Analysis of Computerization Accounting Information System

Implementation using Technology Acceptance Model (TAM) in

Padang Pratama Tax Service Office

Siti Rahmi, Neva Novianti, Dandes Rifa, Yunilma

Faculty of Economic, Bung Hatta University, Indonesia

Keywords: Infrastructure, Human Resources, Costs, Perception of Use, Perception of Convenience, Accounting

Information System

Abstract: Current technological developments have penetrated the field of information, especially in the field of

accounting information in organizations and companies, because of technological developments, many

companies are switching to using computer-based information technology. This study aims to analyze the

influence of infrastructure, human resources, costs, usefulness perceptions, and perceived ease of

implementation of computerized accounting information systems. The population in this study were

employees of the Padang Primary Tax Service Office. Based on the purposive sampling method, this study

uses a sample of 47 respondents who work as employees of the accounting and finance department. For the

dependent variable (y) of this study is the implementation of computerized accounting information systems.

While for the independent variables are infrastructure (x1), human resources (x2), costs (x3), perceived

usefulness (x4), and perceived ease (x5). The method used is quantitative research methods. This study uses

primary data from the questionnaire. Data were analyzed using multiple regression analysis, which was

processed through IBM SPSS Statistic software ver 20. The results of this study indicate that human resources,

perceived usefulness, and perceived convenience have a positive and significant effect on the implementation

of computerized accounting information systems. But infrastructure and costs do not affect the

implementation of computerized accounting information systems.

1 INTRODUCTION

Current technological developments have penetrated

the field of information, especially the field of

accounting information in organizations and

companies. This is indicated by the existence of

certifications made by the American Institute of

Certified Public Accountants (AICPA) to document

the system expertise of accountants, namely Certified

Information Technology Professional (CITP). Before

the development of technology, as it is today,

individuals in companies carry out accounting

information systems such as recording, processing,

and using information manually. With the existence

of computer-based information technology in

companies, it can provide benefits and convenience

to users in implementing the system. This is

consistent with the research of Wijayanti et al. (2009)

in Devi and Suartana (2014: 170) which shows that

the higher the level of personalization, computer self-

efficacy, and trust, the user will feel the use of

information systems is more useful and easier for

him.

Companies that have sophisticated (computerized

and integrated) information technology and are

supported by modern technology supporting

applications are expected to have a positive impact on

the sustainability of the company's performance by

producing timely, accurate, and reliable financial

reports. (Ratnaningsih and Suaryana, 2014: 2)

The process of developing accounting

information systems often experiences obstacles and

becomes a serious problem for the company. With

these obstacles and constraints, the company must be

able to face the risk of failure and understand how the

accounting information system applied in the

company is said to be successful.

Future events are difficult to predict so that the

planning process to achieve company goals becomes

heavier. Management needs tools to coordinate and

plan limited resources to be able to compete in ever-

Rahmi, S., Novianti, N., Rifa, D. and Yunilma, .

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang Pratama Tax Service Office.

DOI: 10.5220/0009958704570468

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 457-468

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

457

changing environmental conditions. (Dharmayanti

and Suardhika, 2015: 410)

The combination of individuals, hardware,

software, communication networks, and data

resources that collect, change, and distribute

information in an organization is an information

system. Information obtained from information

processing can be used as the material in decision

making by the authorities in order to advance the

company. (Rosani, 2011 in Devi and Suartana, 2014:

168).

The success of a system is closely related to the

performance possessed by the system. The

benchmark in determining the good and bad

performance of an information system will be seen

through the satisfaction of the user of the accounting

information system itself and the user of the

accounting information system. (Soegiharto, 2001 in

Mardiana et al., 2014: 2)

Modern use of SIDJP is not only for one particular

DGT unit but for all KPPs throughout Indonesia.

KPP, which is a work unit of DGT, has undergone a

modernization of the system and organizational

structure into a function-oriented agency, not on the

type of tax since 2002. So that there are three types of

modern KPP: Large KPP, Medium KPP, and Primary

KPP. (Lestari et al., 2013: 2)

The Attorney General's Office determined six

suspects in the case, namely Bahar as Chairman of the

Management Information System Procurement

Process Committee, Pulung Sukarno as Commitment

Making Officer. Riza Noor Karim, former Director of

Tax Information for the Special Jakarta Regional

Office, and Achmad Sjarifuddin Alasah, former

Secretary-General of the Directorate General of

Taxes. While from the private sector from PT Berca

Herdaya Perkasa, namely Mikael Surya Gunawan and

Liem Wendra Halilingkar. The suspects are subject to

Articles 2 and 3 of the Law on Corruption Crime

(Tipikor) and Presidential Decree (Presidential

Decree) Number 80 of 2003 concerning Guidelines

for the Implementation of Procurement of Goods and

Services.

The ALshbiel and Al-Awaqleh (2011) and

Haleem (2016) studies examine the same thing,

namely the influence of infrastructure and human

resources on the implementation of computerized

accounting information systems. The results of

ALshbiel and Al-Awaqleh (2011: 50) and Haleem

(2016: 137) studies show that infrastructure and

human resources have a significant positive effect on

the implementation of computerized accounting

information systems. But the Soerosemito study

(2014: 73) has different results than research

conducted by ALshbiel and Al-Awaqleh (2011) and

Haleem (2016). The results of this study indicate that

there is no influence between infrastructure and

human resources on the implementation of

computerized accounting information systems.

