The Effect of Sticky Cost to Profit Prediction using the

Cost Variability and Stickiness Model at Manufacturing

Industry

Sri Mulyati

1

, Dy Ilham Satria

1

, Murhaban

1

, Maulida

2

, and Wardhiah

3

1

Department of Accounting Faculty of Economic and Bussiness Malikussaleh University,

Aceh, Indonesia

2

Graduation of Accounting Department Faculty of Economic and Bussiness,

Universitas Malikussaleh, Aceh, Indonesia

3

Department of Management Faculty of Economic and Bussiness Malikussaleh University,

Aceh, Indonesia

murhaban@unimal.ac.id,maulida.54@yahoo.com,wardhiah@unimal.ac.id

Abstract. This study aims to examine the effect of sticky cost on profit prediction

using the cost variability and cost stickiness (CVCS) model. This study also tries

to look at the relationship between sticky cost behavior on profit predictions. In

this study sticky costs are calculated with variables, namely sales, administration

and general costs. While profit predictions are measured by the model of cost

variability and cost stickiness (CVCS). Cost behavior has traditionally been an

important aspect of management accounting for analyzing profit for managers.

This cost behavior study is important, because of the uncertain future demand

faced by managers. The type of data used in this study is secondary data. This

research was conducted by taking a sample of 62 companies from 144 companies

on the manufacturing industry listed on the Indonesia Stock Exchange from

2014-2016. Sampling is done by purposive sampling method. Processing data is

done by multiple linear regression techniques and has met the classical

assumption test requirements. This study shows the results that the cost of sales

(X

1

) does not affect the profit prediction (Y), The second hypothesis testing X

2

has a significant effect on Y. The results of this study indicate the amount of

increase in sales, administrative and general costs when net sales rise is higher

than the magnitude of decrease in sales, administrative and general costs when

net sales fall. This means that there are sticky cost behaviors in sales,

administration and general costs in IDX manufacturing industry companies.

Keywords: Sticky cost ꞏ Sales cost ꞏ General and administrative costs ꞏ Profit

prediction

1 Background

Cost behavior has traditionally been an important aspect of management accounting for

analyzing profit for managers. The cost accounting literature explains 2 basic types of

cost behavior patterns, namely variable costs and fixed costs. These variable costs and

fixed costs can be used as components to analyze costs, volumes and profits (Garrison

and Noreen, 2002 in Banker and Chen, 2006). If this model is valid then estimation

364

Mulyati, S., Satria, D., Murhaban, ., Maulida, . and Wardhiah, .

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry.

DOI: 10.5220/0009870500002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 364-373

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

using past data can be used as a basis for predicting future profit (Banker and Chen,

2006).

Several companies listed on the Indonesia Stock Exchange (IDX) are many that link

the decline or increase in profits with production, sales and efficiency activities. As PT

Mayora Indah Tbk (MYOR) decided to cut its net profit target this year (2014). Based

on public exposures, MYOR predicts profit will drop 20% compared to 2013. MYOR

said there are three obstacles that will be faced, namely the global economic situation,

competition and stability of supply and prices of raw materials. This study tries to look

at the relationship between sticky cost behavior on profit predictions. In this study

sticky costs are calculated with variables, namely sales, administration and general

costs. While profit predictions are measured by the model of cost variability and cost

stickiness (CVCS).Related to research on profit predictions, there have been several

studies analyzing them, some of them analyzing the Effect of Sticky Cost Behavior on

Profit Prediction Using the Model Variability and Cost Stickiness (CVCS) conducted

by Hidayatullah I. J (2011). The results showed that the effect of sticky cost on profit

predictions using the cost variability and cost stickiness (CVCS) models was very

small, but the accuracy of the model was better than the simple ROE model.Research

conducted by Susilo (2016) which analyzes Sticky Cost Behavior and Its Effect on

Profit Prediction Using Cost Variability and Cost Stickiness (CVCS) Models on Issuers

on the IDX for Manufacturing Industry . The test results show that the variation in

administrative and general marketing costs (PA&U) when net sales have increased is

greater than when net sales have decreased. This means marketing, administrative and

general costs are sticky . This gives a signal that sticky cost behavior needs to be

considered in predicting profit. Variation in cost of goods sold (COGS) when net sales

have increased slightly smaller than when net sales have decreased. This means that the

cost of goods sold is not sticky . This is because the cost component of cost of sales is

largely are variable costs which rise and decline greatly influenced by the volume of

sales. The effect of sticky cost on profit predictions using the costvariability and cost

stickiness (CVCS) models is very small, but the accuracy of the model is better than

the simple ROE model.

