Mezzanine Financing as a Source of Financing for Business Activities

in Russia in a Crisis

Liliya Zavyalova

1a

, Svetlana Garanina

1b

and Nataliya Levochkina

2c

1

Dostoevsky Omsk State University, Omsk, Russia

2

K.G. Razumovsky Moscow State University of Technologies and Management, the First Cossak University, Omsk, Russia

Keywords: Financing, Sources of Financing, Mezzanine Financing, Equity Financing, Debt Financing.

Abstract: The article considers mezzanine financing as a source of financing for the growth and development of Russian

companies. This financial instrument is quite widespread in the market economy of foreign countries. In

Russia mezzanine financing has been introduced relatively recently. However, this tool has a great potential

for development. It is due to the fact that in the conditions of an unstable economic situation caused by various

reasons, including the coronavirus crisis, it becomes difficult for medium-sized businesses to apply traditional

external sources of financing, such as bank loans, project and venture financing. In this situation companies

can use mezzanine capital, which is a hybrid financial instrument that combines elements of equity and debt

capital. Special attention is paid to the characteristics of the debt and equity parts of the mezzanine financing

transaction. Conclusions are drawn about the industry availability of mezzanine financing for medium-sized

businesses in Russia. The minimum threshold level of return on sales for such businesses has been calculated

in order to qualify for mezzanine financing from a large Russian mezzanine investor – Sberbank

1 INTRODUCTION

A lot of Russian companies have financial needs

significantly exceeding the volume of available

domestic financial sources. Therefore, their

development is impossible without raising external

funding. Raising debt financing makes it possible to

increase the volume of company’s financial resources

and invest in fixed and working capital.

Russian scholars pay attention to the study of

traditional external sources used by organizations to

finance their activities and development. O. M.

Turygin considers the possibility of using borrowed

capital to increase the financial resources of Russian

companies, determining the potential for increasing

borrowed sources of financing based on the interest

coverage ratio (Turygin, 2020). S. Fungachova and L.

Solanko study the role of a commercial bank as a

financial intermediary that provides credit to various

business entities, assessing the cost and efficiency of

these services (Fungachova and Solanko, 2010). At

the same time, the researchers emphasize that a small

a

https://orcid.org/0000-0003-4116-7678

b

https://orcid.org/0000-0001-6729-2325

c

https://orcid.org/0000-0002-3035-2475

part of investments in fixed assets comes via bank

loans. Theoretical foundations and analysis of the

venture capital investment market in Russia were

studied by V. P. Postnikov and K. A. Trubnikov

(Postnikov and Trubnikov, 2020). A. G. Filippov and

E. V. Gruzdeva, developing the ideas of venture

financing, examine the sources of venture investment,

analyze the features of Russian and American models

and organizational forms of venture financing,

explore investment exit strategies, identify the

problems of using venture capital in Russia and ways

to overcome them (Filippov and Gruzdeva, 2019). O.

V. Motovilov considers the possibility of creating a

corporate venture fund, venture investment aims,

options for functioning of venture divisions in

domestic companies (Motovilov, 2016). The

problems of development and use of project

financing, its prospects and features are revealed in a

joint study by I. I. Marushchak, N. N. Matnenko and

T. S. Salnikova (Marushchak, Matnenko and

Salnikova, 2017). I. V. Shenaev examines the role of

banks in project financing organization, the

380

Zavyalova, L., Garanina, S. and Levochkina, N.

Mezzanine Financing as a Source of Financing for Business Activities in Russia in a Crisis.

DOI: 10.5220/0010669000003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 380-384

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

mechanism of interaction between the borrower

company and the bank, as well as the types and risks

of project financing (Shenaev, 2006). However, in

foreign practice, a hybrid form of financing

companies' activities – mezzanine financing – is

becoming increasingly widespread.

This form of financing is investigated by various

foreign researchers. Arthur D. Robinson, Igor Fert,

Mark A. Brod, using conceptual approach, revealed

the conditions and products of mezzanine investment,

as well as the documentary and informational support

of mezzanine financing of US corporations

(Robinson, Fert and Brod, 2011). Analysis of using

mezzanine capital in Europe is presented by Jennifer

Bollen (Bollen, 2015). L. G. Vasilescu considered the

features and advantages of mezzanine as a tool for

launching and expanding the activities of small and

medium-sized businesses from the point of view of

investors and borrowers and also identified the main

problems of its use in the European financial market

(Vasilescu, 2010).