2 LITERATURE REVIEW

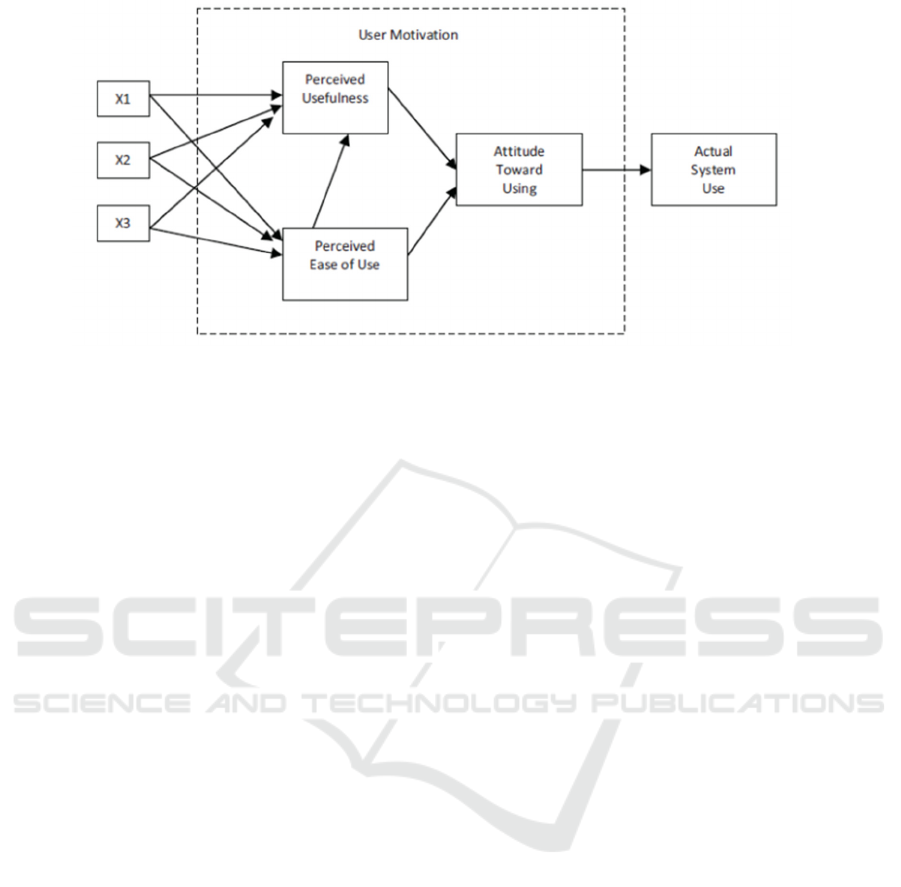

2.1 Technology Acceptance Model

(TAM)

Some models are built to analyze and understand the

factors that influence the acceptance of the use of

technology, including the Theory of Reasoned Action

(TRA), Theory of Planned Behavior (TPB),

Technology Acceptance Model (TAM). (Muslichah,

2015: 171). The Technology Acceptance Model was

introduced by Fred D. Davis in 1986, adopted from

the Theory of Reasoned Action (TRA). The aim of

the Technology Acceptance Model is to give the

theory of developers the success of the design,

evaluation of planning, and implementation of

information systems. The Technology Acceptance

Model is said to adopt the Theory of Reasoned Action

because TRA is the basis for developing a technology

acceptance model to adapt information systems

specifically. The two models have something in

common; they both find the underlying reason for the

user to accept or reject the information system.

Theory of Reasoned Action suggests that interest

in behaving is closely related to an individual specific

behavior, while subjective attitudes and norms are

antecedents of such behavior. According to Davis

(1989: 320), in the concept of the Technology

Acceptance Model, there are two main constructs that

predict interest in behaving in using information

technology, namely perceived usefulness and

perceived ease of use. (Davis, 1989: 320).

The development models in the Technology

Acceptance Model are (1) determining how to

measure the relevant behavioral components of

attitudes, (2) differentiating between beliefs and

attitudes, and (3) determining how external

stimulation, such as objective features and causal

objects connected with beliefs, attitude, and behavior.

(Muslichah, 2015: 171)

Overall, the Technology Acceptance Model

consists of five concepts, namely (1) perceived

usefulness, (2) perceived ease of use, (3) attitudes

towards use, (4) intention to use, and (5) actual use.

(Davis, 1989: 320)

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

458

Figure 1 Original Model proposed by Fred Davis in 1989

2.2 Accounting Information System

According to West Churchman in Krismiaji

(2015: 1), the system is a series of components that

are coordinated to achieve a series of goals. The

system has three characteristics, namely (1) the

component is something that can be seen, heard or

felt, (2) the process is an activity to coordinate the

components involved in a system, and (3) the goal is

the ultimate goal to be achieved from the coordination

of these components.

Krismiaji (2015: 14) defines information as data

that has been organized and has uses and benefits.

The characteristics that must be present in the

information to be useful are as follows: (1) relevant,

(2) trustworthy, (3) complete, (4) timely, (5) easy to

understand, (6) verifiable.

Accounting Principles Board (APB) is a

committee for the preparation of accounting

principles established by the American Institute of

Certified Public Accounts (AICPA). The committee

defines accounting as the art of recording, classifying,

and summarizing financial transactions and events in

an efficient manner and in the form of units of money

and interpretation of the results of the process.

