Problems of Small Business Development and Mechanisms of Its

Support in the Region

Irina Zhuckovskaya

1a

, Marina Krasnova

1b

and Olga Yares

2c

1

Department of Commerce and Hospitality, Vladimir State University named after Alexander and Nikolay Stoletov, Gorky

Street, Vladimir, Russian Federation

2

Institute of Tourism and Entrepreneurship, Vladimir State University named after Alexander and Nikolay Stoletov, Gorky

Street, Vladimir, Russian Federation

Keywords: Small Business, Entrepreneurship, Problems, Business Support Measures, Government Support.

Abstract: The formation and development of the regional economy directly depends on the activities of business,

including small businesses, since the latter is aimed at providing services and producing goods that are

consumed mainly on the territory of the region, its residents and guests. Consequently, small business has a

predominantly pronounced regional focus. In Russia, the contribution of small and medium-sized businesses

to the gross domestic product (GDP) is about 20-22%, and the share of the employed economically active

population does not exceed 20-25%, while in developed economic countries these indicators are several times

higher. In addition, the SARS-CoV-2 (COVID-19) coronavirus pandemic and restrictive measures taken by

the Government of the Russian Federation led to the fact that the turnover of small and medium-sized

businesses, according to experts of the National Rating Agency, decreased by 2.8 trillion rubles in 2020, and

its share in the country's GDP may fall to 18.5% (under a stress scenario) [18]. The article discusses the

dynamics, the main problems of development and state support of small business in the Vladimir region.

1 INTRODUCTION

Small business plays a critical role in the modern

economy. The effectiveness of the functioning of

small enterprises is determined by many factors:

flexibility, mobility, stimulating competition,

mobilizing creative and financial resources of the

population, accelerating the restructuring of industry,

ensuring scientific and technological progress,

solving the problem of employment, and others.

In the economy of most regions of our country,

the potential of small business is not fully realized due

to the presence of problems not only of a regional, but

also of a national character, and in international

ratings Russia looks unattractive for the development

of entrepreneurship. For example, in the Global

Entrepreneurship Monitor (GEM) at the end of 2019,

the Russian Federation was ranked 41 out of 54

countries, and Switzerland, the Netherlands and Qatar

topped the ranking (see file Global Entrepreneurship

a

https://orcid.org/0000-0002-2824-0247

b

https://orcid.org/0000-0001-9022-5171

c

https://orcid.org/0000-0001-8143-3999

Monitor. 2019/2020).

The purpose of the article is to analyze trends in

the development of small business in the region and

the effectiveness of the mechanism of its state

support.

The objectives of the study are reduced to

identifying problems, the solution of which is

necessary for the further economic development of

small business in the region.

2 MATERIALS AND METHODS

The priority of economic thinking in relation to the

problems of entrepreneurship belongs to foreign

economists who have made a significant contribution

to the development of concepts for the development

of entrepreneurship, defining its characteristics in

various fields of activity and formulating its role in

the economy. Among the classic works devoted to

Zhuckovskaya, I., Krasnova, M. and Yares, O.

Problems of Small Business Development and Mechanisms of its Support in the Region.

DOI: 10.5220/0010667500003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 293-299

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

293

entrepreneurship, the scientific works of foreign

researchers from R. Cantillon to J. Schumpeter and

J.M. Keynes, as well as domestic scientists from M.I.

Tugan-Baranovsky to A.A. Aganbegyan. Among

modern studies, it is worth highlighting works that

consider the problems of the development of small

and medium-sized businesses in foreign countries

(including the post-Soviet space) (di Federico and

Dorigatti, 2020; Edmiston, 2007; Herr and

Nettekoven, 2017; Mazzarol and Reboud, 2020;

Sheppard, 2020; Kirby and Watson, 2017, etc.), as

well as in Russia and its regions (Barinova et al.,

2019; Bykovskaya et al., 2018; Chaplyuk, Sorokina

& Al' Humssi, 2019, etc.), including in a pandemic

(Lola, 2020). A number of scientific studies have

considered the mechanism of state support, certain

aspects of the regional economic policy of small

business organizations (Belanova, 2020; Golovetskii

et al., 2018; Kalmykov et al., 2019, etc.). It should

also be noted that at present the state mechanism of

influencing small business is shifting from the federal

to the regional level, which necessitates scientific

analysis and substantiation of developing processes in

regions and municipalities.

