Using Educational Game for Improving Students’ Knowledge and

Interest in Investing in the Capital Market

Tan Ming Kuang

1

a

, Lidya Agustina

1

b

and Yani Monalisa

2

c

1

Department of Accounting, Universitas Kristen Maranatha, Prof. Drg. Surya Sumantri no. 65, Bandung, Indonesia

2

Department of Management, Universitas Kristen Maranatha, Bandung, Indonesia

Keywords: Simulation Games, Educational Games, Card Games, Capital Market.

Abstract

:

This study examines the impact of using a card simulation game named STOCKLAB to improve students'

knowledge and interest in investing in the capital market. Additionally, this study examines the effects of

adding explanation—where an instructor explains the educational contents of the game to the players—during

the game. A total of 172 undergraduate students from three private universities in Indonesia participated in

this study and a randomized control trial with a three-group pretest/posttest research design was used. The

results showed that STOCKLAB with explanation is more effective than STOCKLAB without explanation

in assisting students in acquiring knowledge about capital market, but it is as effective as traditional approach.

The three approaches are equally effective for improving students’ interest in investing in the capital market.

However, both STOCKLAB with and without explanation group reported a significantly higher level of

agreement that the game is an interesting way to study capital market compared to the traditional group. This

study implies that STOCKLAB can be used as an alternative approach to introduce capital market to the

students if it is coupled with explanation.

1 INTRODUCTION

Knowledge of financial literacy has an important role

in improving an individual’s well-being. However,

the latest national survey shows that the Indonesian

people's financial literacy index is relatively low at

38.03% (Otoritas Jasa Keuangan, 2020). From

various financial sectors, public understanding of the

capital market is one of the lowest, i.e. at an index of

4.9% in 2019. This index means that only 4-5 out of

100 Indonesians have knowledge, skills, and

confidence about the capital market in 2019. To

educate the capital market to the public, the

government through the Financial Services Authority

(OJK) has introduced a card simulation game called

STOCKLAB since 2017. OJK in collaboration with

the Indonesia Stock Exchange has even held various

national student-level STOCKLAB competitions in

many major cities in Indonesia. Although

STOCKLAB has been widely recognized nationally,

studies examining the effectiveness of this card

a

https://orcid.org/0000-0003-2996-4009

b

https://orcid.org/0000-0003-2888-5034

c

https://orcid.org/0000-0002-2454-6257

simulation game in educating the capital market to

college students are still very rare. This study aims to

test the effectiveness of the STOCKLAB game to

increase students' knowledge and interest in investing

in stocks in the capital market.

Studies that test the effectiveness of simulation

games in improving cognitive (Chen et al., 2014;

Chuang & Chen, 2009; Keys et al., 2020; Morin et al.,

2020; Soflano et al., 2015), psychomotor (Gopher et

al., 1994; Whitehill & McDonald, 1993), and

affective (Bai et al., 2012; Hwang et al., 2015;

Knechel & Rand, 1994; Manero et al., 2015;

Ruggiero, 2015; Tompson & Dass, 2000; Y.-T. C.

Yang, 2012) abilities have been done extensively. In

terms of affective learning, researchers have even

tested how games can change attitudes (Ruggiero,

2015), increase self-efficacy (Tompson & Dass,

2000), motivation and interest of students (Bai et al.,

2012; Hwang et al., 2015; Knechel & Rand, 1994;

Manero et al., 2015; Y.-T. C. Yang, 2012). Studies

that focus on increasing interest generally tests the

52

Kuang, T., Agustina, L. and Monalisa, Y.

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market.

DOI: 10.5220/0010743000003112

In Proceedings of the 1st International Conference on Emerging Issues in Humanity Studies and Social Sciences (ICE-HUMS 2021), pages 52-62

ISBN: 978-989-758-604-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

effectiveness of simulation games in increasing

learner interest in certain subjects. As an example,

Knechel & Rand, (1994) compare basic accounting

learning methods using traditional accounting

exercises with the business simulation game

Monopoly® in five Accounting Principles classes at

a university in the United States. They found that

students who studied accounting using Monopoly®

showed a higher interest in completing accounting

exercises compared to students who studied using

traditional accounting exercises. Similar research

results were obtained by Manero et al. (2015) who

test the effectiveness of a simulation game in the field

of theater arts. They found that students who studied

using the simulation game method showed a higher

interest in the world of theater than students who

studied using traditional lecture methods (i.e.,

teacher-centered learning). They also found that the

simulation game method was slightly less effective

than the lecture method delivered by professional

actors. These studies, however, do not focus on

learning about the world of stock investing.

Very little studies have linked simulation games

to stock investing learning. Albrecht (1995) used

Monopoly® to teach students to make financial

reports and company stock purchase decisions based

on their financial performance. The survey conducted

at the end of the lesson revealed that most students

were satisfied in learning accounting and investment

using Monopoly®. However, the survey conducted

did not ask whether the students would be interested

in getting to know the real world of stock investing or

not. This study fills the literature gap by examining

the effectiveness of a simulation game called

STOCKLAB in increasing students' knowledge and

interest in getting to know the world of stock

investing.

This study also contributes to the simulation

game-based learning literature by examining the

effect of adding game explanations—the game

instructor explains the educational content of the

game—as long as the game progresses to players on

the knowledge and interest of students investing in

stocks in the capital market. The addition of

explanations can help students understand the

knowledge conveyed so as to increase the

effectiveness of learning using simulation games

(Garris et al., 2002). Although several studies have

tested the effectiveness of simulation games with self-

explanation (Adams & Clark, 2014; Hsu & Tsai,

2012; O’Neil et al., 2014), adaptive advice (Leutner,

1993), scaffolding (Barzilai & Blau, 2014), and

supplemental materials (Miller & Hegelheimer,

2006) in increasing the student’s understanding of the

material, the effect of adding explanations by the

instructor is still very rarely studied. Bagley &

Shaffer (2015) in their study have used the assistance

of an instructor to explain urban science material in a

simulation game both virtual and face-to-face.

Although the researchers found both approaches to be

equally effective, this study has not proven that the

use of instructors increases the effectiveness of

learning because the control group (the group that

does not use an instructor) is not used. Therefore,

studies that specifically examine the impact of using

instructors in game-based learning are still needed.

Understanding the impact of adding explanations by

the instructor is not only useful for STOCKLAB users

to socialize the capital market, but also for users of

simulation game-based learning to deliver learning

materials effectively.

2 THEORETICAL FRAMEWORK

AND HYPOTHESIS

DEVELOPMENT

2.1 Definition of Simulation Games

Simulation games have been interpreted in various

ways, such as a combination of play and simulation

with competition (Heyman, 1982). One definition of

a fairly complete simulation game in an educational

context is given by (Szczurek, 1982), who defines

educational simulation games as: “an instructional

method based on a simplified model or representation

of a physical or social reality in which students

compete for certain outcomes according to an

established set of rules or constraints. The

competition can be (1) among themselves as

individuals or groups, or (2) against some specified

standard, working as individuals or cooperating as a

group” (p.27).

