Knowledge Management for M&A Performance

Ksenija Lace and Marite Kirikova

Riga Technical University, Riga, Latvia

Keywords: Mergers & Acquisitions, Knowledge Management.

Abstract: This study focuses on knowledge management role in Mergers & Acquisitions (M&A). With high proportion

of M&A failure, it is important to define possible ways to increase M&A success rates. Knowledge acquisition

and management is the important part of M&A initiative, as it forms the foundation for M&A decisions. But

with M&A high complexity, uncertainty and ambiguity, effectively organized knowledge management of

M&A can become a challenge. In this article authors review current research on knowledge management in

general and M&A specific knowledge management, identify the levels of M&A knowledge hierarchy, namely

– individual M&A initiative scope, M&A initiatives in scope of one company, M&A initiatives in scope of

the same industry. For each level success factors and obstacles for the effective knowledge management are

defined. As a result, a proposal for M&A knowledge management high level framework is presented,

accumulating all knowledge management levels, and defining the knowledge structure and flow between them.

1 INTRODUCTION

Performance of Mergers & Acquisitions (M&A)

initiatives is a popular topic in the recent research. It

is noticed that proportion of so-called successful

M&A is relatively low and only third part of them is

later evaluated as positive change (Jie-mei, 2011).

One of the challenges for M&A is the ability to

transfer the knowledge about merging parties and

build on competences to make respective decisions

in a fast and efficient way, learn from the previous

M&A activities to make smarter decisions next time,

and learn from other companies experience to

not make the same mistakes (Jie-mei, 2011),

(Schumann & Tittmann, 2008). As an organizational

learning (accumulating, transferring and processing

knowledge) is a part of the effective knowledge

management, we can conclude that effective

knowledge management can contribute to the

overall M&A success (Vásquez-Bravo & Sánchez-

Segura & Medina-Domínguez & Amescua, 2014),

(Lohrkea & Frownfelter-Lohrkea & Ketchen, 2016).

But with M&A complexity, uncertainty and time

limitations, M&A knowledge management faces

known difficulties (Gruber & Paneva, 2014),

(Keizer, 2012).

This research explores how knowledge

management activities can be integrated in the scope

of M&A initiative, defines success factors and

obstacles that can impact M&A knowledge

management. As a result, several knowledge

management hierarchy levels are defined and M&A

knowledge management framework is proposed,

specifying knowledge management levels, activities,

and enabling factors. Research results can be used

later in the real-life M&A case studies.

In the next section each of knowledge

management levels is explored, current practices and

approach are summarized, success factors and

obstacles are identified, and framework architecture

is created. In the last section overall knowledge

management framework is described.

