The Effect of Bank’s Internal Financial Ratio on Lending in

Indonesia Conventional Commercial Banks: Book IV Category

Fitri Karostiana and Sugeng Riadi

Department of Business Management, Politeknik Negeri Batam, Jl Ahmad Yani, Batam, Indonesia

Keywords: Internal Financial Ratio, Lending, Book IV Category.

Abstract: The purpose of this study is to analyse the effects of Third-Party Funds (DPK), Capital Adequacy Ratio (CAR),

Loan Deposit Ratio (LDR), Return on Asset (ROA), Non-Performing Loans (NPL) on Lending. The object

of this research is an Indonesia conventional commercial bank (book IV category) for the period 2012 – 2019.

The sampling technique uses a purposive sampling method with a sample size of 5 banks, namely Bank

Rakyat Indonesia (BRI), Bank Negara Indonesia (BNI), Bank Mandiri, Bank Central Asia (BCA), Bank

CIMB Niaga. The number of research samples used was 40 samples. This study is using multiple regression

analysis with T test and F test, Hypothesis testing methods used with IBM SPSS 26. The results showed that

DPK, CAR and ROA partially had a positive effect on lending, while LDR and NPL partially had no positive

effect on lending. DPK, CAR, LDR, ROA, NPL simultaneously effect on lending

1 INTRODUCTION

The business world in this era of globalization is

increasingly competitive which results in rapid

development of the marketing system. The marketing

activities are carried out to accelerate the circulation

of goods and services from producers to consumers

so that they are effective. The growth of marketing

activities into strategic business ideas that can

produce sustainable satisfaction. The business

activities are complex activities that require the role

of banking in serving the community, where business

activities include legal, economic and political

activities.

Financial ratio analysis is used as a benchmark for

calculating future profits and dividends, therefore

financial ratios can be one of the bases for

consideration in providing credit. Financial ratio

analysis has a big role in providing information about

the financial condition of company results in a certain

period. In accordance with the explanation above, the

formulation of the problem is determined, namely

how is the impact of the bank's internal financial

ratios on lending in conventional commercial banks

in book category IV in Indonesia.

Based on the problem formulation that the

researcher has described, the purpose of this study is

to determine the magnitude of the influence of the

bank's internal financial ratios on lending. Specific

objectives, namely to determine the influence of the

ratio of Third-Party Funds, Loan to Deposit Ratio,

Capital Adequacy Ratio, Non-Performing Loans and

Return on Assets on lending in conventional

commercial banks in the book category IV in

Indonesia.

Based on the problems that occur in the

background, the researcher discusses and limits this

research to the level of financial ratios, namely, Third

Party Fund, Loan to Deposit Ratio, Capital Adequacy

Ratio, Non-Performing Loans, Return on Assets and

lending in 2012-2019. Researchers chose the object

of research on conventional commercial banks in

book category IV, namely Bank BNI, Bank BRI,

Bank Mandiri, Bank BCA, Bank CIMB Niaga.

2 LITERATURE REVIEW

Agency theory explains that the agency relationship

is a cooperation contract where someone or more uses

or employs other people who are tasked with running

or operating company activities (Jensen and

Meckling in (Pratiwi & Prajanto, 2020). Signal

Theory according to (Sa’adah, 2018) this theory is to

increase the value or value in a company through the

reports that are presented and send signals in the

Karostiana, F. and Riadi, S.

The Effect of Bank’s Internal Financial Ratio on Lending in Indonesia Conventional Commercial Banks: Book IV Category.

DOI: 10.5220/0010860000003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 9-18

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

9

presented annual report. Positive accounting theory

developed by Blaug in (Noviantari & Ratnadi, 2015)

explains that this theory aims to describe a process

regarding the understanding and knowledge of

accounting science and the accounting policies used,

where these policies are suitable for certain

conditions in the coming period.

2.1 Previous Research

The research of (Pradana, 2019) examines the

influence of core capital, Third Party Funds or DPK,

Non-Performing Loan or NPL variables and interest

rates on the level of lending at Regional Development

Banks (BPD). The results of this study provide an

illustration that core capital has a negative influence

on lending at BPD. The DPK and NPL variables have

a negative but not significant effect on the level of

lending at the BPD. The interest rate variable has no

effect on the level of lending. Simultaneously the

variables of core capital, NPL, TPF and interest rates

(rate) affect the level of lending (lending) in BPD.

The research of (Ristyasmoro, 2018) conducted a

study on the impact of the CAR, NPL and DPK ratios

on the ROA ratio through total credit at state-owned

banks listed or listed on the Stock Exchange in 2010

to 2016. The independent variables determined were

the ratio of CAR, NPL, DPK, ROA and the dependent

variable is lending. The results obtained are the ratio

of CAR and the NPL variable to the variable number

of lending that have an effect. The ratio of TPF to the

dependent variable of lending has a significant effect,

while the effect of CAR, NPL and TPF indirectly on

return on assets through the amount of credit

disbursement has no effect.

According to (Hidayat, 2018), raised a research

entitled the effect of financial ratios and

macroeconomic variables on lending to the

Indonesian banking sector. The independent variables

are ROA, CAR, NPL, BOPO, DPK, People's

Business Credit on the other hand the dependent

variable is credit. From this research, it is found that

the BOPO, CAR, NPL and Working Capital Loan

Interest Rates have an effect on the credit variable.

The variables of TPF, ROA, KUR Credit and

inflation as well as gross domestic product (GDP)

have a significant influence on credit.

The research of (Pratiwi & Prajanto, 2020)

conducted is on external factors and internal factors

as determinants of increasing commercial bank

lending. CAR, TPF, ROA, Bank Indonesia Interest

Rate (BI Rate) are used as independent variables,

while lending is the dependent variable. The results

obtained are that the ROA, BI Rate and Growth

variables affect lending, while the CAR and TPF

ratios do not affect the credit increase.

