Assets Quality and Capital as Risk and Profitability Determinants in

Banking Industry

Ifdah Faizah

1

and Dian Imanina Burhany

1

1

Post Graduate Program of Islamic Finance and Banking, State Polytechnic of Bandung, Indonesia

Keywords:

banking industry, asset quality, capital, risk, profitability.

Abstract:

Assets quality and capital in Indonesian banking industry have increased every year. However, this increase is

not accompanied by an increase in profitability. Although the determinant of unstable profitability is not easy

to predict, the quality of assets and capital are two important components in the ongoing business of banks

to deal with credit risk and to increase profitability, both in conventional and Islamic banks. This study was

conducted to determine whether assets quality and capital have an effect on credit risk and profitability in both

conventional and Islamic banks in Indonesia. The population of this study was 115 banks in Indonesia. The

research used purposive sampling technique and obtained 39 banks as samples, consisting of 29 conventional

banks and 10 Islamic banks. The data were analyzed using path analysis technique. The results show that

assets quality has a positive and significant effect on credit risk in both conventional and Islamic banks. On

the other hand, capital has no effect on credit risk in both types of banks. Assets quality has a positive and

significant effect on profitability in conventional banks, but has a negative effect on Islamic banks. Capital has

a positive and significant effect on profitability in conventional banks. Meanwhile, credit risk has a negative

and significant effect on profitability in both banks.

1 INTRODUCTION

The banking industry in Indonesia uses dual bank-

ing system, which are conventional banks and Is-

lamic ones. Indonesian banking industry gradually

grows year by year. As of December 2017 there were

102 conventional banks and 13 Islamic banks with

a total of 32,285 offices spread throughout Indone-

sia (Keuangan, 2017). The growth in the number of

banks and offices has a positive impact on the per-

formance of banks in providing financial services to

public and influencingthe growth of their assets and

capital. Total assets and capital in both conventional

and Islamic banks have increased every year. How-

ever, there is still a large gap in total assets and capital

between these two kinds of banks.

Maintaining the assets quality of a bank is very

important to keep the continuity of its business. Based

on the Indonesian Banking Booklet, in order to main-

tain its business, a bank must manage credit risk expo-

sure at an adequate level, among others, by maintain-

ing the assets quality (Keuangan, 2016). Similarly, in

running its business as an intermediary, a bank must

always be prepared to face the risk of loss. With the

existing capital, the bank will be able to absorb losses

that may arise in the future (Siamat, 2005). In ad-

dition, adequate amount of bank capital is needed to

improve resilience and efficiency in the recovery pe-

riod due to banking crisis (Latumaerissa, 1999).

As an intermediary, the conventional and Islamic

banks still rely on credit or financing as the main in-

come in running their businesses. Distributing credit

is their most important activity in generating profits,

but the biggest risk in banks also comes from the pro-

vision of credit (Firmansyah, 2014). Credit risk is one

of the bank’s business risks resulting from uncertainty

in the return or the non-repayment of credit given

by the bank to the debtor (Siahaan and Asandimitra,

2018). High credit risk will worsen the quality of the

bank credit, which will increase the number of non-

performing loans and cause losses.

Both conventional and Islamic banks are estab-

lished to make profit. The amount of profit is one

of the important things for the banking industry. The

role of banks as intermediary institutions requires

them to maintain investors’ trust, whose funds are

managed by the banks (Indonesia, 2013). Profitabil-

ity is one of the most appropriate indicators to mea-

sure the performance of a company because the higher

the profit generated, the better the company’s finan-

198

Faizah, I. and Burhany, D.

Assets Quality and Capital as Risk and Profitability Determinants in Banking Industry.

DOI: 10.5220/0009867201980204

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 198-204

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

cial performance (Sholihah and Sriyana, 2013). Bank

Indonesia as the supervisor of banks in Indonesia pri-

oritizes the value of profitability of a bank as mea-

sured by assets or what is known as ROA (return on

assets) which mostly come from public savings funds

(Kasmir, 2005). The greater the ROA of a bank shows

the success of management in generating profits and

the bank can be included in the healthy category if it

has a minimum ROA ratio of 1.5% (No, ).

