Innovation and Dynamic Capabilities among Traditional Market

Traders: How it Affect Business Performance

Moh Farid Najib, Deddy Saefuloh and Iwan Mulyawan

Business Administration Department, Bandung State Polytechnic, Indonesia

Keywords: Innovation, Dynamic Capabilities, Business Performance.

Abstract: The purpose of this paper is to report research on dynamic capabilities and innovation-how it affects business

performance. The author also examines how the effect of innovation on both dynamic capabilities and

business performance, and how dynamic capability impacts on business performance, also as well as how

dynamic capabilities as the moderating effect of innovation on business performance. The data collected from

an original survey of 840 respondents of the trader in 69 traditional markets around West Java, Indonesia.

This research was developed using a survey and literature review as the basis for its development. Structural

Equation Modeling was used to evaluate the finding, which means that two stages were used; the first was

checking the construct reliability and validity for measuring the model. The second stage was a full model of

structural equation modeling to test the hypothesis developed. The finding of these researches described the

innovation of traditional market trader has a significant positive effect not only on dynamic capabilities but

also on business performance, another finding shows that the dynamic capabilities have a significant positive

effect on business performance.

1 INTRODUCTION

Traditional market traders that are categorized as

Small and Medium Enterprises (SMEs) face

challenges from the growing modern markets as well

as from competition among the traditional market

traders themselves. This is indicated by the

development of modern retails such as mini markets,

which are considered to threaten the existence of

traditional markets in Indonesia

(https://bisniskeuangan.kompas.com). One reason is

the service quality of the traditional market far

inferior to the modern market (Najib and Sosianika,

2018). Hanna and Walsh (2002) suggest SMEs must

adapt to industrial changes, such as technological

progress and the creation of new products so they can

survive to operate. Therefore, SMEs must be more

innovative in serving their customers, due to the

changing preferences of their customers, and the

competitors who keep improving their capabilities in

the business.

Therefore, the challenge of developing a

competency level the dynamic capabilities of

traditional market traders is required to be high. Hitt

et al. (2001) and Helfat et al. (2007) state that the

dynamic capabilities of a company can make a

positive contribution to company performance.

Dadashinasab and Sofian (2014) confirm that

dynamic capability, in principle, is to reconstruct and

enhance the core capabilities of the company in

responding to dynamic markets to maintain

competitive advantage and maintain performance.

Giniuniene and Jurksiene (2015) suggest that the

concept of dynamic capabilities is very important in

today's research because dynamic capabilities can

improve a company's business performance. The

main implication of the dynamic capability concept is

that the company has competency not only to

distribute the utilization of available resources within

the organization but also to renew and develop

themselves, especially in traditional markets.

On the other hand, in today's competitive business

and market environment, Lazonick and O'Sullivan

(2000) and Brem and Voigt (2009) argue that the need

to continue to innovate and provide new products and

services that are better recognized for all company

sizes. Because successful innovation is recognized as

one of the factors that contribute to the company's

competitive advantage (Gunasekaran et al., 2000;

How, 2008; Sanz-Valle and Jimenez-Jimenez, 2011),

and ultimately has an impact on business performance

(Zahra et al., 1999; How, 2008; Talke et al., 2011).

Najib, M., Saefuloh, D. and Mulyawan, I.

Innovation and Dynamic Capabilities among Traditional Market Traders: How it Affect Business Performance.

DOI: 10.5220/0009959801490157

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 149-157

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

149

Previous studies related to the relationship

between innovation and business performance some

mentioned having positive and significant

relationships, but others found that there were no

positive and significant relationships and even no

relationships at all (Geroski and Machin, 1992; Freel,

2000b: Al-Ansari et al.., 2013). Freel (2000a)

emphasized that he did not find this relationship.

Meanwhile, other opinions state that business

performance is positively influenced by innovation,

and the correlation between innovation and business

performance depends on the type of innovation it

develops (Otero-Neira et al. 2009; Forsman and

Temel, 2011). North and Smallbone (2000) found that

there is a relationship between innovation and

business performance that is interdependent and

mutually. Therefore, the role of dynamic capabilities

becomes very important as a mediation that mediates

the relationship of innovation with business

performance. Research on issues that contribute to the

characteristics of SME innovation includes several

things, namely; environmental and cultural issues,

market strategy issues from the process and type of

product, source of ideas, drivers and platforms, and,

research and development (Sebora et al., 1994;

Hadjimanolis, 1999; Guan and Ma, 2003; Blumentritt

and Danis, 2006; Kenny and Reedy, 2006; Laforet

and Tann, 2006).

The purpose of this study is to explore the

relationship of innovation to dynamic capabilities and

business performance. Therefore, this research is

organized as follows. First, background and

theoretical study are presented, and then a description

of the methodology was used. Second, data analysis

that followed with a discussion of test results. The

final part of this study is the presentation of

conclusions.

2 LITERATURE REVIEW

2.1 Innovation

Innovation is a process that can be repeated in various

forms (Damanpour & Schneider, 2006; Dobni, 2008;

Goffin & Mitchell, 2010; Norman & Verganti, 2012).

