Incorporating Attitude towards Islamic Banking in a Customer Loyalty

Model

Mohamad Najmudin

1

, Ferri Kuswantoro

1

and Titop Dwiwinarno

1

1

Faculty of Economics, University of Janabadra, Yogyakarta, Indonesia

Keywords:

Customer Loyalty, Switching Costs, Customer Satisfaction, Service Quality, Attitude, And Islamic Banking.

Abstract:

The objective of the study is to examine the mediating effect of switching costs between the relationship of

customer satisfaction on customer loyalty in islamic banking. 283 respondents were used as samples using

purposive sampling. By structural equation model (SEM) the findings show that of the six hypotheses, five

hypotheses are supported, one hypothesis is not supported. The results of the study show, customer satisfaction

affects customer loyalty both directly and indirectly through switching costs. These results are supported by

previous findings, and at the same time, they reveal that switching costs do not fully mediate the influence of

customer satisfaction on customer loyalty. The direct influence of customer satisfaction on customer loyalty

shows the evidence.

1 INTRODUCTION

(Oliver, 1997) states that loyalty is a strong cause

to reorder a product for customers consistently in

the future. It is substantially important for the com-

pany because it can be an inhibiting factor for com-

petitor, increasing a company’s ability to respond to

competitive threats to the company, increasing more

sales and income, and reducing customer sensitivity

to competitors’ marketing efforts (Delgado-Ballester

and Munuera-Aleman, 2002). In islamic banking,

customer attitudes towards Islamic banking can have

an influence on improving service quality and cus-

tomer satisfaction. Attitudes are dispositions to re-

spond favorably or unfavorably to products, people,

institutions or events (Ajzen, 2005). Meanwhile,

(Berkowitz, 1972) considers attitudes as individu al

internal conditions that influence individual choices

to display behavior towards objects, people or events.

According to (Rizwan et al., 2014) attitudes towards

islamic banking include the following: the level of

customer preference in choosing Islamic banking; al-

ways see the label ”Islamic” in choosing banking

products; Islamic bank products are important for

customers; using Islamic banking products is the cus-

tomer’s own choice; and the closest people to cus-

tomers also use islamic banking products. Still ac-

cording to (Rizwan et al., 2014) attitudes towards is-

lamic banking affect customer perpective of service

quality and complacency.

In addition to attitudes towards islamic banking

affecting customer satisfaction, service quality also

affects customer satisfaction. Service quality is a level

of excellence to meet consumer expectations (Zei-

thaml et al., 1990). And service quality is formed

by comparison between ideal and perceptions of qual-

ity performance (Oliver, 1997). (Scaglione, 1988)

states that if consumers get less service quality from

the company, they will show signs of leaving the

company or reducing their spending. (Hafeez and

Muhammad, 2012) revealed that increasing customer

satisfaction through improving service quality can

maintain customer loyalty.

Customer complacency play cruicial role to cre-

ate customer loyalty. They are able to give several

beneficial factors in creating customer complacency,

increasing organization esteem, reducing price elas-

ticity, reducing transaction costs and increasing em-

ployee efficiency as well as productivity (Anderson

et al., 1993). Besides that, customer satisfaction is

also seen as one of the best indicators for future earn-

ings (Hayes and Bloom, 2002). Furthermore, accord-

ing to (Fornell, 1992), they could increase not only

customer operating costs caused by increasing num-

ber of customers, and increase advertising effective-

ness as well as business reputation.

(Aydin and

¨

Ozer, 2005), say that the increased

switching expense is able to avoid loosing customers.

Likewise, (Chadha and Kapoor, 2009) says that high

switching costs affect customer loyalty. In other

Najmudin, M., Kuswantoro, F. and Dwiwinarno, T.

Incorporating Attitude towards Islamic Banking in a Customer Loyalty Model.

