Stock Performance before & after Stock Split on IDX

Ghazali Syamni

1

, Frisca Damayanti

1

, Wahyuddin Albra

1

, Mahdawi Mahdawi

2

,

and Nasir

3

1

Faculty of Economic and Business, Universitas Malikussaleh, Aceh, Indonesia

2

Magister of Economic, Faculty of Economic and Business, Universitas Trisakti,

Jakarta, Indonesia

3

Faculty of Economic and Business, Universitas Syiah Kuala, Aceh, Indonesia

mahdawi1601@gmail.com,nasiraziz@yahoo.com

Abstract. Stock split is one of the company's actions aimed at making investors

and potential investors more interested in a stock issuer. This research is

conducted to examine differences in stock performance in companies before and

after the stock split. This study uses data of companies registered in IDX for the

2015, 2016 and 2017. During this period, there are different company‘s data in

which there were 8 companies in 2015, 17 companies in 2016 and as many as 21

companies in 2017. The model of data analysis used in this study is a different

test model, particularly paired sample test. This study finds a difference in terms

of price and liquidity before and after the stock split. In addition, a different

performance is not found in term of return.

Keywords: Corporate ꞏ Action ꞏ Stock Split ꞏ Stock ꞏ IDX

1 Introduction

Changes in stock prices from year to year always occur either increase or decrease from

the value of the initial offering to the public. In certain conditions, it is likely that a

good share price will show a continually increase in certain issuers even it becomes

greater. Of course, this condition makes certain share prices more expensive to

investors. This condition requires the company’s management to implement a policy.

A common policy done is called breaking down stock prices into some parts. Then, this

policy is known as stock split.

Stock split is a stock split activity in certain parts and aims to make stock prices a

little cheaper and increase trading liquidity [1]. [2] explains that a stock split is called a

procedure of share distribution with the aim of increasing or decreasing the number of

shares outstanding without declining the value of the company. [3] who states a stock

split is as an action carried out by company’s management in order to make the stock

price lower and affordable for retail investors. Although some say stock split is only as

a sweetener besides it provides an effect on stock performance [4]. [5] mentions the

important reason for a stock split because high stock prices lead to be less excited about

the high stocks. Therefore, the stock split policy is enacted by the issuers.

Some previous studies had been conducted regarding to the stock split policy. [6]

explained how companies do stock split as a bell to remind investors that certain

Syamni, G., Damayanti, F., Albra, W., Mahdawi, M. and Nasir, .

Stock Performance before after Stock Split on IDX.

DOI: 10.5220/0009574600002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 33-38

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

33

companies have good prospects. [7] stated policy of doing a company's action provides

good news for owners of the company, but each company that carries out company

actions does not always provide the same results.

[8] concluded the stock split policy makes the company more liquid when the

announcement of the stock split, then it goes back to a decrease. [9] stated the stock

split policy on liquidity due to changes in high asset prices becomes lower and this

makes the uninformed investors more interested in participating in the transaction.

[10] and [11] explained there is a significant difference in positive abnormal returns

after the stock split policy is announced. On the other hand, [12] said it is not only stock

split which causes an improvement in stock performance. Even on the contrary, the

reverse stock split also provides better stock performance, especially institutional

investors. [13] stated a company which only conducts stock split in the short term gives

a positive return. Thus, investors do not be complacent with the policy.

[14] said the performance of shares before and after the stock split does not highlight

the different results. This is base on the value of EPS/PER which is not statistically

significant. [1] who stated there is no significant difference in stock performance before

and after a stock split and it is appeared in abnormal returns and market liquidity. [15]

and [16] who revealed there is a significant difference before and after a stock split, this

is reflected in abnormal returns and market liquidity. [4] who discovered stock split

increases the stock performance, although sometimes it can be seen there are no

differences in trading volume and return.

Based on the literature reviews aforementioned above, it can be concluded the stock

split policy in the capital market is still different. Even stock split as "cotton candy"

only provides signals in both the short term and not the long term. Therefore, the

purpose of this study is to examine the differences in stock split before and after the

stock split policy which has been carried out by the company.

