Implementation of Financial Management and Financial Accounting

Standard Number 69 Concerning Agricultural Atvillage-owned

Enterprises

Teguh Widodo

1

, and Suharyono

2

1

International Business Administration, State Polytechnic of Bengkalis, BathinAlam Street, 25711

2

Public Financial Accounting, State Polytechnic of Bengkalis, BathinAlam Street, 25711

Keywords: Bumdes, Biological Assets, Management, Finance.

Abstract: PSAK 69 on Agriculture is effective as of January 1, 2018. However, given the many types of agriculture,

there are no specific guidelines that provide guidance on how to apply it to certain agricultural industries. The

purpose of this study is to analyze the application of financial management and application of biological

assets based on Financial Accounting Standards No. 69. The significance of changes in the treatment of

biological assets does not only lead to large business entities, but also BUMDes. This change in treatment

led to all business entities engaged in agriculture such as agriculture, plantations and fisheries being asked to

carry out a transformation in the preparation of their financial statements. But the concern is how the

BUMDes readiness, especially those engaged in the industry. The second problem is that BUMDes has not

applied SFAS 69 in its financial reporting. This is due to the absence of instructions and direction from the

Village in making financial reports on the given capital.So the BUMDes reports in the format that the village

facilitator has. Based on the list of fixed assets provided, there is no record of assets either garden land or

plants or biological assets in the BUMD es asset list. The third problem is recording accounting and preparing

financial statements manually using the Excel application. Not yet computerized with accounting software.

So that the possibility of errors or errors will be easier to occur. With this research, it is expected to be a

guideline for BUMDes who have an agricultural business in managing their business and reporting financial

reports in accordance with applicable regulations.

1 INTRODUCTION

1.1 Background

To support the development of BUMDes businesses

in Riau Province, in 2019 the Riau Provincial

Government provided business capital assistance for

the development of Village-Owned Enterprises

(BUMDes). BUMDes who will get assistance amount

to 1,591 with a total budget of 318.2 billion. Each

BUMDes received stimulant funds to develop a

business unit of Rp 200,000,000.

Some BUMDes in Bengkalis Regency use the

funds to develop business units in the field of

Agriculture. Among them BUMDes Lubuk Muda,

has a business unit in the field of holding agriculture

that grows vegetables and fruits, such as: chilies,

long beans, beans, honey guava and Crystal guava.

BUMDes Tanjung Belit, has a business unit in the

palm oil sector.

Than BUMDes Kuala Alam has a pineapple

farming business unit. BUMDes Pambang Baru has a

chilli farming business unit. Meanwhile BUMDes

Bukit Kerikil has a cattle farm business.

The Indonesian Accountants Association (IAA)

as part of the International Federation of Accountants

together with the government in 2008 announced the

use of International Standards or better known as

IFRS (International Financial Reporting Standards).

The years 2006 to 2008 were the initial stages of

convergence of Financial Accounting Standards

(FAS) in the form of Statement of Financial

Accounting Standards (SFAS) to International

Accounting Standards (IAS).

SFAS No. 16 concerning Fixed Assets and Other

Assets was passed by IAA on May 29, 2007 which

was subsequently revised on November 29, 2011, is

Widodo, T. and Suharyono, .

Implementation of Financial Management and Financial Accounting Standard Number 69 Concerning Agricultural Atvillage-owned Enterprises.

DOI: 10.5220/0010355301650173

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 165-173

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

165

LIST OF PLANTATION

UNITS

IN

VE

N

TO

R

Y

BUMDes: Kencana

M

a

ndiri

Village: Tanjung

Belit

District:

Bengk

a

li

s

Month: December

2019

No

Inventory

T

ype

Unit

Price

@

A

m

ount

Economis

A

g

e

D

epreciation

Use

A

g

e

D

epreciation

Book

V

alue

1

Electric

Spray

1

800.000

800.000

36

22.222

5

111.111

688.889

2

Dodos

knife

2

200.000

400.000

36

11.111

5

55.556

344.444

3

Basket

2

300.000

600.000

36

16.667

5

83.333

516.667

4

Egrek

knife

2

700.000

1.400.000

36

38.889

5

194.444

1.205.556

5

Tojok

2

50.000

100.000

36

2.778

5

13.889

86.111

Total

3.300.000

91.667

458.333

2.841.667

Know by: Made

by:

Juliadi Putra Z

ubaidah

Head of Unit

T

re

as

urer

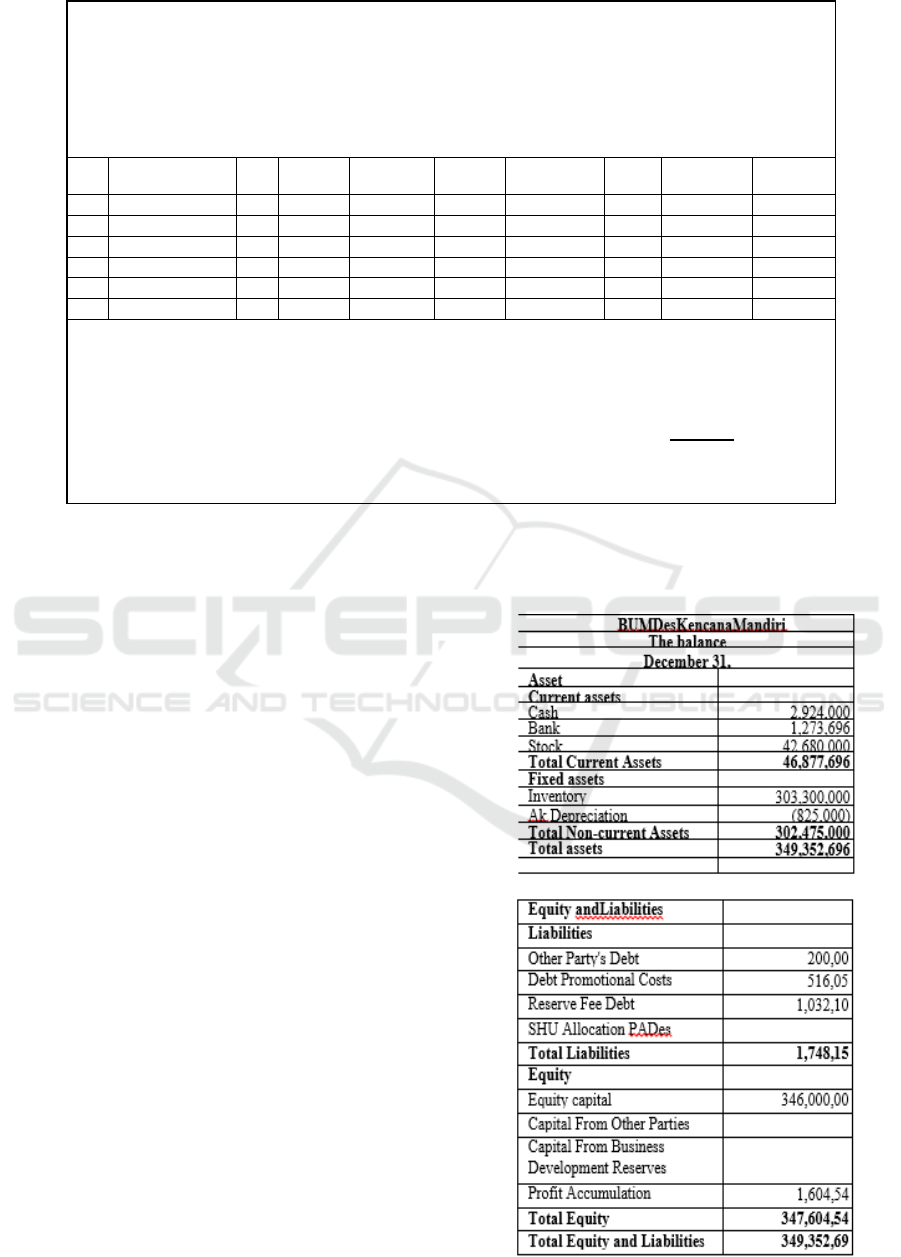

Figure 1. List of Fixed Assets

one of the IAI products that is based on IAS. The

SFAS No. 16 regulates how to recognize, record and

assess fixed assets and other assets. One of the other

regulated assets is Biological Assets in the form of

Agriculture. However, the regulation of Biological

Assets in mid- 2015 is regulated in a separate SFAS,

namely SFAS No. 69 on Agriculture and was

endorsed in December 2015.

SFAS 69 on Agriculture was effective as of

January 1, 2018. However, considering the many

types of agriculture, there are no specific guidelines

that provide guidance on how to apply it to certain

agricultural industries (Trina, 2017).