2 KNOWLEDGE LEVELS IN

M&A

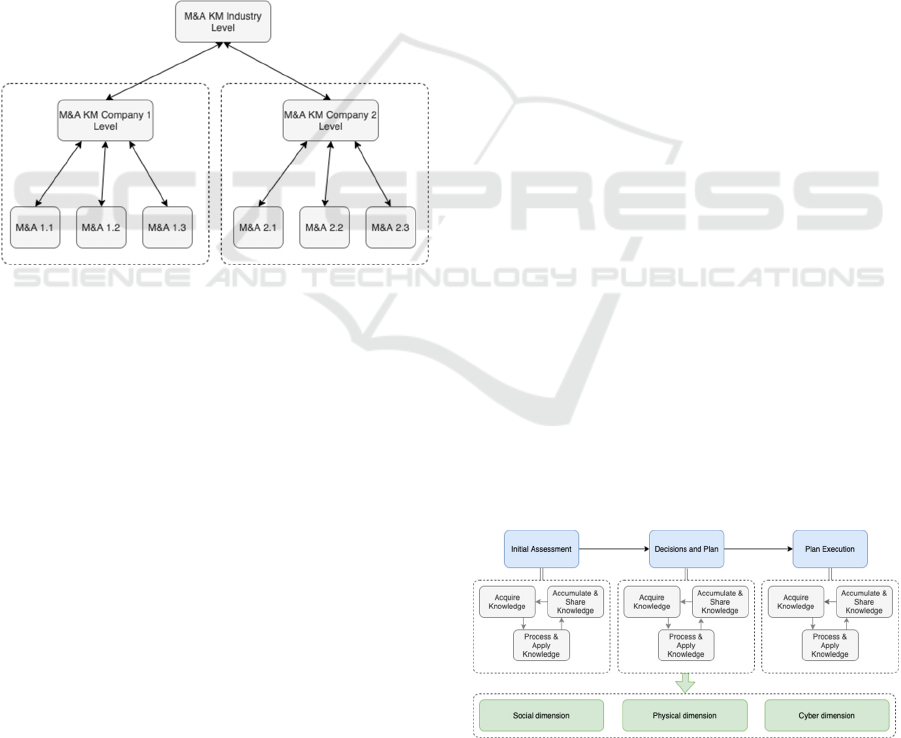

With importance of learning in M&A projects, it is

crucial to inspect how knowledge transfer is

organized during specific M&A, as well as between

several linked M&A activities. This research analyzes

M&A knowledge management from the perspective

of the knowledge accumulating, transferring and

processing for learning on different hierarchical

M&A levels, which can be seen as M&A knowledge

management hierarchy levels (levels have been

obtained by amalgamating findings of 9 related

works) (see Figure 1):

Lace, K. and Kirikova, M.

Knowledge Management for MA Performance.

DOI: 10.5220/0010640100003064

In Proceedings of the 13th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2021) - Volume 3: KMIS, pages 83-89

ISBN: 978-989-758-533-3; ISSN: 2184-3228

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

83

Level 1: Scope of each specific M&A initiative

- knowledge acquisition and integration during

the individual M&A activity (Jie-mei, 2011),

(Horie & Ikawa, 2014), (Eisenman &

Paruchuri, 2019);

Level 2: Scope of M&A initiatives for one

specific acquiring company - knowledge

processing during and after M&A for learning

and developing capabilities for future M&A

initiatives (Vieru & Rivard, 2012), (Zollo &

Singh, 2004), (Ellis & Lamont, 2004);

Level 3: Scope of M&A initiatives for different

acquiring companies – industry knowledge

accumulation and structuring to formalize

M&A processes (Wijnhovena & Spila &

Stegweea, 2006), (Hwang, 2004), (Ravikumar,

2017).

Figure 1: M&A knowledge management levels.

Effective knowledge management on each of

these levels, as well as well-established knowledge

transfer between these levels are key enablers for

M&A final success (Lodden, 2012). In the following

sections each of these levels is explored through the

following aspects based on the literature review:

What is the current knowledge management

approach and best practices on this level?

What are the success factors and obstacles

impacting effective knowledge management on

this level?

In the end, all findings are aggregated in the one

framework for knowledge management in the scope

of M&A activity set. This framework, in the further

research is intended to be applied across several

linked M&A initiatives to gather case study results

and cros-validate it in practice.

2.1 Knowledge Acquisition and

Integration during the M&A

Activity

The main goal for Level 1 is to integrate several

participants of the M&A. This level is the most

popular topic of the overall M&A research.

Knowledge management on this level covers the

following dimensions of the integration: (1) physical,

(2) cyber, (3) social. Many frameworks for M&A

organization are proposed (Ellis & Lamont, 2004),

(Wijnhovena & Spila & Stegweea, 2006), (Hwang,

2004), (Ravikumar, 2017), (Gasik, 2015), however

none of them looks on the M&A from the joint socio-

cyber-physical perspective.