According to Freeman and Soete (1997), innovation

is related to the involvement of various problems,

including; knowledge, capabilities, activities, and

organizational processes. Kanter (1983) defines

innovation as a form of accepting and implementing

the new ideas of the processes, the products, or the

services. It basically means that innovation occurs

when new elements or new combinations of old

elements are introduced. Therefore, the aim of

innovation is to take advantage of the latest

conditions and opportunities, formed in the

environment and used to frame new values and gain

competitive advantage (Porter, 1990; Nonaka &

Kenney, 1991; Damanpour & Schneider, 2006;

Dobni, 2008).

Several types and activities of innovation include

product innovation, process innovation, and market

innovation (Sundbo, 2003). Furthermore, Sundbo

also (2003) describes product innovation as the

introduction of new products to the market; and the

process innovation is the introduction of new

production processes using new technologies or new

work processes; and market innovation is related to

the new market behavior of the companies such as

new strategies, new marketing, new alliances, and

others

.

2.2 Dynamic Capability

The rise of a dynamic capability view is a reaction

response to the not yet covered resource-based view

and action-based view as a result of the development

of new economic notions and innovations (Mintzberg

et al., 2003). On the whole, dynamic capabilities can

be built from strategic and operational processes

(Güttel & Konlechner, 2009). Strategic processes are

mostly related to the ability to feel and take advantage

of new opportunities in a vibrant environment (Teece,

2007). Hence, this process determines the

establishment of corporate strategies (Güttel &

Konlechner, 2009). While in the operational process,

more dynamic capabilities relate to reshaping internal

or external competencies and establishing operational

practices within the company (Güttel & Konlechner,

2009). The study of Hou (2008), Pavlou & Elsawy

(2011), Zheng et al. (2011), Wang & Shi (2011),

Gathungu & Mwangi (2012), Nedzinskas et al.

(2013), and Tiantian et al. (2014) respectively show

some similarities and differences in dimensions used

in measuring the dynamic capabilities of an

organization/company. Lin & Huang (2012) suggest

that dynamic capabilities facilitate a company in

improving its performance, innovation in products,

and the use of sophisticated technology and preparing

the company to survive in an ever-changing business

environment. Furthermore, Najib et al. (2017) state

that dynamic capabilities can be built through

sensitivity capability, absorptive capacity, integrative

capability, and innovative capability.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

150

2.3 Business Performance

Performance is a construct commonly used to

measure the impact of strategic orientation. Voola &

O'Cass (2010) states that business performance is a

major consequence of the responsive market

orientation (RMO) and proactive market orientation

(PMO). Furthermore, Wheelen & Hunger (2012)

argue that performance is the final result of the

activities. Thus to measure the dimensions of

business performance can be based on the concept of

developing dimensions, as suggested by Najmabadi,

Rezazadeh & Shoghi (2013) through using

performance measurement dimensions consisting of

sales growth, return on investment, operating profit

margin, return on equity and customer retention.

Hussin, Thaheer, Badrillah, Harun, & Nasir (2014)

use the dimensions of measuring business

performance covering average net profit growth,

work value received, the number of contracts

received, and the number of contracts renewed.

Hyung & Dedahanov (2014) include four aspects of

measuring performance, i.e., market share, average

growth, success, and profitability. Najib et al. (2017)

the dimensions used to measure business

performance in measuring business success,

including sales growth, market share growth, and

profitability.

2.4 Innovation, Dynamic Capabilities,

and Business Performance

A study has found that innovativeness has a positive

relationship with business performance, which

includes; profitability, market share, and sales growth

(Deshpande et al.,1993). Furthermore, Craig and

Dibrell (1994) have proven that innovation is a

crucial requirement for business performance, as well

as for competitiveness and economic wealth.

Similarly, Baldwin and Johnson (1996) show found

that innovation has a significant influence on various

measures of business performance, which include

such as ROI (return on investment) and the company's

market share. Furthermore, Salavou (2002), based on

asset returns, shows that product innovation is a

significant determinant for business performance.

Innovation helps companies economically, creates

competitive advantages, and can positively influence

on business performance (Fallah and Lechler, 2008;

Talke et al., 2011).

Likewise, there is also a relationship between

dynamic capabilities and business performance

(Teece et al. 1997; Eisenhardt and Martin. 2000;