Significance of changes in the treatment of

biological assets not only leads to large business

entities, but also BUMDes which is a form of small

or medium business entities (Suharyono, 2020). This

change in treatment led to all business entities

engaged in agriculture such as agriculture, plantations

and fisheries being asked to carry out a The second

problem is that BUMDes has not applied SFAS 69

in its financial reporting. This is due to the absence

of instructions and direction from the Village in

making financial reports on the given capital. So the

BUMDes reports in the format that the village

facilitator has. Based on the list of fixed assets

provided, there is no recording of assets either

garden land or plants or biological assets in the

BUMDes asset list as in Figure 1

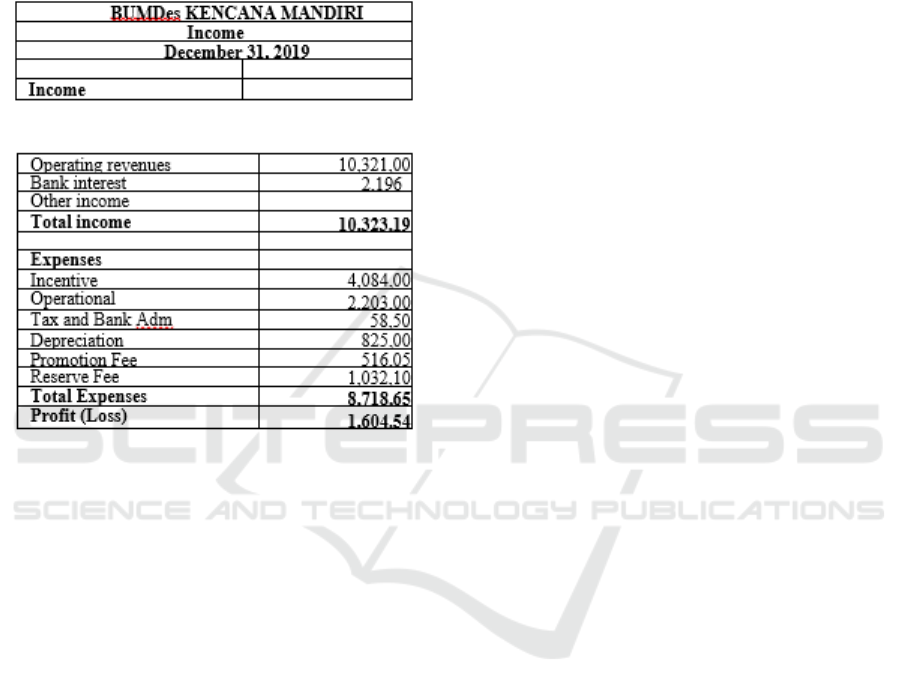

Table 1: Balance Sheet Reports Before the Implementation

of PSAK 69

ICAESS 2020 - The International Conference on Applied Economics and Social Science

166

The third problem is the recording of accounting

and preparation od financial statements that are done

manually using Excel application. Not yet

computerized with accounting software. So that the

possibility of errors will be easier to occour.

Table 2: Income Statement Before the Implementation of

PSAK 69

1.2 Formulation of the Problem

Based on the background described above, the

formulation of the problem in this study are as

follows:

1. How is BUMDes financial management

developing business in agriculture?

2. How is the recognition, measurement and

disclosure of biological assets based on SFAS

Number 69 at BUMDes in Bengkalis Regency?

3. How about financial accountability and

presentation of BUMDes financial statements for

capital assistance from the Riau Provincial

Government?

1.3 Research Limits

The scope of the limitation in this research is that

this study only analyzes the management and

presentation of BUMDes financial statements that

utilize stimulant funds from the Riau Provincial

Government to develop business units in the field of

Agriculture. While for other business units, such as:

UED-SP, trade and services are not the focus of this

research.

1.4 Research Objectives

The purpose of the research conducted by researchers

of this research proposal can be

explained in full as

follows:

1. To implement financial management in

accordance with established financial guidelines.

2. To apply recognition, measurement and

disclosure of biological assets based on Financial

Accounting Standards Number 69 at BUMDes in

Bengkalis Regency.

3. To implement the preparation of financial

statements using accounting software that is

accountable and transparent.

2 LITERATURE REVIEW

Agricultural activity is the management of biological

transformation and biological assets by entities for

sale or conversion into agricultural products or

additional biological assets. Biological assets

(biological assets) are animals or living plants. Costs

to sell (the cost to sell) are incremental costs directly

attributable to the disposal of assets, not including

financing costs and income taxes. A group of

biological assets (the group of biological assets) is a

combination of animals or similar living plants.

Harvest (harvest) is the release of products from

biological assets or termination of the life process of

biological assets. Agricultural products are products

that are harvested from biological assets belonging

to the entity. A productive plant (bearer plant) is a

living plant that:

1. Used in the production or supply of agricultural

products.

2. It is expected to produce products for periods of

more than one period.

3. It has a very rare possibility to be sold as an

agricultural product, except for the sale of

incidental scraps.

The biological transformation consists of the

process of growth, degeneration, production, and

progression which results in qualitative and

quantitative changes in biological assets. The

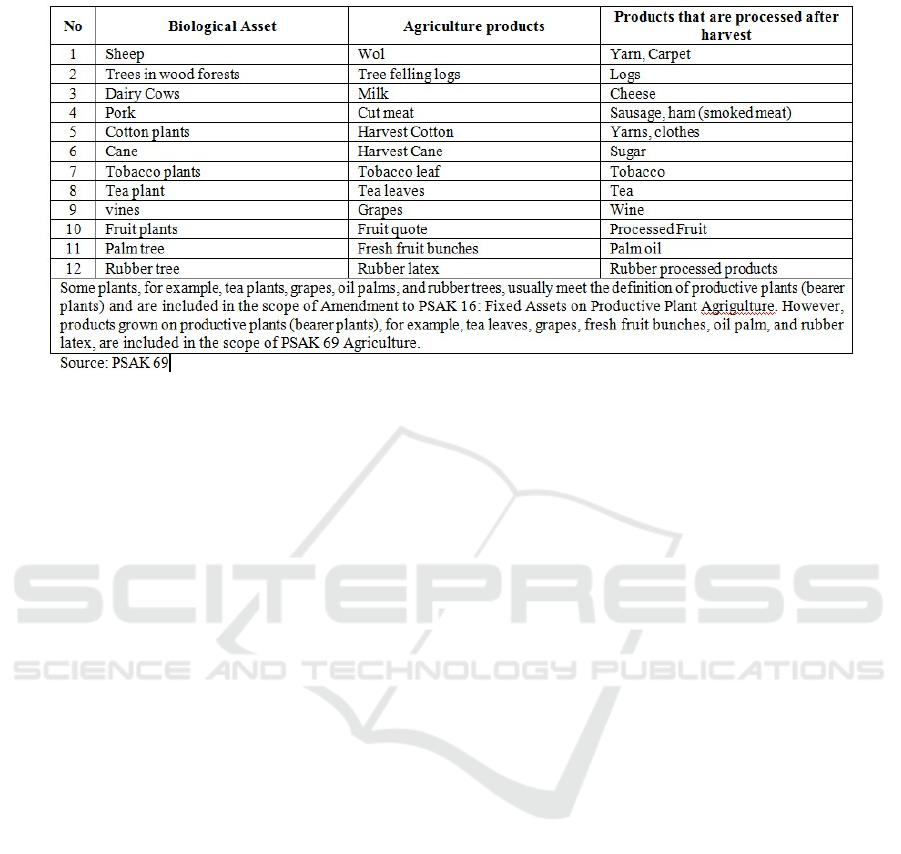

following table presents the biological assets,

agricultural products, and products that are processed

after harvest.

