International Relevancy of Tax Return in Indonesian Tourists Context,

International Duty Free Facility, and Regulation of Indonesian Customs

Duty on Tax Payment and Return Systems

Johanes Ronaldy Polla

1

, Harjanto Prabowo

1

, Mohammad Hamsal

1

, Boto Simatupang

1

and Surya

Ningsih

1

1

BINUS University, Jakarta, Indonesia

Keywords:

Tax refund, Duty Free International, Indonesian Customs, Payment system and Tax return.

Abstract:

Value added Tax or VAT fee charged to a person in accordance with the applicable law in Indonesia. Increased

tourism in Indonesia closely related to tourists visiting Indonesia. The provision of facilities that can support

the tourists while in Indonesia through the development of facilities and infrastructure. The fiscal side of the

support comes in the form of tax refunds to foreign tourists who have spent their money in Indonesia. One

of them is Tax Refund and Duty Free International, offering easy facilities to increase the export of goods

purchased in Indonesia by foreign tourists referring to the increase of state income. Outflow of goods (Export-

Import), which is clearly regulated by the Customs Duty, makes an important foundation for implementing

existing regulations. The more demand for goods purchased by tourists the greater the potential of Indonesia

to continue to be visited by tourists especially through the Facilities that Indonesia provides. The method used

for this research is qualitative method. This study aims to analyse the effect gained through the taxation on

the tourists of Indonesia and abroad and the existence of Duty Free against customs regulation (customs) that

exist in each country.

1 INTRODUCTION

Tourism is an important sector and contributes posi-

tively to the national economy in every country. The

most obvious contribution of this sector is the coun-

try’s foreign exchange earnings. Additional foreign

exchange from the tourism sector has also contributed

to the strengthening of foreign exchange reserves.

The strong position of foreign exchange reserves in

turn will encourage strengthening (appreciation) of

the rupiah exchange rate against foreign exchange,

especially against US dollars (Nizar et al., 2013).

The development of the tourism industry in Indone-

sia has increased from year to year and in these in-

dustries plays an important role in economic develop-

ment in Indonesia. The development of the tourism

sector also has links with international trade (exports

and imports). This is proven through various stud-

ies that have been conducted in a number of countries

where both sectors have a positive causality relation-

ship. That is, the two sectors can influence each other.

So far that can be done only by observing the devel-

opment of the two sectors based on international trade

statistics (exports and imports) and the number of for-

eign tourist visits (tourists) to Indonesia. ”In order to

attract foreign tourists to visit Indonesia, then they are

given tax incentives, where the incentives are called

VAT Refunds in the form of return on Value Added

Tax (PPN) and Sales Tax on Luxury Goods (PPnBM)

that have been paid for the purchase of Taxable Goods

in Indonesia which was then taken by the individual

out of the Customs Area. VAT Refund is done on

the date of departure abroad shortly before leaving In-

donesia. ”

The government can maximize these facilities in

order to improve the quality of services in the country

for tourists, according to the General Chair of the In-

donesian Shopping Center (Hippindo) Tenants Asso-

ciation: ”Currently there are very few foreign tourists

who use these facilities due to the minimum amount

of transactions reaching Rp. 5 million. . This tax re-

fund facility is very good considering that Indonesia

has a target of bringing in 20 million foreign tourists

until next year. ”(Source: www.KlinikPajak.co.id).

Relatively high tourist demand by foreign tourists, in

addition to facilities or ease of tax returns through

Polla, J., Prabowo, H., Hamsal, M., Simatupang, B. and Ningsih, S.

International Relevancy of Tax Return in Indonesian Tourists Context, International Duty Free Facility, and Regulation of Indonesian Customs Duty on Tax Payment and Return Systems.

DOI: 10.5220/0009868702930299

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 293-299

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

293

VAT Refund conducted by foreign tourists, there are

other facilities offered by Indonesia given the increas-

ing interest of tourists to Indonesia, namely by pro-

viding Duty Free facilities located at various airports

International especially in Jakarta. Duty free makes

it easy for shopping lovers, especially for foreign

tourists who want to shop for goods from the coun-

tries they are traveling with, which most of them

choose to buy luxury goods without having to be bur-

dened by the goods tax.

