of the agricultural

sector companies was also sued for bankruptcy in

2020. There were reports of near bankruptcy from PT.

Golden Plantation Tbk (GOLL); this happened

because of two subsidiaries of GOLL, namely PT

Bumiraya Investindo and PT Airlangga Sawit, had

been declared bankrupt. GOLL was sued for

bankruptcy so that it received a special notation 'B',

to note that the special notation 'B' means the issuer

has a petition for a declaration of bankruptcy. The

main reason is because of the negligence of the

management of the company, namely not calculating

financial ratios so that they do not understand the

Company's actual financial condition.

The liquidity ratio or financial ratio shows the

Company's performance in paying its obligations in

the short-term. This Ratio is to calculate and show the

Company's liquidity. For example, suppose the

Company cannot properly manage all its operational

needs. In that case, it will make it difficult for the

Company to pay off its obligations so that at times

like this, the Company will feel financial distress. The

profitability ratio is the ratio of the Company's profit

management (Dewi & Wirajaya, 2013). If the

Company's profitability increases, it can be safe or

avoid a financial crisis. The leverage or solvency ratio

ICAESS 2021 - The International Conference on Applied Economics and Social Science

98

shows company’s ability meeting all of its financial

obligations. If the Company can manage finances

well, Company will be free from financial distress.

Although many previous studies have discussed

how profitability, liquidity and solvency affect

financial distress, the study's results still contain

inconsistencies. Several related studies have

previously been conducted abroad, namely Vietnam,

China, France, Malaysia, and the UAE. They proved

that liquidity, profitability, and solvency significantly

affect financial distress (Vinh, 2015). Another study

by Geng, Bose, & Chen (2014) and Mselmi, Lahiani,

& Hamza (2017) also showed the same results. A

study conducted by Yap, Munuswamy, & Mohamed

(2012) confirmed that liquidity affected financial

distress while profitability and solvency had no

effect. His research shows that profitability has a

significant impact, and liquidity does not

substantially impact financial distress (Zaki, Bah, &

Rao, 2011).

In addition to these countries, related research is

also carried out in Indonesia. Describes the impact of

liquidity, profitability, and leverage on financial

distress, which shows that the three ratios have a

significant effect (Hanifa, 2019). In the same year,

research was also conducted by Fitri & Zannati

(2019). The study results revealed that liquidity and

solvency affect financial distress, while profitability

affected financial distress. Research with the results

of liquidity and solvency ratios has a significant

impact on financial distress (Yuliatri, 2018).

Another study conducted by Afiqoh & Laila

(2018) shows that profitability and solvency affect

financial distress. In the same year, research by

Debora (2018) shows that solvency has a positive

effect, and liquidity affect the financial distress of the

company. The study results, which explained that

solvency has a significant impact, while liquidity and

profitability did not have a considerable impact on

financial distress was carried out by (Hanifah &

Purwanto, 2013). Other studies also explain that

liquidity and solvency do not affect financial distress

(Putri & Merkusiwati, 2014).

Previous research has proven that liquidity and

profitability effect on financial distress significantly.

DAR & DER substantially impacts solvency proxies,

while TIE does not substantially affect financial

distress. This research replicates Rusli, Prihatni &

Buchdadi (2019), who researched in Indonesia. This

research differs from others in terms of the sample

and year of research. This research draws a sample of

companies in the agricultural sector listed on the IDX

from 2015-2019. Therefore, researchers are

interested in researching with the title "The Effect of

Profitability, Liquidity, and Solvency on Financial

Distress in the Agricultural Sector Listed on the

IDX."

2 THEORY AND DEVELOPMENT

OF HYPOTHESES

2.1 Signaling Theory

Signal theory was first coined by Michael Spence

(1973), which is an action by company management

to signal investors about viewing the Company's

prospects. As a result, management must provide the

best decisions to improve the Company's welfare and

increase shareholder wealth. Knowing the

relationship between this research and signal theory

is shown through financial statement information

interpreted as a signal of good news or bad news so

that internal and external parties can appropriately use

it. Therefore, from the beginning, the Company's

business is asked to make financial statements

correctly.

The use of signaling theory is related to

profitability. High profitability will be a good news

signal indicating that the Company's financial

performance is good. Signal theory is associated with

the liquidity ratio, and a good news signal will appear

if the Company has high ability to pay its short-term

debt. The situation shows that the Company can

overcome its debt problems. Signaling theory is

concerned with solvency ratios. Solvency is used to

determine the extent to which the Company can pay

all its debts. The higher the company’s debt indicates

the possibility of the Company having difficulty

paying debts, the lower the solvency will be a signal

of good news.

2.2 Agency Theory

This agency theory arises because of the occurrence

of a contract between the principal and the agent to

manage the company and delegate authority to the

agent in making decisions. The principal delegates

responsibility for the Company's decision-making to

the agent so that the agent is given the mandate to

carry out tasks based on the contract agreement

between the two parties that is carried out properly.

In this case, the principal is the shareholder, while the

management is the agent.

Ownership of information held by managers can

trigger activities according to management's will and

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock

Exchange (IDX)

99

personal interests, so it is difficult for capital owners

to effectively monitor the activities carried out by

management because of the limited information they

have. There is an opportunity for the agent to

maximize personal welfare contrary to the principal's

interests by limiting the information provided about

the Company to the principal (Jansen & Meckling,

1976). The difference in the ownership of information

held between the two parties causes information

misalignment or information asymmetry.

