Identification of Risks in Making Decision for Overseas Expansion by

Indonesian State-owned Construction Enterprise

Jeffrey Limas Lim

1a

, Ayomi Dita Rarasati

2b

and Mohammad Ichsan

2c

1

Department of Civil Engineering, Faculty of Engineering, Universitas Indonesia, Depok, Indonesia

2

Management Department, Business School Undergraduate Program, Bina Nusantara University, Jakarta, Indonesia

Keywords: Risk, Overseas, Construction, Stated-owned Enterprise.

Abstract: Construction markets in ASEAN countries, Africa, Middle East, and Timor Leste are the main targets of

Indonesian state-owned construction enterprises in developing their business internationally. But the

international construction market can be described as complex, uncertain, and risky. Project risk greatly

affects the expected profit. Thus, companies must identify risks and how to deal with them before operating

abroad. The main goal of conducting this research is to identify risks in making decisions for overseas

expansion. This study uses a quantitative approach by distributing closed questionnaires about overseas

construction risks to experts and respondents and the data will be analyzed by descriptive statistics. This

research analyzed international projects and 10 highest risks have been identified. These risks are unbalance

cash flow (0.72), late construction (0.72), currency exchange rate fluctuation (0.56), unclear requirements

(0.56), funding shortage (0.56), productivity decreases (0.56), unclear boundaries of work (0.56), revolution

(0.40), complex planning and permit procedures (0.40), and inconsistencies in design / construction (0.40).

This research has positive implications for Indonesian state-owned construction enterprises in developing

their business overseas. The implication is to provide an overview of the risks that may occur hence Indonesian

state-owned construction enterprises can formulate strategies to overcome them.

1

INTRODUCTION

Construction is an important component to drive the

economy both nationally and internationally. The

industry of construction is considered one of the most

profitable business sectors. So that in addition to the

national construction market, many national

construction companies are also developing their

business to reach overseas markets. Globalization

brings a lot of benefits, and one of them is that it

creates good opportunities for the construction

company to enter attractive international project

markets (Wang, 2019).

Globalization creates a climate of openness in the

economy that allows local companies to take

advantage of opportunities to enter overseas markets

(Utama, et al, 2014; Wang, 2019). For example, the

Malaysian construction industry has generated high

market competition due to internationalization

a

https://orcid.org/0000-0001-8970-954X

b

https://orcid.org/0000-0002-7272-461X

c

https://orcid.org/0000-0001-7221-5172

pressures. However, the highly competitive domestic

market has encouraged much Malaysian construction

companies to expand their business abroad (Sarpin, et

al., 2019). It is undeniable that taking part in

international projects is a difficult and challenging

assignment (Sarpin, et al., 2019). The intensity to

expand their business into international markets for

Indonesian contractors has only recently begun.

Several projects in the ASEAN, Africa, and the

Middle East have continued since 10 years ago

(Utama, et al., 2014).

The global construction markets that are attractive

to national construction companies are the markets in

ASEAN, Africa, South Asia, and the Middle East.

This is in line with research conducted by Utama, et al.

(2014) who concluded that national construction

companies are very interested in the construction

market in ASEAN, Africa, and Middle East regions.

Utama, et al. (2014) explained that the Southeast

206

Lim, J., Rarasati, A. and Ichsan, M.

Identification of Risks in Making Decision for Overseas Expansion by Indonesian State-owned Construction Enterprise.

DOI: 10.5220/0010748100003113

In Proceedings of the 1st International Conference on Emerging Issues in Technology, Engineering and Science (ICE-TES 2021), pages 206-212

ISBN: 978-989-758-601-9

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Asian market represented by Timor Leste and Brunei

Darussalam had a high demand for Indonesian

construction services. There is easy access to market

access in Southeast Asia because there are cultural

similarities, ease of language, and historical relations

that are under the auspices of ASEAN (Utama, et al.,

2014). Markets in the Middle East and Africa are in

great demand due to the similarity of religions and

beliefs as well as the moral relationship between

governments (Utama, et.al., 2014). Ofori (2013) states

that the selection of project locations abroad depends

on the competitive advantage the company has

(Utama, et. al., 2014).

