Fraud Detection Techniques in the Big Data Era

Hanae Abbassi

a

, Imane El Alaoui

b

and Youssef Gahi

c

Ecole National des Sciences Appliquées, Ibn Tofail University, Kenitra, Morocco

Keywords: Fraud, Fraud Detection, ML, DL, data-mining, Big-data, big data analytics.

Abstract: In this age of digital technology, the methodology, complexity, and extent of fraud are drastically increasing,

comprising various sectors such as credit card transactions, insurance claims, et cetera, resulting in significant

financial losses. To detect fraudulent activities, organizations and financial institutions have implemented

different models basing on several techniques, including data mining, machine learning (ML), and deep

learning (DL). However, with the advent of big data, the traditional approaches have shown many limits, such

as real-time detection and false-positive alerts. These limits have been solved mainly by advanced big data

solutions. This paper aims to provide a state of the art of fraud detection techniques in a meaningful data

context. Then, we review the traditional methods and identifying their limits by taking advantage of Big Data

analytics patterns.

1 INTRODUCTION

Although technology has improved consumer

comfort in digital transactions as online payment,

transferring money and et cetera, it has also opened

new forms of fraud such as bank account takeover

fraud, internet fraud, and mail fraud. Financial fraud

figures indicate that every year millions of dollars

(Raghavan & Gayar, 2019) of penalties for the

institution and public entities are triggered by credit

card fraud, insurance fraud, and other fraudulent acts

belonging to various fields. It is therefore essential to

detect fraudulent activities as quickly as possible to

mitigate risk and losses. Several approaches allow to

detect and prevent frauds in various areas. In the past,

the most common method of fraud detection was

based on the "rules-based" system. (Allan & Zhan,

2010). However, this technique is severely limited.

Since it is built on known models, it can only detect

known fraudulent patterns. Therefore, rules-based

only partly mitigated the issue.

Later, other techniques have been developed to

enhance fraud detection, such as Outlier Detection

(OD) techniques and Machine Learning. In OD, the

used methods have their way of handling the issue by

suggesting that most instances in the dataset are

a

https://orcid.org/0000-0002-6451-3441

b

https://orcid.org/0000-0003-4428-0000

c

https://orcid.org/0000-0001-8010-9206

regular and checking for outliers. On the other side,

in ML techniques, fraud detection is typically treated

as a supervised classification problem, where

observations are classified as "fraud" or "non-fraud"

based on those observations' characteristics. All these

techniques have shown good performances in

detecting frauds in various domains. However, with

the enormous growth of data, these techniques

became limited because of their inability to build

accurate models. Therefore, there is an excellent

chance of triggering false alarms. Handling massive

data, known as big data, need special requirements

(such as collection, storage, analysis, and

exploitation) due to their following characteristics,

called big data 7Vs: (Ana-Ramona Bologa et al.,

2010) (El Alaoui & Gahi, 2019) (El Alaoui et al.,

2019).

Volume: refers to the vast amount of data

that is generated and processed.

Variety: Refers to the various data

formats, which might be structured,

semi-structured, or unstructured.

Velocity: Refers to the processing speed

of data.

Abbassi, H., El Alaoui, I. and Gahi, Y.

Fraud Detection Techniques in the Big Data Era.

DOI: 10.5220/0010730300003101

In Proceedings of the 2nd International Conference on Big Data, Modelling and Machine Learning (BML 2021), pages 161-170

ISBN: 978-989-758-559-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

161

Veracity: refers to the data's credibility

and the degree to which it can be trusted

to make decisions.

Variability: refers to data that is

continually changing.

Value: refers to the ability to transform

raw data into meaningful information.

Visualization: refers to the ability to

visualize data in readable graphical

charts or records.

Several solutions, called big data analytics, which

occur as an excellent analysis, have been developed.

Big data analytics are considered a cutting-edge way

for fraud detection in a significant data context. They

provide the ability to capture, store, analyze, reliably

visualize voluminous and heterogenic data. They help

develop a predictive model that can trigger an alarm

as soon as an entry point for fraudulent activity is

detected.

For this aim, several researchers focus on using

big data analytics to detect fraud and develop

preventive measures. They have proposed several

detection models in various domains such as

healthcare, finance, and networks. In this

contribution, we discuss these exciting models that

help to protect big data environments against fraud.

The remainder of this article is structured as

follows: Section 2 gives an overview of some fraud

cases. Section 3 reviews studies that have proposed

traditional methods for fraud detection and also

shows their limitations. Section 4 examines the tasks

that have tackled big data analytics within the fraud

detection context. Section 5 discusses the benefits and

the challenges faced by the big data analytics

techniques for fraud detection. Finally, in section 6,

we conclude our review.

