Determinants of Competitive Advantage: A Case of Malaysian

Bumiputera Contractors

Zainuddin Zakaria

1

, Wan Maziah Wan Ab Razak

1

, Zalinawati Abdullah

1

, Nurul Ulfa Abdol Aziz

1

,

Muna Aimuni Zainal Abidin

1

, Abdul Kadir Othman

2

1

Faculty of Business and Management, Universiti Teknologi MARA (Terengganu), Malaysia

2

Faculty of Business and Management, Universiti Teknologi MARA (Puncak Alam), Malaysia

abdkadir@uitm.edu.my

Keywords: Competitive Advantages, Human Resource Management, Financial Capabilities, Technology, Suppliers, New

Market Entrance

Abstract: In this paper, the authors attempt to discuss the competitive advantage among the contractors in Malaysia

through the relationship between the variables; human resource management, finance, government assistance,

suppliers, technology, and new market entrance with competitive advantage (product differentiation, cost

leadership, and focus strategy). The paper further explored the profile of the contractors in the State of

Terengganu, as well as examining the ability of each class of contractors in maintaining the competitive

advantage. From the total population list, 349 samples were taken for the analysis. The population of the study

was taken based on the sampling frame generated by Contractor Services Centre (PKK). The researchers used

stratified sampling as a sampling technique in order to get the most efficient representation of the population.

The questionnaire was personally distributed to the contractors with the assistance of enumerators. The

instrument consists of five (5) sections measured by using Likert Scale. Based on the findings, it demonstrated

that only five (5) out of six (6) independent variables (human resource management, finance, technology,

suppliers, and new market entrance) had a significant relationship with competitive advantage. Moreover, the

five (5) independent variables were able to explain 72.2% of the variance in the competitive advantage among

contractors in Terengganu.

1 INTRODUCTION

Maintaining competitive advantage is always a

concern for any contractors if they wish to survive.

The construction industry is changing constantly with

the developments of new business methods and

technologies. Thus, construction companies have to

adopt various applications and develop appropriate

strategies to be more competitive in this industry and

to become successful in their business. Competitive

pressures, both in domestic and global markets,

shifted the desired outcomes in management of the

relationship away from compliance of employees’

behavior towards a more positive commitment on

customers and business requirements. People are

individuals who bring their own perspectives, values

and attributes to organizational life, and when

managed effectively, these human traits can bring

considerable benefits to organizations. Construction

organizations have a tendency to use labor as part of

a survival strategy, retaining and retraining the more

skilled employees or those skilled employees could

less easily be replaced (Puni et.al, 2016).

The construction industry is considered as a labor-

intensive industry. In general, the concept of labor

intensity is relative between industries. There are

complexities interfaces of different personnel within

construction industry whether in-house or within an

organization, or even inter-organization.

Construction profession offers opportunity to create

works for the benefit of humankind, but in turn, those

who work in the profession accept substantial

responsibilities. Construction industries serve as

industries that contribute to the growth of country’s

economy and promote continuous improvement to

environment by enhancing better lifestyle. In general,

there are four (4) types of construction; residential,

commercial/institutional building, industrial, and

heavy/high-way segments. Most contracts are

awarded to a general contractor who awards

Zakaria, Z., Wan Ab Razak, W., Abdullah, Z., Abdol Aziz, N., Zainal Abidin, M. and Othman, A.

Determinants of Competitive Advantage: A Case of Malaysian Bumiputera Contractors.

DOI: 10.5220/0009326705630572

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 563-572

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

563

subcontracts to specialty contractors as a common

practice in a traditional design-bid-build procurement

system method. Within the construction industry,

various organization groups put together their efforts

in forming teams to run the project by performing

intellectual effort in devoting individual capability to

complete the project within project delivery criteria.

Clifford and Richard (2004) have stated that, as for

the traditional design-bid-build procurement system,

the project players may involve the professionals in

the industry such as Owners/Clients, Constructors

Groups (including main Contractor, Subcontractors,

Suppliers and etc.), Consultants Groups (including

Architects, Civil and Structural Engineers, Quantity

Surveyors, Land Surveyors, and etc.).

The scenarios of contractors in the state of

Terengganu demonstrated that they are in the state of

anxiety due to the lack of development projects in

Terengganu. As such, the probability of the

contractors to get tenders or projects will be much

lower. Furthermore, the increasing number of

contractors and the imbalance of development

projects in the state further added fierce competition

to the industry. Although there were government

actions to freeze the contractor license for some

classes, but still the number of registered contractors

outnumbered the total existing project in the state. In

terms of business performance, the above

development will generate significant impact,

whereby due to intense competition among the

contractors, it leads to consideration of ‘popular’

pricing at the minimum profit. Although, the

provision of the price tag for the project is much

higher but still they go for a lower price in order to

secure the project. In view of this scenario, the tenders

will take into consideration the ‘popular one’ than the

price that should be as planned. As such, due to low

profit margin, any occurrences of late payments will

further weaken the ability of the contractors.

Consequently, this made it difficult for contractors to

be in a comfortable position.

The competition within the industry rose not only

among the registered contractors but among it also

involved contractors that are not registered with

Contractor Services Centre (PKK). This would

threaten and affect the career and sources of income

of the contractors. Of the total population, only 10%

of the successful contractors were those that have

contacts, high capital capacity, and efficient

management. Meanwhile, 40% of the contractors

could only survive and maintain the business as well

as be able to meet the current needs, while 50% of

them were not capable of sustaining their ability to

remain competitive in the

2 LITERATURE REVIEW

2.1 Competitive Advantage

Competitiveness is a multi-dimensional concept,

which has many definitions at different levels of

analysis. Among the common measures of

competitiveness includes market share, profitability,

growth rate, and the ability to supply low-cost/high

quality products or services at the firm level (Man et

al., 2002). Armstrong et al. (2004) proposed that

competitive advantage is the ability to offer consumer

with greater value either by lowering price or

providing more benefits than competitors that justify

a higher price tag. In the meantime, the company must

design broad competitive marketing strategies by

which can gain competitive advantage through

superior customer value (Kotler & Armstrong, 2012).