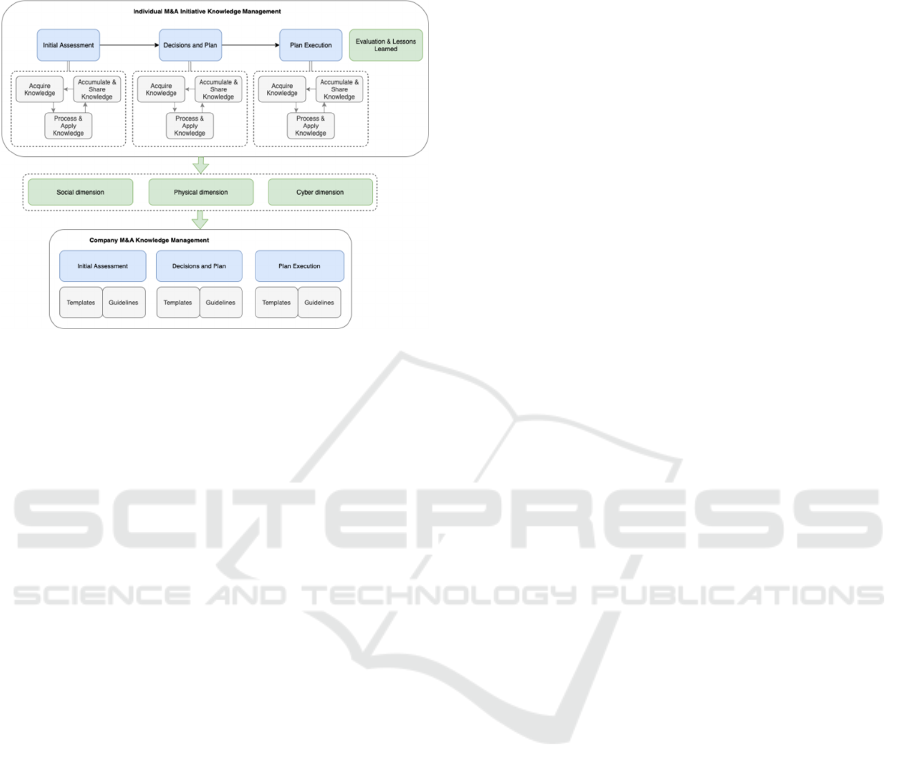

2.1.1 Proposed Approach

This knowledge management level is focused on

specific M&A initiative execution, and can be seen as

the following sequential activities (Chua & Goh,

2009), (Horie & Ikawa, 2012):

Initial assessment of the M&A participants;

Decisions on M&A approach and M&A

execution plan;

Execution of M&A plan, including partners

reorganization and knowledge integration.

Each of these activities consists of the following

knowledge management tasks with the goal also to

transfer the gathered or created knowledge to the next

activity (Chua & Goh, 2009), (Horie & Ikawa, 2012)

(see Figure 2):

Acquire knowledge about the M&A initiative,

as well as about merging parts;

Process and apply knowledge to make

decisions about M&A and define future state;

Accumulate and share knowledge to support

effective decision execution.

Figure 2: M&A knowledge management on an individual

initiative level.

KMIS 2021 - 13th International Conference on Knowledge Management and Information Systems

84

2.1.2 Success Factors and Obstacles

There are several important factors, required for the

efficient knowledge management on this level (Jie-

mei, 2011), (Horie & Ikawa, 2012):

As each merging part shoud be pereceived as a

complex socio-cyber-physical system, all three

dimensions of the integration should be

covered as interrelated: social, physical and

cyber;

As it is extremely important to support cultural

merge and take only the best from all merging

parts - acquiring organization should

understand and respect and importance to learn

from acquired organization;

As for keeping engagement and motivation

high in both merging parts - acquired

organization should be encouraged to share the

opinions and should be involved in decision

making;

As for keeping the transparency and alignment

between all involved participants - acquiring

organization is interested to share knowledge

with acquired organization, especially if

reorganization and optimization is planned;

For the same reason knowledge should be

communicated properly between management

and execution levels of M&A project

participants (meaning - between process

planning and execution phases);

As it is important to base decisions on an actual

and complete facts about M&A initiative and

current state of merging parts - explicit

knowledge should exist and acquisition of

tactic knowledge should be properly planned

prior any decisions about M&A execution.

As can be noticed, success factors are related to

acquiring company’s culture and attitude to the

knowledge management, as well as with acquired

company motivation. But important prerequisites are

also availability of explicit knowledge.

There are also M&A specific factors, that can

negatively impact knowledge management efficiency

(Gruber & Paneva, 2014), (Lodden, 2012):

M&A complexity requires proper resource

allocation on in-depth investigation and

analysis of the current state before future state

definition;

As M&A uncertainty and unpredictability can

block the ability to gather knowledge upfront,

knowledge acquisition should be planned as an

integrated part of decision-making during

M&A execution;

M&A project time constraints usually do not

allow to spend required effort on knowledge

management. With that, predefined knowledge

management process, as well as reused

knowledge management assets from the

previous M&A initiatives could help to

optimize required resources.

These factors can be addressed by accumulating

experience and reusable knowledge in the previous

M&A initiatives. This ability is directly related to the

next M&A knowledge management level.

2.2 Knowledge Processing during and

after M&A for Learning and

Developing Capabilities for Future

M&A Initiatives

As M&A is one of the commonly used tools for

growth, often there is a sequence of M&A projects in

a company. As with any repeating process, it is good

to have lessons learned and best working practices

accumulated from the individual M&A initiatives,

that can be reused in the upcoming M&As. Research

of knowledge management on this (second) level is

not as frequent as on the M&A activity in general.

