Capital Structure, Macroeconomics, Business Risk and

Liquidity to Profitability: Company Listed in the Jakarta

Islamic Index

Muhammad Nashikh, Puji Sucia Sukmaningrum, Ririn Tri Ratnasari, and

Achsania Hendratmi

Faculty of Economics and Business, Universitas Airlangga, Campus B,

Jl. Airlangga No.4, 60286, Surabaya, Indonesia

Abstract. The aims of this study is to investigate the influence of Capital

Structure, Macroeconomics, Business Risk and Liquidity to company

profitability. Profitability is one of the important elements for the existence of a

company because it can be used as an indicator of the return on funds they invest.

The data used are companies listed in Jakarta Islamic Index period 2012-2016.

This study used a panel data and a multiple linear regression method. Based on

Random Effect Model shows that the variable of Capital Structure,

Macroeconomics, Business Risk and Liquidity are influence simultaneously and

significant to Profitability. The variable of Capital Structure, Macroeconomics,

Business Risk are influence and significant to Profitability partially.

Keywords: Company ꞏ Profitability ꞏ Capital structure ꞏ Macroeconomics ꞏ

Business risk ꞏ Liquidity

1 Introduction

The rapid development of economic condition and sharp competition in the global

market will become a new challenge and also opportunity for the company to develop

its business. As an effort to develop, the company requires a proper funding policy to

fulfill the company's operational and expansion activities. The decision on the

fulfillment of funds in the company includes a variety of considerations, whether the

company will use internal sources as well as external sources, which come from liability

including emission sukuk or issue new shares.

(Munawir, 2014) argues that "debt is all the financial liabilities of the company to

other parties that have not been met, which this debt is a source of funds or capital of

companies coming from creditors". Liabilities are divided into long-term liabilities and

short-term liabilities (current liabilities). Long-term liability is "the financial obligation

whose term of payment is still long term", while short-term liability (current liability)

is the financial obligation of the company that the repayment or payment will be made

in the short term by using current assets owned by the company.

The influence of the company's financial performance on capital structure has been

a long debate in various literatures. There are many theories that explain the effect of

the company's financial performance on capital structure. A number of studies that

Nashikh, M., Sukmaningrum, P., Ratnasari, R. and Hendratmi, A.

Capital Structure, Macroeconomics, Business Risk and Liquidity to Profitability: Company Listed in the Jakarta Islamic Index.

DOI: 10.5220/0009854700002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 251-259

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

251

examine the effect of the company's financial performance on capital structure have

been done, whether it is viewed from the side of profitability, liquidity, leverage, level

of sales of companies and so on that show different results. The capital structure is also

considered the most important because the quality of capital structure owned by a

company will have an impact on its financial position

The role of financial management is needed in financing activities, because

financial management is the activities of companies that are related to how to get

working capital funding, allocate funds, and manage assets owned to achieve corporate

goals in which every good company should pay attention to the use of funds in operating

the company. The relationship between capital structure, macroeconomics, business

risk and liquidity to profitability cannot be ignored because increased profitability is

necessary for long-term survival. According to (Sartono, 2014) Profitability shows the

company's ability to earn profit in relation to sales, total assets, and own capital.

Financial performance is a description of the company's financial condition at a

certain period involving funding aspect and measured by using capital adequacy,

activity, liquidity, and profitability. Sources of information that can be used to

determine the level of financial performance of the company is the financial statements.

According to (Moeljadi, 2006) the analysis on the company performance is generally

done by analyzing the financial statements, which include benchmarking the

performance of a company with other companies in the same industry and evaluate the

trend of the company's financial position over time.

The capital market has an important role in bridging the relationship between the

owner of the fund (investor) and the user of the fund (issuer) in which the transaction

is conducted on the Stock Exchange. The rapid development of capital market made

PT Bursa Efek Jakarta together with PT Danareksa Investment Management (DIM)

launched a stock index based on Islamic Sharia, the Jakarta Islamic Index (JII)

consisting of 30 types of shares selected from Sharia compliant stocks. Jakarta Islamic

Index (JII) is a capital market formed to invest in sharia-based stocks and provide

benefits for investors in running Islamic sharia to invest in the stock exchange. JII is

also expected to support the process of transparency and accountability of sharia-based

stocks in Indonesia.

Based on the above description, the research is conducted to answer the research

question: Does Capital Structure, Macroeconomics, Business Risk and Liquidity

influence Profitability of company registered in the Jakarta Islamic Index (JII) Period

2012-2016?

