The Importance of Internal Control on Accounting Information

System’s Quality: Survey on Banking Sector

Ita Salsalina Lingga

a

Department of Accounting, Maranatha Christian University, Jl. Suria Sumantri 65, Bandung, Indonesia

Keywords: Internal Control, Accounting Information System’s Quality.

Abstract: In today’s world that relies more on information technology, all business organizations need accounting

information systems (AIS) to be able to compete and survive. The phenomenon of unqualified AIS occurs in

various organizations including banks. A qualified AIS will have an impact on accounting information’s

quality. Thus, internal control must be developed to ensure proper data entry process, processing techniques,

storage methods and information generated. It is needed to ensure that AIS operates as it should so that the

risk of deviation from predetermined objectives can be avoided. This study aims to analyze the effect of

internal control effectiveness towards AIS’s quality. The research survey was conducted on regional

development banks, located in 27 provincial capitals throughout Indonesia. Data were collected through a

questionnaire. Partial Least Square SEM method was used in data processing and analysis. The results proves

that there is an effect of internal control effectiveness on AIS’s quality. Internal control that was conducted

showed a gap which means that they have not yet been implemented effectively in order to enhance AIS’s

quality. Therefore, internal control effectiveness is very important to enhance AIS’s quality which will have

an impact on accounting information’s quality.

1 INTRODUCTION

1.1 Accounting Information System’s

Quality

Accounting Information Systems (AIS) is the main

information system for an organization which serves

to provide information for users to complete their

work (Romney & Steinbart, 2015). AIS is designed to

support the business processes and operations of an

organization as well as to help in the decision-making

process (O'Brien & Marakas, 2011). In today's world

which relies more on information technology,

organizations genuinely need AIS in order to survive

(Gelinas & Dull, 2008). Without the support of AIS,

it is impossible for an organization to be able to

compete (Bodnar & Hopwood, 2010). In other words,

all forms of business, both small and multinational,

will not be able to survive without the support of a

qualified AIS (Stair & Reynolds, 2016).

A qualified AIS is needed to produce qualified

information to be useful for users in both internal and

external of the company (Wilkinson et al., 2000). The

a

https://orcid.org/0000-0003-1785-5534

criteria for measuring the quality of a system

according to Fortune & Peters (2005) are being able

to meet user needs, able to achieve goals, accordance

with the planned time and budget, able to provide

satisfaction for users, and able to meet quality

standards. In the context of information systems, what

is meant by quality is how well the final results of an

information system are able to meet the goals set by

management (Laudon & Laudon, 2014). Several

experts stated that the quality characteristics of AIS

include flexible, efficient, accessible, timely (Stair &

Reynolds, 2010); availability, security, integrity, and

maintainability (Bagranoff et al., 2010); accuracy,

timelines, and ease of use (Laudon & Laudon, 2014).

The phenomenon related to the quality of AIS is

the problem of AIS that has not been integrated

(integration). For example, the case that occurred at

the Regional Development Banks (Indonesian: Bank

Pembangunan Daerah/BPD). According to the

statement of the Association Chairman of Regional

Development Banks, Budiwiyono (2015), only 15 out

of 26 BPDs had joined the integrated information

system through one online platform (BPD Net

Online). Budiwiyono emphasized that by relying on

Lingga, I.

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector.

DOI: 10.5220/0010745200003112

In Proceedings of the 1st International Conference on Emerging Issues in Humanity Studies and Social Sciences (ICE-HUMS 2021), pages 129-140

ISBN: 978-989-758-604-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

129

an online system, which is a system that is equipped

with several features ranging from cash deposits,

book-entry, transfers to other BPDs and receiving

transfers from other BPDs, banking transactions can

be conducted in real time.

The next problem would be the unreliability of

AIS (reliability). For example, the fictitious credit

case at BSB Bank on behalf of PT CT which involved

BSB employees, through false record keeping which

resulted in PT CT being able to get loan funds of up

to IDR 480 billion (Adil, 2014). According to the

Deputy Commissioner for Banking of Financial

Service Authority, Kristiyana (2015), one of the

programs conducted by BPD is a transformation

program consisting of three phases which in the first

phase it aims to build a supporting process and strong

capital along with a fine quality of human resources,

working culture, and reliable information systems

through synergies of BPD group.

Aside from reliability, the next problem is

regarding the inflexible AIS (flexibility). One of

many examples is the effort made by Panin Islamic

Bank in collaboration with PT Emerio Indonesia in

the context of the application of the Regla RCS

(Banking Regulatory & Compliance Suite) Software,

so that AIS and reporting can be precise and flexible

according to the needs and character of the company

(Sarasidya, 2014). Another example related to

flexibility is what happened to BPD DKI, as stated by

the Governor of DKI Jakarta, Purnama (2016) that the

information system of BPD DKI is considered to be

"out of date". This shows that AIS is not flexible/not

able to adapt to technological changes.

Another problem is regarding AIS that is difficult

to use (usability). For example, the launch of the

MPN-G2 system, which is an online tax payment

acceptance system conducted by BPD Kaltim, with

the aim of making it effortless for taxpayers to pay off

their tax obligations electronically (Hanafiah, 2015).

With this system, deposits could be made more

practically, quickly, and safely through internet

banking, mobile banking, ATMs, or Electronic Data

Capture (EDC) machines, eliminating the need to

queue at teller counters. Another example is the

virtual account system at the BPD DKI which

according to the Governor of DKI Jakarta, Purnama

(2016) was still difficult to use by Jakarta citizens to

conduct financial transactions.

Based on the phenomenon described above, we

could see that there are problems related to the quality

of AIS in the banking sector especially by taking

cases from Regional Development Banks. The

problem of AIS’s quality will eventually have an

impact on the quality of accounting information

produced. We all know that it is important for banks

as a financial institution to be trustworthy. Therefore,

this study aims to analyse the effect of internal control

effectiveness towards AIS's quality. The results will

show how important the internal control effectiveness

in enhancing AIS's quality.

1.2 Internal Control Effectiveness

One of the factors affecting the quality of AIS is the

existence of an effective internal control. Internal

control is basically a process designed to provide

adequate assurance about the achievement of

organizational goals, namely the reliability of

financial reporting, operational effectiveness and

efficiency, and compliance with applicable laws and

regulations (Bodnar & Hopwood, 2010).

In general, internal control is defined as a method

and tool that attempts to ensure the accuracy, validity

and appropriateness of information system activities

(O'Brien & Marakas, 2011). O'Brien & Marakas

further stated that internal control is developed to

ensure that the data entry process (input), processing

techniques (processing), storage methods (storage)

and the information generated (output) were

conducted appropriately so that they could monitor

and maintain the quality, as well as security from

input, process, output and storage activities of any

information system.

Internal control is needed to provide assurance to

management that the implemented system is

functioning as expected and is capable of being

operated in various conditions (Jajodia & Strous,

2004). This is supported by Susanto’s statement

(2013), that internal control is essential to ensure that

AIS operates as it should so that the risk of deviation

from predetermined objectives can be avoided.

According to Boockholdt (1999), internal controls

implemented in AIS are called information systems

controls. This is emphasized by Jones & Rama

(2003), that it is possible to build control in AIS to

help achieve goals. COSO even emphasized the

importance of control procedures for all information

systems related to finance, operations and compliance

(Moeller, 2005).