DOI: 10.5220/0009879801490154

In Proceedings of the 2nd International Conference on Applied Science, Engineering and Social Sciences (ICASESS 2019), pages 149-154

ISBN: 978-989-758-452-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

149

words, the higher the cost of switching, the higher

customer loyalty will be. In many cases, the rela-

tionship between customer loyalty and customer sat-

isfaction are very strong for customer segments that

have high switching costs (Bloemer et al., 1998) And

(Jones et al., 2000).

Eventhough attitude and service quality only

emerge as important factors of customer satisfactions

from most previous studies but they lead to the cus-

tomer loyality and switching cost. They are known

as essential aspects of the profitability determinations.

Hence the objective of the study to identify the effect

of intervening variable : customer satisafaction in this

research framework.

2 LITERATURE REVIEW AND

HYPOTHES

2.1 Attitudes towards Islamic banking

The results of (Abou-Youssef et al., 2015) study show

that religiosity has an impact on consumer attitudes

toward Islamic banking. Nevertheless, the principles

of Islamic finance are not the only reason identified

in choosing Islamic banks. According to (Rizwan

et al., 2014), attitudes towards Islamic banking in-

clude: preference for Islamic products; considera-

tion of seeing ”Islamic labels”; the importance of Is-

lamic products; Islamic products are the customer’s

own choice; and the people closest to users of Islamic

products. The results of the research by (Rizwan

et al., 2014) show that attitudes towards Islamic bank-

ing influence consumer perceptions of the quality

of Islamic bank services. Based on the description

above, a hypothesis can be made as loyalty but also

could prevent turnover, reduce price elasticity of cus-

tomers, the cost of marketing failure, follows:

H1: The higher the attitude towards Islamic bank-

ing, the higher the quality of service

The results of the (Erol and El-Bdour, 1989)

investigated factors that might contribute to repeat

purchases of Islamic bank customers, the results

showed that attitudes towards Islamic banking, rela-

tive prices, efficient service, convenience, confiden-

tiality, cost/benefit, reputation and the bank’s image

contributes to customer satisfaction. (Butt and Aftab,

2013) stated that the supply of products offered by

conventional banks but in accordance with Islamic

principles, it can increase satisfaction for Muslim cus-

tomers. Moreover, according to (Rizwan et al., 2014)

attitudes towards Islamic banking affect consumer

perceptions of customer satisfaction in Islamic banks.

Based on the description above, a hypothesis can be

made as follows :

H2 : The higher the attitude towards Islamic bank-

ing, the higher the customer satisfaction

2.2 Service Quality

Then (Parasuraman et al., 1985) indicates that the

satisfied services can be measured by zero customer

complaint. Therefore providing qualified services be-

come essential factor in business. (Donald et al.,

1998) gave further indications that the quality of ser-

vices are positively significant on consumer satisfac-

tion. Thus, high service quality will increase cus-

tomer satisfaction which encourages customer loyalty

(Santouridis and Trivellas, 2010). The findings of

(Hong and Goo, 2004) indicate a positive relationship

between service quality and customer satisfaction.

(Beerli et al., 2004) find that service quality is an an-

tecedent that exerts a direct influence on satisfaction

and indirect influence on loyalty. Relevant findings

are also found in (Hafeez and Muhammad, 2012)(Sid-

diqi, 2011) (Chadha and Kapoor, 2009) (Salam, 2013)

(Aydin and

¨

Ozer, 2005). Based on the description

above, a hypothesis can be made as follows:

H3: The higher the quality of service, the higher

the customer satisfaction

2.3 Customer Satisfaction

Beerli et al., (2004) find that satisfaction and switch-

ing costs might be found as antecedents of loyalty.

