Social Construction of Risk Management in Local

Government Budgeting

Robinson

University of Bengkulu, Bengkulu, Indonesia

Abstract. Implementation of risk management at the local government level,

especially in the budgeting process, has not been a serious concern and has not

been managed in a structured manner, so that accountability for risk is low.

Most previous research on risk management is a concept that is applied to

private sector organizations such as banking and capital markets. Several other

studies on risk management in the public sector show that the application of

these concepts is very important. Almost all of those studies use a positivist

paradigm, so there are still few risk management studies that are discussed and

analyzed with other paradigms such as interpretive or critical. The data analysis

in this study produced three main themes which were the social constructs of

budget risk management, namely awareness of potential risks in budgeting;

commitment to rules/standards in budgeting; and leadership and culture.

Awareness of potential risks in budgeting is the foundation of commitment with

rules/standards in budgeting. This means that the commitment of the parties

involved in budgeting to rules/standards is largely determined by an awareness

of potential risks. Realizing the potential risks in budgeting such as political risk

and financial risk will encourage these parties to implement budgeting

rules/standards. This is done to anticipate the negative impacts of these risks.

While leadership and culture act as a roof that overshadows the implementation

of commitments to rules/standards in budgeting. Thus, leadership and culture

play a role in guaranteeing and encouraging all parties involved in the

budgeting process, to submit and obey the laws and regulations related to

budgeting.

Keywords: Social Construction · Risk Management · Budgeting · Local

Goverment

1 Introduction

Most research on risk management is a concept applied to private sector (corporate)

organizations, especially in the 1990s when risk management became an 'exploding'

concept and was used as an effort to increase anticipation towards uncertainty by

companies (Arena et al., 2010). The risk management approach is also associated with

business strategy, goal setting, control, accountability, and decision making as well as

company performance. Some of these studies were carried out in the banking and

capital markets (Das, 2005; Crouhy et al., 2006; Jorion, 2007), covering risk types,

risk measures (Fabozzi et al., 2007), risk model development and types types of risk

associated with capital market products (Duffie and Ziegler, 2003; Embrechts et al.,

Robinson, .

Social Construction of Risk Management in Local Government Budgeting.

DOI: 10.5220/0009585800002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 39-54

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

39

2005). Almost all of these studies use a positivist paradigm, so there is little risk

management research that is discussed and analyzed with other paradigms such as

interpretive or critical. The application of alternative approaches in risk management

research is also important because it is based on the opinion of Woods (2009) which

states that risk management is called more as an art than as a science, so it is more

important to understand the nature of a risk than just measuring risk by measurements

quantitative only.

Several other studies on risk management in the public sector show that the

application of this concept is very important. Palermo (2014) who examined the

adoption of frameworks and principles of risk management in the public sector

concluded that risk management is a means of realizing accountability for

organizations, the use of risk management depends on relational skills, knowledge of

business activities and professional experience. Besides, risk management can also be

seen as a device that depends on the context and as a technique described in the

context. Whereas Crawford and Stein (2004) show that risk management is part of a

set of increasingly formal governance arrangements in public sector organizations.

Furthermore, Collier and Woods (2011) revealed that compliance with laws is the

main driver for public sector organizations in implementing risk management.

However, as with risk management research in the private sector, the majority of

the research uses a positivist approach which assumes that risk management practices

generally apply to all public sector organizations. Risk management in the public

sector should be seen in accordance with the specific organizational context (Palermo,

2014), because according to Young and Fone (2001) there are unique things related to

risks in the public sector, in terms of public sector organizations have a unique

organization, has attributes in terms of regulations, social and politics, things that are

not found in the private sector. Also, accountability expectations are one of the drivers

of risk management practices in the public sector about environmental aspects such as

government policies, external assessment criteria, and professional standards

(Crawford and Stein, 2004; Collier and Woods, 2011; Woods, 2009). Thus, another

approach is needed to look at risk management practices in the public sector

specifically, according to the unique context and organizational environment.

One of the planning stages that needs to be the focus of risk management in the

public sector is at the budgeting stage. The important link between risk management

and budgeting can be viewed from two sides, namely the strategic role or function of

the budget and the potential risks inherent in the budgeting process. So the risks

contained in the budgeting process need to be anticipated with risk management.

Furthermore, Collier and Berry (2002) also mentioned that the separation of

budgeting and risk management has significant consequences for risk management in

the budgeting process. Without risk management in the budget can have implications

for the existence of risk in the organization. Another impact of the absence of risk

management in risk management is the lack of accountability for risks, so efforts to

identify, anticipate, and follow-up from risks are weak. Besides, the application of

risk management must consider the contextual aspects of an organization, meaning

that the implementation of the risk management concept must be viewed holistically

including considering the cultural aspects (Mikes, 2009).

It is also important to look at risk management holistically as conveyed by Collier

and Berry (2002), they suggest that research in the public sect

or needs to be carried

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

40

out related to risks in the budgeting process that are linked to policies, ethos, norms,

and values of workers' beliefs.

2 Theoretical Basis

Accounting, budgeting, and risk management are part of the control system of a

complex organization. Accounting guarantees the availability of information needed

by internal and external management of the organization, through various accounting

recording and reporting procedures. The budget, which is part of the planning stage,

provides detailed plan data needs and financial availability related to planned

activities and programs. As for risk management, is a structured and systematic effort

undertaken to anticipate risks that have become an inevitability inherent in every part

and stage of an organization's operations.