Stakeholders must be aware of declining or

unfavorable financial performance conditions. This is

related to the potential for financial distress in the

Company.

2.3 Financial Ratio

The liquidity ratio is to show that the company can

pay its short-term debt. The Company will be said to

be liquid if the Company can fulfill its obligations,

whereas if the Company is not liquid or can be said to

be illiquid because the Company is unable to meet its

obligations. This study uses the current ratio and

working capital to total assets.

Profit is income minus expenses and losses during

the reporting period (Dewi & Wirajaya, 2013).

Profitability analysis is very important for creditors

and equity investors. It can be used for Interest and

principal payments for creditors and the determinants

of changes in the value of securities for equity

investors. Therefore, how these profits can maximize

shareholders is an essential task for the Company.

This study uses Return on Equity and Return on

Assets.

Solvency is often called the leverage ratio, means

the company can meet all of the company's financial

obligations (Yanti & Oktari, 2018). This Ratio also

describes the comparison between the assets owned

by the Company and the debts funded by creditors.

Thus, solvency is used to determine how capable a

company can be seen from the level of debt. This

research uses Debt to Total Asset Ratio, Debt to Total

Equity Ratio, and Time Interest Earned.

2.4 Financial Distress

An economic condition that experienced a decline

and crisis in a company before bankruptcy is called

financial distress. Financial distress starts from

difficulty paying the short-term debt as a mild factor

to bankruptcy, the most severe factor (Hanifah &

Purwanto, 2013). This condition also occurs when the

Company is unable or fails to fulfill its obligations

(Hantono, 2019). Companies that will experience

financial distress are common

2.5 The Effect of Financial Ratios on

Financial Distress

2.5.1 The Effect of the Current Ratio on

Financial Distress

The Current Ratio is the simplest way of calculating

the liquidity ratio compared to other methods. This

calculation is intended to measure whether the

company can meet its short-term obligations with the

Company's current liquid assets or current assets.

The results of Rusli, Prihatni & Buchdadi's

research (2019) prove that current ratio affects on

financial distress significantly negative. This means

that the higher the Company's C.R., the lower the

probability that the Company will experience

financial distress because it can manage its current

assets to pay off debt. Short term. According to this

research, the researcher formulated the first

hypothesis as follows,

H01: Current Ratio has no significant effect on

financial distress.

Ha1: Current Ratio has a significant effect on

financial distress.

2.5.2 The Effect of Working Capital to Total

Assets on Financial Distress

Working Capital to Total Assets (WCTA) is a

measure of liquidity. This ratio shows the proportion

of net working capital to total assets. The larger the

WCTA will increase profits which in turn will affect

the increase in profit growth.

The results of Rusli, Prihatni & Buchdadi's

research (2019) prove that working capital to total

assets have a significant negative effect on financial

distress, which means that the higher the company's

WCTA, the lower the company encounters financial

distress. Based on this research, the researcher

formulated the second hypothesis as follows,

H02: Working capital to total assets has no significant

effect on financial distress.

Ha2: Working capital to total assets has a significant

effect on financial distress.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

100

2.5.3 The Effect of ROE on Financial

Distress

ROE is to see how the company can gain net income

by using its capital. ROE calculation can be used as a

benchmark for the Company's financial performance.

The higher the ROE ratio, the higher the Company's

value; the higher the investment by investor.

The results of Rusli, Prihatni & Buchdadi's

research (2019) prove that ROE has a significant

negative effect on financial distress, which indicates

that the higher the Company's ROE, the lower the

probability that the Company will experience

financial distress. Based on this research, the

researcher formulated the third hypothesis as follows,

H03: ROE has no significant effect on financial

distress.

Ha3: ROE has a significant effect on financial

distress.

2.5.4 The Effect of ROA on Financial

Distress

Return on assets (ROA) is a profitability ratio that

measures the Company's efficiency in generating

income or profits from economic resources or assets

owned in its balance sheet. In simpler terms, ROA can

be defined as comparing net income after tax and total

assets owned by a company.

The results of Rusli, Prihatni & Buchdadi's

research (2019) prove that there is a significant

negative effect of ROA on financial distress. This

means that the higher the ROA, the lower the

probability that the Company will experience

financial distress. It indicates the more effective use

of assets, the greater the profit or profit earned. Will

be obtained by the Company. Based on this research,

the researcher formulated the fourth hypothesis as

follows,

H04: ROA has no significant effect on financial

distress.

Ha4: ROA has a significant effect on financial

distress.

2.5.5 The Effect of DAR on Financial

Distress

The debt to assets ratio is needed by the Company in

measuring the Company's financial health, especially

in bearing the debt it has. The debt to assets ratio uses

the Ratio of total debt to total assets owned.

Therefore, if the debt to asset ratio is high, the

company's risk in paying off its obligations.

The results of Rusli, Prihatni & Buchdadi's research

(2019) prove that DAR has a significant positive

effect on financial distress, which pictures that there

is relationship between DAR and financial distress. If

the Company's DAR is higher, then there will be

possibility the company experiencing financial

distress higher. Based on this research, the researcher

formulates the fifth hypothesis as follows,

H05: DAR has no significant effect on financial

distress.

Ha5: DAR has a significant effect on financial

distress.

2.5.6 The Effect of DER on Financial

Distress

Debt to Equity Ratio (debt to equity ratio), or what

can be abbreviated as DER, is the ratio of debt to

Equity. Debt to Equity Ratio (DER) is a financial

ratio that compares debt to Equity. Equity and the

amount of debt used for company operations must be

in a proportional amount.

