Sensory Profile of Commercial Coffee Products using QDA

(Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

Dase Hunaefi

1,2

, Windi Khairunnisa

1

, Zen Fauzan Sholehuddin

3

and Dede R. Adawiyah

1,2

1

Department of Food Science and Technology, IPB University (Bogor Agricultural University), Indonesia

2

SEAFAST Center, IPB University, Indonesia

3

Sensory Department, Mane, Indonesia

Keywords: CATA, Coffee, Consumer, Expert, Flash profile, QDA.

Abstract: This research was conducted to get sensory profile of eleven commercial coffee samples using the QDA

(Quantitative Descriptive Analysis) method with expert panelists and Flash Profile and CATA (Check-All-

That-Apply) methods using consumer panelists, then comparing the results of the three methods. Results of

the three methods were analyzed using XLSTAT software. The four RTD coffee samples have nearly identical

sensory profiles based on the QDA method by expert panelists. The four samples tend to have vanilla, creamy,

caramel, and milky dominant profiles. The other one RTD coffee sample have dominant in bean attribute.

IPD commercial coffee samples have more dominant in coconut, bitter, and roasted sensory profile than RTD

coffee. Sensory profiles of commercial coffee obtained using the consumer panel on both methods CATA and

flash profile giving quite different results. CATA and flash profile methods can’t replace the QDA method in

terms of testing which required high sensitivity. However, if a quick sensory product profile determination is

required, then it is better to apply CATA method. Expert panelists are selected panelists with sensory

sensitivity who have gone through training and have experience in sensory testing, which is able to provide

consistent and repeated sensory assessments of various products. This study investigates how consumer

panelists performing in flash profile and CATA method, compare to expert panelists using QDA method to

determine sensory profile of a product. This study aims to find alternative methods that can be used if expert

panelists are not available and rapid determination of sensory profile is needed. This sensory evaluation can

be used for various purposes, for example is for product development.

1 INTRODUCTION

Coffee is a major tropical commodity traded

throughout the world with a contribution of half of

the total tropical commodity exports. The popularity

and attractiveness of the world towards coffee is

mainly due to its unique taste and is supported by

historical, traditional, social and economic interests

(Triyanti, 2016). Coffee drinks, beverages made

from coffee bean extract, are one of the most famous

types of drinks. In addition to its benefits, coffee also

popular because it has a distinctive taste and aroma

(Farida et al., 2013).

Coffee is a drink that contains caffeine. Many

benefits can be obtained by consuming coffee.

Caffeine in the coffee can increase the body's

metabolic rate. For some people with routines that

require them to be active at night, coffee can be a

good alternative to drinks because the caffeine

content can overcome drowsiness (Panggabean,

2011). Coffee can be useful as an antioxidant,

stimulates brain performance and as an anticancer

substance (Farida et al., 2013). Coffee can also

reduce fatigue, increase freshness, and make you feel

more excited (Towaha et al., 2012).

Indonesia is the fourth largest producer and

exporter of coffee in the world after Brazil, Vietnam

and Colombia. In 2016 to 2020, Indonesian coffee

production is expected to increase with an average

growth of 2.25% per year (Triyanti, 2016). Data from

the International Coffee Organization (ICO) shows

that Indonesia's coffee consumption in the period

2000-2016 experienced an upward trend. In 2000,

Indonesian coffee consumption only reached 1.68

million bags (packs) @ 60 kg, but in 2016 had

20

Hunaefi, D., Khairunnisa, W., Sholehuddin, Z. and Adawiyah, D.

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA (Check-All-That-Apply) Methods.

DOI: 10.5220/0009977500002833

In Proceedings of the 2nd SEAFAST International Seminar (2nd SIS 2019) - Facing Future Challenges: Sustainable Food Safety, Quality and Nutrition, pages 20-30

ISBN: 978-989-758-466-4

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

reached 4.6 million bags @ 60 kg. Even from 2011

to 2016, Indonesian coffee consumption has always

experienced growth (ICO, 2018). There are various

forms of coffee in the market, including instant

coffee and ready to drink coffee. Instant coffee is a

dry product that is easily soluble in water, obtained

by extracting roasted and ground coffee beans.

Instant coffee can also be made with the composition

of coffee, sugar, cream, milk or by adding flavor

(Dewi et al., 2009). Ready to drink coffee are drinks

made from a mixture of coffee extracts and drinking

water with or without the addition of other food

ingredients and food additives that are permitted,

hermetically packaged. Habits or lifestyles of people

who want practicality lead to increased public

consumption of coffee in the form of instant coffee

and ready to drink coffee.

A description of the product's sensory

characteristics has become an integral part of food

and beverage companies. Information obtained from

the description of the sensory characteristics of the

product allows the company to make more informed

business decisions, becoming a reference in

development of ideal products according to

consumers, knowing the effects of changes in

formulas and processes, and useful for quality control

purposes (Varela & Ares, 2012). Description tests are

used to identify important sensory characteristics in

a product and provide information about the intensity

of these characteristics (Poste et al., 2011). One of

the description test methods commonly used is

Quantitative Descriptive Analysis (QDA). The QDA

method is carried out based on the principle of the

ability of train panelists to measure specific attributes

of a product to obtain a comprehensive quantitative

product description (Chapman et al., 2001).

The availability of trained panelists to carry out

the description test is quite limited because it is

obtained through a training process with relatively

expensive costs, depending on the complexity of the

sample (Varela & Ares, 2012). According to ISO

8586 (2012), sensory panels are "measuring

instruments", where the results obtained are highly

dependent on the performance of its members. ISO

8586 classifies sensory panels into 3: (1) sensory

assessors or untrained sensory panels; (2) selected

assessors or sensory panels that pass the selection

process; (3) expert sensory assessors or sensory

panels that have passed performance testing. The

high cost, length of time, and availability of trained

panelists or limited expert panelists led to the need

for faster and more flexible sensory methods using

untrained panelists (Varela & Ares, 2012).

