Analysis of Macroeconomics Factor Affecting Jakarta Islamic Index

Tri Wijayanti Septiarini

1

, Muhamad Rifki Taufik

2

, Mufti Afif

1

and Atika Rukminastiti Masrifah

1

1

Department of Islamic Economics, University of Darussalam Gontor, Indonesia

2

Department of Occupational, Safety and Health, University of Darussalam Gontor, Indonesia

atikamasrifah@ unida.gontor.ac.id

Keywords: Jakarta Islamic Index, Macroeconomics, Multiple Linear Regression.

Abstract: The goal of this study was to propose analyzing the influence of macroeconomics factor to Jakarta Islamic

Index. The macroeconomics factors consist of inflation, BI rate, exchange rate IDR/USD, and Gross Domestic

Product (GDP). The observation data concerned were obtained during April, 2016 to June, 2019 (in total 39

monthly observation data). The multiple linear regression model is applied to analyze the relation between

independent variable (inflation, BI rate, exchange rate IDR/USD, and Gross Domestic Product) and dependent

variable which is Jakarta Islamic Index (JII). The results explained that the independent variables are

significant except inflation.

1 INTRODUCTION

1.1 Research Background

According to (Huang et al., 2008), there are two groups

in economic theory which are microeconomics and

macroeconomics. Macroeconomics focuses on wide

combination of actions (population agents), instead of

personal behaviour (a single agent). A macroeconomic

variable is a guiding monetary, natural, or geopolitical

event that give large impact in local or national

economy. Macroeconomic factors give effect broadly

to windrows of groups, rather than selected persons.

The examples of macroeconomic factors are economic

outputs, unemployment rates, and inflation. The

governments, businesses and consumers attentively

controlled the barometer of economic

accomplishment. A macroeconomic factor contain the

trend of a particular large-scale market. For example,

fiscal policy and numerous regulations influence state

and national economies, while powerful bring about

broader international implications.

Based on (Masrizal, Mustofa and Herianingrum,

2019), Indonesia is the largest Muslim countries

which represents prospect market for expanding

sharia financial industry. Further, sharia investment

has an crucial task to enhance the Islamic finance

industry in Indonesia. Jakarta Islamic Index (JII) is

the measuring instruments of performance for Sharia

capital market in Indonesia which was established in

July 2000. According to (Sakti and Yousuf, 2013),

Jakarta Stock Exchange Islamic Index (JII) is sharia

stock market index which has companies members in

the under provisions of Islamic stocks regulated by

National Sharia Board. One of the most favored

sectors of sharia investment is to invest in stocks

belonging to the JII. The issue listed in JII conducts

its business activities that are not contrary to the

principles of sharia. Shares listed in the JII consist of

30 most liquid stocks selected from Islamic

compliance shares. According to (Sakti and Yousuf,

2013), the dynamic linkage between macroeconomic

factors and stock returns is well proposed theory in

financial economics literature. As stated in the stock

evaluation model, macroeconomic factors might have

organized relationship on stock prices especially in

influence on discounted future cash flows.

The aim of this paper is to analyse the influence

further to the Jakarta Islamic Index and

macroeconomic linkages for developing economies.

The variables included are exchange rate, inflation,

gross domestic product, and BI rate as being

important in explaining Jakarta Islamic Index. Our

analysis, hence, might be further collecting our

understanding of the Indonesian Islamic equity

market behavior and its relations with various

components of macroeconomic variables. Therefore,

this research attend to complete this gap by analyzing

the influence of macroeconomic factors toward

Islamic stock prices in Indonesia.

Septiarini, T., Taufik, M., Afif, M. and Masrifah, A.

Analysis of Macroeconomics Factor Affecting Jakarta Islamic Index.

DOI: 10.5220/0009864700002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 19-22

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

19

1.2 Objectives

The study aims at analyzing how macroeconomic

variables influence the stock markets index by using

Jakarta Islamic Index as a case study.

