Information Security in Banks

Yulia V. Evdokimova

1

a

, Elena N. Egorova

1

b

and Olga V. Shinkareva

2

c

1

Russian State Social University, Wilhelm Pic Str., Moscow, Russia

2

Moscow City University, Selskokhozyaystvenny Drive, Moscow, Russia

Keywords: Bank Information Security Risks, Payment Infrastructure, Targeted Attacks, Perimeter and Host Security,

Information Security Incidents, Transactions.

Abstract: The study examined key issues of information security of banks in the Russian Federation. The issues of

standardization within the framework of information security of banks, the main risks of banks were studied.

The main crimes in the field of information security threatening banks were considered. The main elements

of the information security system in banks are presented. Data on information security incidents during the

transfer of funds, on embezzlement carried out by cheaters in banks were analysed. The data on distribution

of attacks on banks by their types are given. The main requirements to which the equipment used by banks to

protect information security should meet are considered. We studied the changes that are taking place in banks

taking into account the requirements of our time, the growth of the quality of banking services and their

security, the growing risks and the need to minimize them.

1 INTRODUCTION

Risks in the field of information security are

associated with the loss of confidentiality, integrity or

availability of the organization's information assets.

Risks of information security are closely related to

other risks in other areas, in finance, in the field of

quality, ecology, labour protection or industrial

security (Evdokimova, 2020). Digitisation of the

business, the growing number of changes in the

organization's information infrastructure, the newly

emerging cyber threats and cyberattacks require an

adequate response from specialists.

As a result, in modern conditions, the construction

of an integrated information security system in banks

is turning into a continuous process of introducing

more and more new methods and tools for protecting

and improving existing ones.

2 METHODOLOGY

As part of the study, data on the development of

information security in the banking sector of the

a

https://orcid.org/0000-0003-1721-1368

b

https://orcid.org/0000-0002-0403-7391

c

https://orcid.org/0000-0003-2291-3516

Russian Federation were systematized and analysed.

The goal of the study was the need to structure and

summarize data to identify specific threats in the field

of information security of banks and the possibility of

their minimization.

3 RESULTS

Financial organizations historically, together with the

oil and gas industry and telecom, are one of the

leaders in the formation of integrated information

security systems, the use of the most modern

technologies and solutions in them. The risks of

information security in the banking sector cause

serious reputational and financial losses. The terms

"operational risk" and "information security risk"

appeared in the Bank of Russia Standard on

Information Security in 2004 (Standard STO BR

IBBS 1.0- 2004, 2004). The improvement of this

standard has led to the fact that the risk-oriented

approach has been steadily developing, the

requirements for information security of the bank

have been tightened. In 2010, Recommendations in

Evdokimova, Y., Egorova, E. and Shinkareva, O.

Information Security in Banks.

DOI: 10.5220/0010617800003170

In Proceedings of the International Scientific and Practical Conference on Computer and Information Security (INFSEC 2021), pages 81-86

ISBN: 978-989-758-531-9; ISSN: 2184-9862

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

81

the field of standardization of the Bank of Russia

were put into effect: "Methodology for assessing the

risks of violation of information security" (Bank of

Russia, 2009). Credit institutions are constantly faced

with information security risks associated with the

implementation of information security threats, they

can be caused by shortcomings in the processes of

ensuring information security by banks, which is

associated with technological and other events,

shortcomings in the application software of

automated systems and applications, as well as with

possible inconsistency of these processes of the

bank's activities (Regulation the Bank of Russia from

04/08/2020 № 716-P, 2020).

The ISO 31000 standard provides the following

risk assessment: it is a process that is a continuous

systematic action to apply strategic and tactical

actions, procedures, tools to form communications,

advice, identification, assessment, analysis, risk

monitoring (ISO 31000, 2018.).

First of all, it is necessary to identify the main

crimes in the field of information security that

threaten banks. The most dangerous in financial

institutions are attacks on the payment infrastructure.

In this case, the credit institution incurs large-scale

direct financial losses.

Further, attacks on bank processing centers with

withdrawal of funds through ATMs can be

distinguished. These attacks can be conditionally

divided into two categories. The first category

includes the infection of the ATM management

subsystem or through it the ATMs themselves, with

the subsequent submission of a command to issue

cash. The second category includes hacking of

processing with subsequent crediting to previously

received cards of significant amounts. Then these

funds are cashed through ATMs of various banks.

Attacks on remote banking systems should also be

highlighted. As a rule, they are implemented through

infection of devices from which clients remotely

manage accounts. Of course, many banks have

introduced transaction confirmation technologies

with one-time codes obtained, for example, through

SMS, but various social engineering methods are

actively used to lure these codes from customers.