Directorate General of Tax Information System

Currently, the modern taxation information

system used is SIDJP (Directorate General of Tax

Information System). SIDJP is a tax administration

system application that replaces SIP (Tax Information

System) and SIPMOD (Modification Tax

Information System). (Saputra et al., 2014: 2)

The definition of SIDJP, according to Directorate

General of Tax Regulation Number PER-160 / PJ /

2006 dated November 6, 2006, is "information

systems in tax administration in the Directorate

General of Tax's modern office environment by using

hardware and software associated with a network at

the Head Office." Whereas according to SE-19 / PJ /

2007 dated April 13, 2007, the application of SIDJP

is "the Directorate General of Tax Information

System application that combines all taxation

applications available at DGT, namely SIP, SAPT,

SISMIOP, SIG, and SIDJP in the current version."

(Saputra, 2014: 4)

The Information System of the Directorate

General of Taxation provides supporting facilities for

the creation of accurate taxpayer data with the active

participation of each section in monitoring taxpayer

data. The system produces reports that can be

accessed by KPP, Regional Offices, and DGT

Headquarters.

2.3 Implementation of Computerized

Accounting Information Systems

According to ALshbiel and Al-Awaqleh (2011: 45),

the implementation of computerized accounting

information systems is the integration of manual

accounting science and applying it to computers by

balancing tasks performed manually with computer

activities.

System implementation is the process of installing

hardware and software and making accounting

information systems become and can be run. This

process generally consists of developing plans,

developing and testing software, preparing locations,

installing, and testing systems. (Romney and

Steinbart, 2005: 395)

2.4 Infrastructure

According to Romney and Steinbart (2014: 11),

information technology infrastructure is technology-

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang

Pratama Tax Service Office

459

based equipment to be used in order to process data,

including computers, peripheral devices, and

equipment for network communication. This

component together allows accounting to fulfill three

important functions in the organization, namely:

1. Collect and store data about the activities

carried out by the organization, the resources affected

by these activities, and the actors involved in the

various activities so that the management, employees,

and other interested parties can reviewing things that

happened.

2. Change the data in the information that is useful

for management to make decisions in planning,

implementing, and monitoring activities.

3. Provide adequate controls to safeguard

organizational assets, including organizational data,

to ensure that the data is available when needed,

accurate, and reliable.

2.5 Human Resources

Human resources include all people who are members

of an organization, each of which has roles and

functions. Human resources are human potential that

is inherent in someone who includes physical and

non-physical potential. Whereas human resources in

the context of public organizations are understood as

human potential inherent in an employee consisting

of physical potential and non-physical potential. The

physical potential is the physical ability that

accumulates in an employee, while the non-physical

potential is the ability of an employee to accumulate

both from the background of knowledge, intelligence,

expertise, skills, human relations. (Sulistyani and

Rosidah, 2009: 10)

The performance of human resources is the ability

of a person or individual, an organization

(institution), or a system to carry out its functions or

authority to achieve its objectives effectively and

efficiently. Its capacity must be seen as the ability to

achieve performance, to produce outputs and results.

(Winidyaningrum and Rahmawati, 2010: 6)

Rivai and Sagala (2011: 6) explain that human

resources need to be managed properly and

professionally in order to create a balance between

human resource needs and the guidance and progress

of business enterprises. This balance is the main key

to success for companies to be able to develop and

grow productively and naturally. The development of

the company's business is very dependent on the

productivity of the workforce in the company. If

human resource management can be carried out

professionally, it is expected that HR can work

productively. Professional HR management must

start from recruitment, selection, classification,

placement according to ability, upgrading or training,

and career development.

2.6 Cost

According to Mulyadi (2010: 8), costs in the broadest

sense are sacrifices of economic resources measured

in units of money that have occurred or that are likely

to occur for certain purposes. In the narrow sense of

costs can be interpreted as a sacrifice of economic

resources to obtain assets.

Seyal and Rahim (2006) in Haleem (2016: 135)

concluded that costs have a direct and significant

relationship to technology adoption. Organizations

are reluctant to adopt computerized accounting

systems when setting up initial costs is high.

Donaldkiso (2009) in Haleem (2016: 135) states

that the cost of a computerized accounting system

consists of equipment costs, assembly costs,

installation costs, and testing costs. Specially trained

staff is needed to operate the system. Therefore, large

training costs are incurred to understand hardware and

software usage continuously because newer types of

hardware and software are needed to ensure the

effectiveness and efficiency of the use of

computerized accounting systems. (Haleem, 2016:

135)

2.7 Perception of Benefit

Benefit perception is a level where someone believes

that the use of a particular system can improve

performance. The concept can describe the benefits of

the system for its users relating to productivity, task

performance, effectiveness, the importance of tasks,

and overall usefulness. (Davis, 1989: 320)

When users feel confident, and the use of

technology is not difficult, users will provide greater

benefits and improve performance. So, the higher the

quality of information technology systems will

further improve the usefulness so that it can

determine the success of the implementation of

information technology systems. (Davis, 1989: 320)

2.8 Ease of Perception

Ease of perception is a level where someone believes

that a system used is easy to understand and use, so no

heavy effort is needed. This concept provides an

explanation that the use of information systems and

the ease of use of the system to achieve goals in

accordance with the wishes of users. (Davis, 1989:

320)

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

460

Ease perception is a person's belief about the

decision-making process. If someone feels confident

that the information system is easy to use, that person

will use it. Conversely, if someone does not believe

that the information system is not easy to use, that

person will not use it. (Davis, 1989: 320)

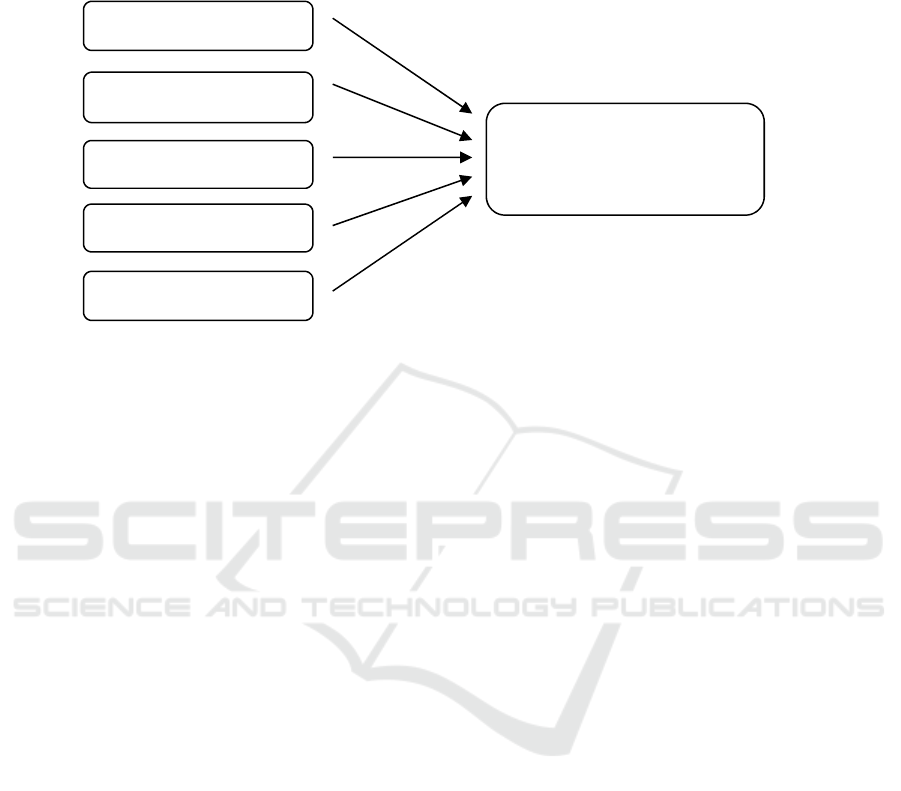

Figure 2 Framework

3 METHOD, DATA, AND

ANALYSIS

The type of research used in this study is quantitative

research. Quantitative methods are methods by which

research data is in the form of numbers as a result of

observation or measurement (Widoyoko, 2012: 21).

This method is used to examine the effect of

infrastructure, human resources, costs, perceived

usefulness, and perceived ease of implementation of

computerized accounting information systems at the

Pratama Tax Office in Padang.

The sample in this study were employees of the

Padang Primary Tax Service Office who used or

played a role in the implementation of computerized

accounting information systems, employees who

worked in accounting and finance, and employees

who were allowed to become respondents. The

sample collection technique used was purposive

sampling method.

3.1 Data Sources

The data sources used in this study are primary data

and secondary data, primary data obtained from

respondents' answers to questionnaires that have been

given to respondents. Respondents in this study were

employees of the Padang Primary Tax Service Office.

Secondary data, obtained from literature, journals,

books, articles, and internet sites.

3.2 Data Collection Technique

The data collection technique used in this study is

survey research because it is done using a

questionnaire as a primary data collection tool that

uses written questions given to respondents. The

technique of data collection is done through a

questionnaire survey that is distributed by a public

relations officer at the Primary Tax Office.

3.3 Data Analysis Technique

Data processing techniques in this study are directed

to test hypotheses and answer all existing problem

formulations. Data analysis techniques used in this

study are as follows:

3.4 Test Reliability

According to Ghozali (2011: 47), a questionnaire is

said to be reliable if the answer to the question given

to someone is consistent or stable over time. To find

out whether or not a variable is reliable, Cronbach

Alpha statistical tests are carried out. A constructor

variable is said to be reliable if it gives the Cronbach

Alpha value> 0.70, so the statement used is reliable.

If Cronbach Alpha is <0.70, the statement used is not

reliable.

3.5 Validity Test

Validity tests are used to measure the validity or

validity of a questionnaire. Ghozali (2011: 52)

Infrastructure

HumanResource

Costs

Perceived usefulness

Perceived ease

Implementation of

computerized accounting

information systems

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang

Pratama Tax Service Office

461

explains that a questionnaire is said to be valid if the

question in the questionnaire is able to express

something measured by the questionnaire.

3.6 Descriptive Analysis

Descriptive analysis is a statistic that functions to

describe or explain the distribution of data from one

variable under study, without analyzing and making

conclusions that apply to the public (Indriantoro and

Supomo, 2002).

3.7 Classic Assumption Test

The classic assumption test is used to detect the

presence or absence of classic assumption deviations

or multiple regression equations used.