Previous studies have been conducted to compare

sensory evaluation methods using trained panelists

and sensory profiling methods using consumer

panelists. Based on the results of Bruzzone et al.

(2015) which compares the intensity scales test using

trained panelists and CATA using consumer

panelists, the result shows that the two methods

provide the same information and the CATA method

can be an alternative way to obtain information about

consumer perceptions of the product sensory

characteristics. The CATA method has some

advantages including simpler, faster, and easier. The

CATA method consists of a list of words describing

the sample, where panelists can choose sensory

attributes which can describe the sample. One

important thing in the CATA test is in determining

the attributes used in the list, because it can determine

the accuracy of the important attributes of the

product. Determination of attributes used in the list

can be obtained through several ways, such as by

trained panelists, by consumers during testing

(modification of free choice profiling), and through

Focus Group Discussion (FGD) (Dooley et al.,

2010).

According to Moussaoui & Varela (2010), the

flash profile method is an accurate method to create

sensory mapping and provide relevant results. This

method is comparable to the results of QDA method

using trained panelists. Flash profile method is a

method that can be used to obtain quick product

profiling when there are no trained panelists

available. Flash Profile method is a combination of

Free Choice Profiling and ranking test, where each

subject chooses and use they own words to evaluate

a whole set of products (Dairou & Siefferman, 2002).

This method does not require prior training to

panelists, so it can reduce the analysis time

(Montanuci et al., 2015).

2 MATERIAL AND METHOD

2.1 Samples

11 brands of Indonesian commercial coffee in the

form of instant and Ready to Drink (RTD) coffee.

2.2 Sample Preparation

Samples in the form of RTD coffee are removed from

the packaging and poured into containers, while

samples in the form of instant coffee are dissolved in

hot water first in accordance with the serving

instructions on the packaging. All samples are then

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

21

served at the same temperature as room temperature

to avoid bias. Samples were presented as much as 20

mL in a small 30 mL plastic cup that had been given

a random three-digit number code. Mineral water is

given to the panelists as neutralizers.

2.3 Procedure of QDA Method

The QDA test was conducted by 12 expert panelists.

Before the QDA test is conducted, expert panelists do

a description of the sample attributes to determine the

sensory attributes of the sample. Furthermore, QDA

testing is done by assessing the intensity of each

sensory attribute found in commercial coffee

samples. All attributes are evaluated using a 10 cm

scale (Papetti & Carelli, 2013). The testing is carried

out in stages, which is to assess two sensory attributes

for all samples in each test.

2.4 Procedure of Flash Profile Method

This method used 30 panelists who were coffee

consumers, both instant coffee and RTD coffee. Each

sample of commercial coffee products is presented as

much as 20 mL with mineral water as a neutralizer.

The panelist tasted the sample and wrote down the

sensory attributes which were contained in the sample

according to their opinion, without any instructions or

without being guided by the panel leader. After

panelists wrote down the list of attributes, they were

asked to sort the intensity of each attribute from the

entire sample (Dairou & Sieffermann, 2002).

2.5 Procedure of CATA Method

In the CATA (Check-All-That-Apply) method, there

is an ideal perception profiling according to

consumers. The panelist used was the same as the

panelist on the flash profile test, which was 30

consumer panelists with the same sample

presentation. Before tasting the sample, panelists

were asked to fill in the ideal coffee criteria column

first. Then the panelist tasted the sample and assessed

what sensory attributes were felt in the sample by

giving a check mark to the sensory attributes which

could describe the sample (Dooley et al., 2010).

Panelists were also asked to give an intensity rating

of hedonic preference.

2.6 Data Analysis

QDA method data was analyzed using XLSTAT 2016

software with PCA (Principle Component Analysis)

tools and Microsoft Excel 2016 software with spider

web tools. PCA is used to get a biplot map which

shows the correlation between commercial coffee

samples and the sensory attributes. Spider web are

used to show all profiles of the sensory attributes of a

sample. Spider web can also identify profile of

samples that are significantly different from other

samples (Rahmawati et al., 2015).

Analysis of flash profile data using XLSTAT

software with the Generalized Procrustes Analysis

(GPA) tool. Data analysis of the CATA (Check-All-

That-Apply) method using XLSTAT software with

CATA Analysis tools. Analysis of the data generated

in the form of Cochran's Q test, correspondence

analysis, Principal Coordinate Analysis (PCoA), and

penalty analysis.

3 RESULTS AND DISCUSSION

3.1 Panelists Profile

The panelists used in the QDA test were 12 expert

panelists. According to ISO 8586 (2012), the expert

sensory panel is the selected panelist with sensory

sensitivity who has passed training and has

experience in sensory testing, which is able to

provide a consistent and repeated sensory assessment

of various products.

The panelists used in the flash profile and CATA

methods were 30 consumer panelists with a ratio of

50% men and 50% women. All the panelists are

consumers of coffee products, which is instant

coffee, ready to drink coffee, or both. Panelists

generally consume coffee in the morning (37%) with

different frequency of coffee consumption. Most of

panelists consume coffee as much as 3-4 times a

week. The frequency of panelists consuming coffee

can be seen in Figure 1.

Figure 1: Aroma profile of 4 groups of cured vanilla bean.

