The Trends of Behavior of the Retail Consumer on the Financial

Market

L. Yuzvovich

1a

, K. A. Danilova

2b

, N. N. Isakova

1c

and Ibrahima Ba Sori

3d

1

Ural State University of Economics, Yekaterinburg, Russia

2

Ural Federal University, Yekaterinburg, Russia

3

General Lansana Conte University, Conakry, Guinea

Keywords: Ecology, Financial Services, Financial Market, Consumer Behavior.

Abstract: The article devoted to trends and external challenges in the behavior of retail consumers in the financial market.

The main focus are the technological trends in the banking services market. The subject of this research is the

economic relations arising in the process of behavior of retail consumers in the financial market in the

framework of obtaining financial services. In recent years, the development of the financial services sector

has the largest increase in the structure of gross domestic product. In addition, there is a high level of

competition in the sector, as evidenced by empirical data presented by the Analytical Center for the

Government of the Russian Federation and other research agencies. Researchers unanimously note the

presence of inorganic growth in the financial services sector, that is, the sector is expanding more intensively

than the needs for its performance are growing, which intensifies the struggle for consumers.

1 INTRODUCTION

In a dynamic economic environment, financial

services organizations are forced to look for ways and

tools of non-price competition, focusing on service

quality management.

However, the empirical data of analytical

agencies and reports of the Central Bank of the

Russian Federation indicate the presence, on the one

hand, of dissatisfaction with consumer requests

regarding the service they receive, and on the other

hand, an increase in exactingness in relation to the

service and quality of financial services. This

consumer trend is mediated by distrust of financial

institutions, changes in the structure of information

sources that consumers use when making a decision

to use the services of financial institutions.

Dissatisfaction and mistrust, in turn, are prerequisites

for the manifestation of opportunistic behavior of

consumers, through which they seek to bridge the gap

between their own expectations and the actually

received service. The comparability of consumer

a

https://orcid.org/0000-0003-0906-5065

b

https://orcid.org/0000-0002-6778-6672

c

https://orcid.org/0000-0001-8444-0246

d

https://orcid.org/0000-0002-8424-0277

behavior in virtual reality and real life has been

considered and studied by many foreign scientists

from the standpoint of the quality of services

(Maltseva, 2019; Parasuraman, 1994).

The requirements of the regulator, retail

consumers and the practices implemented to improve

the quality of services form the main trends in the

development of the financial services sector.

2 RESEARCH METHODOLOGY

Let us consider the conditions in which financial

service organizations are forced to solve problems of

a new type of communication with consumers. We

emphasize that, in our opinion, the financial services

sector, in comparison with other industries, turned out

to be most ready for the external challenges of 2020,

since the digitalization processes in it were launched

en masse much earlier than in many others. For

example, in the GCI (Global Competitiveness Index)

rating

for

the

financial

market

development

factor,

90

Yuzvovich, L., Danilova, K., Isakova, N. and Sori, I.

The Trends of Behavior of the Retail Consumer on the Financial Market.

DOI: 10.5220/0010664400003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 90-95