D’Cruz and Rugman (1992) view competitiveness as

the ability of a firm to design, produce and promote

or market products superior to those offered by

competitors upon considering the price and non-price

qualities.

A review of the literature reveals the paradigm

shift: rational usage of resources was the common

strategy to remain competitive in the 1980s markets,

while more emphasis was put in the 1990s and early

2000s on the multi-dimensional and evolutionary

nature of competition. The dynamic of the businesses

has become more dependent on knowledge

investments and learning ability than on physical

capital (European Commission, 2000). It is often

assumed by most people that only the firms with the

ability to transform individual and organizational

knowledge resources into strategic skills will achieve

competitive advantages and survive (Van Gils & Ve

Zwart, 2004).

The purpose of competitive advantages is not to

retreat from competition but to compete selectively

from an advantageous strategic position. Porter

(1985) defined three generic, competitive strategies

as overall cost leadership, differentiation and focus.

Differentiation is possible only until selection has

taken place; thereafter, competition is on the price

alone. For a contracting firm to be differentiated from

its competitors, it can adopt one or more forms of

competitive advantage; strategic management in

construction, bidding strategy, technological and

organizational innovations, technology strategy,

strategic planning, and alliances.

Competitive advantage is the essence of success

or failure of a company. The competitive spirit

provides determination in executing proper activities

for the company in developing efforts such as

EBIC 2019 - Economics and Business International Conference 2019

564

innovation, cohesive culture and good realization.

With competitive strategy, it lays out a way to find

competitive positions in an industry and to strengthen

and continuously position a company (Porter, 2004).

The definition of competitive advantage therefore

should be able to satisfy customer needs, as a key

characteristic of a product and service, be able to

satisfy the worker needs and have the potential to

grow up (Momaya & Selby, 1998).

2.2 Human Resource Management

Human Resource Management (HRM) includes all

activities related to the management of employment

relationships in the firm (Lin et al., 2008). Having the

ability to develop HRM practices aligned with

business strategy could be a source of sustainable

competitive advantages (Andonova & Zuleta, 2007).

Thus, with strategic HRM practices, it provides firms

with the internal capacity to adapt and adjust to their

competitive environment by aligning HRM policies

and practices (Kidwell & Fish, 2007).

Entrepreneurial orientation is critical for

organizational survival and growth in today's

business environment. Moreover, the current trend

towards knowledge-intensive industries means that

competitiveness increasingly depends on the

management of the relational bases of members of

organizations. HRM theory and practice can

contribute to understanding issues faced by the

entrepreneurial firm (Altinay et al., 2008). An

example of this is human resource acquisition and

deployment in startups, highly innovative ventures,

and development on the speed and direction of

growth in rapidly expanding firms (Barrett &

Mayson, 2007).

Transience arises within projects, since the

composition of teams normally changes during

different project stages, involving people from many

organizations, backgrounds and locations. Male

employment leads to many challenges such as skills

shortages caused by recruiting from only a portion of

population, difficulties in the management of equal

opportunities and workforce diversity, and

considerable challenges in terms of creating an

accommodating atmosphere in which individuals’

diverse skills and competencies are fully utilized

(Bredin, & Söderlund, 2011). Lack of effective

training and performance appraisal - the important

factor in implementing human resources management

in construction is in need of effective training and

ways in measuring the performance of their workers

training. A system of ‘performance measures’ is

needed in order to monitor improvements among

construction teams. In other words, the participative

approach addresses the development of good

supervisor-subordinate relationships and cohesive

work groups in order to satisfy both social needs and

the needs of business demand (Alazzaz & Whyte,

2015). From the discussion above, we propose the

following hypothesis:

2.3 Financial Capabilities

Dyer et.al, (2017), proposed that financial concepts

are considered paramount in acquiring capital,

evaluate the worth of a business, buy raw material,

expand the business, and renovate the premise. A

successful business often requires additional capital.

Besides net profit from the operation and the sale of

assets, other basic sources of capital could be in a

form of loan offered by the financial institutions.

Usually, the financial institution has already

determined the amount of loan that the entrepreneurs

are eligible to apply. However, some entrepreneurs

decided not to apply the loan because the interest

charged is assumed very high and, thus, reduces the

profit margin and burdens the entrepreneurs. Hence,

the alternative is: they will use their own saving, or

borrow from their family. For the partnering

company, the capital comes from the partner(s) of the

company.

Price is also one of the most flexible elements of

the marketing mix; it changes quickly, unlike product

features and subcontractor/supplier commitments.

The number one problem encountered by most

marketing executives in the industry is price

competition. There are at least four common mistakes

made by marketing executives (Kotler, 2012). First,

pricing is too cost oriented. Second, once an offer is

made, price is not revised to capitalize on market

conditions or to fend off competitive pressures. Third,

price is not set as an intrinsic element of a market-

positioning strategy, and fourth, price is not adjusted

enough for different clients, project types, and

amount of work at hand, equipment ownership. With

that, it leads to the next hypothesis:

2.4 Technology

Technology is the knowledge of how to do or make

something which yields benefits to users. Every

business activity involves technology. While this may

seem fundamental, every firm is constrained by what

it knows how to do it. The possession of technology

is the price of entry in all businesses and its

development is important to the maintenance of

competitive position in most, for some, it is the key to

Determinants of Competitive Advantage: A Case of Malaysian Bumiputera Contractors

565

competitive advantage (Gibb & Blili, 2017). New

technologies have made dizzying changes in the way

we live and work. Technology includes equipment,

manufacturing processes, and innovative materials

used in many products. Because of new discoveries

and inventories, better quality goods and services are

built at a faster pace and often at a lower cost (Everard

& Burrow, 2004), and thus, contributed to the

improvement of manufacturing for many years.

