The Effect of Market Attractiveness and Value Creation on the

Performance of Fertilizer Companies in Indonesia

Indarto Pamoengkas and Sulaeman Rahman

Faculty of Economics and Business, Universitas Padjajaran

Keywords: Market Attractiveness, Value Creation, Company Performance

Abstract: In the business development of both organic and inorganic fertilizers in Indonesia, companies have not shown

a high performance, while the demand for fertilizers continues to grow. This condition was allegedly caused

by issues related to the development of the value creation in the fertilizer industry. Other aspects that are

thought to have an impact on these conditions are related to adapting the attractiveness of the fertilizer market.

Based on this background, this research aims at examining the effect of market attractiveness and value

creation on the performance of fertilizer companies in Indonesia.

This research used a quantitative research approach. The unit of analysis in this research was fertilizer

producers in Indonesia, especially producers registered with the Ministry of Agriculture. Observations were

carried out using a cross section/one shot in the time horizon, which was year 2019. The observation unit was

the management of fertilizer producer companies in Indonesia. The population in this research was all

fertilizer producer totaling 55 companies, and a census was carried out on all fertilizer producers in Indonesia.

Verification analysis was used to measure quantitative data and hypothesis testing was conducted using PLS

(Partial Least Square).

The results showed that market attractiveness and value creation had a significant effect on company

performance, where value creation had a greater influence than market attractiveness. The dominant value

creation dimension in improving company performance was business domain, and then followed by business

partners, and customer benefits. While the most dominant dimension of market attractiveness in driving

company performance was market access, followed by market strength, and intensity of competition.

The results of this research have implications for the management of fertilizer companies in Indonesia that

improving company performance rests on the development of value creation, especially in the aspect of the

business domain, which is supported by the adaptation of market attractiveness especially in terms of market

access.

1 INTRODUCTION

At the international level, the fertilizer market

competition in 2018 was still high due to oversupply

faced by the international urea market. This condition

had resulted in difficulties in competing for fertilizer

producers who had uncompetitive selling prices. The

international prices of urea and ammonia hit their

lowest point in 2017, but turned rebounced in 2018

before going down again in H1 2019.

The high climate of competition in the

international fertilizer market was indicated from the

expansion of the establishment of new factories,

especially in areas that had low to medium production

cost advantages. The increase in the expansion of

factory establishment was not directly proportional to

the growth in consumption levels, which caused

oversupply market conditions. Another implication

was that products with uncompetitive prices lost

market share.

According to data from the Association of

Indonesian Fertilizer Producers (APPI – Asosiasi

Produsen Pupuk Indonesia), the consumption of urea

fertilizer throughout 2018 was the largest in the last

10 years with an achievement of 6,26 million tons,

exceeding the realization of urea fertilizer

consumption in 2017 which was 5.97 million tons.

The large amount of consumption was caused by

several factors, including the long rainy season that

encouraged farmers to produce more. The national

urea consumption in 2018 was dominated by the

agriculture (4.10 million tons), plantation (1.56

Pamoengkas, I. and Rahman, S.

The Effect of Market Attractiveness and Value Creation on the Performance of Fertilizer Companies in Indonesia.

DOI: 10.5220/0009311105230530

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 523-530

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

523

million tons), and industrial sectors (600 thousand

tons). Meanwhile, the export of urea fertilizer

throughout 2017 decreased by 39% to 766 thousand

tons compared to the previous year of 1.25 million

tons, later then improved in 2018 by achieving 1.14

million. This fluctuation was mainly due to the

unstable market price of urea and ammonia.

Nonetheless, the total urea consumption for the

domestic and export markets in 2018 increased by

10% to 7.40 million tons compared to the previous

year of 6.73 million tons. Meanwhile, NPK fertilizer

consumption also rose by 7.8% to 2.8 million tons

compared to the previous year of 2.59 million tons.

Urea fertilizer production fluctuated in the 2010-

2018 period. The fertilizer produced by PT Pupuk

Indonesia (PTPI) was dominated by urea, followed by

NPK and other fertilizers. However, production had

already fluctuated from 2013 to 2018.

