Integrated Sukuk based Waqf in Pesantren: A Modified Model

Atika Rukminastiti Masrifah

1

, Khoirul Umam

2

and Setiawan Bin Lahuri

3

1

International Centre for Awqaf Studies (ICAST), UNIDA GONTOR, Indonesia

2

Islamic Economics Department, Faculty of Economics and Management, University of Darussalam Gontor, Indonesia

3

Islamic Economics of Law Department, Faculty of Sharia, University of Darussalam Gontor, Indonesia

Keywords: Pesantren, Sukuk, Waqf Project.

Abstract: Waqf and Sukuk are not seemingly equal things to compare, one is filled with a spiritual and social aspect,

the other with a commercial aspect. But time proves that the development of Islamic economic concerns is

complimentary not only to commercial issues but also to social issues. Besides, Pesantren is serious about

empowering a potential business unit through waqf to enhance the economic development of Pesantren. The

purpose of this study is to propose models of integrated Sukuk based waqf model in Pesantren using a

qualitative approach, accompanied by scholars, academicians, and practitioners with surveys and focus groups

discussion. The results show that Sukuk has an important role to play in supporting Pesantren's waqf quality.

This type of Sukuk will generate a new source of fund for Pesantren based on the ijarah theory, which can

generate own profit for primary pesantren projects. This model shows the way Pesantren maintains and

develops waqf assets toward a self-financing waqf institution. Pesantren is responsible for both the primary

and secondary projects through its two divisions: Pesantren Financing Corporation and Pesantren Production

Corporation. Finally, as a conclusion, the author expects that this model would be an alternative model that

could be more beneficial to Pesantren in need.

1 INTRODUCTION

Islam explains how to worship God not only in ritual

manners but also in many aspects of human being's

behavior. Islam encourages human justice. It

prohibits some groups of the rich to only benefit from

each other but it should reallocate the wealth to those

in need.

Islam introduces the principle of Sadaqah to

redistribute wealth from rich to poor. It may also have

the component of compulsory or voluntary in money

(material) and non-material. Zakah is a kind of

mandatory sadaqah, while waqf is a type of voluntary

one.

Pesantren is well known and has played an

important role in waqf history and Muslim education.

Most pesantren stand today on waqf land, but for a

long time, pesantren stand on the ownership of the

land of its founder. After a proper operation, his

founder endowed the pesantren with his land.

Waqf donations to pesantren are mostly in the

form of property or land that is not prepared for use

at times. To be used properly, the current waqf land

must also be maintained. By putting it into a

profitable waqf, the waqf land of pesantren can be

completely transformed.

Some ways of funding waqf projects, such as cash

waqf, government grants, individual donations, and

others, are available in pesantren. However, this

paper focuses only on how the investment waqf

pesantren can be financed by Sukuk. This paper also

provides a modified model for financing waqf

investment with Sukuk, in general, to discuss the

operation of Integrated Sukuk Based Waqf in

pesantren. In principle, Integrated Sukuk Based Waqf

in pesantren can be accepted by any pesantren as a

finance tool for waqf. However, there are certain

issues to be resolved with a view to revitalizing the

pesantren waqf productivity in the long term.

2 LITERATURE REVIEW

The practice of waqf is not specifically stated in the

Quran and the Sunnah but is part of the general

donation. Donations in the form of waqf are known

as acts of philanthropy which may be described as a

Masrifah, A., Umam, K. and Lahuri, S.

Integrated Sukuk based Waqf in Pesantren: A Modified Model.

DOI: 10.5220/0009572500002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 5-10

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

sustained charity, called sadaqah Jariyah (Zuki, 2012:

174).

Waqf has been developed since the era of Prophet

Muhammad Rasulullah. After his first year of Hijrah

in Madinah, when the Prophet felt the need to pray in

some place, he built a mosque known as Quba.

Because of the increasing numbers of Muslims, he

built a new mosque known as Nabawi. He advised

Utsman ibn Affan to purchase Rumah water well to

supply water for everyone. Waqf has been established

and played an essential role in Muslim socio-

economics.

The experience of waqf organizations has shown

Cizakca (2002: 265) to provide social welfare

programs that many current states are trying to offer.

Baskan (2002: 17) states that during the Ottoman era

the waqf scheme was largely tasked with financing

for health, education and welfare programs. There is

also a need for an improved management approach to

improve its effectiveness and performance

(Boudjellal, 2008: 124).

