Assessment of Various Factors Impact on Cryptocurrency

Functioning using Economic and Mathematical Modeling

E. V. Chaykina

a

, E. A. Posnaya

b

and B. A. Bukach

c

Institute of Finance, Economics and Management, Sevastopol State University, Universitetskaya Street, Sevastopol, Russia

Keywords: Cryptocurrency, Gold, Silver, Platinum, US Dollar, Modeling, Exploratory Factors.

Abstract: This article has developed an economic and mathematical model that reflects the dependence of the

cryptocurrency rate on factors of an exploratory nature. At present, an interesting and promising area of

research is exploratory analysis, the economic meaning of which is to study the influence of sudden factors

on the final result. Against the backdrop of the development of modern technologies in the world, taking into

account the depreciation of the US dollar and the withdrawal of investors from the stock markets, the

cryptocurrency market is considered one of the most promising and most influenced by exploratory factors.

The cryptocurrency rate is based on economic expectation, and not on the availability of real assets. The

article discusses the main indicators that affect the cryptocurrency rate, using the example of Bitcoin. An

economic-mathematical model of the dependence of the price of bitcoin on a number of the most significant

indicators is built. The economic and mathematical model proposed in the study allows you to take into

account the degree of influence of exploratory factors on the formed cryptocurrency rate. The developed

model will allow the most accurate prediction of the cryptocurrency rate in modern financial and economic

conditions, since it takes into account exploratory factors.

1 INTRODUCTION

Today, the cryptocurrency market is actively

developing. At the beginning of 2017, due to the rapid

growth of the cryptocurrency market capitalization,

many saw it as signs of a financial pyramid, but

gradually the opinion began to change. “Financial

institutions introduced Bitcoin futures, large investors

began to come to the cryptocurrency market,

pessimistic forecasts began to be replaced by more

optimistic ones” (Kornilov et al., 2017).

The collapse of bitcoin in March 2020, according

to analysts at JPMorgan Chase, was a stress test for the

cryptocurrency market. “The industry managed to

cope with it in a matter of months. Now Bitcoin is

periodically subject to correction, but it has every

chance to become the main competitor for stock

markets. Many investors transfer their savings from

the stock market to the currency. According to Dan

Tapeiro, an investor and founder of Gold Bullion

International, “the dollar will weaken even more, and

a

https://orcid.org/0000-0003-4413-3414

b

https://orcid.org/0000-0002-7716-9117

c

https://orcid.org/0000-0002-0554-6980

digital assets will become its full-fledged

competitors”.

The iTrustCapital cryptocurrency trading platform

conducted its own research to find out which asset

people of different generations are willing to invest in

during pandemics and epidemics. “Respondents aged

33 to 44 are twice as likely as the others to call bitcoin

and cryptocurrencies the most protected asset in

general. They tend to invest in modern assets such as

cryptocurrencies, stocks and bonds, but they do not

exclude gold. It is worth noting that 44% of

respondents admitted that they consider gold to be the

most profitable investment tool, which is valuable at

any time and under any conditions”.

130

Chaykina, E., Posnaya, E. and Bukach, B.

Assessment of Various Factors Impact on Cryptocurrency Functioning using Economic and Mathematical Modeling.

DOI: 10.5220/0010665000003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 130-137

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 THEORETICAL, EMPIRICAL

AND METHODOLOGICAL

GROUNDS OF THE RESEARCH

Cryptocurrency is an encrypted unregulated digital

asset that is used as an analogue of currency in

exchange transactions. Cryptocurrency does not have

a physical form, it exists only in the electronic

network in the form of data. At the moment, there is

no single approach to determining the nature of

virtual currencies and their classification. According

to the opinion of a group of scientists,

cryptocurrencies can be classified according to their

functions and liquidity level (Jeskindarov et al.,

2018):

the first group: cryptocurrencies that are used as

a means of payment, means of accumulation

(savings), exchange, and as an investment tool

(Bitcoin, Bitcoin-cash, Ripple, etc.);

second group: cryptocurrencies tokens.

Cryptocurrencies of this group are used as a

means of payment, means of accumulation

(savings), exchange, and as an investment tool

(STRAT, Waves, etc.);

the third group: tokens and cryptocurrencies that

have not received distribution as a means of

payment, means of accumulation (savings) and

exchange, and are not used as an investment tool

(TRUMP-COIN etc.).

According to statistics of the Coinmarketcap

service, the list of cryptocurrencies is approaching

one and a half thousand, and according to the A.

Treschev calculations, the founder of the Russian

Association of Cryptocurrencies and Blockchain,

there are more than 900 of them.