PTPI fertilizer sales were divided into two

segments, namely the subsidized and non-subsidized

segments. PTPI's subsidized fertilizer sales

performance increased from 2013 to 2018. However,

the non-subsidized segment fluctuated from time to

time. The performance of export sales even showed a

weakening in line with fluctuations in prices of

fertilizer and ammonia commodities. The description

indicated problems in the performance of fertilizer

companies in Indonesia. According to Wheelen &

Hunger (2015), company performance is related to

sales, market share and profitability.

The aforementioned conditions were considered

to be related to value creation. This thought was based

on a literature review of previous research, such as the

findings of Sanchez et al. (2010) which showed that

producer organization learning is a direct factor to the

positive ability of customer value creation, which is

understood from a functionalist perspective that

directly enhances the business performance of

producers. In addition, Rodgers (2010) found that

corporate value creation causes performance gaps,

which are explained by seven organizational

variables focus on the entire organization, consisting

of vision, mission, core values, goals, strategies,

organizational flexibility and risk.

Conceptually, Kotler & Keller (2012: 79)

explained that customer value creation focuses on

customers, core competencies in business domains,

and collaborative networks at business partners. So

that, companies can create customer value, if they are

able to focus on providing benefits to customers, have

superior core competencies, and have good business

partners in their collaborative network. While

empirically, indications such as the lack of effort to

develop collaboration with business partners were

found. By paying attention to the high international

competition climate, each fertilizer producer is

required to operate efficiently, and be more

responsive to opportunities and take anticipatory

steps to continue to grow sustainably. Fertilizer

companies continued to make efforts to obtain gas

contracts at competitive prices.

Other aspects that are thought to be related to

problems in the performance of fertilizer companies

were the aspect of adapting market attractiveness. Ju

& Zhao (2009) found that the intensity of industrial

competition positively moderated the influence of

slacking organizations on performance.

Best (2013) suggested that the attractiveness of

segments are based primarily on three important

considerations, namely market demand, intensity of

competition, and market access. The measures of

market attractiveness are market forces, competitive

intensity, and market access. While the results of the

observations indicated that fertilizer companies in

producing and marketing fertilizers had not been

based on observations of market forces, such as the

extent of the market coverage, the extent of the

customer's purchasing power, and whether customers

have characteristics as loyal customers.

Based on the background, this research aims at

examining the effect of market attractiveness and

value creation on the performance of fertilizer

companies in Indonesia.

2 LITERATURE REVIEW

2.1 Market Attractiveness

Walker, Mullins and Boyd (2011) revealed that the

measuring factors of market attractiveness are

customers’ needs and behavior, market size, market

growth rate, and macro trends (demographic, socio-

cultural, economic, political/legal, technological, and

natural trends). Meanwhile, the measuring factors to

determine the position of the competitors are

opportunity for competitive advantage, firm and

competitor capabilities and resources, and the

attractiveness of the industry where they complete

(threat of new entrants, or new substitutes, buyer

power, supplier of power, competitive rivalry, and

industry capacity).

Best (2013) suggested that the attractiveness of

segments is based primarily on three important

considerations, namely an assessment of market

demand, competition intensity, and market access.

According to Best (2013), market attractiveness can

EBIC 2019 - Economics and Business International Conference 2019

524

be measured by market forces, competitive intensity,

and market access.

There are three factors that shape market

attractiveness, namely:

1. Market forces with indicators of market coverage

served (market size), level of product/service

growth (growth rate), strength of buyer power,

and customer loyalty

2. Competitive intensity with indicators of number

of competitors, competitor prices, ease of entering

the market, and service products or service

substitutes.

3. Market access with indicators of customer access,

familiarity with products/services of the

company, ease in getting products/services

(channel access), sales requirements, and ease in

managing and developing markets (company fit)

While, according to Huser (2012), market

attractiveness is a multidimensional phenomenon that

includes:

a. Market size

b. Market growth

c. Market potential / dynamics (prospective)

d. Others: distribution of small/medium goals

(diversification), off-season distrisution, length of

stay, and price insensitivity

On the other hand, Hubbard and Beamish (2011)

revealed that market attractiveness can be measured

based on the condition of the company's competitors,

customer demand, supporting and infrastructure

conditions, and supplier conditions.

Based on the description of the concept of market

attractiveness, market attractiveness in this research

refers to the Best’s (2013) description, hence it was

measured by the dimensions of market strength,

intensity of competition, and market access.