2 FRAUD CASES

When information becomes ever more openly shared

and consumers demand almost immediate access to

goods and services, the war against crime is

relentless, posing new challenges. In fact, From the

past until now, Fraudsters continue to evolve their

strategies and techniques. Fraudulent activities are

not limited to a specific field; they relate to all

domains, including insurance, healthcare, and

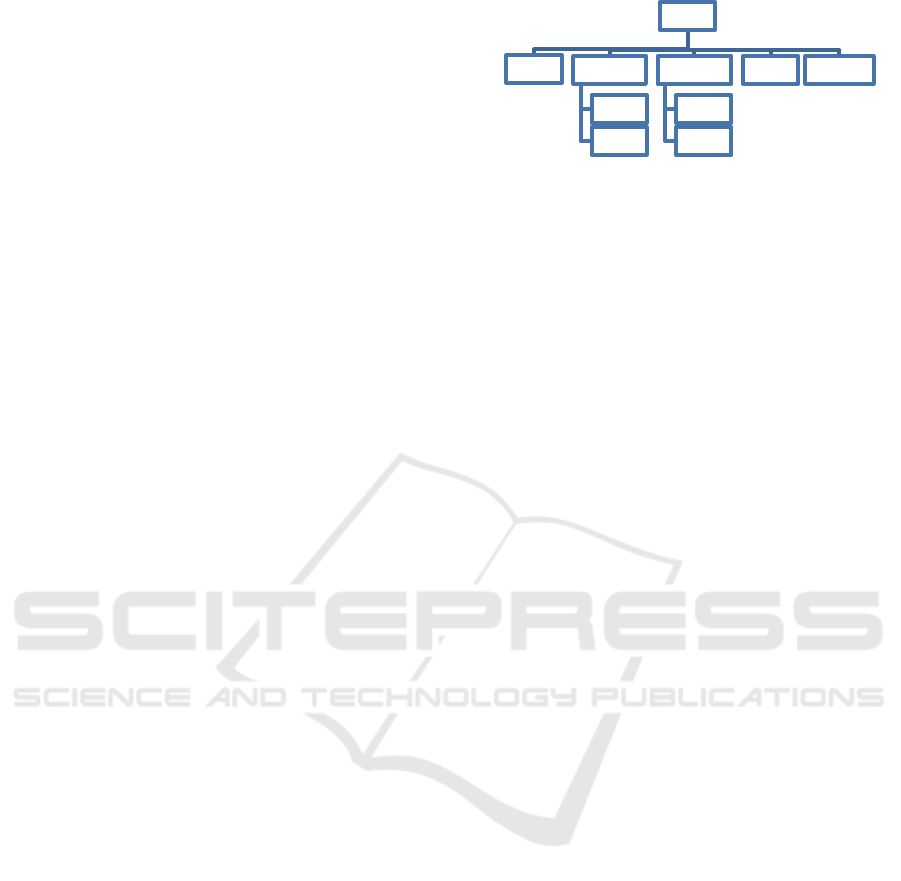

networks, as shown in Figure 1.

Figure 1: Fraud cases.

Insurance Fraud: Insurance fraud is when someone

tries to take advantage of an insurance policy for

financial gain. It refers to the improper use of

insurance policies or applications to profit or obtain

illegal benefits. Insurance fraud includes Healthcare,

Automobile, Home, and life insurance.

Credit Card Fraud: Credit card (CC) fraud occurs

when someone uses a credit card or credit account to

purchase without the person from its holder. This

activity can occur in various ways; offline copy,

which refers to using a physical card stolen, and

online fraud committed through the web or phone.

Telecommunication Fraud: refers to the misuse of

telecommunications services to illegally acquire

money from a communications operator or its

customers. It can be classified into two types: i)

Subscription fraud happens when a fraudster uses

their own or stolen identity to get services with no

intention of paying. In such instances as cellular

cloning, the irregular use is superimposed on the

legitimate customers' regular usage. ii) In

Superimposed fraud, a legal account is taken over by

fraudsters. (Yufeng Kou et al., 2004).

Computer Intrusion: An intrusion is any action that

threatens to violate the credibility, security, or

availability of a resource (file system, user account, et

cetera.). Computer intrusions are divided into two

types:

i) Misuse intrusions, which are attacks against

known weak spots in a system.

Among them, we find denial of service attacks,

malicious use, et cetera. ii) Anomaly intrusions are

described as anomalies from a regular system that are

observed. (Yufeng Kou et al., 2004).

Web Network Fraud: Web fraud is described as

using network resources or applications with Internet

access to defraud or exploit victims. It includes

i) The web advertising network fraud, a go-

between for Internet publishers/advertisers.

ii) Internet auction fraud involving the

misrepresentation or non-delivery of a commodity

available for sale.

These fraudulent activities have a negative impact

not only on financial losses but also on institutions'

reputations. For these reasons, researchers have

Fraud

Insurance

Credit card

offline

fraud

online

fraud

Telecommuni

cation

Subscripti

on

Superimp

osed

Web

Network

Computer

Intrusion

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

162

shown a great interest in fraud detection by proposing

different models basing on machine learning, deep

learning, and data mining. In the next section, we

review attractive fraud, detection models.

3 TRADITIONAL FRAUD

DETECTION METHODS

A variety of fraud detection methods have been

suggested in the literature. We have noticed that ML,

data mining, and DL techniques are the leading used

models by reviewing traditional fraud methods. We

present these models in the following.

Machine Learning: ML is a field of artificial

intelligence (AI) that allows machines to learn and

evolve independently without being programmed

explicitly. We present here two forms of ML

algorithms which are supervised and unsupervised.

- Supervised learning: refers to a group of

structures and algorithms that use sets of

labeled data with known outcomes to create a

predictive model. The model is learned through

a series of trials with the learning algorithm.

Several studies have focused on building

supervised learning algorithms for fraud

detection. In fact, (Adepoju, O. et al., 2019)

have used supervised ML algorithms, namely

Support Vector Machine (SVM), Naive Bayes

(NB), Logistic Regression (LR), and K-Nearest

Neighbor (KNN), to detect fraud in a CC

context. The comparative results show that

logistic regression outperforms other

algorithms in terms of accuracy. Also,

(Dhankhad et al., 2018) have compared eight

supervised algorithms, namely SVM, NB, LR

and KNN, Random Forest (RF), stacking

classifier, decision tree (DT), and Gradient

Boosted Tree (GBT), to evaluate the most

accurate model for a detect fraudulent CC

transaction. The outcomes show that the

stacking classifier gives the best accuracy.

- Unsupervised learning investigates how

systems may deduce a function from unlabeled

data to explain a hidden framework.

Unsupervised algorithms are used when the

training data is not classified or labeled. Large

bodies of literature have tackled unsupervised

learning-based fraud detection models. Such as

(Vaishali, 2014) has used an unsupervised

algorithm named optimized K-Means

clustering to detect fraud in credit card

transactions. K-means showed a good result.

(Subudhi & Panigrahi, 2020), have used an

unsupervised algorithm named optimized

Fuzzy C-Means clustering for automobile

insurance fraud detection. The C-Means

achieved 81.87% accuracy with the balanced

dataset.

Data Mining: is a method for identifying potentially

valuable trends in large data sets. It is

multidisciplinary expertise that integrates ML,

statistics, and AI to extract data. These techniques are

used to detect fraud. Data mining is a significant

advantage of building a new category of models to

spot further attacks before they are seen (Yufeng Kou

et al., 2004). We present here some standard methods

used in fraud detection:

- Imbalanced Classification: As a pre-processing

stage, data balancing techniques rebalance

skewed data sets or eliminate noise. Several

studies employ data-level balancing

techniques. In (Benchaji, I. et al., 2018), a new

approach for generating data for the minority

class of an unbalanced data collection is

proposed as an oversampling technique to

boost fraud detection in e-banking. Also,

(Dornadula & Geetha, 2019) have used

SMOTE (Synthetic Minority Over-Sampling

Technique) to balance the credit card dataset.