Computers have dramatically improved the quality

and speed of the production and have reduced costs.

There are many types of technology that has the

potential to contribute are able to contribute several

strategic processes to which technology has the

potential to contribute. Examples of improving

customer services, improving time to market,

improving management communication, improving

quality and increasing global reach (Nobre, 2016).

IT has been proven to be an important key enabler

in product design and much likely to be implemented

in the construction industry. In manufacturing, a large

scale and complex engineering projects as the

development of the ‘Airbus A380’ aircraft are only

feasible by using simultaneous and concurrent

engineering interwoven with suitable 3D-design

toolkits (Jaeger, 2007). Similar to an advance and

more complex construction technology, for instance,

the modular houses and mass-customization can only

be developed and produced by using extensive and

interwoven IT tools. Eichert and Kazi (2007) pointed

out that IT improves tendering, planning, monitoring,

distribution, logistic and cost comparison process by

establishing collaborative design integration,

accurate data and effective dealing with project

documents.

Verweij and Voorbij, (2007) identified the role of

IT tools which are to establish communication

between project team and suppliers as a medium for

quality control of overall project deliveries. InPro

system, for instance, is one of the IT tools developed

to improve design integration. InPro system is an

advanced system of integrated design, analysis

processes and decision-support developed based on

existing IT tools. The tools will radically improve

collaboration and integration between design,

manufacturing and assembly process (Jaeger, 2007).

The importance of technology in construction has led

to the next hypothesis:

2.5 Government Intervention

Government intervention has been historically

important in creating economic growth and in

fostering diffusion of technological innovations.

Jessop (2016) highlighted the role of the state as a

promoter of economic growth by getting the nation

into the ‘right businesses”, creating competitive

advantages, setting standards and creating demand.

The role of government has been fundamental in the

diffusion of infrastructures such as

telecommunication networks. In e-commerce

diffusion, many studies address the role of

government intervention to avoid digital division of

poor and rich countries. Madon (2000) stated that an

analysis of the relationship between Internet diffusion

and socio-economic development in developing

countries identifies three (3) major areas of

government intervention: creating knowledge,

disseminating knowledge and human resources

development. Government intervention is especially

important at sustaining technological development in

SMEs (Okhrimenko, 2017). Recently, many

governments and international organizations have

taken initiatives to foster the adoption of electronic

commerce in small and medium-sized enterprises

(OECD, 1999). These initiatives are considered

important to avoid a digital divide between small and

large companies. This is a testable hypothesis of this

research:

2.6 Supplier

The result of involving suppliers in product

development seems to be mixed (Hwang & Suh,

2018). For example, involving suppliers in the

decision making process does not always lead to

acceleration of project cycle time. Some may argue

that its involvement may contribute to reduced

development time, reduced development and product

costs and improved product quality. Some authors

conclude that the way supplier involvement is

managed in the product development process is

important in explaining the success of this supplier

involvement (Yoo, Shin & Park, 2015).

However, SMEs themselves are interested in

merging with other complementary enterprises in

order to achieve a critical dimension necessary to

cope with existing challenges (OECD, 2007).

Consequently, there is a real pressure on SME

subcontractors to grow through either mergers or the

development of groups of interconnected enterprises.

For instance, approximately half of the French

manufacturing subcontractors belong to a group. This

figure is highly dependent on the sector in which the

subcontractor is active (i.e. higher presence of groups

in forging activities but lower in other sectors such as

coating of metals) as well as on the size of the

enterprise. Such scenarios lead to the next hypothesis:

EBIC 2019 - Economics and Business International Conference 2019

566

2.7 New Market Entrance

A new venture started by a large company will have

certain features of a classical new venture (i.e.

venture started from scratch, often without substantial

funding and managerial skills). Lofsten (2016) noted

in his fundamental work on new ventures, “Many of

the practices of what we usually consider well-

managed companies tend to inhibit entrepreneurial

behavior”. As far as classical new ventures are

concerned, the leading role here belongs to

entrepreneurship. It is claimed that the success of

every new venture depends mostly on the

entrepreneurial capabilities of the founder(s). The

focus of research is the entrepreneurship itself,

business opportunity in the new market and business

concept, resource acquisition (finance, human,

organization, knowledge), and managing growth of

the venture. One of the important issues in managing

a new venture is the transition from informal, low-

control style of management (characteristic of early

phases of new ventures) to formal, high-control

management present in well-established companies.