2.1 Accounting as a Social Construction

So far, accounting is only seen as a technical aspect, when the benefits of accounting

are limited to the preparation of financial statements as a requirement or compliance

for tax audits or reporting. But accounting has far broader benefits when seen not only

from a technical aspect but also from a strategic side. Accounting should not only act

as a compliance driver but also as a value driver (Tarigan, 2010). Thus, the focus and

perception of accounting need to be shifted from a technical view/compliance driver

to a strategic view/value driver. When accounting in an organization is seen from a

strategic point of view, the contribution of accounting is not just on technical aspects

such as the issue of cost efficiency, at the strategic level of accounting can play a role

in the value creation for the organization. The formation of values in an organization

is very dependent on social construction through the process of social interaction

between individuals, this is important to understand accounting as part of the social

construction.

The interpretive perspective theory views accounting practices and information in

accounting as socially constructed phenomena so that the concept of power and

politics in social construction can be fully applied to accounting practices and

information (Covaleski et al., 1996). As such, accounting practices and information

cannot be viewed as rational technical functions that are raised to serve the needs of

internal operations in the organization alone. This means that accounting is involved

in the construction of reality socially and not as a passive reflection of objective

reality, as held by positivists.

The budgeting process that is inherent in risk management practices is part of the

phenomenon of socially constructed accounting practices and information. Thus, how

the practice of risk management in the budgeting process will be largely determined

by the form of interaction of all parties involved, including in this case the social-

political and cultural aspects. According to Triyuwono (2011), accounting is a child

of the culture of the society where accounting is practiced. The statement

ontologically indicates that the values of people's beliefs have a very large role in

shaping the reality of accounting (Chariri, 2006).

Social Construction of Risk Management in Local Government Budgeting

41

2.2 Budgeting: Accounting and Risk

Research conducted by Collier and Berry (2002) on risk in budgeting using the

exploration case study method of the budgeting process, found that there are four

domains of observed risk: financial risk, operational risk, political risk, and personal

risk. The existence of the four risk domains is because there are differences based on

unique contexts namely the circumstances, history, and technology of the

organization (social construction). In public sector organizations, especially in

government organizations, the domain of political risk often becomes dominant in

budgeting. This happens because the budgeting for the government is carried out in

political institutions namely the legislature (DPR / DPRD) or parliament. Covaleski

and Dirsmith (1986) state that the budgeting system is inseparable from personal

interests and political bargaining aimed at maintaining existing relations and power.

Political bargaining efforts and top-down approaches in budgeting are activities

that often occur in the budgeting process, this can lead to political risks and gaps in

the budget (Covaleski and Dirsmith, 1986; Elmassri and Harris, 2011). In the practice

of local government budgeting in Indonesia, relevant parties actively try to harmonize

various existing interests. Efforts to harmonize the interests can be described through

the management of public legitimacy, the use of procedural-based controls, and

managing the relationship of trust and power (Utomo, 2015).

In addition to political risks, Collier and Berry (2002) also categorize budgeting

risks based on budget processes and content. Based on the budgeting process, the risk

that might occur is if the budgeting process is done with a top-down approach or

determined by the negotiation approach. Budgeting that uses a top-down approach

can lead to budgetary slack. The existence of slack in the budget is caused by the

distortion of information in the planning and budgeting process (Belkaoui, 2002). The

information distortion comes from an understatement and overstatement in the

budgeting process.

Previous research has concluded about budgetary slack from a different

perspective. Some conclude that budgetary slack is common or common in

organizations (Merchant, 1985; Merchant and Manzoni, 1989), while Merchant

(1989) concludes budgetary slack is useful for anticipating uncertainty in the future.

Also, budgetary slack is seen to have negative implications such as low manager

effort, misallocation of resources and bias in evaluating manager's performance (Dunk

and Nouri, 1998; Kren and Liao, 1988; Lowe and Shaw, 1968). Thus budgetary slack

is one of the issues that is still being debated in budgeting.

To minimize the impact of these risks, systematic steps need to be taken to

manage these risks. Therefore a structured approach is needed to determine the best

course of action under conditions of uncertainty or in other words a management

approach is needed in managing risk. One of the objectives to be achieved through a

good budgeting process is the allocation of resources in the budget to be effective and

efficient. Efforts that can be made to realize these goals are through risk management.

The success of achieving goals and objectives depends on how risks and uncertainties

are managed optimally (Tummala and Leung, 1996).

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

42

2.3 Risk Management in the Contextual Setting

The application of risk management in government agencies in Indonesia is more

specifically regulated by laws and regulations, namely in Government Regulation No.

60/2008 concerning the Government Internal Control System, specifically in article

13 to article 17. In Government Regulation No. 60/2008, implicitly requires the

Leadership of Government Agencies, both central and regional, to apply the

principles of risk management in managing existing resources in the government

agencies they lead to achieve the objectives of the relevant government agencies. The

application is absolute and must be done, for the sake of accurate assessment of the

risks of the relevant government agencies, so that the existing risks or obstacles can

be overcome and the objectives of these government agencies can be realized.