According to Stair & Reynolds (2010)

effectiveness is a measure of the extent to which a

system meets its objectives or achieves its goals. The

same thing was also stated by Weber (1999) and

Boockholdt (1999). The fact is not all organizations

have an effective internal control (Romney &

Steinbart, 2015).What is meant by the effectiveness

of internal control in the context of this research is the

successful application of methods, policies and

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

130

procedures designed and influenced by the board of

commissioners, management and employees in

providing assurance that AIS functions as expected in

carrying out data entry, processing, storage, and

output activities so that the risk of deviation from the

stated objectives can be avoided.

Basically, internal controls consist of general

controls and application controls (Boczko, 2007;

Laudon & Laudon, 2014). General controls are the

information system controls that affect all

applications of the computer in the organization while

application controls affect an individual application.

An example of an ineffective internal control case

occurred in the Regionally-Owned Enterprises

(BUMD) of East Java Provincial Government. Weak

internal control resulted in the emergence of the

findings of The Audit Board of the Republic of

Indonesia on two Regionally-Owned Enterprises of

East Java Provincial Government, namely PT

Petrogas Jatim Utama and PT BPD Jatim

(Napitupulu, 2014). According to the Chairman of the

Board of Commissioners of Financial Service

Authority (OJK) Hadad (2017), BPD transformation

needed to be supported by the availability of

professional human resources, adequate IT

infrastructure, GCG implementation, risk

management and an effective internal control.

Another example related to the weak internal

control is the account breaching case of 54 customers

of BPD Kalbar (West Kalimantan) with a total loss

value of IDR 1.6 billion (Nugroho, 2015). The same

problem also occurred at Bank Nagari, Solok branch

(West Sumatera), due to a poor bank security system

which resulted in the loss of customer savings of IDR

350 million (Amir, 2015).

1.3 The Effect of Internal Control

Effectiveness on AIS’s Quality

Internal control aims to ensure the successful

implementation of AIS. In other words, internal

control is required to achieve AIS objectives (Nash &

Roberts, 1984). O'Brien & Marakas (2011)

emphasized that internal control is designed to

monitor and maintain the quality and safety of input,

processing, output and storage activities of any

information system including AIS. This is

highlighted by Laudon & Laudon (2014) that internal

control aims to be able to regulate the production and

documentation of information in financial reports.

Therefore, it is necessary to think about the security

of the AIS so that other controls (internal control) are

needed to ensure the integrity, confidentiality and

accuracy of the data.

The effectiveness of internal control is very

important because the poor quality of the AIS will

give an impact in decision-making process (Moeller,

2011). The need for controls over all aspects of AIS

is expressed by Curtis & Cobham (2005) that in all

information systems, data must be managed in a

structured manner so that it could be accessed easily,

processed efficiently, obtained quickly, and managed

effectively.

The theory above is supported by Fardinal's

research (2013), which proves that the internal

control effectiveness affects the quality of AIS. In

addition, research conducted by Hamzah &

Norwahida (2014) proves that the quality of AIS is

affected by the internal control effectiveness.

Likewise, research conducted by Neogy (2014)

proves that effective internal control will increase the

efficiency of AIS. Another empirical evidence is the

research of Anggadini (2015) which proves that

internal control has a significant effect on the quality

of AIS. The same thing is stated in the results of

research by Mulyani & Enggar (2016) that the

internal control effectiveness effects the quality of

accounting information generated by AIS. Likewise,

the research by Hayale & Kadra (2006) proves that

inadequate internal control over AIS could lead to a

potential fraud in the banking sector in Jordan.

Evidence that internal control effectiveness

affects AIS’s quality is also stated in Chen & Sui's

research (2008), that internal control is a fundamental

security tool to ensure the reliability of AIS

operations. According to Danescu et al. (2012)

internal control effectiveness has an impact on the

information generated by AIS.

In line with O'Brien & Marakas (2011) statement

that internal control is designed to monitor and

maintain the quality of any information system, then

effective internal control is required to provide

assurance to management that the implemented AIS

is functioning as expected (qualified AIS). In other

words, ineffective internal control will cause poor

quality of AIS which in turn will have an impact on

the quality of the resulting accounting information

which will be used by stakeholders in decision

making.

Based on the theory that has been stated above,

which is supported by the results of empirical

research, the hypotheses that can be stated here is:

H

1

: The internal control effectiveness has a positive

effect on AIS’s quality.

The results of this study have benefits or

contribution for the development of science, namely

efforts to find general truths based on the knowledge

possessed to produce additional knowledge through

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector

131

understanding the phenomena that occur to build

theories. Furthermore, based on the theory built and

existing empirical evidence, the results of this study

produce problem solving to the phenomena that occur

as stated in the research background.

2 METHODS AND MATERIALS

2.1 Research Methods

This research is categorized as a descriptive and an

explanatory research conducted using survey method.

Questionnaires is distributed to respondents in data

collecting. Unit of analysis in this research is the

accounting and operational divisions of Regional

Development Banks (BPD) that are spread across all

provinces in Indonesia. BPD is a local government

bank with a different system from other banks. This

makes the difference between this study and previous

research as the novelty of this research. Furthermore,

the observation unit in this study are users of AIS,

especially those who regularly interact with the

accounting information systems in completing their

work. In this case the head and staff of the accounting

and operational divisions of BPD, approximately 3-5

people. The population in this study were 27 BPD

located throughout Indonesia, including the head

office, main branches and sub-branches. The unit of

research analysis is BPD bank

In the context of this study, the effectiveness of

internal control is assessed from whether the internal

control that is implemented consisting of general

controls including software control, hardware

control, computer operating procedure control, data

security control, implementation control, and

administrative control as well as application control

including input control, process control and output

control. is adequate to maintain the quality of AIS

which is then represented by X (independent

variable).

The dimensions and indicators used in assessing

the effectiveness of internal control are described in

detail below.

1. General control is defined as managing the

design, security, and usability of computer

programs and the security of data files in general

through an information technology infrastructure

with indicators includes:

a. Software control is the level of supervision to

prevent unauthorized access to software

programs, software systems, and computer

programs.

b. Hardware control is the level of control to

ensure that the computer hardware is

physically safe, and functioning properly.

c. Computer operating procedure control is the

level of control to ensure that data storage and

processing procedures are carried out

appropriately and consistently.

d. Data security control is a level of control to

ensure that all files cannot be misused by

unauthorized parties.

e. Implementation control is the level of control

through an information system audit to ensure

that the system is executed properly.

f. Administrative control is the level of control

that is carried out to ensure that general

controls and company applications have been

carried out in accordance with standard

operating procedures (Boockholdt, 1999;

Bodnar & Hopwood, 2010; Laudon & Laudon,

2014; Romney & Steinbart, 2015; Susanto,

2013).

2. Application control consist of manual and

automated procedures to ensure that only

authorized data can be processed completely and

accurately by the application with indicators

includes:

a. Input control is the level of control to ensure

that the data entered is complete and accurate.

b. Process control is the level of control to ensure

that data is complete and accurate during the

updating process.

c. Output control is the level of control to ensure

that computer processing results are truly

accurate, complete and properly distributed

(Boockholdt, 1999; Bodnar & Hopwood,

2010; Susanto, 2013: Laudon & Laudon, 2014;

Romney & Steinbart, 2015).