The results of Rusli, Prihatni & Buchdadi's research

(2019) prove that DER has a significant positive

effect on financial distress, which it has relationship

between financial distress and DER. The higher the

DER, the higher the probability that the Company

will experience financial distress. Based on this

research, the researcher formulated the sixth

hypothesis as follows,

H06: DER has no significant effect on financial

distress.

Ha6: DER has a significant effect on financial

distress.

2.5.7 The Effect of times Interest Earned

Ratio on Financial Distress

The TIE ratio measures the amount of profit before

tax and interest is used to pay interest in the future.

Creditors will prefer companies with higher interest

coverage ratios because it means that the company

can pay its interest debt when it is due.

The results of Rusli, Prihatni & Buchdadi's research

(2019) prove that TIE has no significant adverse

effect on financial distress. Based on this research, the

researcher formulated the seventh hypothesis as

follows,

H07: TIE has a significant effect on financial distress.

Ha7: TIE has no significant effect on financial

distress.

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock

Exchange (IDX)

101

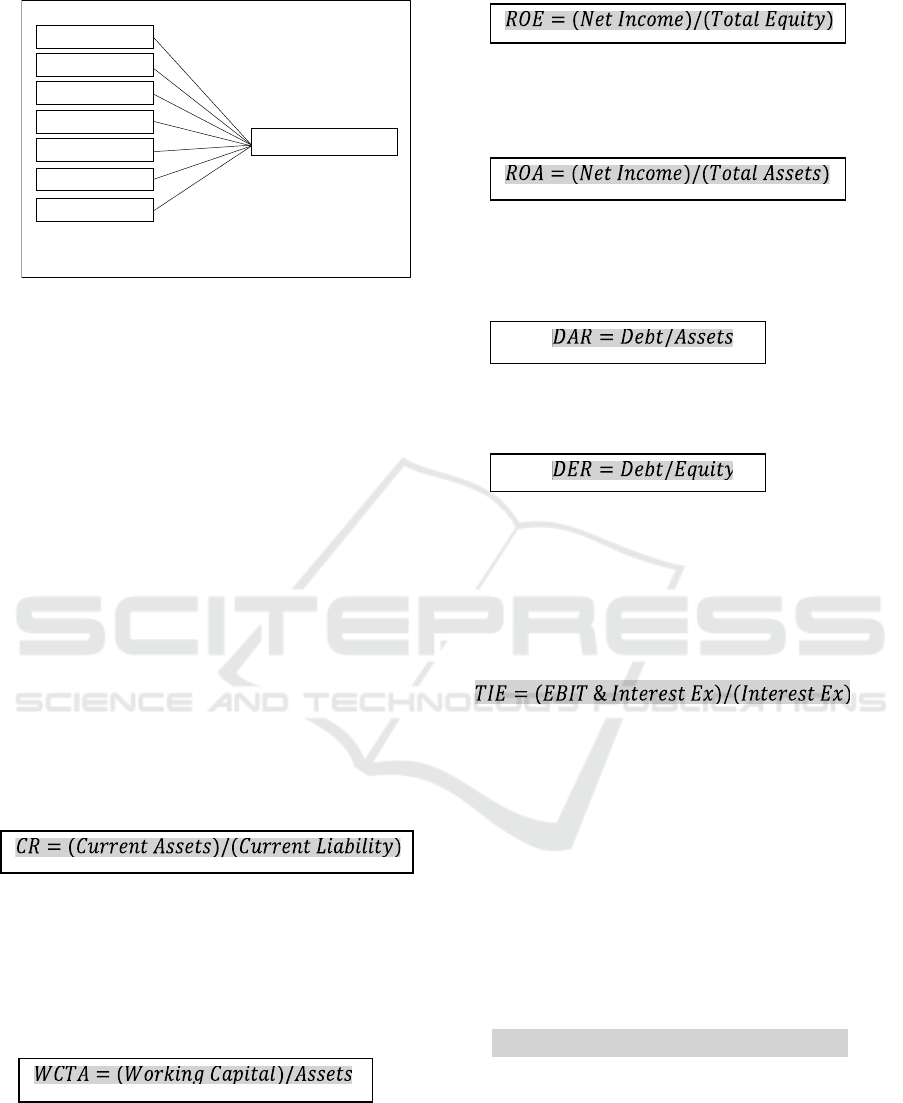

Figure 2: Research Model Framework

3 RESEARCH METHODS

This study is a quantitative study to provide evidence

of the effect of financial ratios on the Company's

financial distress. Secondary data on company annual

reports published on the Indonesia Stock Exchange

(IDX) for the 2015-2019 period through the website

www.IDX.co.id. The population used as the sample

of this study consisted of companies in the

agricultural sector.

3.1 Operational Definition

3.1.1 Dependent Variables

Current Ratio

This ratio is to know the Company's ability to pay off

short-term debts that are maturing.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Working Capital to Total Assets

Calculating the ratio is to compare working capital

with total assets or commonly referred to as ratios to

calculate the liquidity of the Company's assets

relative to total capital.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Return on Equity (ROE)

ROE is to measure net profit after tax with own

capital and the efficient use of own funds.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Return on Assets (ROA)

ROA calculates the yield of the assets used in the

company.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Debt to Asset Ratio

The ratio calculates the ratio between total debt to

total assets.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Debt to Equity Ratio

The ratio compares total liabilities with Equity.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Times Interest Earned Ratio

The ratio analyses the company's ability to pay

interest costs in the next period. This Ratio analyses

profit and interest before tax with interest expense

based on accounting principles.