Fraud using social engineering methods is gaining

momentum, mainly used to lure people into their

payment card data and one-time transaction

confirmation codes. Initial ringing is usually done

programmatically.

There are also internal threats, these are abuses by

employees of the financial organization itself.

The elements of the information security system

in banks can be divided into two categories:

protection of the perimeter of the organization's

computer network and protection of internal hosts.

Perimetre protective equipment included:

firewall systems;

attack detection/prevention systems;

DLP system modules for mail and web traffic

control;

content filtering systems when employees of

the organization access the Internet;

antivirus tools on the mail server and Internet

access proxy server and a number of other

tools.

Host Protection Uses:

antivirus tools;

Personal firewall systems;

system host modules - Intrusion Detection

Systems and Intrusion Prevention Systems;

-DLP System Host Modules (Data Loss

Prevention) - as protection against accidental

data leaks;

means of controlling employee's use of

peripheral devices, primarily USB drives.

Many endpoint security solutions have begun to

combine a significant portion of the listed

functionality.

Now, more and more often in the perimeter and in

the host part began to add protection against targeted

attacks. These are attacks aimed at specific banking

organizations. They are not massive and prepare for a

long time. Attackers study the information systems of

the attacked object, find out which software is used

for various purposes. The targets of the attack are

very limited by any scope or objectives of specific

information systems and/or people. Malicious

software is specifically developed for attack so that

standard antivirus and security tools used by the

object and sufficiently well studied by intruders

cannot detect a threat. Most often, these are zero-day

vulnerabilities and special communication algorithms

with the perpetrators/customers of the attack

(TAdviser, 2021).

Recently, as part of information security, software

developers have been paying attention to the

interaction of perimeter and host security tools to

increase the effectiveness of detecting and countering

modern cyberattacks.

Banks widely practice a process, systematic

approach based on the interconnection of managerial,

technological, legal, information. Business processes.

A specific security tool is a tool built into the bank's

general information security system. The following

processes are distinguished:

malware protection;

data leakage protection;

INFSEC 2021 - International Scientific and Practical Conference on Computer and Information Security

82

protection of electronic document management

systems;

protection of computer networks;

protection of information in mobile users;

management of access rights;

Vulnerability management;

monitoring and response to information

security incidents;

management of information assets;

information security risk management;

-conformance control (compliance);

-secure software development;

improving the competence of employees in

matters of information security.

In financial organizations, information security

systems cover the protection of payment processes

and payment infrastructure. This component is given

key attention in banks. Information security threats

attributed to illegitimate transactions are now

common and do not lose their relevance. Transactions

between the user and the banking system are the least

secure and most frequent objects of cybercrime.

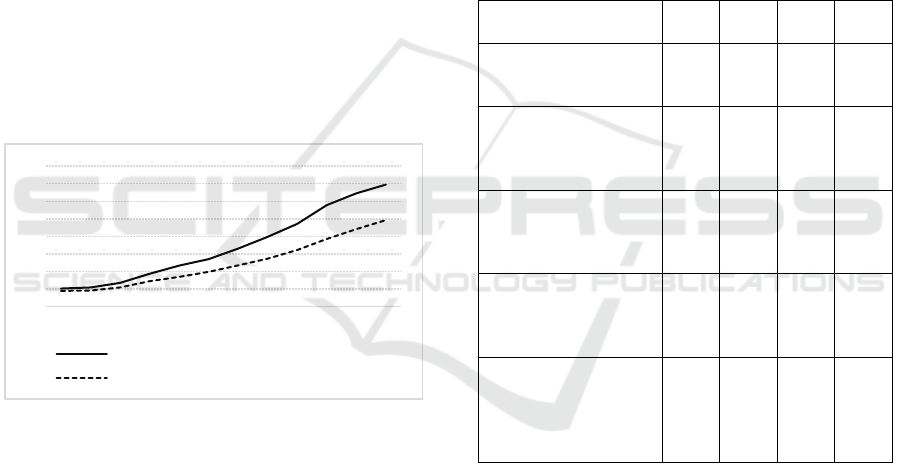

The share of cashless settlements in Russia is

growing (see figure 1).

Figure 1: Dynamics of the share of cashless operations in

Russia (Sberbank, 2020).

Technology, digitalization of the banking sector,

demanded by the market, is gaining momentum. In

this regard, the introduction of contactless mobile

payments using Apple Pay, Google Pay and other

similar applications is extremely fast. Russia has

become the largest market in Europe in terms of

operations using digital wallets.