Main reasons for that are that each M&A is often

assumed to be unique (meaning – previous practice is

not applicable), as well as the fact that M&A can take

long time for accomplishing and evaluating the

results (meaning the next M&A activity can be started

before it is clear what worked and what did not in the

previous projects).

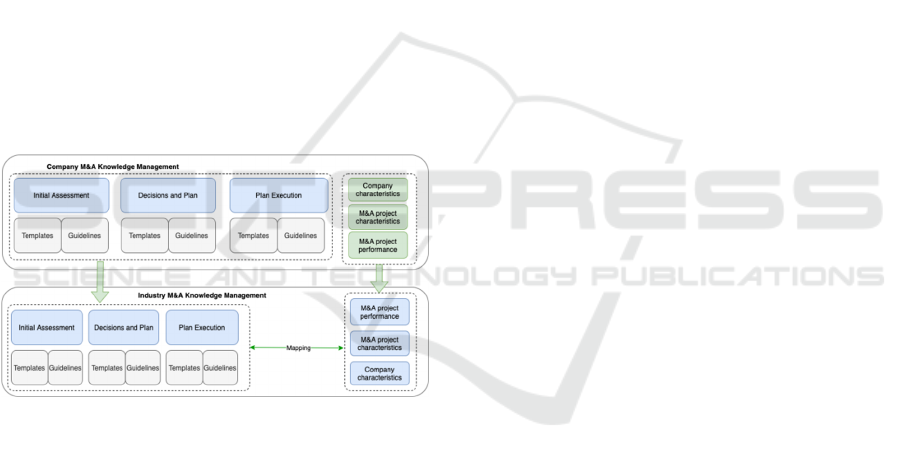

2.2.1 Proposed Approach

Aggregated M&A knowledge can be shared using

several approaches (see Figure 3):

Artefacts produced during previous M&A

projects, can be used in the future projects as

source of inspiration and reusable information.

Basically, the artefacts, created during each

phase of the individual M&A initiative, are

reused in the future projects;

The use of templates and guidelines created

based on the previous M&A lessons learned.

Lessons learned can be incorporated in the

individual M&A initiative as part of the process

(for example, retrospective after each phase),

or can be organized as a separate activity after

the project competition.

Knowledge Management for MA Performance

85

Artefact and template applicability for future

projects usually is evaluated subjectively by specific

executor (Eisenman & Paruchuri, 2019), (Lohrkea &

Frownfelter-Lohrkea & Ketchen, 2016).

Figure 3: M&A knowledge transfer between individual

M&A level and company level.

2.2.2 Success Factors and Obstacles

There are the following prerequisites for M&A

experience gathering and learning (Horie & Ikawa,

2012), (Morrison & James, 2002):

As already stated previously, all acquired

knowledge should cover three dimensions of

merging parts: social, cyber and physical, as

well as interrelationships between them;

To have clear responsibilities on M&A

knowledge sharing, dedicated M&A team in

the organization should be allocated on sharing

M&A experience across the organization;

As M&A previous experience is mentioned as

one of M&A success factors, individual M&A

initiative project team should be capable in

producing and sharing the knowledge about

M&A results;

This team also should have enough motivation

and planned time to share the knowledge

accumulated during the project and promote it

across the company and with future M&A

project teams;

For more efficient knowledge sharing, M&A

evaluation process should be established,

helping to identify similarities across several

M&A approaches and structure the M&A

knowledge to find relevant parts for the future

M&A initiative more easily. Otherwise,

applied inappropriately, previous knowledge

can compromise the usefulness of the

accumulated M&A knowledge.

Several M&A limitations can negatively impact

the learning process (Horie & Ikawa, 2014), (Zollo &

Singh, 2004):

As M&A is time limited, there should be well

defined balance which knowledge should be

documented, to which extent, and how it should

be populated;

It can take time to see and evaluate M&A

results, thus not always it is possible to foresee

which practices are successful or not.

These limitations can be addressed by

accumulating M&A knowledge on the industry level,

which is described in the next section.