Based on the publication of Indonesian banking

statistics, there was a fluctuation on the profitability of

conventional and Islamic banks in the period of 2010-

2017 measured using Return On Assets (ROA). A sig-

nificant decline occurred in Islamic banks in 2015,

which amounted to 2.29% and touched the value of

-1.38%. The conventional banks also experienced a

decline in 2016 but not as big as the Islamic banks. It

amounted to 0.79%. In 2016 the Islamic banks began

to rise again with an increase in ROA of 0.24% and

this number continued to increase until 2017.

The determinants of unstable profitability in con-

ventional and Islamic banks are not easy to predict.

The different principles between these two types of

banks cannot determine whether they have similar de-

terminants. However, from the similarities of activ-

ities carried out, such as collecting and channeling

funds, it can be assumed that there are no different

determinants of profitability between these two types

of banks (Zarrouk et al., 2016). In addition to in-

creasing profitability, managing risk efficiently is also

important to maintain the bank stability. These two

important objectives of managing risk efficiently and

increasing profitability will help management to man-

age risk and increase profitability (Trabelsi and Trad,

2017). The study of credit risk management has at-

tracted the attention of many, investigating the factors

that encourage credit risk in the banking industry is

not only important for bank management but also for

the government (Misman et al., 2015). Taking into

consideration research gap, the study was conducted

in order to determine whether the quality of assets and

capital determine or influence the risk and profitabil-

ity of the banking industry, both conventional and Is-

lamic banks.

2 LITERATURE REVIEW

Performance is how well a company can achieve the

economic goals, while the purpose of the economy is

to maximize economic welfare (Sukarno and Syaichu,

2006). Good bank performance is characterized by a

high level of profitability (Kuncoro et al., 2002). The

most appropriate measure of banking performance is

to measure the ability of banks to generate profits

from various activities they do, as in general the pur-

pose of a company is to achieve high values in which

it has to be able to efficiently and effectively manage

various types of activities (Syofyan, 2003). A bank

performance can be measured by analyzing the finan-

cial aspects, one of which is profitability (Mardiyanto,

2009). Profitability ratio is used to measure a bank’s

ability to generate profits. Therefore, higher prof-

itability ratio is always associated with better perfor-

mance (Trabelsi and Trad, 2017).

2.1 The Effect of Asset Quality on

Credit / Financing Risk

The results of (Trad et al., 2017) research cannot find

a significant relationship between these two compo-

nents. However, (Fitrianto and Mawardi, 2006) stated

that the assessment of asset quality is conducted to see

the condition of bank assets to face the risk of loss by

maintaining the quality of its productive assets. The

same thing happens in the study of (Ariyanti, 2010)

who explained that productive assets means placing

the bank funds to reach the expected level of income

and allow risk. Therefore, observations and analy-

ses should be carried out to see how asset quality

affects the credit risk. So, asset quality influences

credit/financing risk. Based on this explanation, the

following hypothesis can be developed:

Hypothesis 1: Asset quality influences

credit/financing risk

2.2 The Effect of Capital on Credit /

Financing Risk

The stipulation of capital is intended so that banks

have sufficient capital to reduce the possibility of risk

arising as a result of the development of asset expan-

sion, especially the assets that are categorized as prof-

itable and at the same time risky (Pamungkas, 2016).

Capital refers to the amount of available funds owned

by a bank to support its business and it is expected

to be a safeguard if there is a loss (Athanasoglou

et al., 2008). Adequate amount of capital becomes

a safeguard to deal with unexpected losses and inci-

dent (Trad et al., 2017). Research on capital aspects

shows whether it will be able to absorb bank losses as

a result of investing funds or decreasing assets in the

future (Muljono, 1986). Bank capital is the main in-

dicator in reducing credit risk in Islamic banks (Trad

et al., 2017). The research conducted by (Trabelsi

and Trad, 2017) states that capital is negatively and

significantly correlated with credit risk because ade-

quate amount of capital will provide better protection

Assets Quality and Capital as Risk and Profitability Determinants in Banking Industry

199

against the banking crisis. Based on this explanation,

the following hypothesis can be developed:

Hypothesis 2: Capital has a negative effect on

credit/financing risk

2.3 The Effect of Asset Quality on

Profitability

Asset quality is a comparison between classified as-

sets (substandard credit, doubtful credit, bad credit)

and the total credit provided (Siahaan and Asandim-

itra, 2018). The assessment of asset quality can re-

flect the ability of bank management in managing its

productive assets. The placement of bank fund in

the form of productive assets aims to achieve the ex-

pected level of income (Ariyanti, 2010). However, in

a bank research in Malaysia, asset quality has a nega-

tive effect on profitability (Wasiuzzaman and Tarmizi,

2010) (Mun and Thaker, 2016). It also occurs in 94

Islamic banks operating in 18 countries (Trabelsi and

Trad, 2017). Asset quality negatively affects the prof-

itability of banks in Indonesia (Siahaan and Asandim-

itra, 2018). However, different things happen to 51

banks operating in MENA where profitability is pos-

itively affected by the asset quality (Zarrouk et al.,

2016). Based on this explanation, the following hy-

pothesis can be developed:

Hypothesis 3: Asset quality has a negative effect

on profitability.

2.4 The Effect of Capital on

Profitability

Adequate amount of capital becomes the safeguard

and guarantees bank profitability and stability (Trad

et al., 2017). Capital refers to the amount of avail-

able funds owned by a bank to support the its busi-

ness (Athanasoglou et al., 2008). The higher the bank

capital, the lower the need for external funding and

therefore it will increase profitability (Wasiuzzaman

and Tarmizi, 2010). On the other hand, low capital

of a bank causes a decrease in public trust which in

turn can reduce profitability (Sukarno and Syaichu,

2006). Bank capital has a positive and significant in-

fluence on the profitability of domestic banks in the

UK (Kosmidou et al., 2005), 96 Islamic banks oper-

ating in 18 countries (Trad et al., 2017), and Islamic

as well as conventional banks in Malaysia (Mun and

Thaker, 2016). The same thing happens in the study

of (Zarrouk et al., 2016) which shows that profitabil-

ity is positively influenced by the bank’s capital level,

because the higher the capital, the lower the external

funding needed and therefore the higher the profitabil-

ity. However, different thing happens to Islamic banks

in Malaysia, where capital has a negative influence on

bank profitability (Wasiuzzaman and Tarmizi, 2010).

Based on this explanation, the following hypothesis

can be developed:

Hypothesis 4: Capital has a positive effect on

profitability.

2.5 The Effect of Credit / Financing

Risk on Profitability

Credit risk arises from the inability of the borrow-

ers to fulfill the obligation (Fayed, 2013). Problem-

atic financing results in the loss of the opportunity

to earn income from the financing provided so that

it affects earnings and adversely affects ROA (Pa-

mungkas, 2016). Credit risk has a negative impact on

the profitability of Islamic banks in Indonesia (Dodi

et al., ) and 78 Islamic banks in 12 MENA coun-

tries and Pakistan (Trad et al., 2017). Research by

(Ali et al., 2011) states that credit risk also has a

negative influence on profitability as measured by re-

turns on assets and returns on equity. The higher the

credit risk, the higher the bank’s capacity to absorb

loan losses (Fayed, 2013).It will give impact on bank

productivity and negatively effect bank profitability.

Based on this explanation, the following hypothesis

can be developed:

Hypothesis 5: Credit/financing risk has a negative

effect on profitability.

3 RESEARCH METHOD

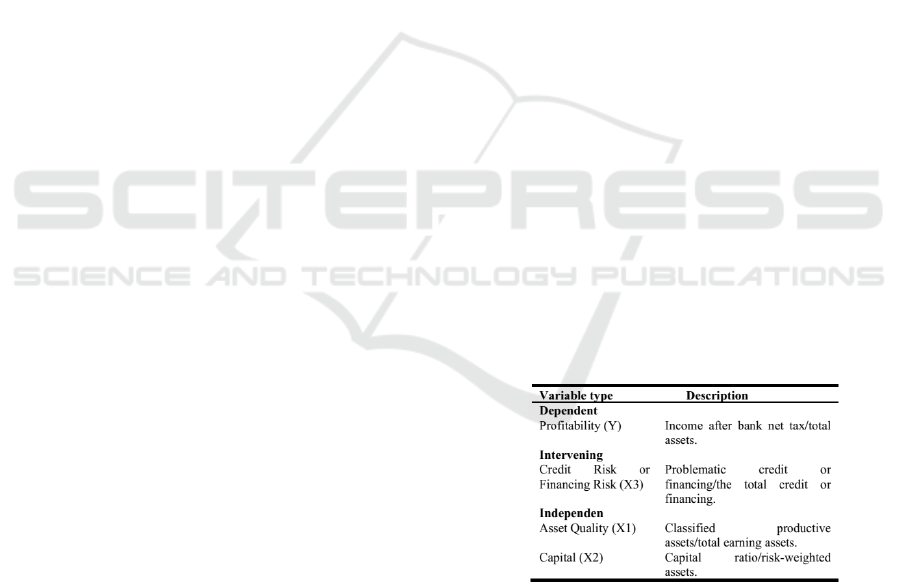

Figure 1: Operationalization of Research Variables.