Since the 1990s, national construction companies

have been expanding overseas with high motivation

and seeing the broad construction market. The

national state-owned construction enterprise

represented by PT Hutama Karya worked on road

infrastructure projects in Malaysia from 1990 to

1993. Followed by PT Adhi Karya, and PT Waskita

Karya. Until finally PT Wijaya Karya has been

working on construction projects overseas the most to

date. This is in line with research conducted by Utama,

et al. (2014), that 6 Indonesian national construction

companies are active in the foreign construction

market, namely, PT Hutama Karya, PT Waskita

Karya, PT Wijaya Karya, PT Pembangunan

Perumahan, PT Adhi Karya, and PT Duta Graha

Indah from the private sector.

So many international projects are undertaken, but

in fact, international construction projects do not

always generate high revenues, contrary to what is

generally expected from risk international efforts

(Han, et al., 2007). The international construction

market can be described as risky, uncertain, and

complex (Gunhan & Arditi, 2005). Doing

construction projects overseas tend to have various

risk factors that can reduce the project’s profitability

(Han, et al, 2007).

Theoretically, doing construction service work

abroad has no difference from doing construction

service work in the home country. Minor differences

in local policies and regulations were confirmed to

exist but did not significantly differ from domestic

employment. But in reality, most large-scale

construction companies in Indonesia experienced

difficulties and even experienced losses during

conducting overseas construction work.

Conducting overseas construction projects is one

of the activities that are vulnerable to global issues

such as politics, economy, finance, social, culture,

and law. These projects are also pressured by various

kinds of business risks, such as inflation, interest rates,

currency exchange, and credit (Utama, et. al, 2019).

Expanding construction business to overseas market

has many risks and are exposed to more complex

problems compare to domestic projects. There is no

standardization for studies related to decision-making

to expand into the construction market overseas (Han

& Diekmann, 2001). Zhi (1995) has stated that

construction work abroad is categorized as a high-

risk business due to lack of information on the

workplace environment and lack of experience.

Various risk factors affect project cash flows,

especially for the international project domain, which

often fluctuates due to a myriad of external and

internal uncertainties (Han et al, 2014).

International projects face more varied and

difficult risks than domestic projects (Wang, 2019).

These risks exist at every stage of the implementation

of an overseas construction project, any negligence

will bring serious economic losses (Feng, et al.,

2014). Project risk greatly affects the expected profit

(Li, et al, 2020). Many companies experience large

losses when completing the project, so the estimation

of risk factors in overseas projects is very important

(Lin, 2016). Due to the wide range of complexities

and uncertainties, the decision to enter overseas

construction is complicated (Wang, 2019).

To enter foreign markets, the first thing we have

to do is identify the construction environment and

then make an initial assessment of the risks.

Reasonable selection of countries and territories can

also help reduce the possibility of unforeseen risks.

After winning the project tender, we must conduct a

detailed evaluation of the initial, intermediate, and

subsequent stages for it, then analyze the risks that

may occur (Lin, 2016).

The problem of risk management for overseas

construction projects is difficult (Liao, 2019). So that

ignoring this risk mitigation is an act of irresponsible

action and could cause making wrong decisions (Zhi,

1995). And if risk mitigation is not carried out

properly, it will have a big impact, namely only

getting a small profit, not getting a profit or even loss

(Han & Diekman, 2001). For this reason, risk

management is becoming more

emphasized and

systemized in international projects

to improve the

quality of difficult decisions which usually include

higher levels of risk exposure (Han, et al, 2008).

Construction companies are expected to be able to

make good decisions in carrying out international

construction projects by considering the main risk

factors at each stage of the project (Han, et al.,

2008). A new comprehensive solution will be

provided to avoid risks and difficulties in previous

overseas construction projects, and improvements

will immediately identify whether the general project

Identification of Risks in Making Decision for Overseas Expansion by Indonesian State-owned Construction Enterprise

207

management method is suitable for project

management purposes. (Liao, 2019).

