Analysis of Factors Affecting the Sustainability of

Village-Owned Enterprise in the Province of West Sumatera

Elvira Luthan

1a

, Yulia H. Yeni

1b

and Eri Besra

2c

1

Accounting Department, Andalas University, Padang, Indonesia

2

Management Department, Andalas University, Padang, Indonesia

Keywords: Financial Literacy, Village Owned Enterprise (BUMDes), Business Sustainability, Competitive Advantage.

Abstract: This study aims to examine the effect of financial literacy & competitive advantage on the sustainability of

BUMDes from the perspective of improving the village economy. For the current situation, the existence of

BUMDes to create an independent village economy is very much needed. Through BUMDes, it is hoped that

institutions in rural areas will work together to maximize the welfare of the community and improve the

village economy. This is quantitative descriptive verification research. This study uses primary data by

distributing questionnaires and interviews. Researchers obtained 37 BUMDes whose data was complete for

analysis. The results of this study show that financial literacy and competitive advantage have a significant

effect on the sustainability of BUMDes, with a determination coefficient (Adj R

2

) of 69.90%. Partially,

financial literacy has a positive and significant effect on the sustainability of BUMDes. This is also the same

as the competitive advantage variable. The level of understanding of respondents' financial literacy is still not

good. Socialization and financial literacy training is needed for BUMDES managers so that the goal of

establishing BUMDES to improve the welfare of village communities can be achieved.

1 INTRODUCTION

Village-owned enterprises (BUMDes) are village

business institutions managed by the government and

village communities, which aim to strengthen the

village economy. This BUMDes was formed based

on the needs and potentials of the village. BUMDes

capital comes from the Village Government, or it

could be from government assistance both at the

provincial and district/city levels, capital

participation, or cooperation with other parties based

on mutual benefit, it could also be through loans. So

BUMDes is a business entity that can help the

community in everything, including meeting daily

needs, becoming business opportunities or

employment opportunities, adding to the insight of

the village community.

The government's commitment to developing

BUMDes is stated in the regulations of Law No. 32

of 2004 concerning Regional Government and

Government Regulation (PP) No. 72 of 2005

a

https://orcid.org/0000-0002-1219-6157

b

https://orcid.org/0000-0002-5242-4572

c

https://orcid.org/0000-0003-2763-1219

concerning the Village. This law states that "Villages

can establish village-owned enterprises according to

the needs and potential of the village". This is

reinforced by other regulations listed in Government

Regulation (PP) no. 71 of 2005 concerning the

Village. The basic substance regulated in the Law and

Government Regulation becomes a reference in the

formulation of a regional regulation on guidelines for

the formation and management of BUMDes. To be

able to develop, BUMDes must be able to compete

with other business entities and revive the economic

sector of the village. 70% of the village economy is

carried out in the agricultural, plantation, and other

natural potential sectors. BUMDes business unit

includes a variety of forms, including cooperatives,

shops, tent rental business, and others.

Based on the data, the potential of the Village in

2019, 48 921 villages have at least one business unit

BUMDes or 64.85% of the total villages in Indonesia.

There was an increase of 7.44 from the percentage of

the number of villages with at least one BUMDes

Luthan, E., Yeni, Y. and Besra, E.

Analysis of Factors Affecting the Sustainability of Village-Owned Enter prise in the Province of West Sumatera.

DOI: 10.5220/0010745100003112

In Proceedings of the 1st International Conference on Emerging Issues in Humanity Studies and Social Sciences (ICE-HUMS 2021), pages 119-128

ISBN: 978-989-758-604-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

119

business unit in 2018. This increase indicates that in

the last year there was the development of 5,615 new

villages with at least one BUMDes business unit. For

West Sumatra, there was an increase in the number of

UMDes by 14.74% from the previous year. (BPS,

2020).

BUMDes also fulfills 23% of total credit in the

banking sector (BPS, 2020). The contribution of

BUMDes to the regional economy is also becoming

increasingly important. A higher per capita Gross

Domestic Product (GDP) increases the contribution

of BUMDes to the economy from an employment

perspective. When compared to large-scale

producers, BUMDes shows a more dynamic structure

by being more innovative, producing higher quality

products, being more responsive to customers. This

situation will lead to the rapid growth of BUMDes,

but also carries relative risks for BUMDes. Due to

this risk, the bank's underdeveloped borrower

relationship and petty cash flow cause the financial

institutions that provide funds to set some limits

resulting in increased operating costs. High

borrowing costs ultimately lead managers only as

stakeholders to abort the "essential in place"

obligation to use more riskless and secure capital

equity. (Adeyinka-Ojo, S.,2018). With all the

activities that can be carried out by BUMDes, the

ability of financial literacy and assistance can

increase managerial and entrepreneurial skills for

BUMDes administrators is important to be analyzed

scientifically.

Based on the regional strata, the financial literacy

index for urban areas reached 41.41% and the

financial inclusion for urban communities was

83.60%, while the literacy index and financial

inclusion for rural communities were 34.53% and

68.49% (OJK,2019). The OJK survey indicates that

Indonesian people's financial literacy is in a low

category. This is a special concern for the government

to provide an understanding of financial literacy to

the public, especially to MSME actors and BUMDes

managers. With more attention to BUMDes

administrators, it is hoped that they will have more

knowledge, skills in managing finances and it's

business so that they can take benefit of the

competitive advantages they have for the

sustainability of BUMDes to improve the village

economy.