The population in this study was 115 banks in In-

donesia, consisting of 103 conventional banks and

12 Islamic banks. This study used purposive sam-

pling technique with the following criteria: (1) banks

that regularly publish complete annual financial state-

mentsas of December 31, 2010 until December 31,

2017; and (2) conventional banks listed on the In-

donesia Stock Exchange (IDX) no later than Decem-

ber 31, 2010 and recorded until December 31, 2017.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

200

Based on these criteria, a sample of 39 banking in-

dustries was obtained consisting of 29 conventional

banks and 10 Islamic banks. Thus, the total observa-

tion of all research samples were 312 observations ob-

tained from 39 banks multiplied by 8 years of obser-

vation. The explanation of the variables is explained

in Figure 1 Operationalization of Research Variables.

This research used regression equation model in han-

dling panel data, namely Pooled Regression Model

(Command Effect). This model assumes that the in-

tercept and regression coefficient (slope) are constant

for all companies over the period of time (years) an-

alyzed. The data were analyzed using path analysis.

This study used random procurement method, namely

the PLS SEM method. Therefore, the assumption of

normality will not be a problem and PLS does not re-

quire a minimum number of samples. PLS is a multi-

variate statistical technique that can handle many in-

dependent variables, even if multicollinearity occurs

between these variables. The program used as a tool

is the WarpPLS 6.0 program.

4 RESULT

A structure model is said to be fit if supported by em-

pirical data. Goodness of fit test results using Warp-

PLS 6.0 based on WarpPLS User Manual: Version 6.0

obtained the following data in Figure 2.

Figure 2 shows that almost all indicators mea-

suring the adequacy of models in both conventional

and Islamic banks state that the model is fit. There

are only four indicators of model adequacy stating

that the model is not fit in conventional banks, which

are Average VIF block, Average full collinearity VIF,

Sympson’s paradox ratio, and R-squared contribution

ratio. Whereas, in Islamic banks there are only three

indicators of model adequacy which state the same,

which are Average block VIF, Average full collinear-

ity VIF and Nonlinear bivariate causality direction ra-

tio. Thus, it can be concluded that the model formed

matches the empirical data and can be used for further

discussion.

Figure 2: Analysis of the Goodness of Fit Model.

4.1 Hypothesis Testing

Complete results of hypotheses testing can be seen

below.

Figure 3: Path Analysis Results.

Based on Figure 3, the results of hypothesis test-

ing can be explained as follows:

1. Hypothesis 1

The test result on the effect of asset quality on

credit risk in conventional banks shows a coeffi-

cient of 0.98 and significance of < 0.01. Whereas

in Islamic banks, the test result shows a coeffi-

cient of 0.99 and significance of < 0.01. It means

that H1 is accepted; asset quality has a positive

and significant effect on credit risk in both con-

ventional and Islamic banks.

2. Hypothesis 2

The test result of the effect of capital on credit risk

in conventional banks shows a coefficient of 0.02

and a significance of 0.37. Whereas in Islamic

banks, the test result shows a coefficient of -0.00

and a significance of 0.50. So, it means H2 is re-

jected; the capital has no impact on credit risk in

both conventional and Islamic banks.

3. Hypothesis 3

The test result of the effect of asset quality on

profitability in conventional banks shows a co-

efficient of 0.49 and a significance of < 0.01.

Whereas in Islamic banks, the test result shows

a coefficient of -0.58 and a significance of < 0.01.

It means that H3 is rejected in conventional banks

and H3 is accapted in Islamic banks. Asset quality

has a positive and significant effect on the prof-

itability of conventional banks while in Islamic

banks it has a negative and significant effect.

4. Hypothesis 4

The test result of the effect of capital on profitabil-

ity in conventional banks shows a coefficient of

0.19 and a significance of < 0.01. Whereas in Is-

lamic banks, the result shows a coefficient of 0.13

and a significance of 0.11. Capital has a positive

and significant effect on the profitability of con-

ventional banks. It means that H4 is accapted in

conventional banks and H4 is rejected in Islamic

banks.