2 Data and Method

This research is conducted on the Indonesia Stock Exchange and takes samples of the

issuers who carried out a stock split for periods of 2015 to 2017. The measurement of

issuer's stock performance is measured on the price, return and liquidity variables both

before and after the stock split activity. All data are collected through the site

http://www.idx.co.id quarterly, in addition to data on closing prices of shares and

trading volume on the website https://finance.yahoo.com. The sampling method in this

study uses a purposive sampling technique since not all samples have criteria in

accordance with those that have been determined.

The sample criteria desired in this study is as follows: The company conducted a

stock split on the Indonesia Stock Exchange in the periods of 2015 to 2017. The

company does a stock split once for the research period of 2015 to 2017. The company

carries out a stock split policy and does not undertake other corporate action policies

affecting the market; rights issue, distribution of bonus shares and others. The data are

completed to use in this study. Thus, the qualifying samples of this study are:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

34

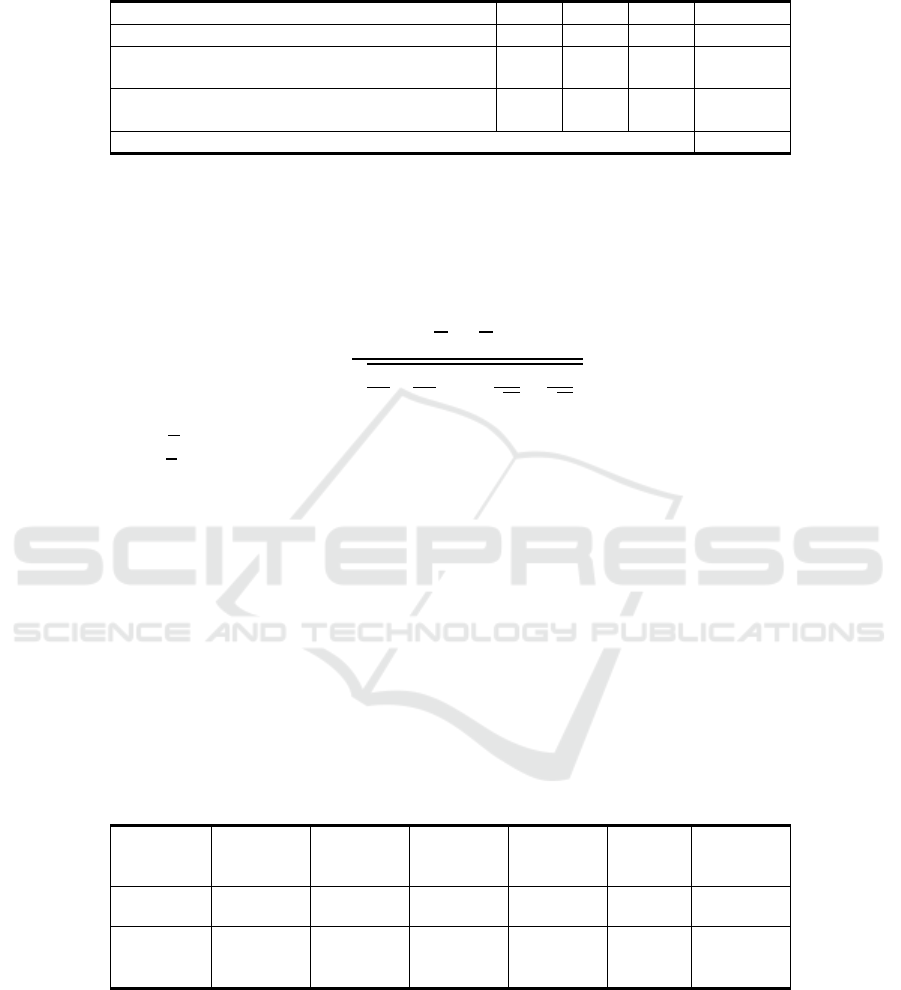

Table 1. Qualifying Samples.