2 LITERATURE REVIEW

There are many methods that have been applied in

examining macroeconomic indicators to stock market

index. This section brings us to the adaptable

literature for this study which were reviewed and

based on the relevance of using any methods to

examine macroeconomic indicators to stock market

index.

According to (Ibrahim and Agbaje, 2018), it had

been examined the relationships between stock

returns (monthly data of the Nigerian Stock Exchange

and Nigerian Consumers Price Index ) and Nigeria

inflation. According to (Alam and Uddin, 2009), due

to monthly data during January 1988 to March 2003,

the study had conducted to explore the entity

efficiency of share market efficiency and represent

the relationship between stock index and interest rate

for fifteen developed and developing countries.

According to (Galí and Gambetti, 2015), VAR is

being as tool to predict the response of stock prices to

monetary policy shocks. According to (Zhao, 2010),

likelihood ratio statistic is used as tool to observe the

cross-volatility effects between foreign exchange and

stock markets. According to (Kurihara, 2006), this

paper investigates the effect macroeconomic factors

of stock prices. According to (Rjoub, Tu¨rsoy and

Gu¨nsel, 2009), the six pre-specified macroeconomic

variables which are the term structure of interest rate,

unanticipated inflation, risk premium, exchange rate

and money supply had been analyzed in this study.