An educational simulation game is an interactive

learning experience developed based on a model of

the real world or imagination, which operates by a

coherent set of rules. In games, participants or

students compete with others to achieve certain goals,

and experience joy when those goals are achieved

(Van Eck & Dempsey, 2002). This definition of

educational games is used in the context of this study.

2.2 Theoretical Framework for

Simulation Games

Simulation games have several elements that make

them capable of being a cognitive, psychomotor, and

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market

53

affective learning tools. Malone’s (Malone, 1981)

Theory mentioned that challenge, fantasy, and

curiosity are factors that make an educational game

intrinsically motivating. Malone & Lepper (1987)

develop this theory by adding elements of control,

cooperation, competition, and recognition. Control

and the three elements in the original model

(challenge, fantasy, and curiosity) relate to individual

motivation, while the other elements (cooperation,

competition, and recognition) relate to interpersonal

motivation. A systematic review conducted by Jabbar

& Felicia (2015) regarding the impact of game

features on learning performance concluded that there

is not one element that specifically causes students to

be motivated and interested in learning material in

educational games. Thus, all elements in the game

work together to influence the cognitive and

motivation of students in order to acquire new

knowledge, skills, and attitudes.

The STOCKLAB game used in this study has

intrinsic motivating characteristics that are relevant to

the individual and interpersonal motivators as stated

by Malone. In terms of individual motivators,

STOCKLAB gives players the control to determine

the amount of money to be invested, the types of

shares/mutual funds to buy or sell, and to decide when

the shares/mutual funds they own will be sold.

Players are challenged to get the largest net asset at

the end of the game by means of decisions made.

Players imagine themselves as stock investors who

have to make investment decisions based on micro

and macroeconomic conditions that occur during the

game. These economic conditions, however, are

highly dependent on the information provided by

game cards or the actions taken by other investors

(i.e., opposing players). Since economic conditions

will affect the net worth of the players, any

information from the cards and actions taken by other

players will generally generate high curiosity. In

terms of interpersonal motivators, STOCKLAB

requires players to compete with other players to

increase their net asset value, and at the end of the

game, the owner with the largest net assets will be

recognized as a winner or a reliable investor. The two

intrinsic motivating elements of STOCKLAB—

personal and interpersonal—are predicted to increase

the effectiveness of conveying knowledge about

stock investing to potential investors, which in turn

increases their desire to know and even invest in real

stocks.

2.3 Research Hypothesis

This study aims to determine whether the

STOCKLAB card game can increase the knowledge

and interest of the players towards the capital market

in Indonesia. This study focuses on cognitive and

affective learning (interest in stock investing),

because there are two following main reasons: (1)

Some of the share trading mechanism that occurs in

games is the same as the share trading mechanism that

occurs in practice. For example, in practice there are

four sectors of shares traded on the Stock Exchange,

i.e., consumer, agriculture, finance, and mining

sectors. These four sectors can be found in the

STOCKLAB game. Therefore, it is relevant to test the

cognitive aspects (i.e., knowledge) of players, and (2)

the main objective of the STOCKLAB game is to

introduce the world of investment to potential

investors. Through STOCKLAB, investors can

familiarize themselves to the terms stocks, risks, and

benefits of investing in stocks so that it is hoped that

through this experience their interest in investing will

increase. Thus, this game is said to be effective if it

succeeds in increasing players' interest in getting to

know the world of investment, especially the capital

market.

Learning using simulation games is more

effective than traditional learning because it can

increase learner motivation. Malone's theory states

that the individual and interpersonal intrinsic

motivating features found in games make students

more willing to invest their time, thoughts, and

emotions in learning the knowledge being taught

(Malone, 1981; Malone & Lepper, 1987). In addition,

the pleasant learning climate created by simulation

games helps students to more easily process the

information provided. The theory of abstract-

interactive cognitive complexity states that

simulation games are more effective than traditional

learning because they involve aspects of thought and

emotion simultaneously (Tennyson & Jorczak, 2008).

These advantages are predicted to be able to make

STOCKLAB an effective method to open up students'

insights about the world of stock investing, which in

turn can increase their interest in getting to know the

real stock investing. Studies show simulation games

are effective in increasing knowledge (Cheng et al.,

2014; Chuang & Chen, 2009; Soflano et al., 2015)

and participants' interest in the material that has been

studied (Knechel & Rand, 1994; Manero et al., 2015).

The literature, however, indicates that simulation

games are not necessarily more effective at improving

learning outcomes than traditional learning methods

(Boyle et al., 2016; Perrotta et al., 2013). The

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

54

explanation of why simulation-based learning is not

always effective in improving learning outcomes can

be due to an intrinsic problem, i.e., that students

generally have difficulty learning various complex

relationships in simulations only from experience (De

Jong & Van Joolingen, 1998). Studies show that

game-based learning increases its effectiveness when

there is instructional support (Wouters & Van

Oostendorp, 2017). This study uses additional

explanations by the instructor throughout the game as

instructional support to increase the effectiveness of

STOCKLAB learning. Adding explanations

improves learning outcomes because it helps students

connect experiences with the material STOCKLAB is

trying to convey. For example, the instructor explains

the benefits of a stock split when a player experiences

a certain skyrocketing stock price increase. Bagley &

Shaffer (2015) found that instructor explanations in a

simulation game both virtual and face-to-face helped

students learn urban science. However, their study

has not compared simulation games with

explanations to simulation games without

explanations, so their effectiveness still needs to be

tested. Therefore, this study uses three learning

methods: STOCKLAB with explanations,

STOCKLAB without explanation, and traditional

presentations using power points to test the

effectiveness of STOCKLAB with explanations in

increasing students' knowledge and interest in

investing in the capital market. Based on the theory

and results of previous studies, the proposed

hypotheses are as follows:

H1 Students will have better knowledge of stock

investing after playing STOCKLAB with Explanation

compared to students who use the STOCKLAB

without Explanation and Traditional approaches.

H2 Students will have a higher interest in stock

investing after playing STOCKLAB with Explanation

compared to students who use the STOCKLAB

without Explanation and Traditional approaches.

3 METHODS

3.1 STOCKLAB Educational Game

STOCKLAB is a commercially available card game

created by Ryan Filbert and supported by the

Financial Services Authority (OJK) made to support

the capital market education program. The number of

players are between three to six people including the

banker who is in charge of managing the game and

managing the bank's assets. The duration of the game

lasts for ± 45 minutes for six rounds. In the game,

players compete to develop assets through investing

in stocks and mutual funds, and use various strategies

optimally to become the most successful investors.

The winner is the player with the most total assets

(i.e.., money coins) at the end of the game.