The attractiveness of cryptocurrencies is due to

the following factors:

the release of cryptocurrency into circulation is

decentralized, there are no non-issuing nature of

crypto assets and state registration;

independence of emissions from political

preferences and economic views of the subjects

of the system. Cryptocurrency is not a debt

obligation of the issuer, it does not belong to

central banks, which distinguishes it from

electronic money and non-cash payments;

indisputable right of ownership (the presence of

an individual key, the operation with

cryptocurrency cannot be performed by the

counterparty without the private key of the

contract holder; the holder can choose to execute

the algorithm regardless of citizenship, place of

residence, nation, religion, gender);

An advanced technology of the register of blocks

of information of the blockchain, on the basis of

which the majority of cryptocurrencies are

created and transmitted. Blockchain technology

ensures the transparency of the cryptocurrency

circulation mechanism, all of whose elements are

controlled by a large number of independent

entities;

uninterrupted operation due to the low

probability of a simultaneous failure in the work

of all entities;

use of cryptocurrency as a means of payment;

current anonymity of payments (privacy of

personal data of the parties);

the transfer of a digital asset occurs without

intermediaries;

the cost of transfers is low or translation is free

of charge;

The transaction speed is higher compared to the

international interbank system SWIFT;

with respect to cryptocurrency, there is no

problem of limiting liquidity even when the

entire amount of cryptocurrency is developed,

since a unit of currency is divisible into smaller

parts. “The total volume of the currency is known

in advance, and the creation of each new block is

accompanied by the solution of more complex

mathematical problems, which leads to an

artificial limitation of the growth rate of the

currency supply” (Shaidullina, 2018).

cryptocurrencies are used by an unlimited

number of people to complete transactions for the

sale of goods, payment for work and services, as

well as for investment purposes;

cryptocurrencies are considered by market

entities as a source of revenue generation in

connection with their use, mining, participation

and raising capital through ICOs, operations on

the exchange.

Despite all its advantages, cryptocurrencies have

the following disadvantages:

cryptocurrency, as a subject of exchange,

settlement operations, a means of creating or

acquiring capital, as well as an object of

investment activity, is risky in nature, since it is

not provided with real assets and is highly

volatile, which creates a risk of losses

(Jeskindarov et al., 2018):

legal vulnerability of investors. The use of

cryptocurrency in many countries is not legally

regulated by legal documents or is prohibited,

due to the lack of the ability to centrally regulate

cryptocurrency and to prevent its use in the

process of combating money laundering and

terrorist financing;

Assessment of Various Factors Impact on Cryptocurrency Functioning using Economic and Mathematical Modeling

131

the danger of cyberattacks entails the possibility

of a risk of insecure cryptographic code, it is

almost impossible to deal with this risk, since the

existing financial infrastructure is built on key

principles of encryption;

the risk of losing access to the crypto asset due to

the loss of keys or because of their theft. This risk

can be reduced through the use of password

managers or specialized equipment.

Cryptocurrency does not act as a commitment to

anyone. It is not provided with anything, and its value

is based on the expectations of market players.

Cryptocurrency quotes are formed solely by the

balance of supply and demand, not initially tied to any

currency or other asset; however, there are factors that

affect its rate.

The most popular virtual and widespread currency

in the world is Bitcoin. Bitcoin's market capitalization

currently stands at about 172.6 billion US dollars.

Bitcoin, despite its high volatility, is considered one

of the most profitable investment tools in the

cryptocurrency market (Figures 1, 2).