Based on the above phenomenon, the researcher is interested in reexamining "The

Effect of Sticky Cost on Profit Prediction Using the Model Variability and Cost

Stickiness (CVCS). (For Issuers on the Indonesia Stock Exchange for

Manufacturing Industry for the 2014-2016 Period) ".

Prior Research. There are several previous studies that have tried to reveal the effect

of sticky cost behavior on profit predictions using the model of cost variability and cost

stickiness (CVC). In the first study conducted by Susilo (2016), with the title Effect of

Sticky Cost Behavior on Profit Prediction Using the Cost Variability and Cost

Stickiness (CVCS) Models . With the results of the study show that the variation in

marketing, administrative and general costs (PA&U) when net sales have increased is

greater than when net sales have decreased. This means the marketing,

administrationand general costs are sticky .In the second study conducted by Ratnawati

and Nugrahanti (2015), with the title Sticky Cost Behavior in Sales, Administration and

General Costs and Cost of Sales in Manufacturing Companies. With the results of the

study that Based on the results of the first hypothesis test that has been done, it is

concluded that there are indications of sticky cost behavior in sales, administration and

general costs of manufacturing companies on the Indonesia Stock

Exchange. The third

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry

365

Profit

Prediction

study was conducted by Apriliawati and Nugrahanti (2015), with the title Sticky Cost

Behavior on Sales, Administration and General Costs. With the results of research that

show that the results of the first hypothesis testing, found indications of sticky cost

behavior in sales, administrative and general costs in manufacturing companies in

Indonesia 2009-2012. The fourth study was conducted by Hidayatullah, et al (2011),

with the title Effect of Sticky Cost Behavior on Profit Predictions Using Cost

Variability and Cost Stickiness (CVCS) Models . With the results of the study show

that the variation in marketing, administrative and general costs (PA&U) when net sales

have increased is greater than when net sales have decreased. This means the marketing,

administration and general costs are sticky.

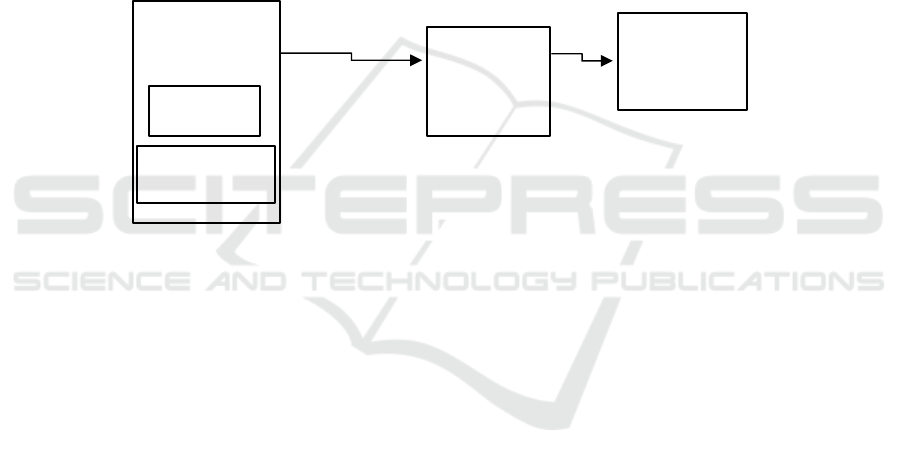

Conceptual Framework. Relationship of Sticky Cost Behavior (sales, administrative

and general costs) to the variable predicted profit. can be described as follows:

Relationship of Sticky Cost Behavior (sales, administrative and general costs) to the

variable predicted profit. can be described as follows:

Fig. 1. Conceptual Framework.

Hypothesis. Based on the theoretical basis and the results of previous studies that have

been described, the hypotheses formulated are as follows:

- Sales costs affect the earning prediction.

- Administrative and general sales costs affect profit predictions.