5. Hypothesis 5

The test result of the effect of credit risk on prof-

itability in conventional banks shows a coefficient

Assets Quality and Capital as Risk and Profitability Determinants in Banking Industry

201

of -1.14 with a significance of < 0.01. As for Is-

lamic banks, the result shows a coefficient of -0.30

with a significance of < 0.01. It means that H5

is accepted; credit risk has a negative effect on

the profitability of both conventional and Islamic

banks.

4.2 Discussion

The test result on the effect of asset quality on credit

risk in conventional banks shows a coefficient of 0.98

and significance of < 0.01. Whereas in Islamic banks,

the test result shows a coefficient of 0.99 and signifi-

cance of < 0.01. It means that H1 is accepted; asset

quality has a positive and significant effect on credit

risk in both conventional and Islamic banks. The re-

sults of this study are not in accordance with (Trad

et al., 2017) but in line with the theory put forward

by (Fitrianto and Mawardi, 2006) who stated that the

assessment of asset quality is conducted to see the

condition of bank assets to face the risk of loss by

maintaining the quality of its productive assets. Ac-

cordingly with (Ariyanti, 2010) who stated that most

of the fund placements in productive assets are in the

form of loans which may cause risk. The higher the

placement of funds in productive assets, the bigger

chance to increase credit risk. Therefore, it is still im-

portant for banks to maintain asset quality in order to

reduce credit risk.

The test result of the effect of capital on credit risk

in conventional banks shows a coefficient of 0.02 and

a significance of 0.37. Whereas in Islamic banks, the

test result shows a coefficient of -0.00 and a signifi-

cance of 0.50. So, it means H2 is rejected; the capital

has no impact on credit risk in both conventional and

Islamic banks. The results of this study indicate that

conventional and Islamic banks capital are not used

for risk-bearing loans. It is confirmed by (Ismail et al.,

2018) who states that capital is used to support assets

that contain or cause risks such as financing. Thus,

banks have the freedom to use capital because it will

not affect their credit risk.

The test result of the effect of asset quality on

profitability in conventional banks shows a coefficient

of 0.49 and a significance of < 0.01. Whereas in

Islamic banks, the test result shows a coefficient of

-0.58 and a significance of < 0.01. Asset quality

has a positive and significant effect on the profitabil-

ity of conventional banks while in Islamic banks it

has a negative and significant effect. It shows that

conventional banks are far better at managing asset

quality. This result is in accordance with (Zarrouk

et al., 2016). Meanwhile, Islamic banks must focus

more on credit risk, because if the improvement on

asset qualityis not accompanied with good manage-

ment on credit risk, it will increase costs and reduce

bank profitability (Wasiuzzaman and Tarmizi, 2010).

The results are in accordance with (Wasiuzzaman and

Tarmizi, 2010), (Mun and Thaker, 2016), (Siahaan

and Asandimitra, 2018).

The test result of the effect of capital on profitabil-

ity in conventional banks shows a coefficient of 0.19

and a significance of ¡0.01. Whereas in Islamic banks,

the result shows a coefficient of 0.13 and a signifi-

cance of 0.11. Capital has a positive and significant

effect on the profitability of conventional banks. It is

in accordance with (Trad et al., 2017) (Akhtar et al.,

2011), (Zarrouk et al., 2016). Meanwhile in Islamic

banks, capital does not have a significant effect on

profitability and it is in accordance with (Akhtar et al.,

2011). Capital condition in Islamic banks during the

eight years of observation was very good, which av-

eraged 25.19%. This condition reflects that Islamic

banks rely more on financing as a source of income

and do not use the potential of capital to increase prof-

itability (Hutagalung et al., 2013). This statement is

reinforced by (Sangmi and Nazir, 2010) in their re-

search in banks in India which shows that high capital

indicates that the bank is conservative and does not

use all potential capital. It also shows that Islamic

banks are lack of product development by using ex-

isting capital to obtain profitability.