The fact that the person who administers the waqf

is allowed to shape it as he wants. Ahmed (2004: 28)

stated that waqf Institutions have a flexible

organizational structure. He is equally responsible for

a waqif/trustee (Ibrahim, 1996: 9). Nevertheless, it is

constrained by certain moral and legal obligations.

For example, it is the responsibility of the nazir to

preserve and optimize its income for the waqf

property (Rassool, 2007: 6).

From an economic point of view, waqf can be

described as an investment of funds in properties that

offer income for possible uses by individuals or

groups (Pirasteh and Abdolmaleki, 2007: 5). It is an

endowment with a strong economic force that guides

the business to growth and prosperity (Yalawae and

Tahir, 2003: 3). Kahf (1998) further defines Waqf as

"an activity that includes savings for the future and

accumulation of sustainable capital that supports the

future generations." Waqf offers certain social

welfare services as part of the voluntary sector, which

are financed via the investment of the funds allocated.

To order to redistribute wealth between the poor and

the rich, the waqf sector is one of the strongest tools

to minimize socioeconomic disparities.

Besides the early development of productive

waqf, the Muslim ummah also has faced the evolution

of the Islamic educational institution known as

pesantren. Pesantren, one of the pioneers of Islamic

education in Indonesia, has long been using waqf for

self-sufficient governance. In major parts of the

country, especially in Java, hundreds of pesantren

arise and expand. It has a common goal of promoting

well-being and a good characteristic for prosperity,

i.e. productive waqf and pesantren.

Pesantren are Islamic institutions of education

with many common features. Their structure in

physics and organizations is typically composed of

several features: mosque, dormitories, students – they

are also popularly called santri – and the Muslim

scholar who leads pesantren, called kyai. The main

area is a mosque in which students and Kyai pray five

times a day and do other things, including public

lectures, group prayers, and public preaching. The

Kyai House is often next to the mosque and the

students ' dormitory (Dhofier, 1999: 33).

Pesantren is often referred to as pondok pesantren

in more formal language. Pondok means a hut

literally while pesantren means a santri place. The

term santri also refers to 'religiously-oriented

Muslims' in a wider sense rather than 'abangan' or

'common Muslims' (Geertz, 1960: 120). The term

'santri' can also be limited to the term 'student of the

pesantren'. In the past, the term pondok pesantren had

only been used in Java, but today in other regions of

Indonesia it has also been used since the central

government has adopted that term for Islamic

boarding schools (Azra 2006: 78).

Waqf donated to pesantren is mostly in the form

of an estate or land that is not ready to be used, such

as old houses, old buildings or others. To work

properly, existing waqf properties must also be

maintained. Existing waqf properties could be

financed by some schemes. Existing waqf properties

are financed entirely by the pesantren internal funds.

In many ways, pesantren could use cash waqf,

government grants, individual grants, and others to

maintain existing waqf properties.

2.1 Previous Studies

The integration of financial instruments and waqf in

pesantren is a new topic, in that the existing studies

on this issue are scarce. The closest literature to this

topic is the waqf through Sukuk al-intifaa. Some of

these studies include, among others, Kholid, et. al.

(2009) and Ismal, et. al. (2015).

Several models of the waqf through Sukuk

according to Kholid, et al. (2009) include Sukuk al-

intifaa. The aim of this paper was mainly to present a

proposed model on the role of Sukuk al-intifaa in

supporting the management of waqf. To be able to

implement this model, some of the requirements

should be met in advance, i.e. Islamic endowment

corporation, waqf financing corporation, SPV

Company for waqf project, waqf developer

corporation, and developer company. The authors

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

6

modified this model so it could be an alternative

model for the performance of pesantren.

Awqaf linked Sukuk with awqaf properties as a

component of underlying assets is proposed by Ismal,

et. al. (2015) to finance government projects as well

as infrastructure development. The paper examined

the possible issuing of awqaf linked Sukuk that would

contribute to sustainable economic development and

social welfare through the strategic alliance among

governments and businesses through a Public-Private

Party (PPP). The creation of awqaf-related Sukuk is

hoped to become a driving force in the global Sukuk

output within Islamic finance.

In our scenario, the waqf institution is represented

by a pesantren who manages the waqf asset himself.

