Sustainable Regional Development based on the Inflation Forecasts:

The Adaptive Models Application

I. A. Astrakhantseva

a

, M. D. Ermolaev

b

and A. S. Kutuzova

c

Ivanovo State University of Chemistry and Technology, Sheremetev Avenue, 7, Ivanovo, Russia

Keywords: Sustainable Regional Development, Consumer Price Index, Inflation, Forecasting, Mathematical Models,

Neural Networks.

Abstract: The article proves the dependence of the regions sustainable development on the inflationary processes

dynamics. The practice of using various mathematical models to predict the consumer price index is

considered. The experience in the regional inflation forecasting on the basis of a recurrent neural network is

presented. The mechanism of forecasting the inflation level on the basis of adaptive models is shown. The

algorithm was tested on the basis of indicators for the Ivanovo region. The source of the primary data was the

monthly data of the chain consumer price indices (CPI) in the Ivanovo region in 2009-2020. The predictive

model was validated on the basis of the consumer price index data for the first three months of 2021.

Independently, the issue of assessing the federal-level inflation dynamics impact on the regional-level

inflation dynamics is considered.

1 INTRODUCTION

The regions sustainable development and the

maximum uniformity achievement of such

development is a necessary condition for the entire

state progressive development. The inflation level has

always been one of the key macroeconomic indicators

that reflect the current state of economy. The inflation

dynamics affects many important areas of public life,

i.e. the investment processes flow, the production

growth, the population standard of living and the level

of social tension, which ultimately contributes to or,

on the contrary, restrains the economy progressive

development. Therefore, the inflation forecasting (as

accurate as possible) is an urgent task for various

political, financial and social institutions.

The model and methodological apparatus for

inflation forecasting is diverse. The typology and

comparative analysis of the predictive qualities of

such methods are presented in sufficient detail, for

example, in the works of (Faust, 2013; Balackij and

YUrevich, 2018; Duncan and Martínez-García, 2018;

Gorshkova and Sinel'nikova, 2016)

a

https://orcid.org/0000-0003-2841-8639

b

https://orcid.org/0000-0002-9502-3621

c

https://orcid.org/0000-0002-7511-1667

Among the various approaches to forecasting the

price rate dynamics, two areas stand out significantly.

The first direction is based on the assessments of

experts in the economic functioning field and on the

ordinary economic actors opinions survey (for

example, the monthly survey of the University of

Michigan (Lahiri and Zhao, 2016)).

The inflation forecasting within the framework of

the second direction is carried out on the econometric

methods and models basis. At the same time, for

short-term forecasting, as a rule, various models of

scalar time series (single-factor models) are used.

These include:

Random walk models (RW models). A random

walk determines the movement of a random

variable (in our case, the inflation rate), the

direction of which changes randomly at certain

points in time. The change in the inflation rate

in this model does not depend on all previous

values and does not affect all subsequent

changes, while obeying an identical probability

distribution with the same parameters, i.e. the

average value and the mean square deviation.

Astrakhantseva, I., Ermolaev, M. and Kutuzova, A.

Sustainable Regional Development based on the Inflation Forecasts: The Adaptive Models Application.

DOI: 10.5220/0010667800003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 313-319

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

313

Models of direct and recursive autoregression.

The prediction in autoregressive models is

based on the analysis of the variable previous

values. Within the framework of such a

forecast, it is assumed that the inflation rate is

in a linear relationship with this indicator in the

previous time steps. Statistical indicators are

used to calculate the correlation between the

output inflation indicator and its values in

previous time steps with different lags.

ARIMA models are created in the

autoregressive models development process.

They allow to bring the series to a stationary

one and implement forecasting by

extrapolation, to identify the trend, seasonality

in the change in the inflation indicator. Based

on these models, for example, monthly

forecasts of the main Russian macroeconomic

indicators are made, published by the staff of

the E.T. Gaidar Institute for Economic Policy.

For medium-term forecasting, multi-factor

models are usually applied. They are expressed

as a system of simultaneous equations. The

greatest number of different techniques and

technical tools for constructing inflation

forecasts have been accumulated within the

framework of these models.

Among them, first of all, the following models are

distinguished:

Models based on the Phillips curve. Thise

models estimate the inverse relationship

between the inflation rate and the

unemployment rate. Currently, the modern

modification of these models is used in the

form of a "triangular model", where the

inflation rate is dependent on its past values, the

unemployment rate and cost shocks.