3.8 Multiple Linear Regression

Multiple linear regression analysis is used to

determine the effect of infrastructure, human

resources, costs, usefulness perceptions, and

perceived ease of computerized accounting

information systems. Model Accuracy Test

3.9 Test F

The F test basically shows whether the model used in

this study is feasible or not feasible continued in this

study. Testing is carried out using a significance level

of 0.05 (alpha = 5%). If the value of Fcount> Ftable,

then the independent variables together have an effect

on the dependent variable.

3.10 Determination Coefficient Test

(R2)

R2 test is used to measure how far the ability of the

model to explain the variation of the dependent

variable. According to Ghozali (2012: 97) in the

regression equation that uses more than one

independent variable, then

R2 value that is well used to explain the regression

equation is the adjusted coefficient of determination

because it has considered the number of independent

variables in a regression model.

3.11 T-test

According to Ghozali (2011: 98), the t-test basically

shows how far the influence of one independent

variable individually explains the variation of the

dependent variable. If t count> t table or p-value

<0.05, it can be concluded that the independent

variable influences the dependent variable.

Conversely, if t count <t table or p value> 0.05, then

the independent variable does not affect the

dependent variable.

4 RESULT AND DISCUSSION

4.1 Reliability Test Results

To measure reliability, Cronbach's Alpha test was

used. A variable is said to be reliable if it gives the

Cronbach's Alpha value> 0.60.

Table 1 Reliability and Reliability Test Results

Variables Cronbach’s Alpha

Corrected item Information

Infrastructure 0,761 0,444 Reliable and valid

Human Resource 0,678 0,528 Reliable and valid

Costs 0,689 0,666 Reliable and valid

Perceived usefulness 0,623 0,816 Reliable and valid

Perceived ease 0,702 0,477 Reliable and valid

Implementation of computerized

accounting information systems

0,885 0,528 Reliable and valid

Source: Primary data processed, SPSS 20

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

462

The table above shows Cronbach's Alpha value for

infrastructure variables of 0.761, human resources of

0.678, costs of 0.689, usefulness perceptions of 0.623,

ease of perception of 0.702, and implementation of

computerized SIA of 0.85. Thus, it can be concluded

that the statement in this questionnaire is reliable

because the value of Cronbach's Alpha is greater than

0.60. The table above shows the variables of

infrastructure, Human Resources, Costs, Perceptions

of Use, Perception of Ease and Implementation of

SIA Computerization has valid criteria for all

question items with a calculated r-value (0.444,

0.528, 0.666, 0.816, 0.477, 0.528) greater than r table

(0.3338) and has a positive value, so the questions or

indicators used are declared valid.

4.2 Normality Test Results

In this study, the normality test was carried out using

the Kolmogorov Smirnov test. The results of the

Kolmogorov Smirnov test can be seen in the table

below:

Table 2 Normality Test Results Using Kolmogorov Smirnov One-Sample Kolmogorov-Smirnov Test

TI TSDM TB TPKEB TPKEM TISIAK

N 47 47 47 47 47 47

Normal Parameters

a

Mean 12.98 20.74 11.26 17.11 23.85 21.28

Std.

Deviation

1.310 2.221 1.799 2.139 1.978 2.243

Most Extreme Differences Absolute .198 .156 .192 .154 .190 .124

Positive .198 .135 .119 .144 .172 .124

Negative -.165 -.156 -.192 -.154 -.190 -.119

Kolmogorov-Smirnov Z 1.357 1.069 1.319 1.053 1.300 .847

Asymp. Sig. (2-tailed) .050 .203 .062 .218 .068 .470

a. Test distribution is Normal.

That data is normally distributed. This can be seen

from the value of Asymp. Sig. (2-tailed) in the

amount of 0.050,0.203,0,062,0,218,0,068,0,470

which is greater than 0.05. So that this research model

meets the test of the classical assumption of

normality.

4.3 Multicollinearity Test Results

The following are the results of multicollinearity tests

using tolerance values and VIF, as follows:

Table 3 Multicollinearity Test Results

Model

Collinearity Statistics

Information

Tolerance

VIF

(Constant)

0,803 1,245

There is no multicollinearity

I

SDM 0,731 1,368

There is no multicollinearity

B 0,914 1,094

There is no multicollinearity

PKEB 0,811 1,233

There is no multicollinearity

PKEM 0,728 1,374

There is no multicollinearity

Source: Primary data processed, SPSS 20

Based on the table above, the tolerance value is close

to 1 or> 0.10, and the VIF value is around 1 or <10

for each variable. The tolerance value for

infrastructure is 0.83, human resources are 0.731,

costs are 0.914, usefulness perceptions are 0.811, and

convenience perceptions are 0.728. Whereas for VIF

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang

Pratama Tax Service Office

463

value for infrastructure is 1,245, human resources are

1,368, costs are 1,094, usefulness perceptions are

1,233, and perceived convenience is 1,374. Thus it

can be concluded that the regression model used does

not have a multicollinearity problem and can be used

in this study.

Heteroscedasticity Test Results. The following are

the results of the heteroscedasticity test using the

values of the glejser method, as follows:

Table 4 Heteroscedasticity Test Results

Variable

Sig Information

I

0,623

There is no heteroscedasticity

SDM

0,570

There is no heteroscedasticity

B

0,153

There is no heteroscedasticity

PKEB

0,611

There is no heteroscedasticity

PKEM

0,667

There is no heteroscedasticity.