While Lee And Cunningh am (2001) mentioned that

switching costs as a mediator variable between cus-

tomer satisfaction and loyalty Aydin et al., (2007) fur-

ther explain that customers who study product knowl-

edge in avoiding purchasing mistakes will rearrange

past buying experiences. In this process, if the cus-

tomer moves, a comparison will be made between the

brand that will be used and the old brand. To reduce

cognitive dissonance, customers tend to purchace sat-

isfied products. Analysis of opportunity cost suggests

that customer satisfaction has a positive significant in-

fluence on switching costs. High customer satisfac-

tion would increases the opportunity cost as they will

feel reluctant to try to other service providers. More

specifically, Aydin et al., (2007) examined the rela-

tionship between consumer satisfaction, trust, switch-

ing costs, and loyalty. They found that trustworthi-

ness and consumer satisfaction were not only corre-

lated positively with loyalty, but also with switching

costs. These finding show that satisfaction does not

only affect loyalty directly but also does indirectly

through switching cost. Consistent with the above de-

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

150

scription, this study proposes the following hypothe-

sis: H4: The higher customer satisfaction, the higher

the rate of switching costs.

Higher customer satisfaction through improving

service quality will encourage customer loyalty. Cus-

tomer satisfaction is directly related to customer loy-

alty. Significant influence of customer satisfaction on

customer loyalty is almost shown by every previous

study, such as (Beerli et al., 2004)(Amin et al., 2013)

(Aydin and

¨

Ozer, 2005) (Chadha and Kapoor, 2009)

and (Ball et al., 2004) Based on the description above,

a hypothesis can be made as follows:

H5: The higher customer satisfaction, the higher

the customer loyalty.

2.4 Switching Costs

(Jones et al., 2000) state that switching costs as an

important factor influencing customers’ decisions to

remain with service providers. Switching costs are

expected to make it difficult for customers or cause

great sacrifices if they want to switch to other service

providers. Lee And (Lee and Cunningham, 2001)

state that basically switching costs occur when there

are two parties (buyers and sellers or consumers and

certain product brands) who make transactions so that

a relationship is formed between the two. When

one party, usually the buyer/consumer, is not too de-

pendent on the other party, then the buyer/consumer

does not have an obstacle to make transactions with

other parties. In such conditions consumers have low

switching costs. The results of (Dick and Basu, 1994)

found that customer loyalty is determined not only

by satisfaction but also by switching costs. In addi-

tion,(Beerli et al., 2004) stated that satisfaction and

switching costs provide a positive influence on cus-

tomer loyalty. In addition, (Aydin and

¨

Ozer, 2005)

found that switching costs were a moderating vari-

able for the influence of satisfaction on customer loy-

alty and a direct effect on customer loyalty. Switching

costs play an important role by making it valuable for

moving to other service providers Lee And (Lee and

Cunningham, 2001), so that switching costs increase,

so customer loyalty will increase as well. In short, the

results of (Chadha and Kapoor, 2009) also show that

switching costs affect consumer intentions to remain

with certain service providers. Based on the descrip-

tion above, a hypothesis can be made as follows:

H6: The higher the cost of switching, the higher

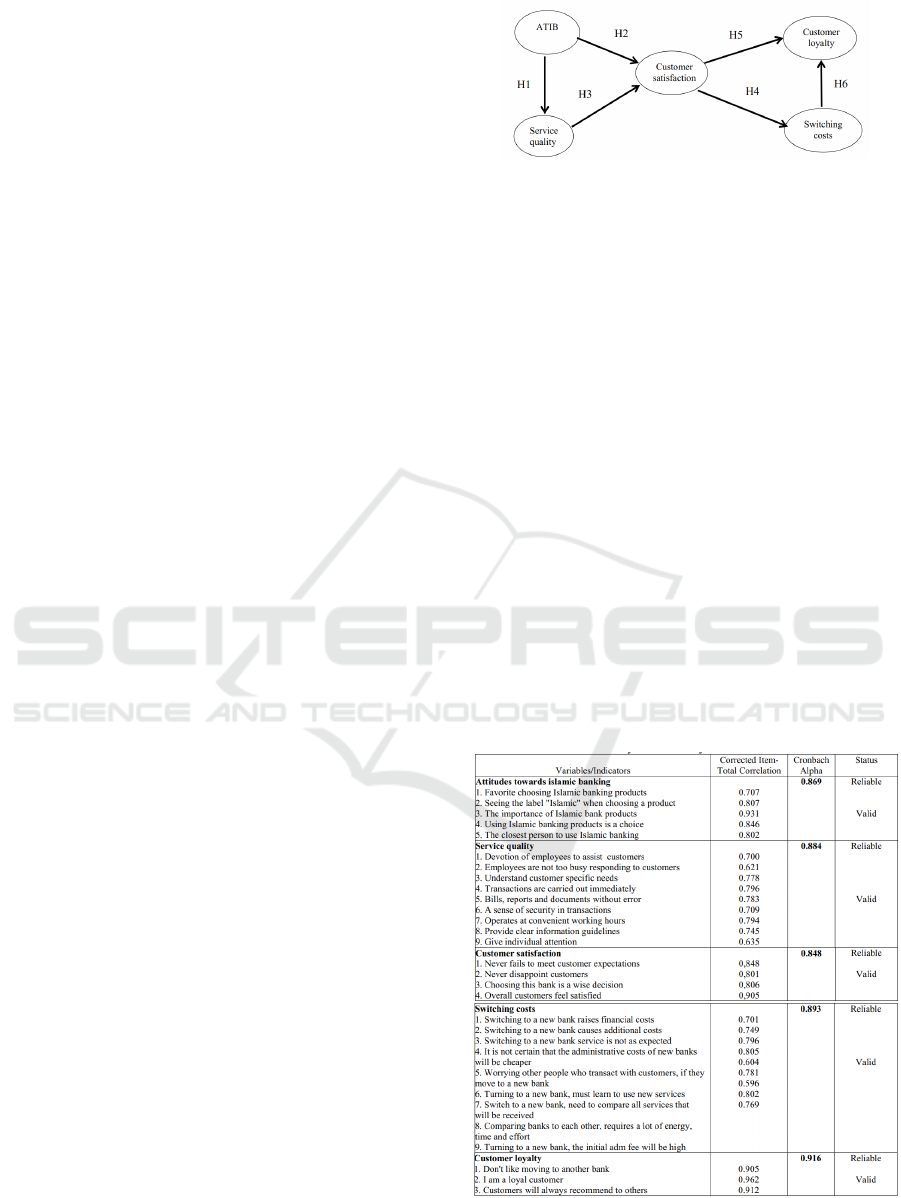

the customer loyalty. Based on the hypothesis above,

the conceptual framework of this research can be de-

scribed as follows :

Figure 1: Conceptual Framework Of Research

3 RESEARCH METHODS

The object of this research is Islamic banking, es-

pecially Bank Umum Islamic/Islamic Commercial

Banks (BUS). The population of this study is Islamic

bank customers. Knowing that the study population

is very broad, the researchers restricted this research

area in Yogyakarta, Jakarta, Bandung and Surabaya.

