Construction of Performance Measurement Indicators

for Halal Banks based on Maqasid Al-Shari'ah

Satia Nur Maharani, Setya Ayu Rahmawati, and Syihabudin

University of Malang, Indonesia

syihabudin.fe@um.ac.id

Abstract. Islam offers values that are holistic, balanced and sustainable, both

material and non-material, in the practice of Islamic economics and halal bank

particularly. Unfortunately, there is no consensus between scientists and

practitioners regarding tools that measure success in implementing these high

values. So far, performance measurement that is used to assess the achievements

of halal banks is still conventional where the financial dimension as a top priority.

This article presents a framework for measuring performance that relays between

business performance and the vision of Islamic ethics based on maqasid al-

shari'ah. Through a process of investigation and in-depth analysis, measurement

indicators are constructed based on the dimensions of maqasid al-shari'ah,

namely faith, intelligence, human self, descent and wealth. This performance

measurement framework ensures that Islamic banks practice ethically in

achieving prosperity. In addition, performance measurement can provide Islamic

banks ranked as "Islam" and become a benchmark for developing performance

measurements for other Islamic business entities.

Keywords: Performance measurement ꞏ Maqasid Al-Shari'ah ꞏ Halal Bank

1 Introduction

Interest in the Islamic financial system is basically driven by the hope that effectively,

Islamic finance is able to offer perspectives that are integrated with world economic

and financial problems. Although this phenomenon is part of the global revival of

Islamic science, interest in practicing is fueled by the philosophy and value system

offered. Dissemination of the Islamic economy gets full support from the intellectuals

of Muslim countries. Finally Islamic banking and finance was born into one of the

fastest growing industries, spreading throughout the world with open acceptance by

both Muslims and non-Muslims.

Islamic banks are financial institutions have fundamentally idiological

characteristics different from conventional banks. Islamic banks are guided by the

principles of Islamic law that promote the sharing of risk and profit between

entrepreneurs and banks. The Islamic bank system ensure equal contribution for all

parties involved both profit and loss. While on the other side, conventional banks are

based on interest and have an intermediation function between savers and those who

need loans. Conventional banks calculate profits from the difference between the

lender's interest rate and the debtor's. Philosophically, the theory and practice of Islamic

120

Maharani, S., Rahmawati, S. and Syihabudin, .

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah.

DOI: 10.5220/0009837300002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 120-132

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and conventional banks have different characteristics. But in the economic

environment, both conventional banks and Islamic banks remain in contestation and

competition. The competitive power of Islamic banks is measured by a measurement

tool in the form of performance indicators. Performance measurement at Islamic banks

can determine how well the bank's performance also functions as a monitoring system

for Islamic bank performance. The benefit of performance measurement is determining

future banking prospects, both opportunities to compete and sustainable economic

capabilities (Laldin, 2013).

Basic indicators to measure the performance of Islamic banks put more emphasis

on the use of financial ratios such as CAMELS (Capital, Assets, Management, Earning,

Liquidity, Sensitivity of Market Risk), RGEC (Risk, GCG, Earning, Capital), and VA

(Economic Value Added). These performance measurement tools are generally used to

measure the performance of conventional banks. Meanwhile, non-financial aspects

such as the elaboration of Islamic ethics and morals which are important characteristics

of Islamic banks are ignored (Antonio et.al., 2012). Therefore, the difference between

Islamic banks and conventional banks in terms of ideological aspects requires a

paradigm shift in the form of performance measurement that is not limited to the

fulfillment of stakeholders but also includes non-financial indicators

(e.g.environmental, social and sharia) (Mohammed and Islam, 2015). Islamic Bank in

achieving sustainable growth, its main activities must be focused on the maslahah

(welfare) approach not only of shareholders but also broader stakeholders namely

environmental, social, and protecting sharia compliance.

2 Discussion

2.1 Performance Measurement

Performance measurement is media to continuously improve the strength of

organizational competition in the business environment that is colored by the

technological and communication revolution. Performance evaluation according to ....

as a benchmarking company to be productive and the results can be seen as an

indication of organizational health. Muhammed and Taib (2015) confirms that

performance measurement can be defined as the process of measuring the efficiency

and effectiveness of policies taken in the previous period as an evaluation material to

improve the quality of policies in the future. Meanwhile, Hanif (2016) explain

performance measurement as an evaluation process of managing an organization as a

service to internal and external stakeholders. Performance measurement becomes

feedback for organizations related to the quality of program implementation as well as

indicators of achievement organizational goals and suitability of actions with planning.

Lau and Sholihin (2005) categorize performance measurement in two parameters as

follows: 1) financial performance, showing the effectiveness of business entities in

utilizing assets to generate revenue. This definition refers to the general function of

performance evaluation to assess the overall financial health of a company; 2) non-

financial performance, refers to the limitations of financial performance as a basis for

decision making related to customer satisfaction, quality management, customer

growth and others.

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

121

In recent years, performance measurement has placed greater emphasis on financial

aspects such as CAMELS, RGEC, EVA which are the basis for evaluating the

performance of Islamic banks. This situation encourages the management of Islamic

banks to focus on how to reach financial targets. This affects the perspective,

orientation, and motivation of Islamic bank management at work, namely achieving

success in the financial aspect and looking at welfare is in the financial aspect. In the

end, the performance appraisal information presented by financial analysts is only

based on conventional measurement tools, this situation is increasingly spurring Islamic

banks to achieve conventional indicators (Lau and Sholihin, 2005). For example, the

basis for evaluating rates of return offered by Islamic banks is lower than conventional

banks, so conventional banks have higher financial efficiency than Islamic banks. Such

assessments encourage Islamic banks to develop financially oriented planning and

implementation. While Islamic banks have multidimensional characteristics rather than

just financial measures. This condition causes a mismatch of Islamic bank performance

measures that should be multidimensional, limited by financial welfare aspects.