Source: (Rusli, Prihatni, & Buchdadi, 2019)

3.1.2 Independent Variables

Financial distress

The declining stage of the company's financial that

takes place before the company goes bankrupt or

liquidates is called financial distress. According to

Altman, Altman Z-Score is a discriminant analysis to

predict financial distress (Y).

bankruptcy model:

Source: (Rusli, Prihatni, & Buchdadi, 2019)

Description:

X1: (Current Assets − Current Liabilities) / Total

Assets

X2: Retained Earnings / Total Assets

X3: Earnings Before Interest and Taxes / Total Assets

X4: Book Value of Equity / Total Liabilities Z-Score

H1: CR

H2: WCTA

H3: ROE

FINANCIAL DISTRESS

H4: ROA

H5: DAR

H6: DER

Variabel Dependen

H7: TIE

Variabel Independen

Z = 6,56 X1 + 3,26 X2 + 6,72 X3 + 1,05X4

ICAESS 2021 - The International Conference on Applied Economics and Social Science

102

Zones of discrimination:

Z > 2,6: safe zone

1,1 < Z < 2,6: grey zone

Z < 1,1: distress zone

3.2 Data Processing Techniques

Data processing in this study was carried out in

several steps: determining variables, summarizing,

calculating ratios, and processing data using the

eviews application. The analysis method in this study

uses descriptive statistics, classical assumption tests,

hypothesis testing, and panel data regression analysis.

The regression model is:

Description:

Y = financial distress

α = Constant

βX1 = Current Ratio

βX2 = WCTA

βX3 = ROE

βX4 = ROA

βX5 = DAR

βX6 = DER

βX7 = TIE

4 RESULT AND DISCUSSIONS

4.1 Descriptive of Research Samples

The data population is companies that are in the

agricultural sector in Indonesia, which are registered

on the Indonesia Stock Exchange during 2015-2019.

The sample taken is the whole of the population

which among some of the data is not sampled due to

certain reasons. The total sample processed during the

2015-2019 period is 75 companies. The number of

samples for this study is shown in Table 1 as follows:

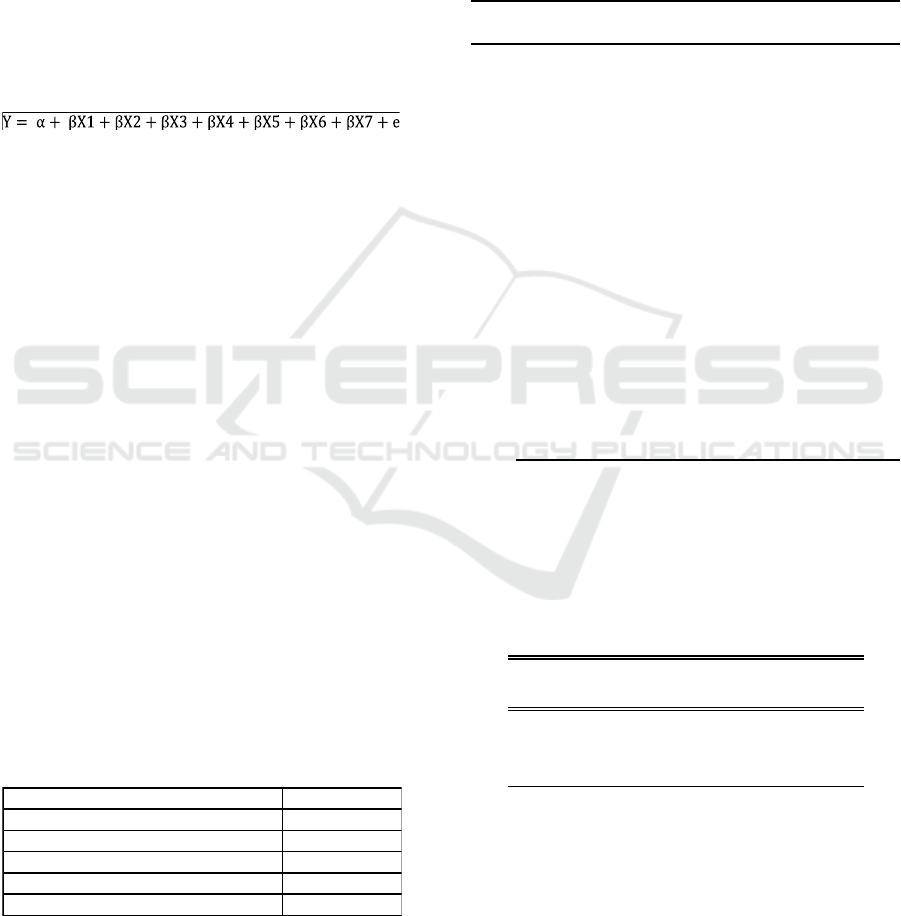

Table 2: Total Research Sample.

4.2 Descriptive Statistics

The description of statistical analysis data in this

research is presented in tabular form. It displays the

minimum, maximum, mean, and standard deviation

values of the research data. In addition, the results of

the descriptive statistical analysis of the study are

shown in table 3 below.

Table 3 Descriptive Statics

Mean Maximum Minimum

Std.