Modified waqf linked Sukuk models from previous

studies provide guidelines for the development of a

pesantren waqf project through Sukuk. This model

shows the maintenance and development of a waqf

asset for the self-funding of pesantren by a holding

pesantren.

For more instructions about the references and

citations usage please see the appropriate link at the

conference website.

3 ANALYSIS MODEL

Our model of investment waqf is based on a model

developed by Kholid, et. al. (2009) and Ismal, et. al.

(2015). The Integrated Sukuk Based Waqf model is a

model of productive waqf development involving the

main parties, namely, pondok pesantren. The main

requirement of this model is the establishment of a

holding pesantren as a nazir or holder of a waqf land,

the main role of which is to manage, maintain,

generate and develop waqf land.

The holding pesantren can be formed not only by

the association of boarding schools but also by

several pesantren who have the same vision and

mission in the field of Islamic education. The holding

pesantren is the parent company of the pesantren

business unit that can control the policies of the

pesantren business unit and oversee its management

decisions. It merely maintains supervisory capacity

and therefore does not actively participate in the

running of day-to-day business operations. The

holding pesantren, supported by good management

and governance, is expected to be able to support

business activities on a larger scale in the context of

the development of the pesantren business unit.

Holding pesantren is the integration of several

pesantren business units to strengthen the presence of

capital, market development and access to

information.

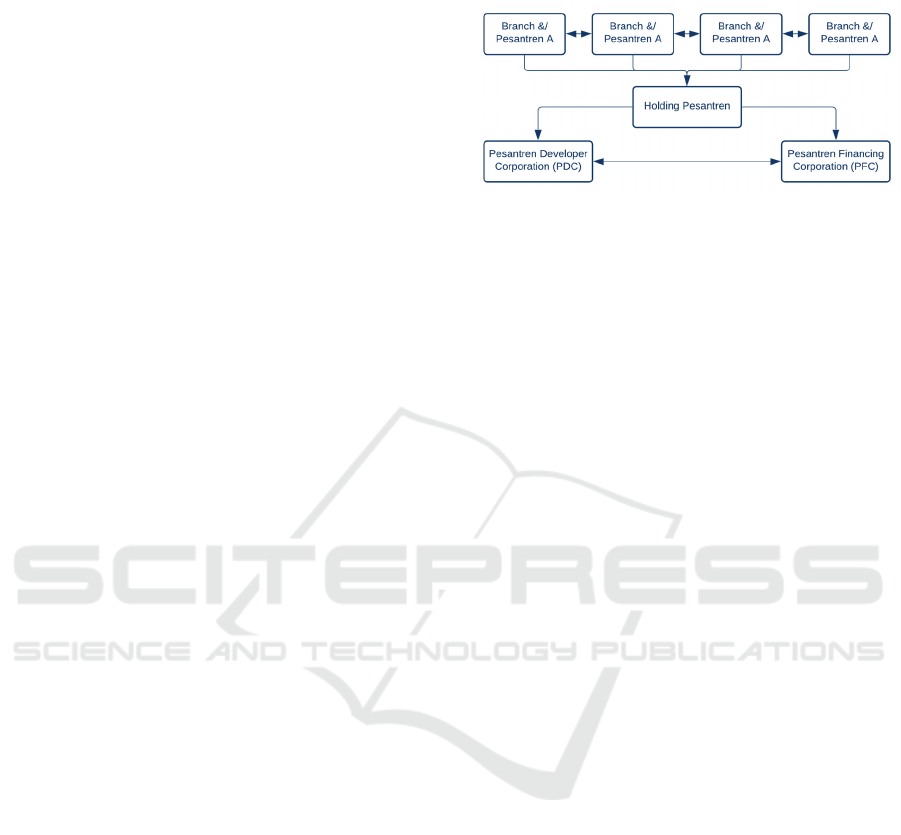

Figure 1: Organization Structure of the Holding Pesantren.

Based on the definition of the holding pesantren,

the objective is to achieve the economic

independence of the pesantren to support the

pesantren as the basis of Indonesia's economic flows.

In this Integrated Sukuk Based Waqf model, the

holding pesantren is responsible for agreeing on the

mega-projects needed for the benefit of the holding

pesantren members. The net profit from the

acquisition of waqf assets is used to finance the

development of other secondary projects or to fund

social programs and is even intended to be reinvested.