Implementation of Financial Management and Financial Accounting Standard Number 69 Concerning Agricultural Atvillage-owned

Enterprises

167

Table 3: Table of Biological Assets, Agricultural Products, and Products

For BUMDes engaged in the plantation,

agriculture, fishery or livestock industries, a specific

type of asset will emerge in a series of asset

classifications that it reports. Specific assets that make

the difference are biological assets. Biological assets

are entity assets in the form of animals and or plants

(SFAS 69). Specific characteristics inherent in

biological assets lie in the process of transformation

or biological changes to these assets until the time

these assets can be consumed or managed further by

the entity (Farida, 2013). These special characteristics

are also inherent in the plantation industry entities as

objects in this study. Biological transformation is a

process of growth, degeneration, production, and

procreation caused by qualitative and quantitative

changes in living things and produce new assets in the

form of agricultural products or additional biological

assets of the same type (Cahyani, 2014). Biological

assets, especially in the form of plantation crops, can

be classified as follows (SE Bapepam, 2002): annual

crops, perennials, plants that can be harvested more

than once but not perennials, horticultural crops, non-

horticultural crops, immature plants, and produce

plants.

2.1 Prior Research

Utomo (2014) research results show that biological

assets are plants and animals that undergo a biological

transformation. The biological transformation

consists of the process of growth, degeneration,

production and procreation that causes qualitative

and quantitative changes in animal and plant life,

can produce new assets that are realized in

agricultural produce or in the form of additional

biological assets in the same class. Because it is

undergoing a biological transformation,

measurements are needed that can show the value of

the asset fairly in accordance with its contribution in

generating an economic profit stream for the

company. IASC (International Accounting Standards

Committee) has published IAS 41 on Agriculture

which regulates biological assets. In SFAS (Statement

of Accounting Standards) there are no standards

governing the accounting treatment of biological

assets. This research was conducted at PT. Wahana

Graha Makmur Surabaya. The purpose of this

research is to find out how accounting treatment of

biological assets at PT. Wahana Graha Makmur

Surabaya based on IAS 41. In conducting this

research, the author bases the analysis based on the

literature relevant to the research topic as well as the

data obtained from the study site. The company

measures its biological assets based on their

acquisition value. Biological assets are measured at

cost and are presented on the balance sheet at book

value (acquisition cost less accumulated

depreciation). This is based on the consideration that

this value is more measurable so that the value

obtained is more reliable. And to achieve the

reliability of financial statements, companies must

make records related to biological assets.

Partiwi (2018) in his research in early 2016

Accounting Standards Board (ASB) issued an

agricultural SFAS-69 exposure draft in which this

PSAK was a full dedication from IAS-41 agriculture.

IAS-41 agriculture is an accounting standard intended

for agricultural entities in applying accounting for

their biological assets. 2018 is the year in which

Indonesia requires all agricultural entities to

implement the agricultural SFAS-69. This research

was conducted at PTPN XII Kalisanen, located in

ICAESS 2020 - The International Conference on Applied Economics and Social Science

168

Jember Regency. The purpose of this study is to

provide empirical evidence regarding the accounting

treatment of biological assets according to the

agricultural SFAS-69 compared to those in PTPN XII

Kalisanen. The results of this study are actually not

much difference between the agricultural SFAS-69

with the accounting treatment at PTPN XII

Kalisanen, but there are difficulties when the

measurement methods on the agricultural SFAS-69

based on the active market do not find the active

market.