Makadok 2001; Najib et al., 2017). Furthermore,

Mauludin et al. (2013) argue that dynamic

capabilities are needed in formulating strategies in

rapidly fluctuating and complicated environments,

high innovation demands, and efforts to improve

organizational capabilities in order to overcome

market dynamics. Dynamic capabilities are

organizational routines that must be obtained through

learning in a very high style, repetitive or repetitive

mastery (Tiantian et al., 2014). Then how far can

dynamic capabilities mediate innovation on business

performance? Based on the background and

theoretical study above, and considering the purpose

of this research, a conceptual model is proposed that

needs to be tested empirically. In this research, the

aim is to examine the relationship between innovation

and dynamic capabilities and the relationship

between innovation and business performance in

traditional market traders. Therefore, some

hypothesis can be derived from the research model,

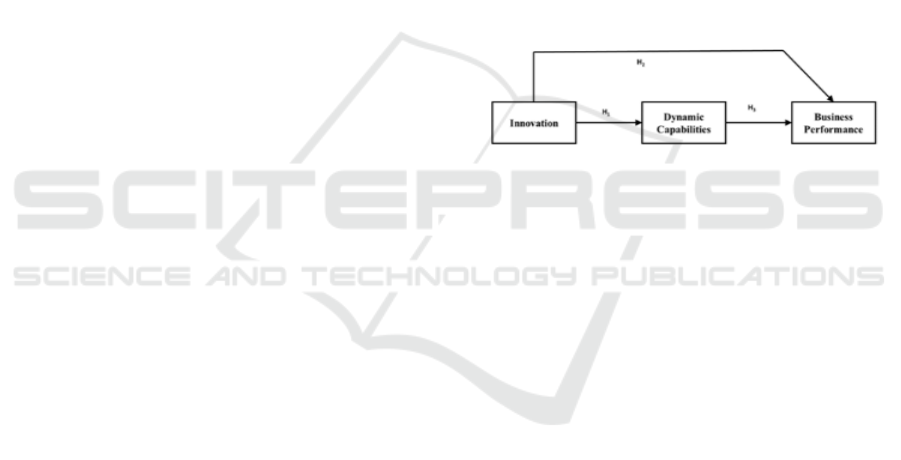

as shown in Figure 1:

Figure 1: Research Model.

Hypothesis1: The dynamic capabilities of traditional

market traders are positively related by

innovation.

Hypothesis2: The business performance of a

traditional market trader is positively

related by innovation.

Hypothesis3: The business performance of a

traditional market trader is positively

related by with dynamic capabilities.

3 METHODOLOGY

3.1 Survey Design, Instrument and

Sample Characteristic

The purpose of this study is to explore innovative

characteristics in traditional market traders and

innovation relationships with dynamic capabilities

and business performance. Data was collected from

traditional market traders in West Java, Indonesia. A

five-point Likert scale is designed for questionnaire

after a literature review; therefore, the survey

instrument for constructing the first variable is an

innovation which is adopted from the research of Al-

Ansari et al. (2013). The second variable constructs is

Innovation and Dynamic Capabilities among Traditional Market Traders: How it Affect Business Performance

151

a dynamic capability that is developed and adapted

from Hou (2008) and Najib et al. (2017). The third

variable construct is business-performance, which is

adopted and developed from Hyung & Dedahanov

(2014) and Najib et al. (2017).

The sample size of this study was 840 respondents

of traditional market traders taken from 66 traditional

markets around West Java, Indonesia. Table 1 shows

the respondents’ profile.

Table 1: Respondent Profile

Description Freq % Description Freq %

Gender

Outlet

Ownership

Status

Male 477 56,8 own property 450 53,6

Female 363 43,2 Rent 390 46,4

840 100

840 100

Business

Experience

Business

license

More than 15 years 286 34,0 License 657 78,2

10 years - 15 years 191 22,7 No License 183 21,8

5 years - 10 years 185 22,0

840 100

Less than 5 years 178 21,2

840 100,0

3.2 First Order - Confirmatory Factor

Analysis (CFA)

The first order-CFA was carried out to adjust and

validate the structural model. The measurement

model was developed to see the relationship between

the variable constructs examined by using AMOS-22

(Byrne, 2013). After using the modification index to

determine the covariance between the variables

studied, the suitability of the model to build the

variables used in the study includes; innovation,

dynamic capability, and business performance. The

results show that the variables can be accepted

because they have the goodness of fit index, as shown

in table 2

.