In our country, research into mezzanine capital is

just beginning, although there is already a number of

publications. The study of the conceptual approaches

of Russian and foreign reserachers of the concept of

"mezzanine financing", the characteristics and

features of the use of its various tools is presented in

the work by E. A. Tarkhanova and K. A. Cheredov

(Tarkhanova and Cheredov, 2019). Yu. S. Ovanesova

examines the features of uing mezzanine capital in the

United States, European countries and Russia,

revealing the reasons for its appearance and the

purpose of application (Ovanesova, 2015). Е. М.

Petrikova explores the possibilities of using

mezzanine capital in the Russian financial market,

highlighting the role of commercial banks in

mezzanine financing (Petrikova, 2013).

Despite the attention paid to the problems of

mezzanine financing in the works of modern Russian

researchers, the possibilities and features of using this

financial instrument by Russian companies require

constant analysis due to their continuous

development, which determines the relevance of this

work.

2 RESULTS AND DISCUSSION

Trends in financial systems development indicate an

increase in interest in mezzanine finance during

periods of economic crises and restrictions. This

method of financing allows to cover the need for

investment projects sources for companies with low

capitalization.

Despite the fact that in developed countries

mezzanine lending has existed since the 1980s and is

used by large, medium-sized and small businesses, a

limited number of businesses have access to it in

Russia.

Being a hybrid form, mezzanine financing

combines the features of both debt and equity

financing. Mezzanine financing is a type of financing

that makes it possible to convert a company's debt

into a share in its capital when certain events occur.

There is always a debt part in mezzanine financing

which is represented by a loan (with or without

collateral), as well as a subordinated loan. When

dealing with the debt part, the investor provides more

flexible terms of repayment and payment of interest

compared to other sources and does not require

unconditional collateral.

The equity part of the mezzanine financing is

based on financial instruments that will provide their

owners the right to purchase the company shares at

certain price when certain conditions occur. The

instruments of the equity part of the mezzanine are

usually options, warrants, agreements on the right to

demand joining the sale (drag-along right),

agreements on the right to join the sale (tag-along

right), as well as preferred shares. The equity part of

a mezzanine may not be realized. The investor is

ready to apply the equity part of the mezzanine only

if the borrower company brings higher profit than the

loan interest in the future.

The composition of the debt and equity parts of

mezzanine financing transactions determines their

main characteristics, summarized in table 1.

Table 1: Main characteristics of mezzanine financing

Mezzanine financing

Debt part Equity part

payment of

current and

capitalized

profitability;

urgency

repayment of

financing

collateral

behavioural and

financial

covenants

additional profit (equity kicker)

is not guaranteed and depends

on:

business value growth;

operational and

financial indicators;

possibility of conversion to

equity (ordinary shares);

the right to manage the company

a limited set of corporate

decisions requiring investor’s

approval;

En

g

lish contract law

Such parameters of mezzanine financing

transactions imply the higher risk level for the

investor than that of debt financing. Nevertheless the

amount of this risk is lower than that of direct

Mezzanine Financing as a Source of Financing for Business Activities in Russia in a Crisis