2.2 Ideological Basis of Islamic Banks

The birth of Islamic banks was motivated by the hope of providing halal financial

services with the aim of clarifying economic and financial practices from the elements

of riba (implementation of the interest system), gambling and speculation (maysir), as

well as practices that contained prohibited or unlawful elements. Islamic law as the

spirit of Islamic economics views that bank interest is usury which is explicitly

prohibited. On the one hand, the impact of phenomena that pays close attention to when

Islamic economic practitioners and scientists look at the prohibition of Islamic law only

on aspects of the interests and demands of the advancement of civilization. That is,

when this prohibition is considered to limit Islamic banks to "success", it will produce

a pragmatic approach in developing the Islamic financial industry while maintaining

conventional financial structures but modified to align with the Islamic economy. El-

Gamal (2008) confirms this situation by describing Islamic banks as an industry driven

by a "prohibition" rule in which "Islamic finance is not built constructively from

classical jurisprudence or returning to the nature of Islamic law, but rather an alternative

or modification of Islam from conventional practices with the pretext of competition

and welfare".

The emergence of Islamic banks was also motivated by the awareness of modern

Islamic thinkers about the importance of rearranging socio-economic aspects within a

framework that is in accordance with Islamic orders as a solution to economic problems

and unrest (Hanif, 2018). Islamic banks are a concrete form of Islamic economics as a

comprehensive effort to deal with the fragility of a modern financial system that is

considered unfair, exploitative, discriminatory and unequal distribution of resources.

Islamic banks are also seen as a complete response to the crisis created by the capitalist

financial system. Robertson (1998) described the capitalist financial system as a system

that transforms people to work in ways that are unreal, incomprehensible, out of control,

and irresponsible. The Islamic value-based financial industry tries to reconstruct the

financial and banking systems with philosophical roots to practices based on Islamic

principles.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

122

Islamic economics directs the Islamic financial and banking system to the spirit,

principles and goals of Islamic economics. The focus isn’t only on maintaining

adherence to Islamic law as well as an active and substantive positive movement

towards a financial system for a better Islamic financial industry based on Islamic

values and principles. Up to this explanation, to maintain the continuity of the

observance, the performance measurement function has a very important position. The

results of the evaluation and analysis of performance measurements will reflect the

effectiveness and totality of Islamic banks in adhering to Islamic principles. Therefore

the need for performance measurement that is able to assess the functions and

responsibilities of Islamic banks in carrying out Islamic principles is urgent. One

perspective that can be used to build the measuring instrument is the concept of

maslahah revealed in Maqasid Al-Shari'ah.

3 Maqasid Al-Shari'ah

The concept of Maqasid Al-Shari'ah according to Auda (2011) is the center of theory

originating from Usul al-Fiqh (Islamic legal methodology) which was developed from

the 5th to the 8th century AH by a number of prominent Muslim scientists, such as Al-

Ghazali, Shams al-Din Ibn al-Qayyim and Al-Shatibi. The term Al-maqasid was first

introduced by Al-Shatibi, a prominent scholar in his book entitled Al-Muwafaqat fi

Usul al-Shari'ah.

Comprehensive discussion among Muslim scholars, emphasizes the relationship

between maqasid and maslahah (welfare) where the implementation of maqasid must

aim to realize maslahah and prevent danger (mafsadah). Maqasid has a specific

character that is based on sharia principles that are metaphysical and are not born from

the structure of human logical thought. Furthermore maqasid not only regulates the

material elements but also mentally and spiritually involving the world and the hereafter

(Auda, 2010).

The results of a comprehensive analysis sourced from textual studies show that the

principle of the aim of Islam is to maintain and ensure that the social order of the

community runs in a healthy, just, and prosperous way. Maqasid Al-Shari'ah is the goal

and objective of Islam in the form of a living system in which there are standards and

criteria, values and bases whose source comes from the word of God to be practiced

concretely (Chapra, 2007). These standards and criteria are guidelines for solving all

problems and guiding people towards prosperity (maslahah). Studying the Al-Shari'ah

maqasid covers all aspects of human life both individually and socially to ensure that

life has been full of benefits, that decisions taken both individually and collectively are

designed to protect these benefits.

Ibn-Ashur defines the Al-Shari'ah maqasid as an instrument to realize the benefits

and maintain these benefits both individually and collectively. Meanwhile Auda (2011)

explain that the maqasid Al-Shari'ah are the goals of sharia established by Allah.

Understanding the Al-Shari'ah maqasid provides knowledge to implement Islamic

values and effective solutions to any problems facing modern life. It can be concluded

that the main objective of the Al-Shari'ah maqasid is the realization of the economic,

social and spiritual welfare of the community.

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

123

4 The Maqasid Al-Shari'ah Dimension to Measure Islamic Bank

Performance

Al-Shatibi categorizes Al-Shari'ah maqasid in three major dimensions namely general

goals (al-maqasid al-'ammah), special objectives (al-maqasid al-khassah) and partial

objectives (al-maqasid al-juz ' iyyah). The general goal (al-maqaṣid al-‘ammah) to

preserve or maintain the benefit of humans in general, both in the world and the

hereafter in this case the benefit of humans in the context of preserving religion, lives,

reason, descendants and property . Specific objectives (almaqaṣid al-khaṣṣah) are goals

relating to specific goals and objectives in certain sections of certain chapters or fields

of study of Islamic law. For example, such as maqasid in business affairs, family life

or criminal court. The purpose of juz`i (almaqaṣid al-juz’iyyah) is a goal which is

related to a specific problem, without touching other issues, limitatively only related to

specific or partial issues. This study is specific in certain matters in the fiqh field, such

as specifically in matters of ablution, family responsibilities as the purpose of marriage

and avoiding the constant danger of avoiding divorce.

The division of the next dimension of maqasid which is no less popular and becomes

the basis in the development of several fields of study in Islamic economics is the view

of Al-Ghazali. He divided the Al-Shari'ah maqasid into five dimensions, namely the

preservation of religion / faith (ad-din), preservation of life (nafs), preservation of

intelligence (al-aql), preservation of offspring (nasl wal 'ird) and preservation of wealth

(al maal). Rahman (2003) asserts that Islamic banks have unique characteristics where

the system aims to build a fair socio-economic welfare including the preservation of faith,

life, intelligence, ancestry and wealth. So building a multidimensional performance

measurement through the perspective of the Al-shari'ah maqasid is very appropriate

because the maqasid itself is protecting, protecting and preserving the world (physical) in

this dimension of faith and metaphysics, life, intelligence, descent, and wealth.