Table 2: Goodness of Fit Index

An

Acceptable

Level

Variable Constructs

Innovation

Dynamic

Capabilities

Business

Performance

CMIN/DF

≤ 3 2.672 2.783 2,630

RMSEA

≤ 0,08 0,054 0,076 0,064

GFI

≥ 0,90

0,91 0,905 0,921

AGFI

≥ 0,90 0,92 0,901 0,906

TLI

≥ 0,90 0,912 0,946 0,948

NFI

≥ 0,90 0,90 0,934 0,524

CFI

≥ 0,90 0,923 0,943 0,959

IFI

≥ 0,90 0,923 0,943 0,959

RFI

≥ 0,90 0,916 0,924 0,959

3.3 Validity and Reliability

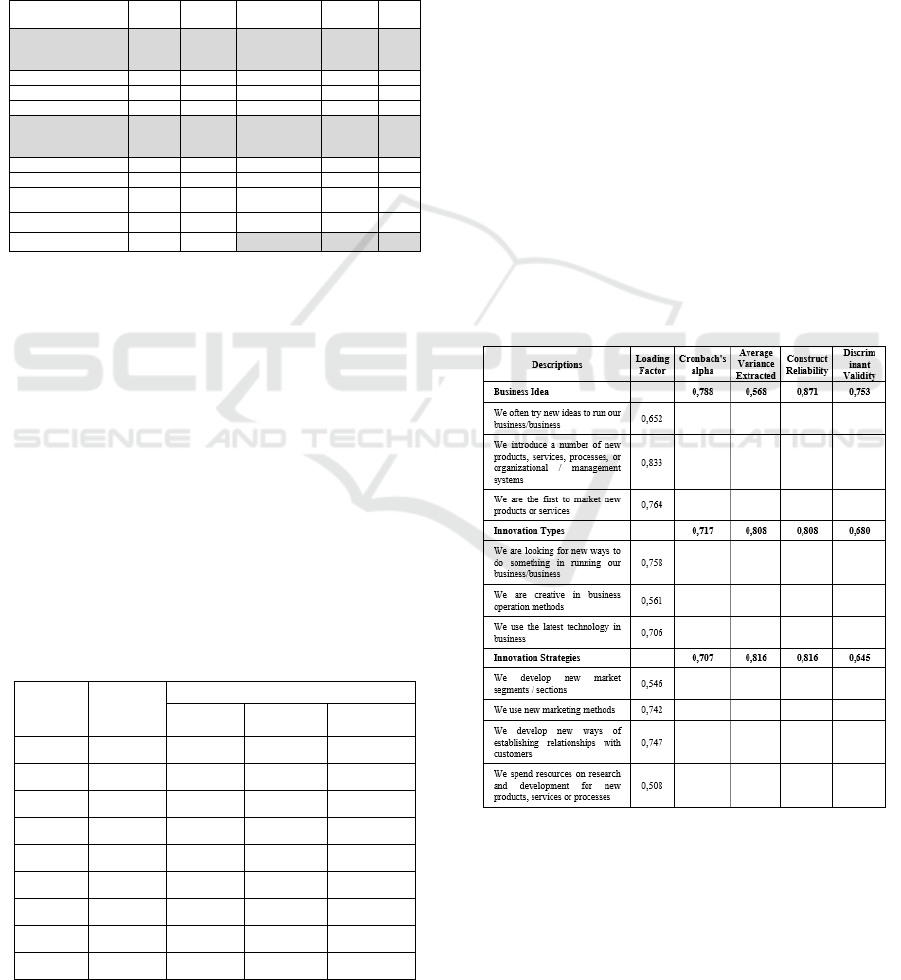

Table 3 shows all loading factors for the constellation

of innovation variables. Table 4 for constructing

variable dynamic capabilities and Table 5 for

constructing business performance variables, all of

them were recommended a minimum threshold of

0.30 for our sample size of 840 (Hair et al., 2006).

Convergent validity and Average Variance Extracted

(AVE) are above 0.50 on all constructs, implying that

each construct explains more than 50 percent of the

variance in each variable indicator. The discriminant

validity was confirmed by the Fornell-Larcker

criterion by comparing the square root of the AVE of

each construct. The correlation between constructs

indicated that, on average, each construct was more

strongly related to its measures what the other

constructs measures (see table 3, table 4 and table 5

of AVE, Construct reliability and Discriminant

validity) (Hair et al., 2006). Pertaining to the model

reliability, the Cronbach's alpha and composite values

for each construct are above 0.7 of the thresholds

(Byrne, 2013).

Table 3: Validity and Reliability Construct Variable:

Innovation

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

152

Table 4: Validity and Reliability Construct Variable:

Dynamic Capabilities

Table 5: Validity and Reliability Construct Variable:

Business Performance

4 RESULT AND DISCUSSION

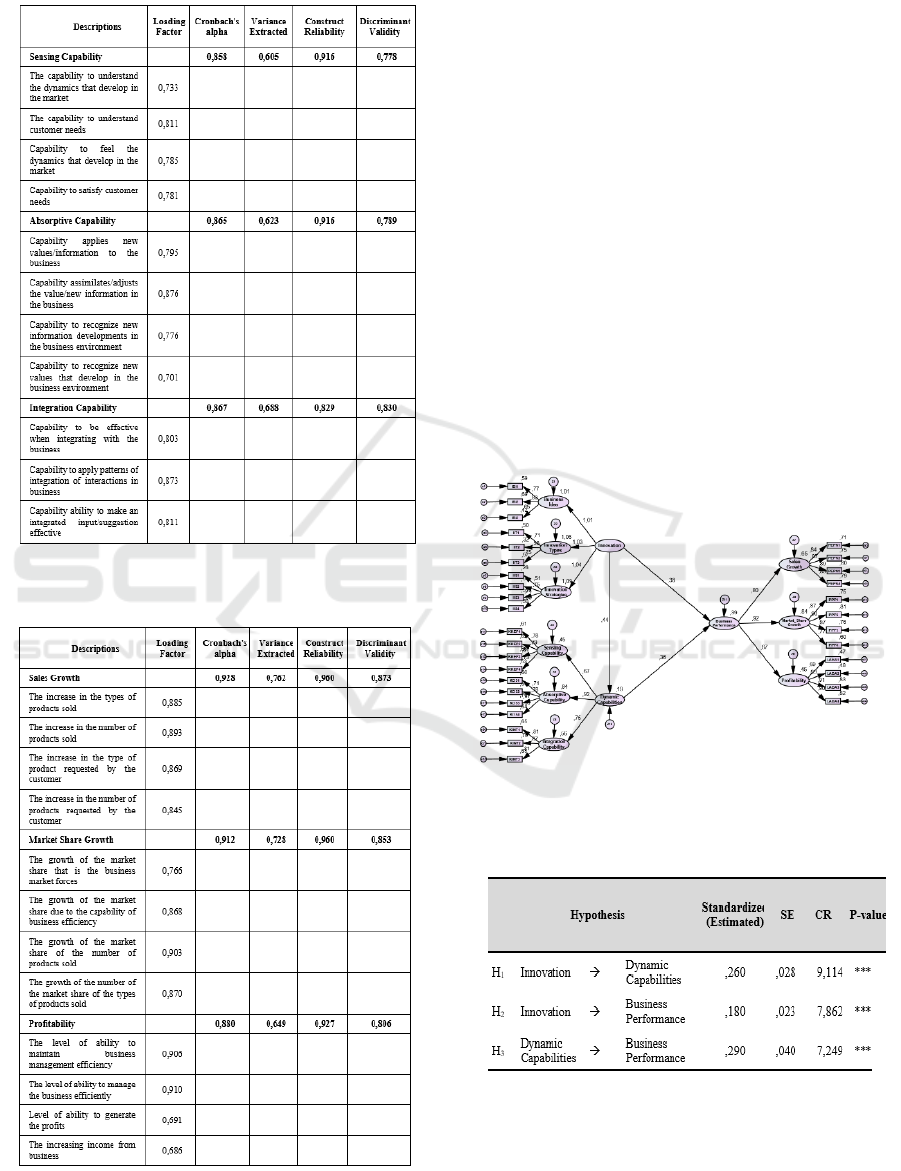

Structural Equations Modelling (SEM) describes the

relationship between exogenous variables

(innovation) and endogenous variables (dynamic

capabilities and business performance). The results

presented in Figure 2 are the results after moving

through the procedure of evaluating the model with

first order-CFA.

The model of the structural equation as shown in

Figure 2 indicated as a perfect model, as CMIN / DF

resulted in 2,835, and also other fit indexes (GFI,

AGFI, TLI, NFI, CFI, IFI, and RFI) gave value over

90% that indicated excellent model, as well as the

RMSEA value of 0.073, is below 0.08 (Hair, 2006).

Consistent with the research objective, which is to

determine the effect of innovation and dynamic

capabilities on the business performance of

traditional market traders, as shown in Figure 2 and

Table 6, there is a significant positive effect of

innovation and dynamic capabilities on the business

performance of traditional market traders.

Figure 2: The SEM Diagram of the Effect of Innovation and

Dynamic Capabilities on Business Performance

Table 6: Hypothesis Testing Result

Hypothesis testing results in the effect of

innovation and dynamic capabilities on business

performance as Table 5 shows that: H

1

(innovation is

positively related to the dynamic capabilities of

Innovation and Dynamic Capabilities among Traditional Market Traders: How it Affect Business Performance

153

traditional market traders) indicates that the critical

value (CR) is 9,114 on the influence of innovation

with the dynamic capabilities, with P-Value

(probability) is significant with ***, it means that it is

significant by default. Therefore the regression

weight on dynamic capabilities foreseen by

innovation is significantly different from zero at the

0.05 level (two-tailed). Thus, it implies that Ha is

rejected, but Ho is accepted. These results conclude

that innovation affects dynamic capabilities. The

result shows that the capabilities of traditional market

traders which include sensing capability, absorptive

capability, and integrated capability must be

supported by innovation capability among traders,

which includes the ability to develop business ideas,

the ability to create various types of innovation, and

the ability to plan innovation strategies. Hou (2008)

confirms the result of this study that dynamic

capabilities are needed to support in dealing with

environmental changes, in the form of innovation

capabilities, as confirmed by Kim et al., (2018) that

innovation is needed in building dynamic capabilities.

However, in reality, the traditional markets, despite

facing a threat from modern markets, are still the

choice of their customers.

H

2

(an innovation of traditional market traders is

positively related to their business performance)

indicated that the critical value (CR) is 7,862 on the

influence of innovation with business performance,

and P-Value (probability) is significant with ***,

which means that by default is significant. In other

words, the regression weight for business

performance predicted innovation is significantly

different from zero at the 0.05 (two-tailed) level.

Thus, it was decided to reject Ha and accept Ho.

Based on these results, it can be concluded that

innovation affects business performance. By

innovating can drive business performance, in the

form of sales growth, market share growth, and

profitability. Therefore, traditional markets need to

innovate in the face of current business competition

and corporate environments that require continuous

innovation, and they should be able to provide such

as; new products and product diversification and give

the best services (Lazonick and O'Sullivan, 2000;

Brem and Voigt, 2009). Another important thing is

related to the ability to innovate traditional market

traders, because innovation has been believed to be

able to improve business performance (North and

Smallbone, 2000; Forsman and Temel, 2011; Kim et

al., 2017). Innovation that can be done in traditional

markets can be done mainly related to changing

traditional markets, which are perceived as dirty,

smelly, muddy, narrow hallways, lots of garbage, and

irregular arrangement of merchandise.

H

3

(dynamic capability is positively related to the

business performance of traditional market traders)

indicated that the critical value (CR) is 7,862 on the

influence of dynamic capabilities with business

performance, and P-Value (probability) is significant

with ***, which means that by default is significant.

In other words, the regression weight for business

performance predicted by innovation is significantly

different from zero at the 0.05 level (two-tailed).

Thus, it was decided to reject Ha and accept Ho.

Based on these results, it can be concluded that

innovation affects business performance. This result

shows the importance of increasing the dynamic

capability of traditional market traders in sensing

capability, absorptive capability, and integration

capability because increasing the dynamic capability

of traditional market traders can improve their

business performance. Dadashinasab and Sofian

(2014) stated that dynamic capabilities could

maintain performance, further Giniuniene and

Jurksiene (2015) claim it can improve business

performance.