> 1

Everyday

20%

1 time

everyday

23%

3-4 in week

33%

1-2 in week

17%

1 - 2 in

month

7%

2nd SIS 2019 - SEAFAST International Seminar

22

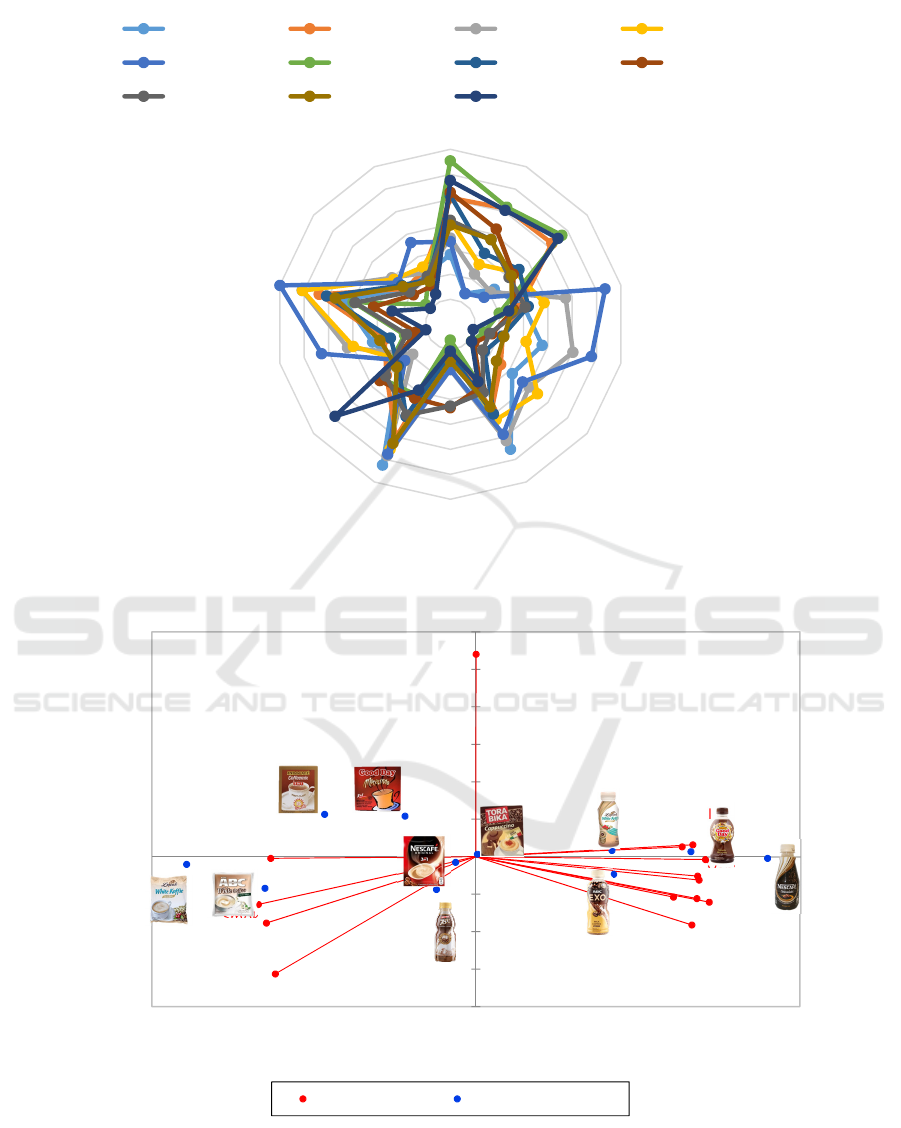

3.2 Sensory Profile using QDA Method

Sensory attributes that were evaluated in the QDA

method consist of 14 attributes obtained from the

Focus Group Discussion (FGD) with expert panelists.

These attributes consist of roasted, smoky, bean,

caramel, vanilla, chocolate, milky, coconut, creamy,

bitter, butter, sweet, cocoa, and salty. The results

obtained from the testing of commercial coffee

samples using the QDA method are in the form of

spider web charts that can be used to know the overall

sensory sample profile. Based on the spider web

graph in Figure 2, products that have the strongest

sweet, butter, vanilla, caramel, and salty attributes is

Nescafe Smoovlatte RTD. Products that have the

strongest roasted, smoky and bean attributes is ABC

White Coffee IPD. The strongest milky and creamy

attribute is the Luwak White Koffie RTD product,

while the Luwak White Koffie IPD product has a

stronger bitter attribute compared to other products.

Products that the chocolate attributes are more

dominant is ABC Exo RTD, while there are no

products that dominant in cocoa and coconut

attributes.