Business actors who have good financial literacy

will be able to identify and respond to changes that

occur in the business, economic and financial climate

so that they can make the right business decisions to

make innovative solutions and are also targeted for

the sustainability of their business (Aribawa Dwitya,

2016). Furthermore, Puspitaningtyas (2017) said that

if a business actor has good financial literacy, then he

is considered capable of using financial knowledge in

making the right business decisions, related to his

competitive advantage so that the sustainability of

BUMDes is guaranteed.

As is known, BUMDes can help the community

and improve the village economy, but in some areas,

most of the entities face closure and risk of

bankruptcy every year. Especially in times of crisis,

BUMDes experience difficulties with their financing

related to working capital requirements. In addition,

the high turnover of competitiveness, especially with

similar businesses, makes the survival rate of

BUMDes lower compared to larger companies.

This has become the main problem that often

causes BUMDes to become suspended animation.

According to the national economic census, 80% of

newly established BUMDes have become stagnant

within 5 years or less. About one-third of BUMDes

face bankruptcy in the first 5 years of their life cycle.

In addition, the low financial literacy skills of the

community, in this case, BUMDes administrators,

make him less able to read business opportunities &

strategies that take advantage of their competitive

advantages. In the end, this harms entrepreneurship

which will threaten the sustainability of the BUMDes

business because the fear of failure increases.

Good financial literacy is a basic need for every

individual, especially BUMDes managers because it

will be able to help make good financial decisions and

be able to manage finances optimally. Besides that,

competitive advantage is the ability obtained through

the characteristics and resources of a company to

have a higher performance than other companies in

the same industry or market. This competitive

advantage is the heart of a company's performance in

a competitive market. BUMDes managers who have

good financial literacy, increase competitive

advantage will be able to achieve BUMDes goals,

have a business development orientation so that they

can survive in difficult economic conditions.

BUMDes managers must be able to manage

finances which are indispensable for business

performance and business continuity. In his research,

Wise Sean (2013) stated that the increase in financial

literacy leads to more frequent individuals making

their business financial statements. The study found

that entrepreneurs who more often produce better

financial reports will have a higher level of

profitability from their loan repayments and that their

business continuity will be higher. Dahmen and

Rodriguez (2014) also stated that it is important for

business owners to understand financial knowledge to

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

120

have better company performance. So that it allows

MSMEs to experience business growth. Based on

this, the authors propose the first hypothesis, namely

financial literacy has a positive and significant effect

on the sustainability of BUMDes businesses.

Conceptually, competitive advantage is a strategy

to create value for a company and is currently not

being implemented by its potential competitors. In

essence, the competitive advantage that a company

has must be compared to other companies and does

not have certain definite standards (Duray, Rebecca,

2000; Ireland & Hitt 2007). Day and Wensley (1988)

stated that a competitive advantage is a form of

strategy to help companies maintain their survival.

This opinion is supported by Ferdinand (2003) which

states that in a competitive market, the company's

ability to produce sustainability, especially financial

sustainability, is highly dependent on the degree of its

competitive advantage. Based on this, the authors

propose the second hypothesis of this study, namely

the increase in competitive advantage has a positive

and significant effect on the sustainability of

BUMDes businesses.

We will also continue our analysis about

descriptions of respondents' understanding of the four

components of financial literacy, namely debt

management, budgeting, banking, and bookkeeping.

This research was conducted in Pesisir Selatan

Regency, West Sumatra, Indonesia. The reason the

researchers chose this district is due to new tourist

destinations (such as Mande tourist areas, beaches

Carocok, Bukit Langkisau, and others) that promises

better economic growth. If BUMDes is managed

professionally, then this is a synergy for economic

growth and community welfare.

2 METHODS

This type of research is causal-explanatory research

Coopers, D.,2014), we try to explain the relationship

between the dependent and independent variables,

which are quantitative in nature. Because this study

seeks to verify several variables that have been tested

by several previous researchers. The population of

this study was BUMDes managers in Pesesir Selatan

district (South Coast district), which has 54 active

BUMDes. The sampling method is non-probability in

the form of convenience sampling, in which

information is obtained from members of the

population that can be accessed by researchers, and

finally, 37 BUMDes are obtained. Data collection

was carried out using questionnaires and structured

interviews. This method is chosen to be able to get the

right information and from the right people. The

questionnaire used for data collection in this study is

the development of several previous researchers.

Before being distributed to respondents, the

questionnaire was tested first to ensure the accuracy

of the indicators and measures used.

2.1 Operationalization of Variables

The independent variables in this study are financial

literacy and competitive advantage. Financial literacy

is an individual who has the knowledge,

understanding, and skills in managing finances and

can make financial decisions. In this study, indicators

for financial literacy focus on knowledge, skills,

attitudes, and behaviours that are supported by

previous research by Okello et al (2017), Atkinson &

Messy (2014), Lusardi & Mitchell (2014).