Deviation

Y

2.376

762

14.915980 -17.775440 5.057127

X1

1.566

533

6.770000 0.070000 1.605499

X2

0.019

938

0.720305 -1.285852 0.302073

X3

-

10.45

5470

25.490000 -350.30000 48.822300

X4

-

0.777

467

15.380000 -58.250000 11.216840

X5

0.531

333

1.650000 0.110000 0.251811

X6

0.830

267

11.270000 -30.640000 4.264892

X7

160.7

72800

6419.5300

00

-3.060000

778.15700

0

N 75

Source: Output Eviews 9 (2021)

4.3 Eviews Model Test Results

Chow Test

Table 4 Chow Test

Effects Test Statistic d.f. Prob.

Cross-section F 7.970037

(

14,53

)

0.0000

Cross-section

Chi-s

q

uare 84.983098 14 0.0000

Source: Output Eviews 9 (2021)

The probability of a chi-square cross-section in the

table above is 0.0000. This indicates that the

probability value of the chi-square cross-section <

0.05. Therefore, the results of the chow test indicate

that it is more appropriate to use the Fixed Effect

Criterion Number of companies

Agricultural companies registered during 2015-2019 24

Incomplete financial statements -7

Not using rupiah -1

Not submitting financial statements -1

(15 companies multiplied by 5 years) 75

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock

Exchange (IDX)

103

Model (FEM) than the Common Effect Model

(CEM).

Hausman Test

Table 5 Hausman Test

Test

Summar

y

Chi-Sq. Statistic Chi-Sq. d.f. Prob.

Cross-

section

rando

m

42.261398 7

0.000

0

Source: Output Eviews 9 (2021)

The magnitude of the random cross-section

probability value in the table above is 0.0000.

Hausman test results show that a significance of <

0.05. So that the selection of the right model is fixed

effect model (FEM) because the results of the chow

test and Hausman test both show that the right model

is FEM, so there is no need to do the next, namely the

langrage multiplier test.

4.4 Classic Assumption Test

Multicollinearity Test

Table 6 Multicollinearity Test

X1 X2 X3 X4 X5 X6 X7

X1

1.0000

00

0.7426

28

0.3104

87

0.4782

41

-

0.5719

35

0.0012

58

0.4617

80

X2

0.7426

28

1.0000

00

0.5716

97

0.6648

92

-

0.7503

36

0.2800

89

0.3106

25

X3

0.3104

87

0.5716

97

1.0000

00

0.5948

12

-

0.5178

63

0.7109

98

0.1055

22

X4

0.4782

41

0.6648

92

0.5948

12

1.0000

00

-

0.6223

86

0.1155

11

0.2346

45

X5

-

0.5719

35

-

0.7503

36

-

0.5178

63

-

0.6223

86

1.0000

00

-

0.1327

12

-

0.3023

72

X6

0.0012

58

0.2800

89

0.7109

98

0.1155

11

-

0.1327

12

1.0000

00

-

0.0307

02

X7

0.4617

80

0.3106

25

0.1055

22

0.2346

45

-

0.3023

72

-

0.0307

02

1.0000

00

Source: Output Eviews 9 (2021)

Based on the test results, all variables do not have

multicollinearity because they value < 0.8.

Heteroskedasticity Test

Table 7 Glejser Test

F-statistic

1.7792

82 Prob. F (7,67) 0.1060

Obs*R-

square

d

11.756

64

Prob. Chi-Square

(7) 0.1089

Scaled

explained SS

10.884

73

Prob. Chi-Square

(7) 0.1437

Source: Output Eviews 9 (2021)

According to the results that the value of *R-

squared is 11.75664 and the value of probability is

0.1089, which means > 0.05, it can be concluded that

the data does not experience heteroskedasticity

problems.

4.5 Hypothesis Test

Table 8 Fixed Effect Model (FEM)

Variable Coefficient Std. Erro

r

t-Statistic Prob.

C 6.465334 0.296775 21.78533 0.0000

X1 0.250005 0.061282 4.079582 0.0002

X2 4.176591 0.566570 7.371709 0.0000

X3 -0.005073 0.002249 -2.256105 0.0282

X4 0.059207 0.008623 6.866052 0.0000

X5 -8.663884 0.549610 -15.76371 0.0000

X6 0.033516 0.019957 1.679408 0.0990

X7 0.000032 0.000081 0.389715 0.6983

Source: Output Eviews 9 (2021)

Partial tests are to know the effect of independent

variables on dependent variables. The decision to

accept or reject a hypothesis is to look at its

probability value. The decision-making criterion is

that if the probability value is <0.05, the variable has

a significant effect. However, if the probability value

is>0.05, then the variable has no effect. The results of

the partial test can be seen in table 7 above. The

coefficient of determination is x` to determine the

percentage of independent variables together to

explain dependent variables. The results of the

coefficient of determination can be seen in Table 8

below as follows.

Table 9 Coefficient of Determination

Wei

g

hted Statistics

R-square

d

0.997339

Mean dependent

va

r

7.54746

0

Adjusted R-

square

d

0.996284 S.D. dependent va

r

10.9089

0

S.E. of re

g

ression0.559338 Sum s

q

uared resi

d

16.5815

0

ICAESS 2021 - The International Conference on Applied Economics and Social Science

104

F-statistic 945.7964

Durbin-Watson

stat

1.85313

9

Prob

(

F-statistic

)

0.000000

Unwei

g

hted Statistics

R-s

q

uare

d

0.987532

Mean dependen

t

va

r

2.37676

2

Sum square

d

reside 23.59616

Durbin-Watson

stat

1.44226

3

Source: Output Eviews 9 (2021)

Adjusted R-squared in table 8 shows a value of

0,996284. This number will be changed to percentage

form. This means that dependent variables in

financial distress are affected by independent

variables (C.R., WCTA, ROE, ROA, DAR, DER,

and TIE)of 99% (0.9962), and the remaining 1% is

explained by other factors outside the research model.