Research Sites. The location of this research is for manufacturing industry companies

listed on the Indonesia Stock Exchange in the 2014-2016 period.

Population and Sample. The population used in this study are all manufacturing

industry companies listed on the Indonesia Stock Exchange (BEI) from 2014 to 2016,

with the aim of knowing how the company's profit prediction development over time.

The company issued financial statements for the period ended December 31, 2014 to

December 31, 2016.

Data Collection Technique. The data collection method in this research is by

conducting a documentation study on the audited financial statements of manufacturing

industry companies in the 2014-2016 period.

Model Cost

Variability

dan Cost

Stickiness

Sticky Cost

Behaviour

Sales Cost

administration

& general cost

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

366

Data Types and Sources. The type of data used in this study is secondary data. This

study obtained necessary data from food and beverage sector companies manufacturing

companies listed on the Indonesia Stock Exchange (IDX), namely the annual financial

statements of companies that have been audited and listed in 2014-2016. Data obtained

by accessing the Indonesia Stock Exchange's website (www.idx.co.id).

2 Operational Definitions of Research Variable

The definitions of each variable are as follows:

Cost Behavior. Garrison and Noreen (2002) in Banker and Chen (2006) define

boarding behavior which is defined as how the boarding will change in the level of

activity that occurs. Managers who understand boarding behavior will be better at

predicting what will happen to the boarding path in several operating situations, making

it easy to plan their activities, results and profits. One of the causes of stickycost on

sales, administration and general costs arises because of decisions taken by managers

whose aim is to maximize profits but are seen as inefficient from the owner's side

(Jensen and Meckling, 1976).

Profit Prediction. Profit prediction is an estimate of the amount of profit or excess

income over costs in return for producing goods and services over an accounting period

for the future. To know the profit prediction, the cost variability and cost stickiness

(CVCS) models are used . Banker and Chen (2006) make a CVCS model based on

accounting profit ( Et ) assumptions in period t , measured from sales revenue ( St )

minus costs ( Ct ):

Et = St - Ct

Information:

Et: accounting profit

St: sales revenue

Ct: costs

Classic Assumption Test. Testing of classical assumptions aims to find out whether a

regression model is good or not if used to do the assessment. A model is said to be good

if it is BLUE ( Best LinearUnder Estimator ), which fulfills classical assumptions or

avoids problems of normality, multicollinearity, heteroscedasticity and autocorrelation.

Therefore in this study a classical assumption is tested, whether deviations occur or not,

so that the research model is feasible to use. The classic assumption tests used in this

study are the normality test, the multicollinearity test, the autocorrelation test, and the

heterokedasticity test.

Normality Test. The normality test aims to test whether in the regression model,

confounding or residual variables have a normal distribution. We can see from the

normal probability plot that compares the cumulative distribution with the normal

distribution. The normal distribution forms a diagonal straight line, and plotting

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry

367

residual data will be compared with the diagonal line. If the data is normally distributed,

then the lines that describe the actual data will follow the normal line, Ghozali (2011:

110). There are two ways to detect whether residuals are normally distributed or not,

namely by graphical analysis and statistical tests, Ghozali (2011: 111).

Graph Analysis. One of the easiest ways to see residual normality is to look at the

histogram chart. A more reliable method is to look at the normal probability plot that

compares the cumulative distribution from the normal distribution. The normal

distribution will form a straight diagonal line and the ploting of residual data will be

compared with the diagonal line. If the distribution of residual data is normal, then the

line that represents the actual data will follow the diagonal line, Ghozali (2011: 161).

Statistic Analysis. Tests for normality with graphs can be misleading if you are not

careful visually it looks normal, even though statistically it can be the opposite.

Therefore it is recommended in addition to the graph test equipped with statistical tests,

Ghozali (2011: 163). Another statistical test that can be used to test residual normality

is the Kolmogorov-Smirnov (KS) non-parametric statistical test, namely by first

determining the testing hypothesis, namely:

If the significance is> 0.05, then the data is normally distributed

If the significance is <0.05, then the data is not normally distributed.

Multicollinearity Test. This test was conducted to test whether the regression model

found a correlation / relationship between independent variables . A good regression

model should not occur correlation between independent variables . If there is a

correlation, then these variables are not orthogonal . Variable orthogonal are variables

independent the correlation values between the members of variables independently

equal to zero, Ghozali (2005: 91).