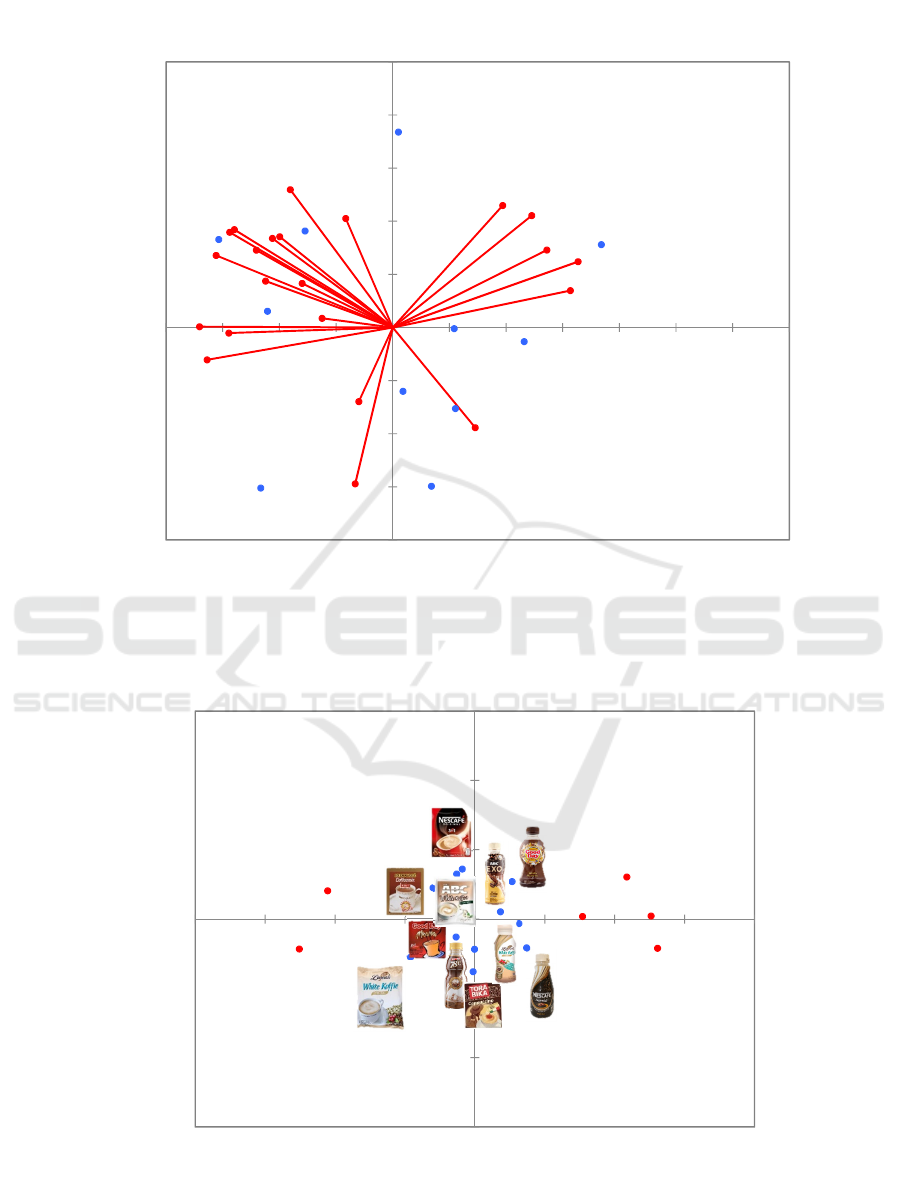

Other results that can be obtained from testing

commercial coffee samples with the QDA method are

the correlation between attributes with attributes and

attributes with samples on the PCA curve. Based on

PCA curve in Figure 3, the sensory attributes of

sweet, butter, salty, chocolate, creamy, milky, vanilla,

cocoa, and caramel are positively correlated with

each other, but negatively correlated with four other

attributes, such as bitter, smoky, roasted, and bean

because of its opposite location. Coconut attributes

have a low correlation to other attributes, because the

location is far apart and contradicts all other sensory

attributes.

The correlation between attributes and the sample

in Figure 3 can show the dominant characteristics of

each product. Nescafe Smoovlatte RTD has a

dominant vanilla attribute with a score of 5.79, while

ABC Exo RTD has dominant attributes of creamy,

chocolate, and milky (5.55, 4.46, 4.23). Good Day

Moccacino RTD has dominant characteristics of

vanilla (5.03) and caramel (4.73), while Good Day

Moccacino IPD has dominant characteristics of bitter

(3.31) and coconut (3.27). Luwak White Koffie RTD

has the characteristics of creamy, milky, and vanilla

(6.25, 5.55, 3.77), while Luwak White Koffie IPD has

a different dominant characteristic, which is bitter

(5.90). Kopiko 78 RTD is dominant in bean attributes

(5.20) and Nescafe IPD dominant in roasted attributes

(5.16). Indocafe Coffeemix IPD coffee has the

characteristics of bitter (3.61) and coconut (3.34).

Torabika Cappuccino IPD is not adjacent to any

sensory attribute on the PCA curve but has dominant

creamy attribute with a score of 5.28.

3.3 Sensory Profile using Flash Profile

Method

Flash profile method using 30 consumer panelists and

generate a total of 22 different sensory attributes.

Sensory attributes obtained are roasted, creamy,

milky, sweet, bitter, caramel, coffee, viscosity, sour,

nutty, vanilla, chemical, floral, coconut, honey, fruity,

smoky, rum, chocolate, color, mocca, and mouthfeel.

The results are processed using GPA, including

the PCA curve which can be seen in Figure 4. If all

attributes of the flash profile test are used to process

the data, many attributes accumulate on the PCA

curve and it is difficult to determine the exact sensory

characteristics for each sample. Therefore, the data

processing is done by using sensory attributes which

are widely used by panelists in describing samples,

those are creamy, milky, sweet, bitter, caramel, and

coffee. The six attributes are analyzed using GPA

tools on XLSTAT with the results of PCA curve

which shows the correlation between the six selected

attributes with the commercial coffee sample. In the

first quadrant there were 3 commercial coffee

samples, which are Indocafe Coffeemix IPD, ABC

White Coffee IPD, and Nescafe IPD which had strong

coffee characters. In the second quadrant there were

only 2 samples, namely ABC Exo RTD and Good

Day Moccacino RTD which had the characteristics of

sweet, caramel, and milky. The third quadrant

consisted of Luwak White Koffie IPD, Good Day

Moccacino IPD, Kopiko 78 RTD, and Torabika

Cappuccino IPD which had sensory characteristics of

bitter. Luwak White Koffie RTD and Nescafe

Smoovlatte RTD are in the fourth quadrant with

creamy sensory characteristics. The correlation

between sensory attributes and samples tested with

the flash profile method can be seen in Figure 5.

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

23

Figure 2: Spider web sensory attributes of commercial coffee sample.

Figure 3: PCA curve of QDA method.

0

1

2

3

4

5

6

7

Roasted

Smoky

Bean

Caramel

Vanilla

Chocolate

Milky

Coconut

Creamy

Bitter

Butter

Sweet

Cocoa

Salty

RLuwak RKopiko78 RGoodDayMoc RABCExo

RNescafe IABC INescafe IIndocafe

IGoodDayMoc ITorabika ILuwak

Roasted

Smoky

Bean

Caramel

Vanilla

Chocolate

Milky

Coconut

Creamy

Bitter

Butter

Sweet

Cocoa

Salty

‐8

‐6

‐4

‐2

0

2

4

6

8

10

12

‐6 ‐4 ‐20246

F2 (11.07 %)

F1 (72.80 %)

Biplot (axes F1 and F2: 83.87 %)

Activevariables Activeobservations

2nd SIS 2019 - SEAFAST International Seminar

24

Figure 4: PCA curve all attributes from flash profile method.

Figure 5: PCA curve of flash profile method.