The research was based on the analysis of the

current legislative framework for the development of

small business at both the federal and regional levels.

To assess the factors of change in the small business

sector, the parameters of the National Project and an

intersectoral strategic planning document were used.

To analyze the situation provoked by coronavirus

infection, we used research by the National Rating

Agency (NPA, 2020), government documents, the

Federal State Statistics Service (Rosstat), materials

published on specially organized information sites for

population and business, etc. The analysis of small

business (SB) and its support was carried out in the

region of the Central Federal District of the Russian

Federation - the Vladimir region.

3 RESULTS

The most frequently used to assess the development

of the institution of small business is the number of

its subjects. If you look closely, then in the Vladimir

region (as well as in Russia as a whole) until 2016

there were relative stability and even a slight increase

in the number of small enterprises. However, since

2017, we have seen a negative trend. In almost all

spheres of activity decreased the number of

entrepreneurs and in 2020. As of January 10, 2021,

the number of small enterprises (including

microenterprises) amounted to 16.5 thousand units (in

2019 - 17.8 thousand units).

However, the growth of small businesses differs

significantly from year to year. In order to conduct a

deeper analysis of the dynamics of MB subjects, let

us turn to the indicators of business demography,

namely, the rates of «fertility» and the official

liquidation of enterprises per 1000 organizations

(Figure 1). In the modern world economy, about 50%

of small businesses live for 5 years, and 33% for 10

years. In Russia and its regions this figure is much

lower.