In this study, to detect the presence or absence of multicollinearity in the regression

model used a correlation matrix of independent variables , and see the value of

Tolerance and Variance Inflation Factor (VIF) with calculations using SPSS program

assistance. Testing the presence or absence of multicollinearity symptoms is done by

taking into account the value of the correlation matrix produced during data processing

and the value of VIF and tolerance . If the value of the correlation matrix between

independent variables has a fairly high correlation (generally above 0.90) then this is

an indication of multicollinearity problems, and vice versa. And the cut-off value that

is generally used to indicate the absence of multicollinearity problems is Tolerance >

0.10 or equal to VIF value <10, Ghozali (2005: 92-93).

3 Heteroscedasticity Test

This test aims to test whether in the regression model there is a similarity in variance

from the residuals of one observation to another. If the variance shows a fixed pattern,

it can be stated that there was no heteroscedasticity. If the variance of the residuals from

one observation to another is fixed, then it is called homokedasticity, and if it is different

is called heteroscedasticity, Ghozali (2005: 105). To detect the presence or absence of

heteroscedasticity, it can be done using a Scatterplot chart . A good regression model

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

368

is a homokedastisitas or heteroscedasticity does not occur.The basis of the analysis is,

Ghozali (2005: 105):

If there are certain patterns, such as dots that form a regular pattern (wavy, widened

and then narrowed), then it indicates heteroscedasticity has occurred.

If there is no clear pattern, and the points above and below the number 0 (zero) on

the Y axis, then there is no heteroscedasticity.

Autocorrelation Test. This test aims to test whether in the linear regression model

there is a correlation of confounding errors in period t, with confounding errors in

period t-1 (previous period). If there is a correlation, then there is a problem called

autocorrelation. Autocorrelation arises because observations that aim all the time are

related to one another, Ghozali (2005: 95).

Data Analysis Method. This study uses a calculation model developed by Anderson

et al. (2003), and used in the research of Subramanyan and Weidenmier (2003),

Windyastuti and Biyanto (2005), Hidayatullah et al. (2011) to find stickycost

indications on sales, administrative and general costs. The explanation of the regression

model is as follows:

Y = a + b

1

X

1

+ b

2

X

2

+ e

Information:

Y = Profit Prediction

A = constant

b

1

-b

2

= Regression coefficient for each variable

X

1

= Cost of Sales

X

2

= Administrative and General Costs

e = standard error

Hypothesis Testing. Statistical tests on multiple linear regression aim to prove the

hypothesis of the presence or absence of a significant or strong influence then it is

performed by t test.

Partial Test (t-test). This test is based on a comparison of the

calculated

t value of each

regression coefficient with the value of t

table

with a significant level of 5% with degrees

of freedom df = (nk), where n is the number of observations and k is the number of

variables.

If t

arithmetic

<t

table

(nk), then the independent variable has no effect on the dependent

variable .

If t

arithmetic

> T

table

(nk ), then the independent variable influences the dependent variable

Statistical Testing. The analysis in this study uses multiple regression analysis which

functions to analyze the presence or absence of influence between the two variables,

namely the independent variable and the dependent variable. To determine the effect of

the theme of environment and energy, social themes, the theme of labor and consumer

and product of the k inerja k euangan p ompany used the regression equation:

Y = a + b

1

X

1

+ b

2

X

2

+ e

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry

369

Data testing was performed with the help of the SPSS ( Statistical Package for the

Social Sciences ) computer program . After processing the data, the results of the

regression analysis are as shown in the following table:

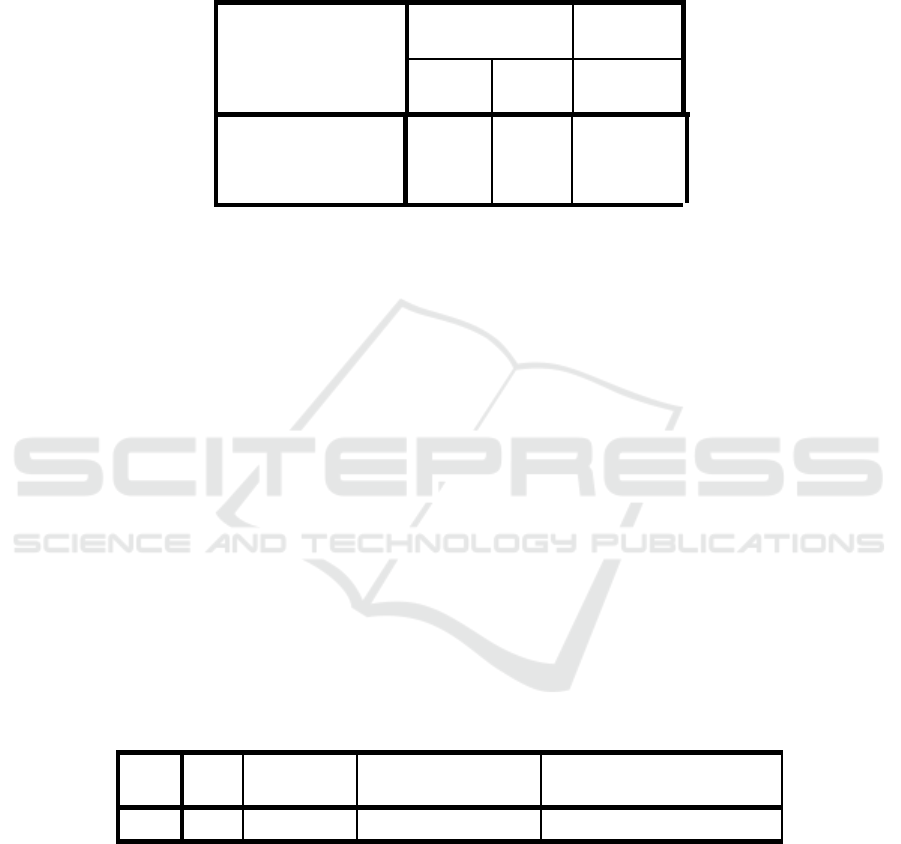

Table 1.

Model

Unstandardized

Coefficients

Standardized

Coefficients

B

Std.

Erro

r

Beta

1 (Constant)

9,305 .869

X

1

-.032 122 -.031

X

2

.923 .118 .948

Dependen

t

Variable: Y

4 Results of Multiple Regression Analysis

Source: research results, 201 6

Based on the results of the analysis of the regression model shown in Table 4. 4

above, it can be arranged into multiple linear regression as follows:

Y = 9.305-0.032X1 + 0.923 + e

From the regression equation it can be seen that the magnitude of a constant value

of 9 , 305 (930.5%) means that if the influence variables X

1

and X

2 are

considered

constant, then the magnitude of Y is 930.5% . Regression coefficient value X

1

of -0.032

indicates negatifyang relationship meant that any drop of X

1

by 1 00 % then causes Y

m en urun amounted to -3 , 2%, assuming other independent variables constant.

Regression coefficient value X

2

for 0, 923 shows the relationship positive which

gives the sense that any increase in X

2

for 1 00 % then causes Y m eningkat by 92 , 3%

assuming other independent variables constant.

4.1 Correlation Analysis and Determination

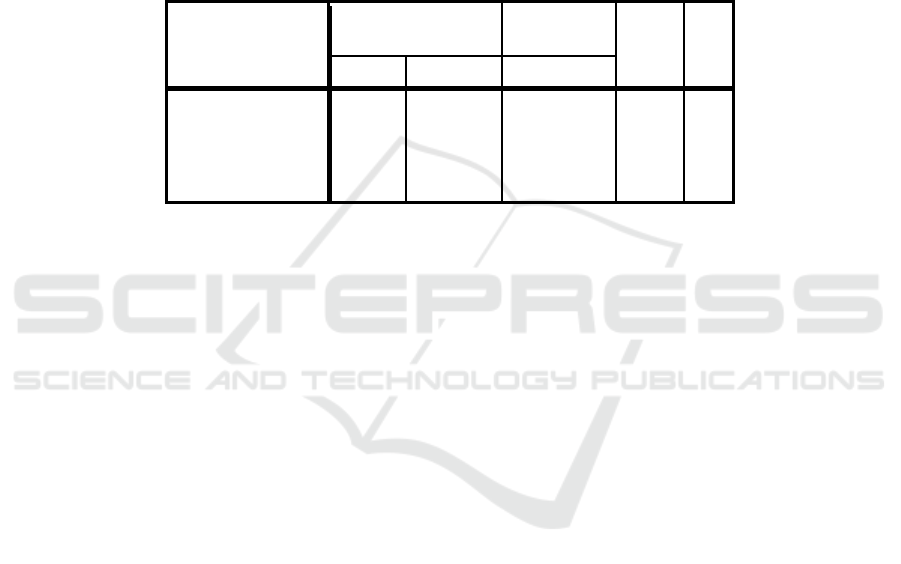

Table 2. Correlation and Determination Analysis Results.