The outcomes show that the classifiers (SVM,

LR) perform better using SMOTE method.

- Model Combination: This approach consists of

building a new model by combining multiple

algorithms to increase efficiency and accuracy

rates. Researchers have combined several

models. (Raghavendra Patidar & Lokesh

Sharma, 2011) have suggested the combination

of neural networks and genetic algorithms to

identify fraudulent CC transactions

successfully. Also, (Song 2020) has proposed a

hybrid algorithm based on both lightguns and

boost to detect fraud in electronic banks. The

proposed model gave an excellent Auc-Roc

score and precision. In the same vein, (Tiwari

et al., 2021) have proposed a hybrid algorithm

based on DT, NN, and K-Nearest Neighbor

algorithm to detect fraudulent CC transactions.

The proposed model gives a good result.

- Outlier detection: It includes statistical, and

data mining approaches. It uses behavioral

profiling techniques to model each individual's

behavior and track any deviations from the

standard. These are essentially unsupervised

learning techniques. (Richard J. Bolton &

David Hand, 2001) have used Peer group

analysis and Breakpoint analysis methods for

behavioral fraud detection, analyzing

longitudinal data.

Deep Learning is a class of ML that uses many

hidden layers. It generally achieves better results than

other ML algorithms. Several researchers have

Fraud Detection Techniques in the Big Data Era

163

adopted DL to deal with fraudulent acts. As an

example, (Raghavan & Gayar, 2019) have compared

different DL algorithms like Convolutional Neural

Networks (CNN), autoencoders, restricted

Boltzmann machine (RBM), and deep belief

networks (DBN) with ML algorithms. The result

reveals that CNN outperforms other DL algorithms.

Also, (H. Gomi et al., 2016) have suggested a model

based on trends in network access logs, using the

Recurrent Neural Networks (RNN) model to detect

fraudulent behaviors. The outcomes demonstrate that

RNN outperforms ML methods SVMs when it comes

to learning the habits of a non-genuine person. For

network anomaly detection systems, (Z. Chen et al.,

2018) have proposed a model based on Autoencoder

(AE) and Convolutional Autoencoder (CAE). The

result shows that CAE outperforms the AE.

All the mentioned above studies have shown

promising results for small datasets. In the table

below, we provide a comparison between these kinds

of literature

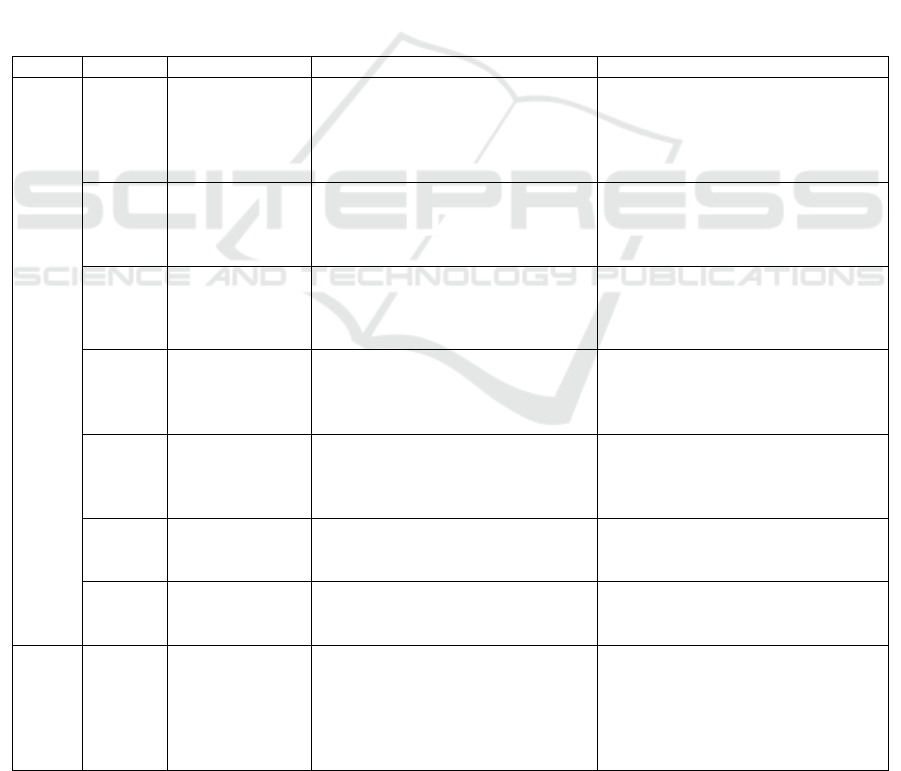

Table 1: comparative literature.

Detection

Method

Paper Technique Performance

Supervised

learning

(Adepoju, O. et al., 2019) logistic regression, k- nearest

nei

g

hbo

r

,an

d

SVM

LR archived the best accuracy

99.07%,

(Dhankhad et al., 2018) SVM, Naive Bayes, LR and K-

Nearest Neighbour, RF,

stacking classifier, decision tree,

and Gradient Boosted Tree

High accuracy: stacking classifier

95.27%

High rank: Support Vector

Machine 53.6%

unsupervised (Vaishali, 2014)

K

-Means Good results

(Subudhi & Panigrahi,

2020)

C-Means 81.87% accuracy

Classification

Emblanced

(Benchaji, I. et al., 2018) Oversampling Performs well

(Dornadula & Geetha,

2019)

SMOTE Give good results

Model

Combination

(Raghavendra Patidar &

Lokesh Sharma, 2011

)

neural networks with genetic

al

g

orithms

Good results

(

Son

g

, 2020

)

li

g

ht

g

un and boost 98.5% accurac

y

(Tiwari et al., 2021) Trees, Neural Network, and K-

Nearest Nei

g

hbo

r

good results

Outlier

Detection

(Richard J. Bolton &

David Hand, 2001)

Peer group analysis Breakpoint

analysis

Peer group analysis outperforms

Breakpoint

Deep

Learning

(Raghavan & Gayar,

2019)

AE, CNN, RBM, DBN CNN outperforms other models

(H. Gomi et al., 2016) RNN, ML models RNN outperforms ML algorithms

(Z. Chen et al., 2018) AE, CAE CAE outperfo

r

ms AE

Although these methods look promising and give

good results, they are unsuccessful in a complex

environment, massive data. It is difficult to apply

traditional fraud detection algorithms on vast

amounts of data within a reasonable time.