A tax refund is imposed when tourists shop in a

country and are still charged by taxes, but then when

they are in airport or when they return to their country,

the tax can be exchanged again, according to regula-

tions in that country. The number of criminal cases

and cheating that occur when a tourist carries their

goods makes regulations imposed by the airport in

any country. The desire of tourists to shop more in

a country but is hindered by the existence of several

provisions and restrictions by Customs and Excise in

addition to the facilities that have also been provided

by the state regarding the procurement of Tax refunds

and Duty Free shopping places, how many items can

be taken, what is prohibited and there are still many

discussions about the tax refund system and the exis-

tence of Duty Free facilities for tourists on the pay-

ment system.

2 LITERATURE REVIEW

2.1 VAT / VAT (Value Added Tax)

Refund

In Law Number 42 of 2009 concerning Value Added

Tax, it is regulated a new thing about the existence of

the provision of Value Added Tax (PPN) reimburse-

ment for foreign tourists for the VAT that has been

paid for the purchase of taxable goods that will be

taken outside Indonesia. This provision is regulated

in Article 16E paragraph (1) to paragraph (5). The

sound of Article 16E Paragraph (1) of the Law is as

follows: ”Value Added Tax and Sales Tax on Luxury

Goods that have been paid for the purchase of Tax-

able Goods brought outside the Customs Area by pri-

vate persons of foreign passport holders can be asked

to return”. The VAT requirements can be requested

again contained in article 16E paragraph (2) of the

VAT.

2.2 Tax Refund Terms and Regulations

for Foreign Tourists in Indonesia

In order to attract foreign passport holders to visit In-

donesia, these individuals were given tax incentives.

The incentives are in the form of return on Value

Added Tax (PPN) and Sales Tax on Luxury Goods

(PPnBM) that have been paid for the purchase of Tax-

able Goods in Indonesia which are then taken by the

individual outside the Customs Area. Taxable Goods

purchased within a period of 1 (one) month before

the individual passport holder leaving Indonesia is

deemed to be consumed outside the Customs Area.

For foreign passport holders who do not have a Tax-

payer Identification Number (NPWP), a Tax Invoice

that can be used to request VAT and Sales Tax on

Luxury goods must include an identity in the form of

name, passport number, and full address of the indi-

vidual person in the country who issued the passport.

Tax Refunds for foreign tourists in Indonesia are reg-

ulated in Article 16E of the Law number 42 of 2009,

which states that:

1. Value Added Tax and Sales Tax on Luxury Goods

that have been paid for the purchase of taxable

goods which are sent outside the Customs Area

by private persons can be requested to return.

2. Value Added Tax and Sales Tax on Luxury Goods

can be requested again as referred to in paragraph

(1) must meet the requirements:

(a) Value Added Tax Value is at least Rp. 500,000

(five hundred thousand rupiahs) and can be ad-

justed to Government Regulations.

(b) Purchases of taxable goods are carried out

within 1 (one) month prior to departure outside

the Customs Area.

(c) All tax invoices fulfill the conditions referred to

in article 13 (5), except in the Taxpayer Number

column and the buyer’s address filled with the

passport number and complete address in the

country that issued the passport for sale to the

person who has a NPWP.

3. The return of Value Added Tax (PPN) and Sales

Tax on Luxury Goods (PPnBM) as referred to

in paragraph (1) shall be carried out when the

foreign passport holder person leaves Indonesia

and is submitted to the Director General of Taxes

through the Office of the Director General of

Taxes in the city air determined by the Minister

of Finance.

4. Documents that must be shown when re-

requesting Value Added Tax and Sales Tax on

Luxury goods

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

294

5. Provisions concerning the procedure for submit-

ting and completing a return request for VAT

and Sales Tax on Luxury Goods as referred to

in paragraph (1) shall be regulated by or based

on the Minister of Finance Regulation, Since 1

April 2010, for Private Foreign Passport Hold-

ers (hereinafter termed Tourist Foreign or Foreign

Tourists who shop for goods subject to VAT (Tax-

able Goods) in the Customs Area, if the goods are

brought back to their home countries (out of the

Customs Area), then the VAT paid at the time of

purchase of the goods can be requested (termed as

Value Added Tax Refund).

2.3 Payment & Tax Return System by

Tourists

Based on the journal that the author got from the au-

thor, Aditya Putra Pramana (2016), said the statement

that in Law Number 42 of 2009 concerning Value

Added Tax, it is regulated a new thing about the provi-

sion of restitution of Value Added Tax (PPN) for for-

eign tourists for the VAT already paid for the purchase

of taxable goods that will be taken outside Indonesia.

This provision is regulated in Article 16E paragraph

(1) to paragraph (5). This provision is a reflection of

the principle of destination, that VAT is imposed at

the destination of goods or services to be consumed.