Lofsten (2016) distinguishes between the ‘promoter’,

who is mainly focused on organizing activities and

bringing entrepreneurial ideas into life, and the

‘trustee’, who is mostly concerned with

administrating the existing business and safeguarding

achieved results. It is critical to reach a reasonable

balance between the two managerial modes. Based on

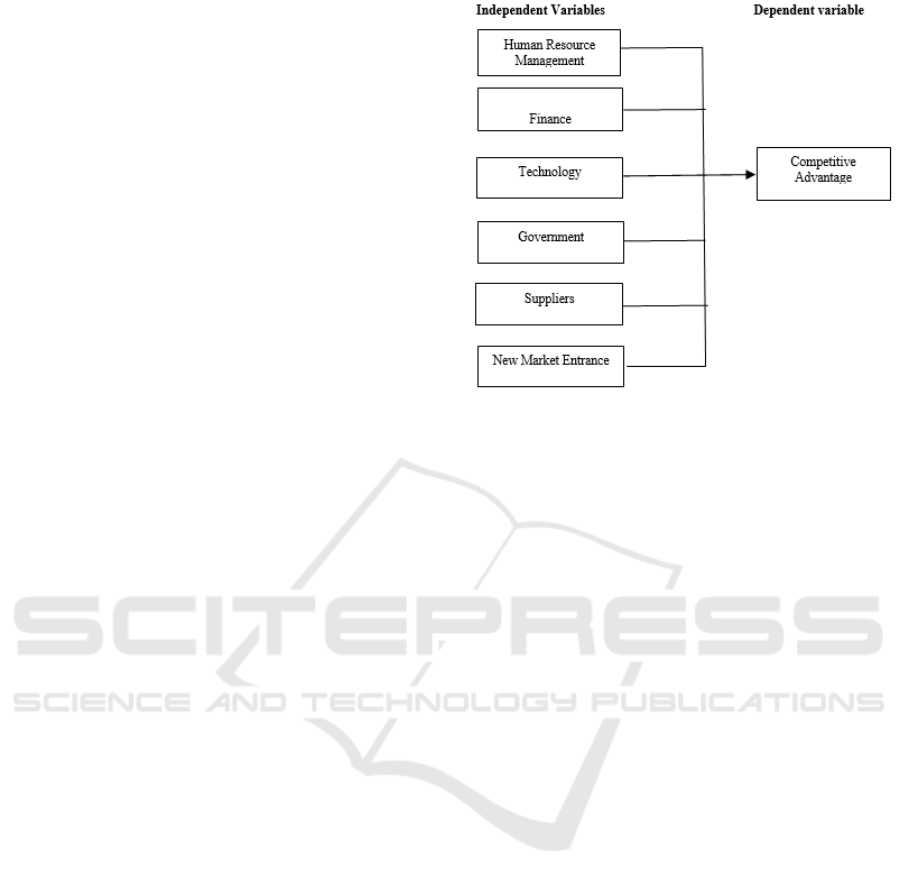

review of the literature, the following conceptual

framework are created as shown in Figure 1, and the

following hypothesis is developed as stated below.

H1: There is a significant relationship between

effective human resource management and

competitive advantage.

H2: There is a significant relationship between

financial capability and competitive advantage.

H3: There is a significant relationship between the

adoption of technology and competitive advantage.

H4: There is a significant relationship between

government intervention and competitive advantage

H5: There is a significant relationship between

suppliers and competitive advantage.

H6: There is a significant relationship between new

market entrance and competitive advantage.

Figure 1: Theoretical Framework

3 METHODOLOGY

3.1 Research Design and Collection

Method

This research applied self-administered questionnaire

survey was collected in 2016. The decision on the

sample size for the study followed the table generated

by Krejcie and Morgan (1970). With the population

of 3,331 contractors, 349 contractors were selected as

the respondents for the research. The population were

determine based on the sampling frame generated by

Contractor Services Centre (PKK) for the year 2010.

The study adopted stratified sampling technique in

order to get the most efficient representation of the

population. The researchers decided to divide 349

samples into seven locations. Of the samples were 32

respondents from Marang, 32 respondents from Setiu,

36 respondents from Kemaman, 136 respondents

from Kuala Terengganu, 30 respondents from Hulu

Terengganu, 32 respondents from Dungun, and 51

respondents from Besut. The technique further

divided the samples according to classification of

contractors. All respondents’ names were placed into

a bowl that has already been marked according to the

business location and classes. Thus, every sample was

given the equal chance to be selected as a respondent

for this study.

3.2 Survey Instruments

The survey instrument, which is personally

administered questionnaire, was distributed to the

contractors (respondents) of classes A, B, C, D, E,

Determinants of Competitive Advantage: A Case of Malaysian Bumiputera Contractors

567

and F. The instrument was made up of five sections

measured by using Likert Scale whereby the

respondents needed to indicate a degree of agreement

or disagreement with each series of statements about

the stimulus object. The scale items were made up of

five responses rating from “1” or “Strongly Disagree”

to “5” or “Strongly Agree”. Section A of the

questionnaires is for demographic profile of the

respondents. This part includes the respondents’

gender, age, origin, race, marital status, education

level, level of monthly income, year(s) involved as a

contractor, license category, area, business status, and

getting project in several years. In section B, the

questions are related to investigating how internal

factors can influence competitive advantage, which

are HRM, Finance, and Technologies. The concept

of HRM focuses on recruitment of management and

providing direction for the employees in the

organization. The financial factor is measured in

terms of the credit and banking involving money,

time, and risk while technology is measured in terms

of the usage and knowledge of tools, techniques,

crafts, systems or methods. As in section C, D, and E,

the questions aimed at measuring external factors

involving Government intervention, Suppliers, and

New Market Entrance subsequently. Section F

examined the level of competitive advantage among

contractors.