381

investment. This forms the scope of the investor's

expectations on such investment profit up to 25% per

annum, which is higher than that of traditional

financing, but lower than that of direct investment

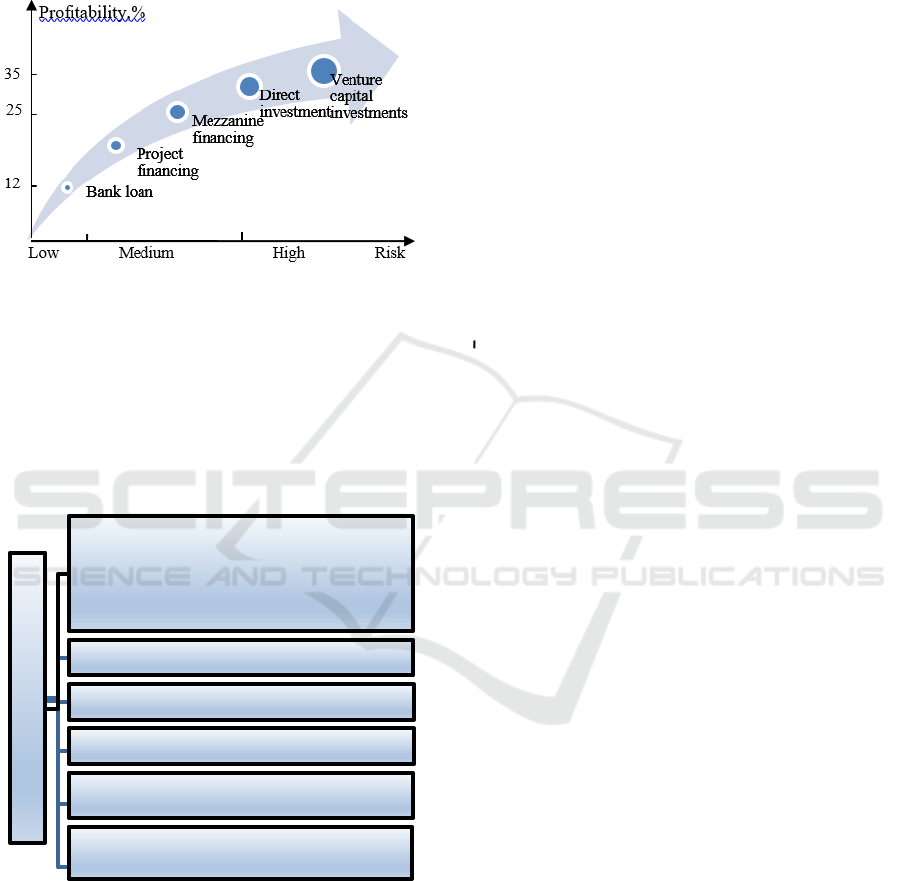

(Figure 1).

Figure 1: Relation between different sources of financing

depending on the level of risk

The level of risk of mezzanine financing

transactions is determined by the aims of the

investment project, the project budget and the

availability of its own sources of financing.

The main aims of the companies ' investment

projects within mezzanine financing are structured in

Figure 2.

Figure 2: Aims of mezzanine financing.

The mass demand for mezzanine financing is

determined by the first three goals, which are of

interest to almost all companies at any stage of their

life cycle. A wide range of mezzanine products can

be developed for such purposes, including products

with unified parameters. M&A transactions and

purchase of controlling interest are single cases, so

mezzanine products parameters are individual and

non-public.

The experience of mezzanine financing

transactions shows that it is applicable for projects

with any share of equity. However, based on the risk-

return ratio, the investor is ready to finance projects

with at least 20-30% of the budget accounted for by

equity.

Mezzanine financing is provided to companies

that generate positive cash flow during the entire

period of the mezzanine transaction. The main criteria

for selecting investment projects are the scale of the

business (large or medium-sized companies); the

presence of a formulated development strategy;

growth prospects and high operational efficiency.

In the world practice large banks, hedge funds and

private equity funds act as mezzanine investors. In

Russia, the main institutional mezzanine investors are

systemically significant banks: Sberbank, VTB,

Otkrytie Bank, Credit Bank of Moscow, and Alfa-

Bank. Moreover, transactions are conducted through

banking groups subsidiaries since the properties of

mezzanine financing instruments meet the capital

requirements of Basel II Capital Accord, but do not

meet the criteria for the first level of capital of Basel

III. The promotion of development institutions by the

state brings new players into the mezzanine market in

the form of venture funds (Skolkovo Ventures, a

Russian venture company), state corporations

(VEB.RF) and private equity funds.

It should be noted that there is no reliable statistics

on the volumes and parameters of mezzanine

transactions in the Russian economy. The available

information is presented in experts’ analytical

reviews, surveys of financial market participants and

press releases of participants in mezzanine

transactions.

Due to the decline in the profitability of project

financing transactions and the scarce M&A

transactions, the interest of Russian mezzanine

investors in financing medium-sized business

projects, involving investing in real investments as

well as business growth/development, is currently

growing.

