Income Tax Incentives Policy in Special Economic Zones

Rizka Fitria, Adang Hendrawan, and Milla Sepliana Setyowati

Department of Fiscal Administration Science, Faculty of Administration Science, Universitas Indonesia,

Keyword: Income Tax Incentive, Special Economic Zones, Good Tax Policy

Abstract: Income tax incentive policy and the development of Special Economic Zones are two policies used to increase

Indonesia's economy through investment. With the implementation of an income tax incentive policy in

Special Economic Zones is the government's maximum effort to increase investment. Therefore, to implement

a better tax incentive policy and a more effective implementation, a tax incentive policy assessment can be

carried out through the 10 principles of Good Tax Policy to know and understand more deeply about the

consideration of formulation and implementation of the policy and can provide solutions so that policies can

work better at doing its purpose. Using post-positivist method, the results of the assessment using the ten

principles are the income tax incentive policy fulfills several principles by fulfilling the main objective of

increasing investment in special economic zones, but from several principles that are not fulfilled, the certainty

principle is a principle that plays a major role in not fulfilling these principles because the certainty of the

policy of providing incentives is considered unclear which affects the interest of taxpayers to use incentives.

To assess the income tax incentive policy in the Special Economic Zones based on the related principles, it

becomes difficult because of the lack of taxpayers who take advantage of these incentives. It means that the

policy still needs improvement in implementing policies so that they can be implemented effectively and

efficiently. The taxpayer informant obtained as resource persons is taxpayers from the food processing

industry and chemical industry so that they are less able to represent the opinion of taxpayers in Special

Economic Zones with a different industry thus this paper cannot represent the entire industries in Special

Economic Zones.

1 INTRODUCTION

Fiscal policy is an economic policy in the context of

directing economic conditions to be better by

changing government revenues and expenditures

(Rahayu, 2010, p.1). According to John. F. Due cited

by Rahayu (2010, p.3), fiscal policy refers to three

things, namely ensuring economic growth that

actually equates with potential growth rates, by

maintaining full employment; achieve a stable and

reasonable general price level; increase the rate of

potential growth without disrupting the achievement

of other goals of the community. One of the fiscal

policy instruments set by the government in carrying

out the policy function is tax policy. In practice, the

tax policy needs to be assessed according to the

country's economic goals. One way to assess the

policy can perform well or not through the principles

of Good Tax Policy issued by Parasthai Shome in his

book titled Tax Policy Handbook which was later

developed further by AICPA (2001). The principle

consists of ten principles that can be reviewed from

various parties related to the application of these

principles in the formulation and implementation of

tax policies. One of the tax policies that can be

assessed based on the principles of the Good Tax

Policy is the income tax incentive policy in the Special

Economic Zones (SEZ) in the form of tax holidays and

tax allowances aimed at increasing investment for the

development of Special Economic Zones.

The granting of income tax incentives in the

Minister of Finance Regulation No. 104 / PMK.010 /

2016 is divided into two classifications. Income tax

incentives for new investments regulated in Article 3

of the PMK state that the provision of income tax

incentives for new taxpayers with business fields is

the main activity of SEZs that carry out new

investments with investment plans of more than Rp.

1,000,000,000,000 will get income tax reduction

facilities with a period of at least ten years and a

maximum of 25 years, and new taxpayers with

business fields are the main activities of SEZs which

carry out new investments with investment plans of at

Fitria, R., Hendrawan, A. and Setyowati, M.

Income Tax Incentives Policy in Special Economic Zones.

DOI: 10.5220/0009402502390245

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 239-245

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

239

least Rp500,000,000,000 to Rp1. 000,000,000,000

will get an income tax reduction facility with a period

of at least ten years and a maximum of 15 years. The

income tax incentive provided is a reduction of

income tax of at least 20% to 100% of the amount of

the Corporate Income Tax owed.