300 samples are carried out using non probability

sampling method. In this study, the sample was taken

using purposive sampling method, which is a non

probality sampling technique where the researcher

determines sampling by specifying specific character-

istics/ criteria that are in accordance with the research

objectives. The criteria determined in this study are

customers who know and use the services of Islamic

banks, which have become Islamic bank customers

for at least 6 months. From the 300 respondents in-

volved in this study, only 283 were included in the

analysis

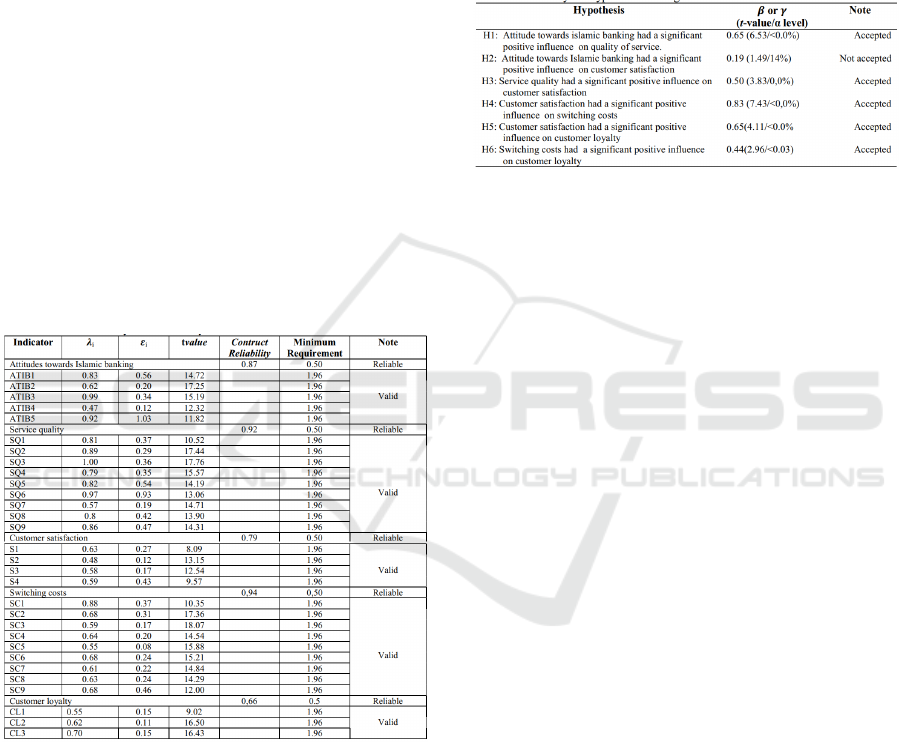

Figure 2: Test Results For Validity And Reliability Of Re-

search Instruments

Incorporating Attitude towards Islamic Banking in a Customer Loyalty Model

151

4 RESEARCH RESULT AND

DISCUSSION

As explained earlier that the respondents involved in

the study and eligible for further analysis amounted

to 283 respondents. Of the respondents involved, the

majority (58%) were women and the rest were men.

Some of them were between 20 and 30 years old, and

the rest over 30 years old. In terms of employment,

the majority (48.4%) are private employees, the rest

work as students/students, civil servants, lecturers,

BUMN employees and others. Furthermore, struc-

tural equation modelin g (SEM) and AMOS 8.80 pro-

grams were used in analyzing the conceptual frame-

work of this research. Before testing the hypothesis,

first test the validity and reliability of the data to be

used in the analysis. An indicator is declared valid

if the value of t is 96 1.96 and a variable is declared

reliable if it has construct reliability ≥ 0.50. Based

on these requirements, all indicators or question items

are declared valid and reliable in measuring the vari-

ables. Table 2 presents the results of testing the valid-

ity and reliability of the collected data.

Figure 3: Test Data Validity And Reliability Test Results

urthermore, with valid and reliable data the re-

searchers conducted structural analysis using the

AMOS 8.80 program to test the hypotheses of this

study. The effect of exogenous variables on endoge-

nous variables and the value of t of each influence ap-

pear as in Figure 3. The statistical value of the final

structural model shows that the model is very good

(fit) in representing this research data. This is proved

by the value of X2 of 412.2 with the degree of free-

dom 393, then Normed X2 = 1.05, which means that

the model has a good level of compatibility. This fact

is reinforced by the RMESEA value of 0.02 and the

TLI and CFI values of 0.99. Furthermore, the value

of the Expected Cross Validation Index (ECVI) of this

study model was 3.78. This value is lower than ECVI

for the saturated model which is 6.07. It shows that

this research model can be replicated in similar sam-

ples in the same population. The significance of the

influence between variables and testing the hypothe-

sis of this research is shown in Figure 4.