There are so many possible risks in international

construction that can be reduced or avoided by

adopting an appropriate project implementation

strategy (Han & Diekman, 2001). For this reason,

companies engaged in the construction sector can

continue to expand overseas by mitigating risks and a

strategy to increase the number of market gains for

construction work abroad (Gunhan & Arditi, 2005).

To do business successfully in the overseas market,

construction companies need reliable risk analysis

and decision-making tools to make consistent

strategic entry decisions (Han & Diekman, 2001).

There are so much researches on the risks of

overseas projects, but there is no research on the risks

faced by Indonesian state-owned construction

enterprises in developing their business abroad.

Hence, the main goal of conducting this research is

to

identify and analyze the risks in making decisions

for

overseas expansion by Indonesian state-owned

construction enterprises. Research on risk

identification is in line with PMI (2017) which states

that risk identification is the second process in risk

management after risk management planning.

This research is limited to one of the most

advanced construction companies because it can

provide a real risk picture for other companies. This

research is expected to become the basis for

construction companies in carrying out risk

management before developing their business abroad.

2

METHODS

2.1 Research Design

In order to achieve the purpose of this research, the

methodology was designed with the quantitative

approach. The research object is Indonesia’s most

experienced state-owned construction enterprise in

handling the overseas project.

2.2 Research Variables

The variables that would be examined in this

research are based on Zhi (1995) namely nation risks

(X1), construction industry risks (X2), company

risks (X3), and project risks (X4). There were also

15 sub-variables and 65 indicators as follows:

1.

Political Situation (X1.1)

2.

Economical and Financial Situation (X1.2)

3.

Social Environment (X1.3)

4.

Market Fluctuations (X2.1)

5.

Law and Regulations (X2.2)

6.

Standards and Codes (X2.3)

7.

Contract Systems (X2.4)

8.

Employer/Owner (X3.1)

9.

Architect (X3.2)

10.

Labor and Sub-Contractor (X3.3)

11.

Material & Equipment (X3.4)

12.

Internal (X3.5)

13.

DefectivePhysical Works (X4.1)

14.

Schedule Delay (X4.2)

15.

Cost Overrun (X4.3)

2.3 Research Stages

The first stage of this research was an expert

judgment by asking the opinions of the experts to the

risks with distributing closed questionnaire with

Guttman scale. The second stage was doing the

respondent survey to assess and give engineering

judgment to the probability and the impact of the

risk.

The instrument was a closed questionnaire with

a Likert

scale.

After getting the data, the data were tested by

several tests such as validity test, reliability test, and

normality test. Then the further analysis was carried

out by analyzing risk value, risk level, and risk

ranking with descriptive analysis. The detail of

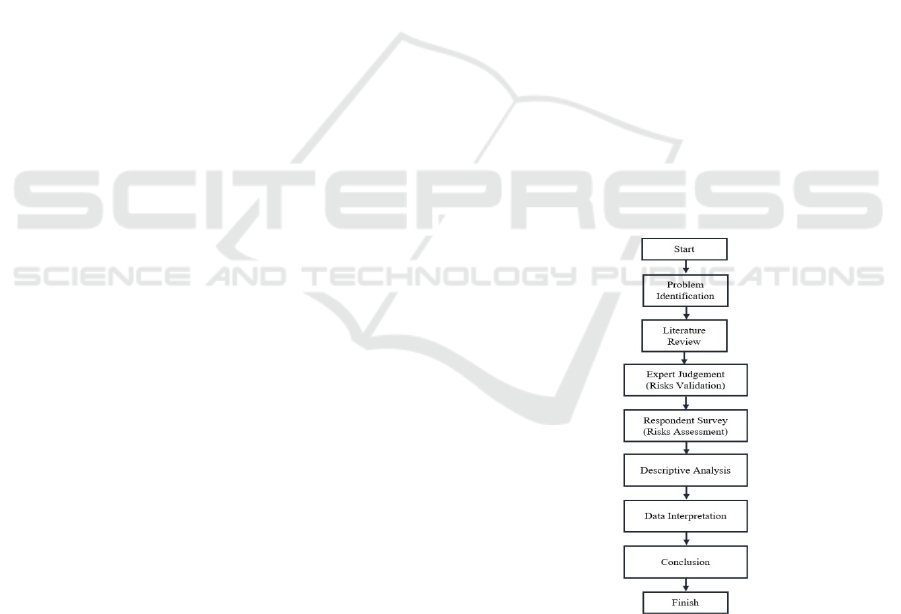

research stages is shown in Figure 1 below.