The data presented in Figure 1 clearly

demonstrate three main stages in the development of

entrepreneurial activity over the past 15 years. The

first stage (2005-2010) - active growth of small

business, when the birth rate significantly exceeded

the death rate, despite the slowdown caused by the

global financial crisis in 2008.The second stage

(2011- early 2016) is characterized by significant

instability and convergence of rates, and in 2015 even

a drop in the official liquidation rate. The third stage

(since 2016) is marked by a significant increase in the

closure of small enterprises and a decrease in their

number, especially since 2018.This indicates a steady

and significant outflow of entrepreneurs from this

sector of the Russian economy even before the start

of the pandemic caused by the coronavirus COVID-

19. In 2020, this situation was further aggravated after

the adoption of restrictive measures to counter the

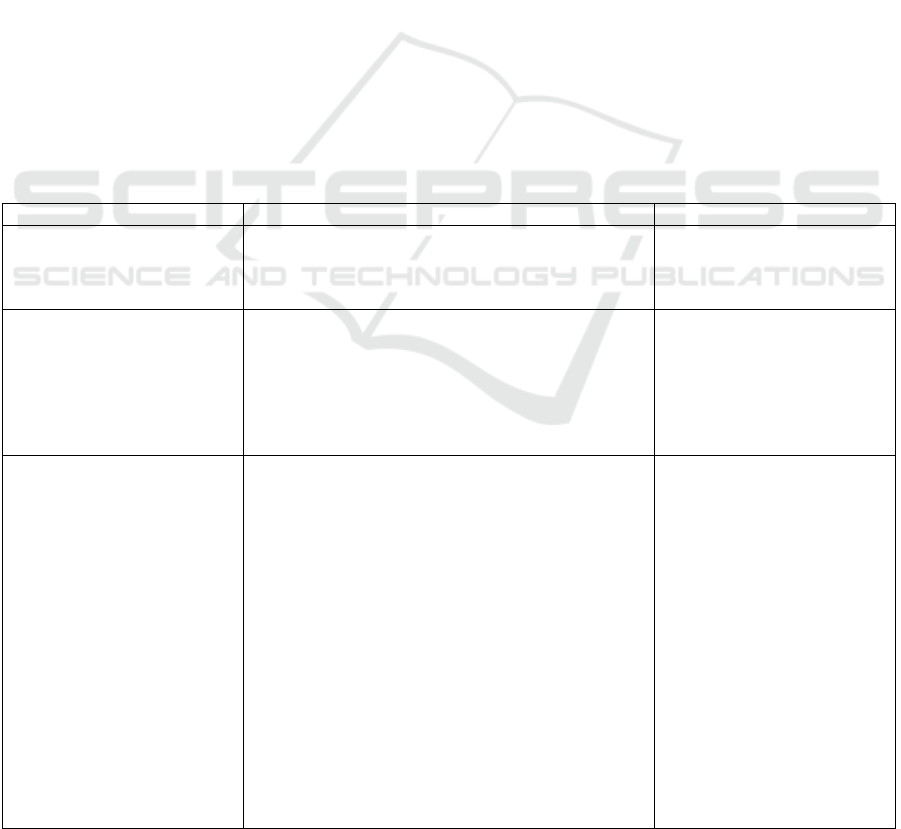

pandemic. All this leads to a sharp decline in the

number of employed workers and the turnover of

small businesses (Figure 2).

With regard to the sectoral structure, the first

place among the number of enterprises was occupied

by wholesale and retail trade (24.7%), the second and

third most important spheres were manufacturing

(9.82%) and enterprises engaged in construction

(9.64%). The smallest number of small businesses in

education, culture, sports, leisure and entertainment.

If we compare these data with the indicators for

Russia as a whole, we can see that in the small

business sector the first places are also occupied by

wholesale and retail trade (36%), construction (13%)

and manufacturing (9%).

Analyzing the change in the volume of

investments for the period from 2017 to 2019, we can

observe a decrease in investments in fixed assets of

small enterprises (by 41.9%).

.

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

294

Source: Federal State Statistic Service. URL: https://gks.ru/

Figure 1: Dynamics of demographic indicators of small businesses in the Vladimir region in 2005-2020.

Source: Federal State Statistic Service. URL: https://gks.ru/

Figure 2: Dynamics of changes in the average number of employees and turnover of small businesses in the Vladimir region

in 2010-2020.

It should be noted that the innovation sector does

not yet play a significant role in the regional

economy: enterprises of the Vladimir region mainly

produce traditional products. The share of

technologically advanced and knowledge-intensive

industries in the gross regional product does not

exceed 2.2%.

The analysis of the state of small business in the

region made it possible to single out the main

problems hindering the development of small

business.

The first problem standing in the way of the

development of small businesses is the concept of

entrepreneurship itself, which always implies the risk

of activity, while this risk is often impossible to

predict. In conditions of political and economic

uncertainty, the risk does not allow a small business

to establish its name and gain a foothold in the

market, which, in fact, destroys the company, it

simply ceases to exist.

The second significant problem is the excessive

administrative and organizational barriers on the way

to obtaining state support for small businesses.

The reduction of the tax burden by entrepreneurs

also speaks of the problem of the imperfection of the

country's tax system and the imperfection of Russian

legislation in general. For example, regional

authorities, in order to support the MB, have the right

to reduce the tax rate for certain types of

entrepreneurial activity, but this right has not been

implemented in the Vladimir region. However, in

connection with the pandemic, entrepreneurs were

provided with a measure of state support at the federal

level - the provision of tax holidays.

The compulsory introduction of cash registers

with a fiscal accumulator and labeling of goods has

also become a problem for small and medium-sized

businesses (especially in retail trade), which entailed

additional financial costs for the business.

The next problem is the lack or complete absence

of free own financial resources, as well as the

inaccessibility of bank loan products for small

businesses.