Based on the table above, the probability values of

infrastructure are 0.623, human resources are 0.570,

costs are 0.153, benefit perceptions are 0.611, and

ease of perception is 0.667. Thus it can be concluded

that there is no heteroscedasticity in all independent

variables because the probability value is more than

0.05.

4.4 Multiple Linear Regression Test

Results

To find out the multiple linear regression equation

used in this study, it can be seen in the table below:

Table 5 Multiple Linear Regression Test Results Coefficients

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) 7.193 4.445 1.618 .113

TI -.261 .243 -.153 -1.076 .288

TSDM .363 .150 .359 2.418 .002

TB .129 .166 .103 .777 .442

TPKEB .351 .148 .335 2.375 .022

TPKEM .104 .169 .092 .618 .040

a. Dependent Variable: TISIAK

From the table above it is known that the equation in

multiple linear regression in this study is

ISIAK = 7,193– 0,261 X1 + 0,363 X2 + 0,129 X3 –

0,351 X4 + 0,104 X5 + e

The interpretations of each variable coefficient are as

follows:

1. The constant value in this study is 7.193, which

means that if the five variables are 0, then the value

of the implementation of the computerized

accounting information system (Y) is constant at

7.193.

2. The infrastructure variable coefficient (X1) is -

0.261 which means that if the infrastructure value

rises by 1 unit, then the value of the implementation

of computerized accounting information system (Y)

will decrease by 0.261 assuming other variables

remain

3. The variable human resource coefficient (X2) is

0.363, which means that if the value of human

resources rises by 1 unit, then the value of the

implementation of a computerized accounting

information system (Y) will increase by 0.363

assuming other variables remain.

4. The cost variable coefficient is 0.129, which means

that if the cost value (X3) rises by 1 unit, then the

value of the implementation of a computerized

accounting information system (Y) will increase by

0.129, assuming other variables remain.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

464

5. The variable usefulness perception coefficient (X4)

is 0.351, which means that if the value of the

usefulness perception rises by 1 unit, then the value

of the implementation of the computerized

accounting information system (Y) will decrease by

0.351 assuming other variables remain.

6. The ease of perception variable coefficient (X5) is

0.104, which means that if the perceived ease of value

rises by 1 unit, then the value of the implementation

of a computerized accounting information system (Y)

will increase by 0.104 assuming other variables

remain.

4.5 Model Accuracy Test

4.5.1 F Test Results

The F test results can be seen in the table. The F test

is used to see the suitability of the regression model

that has been made, and the rejection area is p-value

(Sig.) <α

Table 6 F Test Results

ANOVA

Model Sum of Squares df Mean Square F Sig.

1 Regression 78.220 5 15.644 4.187 .004

a

Residual 153.184 41 3.736

Total 231.404 46

a. Predictors: (Constant), TPKEM, TI, TB, TPKEB, TSDM

b. Dependent Variable: TISIAK

Source: Primary data processed, SPSS 20

In the above table it is known that the F count value

is 4.187 which means that it is greater than the F table

value of 2.55 with a significance level of 0.004 which

means it is smaller than 0.05, simultaneously has a

significant effect and it can be concluded that the

chosen regression model is appropriate for this

research.

4.5.2 Determination Coefficient Test Results

(R2)

The coefficient of determination test (R2) is used to

determine how much the ability of the dependent

variable can be explained by independent variables.

In this study, using independent variables, namely

infrastructure, human resources, costs, usefulness

perceptions, and perceived ease. While the dependent

variable is the implementation of computerized SIA.

The results of the determination coefficient test (R

Square) are presented in the following table:

Table 7 Determination Coefficient Test Results (R2)

Model Summary

Model R R Square Adjusted R Square

Std. The error of the

Estimate

1 .581

a

.338 .257 1.933

a. Predictors: (Constant), TPKEM, TI, TB, TPKEB, TSDM

The table above shows that the R square value is

0.338. This explains that 33.8% of computerized SIA

implementation variables can be explained by

infrastructure variables, human resources, costs,

usefulness perceptions, and perceived ease. While the

remaining 66.2% is explained by other variables

outside the research model.

4.5.3 Test Results t

The t-test is used to determine the influence of each

independent variable individually on the dependent

variable. The table presents the results of the t-test as

a whole in this study, namely:

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang

Pratama Tax Service Office

465

Table 8 Test Results t

Model

t count

t table Sig Information

(Constant) 1,618 2,045 0,000

I -1,076 2,045 0,288

N

o effect

SDM 2,418 2,045 0,002 Significant Positive Effect

B 0,777 2,045 0,442

N

o Effect

PKEB 2,375 2,045 0,022 Significant Positive Effect

PKEM 2,618 2,045 0,040 Significant Positive Effect

Source: Primary data processed, SPSS 20

This test shows a significant level of 0.05. In the table

above, we can see the value of t count for each

independent variable. If the t count is greater than the

t table, then H0 is rejected, which means that there is

an influence of independent variables on the

dependent variable.

4.6 Infrastructure Variable

The results of the t-test analysis for infrastructure

variables obtained t count value of -1.076 <t table of

2.045 with a probability value of 0.288, which means

greater than 0.05, then H0 is accepted, or it can be

said that infrastructure does not affect the

implementation of computerized SIA.