Criterion 2015 2016 2017 Quantities

Issuers carr

y

in

g

out stock s

p

lit 9 22 24 55

Issuers carrying out stock split more than once a

y

ear for the

p

eriod of stud

y

- 5 2 7

Issuers undertaking other corporate policies for the

p

eriod of stud

y

1 - 1 2

Total of Samples 46

The given Table 1 depicts the number of samples in this study are 46 qualifying

issuers. But companies that do stock splits are different each year. In analyzing the data

of differences before and after a stock split by a stock issuer listed on the Indonesia

Stock Exchange is performed using a different test. Moreover, the data is processed

using SPSS program. In this case, it is done by using paired sample t-test. This is due

to two measurements on the same object. Therefore, the difference test formula is:

𝑡

𝑋

𝑋

2𝑟

√

√

Where; 𝑥

1

= Average sample before treatment;

𝑥

2

= Average sample after treatment;

s

1

= Standard deviation before treatment;

s

2

= Standard deviation after treatment;

n

1

= Number of samples before treatment;

n

2

= Number of samples after treatment

3 Results and Discussion

3.1 Data Description

This section explains the description of research data before and after the stock split,

including: price, return, and liquidity in 2015-2017.

Table 2. Average values and standard deviations.

Statistics

Price

Before

Price

After

Return

Before

Return

After

TVA

Before

TVA

After

Mean 11.051 1.464 5,4200 0,4266 0,0004 0,0013

Std.

Deviation

71.606 2.741 22,8135 6,8152 0,0009 0,0055

The Table 2 depicts the state of the data of all variables used is not so good, this can

be interpreted that data in this study is still having a high difference except for the

trading volume activity variable. In addition, the data can also be explained the average

Stock Performance before after Stock Split on IDX

35

price before the stock split is of 11,051 with a standard deviation of 71,606. After the

stock split, the price is 1.464, which is lower with a standard deviation of 2.741.

Furthermore, the return variable before stock split, return is 5.4% and the standard

deviation of 22,813 and after the stockplit becomes 0.42% and the standard deviation

of 6,815. However, the different things do not happen in trading volume activity.

3.2 Correlation Analysis

The correlation analysis is performed to analyze the relationship of correlation levels

between variables before and after stock splits. The variables used in this study are

stock price, stock return and trading volume activity (TVA). The given table 3 below

describes the variable of prices before and after the stock split have respectively values

of 0.212 and 0.222 and significant as many as 1 percent.

Table 3. Correlation Analysis.

Pai

r

stock split variable N Cor

r

elation. Sig.

Pair 1 stock

p

rice before & stock

p

rice afte

r

460 0.212 0.000

Pair 2 stock return before & stock return afte

r

460 0.019 0.690

Pair 3 TVA

b

efore & TVA afte

r

460 0.222 0.000

In addition, the trading volume activity variable does not posses a significant

relationship before and after the stock split.

3.3 Analysis of Different Tests

After analyzing the descriptive and correlation, the different test is examined. The

testing of different tests is done in all and annually (Table 4).