Vector autoregression models (VAR models)

study the macroeconomic variable reactions (in

our case, the inflation rate) to its previous

values and other variables that are responsible,

among other things, for regime changes in

economic policy or individual shocks in the

economy. These models are represented by the

independent regression equations systems.

Dynamic models of general equilibrium. The

DSGE models are based on modeling the

micro-level economic entities behavior. These

models illustrate the dependence of the

inflation rate and many other variables: total

output, the costs rate, the imports volume, the

interest rate, the wages rate, consumption,

savings and investments, and the exchange

rate.

Neural networks. We shall emphasise that for

the study of such a multi-factorial and complex

phenomenon as inflation, this tool can show

high efficiency and accuracy of the forecast.

The following classes of neural networks are

used for time series analysis: multilayer

perceptron, deep neural networks, recurrent

neural networks, and convolutional neural

networks.

We assume the use of a recurrent neural network

based on LSTM (Long Short-Term Memory) blocks

with a dual attention mechanism (in the encoder and

decoder) as the most preferable method. This is a

special type of recurrent neural network architecture

capable of learning long-term dependencies, which

meets the task of the inflation rate forecasting

(Astrakhantseva, Kutuzova and Astrakhantsev,

2020).

At the same time, the application of this set of

models in practice tends to use a combination of

private forecasts made by different methods and

instrumental approaches, including the expert ones

(Dou., Lo, Muleu and Uhlig, 2017; Andreev, 2016).

For example, the Central Bank of the Russian

Federation uses the DSGE model of a "small" open

economy with the following types of agents:

households, firms, the external sector and the central

bank. The inflation factors are the interest rates, the

exchange rate, the consumption and savings level,

wages, the volume of imports, the costs rate, etc. The

inflation forecast is constructed by combining the

forecasts of different models (Balackij and YUrevich,

2018).

Thus, it is noted that to date, more than 20 types

of models for forecasting inflation are used. However,

all of them are oriented and used within the national

economies framework. The regional specifics of the

inflation dynamics within individual countries are not

reflected in these models. There are no serious

developments related to the modeling of inflationary

processes at the regional level. Meanwhile, in the

context of regional heterogeneity, significant

fluctuations within the national picture of inflation are

quite possible. At the same time, in order to apply

sound monetary policy measures, the regulator needs

to assess the inflationary processes dynamics in

regions, since the country sustainable development

requires adequate sustainable development of all its

parts.

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

314

2 MATERIALS AND METHODS

We suggest that it is important to consider the specific

factors on the meso-level. Traditionally, more

attention is paid to the inflation monetary factors,

which are directly influenced by regulators (interest

rates, exchange rate, lending volumes, consumption

volumes, saving volumes). These factors can be

accurately quantified and taken into account in

mathematical models and machine learning

algorithms. However, non-monetary factors also have

a significant impact on the consumer price index.

For example, the economic entities and the

population inflationary expectations can become a

significant factor in the inflationary processes

development. This factor is traditionally very

significant for Russia. Additionally, non-monetary

factors can be the following: the rise in the imports

cost, the economy monopolization and, accordingly,

the monopolistically set prices "inflating", the shadow

sector of the economy presence, the peculiarities in the

movement of goods between regions and the system

of movement of goods within networks. If, for

example, there are no large warehouses in the region,

this will lead to an increase in the prices of goods

imported into the region for the final consumer. Thus,

the Ivanovo Region under study is an outsider region

in terms of price attractiveness for short-term loan

banks, along with the Kursk and Belgorod regions.

The cost of medium-term loans for individuals here is

often lower than the market average (Ahmatov,

Astrahanceva, Kutuzov, Votchel and Vikulina, 2020).

This can provoke an increased demand for credit

resources, increasing the money supply in circulation

and stimulating the inflationary processes.

Previously, the authors used a recurrent neural

network to analyze a number of inflation factors at the

regional level, such as: the amount of the population

income, the average monthly wages, the population

monetary expenditures, the retail turnover, the

volume of paid services to the population, the volume

of individuals deposits, the amount of citizens debt on

loans, the dollar-ruble exchange rate, etc. Having

identified potential factors of inflation, the authors

conducted a correlation and regression analysis and

marked the dollar-ruble exchange rate and the

increase in citizens debt, with the exception of

currency revaluation, as parameters with a

characteristic dependence. Next, all the identified

potential inflation factors were taken for forecasting

using a neural network.