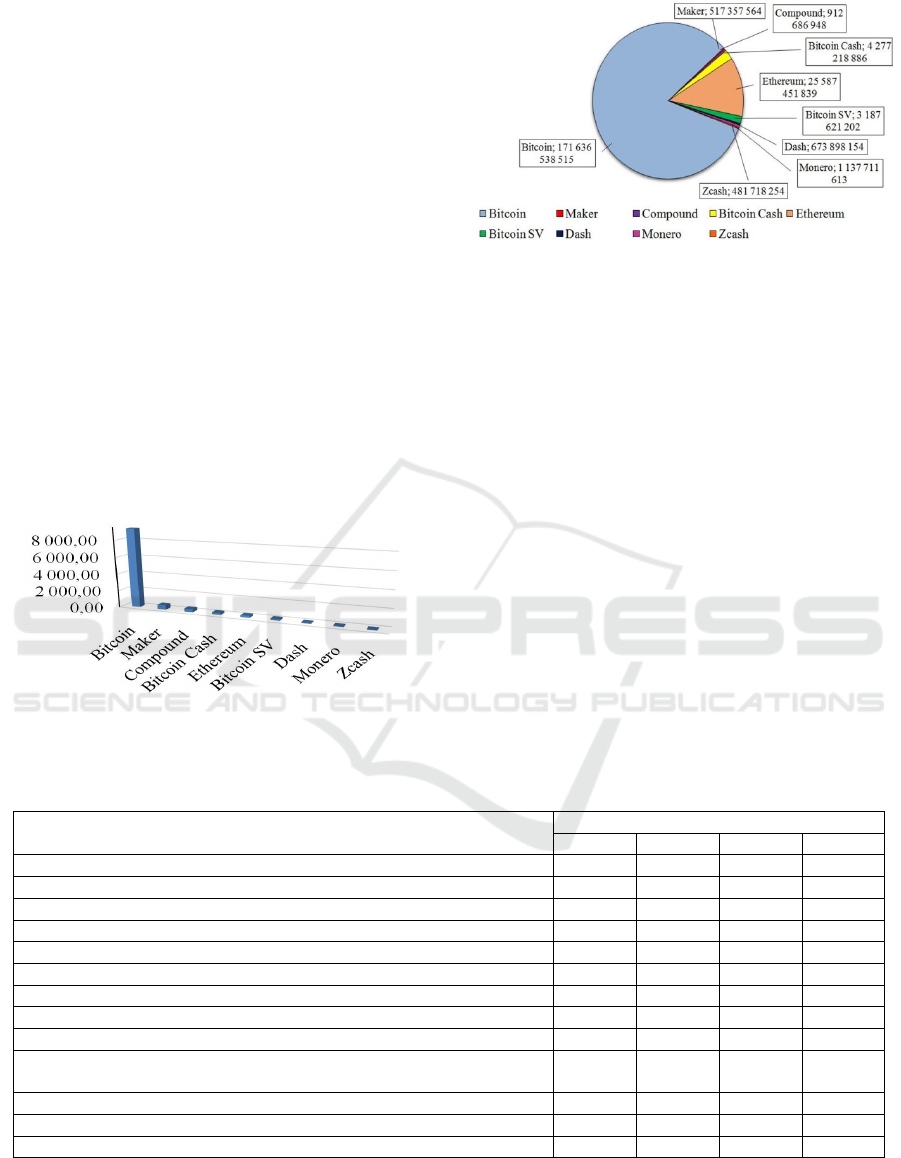

Figure 1: Price of the TOP 10 cryptocurrencies as of

06/20/2020 (USD).

Figure 2: TOP 10 cryptocurrencies in terms of market

capitalization as of June 20, 2020 (USD).

An exploratory factor analysis is used to study

Bitcoin price formation that is, such an analysis

system, according to which it is not initially

determined which factors can most accurately

describe the relationships and interdependencies.

Explosiveness (from French explosion -

explosion) is a clinical violation. Readiness for a

sudden, sometimes inadequate, explosive nature,

manifestation of the effect.

We will build economic and mathematical models

of the impact on the price of Bitcoin of a number of

the most significant indicators indicated below (Table

1).