2.3 Knowledge Accumulation and

Structuring to Formalize M&A

Processes

The third knowledge management level is focused on

the accumulating and aggregating knowledge from

several similar M&A initiatives (like same industry,

same acquisition size, same constraints, etc.) and

creating framework for the M&A knowledge

management organization. Research on this level is

very limited. Together with issues already mentioned

on the previous level (company level), Level 3

additionally faces issues related to the information

privacy.

2.3.1 Proposed Approach

Currently there is no any publicly available M&A

knowledge management framework, which would

accumulate best practices for different M&A

initiatives and would structure these practices per

M&A specific parameters, allowing to choose

appropriate practices for each specific M&A project.

However, there are many described M&A case

studies, which can be analyzed and processed to

extract best practices, guidelines and templates to be

used on the industry level of M&A knowledge

management (see Figure 4) (Jie-mei, 2011), (Horie &

Ikawa, 2014), (Eisenman & Paruchuri, 2019), (Zollo

& Singh, 2004).

In order to structure available case studies, the

classification of different M&A initiative types

should be introduced. There are already several

attempts to classify M&A initiatives and define

specific M&A process parameters, that can have an

impact on the overall project success (Ellis &

Lamont, 2004), (Hwang, 2004), (Ravikumar, 2017).

KMIS 2021 - 13th International Conference on Knowledge Management and Information Systems

86

Some knowledge management efficiency related

parameters are (Ellis & Lamont, 2004), (Gruber &

Paneva, 2014):

Acquired company resource quality and

relatedness to acquiring company;

Differences and geographical distance between

acquisition parties;

The scope and depth of an integration and the

level of management replacement;

Documented integration knowledge

experience.

Still, the parameter list can be expanded to support

the variety of case studies, and a holistic model of

possible M&A characteristics could be established, as

well as M&A taxonomy could be created.

Nevertheless, for managing M&A complexity issue,

only knowledge management relevant characteristics

should be selected.

Additionally, more detailed M&A performance

criteria could be established, as different M&A may

have different goals and priorities and they have

direct impact on required knowledge management

activities.

Figure 4: M&A knowledge transfer between company level

and industry level.

2.3.2 Success Factors and Obstacles

There are several key success factors, enabling the

development of one common M&A knowledge

management process (Ellis & Lamont, 2004),

(Gruber & Paneva, 2014), (Keizer, 2012), (Lodden,

2012):

All three dimensions are represented also on

this level: social, cyber and physical;

As a lot of corporate knowledge stays inside the

specific companies and does not become

publicly shared, close collaboration between

researchers and industry is required, allowing

to access and process M&A experience

knowledge and transform it into publicly

available artefacts;

But as a lot of M&A knowledge is a subject of

limited access information, there should be

specific process how researchers can access

and use M&A knowledge and create publicly

available meta knowledge about M&A

projects.

There are several obstacles currently hindering

future research (Ellis & Lamont, 2004), (Gruber &

Paneva, 2014), (Keizer, 2012), (Lodden, 2012):

Some information about M&A projects still has

strictly limited access rights and will not be

available for external researchers;

Currently there is no taxonomy of different

M&A approaches, neither there are any

established standard M&A frameworks. Often

acquiring organization is developing its own

specific M&A approach, which later is hardly

comparable with approaches developed by

other organizations;

With M&A initiatives complexity and scope, it

is problematic to find correlations between

M&A characteristics, applied knowledge

management approach and M&A results.

To mitigate these obstacles, at least to some

extent, the integrated M&A knowledge management

framework is proposed in the next section.