Competitive advantage is the ability obtained

through the characteristics and resources of an

organization or a company to have a better

performance than other companies in the same

industry or market. In this study, competitive

advantage is measured by 5 indicators, namely Cost

Leadership Strategy, Differentiation Strategy,

Innovation Strategy, Growth Strategy, and Alliance

Strategy (Hestanto.2020).

While the dependent variable in this study is the

sustainability of village owned enterprise, meaning a

business situation or condition, in which there are

ways to maintain, develop and protect resources and

meet the needs of the business. The indicators used

for the sustainability variable of Village-Owned

Enterprises (BUMDes) comes from research

conducted by Widayanti, R., Damayanti, R., &

Marwanti, F. (2017) and Rahayu, A., Y. &

Musdolifah. (2017), there are:

1. Profits and assets that increase continuously

and/or consistently.

2. Increased network, expanded coverage of

targeted consumers”through the ability to create

various products and business units, and through

the ability to create mutually beneficial

collaborations between village owned enterprise

and other parties.”

3. Satisfaction of village owned enterprise

managers,

4. Community satisfaction with the benefits of

having a village owned enterprise” such as

opening jobs, increasing educational

opportunities, improving access to transportation

and others as well as preventing conflicts (due to

competition with similar businesses in their

respective villages).”

Analysis of Factors Affecting the Sustainability of Village-Owned Enterprise in the Province of West Sumatera

121

2.2 Data Analysis Method

Before being analyzed, the research data was a check

for validity and reliability. Before regression analysis,

a classic assumption test is carried out so that the

regression results are not biased. The” classical

assumption is taken from normality testing,

multicollinearity testing, and heteroscedasticity

testing.” The data were analyzed using the regression

analysis method to test the hypothesis with SPSS 24.

The form of the multiple regression equation can be

formulated:

KU

i

= β

1

+ β

2

LKi + β

3

KB i + e

i

(1)

Whereas:

KU = BUMDes Sustainability

LK = Financial Literacy

KB = Competitive Advantage

Β = coefficient

e = error term

This study also analyzes the level of

understanding of the financial literacy of village-

owned enterprise actors. Researchers will determine

the highest score with the following formula:

X = Likert's Highest Scale X number of respondents

Furthermore, the total score of each option will then

be assessed by using the formula: (Nazir, M,2005)

Total Score = ∑𝑇 × 𝑃𝑛 (2)

Whereas: T =Likert’s Scale

Pn = the number of respondents who

chose the answer

Calculations to find the percentage of the total total

answers used the formula: (Sugiyono, 2013)

P = x/Total Score x 100% (3)

Whereas: P = Percentage

x = Highest Score

Then classified into qualitative form by using the

following division (see Tabel 2).

Table 1: Classification Based on the research results Likert

scale.

Percentage Criteria

20% - 36% Very Unprepared / Very Clueless

36,01% - 52% Not Read

y

/Don't Understan

d

52,01% - 68% Quite Read

y

/ Quite Understandin

g

68,01% - 84% Readil

y

/Understoo

d

84,01% - 100% Very Ready / very notion

Source : Narimawati U, 2008

3 RESULTS AND DISCUSSION

3.1 Result

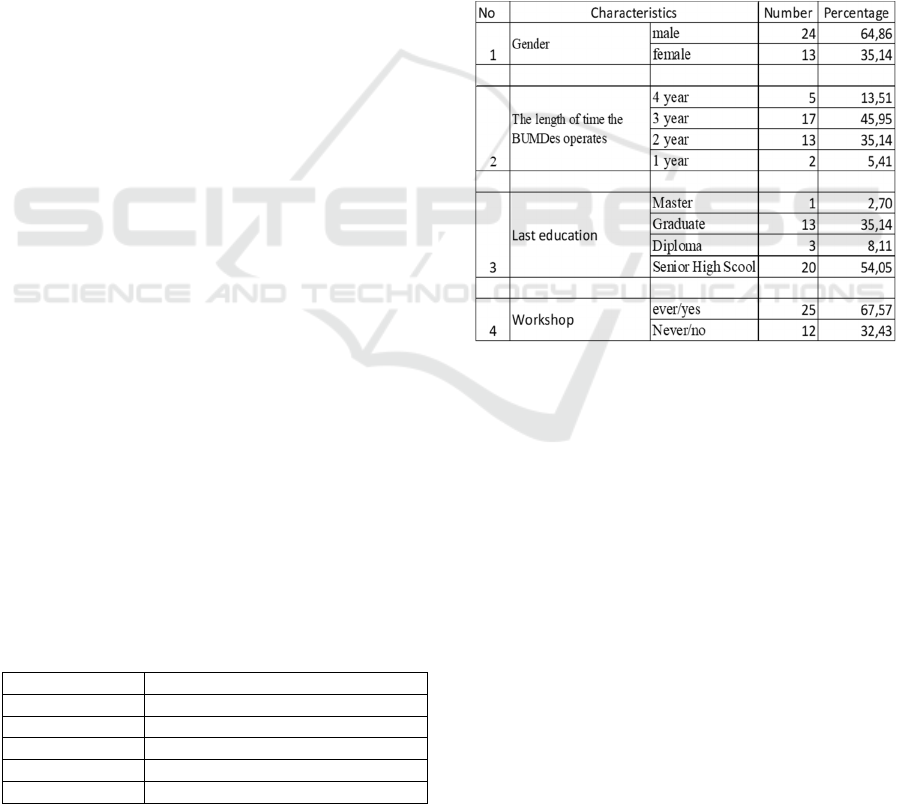

3.1.1 Descriptive Respondent

Respondents in this study were village-owned

enterprise actors in the Pesisir Selatan district. The

questionnaires distributed according to the number of

village owned enterprise that are active 54, but not all

of them are returned and cannot be processed as many

as 17 (31.48%). Finally, 37 questionnaires (68.51)

were obtained which could be processed. The

characteristics of these respondents can be presented

in table 2.