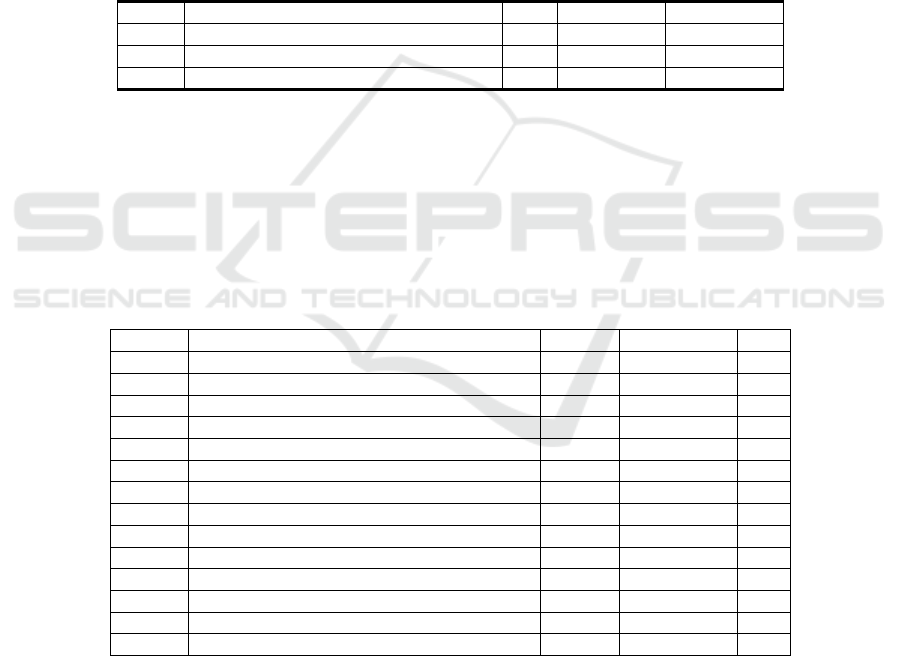

Table 4. Results of different test using paired test.

PAIR Stock S

p

lit Variable: Price N Correlation. Si

g

.

Pair 1 stock price before & stock price after (all) 460 .212 .000

Pair 2 stock price

b

efore & stock price after _2015 80 .961 .000

Pair 3 stock price before & stock price after_2016 180 .402 .000

Pair 4 stock

p

rice before & stock

p

rice after

_

2017 200 .071 .321

PAIR Stock S

p

lit Variable: Return N Correlation. Si

g

.

Pair 1 Return

_

before & Return

_

after

(

all

)

460 .244 .102

Pair 2 Return_before & Return_after _2015 80 -.025 .826

Pair 3 Return_before & Return_after _2016 180 -.063 .398

Pair 4 Return

_

Before & Return

_

After _2017 200 -.027 .699

PAIR Stock S

p

lit Variable: TVA n Correlation. Si

g

.

Pair 1 TVA

_

before & TVA

_

after

(

all

)

460 .599 .000

Pair 2 TVA_before & TVA_after _2015 80 .465 .000

Pair 3 TVA_before & TVA_after _2016 180 .046 .543

Pair 4 TVA_before & TVA_after _2017 200 .400 .000

The Table 4 shows there are 460 observations as a whole, but if it is seen annually,

there are different things. In 2015, there were 80 observations, 180 observations in 2016

and 200 observations in 2017.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

36

Moreover, the paired t test is tested. The test results show that after the stock split

policy is carried out, overall the price and trading volume prove that there is a difference

and the relationship between before and after the stock split. Furthermore, if it is looked

at the testing per year proves that there is year with no difference in performance before

and after the stock split policy is performed. This occurred in 2017 for prices and 2016

for trading volume activity, in which there was no significant value for those years. On

the other hand, returns happening on companies that carry out stock split show no

difference either before and after the policy is done. This can be seen statistically in

both overall and yearly statistics such as 2015, 2016 and 2017.

The results of the study indicate that the company's policy of taking stock split

action only provides a little prospect for investors. This can be seen in terms of prices

and trading volumes, that there are differences before and after the stock split policy.

Instead, it is not with the desired return for investors.

This finding is in accordance with the research conducted by [14]; [1]; [4] [9] and

[6]. They stated the stock split policy is only a sweetener in the company and on the

performance side there is no difference. This stock split policy is only used by the

issuers as an effort of company to attract small investors or retails to transact at the

issuer.

4 Conclusion

This research examines differences in stock performance after stock split. Stock split is

one of the ways carried out by companies to attract investors. Because if a stock split is

done, as if the performance will be better and cheaper price in the sides of investors.

The analyzed performance includes: stock prices, stock returns and trading volume

activity (TVA).

This study finds that price side highlights a significant price defference before and

after the stock split. However, if it was seen per year for the study period of 2015, 2016

and 2017, only in 2017 did not have price differences after a stock split. The stock

returns show that there is no difference in returns either overall or annually. There is no

significant difference in stock returns since the investors are less interested in terms of

stock split conducted by stock issuers. Yet the trading volume activity was only in 2016,

in which there is no difference in company‘s performance before and after a stock split.