Furthermore, the performance of these conventional

models could drastically decrease by giving false

alarms (Sathyapriya & Thiagarasu, 2015). It is also

important to mention that the cost of upgrading and

maintaining these methods is high (Allan & Zhan,

2010). Researchers have proposed new models to

detect fraud in a significant data context to deal with

these limits. We review these models in the following

section.

4 BIG DATA ANALYTICS FOR

FRAUD DETECTION

Big Data analytics is the de facto method for solving

various modeling and decision-making issues

(Faroukhi et al., 2021). This is due to their capability

to process many data and generate information in

real-time, which ultimately reduces costs by ensuring

high precision (Melo-Acosta et al., 2017) (Faroukhi

et al., 2020). In this section, we review fraud detection

studies using Big Data analytics in different fields.

Credit Card: Credit card companies have started to

use big data technologies to identify fraudulent

transactions in real-time, using a range of big data

analytic tools such as Apache Hadoop, MapReduce,

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

164

Apache Spark, and APACHE FLINK. In

(Sathyapriya & Thiagarasu, 2015), researchers have

compared these tools in credit card fraud detection

context, basing on factors such as efficiency,

scalability, fault tolerance, processing speed, and

latency. They have found that Apache Spark

outperforms other techniques. Combining big data

with ML techniques can also give better results. In

fact, (Melo-Acosta et al., 2017) have proposed a fraud

detection system (FDS) for CC transactions based on

the Spark RF model and Balanced Random Forest

(BRF). The technology was developed to overcome

the three difficulties related to fraud detection data

sets: a heavy class imbalance, the incorporation of

unlabeled and labeled samples, and handling many

transactions. The result reveals that the proposed

model successfully solved all the problems. As well,

(Armel & Zaidouni, 2019) have used Apache Spark's

(MLlib) to detect credit card fraud in banking

transaction data, using four supervised algorithms as

Simple Anomaly detection, DT, RF, and Naïve

Bayes. The random Forest algorithm performed best

in terms of accuracy and running time, while a simple

anomaly algorithm performed worst. In the same

context, (Hormozi et al., 2013) have run the Artificial

Immune System's algorithm to credit card FDS on

Hadoop and MapReduce to cope with the AIS long

training time. For this, they have parallelized the

negative selection algorithm on the cloud with

Apache Hadoop and MapReduce. The results reveal

that the algorithm's training time is greatly reduced

compared to the basic algorithm. Other studies have

used hybrid methods to improve the performance of

FDS. (Kamaruddin & Ravi, 2016) have used a model

(POSAANN) over a credit card fraud dataset to

obtain the one-class classification (OCC) solution

within a SAPRK cluster, including the particle swarm

optimization (PSO) and the auto-associative neural

network (AANN). They have also parallelized

AANN in a hybrid architecture. The proposed model

achieves good performance.

Healthcare: Big data from outlets such as Medicare

is being used to protect fraud and patient treatment.

Healthcare fraud significantly impacts insurance

schemes' ability to deliver reliable and affordable

care, such as Medicare (R. Bauder & Khoshgoftaar,

2018). (Georgakopoulos et al., 2020) have presented

the HNOPH (Hellenic National Organization for the

Provision of HeHealthService's methodological

approach to identify medical fraud in claims using the

Local Correlation Integral algorithm. This study aims

to detect any outliers (fraudulent cases) on the dataset.

(Herland, M. et al., 2018) have examined four

Medicare datasets: Part B, Part D, DMEPOS, and

Combined, to assess the fraud detection capabilities

of Medicare datasets individually and in combination.

Each dataset was trained and evaluated using three

different learners: RF, Boosted Gradient Trees, and

LR. The examination is run and validated using Spark

on top of a Hadoop YARN cluster. The combined

dataset had the best overall fraud detection results

using LR. Using the same dataset, (R. A. Bauder et

al., 2018), have provided experimental results using

six data sampling methods (RUS, ROS, SMOTE,

ADASYN, SMOTEb1, SMOTEb2). They have also

used three machine learning models (RF, LR, and

GBT) with Apache Spark to compare the

performance of Medicare fraud detection through

data sampling methods. The outcomes show that RUS

performs well across all learners.

Financial Statements: Big Data analytics are

commonly used in the financial sector. They can help

banks to understand their customers' actions better

and to detect fraud efficiently. (Y.-J. Chen & Wu,

2017) have proposed a method for fraud detection in

financial statements based on big data. They have

used QGA-SVM as a clustering model to enter

established datasets to improve fraud detection

accuracy. The proposed method allows minimizing

losses and investment risks. It is essential to mention

that combining big data tools with DL and ML gives

good results in detecting fraud. In fact, (Purushe, P.,

& Woo, J, 2020) have used Amazon AWS with Spark

ML and DL to detect fraudulent transactions on a

financial transaction dataset. They have compared

three ML algorithms: LR, DT, and random forest with

feed-forward (FF) as a DL model. The results reveal

that random forest had the best accuracy, 95.9%, and

FF had the best recall, with minor false negatives.

(Zhou et al., 2021) have suggested an intelligent and

distributed Big Data solution to detect Internet

financial fraud. They have implemented the graph

embedding algorithm Node2Vec on Spark GraphX

and Hadoop to learn and represent each vertex's

topological characteristics into a dense low-

dimensional vector. The proposed method aims to

predict the fraudulent samples of the dataset. The

experimental outcomes show that the proposed

method increases the efficiency of Internet financial

fraud detections by improving accuracy and recall.

Network Intrusion: Big Data Analytics can

anticipate and track intrusions and threats in real-

time. Big Data technologies such as the Hadoop

ecosystem and flow computing can store and interpret

massive datasets quickly. They also transform

network security detection by extracting large-scale

data for various internal and external sources, such as

vulnerability databases. (Terzi et al., 2017) have

Fraud Detection Techniques in the Big Data Era

165

presented an unsupervised anomaly detection

approach based on Apache Spark cluster in Azure

HDInsight platform. The proposed approach system

accuracy of 96%. Also (Kato & Klyuev, 2017) have

presented an anomaly-based intrusion detection

method using Apache Hadoop and Spark. They have

used a real IDS dataset provided by the UNBISCE

(University of New Brunswick's Information Security

Centre of Excellence) in the framework. They dealt

directly with the packet capture files (pcap) and

evaluated 90.9 GB of data on Hadoop clusters. They

also used principal component analysis (PCA) to

reduce feature dimension and the Gaussian mixture

model (GMM) to divide network behaviors into

regular and attack classes. The results showed that the

method could create intelligent IDS, with a detection

accuracy of 86.2 % and a false positive rate of 13%.