2 Literature and Hypothesis Development

According to (Munawir, 2014), the financial performance of the company is one of the

fundamentals of the assessment of the company's financial condition performed based

on the analysis of the company's financial ratios. Interested parties need the results of

the measurement of the company's financial performance to see the condition of the

company and the success rate of the company in carrying out its operational activities.

In general, the profit equated with profit, in other words the ratio which is

considered able to measure the company's performance is profitability ratios. (Brigham

and Houston, 2011) explain that profitability is the end result of a number of policies

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

252

and decisions made by the company. Profitability is also a group of ratios that show a

combination of liquidity influence, asset management, and debt on operating outcomes.

According (Husnan, 2000) capital structure theory explains the relationship

between the availability of sources of funds and the cost of different capital and the

effect of changes in capital structure on the value of the company and the cost of capital.

The flexibility value of a company depends essentially on the estimation of how much

future funding flows and the rate of recovery as a return (capitalization) of the flow of

funds. The level of capital costs incurred by the company reflects the level of recovery

for investors.

The capital structure policy involves choosing between the risk and expected return,

the addition of the debt raises the risk level of the firm's revenue stream, but higher debt

also means a greater rate of expected return. The high level of risk will lower the stock

price, but the high expected rate of return will raise the price of the stock.

Tax is a mandatory fee derived from a tax subject and addressed to the state.

Company is one of the tax subjects that contributes the most in state tax revenues. Tax

for companies is a burden that can reduce corporate profits, while tax for the state is the

income that will be used to fund the administration. Progressive tax rate leads to the

higher profit of a company, the higher the amount of taxes that must be paid. In Islam,

the tax is known as Al-Usyr or Al-Maks or it can also be called Adh-Dharibah, which

means "levy withdrawn from the people by tax collectors who is called Shahibul Maks

or Al-Asysyar”. Meanwhile, according to linguists, tax is a payment made to the

government to finance expenditures made in the case of providing services for the

public interests.

According to (Suseno and Astiyah, 2009) in the book Seri Kebanksentral Bank

Indonesia, Inflation is an economic phenomenon that becomes the interests of various

parties. Inflation is not only the concern of the general public, but also the concern of

the business world, the central bank, and the government. Inflation can affect the

community and economy of a country. According to Islamic economists, inflation

creates a disruption to the function of money, especially in the saving function, in

advance payments and unit calculations, undermining the spirit of saving in society,

and directing investments in non-productive things such as land and precious metal.

(Brigham and Houston, 2011) state that business risk is uncertainty about the

projected return on assets in the future. Business risk is a failure of internal control

resulting in unexpected losses and unsuccessful management to ensure return to the

company. Therefore, risk is important to manage. In Islamic perspective, risk

management is an effort to keep God's trust in wealth for the welfare of people.

The liquidity of a company is closely related to the ability of a company to meet its

financial obligations that must be fulfilled immediately. In a debt company can affect

the company's performance because the company will assess the ability or speed of the

company in paying its debt.

2.1 Previous Studies

Study conducted by (Ching et al., 2015), relationship between earnings management

and financial performance are significant linear and positively correlated. According to

(Shah and Ilyas, 2014) leverage ratios are regressed on profitability ratio have strong

support for pecking order theory.

Capital Structure, Macroeconomics, Business Risk and Liquidity to Profitability: Company Listed in the Jakarta Islamic Index

253

Capital structure variables are significantly associated with ROA regarding the

study of (Mokhtar, 2006) .In a study conducted by (Widiyanti and Elfina, 2015), Long

Term Debt to Equity Ratio (LDER) is a comparison between long-term liabilities and

the company's own total capital. The lower the ratio the higher the company's ability to

pay long-term liabilities and vice versa (Utari, Purwanti and Prawironegoro, 2014).

According to (Widiyanti and Elfina, 2015) companies with too many liabilities will find

it difficult to obtain additional funds from outside. Then the influence between LDER

and ROA is negative.

Debt to Total Fixed Asset Ratio (DTFAR) is the ratio of debt used to measure the

ratio of total liabilities to total fixed assets. How much fixed assets the company

financed by the obligation or how much the company's liabilities affect the management

of assets.

In (Taqi, Ajmal and Pervez, 2016) study using panel regression analysis with pooled

OLS method, fixed effects and random effects, DTFAR values showed negative

correlation with profitability.