Figure 1: Stages of The Research.

2.4 Research Respondent

According to Sugiyono (2018), non-probability

sampling was used to selecting the samples of

experts and respondents. The requirements of the

samples were:

1.

The experts were minimum of 3 persons

ICE-TES 2021 - International Conference on Emerging Issues in Technology, Engineering, and Science

208

2.

The survey respondents were minimum of 30

persons

3.

The educational background should be a

bachelor degree

4.

The respondents should have experience and

expert in project risks

5.

The respondents should be an academician,

professional association member, and

practitioner in the overseas project for 5 years

minimum. The practitioner should be a project

management qualification.

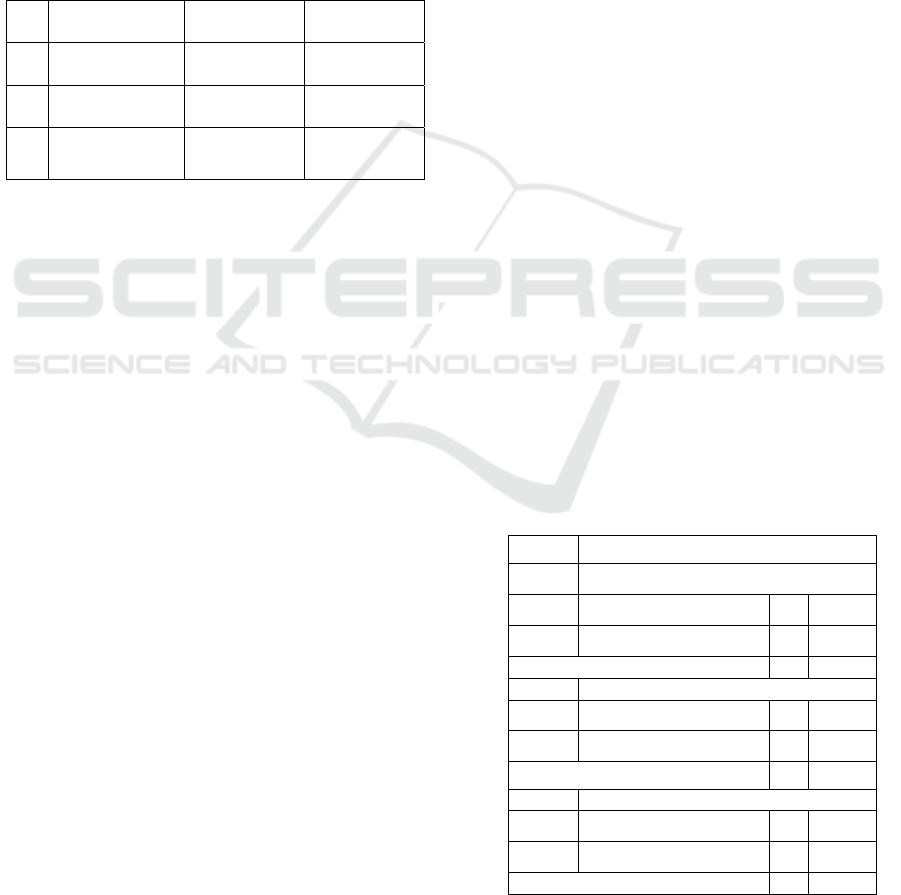

The expert's profile is shown in Table 1 below:

Table 1: Experts Profile.