3 RESEARCH METHODS

3.1 Research Stages

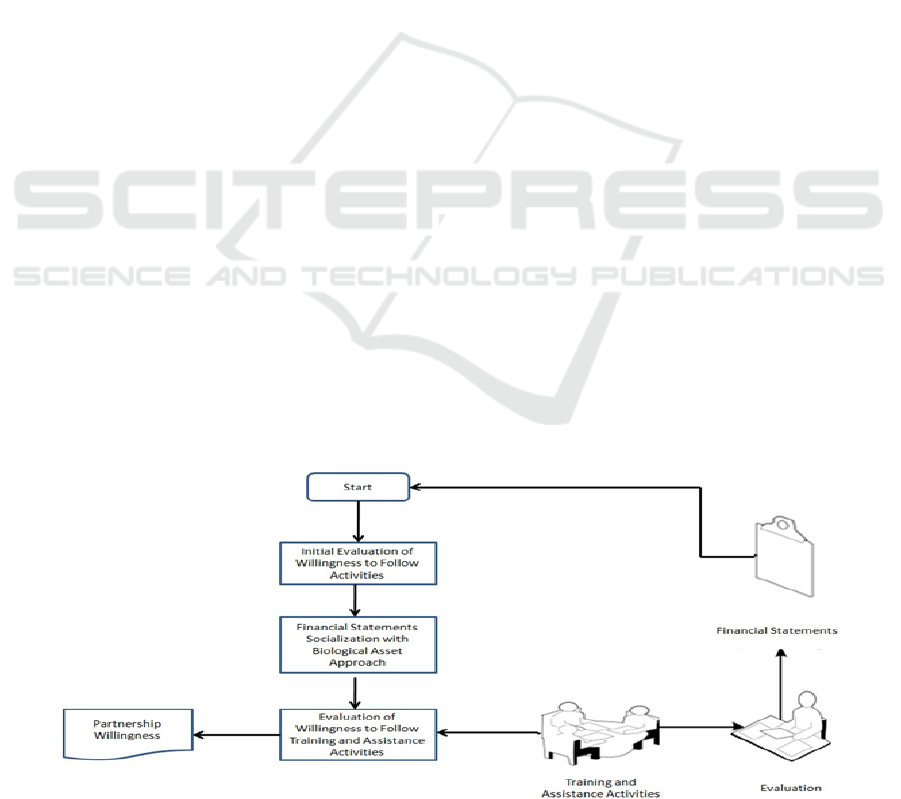

The complete stages of research activities can be

explained and seen in Figure 3, as follows:

1. Initial evaluation through field surveys.

2. Provides an understanding of the benefits of

financial reporting in accordance with the

provisions of Financial Accounting Standards.

3. Implementation and assistance in preparing

financial statements using the biological asset

approach in SFAS 69.

4. Providing training and preparation of financial

statement preparation, both directly and through

communication media.

5. Evaluate the results of training and mentoring that

has been done to evaluate the success of the

activities that have been carried out using simple

statistical calculations.

3.2 Research Location

The location of this research was carried out in

Bengkalis Regency, namely in BUMDes which runs

businesses in agriculture. One of the BUMDes that

we surveyed earlier and obtained financial report data

is BUMDes Kencana Mandiri having its address at

Tanjung Belit Village, Siak Kecil District, Bengkalis

Regency, Riau.

3.3 Measurement Parameters and

Observation

The process of change is observed/measured from

the development of biological assets, namely:

1. Biological assets

Biological assets are assets in the form of living

animals and plants. Biological assets are assets

that are mostly used in business activities in the

framework of the management of biological

transformation of biological assets to produce

products that are ready for consumption or still

require further processing.

2. Recognition of biological assets

Biological assets in financial statements can be

recognized as either current assets or non-current

assets in accordance with the period of biological

transformation of the relevant biological assets

(SFAS 69).

3. Measurement of biological assets

Biological assets are measured at

initialrecognition and at the end of each reporting

period at fair value fewer costs to sell, except for

the case described where fair value cannot be

measured reliably.

4. Disclosure of biological

assets

BUMDes discloses the combined gains or losses

arising during the period when initial recognition

of biological assets and agricultural products, and

from changes in fair value fewer costs to sell

biological assets (SFAS 69).

Figure 3: Stages of Research Activities

Implementation of Financial Management and Financial Accounting Standard Number 69 Concerning Agricultural Atvillage-owned

Enterprises

169

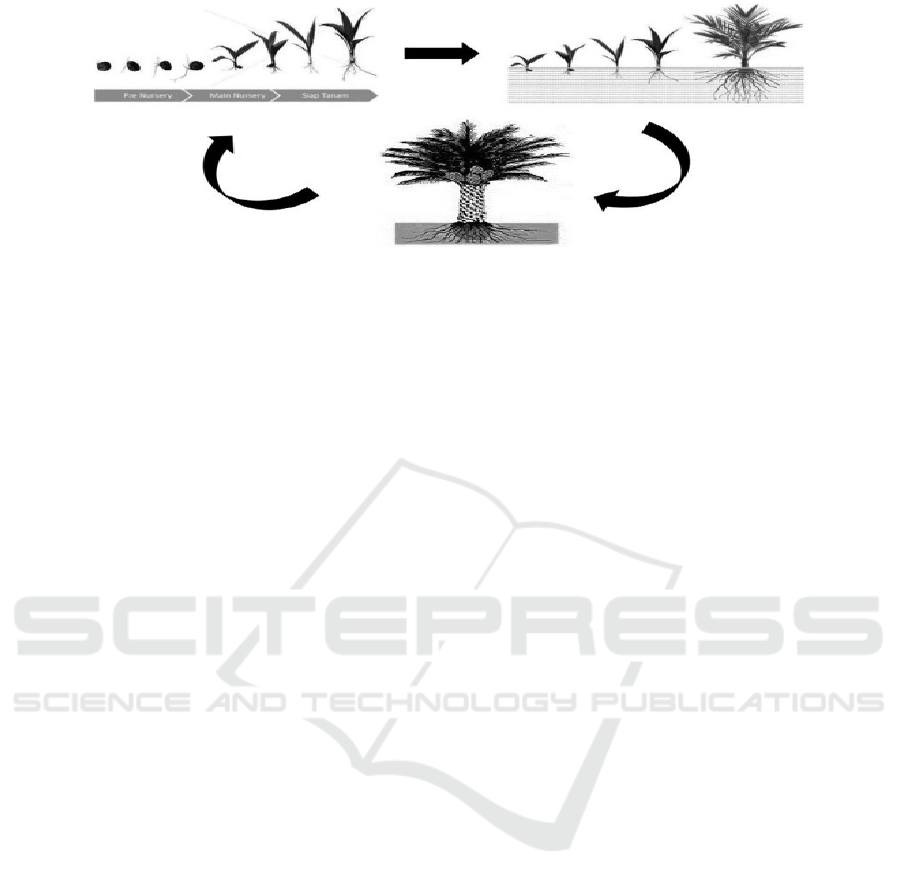

Figure 4: Plantation Biological Assets.