Furthermore, the quality of AIS is assessed by

whether the system being implemented achieves its

objectives as measured by achieving integration,

reliability, flexibility and usability which is then

represented by Y (dependent variable).

The dimensions and indicators used in assessing

the AIS’s quality are described in detail below:

1. Integration means the relationship and

interdependence (harmoniously) between

components (sub systems) in the system and

between the system and the environment (Wu,

1983; Nash & Roberts, 1984; Leitch & Davis,

1992; Grady, 1994; Whitten & Bentley, 2007;

Boczko, 2007; Heidmann, 2008; Baltzan &

Phillips, 2009; Stair & Reynolds, 2010; Bojic,

2015), includes:

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

132

a. Integration between sub-systems (Grady,

1994; Boczko, 2007; Heidmann, 2008; Stair &

Reynolds, 2010; Bojic, 2015).

b. Integration between system and other systems

(Wu, 1983; Nash & Roberts, 1984; Heidmann,

2008; Bojic, 2015).

2. Reliability means the system functions properly

and securely in producing accurate information

(Nash & Roberts, 1984; Avgerou & Conrnford,

1998; DeLone & McLean, 2003; Boczko, 2007;

Baltzan & Phillips, 2009; Bagranoff et al., 2010;

Baltzan, 2014), includes:

a. Accounting information systems operate

correctly starting from data input, processing

to generating accounting information (Avgerou

& Conrnford, 1998; Boczko, 2007; Baltzan &

Phillips, 2009; Baltzan, 2014).

b. Accounting information systems generate

accurate accounting information (Avgerou &

Conrnford, 1998; Boczko, 2007; Baltzan &

Phillips, 2009; Bagranoff et al., 2010).

3. Flexibility means the system is able to adapt to

various user needs and changing conditions

(Avgerou & Conrnford, 1998; Boczko, 2007;

Heidmann, 2008; Baltzan & Phillips, 2009; Stair

& Reynolds, 2010; Bagranoff, et al., 2010;

Romney & Steinbart, 2015), includes:

a. The system's ability to adapt to changing

conditions/environment (Avgerou &

Conrnford, 1998; Boczko, 2007; Heidmann,

2008; Baltzan & Phillips, 2009; Stair &

Reynolds, 2010; Bagranoff, et al., 2010).

b. The system's ability to adapt to changing needs

or business (Boczko, 2007; Heidmann, 2008;

Baltzan & Phillips, 2009; Bagranoff, et al.,

2010; Stair & Reynolds, 2010).

4. Usability means the system must be easy to use,

easy to learn and directly meet people's needs

(Avgerou & Conrnford, 1998; Laudon &

Laudon, 2014; Baltzan, 2014), includes:

a. Easy to use (Avgerou & Conrnford, 1998;

Laudon & Laudon, 2014:505; Baltzan, 2014).

b. Easy to learn (Avgerou & Conrnford, 1998;

Baltzan, 2014).

The following is a research instrument on the

effectiveness of internal control and accounting

information system’s quality using a 5 point of likert

scale.

Table 1: Research Instrument on The Effectiveness of

Internal Control.

1

The AIS that is used is safe from possible access

or misuse by unauthorized parties because it has

used a password, thereby being able to function

as ex

p

ected.

(

not safe

–

ver

y

safe

)

2

The AIS that is used is able to run properly because it

is equipped with hardware that is always guaranteed

to be physically safe and to function properly.

(not guaranteed

–

fully guaranteed.

3

The AIS that is used is able to run well in processing

and storing data because it is always monitored by the

IT department.

(never

–

always).

4

All important files that have been processed using

AIS are safe from the possibility of theft, damage,

viruses, fire, or misuse of data by unauthorized parties

due to security measures such as the use of

passwords, and data backup to a separate server.

(not safe

–

ve

r

y safe).

5

The AIS used is capable of running well because it is

always audited to ensure that AIS has been

implemented as intended. (never

–

always).

6

The AIS used is able to run well because it complies

with the standard operating procedures (SOP) in the

company. (not suitable

–

very suitable).

7

The AIS used has guaranteed the completeness and

accuracy of the data to be inputted into the system,

because it is equipped with a feature that provides a

warning if the data entered is incomplete and

inaccurate. (not guaranteed

–

fully guaranteed).

8

The AIS used is able to run properly because the data

to be processed further is always guaranteed to be

complete and accurate.

(not guaranteed

–

fully guaranteed).

9

The AIS is able to run properly because the

information generated (output) is always guaranteed

to be accurate, complete and in accordance with user

needs. ( not guaranteed

–

fully guaranteed).

Table 2: Research Instrument on The AIS’s Quality.

1

Applications and data in AIS have been connected in

an integrated manner both between levels in the same

section and with other sections.

(not integrated

–

fully integrated).

2

Applications and data in AIS are harmoniously

connected between department.

(not integrated

–

fully integrated).

3

AIS functions correctly starting from inputting data,

processing, to producing accounting information

(not reliable

–

fully reliable).

4

The AIS is reliable because the information

generated is always accurate according to user needs

(not reliable

–

fully reliable).

5

The AIS is able to run well because it has the ability

to adapt to changing conditions or environment.

(lacks of capability

–

very capable).

6

The AIS is able to run well because it has the ability

to adapt to various needs of users.

(lacks of capability

–

very capable).

7

The AIS is able to run well because it has features

that are easy to operate so that it helps users in

completing work. (not easy - very easy).

8

The AIS is able to run well because it has features

that are easy to learn so that it helps users in

completing work. (not easy - very easy).

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector

133

2.2 Data Testing Methods

The validity test used in this study was the Rank-

Spearman correlation technique (Sekaran & Bougie,

2013).

−+

=

22

222

.2 yx

dyx

r

i

s

(1)

To determine the validity of an item/statement, a

t-test was conducted, with the following formula:

2

1

2

.

s

s

r

N

rt

−

−

=

(2)

With a significance level of 95% (alpha = 0.05),

the t-count obtained is compared with the t

table

, with

degrees of freedom (df = n - 2). The conditions used

are as follows:

• If t

count

≥ t

table

, then the questionnaire instrument

is valid.

• If t

count

< t

table

, then the questionnaire instrument is

invalid.

Furthermore, the reliability test was conducted

using Cronbach Alpha to test the interim consistency

reliability and split-half reliability (Sekaran &

Bougie, 2013). An instrument is said to be reliable if

the Cronbach Alpha coefficient exceeds 0.6.

−

−

=

=

total

k

i

i

S

S

k

k

2

1

2

1

1

α

(3)

Information:

k = the number of parts of the item

S

i

2

= the variance of the i-item

S

2

total

= the total variance of the items

2.3 Data Analysis Methods

Inferential analysis in this study was conducted using

a covariance-based structural equation modelling

method, namely partial least square (PLS) (Hair et al.,

2014). Second order model was used for the

measurement model (outer model) in this study,

where the first factor is the dimension while the

second factor is the variable. The outer model

specifies the relationship between latent variables and

their indicator variables or manifest variables

(measurement model). The first factor measurement

model is a model that connects dimensions with

indicators, while the second measurement model is a

model that connects latent constructs with manifest

variables. The latent construct consists of the internal

control effectiveness and the quality of AIS.