Therefore the Directorate General of Taxes as the ex-

ecutor of policy in the field of taxation made the Di-

rectorate General of Tax Regulation Number PER-20

/ PJ / 2010 which on April 1, 2010 began to estab-

lish regulations on Value Added Tax (VAT Refund)

services in Indonesia.

3 RESEARCH METHODOLOGY

A. Data Analysis Techniques

Data analysis in this study uses groove model

analysis techniques. The steps in the data analy-

sis model flow according to Miles and Huberman

(2012: 15-19), are as follows:

(1) Data Collection

Data collection is to collect data at the re-

search location by conducting observations, in-

terviews, and documentation by determining

the data collection strategy that is deemed ap-

propriate and to determine the focus and depth

of data in the next data collection process. The

author uses the In-depth interview method in

the interview to get more in-depth data from the

speakers.

(2) Data Reduction / Data Reduction

According to Sugiyono (2016: 338) The data

obtained from the field is quite a lot, for that

it needs to be carefully and in detail. Thus the

data obtained is then reduced will give a clear

picture, and will make it easier for researchers

to conduct further data collection, and look for

it if needed. Data taken and taken through the

results of interviews by informants.

(3) Presentation of Data / Data Display

After the data has been reduced, the next step

is to present the data namely the assembly of

information organizations that allow research

to be carried out. In presenting data, vari-

ous types, networks, activities or tables are ob-

tained.

(4) Draw Conclusions / Conclusion drawing

Withdrawal of conclusions, namely in collect-

ing data, researchers must understand and be

responsive to something that is directly exam-

ined in the field by arranging patterns of direc-

tion and causation. According to Miles and Hu-

berman in Sugiyono (2016: 337) suggests that

in data analysts in qualitative research is carried

out at the time of data collection takes place,

and after completion of data collection in a cer-

tain period.

B. Flow Models and Components in Data Analysis

Figure 1: Flow of Data Analysis.

C. Testing of Data Validity

The validity of the data in the study is often only

emphasized on the validity and reliability test. In

qualitative research, findings or data can be de-

clared valid if there is no difference between what

the researcher reported and what actually hap-

pened only to the object under study. According

to Sugiyono (2012: 270), the validity of the data

in qualitative research includes credibility tests

(internal validity), transferability (external valid-

ity), dependability (reliability), and confirmation

(objectivity).

International Relevancy of Tax Return in Indonesian Tourists Context, International Duty Free Facility, and Regulation of Indonesian

