Forecasting Stock Returns with Fuzzy HEAVY-r Model

using Genetic Algorithm

Youssra Bakkali, Mhamed El Merzguioui

and Abdelhadi Akharif

Laboratory of Mathematics and Applications, Abdelmalek Essaadi University,

Faculty of Science and Technology of Tangier, Morocco

Keywords: HEAVY-r, GA, fuzzy system, clustering.

Abstract: Financial returns expose complex dynamics that are difficult to capture with classical econometric models,

the most common feature in financial series is volatility clustering. We propose the Fuzzy HEAVY-r model

for modelling and predicting returns of the CAC40 stock market index. This model has been developed by a

combination of the fuzzy inference system and the HEAVY-r model. A Genetic Algorithm (GA) based

parameters estimation algorithm is suggested to obtain the optimal solution for the fuzzy membership function

and the HEAVY-r model. We apply these models to the high-frequency financial data regularly spaced in

time (every minute) and (every five minutes), and we compared it with the Fuzzy GARCH model and the

classical models. The results indicate that the Fuzzy HEAVY-r model outperforms other models in out of

sample evaluation according to RMSE.

1 INTRODUCTION

In econometrics, volatility has been one of the most

active research subjects. The autoregressive

Conditional Heteroscedasticity Models (ARCH)

introduced by Engle (1982) and their extensions

GARCH (generalized ARCH) introduced by

(Bollerslev, 1986) are essentially based on the

concept of conditional variance and play an effective

role in modelling the dynamic features of volatility.

The GARCH family models are ineffective in cases

where volatility changes rapidly to a new level.

With the arrival of high-frequency data in the

world of finance, a large number of studies have been

recently published. Research on realized measures of

volatility is becoming popular in studies, including

realized variance introduced by Andersen et al.

(2001a) and Barndorff-Nielsen (2002), the realized

kernel introduced by Barndorff‐Nielsen et al. (2008),

and many related quantities. These measures are more

precise and effective than the squared return in

determining the current level of volatility.

The HEAVY model (SHEPHARD &

SHEPPARD, 2010) blends the intellectual lessons of

the GARCH model with modern higher frequency

data literature and shows that the HEAVY models are

more resilient than traditional GARCH models to

level breaks in the volatility that adjust much faster to

the new level.

Given that financial series present complex and

nonlinear behaviours that make modelling difficult,

various artificial intelligence techniques have been

tested for prediction problems and have shown better

performance.

Artificial Neural networks (ANNs) have been

used successfully, but the weak point is that the

(ANNs) are black boxes, and it is not possible to

explain the links between inputs and outputs.

In order to compensate for this weakness of

(ANNs), studies insist on the interest of systems

combining the aspect connectionist of (ANNs) to

reasoning techniques. In this objective, neuro-fuzzy

systems are particularly indicated.

Current research on prediction problems of

nonlinear time series shows that the neuro-fuzzy

performs better than ANNs (Wang, Golnaraghi, &

Ismail, 2004).

Hung (2009b) proposed a hybrid Fuzzy-GARCH

model. The model was combining a functional fuzzy

inference system to analyze clustering with a

GARCH model using genetic algorithms to estimate

the parameters.

We propose the Fuzzy HEAVY-r model that

combines the heavy model in order to capture

conditional volatility and the fuzzy approach offers

316

Bakkali, Y., EL Merzguioui, M. and Akharif, A.

Forecasting Stock Returns with Fuzzy HEAVY-r Model using Genetic Algorithm.

DOI: 10.5220/0010733300003101

In Proceedings of the 2nd International Conference on Big Data, Modelling and Machine Learning (BML 2021), pages 316-320

ISBN: 978-989-758-559-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the ability to simulate stock movements with

volatility clustering.

For the Fuzzy HEAVY-r model estimation problem,

the GA method (Holland, 1984) aims to achieve an

optimal solution.

Our study will be based on daily financial

returns 𝑟

and a sequence of daily realised variance

(𝑅𝑉

𝑡1,2…𝑁.