According to (Siregar, 2016), research entitled the

effect of TPF and CAR on the amount of credit

financing in 2012 to 2014. The independent variables

are TPF and CAR while the dependent variable is

lending. Whereas DPK affects the amount of lending,

CAR does not affect lending. Simultaneously, TPF

and CAR affect lending for the 2012 - 2014 research

period.

The results of (Amelia & Murtiasih, 2017),

regarding the internal ratio to the amount of lending

at QNB Bank stated that the DPK and LDR variables

had a positive effect on the amount of credit

disbursement. The NPL ratio has a negative and

significant effect on the amount of lending. The CAR

ratio has a positive and significant effect on the

amount of credit disbursement. Simultaneously, the

variables of DPK, LDR, NPL, and CAR have an

effect on the variable of the amount of credit

disbursement.

Research conducted by (Ismawanto, 2012),

regarding internal banking ratios (DPK, NPL, CAR)

to lending in state-owned banks states that Third

Party Funds (DPK) partially affect the amount of

lending, the ratio of Non-Performing Loans has no

effect on the dependent variable, the CAR ratio

partially affects the amount of credit disbursement.

DPK, NPL, and CAR simultaneously affect the

amount of lending to state-owned banks listed on the

Indonesia Stock Exchange (IDX) for 2009 – 2018.

The research of (Ervina, 2019), raises the theme

of DPK and CAR on the amount of credit, where the

independent variables are DPK and CAR while the

dependent variable is lending. Whereas TPF affects

the amount of lending, the Capital Adequacy Ratio

does not affect the amount of credit disbursement.

Simultaneously, third party funds and CAR have a

significant positive effect on the amount of credit

financing in 2012 - 2014.

The research of (Arullia, 2017) was appointed

with the title of the effect of the ratio of CAR, NPL,

BOPO and NIM on profits with the intervening

variable credit volume. The independent variables

applied are CAR, NPL, BOPO, NIM on the other

hand the dependent variable is the volume of credit.

The results obtained are that the CAR and BOPO

variables negatively affect the credit volume, while

the NPL ratio does not affect the credit volume.

According to (Mangindaan, 2019), analysis the

LDR ratio and the NPL ratio to the volume of credit

at Regional Development Banks in Indonesia from

2013 to 2017. The independent variable in this study

was the LDR, NPL ratio with the dependent variable

ICAESS 2021 - The International Conference on Applied Economics and Social Science

10

being credit volume. From this research, it was found

that the LDR and NPL variables did not affect the

credit volume variable. If taken together, the LDR

and NPL variables do not significantly affect the

credit volume.

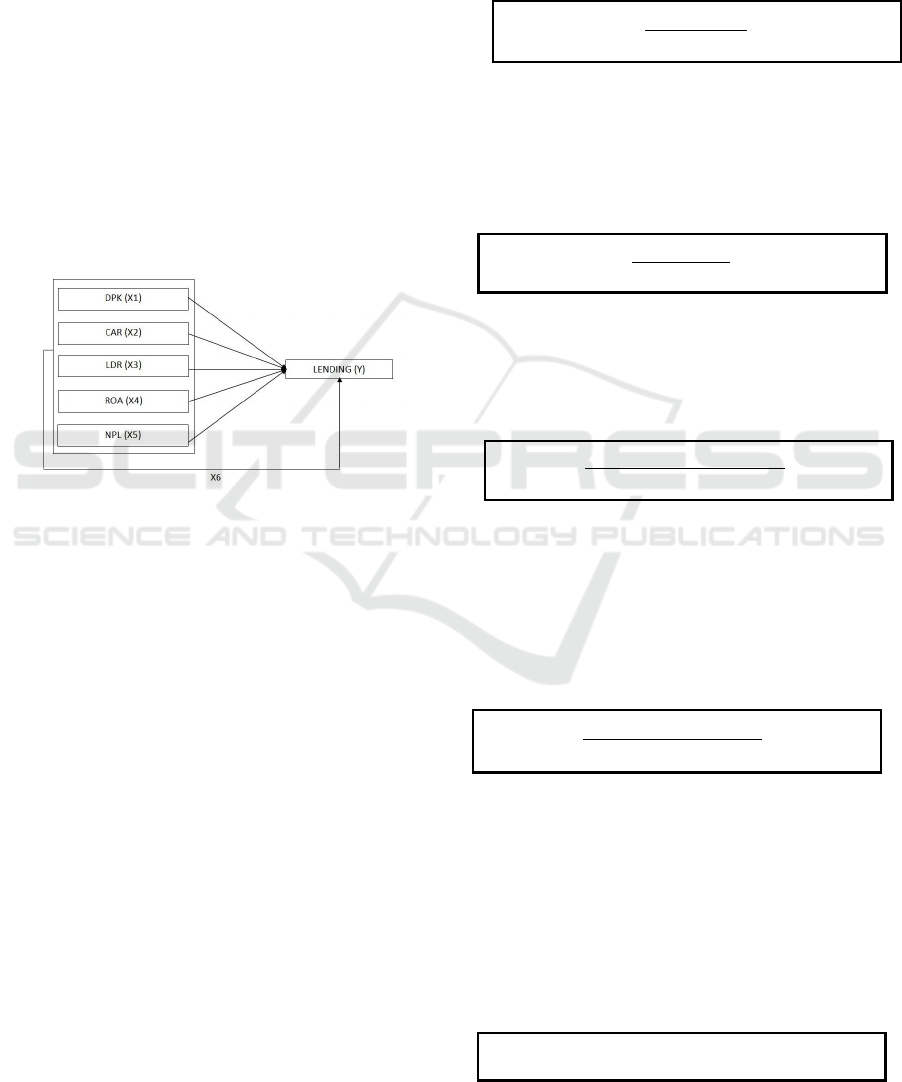

The hypothesis used in this study:

H1: DPK has a positive and significant effect on

lending

H2: CAR has a positive and significant effect on

lending

H3: LDR has a negative and significant effect on

lending

H4: ROA has a positive and significant effect on

lending

H5: NPL has a negative and significant impact on

lending

H6: DPK, CAR, LDR, ROA, NPL have a positive

effect on lending

Figure 1: Conceptual Framework.