Each organization faces a different type and scale of risk, thus, the concept and

design of risk management applied will be different. Likewise, public sector

organizations, including government organizations, that the concept and design of risk

management in government in several countries is different. The application of risk

management in several countries such as the United Kingdom, America, Australia,

and Indonesia, applies different concepts and designs (Susilo, 2013). Besides, there

are unique things related to risks in the public sector, namely in terms of organization,

the public sector has a unique organization, has attributes in terms of regulatory,

social, and political, things that are not found in the private sector (Young and Fone,

2001). Therefore, in the implementation of risk management, continuous adjustments

and evaluations are needed to improve these policies. Herein lies the urgency of the

construction of risk management practices implemented by local government agencies

today, it is hoped that a clear picture of risk management implementation that can be

adapted to the socio-political and cultural context.

3 Research Methods

This research uses an interpretive paradigm with a qualitative approach. The choice of

interpretive phenomenology as a methodology is believed to be appropriate with

research aimed at articulating everyday understanding and practical knowledge, this is

relevant to the problem and purpose of the research. The use of interpretive

phenomenology methodology is expected to provide an understanding of the facts of

risk management practices in government, especially in the budgeting process. The

meaning to gain this understanding is based on the opinions and perspectives of the

parties directly involved in the budgeting process, both from the executive and the

legislature.

3.1 Method of Collecting Data

The data in this study are expressions of experience that contain meaning from

informants in carrying out risk management practices in the budget preparation

process. The intended experience includes actions, responses, and emotional

expressions of informants when identifying, accepting/rejecting, determining

alternative solutions, and evaluating the risks faced in the budgeting process. As for

Social Construction of Risk Management in Local Government Budgeting

43

obtaining data as a whole and relevant to the objectives and formulation of research

problems, the research data collection was carried out through in-depth interviews,

participant observation, and documentation analysis.

In-depth interviews were conducted using semi-structured interview techniques.

The questions in the interview are designed based on research questions that are

adjusted between the context with the concept of budgeting and risk management,

also adjusted to the main tasks and functions of each participant in the budgeting

process as stipulated in the applicable legislation. To document the results of the

interview, a recorder is used.

Participants interviewed in this study were divided into two categories, namely

key participants and regular participants. Key participants are parties as regulated in

legislation (Law No. 17 of 2003 and Permendagri 57 2011) included in the structure

of regional financial management and directly involved in the discussion and decision

making of budgeting (including from the b and budget in the legislature). In the

phenomenological approach, the most important is that the informants used as sources

of information come from individuals who have experience relevant to the

phenomenon under study (Creswell, 1998).

The observation technique used in this study is passive participation observation,

which is involved in the social environment of local government but is not part of the

local government agency. This technique is used to see, feel and understand directly

various aspects related to the questions in this study. These aspects consist of

management, leadership, behavior and political aspects with risk management that

occur during the budgeting process, both in the executive and legislative branches.

The data obtained must meet certain accuracy criteria so that it can be used and

trusted. Several techniques can be used to test the level of trust or credibility of

research data, namely extending engagement, continuous observation, and

triangulation (Lincoln and Guba, 1981). The level of credibility and validity of the

data in this study uses triangulation techniques, while the type of triangulation used is

data triangulation and source triangulation.

3.2 Data Analysis Method

Data obtained from in-depth interviews will be analyzed by the Interpretative

Phenomenological Analysis (IPA) method. The process of analysis in science is often

described in terms of a double hermeneutic or double interpretation, because first,

participants make meaning in their world and second, researchers try to decode the

meaning of the meaning - understanding the meaning-making of participants (Smith

and Osborn, 2008). In other words, researchers who use science try to understand

what the experience (object or event) is from the perspective of the participant.

According to Smith (2009), the stages of science are carried out as follows:

1) Reading and re-reading; 2) Initial noting; 3) Developing Emergent themes;

4) Searching for connections across emergent themes; 5) Moving the next cases, and

6) Looking for patterns across cases.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

44

4 Results and Discussion

Based on the interview transcription results, 339 citations were obtained. Then the

data is analyzed through the Interpretative Phenomenological Analysis (IPA) process.

Data analysis begins with "diving" data by reading interview transcripts repeatedly.

This process is done with the assumption that each informant's words are very

important to enter the analysis phase and the data of those words are treated actively.

Some parts of the informant's narrative obtained through the first stage of data

analysis were coded. These codes include risk (application, human resources,

processes, politics, facilities, financial); role; anticipation; culture; leadership; slack;

implementation. The codes are based on the topics that appear in each sentence

excerpt in the interview transcript.

The second stage of data analysis by the Natural Science Technique is initial

noting, this analysis is carried out to produce a comprehensive and detailed set of

notes and comments about the data. The data analysis process in the second stage

produced 1 (one) note/comment from each interview excerpt so that 339 initial notes

were obtained. Giving meaning for each quote is based on the substance contained in

each sentence in each data, in the process of giving the initial meaning is assisted by

the codes that have been made in the first stage of analysis.

Developing Emergent themes (developing the emergence of themes) is the third

stage of this data analysis, to bring up the researchers' themes regulating data changes

with simultaneous analysis, trying to reduce the amount of detail from the data in the

form of transcripts and initial notes that are still irregular (complexity) for mapping of

interrelationships, connections and patterns between exploratory notes. After the notes

mapping process is completed, 108 (hundred and eight) initial themes are obtained,

the third stage of data analysis is then continued by looking for the interrelationship

between the initial themes. The interrelationship between these initial themes was

built based on the similarity of concepts and the substance of each group of themes,

eventually, 19 19 emergent themes were obtained.

