Analysis of Financial and Non-financial Performance

Measurement with Traditional and Balanced Scorecard

Approaches: Survey of Local Government Water Utility

in Jambi Province

Salman Jumaili, and Primadi Prasetyo

Faculty of Economics and Business, University of Jambi, Indonesia

Abstract. This study aims to analyze the Measurement of Financial and Non-

Financial Performance using two approaches, the Traditional and the Balanced

Scorecard. The study was conducted at Local Goverment Water Utility (PDAM)

in Jambi Province. The data used is the PDAM Performance Report consisting

of Financial and Non-Financial Reports. The results show the most appropriate

performance measurement is the Balanced Score Card approach in the non-

financial perspective consisting of the Customer perspective, the Internal

Business Perspective, and the Growth and Learning Perspective, rather than the

Traditional Performance Measurement which only focuses on Financial

Performance.

Keywords: Financial performance · Non-financial performance · Traditional

approach · Balanced Scorecard Aproach

1 Introduction

Water is a basic need for living things, including humans. We must manage and manage

water sources and uses so that they can be used efficiently and effectively. Water that

involves the needs of the lives of many people, in its management is monopolized by

the government. This is in accordance with the UUD 1945 Article 33 paragraph (3),

which reads "The earth and water and natural resources contained therein are controlled

by the state and used for the greatest prosperity of the people".

Related to the authority of water management by the region regulated in Article 10

of Law no. 22 of 1999 concerning Regional Government states that "the region has the

authority to manage regional resources available in its territory and is responsible for

preserving the environment in accordance with laws and regulations". From this article

the drinking water service is handed over to the Regional Government and through the

Regional Regulation the implementation is handed over to an agency namely the

Regional Drinking Water Company (PDAM).

Performance appraisal that is commonly done by PDAMs is the measurement of

traditional approaches, namely performance measurements sourced from company

financial information. In Indonesia, the measurement of PDAM performance is also

regulated in the Decree of the Minister of Home Affairs Number 47 of 1999 concerning

Guidelines on Performance Evaluation of Regional Water Supply Companies

234

Jumaili, S. and Prasetyo, P.

Analysis of Financial and Non-financial Performance Measurement with Traditional and Balanced Scorecard Approaches: Survey of Local Government Water Utility in Jambi Province.

DOI: 10.5220/0009854500002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 234-241

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(PDAMs). The indicators measured only use three aspects, namely financial aspects,

operational aspects, and administration aspects.

Kaplan and Norton (1996) developed the concept of balanced scorecard (BSC) to

complement financial performance measurements (or known as traditional

measurements) that are important for corporate organizations to reflect new thinking in

an era of organizational competitiveness and effectiveness. This concept measures

company performance by using criteria that describe the company's vision, mission,

and long-term strategy. These criteria are divided into four perspectives: (1) financial

perspective, (2) consumer perspective, (3) internal business process perspective, and

(4) learning and growth perspective.

PDAM is a company engaged in the field of water supply services. One of the

objectives of establishing a PDAM is to meet the needs of the community for clean

water, including the provision, development of facilities and infrastructure services and

distribution of clean water, while the other goal is to participate in developing the

economy to support regional development by expanding employment, and seeking

profit as the main source of financing for the region. PDAM as one of the BUMDs is

expected to be able to provide an adequate contribution.

This study was conducted to determine the differences in financial and non-financial

performance in the PDAM Jambi Province specifically for PDAM Tirta Mayang,

which began implementing the Balanced Scorecard approach in preparing the

Company's Work Budget Work Plan since 2018. The problem raised in this study is

how to measure Financial and Non Performance Finance for PDAMs in Jambi Province

using the traditional approach and by using the Balance Score Card approach, and

which measures are more appropriate for measuring PDAM performance.

2 Literature Review

Performance is a picture of the level of achievement of the implementation of an

activity of an activity / program / policy in realizing the goals, objectives, mission and

vision of the organization as outlined in the formulation of the strategic planning

(strategic planning) of an organization. Performance measurement as a periodic

determinant of the operational effectiveness of an organization, parts of the

organization, and employees based on the targets, standards, and criteria that have been

set previously.