Tax is a mandatory fee derived from a tax subject and addressed to the state. The

Company as one of the tax subjects who contributed the most in state tax revenues.

Based on research conducted (Vătavu, 2015) showed that taxes have a significant

positive effect on ROA. When taxes are high, companies tend to invest less to keep

their income.

Inflation is an increase in the price of daily necessities of life from time to time on

an ongoing basis. Based on research conducted (Vătavu, 2015), it shows that inflation

has a positive impact on ROA.

The business risk of the company can be illustrated by measuring the fluctuations

of the firm's earnings. Companies experiencing profit fluctuations face uncertainty in

terms of ability to raise funds to pay off their loans to creditors. Research conducted by

Saraswathi (Saraswati, Wiksuana and Rahyuda, 2016) shows that business risk has a

significant positive effect on profitability.

Current Ratio is a ratio that indicates a company's ability to pay its short-term

liabilities using its current assets. Based on research (Mahardhika and Aisjah, 2014), it

shows that the Current Ratio (CR) has a significant positive effect on Return on Assets

(ROA).

2.2 Hypothesis

Based on the background, problem formulation, research objectives, and the literature

review, the hypothesis proposed in this research are:

H1: There is influence of Long-term Debt to Equity Ratio (LDER), Debt to Total

Fixed Assets Ratio (DTFAR), Taxes, Inflation, Business Risk and Current Ratio

(CR) to Return on Assets (ROA) of the companies listed in Jakarta Islamic Index

(JII) simultaneously

H2: There is influence of Long-term Debt to Equity Ratio (LDER), Debt to Total

Fixed Assets Ratio (DTFAR), Taxes, Inflation, Business Risk and Current Ratio

(CR) to Return on Assets (ROA) Index (JII) partially.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

254

3 Methodology

Panel data used to combine information from time series data and cross section can

overcome the problems that arise when there are problems omitted variable (omitted

variables) (Widarjono, 2007). To overcome the intercorrelation between independent

variables resulting in misinterpretation of regression, panel data methods are more

appropriate to use (Hill, Griffiths and Judge, 2001). The population in this study is all

companies registered in the Jakarta Islamic Index (JII) Year 2012-2016. Sample

determination was done by a purposive sampling method. The number of samples in

this research were 70. This research used multiple linear regression to find the

correlation between independent variable and dependent variable. Equation model

used in this research is as follows:

ROA = a + β LDER + β DTFAR + βTAX+ βINF + βBUSRISK + βCR + e

Variables

A total of 6 variables were used to determine factors affecting the profitability of

companies listed in Jakarta Islamic Index (JII) Year 2012-2016. These variables were

divided into 4 groups: Capital Structure, Macroeconomics, Business Risk and

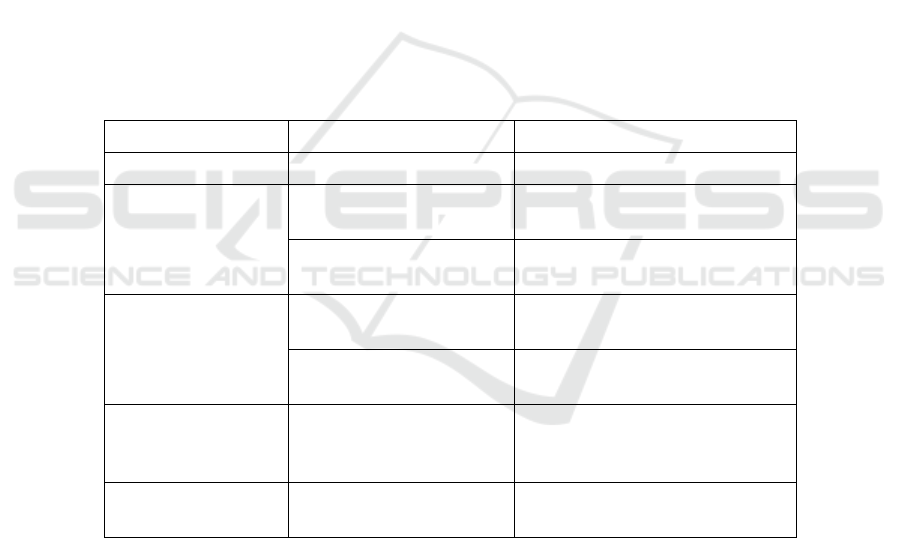

Liquidity. Table 1 represents the variables and how to calculate these variables:

Table 1. Variables and Measurement Tools.