Table 2: Respondent Characteristics.

Source: Primary data that is processed

The validity test in this study uses the Pearson

correlation. The question item is said to be valid if the

significant value is less than 0.05. From the results of

the validity test, all questions in this study have

passed the validity test. So the data from the

questionnaire can be declared valid.

The data analysis can be continued for the

reliability test because the purpose of the validity test

is to determine whether the data resulting from the

questionnaire are appropriate to measure the research

variables. The measurement of reliability in this study

uses the Cronbach Alpha coefficient formula. The

instrument is said to be reliable if r value> 0.6, not

reliable if r value <0.6. Reliability test results show

that the instrument used is reliable.

3.1.2 Classic Assumption Test Results

The results of multiple regressions can be used as a

good predictor and are not biased if they meet some

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

122

classical assumptions. The assumptions are

normality, multicollinearity, heteroscedasticity, and

autocorrelation. The results of the normality test

using the Kolmogorov Smirnov test (0.721), produce

the Asymp value. Sig. (2-tailed) is greater than the

significant level 0.05, which means that the data is

normally distributed.

“Furthermore, the multicollinearity test is based

on the tolerance value and variance inflation factor

(VIF). The research variable is free from

multicollinearity cases if it has a greater tolerance

value of 0.10 (>0.10) and (VIF) less than 10 (<10).

The results of data analysis show that each

independent variable in this study has a tolerance

value greater than 0.10 and a VIF value of less than

10 (VIF financial literacy 1.412 & Tolerance 0.708

and competitive advantage VIF 1.419 & Tolerance

0.705). This means that there are no independent

variables experiencing multicollinearity and there is

no correlation between independent variables in this

study.”

According to Ghozali (2016), the

heteroscedasticity test aims to test whether there is an

inequality/variance from the residuals of one

observation to another in the regression model. Basic

analysis:

i. If a specific pattern, such as existing dots, forms

a specific regular pattern (wavy, widened, then

narrowed), there is heteroscedasticity.

ii. If there is no clear pattern and the dots spread

above and below the 0 on the Y axis, there is no

heteroscedasticity.

3.1.3 Hypothesis Test Results

To test the hypothesis, the multiple linear regression

method, the coefficient of determination (R2), and the

test of significance of individual /partial parameters (t

statistic test) are used. Results of Multiple Linear

Regression Analysis can be seen in table 3.

Table 3: Results of Multiple Linear Regression.

Variable

Unstandardized

Coefficients

t value Sig. Information

Beta

Std

Error

(Constant) 1.315 3.243 .405 .688

LK .211 .068 3.096 .004 Significant

KB .924 .163 5.673 .000 Significant

R .846

a

F value 42.875 .000

b

R Square .716 Sign F .000

b

Adjusted R Square .699 α 0.05

Dependent Variable KU

Source: Primary data that is processed by SPSS 24

From statistical data processing, we get multiple

linear regression equation as follows:

KU = 1.315 + 0.211 LK + 0.924 KB + e

(4)

3.1.4 Financial Literacy

The analysis of financial literacy understanding of

village-owned enterprise (BUMDes) actors as

measured by the total score and classification in table

2.1. From the data analysis described in section 2.2, it

is known that in general, the level of understanding of

respondents' financial literacy is readily/understood,

69.72% (see table 2.1), which is obtained by the

following formula:

Total Score from respondents' answers (X) = 1.651.

The highest score of the number of questions in the

questionnaire and the number of respondents = 2.368

𝑃=

.

.

× 100%

= 69.72%

(5)

Of the respondents, understanding of the financial

literacy (69.72%), seen in the table respondent

characteristics (Table 3.1) amounting to 67.57% of

respondents had attended financial literacy

workshops. Perhaps this is because more than half of

the respondents have a senior high school only

(54.05% see Table 2), so the level of understanding

of financial literacy is relatively low.”

Financial literacy in this study consists of 4

components (see table 4) which describe the

respondent's level of understanding of financial

literacy. Understanding of debt management literacy

is only 67.30% of these components and when

compared to the overall financial literacy component

(4 components), the level of understanding is only

30.16% (very unprepared). If we look at the level of

understanding of financial literacy from all

components, each component has a below standard

level of understanding. However, if we look at the

literacy understanding per component, the

respondent's level of understanding is at the

ready/understand (68% – 84%, see table 4)

Table 4: Level of understanding of financial literacy per

component.