4 DATA FINDINGS AND

ANALYSIS

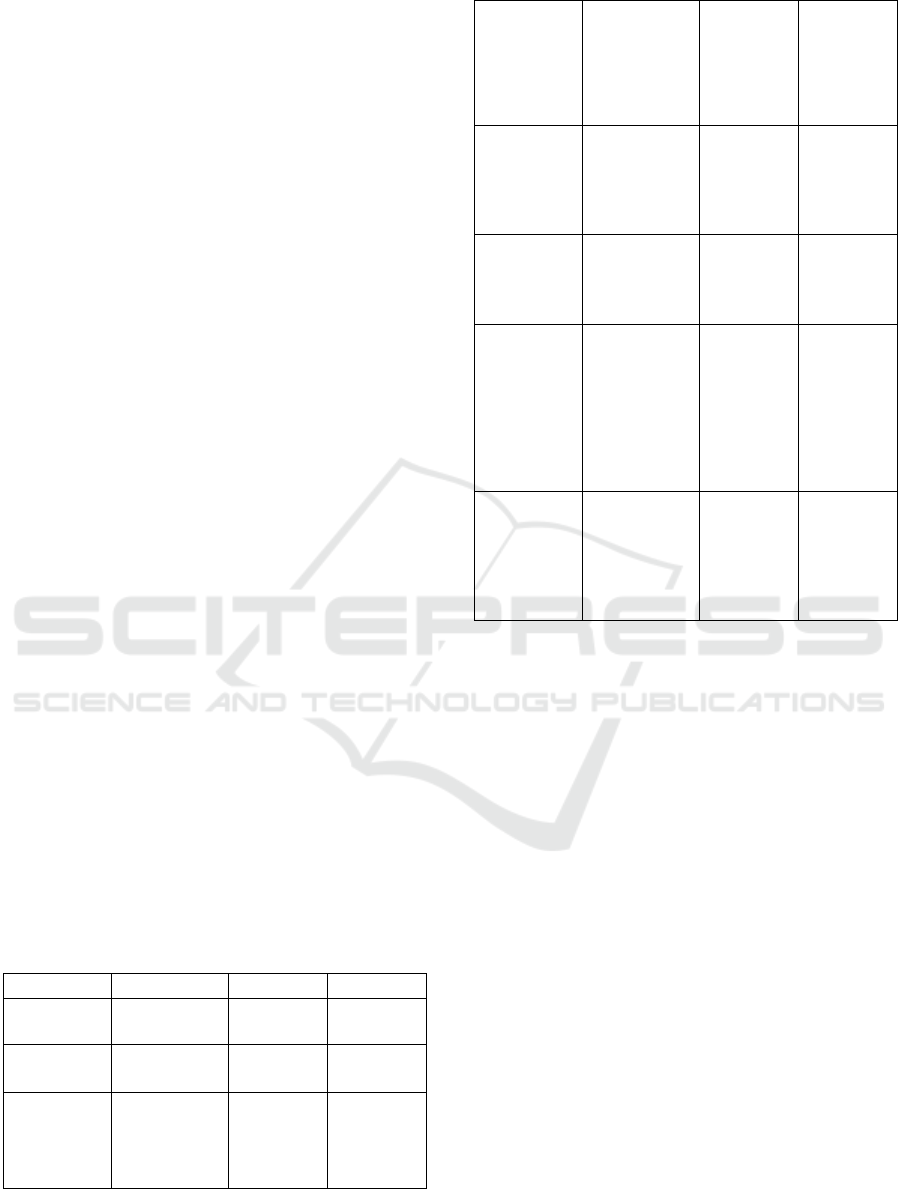

4.1 Frequency Analysis

A frequency analysis was conducted to determine the

demographic profiles of the respondents. The result

in Table 1 highlighted the demographic profiles of the

contractors.

Table 1: Respondents’ (contractors) profiles

Profile Description Responses Percentage

Gender Male

Female

327

22

93.7

6.3

Marital

Status

Single

Married

331

18

94.8

5.2

Age 20-24

25-29

30-34

35-39

40 and >

1

11

4

52

281

0.3

3.2

1.1

14.9

80.5

License

Category

Class A

Class B

Class C

Class D

Class E

Class F

17

14

25

37

16

240

4.9

4.0

7.2

10.6

4.6

68.8

Education

level

PMR

SPM

Diploma

Degree

Further degree

40

183

67

55

4

11.5

52.4

19.2

15.8

1.1

Years

involved as a

contractor

< 1 year

1-5 years

6-10 years

> 10 years

2

25

38

0

0.6

7.2

10.9

81.4

Area

Kemaman

Kuala

Terengganu

Dungun

Marang

Besut

Hulu

Terengganu

Setiu

36

136

32

32

51

30

32

10.3

39.0

9.2

9.2

4.6

8.6

9.2

Business

Status

Sole

Proprietorship

Partnership

Private

Limited Co

(Sdn Bhd.)

226

43

79

1

64.8

12.3

22.6

3

Based on the samples of the study, majority of the

respondents were male-dominated and they were in

the middle age and above the brackets (40 years old

and above) indicating that the youth categories were

not willing or yet to be ready to meet the challenges

in the industry. For those who involved in the industry

where most of contractors were in the form of sole

proprietorship, the earning of the contract business

was not that encouraging compared to the risk

involved. In the meantime, the fourth objective

attempted to examine the ability of each class of

contractors in maintaining the competitive advantage.

The result indicated the existence of differences as

each class had their own strength to maintain in this

industry. Those who were from class F, though made

up the majority of the population, were still at the

handicapped side while those who were from Classes

B and C were found to be more stable in the industry.

4.2 Reliability Analysis

A total of 370 sets of questionnaires were distributed

to the selected respondents for assessing the

reliability of the instrument. The results for the

reliability test for the samples collected are as

follows: 0.895 for Human Resource Management,

EBIC 2019 - Economics and Business International Conference 2019

568

0.797 for Financial Capability, 0.906 for

Technologies, 0.855 for Government intervention,

0.904 for Suppliers, 0.638 for New Market Entrance,

and 0.938 for Competitive Advantage.

