Social Investment and Ownership Structure

Rizky Eriandani

Universitas Surabaya, Raya Kalirungkut Surabaya, Indonesia

Abstract. CSR can be represented as a long-term investment, exchanging current

profitability with long-term sustainability. The value of social investment by the

company shows an increasing trend. The value of this investment may differ

according to the pattern of share ownership, because different types of investors

will have different goals and decision-making. Thus, it is necessary to analyze

the relationship between various types of owners and corporate social investment,

because the results of previous studies cannot be concluded. In this study, the

types of shareholders are divided into two categories– foreign and local

ownership.The abstract needs to summarize the content of the paper. This study

uses 215 firm years as samples that cover two years 2017-2018. Data on stock

ownership is obtained from the Indonesian capital market and measured by the

percentage of ownership. CSR investment is measured by the value of the rupiah

for corporate social activities, which is obtained from disclosures in the annual

report. The method used to estimate the parameters of the research model is linear

regression. The results showed that the higher foreign ownership in companies

would increase social investment. Whereas if local ownership is higher then

social investment will be lower.

Keywords: Social investment · Corporate social responsibility · Ownership ·

Foreign investor

1 Introduction

The concept of corporate social responsibility (CSR) is often discussed in literature and

research. The results of the study still identify knowledge and empirical result gaps that

require academic attention. First, differences of opinion about the potential uses of CSR

and corporate strategies. Second, many variables are used in the context of company

operations, size, type of organization, and ownership that seem to have different effects

on corporate CSR practices in various countries. Third, many CSR studies are carried

out in the context of developed countries (Western Europe, the United States, and

Australia), but there is still limited research in developing countries. CSR activities are

usually driven by various motivations, such as economic, legal, ethical, or discretionary

motives [1]. Business social responsibility can also reflect implicit conformity to social

norms of business behavior and the regulatory framework developed by consensus [2].

Research on CSR is generally divided into two, first investigating the impact or

benefits of CSR. Second, investigate the factors or motivations that drive these

activities. This research belongs to the second category, and specifically explores the

type of company ownership. The relationship between the owner and management of

the company is complicated because their interests are not aligned. There is limited

200

Eriandani, R.

Social Investment and Ownership Structure.

DOI: 10.5220/0009853700002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 200-206

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

research in the types of ownership and social responsibility investment. Barnea and

Rubin [3] say that ownership structure is able to explain the company's social

performance. This is due to every owner have different goals and decision making

horizons. In this study, ownership is categorized into two - foreign ownership and local

ownership. Foreign investors tend to differ from domestic investors in terms of

preferences, time horizons, and the problem of information asymmetry. Given these

differences, it is predicted that different owners have different preferences regarding

corporate social investment. In addition, foreign investors may be more inclined to pay

attention to social problems because they are familiar with these problems and put more

emphasis on CSR in their home countries, and because of the role of CSR involvement

as an important signaling mechanism that can reduce information asymmetry [4].

This study ultimately gave two contributions to the existing literature. First,

comparing CSR motives and practices of foreign and local companies under the

operational context provided to determine how cultural policies and obligations affect

corporate CSR decisions. Second, by conducting studies in Indonesia, this research

contributes to limited knowledge about CSR investments in Indonesia and seeks to offer

policy guidelines and strategies to government institutions that plan to initiate or

promote better CSR practices.

2 Theory and Hypotheses

2.1 CSR Concepts

Wood's research [5] was based on the conceptualization of Carroll. He used the concept

because in previous studies often it did not identify various types of responsibilities

adequately for CSR empirical research. He suggested that researchers should in detail

study the factors that trigger CSR initiatives from certain businesses or industries in a

country (ie principles or reasons that motivate to be involved in CSR activities). There