3.1 Modified Model of the Integrated

Sukuk based Waqf in Pesantren

Modified Model of the Integrated Sukuk Based Waqf

In Pesantren provides a guideline in developing waqf

projects. In this model, the Pesantren Financing

Company (PFC) and the Pesantren Developer

Company (PDC) are required to form a subsidiary.

PFC has to become a financial management company

as well as a financial provider, which is why PFC is

obliged to issue Sukuk to finance the project. Another

task of this division is to act as the manager

(management company), namely the building

manager or the property manager. While PDC is

obliged to build an asset on waqf land. There is close

coordination between the holding pesantren, PDC,

PFC, during and after the development of the waqf

project.

Holding pesantren plans mega property

development projects that require large enough funds

to be financed by Sukuk issuance. The holder of a

pesantren collaboration with the two institutions

formed by the pesantren uses the Build-Operate-

Transfer (BOT) system in the field of real estate for

the construction of installations on the pesantren waqf

land. Holdings pesantren as Nazir sign a long-term

lease agreement (Long Lease, Hukr) with PDC.

The PDC then signs a sub-lease contract (during

or less than a long lease term) with the PFC that will

Integrated Sukuk based Waqf in Pesantren: A Modified Model

7

issue a Sukuk, which may be in the form of Sukuk

Ijarah, Sukuk Musharakah, Sukuk Al-Intifaa or other

Sukuk, where the property will be built by the PDC,

while financing and building property management is

carried out by the PFC.

The main task of PFC is to generate, collect and

distribute funds to finance the activity of waqf

project, to sustain it and to grow it. The appointed

PFC's manager should, with this massive

responsibility, satisfy certain criteria such as amanah,

honestly and good management sense. To order to

maintain and expand the waqf land, he has to be able

to find new sources of funding. The manager should

be able to assign a budget to the primary and

secondary programs.

PFC collects funds from two sources, the

investment fund and the endowment fund from the

holding pesantren. The pool fund that serves as the

PFC's internal fund is then put into all collected funds.

Investment Fund is leveraged by investors investing

in waqf investment through musharaka financing,

mudharabah financing, Ijarah funding, and others.

The primary project was financed primarily by this

fund. This paper explained, however, the use of

Integrated Sukuk Based Waqf for investment funding

in the next section. The second source of funds for the

PFC is a donation fund, which can be used as a cash

waqf, government grant, individual grant, and others.

PFC can issue Sukuk because it is a company

formed by pesantren which is engaged in finance and

has obtained permission from the Ministry of Finance

as an SPV (Special Purpose Vehicle). PFC collects

funds directly from the investor by financing the

project. Sukuk is generally cheaper than Islamic bank

financing and foreign financing.

The property is managed by PFC and is used to

meet the needs of the pesantren mandated at the

beginning of the development of the mega project.

Examples of developments needed by Pesantrens

today are residential buildings, in the form of hotels

or cottages for guests staying overnight, hospitals for

students and surrounding communities, housing for

lecturers, distribution centers as warehouse student

cooperatives in all branches of pesantren. If the

proceeds are used to finance property management,

pay Sukuk coupons to Sukuk holder investors, pay

Sukuk when it is due, and the rest is the profit of the

holding pesantren.

After the project is completed, PFC is the project

operator. But this is not a compulsory arrangement.

The Pesantren holding company can become the

project operator. The agreement between the holders

of pesantren and PFC varies. PFC will then raise

funds from investors to finance the project based on

the financial agreement with PDC. PDC may,

however, also request that PFC use the internal fund

to finance a primary project fully or partially. In the

case where PFC contributes to secondary project

financing, the profit of all projects is divided by

pesantren holding.

Some of the main projects with good management

in pesantren can generate benefits. Every profit made

from both projects is then shifted to PFC to be pooled

in a fund pool with other funds. This fund pool is the

internal financing source for PFC to fund

maintenance costs, operating costs and new waqf

projects. In summary, this model offers an alternative

to managing waqf pesantren in favor of independent

pesantren to ensure that the pesantren continues to

develop.