State support for small and medium-sized

businesses is carried out on the basis of a whole

package of regulatory legal acts, including the

Federal Law of the Russian Federation «On the

Development of Small and Medium Business in the

0,0

50,0

100,0

150,0

200,0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Organizational fertility rate Official liquidation rate of enterprises

100,0

110,0

120,0

130,0

140,0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0,00

100,00

200,00

300,00

400,00

Average number of

employees

Turnover of enterprises

Average number of employees, thousand people Turnover of enterprises, billion rubles

Problems of Small Business Development and Mechanisms of its Support in the Region

295

Russian Federation» (of July 24, 2007 No 209-FZ),

the national project «Small and medium business and

support for individual entrepreneurial initiative»,

Strategy for the development of small and medium

business in the Russian Federation for the period up

to 2030 (Order of the Government of the Russian

Federation of June 02, 2016. No. 1083-r).

To provide assistance to business entities in the

region, in accordance with Russian legislation, a

program of its own was adopted («Development of

small and medium-sized business in the Vladimir

region» of November 05, 2013 No 1254-pg), which

determines the results of its implementation in

dynamics until 2024. This program also includes two

subprograms: first – «Development of regional

infrastructure for supporting small and medium-sized

enterprises»; the second – «Financial support for

small and medium-sized enterprises», which provides

for measures of financial support for small and

medium-sized enterprises.

Government support for small and medium-sized

businesses within their competence is provided by the

Administration of the Vladimir region (Department

of Entrepreneurship of the Vladimir region) and local

government bodies. Infrastructure support of the

Ministry of Railways has been operating in the region

for several years, it includes 10 organizations, for

example, such as the Fund for Assistance to the

Development of Small and Medium-Sized

Businesses in the Vladimir Region, the Vladimir

Leasing Fund, the Business Incubator, etc.

At the level of municipalities, their own small

business support programs were also approved.

Thus, we can conclude that regional and

municipal authorities are trying to comprehensively

help the development of both existing and newly

opened businesses.

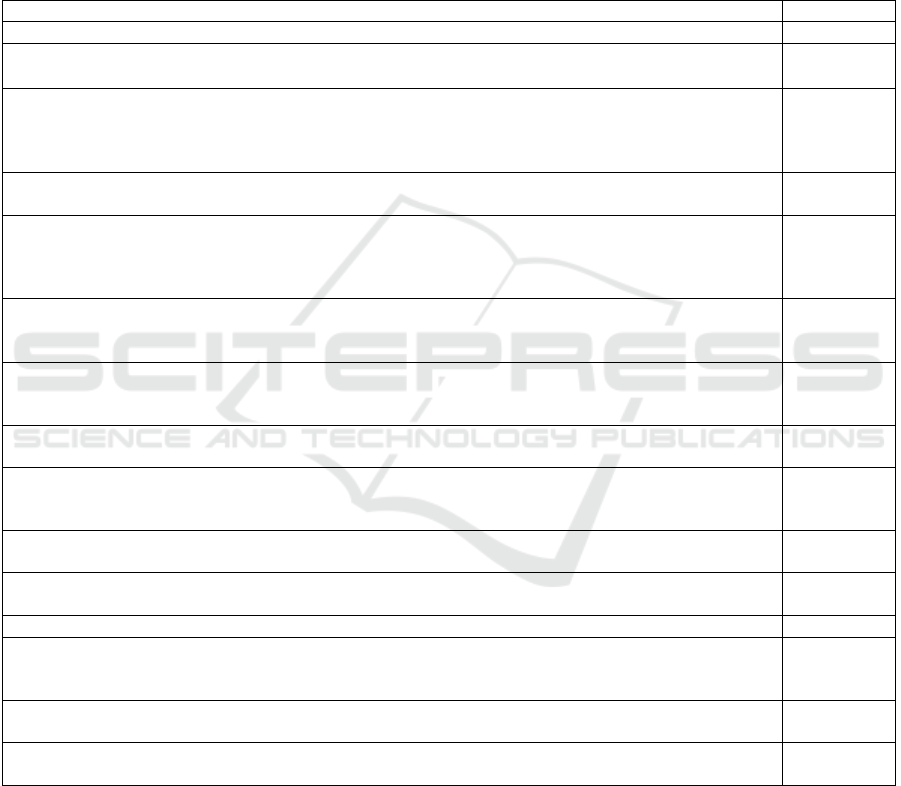

We will assess the effectiveness of the

implementation of the regional program on the basis

of the indicators specified in it. The data for

calculating the effectiveness of the Program

«Financial support for small and medium-sized

businesses» and the state program «Development of

small and medium-sized businesses in the Vladimir

region» were also taken from the report of the

Department of entrepreneurship of the Vladimir

region.