4.6 Data Analysis

Based on the hypothesis test results between

independent and dependent variables, the summary of

hypothesis test results can be seen in Table 9.

Table 10 Summary of Hypothesis Test Results

Hypothesis Conclusion

H1: C.R. significant effect on financial

distress

Accepted

H2: WCTA significant effect on

financial distress

Accepted

H3: ROE significant effect on

financial distress

Accepted

H4: ROA significant effect on

financial distress

H5: DAR significant effect on

financial distress

H6: DER has no significant effect on

financial distress

H7: TIE has no significant effect on

financial distress

Accepted

Accepted

Unaccepted

Accepted

Based on the summary of the results of the study

in table 4.10, it can be concluded that not all

hypotheses are supported. It is seen from the results

showing that partially Current Ratio (C.R.),

Working Capital to Total Assets (WCTA), Return

on Equity (ROE), and Return on Assets (ROA) and

Debt Asset Ratio (DAR) affect financial distress. At

the same time, Debt Equity Ratio (DER) and Time

Interest Earned (TIE) do not affect financial distress.

4.6.1 Current Ratio Affects Financial

Distress

H1 shows that C.R. affects on financial distress

positive significantly. This is evidenced by a

significance value of 0.0002, which means less than

the significance level of 0.05. The coefficient value is

0.250005, which means the Current Ratio (C.R.)

positively influences financial distress. These results

are in line with the results of research conducted by

Yuliatri (2018) and Yap, Munuswamy, & Mohamed

(2012), which explained that the Current Ratio (C.R.)

has a significant positive effect on financial distress.

A positive influence indicates that the higher the

current ratio value, the higher the value of z-score

financial distress.

Based on this, the more current assets owned by

the Company means that assets that can be used as

money are also more and more so that the Company

can meet its short-term obligations in time. So it will

provide information to management that the

Company is able to meet its short-term obligations,

which shows that the Company is in good health and

not in a depressed state. Different from the results of

research conducted by Zaki, Bah, & Rao (2011) and

Fitri & Zannati (2019), which explained that the

current Ratio does not affect financial distress.

4.6.2 Working Capital to Total Assets

Affects Financial Distress

H2 shows that WCTA affects on financial distress

significantly. This is evidenced by a significance

value of 0.0000, which means less than the

significance level of 0.05. The coefficient value is

4.176591, which means wcta has a positive influence

on financial distress. This result implies that the

higher the value of working capital to total assets, the

higher the value of z-score financial distress. Good

capital utilization will result in good working capital

value and can positively impact the Company's

performance in the next period. Paying attention to

working capital will allow the Company to use its

power source economically to minimize the danger of

the financial crisis. The results of this study are

reinforced by research conducted by Vinh (2015) and

Geng, Bose, & Chen (2014), which explained that

Working Capital to Total Assets (WCTA) has a

significant positive effect on financial distress.

Research by Mselmi, Lahiani, & Hamza (2017) did

not show the same results. The study explained that

Working Capital to Total Assets (WCTA) had no

significant effect on financial distress.

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock

Exchange (IDX)

105

4.6.3 Return on Equity Affects Financial

Distress

H3 shows that Return on Equity (ROE) has a

significant effect on financial distress. This is

evidenced by a significance value of 0.028, which

means smaller than the significance level of 0.05. The

coefficient value of -0.00507 means Return on Equity

(ROE) negatively influences financial distress. The

results of this study are in line with research

conducted by Rusli, Prihatni, & Buchdadi (2019) and

Vinh (2015), which states that Return on Equity

(ROE) negatively affects financial distress. This

negative influence indicates that the higher the return

on equity value, the lower the value of z-score

financial distress. This can be due to the low level of

the Company's ability to make a profit when viewed

from the overall average numbers in the last 5 years.

This research is not in line with the research results

owned by Mselmi, Lahiani, & Hamza (2017), which

is ROE has no effect on financial distress. Negative

corporate profitability indicates the lack of

effectiveness of the use of company assets to generate

net income. If the company's profitability actually

decreases and even amounts to negative, then the

possibility of the Company going bankrupt is greater.

On the other hand, if the value of a company's ROE

is high, it can be better, and its performance makes

profits. In other terms, ROE can show how much

profit is earned by the Company. But if the higher the

profit obtained allows the existence of funds that are

not used as needed, if this cannot be observed, the

possibility of the Company can experience

bankruptcy before experiencing financial difficulties.

4.6.4 Return on Assets Has an Effect on

Financial Distress

H4 shows that Return on Assets (ROA) has a

significant effect on financial distress. This is

evidenced by a significance value of 0.0000, which

means less than the significance level of 0.05. The

coefficient value is 0.059207, which means Return on

Assets (ROA) positively influences financial

distress. The results of this study are the similar with

research that was conducted by Hanifa (2019) and

Afiqoh & Laila (2018), which states that Return on

Assets (ROA) positively affects financial distress.

This result explains that the amount of net income can

generate each rupiah of the fund embedded in the total

assets, or vice versa. So if the higher the value of

return on assets (ROA), financial distress conditions

are less likely. In contrast to the research results

owned by Yap, Munuswamy, Mohamed (2012) and

Hanifah & Purwanto (2013), which shows that ROA

has no impact on financial distress.