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

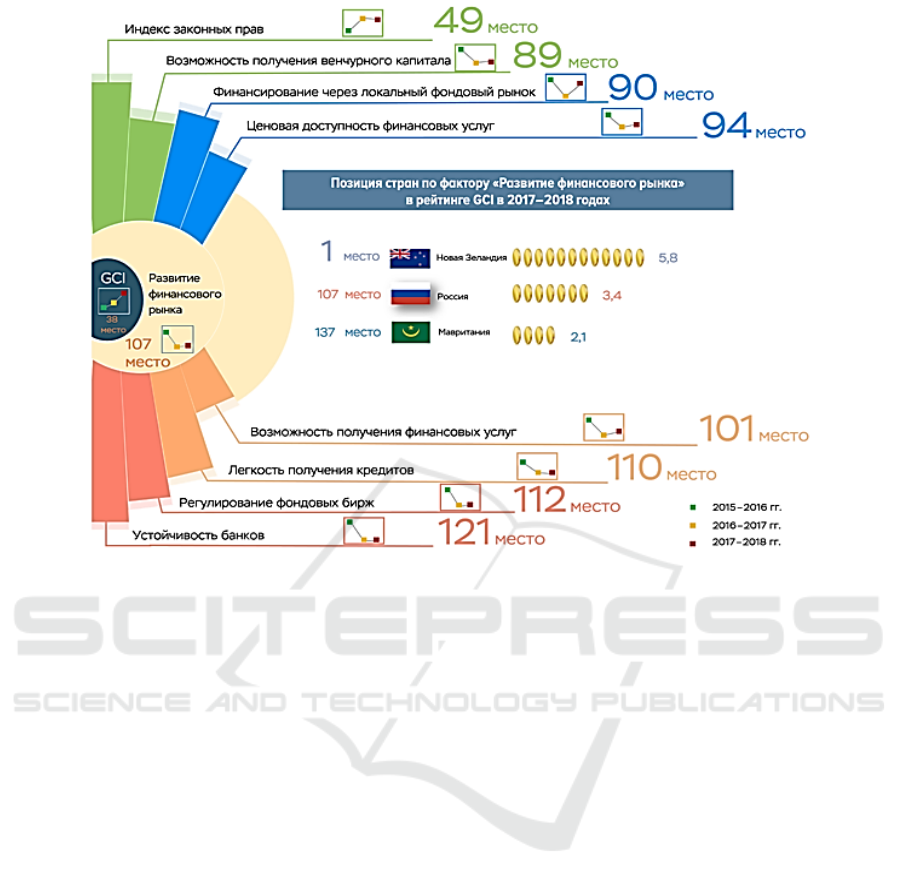

Figure 1: Elements of the factor "Development of the financial market" GCI Russia.

Russia occupies 107th from of 137 places. Sectoring

by elements is shown in Figure 1.

Figure 1 shows that Russia occupies significantly

lagging positions in almost all elements of the

Financial Market Development factor.

In the "Guidelines for the Development of the

Financial Market of the Russian Federation for the

Period of 2019-2021", The Central Bank notes the

preservation of the priority goals:

1. Improving the level and quality of life for

citizens of the Russian Federation through the use of

financial market instruments.

2. Assistance in economic growth by providing

competitive access to the subjects of the Russian

economy to debt and equity financing, risk insurance

instruments.

3. Creating conditions for the growth of the

financial industry ”(Osnovnye napravleniya razvitiya

finansovogo rynka, 2019-2021).

At the same time, the number of development

directions contributing to the achievement of these

goals has been reduced to four:

formation of a trusting environment. Trust is a

social capital that can reduce transaction costs.

The Bank of Russia not only pays attention to

protecting the rights of consumers and

investors, but also to the development of a

corporate culture based on the priority of

consumer interests, information transparency

and accessibility. In addition, the Bank of

Russia “takes an active position in protecting

consumers from possible abuse of behavioral

irrationalities by sellers of financial services”;

development of competition in the financial

market. In order to maintain fair competition,

the Bank of Russia helps to eliminate

regulatory and behavioral barriers, which

increases the efficiency of the Russian financial

market and ensures its international

competitiveness;

financial stability support - ensuring

uninterrupted and efficient functioning of the

financial market, its resistence to internal and

external shocks;

providing the availability of financial services

and capital - ensuring the physical, mental,

price and assortment of financial services. The

Bank of Russia seeks to improve the speed and

quality of access to financial services for all

groups of citizens, including those living in

remote areas or having restrictions on access to

financial services, including increasing the

speed of access through the Internet (Osnovnye

napravleniya razvitiya finansovogo rynka,

2019- 2021).

The Trends of Behavior of the Retail Consumer on the Financial Market

91

It is interesting that, despite the priority of the

direction of increasing the financial literacy of the

population in the previous program and the measures

taken, the indicator of financial knowledge in 2016

was 1.97 (with the best possible value of the indicator

6.00, the target value is 2.50), and the results of a

population survey conducted in 2018 - 1.72.