Another understanding of performance measurement is a process of evaluating

work progress against predetermined goals and objectives, including information on

the efficient use of human resources in producing goods and services; quality of goods

and services (how well goods and services are delivered to customers and to what extent

customers are satisfied); the results of the activities are compared with the intended

purpose; and the effectiveness of actions in achieving goals.

2.1 Performance Evaluation with Traditional Systems

In accordance with the Decree of the Minister of Home Affairs of the Republic of

Indonesia Number 47 of 1999 concerning Guidelines for Performance Assessment of

Analysis of Financial and Non-financial Performance Measurement with Traditional and Balanced Scorecard Approaches: Survey of Local

Government Water Utility in Jambi Province

235

PDAMs, several aspects were assessed, including the following; financial aspects,

operational aspects and administrative aspects which are interrelated.

2.2 Measuring PDAM Performance with the Balanced Scorecard

In the Balanced Scorecard concept, not only the financial aspect (Finance) is the

benchmark for company performance, there are three other measurement angles that

are also taken into account, namely Customer, Internal Business Process and Learning

and Growth.

The objectives of the Balanced Scorecard for organizations or companies (Kaplan,

2000) include:

a) Clarify and consume strategies throughout the community.

b) Aligning departmental and individual goals with organizational strategies.

c) Identifying and aligning strategic initiatives.

d) Conduct periodic strategy reviews.

e) Get the feedback needed to improve the strategy.

3 Research Results

3.1 Overview of Financial and Non-financial Performance

Measurement in PDAMS in Jambi Province using the Traditional

Approach

Based on the level of health of the PDAM which is assessed based on BPPSPAM for

2015 to 2017 is considered healthy, although there are still many things that need

attention from management because the achievement of the value of several indicators

that are still below the standards are as follows:

- Financial aspects, Return of Equity (ROE) is still below the minimum standard

that should be 10%. The operating ratio is still above the standard of 0.50 and the

cash ratio is still low when compared to the minimum standard of 100%

- Service Aspect, Customer growth is still below the minimum standard of 10%

Monthly Domestic Water Consumption is still below the standard of 30 M3 per

month

- Operating Aspects, productivity efficiency is still below the standard of 90%, the

level of water loss is still high with a standard of 20%, replacement of water meters

is still low with a standard of 20%

- In the aspect of Human Resources (HR), the employee education and training ratio

is still below the standard of 60% of the total number of employees. The ratio of

training costs is still below the standard of 10% of the total employee costs.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

236

3.2 Measurement of Financial and Non-financial Performance of

Pdams in Jambi Province using the Balance Score Card Approach

3.2.1 Financial Perspective

Performance evaluation of financial aspects in principle is an assessment that includes

the company's ability to create profits and streamline its operational activities.