3.2 The Operations of Integrated

Sukuk based Waqf in Pesantren

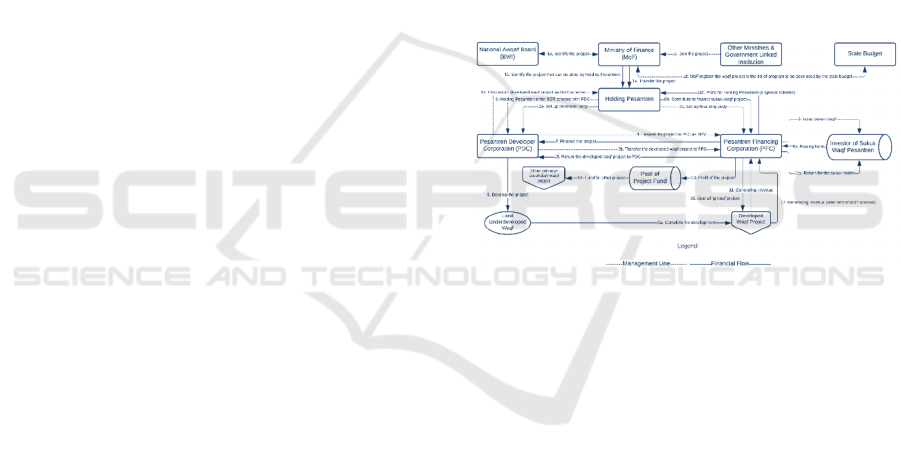

Figure 2: Integrated Sukuk based Waqf Model in Pesantren.

Below is an explanation of how the divisions support

pesantren, tasks and coordination work. This model

explores how the project that a holding pesantren can

carry out to issue Sukuk based on waqf land can be

identified through a financial contract with public

institutions including the Ministry of Finance and the

BWI (1a–1e). The finance ministry is in a pivotal

situation in promoting the initiative regarding its

present roles in the issue of sovereign Sukuk. Finally,

Bank Indonesia and the financial service authority

(OJK) have a role in enabling the tradability of such

a proposed sukuk to deepen the Islamic financial

market in the secondary market.

The holding pesantren manages its waqf project

through its two divisions (2a – 2b), Pesantren

Financing Company (PFC) and Pesantren Developer

Company (PDC). Following the financing scheme, a

holding pesantren contract with PDC (3) for Built

Operate and Transfer (BOT) and then leases the

project contracts to PFC (4), which will then be

implemented. BOT contract between the holding

pesantren and PDC is the underlying asset for the

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

8

leased one. PDC will develop and then transfer the

finished project to PFC following this contract. The

contract period will, however, depend on the funding

scheme used to finance the project.

PFC will then issue a waqf associated Sukuk for

the project following the signing of the lease contract

(5). Investors subscribe to the Sukuk, which has the

right to use the asset for a certain period. For a

specified time, the investor is entitled to use the stated

asset in the Sukuk. Investors can, however, lease the

Sukuk to other parties who want to use the asset. This

is one reason why the Integrated Sukuk Based Waqf

is liquid.

PFC receives funds from project development

funding subscribers (6a). In some situations, the

holding pesantren also contributes to the financing of

the internal fund (6b). But the primary project should

be funded by PFC (7). PDC begins project

development (8) and the developer transfers the

project to the PFC once the project is finished (9a).

PFC is now in charge of the completed project. PFC

operates the project from the completion of the

project to the end of the BOT contract (10). The

income (11) is then shared among Sukuk holders

(12a) and holding pesantren (12b).

The PFC's return is collected in the project fund

pool (13). The pool is made up of an internal fund

used by PFC to finance both the primary project and

the future secondary project (14). The process is

carried on until the BOT contract is concluded. After

the BOT contract, PFC shall return the asset to PDC

(15). PDC shall then return the asset to the holding

pesantren, which has awarded the BOT contract (16).

The project is now fully owned and generates income

for pesantren continuously. To conclude, this model

shows a model in which pesantren receives

permanent benefits through Integrated Sukuk Based

Waqf from the revitalisation of the waqf asset.

4 CONCLUSIONS

Development of productive waqf in Indonesia with

commercial objectives is common but not yet widely

known to the public, while non-productive waqf with

social objectives such as education and health are best

known and appreciated by the public. Productive

waqf models developed in Indonesia are simple

productive waqf models by relying on raising waqf

through money, self-managed or managed by other

parties where Nazhir is a social legal entity or a non-

government organization (NGO). The high-cost

properties are therefore constrained by the length of

the collection of endowments.