For the Internal Control Effectiveness (ESPI)

variable, the measurement model is formative in the

first order consisting of general control (PGUM) and

application control (PGAP), while in the second order

it is reflective. The following are figure and

measurement equations which state the causal

relationship between indicators and latent variables as

follows:

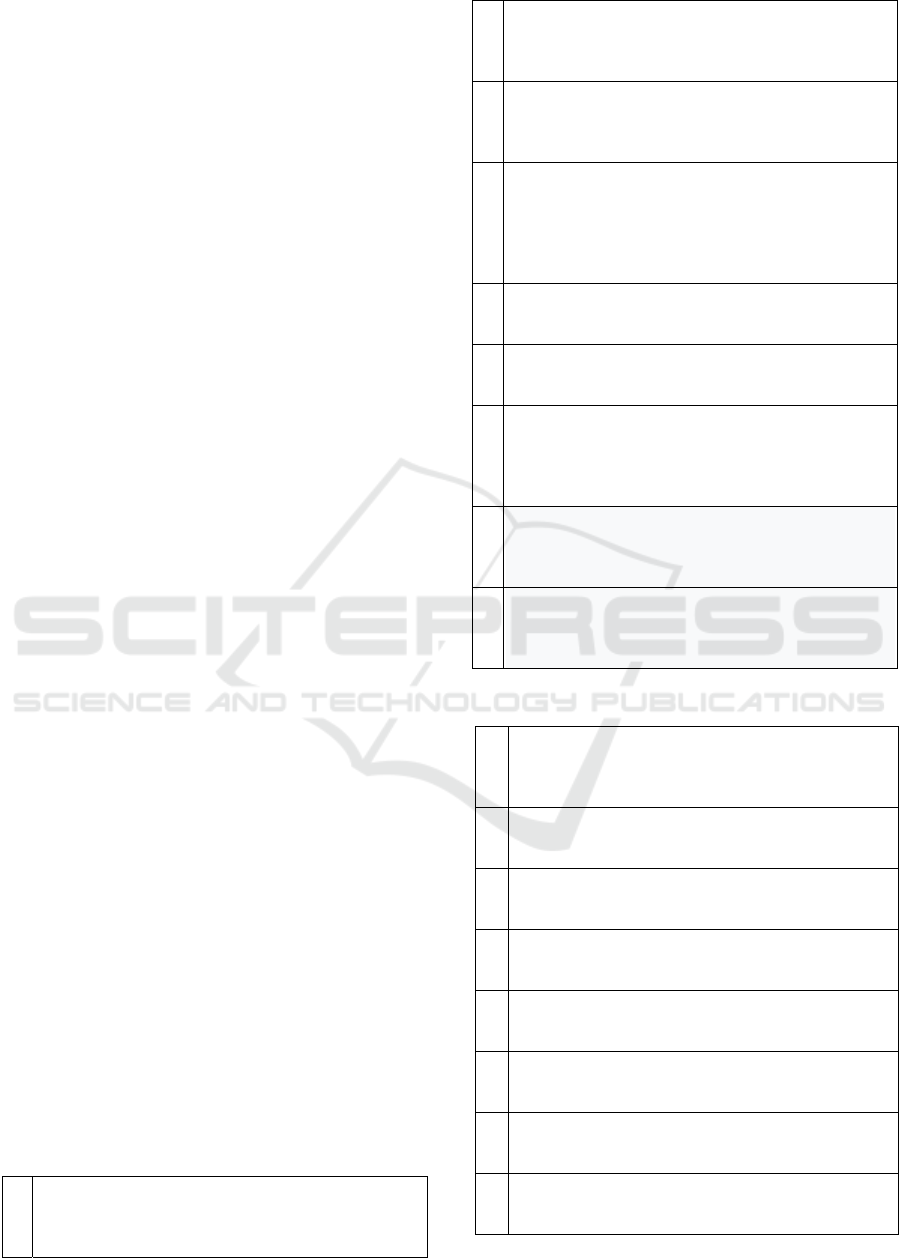

Figure 1: Internal Control Effectiveness Variable

Measurement Model.

For the AIS’s quality (KSIA) variable, the

measurement model is reflective in the first order

which consists of: integration (INTG), reliability

(RELB), flexibility (FLEX), usability (USAB), the

second order is reflective as well. The measurement

equation which states the causality relationship

between indicators and latent variables is as follows:

Figure 2: AIS’s Quality Variable Measurement Model.

Based on the structural measurement model in

Figure 1 and 2, the statistical hypotheses to be tested

in this study are as follows:

H

o

: γ

1.2 =

0 = Internal control effectiveness has no

effect on AIS’s quality.

Ha : γ

1.2 ≠

0 = Internal control effectiveness has a

positive effect on AIS’s quality.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

134

3 RESULTS AND DISCUSSION

The research survey was conducted on regional

development banks, located in 27 provincial capitals

throughout Indonesia including the head offices,

main branches and sub-branches. Data were collected

through questionnaires. The following is table 3

which state the recapitulation of questionnaires

distributed and returned from respondents.

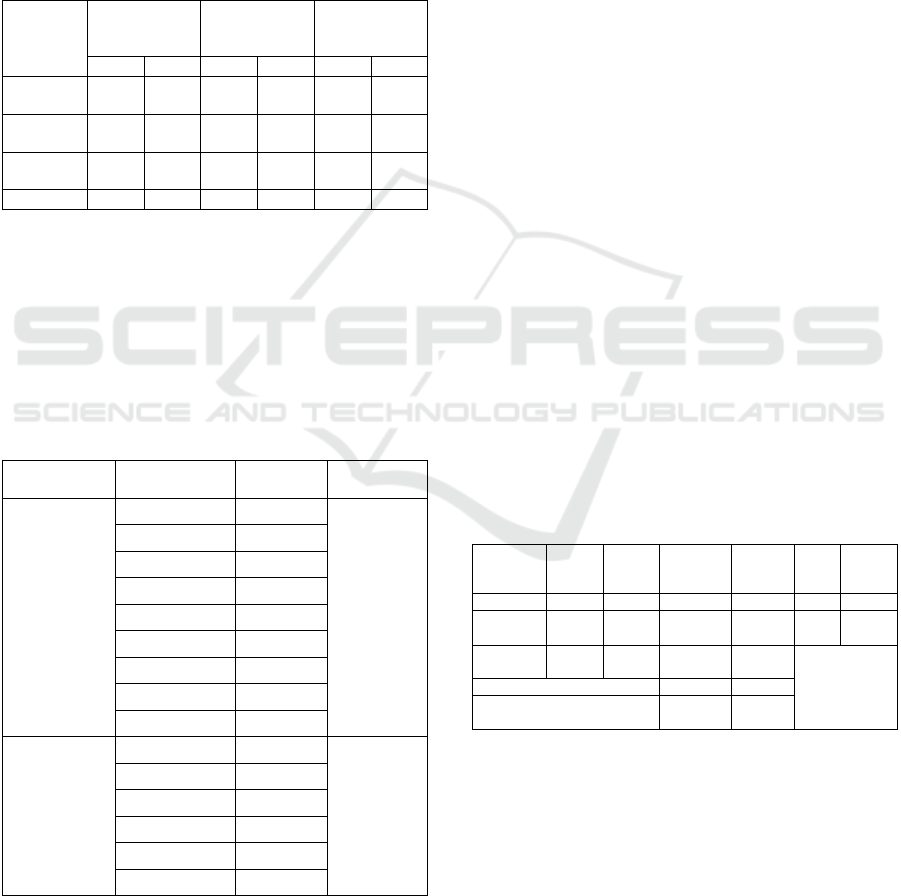

Table 3: Recapitulation of Questionnaires Distributed and

Returned.