Customs Duty on Tax Payment and Return Systems

295

4 RESULT AND DISCUSSION

A. Object of Research

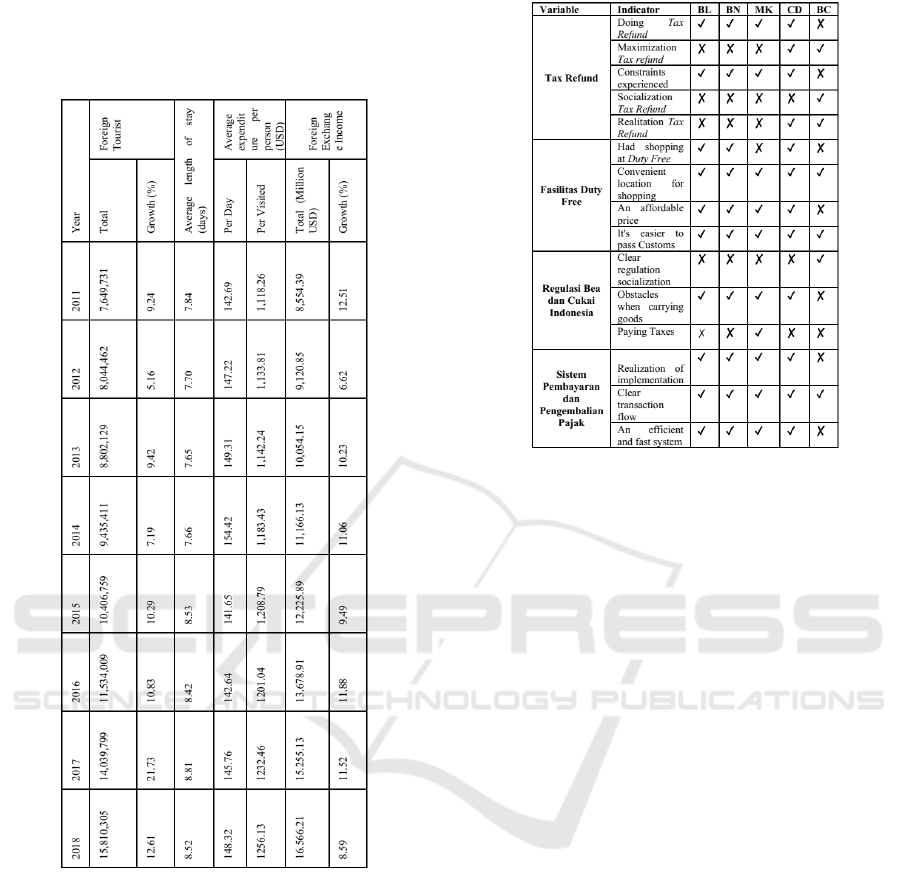

Figure 2: Data on foreign tourists to Indonesia from 2011-

2015

B. Triangulated Data

Source : Author 2018

Information :

5 Responden : BL : Respondents who like travel-

ing

BN : Respondents who like traveling

MK: Respondents who like traveling

CD : Tour Guide

BC : Head of Customs and Excise Information

Service Subsection

The four respondents showed the same answer

about having done a Tax Refund in the country they

had visited. They do this because they remember that

Figure 3: Triangulated Data

the shopping transactions that they spend are quite

large and the taxes returned will be large too, which

makes the four respondents interested in doing it ev-

ery time they shop abroad. Comparing with the im-

plementation and realization of Tax Refunds in In-

donesia, according to them in Indonesia it is still lack-

ing, because they believe that in every country it must

have the Tax Refund facility but how it is practiced

in the field. They still don’t know where the Tax Re-

funds are located at Indonesian airports compared to

the countries they have visited. 4 of the 1 respondents

who answered also they did a Tax Refund when their

local people told them about this facility, awareness

of the community to be able to provide adequate fa-

cilities for their tourists

Other facilities that can be enjoyed are by the exis-

tence of Duty Free International in each country, 5 re-

spondents agree that the price offered at the shopping

place is cheaper than when buying outside Duty Free

because the goods are not taxed anymore and almost

some items are offered in Duty Free are luxury items

or alcoholic beverages. Another reason 4 respondents

agreed to say that the items purchased from Duty Free

did so to easily pass customs airports

Regarding talking about facilities at the airport,

each respondent agreed that they had passed Customs

and Excise at the Airport when they left or entered a

country. The obstacles of the four respondents when

the goods they brought must be held by the Customs

and Excise without clear reasons, they argued that the

socialization of the Customs regulation was to con-

tinue to be carried out so that the people understood

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

296

it was not only approved by some people. In contrast

to the Customs Information Services Subsection Head

explained that the Socialization had been carried out

well by the government and Customs, but sometimes

the people themselves still did not want to find out

what and how these regulations could be formed and

implemented. It goes proactively to both parties so

that the regulation exists to mutually be mutually un-

derstood and obeyed.

The four respondents agreed that handling the tax

payment system was faster and wasted no time. The

four respondents did a Tax Refund and according to

their experience they carried out a tax refund system

very quickly, they hoped that the system could also

be applied in Indonesia to support the convenience of

tourists visiting and providing clear information re-

garding the flow of transactions clear where and how

the process should be done.

5 CONCLUSIONS AND

RECOMMENDATION

A. Changes to the regulations regarding passenger

luggage listed in PMK 188 regarding passenger

luggage are limited to only USD250 to USD500

as stated in PMK 203 regulations. It is hoped that

new regulations will be more useful in the future

to be understood and obeyed by the public that the

government sees great potential in the future, the

tourism sector in Indonesia will increase exports

in the country compared to imports of goods they

carry from abroad.

B. The existence of a tax refund increases interest in

shopping for tourists when going to a country. Be-

cause not infrequently the tax imposed is not com-

parable to the goods obtained. According to

C. Respondents who frequently travel abroad, they

really enjoy these facilities, with the return of the

tax refund, the returned tax can be used again to

shop for others.

D. Duty Free Shop as a shopping place that is mostly

located in the international airport, making it a

shopping center for foreign tourists when they

don’t have time to tour the country or just tran-

sit, Duty Free can build a country’s image towards

tourists who shop there.

E. Customs and Excise have carried out in accor-

dance with existing regulations with regulations

that have been made by the state to protect their

people, but there are still some individuals who

are still less assertive in dealing with the problem

of importing these goods.