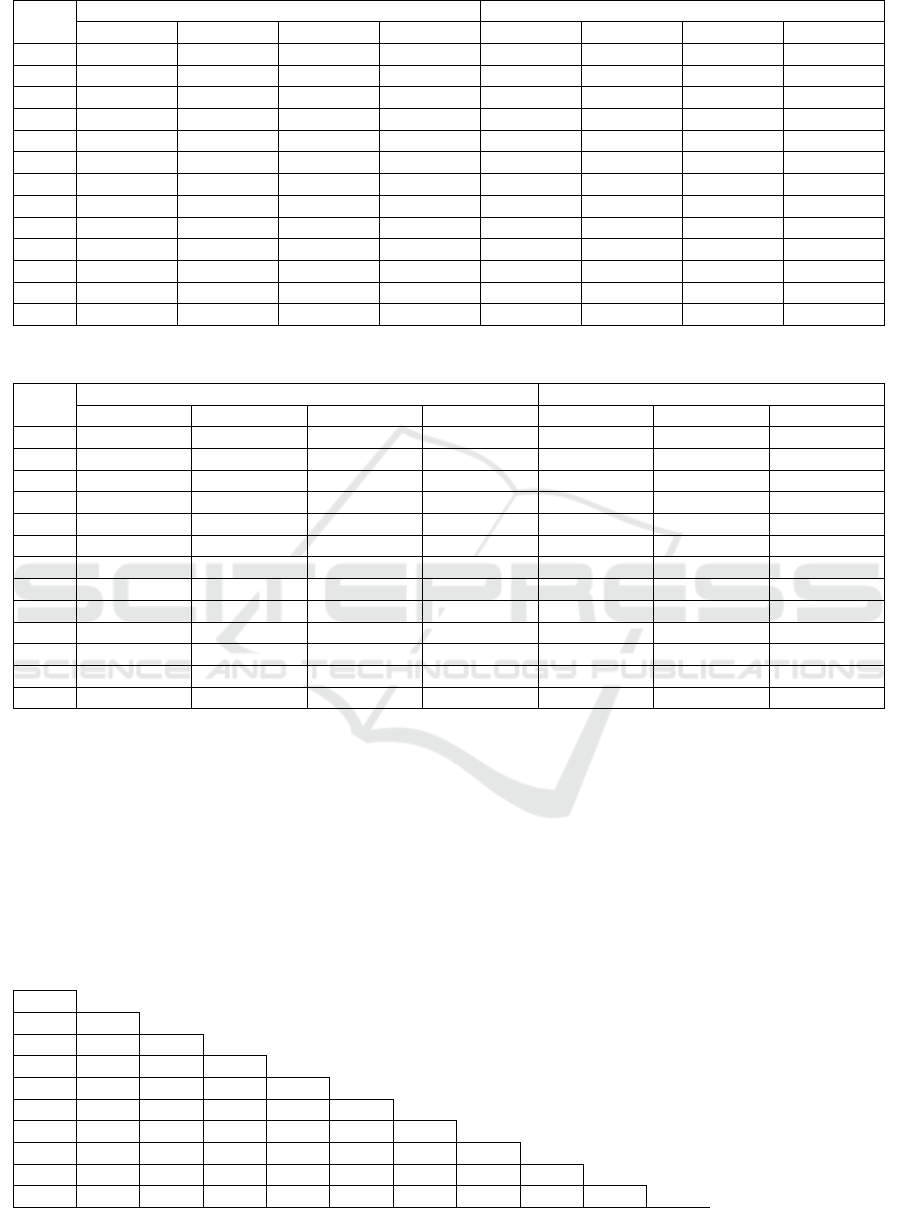

Table 1: Initial data.

Index

2014

I qr. II qr. III qr. IV qr.

X

1

–

Total Gold Offer

(

tn

)

1 104.1 1 104.1 1 104.1 1 104.1

X

2

–

Total

g

old demand

(

tn

)

1 093.9 1 093.9 1 093.9 1 093.9

X

3

–

Gold

p

rice

(

London PM fix

)

(

US$/tro

y

ounce

)

1 293.1 1 293.1 1 293.1 1 293.1

X

4

–

Silver (US$/troy ounce) 19.97 20.87 17.11 15.79

X

5

–

Platinum (US$/troy ounce) 1 418.0 1 480.0 1 300.0 1 206.0

X

6

–

Palladium (US$/troy ounce) 778.0 844.0 775.0 811.0

X

7

–

Brent Oil

(

dollars/barrel

)

107.70 112.40 94.80 57.54

X

8

–

Euro/dollar, €/$ 1.3771 1.3771 1.3771 1.3771

X

9

–

British

p

ound/dollar, £/$ 1.6663 1.6663 1.6663 1.6663

X

10

– S&P 500

1

872.34

1

872.34

1

872.34

1

872.34

X

11

–

U.S. Treasur

y

current liabilities

(

12 months

)

(

Treassur

y

Bills

)

, % 0.13 0.13 0.13 0.13

X

12

–

US Federal Reserve Rate, % 0.25 0.25 0.25 0.25

Y

–

Bitcoin, Bitcoin / $ 702.55 702.55 702.55 702.55

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

132

Table 1: Initial data (cont.).

Index

2015 2016

I

q

r. II

q

r. III

q

r. IV

q

r. I

q

r. II

q

r. III

q

r. IV

q

r.

X

1

1 086.2 1 044.1 1 128.8 1 092.1 1 182.8 1 167.2 1 174.3 1 086.1

X

2

1 110.1 958.3 1 162.7 1 112.2 1 284.0 1 055.1 1 027.7 972.0

X

3

1 218.5 1 192.4 1 124.3 1 106.5 1 182.6 1 259.6 1 334.8 1 221.6

X

4

16.60 15.70 14.65 13.82 15.38 18.36 19.35 16.24

X

5

1 129.0 1 078.0 908.0 868.0 976.0 999.0 1 034.0 898.0

X

6

729.0 677.0 661.0 555.0 569.0 589.0 722.0 670.0

X

7

55.10 62.05 47.92 36.56 39.61 50.73 49.41 56.75

X

8

1.0731 1.1138 1.1177 1.0861 1.1380 1.1105 1.1241 1.0516

X

9

1.4818 1.5709 1.5129 1.4739 1.4362 1.3311 1.2976 1.2338

X

10

2 067.89 2 063.11 1 920.03 2 043.94 2 059.74 2 098.86 2 168.27 2 238.83

X

11

0.26 0.28 0.33 0.65 0.59 0.45 0.59 0.85

X

12

0.25 0.25 0.25 0.50 0.50 0.50 0.50 0.75

Y 248.54 236.67 257.43 341.04 411.58 515.61 616.76 718.09

Table 1: Initial data (cont.).

Index

2017 2018

I

q

r. II

q

r. III

q

r. IV

q

r. I

q

r. II

q

r. III

q

r.