Unit of

Analysis

Total

Questionnaire

Distributed

Total

Questionnaire

Returned

%

Questionnaire

Returned

BPD Resp BPD Resp BPD Resp

Head

Office

27 140 24 120

88,89 85,71

Main

Branches

27 81 8 24

29.63 29.63

Sub-

Branches

27 54 12 32

44.44 59.26

Total 81 275 44 176

54.32 64

Source: data processing results

Based on the data in table 3, it can be seen that the

percentage of questionnaires returned was 65%. It

means that the minimum respond rate of 30% has

been fulfilled (Sekaran & Bougie, 2013).

The following are the results of the validity and

reliability tests:

Table 4: Recapitulation of Validity and Reliability Test

Results.

Variable

Statement

Item

Validity Reliability

Internal

Control

Effectiveness

Item 1

0,635

0,884

Item 2 0,691

Item 3 0,533

Item 4 0,720

Item 5 0,540

Item 6 0,696

Item 7 0,627

Item 8 0,670

Item 9 0,702

AIS’s Quality

Item 10 0,743

0,914

Item 11 0,673

Item 12 0,726

Item 13 0,770

Item 14 0,707

Item 15 0,730

Based on the results of the validity and reliability

test above, it can be seen that all statement items have

met the validity requirements because they have a

correlation value greater than 0.30. Likewise, the

reliability test results have a coefficient greater than

0.60, hence it can be concluded that the questionnaire

used has the reliability to measure each variable and

can be continued for further analysis.

According to Cooper & Schindler (2013) to

make it easier to interpret the variables being studied,

especially for ordinal data, categorization is carried

out using the interquartile range associated with the

median. The first quartile is the 25th percentile, the

second quartile (median) is the 50th percentile and the

third quartile is the 75th percentile. In a questionnaire

using a scale of 1-5, the first quartile (1-<2)

categorized as bad category, the second quartile (2-

<3) categorized as poor category, the third quartile (3-

<4) categorized as adequate category and the fourth

quartile (4-5) categorized as good category.

The internal control effectiveness at Regional

Development Banks in Indonesia in association with

AIS’s quality is measured through two dimensions,

namely general control and application control.

General control dimensions are measured through six

indicators, namely software control, hardware

control, computer operating procedure control, data

security control, implementation control and

administrative control. Furthermore, the application

control dimensions are measured through three

indicators, namely input control, process control and

output control. The following is the recapitulation of

each dimension of the internal control effectiveness

as presented in table 5.

Table 5: Average Score Recapitulation of Respondents

Response for Each Dimension of Internal Control

Effectiveness Variable Related to AIS’s Quality.

Dimension Real

Score

Total

Score

Average

% Real

Score:

Total

%

Gap

Category

G C 586 720 4,07 81,39 18,61 Goo

d

A C 267 360 3,71 74,17 25,83

Ade-

quate

Total

Avera

g

e

853 1080 3,95 78,98

Adequate

Ga

p

1,05 21,02

Actual

Total

100

Based on table 5 above, it can be seen that the

responses of respondents regarding the internal

control effectiveness are as follows:

1. Responses from BPD employees in Indonesia who

became the research samples on the internal

control effectiveness in relation to the quality of

the AIS have an average score of 3.95, which is

categorized as adequate. This shows that in

general, the internal control implemented by BPD

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector

135

in Indonesia is quite effective but not yet fully

effective both general control and application

control in supporting the quality of AIS. There is

still a gap with an average score of 1.05.

2. On average, the real score compared to the total

internal control effectiveness in relation to the

quality of the AIS used is 78.98%. This shows a

gap of 21.02%. This gap shows a form of

quantification of the actual condition that the

implemented internal control is not yet fully

effective in supporting the quality of AIS,

especially with the application control dimension

which has a lower average score (3.71), compared

to general control (4.07).

The following is the description of the respondents'

responses regarding the internal control effectiveness

as seen from the indicators of each dimension.

1. General Control Dimensions

The general control dimensions are measured using

six indicators, namely software control, hardware

control, control of computer operating procedure,

data security control, implementation control and

administrative control. Overall, the six indicators are

operationalized into two statement items.

Based on average score recapitulation of

respondent’s response regarding relationship of each

indicator with AIS’s Quality in General Control

Dimensions, the average respondent's response to the

software control indicators has a score of 3.92, which

is categorized as adequate. From the distribution of

the questionnaire, in general, 29,23% of respondents

stated that generally, the internal control

implemented by BPD in Indonesia had a very good

software control, then 58,3% of respondents stated it

was good, while 12.5% of respondents stated it was

quite good.

Based on the processed data, the average

respondent's response to the hardware control

indicators has a score of 4.25, which is categorized as

good. From the distribution of questionnaires, in

general, 41,7%% of respondents stated that generally,

the internal control implemented by BPD in Indonesia

had a very good hardware control, the remaining

58,3% of respondents stated it was good.

Based on the processed data, the average

respondent's response to the indicators of computer

operating procedures control has a score of 4.33

which is categorized as good. From the distribution of

questionnaires, in general, 70.8% of respondents

stated that generally, the internal control

implemented by BPD in Indonesia had a very good

computer operating procedures control, the remaining

29.2% of respondents stated it was good.

Based on the processed data, the average

respondent's response to the data security control

indicators has a score of 3.96, which is categorized as

adequate. From the distribution of the questionnaire,

in general, 33,3%% of respondents stated that the

internal control implemented by BPD in Indonesia

had a very good data security control, then 54,2% of

respondents stated it was good, while 12.5% of

respondents stated it was quite good.

Based on the processed data, the average

respondent's response to the implementation control

indicators has a score of 4.04, which is categorized as

good. From the distribution of the questionnaire, in

general, 37,5% of respondents stated that the internal

control implemented by BPD in Indonesia had a very

good implementation control, then 54,2% of

respondents stated it was good, while 8.3% of

respondents stated it was quite good.

Likewise, from the processed data, the average

respondent's response to the administrative control

indicator has a score of 3.92, which categorized as

adequate. From the distribution of questionnaires, in

general, 12,5% of respondents stated that the internal

control implemented by BPD in Indonesia had a very

good administrative control, then 79,2% of

respondents stated it was good, while 8.3% of

respondents stated it was quite good.

2. Application Control Dimensions

The dimensions of application control are measured

using three indicators, namely input control, process

control and output control. Overall, the three

indicators are operationalized into two statement

items.

Based on recapitulation of the average score of

respondents' responses regarding the relationship of

each indicator with AIS’s quality in the application

control dimensions, the average respondent's

response on the input control indicator has a score of

3.63, which is categorized as adequate. From the

distribution of the questionnaire, in general, 4,2% of

respondents stated that the internal control

implemented by BPD in Indonesia had a very good

input control, then 66,7% of respondents stated it was

good, while 29,2% of respondents stated it was quite

good.

Based on the processed data, the average

respondent's response to the process control indicator

has a score of 3.71, which is categorized as adequate.

From the distribution of the questionnaire, in general,

8.3% of respondents stated it was very good, then

79.2% of respondents stated it was good, while 12.5%

of respondents stated it was quite good.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

136

Based on the processed data, the average

respondent's response to the output control indicator

has a score of 3.79, which is categorized as adequate.