The rest of this paper is organised into six

sections. The HEAVY models are presented in

section 2. The Fuzzy HEAVY-r is presented in

section 3. In section 4, the Genetic algorithm. In

section 5, We have highlighted the properties

observed empirically in high-frequency financial

data, and we apply the Fuzzy HEAVY-r model to the

real data. Concluding remarks are given in section 6.

2 HEAVY MODELS

The structure of the HEAVY models (SHEPHARD &

SHEPPARD, 2010) is given by:

Var(r

/F

h

α

α h

β RM

, (1)

α0,β∈

0,1

.

E(RM

/F

μ

γα

μ

β

RM

, (2)

α

β

∈

0,1

Where r

denote the daily return, F

is the

information set generated by high-frequency past

data, and RM

t

, that is, the high-frequency volatility

estimators. Note that (1) is called the HEAVY‐r

model and (2) the HEAVY‐RM model.

The volatility estimator that we adopt in our

model is the realized volatility (Barndorff-Nielsen &

Shephard, 2002) , as a realised measure:

𝑅𝑉

∆

log

𝑃

∆

log𝑃

∆

,

The intra-day time subscripted as i = 0, 1, 2, ..., N and

∆ is the frequency. Note that 𝑃

∆

is the closing

price at the i-th interval of day t.

3 THE FUZZY HEAVY-R MODEL

Neuro-fuzzy systems are suitable tools for solving the

prediction problems of nonlinear time series. Since

the most common feature in financial series is

volatility clustering, we combine the HEAVY-r

model and fuzzy systems to capture the accumulation

of volatility.

Fuzzy set theory is similar to human reasoning.

The capacity of fuzzy logic to imitate human

reasoning is one of the reasons why fuzzy systems are

being considered in this study.

The fuzzy inference system is a computational

framework that is used to examine and evaluates the

output of fuzzy systems in three steps: the

fuzzification (i.e. partitioning of the input data to the

antecedent of the fuzzy rules), then IF-THEN rules,

and finally the defuzzification.

The use of language rules IF-THEN reflects

knowledge about a system's dynamics, which makes

creating prediction systems with fuzzy inference

systems interesting.

Fuzzy sets are defined through a membership

function (denoted by 𝜑) which converts data into

scale inputs ranging from 0 to 1.

𝑅𝑢𝑙𝑒

: IF 𝑟

is 𝜑

THEN:

r

h

ε

,

h

α

α

h

β

RM

Such that: 𝑟

the previous value of the stock

returns, 𝜑

is the fuzzy set for rule l (l = 1,2…L), with

L the number of rules IF_THEN.

The function that we adopt in our model is the

Gaussian membership function:

φ

r

exp

,

With c is the center of the Gaussian function and σ is

a positive constant determines the zone of influence

of the cluster in question.

The output y of the inference system is determined

by taking a weighted average of the outputs of the

different rules.

𝑟

ℎ

ε

t

,

h

∑

φ

r

α

∑

α

h

∑

β

RM

∑

φ

r

4 GENETIC ALGORITHM

Genetic algorithms are a family of techniques draws

on the Darwinian theory of evolution to solve

optimization problems (Holland, 1984) based on

three basic genetic operators: reproduction, crossover

and mutation.

Genetic algorithms belong to the family of

evolutionary algorithms. They are used to optimize

complex problems in order to find an optimal

Forecasting Stock Returns with Fuzzy HEAVY-r Model using Genetic Algorithm

317

solution. It is an effective approach for nonlinear

functions (Zhou, Khotanzad, & Alireza, 2007).

5 EMPIRICAL STUDY

This paper focus on daily financial returns (𝑟

) of

CAC40 obtained by taking the logarithmic difference

of the daily price and multiplying it by 100, the

resulting stock return: r(t) = (log P(t) –log P(t-1))

*100, where P(t) is the closing price for day t

over the period from 01/11/2017 through 09/10/2020

and a sequence of daily realised variance 𝑅𝑉 obtained

by the sum of the N intra-day squared returns at

frequency 1 min for the first series and 5 min for the

second series. Where the intra-day time subscripted

as i = 0, 1, 2…N.