Other studies have adopted DL for intrusion

detection. In fact, (Haggag et al., 2020) have

presented an intrusion detection system (IDS), named

Deep Learning Spark Intrusion Detection System

(DLS-IDS), to address the issue of dataset class

imbalance and to improve accuracy and speed. IDS is

implemented on Apache Spark using three DL

algorithms: Multilayer Perceptron (MLP), Recurrent

Neural Network (RNN), and Long-Short Term

Memory (LSTM).

Furthermore, they have compared these models to

ML algorithms. The results have shown that the

proposed model performs well in terms of accuracy

and time. The combination of LSTM and SMOTE

increases the detection accuracy by 83.57%.

All the presented above studies are exciting and

deal with fraud detection in a significant data context.

They provide reliable and promising predictive

models to prevent fraud. In the following table, we

provide a comparison between all these models.

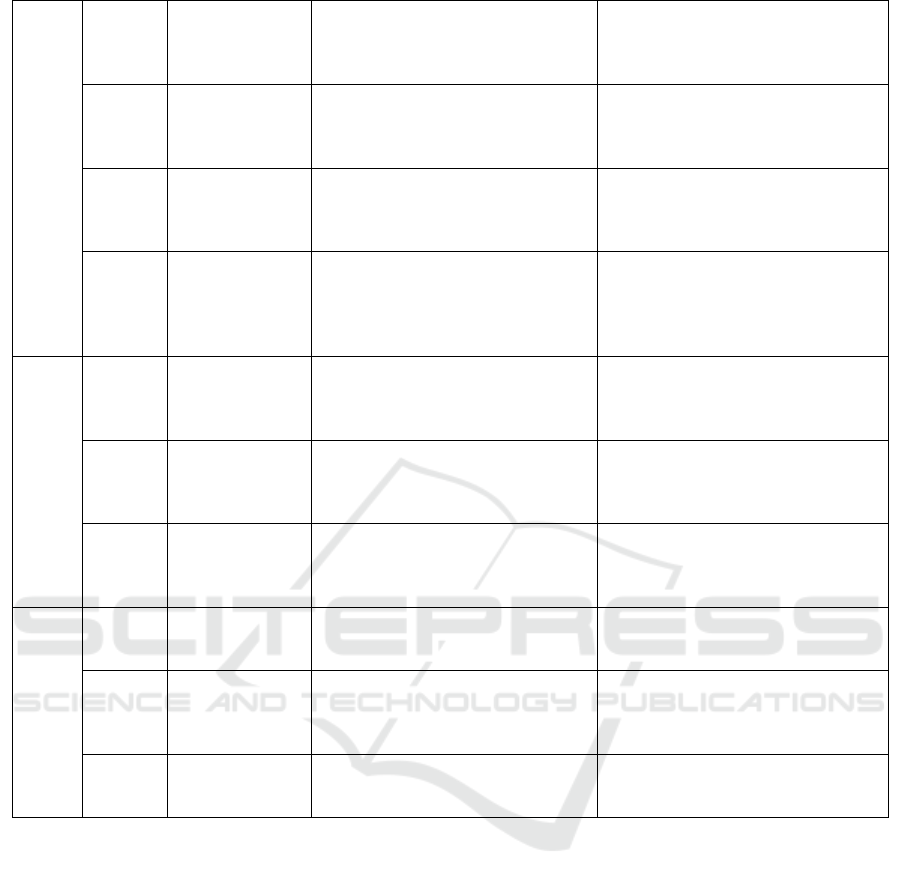

Table 2: Compared Fraud researches.

Area Paper Used data Techniques & technologies Performance

Credit Card

(Sathya

priya &

Thiagar

asu,

2015)

Credit card

transactions

Apache Hadoop, MapReduce,

Apache Spark,

Apache Spark performs better (speed,

low latency, high fault tolerance, fast

performance, and high scalability).

(Melo-

Acosta

et al.,

2017)

Colombian

payment

gateway

compan

y

Spark and Hadoop, Balanced

Random Forest

BRF based on the Spark RF attains an

improvement of around 24% in terms

of geometric compared to a standard

RF.

(Armel

&

Zaidoun

i, 2019

)

Large Brazilian

bank dataset

Apache Hadoop, MapReduce

Artificial Immune System, the

adverse selection algorithm

The training time was significantly

reduced.

(Hormo

zi et al.,

2013)

Banking

transaction data:

Price and

Distance

MLlib of Apache Spark

Simple Anomaly detection

algorithm, Decision Tree, Random

Forest, and Naïve Ba

y

es

Accuracy: Random Forest: 98,18%,

Decision tree: 96,96%, Naïve Bayes:

91,24% and simple anomaly

algorithm: 77,04%

(Kamar

uddin &

Ravi,

2016)

Credit card fraud

dataset

SAPRK, hybrid model PSOAANN

((PSO) and (AANN))

The model achieves an average of

89% accurate classification of the CC

fraud transactions.

(Dai, Y.

et al.,

2016

)

Synthetic data hybrid framework:

Hadoop, Spark, Storm, Hbase

Achieves a scalable, fault-tolerant,

and high-performance system.

(Patil et

al.,

2018

)

Credit card fraud

dataset

LR, DT, Random Forest Decision

Tree

Accuracy of: LR: 70%, DT: 72% and

RFDT: 76%.

Healthcare

(R.

Bauder

&

Khoshg

oftaar,

2018

)

Physician and

Other Supplier

Data calendar

2012 to 2015

Random Forest, random

undersampling (RUS)

The best class distribution is 90:10

with an AUC of 87.302%

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

166

(Georga

kopoulo

s et al.,

2020

)

Prescription data Local Correlation Integral algorithm

(LOCI), Angle-based outlier

detection (ABOD) algorithm

The model detects 7 out of 879 items

as fraudulent

(Herlan

d, M. et

al.,

2018)

CMS datasets t

(Part B, Part D,

and DMEPOS)

Spark on top of a Hadoop YARN

cluster, Random Forest, Gradient

Boosted Trees, and Logistic

Regression

The Combined dataset had the best

overall fraud detection performance

with an AUC of 0.816 using LR

(R. A.