Table 1: Evaluations of the effectiveness of the regional subprogram «Development of regional infrastructure to support small

and medium-sized businesses».

Valuation type Assessment procedure Indicato

r

Assessment of the degree of

achievement of goals and

solves the tasks of the program

as a whole

The assessment is made by comparing the actually

achieved values of the program indicators and their

program values

Lg - the degree of achievement

of goals (solving problems)

Lg =142%

Assessment of the degree of

compliance with the planned

level of costs and the

efficiency of using funds from

the federal, regional budgets

and other sources of resource

support for the Program

The assessment is made by comparing the actual and

planned values of financing of subprograms, from all

sources of support for resources in general

Lf - the level of funding for the

implementation of the main

activities of the Program

(subprogram)

Lf = 128,4%

Assessment of the degree of

implementation of the

activities of the Program

(achievement of direct results

expected from its

implementation) based on

comparison of direct expected

results and effectively

obtained from the

implementation of the main

activities of the subprogram

over the years based on the

annual plans for the

implementation of the

Program

The program is considered to be implemented with

high efficiency if:

- the values of 95% or more of the indicators of the

Program and subroutines are fulfilled by at least 95%;

- the level of funding for the implementation of the

main activities of the Program (UF) was at least 95%,

the level of funding for the implementation of the main

activities of all subprograms was at least 90%;

- at least 95% of the activities planned for the reporting

year have been fully completed.

The program is considered to have been completed

with a satisfactory level of effectiveness if:

- values of 80% or more of the subprogram indicators

are satisfied by at least 75%;

- the level of funding for the implementation of the

main activities of the Program (Lg) was at least 70%;

- at least 80% of the activities planned for the reporting

year have been fully implemented.

Lg = 80%

Lf > 95%

100% of the activities planned

for the reporting year were

completed in full

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

296

Based on the results of the assessment, it can be

concluded that the lowest level of goal achievement

(Lg) was 0.6 for the indicator of measures in the

development of municipalities. The high level of

achievement of the program was 3.75 for the indicator

of the creation of new enterprises.

After a full assessment of subprogram 1, it can be

concluded that 80% of the indicators were achieved

with a high level of efficiency. The level of funding

for the implementation of the main activities of the

Program was more than 95%, and the activities

planned for the reporting year were completed in full.

It follows from the assessment that the level of

effectiveness of the Program implementation is

satisfactory.