No Position

Experience

(Years)

Education

1

Director of

O

p

erations

35

Master Degree

2

Head of Overseas

Division

24

Master Degree

3

Head of Overseas

Branches

25

Bachelor

Degree

2.5 Research Instrument

In making a research instrument, a potential risk

analysis is developed to obtain primary data. Primary

data is data that directly provides data to data

collectors (Sugiyono, 2017). Primary data to answer

research questions is nominal data and ordinal data

that comes directly from respondents which will then

be processed.

The measuring scale used in the instrument to

answer the research question was the Guttman Scale,

and Likert Scale. Guttman scale was used for

expert

judgment questionnaire to get the opinion yes

or no to

the risk variables. The Likert scale was used to assess

the risk probability and risk impact. The Likert scale

would be converted to the probability and impact

matrix with the scoring scheme developed by PMI in

2017.

2.6 Data Analysis

The data that had been obtained through expert

judgment survey and survey respondents were then

analyzed using descriptive analysis. Analysis for

expert judgment by looking at the answer mode of the

experts. However, to analyze the survey results,

respondents must go through validity tests,

instrument reliability tests, and data normality tests to

conclude the survey results. To get the risk value is to

multiply the value of risk possibility and the value of

risk impact and then it was categorized and ranked.

3

RESULTS AND DISCUSSION

3.1 Expert Judgement Result

The risk indicators were examined and validated by

the experts of overseas construction (See Table 1.).

Base on the expert judgment analysis result shows

that only 2 risk indicators were validated by the

experts. They were X1.2.2 Incompatible GNP Per

Capita and X1.3.8 Brotherhood. For the other 63 risk

indicators, more than 65% of experts were agreed and

validated.

3.2 Respondent Survey Result

Based on the results of an analysis of 30 respondents

who are involved in overseas projects, it shows that

most of the respondents have a master education

(70%) and 30% are undergraduate, 67% staff and

33% are managers, and have experienced 5-10 years

80% and 20% 11-15 years. The detailed analysis is

shown in Table 2.

The data on the possibility of risk were tested by

reliability testing and showed that the level of

reliability was very high (Cronbach's Alpha 0.971>

0.8). The data homogeneity test was also carried out on

the education, position, and experience categories and

the results showed that all risk indicators were

homogeneous (Asymp. Sig.> 0.05). In addition, the

data normality test was also carried out to determine

the normality of the data so that the results could be

used as a basis for concluding. The results of the data

normality test showed that all the data obtained were

not normal (sig. <0.05), so that the conclusion of

possible risks was drawn based on the median value.

Table 2: Respondents Characteristics.

No Category

A

Education

1 Bachelor 9 30%

2 Master 21 70%

Total Sam

p

les 30

B Position

1 Manager 10 33%

2 Staff 20 67%

Total Samples 30

C Ex

p

erience

1 5 - 10 Years 24 80%

2 11 - 15 Years 6 20%

Total Samples 30

Identification of Risks in Making Decision for Overseas Expansion by Indonesian State-owned Construction Enterprise