Bauder

et al.,

2018

)

Medicare

datasets, from

2013 to 2015 by

(

CMS

)

Data sampling (RUS, ROS, SMOTE,

ADASYN, SMOTEb1, SMOTEb2)

Apache Spark, Mllib LR, GBT, RF

Full dataset (with no sampling)

performed well for all (GBT, LR, RF)

respectively, with an accuracy of

0.79047, 0.81554, 0.79383

(Ana-

Ramona

Bologa

et al.,

2010)

The National

House for Health

Insurance

Business rules, anomaly detection,

text mining, database searches,

social network analysis, and

Predictive modeling

Applying BDA techniques can lead

to rapid detection of abnormal claims

Financial statements

(Y.-J.

Chen &

Wu,

2017

)

financial

statements of

business groups i

Decision tree, logistic, neural

network, KNN, GA-SVM, POS-

SVM, and QGA-SVM.

QGA-SVM has the higher (90.5%)

(Purush

e, P., &

Woo, J,

2020

)

financial

transaction

dataset

Amazon AWS, Spark ML, and DL.

ML algorithms: logistic regression,

decision tree, and random forest, DL:

FF

Random forest had the best accuracy

of 95.9%, and FF had the best recall,

with minor false negatives.

(Zhou et

al.,

2021)

Internet

financial service

provider in

China

Spark GraphX, Hadoop, Node2Vec,

DeepWalk, SVM, SMOTE

The proposed solution will increase

the reliability of Internet financial

fraud detections.

Network Intrusion

(Terzi et

al.,

2017

)

Public NetFlow

data

unsupervised anomaly detection

approach on Apache Spark cluster in

Azure HDInsi

g

ht

96% accuracy rate was obtained

(Kato &

Klyuev,

2017)

Network packet

dataset

Apache Hadoop and Spark, Hive

SQL, GMM, OCSVM, K-Means,

LR, SVM, RF, GB tree, and Naive

Bayes

The system achieves a detection

accuracy of 86.2% and 13% of false-

positive rate

(Haggag

et al.,

2020

)

NSL-KDD Apache Spark, Multilayer

Perceptron, RNN, and LSTM

The combination of LSTM and

SMOTE increases detection accuracy

to 83.57%.

5 DISCUSSION

The emergence of Big Data has created a new area of

research known as data-driven fraud detection. We

have tackled studies that focus on using Big Data

analytics (BDA) to examine various forms of criminal

activities in multiple fields, such as healthcare,

network intrusion, and credit card fraud. Basing on

these studies, we discuss some significant data

advantages and challenges in the context of fraud

detection.

Big data technologies provide several advantages

in detecting and preventing fraudulent activities. We

present here some of the most important benefits:

- Extensive data processing: Big data tools, as

Apache-Hadoop, enable the collection,

process, and analyze a variety of data from

various sources such as finance, messages, and

social media similarly. It also allows storing

several data types (structured, semi-structured,

and unstructured data) (Jha et al., 2020).

- Accurate time detection: big data analytics

allow to detection of malicious activities in

real-time by using several techniques and

technologies. Among these methods, the Deep

analytics (DA) approaches present

advancement from discrete analysis of

structured data to connected analysis of

unstructured data in real-time. The DA systems

can spot trends and warn of potentially

suspicious activity in real-time by observing

each customer's behavioral trends.

Fraud Detection Techniques in the Big Data Era

167

Furthermore, real-time processing allows

gathering data from a variety of sources and

quickly create contextual baselines. This

allows reducing the number of false alarms

(Bharath Krishnappa, 2015) (Singla & Jangir,

2020)

- Fraud Prediction: BDA algorithms are one of

the most effective solutions to predict security

concerns. These predictive algorithms help to

enhance the reliability of predictions and

analysis models. They are generally based on

ML methods and allow to expect and avoid

malicious activity by evaluating conventional

security incidents, results, and user data.

(Fatima-Zahra Benjelloun & Ayoub Ait

Lahcen, 2015) (Singla & Jangir, 2020).

- Reduce sampling: reducing samples is a

significant advantage of big data technology.

Data analytics sampling methods can examine

a subset of all data to discover meaningful

information in a broader data set and giving the

best results.

Although big data technology had solved

conventional techniques limits, it faces some

challenges:

- Skewed distribution (Imbalance class): the

classification algorithms used within a Big

Data framework are more vulnerable to this

issue. Big Data tools as Hadoop generally split

data into chunks. Hence, the tiny amount of

data in the samples shrinks dramatically. It is

important to note that using extremely skewed

big data does not yield effective fraud detection

results (Georgakopoulos et al., 2020; Makki et

al., 2017).

- Performance: In big data, it is challenging to

carry out input validation or data filters in the

incoming data due to the massive number of

terabytes of continuous data flow. Therefore

this issue has a significant impact on

performance. (Bhandari et al., 2016)

- Data privacy: Analysts may correlate several

separate data sets from different organizations

to expose confidential or critical data even with

anonymization methods. Such correlation

could allow the identification of persons or the

discovery of sensitive information (Yadav et

al., 2019)(Bhandari et al., 2016)(Jensen, 2013)

(Gahi et al., 2016).

6 CONCLUSION

Cases of fraud have caused substantial damage and

losses to financial statements, the government, and

individuals. For this reason, several researchers have

proposed several fraud detections and prevention

models based on various techniques. In this paper, we

have presented a state of the art of fraud detection

metamethods. We have introduced traditional fraud

detection methods such as data mining, ML, and DL,

identifying their limitations. Then, we have given big

data analytics techniques that allow us to cope with

these limitations. We have also presented the

advantages and challenges of big data technologies.

In future works, we aim to address these

challenges such as imbalance class and data privacy.

REFERENCES

Adepoju, O., Wosowei, J, lawte, S, & Jaiman, H. (2019).

Comparative Evaluation of Credit Card Fraud

Detection Using Machine Learning Techniques. 2019

Global Conference for Advancement in Technology

(GCAT).