However, the “The share of types of products and

services available to individual customers through

remote channels” indicator, which is part of the

“Increasing the availability of financial services”

direction, has significantly improved. The share of

types of such products and services in 2016 was only

18%, and as of July 2018 - 68%, but the target of 85%

has not yet been achieved.

Thus, the Department for Strategic Development

of the Financial Market of the Central Bank of the

Russian Federation noted the following features of

the state of the Russian financial market (Byulleten 'o

tekushchih tendenciyah rossijskoj ekonomiki, 2019):

poor development of the capital market;

decrease in the inflow of foreign investment;

low activity of the population on the financial

market;

dishonesty of sellers of financial services,

which generates a response from consumers

(interestingly, 26% of citizens consider loan

default acceptable; 38% are convinced that a

delay in loan payments is not terrible);

the incompleteness of the process of cleansing

the Russian financial market from weak and

unscrupulous players;

insufficient regulation of some areas, such as

preventing conflicts of interest, personal

responsibility of management and owners of

financial institutions;

the leading role of digital technologies for the

provision of services for the development of the

financial market, stimulating innovation in the

financial sector;

customer-centricity as the main factor in the

success of companies that determines the

further development of technologies;

increasing the availability of financial services,

including by expanding the product line for the

consumer;

technological innovations lead to an increase in

the efficiency of the financial market, allowing

easier entry into it, and also shape consumer

preferences;

appearance of a significant number of financial

and technological companies that banks and

other financial institutions prefer to cooperate;

participation in the competitive race of large

digital giants, which could radically change the

financial market in the coming years;

One-click service gradually becoming a new

consumer standard, and platform solutions

adopted to this standard can lead to the

dominance of distributors over primary

manufacturers.

At the same time, the regulator identifies the

following challenges and opportunities of the Russian

financial market:

- remote identification as a solution to the question of

physical accessibility of financial services, the need

to pay special attention to the protection of personal

data;

cyber threats, both local and global;

the usage of artificial intelligence and machine

learning not only provides new opportunities

for managing and maintaining a competitive

advantage, including through new mechanisms

for attracting and retaining customers in the

financial market, but also poses a threat to

financial stability due to issues related to data

interpretation;

relatively low rates of changes in the regulatory

environment in relation to the rate of

implementation of financial innovations.

At the same time, the trends of consumer

behavior in the financial services market include a

gradual increase of trust in financial institutions. As

we noted earlier, consumers are moving from the

stage of distrust of financial market players to a

neutral position (Maltseva, 2019). The Central Bank

of the Russian Federation notes the growth of the

composite index in the period from May 2018 to May

2019 from 51.1 to 52.9 points out of 100 possible. At

the same time, the greatest contribution to the growth

of this indicator was made by the factor of

satisfaction with remote channels for providing

loans, insurance services, and non-bank payment

infrastructure. An increase of the trust for non-bank

financial institutions, rising of satisfaction with bank

payment systems and the work of banks, according

to the materials of the Central Bank of the Russian

Federation, also had a significant impact on the

growth of the composite index (Uroven

'udovletvorennosti rossiyan finansovymi

organizaciyami, 2021).

At the same time, despite the increasing

popularity of remote service channels, the level of

customer satisfaction with them, according to the

"Survey of the state of financial inclusion in 2018"

(Obzor sostoyaniya finansovoj dostupnosti v RF,

2018), is decreasing, which may be caused, among

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

92

other things, by the growing expectations of clients of

financial institutions. Thus, a smaller number of

respondents gave the highest marks for all parameters

of accessibility.

3 RESEARCH RESULTS

Technological trends in the banking services market

shall be described in more detail. These trends are

part of the totality of financial services and are first in

the financial market in terms of innovation and

development. The trends identified in this area on the

banking market, in our opinion, can be extrapolated

to the entire financial services sector.

Thus, D.A. Kurmanova notes that there is a gap in

terms of receiving returns from the introduction of

innovative technologies directly in the retail banking

market between the Russian and European markets.

