Ethical Questions Raised by Public Accountants in Colombia Related

to Tax Advice

Jimmy Leonardo Velandia Daza

1

and Jasleidy Astrid Prada Segura

2 a

1

UNIMINUTO, Bogotá D. C., Colombia

2

Sublínea de Investigación Contabilidad y Articulación con El Entorno Organizacional, Grupo RADCO, Colombia

Keywords: Code of Ethics IFAC, Ethics, Elusion, Evasion.

Abstract: This research seeks to establish the ethical questions posed by public accountants against the responsibility

of satisfying the needs and requirements of clients advised especially in tax and tax matters. An analysis is

carried out through the mixed methodology, in which the survey is used as a collection instrument, applied to

a population of public accountants in progress and in exercise, complementing with the systematic review of

the literature that provides the foundations to sustain from the theory the ethical and moral approaches,

obtaining as results that 41.1% of the respondents know and appropriates the ethics code of the IFAC and

36.7% the law 43 of 1990, but contradicting themselves that despite the knowledge of the breaches of ethics,

61.1% have knowledge about avoidance practices or tax evasion in the companies that have worked, reflecting

in a hypothetical way a breach of ethics from a justified framing in the categorical.

1 INTRODUCTION

The accounting profession is one of the professions

with the greatest responsibility to third parties, since

it is responsible for giving public faith based on

relevant facts concerning the financial, accounting

and tax fields, its wide field of action allows the

perform in different roles such as auditor, analyst,

financial manager, tax reviewer, among others, facing

taking responsibility for meeting the needs of the

client, however it is important to highlight that in a

high probability it will face ethical questions in its

action, therefore the public accounting professional is

confronts a conflict that Kant poses as the categorical

imperative and the hypothetical imperative,

according to (Malishev, 2014), moral reason (as Kant

calls practical reason) entails the ability to choose

one's own action, regardless of motivations, impulses,

needs and sensitive passions, feelings of pleasure and

displeasure. So the moral act takes place where man

behaves not according to his impulses, but submits to

his conscious will expressed through words.

Assuming acts that lead to lack of ethics, for many

accountants becomes a justification argued under the

parameters of economic consideration and efficient

advice, which leads them to deceive their

a

https://orcid.org/ 0000-0002-6130-461X

subconscious, generating a sophistry of distraction

between the ethical and the moral.

2 DEFINITION AND APPROACH

OF THE PROBLEM

Exercising the accounting profession in a country like

Colombia is not an easy task, since it is one of the

countries with one of the highest tax rates worldwide

and a high rate of corruption not only at the state level

but also business, generating in businessmen an

excuse to evade or avoid taxes so that their profits are

not diminished, obtaining through these practices,

greater profits, making use of the so-called creative

accounting, accounting professionals assume a

leading role that not only give The role of accountant

but also in the role of fiscal reviewers is that

internationally known as fiscal reviewer, auditor,

commissioner of accounts among others, putting the

professional in a position of confrontation between

his ethics and his responsibility with the satisfaction

of the client. In order to argue the position of the

Colombian public accountant against the client's

requirements and professional ethics, the following

136

Daza, J. and Segura, J.

Ethical Questions Raised by Public Accountants in Colombia Related to Tax Advice.

DOI: 10.5220/0009791401360144

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 136-144

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

approach will be carried out throughout the

investigation. Does the responsibility of satisfying

customer needs exceed the principles of professional

ethics?

2.1 Antecedents

The aim is to establish the ethical challenges posed by

public accountants and workers in financial

departments regarding the responsibility of satisfying

the needs and requirements of the clients specially

advised in tax matters. Allowing Identify relevant

factors in the avoidance and evasion of taxes and

Understand the main causes of the lack of ethics by

public accountants.

Ethics is immersed in different areas of daily life,

especially in professional life, it reflects the values

with which it has grown and goes hand in hand with

morality. When talking about ethics and profession,

human behavior is evoked in work and professional

performance, its action against different situations

that challenge it to choose between its principles,

values, beliefs and economic success. In the 21st

century, a problem has been visualized within the

accounting profession, which lies in the unfair

competition that some professionals carry out against

the exercise of the same, which, using unconventional

practices, generate an easy and mediocre scheme in

the development of accounting work, (García, 2016).

Ethics and morals are not synonyms. Ethics

considers fundamental concepts, principles and

values that guide people and societies. A person is

ethical when guided by principles and convictions.