Sberbank, which takes a significant share of the

mezzanine lending market and offers a wide range of

mezzanine products, works not only with large, but

also medium-sized businesses that generate revenue

growth (more than 10% per year over the past 3 years)

and EBITDA margin (more than 20%).

The slowdown in the growth of national

economies due to the COVID-19 pandemic will

inevitably lead to relaxation of the quantitative

criteria for selecting companies with real investments

aims of mezzanine financing

growth due to the implementation of projects

(modernization of equipment; development

and construction projects; participation in

supply contracts and auctions, demanding large

deposits, etc.)

recapitalization

restructuring and refinancing

mergers and acquisitions (M&A)

repurchase of company's controlling interest

with the help of loans (Leveraged BuyOut –

LBO)

purchase of company's controlling interest by

its top management (Management BuyOut –

MBO)

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

382

projects to provide mezzanine financing. Sberbank

mezzanine products already provide access to

financing for various medium-sized companies that

have an EBITDA margin of less than 20%.

Sberbank product range includes 2 products that

finance business development: Pay Once (classic

mezzanine) and Equity Participation (with mezzanine

elements) (Table 2).

Table 2: Sberbank mezzanine products available to

medium-sized businesses.

Equity participation in

equity

Pay Once

Goal Financing of business

development with a

commitment on the part o

f

the Client to conduct a

liquidity event within the

agreed period

Business development

financing

Volume Up to 500 million rubles Up to 500 million

rubles

Period Up to 7 years old Up to 5 years old

Size Up to 50% of the share

capital

Up to 70% of the

p

roject cost (including

senior debt)

P

ayment o

f

interest

Missing, dividends paid At the end of the term.

No payment of interes

t

and the body of debt

during the term of the

transaction

Tool Separate class of shares

with reserved matters

Loan and conclusion o

f

an additional yield

agreement (warrant)

Preferred or ordinary

shares with a put

option

Support Prohibition on alienation

of assets (negative pledge)

Pre-emptive right to retur

n

the investment in the even

t

of a liquidity preference

event)

Pledge of shares

Secondary collateral o

f

assets

Sureties of operating

companies

Metrics Operating Debt / EBITDA

< 3.5 x

LTV < 90%

Debt / EBITDA < 4.0

x

(end-to-end)

LTV/LTC < 70% over

the entire term of the

transaction

Exit

m

echanis

m

Liquidity Event

Call option

Right to demand a sale

(drag along)

Repayment at the

expense of funds from

the sale of the

company, its part (IPO

or individual assets

Repayment due to

accumulated flows

from the project

Refinancing with

senior debt

The minimum volume of mezzanine financing

transactions implemented by Sberbank is 250 million

rubles. To meet the requirements of the mezzanine

products, the project initiator company, based on the

"Operating Debt/EBITDA" metric, must generate an

operating profit of at least 125 million rubles for the

Pay Once product, and from 72 to 142 million rubles

for the Equity participation product.

In the course of the study a list of industries,

where functioning medium-sized enterprises can

apply for mezzanine financing, has been devised

(Table 3).

Table 3: Industry availability of mezzanine financing for

medium-sized businesses.

Type of activity Return

on sales,

%*

Profit, billion rubles

r

evenue 2

billion

rubles

r

evenue 1,5

billion

rubles

r

evenue 1

billion

rubles

metallurgical

p

roduction 25,2 402,6 301,9 201,3

activities related

to real estate

transactions 24,3 391,0 293,2 195,5

manufacture of

chemicals and

chemical

p

roducts 21,6 355,3 266,4 177,6

clothing

manufacturing 16,3 280,3 210,2 140,2

production of

computers,

electronic and

o

p

tical

p

roducts 13,5 237,9 178,4 118,9

information and

communication

activities 12,8 227,0 170,2 113,5

manufacturing

industries 12,2 217,5 163,1 108,7

manufacture of

textile

p

roducts 11,8 211,1 158,3 105,5

construction 8,1 149,9 112,4 74,9

*Source: Order of the Federal Tax Service of Russia of

30.05.2007 No. MM-3-06/333@ "On Approval of the

Concept of the System for planning on-site tax audits" –

Appendix No. 4.