Game materials consist of 1 mutual fund card, 4

stock sector cards, 4 price tokens, 5 street order cards,

5 cue cards, 5 debt cards, 10 split tokens, 36 economy

cards, 58 cash coins, and 60 action cards. Each type

of card has its own function. Mutual fund cards serve

as an alternative investment for players other than

stocks. The stock sector card aims to show four traded

stock sectors, i.e., mining, agriculture, finance, and

consumer. The road sequence card aims to determine

which player will start first. The economic card

functions to inform economic conditions (such as

inflation and recession), which also determine stock

price movements. Six economy cards are placed on

each stock card. After all economy cards are opened,

the game will end. Action cards are used by players

to perform various actions such as buying shares,

quick buys, acquisitions, trading fees, rumors, and

stock exchange info. Quickbuy means each player

can take 2 cards at once. Acquisition means that each

player can acquire shares owned by other players on

the condition that the share card ownership they own

must be the same or more than the player whose

shares will be acquired. Trading fee means that each

player can immediately sell the card they have

without having to wait for the sell phase. If it is saved,

the player who takes this card must pay tax according

to the number of card colors they have. Rumor means

that each player can increase or decrease the value of

the shares listed on the stock price board that contain

the price token. Exchange info means that only

players using this action can open 3 economy cards

first before the action card is opened by the banker

and may not be disclosed to other players.

Apart from cards, STOCKLAB also uses three

types of coins, i.e., pricing coins, split coins, and cash

coins. Pricing coins are used to show the price of a

share. The initial share price will all be uniform, at the

price of 5. The split coins will be used when the share

price is too high so that it exceeds the value stated on

the card. Stock split causes the number of shares

owned to increase, but the value remains. Lastly,

money coins serve as a measure of success in the

game. The winner is the player with the highest

number of coins at the end of the game.

STOCKLAB games are usually done in 6 rounds

of ± 45 minutes. Each round consists of 4 stages. First

is the Bidding Phase. At this stage, the player bids

with closed hands, the banker will give an order to

open the fist simultaneously to find out how many

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market

55

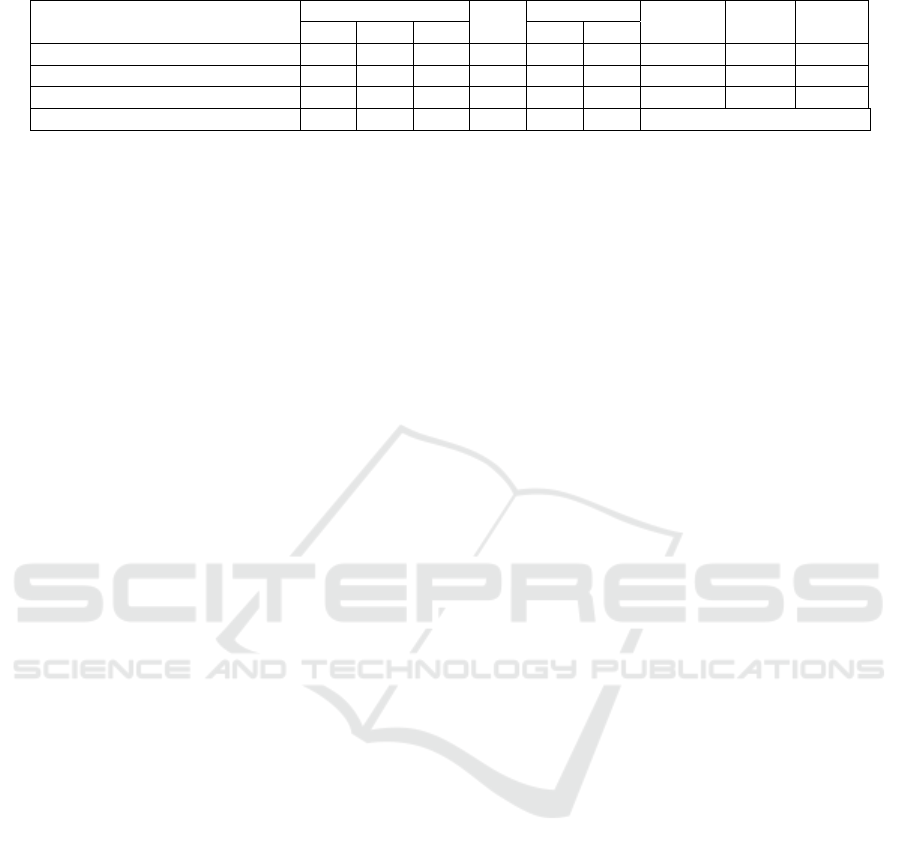

Table 1: Participants’ demographics.

Treatment

Universit

y

N Gende

r

Median Mean SD

S M W M F

STOCKLAB with Ex

p

lanation 20 18 20 58 23 35 20.00 20.00 1.24

STOCKLAB without Explanation 20 18 20 58 21 37 20.00 20.03 1.30

Traditional 22 17 17 56 20 36 20.00 20.09 1.56

Total 62 53 57 172 64 108

coins each player is offering. The player with the

highest coin bid will get a turn to take the first card

followed by the second highest bidder, and so on. All

coins used for bidding are submitted to the Bank.

Second is the action phase. Each player takes a stock

card according to the sequence number that has been

determined during the bidding phase. The cards will

be distributed with 2x players or each player has the

opportunity to get a maximum of 2 stock cards. The

action phase is carried out until the cards that have

been dealt run out. Third is the selling phase. At this

stage, all players have the opportunity to sell one

sector of their shares without a maximum or

minimum number of shares. Lastly, the economic

phase. At this stage, the banker opens the economy

card and executes card instructions which affect the

stock price. Economy cards that have been used cannot

be used again until the game ends. A description of

how to play SOCKLAB can be found at

https://www.youtube.com/watch?v=6-bpc6MCGJ 8.

3.2 Research Design

This study hypothesizes that students' knowledge and

interest in the world of stock investing will increase

after playing STOCKLAB with explanations. To test

this hypothesis, the study used a randomized control

trial with a three-group pretest/posttest research

design. The three groups were 1) STOCKLAB with

explanation, 2) STOCKLAB without explanation,

and 3) Traditional (presentation using a power point)

approach. Instructors and students who participated in

this study were assigned to each group randomly.

3.3 Participants

One hundred and seventy-two students from three

private universities that have the most active

Indonesia Stock Exchange Investment Gallery

(GIBEI) in West Java, Indonesia, participated in this

research. Researchers contacted GIBEI managers at

the three universities and asked for their help in

recruiting students as research participants. Although

students come from three different universities, all

instructors are from M university. Table 1 provide

information about the participants' university origins,

gender, and age.

3.4 Instruments Assessment

This study used two instruments that were given

before and after the treatment was given. The first

instrument consists of 12 multiple choice question

items which were developed by the research team to

measure students' knowledge about stock investment

in the Indonesian capital market. In order to increase

the validity of the instrument, the question items were

made in line with the objectives of the STOCKLAB

game. Each correct response is assigned a point of 1,

so the total points for all correct answers is 12. The

Kuder-Richardson 20, person and item-reliability

statistics for the knowledge test showed -.36 and .97

before and -.55 and .96 respectively after the

intervention. The low person reliability value in the

pre-test may be due to the low ability of the

participants at the beginning of the experiment.