3 RESEARCH METHODS

3.1 Research Design

Researchers will use quantitative research to prove

the existence of a cause-and effect relationship

between the independent and dependent variables.

The independent variable (X) is the bank's internal

financial ratio, namely the ratio of DPK, CAR, LDR,

ROA and NPL. While the dependent variable (Y) is

lending.

3.2 Operational Definition of Variables

Third Party Funds (X1)

(Febrianto, 2013) third party funds are a source of

banking funds collected from the public in the form

of deposits or savings and other forms. Meanwhile,

according to banking’s law number 10 of 1998, third

party funds can be formulated as follows:

Source: Febrianto (2013)

Capital Adequacy Ratio (CAR) (X2)

(Tenrilau, 2012) states that the CAR variable is the

asset ratio that describes the bank's ability to prepare

funds for business expansion and accept the risk of

losses caused by banking operations.

Source: Tenrilau (2012)

Loan to Deposit Ratio (LDR) (X3)

The Loan to Deposit Ratio (LDR) ratio reflects the

level of banking capability in repaying funds that

have been withdrawn and carried out by customers

using extended credit as a source of bank liquidity.

Source: Tenrilau (2012)

Return on Asset (ROA) (X4)

The higher the bank's ability to provide credit to

customers, the higher the ROA ratio, which means

that bank profits will increase.

Source: (Meiranto, 2013)

Non-Performing Loan (NPL) (X5)

Non-performing loans (NPL) are a measure of a

bank's ability to face the risk of default on debtors,

(Tenrilau, 2012), on the other hand, the ratio of non-

performing loans reflects credit risk, the smaller the

non-performing loan, the smaller the credit risk born

by the bank.

Source: Tenrilau (2012)

Dependent Variable (Y)

The dependent variable in this research study is

lending. The amount of credit extended to debtors in

a certain period or in one year period. According to

(Herijanto, 2013) the legal basis for granting credit is

a credit agreement between parties, banking action,

regulation of the implementation of banking actions,

jurisprudence, habits in banking practice and other

Indonesian bank provisions.

CAR = Own Capital x 100%

ATMR

LDR = Total Credit x 100%

Third Parties Fund

ROA = Earnings Before Tax (EBT) x 100%

Total Assets

Third Party Funds=

Deposit + Savings + Current Account

NPL = Non-Performing Loan X 100%

Total Credit

The Effect of Bank’s Internal Financial Ratio on Lending in Indonesia Conventional Commercial Banks: Book IV Category

11

Types and Sources of Data

The types of data used are ratio and nominal data. The

ratio data used are CAR, LDR, ROA, NPL, while the

nominal data is data on DPK and amount of credit.

Data is obtained from banking annual reports for the

period 2012 - 2019 as well as the annual reports of the

Financial Services Authority (OJK).

Location and Research Objects

The object of this research is carried out in Indonesian

conventional commercial banks. The research

location will be taken from several conventional

commercial banks in Indonesia with book category

IV in Indonesia.

Technique for Determining the Number of

Samples

The population determined in this research is

conventional commercial banks. The sample used is

conventional commercial banks that meet the

research standards of book category four, namely

Bank Rakyat Indonesia, Bank Nasional Indonesia,

Bank Mandiri, Bank Central Asia, Bank CIMB

Niaga.

Data Collection Techniques

This study uses secondary data taken from banking

websites and OJK (Financial Services Authority).

The data taken is the internal financial ratio data from

the bank's annual report and OJK's annual report data.

Data Processing Techniques

The SPSS 26 program is used as an application for

data processing techniques in this study. Before being

distributed into SPSS as a whole. There are four steps

that need to be done in data processing, namely

grouping the variables to be entered into tables and

data tabulation, data processing, by checking data and

coding. In addition, Microsoft Office Excel 2013 is

used as a program to input data, then the data that has

been tabulated into Microsoft Office Excel will be

processed using the SPSS 26 data processing tool.

3.3 Data Analysis Techniques

This research uses data analysis in the form of

descriptive analysis and classical assumption test.

Descriptive statistics can provide an outline or

depiction of research data information that can be

seen from the maximum, minimum and standard

deviation values.

Classical Assumption Test

Before testing the predetermined hypothesis, it is first

tested using the classical assumption test so that the

research to be carried out is correct. (Khikmawati,

2015) revealed that there are several ways to test

classic assumptions, namely, Multicollinearity Test,

Autocorrelation Test, Heteroscedasticity Test and

Normality test

Hypothesis Testing

In testing the research hypothesis, there are several

hypothesis tests, namely, Multiple Linear Regression

Test, T test, F test and Determination Coefficient Test

(R2)

4 RESULTS AND DISCUSSION

4.1 Characteristics of Respondents

The research was conducted at conventional

commercial banks in Indonesia, while conventional

commercial banks with book IV criteria were used as

samples. The sample of conventional commercial

bank book IV used is Bank Rakyat Indonesia, Bank

Negara Indonesia, Bank Mandiri, Bank Central Asia,

Bank CIMB Niaga. The data period used is 2012 -

2019 (8 years).

Table 1: Descriptive Variable Statistics with LN DPK and

LN Credit.

Variable N Min Max Mean Std.