It is different with domestic taxpayers who invest

in business sectors where the main activity in SEZs

does not get facilities or business fields which are

other activities outside the main activity of SEZs will

get different income tax incentives. Income tax

incentives obtained to reduce the net income by 30%

from the amount of investment, depreciation of

tangible fixed assets and amortization of intangible

assets accelerated, income tax rates on dividends paid

to foreign taxpayers other than Permanent

Establishment by 10%, and compensation losses can

be longer than 5 years but not more than 10 years.

With these facilities, the growth of investor

interest in Special Economic Zones in 2017 has

increased significantly with the accumulation of

investment commitments reaching IDR41.05 trillion

with 2016 and 2015, respectively IDR17.8 trillion and

IDR541 billion. The increase in 2016 was due to the

taxation facility in advance in Government

Regulation No. 18/2015 which first came into force

in 2016 and then was further regulated in Minister of

Finance Regulation No. 104 / PMK.010 / 2016 which

took effect in 2017. The accumulated investment

realization figure also showed significant growth

within 2017, reaching Rp5.83 trillion from 2016,

which amounted to Rp3.74 trillion and in 2015

amounted to Rp168 billion.

Meanwhile, it can be seen from the table below

that the investment value that receives incentives is

basically at least 500 billion and from the grouping of

these sectors, companies that can take advantage of

the tax holiday income tax incentives in SEI Sei

Mangkei are 3 companies, Palu SEZ are 3 companies,

Tanjung Api SEZ - As many as 3 companies, SEZ

Maloy Batula Trans Kalimantan as much as 2

companies, and Galang Batang SEZ as many as 1

company. As for the tourism sector, in the Tanjung

Lesung SEZ there is only one company whose

investment value exceeds the minimum number of

incentives, and in the Mandalika SEZ there are five

companies.

Table 1. Number of Companies with Special Economic

Zone (SEZ) Investment Plans of more than 500 billion in

2017

Special Economic Zones Number of

Companies

Sei Mangkei 3

Tanjung Lesung 1

Palu 3

Mandalika 5

Bitung 0

Morotai 0

Tanjung Api-Api 3

Maloy Batula Trans Kalimantan 2

Tanjung Kelayang 0

Sorong 0

Arun Lhokseumae 0

Galang Batang 1

Total 18

Source: Coordinating Ministry for Economic Affairs

National Council for Special Economic Zones, kek.go.id,

2018

However, in increasing investment in Special

Economic Zones, investment commitments in SEZs

which have increased quite dramatically are not in

line with developments with the realization of these

investments, which is indeed to get income tax

incentives in the form of income tax reduction, one of

the conditions is only an investment commitment or

plan, but if it has been obtaining the tax incentive, the

taxpayer must do some investment realization. This

can be interpreted as saying that income tax

incentives have not yet been provided with an

incomparable rate of increase in investment

commitments with investment realization in Special

Economic Zones.

So in order to implement a better tax incentive policy

and more effective implementation and increase

investment in order to increase the development of

Special Economic Zones, a tax incentive policy

assessment can be done through the 10 principles of

Good Tax Policy in order to know and understand

more deeply related to the consideration of the

formulation and implementation of the policy and can

provide solutions so that the policy can work better in

carrying out its objectives. This is related to the

income tax incentive policy in the Special Economic

Zones; this research is to find out the reasons or

influencing factors related to the lack of interest of

taxpayers in increasing investment realization

compared to the level of investment commitments in

the Special Economic Zones. So that with the

issuance of tax policies related to income tax

incentives in the Special Economic Zones (SEZ)

established by the government to improve what is

stipulated in the Minister of Finance Regulation No.

104 / PMK.010 / 2016 concerning Tax, Customs and

Excise Treatment in Special Economic Zones, the

subject raised can be elaborated in the research

Keyword: Income Tax Incentive, Special Economic

Zones, Good Tax Policy

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

240

question is "How is the Analysis of Income Tax

Incentive Policy in Special Economic Zones based on

the principle of Good Tax Policy?"

2 THEORETICAL REVIEW

2.1 Fiscal Policy

Fiscal policy is a policy carried out by the government

in relation to state revenues, expenditures, and

financing. Fiscal policy in a country has a very

important role in driving the country's economic

growth. Thus, the determination of fiscal policy must

go through a carefully crafted process. Valid and

accurate information is very important as a

consideration tool for determining fiscal policy

(Nazier, 2004, p.504). Fiscal policy is an economic

policy in the context of directing economic conditions

to be better by changing government revenues and

expenditures (Rahayu, 2010, p.1).