209

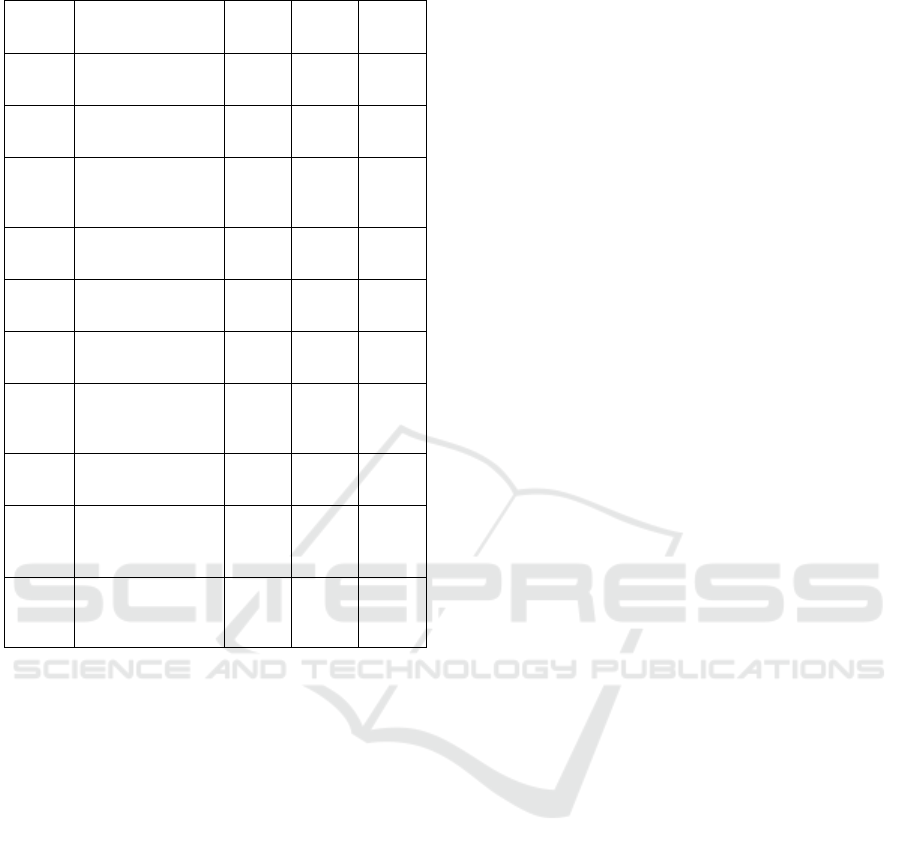

Table 3: Top Ten High-Risk Indicators.

Code Risk Indicator Score

Risk

Level

Risk

Rank

X3.5.1

Unbalance Cash

flow

0.72 High

1

X4.2.2

Late Construction

0.72 High

2

X1.2.5

Currency

Exchange Rate

Fluctuation

0.56

High

3

X3.1.1

Unclear

Requirements

0.56 High

4

X3.1.2

Funding Shortage

0.56 High

5

X3.5.4

Productivity

decreasses

0.56 High

6

X4.3.1

Unclear

boundaries of

works

0.56 High

7

X1.1.2 Revolution 0.4 High

8

X2.2.2

Complex

p

lanning

and permit

prochedures

0.4 High

9

X2.3.1

Inconsistencies in

design/

construction

0.4 High 10

The data on the impact of risk were tested by

reliability testing and showed that the level of

reliability was very high (Cronbach's Alpha 0.971>

0.8). The data homogeneity test was also carried out on

the education, position, and experience categories and

the results showed that all risk indicators were

homogeneous (Asymp. Sig.> 0.05). In addition, the

data normality test was also carried out to determine

the normality of the data so that the results could be

used as a basis for concluding. The results of the data

normality test showed that all the data obtained were

not normal (sig. <0.05), so that the conclusion of

possible risks was drawn based on the median value.

The conclusion of the possibility and impact of the

risk is then multiplied to obtain a risk value. The result

of the analysis shows that 222 risk indicators are high,

36 risk indicators are moderate and 4 risk indicators

are low. Table 3 shows the top ten high- risk

indicators which must be controlled.

The results of the international project risk

analysis that has been carried out show that 10 high

risks have been identified. These risks are unbalance

cash flow (0.72), late construction (0.72), currency

exchange rate fluctuation (0.56), unclear

requirements (0.56), funding shortage (0.56),

productivity decreases (0.56), unclear boundaries of

work (0.56). , revolution (0.40), complex planning

and permit procedures (0.40), and inconsistencies in

design / construction (0.40). Details of the results of

the international project risk assessment analysis can

be seen in Table 3 above.

3.3 Discussion

The main motivation of construction companies to

develop their business internationally is mainly to

increase its profitability (Utama, et al., 2019). But the

international construction market can be described as

risky, uncertain, and complex (Zhi, 1995; Gunhan &

Arditi, 2005; Wang, 2019). Li, et al. (2020) stated that

project risk greatly affects the expected profit (Li, et

al, 2020).