X

1

1 037.2 1 092.1 1 185.7 1 138.0 1 107.1 1 079.0 1 161.6

X

2

1 107.5 1 031.9 988.8 1 073.6 998.3 992.8 1 013.0

X

3

1 219.5 1 256.6 1 277.9 1 275.4 1 329.3 1 306.0 1 213.2

X

4

18.06 16.47 16.86 16.74 16.52 16.03 14.31

X

5

940.0 922.0 920.0 917.0 936.0 851.0 815.0

X

6

798.0 841.0 935.0 1 033.0 970.0 953.0 1 094.0

X

7

53.62 48.94 56.53 66.87 69.35 79.12 82.98

X

8

1.0652 1.1426 1.1814 1.1998 1.2323 1.1685 1.1609

X

9

1.2550 1.3027 1.3397 1.3515 1.4018 1.3209 1.3039

X

10

2 362.72 2 423.41 2 519.36 2 673.61 2 640.87 2 718.37 2 913.89

X

11

1.03 1.24 1.31 1.76 2.09 2.33 2.59

X

12

1.00 1.25 1.25 1.50 1.75 2.00 2.25

Y 934.49 1864.46 3397.77 9398.57 10672.55 7829.15 6799.21

3 RESULTS

Quarterly values are considered for calculation:

indicators of supply and demand for gold, prices for

precious metals (gold, silver, platinum, palladium),

oil prices, exchange rates of major currencies, stock

indices, discount rate of the Fed, securities with a

guaranteed level of yield (short-term US Treasury

Obligations) for the period from 2014 to 2018

inclusive. The number of members of the time series

of indicators (20) is quite sufficient for reliable

statistical analysis. First, we compose a matrix of pair

correlations between the variables (Table 2). Since

this matrix is symmetric, its lower part is presented.

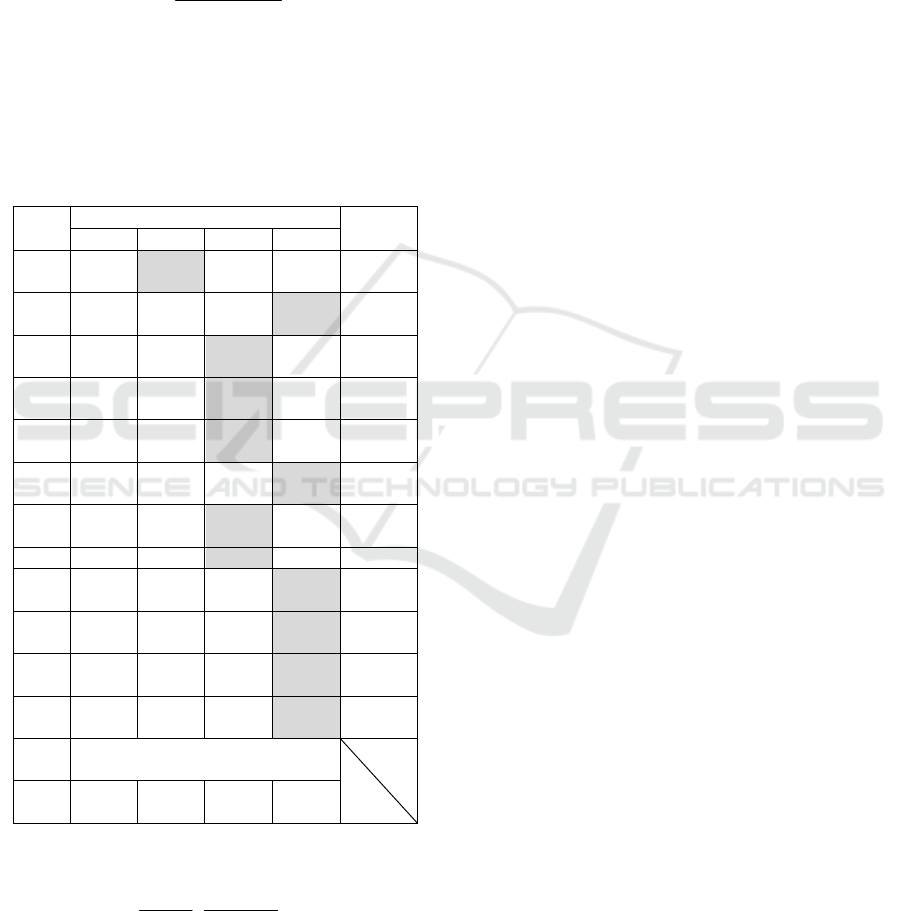

Table 2: Correlation matrix.

Index

X

1

1.00

X

2

0.20 1.00

X

3

0.09 -0.43 1.00

X

4

-0.06 -0.09 0.68 1.00

X

5

-0.16 0.17 0.28 0.68 1.00

X

6

0.06 -0.45 0.52 0.04 -0.12 1.00

X

7

-0.23 -0.19 0.52 0.53 0.67 0.47 1.00

X

8

0.06 0.02 0.50 0.55 0.73 0.38 0.84 1.00

X

9

-0.18 0.30 -0.10 0.24 0.83 -0.19 0.54 0.67 1.00

Assessment of Various Factors Impact on Cryptocurrency Functioning using Economic and Mathematical Modeling

133

Table 2: Correlation matrix (cont.).