This spread of cashless payments entails an

increase in information security risks in banks. Risks

are associated with the organization of the payment

process itself and with the possible loss of control of

the bank over it, and with the risk of fraud through

users of payment systems.

To manage risks in the process of organizing

payments, there are a number of standards and

mandatory standards that the bank must comply with.

However, the whole point is that from the point of

view of the system, fraudulent payments can satisfy

all the necessary requirements to confirm the

voluntary intention of the client. Payment fraud

schemes aimed at users have become systematic in

recent years. Multiple customer misleading schemes

are used. A large number of complaints come from

victims over the age of 60. "Tech Support Fraud"

quantity is increasing - operation of user trust in

technical support.

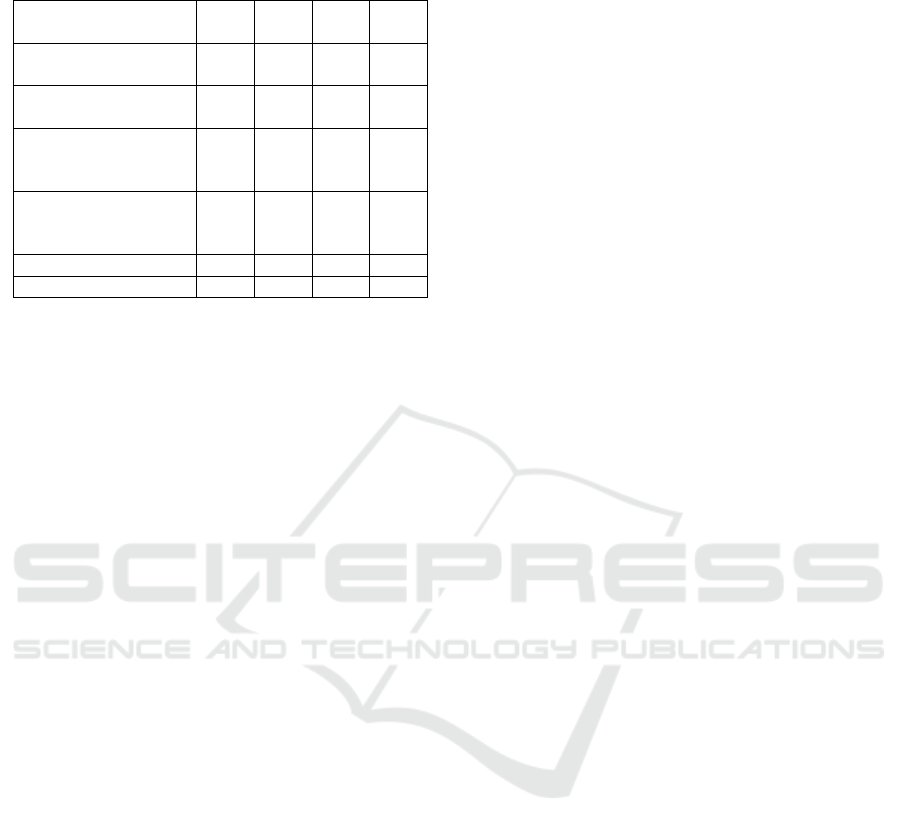

The Bank of Russia data on information security

incidents during the transfer of funds are as follows

(see Table 1).

Table 1: Volume of operations carried out without the

consent of customers for the 1st and 2nd quarters of 2019

and 2020 (Bank of Russia, 2020).

Indicator

2019

Q1

2019

Q2

2020

Q1

2020

Q2

ATMs, terminals,

imprinters, million

rubles

157

111

112

127

Payment of goods and

services on the

Internet, million

rubles

669

603

926

1122

Remote Banking

System for Physical

Persons, million

rubles

397

460

559

728

System of remote

banking services for

legal persons, million

rubles

105

194

231

193

Volume of

transactions using

electronic means of

payment, trillions of

rubles

24

23,1

19,4

22,5

The total amount of embezzlement of funds is

5723.5 million rubles, the average cost of theft is: for

individuals - 10 thousand rubles, for legal entities -

152 thousand rubles. According to the structure, the

main number of incidents is related to transactions for

payment of goods and services on the Internet (CNP-

transactions) and methods of social engineering

(fraud). The concentration of incidents falls on

Moscow and the Central Federal District, St.

Petersburg, Ural, Volga and Far Eastern Federal

Districts (Bank of Russia, 2020).

The distribution of attacks on banks by their types

made it possible to trace the following patterns (see

Table 2).