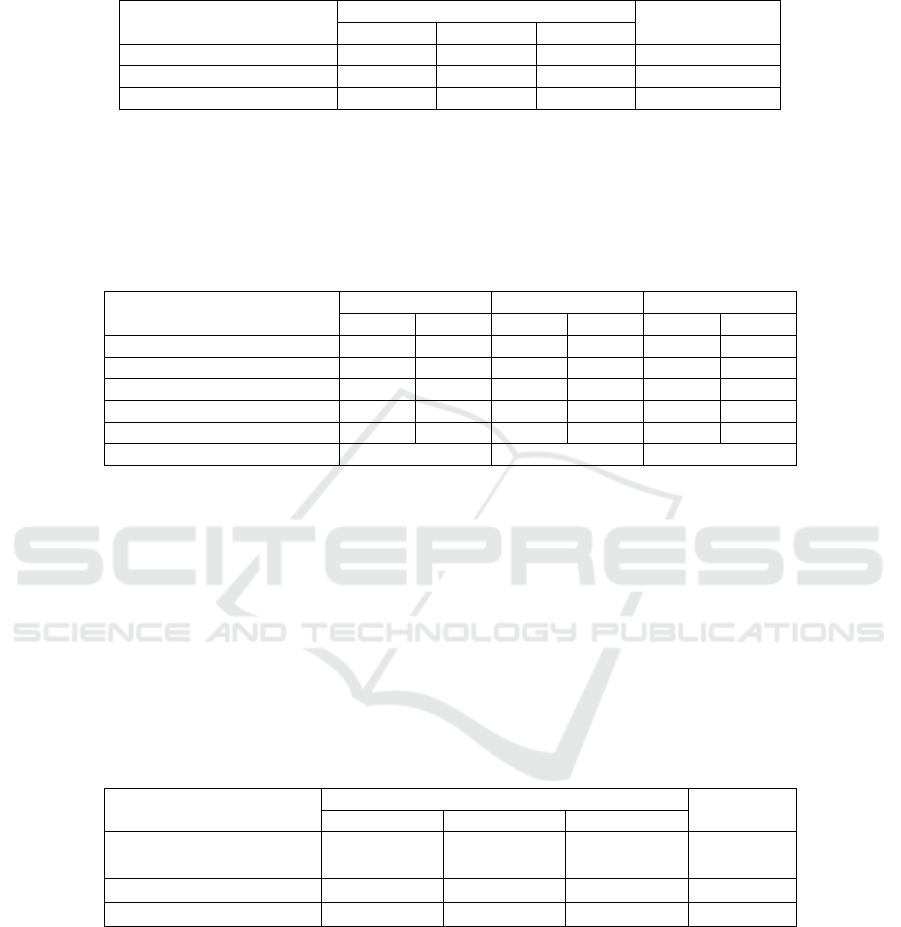

Table 1. Overall Measurement Results of Financial Perspective indicators.

Indicator

yea

r

Good

criteria

2015 2016 2017

Gross Profit Margin 40,06% 42,15% 41,65% >6%

Operating Profit Margin 0,77% −2,49% −0,91% >6%

Return On Asset 0,71%

−1,99% −0,74%

>7%

Current Ratio 63,77% 269,47% 150,06% >200%

Total Asset Turnove

r

92,75% 79,94% 81,17% >100%

From the table above, it can be seen that in the gross profit margin ratio, the

company's financial performance can be assessed as good, then for the current ratio of

companies that need to be active every year, but it must still be done efficiency of assets

owned and properly control current debt. Furthermore, for the operating profit margin

ratio, ROA, and TATO, the company's financial performance is considered bad, the

company must be better able to maximize and manage every resource it has to increase

the company's revenue / profit in order to realize good corporate financial performance.

Furthermore, given the above achievement scores as follows based on guidelines

from BPPSPAM as follows:

Table 2. Results of BPPSPAM Financial Aspects Measurement.

INDICATOR

y

ea

r

2015

y

ea

r

2016

y

ea

r

2017

condition score condition score condition score

Return On E

q

uit

y

2,10% 2 -2,71% 1 -1,03 1

O

p

eratin

g

Ratio

0,99 2 1,02 1 1,01 1

Cash Ratio

14,70% 1 31,26% 1 18,36 1

Billin

g

Effectiveness

93,43% 5 73,21% 1 84,02% 3

Solvenc

y

182,0% 4 375,8% 5 355,7% 5

Value

0,67 0,37 0,48

In line with the results of financial performance measurements conducted by

researchers using several different measurement indicators, the results of BPPSPAM

measurements on the overall financial aspects are considered less healthy.

3.2.2 Customer Perspective

The assessment of customer perspective performance aims to measure several service

indicators that illustrate the level of the company's ability to meet the needs of its

customers.

Analysis of Financial and Non-financial Performance Measurement with Traditional and Balanced Scorecard Approaches: Survey of Local