No Components

Financial

Literacy per

component

Literacy (%)

Financial

Literacy as a

whole (%)

1 debt management literacy

67,30 30,16

2

b

udgeting literacy 70,14 31,44

3 banking service literacy

76,35 13,69

4 bookkeeping literacy 68,92 24.71

Source: Primary data that is processed

Analysis of Factors Affecting the Sustainability of Village-Owned Enterprise in the Province of West Sumatera

123

3.2 Discussion

From the results of the regression analysis in table 3,

it can be seen that the coefficient of determination

(R2), that is used to measure how far the model is

capable of explaining the variation of independent

variables simultaneously to the dependent variable.

The value of the adjusted R square is 0.699. This

means that 69.9% of variations in village-owned

enterprise sustainability variables are influenced by

financial literacy and competitive advantage. The

remaining 31.1% is influenced by other variables not

included in this study.

“Statistical test F (F test) is conducted to test the

feasibility of the model whether the model used is

significant or not. The criterion for decision making

is when the value of sig. is smaller than the degree of

significance (α = 0.05), then the regression equation

obtained is reliable and feasible to use. The result of

the data processing shows the value of F is equal to

42.875 and sig. 0.000 (sig 0,000 <0,05). This means

that the regression equation obtained is reliable or the

model used is feasible.”

Statistical test t is done to find out how big the

influence of each independent variable to dependent

variable. The default is to compare the value of

significance produced with α 0.05 and to compare the

t value with the t table. The test results can be seen in

table 3.

From the results of the hypothesis testing that has

been conducted, this study concludes that financial

literacy has a positive and significant effect on the

sustainability of village-owned enterprise. This is

consistent with several previous studies of Zinsari

(2014), Wise (2013), Dahmen and Rodriguez (2014).

Financial literacy affects the way a person thinks

about financial conditions which can affect strategic

decision making in terms of finances and better

management for village-owned enterprise managers.

Their ability to manage finances is very necessary for

the performance and continuity of their business.

Increased understanding of financial literacy causes

them to make more frequent financial reports for their

businesses. This study found that village-owned

enterprise managers who more often produce better

financial reports, will have a high level of profitability

from loan payments and also for business continuity

will be higher. Village-owned enterprise managers

need to understand financial knowledge to have better

company performance. So that it allows village-

owned enterprise to experience business growth so

that its business can continue.

Furthermore, for the competitive advantage

variable, this study has proven that competitive

advantage has a positive and significant effect on the

sustainability of village-owned enterprise. These

results are consistent with some of the previous

researchers Ferdinand A (2003), Duray, Rebecca

(2000), Ireland & Hitt (2007), Yudi N Supriadi (2018).

Competitive advantage is the company's way and

model of placing a superior strategy in its operational

practices. “Competitive advantage is the ability

obtained through the characteristics and resources of

the company to have a higher performance than

competitors in the same market category.” Competitive

advantage grows fundamentally from the value that

allows village-owned enterprise to create value for

their buyers beyond the costs involved in creating it.

For the business to grow, village-owned enterprise of

managers must be able to create their business

competitiveness.

In this study, there are 4 components of financial

literacy that are analysed. The first component is debt

management literacy. Table 4 shows that the

respondents' understanding of debt management is

67.30%, whereas when compared to the overall

financial literacy, this component is only 30.16%.

Budgeting literacy is better than debt, namely 70.14%.

Likewise, when compared with overall financial

literacy which has a proportion of 31.44%. Meanwhile,

the respondents' understanding of banking literacy is

76, 35%, which is quite good even though when

compared to the overall literacy level, the level of

understanding is only13.69%. While the respondents'

understanding of bookkeeping literacy 68,92%, but

when compared with the overall literacy rate of only

24.71%. From the results of this analysis, it can be

concluded that the understanding of the respondents in

this study for the four components of financial literacy

has not yet reached the maximum (above 80%). This is

why the understanding of the respondents' total

financial literacy is also not very good.

4 CONCLUSIONS

The results of this study concluded that financial

literacy and competitive advantage have a significant

effect on the sustainability of village-owned

enterprise, with a determination coefficient (Adjusted

R2) of 69.90%. Partially, financial literacy has a

positive and significant effect on the sustainability of

village-owned enterprise. This is also the same as the

competitive advantage variable.

The level of understanding of respondents'

financial literacy is still not good. This is also

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

124

reflected in the 4 components of financial literacy

which are used as indicators in this study.

“For academic purposes, the results of this study

should be able to add information, the contribution of

thought, and study in building theory related to

subjects which related to variables in this research,

such as marketing, accounting theory, and financial

management.”

For the government, it is necessary to increase

training and socialization on financial literacy and

how to increase the competitive advantage of village-

owned enterprise, so that the managers can work

professionally. Finally, the sustainability of the

village-owned enterprise will benefit rural

communities and the progress of the rural economy,

so that the government's goals will be achieved.

ACKNOWLEDGEMENTS

This research was funded by the University of

Andalas, under The Superior Basic Research

Contract, The Accelerated Research-Publication

Cluster to Professors (PDU KRP2GB-Unand). No

T/4 UN1617/PP Soshum-KRP2GB/LPPM2020, the

Fiscal year 2020

REFERENCES

Adeyinka-ojo, S. (2018). A strategic framework for

analyzing employability skills de fi cits in rural

hospitality and tourism destinations. Tourism

Management Perspectives, 27(April),47–54. https://doi.

org/10.1016/j.tmp.2018.04.