Model R R Square Adjusted R Square Std. Error of the Estimate

1 .919

a

.845 .840 2.14823

Source: Research Results, 2018

Based on the table above can be seen the value of the correlation coefficient (R) of

0.919 indicates that there is a relationship which is significant / strong among

independent variables on the dependent variable amounted to 91.9% , while the value

of adjudted R

2

is 0.840, this shows that the variation of the independent variable

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

370

capable explain the variation of the dependent variable by 84%, while the remaining

16% is explained by other variables outside the model.

Hypothesis Testing. To prove the hypothesis in this study whether the independent

variables affect the dependent variable, then several tests are used, namely:

Partial Influence (t test). Partial effect was carried out using t test statistics. This test

aims to determine whether the independent variables included in the model are able to

explain the dependent variable individually. The test results can be seen in the table

below:

Table 3. Partial Analysis Results (t test).

Model

Unstandardized

Coefficients

Standardized

Coefficients

t

Si

g

. B Std. Erro

r

Beta

1 (Constant) 9,305 .869 10,704 .000

Sales fee -.032 122 -.031 -.260 .796

Administration

an

d

g

eneral fee

.923 .118 .948 7,842 .000

Source: Research 2016

From the above table it can be seen that the

calculated

t value of X

1

is -0 , 260 with a

significant value of 0.796, while the value of t

table

with (df) = nk (62 - 3 = 59) at α =

0.05 obtained values amounted to 1,671. Thus t

count

<t

table

is -0.260 <1.671 and 0.796

significant level, then X

1

no effect on Y .

The first hypothesis testing X

1

does not significantly influence Y. The magnitude

of the increase in sales, administrative and general costs when net sales rise is higher

than the magnitude of the decrease in sales, administrative and general costs when net

sales fall. This means that there are sticky cost behaviors in sales, administration and

general costs in BEI manufacturing industry companies, Anderson, et al (2003).

However, the results of this study indicate that the increase in sales, administrative and

general costs when net sales fluctuate compared to the magnitude of the decrease in

sales, administrative and general costs when net sales rise, so there is no sticky cost

behavior in sales, administration and general costs.

This study shows the results that the cost of sales (X

1

) does not affect the earning

prediction (Y), this is in accordance with research conducted by

From Table 4.6 it can be seen that the value of t

arithmetic

of X

2

is equal to 7 , 842 with

significant value is 0,000, while the value of t

table

with (df) = nk (62-3 = 59) at α = 0.05

was obtained a value of 1.671 . Thus the t

count

> t

table

is 7.842> 1.671 and significant

level of 0.000, then X

1

influence on Y . This is according to research conducted by

Susilo (201 6 ) X

2

effect on Y .

The second hypothesis testing X

2

has a significant effect on Y. The results of this

study indicate the amount of increase in sales, administrative and general costs when

net sales rise is higher than the magnitude of decrease in sales, administrative and

general costs when net sales fall. This means that there are sticky cost behaviors in

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry

371

sales, administration and general costs in BEI manufacturing industry companies,

Anderson, et al (2003).

This study shows the results that administrative and general costs (X

2

) affect

profitpredictions (Y), this is consistent with research conducted by Susilo (2016) where

administrative and general costs affect profit predictions , with the title of his research

" Effect of Sticky Behavior Cost Against Profit Prediction Using the Cost Variability

and Cost Stickiness (Cvcs) Model ". Also in accordance with research conducted by

Nugrahanti (2015) where the results of the study showed indications of behavior at

administrative and general costs, with the research title " Sticky Cost Behavior in Sales,

Administration and General Costs and Cost of Sales in Manufacturing Companies".