ITorabika

IGoodDayMoc

RKopiko78

ILuwak

RABCExo

INescafe

IABC

RGoodDayMoc

RNescafe

IIndocafe

RLuwak

Roasted

Creamy

Milky

Sweet

Bitter

Caramel

Coffee

Viscosity

Sour

Nutty

Vanilla

Chemical

Floral

Coconut

Honey

Fruity

Smoky

Rum

Chocolate

Colour

Mocca

Mouthfeel

‐2

‐1.5

‐1

‐0.5

0

0.5

1

1.5

2

2.5

‐2 ‐1.5 ‐1 ‐0.5 0 0.5 1 1.5 2 2.5 3 3.5

F2(13.54%)

F1(59.51%)

Biplot(axesF1andF2:73.04%)

Creamy

Milky

Sweet

Bitter

Caramel

Coffee

‐6

‐4

‐2

0

2

4

6

‐8 ‐6 ‐4 ‐202468

F2(11.96%)

F1(66.23%)

Biplot(axesF1andF2:78.19%)

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

25

Figure 6: Ideal characteristic of RTD and IPD coffee.

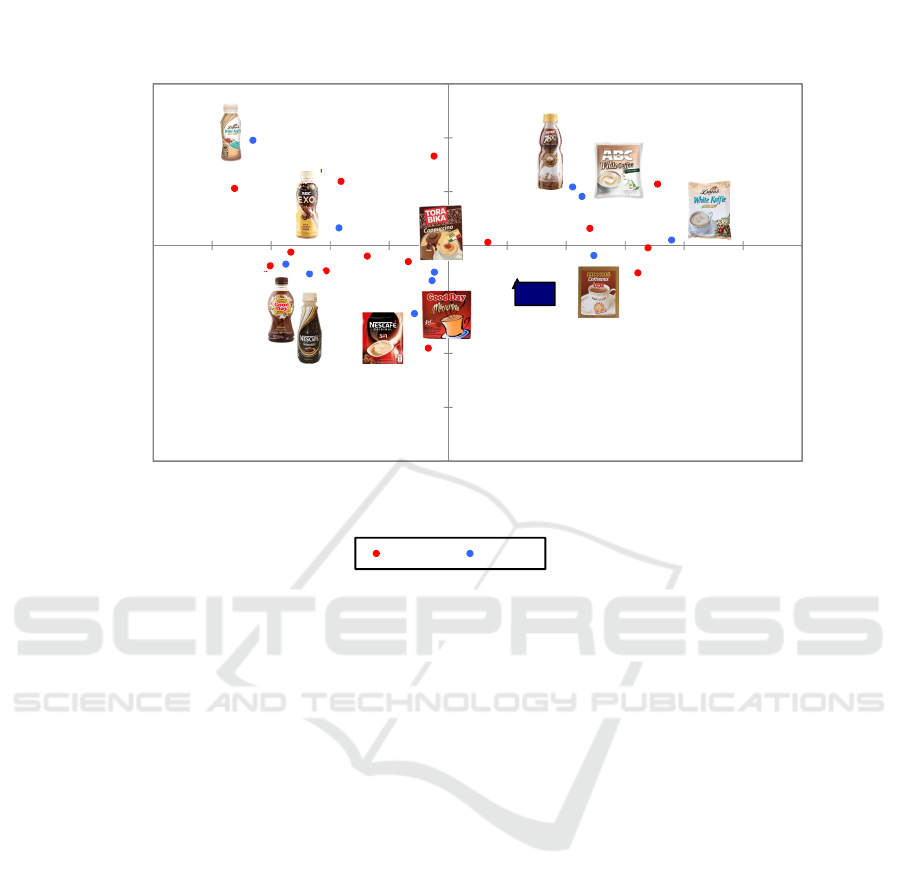

3.4 Sensory Profile using CATA

Method

The results of the Cochran’s Q test with multiple

pairwise comparisons Marascuilo compare each

sensory attribute in each sample with a significance

level of 5%. The results of Cochran's Q test show that

all sensory attributes were significantly different in

each sample at a 5% significance level, except for

mouthfeel attributes. The results of the

Correspondence analysis, which is obtained by the

biplot map that represents the profile of commercial

coffee and ideal coffee, are in accordance with

appropriate sensory attributes (Ares et al., 2014).

Biplot maps that illustrate the correlation between

samples, ideal coffee products, and sensory attributes

tested can be seen in Figure 6.

Based on the results of the Correspondence

analysis in Figure 6, ideal coffee products according

to the panelists should have strong bitter, roasted and

mouthfeel attributes. The sample closest to the ideal

coffee product is Indocafe coffemix IPD. Luwak

White Koffie IPD also approaches the ideal coffee

product because it has strong roasted and bitter

attributes, but it is located in a different quadrant.

ABC White Coffee IPD and Kopiko 78 RTD have

dominant bean and smoky attributes. Torabika

Cappuccino IPD and Good Day Moccacino IPD have

the same dominant attributes, sweet and creamy

because they are very close to the biplot map, while

Nescafe IPD has the dominant caramel attribute.

Good Day Moccacino RTD has the dominant

attributes of vanilla and coconut, while Nescafe

Smoovlatte RTD is dominant in chocolate attributes.

ABC Exo RTD has a milky dominant attribute, while

Luwak White Koffie RTD that located in the same

quadrant has milky dominant attributes and buttery.

Luwak White Koffie RTD has the smallest bitter and

roasted attribute value compared to other samples, so

the position is the farthest from the ideal.