2.2 Tax Incentives

Tax incentives or tax facilities can be interpreted as

facilities provided by the government in the field of

taxation. Viherkenttä (1991, p.6), states that there is

no fixed definition for defining tax incentives.

Bolnick (2004, p.4) states, tax incentives are fiscal

measures used to attract investors both from within

and outside the country, into certain economic

activities, or certain regions in a country. According

to Easson, tax incentives are special tax provisions

given to certain investment projects that have the

effect of reducing the effective tax burden.

Furthermore, tax incentives are defined as special

exemptions, exemptions, reductions, preferential tax

treatment, or deferral of tax obligations (Easson, 2004

p.2-3).

2.3 Income Tax

Tax is a mandatory contribution to the state owed by

individuals or entities that are coercive based on the

law with no direct compensation and is used for the

country's needs for the greatest prosperity of the

people. An alternative application of the concept of

ability to pay approach that is most widely used is to

approach the taxation of income, which is an

additional economic received by taxpayers at a

certain time period.

Income Tax is carried out in accordance with the

accreditation concept. The concept means that all

additional economic capabilities are objects of

income tax. The exact formula of "additional

economic capacity" is the calculation of taxable

income which includes total income as an object of

income tax, which must then be reduced first by

reducing tax burden or tax relief. Can be interpreted

that corporate income tax or corporate tax is a policy

that is applied to the profits of an entity to increase

taxes with taxable income calculated by deducting

expenses, including COGS and depreciation of

profits.

2.4 Good Tax Policy

Good Tax Policy Principles as detailed by Shome

(1995) in the Tax Policy Handbook, have ten

principles which are then further explained and

further updated by the Association of International

Certified Professional Accountants (2001). The ten

principles can be used as benchmarks in analyzing

new tax policy proposals and existing policies. Ten

principles of Good Tax Policy, namely:

1. Equity and Fairness

2. Certainty

3. Convenience of payment

4. Economy in collection

5. Simplicity

6. Neutrality

7. Economic growth and efficiency

8. Transparency and visibility

9. Minimum tax gap

10. Appropriate government revenues

2.5 Special Economic Zones

Special Economic Zone (SEZ) is an area that is

geographically and jurisdictionally an area where free

trade, including facilities and duty-free facilities for

the import of capital goods for export commodity raw

materials, are opened as widely as possible

(Johansson and Nilsson, 1997). Understanding of the

definition of Special Economic Zones (SEZ), which

can be interpreted as one form of specificity in trade

and investment activities such as bonded zones, trade

zones, etc. or can be interpreted as zones within the

zone.

In Indonesia, the Special Economic Zone is also a

form of government facilitation to develop growth

centers to support the acceleration and expansion of

Indonesia's economic development. The aim of

developing centers of economic growth is to

maximize the benefits of agglomeration, explore the

potential and superiority of the region, and correct the

social and spatial inequality of economic

development in Indonesia. The centers of economic

Income Tax Incentives Policy in Special Economic Zones

241

growth are developed in the form of industrial

clusters and SEZ in each economic corridor. The

development of growth centers is accompanied by

strengthening connectivity between centers of

economic growth and between centers of economic

growth with the location of economic activities and

supporting infrastructure. The government can

provide special treatment to support these centers,

especially those located outside Java.

3 RESEARCH METHOD

This research is based on a post-positivist paradigm

approach. In this research, descriptive research is

used, which is used to describe or analyze a research

result but is not used to make broader conclusions by

using qualitative data collection techniques with field

studies and library studies. While the data analysis

technique used is quantitative data analysis

techniques with coding.