International projects are particularly vulnerable to

economic and financial problems. Therefore poor cost

control is a problem in project risk management (Liao,

2019) because it can cause the highest risk, namely

unbalanced cash flow (Zhi, 1995). Determining

payment terms and conditions and the financing

schedule is the main key related to estimating the

project cash flow situation before the project starts.

However, there are a variety of risk

factors that affect

project cash flows, particularly for

the international

project domain, which often fluctuates due to a

myriad of external and internal uncertainties (Han, et

al, 2014) such as currency exchange rate fluctuations

(Zhi, 1995; Utama, 2019).

The imbalance of cash flows can cause a very high

risk, namely a lack of funds to finance project

operations (Zhi, 1995). In addition, without sufficient

financing, it will create new risks such as difficulty

finding reliable skilled workers (Zhi, 1995; Sarpin,

2019). If the project is not supported by skilled

personnel, it will cause productivity to decrease (Zhi,

1995) and in the end, the project will be late (Zhi,

1995). All of this includes a very high risk to an

international project which must be managed

properly because it will greatly affect cost and time

performance. And in the end, it will affect the

profitability of the project.

Based on research conducted by Utama (2019)

which states that politics is also one of the highest

project risk. Zhi (1995) previously stated that politics

is one of the project risks, one of which is revolution.

This is also closely related to the economic stability

of the host country where the project is constructed.

Overseas engineering construction project faces

high risks, as these risks are inherent at every stage of

project construction (Han, et al., 2008; Feng, et al.,

ICE-TES 2021 - International Conference on Emerging Issues in Technology, Engineering, and Science

210

2014). At the time of signing the contract, for

example, the contractor must carefully read, translate

and understand every contract clause, because the

clarity of the contract is an important thing that affects

the work of international projects (Utama, et al.

2019). In line with this statement, the result shows that

unclear requirements and unclear

boundaries of works

contained in the contract clause

are considered high

risks.

Apart from the foregoing, project complexity is

also one of the problems in international construction

projects (Han & Diekman, 2001; Utama, et al., 2019).

The complexity of the project is not only the type of

project but also complex planning and permit

procedures (Zhi, 1995). And in the construction

implementation process, design changes often occur,

causing a very high risk of inconsistencies in

design/construction (Zhi, 1995).

It will have a big impact such as getting a small

profit, or even loss (Han & Diekman, 2001). These

can also lead to increased costs and project delays

resulting in decreased project time and cost

performance. And all of these risks can be a

consideration in making decision regarding overseas

expansion (Han, et al., 2008; Liao, 2019).

4

CONCLUSIONS

Based on the results of the analysis that has been

done, several things can be concluded from this study.

There are 10 highest risk indicators with risk value

between 0.40 – 0.72 on the variable examined as

follows:

1.

Unbalance Cash flow (0.72)

2.

Late construction (0.72)

3.

Currency exchange rate fluctuation (0.56)

4.

Unclear requirements (0.56)

5.

Funding shortage (0.56)

6.

Productivity decreases (0.56)

7.

Unclear boundaries of work (0.56)

8.

Revolution (0.40)

9.

Complex planning and permit procedures

(0.40)

10.

Inconsistencies in design/ construction (0.40)

This research has positive impact for Indonesian

state-owned construction enterprises in developing

their business overseas. The implication is to provide

an overview of the risks that may occur hence

Indonesian state-owned construction enterprises can

formulate strategies to overcome them.

This research can be developed in further research

by analyzing preventive and corrective actions to

reduce the risk value. The risks in this study can be

used as a basis for advanced research on the strengths,

weaknesses, opportunities, and threats of the company

in dealing with these risks, and in the end, strategies

can be formulated to manage the risks hence the

overseas business development becomes an

opportunity that benefits the company.

ACKNOWLEDGEMENTS

The authors would like to thank The Overseas

Division of PT. Wijaya Karya (Persero), Tbk. for

permitting us to carry out this research and to

support morally.