From the distribution of questionnaires, in general,

12,5% of respondents stated that the internal control

implemented by BPD in Indonesia had a very good

output control, then 75% of respondents stated it was

good while 12.5% of respondents stated it was quite

good.

Following the explanation of the measurement

model of the internal control effectiveness variable.

The internal control effectiveness is measured using

two dimensions which are operationalized into nine

indicators. Based on the results of data processing

using the second order confirmatory factor analysis,

the measurement model for the latent variable on the

internal control effectiveness was obtained as

presented in the following figure.

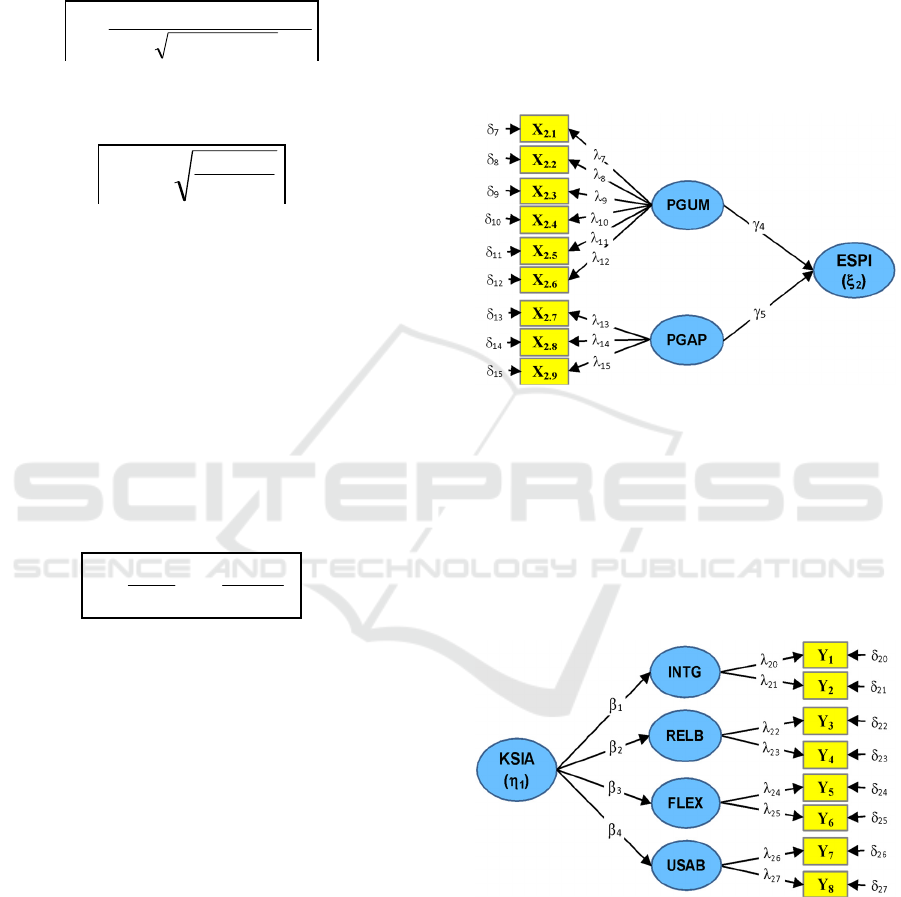

Figure 3: Path Diagram of The Measurement Model of

Internal Control Effectiveness Variable.

Following the explanation of the measurement model

of AIS’s quality variable. AIS’s quality is measured

using 4 dimensions which are operationalized into 8

indicators. Based on the results of data processing

using second order confirmatory factor analysis, the

measurement model for the latent variables of the

accounting information system quality was obtained

as presented in the following figure.

Figure 4: Path Diagram of The Measurement Model of

AIS’s Quality Variable.

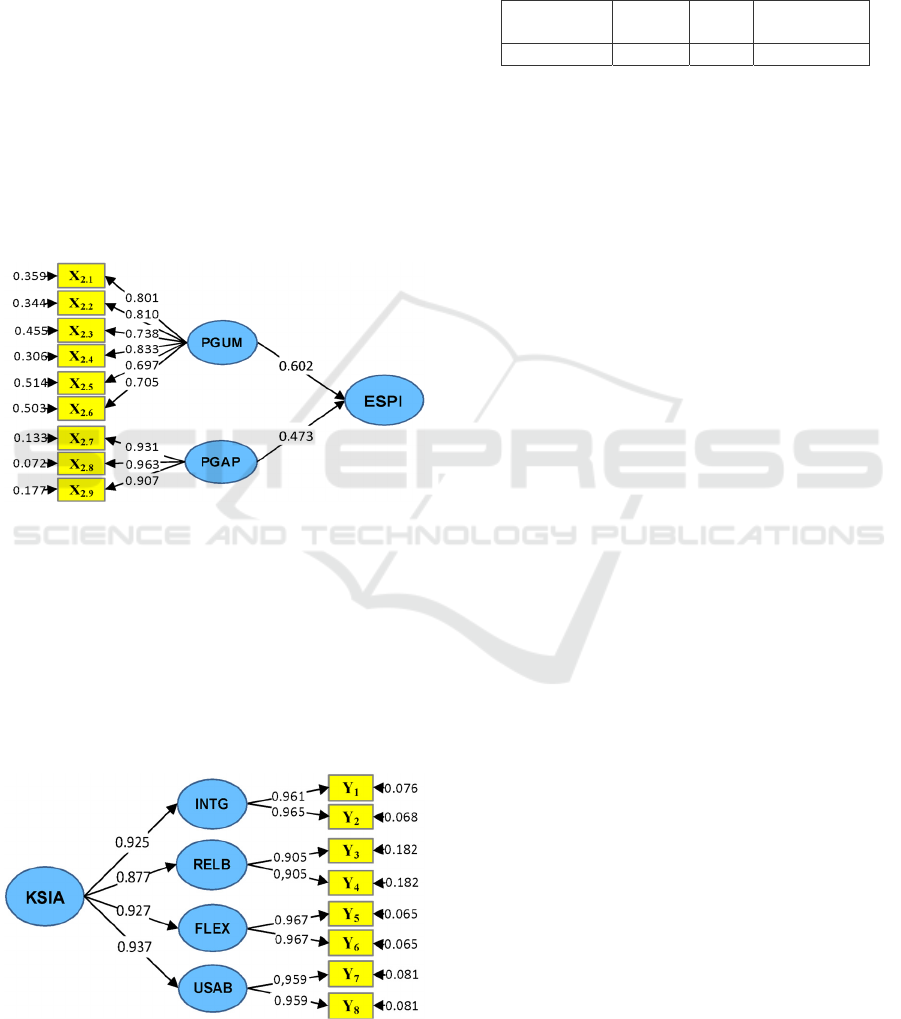

Furthermore, hypothesis testing was conducted to

determine the effect of the internal control

effectiveness on AIS’s quality as described in the

following table.

Table 6: Test Results of The Effect of Internal Control

Effectiveness on AIS’s Quality.