References

Anderson, M. C., Banker, R. D. And Jankiraman, S. N. (2003). Are Selling,General, and

Administrative Costs “Sticky”?. Journal Of Accounting Research. Vol 41, No. 1.

Atkinson, A., Banker, R., Kaplan, R.S. (1995).Management Accounting. NewJersey:Prentice-

Hall International. Inc.

Banker, R. D. and Chen, Lei (2006). Predicting Earning Using A Model Based On Cost

Variability and Cost Stickiness. The Accounting Review Vol. 81, No. 2.

Cooper, R., and R. Kaplan (1998). The Design Of Cost Management Systems:ext, Cases, And

Readings. Upper Saddle River, Nj: Prentice Hall.

EkoSusilo, (2016). “Analisis Perilaku Sticky Cost dan Pengaruhnya Terhadap Prediksi Laba

Menggunakan Model Cost Variability dan Cost Stickiness (CVCS) Pada Emiten Di BEI

Untuk Industri Manufaktur”,Jurnal Vol. 2No. 2, Januari 2016

Ghozali, Iman. (2005). Aplikasi Analisis Multivariate Dengan Program SPSS. Badan Penerbit

Universitas Diponegoro Semarang.

___________. (2011 “AplikasiAnalisisMultivariat Dengan Program IBM SPSS 19”.Badan

Penerbit Universitas Diponegoro.

Harahap, SofyanSyafri, (2009). “Analisis Kritis Atas Laporan Keuangan”. Jakarta: RajaGrafindo

Persada.

Hidayatullah, IJ., et al., (2011), “Analisis Perilaku Sticky Cost dan Pengaruhnya Terhadap

Prediksi Laba Menggunakan Model Cost Variability dan Cost Stickiness (CVCS) Pada

Emiten Di BEI Untuk Industri Manufaktur”,SNA, Availableat SNA:

sna.akuntansi.unikal.ac.id/ makalah/029AKPM45.pdf

Horngren, C. T., Foster, G., Datar, S. M. (1997). Cost Accounting A Managerial Emphasis.

9

Th

Editions. New Jersey: Prentice Hall International Edition.

Husein, Umar. (2001). Strategic Management In Action.Edisi 1, Jakarta:Gramedia Pustaka

Utama. Jensen, M. C. dan W. H. Meckling (1976). Theory ofThe Firm: Managerial

Behavior,Agency Cost, and Ownership Structure.Journal of Financial Economics 3, 305-360

Lea Ratnawati danYeterina Widi Nugrahanti, (2015). “Perilaku Sticky Cost Biaya Penjualan,

Administrasi Dan Umum Dan Harga Pokok Penjualan Pada Perusahaan Manufaktur”. Jurnal

Ekonomi Dan Bisnis Fakultas Ekonomika Dan Bisnis Vol. Xviii No 2 Edisi Agustus 2015

Universitas Kristen Satya Wacana Issn :1979-6471

Malcom, Robert E. (1991). Overhead Control Implications of Activity Costing. Accounting

Horizons.

Risvia Apriliawati dan Yeterina Widi Nugrahanti, (2015). “Perilaku Sticky Cost Pada Biaya

Penjualan, Administrasi Dan Umum”, Jurnal Universitas Kristen Satya Wacana.

Sugiyono. (2013). Metode Penelitian Pendidikan.= Edisi 16. Bandung: Alfabeta.

Suwardjono. (2008). Teori Akuntansi: Perekayasaan Pelaporan Keuangan.Yogyakarta:BPFE.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

372

Weis, D., 2010, “Cost Behavior And Analysts Profit Forecast”. The Accounting Review Vol. 85,

No. 4 Windyastuti Dan FrastoBiyanto (2005). Analisis Perilaku Kos : Stickiness Cost

Pemasaran, Administrasi & Umum Pada Penjualan Bersih. Sna VIII Solo,15 – 16 September

2005.www.idx.co,id

Yasukata, K., Kajiwara , T., 2011, "Are 'Sticky Costs' The R esult of Deliberate Decision of

Managers ?", Working Paper, Available at SSRN: http: // ssrn . com / abstract = 1444746 or

http: //dx.doi . org / 10.2139 / ssrn.1444746

The Effect of Sticky Cost to Profit Prediction using the Cost Variability and Stickiness Model at Manufacturing Industry

373