This study explores the innovative capabilities

and dynamic capabilities of traditional market traders

in Indonesia and examines the relationship between

innovation and dynamic capabilities on business

performance in traditional market traders. This study

provides support for previous studies conducted in

traditional markets in Indonesia and provides useful

insights on the importance of innovation of traditional

market traders in developing countries by

investigating the extent to which innovation and

dynamic capabilities of traditional market traders

influence their business performance. The results

show that innovation and dynamic capabilities have a

positive relationship with the business performance

of traditional market traders in Indonesia. The results

of this study strengthen and provide empirical support

for the view that innovation and dynamic capabilities

have a positive impact on business performance and

counter the assumption that innovation and dynamic

capabilities will consume of the resources and

jeopardize of the competitive advantage of traditional

market traders, especially in traditional markets in

developing countries

.

5 CONCLUSIONS

The contribution of this research is expected to be

able to add to the literature for innovation and

dynamic capabilities making available the data from

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

154

traditional markets and challenging whether previous

research findings are relevant in developing

traditional markets. This research reveals some

implications. It also has several implications. First,

there is an indication that traditional market traders

have different views on innovation and dynamic

capabilities and show that innovation and dynamic

capabilities are statistically significant in relation to

business performance in the context of developing

traditional market traders in Indonesia. Second, these

findings provide more insight into the innovative

characteristics and dynamic capabilities of traditional

market traders in Indonesia and show that the

attention must be paid to innovation and dynamic

capabilities, ensuring traditional market traders can

achieve much better business performance. Third,

this finding might support the policymakers of the

traditional market in Indonesia to take the new steps

towards national policies that enhance the

revitalization of traditional markets not only for the

facilities but for business actors themselves who are

traditional market traders. Finally, the findings of this

study may further encourage traditional market

traders to take specific actions to build, lead, and

improve their innovative business and dynamic

capabilities to achieve better business performance.

ACKNOWLEDGMENTS

This research was supported from Strengthening the

Directorate General of Research and Technology and

Development, The Ministry of Research and Higher

Education, Republic of Indonesia, according to the

letter agreement implementation competitive

research grant program of work, the number

237.11/PL1.R7/LT/2018

REFERENCES

Al-Ansari, Y., Pervan, S and Xu, J. 2013. Innovation and

business performance of SMEs: the case of Dubai,

Education, Business and Society: Contemporary

Middle Eastern Issues, Vol. 6 No. 3/4, pp. 162-180

Baldwin, J. R., & Johnson, J. 1996. Business Strategies in

Innovative and Non-Innovative Firms in Canada. SSRN

Electronic Journal. DOI:10.2139/ssrn.4120

Blumentritt, T. and Danis, W. 2006, “Business strategy

types and innovative practices”, Journal of

Management Issues, Vol. 18 No. 2, pp. 274-291.

Brem, A. and Voigt, K.-I. 2009, "Integration of market pull

and technology push in the corporate front end and

innovation management-insights from the German

software industry," Technovation, Vol. 29 No. 5, pp.

351-367.

Byrne, B.M. 2013, Structural Equation Modelling with

AMOS: Basic Concepts, Applications, and

Programming, 2nd ed., Routledge, New York, NY.

Craig, J., & Dibrell, C. 2006.”The Natural Environment,

Innovation, and Firm Performance: A Comparative

Study”. Family Business Review, Vol. 19 No. 4, pp

275–288.

Dadashinasab, M, and Sofian, S. 2014. “The Impact of

Intellectual Capital on Firm Financial Performance by

Moderating of Dynamic Capability”, Asian Social

Science; Vol. 10, No. 17; 2014, pp 93-100.

Damanpour, F and Schneider, M. 2006. “Phases of the

Adoption of Innovation in Organizations: Effects of

Environment, Organization, and Top Managers”,

British Journal of Management, Vol. 17, pp 215–236

Deshpande, R., J. U. Farley, and F. E. Webster Jr. 1993.

“Corporate Culture, Customer Orientation, and

Innovativeness in Japanese Firms: A Quadrad

Analysis,” The Journal of Marketing 57, 23–37.

Dobni, C.B. 2008. ”Measuring Innovation Culture in

Organizations: The Development and Validation of a

Generalized Innovation Culture Construct Using

Exploratory Factor Analysis”, European Journal of

Innovation Management, Vol. 11(4), pp 539-559

Eisenhardt, K. M., and Martin, J.A. 2000. “Dynamic

Capabilities: What Are They?” Strategic Management

Journal 21(10–11), 1105–1121.

Fallah, M.H. and Lechler, T.G. 2008. “Global innovation

performance: strategic challenges for multinational

corporations”, Journal of Engineering & Technology

Management, Vol. 25 Nos 1/2, pp. 58-74.

Forsman, H. and Temel, S. 2011. “Innovation and business

performance in small enterprises: an enterprise-level

analysis”, International Journal of Innovation

Management, Vol. 15 No. 3, pp. 641-665.

Freel, M.S. 2000a. “Barriers to product innovation in small

manufacturing firms”, International Small Business

Journal, Vol. 18 No. 2, pp. 60-80.

Freel, M.S. 2000b. “Do small innovating firms outperform

non-innovators?”, Small Business Economics, Vol. 14

No. 3, pp. 195-210.

Freeman, C. and Soete, L. 1997. The Economics of

Industrial Innovation, 3rd ed., Pinter, London.