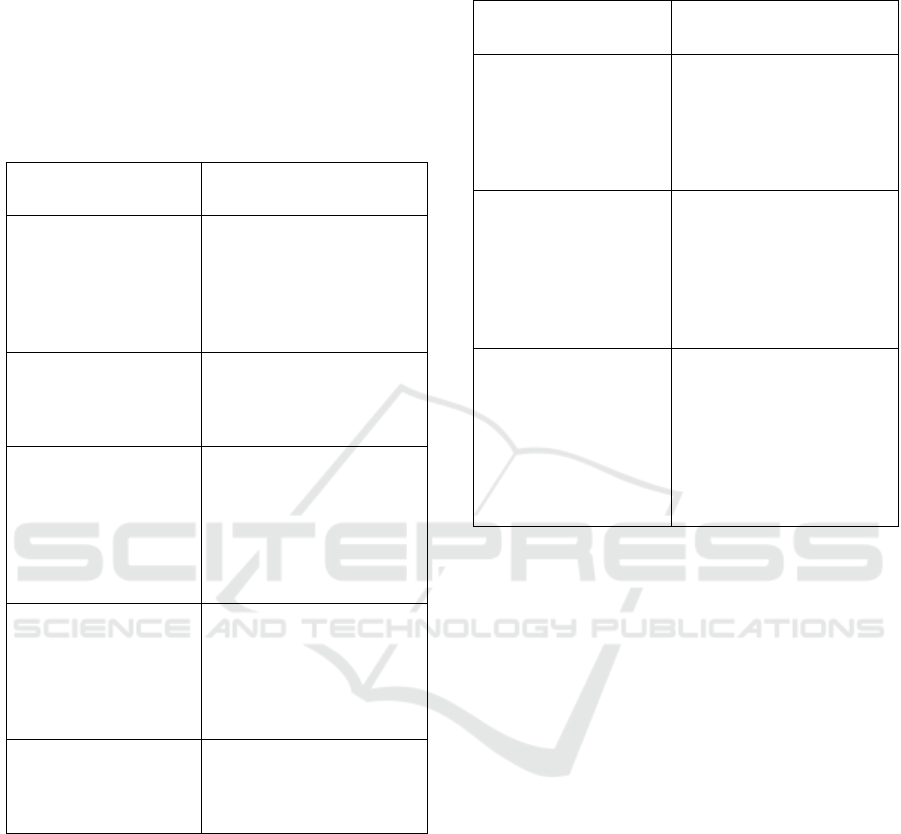

We will assess the compliance of the degree of

cost effectiveness under the second program (table 2).

Table 2: Evaluations of the effectiveness of the regional program «Financial support for small and medium-sized businesses».

Valuation t

yp

e Indicato

r

Assessment of the de

g

ree of achievement of

g

oals and solves the tasks of the

p

ro

g

ram as a whole L

g

=142%

Assessment of the degree of compliance with the planned level of costs and the efficiency of using funds

from the federal, regional budgets and other sources of resource support for the Program

Lf = 128,4%

Measure 1.1 - State support of small and medium-sized businesses in the constituent entities of the Russian

Federation - a gratuitous subsidy to the Microcredit Company «Fund for Assistance to the Development

of Small and Medium-Sized Businesses of the Vladimir Region» (to provide loans to small and medium-

sized businesses)

Lf = 148,9%

Measure 1.2 - State support for small and medium-sized businesses in the constituent entities of the

Russian Federation - free of char

g

e

Lf = 100%

Measure 2.1 - State support for small and medium-sized businesses in the constituent entities of the

Russian Federation - support for small and medium-sized businesses as part of the implementation of

municipal programs (subprograms) for the development of small and medium-sized businesses, including

sin

g

le-industr

y

munici

p

alities

Lf = 100%

Measure 2.2 - State support for small and medium-sized businesses in the constituent entities of the

Russian Federation - a subsidy to the «My Business» Center for the provision of services to small and

medium-sized businesses

Lf = 100%

Measure 2.3 - State support for small and medium-sized businesses in the constituent entities of the

Russian Federation - subsidy Autonomous non-profit organization «Coordination Center» to provide

services to small and medium-sized businesses

Lf = 100%

Measure 2.4 - State support for small and medium-sized businesses in the constituent entities of the

Russian Federation

Lf = 100%

Measure 3 - Subsidy to the «Business Incubator» for financial support of the fulfillment of the state

assignment for the provision of public services in accordance with the list approved by the Department of

Entre

p

reneurshi

p

Lf = 102,5%

Measure 4 - Federal project «Popularization of entrepreneurship» of the national project «Small and

medium-sized entre

p

reneurshi

p

and su

pp

ort of individual entre

p

reneurial initiative»

Lf = 100%

Measure 5 - Provision of leasing services by the VladimirLeasing Fund to small and medium-sized

b

usinesses

Lf = 101,9%

Measure 6 - Provision of services b

y

the Protot

yp

in

g

Center to small and medium-sized businesses Lf = 107,2%

Measure 8 - Support for small and medium-sized businesses in the framework of the implementation of

municipal programs (subprograms) for the development of small and medium-sized businesses, including

sin

g

le-industr

y

munici

p

alities

Lf = 100%

Measure 9 - Provision of a range of services, services and support measures to small and medium-sized

b

usinesses in the Center «My Business»