The fourth stage of data analysis is searching for a connection between cross

emergent themes, looking for relationships between themes that emerge after the

researcher establishes a set of themes in the transcript. The relationships between

these themes are developed in the form of graphics or mapping and think of themes

that are in harmony with one another. This level of analysis has no stipulations,

researchers are encouraged to explore and introduce something new from the results

of their research in the form of organizing analyzes. Not all themes that emerge must

be combined in this stage of analysis, some themes may be removed. This analysis

depends on the entirety of the research question and the scope of the study.

The process of looking for relationships between emergent themes is based not

only on the corresponding themes but also considers a concept at a more abstract level

that can include the substance of all themes in one group. The results of the fourth

stage of data analysis through mapping emergent themes produced 3 (three) main

themes namely: 1) Awareness of potential risks; 2) Commitment with rules/standards

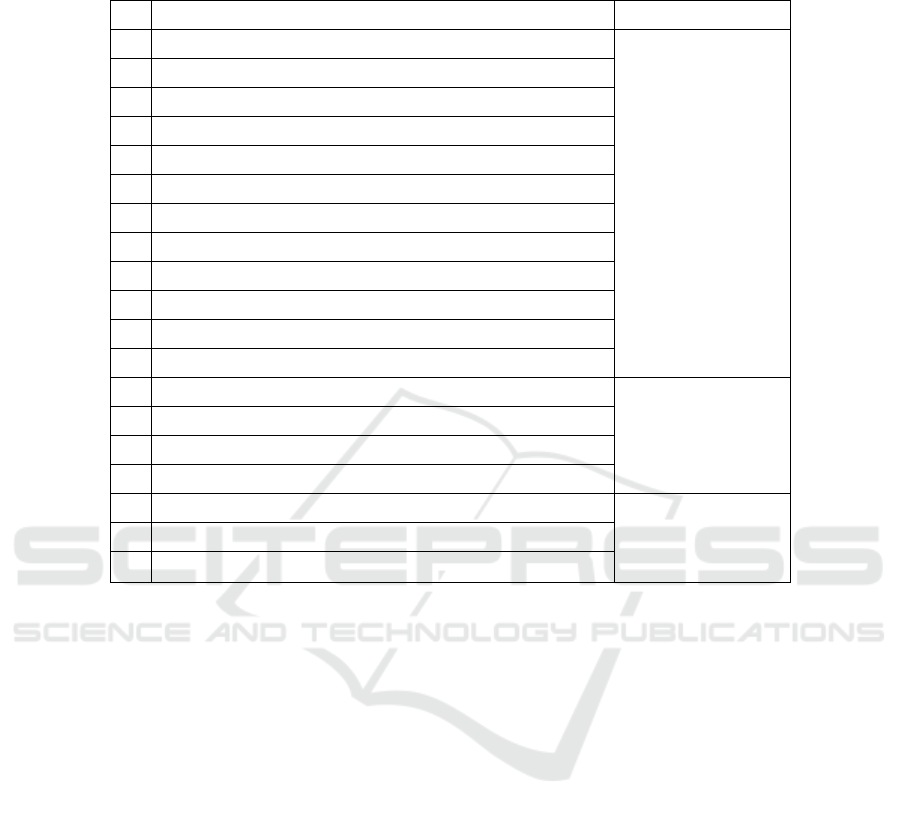

and 3) The role of leadership and culture. Table 4.1 below is the result of the analysis

of the relationship between emergent themes that produced the main theme.

Social Construction of Risk Management in Local Government Budgeting

45

Table 1. Connection a Cross Emergent Themes.

No Emergent Themes Tema Utama

1 Be aware of the risk of asynchronous budgeting

Awareness of

Potential Risks in

Budgeting

2 Be aware of the risks of budgeting system weaknesses

3 Be aware of the demands of budgeting professionalism

4 Be aware of the potential risk of budget priority errors

5 Realizing the potential for low quality budget

6 Political interests and power in budgeting

7 HR carrying capacity

8 Be aware of weaknesses in budgeting applications

9 Potential risk of budget deviations

10 Risk of late budgeting

11 External factors in budgeting

12 Understanding the existence of slack in budgeting

13 The importance of shopping standards

Commitment to

Rules and Standards

in Budgeting

14 The role of risk-based SOP

15 The consequences and changes in rules / laws

16 Commitment to rules and standards in budgeting

17 The role of communication and participation in budgeting

The Role of

Leadership and

Culture in

Bud

g

etin

g

18 The role of culture

19 Leadership role

Source: Developed for research, 2019

The final stage of data analysis using the IPA technique is looking for patterns

across cases. Look for patterns that emerge between the main themes generated in the

previous stage. This stage activity involves searching for relationships between

emerging themes, grouping them according to the similarity of concepts and

providing each cluster with a descriptive label. In practice, it means looking for and

determining the form of relationships between the main themes supported by certain

concepts or theories. Finally, this process leads to the determination of what is the

main theme of risk management in local government budgeting. Next will be

described how the relationship between the main themes resulting from this research,

namely how the relationship between the concept of awareness of potential risks with

the concept of commitment to the rules/standards, and how it relates to the role of

leadership and culture in budgeting.