The second instrument consists of 10 survey items

adapted from Nussbaum et al. (2015) to measure the

student’s interest in stock investing. The survey items

used a 5-point Likert scale ranging from 1 (very

uninterested) to 5 (very interested). Adaptation is

needed because the original instrument asked

students' interest in the context of climate change

education, while this research is in the context of

stock investment education. Nussbaum et al. (2015)

found that the instrument had an internal consistency

of .81 before and .86 after the intervention. This study

found similar results, i.e., an internal consistency of

.85 before and .86 after the intervention. In addition,

a feedback survey consisting of 7 items with a 5-point

Likert Scale that ranges from 1 (Strongly disagree) to

5 (Strongly Agree) was given after the intervention.

This survey was also adapted from Nussbaum et al.

(2015) who found the internal consistency value of

.89, while the internal consistency value in this study

was .82.

3.5 Procedure

Prior to the study, 11 instructors were trained to

administer tests and treatments. Each instructor was

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

56

in charge of handling 5-6 students during the study.

The researchers explained to the instructors that the

research objective was to test the effectiveness of the

three learning methods to educate the capital market.

Instructors only described the methods assigned to

them without explaining the other two methods. In

order to familiarize the instructor with the method to

be carried out, the instructors were asked to practice

and were informed about the important features of the

method. The test protocol was also described. In

particular, they were informed that the type of test

was closed books, that the study participants had to

take the test individually, and that the instructor was

not allowed to assist the participants during the test.

The study was conducted outside regular class

hours and consisted of three main stages: pre-test,

treatment, and post-test. In the first stage, students

were asked to complete a pre-test questionnaire

containing demographic questions and two

instruments, each of which was used to measure

students' knowledge and interest about stock

investing in the capital market. Students were asked

to work individually and were informed that the

scores obtained during the study do not affect their

course scores. This pre-test lasts twenty minutes.

The treatment stage lasts for one hour and forty

minutes. Each researcher who was present acted as an

observer and kept the interaction to a minimum with

the instructors and the students in the three groups:

STOCKLAB with explanation, STOCKLAB without

explanation, and Traditional approach. STOCKLAB

Group with explanation to learn to invest in the

capital market using STOCKLAB accompanied by an

explanation of the capital market material being

experienced by the instructor. For example, the

Instructor while distributing stock cards explains the

sectors traded in the capital market. Likewise, when a

player experiences a Stock Split, the instructor

explains how this event causes the number of player

shares to increase, but the overall share value does not

change. In contrast, the STOCKLAB Group without

explanation learns to invest in the capital market

using STOCKLAB without obtaining an explanation

regarding the capital market educational content

contained in the game. Instructors in the STOCKLAB

group with and without explanation act as bankers in

charge of explaining the rules of the game and

managing bank assets. In the Traditional approach

group, students learn the capital market by listening

to the instructor's presentation using power points.

Students can also ask questions and discuss with the

instructor if there is material that they did not

understand.

The final stage of the research procedure was to

conduct a post-test after the treatment stage had been

completed. This test used the same instrument and

duration as the pre-test. In addition, a survey aimed at

obtaining information about their perceptions of the

learning experience was conducted after the post-test

ended.

4 RESULTS AND DISCUSSION

4.1 Learning Outcomes

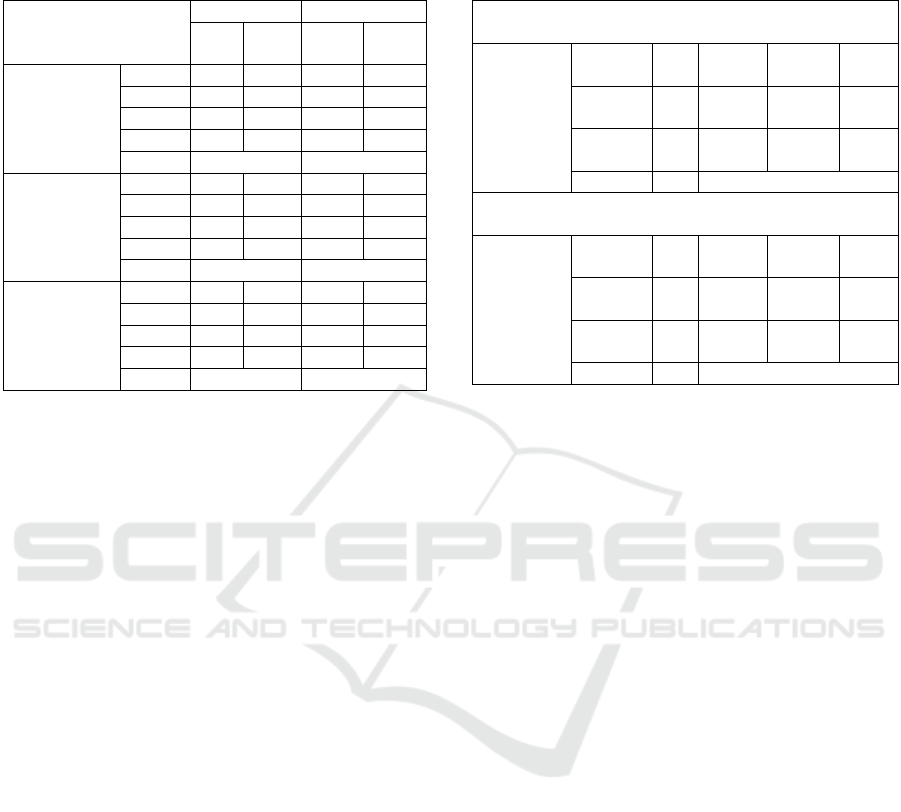

Table 2 shows the mean, standard deviation,

minimum, maximum, and results of the paired t-test

for each experimental group. One-way ANOVA

results showed that there was no significant

difference at p <.05 level in knowledge: F (2, 169) =

2.04, p = .13 and interest pre-test scores: F (2, 169) =

.07, p = .94 for all three groups. The ANOVA was

performed after verifying that the assumptions of

homogeneity of variance was satisfied (Pallant,

2016). Based on the results of the Levene’s test of

variance for knowledge (2, 169) = 1.86, p = .16 and

interest pre-test scores (2, 169) = 1.32, p = .27, using

ANOVA is appropriate. Furthermore, the paired t-test

results showed a significant increase in knowledge

and interest after treatment at STOCKLAB with

Explanation (knowledge: t = 4.30, p <0.01; interest: t

= 4.82, p <0.01), STOCKLAB without Explanation

(knowledge: t = 2.54, p <0.05; interest: t = 6.30, p

<0.01), and Traditional approach (knowledge: t =

7.37, p <0.01; interest: t = 4.54, p <0.01). This

illustrates that these three methods can be effective.