Index

X

10

0.12 -0.48 0.32 -0.28 -0.65 0.80 0.00 -0.14 -0.67 1.00

X

11

0.11 -0.40 0.27 -0.35 -0.68 0.74 0.01 -0.11 -0.63 0.97 1.00

X

12

0.10 -0.42 0.32 -0.28 -0.64 0.77 0.06 -0.07 -0.63 0.98 0.99 1.00

Y 0.10 -0.36 0.44 -0.18 -0.43 0.80 0.19 0.17 -0.35 0.86 0.88 0.87 1.00

Y – the price of Bitcoin – is the resulting indicator,

and if we examine its functional dependence on other

indicators, then at the initial stage, the most obvious

is the idea of using linear regression.

y

= Xꞏb + e; (1)

where y is the vector (column matrix) of the bitcoin

exchange rate (Y) in the period from 2014 to 2018; X

- a matrix of supply values (X

1

) and demand (X

2

) of

gold, prices for banking metals and other indicators;

b - vector of regression coefficients; e - vector of

random deviations.

However, the classical linear regression model

does not fit in this case, since the regressors are

random variables and, at the same time, are

interdependent, as shown by the correlation matrix.

We will use the model of exploratory factor

analysis in order to circumvent this problem. She has

the form

X = FꞏA

T

+ U; (2)

where X is the matrix of values of indicators (the

same as in (1)); F - matrix of values of exploratory

factors; A - matrix of factor loads; ...

T

- sign of the

transpose of the matrix; U - matrix of random

deviations of the model of exploratory factor analysis.

We substitute expression (2) in (1), we obtain a

regression-factor model

Y = Fꞏc + u. (3)

Expression (3) is an equation of regression of a

dependent variable on independent exploratory

factors, in it

c = A

T

b

; (4)

u=Uꞏb + e. (5)

Expression (4) denotes the vector of regression

coefficients for factors, and in (5) the vector of

random deviations of the regression factor model.

It should be noted that in order to solve the issue

of joint consideration of indicators having different

units of measurement, they are all reduced to the so-

called standard form, i.e. centered and normalized:

z

t

= (

t

z

~

–

z

)/σ

z

;

(6)

where z

t

is the indicator in standard form;

t

z

~

- the

real value of the indicator;

z

- the average value of

the indicator; σ

z

- standard deviation of the indicator.

A variable in standard form has zero expectation

and unit variance. In this case, the values of

exploratory factors are also normalized and centered.

Moreover, the factors are interdependent and

orthogonal, i.e. satisfy the condition

F

T

F = I, (7

)

where I is the identity matrix.

After factor loads and factor values are found, to

obtain an estimate of the regression coefficients of

equation (3), you can use the usual least-squares

method:

c

ˆ

= (F

T

F)

-1

F

T

y;

(8

)

and taking into account (7), expression (8) takes the

form

c

ˆ

= F

T

y.

(9

)

Let us find an estimate of the regression

coefficients of model (1). To do this, we use

expression (4), on the basis of which we need to find

the vector of regression coefficients. If the matrix is

chosen so that

WꞏA

T

= I, (10

)

then

b

= Wꞏc. (11

)

Multiply (10) by A(A

T

A)

-1

the right, we get

Wꞏ(A

T

A) (A

T

A)

-1

= Aꞏ(A

T

A)

-1

,

then

W = Aꞏ(A

T

A)

-1

, (12

)

Substituting (12) in (11), we obtain an estimate of

the regression coefficients

b

= Aꞏ(A

T

A)

-1

ꞏc.

(13

)

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

134

In the course of calculations, 4 exploratory factors

for regressors were identified. The final results of the

calculations are summarized in Table 3.

We check the adequacy of the regression

equations according to the Fisher criterion, calculated

on the basis of the coefficient of determination

,

)1N(

)yy

ˆ

(

1R

2

N

1t

2

tt

2

where N is the number of observations;

t

y

ˆ

- the value

of the resulting indicator restored by the regression

equation; 𝑦

- the observed value of the resulting

indicator; 𝜎

- the variance of the index Y.

Table 3: Calculation results.

Index

Ex

p

lorator

y

factor loads

Regress.

coeff.

F1 F2 F3 F4

X

1

-

0.120

0.139

-

0.026

-

0.094

0.073

X

2

0.180

-

0.220

-

0.288

0.438

0.275

X

3

-

0.130

0.616 0.770

-

0.113

0.479

X

4

-

0.207

0.219 0.732 0.381

-0.448

X

5

0.119

-

0.280

0.699 0.627

-0.848

X

6

0.275 0.111 0.518

-

0.765

0.111

X

7

0.508

-

0.009

0.772 0.075

0.389

X

8

0.524 0.015 0.762 0.233 0.551

X

9

0.421

-

0.439

0.385 0.617

-0.296

X

10

0.102 0.336 0.032

-

0.935

0.676

X

11

0.261 0.420

-

0.069

-

0.865

1.345

X

12

0.251 0.415

-

0.007

-

0.871

1.252

Exploratory factor regression

coeff.