Deviation

DPK 40 23.7 27.6 26,654 0.9522

CAR 40 14.9 23.8 18,913 2.7213

LDR 40 68.6 99.4 86,808 7,4292

ROA 40 1.0 5.3 3,238 0.9418

NPL 40 0.4 3.9 2,245 0.8753

Credit 40 18.76 20.56 19.7403 0.52581

According to the statistical results above, several

analyses can be presented, namely;

1) The variable X1 (DPK) has a minimum value of

23.7 which is owned by Bank CIMB Niaga (2016)

and a maximum value of 27.6 is owned by Bank

Rakyat Indonesia (2019) with an average of 26.65

and a standard deviation of 0.95. The standard

deviation which is less than the average indicates

ICAESS 2021 - The International Conference on Applied Economics and Social Science

12

that banks are able to manage liquidity and short-

term debt well and the high amount of third-party

funds received illustrates that the banking

intermediation factor is getting better.

2) The variable X2, namely CAR has minimum

value amounted to 14.9 owned by Bank Mandiri

(2013) and maximum value amounted to 23.8

owned by Bank Central Asia (2019) with an

average value of 18.91 and a standard deviation of

2.7. The higher the capital adequacy ratio, the

more financial resources that can be used for

business development purposes, and the potential

losses caused by loans can be predicted, which

means that the capital adequacy variable has a

positive impact on borrowing.

3) The variable X3 is the LDR minimum value 68.6

by Bank Central Asia (2012) and maximum value

99.4 by Bank CIMB Niaga (2014) with an average

value of 86.8 and a deviation of 7.4. The Loan to

Deposit ratio indicates the level of the bank's

capability to repay the funds that have been taken

by the customer using the credit provided as the

basis for the ability to pay the bank's short-term

obligations.

4) Minimum value the ROA variable (X4) owned by

Bank CIMB Niaga (2016) is 1.0 and maximum

valuein 2013 owned by Bank Rakyat Indonesia

amounted to 5.3 and a standard deviation of 0.94.

ROA in the implementation of credit allocation

can be used to measure bank profitability, the

higher the ROA ratio, the bank will get higher

profits which will increase the bank's credit

ability.

5) Minimum value NPL variable (X5), namely 0.4

owned by Bank Central Asia (2013) and

maximum value amounting to3.9 in Bank Mandiri

(2017) with an average value of 2.24 and a

standard deviation of 0.87. This non-performing

loan ratio illustrates bank credit risk. If the NPL

ratio is low, the credit risk received will

automatically be smaller, if the NPL ratio is high,

the credit risk received by the bank will be even

greater.

6) Loans disbursed by conventional commercial

banks book IV during the 2012 - 2019 period in

the form of an average credit obtained were

19.7403 and a standard deviation of 0.52581.

4.2 Classic Assumption Test

Table 2: Multicollinearity Test Result.

Criteria Tolerance VIF

DPK

CAR

0.432

0.613

2,317

1,632

LDR

0.478

ROA

N

PL

0.447

0.400

From the multicollinearity test table above, it can be

seen that the tolerance value of each independent

variable is > 0.1, and the VIF value of each variable

is also < 10, it can be determined that there are no

symptoms of multicollinearity from the five

variables.

Table 3: Auto Correlation Test Result.

Model Durbin-Watson

1

1968

The result of the calculation of the correlation test

using the Durbin Watson test is 1.968, which is

between -2 and +2, with the assumption that k = 5 and

N = 40 (Nk-1): It can be concluded that this research

does not have autocorrelation problems.

Heteroscedasticity Test Results

Based on testing with the Glesjer Test, it can be

seen that the significance value is more than 0.05,

meaning that the data of this study have no indication

of experiencing heteroscedasticity symptoms.

Table 4: Heteroscedasticity Test Result.

Based on the results of the normality test above

using the Kolmogorov-Smirnov test, the test results

show that the estimated value of the residual variable

is very large, namely 0.200 or more significant than

0.05, which indicates that the data is normally

distributed.

Model t Sig

Constant 1,389 0.174

DPK

CAR

-1,229

-0,624

0.228

0.537

LDR

1,322

0.195

ROA

N

PL

-3,175

-0.361

0.003

0.720

The Effect of Bank’s Internal Financial Ratio on Lending in Indonesia Conventional Commercial Banks: Book IV Category

13

Table 5: Normality Test Result.