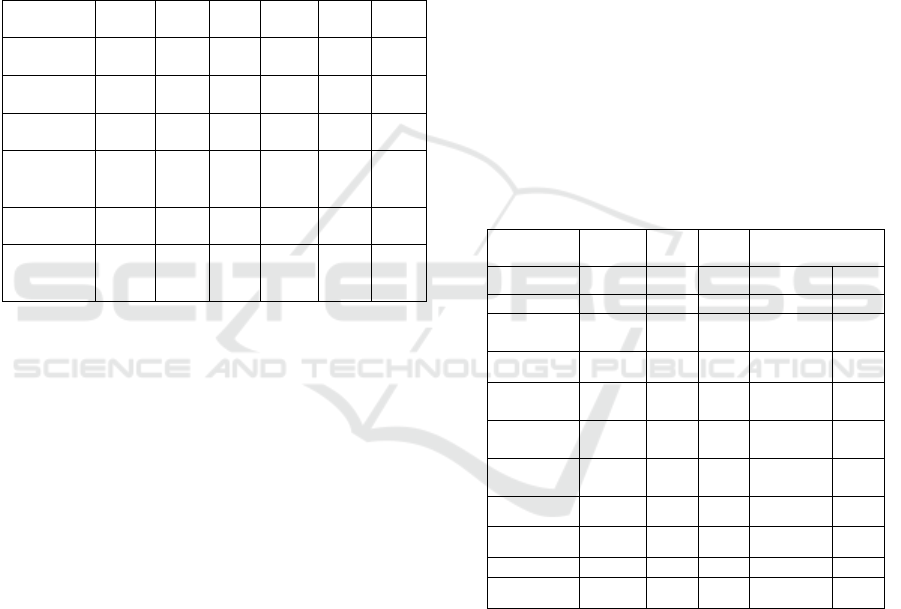

4.3 Correlation Analysis

Pearson Correlation test was conducted as a

preliminary analysis to investigate the relationship

between the independent variables and the dependent

variable. Using SPSS version 21, data was then being

ran and tabulated. All figures are shown in table 2.

Table 2: Correlation analysis

COM

P

HRM FIN TECH GOV SUPP

HRM

0.744*

*

Finance

(FIN)

0.580*

*

0.612

**

Technology

(TECH)

0.764*

*

0.658

**

0.498

**

Government

Intervention

(GOV)

-0.040 .085 0.163

**

-0.156

**

Suppliers

(SUPP)

-.485** -0.312

**

-0.164

**

-0.465

**

0.398

**

New Market

Entrance

(NME)

-0.059 0.019 -0.265

**

-0.089 -0.228

**

0.087

*COMP- Competitive Advantage

**correlation is significant at the 0.01 (2 tailed)

The results of the analysis showed that the

relationship between HRM and Technologies with

Competitive Advantage indicating a high correlation

as shown by 0.744 and 0.764, respectively. The

coefficient analysis between Finance with

Competitive Advantage showed that it is moderate at

correlation value of 0.580. But there was a moderate,

negative correlation between Suppliers and

Competitive Advantages, r=-0.485, n 349, p<0.05,

with higher involving suppliers in product

development, the less contractor’s competitive

advantages. However, Government intervention and

New Market Entrance were not significant as

indicated by the value of -0.040 and -0.059.

4.4 Multiple Regression Analysis

Multiple Regression Analysis technique was then

used to further examine the relationship between the

observed independent variables and the dependent

variable. Table 3 provides the result of regression

analysis. The result showed that HRM, Finance,

Technologies, Government intervention, Suppliers,

and New Market Entrance contributed significantly

(F = 148.396; p<0.01) to competitive advantage. The

results further showed that there was a significant

relationship between HRM (β= 0.320; p<0.01),

Finance (β= 0.156; p<0.01), Technology (β= 0.394;

p<0.01), Suppliers (β=-0.202; p<0.01) and

Competitive Advantage at 5 % significant level.

However, the result showed no significant

relationship between Government intervention (β=

0.058; p>0.05) and Competitive Advantage and New

Market Entrance (β= 0.042; p>0.05) and Competitive

Advantage. Among all the six dimensions,

technology possesses the strongest value, followed by

HRM, Finance, and Suppliers. There was no

statistical support for H

4

and

H

6

. There was significant

evidence to support for H

1

, H

2

, H

3

, and H

5

. However,

H

5

shows the negative significant relationship with

competitive advantage such as the supplier’s

involvement becomes higher, the level of competitive

advantage becomes lower. All the above variables

were able to explain 72.2% of the variations in

competitive advantage.

Table 3: Summary of multiple regression analysis

Dimensions Β T P Collinearity

Statistics

Tolerance V IF

H R M 0.320 7.120 0.000 0.402 2.488

Financial

Capability

0.156 3.991 0.000 0.530 1.887

Technology 0.394 9.344 0.000 0.456 2.194

Government

intervention

0.058 1.697 0.091 0.696 1.438

Suppliers

Involvemen

t

-0.202 -

5.686

0.000 0.644 1.553

New Market

Entrance

0.042 1.321 0.187 0.791 1.265

R 0.850

R

2

0.722

F value 148.396

Sig. 0.000

Note: Predictors (constant) HRM, finance, technology,

Government, suppliers and new market entrance. P ≤ 0.05.

Table 3 provides a summary of the result of the

regression analysis. The result showed that HRM,

Finance, Technologies, Government intervention,

Suppliers, and New Market Entrance contributed

significantly (F = 148.396; p<0.01) to competitive

advantage. The results further showed that there was

a significant relationship between HRM (β= 0.320;

p<0.01), Finance (β= 0.156; p<0.01), Technology (β=

0.394; p<0.01), Suppliers Involvement (β=-0.202;

p<0.01) and Competitive Advantage at 5 %

significant level. However, the result showed no

Determinants of Competitive Advantage: A Case of Malaysian Bumiputera Contractors

569

significant relationship between Government

intervention (β= 0.058; p>0.05) and Competitive

Advantage and New Market Entrance (β= 0.042;

p>0.05) and Competitive Advantage. Of all the six

dimensions, technology possesses the strongest

value, followed by HRM, Finance, and Suppliers.