Gathungu, J. M., and Mwangi, J. K. 2012. “Dynamic

Capabilities, Talent Development and Firm

Performance”, DBA Africa Management Review,

2012, Vol 2 No 3, pp 83-100.

Geroski, P. and Machin, S. 1992, “Do innovating firm

outperformed non-innovators?”, Business Strategy

Review, Vol. 3 No. 2, pp. 79-90.

Giniuniene, J., and Jurksiene, L. 2015. “Dynamic

Capabilities, Innovation, and Organizational Learning:

Interrelations and Impact on Firm Performance”, 20th

International Scientific Conference Economics and

Management - 2015 (ICEM-2015), Procedia - Social

and Behavioral Sciences, Vol. 213, 985 – 991.

Innovation and Dynamic Capabilities among Traditional Market Traders: How it Affect Business Performance

155

Goffin, K, and Mitchell, R. 2010. “Innovation

Management: Effective Strategy and Implementation “,

Third Edition, Palgrave, UK

Guan, J. and Ma, N. 2003. “Innovative capability and

export performance of Chinese firms”, Technovation,

Vol. 23 No. 9, pp. 737-747.

Gunasekaran, A., Forker, L. and Kobu, B. 2000.

“Improving operations performance in a small

company: a case study”, International Journal of

Operations & Production Management, Vol. 20 No. 3,

pp. 1-14.

Güttel, W.H. and Konlechner, S.W. 2009. “Continuously

hanging by a thread: managing contextually

ambidextrous organizations”, Schmalenbach Business

Review, Vol. 61 No. 2, pp. 150-172

Hadjimanolis, A. 1999. “Barriers to innovation for SMEs in

a small less developed country (Cyprus)”,

Technovation, Vol. 19, pp. 561-570.

Hair, J.F., Tatham, R.L., Anderson, R.E. and Black, W.

(2006), Multivariate Data Analysis, Pearson Prentice

Hall, Upper Saddle River, NJ.

Hanna, V. and Walsh, K. 2002. “Small firm network: a

successful approach to innovation?”, R & D

Management, Vol. 32 No. 3, pp. 201-7.

Helfat, C. E., Finkelstein, S., Mitchell, W., Peteraf, M. A.,

Singh, H., Teece, D. J. & Winter, S. G. 2007. Dynamic

capabilities: understanding strategic change in

organizations. Blackwell: London.

Hitt, M., R. Duane I. S., Michael, and Donald L. S. 2001.

“Guest Editors’ Introduction to The Special Issue,

Strategic Entrepreneurship: Entrepreneurial Strategies

for Wealth Creation”, Strategic Management Journal,

22, 479-491.

Hou, J. J. 2008. “Toward a Research Model of Market

Orientation and Dynamic Capabilities,” Social

Behavior and Personality: An International Journal

36(9), 1251–1268.

https://bisniskeuangan.kompas.com/read/2017/06/10/1600

00026/perkembangan.ritel.modern.ancam.eksistensi.pa

sar.tradisional

http://bisniskeuangan.kompas.com/read/2017/06/10/16000

0026/ the development of modern retailers threatens the

existence of traditional markets) retrieved, August,

18th 2019.

Hussin, M.H.F., Thaheer, A. S. M., Badrillah, M. I. M.,

Harun, M. H. M., and Nasir, S. 2014. “ The Aptness of

Market Orientation Practices on Contractors’ Business

Performance: A Look at the Northern State of

Malaysia”, International Journal of Social Science and

Humanity, Vol. 4, No. 6, pp 468-473

Kanter, R.M. 1983. “When a thousand flowers bloom:

structural, collective and social conditions for

innovation in organization”, in Swedberg, R. (Ed.),

Entrepreneurship: The Social Science View, Oxford

University Press Inc., New York, NY, pp. 167-210.

Kenny, B. and Reedy, E. 2006. “The impact of

organizational culture factors on innovation levels in

SMEs: an empirical investigation”, Irish Journal of

Management, Vol. 27 No. 2, pp. 119-142.

Kim, M., Ji-eung Kim, Sawng, Y., and Kwang-sun Lim, K.,

2018. "Impacts of innovation type SME’s R&D

capability on patent and new product development",

Asia Pacific Journal of Innovation and

Entrepreneurship, Vol. 12 Issue: 1, pp.45-61

Laforet, S. and Tann, J. 2006, “Innovative characteristics of

small manufacturing firms”, Journal of Small Business

and Enterprise Development, Vol. 13 No. 3, pp. 363-

380.

Lazonick, W. and O’Sullivan, M. 2000. Perspective on

Corporate Governance, Innovation, and Economic

Performance, Research Project, INSEAD,

Fontainebleau, July.

Lin, K. & Huang, K. 2012. Dynamic Capability and Its

Effects on Firm Performance, American Journal of

Applied Sciences, Vol. 9, Issue. 1, pp. 107-110.

Makadok, R. 2001. “Toward a Synthesis of the Resource-

based and Dynamic-Capability Views of Rent,”

Strategic Management Journal 22(5), 387–401.

Mauludin, H., Alhabsji, T., Idrus, S., and Arifin, Z. 2013.

“Market Orientation, Learning Organization, and

Dynamic Capability as Antecedents of Value

Creation”, IOSR Journal of Business and Management

(IOSR-JBM), Volume 10, Issue 2, pp 38-48

Mintzberg, H., Lampel, J., Quinn, J. B., and Ghoshal, S.