The first series is uniformly sampled at 1-minute

scales. This series includes exactly 388,074

observations of 01/11/2017 09: 00 until 09/10/2020

18: 00 or 520 points per day.

The second series is uniformly sampled at 5-

minute scales. This series includes exactly 77,657

observations of 01/11/2017 09: 00 until 09/10/2020

18: 00 or 105 points per day.

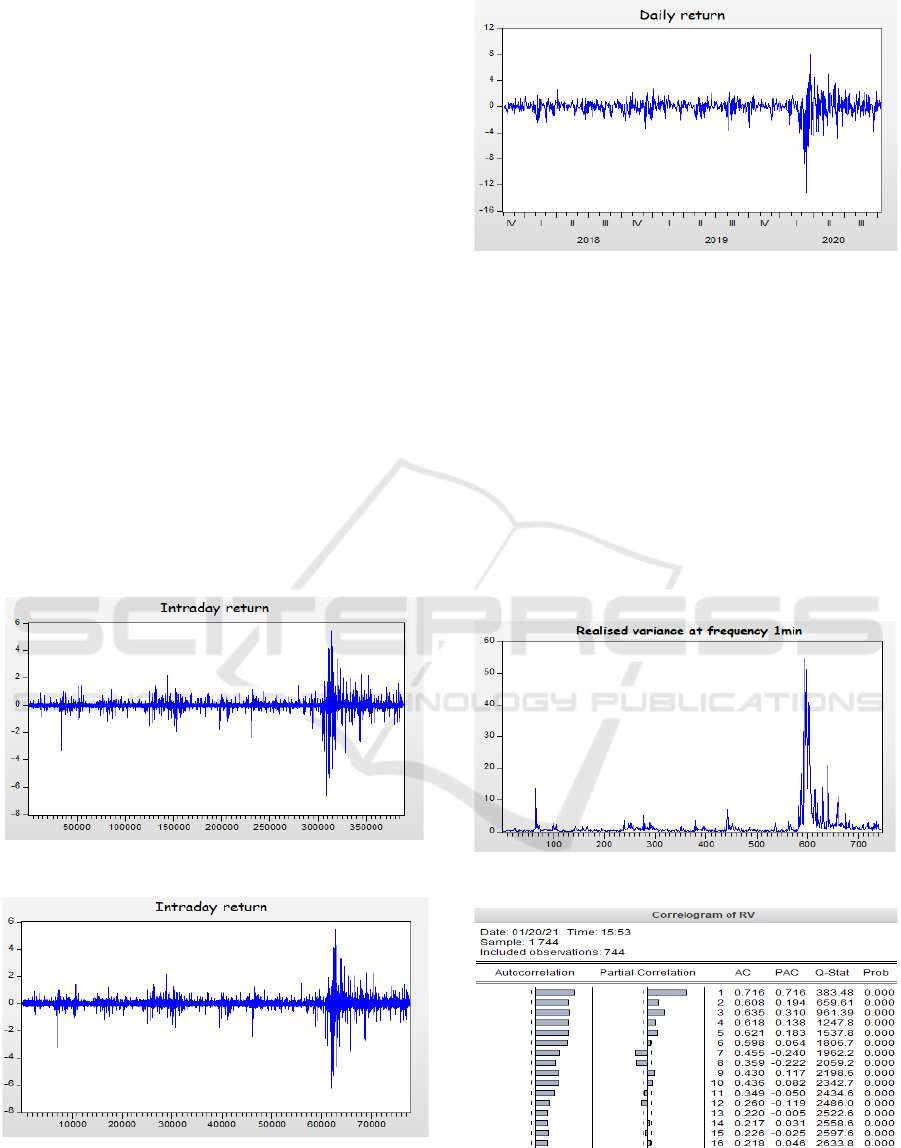

Figure 1: The intraday return at frequency 1 min

Figure 2: The intraday return at frequency 5 min

Figure 3: The daily return

The graphics (figures 1, 2, 3) represent the Time

series plots of the intraday returns and daily returns.