3 METHODOLOGY

3.1 Data

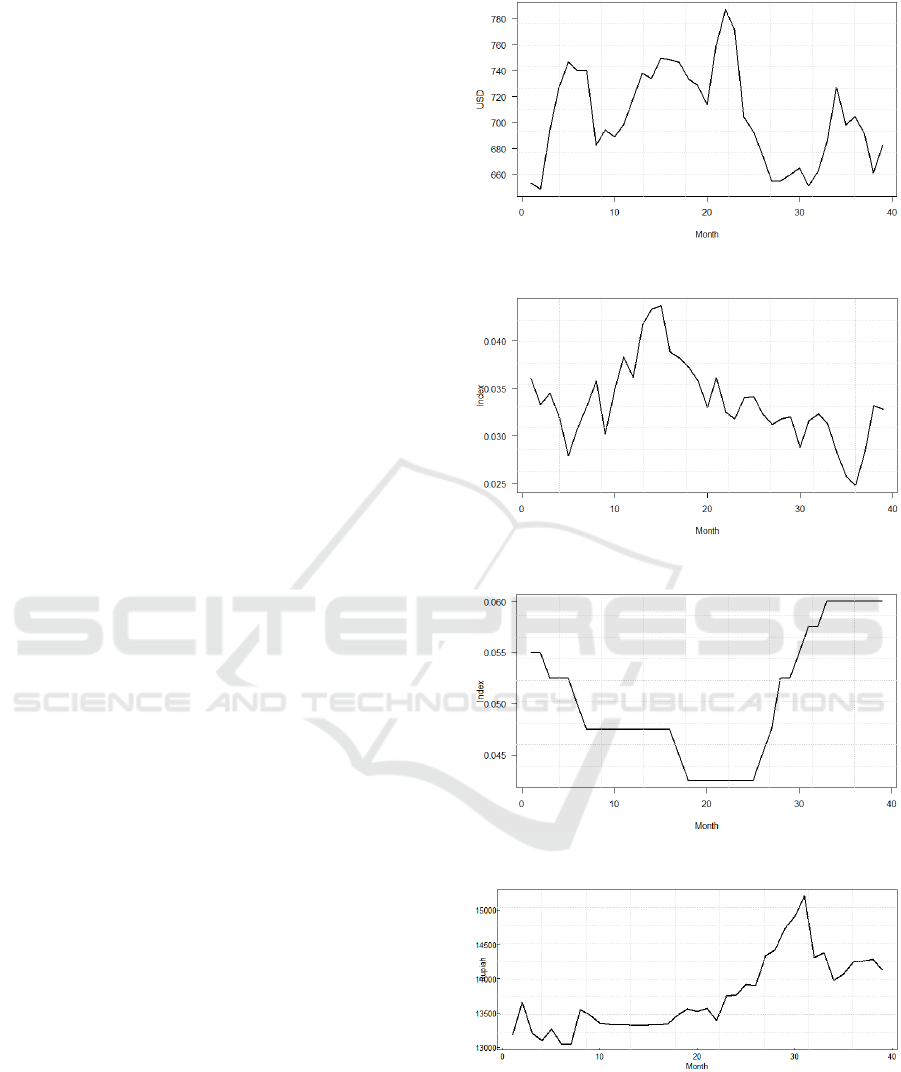

The observations data considered in this study is

contained of Jakarta Islamic Index (JII) as showed in

Figure 1, inflation as showed in Figure 2, BI rate as

showed in Figure 3, exchange rate IDR/USD as

showed in Figure 4, and Gross Domestic Product

(GDP) as showed in Figure 5. All of data are collected

during April, 2016 to June, 2019 (in total 39 monthly

observation data).

Figure 1: The Jakarta Islamic Index time series plot.

Figure 2: The inflation rate time series plot.

Figure 3: The BI rate time series plot.

Figure 4: The exchange rate IDR/USD time series plot.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

20

Figure 5: The Gross Domestic Product (GDP) time series

plot.

3.2 Method of Estimation Technique

There are various research hypotheses considered in

conditional relationship which is the effect between

single predictor with other factors. Such relations are

commonly evaluated as multiplicative interactions

and can be tested in both fixed- and random-effects

regression. The most common method for probing

interactions is to test simple slopes at specific levels

of the predictors for example multiple linear

regression.

The purpose of multiple regression is to construct

the relationship of the outcome with all of

determinants. The multiple regression equation is

constructed in equation (1) as follows

=

+

+

+⋯+

+

(1)

where,

is the outcome variable,

is the intercept,

,

,…,

are the regression coefficient in each

independent variable,

,

,…,

are independent variables

is error term.

After fitting the linear model, the normality

assumption of residuals is required for evaluating the

goodness of fit the model.

4 RESULT AND ANALYSIS

The stepwise procedure of multiple linear regression

to analyze macroeconomics factor affecting Jakarta

Islamic Index (JII) is presented as:

1. Defining the dependent and independent

variables

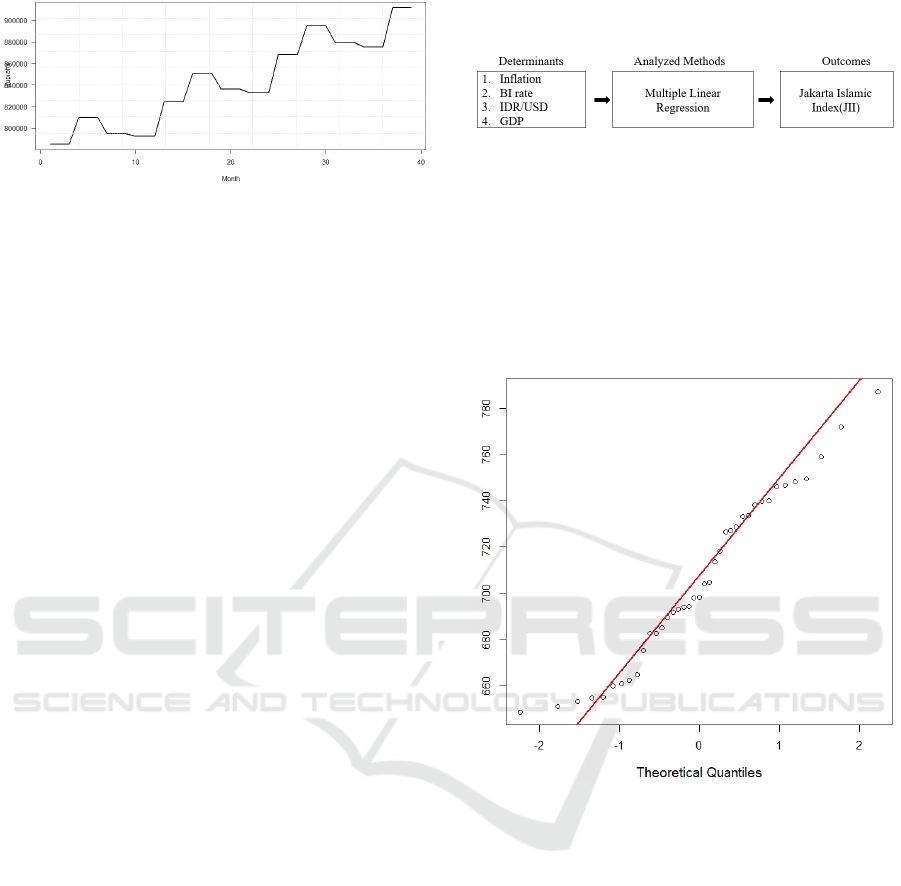

The path diagram is represented in Figure 6

which show the outcome and determinants. The

outcome is Jakarta Islamic Index (JII) and and

multiple linear regression will be used to analyze

the correlation of all determinants with Jakarta

Islamic Index (JII).

Figure 6: The study path diagram.

2. Checking the normality distribution

Multiple linear regression has assumption that

the dependent variable satisfied the normality

distribution. Saphiro-Wilk normality test can be

a tool to check the normality distribution. Since

p-value 0.1577 > 0.05, it means that the

dependent variable fulfill the assumption of

multiple linear regression.

Figure 7: The Q-Q plot.

The Q-Q plot is being as a tool to check the normality

distribution by visual. And Figure 7 shows the Q-Q

plot, the dot group follow the red line so it indicate

that the dependent variable is acceptable in normally

distribution.