Lf = 81,6%

Measure 10 - Provision of services by the center (agency) for coordination of support for export-oriented

small and medium-sized businesses of the Vladimir region to small and medium-sized businesses

Lf = 81,3 %

So, after assessing the effectiveness of

Subprogram No. 2, it can be concluded that the

financing of activities in general is 95% completed,

which was influenced by the underfunding of the

«My Business» event and the provision of services by

the coordination center to support export-oriented

small and medium-sized businesses in the Vladimir

region. From this we can conclude that entrepreneurs

are little aware of changes in legislation and support

measures.

4 DISCUSSION

Now we will consider in detail the problems of

Problems of Small Business Development and Mechanisms of its Support in the Region

297

implementing state programs for supporting small

businesses and the proposed directions for improving

the financial and credit mechanism of regional

support for small businesses in the Vladimir region.

Let's start with revising the instruments of state

financial support for small businesses (Table 3).

Table 3: The main problems of instruments for regional

financial support of small businesses in the region and ways

to solve them.

Description of the

p

roble

m

Solutions

Microcredit organization

operates in competitive

lending markets and is

actually not a

development institution

Consider the possibility of

focusing activities on project

financing for innovative

businesses, industrial startups

and other priority areas of small

b

usiness

A small number of issued

guarantees and sureties

Guarantee Fund (GF)

The GF to double the number

of unique small businesses

that have received a surety /

guarantee.

Lack of understanding of

the small business entity

about the reasons for the

refusal by the GF

To oblige the participants of

the GF to provide information

on the reasons for refusals at

the request of a small business

entity (if information is

obtained from open data

sources).

The GF is not efficient

enough

Form the Regional

Development Council on the

principles of

representativeness of all

stakeholders, primarily

b

usiness and bankin

g

ex

p

erts

VladimirLizin» - in

demand by small

businesses - no collateral

re

q

uire

d

Increase limits for small

businesses. Subsidize lease

rates.

The next step is to revise the program of the

regional program to support small and medium-sized

businesses (Table 4).

In our opinion, the operation of the mechanism of

state support for small and medium-sized businesses

in the region should be strengthened by attracting

resources of state, targeted, departmental programs

implemented at all levels, on a consolidating basis, as

well as a comprehensive mechanism and support

tools that have received the best development in other

regions.

Table 4: Ways to solve the problems of regional financial

support for small and medium-sized businesses in the

Vladimir region.

Description of the

p

roble

m

Solutions

A different list of

documents and

questionnaire forms

complicates the process of

submitting applications to

several banks at once

Introduce a standardized list

of documents requested from

borrowers to obtain loans

A small business entity's

lack of understanding of

the reasons for the bank's

refusal makes it

impossible to reapply for

support

To oblige authorized banks to

provide information on the

reasons for refusals at the

request of a small business

entity (if the information is

obtained from open data

sources)

Low margins and high

labor costs of banks for

consideration of

applications of small

businesses

To increase the amount of

subsidies for authorized banks

to compensate for lost income

on loans to small businesses.

Consider the possibility of

developing special programs

for financial support of small

b

usinesses and their startu

p

s

5 CONCLUSION

In conclusion, it should be noted that at present the

activity of small business in the region is proceeding

with complications, and its effectiveness remains

rather low. Small businesses for the most part do not

expand their production potential, do not participate

in the implementation of innovative projects, but only

perform certain functions of an intermediary between

the manufacturer and the consumer directly. This

situation is a negative factor for the development of

the region's economy.

It should also be noted that the future of small

business in Russia is directly determined by the

possibilities for the development of real production

and the formation of close cooperation ties between

small and large businesses. As practice shows, in the

current economic situation a large, if not dominant,

part of small business is in one way or another in the

sphere of interests of big business. At the same time,

the stability of the situation, income, financial and

investment opportunities of small enterprises directly

depend on their relationship with large enterprises.