4.3 Hypothesis Testing

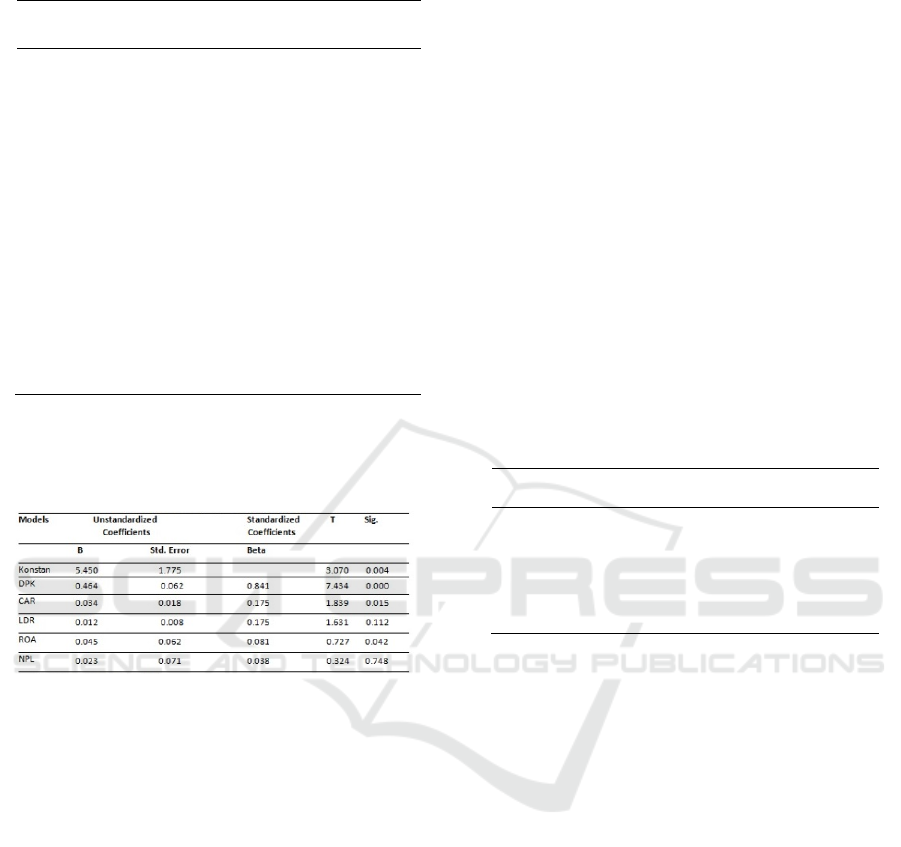

Table 6: Multiple Linear Regression Test.

Credit (Y) = 5,450 + 0.464x1 +

0.034x2 + 0.012x3 + 0.045x4 + 0.023x5

(1)

From the results of the regression analysis above, it

can be explained as follows:

1) The constant value with a positive number is

5.450. This means that if the value of the five

independent variables (DPK, CAR, LDR, NPL,

ROA) is fixed or zero, the credit value will be

5,450.

2) The regression coefficient for the DPK variable is

0.464. A positive coefficient value indicates that

if the value of DPK increases by 1%, the credit

value will increase by 0.464.

3) The regression coefficient for the positive CAR

variable is 0.034. A positive coefficient value

means that if the CAR value increases by 1%, the

credit value will increase by 0.034.

4) The regression coefficient for the positive LDR

variable is 0.012. A positive coefficient value

means that if the LDR value increases by 1%, the

credit value will increase by 0.012.

5) The regression coefficient for the positive ROA

variable is 0.045. The positive coefficient value

means that if the value of the variable increases by

1%, credit will increase by 0.045.

6) The regression coefficient for the NPL variable is

0.023. A positive coefficient value indicates that

if other independent variables are considered

constant, then if the value of non-performing

loans increases by 1%, then credit will increase by

0.023.

T test

This test is to determine the influence of each

independent variable on the dependent variable. The

degree of influence of the independent variable or the

dependent variable can be used to clarify the variables

that need it.

Table 7: T Test Result.

Model t Sig.

DPK

CAR

7,434

1,839

0.000

0.015

LDR

1,631

ROA

N

PL

0.727

0.324

Hypothesis testing 1 (X1) can be explained that

the t-count is 7,434 with a significance of 0,000 <

0.005. According to these results it can be determined

that hypothesis 1 is accepted, where third party funds

have a positive effect on lending. This means that the

more DPK a bank has, the wider the banking sector

will be to channel its loans.

Hypothesis testing 2 (X2) can be explained that

the t-count is equal to 1,839 with a significance of

0.015 < 0.05. According to these results it can be

concluded that hypothesis 2 is accepted, where CAR

has a positive effect on lending. A high CAR ratio

value allows banks to have high capital so that the

management of their earning assets is getting better.

Hypothesis testing 3 (X3) can be explained that

the t-count is equal to 1.631 with a significance of

0.112 > 0.05. According to these results it can be

determined that hypothesis 3 is rejected, where the

LDR ratio does not have a positive effect on lending.

The LDR ratio is used to measure how much credit is

extended by banks to the amount of DPK held. The

greater the LDR ratio, the more credit is extended and

the banking liquidity is getting smaller.

Hypothesis testing 4 (X4) can be seen that the t-

count is 0,727 with a significance of 0.072 < 0.05.

Model Unstandardized

Residual

N

N

ormal

Parameters

Most Extreme

Differences

Kolmogorov-

Smirnov Z

Asymp. Sig. (2-

tailed)

Mean

Std.

Deviation

Absolute

Positive

N

egative

40

0.0000000

0.22786632

0.110

0.073

-0.110

0.110

0.200

Asymp. Sig. (2-

tailed)

0.115

ICAESS 2021 - The International Conference on Applied Economics and Social Science

14

According to these results, it can be concluded that

hypothesis 4 is accepted, in which the ROA ratio has

a positive effect on lending. The higher the ROA ratio

the banks have, the greater the level of profitability

they have. It can be seen that banks are very effective

in managing their productive assets in order to

generate profits.

Hypothesis testing 5 (X5) can be seen that the t-

count is 0.324 with a significance of 0.748 > 0.05.

According to these results it can be concluded that

hypothesis 5 is rejected, where NPL does not have a

positive effect on lending. According to Bank

Indonesia, the maximum NPL value is at 5%, while

statistical data from the NPL of all conventional

commercial banks studied is at an average of 2.2%,

which means good so that non-performing loans are

classified as low, therefore NPL has no impact on

credit. The positive direction of the results of this

study means that the NPL ratio increases if the

amount of credit also increases. The increase in the

number of credit customers goes hand in hand with

the number of non-performing loans (NPLs).