2.2 Value Creation

Kotler & Keller (2016:43) developed the concept of

holistic marketing. Holistic marketing is based on the

development, design, and implementation of various

marketing programs, processes, and activities that are

broad and interdependent. Holistic marketing

requires an integrated perspective in understanding

various issues related to marketing. Therefore,

holistic marketing recognizes and adjusts the scope

and complexity of various marketing activities.

Holistic marketing has four broad components,

namely relationship marketing, integrated marketing,

internal marketing, and performance marketing.

The holistic marketing dimensions relates to the

business task of delivering customer value to an

advantage. Marketers can succeed if they adjust the

value delivery process and select, provide, and

communicate superior value to the buyer. Kotler &

Keller (2012:79) explained that customer value

creation focuses on customers, core competencies in

business domains, and collaborative networks with

business partners. Therefore, companies can create

customer value, if they are able to focus on providing

benefits to customers, have superior core

competencies, and have good business partners in

their collaborative network.

Value creation activities are related to business

strategy. Hubbard & Beamish (2011:36) explained

that business strategies are related to value creation

that results in customer value, namely the difference

between what is sacrificed in costs and what is

received in a number of benefits derived from the

performance of a product or service received from the

organization. According to Bowman & Ambrosini

(2000), value creation is related to innovation that

increases benefits for consumers; from the

consumer’s perspective, value creation is related to

increasing value that can have an impact on

increasing consumer loyalty.

Based on the description of the concept, the value

creation in this research was measured by the

dimensions of benefits for customers, business

domains, and business partners.

2.3 Company Performance

The concept of performance was explained by

Wheelen et al. (2015) as the end result of an activity.

Performance is related to the objectives formulated in

the strategies as part of the management process.

In measuring performance, David (2013) used

quantitative criteria in the form of financial ratios to

compare company performance in several periods, to

compare company performance with competitor

performance, and to compare the company's

performance towards the industry average. Financial

ratios that are used to evaluate strategies are Return

on Investment (ROI), Return on Equity (ROE), Profit

Margin, Market Share, Debt to Equity, Earnings per

Share, Sales Growth, and Assets Growth.

Hassabelnaby, Hwang & Vonderembse (2012)

measured company performance with the dimensions

of financial performance (Return on Assets/ROA)

and nonfinancial performance (Quality). Huang

(2010) measured company performance based on

financial performance, measured by ROA, while

Fonseka et al. (2013) measured company

performance through accounting-based performance

measure, and ROI.

The Effect of Market Attractiveness and Value Creation on the Performance of Fertilizer Companies in Indonesia

525

Based on the concepts and dimensions of

company performance, the company performance

variable in this research was measured by the

dimensions of sales, profitability, and market share.

2.4 Hypothesis

H : Market attractiveness and value creation affect

company performance.

3 METHODOLOGY

This research examined the fertilizer industry in

Indonesia using a quantitative research approach

focused on the numerical assessment of the learned

phenomenon. Quantitative research is more

systematic, planned, structured, clear from the

beginning to the end of the research. This quantitative

approach is used to identify all concepts of the

research objectives (Malhotra, 2010). Quantitative

research seeks to test a theory by specifying

hypotheses, and then collecting data to support or

refute the theory. The data were collected using

special instruments designed to assess behavior, and

the information was analyzed using statistical

procedures and hypothesis testing.

Observations were carried out using a cross

section/one shot in the time horizon, meaning that the

information or data obtained was the result of

research conducted at one time, namely in 2019.

According to Sekaran (2010: 132), the unit of

analysis is level of aggregation of the data collected

during the subsequent data analysis stage. The units

of analysis in this research were companies of both

organic and inorganic fertilizers. Thus, the population

in this research was all fertilizer producers totaling 55

companies. Based on this population, a census of all

fertilizer producers in Indonesia was conducted. The

observation units used as the respondent in this

research were the managers or management of

fertilizer producer companies in Indonesia.

Verification analysis was used to measure

quantitative data and hypothesis testing using the PLS

(Partial Least Square).

4 RESULT AND FINDING

The following explains about the results of analysis

based on PLS method.

4.1 Result of Model Analysis Using

PLS

4.1.1 Evaluation of Measurement Model

(Outer Model)

The measurement model in this research used

SmartPLS program. The outer model analyzed the

relationship between latent variables and indicators.