Morality is about the real practice of people who

express themselves by accepted customs, habits and

values. A person is moral when it works according to

established customs and values that, eventually, can

be questioned by ethics. A person may be moral

(follow customs) but not necessarily ethical (obey

principles), (Boff, 2003). When the public accountant

exercises their functions, requirements may be

presented by their bosses that lead them to question

themself in an ethical manner, but also to commit tax

fraud, becoming one of the greatest corruption crimes

at the business level, having as a major protagonist

the accountant, fiscal reviewer or auditor who is the

one who gives public faith of all the actions of the

organization both financially and fiscally, as

evidenced (Mompotes & Soto, 2017), who show that

Colombia currently ranks 90th among 176 nations

evaluated for Transparency International, having as

significant figure that in the last seven years, more

than 19,000 people have been sanctioned for acts of

corruption. In fact, 80% of Colombian entrepreneurs

who responded to Ernst & Young's 'Global Fraud

Survey 2016' admitted that there is corruption in their

businesses. Worse, 30% are willing to forge financial

statements and pay bribes for a contract. According to

the report (KPMG, 2016), one of the biggest

motivations when committing fraud is economic. Of

the total of 1,082 motivations mentioned in the

analysis, 614 relate to greed, profit and economic

difficulties, while another 114 were related to the

achievement of business objectives. The only non-

financial reason with a similar frequency is the simple

will to do so (or "because I can") with 106 cases. As

for the most common crimes, in 56% of the cases the

most frequent fraud is the misappropriation of assets,

where the embezzlement represents 40% and the

fraud in purchases 27%. The second most common

fraud is obtaining income from assets through

fraudulent or illegal activities (24%), demonstrating

that a high percentage of crimes are committed

conscientiously and for convenience. Many of the

public accountants who commit crimes of tax fraud

are discovered and sanctioned by the central board of

accountants, a government entity that controls public

accounting professionals in Colombia.

2.2 Theoretical Framework

According to (Mayorga, 2018) who extracts a section

of Kant (2002) defines ethics in the categorical

imperative as objectivity regardless of the particular

interests of the being; Compared to Law 43 of 1990,

it is estimated that they are mandates that must be

fulfilled without restriction. For the exercise of the

accounting profession in Colombia, this law sets out

the ethical principles that must be strictly adhered to.

According to (Álvarez, 2017), in the last six years the

number of accountants who are duly registered and in

an active state before the UAE Central Board of

Accountants amounts to 268,267 of which 486 public

accountants sanctioned since the year have been

submitted 2011 to 2016, these actions are presented

from the lack of ethics, the thirst for power, to

pointing out the administrators and managers as

guilty, one of the purposes of the standardizing and

regulatory bodies, is skepticism in the accounting

profession, for (Viloria, 2016), standards-issuing

bodies, regulators of the profession and markets, and

academics linked to insurance and audit activities

agree on the importance of professional skepticism

and raise the need to focus on raising levels the same

in public accountants in public practice, however

(Daz, 2014) ensures that in today's world success is

measured taking into account variables such as power

and wealth, under a scheme in which the end justifies

Ethical Questions Raised by Public Accountants in Colombia Related to Tax Advice

137

the means. The accountant when becoming the person

who generates the reports, of the financial situation of

a company, before the governmental institutions,

causes that at present this discipline acquires a

relative importance in terms of growth and economic

development, (Vallejo, et al ., 2017), in a globalized

and demanding environment such as the one that is

experiencing the current situation of the accounting

profession, the issue of ethics and social

responsibility is not only raised from the legal point

of view, there are also situations and contextual

characteristics that it is necessary to develop to try to

find a public accountant capable of solving all

situations, not only of their working life but also of

the environment and social resources that surround

them, in order to establish and form a suitable and

dignified space where the accounting public fulfills

the true role for which it was created. Until the year

2018, there were 236,719 active accountants

registered in Colombia since 1956, although it is true

that it becomes a striking profession, it has also

generated great scandals because it has been misused.

In 2017, the Central Board of Accountants reported

547 professionals sanctioned as natural persons and 7

companies as legal entities (Central Board of

Accountants, 2018).

The Public Accountant, empowered by law, to

prepare the accounting information, as a faithful

reflection of the financial situation and the results

obtained by a company; and that, based on this

information, many interested in the company

(Stakeholders), make transcendental economic

decisions, it is expected that their performance, get

the highest ratings or failing that, very close to the

optimum, which, expressed in figures percentage

should be between 98% and 100%. Any minor

qualification will be an expression of distrust in the

fulfillment of their professional work, (Guibert,

2013). (Acuña, et al., 2019), mention that the human

being, by their natural way of being, always seeks to

realize themself within their possibilities; in that

effort of realization they build their world, the

"concrete" world by which they realize in their

possibilities; the world that they build “in their

realization as a human being” constitutes it, and in

that constitution the cultural already becomes, the

culture is already there. (González, et al., 2012) they

cite (Trejos, 2003), who evidences that an important

organizational component in the organization's

decision making is constituted by the Public

Accountant because his dignified and well-

represented profession constitutes a guarantee of

ethical and optimal business management; The

transparency of the company must be reflected in the

financial and accounting statements, in the fiscal

reports and in the management of the money. In

Colombia, before working with IFRS, Law 43 of

1990 is created, which regulates the profession of

Public Accountant, which states that the Public

Accountant must have mental independence in

everything related to their work, to guarantee the

impartiality and objectivity of their judgments, in

addition to this, the Public Accountants are obliged

to:

1. Observe the standards of professional ethics.

2. Act subject to generally accepted auditing

standards. This norm is of vital importance in the

development of the accounting profession, since it

clearly establishes the obligations that the Public

Accountant has regarding its performance. (Congress

of the Republic of Colombia, 1990).