4.1 Dimension 1: Maintaining Religion / Faith (deen)

Maintaining faith in this context is ensuring spiritual needs are met. In the perspective

of Islam, religion is the way of life, so that the meaning and purpose of life both in their

behavior, lifestyle, tastes and attitudes in life are for the Creator. The power of religion

in the form of meaning of the nature and purpose of life is transformed into the hearts and

minds of every individual to make themselves develop and change into a better human

being. Chapra (2007) emphasized that increasing moral and social solidarity would not

be possible to reach the point of maximum quality without the strength, help and

encouragement of faith. First, faith makes the existence of values and rules of behavior

widely accepted and unconditionally categorical imperative. Second, faith encourages

social sanctions as a form of moral encouragement when seeing who violates them.

Therefore guarding the faith is related to freedom to carry out religious orders both

in relation to God and with humans, other beings and nature. In this case guarding the

faith not only protects the sanctity of religion but also concrete implementation such as

building religious facilities as fulfillment of the right to space to worship and creating

healthy relationships in practicing religion (Asraf, 2017). Thus this right will indirectly

create a harmonious and conducive atmosphere in internalizing individual and

collective religiosity. Islamic banks in maintaining faith are part of the objectives of the

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

124

mission and vision of which the foundation is the value of Islam. This is an important

part of what is called "performance" in Islamic banks. For this reason, the assessment

indicators must touch and be able to measure the performance of banks related to

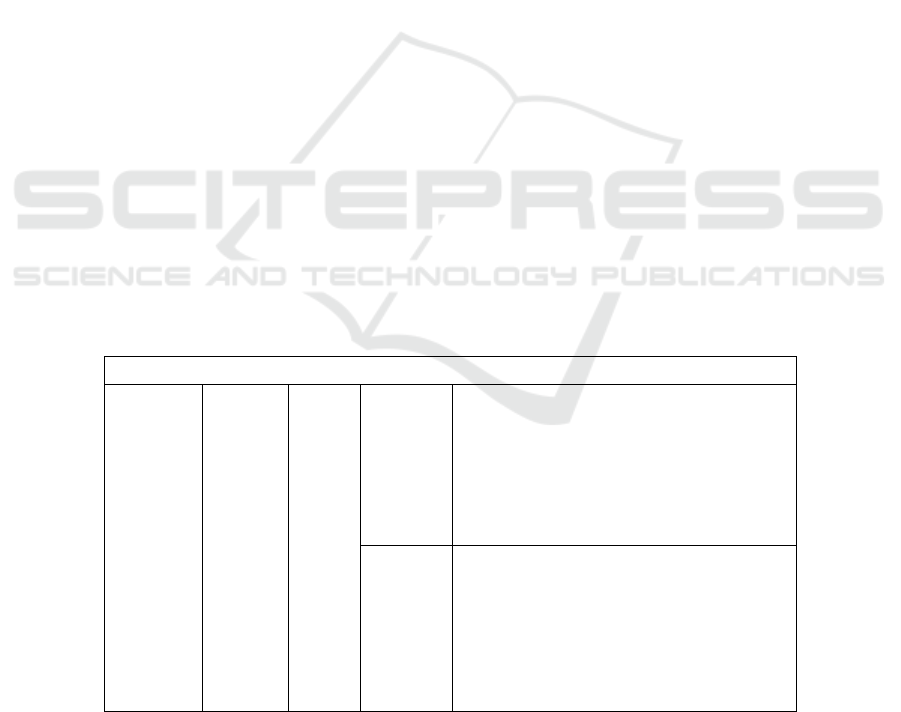

safeguarding faith. This can be derived in the indicators in the following table:

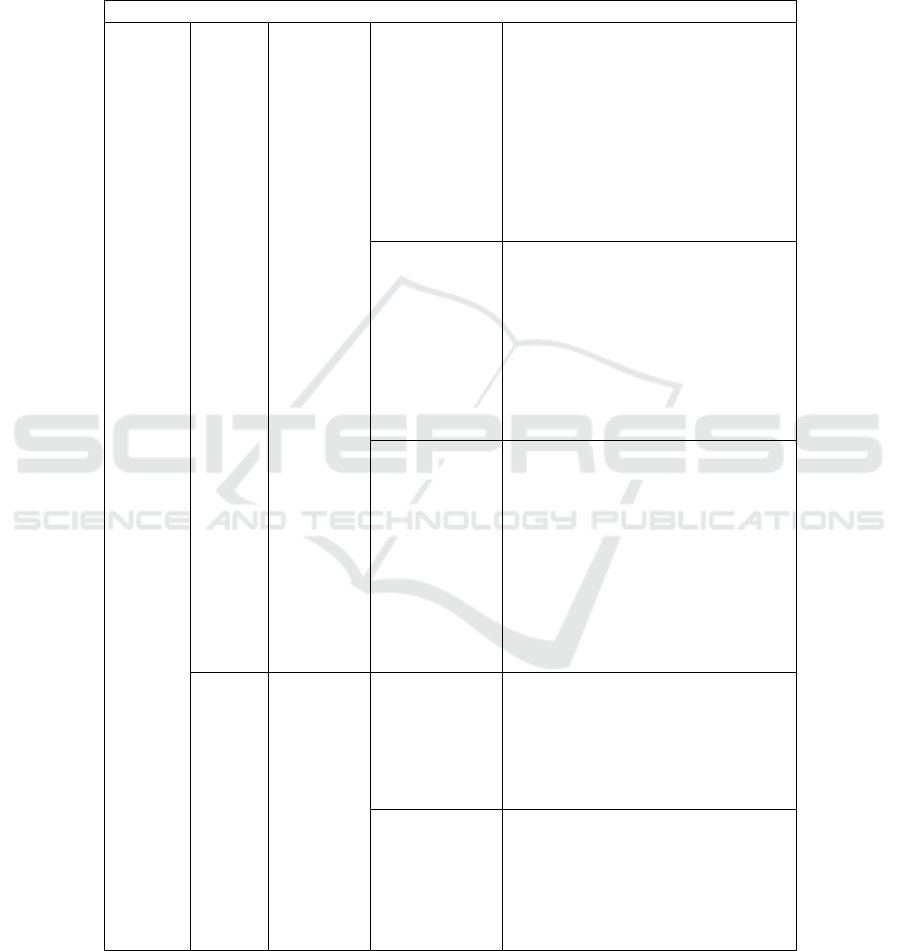

Table 1. Maintaining Religion / Faith (deen) Indicator Performance Framework.