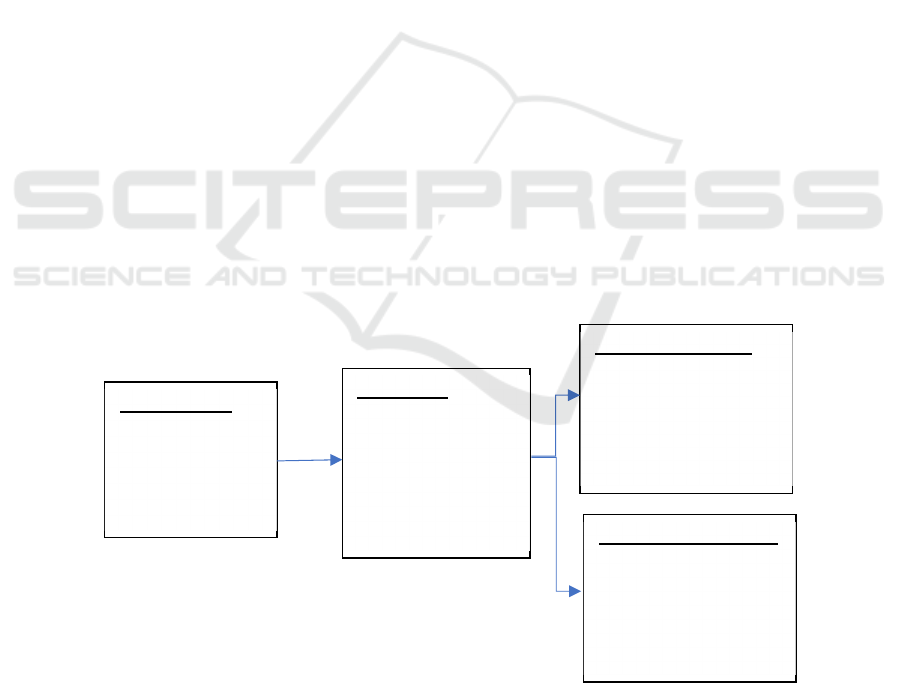

Fig. 1. CSR Antecedent Consequence (Kuada and Hinson, 2012).

CSR Motives

Economic

Ethical

Legal

Discretionary

Key Issues

Social Welfare

Human Rights

Physical

Environment

Community Work

Health and Safety

Societal Outcomes

Physical Environment

Social Welfare

Community

Development

Etc

Corporate Outcomes

Earnings

Cost Reduction

Corporate Image

Worker Satisfaction

Etc

Social Investment and Ownership Structure

201

are many definitions for corporate social responsibility but basically all companies must

act in a socially responsible manner. That is, they must be more involved and promote

sustainable development. First, by taking responsibility for the impact on the

community. Second, involved in community investment and other projects that can help

improve the environment and society in general.

We use the analytical framework of the Kuada and Hinson research [6], which uses

the CSR Carroll category (Economy, law, ethics, and wisdom) as the basis for reasons

(motives) that underlie corporate CSR decisions. Within this framework, the

consequences (benefits / results) of CSR are grouped into two: (1) community outcomes

- including benefits for the physical environment, social welfare benefits, and

community development; and (2) company results - including (but not limited to)

economic benefits such as cost reduction, company image enhancement, and employee

satisfaction.

2.2 Foreign Ownership and Social Investment

It is assumed that the level of investment from abroad might have a greater influence

than domestic practices [7, 8]. For example, current CSR implementation trends in

many Asian countries are largely influenced by Western-style management practices,

which are assumed to have a higher level of social involvement. Empirical findings also

support this argument. For example, Chapple and Moon [9] noted that globalization

increased the involvement of corporate CSR in Asian countries. When reviewing the

literature discussing international strategies that can provide social benefits to the host

country, the literature leads to CSR and business ethics [10,11]. Infrastructure

improvements through foreign funds, for example Chinese investors in Africa improve

roads, telecommunications, or educational institutions [12,13].

Besides having a high preference for social activities, companies with foreign

ownership are also more compliant with laws and regulations [6]. Outside countries,

especially Europe and the United State are countries that are very concerned about

social issues such as violations of human rights, education, labor, and environmental

issues such as, the greenhouse effect, illegal logging, and water pollution [14]. This also

makes in the last few years, multinational companies began to change their behavior in

operating in order to maintain the legitimacy and reputation of the company [14].

Multinational companies or with foreign ownership mainly see the benefits of

legitimacy derived from its stakeholders based on the home market (market where it

operates) that can provide high existence in the long run [15,16]. In other words, if a

company has foreign ownership, the company will be more supported in making social

investments.

H

1

: The greater the foreign ownership in a company, the greater the value of social

investment.

2.3 Local Ownership and Social Investment

Each country has different behaviors towards social responsibility activities. CSR

patterns are based on national specific norms of business-community relations,

corporate governance, government responsibilities, and broader community

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

202

governance norms [9]. Several previous studies have shown that companies in

Indonesia carry out less social responsibility than other countries. Chapple and Moon's

research [9] shows that Indonesia not only has the lowest level of CSR penetration, but

also has the lowest level of community involvement. On the other hand, Indonesian

investors also do not respond well to CSR activities. One of the CSR activities is the

environment, in Indonesia environmental performance actually has a negative impact

on the value of equity costs, the more environmental activities carried out will increase

the company's equity costs [17]. Mulyadi and Anwar's research [18] has proven that

investors in Indonesia still do not pay too much attention to social and environmental

responsibilities. Indonesia as a growing market and still attracts many investors because

of its potential to increase in the future, and focus on financial issues

.