To test the research hypothesis that the STOCKLAB

with Explanation learning method outperformed two

other methods, One-way between-groups analysis of

variance (One-way ANOVA) with Planned Contrast

tests were performed. One-way ANOVA was

performed after verifying that the assumptions of

homogeneity of variance was satisfied (Pallant,

2016). Based on the results of the Levene’s test of

variance for knowledge (2, 169) = .32, p = .73 and

interest post-test scores (2, 169) = 2.71, p = .07, using

ANOVA is appropriate.

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market

57

Table 2: Pre-test and post-test knowledge and interest

scores for the STOCKLAB with Explanation group versus

two comparison groups.

Group

Interest Knowled

g

e

Pre-

test

Post-

test

Pre-

test

Post-

test

STOCKLAB

with

Explanation

(n = 58)

Mean 4.02 4.27 6.84 7.86

SD 0.53 0.48 2.10 2.20

Min. 2.10 3.10 3.00 2.00

Max. 5.00 5.00 11.00 12.00

t value* 4.82*** 4.30***

STOCKLAB

without

Explanation

(n = 58)

Mean 4.06 4.33 6.33 6.86

SD 0.43 0.41 2.08 2.36

Min. 2.40 3.40 2.00 2.00

Max. 5.00 5.00 11.00 12.00

t value* 6.30*** 2.54**

Traditional

Approach

(n = 56)

Mean 4.04 4.30 6.11 8.09

SD 0.40 0.36 1.83 2.25

Min. 3.30 3.50 2.00 2.00

Max. 5.00 5.00 10.00 12.00

t value* 4.54*** 7.37***

Note: *post – pre; **p < 0.05; ***p < 0.01

4.2 The Impact of the STOCKLAB

Game on Students’ Knowledge

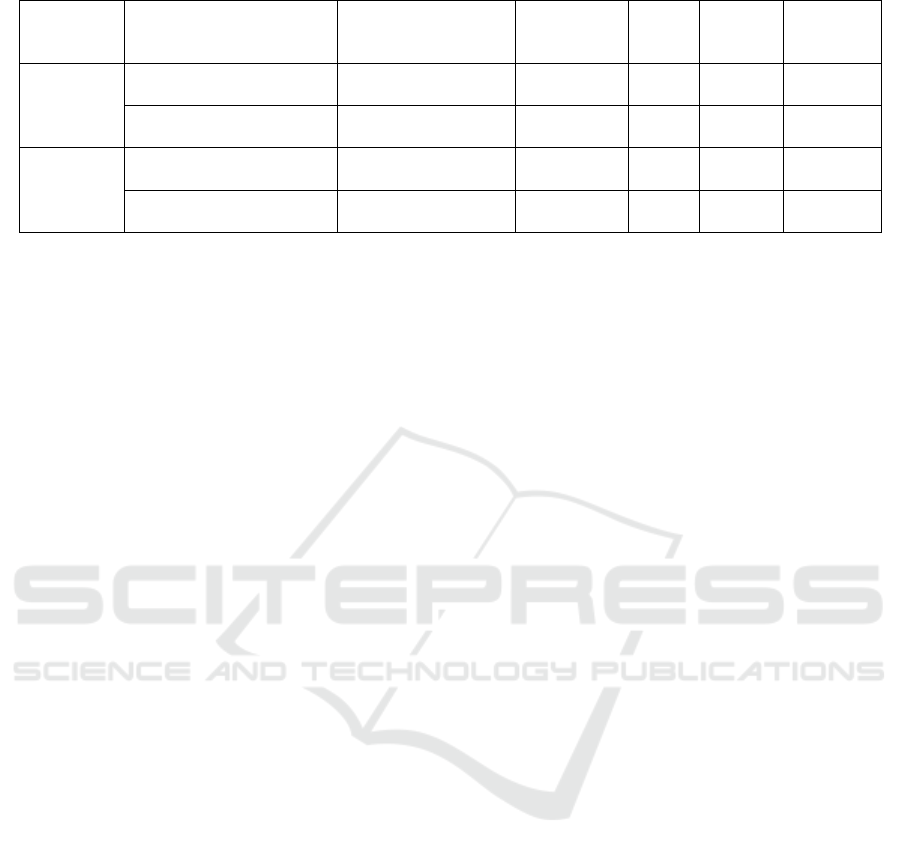

H1 predicts that students will have better knowledge

of the world of stock investing after playing

STOCKLAB with Explanation compared to students

who use the STOCKLAB without Explanation and

Traditional approach. H1 was partially supported.

Panel A of Table 3 shows a significant main effect in

the knowledge post-test scores among the three

groups, F (2, 169) = 4.74, p = .01. As shown in Table

4, planned contrasts revealed that the students’

knowledge post-test scores of the STOCKLAB with

Explanation were significantly different from the

STOCKLAB without Explanation, t (169) = 2.37, p =

.02. Meanwhile, no significant difference was found

between STOCKLAB with Explanation and

Traditional groups, t (169) = -.53, p = .59. These

statistical results are supported by the effect size

analysis comparing the knowledge post-test scores of

the STOCKLAB with Explanation and controls

groups. The effect size analysis shows a medium to

large effect for the STOCKLAB with Explanation

compared with STOCKLAB without Explanation,

while it shows a negligible effect for the STOCKLAB

with Explanation compared with Traditional. These

results suggest that students in the STOCKLAB with

Explanation group exhibited a greater level of

improvement in knowledge about stock investment

than those in the STOCKLAB without Explanation

group, but the STOCKLAB with Explanation group’s

improvement is as high as the Traditional group.

Table 3: Effects of treatment groups on students’

knowledge and interest post-test scores (Analysis of

variance summary table).

Panel A: ANOVA-The effects of treatment groups on

students’ knowledge scores

Knowledge

post-test

scores

df

Mean

Square

F-

statistic

p-

value

Between

groups

2 24.49 4.74 .010

Within

g

rou

p

s

169 5.16

Total 171

Panel B: ANOVA-The effects of treatments groups on

students’ interest scores

Interest

post-test

scores

df

Mean

Square

F-

statistic

p-

value

Between

groups

2 .10 .57 .57

Within

g

rou

p

s

169 .18

Total 171

4.3 The Impact of the STOCKLAB

Game on Students’ Interest

H2 predicts that students will have a higher interest in

stock investment after playing STOCKLAB with

Explanation compared to students who use the

STOCKLAB without Explanation and Traditional

approach. H2 was not supported. Panel B of Table 3

shows insignificant main effect in the interest post-

test scores among the three groups, F (2, 169) = .57,

p = .57. Planned contrasts (see table 4) shows the

interest post-test scores of the STOCKLAB with

Explanation group do not differ significantly from the

STOCKLAB without Explanation, t (169) = -.82, p =

.42 and Traditional groups, t (169) = .20, p = .85.

These statistical results are supported by the effect

size analysis comparing the knowledge post-test

scores of the STOCKLAB with Explanation and

controls groups.

The effect size analysis shows a negligible effect

for the STOCKLAB with Explanation compared with

STOCKLAB without Explanation and Traditional.

These findings suggest that the three approaches are

equally effective for improving students’ interest in

stock investment in the capital market.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

58

Table 4: Planned contrasts by dependent variable.