4 RESULTS AND DISCUSSION

This research was compiled by evaluating using the

following principles, which were then assessed as

income tax incentive policies in the Special Economic

Zones which met or did not meet the following

dimensions:

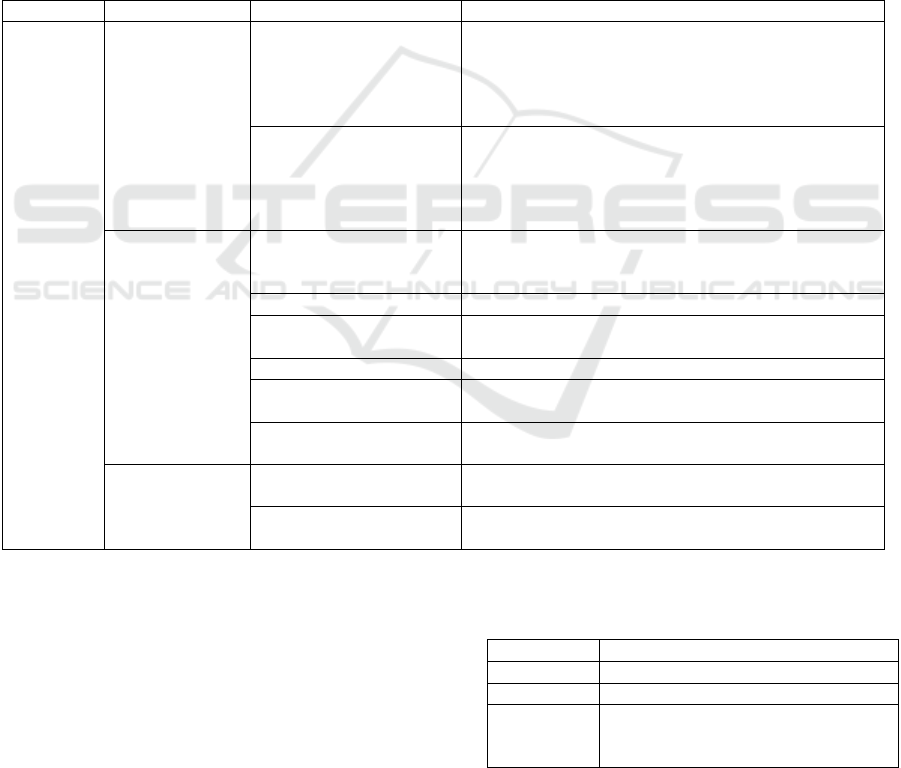

Table 2. Operating Concept

Concept Variable Dimension Indicator

Good Tax

Policy

Fairness and

Fairness of

Policy

Equity and Fairness Equity income tax incentive policies

Equally the treatment of income tax incentives for

individuals who have the same situation

Consideration of the ability to pay taxpayers in the

formulation stage

Transparency and

Visibility

Ease of calculating the tax incentive obligations

obtained by the Taxpayer

Taxpayers understand the reasons for the policy

Taxpayers know the incentives obtained by other

taxpayers

Level of

Operability

Policy

Certainty Income tax incentive policies specifically explain when

and how these incentives can be received and where

the number of incentives they have come from

Convenience of payment the ease of obtaining income tax incentives

Economy in collection the costs for implementing minimal income tax

incentives for the government and taxpayers

Simplicity Ease in implementing income tax incentives

Minimum tax gap Potential taxpayers who do not meet the requirements

to get income tax incentives

Appropriate Government

Revenues

The potential for error in fulfilling obligations in order

to obtain incentives

Level of

Fulfillment of

Policy

Objectives

Neutrality The policy can estimate revenue or the number of

taxpayers who make use of tax incentives

Economic growth and

Efficiency

the policy is in favor of one industry or not in the

formulation

Source: The data is processed by the researcher

Referring to the evaluation criteria provided by

Joint Venture, which states that the ten taxation

principles can be applied to identify and evaluate the

advantages and disadvantages of existing taxation

policies. The evaluation will emphasize the

advantages and disadvantages of tax policies to

identify ways to reduce these shortcomings. The

rating system uses a rating that can be used:

Table 3. Good Tax Policy Rating System

Assesment The principle being assessed

+ This principle is fulfilled

- This principle is not fulfilled

+/- Some aspects meet the principle, and

some aspects do not meet the

principle

Source: Joint Venture’s Tax Policy Group, 2003

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

242

In the case of the assessment of income tax

incentives in the Special Economic Zones, it is done

by looking at two sides, namely the government

represented by the Directorate of Taxation

Regulations II, the Fiscal Policy Agency, and the

Coordinating Ministry for Economic Affairs of the

National Council of the Special Economic Zones of

the Republic of Indonesia, while in terms of taxpayers

based on a statement from Andi as PT X's Tax

Manager Assistant and Sumarno as PT Y Tax

Manager who both carry out business activities in

Special Economic Zones. So that in assessing the

income tax incentive policy in Special Economic

Zones, it can be assessed both from the government

and taxpayers' basis based on the explanation above

as follows:

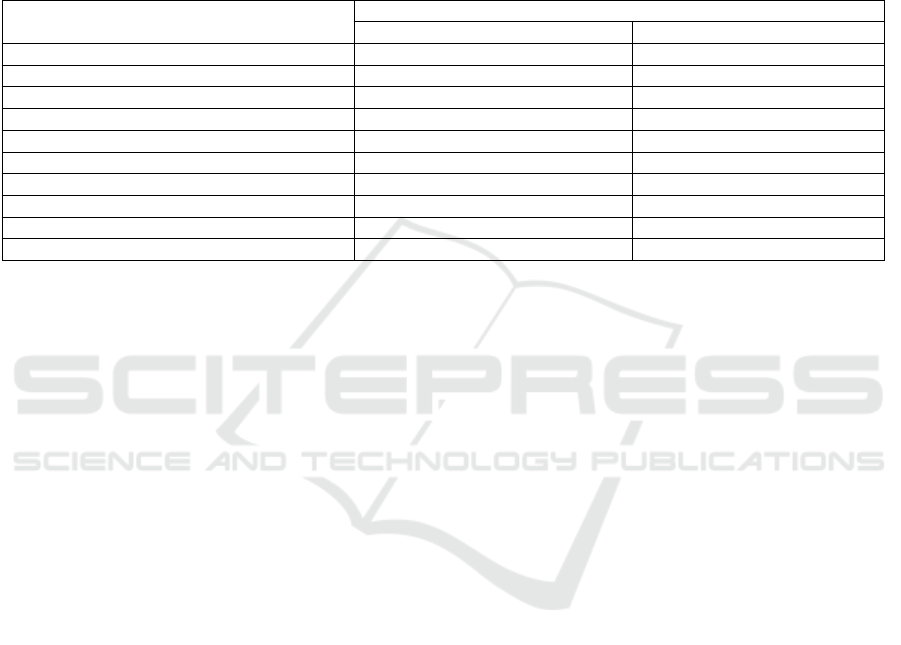

Table 4. The trend of Fulfillment of Income Tax Incentive Policy towards Good Tax Policy Principles

Principle

Assesment

Government Taxpayer

Equity and Fairness - -

Transparency and Visibility +/- +/-

Certainty +/- +/-

Convenience of payment +/- +/-

Economy in collection - +/-

Simplicity + -

Minimum tax gap + +

Appropriate government revenues + +

Neutrality + -

Economic growth and efficiency + +

Source: The data is processed by the researcher

The principle aspect of Equity and Fairness which

is assessed based on three aspects, namely, fairness of

income tax incentive policies, whether or not the

treatment of income tax incentives for individuals

who have the same situation, and consideration of the

ability to pay Taxpayers in the formulation stage,

policies providing income tax incentives by giving

income tax incentives given only to certain taxpayers

and formulations that are only based on generally

applicable regulations.

For the principle of transparency and visibility,

from the three indicators that are owned, the ease of

calculating the tax incentive obligations obtained by

the Taxpayer, the Taxpayer understands the reasons

for the policy, the Taxpayer knows the incentives

obtained by other Taxpayers, the aspects that are

fulfilled namely the aspect that the taxpayer know the

main reason for the existence of an income tax

incentive policy in Special Economic Zones, which is

to increase investment.