Tax avoidance, is the decrease in the payment of

taxes without the need to violate tax laws, taking

advantage of the gaps in the rule, can be considered

as circumvention when a trader anticipates that

according to their annual income they must pass from

simplified regime to common regime, and to avoid it,

they divide their business into two parts, one remains

in their name and the other in the name of a relative

(Rodríguez Calderón, 2015). Tax Evasion It consists

of reducing or eliminating the payment of taxes

through illegal methods such as: the non-declaration

of the real income obtained, expenses not

corresponding to the economic activity that develops,

often occurs in small and medium-sized companies

that When trying to compete in the market, the non-

invoicing of VAT is the best option in reducing costs.

One of the most common practices is tax

avoidance. “For example, do not enter business

resources in the financial system to avoid paying 4 per

thousand; or not to invoice all the sales of a company

to pay the minimum part of this tax ”, an important

focus of corruption has also been given by the entry

into force of international accounting standards, since

these have allowed to misunderstand concepts such

as“ fair value ”, which has made it easier for

entrepreneurs with the satisfaction of some

accountants to make incorrect valuations of assets, in

order to obtain fraudulent benefits, (Universidad

Libre de Colombia, 2018). Many professionals to see

that the laws are not complied with and that there are

no drastic punishments or sanctions opt for the easiest

way to commit acts of corruption and forget the

application of ethical principles. However, modifying

the thinking of people is not easy and less so

nowadays, since professionals pressured by economic

factors and faced with precarious compensation,

conduct reprehensible behaviors (G. & M., 2018). As

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

138

mentioned (A. & A., 2017), professional ethics is one

of the most relevant issues during the formation of

future public accountants, since bad practices

generate a negative impact and this implies the

affectation of society that trust the financial

information that is reported and with which decisions

are made.

2.3 Methodology

In order to respond to the problem statement, an

explanatory investigation is carried out, since it seeks

the main causes that lead the public accountant to

disregard their ethics against the responsibility of

satisfying a client's requirement, especially in tax

matters, It aims to investigate a phenomenon that

affects the good name of the accounting profession,

applying a mixed approach methodology, since the

collection of information will be through systematic

documentary review and application of surveys to a

significant sample of public accountants in progress

and exercise, the mixed methodology has, as

mentioned (Binda & Balbastre-Benavent, 2013), as a

final purpose to produce knowledge through the

resolution of the problem established at the beginning

of the study.

Under the research methodology label, reference

is made to all the decisions the researcher takes to

achieve their objectives, which focus on aspects such

as the design of the research, the strategy to be used,

the sample to be studied, the methods used to collect

the data, the techniques selected for the analysis of the

results and the criteria to increase the quality of work,

among others.

2.3.1 Collection Instruments

The information collection is initially carried out

through the systematic review of the literature, which

gives theoretical support to the arguments raised,

supported by the application of surveys to the main

actors of the research, the survey is supported by 17

multiple-choice questions that allow answering the

main problem statement.

2.3.2 Population and Sample

The target population is the Public Accountants and

Public Accountants students of the Minuto de Dios

University in the city of Bogotá, Calle 80D

Headquarters that work in financial departments. In

order to establish the sample, the following

calculation is made:

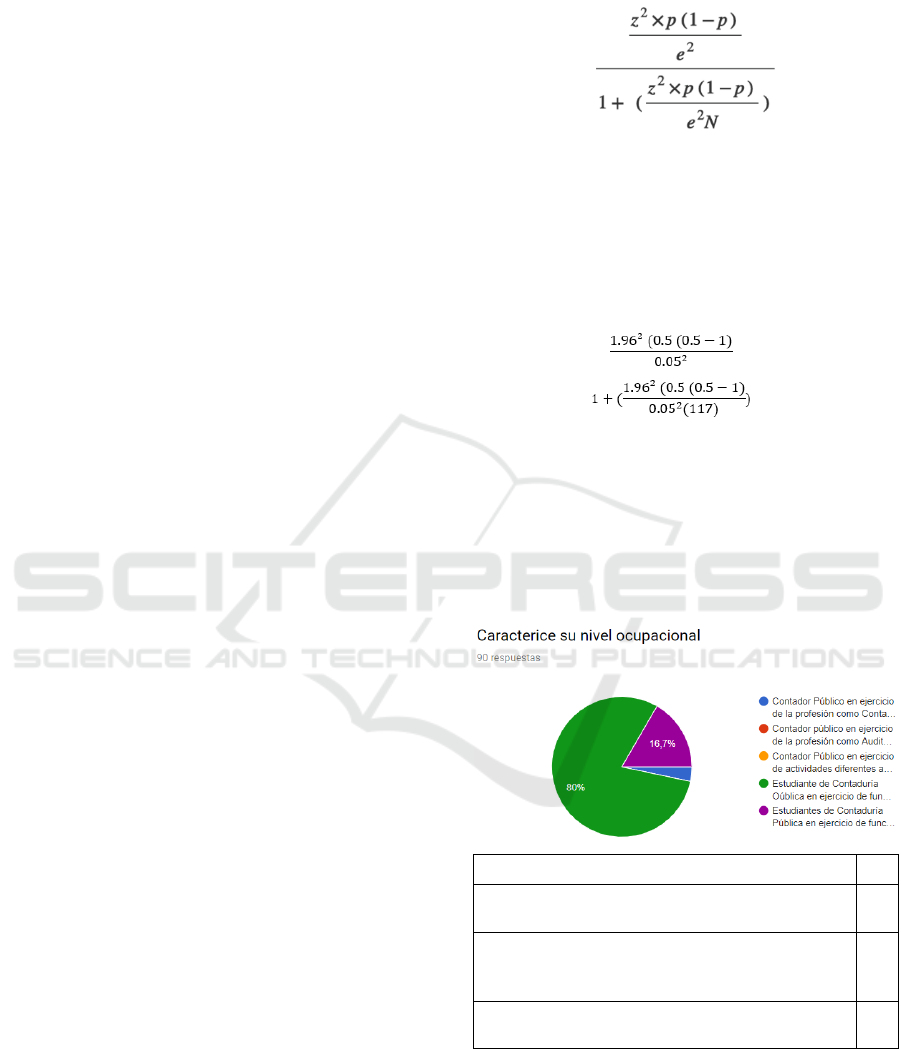

2.3.3 Sample Size =

● N = population size

● e = margin of error (percentage

expressed with decimals)

● z = score z

The population size chosen is 117 people, of

which when applying the formula gives the

following results.

= 90 surveys

2.4 Results

By applying the 90 surveys to the selected sample, the

following results have been obtained:

1.

Characterize your occupational level

Q

Public Accountant in the profession as an

Accountant

3

Public Accounting students in the

exercise of functions other than

accounting

15

Public Accounting student in the exercise

of accounting functions

72

Ethical Questions Raised by Public Accountants in Colombia Related to Tax Advice

139

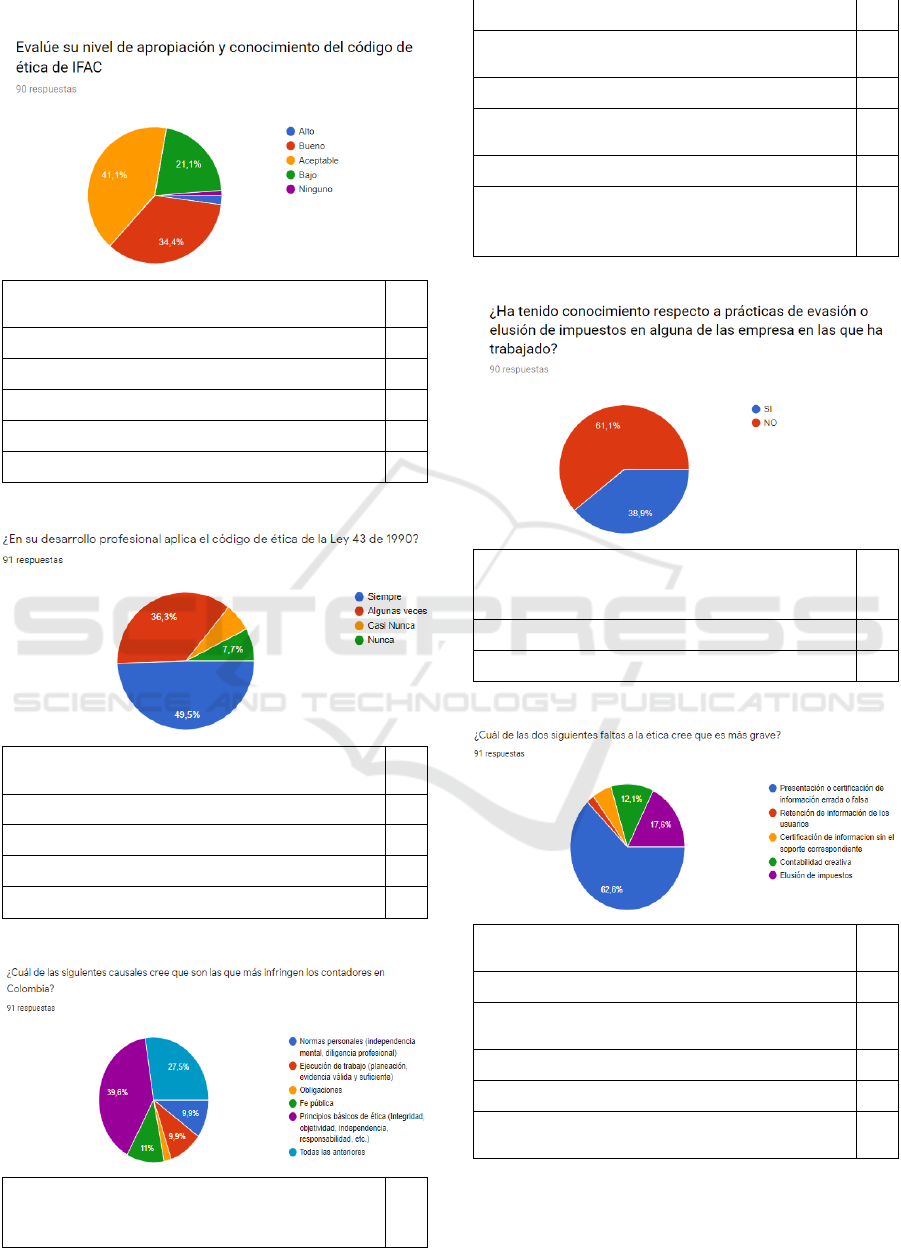

2.