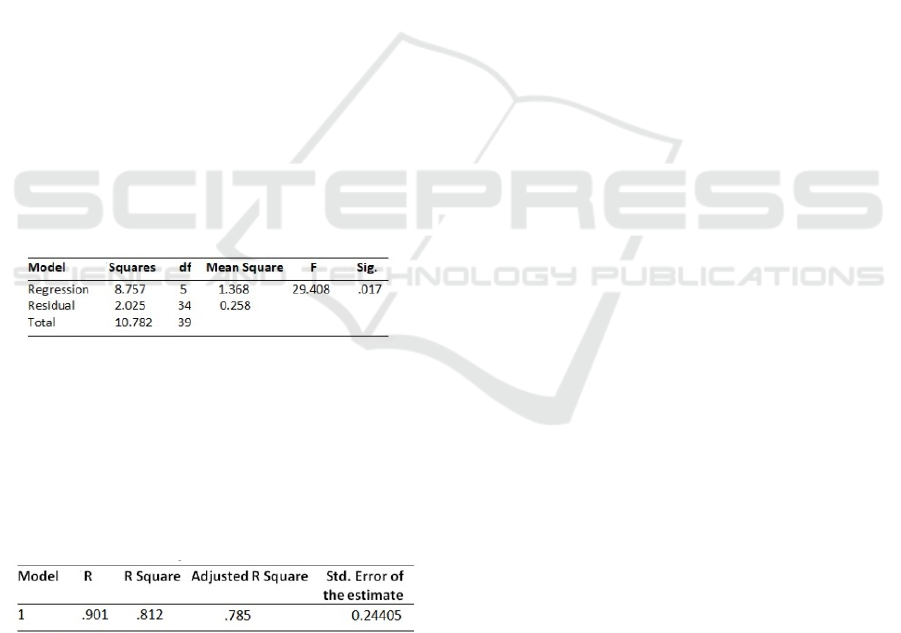

F test

Hypothesis testing is carried out using the F test

to calculate whether the existing independent

variables have a joint effect on the dependent

variable. The following test results:

Table 8: F Test Result.

As can be seen from the F test table above, the F

value is 29.408, with a significance of 0.017.

Correspondingly, F counts more attention than F

table, and the probability is 0.017 under 0.05. This

shows that simultaneously or simultaneously the

variables of DPK, LDR, NPL, and ROA affect

lending.

Table 9: Determination Coefficient Test

From the table above, it can be seen that the

Adjusted R2 value is 0.785. This shows that 78.5% of

credit is influenced by the five independent variables

used (namely DPK, LDR, CAR, NPL, ROA). From

this value, it can be seen that the Adjusted R2 value

can be said to be relatively large, because other

factors that affect loans outside of research are 21.5%.

4.4 Discussion

4.4.1 The Effect of TPF on Lending

Based on the test results, it can be seen that the

regression coefficient value of the DPK variable (X1)

is 0.000 < 0.05, which means that DPK has a positive

effect on lending, and the results of this study are

supported by research by (Meiranto, 2013) (Siregar,

2016), (Hidayat, 2018), (Amelia & Murtiasih, 2017),

(Ristyasmoro, 2018), (Ismawanto, 2012) suggest that

third party funds have a positive and significant effect

on credit. Third Party Funds owned by the bank are

funds collected from the public which will be

channeled back to the community in the form of

credit. The more DPK a bank has, the wider the

banking sector is to distribute its loans.

H1: TPF has a positive effect on lending, accepted.

4.4.2 The Effect of Capital Adequacy Ratio

on Lending

Based on the test results, it can be seen that the

regression coefficient value of the CAR variable is

0.015 < 0.05, which illustrates that CAR has a positive

effect on lending. The research results of (Meiranto,

2013), (Yuliana, 2014), (Amelia & Murtiasih, 2017),

(Ristyasmoro, 2018), (Ismawanto, 2012), (Riadi,

2018) also prove this. The higher the capital adequacy

ratio, the more financial resources available for

business development purposes, including increasing

lending. The CAR variable is used as a prediction of

potential losses that may be caused by loans, which

means that the CAR variable has a positive effect on

loans.

H2: CAR has a positive effect on lending,

accepted.

4.4.3 The Effect of LDR on Lending

Statistical testing can be explained LDR (X2) with

LDR variable regression coefficient value of 0.112 >

0.05 means that the variable has no effect on lending.

The results of this study are supported by research

results from (Meiranto, 2013), (E Ervina, 2019),

(Mangindaan, 2019) which explain that LDR has no

effect on credit. The LDR ratio indicates the level of

the bank's capability to repay the funds that the

customer has taken by using the credit provided as the

basis for the bank's ability to pay short-term

obligations.

H3: Loan to Deposit Ratio (LDR) has no positive

effect on lending, rejected.

The Effect of Bank’s Internal Financial Ratio on Lending in Indonesia Conventional Commercial Banks: Book IV Category

15

4.4.4 The Effect of ROA on Lending

Judging from the data processing, it can be seen that

the level of significance obtained is 0.042 <0.05, so

the decision taken is that H4 is accepted and ROA is

proven to have a positive and significant impact on

credit. These results are also supported by research by

(Hidayat, 2018), (Pratiwi & Prajanto, 2020), that in

distributing credit, the ROA ratio can be used to

measure profits in banking. A high proportion of

ROA shows that the higher the profit received by

banks, so that the capacity of the bank to provide

loans will be higher.

H4: Return on Assets has a positive effect on

lending, accepted.

4.4.5 The Effect of Non-Performing Loans

on Lending

The results of the hypothesis test show that the

significance is 0.748 > 0.05, so the decision taken is

that H5 is rejected and the conclusion is that the NPL

variable does not have an effect on lending. This is

also supported by the results of research conducted by

(Arullia, 2017), (Riadi, 2018), (Hidayat, 2018),

(Amelia & Murtiasih, 2017), (Ristyasmoro, 2018), (E

Ervina, 2019), (Mangindaan, 2019), (Pradana, 2019),

(Ismawanto, 2012) which provides an explanation,

namely that NPL does not affect lending. If the

proportion of non-performing loans is low, the credit

risk obtained is small, if the proportion of non-

performing loans is high, the credit risk obtained by

the bank will be even greater.

H5: NPL has no effect on lending, rejected.

