Mechanism Categorizing Investors in the Russian Stock Market in

the Context of Sustainable Development

I. G. Gorlovskaya

1a

, L. V. Zavyalova

1b

, E. V. Lyuts

1c

and N. A. Levochkina

2d

1

Dostoevsky Omsk State University, Omsk, Russia

2

K.G. Razumovsky Moscow State University of Technologies and Management, the First Cossak University, Omsk, Russia

Keywords: Qualified Investors, Unqualified Investors, Categorization of Investors.

Abstract: The article examines the mechanism of categorization of investors in the Russian securities market from a

systematic perspective. The mechanism of categorization of investors in the securities market is defined as a

set of interrelated components and elements that protect the interests of investors, as well as the development

of the securities market. The main components are subject, object, target, resource, tool, and organizational

components. Special attention is paid to the characteristics of the components and elements of the

categorization mechanism in the context of qualified and unqualified investors in the Russian securities

market. This allowed us to identify the main problems of the current mechanism of categorization of investors

and to determine ways to solve them. There are drawn conclusions about the need to identify subgroups of

investors in each of the studied groups, as well as that it is necessary to take into account digitalization when

categorizing investors in the securities market.

1 INTRODUCTION

The main function of the stock market is the

redistributive function, according to which economic

entities with a shortage of funds (issuers) are

allocated the necessary funds by placing their

securities among investors. Investors, as economic

entities with a surplus of cash, play a key role in the

implementation of this function. In developed stock

markets, a categorization mechanism is used to

protect investors from investment risks, i.e., to divide

investors into qualified and unskilled ones based on

awareness of the risks associated with investing in

securities. Unqualified investors are prohibited from

investing in certain groups of securities and financial

instruments. However, in emerging stock markets, the

categorization mechanism has a downside: the ban on

investing in high-risk financial instruments restricts

issuers ' access to the funds of unskilled investors, and

pushes unskilled investors themselves to search for

unregulated high-risk instruments for investment.

This affects the development of the stock market and

a

https://orcid.org/0000-0002-1639-0870

b

https://orcid.org/0000-0003-4116-7678

c

https://orcid.org/0000-0002-0465-9377

d

https://orcid.org/0000-0002-3035-2475

leads to the emergence of new risks, especially in the

context of digitalization. The division of Russian

investors into qualified and unskilled ones has been

fixed in Federal Law No. 39-FZ "On the Stock

Market" since 2007. At the same time, the law does

not disclose the content of the concept of qualified

investors and defines them through the established list

on a formal basis. Starting from April 2022, the

megaregulator introduces new rules and norms for

classifying investors as

qualified investors for the

Russian stock market. The criteria and rules proposed

by the megaregulator for classifying investors as

qualified are quite strict (for example, individuals will

be required to have a certificate of qualification in

accordance with Federal Law No. 238-FZ "On

Independent Assessment of Qualifications" or at least

one of the international certificates (certificates)

listed by the Bank of Russia). For unqualified

investors, entrance testing is introduced and the list of

permitted financial instruments is sharply narrowed.

In general, the innovations affect the economic

interests of not only investors, but also issuers, as well

Gorlovskaya, I., Zavyalova, L., Lyut, E. and Levochkina, N.

Mechanism Categorizing Investors in the Russian Stock Market in the Context of Sustainable Development.

DOI: 10.5220/0010668700003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 365-368

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

365

as professional participants in the stock market. The

changes proposed by the mega-regulator do not

disclose the impact of the new categorization on the

development of the stock market and related financial

markets, and create a

problem of admission of new

investors to the stock market.

2 METHODOLOGY

Scientific papers on the subject under study are not

numerous, most often they apply a legal approach and

describe the categorization of investors within the

framework of current legislation. In this regard, there

is a need for a systematic theoretical and

methodological justification of the mechanism for

categorizing investors, understanding its application

in the field of state regulation of the stock market,

self-regulation of the activities of professional

participants in the stock market, influence on the

implementation of the redistributive function of the

stock market and, in general, on the development of

the Russian stock market.