There was no statistical support for H

5

and

H

7

. There

was significant evidence to support for H

2

, H

3

, H

4

,

and H

6

. However, H

6

shows the negative significant

relationship with competitive advantage such as the

supplier’s involvement becomes higher, the level of

competitive advantage becomes lower. All the above

variables were able to explain 72.2% of the variations

in competitive advantage.

5 CONCLUSION AND

RECCOMENDATION

In general, the entire proposed objectives have been

addressed. The first objective was to investigate the

relationship between independent variables and

competitive advantage of the contractors in

Terengganu. The result showed that the most

significant factor that has the relationship with

competitive advantage of the contractors was

technology. This was similar to the early theory

mentioned as well as some earlier findings supported

the notion that, with the technology application, it

will eventually improve quality, speed of production,

and cost reduction (Awward & Akroush, 2016,

Everard & Burrow, 2004).

Four out of six independent variables showed

significant relationship with the contractor’s

competitive advantage. However, there was

moderately negative relationship between suppliers

and competitive advantage. In some cases, the

suppliers and contractors were competing with each

other. Thus, not all suppliers were willing to

collaborate with the contractors. In addressing the

relationship between government intervention and

new market entrance on contractors competitive

advantage, both variables failed to help contractors to

build their competitive advantage. Government

intervention and new market entrance were the

external factors that were beyond the control of

contractors who were responsible for an activity but

those had an effect on the success or failure of the

activity. In summary, the role of government is still

crucial. Government agencies are responsible to

create a conducive environment in terms of

regulations, institutional structures, and policy

initiatives in micro- and macro-economic levels to

enable corporations to make economic decisions that

can facilitate and enhance their productivity,

provision of quality human resources, and provide the

physical and communication infrastructures. All the

above achievements provided a road map for

continuously gaining competitive advantage in the

industry. Having a more transparent “contract award”

to the contractors will definitely make the industry

healthier.

In order to improve their level of competitive

advantage, contractors should focuses on improving

the management of their human resources which

include planning, organizing, staffing, leading and

controlling. Moreover, factors that are frequently

considered as a part of the internal environment

including organization mission statement, leadership

styles, and its organizational culture should also be

considered. To maintain as contractors, they need

financial strength to roll their capital if they face late

compensation. The contractors must also consider the

differentiation of their products in terms of price and

quality compared to its competitors and developing

sound business strategies. These effort can be

achieved by appropriate configuration in terms of

inbound and outbound logistics, marketing and sales,

and high level of co-ordination. Moreover these

efforts may contribute to stronger competitive

advantages particularly for corporations involved in

international business and industries.

Based on the findings, 72.2% of changes in the six

independent variables were able to explain their

relationship with competitive advantage among

contractors. Furthermore, 27.8% of the variance was

unexplained. This variance could be attributed by

other elements such as political actor, timeliness, and

service quality. For further research, these variables

can be added to obtain more information in

explaining the competitive advantage. Political actors

can be either individuals or temporal or functional

coalitions of actors with common interests.

Accordingly, the literature on political NPD project

selection distinguishes between actors with product

championing or similar roles (Singh et al., 2008). In

the definition of a product champion, implicit

acknowledgement of organizational politics can be

found in championing literature since championing

roles are suggested to be related to hierarchy,

autonomy, persuasion or cross-functional ties.

Similarly, Rosenau and Grithens (2005) highlighted

that time is the most important measure of project

performance success. This idea is supported by Xiao

and Proverbs (2006) who claimed that project delays

have a significant implication on cost and quality.

Mpofu et.al (2017) conducted a literature survey on

EBIC 2019 - Economics and Business International Conference 2019

570

causes of a project delay where they claimed that 50

percent of the delays could be categorized as non-

excusable delays why the contractors were

responsible.

The fact that management commitment to service

quality critically affects the excellence of the services

delivered and the neglect in this area may lead to

service failure. In order to assess objectively the

initiatives relating to management commitment to

service quality, Forrester (2000) has suggested that

employee evaluations of management initiatives are

an appropriate tool to use. According to Lytle and

Timmerman (2006), when the management is

committed to improve service quality, employees will

be provided with more opportunity for training. Such

training may enhance the skills of employees in

dealing with unexpected work problems and their

competence in making appropriate suggestions for

decision-making.

REFERENCES

Alazzaz, F., & Whyte, A. (2015). Linking Employee

Empowerment With Productivity In Off-Site

Construction. Engineering, Construction and

Architectural Management, 22(1), 21-37

Altinay, L., Altinay, E., Gannon, J. (2008), "Exploring the

relationship between the human resource management

practices and growth in small service firms", The

Service Industries Journal, Vol. 28 No.7, pp.919-37.

Andonova, V., Zuleta, H. (2007), "The effect of

enforcement on human resources practices",

International Journal of Manpower, Vol. 28 No.5,

pp.344-53.

Awwad, A., & Akroush, D. M. N. (2016). New Product

Development Performance Success Measures: An

Exploratory Research. EuroMed Journal of

Business, 11(1), 2-29.

Barrett, R., Mayson, S. (2007), "Human Resource

Management In Growing Small Firms", Journal of

Small Business and Enterprise Development, Vol. 14

No.2, pp.307-20.

Bredin, K., & Söderlund, J. (2011). The HR Quadriad: A

Framework For The Analysis Of HRM In Project-

Based Organizations. The International Journal of

Human Resource Management, 22(10), 2202-2221.

Clifford. J. S., and Richard S. M., (2004), Construction

Management Fundamentals, McGraw Hill, New Yoon.

Dainty, A.R.J., Bagilhole,B.M. and Neale, R.H., (2000)

‘The Compatibility of Construction Companies’

Human Resource Development Policies with Employee

Career Expectations,’ Engineering, Construction &

Architectural Management 7 (2): 169-78.

Dyer, J. H., Godfrey, P., Jensen, R., & Bryce, D.