3 M&A KNOWLEDGE

MANAGEMENT FRAMEWORK

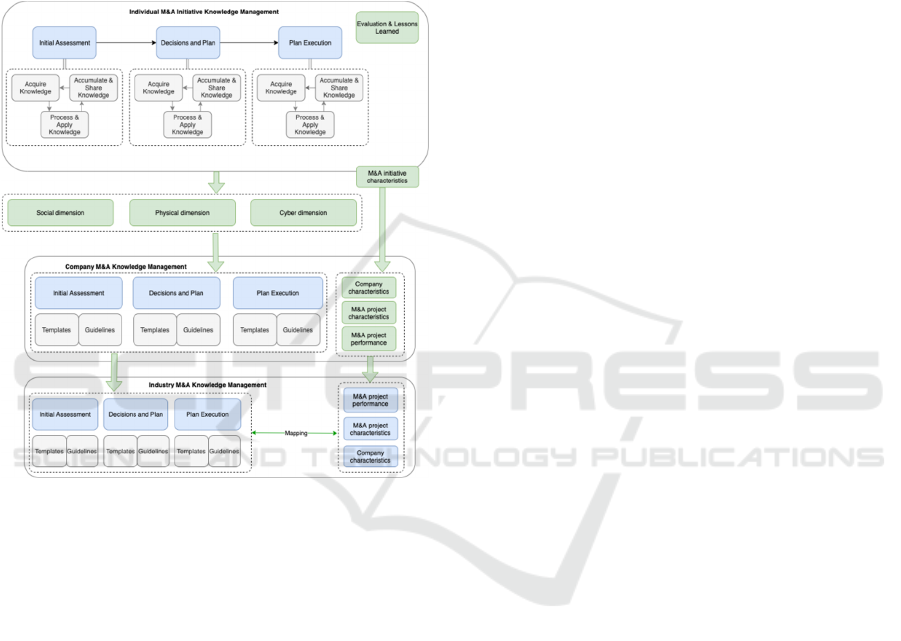

M&A knowledge management levels together with

corresponding success factors and obstacles,

discussed in Section 2, form the proposed M&A

knowledge management framework with a purpose to

accumulate and share gathered knowledge and

improve M&A performance.

The framework illustrates how M&A knowledge,

covering all social, cyber and physical perspectives,

is gathered in the scope of one individual activity; is

transferred to the company level, where company

specific M&A experience is accumulated; and then

how company level M&A knowledge can be

aggregated into industry level M&A knowledge (see

Figure 5).

The framework represented in Figure 5

corresponds to the quality parameters that should be

present in any proposed reference model (Taylor &

Sedera, 2003). All these quality parameters can be

Knowledge Management for MA Performance

87

divided into three main quality aspects reviewed

below.

One quality aspect is a syntactic quality, related to

a language used in the model. From this perspective,

the model has both clear structure and clear language.

Model notation includes data structures and data

flow, represented by graphical elements commonly

used for data modelling. Definitions used in the

model are aligned with ones used in the M&A

scientific research.

Figure 5: M&A knowledge management framework.

Another quality aspect is a semantic quality,

related to a domain coverage in the model. Model

incorporates M&A domain and knowledge

management domain principles. Several hierarchical

knowledge management levels specific for M&A

initiatives is an important topic for both domains.

Despite the novelty of the structural hierarchy of KM

levels, the model still is easy to understand for all

M&A practitioners and does not require additional

trainings or clarifications.

And one more quality aspect is pragmatic quality,

linked to the fact how effectively the model can be

interpreted by the audience and applied in practice.

Two important specific quality parameters here are

pragmatics (accessibility and applicability) and

feasibility (economical efficiency). Analysis of these

quality characteristics are the matter of further

research as it requires the data gathered in rela world

applications of the proposed framework.

4 CONCLUSIONS

In this paper we highlighted the importance of M&A

knowledge management for overall M&A initiative

success. We reviewed and proposed models for

different hierarchy levels of M&A knowledge

management – specific M&A initiative level,

organizational learning between M&A initiatives,

cross organizational M&A knowledge management.

For each of the levels current practices were analyzed,

success factors and obstacles defined. Based on this,

and also, for M&A experience accumulation, overall

M&A knowledge management framework was

proposed that incorporates all three knowledge

management levels. This framework can help in

M&A knowledge management as it represents the

experience and scientific evidences in this area in a

structured and conceptually clear manner. It takes

into account three essential perspectives: social, cyber

and physical ones, combination of which becomes

more and more important in todays M&As. As a

future work, framework can be elaborated in more

details and the model of M&A specific knowledge

management can be created. Additionally, the

framework should be applied to real M&A initiatives

and potential improvements should be identified.

REFERENCES

Vieru, D., & Rivard, S. (2012, January). Working under

grey skies: Information systems development and

organizational identity in a post-merger context.

In 2012 45th Hawaii International Conference on

System Sciences (pp. 5267-5276). IEEE.

Chua, A. Y., & Goh, D. H. (2009). Why the whole is less

than the sum of its parts: Examining knowledge

management in acquisitions. International Journal of

Information Management, 29(1), 78-86.

Jie-mei, Z. (2011, August). The knowledge integration

strategy analysis after Geely acquisition of Volvo.

In 2011 2nd International Conference on Artificial

Intelligence, Management Science and Electronic

Commerce (AIMSEC)(pp. 3504-3507). IEEE.