3.4 Research Models

The model used in this study is applied research

(applied research) because this study intends to find

out and describe the application of agricultural

accounting in BUMDes engaged in agriculture.

3.5 Research Design

The overall research design on biological assets can

be understood in Figure 4.

In summary, the stages of transformation of oil

palm are started from seedlings in the form of palm

fruit which are then sown to become palm oil

seedlings. After the palm seedlings are 3-4 months

old, the palm seedlings are moved to a wider planting

area that has already been prepared. Furthermore, the

oil palm plantations go through a process of

treatment in the form of weeding, fertilizing and

watering into plants that learn to bear fruit known as

sand fruits which usually have started from the age

of 3-3.5 years. In the 4th year oil palm has begun to

produce perfect fruit-producing FFB, and will stop at

the age of 20-25 years. The next stage returns to the

initial process of replanting young plants from

nurseries. This process is what will subsequently

receive treatment as a biological asset (DP, 2019).

3.6 Data Collection and Analysis

Techniques

Data analysis in this research was conducted

descriptively to analyze the data carried out by

describing, managing, describing and interpreting the

results of research with words and sentences as

answers to the problems studied. The data analysis

in this study was conducted by describing the results

of interviews before and after the application of SFAS

69, managing data into data tabulation, describing the

research process and the results of interviews into

the discussion in this study and finally interpreting the

results of this study by linking theories and data

available with the results of the interview.

4 RESULTS AND DISCUSSION

4.1 Application of Financial

Management in Accordance with

Established Financial Guidelines

BUMDes Kencana Mandiri has an oil palm plantation

with an area of 7 hectares. The number of oil palm

plants managed is as many as 650 trees, with details

of 400 trees that have already produced and are

included in the scope of SFAS 16 regarding fixed

assets. Whereas 250 trees are immature plants and fall

within the scope of SFAS 69 on agriculture.

Biological assets in the form of oil palm plants that

have already been produced or that have not yet

been produced will be presented in the BUMDes

financial statements as fixed assets.

Agricultural products are products harvested from

biological assets recognized as inventories.

Agricultural products harvested from BUMDes'

biological assets are measured at fair value fewer

costs to selling at the point of harvest. Measurements

of this kind are the costs of that date when applying

SFAS 14 regarding inventories.

4.2 Application of Recognition,

Measurement and Disclosure of

Biological Assets based on

Financial Accounting Standards

Number 69 at BUMDes in

Bengkalis Regency

As an entity that controls the biological assets

BUMdes Kencana Mandiri must book according to

applicable financial standards. Measurement of

biological assets is the calculation of the value of

ICAESS 2020 - The International Conference on Applied Economics and Social Science

170

biological assets owned by an entity starting from

the purchase value of biological assets up to the costs

incurred to obtain these biological assets.

(Suharyono, 2020) Following are measurements of

each biological asset.

The measurement of biological assets produces

starts from the calculation of the number of

productive plants owned by BUMDes, namely 400

trees. The fair value of oil palm seedlings is IDR

50,000 per polybag. While the costs incurred during

managing the crop are fertilizer costs, labor costs,

and costs for land preparation.

Table 4: Component of Biological Asset Cost of

Producing

Plants

No Description Total

1 Seedlings (400

p

olybags) 20,000,000

2 Fer

t

ilize

r

43,500,000

3 Lan

d

p

re

p

ara

t

ion 5,000,000

4 Wage 10,000,000

Total 78,500,000

For oil palm plants that have not produced yet in

BUMDes Kencana Mandiri, 250 trees are available.

The fair value of oil palm seedlings is IDR 50,000 per

polybag. While the costs incurred during managing

the crop are fertilizer costs, labor costs, and costs for

land preparation.