Prihatiningtias and Dayanti [19] also show that CSR disclosure does not affect market

performance, which means investors do not value the activity. Based on the description above,

the second hypothesis is :

H

2

: The greater the local ownership in the company, the smaller the value of social

investment.

3 Data and Methodology

The total sample of this study was 215 and determined by several criteria. First, all

companies listed on the IDX in 2017-2018, except the financial and service industry

sectors. Second, the Company discloses the amount of CSR investment in the annual

report. Third, other variable data used in the study are available. Social investment

(INVCSR) is proxied by the amount of CSR expenditure for social activities, the

environment, employees, and community development mentioned in the annual report.

This study includes donations as CSR expenditures assuming they serve the same social

purpose because many companies do not provide details of CSR expenditures. The

greater this investment is assumed to have more CSR activities. Foreign ownership

(FOREIGN) is measured by the number of shares owned by foreign investors compared

to the outstanding shares. Local ownership (LOCAL) is measured by the number of

shares owned by local investors compared to outstanding shares. The percentage of

ownership is obtained from The Indonesia Capital Market Institute (TICMI). The

control variables of this study are Return on Assets (ROA), Leverage (LEV), and

company size (SIZE). The purpose of this study is to determine the relationship between

social investment with foreign ownership and local ownership. The statistical model is

as follows :

INVCSR

i,t

= β

0

+ β

1

FOREIGN

i,t

+ β

2

LOCAL

i,t

+ β

3

ROA

i,t

+ β

4

LEV

i,t

+ β

5

SIZE

i,t

+ε (1)

Dimana:

INVCSR : Social Investmen

t

FOREIGN : Forei

g

n Investo

r

LOCAL : Local Investo

r

ROA : Return on Assets

LEV : levera

g

e

Social Investment and Ownership Structure

203

SIZE

β0 - β2

εit

i

t

: Firm‟s Size

: the estimated coefficient

:error term

: 1, 2, ..., N (number of observations)

: 1, 2, ..., T (amount of time)

4 Result

Empirical test results support the research hypothesis. These results can be seen in

Table 1. Hypothesis 1 is supported, the greater the foreign ownership in a company the

greater the value of social investment. The FOREIGN variable shows a significance

level of five percent with a positive beta coefficient. Hypothesis 2 is supported, showing

that the greater local ownership will reduce the value of investment for CSR activities.

This can be seen in the LOCAL variable which shows a negative and significant beta

coefficient at the 5 percent level. The ROA and SIZE variables are significant at the

one percent level, while the LEV variable has no significant effect on social investment.

Table 1. Empirical Result.

Dependen Variabel : social investment (INVCSR).

Independen Variabel B t

Constanta

FOREIGN 1.341 2.564**

LOCAL -1.027 -2.371**

ROA 7.520 5.118***

LEV 0.011 1.621

SIZE 0.100 2.837***

***significant 1% **significant 5% *significant 10%

Foreign institutional investors have high monitoring capabilities, and encourage

increased governance arrangements in the companies where they invest, resulting in

high performance [10]. Foreign investment can also have a greater influence on the

adoption of Clean technology in companies and CSR ratings increase in the proportion

of equity held by all foreign parties [4]. The results of this test can be explained with

two reasons. First, foreign investors are more concerned with social long-term goals

and are accustomed to having a concern for social and environmental conditions, for

example environmental protection. The company will still get a positive advantage,

which is getting legitimacy from the community which will ultimately have an impact

on increasing company profits in the future. Second, the resources owned by companies

with greater foreign ownership, so they are able to make large amounts of CSR

investment. The results of this study are consistent with Rustiarini's research [21] which

found that there was a significant positive relationship between foreign ownership and

CSR disclosure. This shows that in general foreign ownership in Indonesia also cares

about social issues such as human rights, education, labor, and the environment which

must be disclosed in the company's annual report.

Conversely, local investors in Indonesia tend not to encourage social investment.

This may be explained by several reasons, first, local investors in Indonesia are not yet

concerned about social responsibility, as long as the company has fulfilled existing

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

204

obligations in law and regulations, it is considered unnecessary to invest large amounts

of CSR. Second, local investors still focus on financial performance. Based on several

previous studies, it appears that Indonesian investors do not respond to social

responsibility activities [9,12].

5 Conclusion and Implication

This research enrich the literature on ownership structure and social investment. The

ownership structure is divided into two - foreign and local ownership. This category is

based on theory and the results of previous research, which states that each investor in

a different country has a different social activity preferences. Foreign investors in

Indonesia show a great preference for social responsibility activities. The greater the

ownership of foreign investors will encourage large amounts of CSR investment.

Whereas local investors, showed less interest in CSR investments. This shows that the

ownership structure has an influence on corporate social investment decisions.