0,0%

10,0%

20,0%

30,0%

40,0%

50,0%

60,0%

70,0%

80,0%

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

share of cashless transactions in card expenditure transactions

share of cashless trade turnover in total expenses of citizens

Information Security in Banks

83

Table 2: Number of attacks on banking organizations by

their types in units (Bank of Russia, 2020).

Indicator

2019

Q1

2019

Q2

2020

Q1

2020

Q2

Phishing mailings by

customer

554

340

432

583

Attacks using social

engineering methods

6

466

4

462

4

806

4

589

Attacks on banks

using malicious

software

172

251

102

103

Attacks exploiting

software

vulnerabilities

223

430

165

186

Other types of attacks

224

113

131

113

Total

7639

5596

5636

5574

Attacks using social engineering methods

predominate for all study periods in the number of

cases, accounting for more than 80% of the total

number of attacks.

4 DISCUSSION OF RESULTS

The specifics of information security in banks is that

serious information security efforts are aimed at

protecting the payment infrastructure and payment

processes. It should be noted that most banking

transactions and most of the information processed in

the bank relate to bank secrecy, the task of ensuring

its protection can be solved only by building a

complex security system. You should also not forget

about the threats to information security associated

with personal data. Banks process them in significant

volumes, and they must be protected in accordance

with federal law 152 "About Personal Data" (Federal

Law from 07/27/2006 № 152-FL, 2006).

"The main directions for the development of

information security of the credit and financial sector

for the period 2019-2021" formed by the Bank of

Russia, as the main goals and objectives of today,

include ensuring cyber stability, operational

reliability and continuity of banks, as well as their

need to counter attacks in order to ensure the interests

of consumers of financial services (Bank of Russia,

2019).

The Bank of Russia considers the main areas of

development of banking informatization and

protection by regulating the use of big data, artificial

intelligence, robotization and the Internet of things in

the credit and financial sphere. Special attention is

paid to data processing using digital technologies.

The initiative of the Bank of Russia is the massive use

of cryptography in the financial market. The

controversy of this issue is related to a number of

legal and administrative barriers from the positions of

the Federal Security Service. The Bank of Russia will

stimulate actions on import substitution. However,

there are (at the moment) no alternative foreign

remedies, which will make it difficult for banks to

fulfill these requirements. Much attention will be paid

to the education of information security specialists:

from the preparation of an educational professional

standard and the identification of the need for

specialists to the introduction of certification of

employees of financial organizations at the

University of the Central Bank. In addition, it is

planned to teach students and university students the

basics of cybersecurity. The information security of

credit and non-credit financial institutions, according

to this document, should be ensured at the level of

infrastructure, application software and applications.

The level of bank information security will be

determined by the indicators established by the Bank

of Russia. Such indicators include compliance of

supervised organizations with the requirements of

state standards in terms of information protection,

business continuity, risk management and

outsourcing. For applications, certification will be the

criterion for assessing their level of protection and

quality. Special attention is also paid to the need for

international cooperation, taking into account the fact

that threats in the field of cybersecurity are universal.

Such threats are cross-border, change the formed

business models. The necessary tasks in this area are

the exchange of information on cyber threats, the

development of unified standardized approaches in

the cybersecurity field, the establishment of an

experience exchange in regulating and introducing

financial technologies in the framework of bank

information protection and security. Accelerated

banking sector digitalization due to the pandemic

entailed the intense emergence of new services,

which will certainly become the sphere of interests of

attackers, so the development of warning positions

should be ahead of the onset of possible negative

events. Such innovations should be mandatory and

universal for the entire banking sector in the

framework of optimizing information security.

Changes in regulatory documents for financial

organizations in 2021 are obvious. In 2019, the Bank

of Russia approved two new provisions for banks-

672-P and 683-P. They regulate unified rules for

ensuring information security in banks on the basis of

the national standard in the field of financial

transactions (GOST R 57580.1-2017). This standard

is a list of 343 security processes in 8 key areas:

access control protection, network protection,

INFSEC 2021 - International Scientific and Practical Conference on Computer and Information Security

84

information infrastructure integrity and security

control, malicious code protection, data loss

prevention, incident management, virtualization

protection, and mobile security. In addition, the

standard includes 65 requirements for organizing and

managing information protection. There are three

levels of information protection: minimum, standard

and enhanced. For each of the points of the standard,

it is indicated how they should be provided depending

on the level of information security: at the standard

level, a significant part of information security

processes is implemented by organizational

measures, with an enhanced level, more stringent

requirements are put forward for the implementation

of technical solutions (software or software and

hardware), while at the minimum level, meeting part

of the requirements is not necessary (National

standard of the Russian Federation GOST R 57580.1-

2017, 2017.).