Awareness of potential risks in budgeting becomes the foundation or foundation

of commitment to the rules/standards in budgeting. This means that the commitment

of the parties involved in budgeting to the rules/standards is largely determined by the

awareness of potential risks. Being aware of potential risks in budgeting such as

political risk and financial risk will encourage these parties to implement budgeting

rules/standards. This was done to anticipate the negative effects of these risks. While

the pillars of leadership and culture play a role as a roof that oversees the

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

46

implementation of commitments to the rules/standards in budgeting. Thus, leadership

and culture play a role in guaranteeing and encouraging all parties involved in the

budget preparation process, to obey and comply with the laws and regulations related

to budgeting.

4.1 Awareness of Potential Risks

Risk management is designed to identify potential events that can affect the entity,

and manage risks within the limits of the desired risk, to provide adequate confidence

regarding the achievement of the entity's objectives (Moeller and Robert, 2007). The

concept of risk management emphasizes the urgency of the ability to identify

events/activities that contain risks. Thus, awareness of potential risks must indeed be

owned by every individual who is responsible for the risk management process. In the

context of budgeting in local government, the existence of various potential risks in

budgeting must be realized by the parties involved in the budgeting process, as stated

by informant 18 as follows:

"... we have the fact of integrity, every time there is an inauguration of the

fact of integrity ... we really have to be careful in planning, for example I will

move, then I must have a shadow, what risks will be faced later, how to get

out, for example there is this obstacle what do we do to solve it ... so in

planning the net smoothly ... there's no way there must be a risk, we take this

... this risk ... later how to overcome it, we have to anticipate it from the

start... "

The information from the informant above reminds us to be careful in facing

various possible risks in budgeting, including the need to anticipate possible solutions

to each risk faced. One form of potential risk that often occurs is the

unsynchronization of proposals between stages in budgeting. Informant 13 states the

following:

"What is it ... to bring together (the proposed program/activity) between the

bottom up (village/district) and the top-down (Central / Provincial / Regency)

... often not met ... from the village and subdistrict musren, the priority has

been made. ... for example for roads, bridges or irrigation ... well, at the

district musrenbang there are priorities from SKPDs ... here they are not

found... "

Other informants also expressed the same thing about the possibility of

unsynchronization of proposed programs/activities at each stage in the preparation of

the budget through the following statement of informant 2:

"... after the musrenbang, there is an OPD forum, here later there will be

proposals from the council ... this is sometimes ostentatious (planning policy

framework) hehe.. that's already the realm of politics huh ... why are

members of the council does not follow the priorities set by the Regency ...

maybe because of the will of the constituents, but this must be a real

synchronization, sitting together so that there is a common perception ...

Social Construction of Risk Management in Local Government Budgeting

47

indeed there must be synergy between the executive and legislative branches

... "

There are several potential risks that must be realized by the parties involved in

the budgeting process, based on the results of data analysis in the fourth stage, namely

looking for relationships between emerging themes, then obtained at least 4 (four)

potential risks, including operational risks, personal risk, financial risk and political

risk. The four potential risks are the same as the types of risks in budgeting proposed

by Collier and Berry (2002).

4.2 Commitment to Rules and Standards

Understanding and awareness of the need to implement risk management in an

organization are one of the conditions for success in implementing risk management.

The following informants revealed that it is necessary to manage the risks that may be

faced by an organization, namely to ensure the achievement of the goals or targets of

the organization's performance:

"Yes, it is important, because every organization has a vision, mission, goals

to be achieved ... in its journey there are risks, which if not managed, the

performance targets or objectives to be achieved will be disrupted / not

achieved ... for me the risk must be controlled so performance targets, goals

can be achieved "(Informant 14)

The quotation from informant 14 above implied that the risk management must

also be carried out with systematic steps or approaches. At least this step begins with

an effort to identify risks, the following informant's statement shows that each

organization must be able to identify potential risks from planning, implementation to

accountability for a program/activity:

"... so each OPD identifies risks in carrying out its duties and functions, since

planning, each implementation has risks, how to anticipate risks. For this

reason, each OPD task force should have a SPIP task force, each identifying a

risk ... "(Informant 14)

Risk identification is a form of caution against potential risks, this is very

necessary especially in the budgeting process, this step can help find alternative

solutions or actions needed for these risks, such as the following informant's

statement:

"... we have to be careful in planning, for example, I will move, then I must

have a shadow, what risks will be faced later, how to get out, for example,

there is an obstacle, what do we get out ... we take this ... this risk .. how to

overcome it later, it must be anticipated from the start .. "(Informant 18)

Attitudes and actions that must be carried out as stated above, in accordance with

the demands for the realization of the role of an effective government internal control

apparatus as referred to in Article 4 letter g PP 60 2008, including by providing early

warning and increasing the effectiveness of risk management in carrying out the tasks

and functions of the Agency Government.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

48

The compilation and establishment of the APBD must follow the applicable laws

and regulations. Government Regulation number 58 of 2005 article 4 paragraph (1)

states that, regional finance (including the preparation of APBD) is managed in an

orderly, obedient to statutory regulations, efficient, economical, effective, transparent,

and responsible with due regard to the principles of justice, propriety, and benefits for

the community.