For certainty principle, the indicator is the income

tax incentive policy explaining specifically when and

how the incentive can be received and where the

amount of incentives derived from, the unmet aspects

of income tax incentives which according to the

government or taxpayers, tax incentive policies

holiday is still ambiguous with loading bracket while

the aspect that is fulfilled is for income tax incentive

tax allowance which is relatively clear for the

government and taxpayers.

For the principle of convenience of payment, the

indicator is the ease of obtaining income tax

incentives, aspects that are met in the difference in the

ease of obtaining income tax incentives and tax

allowance, which for income tax incentives for tax

holidays in Special Economic Zones must verify with

the Investment Coordinating Board Capital and

research by the Verification Committee for the

Reduction of Corporate Income Taxes, while tax

allowances tend to be easier than tax holidays because

the submission of incentives is only through the

Investment Coordinating Board with the help of the

Ministry of Finance.

Income tax incentive policies in Special

Economic Zones are assessed through the principle of

economy in collection based on the costs for

implementing minimal income tax incentives for the

government and taxpayers, the costs incurred in the

implementation of these incentives are not a problem

because they are comparable with the objectives of

issuing income tax incentives in Special Economic

Zones. But it is different for taxpayers whose bracket

of income tax deduction that is not specified becomes

the potential for high costs that can be issued through

negotiations with the government. However, in

practice, this income tax incentive policy will incur

more costs for taxpayers to conduct audits and reports

that need to be prepared periodically to be reported to

the Tax Office for tax allowance and the Tax Office

Income Tax Incentives Policy in Special Economic Zones

243

and the Corporate Income Tax Reduction

Verification Committee for tax holidays.

Assessing the income tax incentive policy through

the principle of simplicity is assessed based on

indicators of ease in implementing income tax

incentives, in fact it cannot be assessed because the

implementation of the tax holiday so far only one

business actor has registered with data including from

the Directorate General of Taxes that cannot disclose

companies that register themselves the. However, the

implementation of the income tax incentive policy in

the Special Economic Zones for this type of tax

holiday is not complicated by submitting reports that

must be submitted periodically, but there may be

obstacles that the report must be audited which will

certainly take time. For the implementation of tax

allowance incentives can be assessed more or less the

same as the implementation of income tax incentives

in general tax allowance so that taxpayers consider

that the implementation of tax allowance incentives is

simpler because the reporting stage is only carried out

to the Tax Office and there is no regulating policy

change compared to tax incentives allowance in

general.

The principle of minimum tax gap by assessing

through indicators of the lack of non-compliance of

taxpayers in implementing income tax incentives in

the Special Economic Zones for the type of tax

holiday incentives cannot be assessed because so far

there is only 1 (one) company that registers and is

uncertain of getting the incentive so that there are no

taxpayers who carry out tax holiday incentives, while

for tax allowance incentives, non-compliance with

the implementation of these incentives is very

minimal because the policies governing tax

allowance incentives have been applied in previous

policies regarding tax allowance incentives given in

general. For taxpayers who do not meet the

requirements to get income tax incentives, it will also

be difficult with document verification, and continued

verification carried out by the government so that the

minimum tax gap principle is fulfilled.

The principle of appropriate government revenues

is assessed from the indicator that the policy estimates

revenues or the number of taxpayers who utilize tax

incentives. In the matter of utilizing tax incentives,

according to DGT, the number of taxpayers who use

tax incentives is not targeted because the main

purpose of the formulation of the policy is to

encourage investment not to increase the interest of

taxpayers in using incentives. So it can be concluded

that the income tax incentive policy in Special

Economic Zones does not pay attention to the

principle of appropriate government revenues

because basically, the issuance of this policy focuses

on increasing investment rather than on state revenue.

Assessment of the principle of neutrality with

policy indicators in favor of one industry or not in the

formulation. The provision of income tax incentives

cannot be said to be neutral because for the tax

holiday tax facility is only enjoyed by certain

taxpayers mentioned in PMK-104 / PMK.010 / 2016

and for taxpayers who do not get a tax holiday will

only get a tax allowance with the granting of different

facilities which are certainly less profitable for

taxpayers than tax holidays.