M

aslahah =

M

aqashid Sharia

Protecting

religion or

faith

(deen)

Firmness

protect

Sharia:

piety to

God

Supervision

of Worship

Protect Prayer

• Is the prayer schedule is set out in

clause management policy and

implemented in practice as evidenced

by the rules that are written

• Do not cut management time praying

with any activity

• Is Islamic bank providing its own

representative worship space for

prayer in congregation

Protecting

Qur'an

• Does the management have read the

Koran in a periodic schedule and

enforced a clause in the policy

• Does the management have a

periodic assessment study tadabur

Qur'an that are periodically to

improve the quality of faith and

practice

Keeping Zakat

• Are the commissioners and the

Sharia Supervisory Board perform

periodic evaluations related to zakat

paid by all management and

employees

• Does the Commissioner and Sharia

Supervisory Board regularly

evaluates the calculation of the

amount of zakat paid by all

management and employees

Their sharia

conformity

assurance

mechanisms

on all

aspects of

corporate

activities

Products and

services are easy

and inexpensive:

The distribution

function

Total Mudaraba and Musharaka / Total

Investment

Reducing the

income element

of illicit and

unjust Interest

Free Products

Non Interest Income / Total Revenue

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

125

Table 1. Maintaining Religion / Faith (deen) Indicator Performance Framework (cont.).

M

aslahah =

M

aqashid Sharia

Protecting

religion or

faith

(deen)

Their sharia

conformity

assurance

mechanisms

on all

aspects of

corporate

activities

The

application of

ethical values

Derivative of

values and

ethical norms

• The vision, mission and principles of

Islamic banks in accordance and consistent

with the objectives of sharia

• The process of the bank's operational

commitment to the values of sharia

• Their ethical values and moral guidance in

writing based on Islamic values

• Focus on maximizing return on all

stakeholders

• The commitment to engage in investment

activity that is lawful

• Commitments are involved in financing

activities were lawful

• The commitment that any agreement

stipulated in the contract in accordance

with Islamic law and do not break the

contract

• Care for the interests of shareholders and

customers for in accordance with the

values of sharia

Products

offered license

from the Board

of sharia

• No involvement in activities that are not

permitted by law

• If there is involvement in activities that are

not permitted then it should set a minimum

prosentase of Earnings

• Reason involvement in activities that are

not allowed

• The process of handling activities that are

not allowed

• The process of the Agreement of new

products by Board of Sharia

• By Shari'a basis for approving new

products

• There is no violation of sharia on the

contract and its application in the activities

of distribution and receipt of funds.

• Presentation of the recognition of income

and expense in accordance with

accounting standards and guidelines

applicable to Islamic banks

4.2 Dimension 2: Maintaining Intelligence (Aql)

Intellect is the potential to think, understand, analyze, evaluate and synthesize something

or reality. Intellect is a characteristic that distinguishes humans from other creatures, a

source of potential that must be enriched with science continuously (Chapra, 2007).

Maintaining the mind does not mean simply protecting the ability of reason to avoid

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

126

getting drunk, depressed and even crazy. The purpose of maintaining intelligence is to

fulfill both individual and collective intellectual rights. So keeping products from

intelligence like copyrights, patents and other works is part of protecting intelligence.

Islamic banks in the perspective of maqasid have the performance to protect and

preserve the minds of internal and external stakeholders from damage. The

development of technology is picking up life into an instant and easy civilization.

Technology is an extension of modern science which is considered to always deal with

rational certainty in the logic of the positivism paradigm. Violence, pornography and

norm reduction are not only easily found in various reading sources but also programs

that can be watched through electronic devices and social media. This brings damage

to intelligence in an evolutionary and revolutionary way through the subconscious that

affects the point of view, mindset, and behavior. Islamic banks have a responsibility to

maintain and improve intelligence through internalization of Islamic values through the

continuous injection of knowledge (Hudaefi and Heryani, 2019). Plan and

implementation of training programs, professional certification, further studies,

workshops and so on for Islamic bank employees is one form of maintaining

intelligence. Islamic banks in preserving reason not only improve the quality of

scientific knowledge but also improve the health of reason in relation to faith. This is

due to the fact that the health of reason is not sufficient with intellectuals without the

intelligence of faith, to produce intelligent behavior requires a strong bond between

science and faith. Maintaining intelligence can be derived in the following indicators:

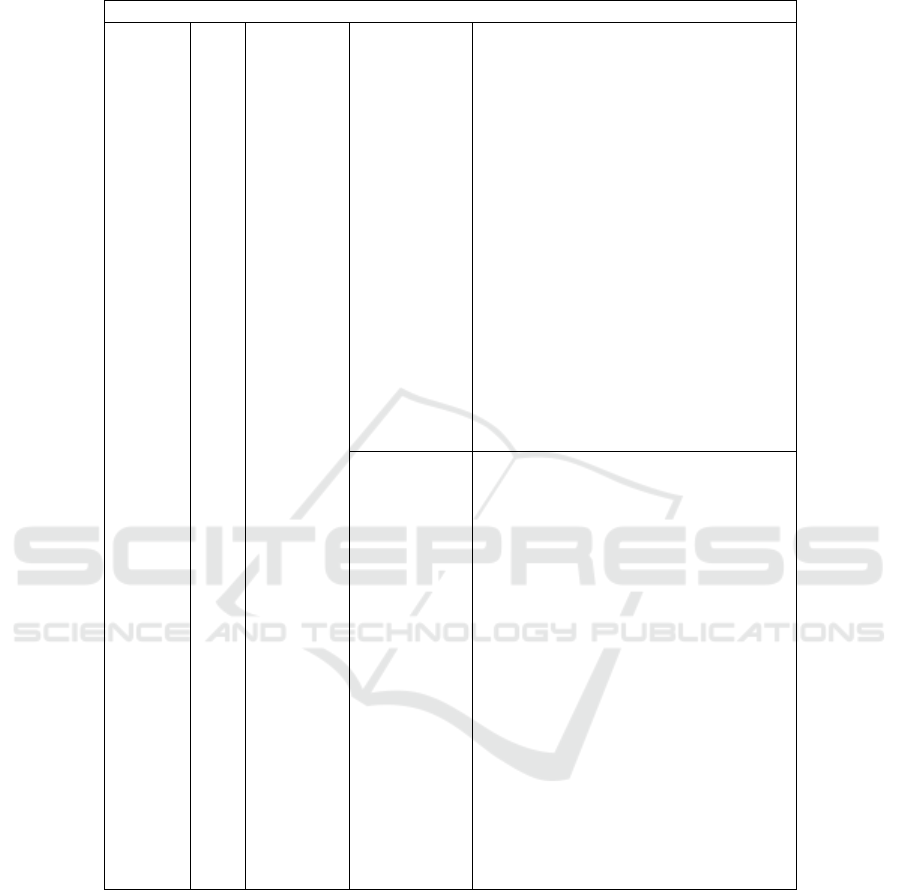

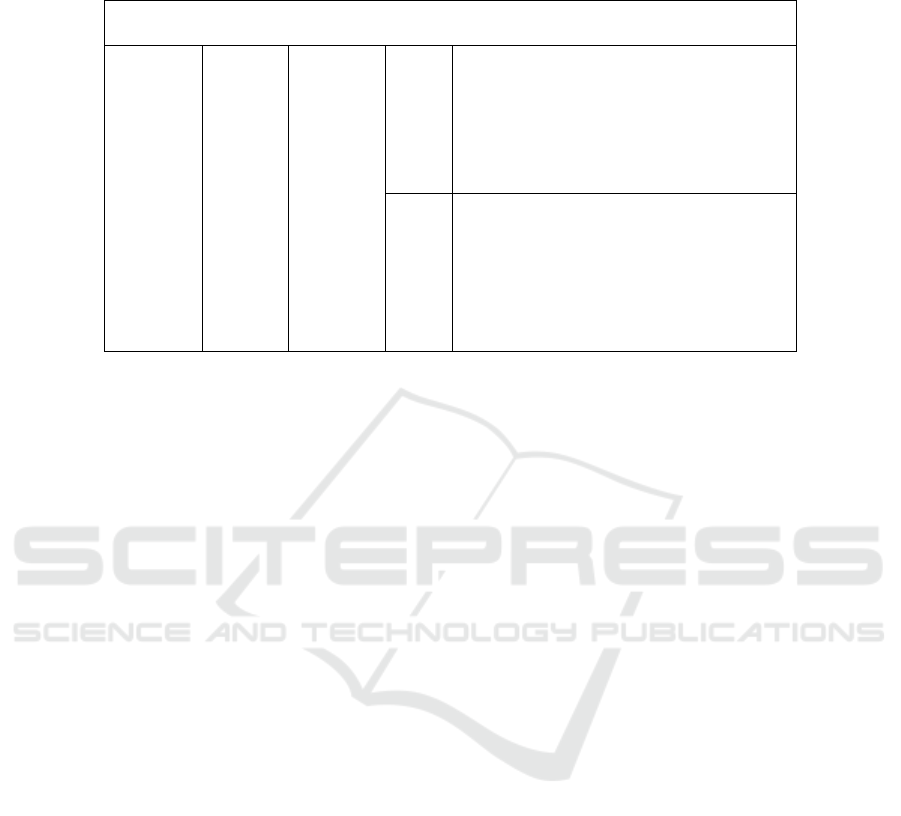

Table 2. Maintaining Intelligence (Aql) Indicator Performance Framework.

M

aslahah = Maqashid Al-Shari'ah

Protecting

Intelligence

(Aql)

Keeping

Yourself

and Actors

Internal

Intelligence

Concern

for

employees

by

improving

the quality

of human

resources

and the

welfare of

free usury

Aspect employees

• Appreciation/awareness to

employees

• The same opportunities policies

in career

• Employee welfare benefits

• Training on self-awareness of

servitude to God through the

values of sharia

• Professional training

• Scheme of scholarships and

recruitment notice justice

• Gift material in the form of

money to employees excel in

spiritual and professional aspects

of wor

k

Increased

Science

Scholarship Scholarship / Total Revenue

Upgrading

and

Developing

Skills

Implementation of

technology to ease

and effectiveness

of decision-making

The total cost of procurement and

technology updates / Total

Revenue

Training Training / Total Revenue

Creating

Awareness

Against

I

slamic Ban

k

Advertisement Cost Advertising (Promotion)/

Total Revenue

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

127

4.3 Dimension 3: Maintaining Life (nafs)

Maintaining life in the perspective of the Maqasid al-Shari'ah is to ensure that the needs

of human life at the basic level both physical (economic, health) and metaphysical

(mental, spiritual, social) have been met (Chapra, 2008). Critical issues that must be

considered by Islamic banks in safeguarding life are employee welfare programs in the

aspects of health, work safety, benefit programs for employees and their families and

others. The establishment of an employee committee as a channel for employee

aspirations in aspects of work safety, health and other welfare needs to be accommodated

by Islamic banks and realized in a formalized regulatory system. This is no longer just a

demand but has arrived at an obligation to be fulfilled by Islamic banks.