Deviations and asynchronies between planning and budgeting documents are one

form of potential risks that may occur in the budget preparation process. As a

precautionary measure against these potential risks, all parties involved in budgeting

must be consistent with the rules and procedures, such as the following informant's

quote:

"... first we try to be careful, in the sense that (it must be) on the track, in the

sense that according to the rules ... if it is not according to the rules then no,

the point is we must have firmness because this is related to the budget earlier

... then we try everything there must be a plan, when there is no good

planning we are not easy to approve the budget.. "(Informant 4)

"... That is important for us according to the rules, according to the procedure

... if it is against the rules or contradictory to the procedure we say no ...,

unlike years or eras, and it was educated by our top managers ... when we

submitted the report it is not necessarily signed.. examined one by one, the

range of control is also running ... "(Informant 2)

The statement of informant 2 above, emphasizes that it is important to remain

consistent with the rules and process in submitting the budget proposal. One

procedure that must be followed in budgeting is that a proposed program/activity

must conform to the strategic plan (strategic plan) and the work plan (renja) of the

organization. According to Blumentritt (2006), by integrating the process of strategic

planning and budgeting, the results achieved are more realistic and useful which in

turn will facilitate financial and strategic performance.

4.3 The Role of Leadership and Culture

Law number 17 of 2003 article 6 paragraph (2) authorizes the authority of regional

financial management to be handed over to the Governor / Regent / Mayor. Based on

article 10 paragraph (2) of the Act, one of the tasks in the framework of the

management of regional finances is to compile and implement a policy on the

management of the regional budget. Thus, the leadership role of regional heads

cannot be separated from the budget preparation process.

The role and function of the leader are very important to build a conducive

atmosphere in the management of regional finance in general, especially in budgeting.

The existence of a leader is expected to provide motivation, role models and

innovation. The majority of informants recognized this leadership role in planning

and budgeting, including the following:

"For our superiors ... from the assistants, it is enough to support them anyway

... because it is the main duty of the superiors ... if the Bupati's leadership ...

Social Construction of Risk Management in Local Government Budgeting

49

the way is fast yes ... run ... we must adjust ... change the work culture, then

always motivate for example at the time of the apple ... "(Informant 12)

"Yes ... that was ... innovative ... with its breakthroughs ... then work culture

... yes, it can't be helped, if the Regent runs ... we don't adjust ..." (Informant

12)

Two excerpts from informant 12 above, illustrate how the leadership role of

regional heads can motivate the employees they lead to wanting to change their work

culture for the better. With the statement that the work rhythm of leaders who "run",

this shows that they are required to perform tasks or provide services to the

community quickly or on time. This condition is experienced by the researcher

himself when taking care of a research permit and during conducting research, all

services and administrative matters can be resolved quickly and satisfactorily. In

addition to providing motivation, the leadership role recognized by other informants,

namely the ability to innovate in programs/activities proposed in the budget:

"... it was felt, because of his innovations ... what, related to the budget, his

innovations colored the existing budget ... it colored the activities carried out

by the OPDs ... even though sometimes the patch of wong mlayu [like people

running] we move to the horizontal ... including the budget must also be fast,

there are priorities ... "(Informant 4)

The excerpt from the informant 4 above states that the leadership role is strongly

felt by staff/employees, in the context of budgeting the role is seen in the innovation

in the program/activity as outlined in the budget.

The application of risk management must consider the contextual aspects of an

organization, meaning that the implementation of the risk management concept must

be viewed holistically, including considering the cultural aspects (Mikes, 2009). It is

also important to look at risk management holistically as conveyed by Collier and

Berry (2002), they suggest that research in the public sector needs to be carried out

related to risks in the budgeting process that are linked to policies, ethos, norms, and

values of workers' beliefs.

Cultural factors are one of the keywords in the application of risk management, as

the definition of risk management from the Australian and New Zealand Risk

Management Standards AS / NZS 4360, that risk management is a culture, process,

and structure directed at effective management of opportunities that are potential and

adverse effects. The majority of informants in this study stated that the role of cultural

aspects or cultural values that are relevant to planning and budgeting is the application

of cooperation culture.

"Java is ... the main priority is cooperation ... for example, there are friends

who are having difficulties so we help ... between sub-parts / sections, for

example, some things are stuck ... we help ... (Informant 1)

In addition to solving planning and budgeting problems as stated by informant 1

above, the application of cooperation or mutual assistance culture also needs to be

maintained because we realize that we are interrelated and cannot stand alone, as the

quotation below:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

50

".. The values of cooperation, must not be arbitrary, fair, mutual

understanding and cooperation ... that's what we fertilize because we are

interrelated cannot stand alone ... the success of planning also depends on

other parties such as community leaders, NGO. Their involvement was

assessed ... "(Informant 18)

The culture of cooperation or cooperation between all parties in planning and

budgeting is also needed in the context of making decisions that require consideration

or thinking not from just one person.

".. Mutual help or cooperation, even though we have divided the tasks, if

there is something to be solved together we help each other ... or when there

is one difficulty then we share, so it is not the thought of just one person, we

discuss it because in management This is a lot of financial rules adopted.

"(Informant 5)

Another cultural value that is considered relevant by informants related to the

budget preparation process is to adopt a "nrimo" attitude. Nrimo [accepts] is a

Javanese philosophy which is the indigenization of the construct of self-acceptance

(Herdiana and Trisepdiana, 2013). Meanwhile, according to Chaplin (2004), self-

acceptance is an attitude that is a sense of satisfaction with quality and talent, and

recognition of self-limitations.