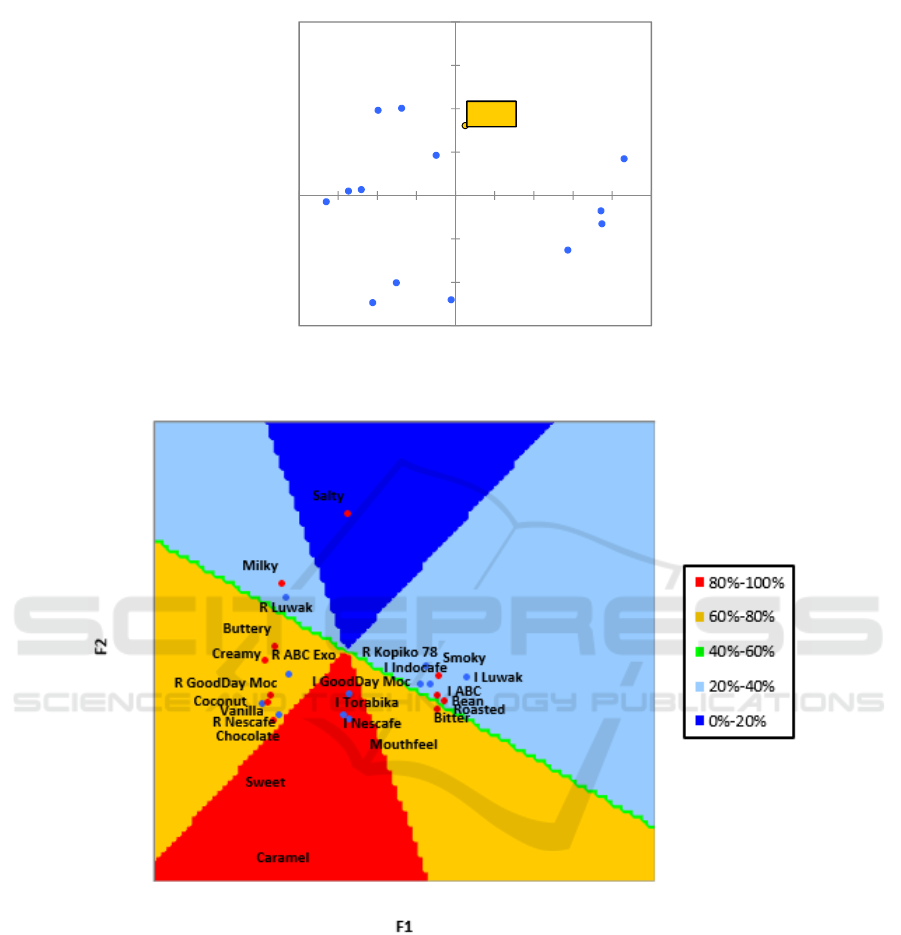

Based on the results of CATA Analysis, there is a

Principal Coordinate Analysis (PCoA) graph which

illustrates the correlation between sensory attributes

and panelists preference for commercial coffee

samples. The results of PCoA analysis in Figure 7

show that the dominant attributes that positively

influence panelists preference are the attributes of

mouthfeel, caramel, chocolate, and sweet with the

correlation between attributes with liking

respectively 0.072, 0.147, 0.063 and 0.132. This is not

in accordance with ideal coffee according to panelists

who are close to the bitter, roasted and mouthfeel

attributes. Only the mouthfeel attribute is close to the

ideal and also has a positive effect on preference.

Bitter

Sweet

Salty

Chocolate

Milky

Vanilla

Creamy

Caramel

Smoky

Coconut

Bean

Buttery

Roasted

Mouthfeel

Ideal

‐0.8

‐0.6

‐0.4

‐0.2

0

0.2

0.4

0.6

‐1 ‐0.8 ‐0.6 ‐0.4 ‐0.2 0 0.2 0.4 0.6 0.8 1 1.2

F2(10.41%)

F1(71.14%)

Symmetricplot

(axesF1andF2:81.55%)

Attributes Products

2nd SIS 2019 - SEAFAST International Seminar

26

Figure 7: Correlation map between sensory attribute and consumer preference.

Figure 8: Consumer preference map towards commercial coffee.

Preference mapping is a technique that connects

consumer acceptance data (hedonic data) with

sensory characteristics of the product (descriptive

data) to find out product characteristics that influence

consumer preferences (Martinez et al., 2002).

Contour plot is one part of preference mapping that

have functions to show the number of clusters that

have a level of preference above the average. The

level of preference of each cluster is expressed in

terms of percent (%) and with different percentage of

each color (Manik et al., 2016). The results of

preference mapping can be seen in Figure 8.

The red area on the contour plot shows the highest

percentage of 80 - 100%. All panelists (100%) gave

the preference values above average for products

located in red areas, which are Good Day Moccacino

IPD, Torabika Cappuccino IPD, and Nescafe IPD.

While, 67% of panelists gave the preference values

above average on ABC Exo RTD products, Good Day

Moccacino RTD, and Nescafe Smoovlatte RTD,

which are located in yellow areas. In the light blue

Bitter

Sweet

Salty

Chocolate

Milky

Vanilla

Creamy

Caramel

Smoky

Coconut

Bean

Buttery

Roasted

Mouthfeel

Liking

‐0.6

‐0.4

‐0.2

0

0.2

0.4

0.6

0.8

‐0.8 ‐0.6 ‐0.4 ‐0.2 0 0.2 0.4 0.6 0.8 1

F2

F1

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

27

area, 33% of the panelists gave score above-average

on Luwak White Koffie RTD, Indocafe Coffemix

IPD, ABC White Coffee IPD, Luwak White Koffie

IPD, and Kopiko 78 RTD.

The attributes that most desired by panelists for

commercial coffee products are sweet, caramel, and

mouthfeel attributes. This is in accordance with the

graph (PCoA) above which states that the three

attributes have a positive effect on panelists

preferences. The attributes rather desired by panelists

are bitter, buttery, creamy, coconut, vanilla, and

chocolate, while the attributes that panelists don’t

really want to be present in the product are milky,

smoky, bean, and roasted. The most unwanted

attribute for the product is the salty attribute.

Penalty analysis based on the CATA method can

be done if there are hedonic data and data about ideal

product (Meyners et al., 2013). Based on the results

of the penalty analysis on XLSTAT software, there

are five categories of sensory attribute, which are

must have, nice to have, must not have, does not

harm, and does not influence. A sensory attribute can

be grouped as a must have if the attribute is desired

for the ideal product, but not found in the real product.

The must have attribute analysis can be determined if

the liking score for both the ideal product and the real

product (1.1) is greater than when the attribute is

chosen for the ideal product, but not for the real

product (1.0). Must not have attribute is the opposite

of the must have attribute, that is, sensory attributes

found on real products but not on ideal products.