3 RESULTS AND DISCUSSIONS

In the scientific literature, the categorization of

investors in the stock market is considered from

different positions. The classical typology, which is

presented in Russian and foreign studies, includes the

division of investors into institutional and individual

(retail). The activities of institutional investors are

considered in great detail in the domestic and foreign

literature. Trends in the functioning of institutional

investors abroad are presented in the works of Davis

E. Philip, Steil B. (Davisand Steil, 2001) Maranho, F.

S., Bortolon, P. M. & Leal, R. P. C (Maranho,

Bortolonand Leal, 2020), A. D. Crane, A. Koch, S.

Michenaud (Crane, Kochand Michenaud, 2019), Simi

Kedia, Laura T Starks, Xianjue Wang (Kedia,

Starksand Wang, 2020), and D. Schmidt (Schmidt,

2009). The main focus of research on the activities of

retail investors is the protection of their rights and

interests. This position is presented in the works of

the following authors: Y. M. Mirkin (Mirkin, 2002);

A. E. Abramov (Abramov, 2014); Garg Atin, Chawla

K. (Gargand Chawla, 2015). The methodological

foundations for the typologization of investors in

terms of

the possibility of conscious risk-taking were

laid down in the works on behavioral finance by D.

Kanneman and A. Tversky (Kanneman & Tversky,

1979). Further division of investors into qualified

(accredited, professional) and unskilled ones took

place within the framework of the financial

legislation of individual countries. Scientific research

on the categorization of investors is based on the

regulatory framework and approaches to the

separation of investors

already established by the

State. The applied aspects of the functioning of

qualified investors are presented on the basis of

country-specific features. Thus, the works of

Vijay

Jog (Jog, 2015), Kamila Veselá (Veselá, 2015),

Kailiang Ma (Ma, 2016) focus on the problems of

information disclosure by issuers of financial

instruments intended for qualified investors. Studies

by a number of foreign authors are devoted to the

recognition procedure and legal features of the

functioning of qualified investors in a particular

country (Roberta S. Karmel (Karmel, 2008),

Hubertus Hillerström (Hillerström, 2007), Karen Lu

(Lu, 2003)). The influence of qualified institutional

investors on the dynamics of national stock markets

is presented in the works of Liping Zou, William

Wilson, Shijie Jia (Zou, Wilsonand Jia, 2017), Lu,

Yang-Cheng, Wong, Jehn-Yih and Fang, Hao (Lu,

Wongand Fang, 2009), Andy Lin, Chih-Yuan Chen

(Linand Chen, 2006), Yu-Fen Chen, Chih-Yung

Wang & Fu-Lai Lin (Chen, Wangand Lin, 2008), Wei

Ting, Sin-Hui Yen and Chien-Liang Chiu (Ting,

Yenand Chiu, 2008). The research describes the

activities of foreign institutional qualified investors in

the stock markets of developing Asian countries. The

problems of functioning of the institute of qualified

investors in Russia are fully reflected in the works of

S. V. Lvova (it is proposed to introduce the concept

of a candidate for the status of a qualified investor)

(Lvova, 2020); N. B. Boldyreva and L. G.

Reshetnikova (Boldyrevaand Reshetnikova, 2017).

Thus, in the scientific literature, the description of the

categorization of investors is mainly based on the

already existing norms of state regulation and the

gradation of the "qualifications" of investors, while

the mechanism of categorization is not an object in

the presented studies.

By the mechanism of categorization, the authors

understand a system that includes components

(subject, object, target, resource, instrumental,

organizational). The components have a mixed

impact on the stock market. Some components lead to

deterrence, while others lead to the development of

the stock market. The analysis of information sources

on the categorization of investors in the Russian

Federation showed that, firstly, following the current

legislation, institutional (qualified investors) do not

disclose information about their strategies; secondly,

aggregated information on the market of qualified

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

366

investors as a whole is not publicly available or is

very fragmentary, which greatly reduces the base for

researching this category of investors. This

predetermined the emphasis on the qualitative

characteristics of the mechanism for categorizing

investors.