The test result of the effect of credit risk on prof-

itability in conventional banks shows a coefficient of

-1.14 with a significance of < 0.01. As for Islamic

banks, the result shows a coefficient of -0.30 with a

significance of < 0.01. It means that H5 is accepted;

credit risk has a negative effect on the profitability of

both conventional and Islamic banks. The results of

this study are in accordance with(Dodi et al., ), (Ali

et al., 2011) (Trad et al., 2017). The higher the credit

risk, the higher the bank’s capacity to absorb loan

losses (Fayed, 2013). It will give impact on bank pro-

ductivity and will have a negative effect on bank prof-

itability. Then the bank must maintain a high level of

credit risk so as to reduce profits.

The magnitude of the effect of asset quality and

capital on credit risk is 98%, while the magnitude of

the influence of asset quality, capital, and credit risk

on profitability is 40%. The magnitude of the effect of

asset quality and capital on credit risk is 98%, while

the magnitude of the influence of asset quality, capi-

tal, and credit risk on profitability is 82%. The impli-

cation of this research is the understanding that man-

aging asset quality well is very important because it

will affect credit risk. High asset quality will affect

profitability, but the it must be managed properly so as

not to cause losses. Increased asset quality is poorly

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

202

managed in Islamic banks, so it leads to a decrease

in profitability. Likewise with credit risk that must be

maintained so that it is not too high so as to reduce

profits..

5 CONCLUSION AND

LIMITATION

The main objective of this research is to find out the

impact of asset quality and capital as determinants

of credit risk and profitability in the banking indus-

try. Overall the results of this study indicate that asset

quality has a positive and significant effect on the risk

of credit or financing in both conventional and Islamic

banks. Meanwhile, capital does not have an influence

on credit or financing risk in both conventional and

Islamic banks. Asset quality has a positive and signif-

icant effect on the profitability of conventional banks.

However, in Islamic banks, it has a negative and sig-

nificant effect. Capital has a positive and significant

impact on the profitability of conventional banks but

has no influence on Islamic banks. Credit risk has a

negative and significant impact on profitability in both

conventional and Islamic banks. It is important for

the management of both types of banks to find out the

factors that influence credit or financing risk and prof-

itability in the banking industry. This research is only

limited to the banking industry listed on the Indone-

sia Stock Exchange in 2010 until 2017. It does not

involve external factors that might have influence risk

and profitability. The risks used is credit risk which is

the biggest risk of the banking industry.

REFERENCES

Akhtar, M. F., Ali, K., and Sadaqat, S. (2011). Factors influ-

encing the profitability of islamic banks of pakistan.

International Research Journal of Finance and Eco-

nomics, 66(66):1–8.

Ali, K., Akhtar, M. F., and Ahmed, H. Z. (2011).

Bank-specific and macroeconomic indicators of

profitability-empirical evidence from the commercial

banks of pakistan. International Journal of Business

and Social Science, 2(6):235–242.

Ariyanti, L. E. (2010). Analisis Pengaruh CAR, NIM, LDR,

NPL, BOPO, ROA dan Kualitas Aktiva Produktif ter-

hadap Perubahan Laba Pada Bank Umum di Indone-

sia. PhD thesis, UNIVERSITAS DIPONEGORO.

Athanasoglou, P. P., Brissimis, S. N., and Delis, M. D.

(2008). Bank-specific, industry-specific and macroe-

conomic determinants of bank profitability. Journal

of international financial Markets, Institutions and

Money, 18(2):121–136.

Dodi, D., Supiyadi, D., Arief, M., and Nugraha, N. Is-

lamic bank profitability: A study of islamic bank in

indonesia. The International Journal of Business Re-

view (The Jobs Review), 1(1):55–66.

Fayed, M. E. (2013). Comparative performance study of

conventional and islamic banking in egypt. Journal of

Applied Finance and Banking, 3(2):1.

Firmansyah, I. (2014). Determinant of non performing

loan: The case of islamic bank in indonesia. Buletin

Ekonomi Moneter dan Perbankan, 17(2):241–258.

Fitrianto, H. and Mawardi, W. (2006). Analisis pengaruh

kualitas aset, likuiditas, rentabilitas, dan efisiensi ter-

hadap rasio kecukupan modal perbankan yang terdaf-

tar di bursa efek jakarta. Jurnal Studi Manajemen Or-

ganisasi, 3(1):1–11.

Hutagalung, E. N., Ratnawati, K., et al. (2013). Analisa ra-

sio keuangan terhadap kinerja bank umum di indone-

sia. Jurnal Aplikasi Manajemen, 11(1):122–130.

Indonesia, I. B. (2013). Memahami bisnis bank. Gramedia

Pustaka Utama.