Government Water Utility in Jambi Province

237

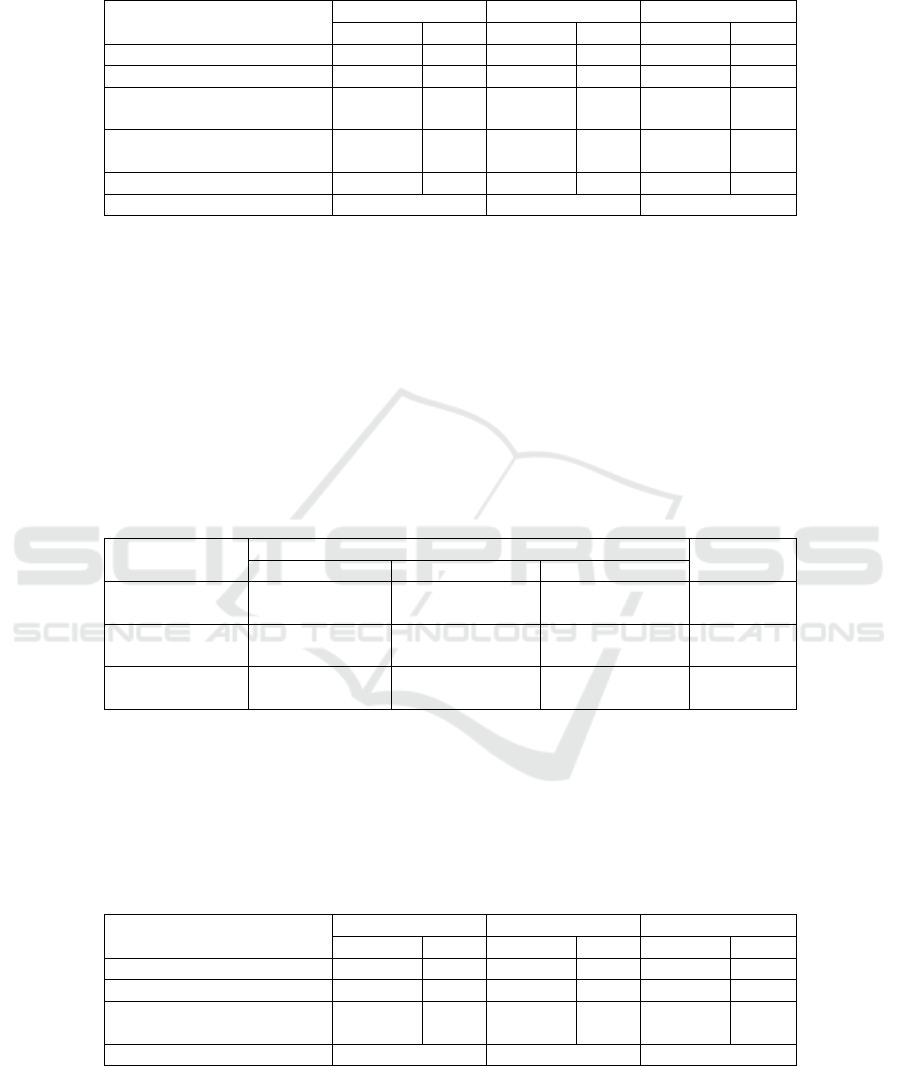

Table 3. Overall Measurement Results of Customer Perspective.

Indicator

yea

r

Good criterion

2015 2016 2017

Customer Retention 96,97% 93,47% 96,09% Increase

Customer Ac

q

uisition 3,03% 6,53% 4,91% Increase

Customer Complaint Level 11,43% 12,57% 6,56% Decrease

Overall customer perspective performance shows that the company's management

is good enough in meeting customer needs and in increasing customer growth for the

company. The company's management must continue to strive to improve performance

in the customer sector because during 2015-2017 there are still several indicators that

experience fluctuations in each year. Next to score the service aspects as follows:

Table 4. BPPSPAM Measurement Results Service Aspects.

INDIKATOR

2015 2016 2017

condition value condition value condition value

Service Coverage 80,35% 5 85,50% 5 87,73% 5

Customer Growth 3,12% 5 6,98% 5 5,17% 5

Com

p

laint Settlement Rate 100,00% 5 98,39% 5 79,88% 5

Pela

gg

an Water Qualit

y

100,00% 5 0,00% 1 80,93% 4

Domestic Water Consum

p

tion 16,35 2 15,77% 2 15,55 2

Weight 1,10 1,03 1,08

BPPSPAM measurement results on the overall service aspects are considered

healthy even though the indicators for customer water quality and domestic water

consumption are still at a low value and must be improved. While in other indicators,

the company's performance is considered good or in the healthy category.

3.2.3 Internal Business Process Perspective

The internal business process perspective in the balanced scorecard highlights various

important processes that support the company's strategy and operational activities.

According to Kaplan and Norton (2001) performance measurement in the perspective

of internal business processes as follows:

Table 5. Measurement Results of Several Internal Business Process Perspective Indicators.