So, the author identifies five main modern trends in

the development of banking innovations (Kurmanova

D., 2019):

development of fin-tech companies;

robotization of technologies;

gamification;

expanding the use of Big Data technologies

(big data);

increasing the role of risk management in the

conduct of innovative activities.

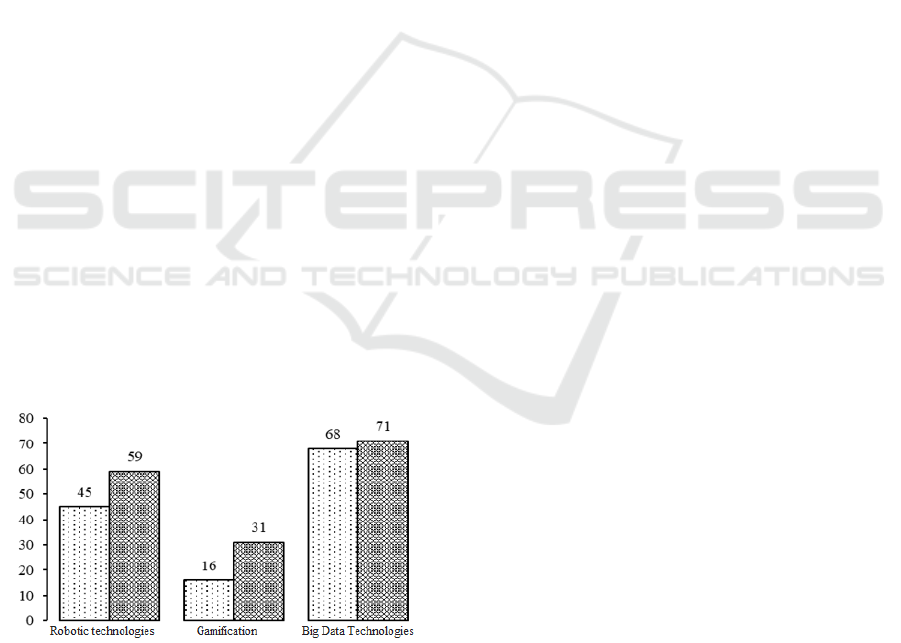

At the same time, Big Data technologies, robotic

technologies and gamification are recognized as the

most successful. The author proposes we pay

attention to the deviation in the effectiveness of the

development of these technologies in Russia and

Europe (Figure 2).

Figure 2: The level of success of innovative banking

products and services in Russia and Europe.

Thus, the largest gap is noted in terms of the use of

gamification tools. Based on world experience, D.A.

Kurmanova proposes to use game components to

announce a chain of innovative banking products.

However, taking into account the level of financial

literacy of the population, as we indicated in the first

chapter of the dissertation research, we propose to

gamify the process of not only the presentation of

innovative products and services, but also traditional

ones, which will simultaneously increase the level of

financial literacy of the population and its

involvement in the process of providing services, and

therefore, the competitiveness of Russian financial

institutions.

International consulting company Accenture

presented 10 trends that should determine the

development of the banking sector in 2020 (Trendy

bankovskoj cifrovizacii, 2020):

in addition to building more efficient and

lower-cost business models, digital leaders in

the sector need to find new ways to make

money in a low-interest environment. The

perfection of customer experience by

personalizing interaction, they will have to win

market share from less developed digital

players;

despite the fact that the number of accounts in

neobanks is growing, their clients form these

accounts on a leftover basis, keeping the main

accounts in other banks. The prospects for

further development of the sector are not yet

clear, what the models will be able to provide a

decent level of profitability: lighter, low-cost

versions of banks or alternative data-centric

banking services "by subscription";

rising the relevance of capital mergers for

middle size organizations due to a lack of

leverage of scale or investment in disruptive

innovation;

rising the importance of artificial intelligence

technologies and analytics systems in the work

of personal managers while maintaining the

importance of interpersonal skills;

development of Open Banking technologies

makes the questions of rights to disseminate

information debatable, according to the new

legal regulations that are spreading around the

world, customers will be able to control how

their personal information is disseminated.