We can notice that the returns appear to be stationary

around a constant. The evolution of returns indicates

that the series is highly volatile.

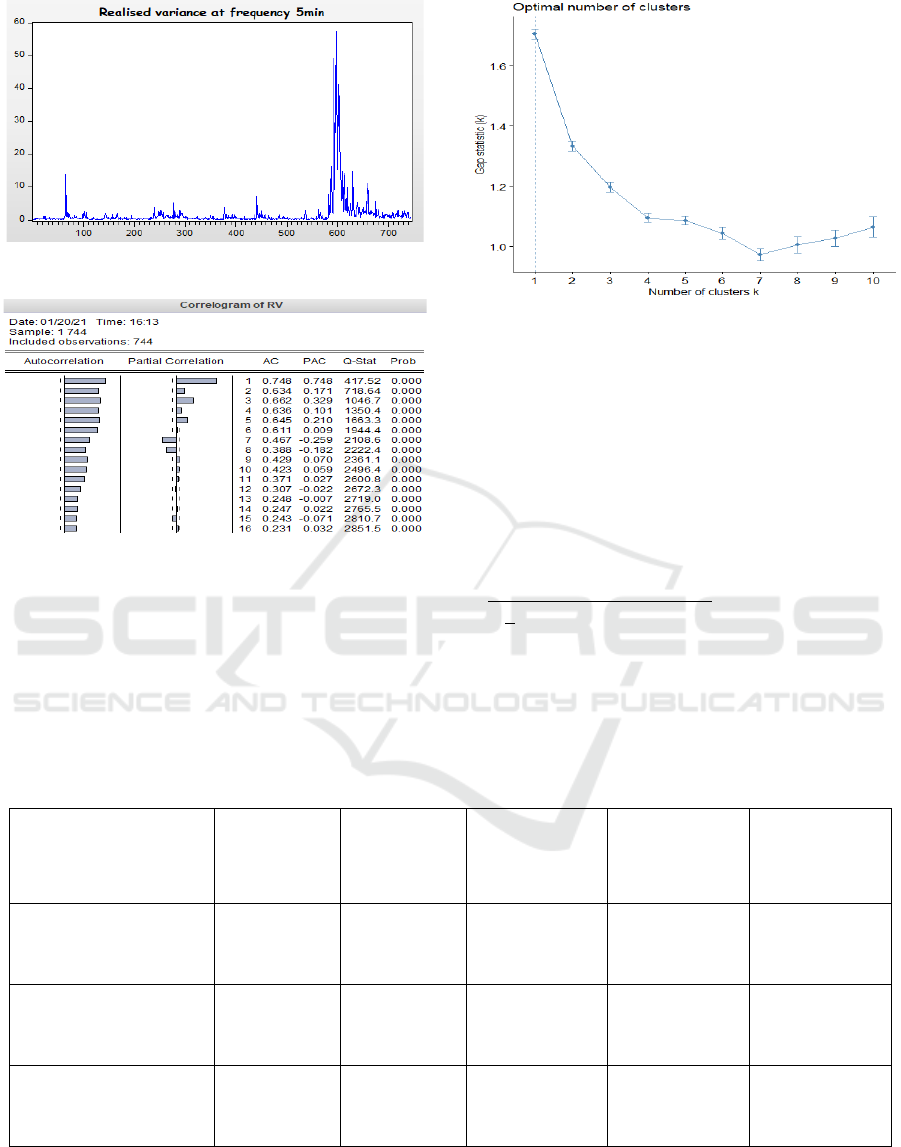

Figures 4 and 6 below, presented the realized

variance 𝑅𝑉 of high-frequency logarithmic returns.

We observe the clustering of volatilities of the

realized variance obtained by the sum of the N intra-

day squared returns.

The correlograms (figures 5, 7) show the presence

of a significant correlation between the 𝑅𝑉

and

𝑅𝑉

.