Category Variable Measurement Tools

Dependent Variable Profitability (ROA) Profit before tax on total assets

Capital Structure

Long-term Debt to Equity

Ratio (LDER)

Total long-term debt to total

equity

Debt to Total Fixed

Assets Ratio (DTFAR)

total debt to total fixed assets

Macroeconomic

TAX

ratio of tax on earnings before

interest and taxes

Inflation (INF)

The annual rate of inflation

provided by Bank Indonesia

Business Risk BUSRISK

standard deviation ratio of Profit

before interest and tax on total

assets

Liquidity Current Ratio (CR)

ratio of current assets to current

liabilities

4 Results and Discussion

Table 2 describes the results of descriptive analysis of each variable used to measure

the profitability level of companies listed in Jakarta Islamic Index (JII).

Capital Structure, Macroeconomics, Business Risk and Liquidity to Profitability: Company Listed in the Jakarta Islamic Index

255

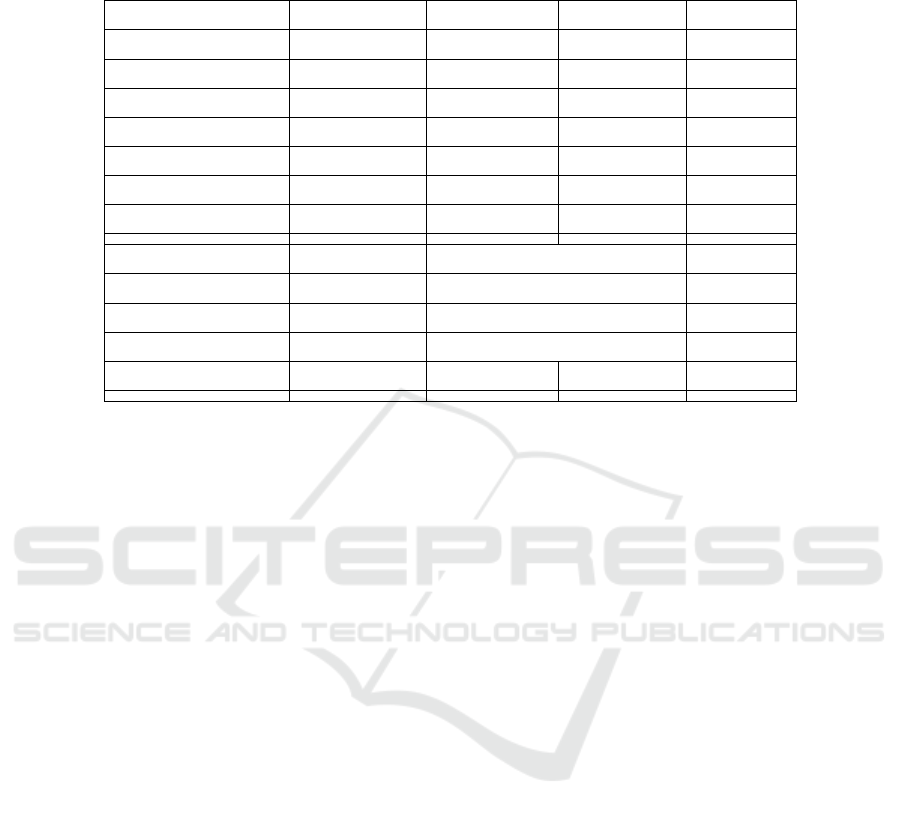

Table 2. Statistic Descriptive.

Variable Coefficient Std. Error t-Statistic Prob.

C 0.057179 0.023158 2.469119 0.0163

LDER? -0.082128 0.027815 -2.952660 0.0044

DTFAR? -0.010688 0.006607 -1.617745 0.1107

TAX? 0.018393 0.057412 0.320370 0.7497

INFLATION 0.265602 0.120564 2.202993 0.0313

BUSRISK? 1.809059 0.123493 14.64909 0.0000

CR? 0.007389 0.005553 1.330670 0.1881

R-square

d

0.833084 Mean dependent va

r

0.033666

Ad

j

usted R-square

d

0.817188 S.D. dependent va

r

0.053709

S.E. of re

g

ression 0.022964 Sum squared resi

d

0.033224

F-statistic 52.40607 Durbin-Watson sta

t

1.245625

Prob(F-statistic) 0.000000

Constant value of 0.057179 indicates if the variable LDER, DTFAR, Tax, Inflation,

business risk and CR is zero or constant, then the value of ROA is 0.057179.