So in the assessment of income tax incentive

policies based on the principles of economic growth

and efficiency, it is assessed from indicators of

economic efficiency, reduction of unemployment

rates, and increased economic growth, sufficiently

fulfilled by providing these incentives to increase

economic growth and reduce unemployment

indirectly with the presence of investment and

industrial development new in the Special Economic

Zone.

5 CONCLUSION

Based on the description in the previous discussion, it

can be concluded that the income tax incentive

policies in the Special Economic Zones which are

analyzed through the ten principles of Good Tax

Policy are assessed from two sides, namely the

government and the taxpayer only meet certain

principles. For the government, income tax incentive

policies in Special Economic Zones meet the

principle of simplicity, minimum tax gap, appropriate

government revenues, neutrality, and economic

growth and efficiency. As for taxpayers, the

principles fulfilled are the principle of the minimum

tax gap, appropriate government revenues, and

economic growth and efficiency. Meanwhile, in

terms of the principle of equity and fairness, it was

not fulfilled by the two parties. Meanwhile,

transparency and visibility, certainty, the

convenience of payment, and economy in the

collection are principles which some aspects are

fulfilled, and some aspects are not fulfilled.

Based on the element aspects that are not met, the

most significant principle is the certainty principle

because the number of tax holiday tax incentives that

can be obtained are not explained in detail, using a

bracket, which then influences the taxpayer's interest

in utilizing the tax holiday income tax incentives

which then affect the fulfillment of income tax

incentive policies on the principle of simplicity,

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

244

transparency and visibility, convenience of payment

due to the lack of taxpayers who take advantage of the

income tax incentives while the tendency for the

fulfillment of the principle of tax allowance for

certainty principles, transparency and visibility, and

convenience of payment has been fulfilled.

But on the other hand, the principles that focus on

economic growth and investment increase, namely

the principle of the minimum tax gap, appropriate

government revenues, and economic growth and

efficiency are met according to both the government

and the taxpayer. This is in line with the main

objective of the income tax incentive policy in the

Special Economic Zone, namely, to increase

investment, regional development, and economic

growth.

LIMITATIONS

A limitation in the study, entitled Analysis of of

Income Tax Incentives Policy in Special Economic

Zones, was the limitations of researchers to get

taxpayers to be informant, because many taxpayers

are not willing to be interviewed as research objects

so that taxpayers obtained as resource persons are

taxpayers from the food processing industry and

chemical industry so that they are less able to

represent the opinion of taxpayers in special

economic zones with a different industry

REFERENCES

AICPA. (2001) Guiding Principles of Good Tax Policy: A

Framework for Evaluating Tax Proposals. New York:

American Institute of Certified Public Accountants.

Bolnick, B. (n.d). Effectiveness and Economic Impact of

Tax Incentives in the SADC Region.

Easson, A., & Zolt, E. M. (2004). Tax Incentives for

Foreign Direct Investment. The Hague: Kluwer Law

International.

Johansson, Helena, and Nilsson. (1997). Export processing

Zones as Catalyst. World Development, Vol 25 No 12.

Joint Venture’s Tax Policy Group. (2003) Principles of

Good Tax Policy: A Tool For Critiquing Tax & Fiscal

Proposals and Systems. California, Joint Venture

Silicon Valley Network Inc.

Kementrian Koordinator Bidang Perekonomian Dewan

Nasional Kawasan Ekonomi Khusus. (2018). Laporan

Kegiatan Tahun 2017. Retrieved on

http://kek.go.id/assets/images/report/2018/LAPORAN

-AKHIR-TAHUN-2017.pdf

Nazier, Daeng M. (2004) Kebijakan Fiskal Pemikiran,

Konsep, dan Implementasi dalam Teknologi

Menunjang Penetapan Kebijakan Fiskal. Jakarta: PT

Kompas Media Nusantara.

Rahayu, A.S. (2010). Pengantar Kebijakan Fiskal. Jakarta:

Bumi Aksara.

Shome, Parasathai. (1995). Tax Policy Handbook.

Income Tax Incentives Policy in Special Economic Zones

245