Analysis of must not have attributes can be

determined if the liking score of attributes that are not

selected both on the ideal product and the real product

(0,0) is greater than when the attribute absent on the

ideal product, but found in the real product (0,1)

(Meyners et al., 2013).

Nice to have attribute can be determined if the

liking score of attributes found only in the real

product (0.1) is greater than when the attribute is not

found either on the ideal product or on the real

product (0.0). If the liking score of the attribute that

is not selected for both the ideal product and the real

product (0,0) is almost the same as when the attribute

is not chosen for the ideal product, but present in the

real product (0,1), the attribute is classified as does

not harm (Meyners et al., 2013).

There are 3 attributes that categorized as must

have, which are bitter, sweet, and creamy. Attributes

included in this category are attributes that must be

found in commercial coffee products according to

panelists and have a positive impact on preferences.

Nice to have attributes are attributes that do not have

to exist in commercial coffee products, but have a

positive impact on the liking score, while the must not

have attribute is an unwanted attribute found in the

product and has a negative impact on the liking score

(Meyners et al., 2013). Based on the analysis results,

there are no attributes that categorized as nice to have

and must not have. Salty, chocolate, vanilla, smoky,

coconut, bean, buttery and mouthfeel attributes

categorized as does not harm and caramel and roasted

attributes are categorized as does not influence. A

summary analysis of the sensory attributes of

commercial coffee products based on penalty analysis

can be seen in Table 1.

Table 1: Sensory attribute category based on CATA

analysis.

Must

have

Nice to

have

Does not

influence

Does not

harm

Must

not

have

Bitter - Caramel Salty -

Sweet Roasted Chocolate

Crea

my Vanilla

Smoky

Coconut

Bean

Buttery

Mouthfeel

3.5 Comparison of Analysis Results of

QDA, Flash Profile, and CATA

Methods

QDA, flash profile, and CATA methods have several

differences in practice and also the results obtained.

The QDA method requires trained panelists or expert

panelists in the testing. Flash profile and CATA

methods can be done using consumer panelists, but

with a different approach. Although they have

differences, the three methods can be used to obtain a

sensory profile of the sample, which is commercial

coffee.

To find out the differences in the results of the

three methods, it can be seen through the dominant

attributes that describe each sample. The dominant

attribute can be known from the PCA curve generated

in each method. To determine the dominant attributes

of the QDA method, spiderweb graphs can also be

2nd SIS 2019 - SEAFAST International Seminar

28

used as a consideration. Table 2 shows a summary

comparison of the three methods in determining the

dominant attributes of commercial coffee samples.

Based on Table 2, it can be seen that there are

several sensory attributes that can be identified

equally in the three methods. For example, milky

attribute in ABC Exo RTD and bitter attribute in

White Koffie IPD that can be identified by the

panelists on the CATA, flash profile, and QDA

methods. Some attributes can be identified equally in

the CATA and QDA methods, but not found on the

flash profile method. The sensory attributes are

vanilla attributes in Good Day Moccacino RTD and

Nescafe Smoovlatte RTD, bean attributes in Kopiko

78 RT, milky attributes in Luwak White Koffie RTD,

smoky attributes in ABC White Coffee IPD, and

creamy attributes in Torabika Cappuccino IPD. Only

two attributes that can be identified the same as the

flash profile and QDA methods but not found in the

CATA method, including the caramel attribute on

Good Day Moccacino RTD and creamy attribute on

Luwak White Koffie RTD. For Good Day Moccacino

IPD, Indocafe Coffeemix IPD, and Nescafe IPD,

there were no sensory attributes in the QDA test

which were also identified in the CATA and flash

profile methods.

There are several attributes that identified as

dominant attributes by expert panelists but cannot be

identified by consumer panelists. Nevertheless, the

attributes that included in “must have" category of the

CATA test, which are bitter and creamy, can be well

identified by consumer panelists. It can be seen in

Luwak White Koffie IPD sample which was

identified as having bitter attributes on the three

methods. The same with creamy attributes in the

Luwak White Koffie RTD and Torabika Cappuccino

IPD which can also be identified by consumer

panelists. This shows that consumer panelists are

quite good at identifying attributes that have a

positive effect on preferences.

QDA, flash profile, and CATA method have their

own advantages and disadvantages depending on the

objectives to be obtained. The QDA method can

provide more accurate results because using trained

panelists or expert panelists. However, trained

panelists or expert panelists are not always available

in the company and usually to obtain a trained

panelist takes a longer time. This method can be used

to describe products, detect changes in formulations,

determine the effect of storage and packaging

duration, and quality control (Rahmawati et al.,

2015).

CATA and flash profile methods can be done by

using consumer panelists, so it is more flexible and

shorter the time needed. The advantages of the CATA

method for use by companies are they can provide

information about the sensory attributes of the sample

quickly and know the relationship to the acceptance

and preferences of consumers. The CATA method

can also provide information about the characteristics

of ideal products according to consumers, which can

be useful in product development. The flash profile

method has the advantage of being able to give the

panelists the freedom to describe the sample and

determine the intensity of each attribute, so that

consumer perceptions can be quickly detected. But

this method can be considered impractical because if

the panelists determine their own attributes on the

sample, then each attribute must be interpreted and

then combined with similar attributes (Dooley et al.,

2010).

Based on the results of this research, sensory

attributes obtained from the analysis of the CATA

method have more in common with the QDA method.

This can be caused the panelist in CATA method only

need to select the attributes contained in the sample,

so that it is easier to do. In addition, the flash profile

method gives the panelists the freedom to determine

the sensory attributes of the sample, so that the results

obtained are broader and less consistent with the

results obtained in the QDA method. The CATA

method and flash profile cannot replace the QDA

method in terms of testing that requires high

sensitivity. But if it’s necessary to determine the

product's sensory profile quickly, then the CATA

method is better to do.