Evaluate your level of ownership and

knowledge of the IFAC code of ethics

Q

None

1

High

2

Low

19

Good

31

Acceptable

37

3.

In your professional development, do you

apply the code of ethics of Law 43 of 1990?

Q

Hardly ever

6

Never

6

Sometimes

33

Always

45

4.

Which of the following causes do you think

are the most infringing accountants in

Colombia?

Q

Obligations

2

Work execution (planning, valid and

sufficient evidence)

9

Public faith

9

Personal rules (mental independence,

professional diligence)

9

all of the above

25

Basic principles of ethics (Integrity,

objectivity, independence, responsibility,

etc.)

36

5.

Have you had knowledge regarding tax

evasion or avoidance practices in any of the

companies where you have worked?

Q

No

55

Yes

35

6.

Which of the following two failures to ethics

do you think is more serious?

Q

Retention of user information

2

Certification of information without the

corresponding support

5

Creative accounting

11

Tax avoidance

16

Presentation or certification of erroneous

or false information

56

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

140

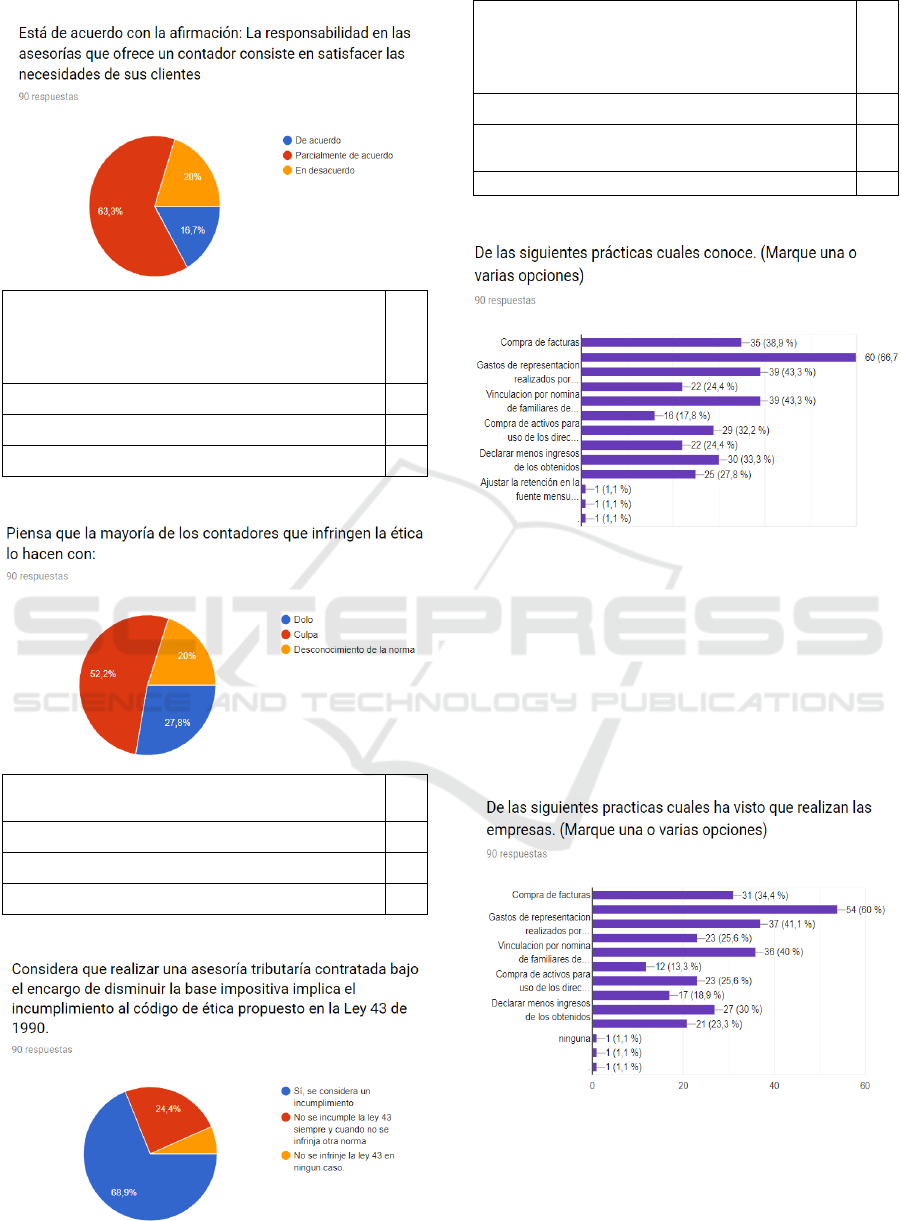

7.

Do you agree with the statement: The

responsibility in the advice offered by an

accountant is to meet the needs of their

customers?

Q

In agreement

15

In disagreement

18

Partially agree

57

8.

Do you think that most accountants who

violate ethics do so with:

Q

Ignorance of the norm/politics

18

Mens rea / Fraud

25

Guilt

47

9.

Do you consider that conducting tax advice

contracted under the order to reduce the tax

base implies a breach of the code of ethics

proposed in Law 43 of 1990?

Q

Law 43 is not violated in any case.

6

Law 43 is not broken as long as no other

rule is violated.

22

Yes, it is considered a breach.