Y 1.097 1.844 -

0.048

-

3.638

The criterion itself has the form

,

k

1kN

R1

R

F

2

2

where k is the number of parameters of the regression

equation. In the regression equation of exploratory

factors, this is the number of factors (m), and in the

usual regression equation, this is the number of

variables (indicators) - n.

For the equation of regression of factors, the

calculated value of the criterion is F = 392.546; and

the critical value: qF (0.95; m; N – m – 1) = 3.112.

The calculated value of the criterion is more than

critical, therefore, the equation is adequate.

For the equation of regression of variables, the

calculated value of the criterion is F = 56.078; and the

critical value: qF (0.95; n; N – n – 1) = 4,000. The

calculated value of the criterion is more than critical,

therefore, the equation is adequate.To interpret the

factor solution in each row of the matrix of factor

loads, we select the largest absolute value (shaded

cells in Table 3).

The second factor accounted for one selected cell,

and this factor can be unambiguously interpreted as

the presence of gold on the market - the "gold factor".

The third factor is loading the prices of banking

metals, except for palladium, as well as the price of

oil and the euro-dollar pair the most. It can be

interpreted as a “price factor”.

The fourth factor has the largest load with a minus

sign on the S&P 500 index, as well as financial

obligations and the Fed discount rate, i.e. it

determines negative trends in the financial sector, so

it can be called a “crisis factor”. Note that the crisis

factor, in comparison with others, most determines

the decrease in the stock index (S&P 500), the

reduction in the rate of the Fed and securities with a

guaranteed level of profitability (short-term

obligations of the US Treasury) and increases the

demand for gold.

The first factor does not have allocated cells,

however, the loads are greater than 0.5 for the brand

oil price and the euro-dollar pair. These indicators

were under the dominant price factor. But the first

factor can be called European.

The Bitcoin exchange rate regression equation for

exploratory factors has the form

Y = 1.097 F

1

+1.844 F

2

–

0.048 F

3

–

3.638 F

4

+U. (14)

If we consider the coefficients of regression of

factors, it becomes obvious the dominant negative

impact of the "crisis factor" in the formation of the

Bitcoin exchange rate. The growth of the “crisis

factor” leads to a decrease in the price of Bitcoin,

while the formation of the above factor is

significantly affected by the following indicators: a

decrease in the stock index, the rate of short-term

liabilities of the US Treasury, the discount rate of the

Fed, as well as an increase in demand for gold.

Assessment of Various Factors Impact on Cryptocurrency Functioning using Economic and Mathematical Modeling

135

The second most important factor influencing

Bitcoin is the “golden” factor - the larger the gold

supply, the higher the Bitcoin exchange rate.

The factor determined by the price of oil and the

euro exchange rate is in third place. And the price

factor turned out to be in last place among the

exploratory factors, and its influence is negative and

insignificant.

Regression coefficients of variables allow you to

determine the sensitivity of the change in each

indicator to the cryptocurrency rate. So, an increase

in the supply of gold per unit leads to an increase in

the exchange rate of Bitcoin by 0.073 units.

In April 2020, Quantum Economics founder Mati

Greenspan noted that the entire financial industry

depends on the correlation of Bitcoin with the S&P

500 index.

Gold is also gradually increasing its correlation

with Bitcoin, while it remains an alternative financial

instrument and remains attractive to potential

investors. The influence of gold supply and demand

on the price of Bitcoin is increasing. The price of

Bitcoin with an increase in the supply (production) of

gold rises and with the emergence of factors that

reduce the demand for gold (the absence of global

financial turmoil), the price of cryptocurrency

decreases. The impact of the rising cost of other

precious metals, such as silver and platinum, is

negligible, but still reduces the cost of Bitcoin.

On the world market, the value of Bitcoin falls

during periods of political and economic instability

(along with US assets) and increases in times of

relative calm and prosperity. The price of Bitcoin has

a strong correlation with stocks and other American

traditional assets. With tight monetary policy in the

United States, Bitcoin will not be an attractive tool for

hedging the risks of global instability. The exchange

rate of Bitcoin with an increase in demand for

precious metals behaves similarly to the US currency.

Perhaps in the future, “Bitcoin will equal the US

dollar in terms of its payment properties and eclipse

gold as a means of savings” (interview with

Bloomberg CEO of Bitcoin exchange Kraken Jess

Powell).

The growth of investor interest in Bitcoin from

asset hedge funds, retail investors and day traders will

increase, but this will be associated with Bitcoin as an

alternative means of investment (in this quality,

Bitcoin competes with other financial assets in

different ways, yielding in terms of reliability, but

surpasses them in profitability), especially with the

improvement of technological characteristics of

cryptocurrencies.