Since January 1, 2021, changes entered Provision

683-P of the Bank of Russia (Regulation Bank of

Russia from 04/17 /2019 № 683-P, 2019.). Banking

organizations should ensure compliance assessment

according to GOST R 57580.1-2017 at least once

every two years. From January 1, 2021, banks need to

provide a third level of security. An appropriate

methodology has been developed that defines six

levels of conformity, from zero (no protection

systems) to fifth (compliance with all items of the

standard on an ongoing basis with proper control). At

the zero level of compliance, organizational and

technical measures of the information protection

system process are not implemented or are

implemented in isolated cases. There are no common

approaches to their implementation and monitoring of

implementation. At the first level, the organizational

and technical measures of the information protection

system process are implemented in a small number,

randomly and/or occasionally. There are also no

common approaches to implementation and control.

At the second level, organizational and technical

measures are implemented in a significant number on

an ongoing basis. General implementation

approaches are established in isolated cases.

Monitoring and improvement of the implementation

of organizational and technical measures of the

information protection system process is practically

not carried out. The third level of compliance adds

control and improvement of the implementation of

organizational and technical measures of the

protection system process, although they are carried

out randomly and/or sporadically. At the fourth level

of conformity, organizational and technical measures

are implemented in full and on an ongoing basis in

accordance with the general approaches established

in the organization. Control processes and

improvement of the information protection process

are mainly implemented. The fifth level of

compliance adds continuous monitoring and

necessary timely improvement of organizational and

technical measures of the information protection

system process

The main requirements of the Regulations of the

683-P in the framework of countering threats to

information security in banks contain the following

requirements are:

assessment of compliance with the National

Standard GOST R 57580.1-2017;

two-stage modernization of the information

protection system;

penetration testing and vulnerability analysis;

certification of vulnerabilities;

application of personal data protection

measures;

recommendations for clients on information

security;

recording of information protection incidents;

Information Security Requirement for Business

Processes.

5 CONCLUSIONS

The main requirements to be met by the equipment

used by banks to protect information security should

be attributed to these. how: functionality, reliability,

simplicity and ease of use at an acceptable cost. The

role of effective security interactions with each other

and with information security management systems is

also growing. As a rule, different products of the same

manufacturer are effectively integrated with each

other, but today the needs of the informatization

market are aimed at ensuring effective interaction and

from the solutions of different manufacturers.

The fact of warning is extremely important, that

is, banks faced with the inevitable need to invest in

promising research and development so that

information security systems can improve not in

connection with the crimes that occurred, but allow

preventing, among other things, completely new,

previously unknown types of attacks.

Solutions in the field of information security of

the bank require constant improvement and

development. They must be adequate to modern

threats, which, in turn, are also constantly developing

and improving.

Information Security in Banks

85

REFERENCES

Federal Law from 07/27/2006 № 152-FL, 2006. About

Personal Data

ISO 31000, 2018. Risk Management – Management

National standard of the Russian Federation GOST R

57580.1-2017, 2017. Security of financial (banking)

operations. Protecting the information of financial

institutions. Basic set of organizational and technical

measures

Regulation the Bank of Russia from 04/08/2020 № 716-P,

2020. On requirements for the operational risk

management system in a credit institution and a

banking group

Regulation Bank of Russia from 04/17 /2019 № 683-P,

2019. On the establishment of mandatory requirements

for credit institutions to ensure the protection of

information during banking activities in order to

counter the implementation of money transfers without

the consent of the client

Bank of Russia (2009). Recommendations in the field of

standardization RS BR IBBS-2.2-2009. Ensuring

information security of organizations of the banking

system of the Russian Federation. Methodology for

assessment of risks of violation of information security

Bank of Russia (2020). Overview of reporting on

information security incidents during the transfer of

funds in the I and II quarters of 2019/2020

Bank of Russia (2019). The main directions for the

development of information security of the credit and

financial sector for the period 2019-2021

Standard STO BR IBBS 1.0- 2004, 2004. Ensuring

information security of organizations of the banking

system of the Russian Federation

Evdokimova, Y., Egorova, E. and Shinkareva, O. (2020).

Information technology in financial sector Russian

Federation - Driver of the formation of the Russian

economy, E3S Web of Conferences, 208, 03017.

Sberbank, 2020. Rating of "cashless" cities and regions.

Results of 2019

TAdviser, 2021. APT - Targeted or Targeted Attack

INFSEC 2021 - International Scientific and Practical Conference on Computer and Information Security

86