Tests were carried out on external models include:

Convergent Validity: The value of convergen

validity was the value of loading factor on the

latent variable with its indicators. The expected

value was > 0.7.

Composite Reliability: The data had high

eliability with the composite reliability > 0.7.

Average Variance Extracted (AVE). The

expected AVE value was > 0.5.

Table 1: Reliability

Construct AVE Composite

Reliability

Cronbach’s

Alpha

PERFORMANCE 0.504 0.854 0.794

MARKET

ATTRACTIVENESS

0.558 0.902 0.880

VALUECREATION 0529 0.854 0.802

Table 1 depicted the reliability test of variables.

The values obtained were AVE > 0.5. Cronbach’s

Alpha > 0.7 and Composite Reliability > 0.7.

Therefore, the research variables had good reliability.

Table 2: Convergent Validity Dimension-Indicator (1

st

order)

Indicator <‐

Dimension

Original

Sample

(O)

Standard

Error

(STERR)

T Statistics

(|O/STERR|)

Concl

usion

CP1<‐Sales 0.886 0.028 32.073 Valid

CP2<‐Sales 0.914 0.014 64.873 Valid

CP3 <‐

Profitability

0.803 0.048 16.701 Valid

CP4 <‐

Profitability

0.849 0.020 41.606 Valid

CP5 <‐

Market

share

0.924 0.023 41.022 Valid

CP6 <‐

Market

share

0.907 0.024 37.764 Valid

MA1 <‐

Market

forces

0.762 0.035 21.817 Valid

MA2 <‐

Market

forces

0.709 0.053 13.333 Valid

MA3 <‐

Market

forces

0.613 0.074 8.280 Valid

EBIC 2019 - Economics and Business International Conference 2019

526

MA4 <‐

Market

forces

0.758 0.047 16.057 Valid

MA5 <‐

Intensity

0.654 0.055 11.837 Valid

MA6 <‐

Intensity

0.771 0.062 12.416 Valid

MA7 <‐

Intensity

0.864 0.024 36.257 Valid

MA8 <‐

Market

Access

0.777 0.040 19.416 Valid

MA9 <‐

Market

Access

0.638 0.078 8.191 Valid

MA10 <‐

Market

Access

0.658 0.068 9.724 Valid

MA11 <‐

Market

Access

0.717 0.041 17.357 Valid

VC1 <‐

Customer

benefit

0.839 0.045 18.679 Valid

VC2 <‐

Customer

benefit

0.848 0.031 27.037 Valid

VC3 <‐

Customer

benefit

0.665 0.088 7.559 Valid

VC4 <‐

Business

domain

0.811 0.055 14.741 Valid

VC5 <‐

Business

domain

0.677 0.093 7.264 Valid

VC6 <‐

Business

domain

0.608 0.118 5.161 Valid

VC7 <‐

Business

Partner

0.920 0.021 43.335 Valid

VC8 <‐

Business

Partner

0.930 0.017 54.576 Valid

The value of convergen validity was the value of

the loading factor in the latent variable with its

indicators. The value of loading factor was > 0.5,

meaning that the indicator was a valid mesurement

for latent variables in first order.

Table 3: Convergent Validity of Latent Variables-Dimensions

(2

nd

order)

Original

Sample

(

O

)

Standard

Error

(

STERR

)

T Statistics

(|O/STERR|)

Concl

usion

MARKET

ATTRACTIVENESS ->

Intensit

y

0.894 0.018 49.306 Valid

MARKET

ATTRACTIVENESS ->

Market Access

0.965 0.006 162.779 Valid

MARKET

ATTRACTIVENESS -

>Market forces

0.954 0.009 105.485 Valid

VALUE CREATION ->

Business Partner

0.679 0.082 8.255 Valid

VALUE CREATION ->

Business domain

0.911 0.020 45.789 Valid

VALUE CREATION ->

Customer benefit

0.883 0.020 44.170 Valid

PERFORMANCE ->

Market share

0.551 0.133 4.158 Valid

PERFORMANCE ->

Profitability

0.953 0.008 112.319 Valid

PERFORMANCE -> Sales 0.890 0.023 38.195 Valid

The value of loading factor was > 0.5, meaning

that the indicator was a valid mesurement for latent

variables in second order.