Table 5. Components of Biological Asset Cost for

Immature Plants

No Description Tota

1 Seeds (250

p

olybags) 12,500,000

2 Fer

t

ilize

r

11,500,000

3 Lan

d

p

re

p

ara

t

ion 4,000,000

4 Wage 8,000,000

Total 36,000,000

4.3 Application of the Preparation of

Financial Statements using

Accounting Software That Is

Accountable and Transparent

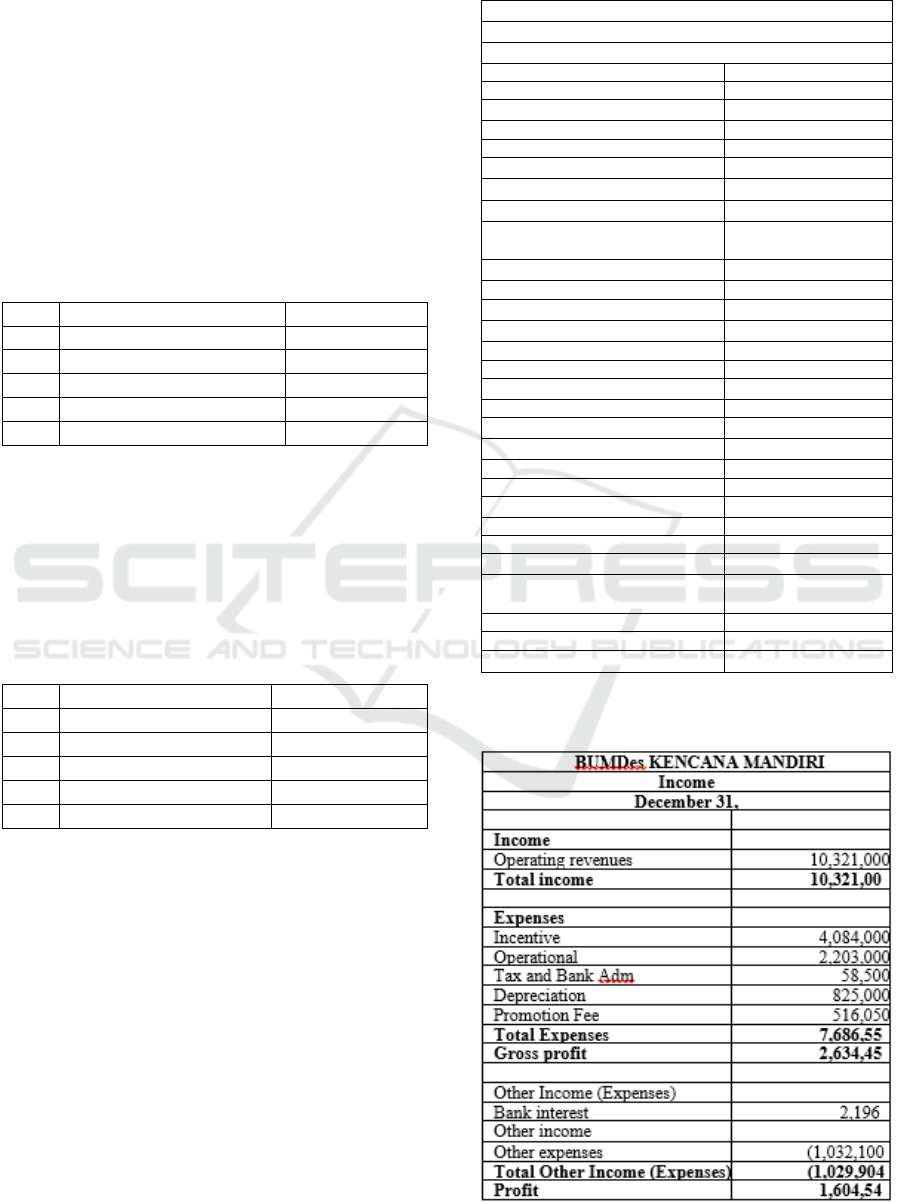

Based on the existing problems, the BUMDes

financial statements have been adjusted in accordance

with the application of SFAS 69. The financial

statements presented include the balance sheet and

income statement.

Table 6: Balance Sheet Report After the Application of

SFAS 69

BU

M

Des Kenca

n

a

M

andiri

The balance sheet

December 31, 2019

Asset

Current assets

Cash

2.924.000

Bank

1.273.696

Shopping Goods

42.680.000

Stock

950.000

Total Current Assets

46.877.696

Non-current Assets

Biological-Plant-Producing

Assets

78,500,000

Inventory

303,300,000

Ak Depreciation

(

825,000

)

Biological-Plant Asset Immature

36,000,000

Total Non-current Assets

416,975,000

Total assets

463,852,696

EQUITY AND OBLIGATIONS

The obligation

Other Party Debts

200,000

Promotion Debt

516,050

Other Reserve Debt

1,032,100

SHU Allocation PADes

Total Obligations

1,748,150

Equity

Equity capital

346,000,000

Capital From Other Parties

Increase in the capital due to

reco

g

nition of

b

io

l

o

g

ical assets

114,500,000

Profit Accumulation

1,604,546

Total Equity

462,104,546

Total Equity and Liabilities

463,852.696

Table 7: Income Statement Before the Implementation of

SFAS 69.

Implementation of Financial Management and Financial Accounting Standard Number 69 Concerning Agricultural Atvillage-owned

Enterprises

171

The positive impact of the recognition of

biological assets that were not previously recorded in

the BUMDes financial report, then the value of equity

experienced a significant increase of Rp 114,500,000.

This increase is due to the recognition of biological

assets both in the form of mature and immature

plantations. The importance of applying PSAK 69 to

the plantation business unit has helped BUMDes in

presenting the financial reporting needed by the

Village. The results of this study are in line with DP

(2019) which shows an increase in understanding of

the importance of financial statements in general and

the production of simple financial reports for the palm

oil industry.

5 CONCLUSION AND

CONTRIBUTION

5.1 Conclusion

In this section we will explain the conclusions

obtained from the analysis in previous Sections.

Conclusions of the study results are based on the

research analysis to know how application of

financial management in accordance with established

financial guidelines, application of recognition,

measurement and disclosure of biological assets

based on Financial Accounting Standards Number 69

at BUMDes in Bengkalis Regency, furthermore how

application of the preparation of financial statements

using accounting software that is accountable and

transparent.