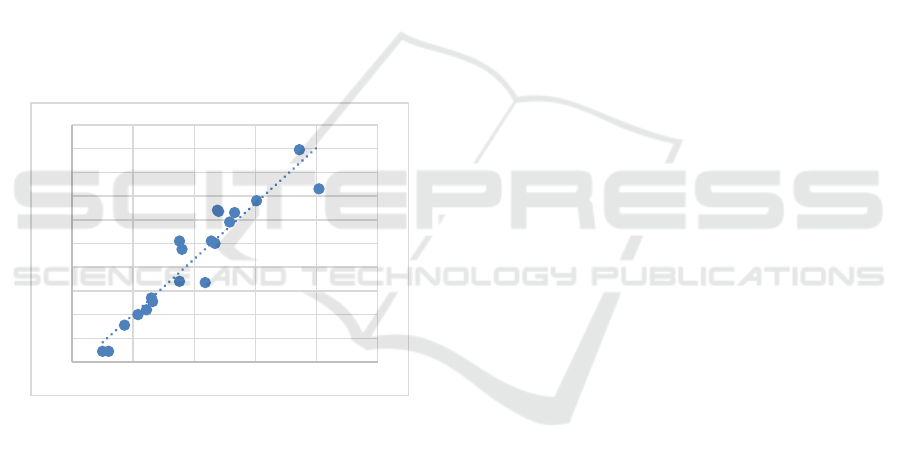

The results of the forecast are presented in Figure

1. These results indicate that the direction of changes

in the actual indicator and the planned indicator

coincides almost over the entire time horizon,

however, the algorithm could not accurately predict

the fluctuations amplitude. We shall note the

divergence between the fact and the forecast in the

first half of 2019 and in the spring of 2020. The

increase in inflation in January-February 2019 and its

increased values compared to the forecast in the first

half of 2019 is explained by the increase in utility

tariffs and the rise in the price of fruit and vegetable

products. In addition, the increase in prices at the

beginning of 2019 could be due to the factor of high

inflation expectations already mentioned above,

which, according to the Bank of Russia, were formed

under the influence of the dynamics of prices for

gasoline, food and fluctuations in the ruble exchange

rate. We shall note that the model could not

accurately account for these factors (Figure 1).

Figure 1: The comparison of predicted data with actual CPI figures.

However, while considering the importance of

specific meso-level factors, it seems fair that the

processes occurring in lower-level systems are

formed and largely reflect the dynamics of processes

occurring in higher-level systems. Obviously, the

same applies to inflation. Therefore, at the first stage

of the study, it is expected to assess the degree of CPI

dynamics correlation at the federal and regional levels

over a sufficiently long time interval.

Sustainable Regional Development based on the Inflation Forecasts: The Adaptive Models Application

315

The applied part of the study concerns the actual

forecasting of the inflation rate in a particular region

(in the Ivanovo region). The initial statistical basis for

the predictive models construction was the monthly

data of the Ivanovo branch of the Central Bank of the

Russian Federation on indicators reflecting the

inflation rate in the region (CPI). The period relative

to which the models were built, 2009-2020, the period

relative to which the quality of the models was

checked, the first three months of 2021.