REFERENCES

Feng, X., Lin, S., Hao, H., & Wei, Z. (2014). Quantitative

Solution of Overseas Project Risk Management by

Knowledge Engineering. Sustainable Development of

Critical

Infrastructure. Doi:10.1061/9780784413470.016 Gunhan,

S., & Arditi, D. (2005). International Expansion

Decision for Construction Companies. Journal of

Construction Engineering and Management, 131(8),

928–937.

Han, S. H., & Diekmann, J. E. (2001). Making a Risk- based

Bid Decision for Overseas Construction Projects.

Construction Management and Economics, 19(8), 765–

776. Doi:10.1080/01446190110072860

Han, S. H., Park, H. K., Yeom, S. M., Chae, M. J., & Kim, D.

Y. (2014). Risk-Integrated Cash Flow Forecasting for

Overseas Construction Projects. KSCE Journal of Civil

Engineering, 18(4), 875–886. Doi:10.1007/S12205-

014-0464-8

Han, S. H., Park, S. H., Kim, D. Y., Kim, H., & Kang, Y.

W. (2007). Causes of Bad Profit in Overseas

Construction Projects. Journal of Construction

Engineering and Management, 133(12), 932–943.

Doi:10.1061/(Asce)0733-9364(2007)133:12(932)

Han, S. H., Park, S. H., Kim, D. Y., Kim, H., & Kang, Y.W.

(2007). Causes of Bad Profit in Overseas Construction

Projects. Journal of Construction Engineering and

Management, 133(12), 932–943. Doi:10.1061/(Asce)

0733-9364(2007)133:12(932)

Li, G., Zhang, G., Chen, C., & Martek, I. (2020). Empirical

Bid or No Bid Decision Process in International

Construction Projects: Structural Equation Modeling

Framework. Journal of Construction Engineering and

Management, 146(6), 04020050. Doi:10.1061/(Asce)

Co.1943-7862.0001830

Liao, L. (2019). a Proposed Comprehensive Analysis and

Solution for Overseas Construction Project

Management, 2nd International Symposium on Social

Science and Management Innovation (SSMI 2019),

Identification of Risks in Making Decision for Overseas Expansion by Indonesian State-owned Construction Enterprise

211

Advances in Social Science, Education and Humanities

Research, Volume 375, 481-485

Lin, C. (2016). the Risk Management under Conditions of

Contract for EPC in Overseas Projects. 2016

International Conference on Logistics, Informatics and

Service Sciences (LISS). Doi:10.1109/Liss.2016

.7854480

PMI. (2017). Project Management Body of Knowledge.

Project Management Institut, Inc. : Pennsylvania

Sarpin, N., Chia, Y. L., Kasim, N., Mohd Noh, H., Omar,

R., & Zainal, R. (2019). Key Strategies in Undertaking

International Construction Project: Contractors’

Perspective. MATEC Web of Conferences, 266, 03019.

Doi:10.1051/Matecconf/201926603019

Sugiyono. (2018). Metode Penelitian Kuantitatif

Bandung: Alfabeta Utama, W. P., Chan, a. P. C., Zahoor,

H., & Gao, R. (2014). Indonesian Contractors in

Overseas Construction Projects: Southeast Asia, the

Middle East and Africa. ICCREM 2014. Doi:10.1061/

9780784413777.063

Utama, W. P., Chan, a. P. C., Zahoor, H., Gao, R., & Jumas,

D. Y. (2019). Making Decision toward Overseas

Construction Projects. Engineering, Construction, and

Architectural Management. Doi:10.1108/Ecam-01-

2018-0016

Wang, C., Loo, S. C., Yap, J. B. H., Dan Abdul-Rahman,

H. (2019). Novel Capability- based Risk Assessment

Calculator for Construction Contractors Venturing

Overseas. Journal of Construction Engineering and

Management, 145(10), 04019059.

Doi:10.1061/(Asce)Co.1943-7862.0001696 S

Zhi, H. (1995). Risk Management for Overseas

Construction Projects. International Journal of Project

Management, 13(4), 231–237. Doi:10.1016/0263-

7863(95)00015-I

ICE-TES 2021 - International Conference on Emerging Issues in Technology, Engineering, and Science

212