Path

Coefficient

t

count

t

critical

H

0

0,436 2,548 1,96 Re

j

ecte

d

Based on the data in table 6, it can be seen that the

t

count

value of the internal control effectiveness

variable (2.548) is greater than t

critical

(1.96). Because

the value of t

count

is greater than t

critical

level, then at an

error level of 5%, it was pronounced to reject H

0

. So

based on the test results, it can be concluded that the

internal control effectiveness has a positive effect on

AIS’s quality. The results of this study in line with the

empirical evidence that the more effective internal

control is, then the higher quality of AIS will be.

4 CONCLUSIONS

Based on the results of hypothesis testing, it is known

that the internal control effectiveness has a positive

effect on AIS’s quality. The results of this hypothesis

testing support the theory as stated by Nash & Roberts

(1984); O'Brien & Marakas (2011); Moeller (2011)

who state that internal control is designed to monitor

and maintain the quality and security of input,

processing, output and storage activities of any

information system.

The results of the hypothesis testing are in

accordance with the conclusions of previous studies

which were conducted by Hayale & Kadra (2006);

Fardinal (2013); Hamzah & Norwahida (2014);

Anggadini (2015); Mulyani & Enggar (2016).

Ineffective of internal control over AIS could lead to

potential irregularities.

Internal control effectiveness gave an effect of

37%. It means that 37% of AIS’s quality was caused

or could be explained by the internal control

effectiveness. Insufficient contribution of general

control conducted by BPD in Indonesia in enhancing

the quality of AIS was shown by the fact that there

was a gap of 18.48%, which means that general

control conducted by BPD in Indonesia, through

software control, hardware control, computer

operating procedures control, data security control,

implementation control, and administrative control

have not been fully effective in enhancing the quality

of AIS at each BPD in Indonesia.

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector

137

Furthermore, insufficient contribution of

application control conducted by BPD in Indonesia in

enhancing the quality of AIS was shown by the fact

that there was a gap of 25.15%, which means that

application control conducted by BPD in Indonesia

through input control, process control, and output

control have not been fully effective in enhancing the

quality of AIS at each BPD in Indonesia.

Based on the results of research, discussion and

conclusions, the suggestions that can be put forward

are as follows:

1. Increasing the Effectiveness of Internal Control by:

a. Safeguard the AIS (software) by ensuring that the

password used is completely safe from possible

accessibility by unauthorized parties through the

design of the AIS software which automatically

requires AIS’s users to use password when

accessing data files and automatically requests

AIS’s users to change password periodically.

b. Perform regular checks on the hardware used by

employees regarding AIS use to ensure that the

hardware is always in good working condition.

c. Perform regular monitoring by the special unit

that handles information technology issues (IT

department) on AIS software used to ensure that

the application can be run properly in processing

and storing data.

d. Perform regular data backups to a separate server

to ensure that all important files that have been

processed using AIS software are safe from the

possibility of theft, damage, viruses, fires or

misuse of data by unauthorized parties.

e. Conduct periodic audits to ensure that the AIS

has been carried out in accordance with the

objectives, namely with the standard operating

procedures (SOP) at each BPD.

f. Completing the AIS software used with a feature

that automatically gives a warning if the data

entered is incomplete and inaccurate so as to

guarantee the completeness and accuracy of the

data that will be inputted into the system and will

be further processed so that the resulting

accounting information (output) will be

qualified.

2. Improving the Quality of AIS, Including:

a. Creating integration in AIS between hardware,

software, brainware, procedures, databases and

communication networks by:

1) Striving for harmonization between the

communication network technology used

with the brainware's ability by increasing user

competence, harmonizing communication

network technology with the data that will be

distributed using a high-speed data

communication network if the data to be

distributed is large enough, harmonization

between network technologies

communication with procedures, by using

network security systems, data access

systems and others. One way to secure the

system is through the use of a password. In

addition, it is necessary to harmonize the

communication network technology used

with software and hardware. Hardware is

equipped with AIS (software) which is

harmonious with the operating system.

b. Building AIS reliability by:

1) Making internal control effective through

controlling software, hardware, computer

operating procedures, data security,

implementation and administration to ensure

the completeness and accuracy of the data

that will be inputted into the accounting

information system, further processed so as to

produce qualified accounting information.

c. Creating AIS flexibility by:

1) Anticipating rapid changes in both user and

environmental needs, for example the

growing need for banking applications such

as m-banking. Therefore, it is necessary to

think about the development of an up-to-date

accounting information system so that BPD

can compete with other commercial banks.

d. Increasing the ease of use of AIS by completing

the AIS software with features that are easy to

understand and operate so that it helps users in

completing their work.

REFERENCES

Adil, M. (2015). Bank Sumsel Babel digeledah polisi

terkait kredit fiktif PT CT. https://www.

merdeka.com/peristiwa/bank-sumsel-babel-digeledah-

polisi-terkait-kredit-fiktif-pt-ct.html.

Amir, A. (2015). Tabungan Raib Rp 350 Juta, Nasabah

Ragukan Sistem Bank Nagari. http://www.republika.

co.id/berita/nasional/hukum/15/04/15/nmuub6-tabungan

-raib-rp-350-juta-nasabah-ragukan-sistem-bank-nagari.

Anggadini, S. D. (2015). ‘The Effect of Top Management

Support and Internal Control of the Accounting

Information Systems Quality and Its Implications on

the Accounting Information Quality’. Information

Management and Business Review, 7(3), pp. 93-102.

https://doi.org/10.22610/imbr.v7i3.1157.

Avgerou, C., & Conrnford, T. (1998). Developing

Information Systems: Concepts, Issues and Practice.

2

nd

edition. Palgrave Macmillan.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

138

Bagranoff, N. A., Simkin, M. G. & Norman, C. S. (2010).

Accounting Information Systems. 11

th

edition. John

Wiley & Sons, Inc.

Baltzan, P. & Phillips, A. (2009). Essentials of Business

Driven Information Systems. McGraw-Hill Irwin.

Baltzan, P. (2014). Business Driven Information Systems.

4

th

edition. McGraw-Hill Irwin.

Boczko, T. (2007). Corporate Accounting Information

Systems. 7

th

edition. Pearson Education Ltd.

Bodnar, G. H. & Hopwood, W. S. (2010). Accounting

Information Systems. 10

th

edition. Pearson Education Inc.

Bojic, P., Greasley, A. & Hickie, S. (2015). Business

Information Systems: Technology, Development and

Management for the E-Business. 5

th

edition. Pearson

Education Ltd.

Boockholdt, J. (1999). Accounting Information Systems:

Transaction Processing and Control. MacGraw-Hill.

Budiwiyono, E. (2015). Baru 15 bank daerah gunakan

sistem online. https://www.merdeka.com/uang/baru-

15-bank-daerah-gunakan-sistem-online.html.

Budiwiyono, E. (2015). Menanti Gebrakan Transformasi

BPD. http://www.republika.co.id/berita/koran/pareto/15/

06/08/npmbo6-menanti-gebrakan-transformasi- bpd.

Chen, W. & Sui, S. (2008). ‘On the Challenge of

Accounting Standards for Enterprise Towards

Enterprise Internal Control’. Journal of Sustainable

Development, Vol 1, No.2, July 2008.

Cooper, D. R. & Schindler, P. S. (2013). Business Research

Methods. 12

th

edition. Mc.Graw-Hill Irwin.

Curtis, G. & Cobham, D. (2005). Business Information

Systems. 5

th

edition. FT Prentice Hall.