The head of Kraken expects improved payment

functions of the first cryptocurrency thanks to second-

level solutions like the Lightning Network. They will

provide the same affordable and easy to understand

features, such as the popular payment systems PayPal

and Venmo, eliminating the need to transfer coins on

the blockchain. “Soon the technology underlying

Bitcoin will dissolve. It will become like an American

dollar: no one understands how it works, but everyone

uses it. ”

Cryptocurrencies, including Bitcoin, cannot be

considered as an alternative way of investing in

conditions of falling profitability of traditional

financial instruments. However, according to the

analytical center of the international audit and

consulting network FinExpertiza, which presented

the results of the study of the most profitable

investment investments, Bitcoin has become one of

the most profitable financial instruments for 2019.

4 CONCLUSIONS

Based on the methods of correlation and regression

analysis, methods of exploratory factor analysis,

economic and mathematical models made it possible

to more deeply analyze and confirm the degree of

influence of indicators on changes in Bitcoin prices,

as well as to identify the most significant of these

indicators and use these results in the future to

forecast the rate of Bitcoin in the world market.

The financial analysis carried out in the study

using the exploratory principle made it possible to

formulate a factor analysis scheme, in which it was

not initially determined which system of factors made

it possible to describe the correlation matrix.

It should be noted that it is precisely when

constructing a model for assessing the level of

influence of explorer factors on the cryptocurrency

exchange rate that the introduction of an analysis

based on the exploratory principle is of particular

importance, since the cryptocurrency exchange rate,

the price of Bitcoin are indicators whose values are

most dependent not on constant, but on variables that

suddenly appear parameters.

REFERENCES

Cryptocurrency market capitalization will increase 30 times

thanks to $ 5 trillion investment in bitcoin,

https://mining-cryptocurrency.ru/kapitalizaciya-

kriptorynka-uvelichitsya-v-30-raz/

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

136

Eskindarov, M.A. Abramova, M.A., Maslennikov, V.V.,

Amosova, N.A., Barnavsky, A.V., Dubova, S.E.,

Zvonova, E.A., Krivoruchko, S.V., Lopatin, V.A.,

Pishchik, V.Ya., Rudakova, O.S., Ruchkina, G.F.,

Slavin, B.B., and Fedotova, M.A. (2018). Directions of

development of fintech in Russia: expert opinion of the

Financial University. World of the new economy, 2: 6-

23.

iTrustCapital Survey: Millennials Are More Likely to

Choose Bitcoin as the Best Investment During a

Coronavirus Pandemic,

https://www.prnewswire.com/news-

releases/itrustcapital-survey-millennials-are-more-

likely-to-choose-bitcoin-as-the-best-investment-

during-a-coronavirus-pandemic-301014915.html

Kornilov, D. A., Zajcev, D. A., and Kornilova, E. V. (2017).

Cryptocurrency market analytics. Dynamics and

forecasts, ITportal, 3(15).

Manuylenko, V.V., Mishchenko, A.A., Bigday, O.B.,

Sadovskay, T.A., and Lisitskay, T.S. (2017).

Evaluation Method for Efficiency of Financial and

Innovative Activities in Commercial Organizations

Based on Stochastic Modelling, Journal of Applied

Economic Sciences, 12, 4 (50): 1226 – 1246.

Manuylenko, V. V., Ryzin, D. A., Gryzunova, N. V.,

Bigday, O. B., and Mandrytsa, O. V. (2020). Toolset for

financial risk strategic assessment in corporations based

on stochastic modeling, Amozonia Investiga, 9(28): 451

– 464.

Melnikova, Y.V., Posnaya, E.A., Bukach, B.A.,

Shokhnekh, A.V., and Tarasenko, S.V. (2020).

Defining Key Determinants of the Strategic Economic

Security of the Agro-Industrial Complex in Terms of

Stabilizing Political Course, E3S Web of Conferences.

Posnaya, E.A., Kaznova, M.I., Shapiro, I.E., and

Vorobyova, I.G. (2018). Theory and Practice of Capital

Estimation Methods: An Application in Bank

Management, European Research Studies Journal,

21(2): 497-505.

Posnaya, E.A., Semenyuta, O.G., Dobrolezha, E.V., and

Smolander, M. (2019). Modern Features for Capital

Portfolio Monitoring, International Journal of

Economics and Business Administration, 7(1): 53-60.

Posnaya, E.A., Dobrolezha, E.V., Vorobyova, I.G., and

Chubarova, G.P. (2018). The economic capital model

in bank's capital assessment, Contemporary Studies in

Economic and Financial Analysis, 100: 111 – 119.

Posnaya, E.A., Tarasenko, S.V., Bukach, B.A., Shokhnekh,

and A.V. (2019). The Significance of Bank Financial

Security in Capital Management. Proceedings of the

"New Silk Road: Business Cooperation and Prospective

of Economic Development", Advances in Economics,

Business and Management Research, Atlantis Press,

131: 977-979.

Shaidullina, V.K. (2018). Cryptocurrency as a new

economic and legal phenomenon, University Bulletin,

2: 137-142.

Assessment of Various Factors Impact on Cryptocurrency Functioning using Economic and Mathematical Modeling

137