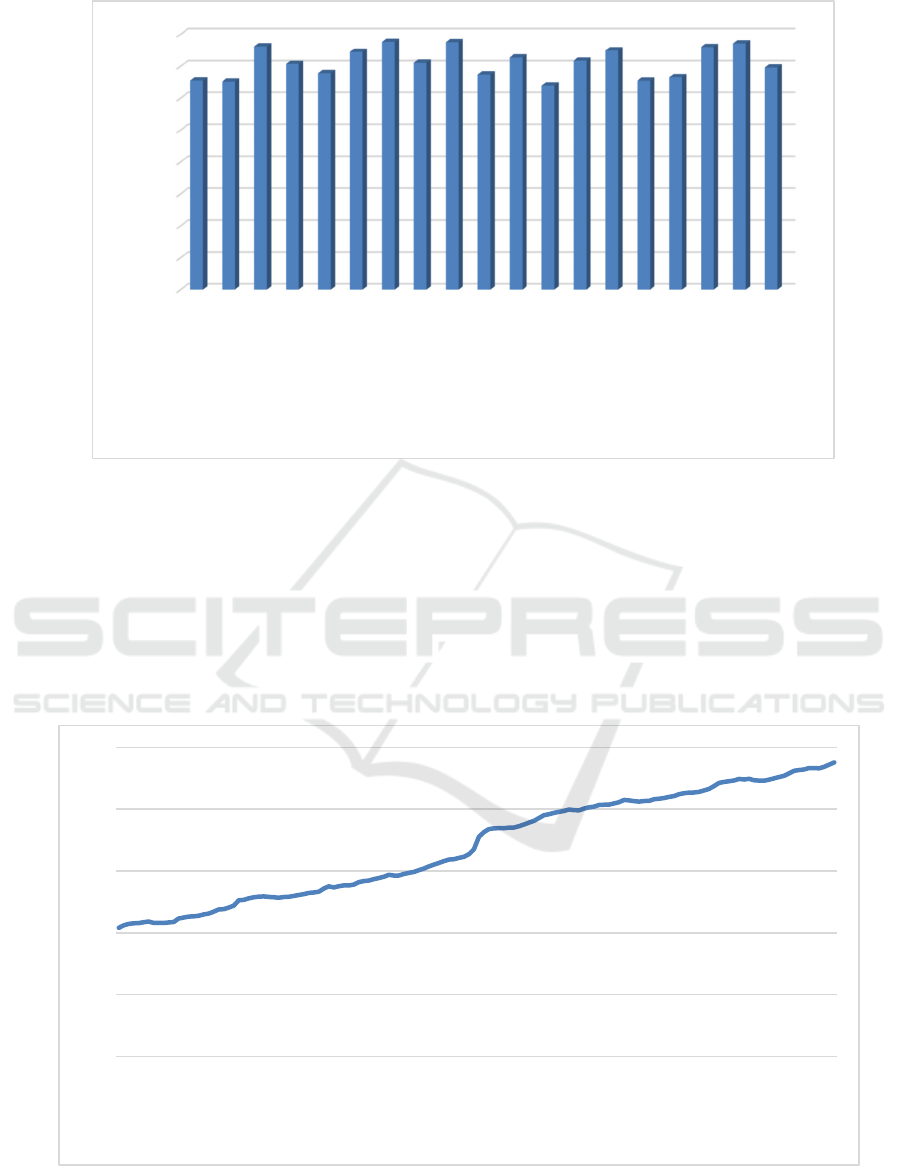

In the first part of the study, we compared the

inflation rates dynamics (December to December last

year) in the Central Federal District regions with the

inflation rate dynamics in Russia as a whole for the

period 2000-2020. The comparison was carried out

by the methods of correlation and regression analysis.

As follows, the linear regression models of the

dependence of the regional level of inflation on the

federal level were constructed. The quality of models

was traditionally evaluated by the value of the

determination coefficient. The comparison of the

inflation rates dynamics in the Russian Federation

and in the Ivanovo Region is shown in Figure 2.

Figure 2: Comparison chart of inflation rates in the Russian

Federation and in the Ivanovo region by year in the period

2000-2020.

All constructed models are statistically significant

at a significance level of 0.01. The values of the

determination coefficient for all regions are within the

range of 0.874<R2<0.983, which indicates the high

quality of the constructed models.

For the Ivanovo region, R2=0.891. It can be

interpreted as follows: the price variation in this region

is on average 89% due to the impact of inflationary

processes at the macro level. It should be noted that in

terms of this indicator, the Ivanovo Region occupies

the penultimate place among the Central Federal

District regions. Taking into account the internal

annual dynamics, we can conclude that there are

certain features of the inflationary processes in this

region.

In the context of comparing the inflationary

processes at the meso-and macro-levels, another

important indicator is a matter of concern, in

particular, the total price growth in the region over the

entire period under review. In contrast to the

determination coefficient, which reflects the degree of

price dynamics synchronicity at the federal and

regional levels, this indicator represents the main

inflationary outcome in the region or country under

consideration. At the same time, it is obviously

equivalent to consider the actual values of consumer

price growth in the regions or the ratio of these values

at the regional and federal levels. Figure 3 shows the

growth of prices in the Central Federal District

regions, as well as in Russia as a whole for the period

2000-2020.