"... the values of responsibility ... if I am more personal, that is, nrimo ...

meaning that it is placed everywhere, yes, I live it ..." (Informant 3)

In another context, informant 8 stated that the application of the nrimo attitude

was also implemented when dealing with conditions that were too limited, such as

staff limitations as well as the limited time frame for completing tasks. The role of

other cultural values that are no less important in determining the success of

budgeting is a sense of responsibility, awareness to be responsible for carrying out the

task is very important, as quoted from informant 2 below:

"... in our service, there is such a thing as" Satria "born from a specialty in

Yogyakarta; senggeh, greget ora mingkuh. Senggeh is a friend, it means that

you are truly responsible and that the mingkuh does not run away from that

responsibility, it is not easy to despair and keep up the spirit. 3 people, why

do we have to leave 5 people? ... well, we still carry out values like that ... "

The consequence of having a sense of responsibility in carrying out the task is

professional in its implementation, in the context of preparing a budget the demands

for careful and thorough are the characteristics of the professional. The

implementation of the cultural values discussed above, namely cooperation, nrimo,

responsibility, and scrutiny / are very relevant to the implementation of risk

management in budgeting.

5 Conclusions, Implications, and Limitations of Research

This research produces three main themes which are a form of the social construction

of budgeting risk management. The three main themes are 1) Awareness of potential

Social Construction of Risk Management in Local Government Budgeting

51

risks in budgeting; 2) Commitment to the rules/standards in budgeting; and 3)

Leadership and culture.

5.1 Conclusion

Awareness of potential risks in budgeting becomes the foundation or foundation of

commitment to the rules/standards in budgeting. This means that the commitment of

the parties involved in budgeting to the rules/standards is largely determined by the

awareness of potential risks. Being aware of potential risks in budgeting such as

political risk and financial risk will encourage these parties to implement budgeting

rules/standards. This was done to anticipate the negative effects of these risks. While

the pillars of leadership and culture play a role as a roof that oversees the

implementation of commitments to the rules/standards in budgeting. Thus, leadership

and culture play a role in guaranteeing and encouraging all parties involved in the

budget preparation process, to obey and comply with the laws and regulations related

to budgeting.

5.2 Implication

Awareness of potential risks, some potential risks in budgeting that must be realized

by all parties involved in the budgeting process, namely operational risk, personal

risk, financial risk, and political risk. In general, when these potential risks are not

realized and anticipated from the start, they can have implications for the process of

budget constraints and low-quality planning and budgeting. The existence of each of

these risks in the budgeting process certainly has different implications.

Commitments to the rules and standards in budgeting, forms of commitment to the

rules and standards in budgeting include: a) Application of risk-based SOPs, when

budgeting has not implemented risk-based SOPs, it can have implications for delays

at each budgeting stage, as well as the synchronization between planning and

budgeting documents. To anticipate this, the preparation and application of risk-based

SOPs related to budgeting are important to be realized immediately. b) Application of

expenditure standards, budgeting that has not made spending standards as a reference

will have an impact on efforts to realize an economical, efficient, and effective

financial management to be not yet maximized. Thus it becomes important for local

governments to compile and apply an analysis of expenditure standards in budgeting.

c) Comply with legislation related to budget preparation. Compliance with laws and

regulations in budgeting will minimize the possibility of irregularities and violations

of the provisions in the budgeting, thereby avoiding the consequences of lawsuits.

The role of leadership and culture in budgeting, the role of leadership cannot be

separated from the budgeting process. The existence of leadership with its various

roles in budgeting has become a role model for all parties so that it can inspire and

motivate them to innovate and be committed and consistent in budgeting. In the

context of risk management, both directly and indirectly, the role of leadership

through motivation and innovation and role models have encouraged all parties

involved in budgeting to be able to anticipate potential risks in budgeting.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

52

Culture is a contextual aspect that must be considered in the application of risk

management in budgeting. Through mutual cooperation or cooperation, it will

increase participation in budgeting, thereby anticipating the risk of asynchronous

proposals of programs/activities in the budget. Potential risks due to various

limitations of supporting facilities and resources in budgeting can be overcome by the

Nrimo cultural approach. Budgeting demands to comply with laws and regulations

can be met when all parties involved have a sense of responsibility in carrying out the

tasks of preparing, discussing and determining the budget.

5.3 Limitation

This research has not been able to investigate all the potential risks at each stage of

budgeting in detail, this is because the preparation process until the budget

determination takes place almost throughout the year (February to November), with

flexible schedules and agendas that are difficult for researchers to attend/attend.

References

Arena, M., et al. 2010. The Organizational Dynamics of Enterprise Risk Management.

Accounting, Organizations and Society 35. 659–675

Belkaoui, A. R. 2002. Behavioral Management Accounting QUORUM BOOKS Westport,

Connecticut London

Berger, P. L., and T. Luckmann. 1966. The Social Construction of Reality, Penguin Putnam

Inc., 375 Hudson Street, New York, New York 10014, USA

Blumentritt, T. 2006, Integrating Strategic Management and Budgeting. Journal of Business

Strategy, Vol. 27 Iss 6 pp. 73 – 79

Chariri, A. 2006. The Dynamics of Financial Reporting Practice in an Indonesian Insurance

Company: a Reflection of Javanese Views of an Ethical Social Relationship. Disertasi tidak

Dipublikasikan, Scholl of Accounting and Finance. University of Wollongong.