Figure 4: Realized volatility (RV) at frequency 1 min.

Figure 5: correlogram of RV at frequency 1min.

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

318

Figure 6: Realized volatility (RV) at frequency 5 min

Figure 7: correlogram of RV at frequency 5 min

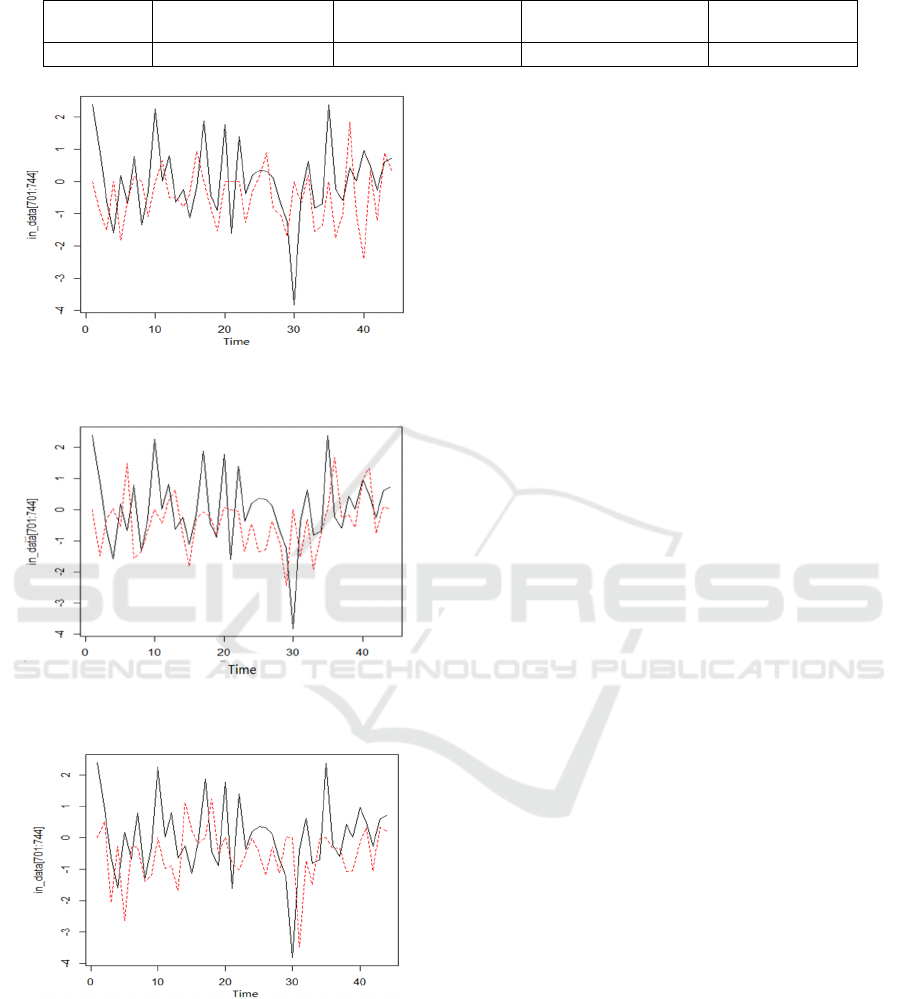

The data sample was subdivided into two sets, the

first set contains 700 observations for the training

model, and the second set contains 44 observations

for the testing model.

Using the K-means algorithm, the number of rules

was specified using the "gap" method for estimating

the optimal number of clusters.

Figure 8: Gap curve

Our system has three inference rules, and the

membership function chosen is the Gaussian

function.

𝑅𝑢𝑙𝑒

: IF 𝑟

is 𝜑

THEN

ℎ

𝛼

𝛼

ℎ

𝛽

𝑅𝑉

, l = 1, 2, 3.

The parameters are significant at a 0.05 significance

level.