The categorization of investors, that is, the

division of investors into qualified and unskilled to

protect their interests, leads to a corresponding

division of the financial instruments of the market

itself into two unequal segments. If in the conditions

of

developed stock markets, unskilled investors have

a fairly large choice of financial instruments (in

particular, listed securities), then in the conditions of

emerging stock markets,

the tightening of

categorization requirements for unskilled investors

narrows their investment opportunities. The analysis

of the norms of the current legislation and the use of

the expert method allowed us to characterize the

elements of the mechanism for categorizing investors

(Table 1).

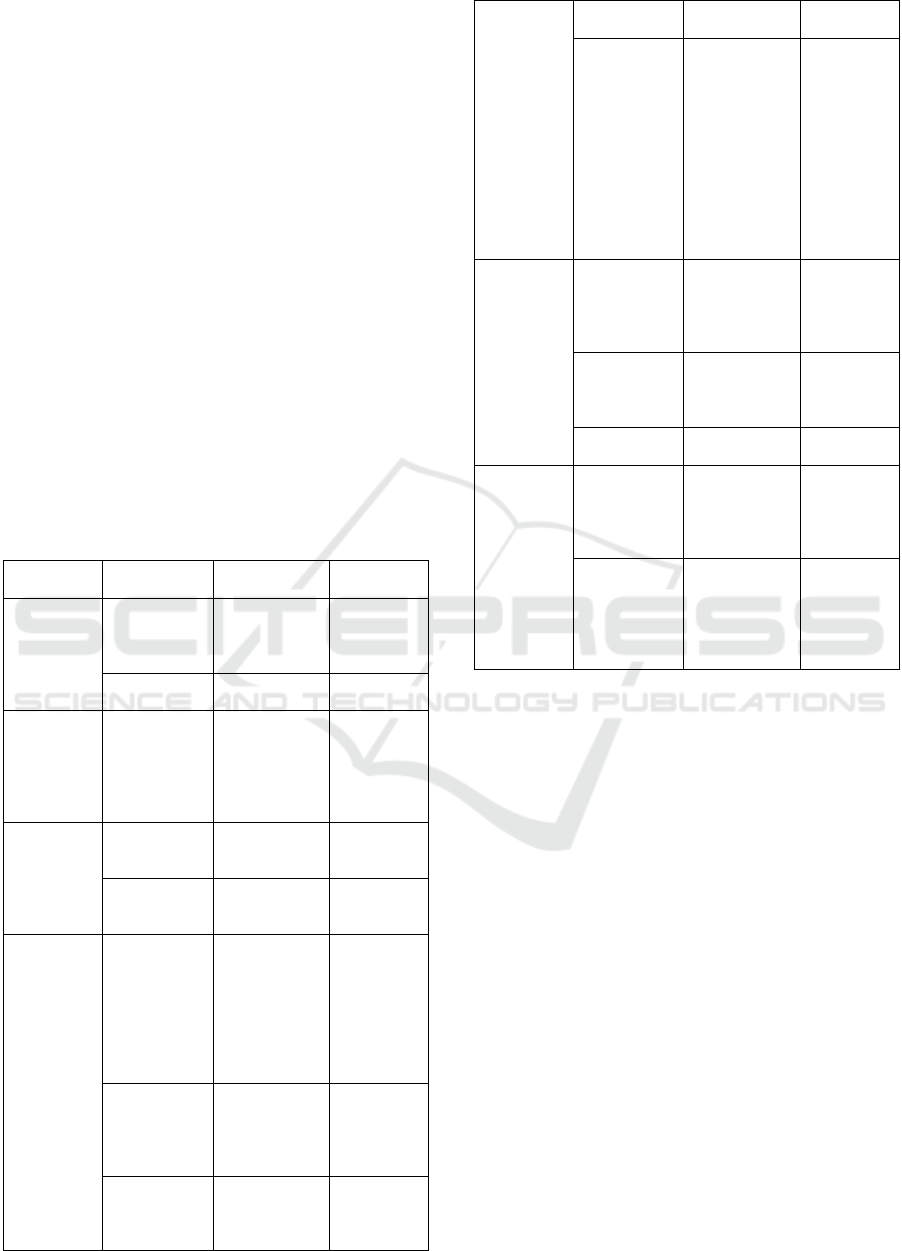

Table 1: Characteristics of the mechanism of categorization

of investors in the Russian stock market

Mechanism

components

Mechanism

elements

Qualified

investors

Unqualified

investors

Subject

Instrumental

Organizational

Regulators Bank of Russia,

self-regulatory

organizations

Bank of

Russia, self-

regulatory

organizations

Types of

investors

Institutional

Private

Not defined

Object Indicators of

attribution to the

group

Quantitative

Qualitative

According to

the residual

principle, the

group is not

defined within

the group

Target Target regulator

y

settings (micro-

level)

Not defined Reducing

investment

risks

Regulatory

targets (macro-

level)

Not defined Not defined

Resource Legal support Federal Law "On

the Stock Market

"

Federal Law "On

Investment

Funds"

Federal Law "On

Non-State

Pension Funds"

Federal Law

"On the Stock

Market"

Regulatory

support

Regulations of th

e

Bank of Russia

and self-

regulatory

organizations

Basic standard

s

of self-

regulatory

organizations

Information

support

Publicly availabl

e

information

Exchange

information

Publicly

available

information

Exchange

information

F

inancial suppor

t

Budget financing

of the

development of

regulatory legal

acts on the

categorization of

investors and self

-

financing of self-

regulatory

organizations

through

membership fees

Budget

financing of

the

development o

f

regulatory

legal acts on

the

categorization

of investors

Instrumental Restriction

methods

Licensing for

institutional

investors

Certification for

private investors

Testing

Stimulating

methods

Unlimited set of

financial

instruments for

investmen

t

Not provided

Compensation

methods

Not provided Not provided

Organizational Methods and

technologies of

regulation and

supervision by

the regulato

r

Prudential

proportional

regulation of