Aribawa, Dwitya, 2016, Pengaruh Literasi Keuangan

Terhadap Kinerja dan Keberlansungan UMKM di Jawa

Tengah, Jurnal Siasat Bisnis (JSB), Vol 20, No. 1.

Atkinson, A & Messy, F. (2012). Measuring Financial

Literacy: Results of the OECD/ International Network on

Financial Education (INFE) Pilot Study, OECD Working

Papers on Finance, Insurance and Private Pensions, (15)

Bayrakdaro, A., & Botan, Ş. (2014). Financial Literacy

Training As a Strategic Management Tool Among

Small-Medium Sized Businesses Operating In Turkey,

Procedia - Social and Behavioural Sciences 150:148-

155. DOI:10.1016/j.sbspro.2014.09.019

Biro Pusat Statistik. (2020). Data Desa Indonesia.

Cooper, Donald R.2014, The Book: Business research

methods; Florida Atlantic University, Pamela S.

Schindler, Wittenberg University.Twelfth edition.

Dahmen, Pearl, and Rodriguez, Eileen (2014). “Financial

Literacy and the Success of Small Businesses: An

Observation from a Small Business Development

Centre,” Numeracy: Vol. 7 (.1), Article 3

Day, G.S., and Wensley, R. (1986). Assessing advantage: A

framework for diagnosing competitive superiority.

Journal of Marketing, 52(2),1-20

Duray R. (2000) The Book Chapter: Mass Customization. In:

Swamidass P.M. (eds) Innovations in Competitive

Manufacturing. Springer, Boston, MA. https://doi.org/

10.1007/978-1-4615-1705-4_23

Ferdinand, Augusty, 2003, The Book: Suistainable

Competitive Adventage, Badan penerbit universitas

Dipenogoro, Semarang.

Ghozali, Imam. 2016. The Book: Aplikasi Analisis

Multivariate Dengan Program IBM SPSS 19. Semarang:

Badan Penerbit Universitas Diponegoro.

Heriyanto, A. (2015). Penerapan Prinsip-Prinsip Good

Governance dalam Tata Kelola Pemerintahan Desa

Triharjo Kecamatan Sleman Kabupaten Sleman.

Universitas PGRI Yogyakarta., online at http://repos

itory.upy.ac.id/id/eprint/177, accessed on 11th March

2020.

Hestanto, 2020, online at https://www.hestanto.web.id/

keunggulan-kompetitif-untuk-bisnis-yang-sukses/,

accessed on 29th March 2020.

Hitt, Ireland (2007), The Book: Strategic Management

Competitiveness and GlobalizationThomson Higher

Education 5191 Natorp Boulevard Mason, OH 45040

USA. Library of Congress Control Number: 2005911294

Keuangan Desa. (2015). Pendirian BUMDesa, online at

http://www.keuangandesa.com/2015/09/pendiriandan-p

engelolaan-badan-usaha-milik-desa/

Andika Drajat Murdani, 2020, Pengertian Potensi Desa serta

Penjelasannya, online at https://portal-ilmu.com/penger

tian-potensi-desa/, accessed on 25th April 2020.

Kesa, Deni. D. 2019. Realisasi Literasi Keuangan

Masyarakat dan Kearifan Lokal : Studi Kasus Inklusi

Keuangan di Desa Teluk Jambe, Karawang, Jawa

Barat.Jurnal Sosial Humaniora Terapan. DOI: https://

doi.org/10.7454/jsht.v1i2.57

Khamidah, Nur, 2005.Analisis Pengaruh Faktor Lingkungan

Terhadap Inovasi Produk dan Kreativitas Strategi

Pemasaran Terhadap Kinerja Pemasaran (Studi pada

Perusahaan Kerajinan Keramik di Sentra Industri

Kasongan Kabupaten Bantul, Yogyakarta). Jurnal Sains

Pemasaran Indonesia, Vol IV

(3) Program Magister

Manajemen . Universitas Diponegoro.

Lusardi M, Mitchell O 2014. The Economic Importance of

Financial Literacy Theory and Evidence. Journal of

Economic Literature 52(1),5–44, online at <http://arno.

uvt.nl/show.cgi?fid=129675> (Retrieved on 18 March

2020).

Narimawati, U. 2008. The Book: Metodologi Penelitian

Kualitatif Dan Kuantitatif, Teori Dan Aplikasi. Bandung:

Agung Media.

Nazir, Mohammad. 2005. The Book: Metode Penelitian.

Jakarta: Ghalia Indonesia

Puspitaningtyas, Z. (2017). Manfaat Literasi Keuangan Bagi

Business Sustainability. Prosiding Seminar Nasional

Kewirausahaan dan Inovasi Bisnis VII (SNKIB 2017)

Yogyakarta: Universitas Tarumanegara.

Rahayu, A.,Y. & Musdholifah. 2017. Pengaruh Literasi

Keuanga Terhadap Kinerja Dan Keberlanjutan UMKM

Analysis of Factors Affecting the Sustainability of Village-Owned Enterprise in the Province of West Sumatera

125

Di Kota Surabaya. Jurnal Ilmu Manajemen. Vol 5(3).