Indicators

yea

r

Good criteria

2015 2016 2017

Water Distribution Time

4 hours to

6 hours

6 hours to

12 hours

12 hours to

24 hours

Increases

N

ew Connection Spee

d

3-6 days 3-6 days 3-6 days decreases

Tera Water Mete

r

0,00% 0,00% 0,00% -

Based on the above table and the results of in-depth interviews with related speakers

as a whole the performance of the perspective of internal business processes shows that

the company's management is quite good in optimizing the company's business

processes and in improving services to consumers. Next to find out the score as

follows:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

238

Table 6. BPPSPAM Measurement Results Operational Aspects.

INDICATORS

2015 2016 2017

condition value condition value condition value

Production Efficienc

y

74,45% 3 77,68% 3 68,17% 2

Water Loss Rate 45,86% 1 46,71% 1 44,82% 1

Operating Hours of Service /

Da

y

23 5 24 5 24 5

Operating Hours of Service /

Day

96,53% 5 55,86% 3 28,75% 2

Water Meter Replacement 1,97% 1 3,90% 1 5,24% 2

Wei

g

ht 1,07 0,94 0,87

The results of the measurement of operational aspects by BPPSPAM as a whole are

considered healthy. However, it is necessary to improve performance, especially in the

indicator of the level of water loss, where the existing conditions can be categorized as

unhealthy because they are at a low value. This shows that the company has not been

able to properly overcome the problem of this level of water loss, either caused by a

leaky pipe, broken customer water meter or water theft.

3.2.4 Learning and Growth Perspective

This perspective assessment is whether there is productivity or not to create growth and

improve the performance of human resources owned in the long run.

Table 7. Measurement Results Overall Perspective indicators.

Indicators

y

ea

r

good criteria

2015 2016 2017

Employee

Productivit

y

Rp.235.397920 Rp.244.007.110 Rp.255.307.710 Increasing

Employee

Turnover Rate

0,58% 4,61% 0,57% Decreased

Employee

Absenteeis

m

7,90% 5,50% 3,72% Decreased

Overall the performance of growth and learning perspectives has been good in

improving employee quality, loyalty as well as employee interest and motivation in

work as indicated by the measurement results of the three indicators which are

considered good. Company management must continue to strive for growth and

improvement in the quality of human resources owned by the company in order to

improve overall company performance. Next to find out the score as follows:

Table 8. BPPSPAM Measurement Results Aspects of Human Resources.

INDICATORS

2015 2016 2017

Condition value Condition value Condition value

Number of Em

p

lo

y

ees / 1000 5,29 5 5,00 5 4,78 5

Em

p

lo

y

ee Trainin

g

Ratio 41,40% 3 50,43% 3 27,22% 2

Training Costs Against

Employee Costs

1,16% 1 1,61% 1 0,60% 1

WEIGHT 0,51 0,51 0,47

Analysis of Financial and Non-financial Performance Measurement with Traditional and Balanced Scorecard Approaches: Survey of Local

Government Water Utility in Jambi Province

239

The table above is the result of performance measurement of aspects of PDAM

human resources using different indicators, the results of the measurement of HR

aspects conducted by BPPSPAM as a whole are considered healthy.

4 Conclusion

1 The measurement of the financial and non-financial performance of PDAMs is

measured by the traditional approach showing:

- Financial aspects show Return of Equity (ROE) which is 10% is still below the

minimum standard that should be, operating ratio of 0.50 which is still above the

standard, and Cash ratio of 100% is still low when compared with the minimum

standard.

- Service Aspect of 10% shows that customer growth is still below the minimum

standard and Domestic Water Consumption per month is still below the standard

of 30 M3 per month.

- The Operational Aspect shows that the productivity efficiency is still below the

standard of 90%, the level of water loss is still high with a standard of 20%, and

the water meter replacement is still low with a standard of 20%.

- The aspect of Human Resources (HR) shows that the ratio of employee training is

still below the standard, which is 60% of the total number of employees and the

ratio of training costs is still below the standard of 10% of the total employee cost.