Allan, T., & Zhan, J. (2010). Towards Fraud Detection

Methodologies. 2010 5th International Conference on

Future Information Technology, 1–6.

https://doi.org/10.1109/FUTURETECH.2010.5482631

Ana-Ramona Bologa, Razvan Bologa, & Alexandra Maria

Ioana Florea. (2010). Big Data and Specific Analysis

Methods for Insurance Fraud Detection. Database

Systems Journal Vol. I, No. 1/2010.

https://www.researchgate.net/publication/292980386_

Big_Data_and_Specific_Analysis_Methods_for_Insur

ance_Fraud_Detection

Armel, A., & Zaidouni, D. (2019). Fraud Detection Using

Apache Spark. 2019 5th International Conference on

Optimization and Applications (ICOA), 1–6.

https://doi.org/10.1109/ICOA.2019.8727610

Bauder, R. A., Khoshgoftaar, T. M., & Hasanin, T. (2018).

Data Sampling Approaches with Severely Imbalanced

Big Data for Medicare Fraud Detection. 2018 IEEE

30th International Conference on Tools with Artificial

Intelligence (ICTAI), 137–142.

https://doi.org/10.1109/ICTAI.2018.00030

Bauder, R., & Khoshgoftaar, T. (2018). Medicare Fraud

Detection Using Random Forest with Class Imbalanced

Big Data. 2018 IEEE International Conference on

Information Reuse and Integration (IRI), 80–87.

https://doi.org/10.1109/IRI.2018.00019

Benchaji, I., Douzi, S, & ElOuahidi, B. (2018). Using

Genetic Algorithm to Improve Classification of

Imbalanced Datasets for Credit Card Fraud Detection.

Using Genetic Algorithm to Improve Classification of

Imbalanced Datasets for Credit Card Fraud Detection.

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

168

2018 2nd Cyber Security in Networking Conference

(CSNet).

Bhandari, R., Hans, V., & Ahuja, N. J. (2016). Big Data

Security – Challenges and Recommendations.

International Journal of Computer Sciences and

Engineering, 4, 7.

Bharath Krishnappa. (2015). BIG DATA ANALYTICS

FOR CYBERSECURITY. EMC, India Center of

Excellence.

https://education.dellemc.com/content/dam/dell-

emc/documents/en-us/2015KS_Krishnappa-

Big_Data_Analytics_for_Cyber_Security.pdf

Chen, Y.-J., & Wu, C.-H. (2017). On Big Data-Based Fraud

Detection Method for Financial Statements of Business

Groups. 2017 6th IIAI International Congress on

Advanced Applied Informatics (IIAI-AAI), 986–987.

https://doi.org/10.1109/IIAI-AAI.2017.13

Chen, Z., Yeo, C. K., Lee, B. S., & Lau, C. T. (2018).

Autoencoder-based network anomaly detection. 2018

Wireless Telecommunications Symposium (WTS), 1–

5. https://doi.org/10.1109/WTS.2018.8363930

Dai, Y., Yan, J., Tang, X., Zhao, H., & Guo, M. (2016).

Online Credit Card Fraud Detection: A Hybrid

Framework with Big Data Technologies. IEEE

Trustcom/BigDataSE/ISPA.

Dhankhad, S., Mohammed, E., & Far, B. (2018).

Supervised Machine Learning Algorithms for Credit

Card Fraudulent Transaction Detection: A Comparative

Study. 2018 IEEE International Conference on

Information Reuse and Integration (IRI), 122–125.

https://doi.org/10.1109/IRI.2018.00025

Dornadula, V. N., & Geetha, S. (2019). Credit Card Fraud

Detection using Machine Learning Algorithms.

Procedia Computer Science, 165, 631–641.

https://doi.org/10.1016/j.procs.2020.01.057

El Alaoui, I., & Gahi, Y. (2019). The Impact of Big Data

Quality on Sentiment Analysis Approaches. Procedia

Computer Science, 160, 803–810.

https://doi.org/10.1016/j.procs.2019.11.007

El Alaoui, I., Gahi, Y., & Messoussi, R. (2019). Big Data

Quality Metrics for Sentiment Analysis Approaches.

Proceedings of the 2019 International Conference on

Big Data Engineering, 36–43.

https://doi.org/10.1145/3341620.3341629

Faroukhi, A. Z., El Alaoui, I., Gahi, Y., & Amine, A.

(2020). Big data monetization throughout Big Data

Value Chain: A comprehensive review. Journal of Big

Data, 7(1), 3. https://doi.org/10.1186/s40537-019-

0281-5

Faroukhi, A. Z., El Alaoui, I., Gahi, Y., & Amine, A.

(2021). A Novel Approach for Big Data Monetization

as a Service. In F. Saeed, T. Al-Hadhrami, F.

Mohammed, & E. Mohammed (Eds.), Advances on

Smart and Soft Computing (pp. 153–165). Springer.

https://doi.org/10.1007/978-981-15-6048-4_14

Fatima-Zahra Benjelloun & Ayoub Ait Lahcen. (2015). Big

Data Security: Challenges, Recommendations, and

Solutions. Handbook of Research on Security

Considerations in Cloud Computing.

https://www.researchgate.net/publication/278962714_

Big_Data_Security_Challenges_Recommendations_an

d_Solutions

Gahi, Y., Guennoun, M., & Mouftah, H. T. (2016). Big

Data Analytics: Security and privacy challenges. 2016

IEEE Symposium on Computers and Communication

(ISCC), 952–957.

https://doi.org/10.1109/ISCC.2016.7543859

Georgakopoulos, S. V., Gallos, P., & Plagianakos, V. P.

(2020). Using Big Data Analytics to Detect Fraud in

Healthcare Provision. 2020 IEEE 5th Middle East and

Africa Conference on Biomedical Engineering

(MECBME), 1–3.

https://doi.org/10.1109/MECBME47393.2020.926511

8

H. Gomi, H. Tanaka, & Y. Ando,. (2016). Detecting

Fraudulent Behavior Using Recurrent Neural

Networks. Computer Security Symposium, 11-13

October 2016 Pdfs.Semanticscholar.Org, 2016.

Haggag, M., Tantawy, M. M., & El-Soudani, M. M. S.

(2020). Implementing a Deep Learning Model for

Intrusion Detection on Apache Spark Platform. IEEE

Access, 8, 163660–163672.

https://doi.org/10.1109/ACCESS.2020.3019931

Herland, M., Khoshgoftaar, T. M, & Bauder, R. A. (2018).

Big Data fraud detection using multiple medicare data

sources. Journal of Big Data, 5(1).

Hormozi, H., Akbari, M. K., Hormozi, E., & Javan, M. S.