4 CONCLUSIONS

Four RTD coffee samples, Nescafe, ABC Exo, Good

Day Moccacino, and Luwak White Koffie have

almost the same sensory profile based on the QDA

method by expert panelists. The four samples tend to

have the dominant profile of vanilla, creamy,

caramel, and milky. One other RTD coffee sample,

Kopiko 78, is dominant in bean attributes.

Commercial IPD coffee samples have coconut, bitter,

and roasted sensory profiles that are more dominant

than RTD coffee.

The sensory profile of commercial coffee

obtained using the consumer panel in the two

methods, CATA and flash profile, gave quite

different results. The results of the CATA method

analysis have more in common with the QDA

method. This can be caused because the CATA

method is easier to do. In addition, the flash profile

method gives the panelists the freedom to determine

Sensory Profile of Commercial Coffee Products using QDA (Quantitative Descriptive Analysis), Flash Profile, and CATA

(Check-All-That-Apply) Methods

29

the sensory attributes of the sample, so that the results

obtained are broader and less consistent with the

results obtained in the QDA method. Compared to

flash profiles, the CATA method can provide more

accurate results and can be used if no trained panelists

are available or needed to determine the sensory

profile of the product quickly.

REFERENCES

Ares, G., Dauber, C., Fernández, E., Giménez, A., Varela,

P. (2014). Penalty analysis based on CATA questions

to identify drivers of liking and directions for product

reformulation. Food Quality and Preference, 32A, 65-

76.

[BSN] Badan Standardisasi Nasional. (1996). Minuman

Kopi dalam Kemasan. Jakarta (ID): BSN.

Bruzzone, F., Vidal, L., Antúnez, L., Giménez, A., Deliza,

R., Ares, G. (2015). Comparison of intensity scales and

CATA questions in new product development: Sensory

characterisation and directions for product

reformulation of milk desserts. Food Quality and

Preference, 44, 183-193.

Chapman, K.W., Lawless, H.T., Boor, K.J. (2001).

Quantitative descriptive analysis and principal

component analysis for sensory characterization of

ultrapasteurized milk. Journal of Dairy Science, 84, 12-

20.

Dairou, V, Siefferman, J.M. (2002). A comparison of 14

jams characterized by conventional profile and a quick

original method, the flash profile. Journal of Food

Science, 67, 826-834.

Dewi, F.I., Anwar, F., Amalia, L. (2009). Persepsi terhadap

konsumsi kopi dan teh mahasiswa TPB-IPB tahun

ajaran 2007-2008. Jurnal gizi dan pangan, 4(1), 20-28.

Dooley, L., Lee, Y., Meullenet, J.F. (2010). The application

of Check-All-That-Apply (CATA) consumer profiling

to preference mapping of vanilla ice cream and its

comparison to classical external preference

mapping. Food Quality and Preference, 21, 394–401.

Farida, A., Ristanti, E., Kumoro, A.C. (2013). Penurunan

kadar kafein dan asam total pada biji kopi robusta

menggunakan teknologi fermentasi anaerob fakultatif

dengan mikroba nopkor MZ-15. Jurnal Teknologi

Kimia dan Industri, 2(3), 70-75.

[ICO] International Coffee Organization. (2018). World

Coffee Consumption. London (UK): ICO.

[ISO] International Organization for Standardization.

(2012). Sensory analysis: General guidelines for the

selection, training and monitoring of selected assessors

and expert sensory assessors. Geneva (CH): ISO.

Manik, M., Restuhadi, F., Rossi, E.. (2016). Analisis

pemetaan kesukaan konsumen terhadap lempuk

dikalangan mahasiswa Universitas Riau. Jom Faperta,

3(2), 1-15.

Martinez, C., Cruz, M.J.S., Hough, G., Vega, M.J. (2002).

Preference mapping of cracker type biscuits. Food

Quality and Preference, 13, 535-544.

Meyners, M., Castura, J.C., Carr, B.T. (2013). Existing and

new approaches for the analysis of CATA data. Food

Quality and Preference, 30(2), 309-319.

Montanuci, F.D., Marques, D.R., Monteiro, A.R.G. (2015).

Flash profile for rapid descriptive analysis in sensory

characterization of passion fruit juice. Maringá, 37(3),

337-344. doi: 10.4025/actascitechnol.v37i3.26238

Moussaoui, K.A., Varela, P. (2010). Exploring consumer

product profiling techniques and their linkage to a

quantitative descriptive analysis. Food Quality and

Preference, 21, 1088-1099. doi:

10.1016/j.foodqual.2010.09.005

Panggabean, E. (2011). Buku Pintar Kopi. Jakarta (ID):

Agromedia Pustaka.

Papetti, P., Carelli, A. (2013). Composition and sensory

analysis for quality evaluation of a typical Italian

cheese: Influence of ripening period. Czech Journal of

Food Science, 31(5), 438-444.

Poste, L.M., Deborah, A.M., Gail, B., Elizabeth, L. (2011).

Laboratory methods for sensory analysis of food.

Research Branch Agriculture Canada Publication 1864

Rahmawati, D., Andarwulan, N., Lioe, H.N. (2015).

Identifikasi atribut rasa dan aroma mayonnaise dengan

metode Quantitative Descriptive Analysis (QDA).

Jurnal Mutu Pangan, 2(2), 80-87.

Towaha, J., Purwanto, E.H., Aunillah, A. (2012). Peranan

Pengolahan terhadap Pembentukan Citarasa Kopi. Di

dalam: Amaria W, Chan AN. Bunga Rampai Inovasi

Teknologi Tanaman Kopi untuk Perkebunan Rakyat.

Sukabumi (ID): Balittri.

Triyanti, D.R. (2016). Outlook Kopi. Jakarta (ID): Pusat

Data dan Sistem Informasi Pertanian Sekretariat

Jenderal – Kementerian Pertanian.

Varela, P., Ares, G. (2012). Sensory profiling, the blurred

line between sensory and consumer science. A review

of novel methods for product characterization. Food

Research International, 48, 893-908.

2nd SIS 2019 - SEAFAST International Seminar

30