4.6.5 Debt to Assets Ratio Has an Effect on

Financial Distress

H5 shows that the Debt to Total Assets Ratio

(DAR)has a significant effect on financial distress.

This is evidenced by a significance value of 0.0000,

which means less than the significance level of 0.05.

The coefficient value of -8.66388 means the Debt to

Assets Ratio (DAR) negatively influences Financial

distress. The presence of this negative influence

indicates that the higher the value of debt to total

assets, the lower the value of z-score financial

distress. Companies with high DAR values will not

necessarily be spared from financial distress, and

companies with the lowest DAR values also do not

always experience financial distress. This can be

caused if many companies whose activities are

financed by debt will also be the possibility of

financial distress conditions due to the greater the

obligation of the Company to pay the debt. This study

is in line with the results analyzed by Yuliatri (2018)

and Mselmi, Lahiani, & Hamza (2017), who stated

that DAR negatively affects financial distress but,

this study is not in line with the results of Debora

(2018) and Yap, Munuswamy, & Mohamed (2012).

They said that DAR has no effect on financial

distress.

4.6.6 Debt to Equity Ratio Has an Effect on

Financial Distress

H6 shows that the Debt to Total Equity Ratio (DER)

has no significant effect on financial distress. This is

evidenced by a significance value of 0.099, which

means greater than the significance level of 0.05, then

DER cannot predict the condition of financial distress

in agricultural sector companies. The coefficient

value is 0.033516, which means the debt to equity

ratio (DER) positively influences financial distress.

The amount of debt greater than the amount of all net

capital can result in the Company's burden on large

outsiders as well, which will adversely affect the

financial health condition of the Company. In

addition, the amount of debt burden can reduce the

amount of net income the Company will receive,

which will ultimately reduce profits for shareholders.

This research is not in line with the results of research

conducted by Hanifa (2019) and Afiqoh & Laila

(2018), in which DER is able to predict financial

distress. The ideal DER is below 1, but if there are

companies with DER above 1, it can not be said the

Company is not good. This can happen if the

ICAESS 2021 - The International Conference on Applied Economics and Social Science

106

obligation is only short-term debt, business debt to

suppliers (vendors), or debts resulting from income

received in advance (down payment). It can be said

that the debt is relatively healthy. If it turns out that

long-term debt is greater than short-term debt, the

condition is less healthy. The Company will continue

to bear the obligation to pay principal and interest on

the loan until the debt is paid off. These conditions

will suppress profits earned by the Company or may

interfere with liquidity in the future.

4.6.7 Time Interest Earned Has No Effect on

Financial Distress

H7 shows that TIE has no significant effect on

financial distress. This is evidenced by a significance

value of 0.6983, which means greater than the

significance level of 0.05. The coefficient value is

0.000032, which means TIE positively influences

Financial distress. TIE is not the main factor affecting

financial distress in agricultural sector companies

because it has no significant effect. Creditors will

prefer companies with a higher Times Interest Earned

Ratio because it shows the Company can afford to pay

its interest expense at maturity. Companies that have

a high Times Interest Earned Ratio have lower credit

risk. According to the results of research conducted

by Rusli (2019), TIE has no significant negative

influence on financial distress.

5 CONCLUSIONS

In this research, the independent variables used are

financial ratios specified into liquidity (current ratio

and working capital to total assets), profitability

(return on equity and return on assets), and solvency

(debt asset ratio, debt-equity ratio, and time interest

earned). The dependent variable in this study is

financial distress. Then you can conclude as follows:

1. The Current Ratio (C.R.) has a significant effect

on financial distress and positive direction.

2. Working Capital to Total Assets (WCTA) has a

significant effect on financial distress and

positive direction.

3. Return on Equity (ROE) has a significant effect

on financial distress and negative direction.

4. Return on Assets (ROA)has a significant effect

on financial distress and positive direction.

5. Debt Asset Ratio (DAR) has a significant effect

on financial distress and negative direction.

6. Debt Equity Ratio (DER) has no significant

effect on financial distress and positive direction.

7. Time Interest Earned (TIE) has no significant

effect on financial distress and positive direction.

Some limitations in this research need to be put

forward that are useful for developing similar

research in the future. There are several limitations,

namely: This research is limited to companies in the

agricultural sector listed on the IDX, so it has not

represented all companies listed on the IDX, the

period of this study was only conducted for five years,

namely 2015-2019 so that results cannot be

generalized for previous years or after and this study

only tested a few variables namely liquidity ratio,

profitability ratio, and solvency ratio.

Based on the limitations that have been outlined,

the suggestions for future research are: (1) Further

research is expected to expand the research sample;

(2) Expand longer timescales to illustrate the

comparison of financial performance better and better

illustrate the effect of liquidity and solvency on

profitability; (3) Further research is expected to add

other independent variables that are likely to affect

the Company's financial distress.

REFERENCES

Moore, R., Lopes, J., 1999. Paper templates. In

TEMPLATE’06, 1st International Conference on

Template Production. SCITEPRESS.

Smith, J., 1998. The book, The publishing company.

London, 2

nd

edition.

Afiqoh, L., & Laila, N. (2018). Effect of Financial

Performance on The Risk of Bankruptcy of Islamic

Commercial Banks in Indonesia (Altman Z-Score

Modification Method). Journal of Islamic Economics

and Business, Vol. 4, No. 2.

Altman, E. L. (2000). Predicting Financial Distress Of

Companies: Revisiting The Z-Score And Zeta®.