62

10.

Which of the following practices do you know?

(Check one or more options)

90 Answers

Purchase of invoices.

Representation expenses incurred by.

Payroll for family members.

Purchase of assets for management use.

Declare less income than obtained.

Adjust the retention at the monthly source.

11.

Of the following practices, which have you seen

that companies do (Check one or more options)

90 Answers

Purchase of invoices.

Representation expenses incurred by.

Ethical Questions Raised by Public Accountants in Colombia Related to Tax Advice

141

Payroll for family members of

Purchase of assets for management use.

Declare less income than obtained.

None.

12.

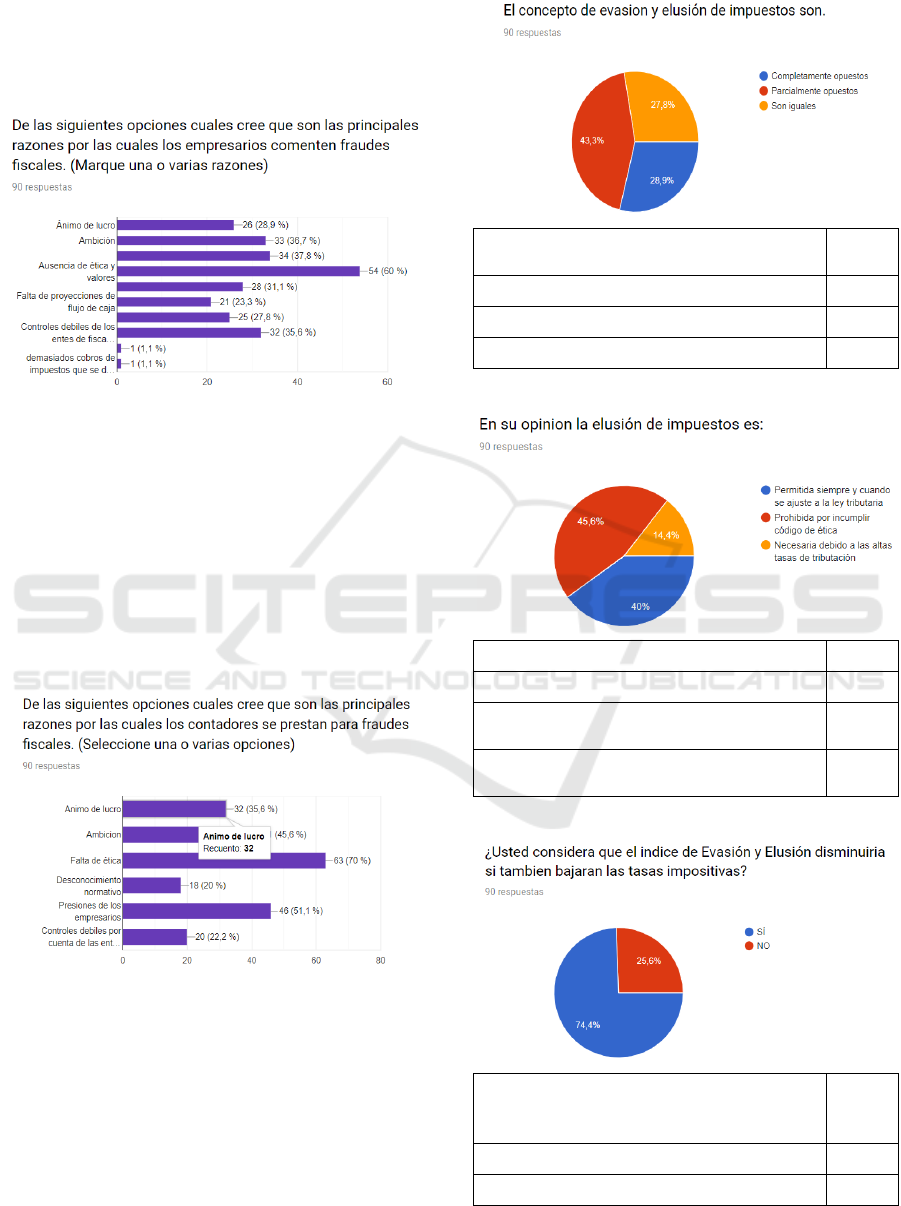

Of the following options, which do you think are

the main reasons why employers commit tax

fraud? (Check one or several reasons)

90 Answers

For profit

Ambition

Absence of ethics and values

Lack of cash flow projections

Weak controls of entities

Too many tax collections

13.

Of the following options, which do you think are

the main reasons why accountants do themselves

to tax fraud? (Select one or more options)

90 Answers

For profit

Ambition

Absence of ethics and values

Regulatory Ignorance

Pressures from entrepreneurs

Weak controls of entities

14.

The concept of tax evasion and avoidance

are.

Q

They are equal

25

Completely opposite

26

Partially opposed

39

15.

In your opinion, tax avoidance is:

Q

Necessary due to high tax rates.

13

Allowed as long as it conforms to the

tax law

36

Prohibited for breaching code of

ethics

41

16.

Do you think that the Evasion and

Avoidance rate would decrease if tax

rates also fell?