institutional

investors

Limiting the

set of financial

instruments fo

r

investment

Methods and

technologies of

digitalization

Regulatory

Technology

RegTech

Financial and

investment

platforms

Key

information

documents

It can be assumed that in the conditions of

digitalization, when new, often unregulated, financial

instruments appear, unqualified investors will go to

the associated financial markets, and thus the

development of the domestic stock market will be

slowed down. Thus, the mechanism for categorizing

investors requires:

the megaregulator (the Bank of Russia) defines

clear targets for the use of the mechanism for

categorizing investors, taking into account the

impact of categorization on the volume of

investment in individual segments and on the

capitalization of the market as a whole;

introduction of intermediate categories of

investors in each group. This will allow

investors to smoothly prepare for the transition

to a more risky group and at the same time will

not dramatically reduce the volume of

investments in risky, but potentially profitable

assets;

clarification of the areas of protection of

unqualified investors and protective tools in the

basic standards of self-regulatory organizations

(Gorlovskaya, 2020);

Mechanism Categorizing Investors in the Russian Stock Market in the Context of Sustainable Development

367

development of incentive and compensatory

methods to protect unqualified investors;

taking into account digitalization when

categorizing investors.

Digitalization as one of

the main drivers of financial markets provides

new opportunities for investment and should be

taken into account when determining

(changing) quantitative and qualitative

indicators of categorization of investors in

order to develop the stock market.

4 CONCLUSIONS

Consideration of the categorization mechanism from

a systematic perspective allows us to develop a

system of quantitative and qualitative criteria for

assigning investors to certain groups for state

regulation of the stock market as a whole in the

context of digitalization; as well as basic standards of

self-regulatory organizations in the stock market.

REFERENCES

Davis, E. Ph, Steil, B. (2001). Institutional Investors, The

MIT Press. London.

Maranho F. S., Bortolon P. M., Leal R. P. C. (2020). The

firm–investor level characteristics of institutional

investor engagement in Brazil. International Journal of

Disclosure and Governance. DOI: 10.1057/s41310-

020-00095-w.

Crane A. D., Koch A., Michenaud S. (2019). Institutional

investor cliques and governance. Journal of Financial

Economics. DOI:10.1016/j.jfineco.2018.11.012.