Figure 4: Summary Of Hypothesis Testing

The coefficient of the effect of switching costs to

loyalty is 0.44 with a significance level of 0.03% in-

dicating that the sixth hypothesis (H6) of this study

is proven. This finding illustrates that when respon-

dents feel high costs when moving to another bank,

they tend to continue using the bank that has been

used. This is consistent with the opinion of (Ball

et al., 2004) which states that consumers tend to be

disloyal to certain service providers or brands when

they do not feel there are obstacles to moving to other

service providers or brands, and vice versa. This find-

ing is consistent with the results of a study by (Aydin

and

¨

Ozer, 2005) and (Chadha and Kapoor, 2009). The

regression coefficient of the influence of customer sat-

isfaction on loyalty is 0.65 with a significance level

of 0.0% indicating that the fifth hypothesis (H5) of

this study is proven. It shows that respondents will be

loyal when they feel satisfied. This finding supports

previous results stating that customer satisfaction has

a positive effect on customer loyalty (Dick and Basu,

1994) And (Chadha and Kapoor, 2009). The proof of

H6 and H5 indicates that the loyalty of respondents

to Islamic banking is not solely because they are sat-

isfied, but because they face obstacles to moving to

another bank.In addition, the results of this study indi-

cate that satisfaction not only directly affects loyalty,

but also has an indirect influence through switching

costs. The indirect effect of satisfaction with loyalty

is 0.83 with a significance level of 0.0%. In other

words, this result supports H6 and H5. The proof of

this hypothesis illustrates that respondents’ satisfac-

tion not only increases their loyalty to Islamic bank-

ing but also increases their barriers to moving to other

banks. Meanwhile, the results of this study also show

that satisfaction is influenced by the quality of ser-

vice and attitudes towards Islamic banking. The re-

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

152

gression coefficient of the influence of service qual-

ity on satisfaction is 0.50 with a significance level of

0.0% indicating that the third hypothesis (H3) of this

study is proven. This finding indicates that respon-

dents will be satisfied when the quality of service in-

creases. This finding supports previous results stating

that service quality has a positive effect on customer

satisfaction (Salam, 2013). Meanwhile, the regressi

on coefficient of the influence of attitudes toward Is-

lamic banking on satisfaction is 0.19 with a signifi-

cance level of 0.14% indicating that the second hy-

pothesis (H2) of this study is not proven. This find-

ing shows that although respondents have a positive

attitude towards Islamic banking it does not satisfied.

This finding does not support previous research which

stated that attitudes towards Islamic banking had a

positive effect on customer satisfaction (Rizwan et al.,

2014).

5 CONCLUSIONS

This research has several weaknesses that need to be

overcome for researchers who are interested in exam-

ining customer loyalty, especially with regard to the

selection of research subjects. Further researchs need

to use islamic credit bank institutions to test the con-

sistency of findings across markets.

REFERENCES

Abou-Youssef, M. M. H., Kortam, W., Abou-Aish, E., and

El-Bassiouny, N. (2015). Effects of religiosity on con-

sumer attitudes toward islamic banking in egypt. In-

ternational Journal of Bank Marketing.

Ajzen, I. (2005). Attitudes, personality, and behavior.

McGraw-Hill Education (UK).

Amin, M., Isa, Z., and Fontaine, R. (2013). Islamic banks.

International Journal of Bank Marketing.

Anderson, T. L., Charlson, R. J., and Covert, D. S. (1993).

Calibration of a counterflow virtual impactor at aero-

dynamic diameters from 1 to 15 µm. Aerosol science

and technology, 19(3):317–329.

Aydin, S. and

¨

Ozer, G. (2005). The analysis of antecedents

of customer loyalty in the turkish mobile telecommu-

nication market. European Journal of marketing.

Ball, D., Coelho, P. S., and Mach

´

as, A. (2004). The role of

communication and trust in explaining customer loy-

alty. European journal of marketing.

Beerli, A., Martin, J. D., and Quintana, A. (2004). A model

of customer loyalty in the retail banking market. Eu-

ropean journal of marketing.

Berkowitz, L. (1972). Social norms, feelings, and other.

Advances in experimental social psychology, page 63.

Bloemer, J., De Ruyter, K., and Peeters, P. (1998). Inves-

tigating drivers of bank loyalty: the complex relation-

ship between image, service quality and satisfaction.