Danescu, T., Prozan, M., & Danescu, A.C. (2012). ‘The

Role of The Risk Management and of The Activities of

Internal Control in Supplying Useful Information

Through the Accounting and Fiscal Reports’. Procedia

Economics and Finance, 3 (2012) 1099-1106. DOI:

10.1016/S2212-5671(12)00280-8.

Fardinal. (2013). ‘The Quality of Accounting Information

and The Accounting Information System through The

Internal Control Systems: A Study on Ministry and

State Agencies of The Republic of Indonesia’.

Research Journal of Finance and Accounting, Vol.4,

No.6. ISSN 2222-1697 (Paper) ISSN 2222-2847

(Online).

Fortune, J. & Peters, G. (2005). Information Systems:

Achieving Success By Avoiding Failure. John Wiley &

Sons, Ltd.

Gelinas, U. J. & Dull, R. B. (2008). Accounting Information

Systems. 7

th

edition. Thomson South Western.

Grady, B. (1994). Object-Oriented Analysis and Design

With Applications. 2

nd

edition. The Benjamin

Cummings Publishing Company.

Hadad, M. D. (2017). OJK gaungkan kembali program

transformasi BPD. https://keuangan.kontan.co.id/ news/

ojk-gaungkan-kembali-program-transformasi- bpd.

Hair, J. F., Hult, G., Thomas, M., Ringle, C. M., & Sarstedt,

M. (2014). A Primer on Partial Least Squares

Structural Equation Modeling (PLS-SEM). SAGE

Publications, Inc.

Hamzah, M. A., & Norwahida, Al_Qudah S. (2014). ‘The

Role of Data Quality and Internal Control in Raising

The Effectiveness of AIS In Jordan Companies’.

International Journal of Scientific & Technology Re-

search, Vol. 3, Issue 8, August 2014. ISSN 2277-8616.

Hanafiah, S. M. (2015). BPD Kaltim Cabang Bontang

Perkenalkan Sistem yang Membuat Bayar Pajak

MakinMudah.http://klikbontang.com/berita-2394-

bpd-kaltim-cabang-bontang-perkenalkan-sistem- yang-

membuat-bayar-pajak-makin-mudah.html.

Hayale, T. H., & Khadra, H. A. (2006). ‘Evaluation of The

Effectiveness of Control Systems in Computerized

Accounting Information Systems: An Empirical

Research Applied on Jordanian Banking Sector’.

Journal of Accounting-Business & Management. 13

(2006) 39-68.

Heidmann, M. (2008). The Role of Management

Accounting Systems in Strategic Sensemaking. 1

st

edition.Germany: Deutscher Universitats-Verlag.

Jajodia S. & Strous, L. (2004). Integrity and Internal

Control in Information Systems VI IFIP TC11/WG11.5

Sixth Working Conference on Integrity and Internal

Control in Information Systems (IICIS) 13–14 November

2003, Lausanne, Switzerland. George Mason University

Fairfax, Virginia, USA. Kluwer Academic Publishers.

Jones, F. L. & Rama, D. V. 2003. Accounting Information

Systems: A Business Process Approach. Thomson,

South-Western.

Kristiyana, H. (2015). Baru 15 bank daerah gunakan sistem

online. https://www.merdeka.com/uang/baru- 15-bank -

daerah-gunakan-sistem-online.html.

Kristiyana, H. (2015). Menanti Gebrakan Transformasi BPD.

http://www.republika.co.id/berita/koran/pareto/15/06/08

/npmbo6-menanti-gebrakan-transformasi- bpd.

Laudon, K. C. & Laudon, J. P. (2014). Management

Information Systems: Managing the Digital Firm. Global

Edition. 14

th

edition. Pearson Education Ltd.

Leitch, R. A. & Davis, K. R. (1992). Accounting

Information Systems: Theory and Practice. Prentice-

Hall International, Inc.

Moeller, R. R. (2005). Brink’s Modern Internal Auditing.

6

th

edition. John Wiley & sons, Inc.

Moeller, R. R. (2011). COSO Enterprise Risk Management:

Establishing Effective Governance, Risk, and Com-

pliance Processes. 2

nd

edition. John Wiley & Sons, Inc.

Mulyani, S. & Enggar, D.P.A. (2016). ‘The Influence of

Manager Competency and Internal Control

Effectiveness Toward Accounting Information

Quality’. IJABER, Vol. 14(1): 181-190.

Napitupulu, H. (2014). Penyebab Temuan BPK: Lemahnya

GCG dan Pengendalian Intern. http://www.bpkp.go

.id/berita/read/12652/0/Penyebab-Temuan-BPK-Lemah

nya-GCG-dan-Pengendalian-Intern.bpkp.

Nash, J. F. & Roberts, M. B. (1984). Accounting Information

Systems. Macmillan Publishing Company.

Neogy, T.K., (2014). ‘Evaluation of Efficiency of AIS: A

Study on Mobile Telecommunication Companies in

Bangladesh’.Global Disclosure of Economic &

Business. Vol 3(1), 2014, pp. 40-55.

The Importance of Internal Control on Accounting Information System’s Quality: Survey on Banking Sector

139

Nugroho, A. (2015). Cetak Kartu ATM Palsu, Staf Bank

Kalbar Bobol Rekening 54 Orang Nasabah. http://

regional.kompas.com/read/2015/09/04/20120281/Ceta

k.Kartu.ATM.Palsu.Staf.Bank.Kalbar.Bobol.Rekening

.54.Orang.Nasabah.

O’Brien, J. A. & Marakas, G. M. (2011). Management

Information Systems. 10

th

edition. McGraw-Hill

Companies, Inc.

Purnama, B. T. (2016). Basuki Kritik Sistem TI Bank DKI

yang Masih Jadul. http://www.beritasatu.com/

aktualitas/355519-basuki-kritik-sistem-ti-bank-dki-

yang-masih-jadul.html.

Romney, M. B. & Steinbart, P. J.(2015). Accounting

Information Systems. 13

th

edition. Pearson Education Inc.

Sarasidya, M. (2014). Panin Bank Syariah jalin kerjasama

dengan Emerio. http://keuangan.kontan.co.id/news/

panin-bank-syariah-jalin-kerja sama-dengan-emerio.

Sekaran, U. & Bougie, R. (2013). Research Methods for

Business: A Skill-Building Approach. 6

th

edition. John

Wiley & Sons, Ltd.

Stair, R. M. & Reynolds, G. W. (2010). Fundamentals of

Information Systems. 5

th

edition. Course Technology,

Cengage Learning.

Stair, R. M. & Reynolds, G. W. (2016). Fundamentals of

Information Systems. 8

th

edition. Cengage Learning.

Susanto, A. (2013). Sistem Informasi Akuntansi: Struktur-

Pengendalian-Resiko-Pengembangan. Lingga Jaya.

Weber, R. (1999). Information Systems Control and

Audit. Prentice-Hall, Inc.

Whitten, J. L. & Bentley, L. D. (2007). Systems Analysis

and Design Methods. 7

th

edition. McGraw-Hill.

Wilkinson, J. W., Cerullo, M. J., Raval V., & Wong-On-

Wing, B. (2000). Accounting Information Systems:

Essential Concepts and Applications. John Wiley &

Sons, Inc.

Wu, F. H. (1983). Accounting Information Systems: Theory

and Practice. McGraw-Hill, Inc.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

140