4.1.2 Evaluation of Structural Model (Inner

Model)

The evaluation of inner model was tested in three

ways, namely R

2

, Q

2

and GoF. According to Chin

(1998), the value of R

2

amounted to 0.67 was

categorized as strong, 0.33 as medium, and 0.19 as

weak. The Q

2

value of 0.02 was categorized as minor,

0.15 as medium, and 0.35 as large, and they were only

used for the endogenous construct with reflective

indicator. The value of GoF was considered small if

it was < 0.1, medium if it was 0.1-0.25, and large if it

was > 0.38 (Tenenhaus, 2004).

Table 4: Inner Model Test

Variable R

2

Q

2

GoF

PERFORMANCE 0.541 0.434 0.487

MARKETATTRACTIVENESS 0.450

VALUECREATION 0.431

Table 4 depicted that the R

2

value of company

performance as endogenous variables were in the

medium criteria (> 0.33), and Q

2

values were in the

large criteria (> 0.35), and GoF was in the large

criteria (> 0.35). Therefore, it could be concluded that

the research model was supported by the empirical

condition, so that the model was fit.

Based on the test results of R

2

, Q

2

and GoF, the

resulting model could be considered as robust.

The Effect of Market Attractiveness and Value Creation on the Performance of Fertilizer Companies in Indonesia

527

Therefore, the hypothesis testing was able to be

conducted.

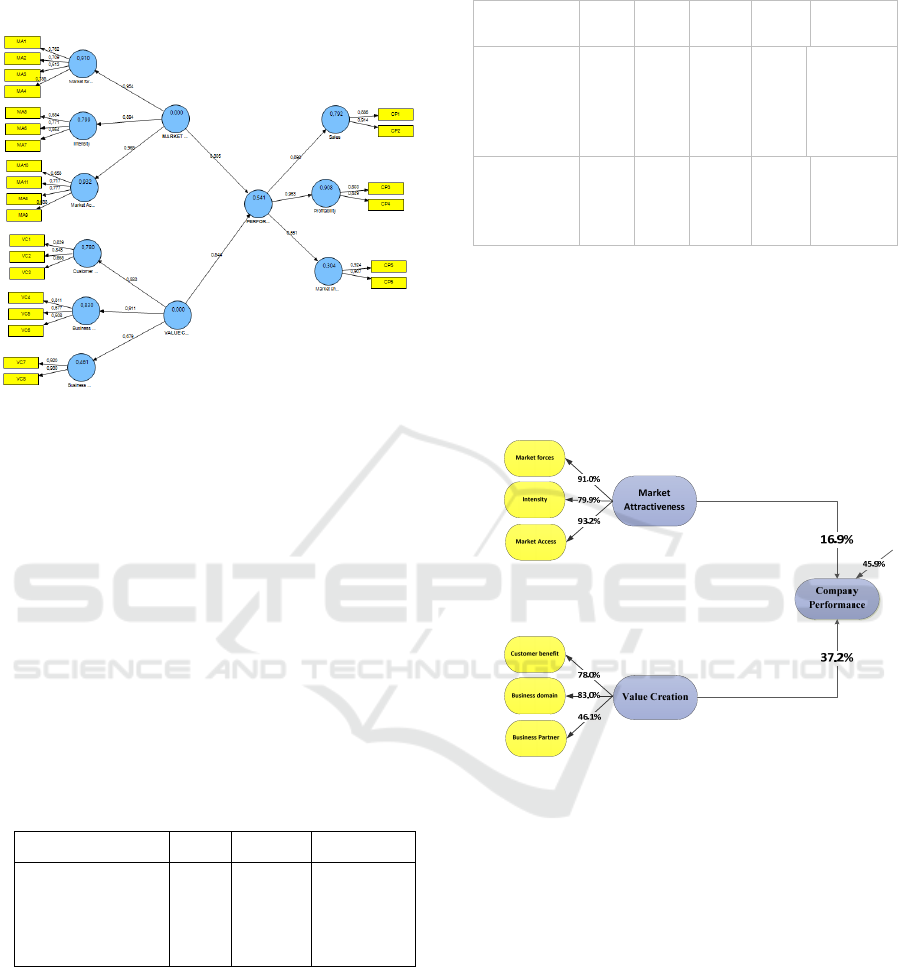

Figure 1: Complete path diagram the of research model

Based on the research framework, then the

structural model obtained was:

η

1

= 0.305

1

+ 0.544

2

+

1

η

1

= company performance

1

= market attractiveness

2

= value creation

1

= Residual

4.2 Hypothesis Testing

Table 5 presents the results of hypothesis testing both

simultaneously and partially.