2 Measurement of PDAM's financial and non-financial performance measured by the

Balanced Scorecard approach shows:

a. The results of the measurement of financial perspectives with five indicators

namely the ratio of gross profit, operating profit ratio, return on assets, current

ratio, and total asset turnover can be said to be bad. Whereas on other indicators

the company's financial performance is said to be bad because the measurement

results are far below the good criteria. This shows that the company has not been

able to optimally in the achievement of sound and sustainable financial

management.

b. The results of measuring the customer perspective with three indicators namely

customer retention, customer acquisition, and the level of customer complaints

looks good The company must continue to pay attention to the development of

customer needs and improve service, especially to customer complaints.

c. Measurement of the perspective of internal business processes with indicators

such as time of water distribution, efficiency and effectiveness of production,

speed of new connections, customer service, and lighting of water meters need

to be developed continuously. Then in terms of consumer protection is still bad,

this can be seen from the company has never done customer water meter

illumination in order to maintain honest, fair and transparent orderly measures.

d. The results of measuring growth and learning perspectives show good. Employee

productivity continues to increase every year by motivating and controlling

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

240

work so that employees are increasingly motivated and continue to produce

productivity for the company which will certainly affect other perspectives.

3 The balanced scorecard approach is more appropriate in measuring the financial and

non-financial performance of PDAMs than the traditional approach.

References

Christina, Ni Putu Yessy dan I Putu Sudana, 2013. Penilaian kinerja pada PT. Ardhi Karya

dengan Pendekatan Balanced Scorecard. E-Jurnal Akuntansi. Vol 5, No 3. Universitas

Udayana: Bali.

F., Dewi, W., Tiswiyanti, P., Eko, 2015. Praktik Good Corporate Governance Dan Dampaknya

Terhadap Kinerja Berdasarkan Balanced Scorecard Pada Perusahaan Daerah Air Minum

(PDAM). E-Conference in Business, Accounting, and Management (CBAM) Fakultas

Ekonomi UNISSULA Semarang. Vol 2 No.1 Mai 2015.

F., Ahmad, 2016. Analisis Pengaruh Penerapan Balanced Scorecard Terhadap Peningkatan

Kinerja Perusahaan (Studi Kasus Pada Perusahaan Daerah Air Minum (Pdam) Lamongan).

Jurnal Penelitian Ekonomi dan Akuntansi Volume I No. 1, Februari 2016.

Kaplan, Robert S., dan David P. Norton. 2000. Balanced Scorecard Menerapkan Strategi Menjadi

Aksi. Terjemahan Erlangga: Jakarta.

Mulyadi dan Johny Setyawan, 2001. Sistem Perencanaan Dan Pengendalian Manajemen: Sistem

Pelipat Ganda Kinerja Keuangan Perusahaan. Edisi III. Salemba Empat: Jakarta. Jakarta:

Salemba Empat.

Mulyadi, 2001. Balanced Scorecard: Alat Manajemen Kontemporer Untuk Pelipatganda Kinerja

Keuangan Perusahaan. Edisi II. Salemba Empat: Jakarta. Jakarta: Salemba Empat.

Mulyadi. 2005. Sistem Manajemen Strategik Berbasis Balanced Scorecard. Unit Dan Percetakan

Sekolah Tinggi Lmu Manajemen YKPN: Yogyakarta.

Octavyanti, Shelvy, 2014. Analisis Kinerja Melalui Pendekatan Balanced Scorecard

Pada PDAM Surya Sembada Kota Surabaya. Vol. 36 No. 1 Juli 2016

dministrasibisnis.studentjournal.ub.ac.id 203.

Putri, D. Nengah, F., Sudjana, Dwiatmanto, 2016. Analisis Kinerja Perusahaan Dengan

Pendekatan Balanced Scorecard Pada PDAM Kota Malang (Studi Kasus Pada Perusahaan

Daerah Air Minum Kota Malang Periode 2012 -2014). Jurnal Administrasi Bisnis (JAB) Vol.

36 No. 1 Juli 2016 administrasibisnis.studentjournal.ub.ac.id.

Robert, A. N, Vijay Govindarajan, (2003). Management Control System Buku II. Jakarta:

Salemba Empat.

www.pdamjambi.co.id

www.peraturan.go.id

Analysis of Financial and Non-financial Performance Measurement with Traditional and Balanced Scorecard Approaches: Survey of Local

Government Water Utility in Jambi Province

241