(2017). Strategic Management: Concepts And Cases.

Wiley Global Education.

Eichert, J., Kazi, A. S. (2007) Vision and Strategy of

Manubuild- Open Building Manufacturing (edited by)

Kazi, A. S., Hannus, M., Boudjabeur, S., Malone, A.

(2007), Open Building Manufacturing – Core Concept

and Industrial Requirement’, Manubuild Consortium

and VTT Finland Publication, Finland

European Commission (2000), Innovation Policy in a

Knowledge-Based Economy. A Merit Study

Commissioned by the European Commission, EUR

17023. Enterprise Directorate General.

Everard, K. E. and Burrow, J. L. (2004). Business principles

and management 11E anniversary edition. United

States of America: Thomson South-Western.

Forrester, R. (2000), "Empowerment: rejuvenating a potent

idea", Academy of Management Executive, Vol. 14

No.3, pp.67-80.

Gibb, Y. K., & Blili, S. (2017). Small Business and

Intellectual Asset Governance: An Integrated

Analytical Framework. GSTF Journal on Business

Review (GBR), 2(2).

Hwang, S., & Suh, E. K. (2018). A Study on Supplier

Involvement and Buyer Strategic Decisions. The

International Journal of Industrial Distribution &

Business, 9(4), 53-62.

Jaeger, J., (2007) InPro- Integrated project within the 6th

Framework Program, The Proceedings Of 1st

Manubuild Conference, April 2007, Rotterdam

Jessop, B. (2016). The Developmental State in an Era of

Finance-Dominated Accumulation. In The Asian

Developmental State (pp. 27-55). Palgrave Macmillan,

New York.

Kidwell, R.E., and Fish, A.J. (2007), "High Performance

Human Resource Practices in Australian Family

Business: Preliminary Evidence Form the Wine

Industry", International Entrepreneurship and

Management Journal, 3 (1), pp.1-14.

Kotler, P. (2012). Marketing Management Analysis,

Planning, Implementation, and Control, 9th edition,

Prentice Hall, New Jersey.

Kotler, P., and Armstrong, G., (2012). Principle of

Marketing, 14

th

Edition, Pearson Education Limited,

England.

Krejcie, R. & Morgan, D. (1970). Determining Sample Size

for Research Activities, Educational and Psychological

Measurement, 30 (3), 607-610.

Lin, C.H., Peng, C.H., Kao, D. (2008), "The Innovativeness

Effect of Market Orientation and Learning Orientation

on Business Performance", International Journal of

Manpower, Vol. 29 No.8, pp.752-72.

Löfsten, H. (2016). New Technology-Based Firms and

Their Survival: The Importance of Business Networks,

and Entrepreneurial Business Behavior and

Competition. Local Economy, 31(3), 393-409.

Lytle, R.S., Timmerman, J.E. (2006), "Service Orientation

and Performance: An Organizational Perspective",

Journal of Services Marketing, Vol. 20 No.2, pp.136-

47.

Madon, S. (2000), ‘The Internet and Socio-Economic

Development: Exploring the Interaction’, Information

Technology and People, Vol. 13, No. 2, pp.85-101.

Determinants of Competitive Advantage: A Case of Malaysian Bumiputera Contractors

571

Okhrimenko, O. (2017). The Mechanisms of Integration in

Conditions of Asymmetry of Innovative Development

of the EU. CES Working Papers, 9(3), 293-312.

Malhotra, N.K. and Peterson, M. (2001), “Marketing

Research In The New Millennium: Emerging Issues

And Trends”, Marketing Intelligence and Planning,

Vol. 19 No. 4, pp. 216-35.

Man T.W.Y.; Lau T. and Chan K.F. (2002), “The

Competitiveness of Small and Medium Enterprises: A

Conceptualization with Focus on Entrepreneurial

Competencies”, Journal of Business Venturing, (vol.17,

no.2) pp.123-142. Management, 8.

Momaya, K., and Selby, K., (1998)."International

Competitiveness of the Canadian Construction

Industry: A Comparison with Japan and the United

States." Canadian Journal Civil Engineering 25: 640-

652.

Mpofu, B., Ochieng, E. G., Moobela, C., & Pretorius, A.

(2017). Profiling Causative Factors Leading To

Construction Project Delays in the United Arab

Emirates. Engineering, Construction and Architectural

Management, 24(2), 346-376.

Nobre, A. L. (2016, July). Learning Capabilities and

Organizational Learning–The Strategic Role of

Information Systems in the Knowledge Economy.

In Atas Da Conferência Da Associação Portuguesa De

Sistemas De Informação (Vol. 3, No. 3).

OECD (1999) ‘Business-to-Business E-commerce: Status,

Economic Impact and Policy Implications’, OECD

Working Paper, NO. 77.

OECD. (2007), Enhancing the Role of SMEs in Global

Value Chains- Background Report, Paris. Available on

the Internet at:

http://www.oecd.org/dataoecd/27/43/38900592.pdf.

Porter, M.E. (1985), Competitive Strategy: Creating and

Sustaining Superior Performance. The Free Press, New

York, NY.

Porter. (2004), M. E. Global Competitiveness Report

2004-2005: Findings from the Business

Competitiveness Index. New York, Institute for

Strategy and Competitiveness Harvard Business

School.

Puni, A., Agyemang, C. B., & Asamoah, E. S. (2016).

Leadership styles, employee turnover intentions and

counterproductive work behaviors. International

Journal of Innovative Research and Development, 5(1),

1-7.

Rosenau, M. D. and Githens, G. D., (2005). Successful

Project Management: A Step by Step Approach with

Practical Examples. Published by John Wiley and Son,

Inc.

EBIC 2019 - Economics and Business International Conference 2019

572