Schumann, C. A., Tittmann, C., & Tittmann, S. (2008,

September). Merger of knowledge network and users

support for lifelong learning services. In IFIP World

Computer Congress, TC 3 (pp. 149-152). Springer,

Boston, MA.

Vásquez-Bravo, D. M., Sánchez-Segura, M. I., Medina-

Domínguez, F., & Amescua, A. (2014). Knowledge

management acquisition improvement by using

software engineering elicitation techniques. Computers

in Human Behavior, 30, 721-730.

Horie, N., & Ikawa, Y. (2014, July). Knowledge integration

in a product development organization for new

KMIS 2021 - 13th International Conference on Knowledge Management and Information Systems

88

businesses: A case study of a precision device

manufacturer. In Proceedings of PICMET'14

Conference: Portland International Center for

Management of Engineering and Technology;

Infrastructure and Service Integration (pp. 1834-1840).

IEEE.

Eisenman, M., & Paruchuri, S. (2019). Inventor knowledge

recombination behaviors in a pharmaceutical merger:

The role of intra-firm networks. Long Range

Planning, 52(2), 189-201.

Zollo, M., & Singh, H. (2004). Deliberate learning in

corporate acquisitions: post‐acquisition strategies and

integration capability in US bank mergers. Strategic

management journal, 25(13), 1233-1256.

Horie, N., & Ikawa, Y. (2012, July). Adverse factors of

knowledge integration in a product development

organization after M&A: A case study of a precision

device manufacturer. In 2012 Proceedings of

PICMET'12: Technology Management for Emerging

Technologies (pp. 2570-2576). IEEE.

Morrison, M. J., & James, A. D. (2001, July). The role of

dedicated integration teams in the post-merger

management of technology. In PICMET'01. Portland

International Conference on Management of

Engineering and Technology. Proceedings Vol. 1:

Book of Summaries (IEEE Cat. No. 01CH37199) (Vol.

1, pp. 12-13). IEEE.

Morrison, M. J., & James, A. D. (2001, July). The role of

dedicated integration teams in the post-merger

management of technology. In PICMET'01. Portland

International Conference on Management of

Engineering and Technology. Proceedings Vol. 1:

Book of Summaries (IEEE Cat. No. 01CH37199) (Vol.

1, pp. 12-13). IEEE.

Ellis, K. M., & Lamont, B. T. (2004). “Ideal” acquisition

integration approaches in related acquisitions of

equals: A test of long-held beliefs. In Advances in

mergers and acquisitions. Emerald Group Publishing

Limited.

Wijnhoven, F., Spil, T., Stegwee, R., & Fa, R. T. A. (2006).

Post-merger IT integration strategies: An IT alignment

perspective. The Journal of Strategic Information

Systems, 15(1), 5-28.

Lohrke, F. T., Frownfelter-Lohrke, C., & Ketchen Jr, D. J.

(2016). The role of information technology systems in

the performance of mergers and acquisitions. Business

Horizons, 59(1), 7-12.

Hwang, M. (2014). Integrating Enterprise Systems in

Mergers and Acquisitions. In: 10th Americas

Conference on Information Systems, AMCIS 2004,

New York, USA, August 6–8, 2004, vol. 12, pp. 62–66.

Ravikumar, N. (2017, June). Post-Merger IS Integration:

Influence of Process Level Business-IT Alignment on

IT-based Business Value. In Proceedings of the 2017

ACM SIGMIS Conference on Computers and People

Research (pp. 195-196).

Paneva, I., & Gruber, J. (2014). The process of knowledge

transfer in mergers and acquisitions: A single-case

study of a Swedish manufacturing organization.

Keizer, M. (2012). A knowledge integration approach

within acquisitions: how to deal with innovative

acquired firms? Master's thesis, University of Twente.

Lodden, I. (2012). Knowledge transfer in mergers and

acquisitions: a case analysis of CISCO. Master's thesis,

Universitetet i Agder; University of Agder.

Gasik, S. (2015).

An analysis of knowledge management in

PMBOK® guide. PM World Journal, 4(1), 1-13.

Taylor, C., & Bandara, W. (2003). Defining the quality of

business process reference models. In Proceedings of

the 14th Australasian Conference on Information

Systems (pp. 1-10). Edith Cowan University.

Knowledge Management for MA Performance

89