Banks will have to show that they can be

trusted, and also be able to create additional

value using this information to take care of the

financial health of their clients;

it is not clear will the era of value-based

banking begin, will banks really embody

socially responsible actions or will stop at the

level of statements;

The Trends of Behavior of the Retail Consumer on the Financial Market

93

banks are beginning to abandon commission

payments in favor of building trusting

relationships with their customers, while most

of the world's banks are using artificial

intelligence technologies to level the number of

“bad” decisions of their customers;

the need to monitor the quality of loan

portfolios increases;

appearance of a new type of money: tokenized

currencies issued by the central banks of

countries for settlements between partners;

abandoning the term challenger in the bank's

strategic documents and turning to terminology

that more clearly describes a specific business

model.

Summing up the above material, let us emphasize

the ever-growing role of customer-centricity,

appearance of new consumer standards, such as one-

click service, an increase in the level and number of

innovations, appearance of numerous financial and

technological companies that financial institutions

seek to cooperate. But at the same time, there is a

threat associated with the entry of large digital giants

into the financial market, which will be able to

radically change it, including due to the fact that they

have experience in building relationships with

customers in a digital environment.

At the same time, there is a significant gap

between Russian and European organizations. In

terms of the return on innovation.

We are probably on the verge of a new era of

production and consumption of financial services - an

era based on values and at the same time on the search

for ways to earn money in an environment of non-

price competition and a low interest rate market,

including through improving customer experience,

personalizing interaction, refusal of commission

payments in favor of building relationships with

customers.

From the above follows that the role and

importance of clients, their trust and desire to build

relationships with financial institutions is gradually

increasing. Even market leaders need to think about

how to maintain the trust and loyalty of their

customers.

4 DISCUSSION OF RESULTS

To overcome the above challenges, it is necessary to

turn to the trends in consumer behavior of retail

consumers on the financial market. In our opinion, the

Central Bank provides a fairly complete characteristic

of these trends:

predictable irrationality of consumer behavior

caused by development of the behavioral

direction of the economic field of knowledge

(behavioral reactions that previously seemed

non-forecast can now be predicted);

the appearance and strengthening of the role of

generations of people who spend most of their

time online;

increased requirements for the service due to

the development of customer-oriented

approaches to business;

an increase in the value of time due to the

increasing role of the Internet in people's lives

(the need to travel and stand in line is perceived

by customers as extremely negative);

requirements for transparency of pricing,

simplicity of services and their one-click

availability;

“Basic” options, according to modern

consumers, already shall be included in the

package, they do not create additional value for

customers;

the generation of millennials does not differ in

their requirements for financial services, but in

a fundamentally different way perceives their

own free resources, prefers to invest them in

impressions, and does not always focus on the

future in these decisions;

development of sharing models, that's probably

lead to changes in the structure of

accumulations and savings.

At the same time, according to the research

National Agency for Financial Studies (NAFI),

digital technologies are hot among consumers - 67%

of clients use them to receive financial services. At

the same time, the transition to digital technologies in

the financial sector prevent: in 57% of cases by lack

of need, self-exclusion, 26% by lack of the necessary

device, 24% by psychological barriers and attitudes.

According to the NAFI research, 40% of clients

are convinced that financial literacy should be taught

directly by the financial institution whose clients they

are. Thus, any events in this direction, proceeding

from the organization, will increase the reputation of

the organization, satisfying the needs of customers.

At the same time, the researchers note that there is

a noticeable positive trend towards an increase in the

level of financial literacy among consumers using

digital technologies.

According to NAFI researchers, the following

prerequisites may become drivers of the use of digital

technologies in the financial sector (Analiticheskij

centr NAFI, 2019):

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

94

help from friends and relatives (22% of

respondents' positive marks);

- purchase of a modern device (18%);

check list with step-by-step instructions (16%);

training (11%);

start-up bonus (7%).