In view of the 4 functions of Customs and Excise,

namely:

• Trade Facilitator: Facilitating trade country

• Indutrial Assitency: Give related assistance with

the problem of goods industry

• Revenue Collector: Tax Collector

• Comumunity Protector: Community Protection

The procurement of Tax Refunds and Duty Free

facilities in Indonesia without us realizing that it has

a great advantage for the development of the coun-

try of Indonesia through increased demand for goods

and the interest of tourists to visit Indonesia, this can

be used as a means of income for Indonesia in the

tourism sector Suggestion :

A. The VAT Refund counter is currently considered

far from comfortable in Indonesia because it is

too small, narrow, and difficult to find its location,

making airport visitors reluctant to visit, they do

not know where the VAT Refund counter is, so

the airport / the government can improve facili-

ties that are considered to be lacking because this

affects the level of service that is not optimal so

that tourists are reluctant to do VAT Refunds, so

Indonesia has the potential to lose the opportunity

to provide good facilities and tourist buying inter-

est may decrease due to tax returns they did not.

B. High-quality goods such as luxury goods that

have a well-known brand with cheaper offers can

be obtained at Duty Free (for example, bags,

watches, clothes, shoes), because at Duty Free

tourists can shop luxury goods without being

taxed , hence the importance of developing this

facility so that it is increasingly spread out in var-

ious international airports which become tourist

transit centers to Indonesia.

C. In this new year, airlines are also competing

to offer low-priced packages for tours abroad.

And travel abroad has become one of the needs

for some people to spend their vacation time.

Dissemination of information and dissemination

through tourism parties such as tour parties, air-

port tags, or collaborating with small SMEs to of-

fer goods at affordable prices to the most expen-

sive.

D. Regulations that are not complicated in their han-

dling and clarity of regulations so that the people

themselves can obey them and tourists who come

can be more aware of the existing regulatory tags

to avoid violations.

International Relevancy of Tax Return in Indonesian Tourists Context, International Duty Free Facility, and Regulation of Indonesian

Customs Duty on Tax Payment and Return Systems

297

6 IMPLICATIONS

A. Research Implications

– Theoretical implications The contribution of this

research is based on empirical studies, which

come from the formulation of the problems that

have been prepared. Through the formulation

of the problems that researchers have collated,

there are phenomena regarding the development

of tourism in Indonesia.

In the study, the researchers found several variable

relationships including Tax Refunds, Duty Free

International, Customs and Excise Regulations on

the Tax return and payment system, with the fol-

lowing explanation:

A. Tax Refund

According to the journal presented by (Pra-

mana et al., 2016), ”The application of VAT

Refund is closely related to Indonesian tourism,

because according to Law Number 42 of 2009

article 16E paragraph 1 and Regulation of the

Directorate General of Taxes Number PER-28

/ PJ / 2013 Article 1 paragraph 1 states that the

target recipient of this VAT Refund service is

an individual who is a foreign passport holder

and the majority of foreign passport holders

are foreign tourists who come to Indonesia to

travel. ”In the study found 3 out of 4 respon-

dents who used to travel frequently Overseas,

we don’t know about the Tax refund in Indone-

sia, where we are, while we as hosts don’t know

about this facility, especially foreign tourists or

tourists when visiting Indonesia. According to

Aditya, he explained that ”Many Indonesians

are still foreign to the VAT Refund program,

but in other countries this program has been im-

plemented for a long time, Indonesia has only

implemented this program for 5 years since it

was first implemented on April 1, 2010, the first

place implementing this is Soekarno Hatta In-

ternational Airport and I International Airport

”

B. Duty Free International

According to Anwar Zaib in the journal he cited

(2013)(Anwar and Utama, 2014), ”The inter-

relationship between shopping and tourism has

resulted in the rising number of travelers and

the increasing amount of shops and sales. ”It

is said that tourism is closely related to shop-

ping for demand for goods to meet the needs

of visiting tourists. In this study it was found

that Duty Free in Indonesia was still lacking

in knowing and the items offered were limited,

only a few items were traded. When compared

to the South Korean countries they strongly en-

courage Duty Free as a tourist place, and al-

most all tourists visit to come to their Duty Free

by offering cheap prices with good brands from

their country (cosmetics).