Furthermore, besides ensuring physical needs, maintaining life includes

metaphysical health such as psychologically, mentally, and spiritually. Personality

training, leadership, and emotional spiritual questions are efforts to protect the

metaphysical life. Besides human life, protecting life includes other creatures and the

natural environment. The environmental awareness program through CSR is an effort

to maintain the harmony of the natural environment. This is categorized as the

performance of an Islamic bank, so the measurement of performance related to the

concern for nature by Islamic banks is also a crucial thing that must be assessed (Hasan

and Ali, 2018). Environmental management systems such as the discipline of using

paper, electricity and water are one of the important agendas in the scope of the global

economy. In addition, the involvement of Islamic bank CSR funds for environmental

conservation from the closest to the farthest in accordance with needs is also a form of

performance of Islamic banks in protecting natural life (Haniffa, 2002). Maintaining

life can be explained in the following table:

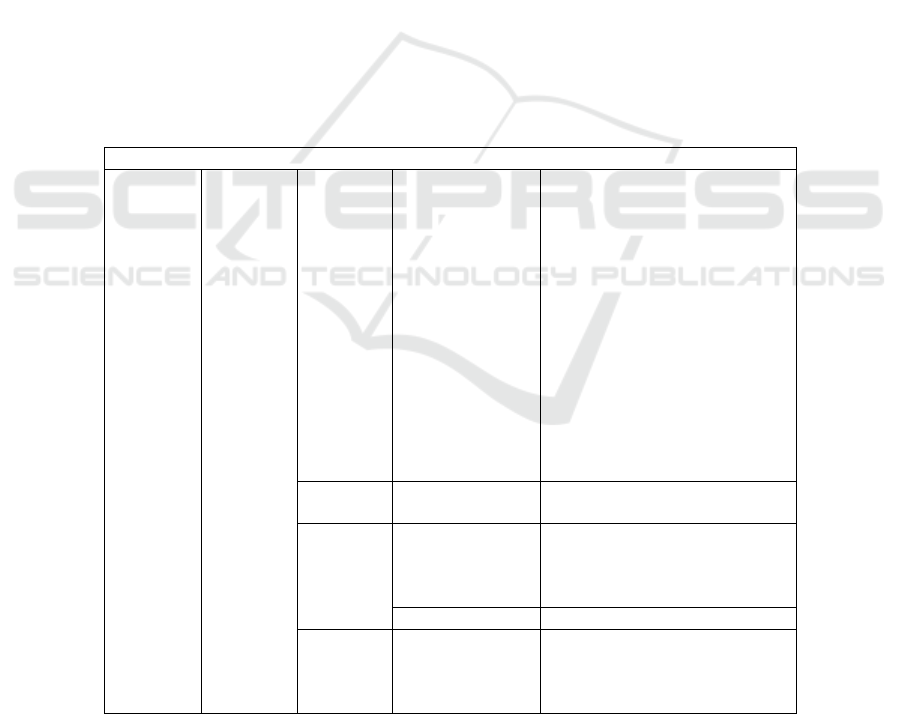

Table 3. Maintaining Life (nafs) Indicator Performance Framework.

M

aslahah = Maqasid Al-Shari'a

h

Preserving

Life (nafs)

Fairness

in social

entities

Social

indicators,

and Capital

adequacy

Policy Objectives and

Social Issues

Vision and Mission related social

policy

Target & Social Goals

Concern for consumers

Fairness in Revenue Profit Equalization Reserve (PER) /

Earnings

Leadership training,

p

ersonality, etc. ESQ.

Total all the training costs compared to

total costs

Disclosure of

quantitative

cleanliness

and division

of propert

y

Justice in Distribution

of Welfare

Total number of the charity fund

compared with total net income

Employee welfare Total Cost of Employee Benefits as

compared to total net income

Welfare Shareholders Total dividends are distributed

compared to total net income

Environment

al Indicators

Policy Objectives and

Issues About the

Environmen

t

Protection of Environment

The environmental management system

energy savings

CSR for the

environmen

t

Contribution to the Environment

compare

d

with a total funding of virtue

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

128

4.4 Dimension 4: Maintain Descent (nasl)

The spiritual, physical, and mental qualities of future generations are the determinants

of the survival of a civilization. If the quality is good and healthy, they will successfully

respond to every opportunity and challenge. Therefore, ongoing protection the quality

of future generations is influenced by parenting factors. To produce a noble Muslim,

character education is needed such as honesty, conscientiousness, tolerance, hard work,

frugal, polite, respecting parents and teachers, caring, loving towards the less fortunate,

able to get along and be reconciling in differences (Chapra, 2008).

Families, in this case parents, are early education related to character glory. Families

who fail to instill the quality of character will find it difficult to overcome the setbacks

of generations. Parents are an example that is always a role model for children and

influential in developing quality care and care patterns. If we draw this perspective in

the context of Islamic banks, the so-called family is all internal and external

stakeholders involved with Islamic banks. While in the internal scope of Islamic banks,

the relationship between management and all employees is a form of family that is

formally endorsed and has the same vision, mission and goals. All elements of Islamic

banks have the same commitment to maintain and improve the quality of products and

services. Policies taken by Islamic banks must be sustainable without harming the next

generation. The program of activities of Islamic banks in maintaining product quality,

product compliance with Islamic values, strategies and practices to maintain the

sustainability of products and services is also a form of protecting offspring in the

context of Islamic banks (Ashraf, and Lahsasna, 2017).

As explained above, management, employees, the sharia board, customers, the

community, the natural environment are objects of heredity preservation. Execution is

carried out with the maximum then the effect is a harmonious work environment. In

this aspect, concrete manifestations of caring for offspring are gathering family

employees, educational benefits for children, family health benefits and other programs

whose orientation is family (Hanif, 2018). Caring for offspring can be described in the

following table:

Table 4. Maintain Descent (Nasl) Indicator Performance Framework.

Maslahah = Maqasid Al-Shari'ah

Maintaining

Descendants

(Nasl)

Maintain

cleanliness

Keeping

the

Family

Quality

Keeping

families of

employees

Number of events involving families in one

year

Total cost of family health compared to total

costs

The total cost for the provision of educational

scholarships to children of employees

compared to the total cost

Maintain

social and

community

Create job opportunities

Support for organizations that provide benefits

to the community.

Government participation in social activities.

Sponsor community events

Commitment to participate in social activities.