In order to evaluate the performance of models in

forecasting returns, a loss function is considered:

Root mean square error (RMSE): 𝑅𝑀𝑆𝐸

∑

𝑟

𝑟

Table1: Parameters estimation of Fuzzy HEAVY-r using GA.

Parameters

𝑐

𝑐

𝑐

𝜎

𝜎

𝜎

𝛼

𝛼

𝛼

𝛼

𝛼

𝛼

𝛽

𝛽

𝛽

Fuzzy HEAVY-r

(RV at frequency

1min)

0.014

0.012

0.007

0.032

0.002

0.013

0.005

0.003

0.04

0.058

0.02

0.024

0.043

0.058

0.025

Fuzzy HEAVY-r

(RV at frequency

5 min)

0.024

0.030

0.046

0.004

0.02

0.05

0.04

0.05

0.008

0.019

0.018

0.057

0.022

0.035

0.051

Fuzzy GARCH(1,1)

0.027

0.001

0.038

0.015

0.023

0.043

0.043

0.015

0.017

0.041

0.047

0.044

0.021

0.016

0.051

Forecasting Stock Returns with Fuzzy HEAVY-r Model using Genetic Algorithm

319

Table2: The results of forecasting returns in out‐of‐sample evaluation.

Loss

function

Fuzzy HEAVY-r

(at frequency 1min)

Fuzzy HEAVY-r

(at frequency 5min)

Fuzzy GARCH(1,1) GARCH(1,1)

RMSE 1.33 1.32 1.44 1.34

Figure 9: Predicted return by the Fuzzy HEAVY-r model

(RV at frequency 1min)

Figure 10: Predicted return by the Fuzzy HEAVY-r model

(RV at frequency 5min)

Figure 11: Predicted return by the FUZZY GARCH model.

6 CONCLUSION

We found that the correlation and the clustering of

volatilities observed empirically better captured by

the Fuzzy HEAVY-r model.

The result shows that the Fuzzy HEAVY-r models

outperform the Fuzzy GARCH model and GARCH

model in out‐of‐sample evaluation according to

RMSE.

REFERENCES

Andersen, T. G., Bollerslev, T., & Labys, F. X. (2001a).

The Distribution of Realized Exchange Rate Volatility.

Journal of the American Statistical Association, 96, 42-

55.

Barndorff-Nielsen, O. E., & Shephard, N. (2002).

Econometric analysis of realized volatility and its use

in estimating stochastic volatility models. Royal

Statistical Society, 64, 253-280. Récupéré sur

https://doi.org/10.1111/1467-9868.00336

Barndorff-Nielsen, O. E., Hansen, P. R., Lunde, A., &

Shephard, N. (2008). Designing Realized Kernels to

Measure the ex post Variation of Equity Prices in the

Presence of Noise. ECONOMETRICA, 76(6), 1481-

1536.

Bollerslev, T. (1986). Generalized autoregressive

conditional heteroskedasticity. Journal of

Econometrics, 31, 307-327.

Engle, R. F. (1982). Autoregressive Conditional

Heteroscedasticity with Estimates of the Variance of

United Kingdom Inflation. Econometrica, 987-1007.

Holland, J. H. (1984). Genetic Algorithms and Adaptation

(Vol. 16). Boston: Springer.

Hung, J.-C. (2009b). A fuzzy GARCH model applied to

stock market scenario using a genetic algorithm. Expert

Systems with Applications, 11710–11717.

SHEPHARD, N., & SHEPPARD, K. (2010). Realising the

future: forecasting with high-frequency-based volatility

(HEAVY) models. JOURNAL OF APPLIED

ECONOMETRICS, 197-231. Récupéré sur

https://doi.org/10.1002/jae.1158

Wang, W. Q., Golnaraghi, M., & Ismail, F. (2004).

Prognosis of machine health condition using neuro-

fuzzy systems. Mechanical Systems and Signal

Processing, 813-831.

Zhou, Khotanzad, E. a., & Alireza. (2007). Fuzzy classifier

design using genetic algorithms. Pattern Recognition,

3401-3414.

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

320