One of the educational institutions, known as

pondok pesantren, is engaged in education and can

also develop waqf through one of the financial market

tools, namely Sukuk. But there are still barriers that

have not been fully addressed, such as Islamic

boarding schools, which are still traditional and do

not have access to finance. To ensure that innovative

productive waqf models through Sukuk have not yet

been applied in Islamic boarding schools, Sukuk-

linked waqf models have been applied in several

countries and other waqf management institutions in

Indonesia, namely foreign financing or Indonesian state

owned enterprises (BOT with Sukuk issuance).

The most important elements of the Integrated

Sukuk Based Waqf models are nazir waqf or holding

pesantren capable of establishing PFC and PDC as

independent subsidiaries, the form of waqf assets to

be financed by the issuance of this Sukuk, the

professional waqf asset management schemes and the

Shariah compliance elements that must be

encountered.

The main problems for managing the productive

waqf in Pesantren include a lack of understanding of

the pondok community concerning investment tools

in the Islamic financial market, a low level of

professionalism in Nazhir (including assatidz

(teachers), musyrif, musyrifah, santri or business

units staffs) or other problems that can be identified

in the pondok. Therefore, some urgent things to do

include:

1. Community education, especially students and

female students of pesantren through education

programs in colleges and recitations, productive

waqf forums, productive waqf movements, and so

on.

2. Nazhir's certification and standardization from

basic to advanced, Nazhir's education and

training, increasing Nazhir's remuneration, etc.

3. Designing Sharia financing schemes that are

consistent with the character of developing waqf

land in pesantren

REFERENCES

Ahmed, H., 2004. Role of Zakat and Awqaf in Poverty

Alleviation. Jeddah, Saudi Arabia: Islamic

Development Bank Group, Islamic Research and

Training Institute.

Azra, A., 2006. Islam in the Indonesian World: An Account

of Institutional Formation. Bandung: Mizan.

Baskan, B., 2002. Waqf System as a Redistribution

Mechanism in the Ottoman Empire. Paper presented at

17th Middle East History and Theory Conference.

Integrated Sukuk based Waqf in Pesantren: A Modified Model

9

Center for Middle Eastern Studies, University of

Chicago.

Boudjellal, M., 2008. The Need for a New Approach of the

Socio-Economic Development Role of Waqf in the 21st

Century. Review of Islamic Economics. 12(2), 125-136.

Cizakca, M., 2002. Latest Development in the Western Non-

Profit Sector and the Implications for Islamic Awaqf.

Iqbal, M. (Ed.). Islamic Economic Institutions and the

Elimination of Poverty. pp. 263-287. Leicester: The

Islamic Foundation.

Dhofier, Z., 1999. The Pesantren Tradition: The Role of the

Kyai in the Maintenance of Traditional Islam in Java.

Arizona: Program for Southeast Asian Studies, ASU.

Geertz, C., 1960. The Javanese Kyai: The Changing Role

of a Cultural Broker. Comparative Studies in Society

and History 2 (2): 228-249.

Ibrahim, M., 1996. The Concept of Waqf (Endowment),

Gifts and Wills in Islam. Qatar: Islamic Book

Development and Translation Council.

Ismal, R., Dadang, M., Mega, R.C., Jhordy, K., Suminto,

S., 2015. Awqaf Linked Sukuk to Support The

Economic Development. Occasional Paper, 1/2015.

Kahf, M., 1998. Financing the Development of Awqaf

Property. Paper presented at the Seminar on

Development of Awqaf. Kuala Lumpur.

Kholid, M., Sukmana, R., Hassan, K. A. K., 2009. Waqf

Management through Sukuk Al-intifa'a: A Generic

Model, Refereed Biannual Journal Spscialized in Waqf

and Charitable activities, No.17.

Pirasteh, H., Abdolmaleki, H., 2007. Developing Awqaf

Properties and Islamic Financial Engineering: a

Conceptual and Empirical Analysis. Paper presented at

1st Singapore International Waqf Conference:

Integration of Awqaf (Islamic Endowment) in the

Islamic Financial Sector. Singapore.

Rassool, N. H., 2007. Waqf: A Mauritius Case Study.

Mauritius: Islamic Institute of Education and Training

Yalawae, A., Tahir, I. M., 2003. The Role of Waqf

Organisation in Achieving Equality and Human

Development: Waqf or Endowment. Malaysia:

Universiti Darul Iman Malaysia

Zuki, M. S., 2012. Waqf and Its Role In Socio-Economic

Development. ISRA International Journal of Islamic

Finance, Vol. 4, 2.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

10