In general, in most regions of the Central Federal

District, the growth rate exceeds the national level.

The leader is the Yaroslavl region (the growth is

771%), the outsider is the Oryol region (the growth is

639%). The growth in Russia is 655%.

Thus, we can talk about a certain differentiation of

inflationary processes in the regions. At the same time,

it is possible to assume the existence of some

typologically similar realizations of price dynamics

for certain groups of regions. Therefore, at the next

stage of the study, we conducted a cluster analysis of

the Central Federal District regions based on the two

above-mentioned indicators, i.e. on the determination

coefficient of the regional inflation rate dependence on

the federal level, as well as the amount of consumer

price growth in the regions for the period 2000-2020.

After the necessary data standardization

procedure, the clustering itself was carried out using

the k-means method. The choice of the optimal

number of clusters n was carried out on the results

variance analysis basis, in particular, for the first n, for

which the p-values for both variables were less than

the accepted significance rate α=0.01. This condition

was achieved at n=3. Thus, the Central Federal

District regions were divided into three groups with

typologically similar characteristics of price

dynamics. The most interesting cluster is the one

containing four regions – Ivanovo, Kursk, Ryazan,

and Tula. The distinctive features of the cluster are,

first, relatively low determination coefficient values

and, on the contrary, a significant increase in

consumer prices in the period under review. That is,

the inflation rate dynamics in these regions is the most

individualized and unstable. We shall also note that

the Ivanovo Region is the closest to the center of this

cluster.

y = 0,9383t + 7,4927

R² = 0,8913

102

104

106

108

110

112

114

116

118

120

122

100 105 110 115 120 125

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

316

Figure 3: The consumer price growth in the Central Federal District and the Russian Federation as a whole for the period

2000-2020 (in %)

3 RESEARCH RESULTS

The forecast of the inflation rate in the Ivanovo region

was carried out on the basis of adaptive models (or

exponential smoothing models). Methodically, this

can be represented as follows.

At first, the initial series of chain consumer price

indices is converted into a series of basic indices (the

base is December 2008).

The resulting series represents the generalized

price level dynamics in the Ivanovo region relative to

the prices of December 2008 (Figure 4).

Figure 4: The dynamics of basic consumer price indices in the Ivanovo region in the period 2009-2020 (the basis is 100% –

December 2008).

0,0

100,0

200,0

300,0

400,0

500,0

600,0

700,0

800,0

RussianFederation

Central

federaldistrict

Belgorodregion

Bryanskregion

Vladimirregion

Voronezhregion

Ivanovoregion

Kalugaregion

Kostromaregion

Kurskregion

Lipetskregion

Moscowregion

OryolRegion

RyazanOblast

Smolenskregion

TambovRegion

Tverregion

Tularegion

0

50

100

150

200

250

2009‐01‐01

2009‐07‐01

2010‐01‐01

2010‐07‐01

2011‐01‐01

2011‐07‐01

2012‐01‐01

2012‐07‐01

2013‐01‐01

2013‐07‐01

2014‐01‐01

2014‐07‐01

2015‐01‐01

2015‐07‐01

2016‐01‐01

2016‐07‐01

2017‐01‐01

2017‐07‐01

2018‐01‐01

2018‐07‐01

2019‐01‐01

2019‐07‐01

2020‐01‐01

2020‐07‐01

Sustainable Regional Development based on the Inflation Forecasts: The Adaptive Models Application

317

It is easy to see that the dynamics are quite regular

and generally close to linear. Notable deviations from

the general trend are visible at the end of 2014 (to a

greater extent) and at the end of 2010 (to a lesser

extent). In addition, at the turn of 2014-2015, there is

a certain slowdown in the inflation rate.

The visual analysis of the dynamics allows us to

conclude that it is advisable to use the adaptive

forecasting methods that take into account the fact

that the data obtained chronologically last. These data

are considered the most important in forecasting,

since they give an idea of the direction in which the

development of the current trend will go.

Adaptive models were built using the

STATISTICA 10 application software package. At

the same time, we proceeded from two premises.

Firstly, we proceeded from the existing but changing

trend of the dynamics under consideration and,

secondly, from the presence of an inflation seasonal

factor, although visually it is difficult to grasp, but

theoretically it occurs quite reasonable.