(2013). Credit cards fraud detection by negative

selection algorithm on hadoop (To reduce the training

time). The 5th Conference on Information and

Knowledge Technology, 40–43.

https://doi.org/10.1109/IKT.2013.6620035

Jensen, M. (2013). Challenges of Privacy Protection in Big

Data Analytics. 2013 IEEE International Congress on

Big Data, 235–238.

https://doi.org/10.1109/BigData.Congress.2013.39

Jha, B. K., Sivasankari, G. G., & Venugopal, K. R. (2020).

Fraud Detection and Prevention by using Big Data

Analytics. 2020 Fourth International Conference on

Computing Methodologies and Communication

(ICCMC), 267–274.

https://doi.org/10.1109/ICCMC48092.2020.ICCMC-

00050

Kamaruddin, Sk., & Ravi, V. (2016). Credit Card Fraud

Detection using Big Data Analytics: Use of PSOAANN

based One-Class Classification. Proceedings of the

International Conference on Informatics and Analytics,

1–8. https://doi.org/10.1145/2980258.2980319

Kato, K., & Klyuev, V. (2017). Development of a network

intrusion detection system using Apache Hadoop and

Spark. 2017 IEEE Conference on Dependable and

Secure Computing, 416–423.

https://doi.org/10.1109/DESEC.2017.8073860

Makki, S., Haque, R., Taher, Y., Assaghir, Z., Ditzler, G.,

Hacid, M.-S., & Zeineddine, H. (2017). Fraud Analysis

Approaches in the Age of Big Data—A Review of State

of the Art. 2017 IEEE 2nd International Workshops on

Foundations and Applications of Self* Systems

(FAS*W), 243–250. https://doi.org/10.1109/FAS-

W.2017.154

Fraud Detection Techniques in the Big Data Era

169

Melo-Acosta, G. E., Duitama-Munoz, F., & Arias-

Londono, J. D. (2017). Fraud detection in big data using

supervised and semi-supervised learning techniques.

2017 IEEE Colombian Conference on Communications

and Computing (COLCOM), 1–6.

https://doi.org/10.1109/ColComCon.2017.8088206

Patil, S., Nemade, V., & Soni, P. K. (2018). Predictive

Modelling For Credit Card Fraud Detection Using Data

Analytics. Procedia Computer Science, 132, 385–395.

https://doi.org/10.1016/j.procs.2018.05.199

Purushe, P., & Woo, J. (2020). Financial Fraud Detection

adopting Distributed Deep Learning in Big Data. KSII

The 15th Asia Pacific International Conference on

Information Science and Technology(APIC-IST) 2020.

Raghavan, P., & Gayar, N. E. (2019). Fraud Detection using

Machine Learning and Deep Learning. 2019

International Conference on Computational

Intelligence and Knowledge Economy (ICCIKE), 334–

339.

https://doi.org/10.1109/ICCIKE47802.2019.9004231

Raghavendra Patidar & Lokesh Sharma. (2011). Credit

Card Fraud Detection Using Neural Network.

International Journal of Soft Computing and

Engineering (IJSCE) ISSN: 2231-2307, Volume-1,

Issue-NCAI2011, June 2011.

Richard J. Bolton, & David Hand. (2001). Unsupervised

Profiling Methods for Fraud Detection. Credit Scoring

and Credit Control, VII.

https://www.researchgate.net/publication/2407747_Un

supervised_Profiling_Methods_for_Fraud_Detection

Sathyapriya, M., & Thiagarasu, D. V. (2015). Big Data

Analytics Techniques for Credit Card Fraud Detection:

A Review. International Journal of Science and

Research (IJSR) ISSN (Online): 2319-7064 Index

Copernicus Value (2015): 78.96 | Impact Factor (2015):

6.391, 6(5), 6.

Singla, A., & Jangir, H. (2020). A Comparative Approach

to Predictive Analytics with Machine Learning for

Fraud Detection of Realtime Financial Data. 2020

International Conference on Emerging Trends in

Communication, Control and Computing (ICONC3),

1–4.

https://doi.org/10.1109/ICONC345789.2020.9117435

Song, Z. (2020). A Data Mining Based Fraud Detection

Hybrid Algorithm in E-bank. 2020 International

Conference on Big Data, Artificial Intelligence and

Internet of Things Engineering (ICBAIE), 44–47.

https://doi.org/10.1109/ICBAIE49996.2020.00016

Subudhi, S., & Panigrahi, S. (2020). Use of optimized

Fuzzy C-Means clustering and supervised classifiers

for automobile insurance fraud detection. Journal of

King Saud University - Computer and Information

Sciences, 32(5), 568–575.

https://doi.org/10.1016/j.jksuci.2017.09.010

Terzi, D. S., Terzi, R., & Sagiroglu, S. (2017). Big data

analytics for network anomaly detection from netflow

data. 2017 International Conference on Computer

Science and Engineering (UBMK), 592–597.

https://doi.org/10.1109/UBMK.2017.8093473

Tiwari, P., Mehta, S., Sakhuja, N., Gupta, I., & Singh, A.

K. (2021). Hybrid Method in Identifying the Fraud

Detection in the Credit Card. In V. Suma, N. Bouhmala,

& H. Wang (Eds.), Evolutionary Computing and

Mobile Sustainable Networks (Vol. 53, pp. 27–35).

Springer Singapore. https://doi.org/10.1007/978-981-

15-5258-8_3

Vaishali, V. (2014). Fraud Detection in Credit Card by

Clustering Approach. International Journal of

Computer Applications, 98(3), 29–32.

https://doi.org/10.5120/17164-7225

Yadav, D., Maheshwari, Dr. H., & Chandra, Dr. U. (2019).

Big Data Hadoop: Security and Privacy. SSRN

Electronic Journal.

https://doi.org/10.2139/ssrn.3350308

Yufeng Kou, Chang-Tien Lu, Sirwongwattana, S., & Yo-

Ping Huang. (2004). Survey of fraud detection

techniques. IEEE International Conference on

Networking, Sensing and Control, 2004, 2, 749–754.

https://doi.org/10.1109/ICNSC.2004.1297040

Zhou, H., Sun, G., Fu, S., Wang, L., Hu, J., & Gao, Y.

(2021). Internet Financial Fraud Detection Based on a

Distributed Big Data Approach With Node2vec. IEEE

Access, 9, 43378–43386.

https://doi.org/10.1109/ACCESS.2021.3062467

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

170