Q

NO

23

YES

67

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

142

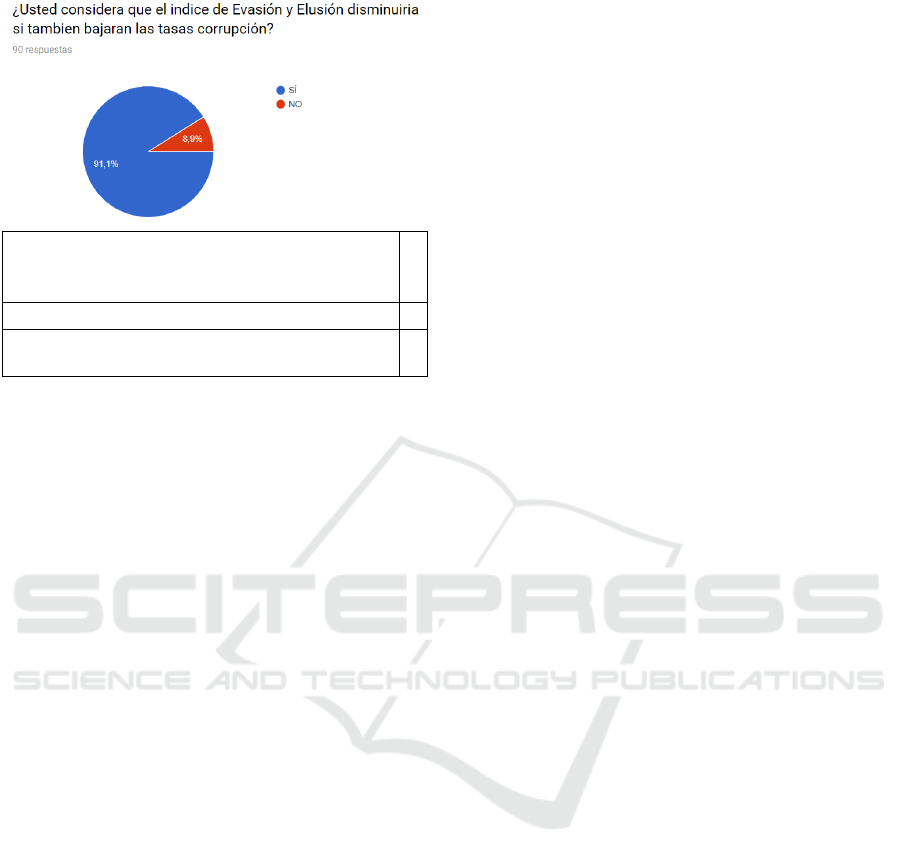

17.

Do you think that the Evasion and Avoidance

rate would decrease if corruption rates also

fell?

Q

NO

8

YES

8

2

3 CONCLUSIONS

It can be shown that 36% of respondents believe that

tax avoidance is allowed as long as it complies with

the tax law, considering 82% that corruption will be

reduced if the high tax rate is reduced, demonstrating

that a high percentage of the accountants who break

the laws and lack ethics, they do it with guilt,

presenting false information and giving public faith

of financial data that they do not know, shielding their

failures in customer satisfaction. It is necessary to

address the problem from different instances.

Educational instructions: those who must

implement chairs of professional ethics in which the

code of ethics is approached under the case study

strategy as promoted by IFAC in its standard called

IES 4 (International Education Standards), (IFAC -

INTERNATIONAL FEDERATION OF

COUNTERS, 2008) Collegiate control or

professional regulation entities: A second instance

corresponds to the inspection and control that is

instituted by the profession, increasing the degree of

supervision and sanctioning policies in order to

promote the control environment in professional

performance.

Fiscal authorities: Finally, given the results of the

evasion and circumvention that according to ECLAC,

(ECLAC, 2018) can amount to 6.3% of GDP, it is

important that governors take measures to reduce

these indicators, such tax reform that complements

measures such as electronic billing and third-party

reporting that has been insufficient, a proposed

alternative may correspond to promoting bank

retention that guarantees the flow of resources to the

state and avoids the decision to transfer them by the

employer who probably prefers to design evasion

strategies.

REFERENCES

A., N. T., & A., S. H. (2017). La importancia de la

responsabilidad social del Contador Público en su

quehacer profesional. Recuperado el 19 de octubre de

2019, de

https://repository.libertadores.edu.co/bitstream/handle/

11371/1011/NavarroTorresJorgeArmando.pdf?sequen

ce=2&isAllowed=y

Acuña, M. L., Laverde, M. H., Lora, A. L., A., O. H., &

Ruiz, U. J. (12 de octubre de 2019). Reflexiones sobre

ética en contabilidad. Obtenido de Area Andina:

https://digitk.areandina.edu.co/bitstream/handle/areand

ina/3549/3%20-

%20Reflexiones%20sobre%20etica%20en%20contabi

lidad%205%20NOV%20%281%29.pdf?sequence=1&

isAllowed=y

Álvarez, R. D. (25 de junio de 2017). Análisis de las

sanciones impuestas por la junta central de contadores

en los últimos 6 años, a la luz del código de ética del

contador público contemplado en la ley 43 de 1990 y

del código de ética emitido por la IFAC. Recuperado el

9 de julio de 2019, de Universidad pedagógica y

tecnológica de Colombia:

https://repositorio.uptc.edu.co/bitstream/001/2522/1/T

GT-1138.pdf

Binda, N. U., & Balbastre-Benavent, F. (2013).