Dependent

Variable

Experimental group (a) Comparison group (b)

Mean

difference

(a-

b

)

Std.

Error

p value Cohen’s d

Knowledge

STOCKLAB with

Ex

p

lanation

(µ

= 7.86

)

STOCKLAB without

Ex

p

lanation

(µ

= 6.86

)

1.00 .42 .02

a

.44

STOCKLAB with

Ex

p

lanation

(µ

= 7.86

)

Traditional

(µ

= 8.09

)

-.23 .43 .59 .10

Interest

STOCKLAB with

Explanation (µ = 4.27)

STOCKLAB without

Explanation (µ = 4.33)

-.06 .08 .42 .13

STOCKLAB with

Ex

p

lanation

(µ

= 4.27

)

Traditional

(µ

= 4.26

)

.01 .08 .85 .07

Note: Significant at the 0.05 level.

4.4 Student Feedback Survey

In addition to knowledge and interest assessments,

the present study surveys students’ perceptions of the

assigned approach. The means and standard

deviations of the STOCKLAB with Explanation,

STOCKLAB without Explanation, and Traditional

groups on the five Likert-scale items (with some

items reversed scored) are 4.26 (SD = .52, n = 58),

4.27 (SD = .43, n = 58), and 4.01 (SD = .52, n = 56),

respectively. These indicate that students’

perceptions of the assigned approach were generally

positive. However, the results of ANOVA revealed a

statistically significant difference at the p < .05 level

in survey item scores for the three groups: F (2, 169)

= 3.08, p = .049. Planned contrast indicates no

statistical difference in the item scores between the

STOCKLAB with Explanation and STOCKLAB

without Explanation, t (169) = -.19, p = .85.

Meanwhile, a significant difference is observed

between the STOCKLAB with Explanation and

Traditional, t (169) = 2.06, p = .04. These findings

suggest that students learning through game approach

(i.e., the STOCKLAB with and without Explanation)

demonstrate a higher level of level of agreement that

the game is an interesting way to study capital market

compared to the Traditional approach.

4.5 Discussion

The main purpose of this study is to examine the

effectiveness of STOCKLAB for improving students’

knowledge (H1) and interest (H2) in investing in the

capital market. To improve the internal validity of this

study and determine which approach work best, the

STOCKLAB with Explanation is compared with

STOCKLAB without Explanation and Traditional

approach with each having similar learning

objectives.

This study finds the three methods can be

effective in improving students’ knowledge and

interest in investing in the capital market. However,

the results of this study exhibit partial support for H1.

The students in the STOCKLAB with Explanation

group scored higher on knowledge post-test than

those in STOCKLAB without Explanation group.

These findings are consistent with the review studies

that show the effectiveness of the game approach can

be enhanced when it includes instructional supports

(Hays, 2005; O’Neil et al., 2005; Wouters & Van

Oostendorp, 2017). The knowledge about capital

market (e.g., capital gain, capital loss, stock split)

explained by the instructor during the game might

have prompted the students to form connections

between the knowledge and game actions. In contrast,

this study did not find the game approach with

explanation is more effective than Traditional in

enhancing students’ knowledge. This result is

contrary to the theory of abstract-interactive cognitive

complexity (Tennyson & Jorczak, 2008). The

inconsistent result is perhaps due to two factors. First,

the nature of the experimental design requires

students in the game groups to study more

information in the same amount time (i.e., both the

rules of STOCKLAB and the knowledge of the

capital market). Second, the problems appearing on

the test may focus on the lower-order thinking (i.e.,

memorization, understanding, and application. For

instance, Mr. X invested in stock for Rp100 million

in the beginning of year. If the stock has a fair value

Rp90 million in the end of year, calculate the realized

or unrealized profit/loss of Mr. X’s stock investment.)

rather than higher-order thinking (analyzing,

evaluating, and creating). The education literature

argue that educational simulation games are more

effective than traditional teaching methods for

fostering complex thinking skills (Bonner, 1999;

Fowler, 2006) such as complex decision making

(Pasin & Giroux, 2011), problem solving and critical

thinking (Lovelace et al., 2016; Yang, 2015), and the

higher-order thinking skills associated with Bloom’s

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market

59

taxonomy (Anderson & Lawton, 2009; Kuang et al.,

2021; Zigmont et al., 2011).

The finding that students in the STOCKLAB with

Explanation group scored equally on the interest post-

test with students in the STOCKLAB without

Explanation and Traditional groups, does not lend

support to H2. The result is inconsistent with the

previous studies showing game is more effective at

increasing students’ interest in materials learned than

traditional approach (Knechel & Rand, 1994; Manero

et al., 2015). Upon reflection, it is possible that the

topic itself (i.e., stock investment in capital market) is

interesting for the students. A national survey shows

the young Indonesian (aged 17-29) considers a

financial self-sufficiency is one of the most important

factors for happiness (CSIS, 2017). A substantial

financial return potential from stock investment may

arouse students’ enthusiast to learn more about capital

market. A survey performed by Fintechnews

Singapore, (2020) found that the young Singaporean

(aged 18-23) ranked the bonds/stock (59%) as the

most preferred investment followed by real estate

(41%), and mutual funds (35%).

A feedback survey at the end of experiment shows

that students in the STOCKLAB with and without

Explanation group demonstrate a significantly higher

level of enjoyment with and enthusiasm to continue

to use the game than those in the Traditional group.

Special features of game-such as challenge,

competition, curiosity, and recognition- effectively

produce the affective effects for the STOCKLAB.

These effects, however, are insufficient to improve

students’ knowledge and interest higher than

Traditional approach. The emotion may affect the

long-term memory rather than the short one (Thomas

& Hasher, 2006). Studies find simulation games are

more effective than alternative learning methods in

promoting knowledge retention (e.g., Brom et al.,

2011; Curry & Brooks, 1971; Lucas et al., 1975). As

this study only performed an immediate knowledge

post-test, the long-term effect of the game was not

known.

5 CONCLUSIONS

This study investigates the effectiveness an

educational game called STOCKLAB for improving

students’ knowledge and interest in investing in the

capital market. This study argues that the game is

more effective than traditional approach (presentation

using power point) if it is used with combination of

explanation, —where an instructor explains the

educational contents of the game to the players—

during the game. The results show that STOCKLAB

with Explanation is more effective than STOCKLAB

without Explanation in assisting students in acquiring

knowledge about capital market, but it is as effective

as Traditional method. The three approaches are

equally effective in improving students’ interest in

investing in the capital market. However, students

learning through STOCKLAB with and without

Explanation reported a significantly higher level of

enjoyment with and enthusiasm to continue to use the

game than those in the Traditional group.

Taken together, the findings of this study imply

that STOCKLAB can be used as an alternative

approach to introduce capital market to the students if

it is coupled with explanation. The next steps include

assessing students’ higher-order thinking skills and

knowledge retention, and replicating the findings

with another simulation game, subjects, and topics.