4.6.1 Variable Human Resources

The results of t-test analysis for human resource

variables obtained t count value of 2.418> t table of

2.045 with a probability value of 0.002, which means

smaller than 0.05, then H0 is rejected, or it can be said

that human resources have a significant effect on the

implementation of computerized SIA.

Cost variable

The results of the t-test analysis for the cost variable

obtained by the value of t arithmetic of 0.777 <t table

of 2.045 with a probability value of 0.442 which

means greater than 0.05 then H0 is accepted or it can

be said that the cost does not affect the

implementation of computerized SIA.

4.6.2 Variables of Usefulness Perception

The results of the t-test analysis for the usefulness

perception variable obtained a value of t count of -

2.375 <t table of 2.045 with a probability value of

0.022 which means smaller than 0.05 then H0 is

rejected or it can be said that useful perceptions have

a significant effect on computerized SIA

implementation.

4.6.3 Variable Perception of Ease

The results of t-test analysis for perceived

convenience variables obtained t count value of

0.618> t table of 2.045 with a probability value of

0.540, which means it is more than 0.05, then H0 is

accepted, or it can be said that perceived ease does not

affect the computerized SIA implementation.

5 CONCLUSION

This study examines infrastructure, human resources,

costs, perceived usefulness, and perceived ease of

implementation of computerized accounting

information systems at the Pratama Tax Office in

Padang. The analysis was carried out using the

multiple regression analysis methods with the

Statistical Package for Social Science (SPSS)

Program Ver. 20.

Based on the results of the research that has been

obtained, it can be concluded as a few points below:

1. Infrastructure does not affect the implementation of

computerized accounting information systems.

The results of this study can be seen in the results

of the t test, which shows that the value of t count

(-1,076) is smaller than the t table (2,045) with a

probability value of 2,888, which means greater

than 0.05. The results of this hypothesis test

contradict the results of research from ALshbiel

and Al-Awaqleh (2011: 50) and Haleem (2016:

137), which show that infrastructure has a

significant positive effect on the implementation

of computerized accounting information systems.

This can be caused in the infrastructure there are

some problems that may not have been covered,

such as inadequate modern programs and

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

466

networks used, lack of databases that contribute to

the implementation of computerized accounting

information systems.

2. Human resources have a significant positive effect

on the implementation of computerized

accounting information systems. The results of

this study can be seen in the results of the t test,

which shows the value of t arithmetic (2.418)

greater than the t table (2.045) with a probability

value of 0.002, which means it is smaller than

0.05. The positive regression coefficient value in

the results of this hypothesis can be interpreted

that the better the human resources that contribute

to the utilization of the system, the better the

implementation of existing computerized

accounting information systems.

The results of this hypothesis test support the

results of research from ALshbiel and Al-

Awaqleh (2011) and Haleem (2016), which show

that human resources have a significant positive

effect on the implementation of computerized

accounting information systems.

3. Costs do not affect the implementation of

computerized accounting information systems.

The results of this study can be seen in the results

of the t-test, which shows that the value of t count

(0.777) is smaller than t table (2.045) with a

probability value of 0.442, which means greater

than 0.05. The results of this hypothesis test are

contrary to the results of research from ALshbiel

and Al-Awaqleh (2011: 50), showing that costs

have a significant negative correlation to

computerized accounting information systems.

This can be caused by a lack of financial

allocations for infrastructure improvement, lack

of financial allocations for employee training, and

the development of modern networks in the

implementation of computerized accounting

information systems.

4. Perception of use affects the implementation of

computerized accounting information systems.

The results of this study can be seen in the results

of the t test, which shows the value of t count

(2.377) smaller than the t table (2.045) with a

probability value of 0.022, which means it is

smaller than 0.05. This shows that employees

have perceptions of ease with the existence of a

computerized accounting information system that

greatly helps their work so that employees can

maximize work with the implementation of

computer-based information systems.

5. Perception of ease has a significant positive effect

on the implementation of computerized

accounting information systems. The results of

this study can be seen in the results of the t test,

which shows the value of t arithmetic (2.618)

greater than the t table (2.045) with a probability

value of 0.040, which means smaller than 0.05.

The value of the positive regression coefficient in

the results of this hypothesis can be interpreted

that the higher the perception of a person's ease of

the system, the more it will optimize the

implementation of computerized accounting

information systems. The lower the perception of

a person's ease of the system, the lower the

optimization of the computerized accounting

information system implementation.

REFERENCES

ALshbiel, S. O., and Al-Awaqleh Q. A. (2011). Factors

Affect the applicability of the computerized accounting

system. International Research Journal of Finance and

Economics. ISSN 1450-2887, Issue 64.

Armanda, R., and Hermanto, S. B. (2015). Analysis of the

factors of acceptance and use of technology in

accounting information systems with the TAM

approach. Journal of Accounting Science & Research

Vol. 4 No. 3.

Awosejo, O. J., Kekwaletswe, R. M., Pretorius, P., and

Zuva, T. (2013). The effect of accounting information

systems in accounting. International Journal of

Advanced Computer Research. ISSN (print): 2249-

7277 ISSN (online): 2277-7970) Volume-3 Number-3

Issue-12 September 2013.

Davis, F. D. (1989). Perceived usefulness, perceived ease

of use, and user acceptance of information technology.