It is obvious that the development of cooperation

between small and large enterprises is an important

direction for the development of the entire business

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

298

environment. If small businesses continue to shrink,

not grow, then there will be no medium or large

business in the region. Therefore, stimulating

cooperation between small and large businesses

should become an important part of government and

business policy.

Thus, the analysis and the identified problems

allowed us to conclude that it is necessary to use a

systemic mechanism of state support for small

businesses in Russia and its regions. In our opinion,

the operation of the mechanism of state support for

small business in certain regions should be

strengthened by attracting resources from state,

targeted, departmental programs implemented at all

levels, on a consolidating basis. Such a systematic

application of the mechanism of state support for

small business will not only increase the efficiency of

the use of budgetary funds, but will also make it

possible to quickly restore the turnover of small

business to the pre-crisis level and develop further.

REFERENCES

Barinova, V.A., Zemtsov, S.P., Knobel, A.Yu. and

Loschenkova, A.N. (2010). Small and Mid-Sized

Business as a Factor of Economic Growth in Russia,

https://www.iep.ru/files/text/working_papers/Nauchny

e_trudy-178.pdf

Belanova, N.N. (2020). Government programs efficiency

assessment: key indicators and indices, Ekonomika,

predprinimatelstvo i pravo, 10(3): 487-502.

Bykovskaya, Yu.V., Ivanova, L.N. and Safokhina, E.A.

(2018). Small and medium-sized business in modern

Russia: the state, problems and directions of

development, The Eurasian Scientific Journal, 10(5).

Chaplyuk, V.Z., Sorokina L.N. and Al' Humssi, Ahmad

(2019). Trends and incentives of small and medium

business development, Financial economics, 4: 772-

777.

di Federico, R. and Dorigatti L. (2020). Small Firms and the

Labour Market, Regalia I. (eds) Regulating Work in

Small Firms, Palgrave Macmillan, Cham.

Edmiston, K. (2007). The Role of Small and Large

Businesses in Economic Development, SSRN

Electronic Journal, 92(Q II): 73-97.

Federal State Statistics Service, https://www.gks.ru/

Global Entrepreneurship Monitor. 2019/2020. Global

Report, https://www.gemconsortium.org/report/gem-

2019-2020-global-report.

Golovetskii, N., Grebenik, V. and Kokhanovskaya, I.

(2018). State support of small and medium

entrepreneurship in Rusia at federal and regional levels,

Vestnik Universiteta, 12: 71-76.

Herr, H. and Nettekoven, Z.M. (2017). The Role of Small

and Medium-sized Enterprises in Development What

Can be Learned from the German Experience? Berlin,

https://library.fes.de/pdf-files/iez/14056.pdf

Kalmykov, N.N., Ivanova, T.B., Zemlyanskaya, I.S.,

Miroshnikov, N.I. and Isaev A.P. (2019). About

improvement of mechanisms of support of subjects of

small and medium business, Rossiyskoe

predprinimatelstvo. 20(3): 789-806.

Lola, I.S. (2020). Business activity and prospects for the

development of small enterprises in Russia in the

context of the coronavirus crisis, Moscow: HSE.

Mazzarol, T. and Reboud, S. (2020). Innovation in Small

Firms, Entrepreneurship and Innovation, pages 131-

164.

NPA, SMB: Deferred Victims. Analytical review,

https://www.ra-

national.ru/sites/default/files/analitic_article/Research

_SME_21022021.pdf.

Sheppard, M. (2020). The relationship between

discretionary slack and growth in small firms,

International Entrepreneurship and Management

Journal, 16: 195-219.

Small Firms and Economic Development in Developed and

Transition Economies: A Reader (2017). Edited by

David A. Kirby, Anna Watson. – LÍÍondon: Routledge.

Problems of Small Business Development and Mechanisms of its Support in the Region

299