4.4.6 The Effect of DPK, CAR, LDR, ROA,

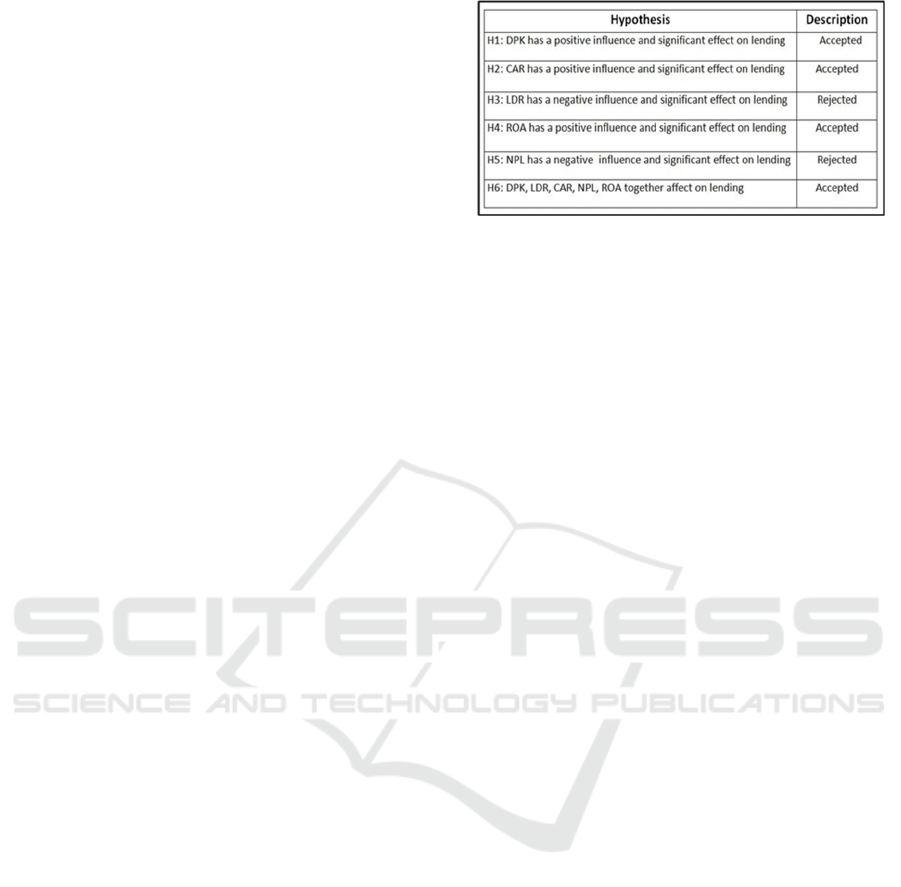

NPL on Lending

The results obtained are H6 with the results of DPK,

CAR, LDR, ROA, NPL factors affecting credit. This

shows that the five internal factors, especially DPK,

CAR, LDR, ROA, NPL together affect credit. This is

also supported by research by (Putri & Akmalia,

2016), (Amelia & Murtiasih, 2017), (Ismawanto,

2012), (Sari, 2018) on the grounds that all factors of

DPK, CAR, LDR, ROA, NPL are interrelated internal

financial components so that at the same time will

affect credit.

H6: Third party funds, CAR, LDR, ROA, NPL

affect lending, accepted.

Figure 2: Summary of Hypothesis Results.

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusions

According in the discussion in the previous chapter,

the researcher can conclude that third party funds in

hypothesis (H1) is accepted to have a positive effect

on lending. The results of hypothesis (H2) are

accepted, namely the loan to deposit ratio variable

does not have a positive effect on lending. The results

on hypothesis (H3) are rejected, the capital adequacy

ratio variable has a positive effect on lending. The

hypothesis (H4) is accepted that the non-performing

loan variable does not have a positive effect on

lending. H5 rejected, the non-performing loan no

have effect on lending. Simultaneously, all variable

has effect on lending (H6).

5.2 Suggestions

Based on the results of the discussion, the conclusions

and limitations that the researchers made, the

suggestions for further research are; using research

samples other than conventional commercial banks

(Book IV) namely Indonesian Islamic banks, state-

owned banks, conventional commercial banks listed

on the Indonesia Stock Exchange, and may even use

a sample of banks in the ASEAN region; using other

independent variables such as BOPO and NIM (Net

Interest Margin) and external ratios or macro factors,

namely growth (economic growth), inflation, foreign

exchange rates and dependent variables on credit card

growth, working capital loans, interbank syndicated

loans and UMKM credit.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

16

REFERENCES

Amelia, K., & Murtiasih, S. (2017). ANALISIS

PENGARUH DPK, LDR, NPL DAN CAR

TERHADAP JUMLAH PENYALURAN KREDIT

PADA PT. BANK QNB INDONESIA, Tbk PERIODE

2005 - 2014. Jurnal Ilmiah Ekonomi Bisnis, 22(1),

97059.

Arullia, M. (2017). Pengaruh Capital Adequacy Ratio

(Car), Non Performing Loan (Npl), Biaya Operasional

Dan Pendapatan Operasional (Bopo) Dan Net Interest

Margin (Nim) Terhadap Laba Perusahaan Perbankan

Dengan Volume Penyaluran Kredit Sebagai Variabel

Intervening. Jurnal Ilmiah Ekonomi Bisnis, 22(3),

229008.

E Ervina. (2019). ANALYSIS OF CAPITAL

ADEQUACY RATIO EFFECT, NON

PERFORMINGLOAN, OPERATIONAL LOAD

OPERATIONAL INCOME AND LOAN

TODEPOSITRATIO OF PROFIT CHANGES WITH

CREDITDISTRIBUTIONAS AN INTERVENING

VARIABLE. International Journal of Public

Budgeting, Accounting and Finance, 2(4), 1-13., July

2016.

Febrianto, dwi F. (2013). ANALISIS PENGARUH DANA

PIHAK KETIGA, LDR, NPL, CAR, ROA, DAN

BOPO TERHADAP JUMLAH PENYALURAN

KREDIT (Studi pada Bank Umum yang Terdaftar di

Bursa Efek Indonesia Periode Tahun 2009-2012).