Management Information Systems Quarterly Vol. 13

September 3, 1989, pp. 319-340.

Devi, N. L. N. S., and Suartana, I. W. (2014). Analysis of

technology acceptance model (TAM) on the use of

information systems at Nusa Dua Beach Hotel & SPA.

Accounting E-Journal of Udayana University 6.1: 167-

184. ISSN: 2302-8556.

Dharmayanti, N. M., and Suardikha M. S. (2015). Analysis

of factors that influence management performance due

to the use of accounting information systems.

Accounting E-Journal of Udayana University 12.2:

409-421. ISSN: 2302-8556.

Estiningrum, S. D. (2013). Accounting. Tulungagung:

STAIN Tulungagung Press.

Ghozali, I. (2011). Multivariate Analysis Application with

IBM SPSS 20 Program.Semarang: BP UNDIP. ISBN

979.704,015.1. (2012). Multivariate Analysis

Application with IBM SPSS 20 Program. Semarang:

BP UNDIP. ISBN 979.704,015.1.

Analysis of Computerization Accounting Information System Implementation using Technology Acceptance Model (TAM) in Padang

Pratama Tax Service Office

467

Githinji, C. K., Kiminda, R. W., Ofunya. F. A. (2014).

Adoption of computerized accounting systems by

Coffee Societies in Nyeri County, Kenya. European

Journal of Business and Social Sciences, Vol. 3, No.3,

p.p 88-103, June 2014. ISSN: 2235 -767X

Haleem, A. (2016). The factor affecting is computerized

accounting system with the reference to government

department in the Ampara District. EPRA

International Journal of Economic and Business Review

Vol. 4, Issue. 7, July 2016. e-ISSN: 2347 - 9671, p-

ISSN: 2349 - 0187. http://www.kppbumn.depkeu.go.id

Indriantoro, N., and Supomo B. (2014). Business Research

Methods (For Accounting and Management).

Yogyakarta: BPFE Yogyakarta.

Jogiyanto. (2009). Information Technology System.

Yogyakarta: Andi Offset.

Prosecutor's Office Delivers SIDJP Corruption File to

Corruption. December 11, 2014

http://news.liputan6.com

Krismiaji. (2015). Accounting information system.

Yogyakarta: STIM YKPN.

Kurniawan. (2012). IT experts become witnesses to the case

of the Directorate General of Tax Information System.

August 29, 2012. http://news.okezone.com.

Lestari, M., Kertahadi., And Suyadi, I. (2013).

Effectiveness of the Directorate General of Tax

Information System (SIDJP). Journal of Business

Administration (JAB) Vol. 6 No. December 2, 2013.

Mardiana, I.G.E.P., Sinarwati, N.K., and Atmadja, A.T.

(2014). Analysis of factors that influence the

performance of the accounting information system

(SIA) in Village Credit Institutions (LPD) in Susut

District. S1 E-Journal Ak University of Education

Ganesha Accounting Department S1, Volume: 2 No. 1

of 2014.

Mulyadi. (2010). Cost accounting. Yogyakarta: STIE

YKPN.

Muslichah, I. (2015). An antecedent analysis of the

attitudes and intentions of using a Blackberry with the

basis of a technology acceptance model. Business

Strategy Journal. Volume 19 No 2, July 2015. ISSN

0853-7666.

Ratnaningsih, K. I., and Suaryana, I. G. N. A. (2014). The

influence of information technology sophistication,

management participation, and accounting manager

knowledge on the effectiveness of accounting

information systems. Accounting E-Journal of Udayana

University 6.1: 1-16. ISSN: 2302-8556.

Rivai, V., and Sagala, E. J. (2011). Human Resource

Management for the Company. Jakarta: Rajawali Press.

Romney, M. B., and Steinbart, P. J. (2005). Accounting

Information System (Ed. 9th). Jakarta: Salemba Empat.

Romney, M. B., and Steinbart, P. J. (2014). Accounting

Information System (Ed. 13th). Jakarta: Salemba

Empat.

Saputra, R., Astuti, E. S., and Rahardjo, K. (2014). Analysis

of the use of directorate general tax information system

applications (SIDJP) and employee performance.

Journal of Taxation Vol. 3 No. November 1, 2014.

Soerosemito, V.N. (2014). Effect of Infrastructure, Human

Resources, Managerial Performance, E-Decision, and

Software on the Implementation of Computerized

Accounting Information Systems. (Thesis. Sebelas

Maret University Surakarta).

Sugiyono. (2014). Quantitative, qualitative, and R & D

research methods. Bandung:

Sulistyani, A. T., and Rosidah. (2009). Human Resource

Management. Yogyakarta: Graha Ilmu.

Sulistyowati, L. (2013). Analysis of Factors Affecting the

Implementation of Computerized Accounting

Information Systems. (Thesis. Sebelas Maret

University Surakarta.

Sutrisno, E. (2015). Human Resource Management.

Jakarta: Kencana.

Winidyaningrum, C., and Rahmawati. (2010). The

influence of human resources and the use of

information technology on the reliability and timeliness

of local government financial reporting with

intervening variables on internal accounting controls.

National Accounting Symposium XIII. October 13-14,

2010.

Wiyono, G. (2011). Designing Business Research with the

SPSS 17.0 and Smart PLS 2.0 Analysis Tools.

Yogyakarta: STIM YKPN.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

468