The conference on Islamic economics

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

129

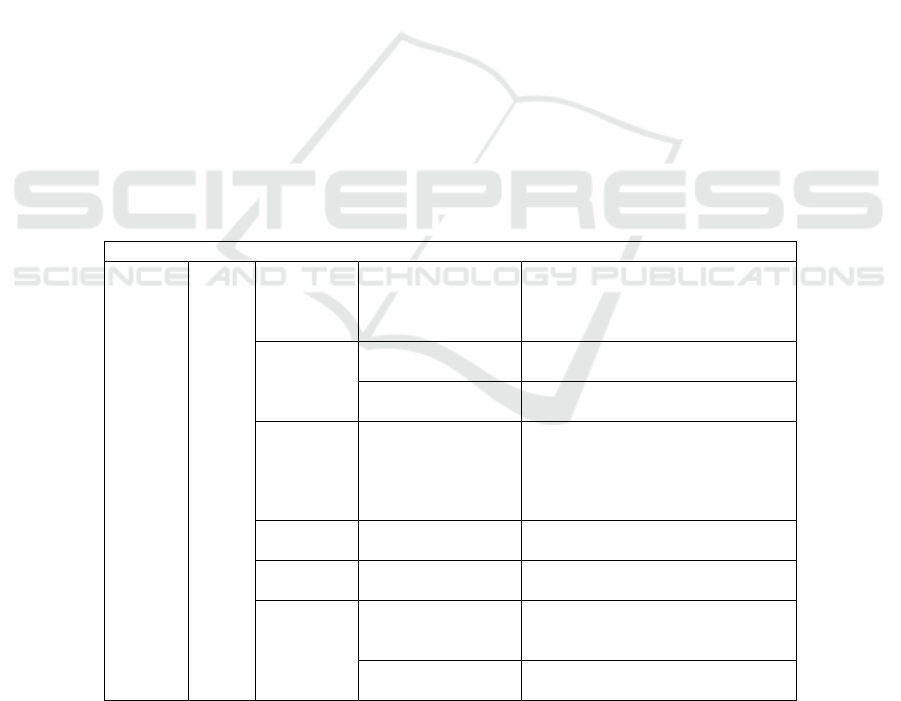

Table 4. Maintain Descent (Nasl) Indicator Performance Framework (cont.).

Maslahah = Maqasid Al-Shari'ah

Maintaining

Descendants

(Nasl)

Maintain

cleanliness

Maintaining

the quality

of products

and services

Product

quality

Cost of product-related research than the total

cost

Sharia board involvement in planning,

controlling, and evaluated a product

Periodic internal evaluations in maintaining

product quality to maintain the good name

Quality

of

services

Costs related research than the total costs of

services

Sharia board involvement in planning,

controlling, and evaluated services

Periodic internal evaluations in maintaining the

quality of services to maintain the good name

4.5 Dimension 5: Protecting Wealth (Maal)

Islam places wealth as a form of absolute giving from God to humans to improve the

quality of life both physically and spiritually. A person's honor before God does not

depend on how much property is owned, but rather how to get the wealth (acquisition

management) and how to place assets as a tool for worship (Auda, 2011). Islam

regulates the entire process of property in terms of how to obtain, produce and distribute

assets. The right of the unlucky person in every asset is absolute. So the concepts of

injustice, seizure of property, waste, corruption, and other dishonorable actions are

opposed in Islam.

Chapra (2008) asserts that protecting wealth is by developing and expanding wealth.

Chapra explained that even though the protection of assets included in the last rank does

not mean protecting assets is something that is no more important than others. The level

of urgency is the same as the other four dimensions because without welfare in the

aspect of wealth, human life in general will not be good. Through wealth in the aspect

of wealth, the problem of economic inequality can be reduced by the redistributive

method of zakat and shadaqah.

The dimension of preserving wealth in the perspective of Islamic banks preserves

the wealth of all stakeholders involved with Islamic banks (shareholders, management,

employees, community environment and nature). Policies and strategies developed by

Islamic banks must support the preservation of economic wealth and ensure that there

are no problems and risks in developing the potential of the wealth (Laldin and Furqani,

2013). The responsibility of Islamic banks is to maintain and preserve economic

interests based on Islamic values. This is done by protecting the function of ownership,

protecting wealth development through hedging, acquisition, circulation, distribution,

and prevention of damage. All these aspects are part of the performance of Islamic

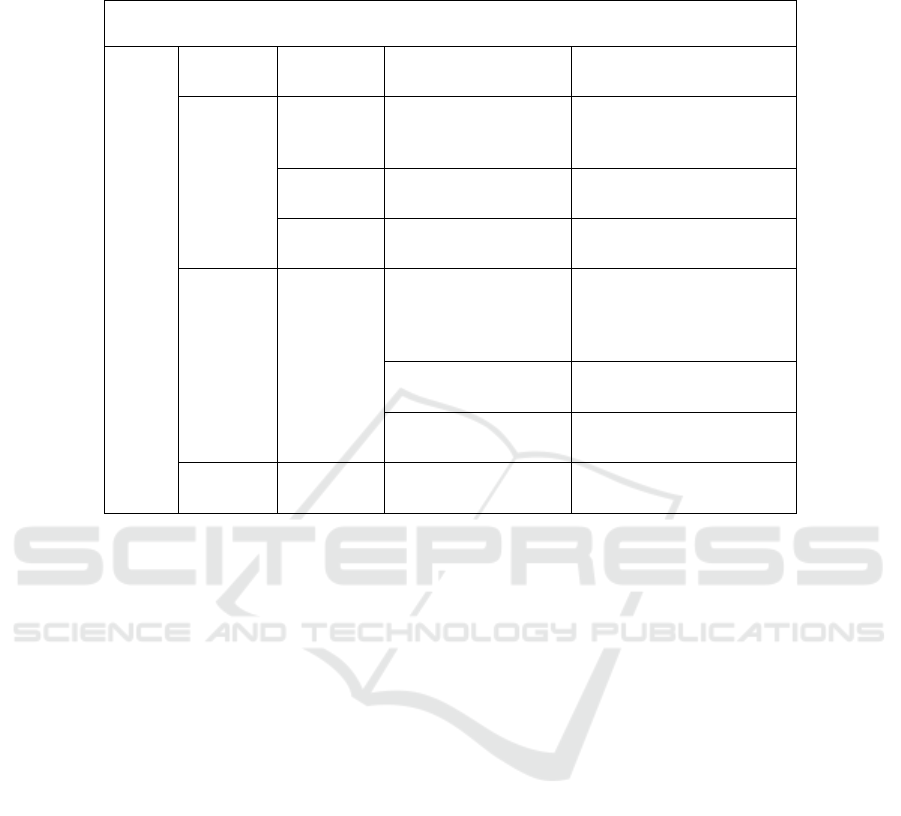

banks. Protecting wealth can be described in the following table:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

130

Table 5. Protecting Wealth (Maal) Indicator Performance Framework.