Ratna Kusumawati, 2010, Pengaruh Karakteristik Pimpinan

dan Inovasi Produk Baru terhadap Kinerja Perusahaan

untuk Mencapai Keunggulan Bersaing Berkelanjutan,

AKSES; Jurnal Ekonomi & Bisnis Vol.5 No.9, April

2010.

Rokhmatussa’dyah, Ana & Suratman. (2017). The Book:

Hukum Investasi dan Pasar Modal. Jakarta: Sinar

Grafika.

Rumbianingrum, W., & Wijayangka, C. (2018). Pengaruh

Literasi Keuangan Terhadap Pengelolaan Keuangan

UMKM. Jurnal Manajemen Dan Bisnis (Almana), 2(1),

156–164.

Sugiono. 2013. The Book: Metodologi Penelitian Kuantitatif,

Kualitatif Dan R&D. Bandung:Alfabeta.

Wardani, A. K., & Lutfi, L. (2019). Pengaruh Literasi

Keuangan, Experienced Regret, Risk Tolerance, dan

Motivasi Pada Keputusan Investasi Keluarga Dalam

Perspektif Masyarakat Bali. Journal of Business &

Banking, 6(2), 195–214.

Welly, K., & Juwita. (2012). The Book: Analisis Literasi

Keuangan Terhadap Keputusan Investasi di STIE Multi

Data Palembang. Palembang: STIE MDP.

Widayanti, R., Damayanti, R., & Marwanti, F. (2017).

Pengaruh Financial Literacy Terhadap Keberlangsungan

Usaha (Business Sustainability) Pada UMKM Desa

Jatisari. Jurnal Ilmiah Manajemen & Bisnis, 18(2), 153.

Widowati, M., & Winarto. (2017). Literasi Keuangan Pelaku

UMKM Kota Semarang. Jurnal Ilmiah Akuntansi Dan

Keuangan, 3(2), 10–18.

Wise, Sean, 2016, The Impact of Financial Literacy on New

Venture Survival, International Journal of Business and

Management Vol 8, November.

Yudi N Supriadi, 2018, Analisis Keberlanjutan Usaha

UMKM di Propinsi Banten, Jurnal Manajemen Bisnis:

Pascasarjana Universitas Muhammadiyah Tangerang,

Vol 7, No. 1

Zinsari. 2014. Edukasi literasi keuangan http://www.zinsari.

wordpress.com/2014/08/07/edukasi-literasi-keuangan.

Diakses Tanggal 3 Maret 2019.

APPENDIX

Appendix: Research Questionnaire

Kepada Yth,

Bapak/Ibu Pengelola BUMDES/BUMNAG

Di Tempat.

Assalamualaikum Warahmatullahi Wabarakatu.

Perkenalkan kami, Tim Peneliti Fakultas Ekonomi, Universitas Andalas, saat ini sedang melakukan penelitian

tentang sustainabilitas BUMNAG/BUMNAG. Salah satu tujuan di dirikan BUMDES/BUMNAG adalah untuk

meningkatkan perekonomian dan kesejahteraan masyarakat pedesaan. Namun, menurut survey ekonomi 2019,

banyak BUMNAG/BUMNAG yang stagnan dan tidak mampu bertahan kurang dari 5 tahun. Kendala utama yang

dihadapi pihak BUMDES/BUMNAG selain modal adalah penerapan manajemen yang profesional.

Penelitian ini bertujuan untuk menganalisis faktor faktor yang berpengaruh terhadap sustainabilitas

BUMDES/BUMNAG. Hasil Penelitian akan memberikan kontribusi dan masukan untuk pembuatan kebijakan

yang berkaitan dengan BUMDES/BUMNAG, seperti pemerintahan desa & kabupaten. Dengan adanya penelitian

ini, diharapkan BUMDES/ BUMNAG makin dapat memberikan kontribusi dalam peningkatan perekonomian &

kesejahteraan masyarakat.

Kami mengharapkan partisipasi Bapak/Ibu dalam mensukseskan penelitian ini. Informasi yang Bapak/Ibu

sampaikan hanya akan digunakan untuk kepentingan penelitian semata, dan akan kami jaga kerahasiaannya.

Demikian kami sampaikan, atas partisipasi Bapak/Ibu kami ucapkan terima kasih banyak. Semoga Allah swt

membalas semua kebaikan Bapak/Ibu.

Wassalamulaikum wr wb.

Ketua Tim Peneliti

ttd

Dr. Elvira Luthan, SE.MSi.AK.CA.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

126

Profil BUMDES/BUMNAG & Responden

Mohon diisi data atau profil BUMNAG dan responden

1 Nama BUMNAG

2 Jenis Usaha BUMNAG

3 Umur/ Tahun berdirin

y

a BUMNAG

4 Alamat BUMNAG

5 Nama Ba

p

ak/Ibu

6 Jenis Kelamin &Usia Ba

p

ak/Ibu

7 No. HP Ba

p

ak/Ibu

8 Pendidikan Terakhi

r

9 Jabatan di BUMNAG

10 A

p

akah Ba

p

ak/Ibu

p

ernah men

g

ikuti

p

elatihan BUMNAG?