2003: The Strategy Process. Concepts, Contexts, Cases,

4th Ed., Upper Saddle River (NJ)

Najib, M.F., Kartini, D., Suryana, Y. and Sari, D. 2017.

‘Market orientation, buyer-supplier relationship and

firm performance with dynamic capabilities as an

intervening variable: a research model’, Int. J. Business

and Globalisation, Vol. 19, No. 4, pp.567–582.

Najib, M.F. and Sosianika, A. 2018. ‘Retail service quality

scale in the context of Indonesian traditional market’,

Int. J. Business and Globalisation, Vol. 21, No. 1,

pp.19–31.

Najmabadi, A. D., Rezazadeh, A., & Shoghi, B. 2013.

“Entrepreneurial Orientation and Firm Performance-

The Moderating Effect or Organizational Structure”,

Asian Journal of Research in Business Economics and

Management, Volume 3, Issue 2, pp 142-164

Nedzinskas, S., Pundziene, A., Rafanaviciene, S. B., and

Pilkiene, M. 2013. “The impact of dynamic capabilities

on SME performance in a volatile environment as

moderated by organizational inertia”, Baltic Journal of

Management, Vol. 8 No. 4, pp. 376-396

Nonaka, I. and Kenney, M. 1991. “Towards a new theory

of innovation management: a case study comparing

Canon, Inc. and Apple Computer, Inc.‟. Journal of

Engineering and Technology Management, Vol 8 No.

1, pp. 67-83

Norman, D.A. and Verganti, R. 2012. Incremental and

Radical Innovation: Design Research versus

Technology and Meaning Change.

http://jnd.org/dn.mss/Norman%20%26%20Verganti.%

20Design%20Research%20%26%20I innovation-

18%20Mar%202012.pdf

North, D. and Smallbone, D. 2000. “The innovativeness

and growth of rural SMEs during the

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

156

Pavlou, P. A., and Elsawy, O. A. 2011. “Understanding the

Elusive Black Box of Dynamic Capabilities”, Journal

of Decision Sciences, Volume 42 Number 1 February

2011, pp 239-273

Porter, M. 1990, Competitive Strategy: Techniques for

Analyzing Industries and Competitors, The Free Press,

New York, NY.

Salavou, H. 2002. “Profitability in market-oriented SMEs:

does product innovation matter?”, European Journal of

Innovation Management, Vol. 5 No. 3, pp. 164-71.

Sanz-Valle, R. and Jimenez-Jimenez, D. 2011. “Innovation,

organizational learning, and performance”, Journal of

Business Research, Vol. 64 No. 4, pp. 408-417.

Sebora, T.C., Hartman, E.A. and Tower, C.B. 1994.

“Innovative activity in small business: competitive

context and organization level”, Journal of Engineering

Technology Management, Vol. 11 Nos 3/4, pp. 253-

272.

Sundbo, J. 2003. “Innovation and strategic reflexivity: an

evolutionary approach applied to service”, in

Shavinina, L. V. (Ed.), The International Handbook on

Innovation, 1st ed., Elsevier Science Ltd., Oxford, pp.

97-114.

Talke, K., Salomo, S. and Kock, A. 2011. “Top

management team diversity and strategic innovation

orientation: the relationship and consequences for

innovativeness and performance”, Journal of Product

Innovation Management, Vol. 28 No. 6, pp. 819-832.

Teece, D. J. 2007. “Explicating Dynamic Capabilities: The

Nature and Micro foundations of (sustainable)

Enterprise Performance,” Strategic Management

Journal 28(13), 1319–1350.

Teece, D. J., G. P. Pisano, and A. Shuen. 1997. “Dynamic

Capabilities and Strategic Management,” Strategic

Management Journal 18(7), 509–533.

Tiantian, G., Yezhuang, T., and Qianqian, Y. 2014. “Impact

of Manufacturing Dynamic Capabilities on Enterprise

Performance- The Nonlinear Moderating Effect of

Environmental Dynamism”, Journal of Applied

Sciences, 14 (18), pp 2067-2072.

Voola, R.t, and O'Cass, A. 2010. “Implementing

competitive strategies: the role of responsive and

proactive market orientations”. European Journal of

Marketing, Vol. 44 Iss: 1 pp. 245 – 266

Wang, Y., and Shi, X. 2011. “Thrive, Not Just Survive:

Enhance Dynamic Capabilities of SMEs Through IS

Competence,” Journal of Systems and Information

Technology 13(2), 200–222.

Wheelen, T. L., and Hunger, J. D., 2012. Strategic

Management and Business Policy- TOWARD

GLOBAL SUSTAINABILITY, THIRTEENTH

EDITION, Pearson Education, Inc., publishing as

Prentice Hall. All

Zahra, S.A., Nielson, A.P. and Bognar, W.C. 1999.

“Corporate entrepreneurship, knowledge, and

competence development”, Entrepreneurship: Theory

and Practice, Vol. 23 No. 3, pp. 169-189.

Zheng, S., Zhang, W., Wu, X., and Du, J. 2011.

“Knowledge-based dynamic capabilities and

innovation in networked environments”, Journal of

Knowledge Management, Vol. 15 No. 6 2011, pp.

1035-1051

Innovation and Dynamic Capabilities among Traditional Market Traders: How it Affect Business Performance

157