Maslahah = Maqasid Al-Shari'ah

Keeping

Life

Matter

and

Nature

Profit Net profit Against Liabilities Net

Income

Total net income compared to

total revenues

Community

interest

Dividend Seeing the bank's ability

to distribute dividends to

shareholders

Total dividends are

distributed compared to total

revenues

Quality

Management

Efficient Operations

Asset

Quality

Bad credit Estimates of bad loans

compared to total revenues

Wealth Development

and growth

Measuring the quality of

earning assets of Islamic

banks.

Productive assets classified

are assets which already

well containing no earnings

or potential to cause harm

Protection against risk Building a risk management

system

Ability to Generate

Profits

Financial ratios

Distribution of wealth Fair distribution of wealth to

all stakeholders

5 Conclusion

The perspective of the Maqasid Al-shari'ah offers five dimensions. Maintain, protect,

and preserve the five aspects of religion, intelligence, ancestry, soul and wealth to

achieve prosperity. These five aspects, when analyzed and studied more deeply, can

become perspectives in developing performance measurement indicators to assess the

health of Islamic banks. Achieving these indicators without differentiating and leaving

one dimension with another because the whole dimension is in harmony with the

performance characteristics of Islamic banks. By making the Maqasid Al-shari'ah, the

basis for a performance measurement framework, the values contained in the maqasid

are able to provide transformative power to improve the quality of Islamic bank

performance so as to become a financial institution that is lively and beneficial to all

relevant stakeholders.

References

Auda, J. Maqasid al-Shari'ah as philosophy of Islamic law: A systems approach. Kuala Lumpur:

Islamic Book Trust & The International Institute of Islamic Thought (2010)

Auda, J. A., Maqasid approach to contemporary application of the Shari'ah. Intellectual

Discourse, Vol.19, pp.193-217 (2011)

Construction of Performance Measurement Indicators for Halal Banks based on Maqasid Al-Shari’ah

131

Ashraf, M.A. and Lahsasna, A.:Proposal for a new sharīʿah risk rating approach for Islamic

banks. ISRA International Journal of Islamic Finance, Vol. 9 No. 1, pp. 87-94 (2017)

Antonio, Muhammad Syafii, Sanrego, Yulizar D dan Taufiq Muhammad. 2012. “An Analisys of

Islamic Banking Performance; Maqosid Indeks Implementation in Indonesia and Jordania”.

Journal of Islamic Finance 1(1), 012-029. IIUM Institute of Islamic Banking and Finance:

Malaysia.

Chapra, M.U.:The islamic vision of development in the light of maqasid al-sharī‘ah, working

paper, Islamic Research and Training Institute (IRTI), Jeddah, available at:

www.researchgate.net/publication/303499103_The_Islamic_Vision_of_Development_in_t

he_Light_of_Maqasid_ Al-Shari’ah (accessed 9 August 2019) (2007)

Chapra, M.U.: The Islamic vision of development in the light of the Maqasid Al-Shari’ah

(research paper)”, The Islamic Research and Teaching Institute (IRTI), available at: https://

econpapers.repec.org/paper/risirtiop/0235.htm (accessed 1 September 2019 (2008),

Hanif, M. Sharīʿah-compliance ratings of the islamic financial services industry: a quantitative

approach”, ISRA International Journal of Islamic Finance, Vol. 10 No. 2, pp. 162-184 (2018)

Hudaefi, F.A. and Heryani, N.:The practice of local economic development and maqa sid

alSharī‘ah: evidence from a pesantren in west java, Indonesi, International Journal of Islamic

and Middle Eastern Finance and Management, available at: https://doi.org/10.1108/IMEFM-

08-2018- 0279 (accessed 10 June 2019) (2019)

[9]Hasan, H. and Ali, S.S.:Measuring deprivation from Maqa sid al-Sharīʿah dimensions in OIC

countries: ranking and policy focus”, Journal of King Abdulaziz University: Islamic

Economics, Vol. 31 No. 1, pp. 3-26, available at: https://papers.ssrn.com/sol3/papers.cfm?

abstract_id=3183591(2018)

Haniffa, R. Social Reporting Disclosure: An Islamic Perspektif “. Indonesian Management and

accounting Research, 128-146. (2002)

Hanif, M.:Economic substance or legal form: an evaluation of Islamic finance practice”,

International Journal of Islamic and Middle Eastern Finance and Management, Vol. 9 No. 2,

pp. 277-295 (2016)

Lau C.H., Sholihin M. Financial and non-financial performance measures: How do they affect

job satisfaction? The British Accounting Reviewer, Vol. 37, P.389-413(2005)

Laldin, M.A. and Furqani, H.:The foundations of islamic finance and the maqa sid al sharīʿah

requirements”, Journal of Islamic Finance, Vol. 2 No. 1, pp. 31-37, available at:

http://journals. iium.edu.my/iiibf-journal/index.php/jif/article/download/9/9 (accessed 11

January 2019) (2013),

Mohammed, M.O. Tarique, K.M. and Islam, R.:Measuring the performance of islamic banks

using maqa sid-based model”, Intellectual Discourse, Vol. 23, pp. 401-424, available at:

http:// journals.iium.edu.my/intdiscourse/index.php/islam/article/view/692 (accessed 5

January 2019) (2015)

Muhammed, M.O. and Taib, F.:Developing islamic banking performance measures based on

maqasid al-shariah framework: cases of 24 selected banks, Journal of Islamic Monetary

Economics and Finance, Vol. 1 No. 1, pp. 55-77. (2015)

Robertson, J.:Transforming Economic Life: A Millennial Challenge, Devon: Green Books

(1998)

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

132