Ya pernah

Tidak Pernah

11

Jika jawaban diatas Ya, berapa kali dan pelatihan BUMNAG tentang apa?

Cara mengisi kuesioner

Mohon untuk memberikan tanda (

√

) untuk setiap pernyataan yang dipilih :

Keterangan :

• Sangat setuju = SS

• Setuju = S

• Tidak setuju = TS

• Sangat tidak setuju = STS

Pertan

y

aan SS S TS STS

K

ami selalu melunasi cicilan BUMDES tepat waktu

K

ami membandingkan syarat dan ketentuan berlaku dari berbagai kreditur sebelum memilih

p

roduk dan la

y

anan untuk usaha BUMDES.

Saya menggunakan lebih dari separuh pendapatan yang dihasilkan untuk melunasi pinjaman

B

MUDES

D

engan kemampuan pengelolaan hutang, BUMDES dapat mengakses berbagai sumber keuangan

u

ntuk usaha BUMDES.

K

ami tahu dampak inflasi dan suku bunga pinjaman yang kami pinjam untuk usaha BUMDES

K

ami dapat menentukan secara akurat berapa total hutang pada usaha BUMDES.

B

UMDES mempersiapkan tujuan keuangan tertulis yang ingin dicapai dalam waktu satu tahun

K

ami mampu mempersiapkan perencanaan keuangan untuk rencana kegiatan usaha BUMDES.

K

ami membandingkan tujuan keuangan dengan kinerja usaha BUMDES secara berkala

K

ami menggunakan rencana anggaran untuk menetapkan target kinerja bagi karyawan BUMDES

K

ami menggunakan rencana anggaran untuk mengawasi pengeluaran pada usaha BUMDES

B

UMNAG menyetorkan hasil usahanya pada bank setiap hari

K

ami mampu menyiapkan laporan keuangan untuk usaha BUMNAG

B

UMDES menyetorkan hasil usahanya pada bank setiap hari

K

ami mampu melakukan analisis keuangan terhadap laporan keuangan BUMNAG

K

ami memiliki pengetahuan yang memadai tentang pemiliharaan buku kas

K

ami mampu memposisikan buku besar dalam laporan keuangan BUMNAG dengan seimbang

(

balance

)

dan akurat

K

ami mampu melakukan rekonsiliasi bank (penyesuian perbedaan pencatatan pada bank dengan

p

encatatan pada usaha BUMNAG)

M

odal awal

y

an

g

di

g

unakan dalam mendirikan usaha BUMNAG telah berhasil di

p

eroleh Kembali

Analysis of Factors Affecting the Sustainability of Village-Owned Enterprise in the Province of West Sumatera

127

Pertanyaan SS S TS STS

K

omplein dari konsumen menjadi masukan dan pedoman bagi Pengelola BUMNAG dalam

m

emperbaiki Kinerja nya agar menjadi lebih baik kedepannya

P

endapatan yang diperoleh BUMNAG sesuai dengan target yang ditetapkan.

J

umlah pelanggan BUMNAG cenderung mengalami peningkatan setiap tahunnya

P

elanggan BUMNAG cenderung menaikkan jumlah pembeliannya

B

UMNAG membuka lapangan kerja bagi masyarakat desa

B

UMNAG meningkatkan peluang masyarakat untuk melanjutkan pendidikan

B

UMNAG meningkatkan akses transportasi desa

B

UMNAG mencegah konflik antar usaha yang ada di desa.

B

UMNAG meningkatkan perkonomian masyarakat desa

B

UMNAG meningkatkan kesejahteraan pengelolanya

B

UMNAG senantiasa menawarkan harga yang kompetitif dibandingkan dengan pesaing

B

UMNAG senantiasa menawarkan produk yang berkualitas dibandingkan dengan pesaingnya

B

UMNAG senantiasa melakukan pengiriman barang kepada pelanggan tepat waktu

B

UMNAG senantiasa menyediakan produk sesuai dengan keinginan dan kebutuhan pelanggan

d

ibandingkan pesaingnya

B

UMNAG senantiasa melakukan inovasi produk sesuai dengan kebutuhan pelanggan dibanding

p

esaingya

B

UMNAG merupakan pionir dalam memperkenalkan produk baru kepada pelanggan

B

UMNAG bekerja sama dengan pihak lain dalam melakukan bisnisnya (Ekspedisi, Lembaga

k

euangan, transportasi online , dll)

B

UMNAG mendapat dukungan baik dari masyarakat desa

U

saha BUMNAG sesuai dengan potensi sumber daya alam yang dimiliki masyarakat desa

B

UMNAG bisa bekerja sama dengan Lembaga social desa lainnya. Bundo kanduang (PKK),

L

KAM, Karang taruna, KAN, POKDARWIS.

B

UMNAG dikelola oleh masyarakat desa yang bekerja secara maksimal

M

asyarakat berperan aktif dalam memberikan saran untuk perbaikan usaha BUMNAG

Catatan : Jika Bapak/Ibu pengelola BUMDES/BUMNAG berkenan, mohon berikan komentar atau saran tentang

BUMDES/BUMNAG. (optional).

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

128