The STATISTICA package allows to build

several types of adaptive models, differentiated on the

basis of the microtrends types (linear, exponential,

damped), as well as the seasonal dynamics nature

(additive or multiplicative). The selection of adaptive

parameters for each model type was carried out

according to the criterion of minimizing the mean

absolute percentage error (MAPE).

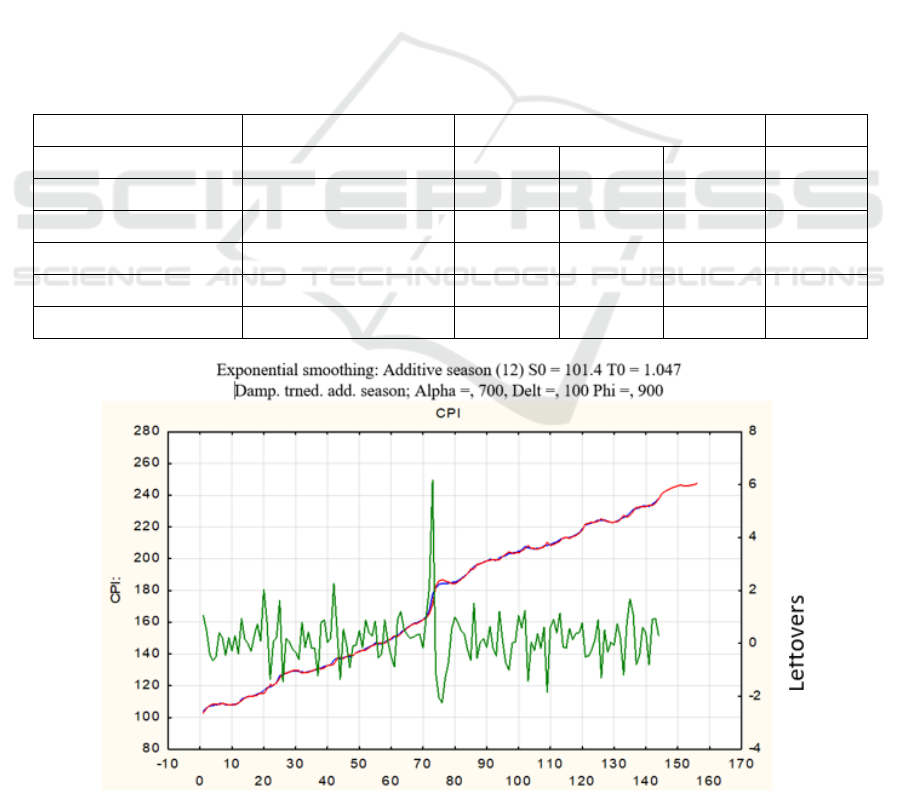

Table 1 shows the results of constructing the

optimal adaptive models of each type. In general, the

MARE index minimum value corresponds to a model

with the damped microtrends and additive

seasonality. The optimal adaptation parameters are

0.7, 0.1, and 0.9 (VM model (0.7; 0.1; 0.9)).

The inflation post-forecast for 2021 was carried

out precisely on the basis of this model.

Figure 5 shows the results of forecasting based on

this model.

Table 2 shows the inflation rate forecast values in

the Ivanovo region in 2021.

Table 1: The results of the inflation dynamics adaptive models constructing in the period 2009-2020.

The seasonality nature

The microtrends type Parameters MAPE

additive linear 0.9 0.1 0.6

0.406

additive exponential 0.9 0.1 0.7

0.416

additive damped 0.7 0.1 0.9

0.400

multiplicative linear 0.9 0.1 0.4

0.414

multiplicative exponential 0.9 0.1 0.3

0.415

multiplicative damped 0.7 0.1 0.9

0.416

Figure 5: The demonstration of the results of forecasting the basic inflation indices in the Ivanovo region

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

318

Table 2: The inflation rate forecast in the Ivanovo region in 2021 (in the YoY - Year over Year format).

Month Forecast Fact Month Forecast Fact

January 6.61 6.33 July 5.65 -

February 6.78 6.97 August 5.38 -

March 6.36 6.64 September 5.55 -

April 5.82 - October 5.10 -

May 5.89 - November 4.50 -

June 5.94 - December 4.00 -

Within this format, the average monthly forecast

error was 4.4% in January, 2.7% in February, and

4.2% in March. If we consider the inflation growth as

a whole for three months, the error will be less than

1%, which indicates the adequacy of the chosen

forecasting methods.