The LDER variable has a probability value of 0.0044 significant at the 5%

significance level so that H0 is rejected and H1 is accepted. This shows that there is

significant influence between Long-term Debt to Equity Ratio (LDER) to ROA. While

the value of LDER variable coefficient is equal to - 0.082128, it shows that each

decrease of one unit LDER then ROA has increased by 0.082128 with the assumption

that the other variable is constant. So it can be concluded that LDER has a significant

negative effect on ROA. So the lower the Long-term Debt to Equity Ratio (LDER) the

higher the Return on Assets (ROA) of the company.

The DTFAR variable has a probability value of 0.1107 not significant at the 5%

significance level so that H0 is accepted and H2 is rejected. This shows that Debt to

Total Fixed Assets (DTFAR) has no significant effect on the ROA of companies

registered in the Jakarta Islamic Index (JII) period 2012-2016. If the debt ratio is higher

in the fear of the company is not able to cover its obligations with the assets it has.

Because of how much fixed assets the company is financed by the obligation or how

much the company's liabilities affect the management of assets will determine the

financial health of the company.

The Tax Variable has a probability value of 0.7497 not significant at the 5%

significance level so that H0 is accepted and H3 is rejected. This indicates that Tax has

an insignificant influence on the ROA of companies registered in the Jakarta Islamic

Index (JII) period 2012-2016.

Inflation variable has a probability value of 0.0313 smaller than the 5% significance

level (α = 0.05) so that H0 is rejected and H4 is accepted. This shows that there is a

significant influence between Inflation on ROA. While the value of the variable

coefficient of inflation is 0.265602 it shows that every increase of one unit of inflation,

then ROA also increased by 0.265602 with the assumption that the other variable is

constant. So it can be concluded that inflation has a significant positive effect on ROA.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

256

The higher the Inflation rate, the higher the Return on Assets (ROA) of the company.

If the price increase that can be enjoyed by the company is higher than the production

cost incurred, then the profitability of the company will rise because the increase of

inflation during a certain period of time followed by the average increase of ROA.

Business risk variable (BusRisk) has a probability value of 0.0000 is smaller than

the 5% significance level (α = 0.05) so that H0 is rejected and H5 is accepted. This

shows there is a significant influence between Busrisk on ROA. While the value of the

variable coefficient of BusRisk is 1.809059 it shows that every increase of one unit of

inflation, then ROA also increased by 0.265602 with the assumption that the other

variable is constant. Then it can be concluded that BusRisk has a significant positive

effect on ROA. The higher the level of business risk the higher the Return on Assets

(ROA) of the company. In the theory of high risk high return, to get a high return, the

risk is also high, and vice versa. If the risk of business in the company is high, then the

profitability of the company will increase. Described in QS. Luqman verse 34:

ِ

ّ

ﺰَﻨ

ُ

ﻳ

َ

ﻭ

ِ

ﺔ

َ

ﻋﺎ

ﱠ

ﺴﻟٱ

ُ

ﻢ

ۡ

ﻠ

ِ

ﻋ ۥ

ُ

ﻩ

َ

ﺪﻨ

ِ

ﻋ

َ

ﱠ

ٱ

ﱠ

ﻥ

ِ

ﺇ

ۢ

ُ

ﺲ

ۡ

ﻔَﻧ ﻱ

ِ

ﺭ

ۡ

ﺪ

َ

ﺗ ﺎ

َ

ﻣ

َ

ﻭ

ۖ

ﺍ

ٗ

ﺪَﻏ

ُ

ﺐ

ِ

ﺴ

ۡ

ﻜ

َ

ﺗ ﺍ

َ

ﺫﺎ

ﱠ

ﻣ

ٞ

ﺲ

ۡ

ﻔَﻧ ﻱ

ِ

ﺭ

ۡ

ﺪ

َ

ﺗ ﺎ

َ

ﻣ

َ

ﻭ

ۖ

ِ

ﻡﺎ

َ

ﺣ

ۡ

ﺭ

َ

ۡ

ﻷٱ ﻲ

ِ

ﻓ ﺎ

َ

ﻣ

ُ

ﻢ

َ

ﻠ

ۡ

ﻌ

َ

ﻳ

َ

ﻭ

َ

ﺚ

ۡ

ﻴَﻐ

ۡ

ﻟٱ

ُ

ﻝ

ۢ

ُ

ﺮﻴ

ِ

ﺒَﺧ

ٌ

ﻢﻴ

ِ

ﻠ

َ

ﻋ

َ

ﱠ

ٱ

ﱠ

ﻥ

ِ

ﺇ

ۚ

ُ

ﺕﻮ

ُ

ﻤ

َ

ﺗ

ٖ

ﺽ

ۡ

ﺭ

َ

ﺃ

ِ

ّ

ﻱ

َ

ﺄ

ِ

ﺑ٣٤

'Inna Allāha `Indahu `Ilmu As-Sā`ati Wa Yunazzilu Al-Ghaytha Wa Ya`lamu Mā

F

ī Al-'Arĥāmi Wa Mā Tadrī Nafsun Mādhā Taksibu Ghadāan Wa Mā Tadrī

Nafsun Bi'ayyi 'Arđin Tamūtu 'Inna Allāha `Alīmun Khabīrun

Meaning:

“Indeed, Allah [alone] has knowledge of the Hour and sends down the rain and

knows what is in the wombs. And no soul perceives what it will earn tomorrow,

and no soul perceives in what land it will die. Indeed, Allah is Knowing and

Acquainted”.

Variable Current Assets (CR) has a probability value of 0.1881 is not significant at

the 5% significance level so that H0 is accepted and H6 is rejected. This indicates that

Current Assets (CR) have an insignificant influence on the ROA of companies

registered in the Jakarta Islamic Index (JII) year 2012-2016.

Based on test result with best model that is Random Effect Model (REM), it can be

seen that F-statistic probability value is 0.0000000, this value is smaller than 0.05 and

significant at 95% confidence level (α=0,05), so H0 is rejected and H1 accepted. It can

be concluded that the independent variables, namely the Long-term Debt to Equity

Ratio (LDER), Debt to Total Fixed Assets Ratio (DTFAR), Tax, Inflation, Business

Risk, and Current Ratio (CR) simultaneously have significant effect to the dependent

variable, ie Return on Assets (ROA) of companies listed in Jakarta Islamic Index (JII)

year 2012-2016.

Based on the results of statistical tests with the best model of the Random Effect

Model (REM), R-Squared value of 0.833084 was obtained. So it can be concluded that

the independent variables of Long-term Debt to Equity Ratio (LDER), Debt to Total

Fixed Assets Ratio (DTFAR), Taxes, Inflation, Business Risk, and Current Ratio (CR)

can impact 83.30% to Return on Assets (ROA) of companies listed in the Jakarta

Islamic Index (JII) period 2012-2016 and the remaining 16.70% influenced by other

factors not used in regression model in this research.

Capital Structure, Macroeconomics, Business Risk and Liquidity to Profitability: Company Listed in the Jakarta Islamic Index

257

5 Conclusion

Based on the results of research and discussion that has been done, the conclusions that

can be taken are:

1. Long-term Debt to Equity Ratio (LDER) partially has a negative and significant

effect on Return on Assets (ROA) of companies registered in the Jakarta Islamic

Index (JII) period 2012-2016 at 5% significance level (α = 0.05).

2. Debt to Total Fixed Assets Ratio (DTFAR) partially have no significant effect

on Return on Assets (ROA) of companies registered in Jakarta Islamic Index

(JII) period 2012-2016 at 5% significance level (α = 0,05).

3. Tax partially have no significant effect on Return on Assets (ROA) of companies

registered in the Jakarta Islamic Index (JII) period 2012-2016 at 5% significance

level (α = 0,05).

4. Inflation partially has a positive and significant impact on Return on Assets

(ROA) of companies registered in the Jakarta Islamic Index (JII) period 2012-

2016 at 5% significance level (α = 0,05).

5. The business risks partially have a positive and significant impact on the Return

on Assets (ROA) of companies registered in the Jakarta Islamic Index (JII)

period 2012-2016 at the 5% significance level (α = 0,05).

6. Current ratio (CR) partially has no significant effect on Return on Assets (ROA)

of companies registered in the Jakarta Islamic Index (JII) period 2012-2016 at

5% significance level (α = 0,05).

7. Long-term debt to Equity Ratio (LDER), Debt to total Fixed Assets Ratio

(DTFAR), Tax, Inflation, Business Risk and Current Ratio (CR) simultaneously

have a significant effect on Return on Assets (ROA) Jakarta Islamic Index (JII)

period 2012-2016 at 95% confidence level (α = 0,05).