The results of this study illustrate that the motives of foreign and local investors are

reversed so that it can have implications for regulatory or policy-making bodies in

Indonesia. The low motivation of local investors in Indonesia should receive attention,

so that the company's sustainability is not only from the economic side but also from

the social and environmental condition.

References

[1] Carroll, A. B. The four faces of corporate citizenship. Business and Society Review,

100(1), 1-7. (1998).

[2] Matten, D., & Moon, J. “Implicit” and “explicit” CSR: A conceptual framework for

understanding CSR in Europe. In A. Habisch, J. Jonker, M. Wegner, & R. Schmidpeter

(Eds.), CSR across Europe (pp. 335-356). Berlin, Germany: Springer-Verlag. (2004).

[3] Barnea, A., & Rubin, A. Corporate social responsibility as a conflict between shareholders.

Journal of Business Ethics, 97, 71-86. (2010).

[4] Oh, W. Y., Chang, Y. K., & Martynov, A. The effect of ownership structure on corporate

social responsibility: Empirical evidence from Korea. Journal of business ethics, 104(2),

283-297. (2011).

[5] Wood, D. Corporate social performance revisited. Academy of Management Review, 16,

691–717. (1991)

[6] Kuada, J., & Hinson, R. E. Corporate social responsibility (CSR) practices of foreign and

local companies in Ghana. Thunderbird International Business Review, 54(4), 521-536.

(2012).

[7] Jeon, J. Q., Lee, C., & Moffett, C. M. Effects of foreign ownership on payout policy:

Evidence from Korean market. Journal of Financial Market, 14, 344–375. (2011).

[8] Yoshikawa, T., Rasheed, A. A., & Del Brio, E. B. The impact of firm strategy and foreign

ownership on executive bonus compensation in Japanese firms. Journal of Business

Research,

63, 1254–1260. (2010).

[9] Chapple, W., & Moon, J. Corporate social responsibility in Asia: A seven country study of

CSR website reporting. Business and Society, 44, 415–441. (2005).

Social Investment and Ownership Structure

205

[10] Pratt,C. B. Multinational corporate social policy process for ethical responsibility in sub-

Saharan Africa. Journal of Business Ethics, 10(1), 527-54. (1991).

[11] Hart, S. S., & London, T. Developing native capability: What multinational corporations

can learn form the base of the pyramid. Stanford Social Innovation Review, 3(2), 28-33.

(2005).

[12] Sautman, В., & Hairong Y. Trade, investment, power and the China-in-Africa discourse.

The Asia-Pacific Journal, 52-3-09. (2009)

[13] Williams, A., Bonney, T., & Xuereb, M. (2009). Assess the influence of China in suh-

Saharan Africa. London, UK: The Royal College of Defence Studies. (2009)

[14] Machmud, N., & Djakman, C. D. Pengaruh Struktur Kepemilikan terhadap Luas

Pengungkapan Tanggung Jawab Sosial (CSR Disclosure) pada Laporan Tahunan

Perusahaan: Studi Empiris pada Perusahaan Publik yang Tercatat di Bursa Efek Indonesia

Tahun 2006. Simposium Nasional Akuntansi, 11, 50-63. (2008).

[15] Simerly, R. L., & Li, M. Corporate social performance and multinationality, a longitudinal

study. Http//. www. westga. edu/~ bquest/2000/corporate. html. (2001)

[16] Barkemeyer, R. Legitimacy as a key driver and determinant of CSR in developing

countries. Paper for the 2007 Marie Curie Summer School on Earth System Governance,

28 May – 06 June 2007, Amsterdam.

[17] Eriandani, R., Narsa, I., & Irwanto, A. Environmental Risk Disclosure and Cost of

Equity. Polish Journal of Management Studies, 19(2), 124-131. (2019).

[18] Mulyadi, M. S., & Anwar, Y. Investors perception on corporate responsibility of

Indonesian listed companies. African Journal of Business Management, 5(9), 3630-3634.

(2011).

[19] Prihatiningtias, Y. W., & Dayanti, N. (2014). Corporate Social Responsibility Disclosure

and Firm Financial Performance in Mining and Natural Resources Industry. The

International Journal of Accounting and Business Society, 22(1).

[20] Miyajima, H., & Ogawa, R. (2016). Convergence or emerging diversity? Understanding

the impact of foreign investors on corporate governance in Japan. Research Institute of

Economy, Trade and Industry (RIETI).

[21] Rustiarini, Ni Wayan. 2009. “Pengaruh Struktur Kepemilikan Saham Pada Pengungkapan

Corporate Social Responsibility” Simposium Nasional Akuntasi.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

206