International Journal of bank marketing.

Butt, M. M. and Aftab, M. (2013). Incorporating attitude

towards halal banking in an integrated service quality,

satisfaction, trust and loyalty model in online islamic

banking context. International Journal of Bank Mar-

keting.

Chadha, S. and Kapoor, D. (2009). Effect of switching cost,

service quality and customer satisfaction on customer

loyalty of cellular service providers in indian market.

IUP Journal of Marketing Management, 8(1):23.

Delgado-Ballester, E. and Munuera-Aleman, J. L. (2002).

Development and validation of a brand trust scale

across product categories: a confirmatory and multi-

group invariance analysis. In American Marketing As-

sociation. Conference Proceedings, volume 13, page

519. American Marketing Association.

Dick, A. S. and Basu, K. (1994). Customer loyalty: toward

an integrated conceptual framework. Journal of the

academy of marketing science, 22(2):99–113.

Donald, D. B., Stern, G. A., Muir, D. C., Fowler, B. R.,

Miskimmin, B. M., and Bailey, R. (1998). Chlorobor-

nanes in water, sediment, and fish from toxaphene

treated and untreated lakes in western canada. Envi-

ronmental science & technology, 32(10):1391–1397.

Erol, C. and El-Bdour, R. (1989). Attitudes, behaviour, and

patronage factors of bank customers towards islamic

banks. International Journal of Bank Marketing.

Fornell, C. (1992). A national customer satisfaction barom-

eter: The swedish experience. Journal of marketing,

56(1):6–21.

Incorporating Attitude towards Islamic Banking in a Customer Loyalty Model

153

Hafeez, S. and Muhammad, B. (2012). The impact of

service quality, customer satisfaction and loyalty pro-

grams on customer’s loyalty: Evidence from banking

sector of pakistan. International Journal of Business

and Social Science, 3(16).

Hayes, T. and Bloom, P. (2002). Marketing professional ser-

vices: Forward-thinking strategies for boosting your

business.

Hong, S.-C. and Goo, Y. J. (2004). A causal model of cus-

tomer loyalty in professional service firms: an em-

pirical study. International Journal of Management,

21(4):531.

Jones, M. A., Mothersbaugh, D. L., and Beatty, S. E.

(2000). Switching barriers and repurchase intentions

in services. Journal of retailing, 76(2):259–274.

Lee, M. and Cunningham, L. F. (2001). A cost/benefit ap-

proach to understanding service loyalty. Journal of

services Marketing.

Oliver, R. L. (1997). Satisfaction, a behavioral perspec-

tive on the consumer. the mcgrawhill companies. Inc.,

New York.

Parasuraman, A., Zeithaml, V. A., and Berry, L. L. (1985).

A conceptual model of service quality and its impli-

cations for future research. Journal of marketing,

49(4):41–50.

Rizwan, M., Yaseen, G., Nawaz, A., and Hussain, L. (2014).

Incorporating attitude towards islamic banking in an

integrated service quality, satisfaction, trust and loy-

alty model. International Journal of Accounting and

Financial Reporting, 4(2):456.

Salam, E. M. A. (2013). The impact of corporate image and

reputation on service quality , customer satisfaction

and customer loyalty : Testing the mediating.

Santouridis, I. and Trivellas, P. (2010). Investigating the

impact of service quality and customer satisfaction on

customer loyalty in mobile telephony in greece. The

TQM Journal.

Scaglione, F. (1988). Two-way communication: Tapping

into gripes and profits. Management Review, 77(9):51.

Siddiqi, K. O. (2011). Interrelations between service quality

attributes, customer satisfaction and customer loyalty

in the retail banking sector in bangladesh. Interna-

tional journal of business and management, 6(3):12.

Zeithaml, V. A., Parasuraman, A., Berry, L. L., and Berry,

L. L. (1990). Delivering quality service: Balancing

customer perceptions and expectations. Simon and

Schuster.

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

154