Investigación cuantitativa e investigación cualitativa:

buscando las ventajas de las diferentes metodologías de

investigación. . Revista de Ciencias económicas, 179-

187.

Boff, L. (2003). Ética y moral. Bilbao: Editorial Sal Terrae.

CEPAL. (2018). Anuario estadístico de América Latina y

el Caribe 2018. Recuperado el 19 de octubre de 2019,

de https://www.cepal.org/es/publicaciones/44445-

anuario-estadistico-america-latina-caribe-2018-

statistical-yearbook-latin

Congreso de la República de Colombia. (1990). Ley 43 de

1990. Recuperado el 10 de octubre de 2019, de

https://www.mineducacion.gov.co/1621/articles-

104547_archivo_pdf.pdf

Daz, A. M. (2014). INCIDENCIA ECONÓMICA DEL

CONTADOR ÉTICO. . Revista Colombiana de

Contabilidad-ASFACOP , 70-91.

G., P. R., & M., S. M. (2018). Percepciones de estudiantes

y contadores en ejercicio de las sanciones impuestas por

la Junta Central de Contadores. Periodo 2013-2017.

Recuperado el 19 de octubre de 2019, de

https://ciencia.lasalle.edu.co/cgi/viewcontent.cgi?articl

e=1729&context=contaduria_publica

García, V. (2016). La competencia desleal un problema de

ética profesional. Recuperado el 19 de octubre de 2019,

de

Ethical Questions Raised by Public Accountants in Colombia Related to Tax Advice

143

https://repository.unimilitar.edu.co/handle/10654/1518

2

González, M. L., Contreras, M. J., & Guajardo, M. E.

(2012). Percepción del sector empresarial sobre el

desempeño laboral del Contador Público egresado de la

FCA de la UA de C. Recuperado el 19 de octubre de

2019, de UNIVERSIDAD AUTONOMA DE

CHIHUAHUA:

http://www.fca.uach.mx/apcam/2014/04/05/Ponencia

%2015-UACoah-Monclova.pdf

Guibert, A. M. (1 de diciembre de 2013). El rol del contador

público y su responsabilidad ética ante la sociedad.

Recuperado el 08 de julio de 2019, de Universidad de

San Martín de Porres:

http://www.repositorioacademico.usmp.edu.pe/bitstrea

m/usmp/568/3/guibert_gm.pdf

IFAC - FEDERACIÓN INTERNACIONAL DE

CONTADORES. (2008). Manual de los

pronunciamientos internacionales de formación.

Recuperado el 18 de octubre de 2019, de

https://www.ifac.org/system/files/downloads/Spanish_

Translation_Normas_Internacionales_de_Formacion_

2008.pdf

Junta Central de Contadores. (2018). Listado de Contadores

Publicos Sancionados los ultimos 5 años. Recuperado

el 19 de octubre de 2019, de

http://www.jcc.gov.co/tramites-y-

servicios/servicios/sanciones/contadores-sancionados

KPMG. (20 de mayo de 2016). Perfiles globales del

defraudador. Recuperado el 09 de julio de 2019, de

KPMG:

https://assets.kpmg/content/dam/kpmg/pdf/2016/05/pr

ofiles-of-the-fraudster.pdf

Malishev, M. (2014). Kant: ética del imperativo categórico.

La colmena, 9-21.

Mayorga, L. A. (2018). La importancia del imperativo

categórico en la ética del ejercicio de la profesión

contable. Reflexiones sobre contabilidad., 43.

Mompotes, A., & Soto, M. (26 de Febrero de 2017). La

cruzada para que no se sigan robando el país con

corrupción. El tiempo, pág. 2.

Rodríguez Calderón, D. E. (diciembre de 2015). Evasión y

elusión de Impuestos. Recuperado el 10 de octubre de

2019, de

https://repository.unimilitar.edu.co/bitstream/handle/1

0654/6958/RODRIGUEZ%20CALDERON%20DIAN

A%20ESPERANZA%202015.pdf?sequence=1&isAll

owed=y

Trejos, M. F. (2003). Responsabilidad ética del Contador

Público . Estudio de caso realizado en la Ciudad de Cali,

Colombia. Universidad de Colombia. Retrieved from

http://www.monografias.com/trabajos16/responsabilid

ad-eticacontador/responsabilidad-etica-contador.shtml

Universidad Libre de Colombia. (1 de marzo de 2018). 504

contadores públicos han sido sancionados por casos de

corrupción, revela informe. Recuperado el 9 de julio de

2019, de Universidad Libre de Colombia:

http://www.unilibre.edu.co/bogota/ul/noticias/noticias-

universitarias/3417-504-contadores-publicos-han-sido-

sancionados-por-casos-de-corrupcion-revela-informe

Vallejo, S. Y., Pérez, V. Y., & Ramírez, H. A. (2017). El

contador público y su proceso de formación ética y

social. Revista Visión Contable, 97-106.

Viloria, N. (2016). Estrategias de reforzamiento de

escepticismo profesional para los contadores públicos

en actividad de auditoría. Actualidad Contable Faces,

112-134.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

144