This research also cannot be separated from the limitations that include the variables

used suggestions that can be delivered from the above conclusions are:

1. For managers and owners of the company, should better optimize its debt, so the

company's profit will increase. The optimization of debt will have a positive

impact that will increase the value of the company.

2. For other stakeholders, should pay more attention to the company's financial

ratios, because the company's financial ratios can provide the information

needed as a decision-making material in projecting its investment.

3. For the next researcher

a. the need for further research where there are many other variables that can

also affect the profitability of the company.

b. preferably more advanced research using other issuers such as ISSI and also

should the study period of observation be extended so that will give more

different picture.

References

Brigham, E. F. and Houston, J. F. (2011) Dasar-dasar Manajemen Keuangan Buku 2. Jakarta:

Salemba Empat.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

258

Ching, C. P. et al. (2015) ‘The relationship among audit quality, earnings management, and

financial performance of Malaysian public listed companies’, International Journal of

Economics and Management, 9(1), pp. 211–229.

Hill, R. C., Griffiths, W. and Judge, G. (2001) Undergraduate econometrics, Volume 1.

University of California: Wiley.

Husnan, S. (2000) Manajemen Keuangan : Teori dan Penerapan (Keputusan Jangka Panjang).

Yogyakarta: BPFE.

Mahardhika, B. P. and Aisjah, S. (2014) ‘Pengujian Pecking Order Theory Dan Trade Off Theory

Pada Struktur Modal Perusahaan (Studi Pada Perusahaan Consumer Goods Di Bursa Efek

Indonesia)’, JIMFEB, Vol 2, No.

Moeljadi (2006) Manajemen keuangan 1: pendekatan kuantitatif dan kualitatif. Malang:

Bayumedia.

Mokhtar, M. Z. (2006) ‘An Evaluation of the factors affecting corporate performance of Malaysia

listed companies’, International Journal of Economics and Management, 1(1), pp. 91–116.

Munawir, S. (2014) Analisa Laporan Keuangan. 17th edn. Yogyakarta: Liberty.

Saraswati, I. A. A., Wiksuana, I. G. B. and Rahyuda, H. (2016) ‘Pengaruh Risiko Bisnis,

Pertumbuhan Perusahaan Dan Struktur Modal Terhadap Profitabilitas Serta Nilai Perusahaan

Manufaktur’, E-Jurnal Ekonomi dan Bisnis Universitas Udayana, 6(5), pp. 1729–1756. doi:

10.1017/CBO9781107415324.004.

Sartono, R. A. (2014) Manajemen Keuangan Teori dan Aplikasi. 4th edn. Yogyakarta: BPFE.

Shah, A. and Ilyas, J. (2014) ‘Is Negative Profitability-Leverage Relation the only Support for

the Pecking Order Theory in Case of Pakistani Firms ?’, Pakistan Development Review,

53(1), pp. 33–55.

Suseno and Astiyah, S. (2009) ‘Inflasi’, in, p. 55.

Taqi, M., Ajmal, M. and Pervez, A. (2016) ‘Impact Of Capital Structure On Profitability Of

Selected Trading Companies Of India’, Arabian Journal of Business and Management

Review (Oman Chapter), 6(3), pp. 1–16.

Utari, D., Purwanti, A. and Prawironegoro, darsono (2014) Manajemen Keuangan (Kajian

Praktik dan Teori dalam Mengelola Keuangan Organisasi Perusahaan). Revisi. Bogor:

Mitrawacanamedia.

Vătavu, S. (2015) ‘The Impact of Capital Structure on Financial Performance in Romanian Listed

Companies’, Procedia Economics and Finance, 32(15), pp. 1314–1322. doi: 10.1016/S2212-

5671(15)01508-7.

Widarjono, A. (2007) Ekonometrika : teori dan aplikasi untuk ekonomi dan bisnis. Yogyakarta:

Ekonisia.

Widiyanti, M. and Elfina, F. D. (2015) ‘Pengaruh Financial Leverage terhadap Profitabilitas pada

Perusahaan Sub Sektor Otomotif dan Komponen yang Terdaftar di Bursa Efek Indonesia’,

Jurnal Manajemen dan Bisnis Sriwijaya Bisnis, 13(1), pp. 117–136.

Capital Structure, Macroeconomics, Business Risk and Liquidity to Profitability: Company Listed in the Jakarta Islamic Index

259