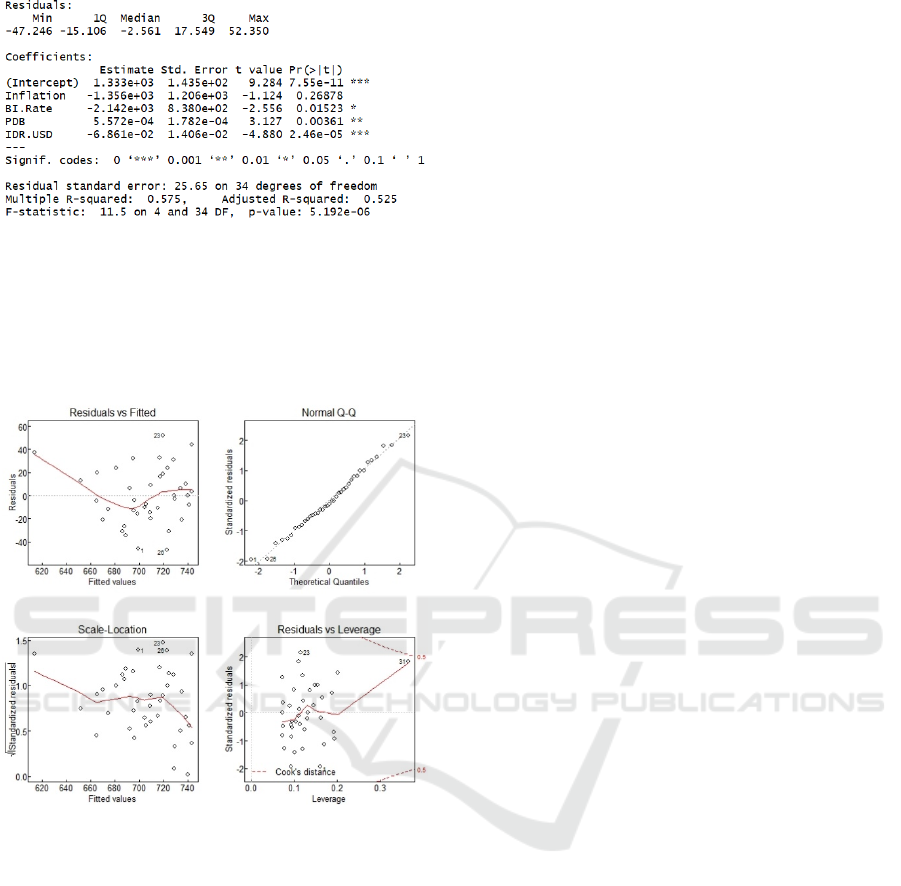

3. Building model

Multiple linear regression model of Jakarta

Islamic Index (JII) was identified using four

predictors where all were time series. The model

were able to estimate JII up to 57% with very

small p-value. Four time series data had vary

performances since three of four determinants

indicating high significances level precisely BI

rate, PDB and exchange rate. Exchange rate seem

negatively influenced JII more than others while

exchange rate increased then JII would decreased

where this effect was likely BI rate toward JII.

Contrary with PDB, it had positive impact to JII.

Analysis of Macroeconomics Factor Affecting Jakarta Islamic Index

21

Figure 8: The multiple linear regression results.

Based on model summary, the multiple linear

regression model well fitted to JII with three

significant predictors. Moreover, residual of

model was depicted in Figure 9, where residuals

fit to linear line depicted by Q-Q plot.

Figure 9: The model residuals plot.

5 CONCLUSIONS AND

RECOMMENDATION

5.1 Conclusions

The aim of this study was to analyse the influence of

macroeconomics factor to Jakarta Islamic Index. The

multiple linear regression method is applied to

analyse the relation between independent variable

(inflation, BI rate, exchange rate IDR/USD, and

Gross Domestic Product) and dependent variable

which is Jakarta Islamic Index. The results explained

that the independent variables are all significant

except inflation. It means that BI rate, exchange rate

IDR/USD, and Gross Domestic Product has

possibility to give influence on Jakarta Islamic Index.

5.2 Recommendation

In this study, it may consider the independent

variables which are inflation, BI rate, exchange rate

IDR/USD, and Gross Domestic Product. It also can

be investigated to other macroeconomics factors, for

example economic growth (index of industrial

production), oil price, etc. Nowadays, there are

various statistical which can be as tool to analyze for

example Vector Auto Regression (VAR),

multivariate co-integration, Autoregressive

Distributed Lag (ARDL), etc.

REFERENCES

Alam, M. and Uddin, M. G. S. (2009) ‘Relationship

between Interest Rate and Stock Price : Empirical

Evidence from Developed and Developing Countries

Relationship between Interest Rate and Stock Price :

Empirical Evidence from Developed and Developing

Countries’, 4(3), pp. 43–51.

Galí, J. and Gambetti, L. (2015) ‘The Effects of Monetary

Policy † on Stock Market Bubbles: Some Evidence’,

7(1), pp. 233–257.

Huang, P. et al. (2008) ‘Macroeconomics based Grid

resource allocation’, 24, pp. 694–700. doi:

10.1016/j.future.2008.03.003.

Ibrahim, T. M. and Agbaje, O. M. (2018) ‘The Relationship

Between Stock Return and Inflation in Nigeria’,

(February 2013).

Kurihara, Y. (2006) ‘The Relationship between Exchange

Rate and Stock Prices during the Quantitative Easing

Policy in Japan’, 11(4).

Masrizal, Mustofa, M. U. Al and Herianingrum, S. (2019)

‘Macroeconomic Determinants of Jakarta Islamic

Index’, 2019(2016), pp. 510–524. doi: 10.18502/

kss.v3i13.4227.

Rjoub, H., Tu¨rsoy, T. and Gu¨nsel, N. (2009) ‘The effects

of macroeconomic factors on stock returns : Istanbul

Stock Market’. doi: 10.1108/10867370910946315.

Sakti, M. R. P. and Yousuf, M. (2013) ‘Relationship

between Islamic Stock Prices and Macroeconomic

Variables: Evidence from Jakarta Stock Exchange

Islamic Index’, 1(1), pp. 71–84.

Zhao, H. (2010) ‘Research in International Business and

Finance Dynamic relationship between exchange rate

and stock price : Evidence from China’, Research in

International Business and Finance. Elsevier B.V.,

24(2), pp. 103–112. doi: 10.1016/j.ribaf.2009.09.001.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

22