Overall, there are differences in stock performance and it happened again in 2015 and

2017, however.

References

[1] Dewi, A. S., & Zulfiah, A. (2018). Comparative Analysis of Liquidity and Abnormal

Return Before and After Stock Split (Case Study on the Company Taking Sock Split Period

2013-2014). Sustainable Collaboration in Business, Technology, Information and

Innovation (SCBTII).

[2] Nadig, A. (2015). An empirical study of stock split announcements of select BSE sectors

using event study methodology. SDMIMD Journal of Management, 6(1), 1-12.

[3] Baker, H. K., & Powell, G. E. (1993). Further evidence on managerial motives for stock

splits. Quarterly Journal of Business and Economics, 20-31.

Stock Performance before after Stock Split on IDX

37

[4] Adisetiawan, R. (2018). Does Stock Split Influence to Liquidity and Stock

Return?(Empirical Evidence in The Indonesian Capital Market). Asian Economic and

Financial Review, 8(5), 682-690.

[5] Nagendra, M., & Babu, M. S. (2018, May). Impact of Corporate (Stock Split) Action on

Stock Price in India. In Presented paper in International Conference, Organised by St.

Joseph College, Bangalore.

[6] Smith, G. (2019). Stock Splits: <em>A Reevaluation</em>. The Journal of Investing,

28(4), 21-29. doi: 10.3905/joi.2019.1.085

[7] Pradhan, S. K., & Kasilingam, R. (2019). Impact of Corporate Actions on Shareholder

Wealth: <em>A Study on the Bombay Stock Exchange</em>. The Journal of Wealth

Management, 21(4), 85-97. doi: 10.3905/jwm.2019.21.4.085

[8] Huang, G.-C., Liano, K., & Pan, M.-S. (2015). The effects of stock splits on stock liquidity.

Journal of Economics and Finance, 39(1), 119-135. doi: 10.1007/s12197-013-9250-6

[9] Hu, M., Jain, A., & Zheng, X. (2018). Stock Splits and Liquidity Risk in the Chinese Stock

Market. Paper presented at the 9th Conference on Financial Markets and Corporate

Governance (FMCG).

[10] How, C. C., & Tsen, W. H. (2019). The Effects of Stock Split Announcements on the Stock

Returns in Bursa Malaysia (Kesan Pengumuman Pembahagian Saham terhadap Pulangan

Saham di Bursa Malaysia). Jurnal Ekonomi Malaysia, 53, 2.

[11] Gharghori, P., Maberly, E. D., & Nguyen, A. (2017). Informed Trading around Stock Split

Announcements: Evidence from the Option Market. Journal of Financial and quantitative

Analysis, 52(2), 705-735. doi: 10.1017/S0022109017000023

[12] Chung, K. H., & Yang, S. (2015). Reverse Stock Splits, Institutional Holdings, and Share

Value. Financial Management, 44(1), 177-216. doi: 10.1111/fima.12077

[13] Chan, K., Li, F., & Lin, T.-C. (2019). Earnings management and post-split drift. Journal of

Banking & Finance, 101, 136-146. doi: https://doi.org/10.1016/j.jbankfin.2019.02.004

[14] Saureka, N. S., & Tanti Irawati, M. (2012). Stock Performance Analysis Before and after

Stock Split on Basic Industry and Chemical in Indonesia. Academic Journal, 43, p175.

[15] Listarani, P. R., & Kesuma, I. K. W. (2014). Analisis perbandingan Abnormal Return dan

Likuiditas saham sebelum dan sesudah stock split. E-Jurnal Manajemen, 3(10).

[16] Munthe, K. (2016). Perbandingan Abnormal Return Dan Likuditas Saham Sebelum Dan

Sedudah Stock Split: Studi Pada Perusahaan Yang Terdaftar Di Bursa Efek Indonesia.

Jurnal Akuntansi, 20(2), 254-266.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

38