The conclusions of the research results that were

conducted completely can be explained as follows:

1. The BUMDes Kencana Mandiri financial report

is in accordance with SFAS No. 69 concerning

agriculture, and

2. The application of SFAS 69 in BUMDes Kencana

Mandiri has an impact on the increase in

BUMDes assets due to the recognition of

biological assets.

5.2 Contribution

5.2.1 Theoretical Contribution

The theoretical contribution of the research which was

conducted are as follows:

1. BUMDes management understands the urgency of

preparing financial statements accordance with

applicable Accounting Standard; and

2. BUMDes financial statements become more

transparent and accountable.

5.2.2 Managerial Contribution

Managerial contribution of the research which was

conducted are as follows:

1. BUMDes management get an understanding of

the application of financial management in

accordance with established financial guidelines.

2. Through training and mentoring activities in the

preparation of financial statements carried out,

BUMDes management at Bengkalis Regency

must be able to examine and manage carefully

the application of Recognition, Measurement and

Disclosure of Biological Assets based on

Financial Accounting Standards Number 69.

3. It is expected that the Riau Provincial Government

will give high appreciation to BUMDes in Riau

Province who can develop and manage biological

assets properly in accordance with SFAS Number

69.

4. The results of this study are expected to be used

as a reference or consideration for BUMDes

management regarding the importance of

managing biological assets owned by BUMdes

based on financial accounting standards in SFAS

Number. 69.

5.3 Limitation

This research has several important limitations, in

the methodology and access to the distance between

the locations of BUMDes Kencana Mandiri partners

and researchers living in different islands, where

BUMdes Kencana Mandiri partners are located in

TanjungBelit Village on Sumatra Island and

researchers residing on Bengkalis Island. This

condition sometimes becomes an obstacle in the

implementation of intensive assistance activities to

BUMDes Partners.

ACKNOWLEDGEMENTS

This research was supported by the Center for

Research and Community Service (P3M) Bengkalis

State Polytechnic (Polbeng). We Thank the P3M

Leaders and Polbeng Director who have allowed us

the opportunity to get Research grants sourced from

Non-Tax National Revenues (PNBP) from the

campus so that we can carry out and complete our

research activities in 2020. Hopefully going forward

through this institution will continue to provide fresh

ICAESS 2020 - The International Conference on Applied Economics and Social Science

172

funding support to all lecturers and education staffs

of Polbeng with a research grant competition scheme

so that the research climate of lecturers and education

staffs on this campus continues to develop rapidly and

progress.

REFERENCES

Cahyani, R. C., & Aprilina, V. (2014).Evaluation of the

application of SAK ETAP in the reporting of biological

assets in Bogor Superior Farm. JRAK: Jurnal Riset

Akuntansi dan Komputerisasi Akuntansi, 5(1), 14-37.

DP, E. N., Rusli, R., & Haryani, E. (2019, September).

Membumikan penyusunan laporan keuangan industri

perkebunan kelapa sawit menggunakan pendekatan

asset biologis berdasarkan PSAK 69. In Unri

Conference Series: Community Engagement (Vol. 1,

pp. 168-179).

Farida, I. (2013). Analisis Perlakuan Akuntansi Aset

Biologis Berdasarkan International Accounting

Standard 41 Pada PT. Perkebunan Nusantara VII

(Persero). Jurnal Akuntansi AKUNESA, 2(1).

I. A. I., & Indonesia, I. A. (2009). Standar Akuntansi

Keuangan. Jakarta, Salemba Empat.

Maruli, S., &Mita, A. F. (2010).Analysis of the fair value

and historical value approaches in valuing biological

assets in agricultural companies: A critical review of

IAS adoption plans 41. Simposium Nasional Akuntansi

XIIIPurwokerto, 1-38.

Pratiwi, W. (2018).Analysis of Accounting Treatment for

Biological Assets based on Agricultural PSAK-69 at

PT. Perkebunan Nusantara XII Kalisanen, Jember

Regency. UNEJ e-Proceeding, 140-150.

Circular Letter of the Chairman of Bapepam No SE-02 / PM

/ 2002 concerning Reporting and Disclosure of Issuers

or Companies' Financial Statements.

Suharyono, S. (2020).Evaluasi Penggunaan Dana Desadan

Alokasi Dana Desa. Jurnal Ilmiah Universitas

Batanghari Jambi, 20(2), 648-651.

Suharyono, S. (2020). Analisis Kinerja Pemerintah Provinsi

Di Indonesia. Jurnal Neraca: Jurnal Pendidikan dan

Ilmu Ekonomi Akuntansi, 4(1), 11-25.

Trina, Z. I. (2017). Analisis perlakuan akuntansi dan

deplesi aset biologis berdasarkan IAS 41 pada

perusahaan peternakan: Studi kasus pada CV.

Milkindo Berka Abadi Kepanjen (Doctoral dissertation,

Universitas Islam NegeriMaulana Malik Ibrahim).

Utomo, R., & Khumaidah, N. L. (2014). Perlakuan

Akuntansi Aset Biologis (Tanaman Kopi) Pada PT.

Wahana Graha Makmur-Surabaya. GEMA EKONOMI

(Jurnal Fakultas Ekonomi), 3(1), 85-95.

Implementation of Financial Management and Financial Accounting Standard Number 69 Concerning Agricultural Atvillage-owned

Enterprises

173