Journal of Banking & Finance.

Central Bureau of Statistics. (2020). Indonesia National

Income 2015-2019. Jakarta: Central Bureau of

Statistics.

CENTRAL BUREAU OF STATISTICS. (2021, January).

Https://www.bps.go.id. Retrieved from

https://www.bps.go.id/publication/download.html?

Basuki, A. T., & Nano, P. (2016). Regression Analysis in

Economic &Business Research. Jakarta: Rajawali Pers.

INDONESIA STOCK EXCHANGE. (2020). Retrieved

from www.IDX.co.id

Deborah, L. I. (2018). The Effect of Good Corporate

Governance & Ratio of Corporate Finance to Financial

Distress.

Dewi, A. S., & Wirajaya, A. (2013). The Effect of Capital

Structure, Profitability, and Company Size on

Company Value. E-Journal of Accounting Udayana

University 4.2,358-372.

The Effect of Liquidity, Profitability, and Solvency to the Financial Distress in Agricultural Sector Companies Listed on the Indonesia Stock

Exchange (IDX)

107

Fauziah, E. S., & Khoerulloh, A. K. (2020). The Effect of

Exports and Imports on Economic Growth with

Exchange Rates as An Intervening Variable. Social

Treasures, Vol. 2,15-24.

Fitri, N., & Zannati, R. (2019). Altman Z-Score Model on

Financial Performance on The Indonesia Stock

Exchange Through Logistic Regression Approach.

ACCURACY: Journal of Accounting and Financial

Research,63 - 72.

Gang, R., Bose, I., & Chen, X. (2014). Prediction of

Financial Distress: An Empirical Study of Listed

Chinese Companies Using Data Mining. European

Journal of Operational Research.

Ghozali, I. (2016). Multivariate Analysis Application With

IBM SPSS 23 Program (8th Edition). Semarang:

Diponegoro University Issuing Board.

Greenpeace Indonesia. (2020). Greenpeace.org. Retrieved

from https://www.greenpeace.org/

Hanifa, R. U. (2019). Effect of Liquidity, Profitability,

Leverage, and Activity on Corporate Financial Distress.

Hanifah, O. E., & Purwanto, A. (2013). The Effect of

Corporate Governance Structure and Financial

Indicators on Financial Distress Conditions.

Diponegoro Journal of Accounting, 1.

Hantono. (2019). Predicting Financial Distress Using the

Altman Score Model, Grover Score, Zmijewski Score

(Case Study On Sub-Sectors of Large Trading

Companies). Jem Site Mikroskil.

Jansen, M.C., & Meckling, W. H. (1976). Theory of the

Firm: Managerial Behavior, Agency Cost, and

Ownership Structure. Journal of Financial and

Economics, 3(4), 305-360.

Cashmere. (2012). Analysis of Financial Statements 5th

edition. Jakarta: PT Raja Grafindo Persada.

MINISTRY OF AGRICULTURE OF THE REPUBLIC

OF INDONESIA. (2015-2019). Financial Statements.

Jakarta: Ministry of Agriculture of the Republic of

Indonesia.

MINISTRY OF AGRICULTURE OF THE REPUBLIC

OF INDONESIA. (2020). Retrieved from

https://www.pertanian.go.id/.

Khaliq, A. (2014). Identifying Financial Distress Firms: A

Case Study of Malaysia's Government Linked

Companies. International Journal of Economics,

Finance, and Management.

Mselmi, N., Lahiani, A., & Hamza, T. (2017). Financial

distress prediction: The case of French small and

medium-sized firms. International Review of Financial

Analysis,67-80.

Princess, N. K., & Merkusiwati, N. L. (2014). The Effect of

Corporate Governance Mechanism, Liquidity,

Leverage, and Corporate Size on Financial Distress. E-

Journal of Accounting Udayana University 7.1.

Rusli, M., Prihatni, R., & Buchdadi, A. D. (2019). The

Effect Of Liquidity, Profitability, And Solvability To

The Financial Distress Of Manucatured Companies

Listed On The Indonesia Stock Exchange (Idx) Period

Of the Year 2015-2017. Academy of Accounting and

Financial Studies Journal.

Spence, M. (1973). Job Market Signaling. Quarterly

Journal of Economics,355-374.

Vinh, V. X. (2015). Using Accounting Ratios in Predicting

Financial Distress: An Empirical Investigation in the

Vietnam Stock Market. Journal of Economics and

Development, Vol.17, No.1, 41-49.

Widarjono, A. (2009). Econometrics: Theory and

Application for Economics and Business. Yogyakarta:

Ekonisia.

Yanti, L. D., & Oktari, Y. (2018). Effect of Profitability

Rate, Solvability, Company Size and Size of Public

Accounting Firm On Inspection Delay (Empirical

Study: Manufacturing Companies Registered in IDX

2013-2016). Eco-Buss.

Yep, B.C., Munuswamy, D. S., & Mohamed, D. Z. (2012).

Evaluating Company Failure in Malaysia Using

Financial Ratios and Logistic Regression. Asian

Journal of Finance & Accounting.

Yuliatri, P. (2018). Effect of Liquidity, Solvency, Activity,

and Cash Flow on the Company's Health.

Zakaria, M. (2020). The Effect of the Fed's Interest Rate on

Exchange Rates.

Zaki, E., Bah, R., & Rao, A. (2011). Assessing probabilities

of financial distress of banks in UAE. International

Journal of Managerial Finance, 304-320.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

108