4 CONCLUSION

Thus, the study revealed differences in the course of

inflationary processes in regions. Based on the cluster

analysis, three classes of regions with typologically

similar dynamics of consumer prices were identified.

As a hypothesis, we can assume that each of these

typologies determines the choice of a particular

model for predicting the regional inflation rate.

For the Ivanovo region (the region of the most

"unstable" cluster) an adaptive model for forecasting

monthly data on the inflation rate was built. The

forecast results in the post-forecast period (the first

three months of 2021) showed a fairly high accuracy.

This study complements the domestic and foreign

methods of studying the inflation factors and its

forecasting, taking into account regional specifics.

The identification of these specifics in the inflationary

processes formation will allow us to adjust the

regulator monetary policy and create conditions for

ensuring the progressive development of the regions

within the country.

REFERENCES

Faust J. (2013). Wright J.H. Forecasting inflation.

Handbook of economic forecasting. Vol. 2, pages 2–56.

Balackij E.V., YUrevich M.A. (2018). Prognozirovanie

inflyacii: praktika ispol'zovaniya sinteticheskih

procedur. Mir novoj ekonomiki, 4 pages 20–31.

Duncan R., Martínez-García E. (2018). New Perspectives

on Forecasting Inflation in Emerging Market

Economies: An Empirical Assessment. Working paper.

https://www.dallasfed.org/~/media/documents/institute

/wpapers/2018/0338.pdf.

Gorshkova T., Sinel'nikova E. (2016). Sravnitel'nyj analiz

prognoznyh svojstv modelej rossijskoj inflyacii.

Nauchnyj vestnik IEP im. Gajdara, 6, pages 34–41.

Lahiri K., Zhao Y.(2016). Determinants of consumer

sentiment over business cycles: Evidence from the US

surveys of consumers. Journal of Business Cycle

Research, Vol. 12, 2, pages 187–215

Astrakhantseva I., Kutuzova A., Astrakhantsev R. (2020).

Artificial Neural Networks in Inflation Forecasting at

the meso-level. SHS Web of Conferences. 93. 3rd

International Scientific Conference on New

Industrialization and Digitalization, 2020. 02005. DOI:

10.1051/shsconf/20219302005 https://www.shs-

conferences.org/articles/shsconf/abs/2021/04/shsconf_

nid2020_02005/shsconf_nid2020_02005.html

Dou W., Lo, A., Muley A., Uhlig H. (2017).

Macroeconomic models for monetary policy: a critical

review from a finance perspective SSRN working

paper. https://ssrn.com/abstract=2899842.

Andreev A. (2016). Prognozirovanie inflyacii metodom

kombinirovaniya prognozov v Banke Rossii. Bank

Rossii. Seriya dokladov ob ekonomicheskih

issledovaniyah, 14, pages 2–11.

Ahmatov K, Astrahanceva I., Kutuzova A., Votchel L.,

Vikulina V., (2020). Harmonization of banking

business models with the needs of the economy by

encouraging the exogenous social responsibility.

Journal Quality-Access to Success” Journal, Vol.

21,174, pages 81-87.

Inflyacionnye ozhidaniya (2020).

https://cbr.ru/statistics/ddkp/inflationary_expectations/

Federal'naya sluzhba gosudarstvennoj statistiki. (2020).

https://rosstat.gov.ru/priceVuiT, 4(32).:

https://cyberleninka.ru/article/n/ekologicheskaya-

sostavlyayuschaya-pri-razrabotke-strategii-

ustoychivogo-razvitiya-regionalnogo-apk (Accepted:

13.04.2021).

Dudin M.N., Kalendzhyan S.O., Lyasnikov N.V. 2017.

Green economy: a practical vector for Russia's

economic development. Ekonomicheskaya politika,

12(2), pages 86–99.

Mirzekhanova Z.G. 2018. Ecological aspects of the modern

development of remote regions in the format of the

"green economy" model. Regional'naya ekonomika:

teoriya i praktika, 6, pages 1082-1096.

Sustainable Regional Development based on the Inflation Forecasts: The Adaptive Models Application

319