Ismail, M. et al. (2018). Manajeman Perbankan: Dari Teori

Menuju Aplikasi. Kencana.

Kasmir, S. (2005). Dasar-dasar perbankan. PT Raja-

Grafindo Persada.

Keuangan, O. J. (2016). Booklet perbankan indonesia.

Jakarta: OJK.

Keuangan, O. J. (2017). Statistik perbankan indonesia 2017.

Otoritas Jasa Keuangan, Jakarta.

Kosmidou, K., Tanna, S., and Pasiouras, F. (2005). De-

terminants of profitability of domestic uk commercial

banks: panel evidence from the period 1995-2002. In

Money Macro and Finance (MMF) Research Group

Conference, volume 45, pages 1–27.

Kuncoro, M. et al. (2002). Manajemen perbankan: Teori

dan aplikasi. Suhardjono, BPFE Yogyakarta.

Latumaerissa, J. R. (1999). Mengenal aspek-aspek operasi

bank umum. Jakarta: Bumi Aksara.

Mardiyanto, H. (2009). Intisari manajemen keuangan:

Teori. Soal dan Jawaban, Grasindo, Jakarta.

Assets Quality and Capital as Risk and Profitability Determinants in Banking Industry

203

Misman, F. N., Bhatti, I., Lou, W., Samsudin, S., and Rah-

man, N. H. A. (2015). Islamic banks credit risk: a

panel study. Procedia Economics and Finance, 31:75–

82.

Muljono, T. P. (1986). Analisa laporan keuangan untuk per-

bankan. Djambatan.

Mun, Y. L. and Thaker, H. M. T. (2016). Asset liabil-

ity management of conventional and islamic banks in

malaysia. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah,

9(1):33–52.

No, S. E. B. I. No. 9/24/dpbs tanggal 30 oktober 2007,“.

Tentang Sistem Penilaian Tingkat Kesehatan Bank

Umum berdasarkan Prinsip Syariah (http://www. bi.

go. id).

Pamungkas, L. (2016). Pengaruh permodalan, likuidi-

tas, kualitas aset terhadapprofitabilitas bank umum

syariah yang terdaftar di bank indonesia (periode

2010–2014). Jurnal Akuntansi AKUNESA, 4(2).

Sangmi, M.-u.-D. and Nazir, T. (2010). Analyzing financial

performance of commercial banks in india: Applica-

tion of camel model. Pakistan Journal of Commerce

and Social Sciences (PJCSS), 4(1):40–55.

Sholihah, N. and Sriyana, J. (2013). Profitabilitas bank

syariah pada kondisi biaya operasional tinggi. Sum-

ber, 11(24):159.

Siahaan, D. and Asandimitra, N. (2018). Pengaruh likuidi-

tas dan kualitas aset terhadap profitabilitas pada bank

umum nasional (studi pada bursa efek indonesia pe-

riode 2010-2014). BISMA (Bisnis dan Manajemen),

9(1):1–12.

Siamat, D. (2005). Manajemen lembaga keuangan edisi ke-

lima. Jakarta (ID): Lembaga Penerbit FE UI.

Sukarno, K. W. and Syaichu, M. (2006). Analisis faktor-

faktor yang mempengaruhi kinerja bank umum di

indonesia. Jurnal Studi Manajemen Organisasi,

3(2):46–58.

Syofyan, S. (2003). Keputusan go public dan hubungannya

dengan kinerja bank-bank swasta di indonesia. Jurnal

Media Riset dan Manajemen, 3(1).

Trabelsi, M. A. and Trad, N. (2017). Profitability and risk in

interest-free banking industries: a dynamic panel data

analysis. International Journal of Islamic and Middle

Eastern Finance and Management.

Trad, N., Trabelsi, M. A., and Goux, J. F. (2017). Risk

and profitability of islamic banks: A religious decep-

tion or an alternative solution? European Research on

Management and Business Economics, 23(1):40–45.

Wasiuzzaman, S. and Tarmizi, H. (2010). Profitability

of islamic banks in malaysia: an empirical analysis.

Journal of Islamic Economics, Banking and Finance,

6(4):53–68.

Zarrouk, H., Jedidia, K. B., and Moualhi, M. (2016). Is is-

lamic bank profitability driven by same forces as con-

ventional banks? International Journal of Islamic and

Middle Eastern Finance and Management.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

204