Collier, P. M and A. J. Berry. 2002. Risk in the Process of Budgeting. Management

Accounting Research, Vol. 13, pp. 273-297

Collier, P. M and M. Woods. 2011. A Comparison of the Local Authority Adoption of Risk

Management in England and Australia. Australian Accounting Review, Vol. 21, No. 57,

pp. 111–23.

Covaleski, M. A and M. W. Dirsmith. 1986. The Budgetary Process of Power and Politics.

Accounting, Organizations and Society, Vol. 11, No. 3, pp. 19.3-2 14

Covaleski, M. A., M. Dirsmith, and S. Samuel, 1996. Managerial Accounting Research: the

Contributions of Organizational and Sociological Theories. Journal of Management

Accounting Research, Vol. 8: I – 35

Crawford, M. and W. Stein. 2004. Risk Management in UK Local Authorities: The

Effectiveness of Current Guidance and Practice. International Journal of Public Sector

Management, Vol. 17, No. 6, pp. 498–512

Creswell, J. W. 2013. Penelitian Kualitatif & Desain Riset: Memilih diantara Lima Pendekatan,

Edisi ke-3, Yogyakarta, Pustaka Pelajar.

Creswell, J. W., 1998. Qualitative Inquiry and Research Design. Choosing Among Five

Traditions. Sage Publications Inc

Crouhy, M, D. Galai, and R. Mark. 2001. Risk Management. New York: McGraw-Hill

Professional

Social Construction of Risk Management in Local Government Budgeting

53

Das, S. 2005. The Swaps & Financial Derivatives Library: Products, Pricing, Applications, and

Risk Management. Hoboken, NJ: John Wiley & Sons.

Duffie, D, and A. Ziegler. 2003. Liquidation Risk. Financial Analysts Journal, vol. 59, no. 3

(May/ June):42–51.

Dunk, A. S. 1993. The Effects of Budget Emphasis and Information Asymmetry, on the

Relation Between Budgetary Participation and Slack. The Accounting Review, Vol. 68.

Elmassri, M and E. Harris. 2011. Rethinking Budgetary Slack as Risk Management. Journal of

Applied Accounting Research, Vol. 12 Iss 3 pp. 278 – 293

Embrechts, P, R. Frey, and A. McNeil. 2005. Quantitative Risk Management: Concepts,

Techniques, and Tools. Princeton, NJ: Princeton University Press.

Fabozzi, F. J., S. Focardi, and C. Jonas. 2007. Trends in Quantitative Equity Management:

Survey Results. Quantitative Finance, vol. 7, no. 2 (April):115–122.

Herdiana, I dan Triseptiana, N.A. 2013. Gambaran Kesehatan Mental Narapidana Suku Jawa di

Tinjau Dari Konsep Nrimo. Jurnal Psikologi Kepribadian dan Sosial.Volume 2 No.1.April

2013

Jorion, P. 1997. Lessons from the Orange County Bankruptcy. Journal of Derivatives, vol. 4,

no. 4 (Summer):61–66.

Lowe, E. 1970. A Budgetary Control: An Evaluation in Wider Managerial Perspective.

Accountancy, November. pp. 765

Merchant, 1985;

Merchant dan Manzoni, 1989), sedangkan Merchant (1989)

Mikes, A. 2009. Risk management and calculative cultures. Management Accounting

Research, 20(1), 18–40.

Palermo, T. 2014. Accountability and Expertise in Public Sector Risk Management: A Case

Study. Financial Accountability & Management, 30(3), August 2014, 0267-4424

Smith, J.A. (1996) ‘Beyond the divide between cognition and discourse: using interpretative

phenomenological analysis in health psychology', Psychology and Health, 11: 261–71.

Smith, J.A., Flowers, P. and Osborn, M. (1997) ‘Interpretative phenomenological analysis and

health psychology', in L. Yardley (ed.), Material Discourses and Health. London:

Routledge, pp. 68–91.

Smith, J. A., Flowers, P., and Larkin, M. 2009. Interpretive Phenomenological Analysis:

Theory, Method and Research. London, Sage Publication.

Susilo, L. J. 2013. Manajemen Risiko Untuk Instansi Pemerintah ? Mengapa Tidak..

(http://www.academia.edu/20365548/Manajemen Risiko untuk Instansi Pemerintah)

Tarigan, J. 2010. Value-Driven Accounting. PT Elex Media Komputindo. Jalarta.

Triyuwono, I. 2011. Mengangkat "Sing Liyan" Untuk Formulasi Nilai Tambah Syariah. Jurnal

Akuntansi Multiparadigma. Vol.2, No.2 pp. 186-200

Tummala, V. M. R and Y. H. Leung. 1996. A risk management model to assess safety and

reliability risks. International Journal of Quality & Reliability Management, Vol. 13 Iss 8

pp. 53 – 62

Utomo, D. C. 2015. Indonesian Local Governments’ Budgeting Practices: A Theory of

Managing The Harmonising of Interests. https://eprints.soton.ac.uk/387185/1/Final%

2520PhD%2520thesis%2520-%2520Dwi%2520Utomo.pdf

Woods, M. 2009. A Contingency Theory Perspective on the Risk Management Control System

within Birmingham City Council. Management Accounting Research, Vol. 20, No. 1, pp.

69–81.

Young, P and M. Fone. 2001. Public Sector Risk Management. Else

vier Publisher.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

54