These are crucial to enhance our understanding about

the efficacy of game-based learning and

generalization of this study.

ACKNOWLEDGEMENTS

This study has been fully funded by Universitas

Kristen Maranatha. We also thank to all the

instructors and universities involved in this

experiment, particularly to Siti Komariah and Ramlah

Puji Astuti.

REFERENCES

Adams, D. M., & Clark, D. B. (2014). Integrating self-

explanation functionality into a complex game

environment: Keeping gaming in motion. Computers

and Education, 73, 149–159. https://doi.org/10.1016

/j.compedu.2014.01.002

Albrecht, W. D. (1995). A financial accounting and

investment simulation game. Issues in Accounting

Education, 10(1), 127–141.

Anderson, P. H., & Lawton, L. (2009). Business

simulations and cognitive Learning: Developments,

desires, and future directions. Simulation & Gaming,

40(2), 193–216. https://doi.org/10.1177/104 687810

8321624

Bagley, E. A., & Shaffer, D. W. (2015). Stop talking and

type: Comparing virtual and face-to-face mentoring in

an epistemic game. Journal of Computer Assisted

Learning, 31(6), 606–622. https://doi.org/10.1111/

jcal.12092

Bai, H., Pan, W., Hirumi, A., & Kebritchi, M. (2012).

Assessing the effectiveness of a 3-D instructional game

on improving mathematics achievement and motivation

of middle school students. British Journal of

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

60

Educational Technology, 43(6), 993–1003.

https://doi.org/10.1111/j.1467-8535.2011.012 69.x

Barzilai, S., & Blau, I. (2014). Scaffolding game-based

learning: Impact on learning achievements, perceived

learning, and game experiences. Computers and

Education, 70(January), 65–79. https://doi.org/10.1016/

j.compedu.2013.08.003

Bonner, S. E. (1999). Choosing teaching methods based on

learning objectives: An integrative framework. Issues

in Accounting Education, 14(1), 11–39.

Boyle, E. A., Hainey, T., Connolly, T. M., Gray, G., Earp,

J., Ott, M., Lim, T., Ninaus, M., Ribeiro, C., & Pereira,

J. (2016). An update to the systematic literature review

of empirical evidence of the impacts and outcomes of

computer games and serious games. Computers and

Education, 94, 178–192. https://doi.org/10.1016/j.com

pedu.2015.11.003

Brom, C., Preuss, M., & Klement, D. (2011). Are

educational computer micro-games engaging and

effective for knowledge acquisition at high-schools? A

quasi-experimental study. Computers and Education,

57(3), 1971–1988. https://doi.org/10.1016/j.com

pedu.2011.04.007

Chen, S., Chang, W. H., Lai, C. H., & Tsai, C. Y. (2014). A

Comparison of Students’ Approaches to Inquiry,

Conceptual Learning, and Attitudes in Simulation-

Based and Microcomputer-Based Laboratories. Science

Education, 98, 905–935. https://doi.org/10.

1002/sce.21126

Cheng, M. T., Su, T., Huang, W. Y., & Chen, J. H. (2014).

An educational game for learning human immunology:

What do students learn and how do they perceive?

British Journal of Educational Technology, 45(5), 820–

833. https://doi.org/10.1111/bjet.12098

Chuang, T. Y., & Chen, W. F. (2009). Effect of computer

based video games on children: An experimental study.

Educational Technology and Society, 12(2), 1–10.

https://doi.org/10.1109/DIGITEL.2007.24

CSIS. (2017). Ada Apa dengan Milenial? Orientasi Sosial,

Ekonomi dan Politik. Survei Nasional CSIS 2017,

November, 1–45. https://www.csis.or.id/uploaded

_file/event/ada_apa_dengan_milenial____paparan_surv

ei_nasional_csis_mengenai_orientasi_ekonomi__sosial

_dan_politik_generasi_milenial_indonesia__notulen.pdf

Curry, J. F., & Brooks, R. L. (1971). A comparison of two

methods of teaching life career planning to junior high

school students. http://files.eric.ed.gov/fulltext

/ED059401.pdf

De Jong, T., & Van Joolingen, W. R. (1998). Scientific

Discovery Learning with Computer Simulations of

Conceptual Domains.

Review of Educational Research,

68

(2), 179–201.https://doi.org/10.3102/00346543068002179

Fowler, L. (2006). Active learning: An empirical study of

the use of simulation games in the introductory

financial accounting class. Academy of Educational

Leadership Journal, 10(3), 93–103.

Garris, R., Ahlers, R., & Driskell, J. (2002). Games,

motivation, and learning: A research and practice

model. Simulation & Gaming, 33(4), 441–467.

https://doi.org/10.1177/1046878102238607

Gopher, D., Weil, M., & Bareket, T. (1994). Transfer of

skill from a computer game trainer to actual flight.

Human Factors, 36(3), 387–405. https://doi.org/10.

1518/107118192786749243

Hays, R. T. (2005). The effectiveness of instructional

games: A literature review and discussion. Technical

report 2005-004. Naval Air Warfare Center Training

Systems Division.

Heyman, M. (1982). What are simulation games?

Environmental Education Report, 10(5), 2–5.

Hsu, C.-Y., & Tsai, C.-C. (2012). Examining the effects of

combining self-explanation principles with an

educational game on learning science concepts. Interactive

Learning Environments, 4820(February 2015), 1–12.

https://doi.org/10.1080/10494820.2012.705850

Hwang, G.-J., Chiu, L.-Y., & Chen, C.-H. (2015). A

contextual game-based learning approach to improving

students’ inquiry-based learning performance in social

studies courses. Computers & Education, 81, 13–25.

https://doi.org/10.1016 /j.compedu.2014.09.006

Jabbar, A. I. A., & Felicia, P. (2015). Gameplay

engagement and learning in game-based learning: A

systematic review. Review of Educational Research,

85(4), 740–779. https://doi.org/10.3102/0034654

315577210

Keys, E., Luctkar-Flude, M., Tyerman, J., Sears, K., &

Woo, K. (2020). Developing a Virtual Simulation

Game for Nursing Resuscitation Education. Clinical

Simulation in Nursing, 39, 51–54. https://doi.org/

10.1016/j.ecns.2019.10.009

Knechel, W. R., & Rand, R. S. (1994). Will the AECC’s

course delivery recommendations work in the

introductory accounting course? Some preliminary

evidence. Journal of Accounting Education, 12(3), 175–

191. https://doi.org/10.1016/0748-5751(94)90030-2

Kuang, T. M., Adler, R. W., & Pandey, R. (2021). Creating

a Modified Monopoly Game for Promoting Students’

Higher-Order Thinking Skills and Knowledge

RetentionA Modified Monopoly for Promoting

Students’ Higher-Order Thinking Skills. Issues in

Accounting Education, 36(3). https://doi.org/10.

2308/ISSUES-2020-097

Leutner, D. (1993). Guided discovery learning with

computer-based simulation games: Effects of adaptive

and non-adaptive instructional support. Learning and

Instruction, 3(2), 113–132. https://doi.org/10.