The study includes the types of economic

activities of the real sector of the economy. At the

same time, raw materials industries are excluded

since they are traditionally dominated by big

business. The calculations use the industry average

return on sales by type of activity in 2020, calculated

as the ratio of profit from sales to cost of sales. The

sample of Russian companies by type of economic

activity was compiled according to Rosstat data. The

average industry value of return on sales in 2020 in

all types of economic activity is 9.9%. The maximum

Mezzanine Financing as a Source of Financing for Business Activities in Russia in a Crisis

383

value of the revenue indicator of 2 billion rubles is

determined by the norms of the federal law "On the

Development of Small and Medium-sized Businesses

in the Russian Federation" of 24.07.2007, No. 209-

FZ.

The results of the study indicate that companies

that have return on sales above the industry average

have the ability to generate revenue, ensuring

compliance with the required level of EBITDA

marginality for mezzanine products for business

development. The data presented in Table 3 shows

that medium-sized companies having revenue of 1

billion rubles with return on sales at 14.3%, can

receive mezzanine financing for the Pay Once

product for the implementation of their investment

projects. Medium-sized companies that generate

revenue close to the limit of 2 billion rubles have this

opportunity with a return on sales of more than 7%.

3 CONCLUSIONS

The ability of medium-sized business initiators,

which form the basis of the Russian economy, to

generate income allows investors to develop

mezzanine financing products, creating their unified

versions, even in the conditions of the financial crisis,

the EEC countries and the USA sanctions policy, and

the ongoing pandemic caused by COVID-19.

REFERENCES

Turygin O. (2020). Growth of investments in the fixed

capital of the region's economy due to increased debt

financing. Economy of region.

Fungachova S., Solanko L. (2010). How successful have

Russian banks been in financial intermediation?

Journal of New Economic Association.

Postnikov V., Trubnikov K. (2020). Correlation analysis of

the impact of venture investment on the innovative

development of the economy. Finance and Credit

Filippov A., Gruzdeva E. (2019). Models of venture

investment in Russia and the United States as the main

element of the formation of innovative enterprises. MIR

(Modernization Innovation Research) DOI:

10.18184/2079-4665.2019.10.4.501-515.

Motovilov O. (2016). Corporate venture financing of

innovative projects. Vestnik of the St. Petersburg

University. Series 5. Economics. DOI: 10.21638/11701/

spbu05.2016.404.

Marushchak I., Matnenko N., Salnikova T. (2017).

Formation and use of the concept of project financing.

Eurasian Union of Scientists.

Shenaev I. (2006). Project financing as an effective form of

lending to investment projects. BANKING SERVICES.

Robinson A. D., Fert I., Brod M. A. (2011). Mezzanine

Finance: Overview.

http://us.practicallaw.com/2-502-3062.

Bollen J. (2015). Mezzanine Finance: Mezzanine’s Brief

Hour in the Sun. IPE.

https://www.ipe.com/mezzanine-finance-mezzanines-

brief-hour-in-the-sun/10007772.article.

Vasilescu L.G. (2010). Financing Gap for SMEs and the

Mezzanine Capital. Economic Research.

Tarkhanova E., Cheredov K. (2019). Mezzanine financing:

potential implementation opportunities in Russia.

Financial Economics.

Ovanesova Yu. (2015). Mezzanine financing as a new

direction for Russia. BSc Management Accounting &

Finance

Petrikova E. (2013). Mezzanine loan as an alternative to

project financing of investment projects. Finance and

Credit

Development of alternative investment mechanisms: direct

investment and crowdfunding: Report for public

consultation. –

https://cbr.ru/Content/Document/File/112055/Consulta

tion_Paper_200811.pdf.

Mezzanine financing -

https://www.sberbank.ru/ru/legal/mez_finance?utm_so

urce=rg_publication&utm_medium=publication&utm

_campaign=legal.mez_finance_frk_pr_sept19&utm_c

ontent=publication.

Order of the Federal Tax Service of Russia (2007). MM-3-

06/333. On Approval of the Concept of the System for

planning on-site tax audits. Appendix No. 4.

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

384