Kedia S., Starks L. T., Wang X., (2020). Institutional

Investors and Hedge Fund Activism. The Review of

Corporate Finance Studies. DOI: 0.1093/rcfs/cfaa027.

Schmidt D. (2009). Distracted Institutional Investors. In

Journal of Financial and Quantitative Analysis: JFQA.

DOI: 10.1017/S0022109018001242.

Mirkin Ya. (2002). Stock market: impact of fundamental

factors, forecast and development policy, Alpina

Publisher. Moscow.

Abramov A. (2014). Institutional investors in the world:

features of activity and development policy, Delo.

Moscow.

Garg A., Chawla K. A. (2015). Study of Trend Analysis and

Relationship Between Foreign Institutional Investors

(FIIs) & Domestic Institutional Investors (DIIs)

International Multi-Track Conference on Sciences,

Engineering and Technical., DOI:

10.13140/RG.2.1.4051.5688.

Kahneman D., Tversky A. (1979). Prospect theory: An

analysis of decision under Risk. In ECONOMETRICA.

Jog, V., 2015. The exempt market in Canada: empirics,

observations and recommendations. SPP Research

Papers, The School of Public Policy.

Veselá, Kamila. (2015). Asymmetry of information, risk a

decision making in the process of investing to funds of

qualified investors. Economics and Management.

Ma K. (2016). Discussing the Legal Standards of Qualified

Investors in Chinese Private Equity Crowdfunding. 2nd

International Conference on Economics, Social

Science, Arts, Education and Management

Engineering.

Karmel R. S. (2008). Regulation By Exemption: the

Changing Definition of an Accredited Investor. Rutgers

Law Journal.

Hillerström H. (2007). «Qualified Investors» under the new

Federal Collective Investment Schemes Act.

Newsletter.

https://www.walderwyss.com/user_assets/publications

/470.pdf

Lu K. (2003). An overview of the Taiwanese qualified

foreign institutional investor system. China's capital

account liberalisation: international perspective.

http://www.bis.org/publ/bppdf/bispap15q.pdf.

Zou L., Wilson W., Jia Sh. (2017). Do qualified foreign

institutional investors improve information efficiency:

a test of stock price synchronicity in china? Asian

Economic and Financial Review.

http://www.aessweb.com/pdf-files/AEFR-2017-7(5)-

456-469.pdf

Lu Ya., Wong Je., Fang H. (2009). Herding momentum

effect and feedback trading of qualified foreign

institutional investors in the Taiwan stock market. In

Asian Economic and Financial Review.

http://www.theibfr2.com/RePEc/ibf/ijbfre/ijbfr-v3n2-

2009/IJBFR-V3N2-2009-11.pdf.

Lin A., Chen Ch. (2006). The Impact of Qualified Foreign

Institutional Investors on Taiwan’s Stock Market. Web

Journal of Chinese Management Review.

http://cmr.ba.ouhk.edu.hk/cmr/webjournal/v9n2/CMR

503E05.pdf.

Chen Yu., Wang Ch. Lin F. (2008). Do Qualified Foreign

Institutional Investors Herd in Taiwan's Securities

Market? Emerging Markets Finance and Trade. DOI:

10.2753/REE1540-496X440405/

Ting W., Yen S. Chiu Ch. (2008). The Influence of

Qualified Foreign Institutional Investors on the

Association between Default Risk and Audit Opinions:

Evidence from the Chinese Stock Market. Corporate

governance. DOI:10.1111/j.1467-8683.2008.00699.

Lvova S. (2020). Qualified investor: experience, reality and

prospects, Justicinform. Moscow.

Boldyreva B., Reshetnikova L. (2017). Updating the

Russian model of investor qualification in the

conditions of modernization of the country's economy.

ECONOMIC, Economic, social and sprintual renewal

as the basic of the new industrialization.

Gorlovskaya, I. (2020). Financial policy in relation to the

categorization of individual investors in Russia and the

protection of their interests. Bulletin of the Omsk

University.

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

368