1016/0959-4752(93)90011-N

Lovelace, K. J., Eggers, F., & Dyck, L. R. (2016). I do and

i understand: Assessing the utility of web-based

management simulations to develop critical thinking

skills. Academy of Management Learning and

Education, 15(1), 100–121. https://doi.org/10.546

5/amle.2013.0203

Lucas, L. A., Postma, C. H., & Thompson, J. C. (1975). A

comparative study of cognitive retention using

simulation‐gaming as opposed to lecture‐discussion

techniques. Peabody Journal of Education, 52(4), 261–

266. https://doi.org/10.1080/016195675095380 29

Malone, T. W. (1981). Toward a theory of intrinsically

motivating instruction. Cognitive Science: A

Using Educational Game for Improving Students’ Knowledge and Interest in Investing in the Capital Market

61

Multidisciplinary Journal, 5(4), 333–369.

https://doi.org/10.1207/s15516709cog0504

Malone, T. W., & Lepper, M. R. (1987). Making learning

fun: A taxonomy of intrinsic motivations for learning.

In R. E. Snow & M. J. Farr (Eds.), Aptitude, Learning,

and Instruction (3rd ed., pp. 223–253). Lawrence

Erlbaum Associates.

Manero, B., Torrente, J., Serrano, Á., Martínez-Ortiz, I., &

Fernández-Manjón, B. (2015). Can educational video

games increase high school students’ interest in theatre?

Computers & Education, 87, 182–191.

https://doi.org/10.1016/j.compedu.2015.06.006

Miller, M., & Hegelheimer, V. (2006). The SIMs meet ESL

Incorporating authentic computer simulation games

into the language classroom. Interactive Technology

and Smart Education, 3(4), 311–328. https://doi.org

/10.1108/17415650680000070

Morin, J., Tamberelli, F., & Buhagiar, T. (2020). Educating

business integrators with a computer-based simulation

game in the flipped classroom. Journal of Education for

Business, 95(2), 121–128. https://doi.org/10.1080/0883

2323 .2019. 1613951

Nussbaum, E. M., Owens, M. C., Sinatra, G. M., Rehmat,

A. P., Cordova, J. R., Ahmad, S., Harris, F. C., &

Dascalu, S. M. (2015). Losing the lake: Simulations to

promote gains in student knowledge and interest about

climate change. International Journal of

Environmental and Science Education, 10(6), 789–811.

https://doi.org/10.12973/ijese.2015.277a

O’Neil, H. F., Chung, G. K. W. K., Kerr, D., Vendlinski, T.

P., Buschang, R. E., & Mayer, R. E. (2014). Adding

self-explanation prompts to an educational computer

game. Computers in Human Behavior, 30, 23–28.

https://doi.org/10.1016/j.chb.2013.07.025

O’Neil, H. F., Wainess, R., & Baker, E. L. (2005).

Classification of learning outcomes: evidence from the

computer games literature. Curriculum Journal, 16(4),

455–474. https://doi.org/10.1080/0958517 0500384529

Otoritas Jasa Keuangan. (2020). Survei Nasional Literasi

dan Inklusi Keuangan 2019. https://www.ojk.go.

id/id/berita-dan-kegiatan/publikasi/Pages/Survei-

Nasional-Literasi-dan-Inklusi-Keuangan-2019.aspx

Pallant, J. F. (2016). SPSS survival manual: A step by step

guide to data analysis using IBM SPSS (6th ed.).

McGraw-Hill Education.

Pasin, F., & Giroux, H. (2011). The impact of a simulation

game on operations management education. Computers

& Education, 57(1), 1240–1254. https:// doi.org/10.101

6/j.compedu.2010.12.006

Perrotta, C., Featherstone, G., Aston, H., & Houghton, E.

(2013). Game-based learning: Latest evidence and

future directions. In NFER Research Programme:

Innovation in Education. NFER. www.nfer.ac.uk

Ruggiero, D. (2015). The effect of a persuasive social

impact game on affective learning and attitude.

Computers in Human Behavior, 45, 213–221.

https://doi.org/10.1016/j.chb.2014.11.062

Singapore, F. (2020). Gen Z Versus Millennials – Who

Fared Better at Saving Money and Budgeting?

https://fintechnews.sg/43844/personalfinance/gen-z-

versus-millennials-who-fared-better-at-saving-money-

and-budgeting/

Soflano, M., Connolly, T. M., & Hainey, T. (2015). An

application of adaptive games-based learning based on

learning style to teach SQL. Computers and Education,

86, 192–211. https://doi.org/10.1016/j.compedu.2015

.03 .015

Szczurek, M. (1982). Meta-analysis of simulation games

effectiveness for cognitive learning (Doctoral

dissertation, Indiana University). Dissertation Abstract

International, 43, 1031A.

Tennyson, R. D., & Jorczak, R. L. (2008). A conceptual

framework for the empirical study of instructional

games. In H. F. O’Neil & R. S. Perez (Eds.), Computer

games and team and individual learning (pp. 39–54).

Elsevier Inc.

Thomas, R. C., & Hasher, L. (2006). The influence of

emotional valence on age differences in early

processing and memory. Psychology and Aging, 21(4),

821–825. https://doi.org/10.1037/0882-7974. 21.4.821

Tompson, G. H., & Dass, P. (2000). Improving students’

self-efficacy in strategic management: The relative

impact of cases and simulations. Simulation & Gaming,

31(1),22–41. https://doi.org/10.1177/104687810003100

102

Van Eck, R., & Dempsey, J. (2002). The effect of

competition and contextualized advisement on the

transfer of mathematics skills in a computer-based

instructional simulation game. Educational Technology

Research & Development, 50(3), 23–41.

Whitehill, B. V., & McDonald, B. A. (1993). Improving

learning persistence of military personnel by enhancing

motivation in a technical training program. Simulation &

Gaming, 24(3), 294–313. https://doi.org/0803973233

Wouters, P., & Van Oostendorp, H. (2017). Overview of

instructional techniques to facilitate learning and

motivation of serious games." In Instructional

techniques to facilitate learning and motivation of

serious games. In Instructional techniques to facilitate

learning and motivation of serious games (pp. 1–16).

Springer, Cham.

Yang, Y.-T. C. (2012). Building virtual cities, inspiring

intelligent citizens: Digital games for developing

students’ problem solving and learning motivation.

Computers and Education, 59(2), 365–377.

https://doi.org/10.1016/j.compedu.2012.01.012

Yang, Y. T. C. (2015). Virtual CEOs: A blended approach

to digital gaming for enhancing higher order thinking

and academic achievement among vocational high

school students. Computers and Education, 81, 281–

295. https://doi.org/10.1016/j.compedu.2014.10.004

Zigmont, J. J., Kappus, L. J., & Sudikoff, S. N. (2011).

Theoretical foundations of learning through simulation.

Seminars in Perinatology, 35(2), 47–51.

https://doi.org/10.1053/j.semperi.2011.01.002

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

62