C. Customs and Excise Regulations

According to the respondents, the researchers

interviewed related to legal treatment in the

event of a violation in carrying excess goods in

a country, contained in an article compiled by

the following countries, ”PMK-182, continued

in PMK-188, and the latest PMK, PMK-203,

concerning provisions on the export and import

of goods carried by passengers and transporta-

tion equipment. Before I explain it, the con-

cept; the concept starts from the Basic Law - the

constitution -, Law (UU) no. 17, 2006. That is,

changes to the law no. 10 of 1995; especially in

article 2 paragraph 1, which states that: goods

entered into the customs area are treated as im-

ported goods and are subject to import duties.

So all goods entered into from abroad are stated

to be payable by import duty. Including items

carried by passengers. Which in 2018 revised

new regulations in PMK-201 which stated that

passenger luggage became USB500 which was

previously from USD250 per individual. How-

ever, in this study, it was found that respondents

who interviewed researchers brought the excess

content of individuals to their respective rea-

sons.

D. Payment and Tax Return System

According to Probir (Roy et al., 2015) in his

journal said, ”Among direct taxes, income tax

is the main sources of revenue. ”The more a

taxpayer earns the tax that is one of the biggest

income in getting it through various sectors

in a country, because it becomes However, in

this study it was found that there were difficul-

ties when someone wanted to pay taxes, reg-

ulations that were too complicated and some-

times unclear made someone confused where

and when this was implemented, and not only

about money. per year makes someone more

creative think again to simplify the system to

make it easier and effective, as stated again in

the findings in the journal Probir Roy (2015)

mentioning, ”Smart and efficient tax and VAT

systems are now obvious need for healthy fi-

nancial situation” system online for tax and

VAT payments.

– Practical implications

Some of these studies are summarized in the re-

sults of the research in the form of the points be-

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

298

low:

A. Tax Refund

The provision of Tax refunds that are more

spread throughout the airport, especially in the

International Airport because this is a facility

that can be given to tourists visiting Indone-

sia that the ease in offering existing facilities is

easy to do without a complicated system. Make

Tax refund as a facility that can support tourism

in Indonesia with more attractive offers and try

to make people aware to be able to help develop

these facilities in various places in Indonesia.

B. Duty Free International

Duty Free International, which is usually al-

ways on the airport, can be developed outside

the airport, adding more value to every item

sold, Duty Free is one of the tourist destinations

when it cannot get out of the airport because it

only transits between countries, building a good

image for tourists for our country that’s very

important. Cooperate with SMEs to develop

what they want to offer to foreign tourists to

increase exports of goods from Indonesia when

they bring them back to their countries.

C. Customs and Excise Regulations

The existence of applicable regulations some-

times does not make people aware of the impor-

tance of this. Customs and Excise has worked

as much as possible in order to implement the

regulations that can be implemented properly

in accordance with practice in the field. Social-

ization to the public was more informed in each

airport that the Customs and Excise had a rea-

son why every item carried by passengers had

certain limitations. Not infrequently this still

makes people confused

D. Payment and Tax Return System

Payment systems that are faster and more ef-

ficient in terms of time, a convoluted process

that is expected by the community. Human Re-

source Development also must be more respon-

sive in handling in their field, because this is

related to foreign tourists, and all submissions

must be correct to avoid the existence of miss-

comunication, not to mention discussing taxes,

then closely related to money (foreign currency

)

7 LIMITATION

This research is limited to the service quality in partic-

ular public hospital with 202 respondents. Suggestion

for future research is to analyze and compare service

quality in more than one hospital, especially in pri-

vate hospitals. Find more respondents with various

backgrounds. Most respondents in this study chose

the hospital because this hospital because it is free of

charge and they get recomendation letter from their

nearest health care.

REFERENCES

Anwar, S. and Utama, W. (2014). Konsep teoretik

toko bebas bea (duty free shop) dan pengawasannya.

Widyaiswara Utama Pusdiklat Bea dan Cukai.

Nizar, M. A. et al. (2013). Pengaruh pariwisata ter-

hadap perdagangan internasional di indonesia [effect

of tourism on international trade in indonesia]. Tech-

nical report, University Library of Munich, Germany.

Pramana, A. P., Al Musadieq, M., and Agusti, R. R. (2016).

Analisis pelaksanaan pengembalian ppn untuk turis

asing (vat refund). Jurnal Mahasiswa Perpajakan,

9(1).

Roy, P., Jobaer, S., and Sultana, N. (2015). Automation of

electronics tax & vat collection. system, 40(40).

International Relevancy of Tax Return in Indonesian Tourists Context, International Duty Free Facility, and Regulation of Indonesian

Customs Duty on Tax Payment and Return Systems

299