At the same time, an increase in the relevance and

demand for social networks (almost all modern

consumers have accounts in social networks, many

cannot imagine their life without them), in our

opinion, gives another opportunity to attract

consumers to use digital technologies - creation of a

specialized social network based on a mobile

application of a financial institution, where users

could easily and quickly exchange customer

experience about various types of services, feel their

involvement, and become a group around a single

brand of a financial institution.

5 CONCLUSION

Resuming the material above, emphasize that,

despite the desire of financial institutions to move

interaction with customers to a digital environment,

about a third of customers are not ready for this,

remaining unsatisfied by digital platforms. Events to

improve financial literacy, initiated by the Central

Bank of the Russian Federation, remain with poor

demand cause consumers are convinced that the

financial institution which they use should improve

their financial literacy. At the same time, the cases

are happened when an organization, conducting such

events, does not take into account the requirements

and requests of its customers for this type of event.

In efforts to present innovative products and

services through advanced technologies,

practitioners find themselves in a difficult situation,

since the level of financial literacy allows only a

relatively small circle of clients to use such services.

The generation of millennials who are eager to invest

their free resources in impressions becomes today the

main solvent generation of consumers, while

financial institutions, judging by the development

trends, are not actively using this aspiration.

REFERENCES

Byulleten' o tekushchih tendenciyah rossijskoj ekonomiki.

Vyp. 60: Rynok platnyh uslug.

https://ac.gov.ru/uploads/2-Publications/_aprel'.pdf

Gotovnost' rossiyan k perekhodu na cifrovye finansovye

uslugi. Analiticheskij centr NAFI za 2019 god.

https://nafi.ru/upload/iblock/bcf/bcf4afa70a68548a2f8

ed369254b9229.pdf

Kurmanova D. A. (2019). Finansovye tekhnologii na

roznichnom rynke bankovskih uslug, Vestnik

Ufimskogo gosudarstvennogo neftyanogo

tekhnicheskogo universiteta. Nauka, obrazovanie,

ekonomika. Seriya: Ekonomika, 1 (27), pages 60–67.

Maltseva, Yu. A. (2019). Comparative analysis of trends in

Russian, Chinese and American consumer behavior in

the digital environment. Proceedings of the

International Scien-tific and Practical Conference on

Digital Economy (ISCDE 2019)., vol. 1:666-669. DOI:

10.2991/iscde-19.2019.1

Obzor sostoyaniya finansovoj dostupnosti v RF v 2018 g.

Bank Rossii. https://cbr.ru/Collection/Collection/File/

25684/ review_24122019.pdf

Orlova E. S., Fedotova G. V. (2014). Innovacionnye

bankovskie produkty i uslugi, Instituty i mekhanizmy

innovacionnogo razvitiya: mirovoj opyt i rossijskaya

praktika : sb. nauch. st. 4-ĭ Mezhdunar. nauch.-prakt.

konf. – Kursk : Universitetskaya kniga, pages 288–290.

Osnovnye napravleniya razvitiya finansovogo rynka

Rossijskoj Federacii na period 2019–2021 gg.

Departament strategicheskogo razvitiya finansovogo

rynka CB RF. http://www.cbr.ru/content/document/

file/71220/main_directions.pdf

Parasuraman, A. 1994. Reassessment of expectations as a

comparison standard in measuring service quality:

implications for further, Journal of marketing. DOI:

10.2307/1252255

Trendy bankovskoj cifrovizacii. TAdviser.

https://www.tadviser.ru/index.php

Uroven' udovletvorennosti rossiyan finansovymi

organizaciyami, ih uslugami i kanalami

predostavleniya prodolzhaet povyshat'sya. Bank Rossii.

https://cbr.ru/PRESS/ event/?id=5273

Xu, C. (2021). The comparability of consumers’ behavior

in virtual reality and rea life: a validation study of

virtual reality based on a ranking task. Food quality and

prefer-ence. DOI: 10.1016/j.foodqual.2020.104071

The Trends of Behavior of the Retail Consumer on the Financial Market

95