Diponegoro Journal of Accounting, 2(4), 259–269.

Herijanto, H. (2013). Teori dan Praktek Proses Keputusan

Pemberian kredit Perbankan yang Bersandar pada

Prinsip Kehati-hatian. Universitas Padjajaran.

Bandung.

Hidayat, R. A. L. (2018). Pengaruh Variabel Rasio

Keuangan Dan Makroekonomi Terhadap Pemberian

Kredit Sektor Umkm Oleh Perbankan Di Indonesia.

Jurnal Manajemen Dan Pemasaran Jasa, 9(2), 253.

https://doi.org/10.25105/jmpj.v9i2.2035

Ismawanto, T. R. G. S. M. R. E. (2012). Pengaruh Dana

Pihak Ketiga , Capital Adequacy Ratio , Non

Performing Loan , Return on Assets , Dan Loan To

Deposit Ratio Terhadap Jumlah Penyaluran.

Diponegoro Journal Of Accounting, 1, Nomor 1(1), 1–

14.

Khikmawati, I. L. A. (2015). Analisis Rasio Keuangan

Terhadap Pelaporan Keuangan Melalui Internet Pada

Website Perusahaan. Accounting Analysis Journal.

Mangindaan, A. K. P. T. P. V. R. (2019). Analisis Pengaruh

Loan To Deposit Ratio (Ldr) Dan Non Performing

Loan (Npl) Terhadap Volume Kredit Pada Bank

Pembangunan Daerah (Bpd) Di Indonesia Periode 2013

€“ 2017. Jurnal EMBA: Jurnal Riset Ekonomi,

Manajemen, Bisnis Dan Akuntansi, 7(1), 601–610.

https://doi.org/10.35794/emba.v7i1.22460

Meiranto, D. M. W. (2013). ANALISIS FAKTOR-

FAKTOR PEMBENTUK KINERJA (RGEC) PADA

PERBANKAN INDONESIA: (Studi Kasus pada Bank

yang Terdaftar di BEI Periode 2010-2013). Diponegoro

Journal of Accounting, 4(4), 485–499.

Noviantari, N. W., & Ratnadi, N. M. D. (2015). Pengaruh

Financial Distress, Ukuran Perusahaan, Dan Leverage

Pada Konservatisme Akuntansi. E-Jurnal Akuntansi,

11(3), 646–660.

http://repositori.usu.ac.id/handle/123456789/22053

Pradana, A. N. (2019). Pengaruh Equity, Dpk, Npl, Dan

Suku Bunga Terhadap Penyaluran Kredit Pada Bank

Pembangunan Daerah. Jurnal Online Internasional &

Nasional Universitas 17 Agustus 1945, 53(9), 1689–

1699. www.journal.uta45jakarta.ac.id

Pratiwi, R. D., & Prajanto, A. (2020). Faktor Internal dan

Eksternal Sebagai Determinan Peningkatan Penyaluran

Kredit Bank Umum di Indonesia. Jurnal Penelitan

Ekonomi Dan Bisnis, 5(1), 16–26.

https://doi.org/10.33633/jpeb.v5i1.3133

Putri, Y. M. W. &, & Akmalia, A. (2016). Pengaruh CAR,

NPL, ROA dan LDR Terhadap Penyaluran Kredit Pada

Perbankan. Journal Balance, XIII(2), 82–93, ISSN

Print: 1693-9352, e-ISSN: 2614-820X.

Riadi, S. (2018). The effect of Third Parties Fund, Non

Performing Loan, Capital Adequacy Ratio, Loan to

Deposit Ratio, Return On Assets, Net Interest Margin

and Operating Expenses Operating Income on Lending

(Study in Regional Development Banks in Indonesia).

Proceedings of the International Conference on

Industrial Engineering and Operations Management,

2018-March, 1015–1026.

Ristyasmoro, S. K. (2018). Keywords : Capital Adequacy

Ratio ( CAR ), Non Performing Loan ( NPL ), Third

Party Funds , Lending of Credit , Return On Assets (

ROA ). 1–15.

Sa’adah, N. (2018). PENGARUH DPK, CAR, NIM, ROA

DAN LDR TERHADAP PENYALURAN KREDIT

PADA BUSN DEVISA DAN BUSN NON DEVISA

YANG TERDAFTAR DI BEI. Sekolah Tinggi Ilmu

Ekonomi Perbanas.

Sari, R. F. (2018). FAKTOR FAKTOR YANG

MEMPENGARUHI PENYALURAN KREDIT PADA

BANK YANG TERDAFTAR DI BURSA EFEK

INDONESIA. SEKOLAH TINGGI ILMU EKONOMI

PERBANAS SURABAYA.

Siregar, E. (2016). Pengaruh Dana Pihak Ketiga Dan Car

Terhadap Jumlah Penyaluran Kredit Periode 2012-

2014. Jurnal Profita, 2(8), 1–15.

Tenrilau. (2012). ANALISIS PENGARUH DANA PIHAK

KETIGA ( DPK ), CAPITAL ADEQUACY RATIO (

CAR ), DAN NON PERFORMING LOAN ( NPL )

TERHADAP LEMBARAN PENGESAHAN ANALISIS

PENGARUH DANA PIHAK KETIGA ( DPK ),

CAPITAL ADEQUACY RATIO ( CAR ), DAN NON

PERFORMING LOAN ( NPL ) TERHADAP.

The Effect of Bank’s Internal Financial Ratio on Lending in Indonesia Conventional Commercial Banks: Book IV Category

17

Yuliana, A. (2014). Pengaruh LDR, CAR, ROA, dan NPL

terhadap Penyaluran Kredit pada Bank Umum di

Indonesia Periode 2008- 2013. Jurnal Dinamika

Manjemen, 2(3), 169–186.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

18