Table 5: Simultaneous Testing of Hypothesis

Hypothesis R

2

F Conclusion

Market

Attractiveness and

Value Creation ->

Performance

0.541 30.667* Hypothesis

accepted

*significant at =0.05 (F

table

=3.175)

Table 5 depicted that there was simultaneous

influence of market attractiveness and value creation

on company performance amounted to 54.1% with

degree of confidence of 95% (=0.05), while the rest

of 45.9% was affected by other factors not examined

in this research.

Table 6: Partial Testing of Hypothesis

Hypothesis

SE

()

t R

2

Conclusi

on

Market

Attractiven

ess ‐>

Performan

ce

0.30

5

0.09

6

3.16

1*

0.16

9

Hypothes

is was

accepted

Value

Creation ‐>

Performan

ce

0.54

4

0.08

5

6.38

2*

0.37

2

Hypothe

sis was

accepte

d

*significant at = 0.05 (t

table

=1.68)

Partially, market attractiveness and value creation

had a significant influence on company performance, in

which value creation had a greater influence

(R

2

=37.2%).

Based on the results of the hypothesis testing, then the

research findings are described as follows.

Figure 2 : Research Findings

The hypothesis testing results revealed that

market attractiveness and value creation had an effect

on company performance, thus the hypothesis was

accepted. The results of statistical tests showed that

value creation had a greater influence than market

attractiveness on the achievement of company

performance in the fertilizer industry in Indonesia.

Value creation was formed by three dimensions,

namely customer benefits, business domains, and

business partners. From these dimensions, the

business domain had the highest influence (83%),

followed by customer benefits (78%), and business

partners (46.1%). Business domains were related to

the creation of distinctive product characteristics

compared to competitors, the creation of standards for

on-time and delays, and an increase in the company's

understanding of product trends in the future. These

EBIC 2019 - Economics and Business International Conference 2019

528

aspects had the highest implications in improving the

performance of fertilizer companies in Indonesia. The

second dimension that supported the achievement of

business performance was customer benefits relating

to the creation of product variations, the creation of

additional benefits, and the improvement of quality

standards. Meanwhile, the creation of business

partners' value was related to the creation of

partnerships with customers and business networks

with competent parties.

Market attractiveness was formed by three

dimensions, namely market forces, competitive

intensity, and market access. From these dimensions,

market access had the highest influence (93.2%),

followed by market forces (91%), and competitive

intensity (79.9%). These results illustrated that the

achievement of company performance produced by

companies were able to adapt market attractiveness,

especially in terms of market access aspects.

Adaptation of market access was mainly related to the

condition of the customer, the extent to which the

customer recognizes the company's products,

distribution channels, and the company's

understanding of product trends. The introduction of

market attractiveness also needed to be supported by

adaptation of market forces and competitive intensity.

Market forces were related to market coverage,

market growth, market forces, and market

characteristics. Meanwhile competitiveness is related

to the growth in the number of competitors, price

competition, and the quality of substitute products.

These aspects support the companies’ efforts to

analyze the extent to which the attractiveness of the

market in the fertilizer industry as an appropriate

strategy for winning the competition so as to produce

optimal company performance.

The research results revealed that company

performance was dominantly formed by value

creation, which was supported by the adaptation of

market attractiveness. The results of this research

supported the findings of Sanchez et al. (2010), which

showed that producer organization learning was a

direct factor to the positive ability of customer value

creation, which was understood from a functionalist

perspective that directly enhanced the business

performance of producers. In addition, Rodgers

(2010) found that corporate value creation affected

performance gaps, which were explained by seven

organizational variables focuses on the entire

organization consisting of vision, mission, core

values, goals, strategies, organizational flexibility and

risk; and Ju & Zhao (2009) found that the intensity of

industrial competition positively moderated the

influence of slack organizations on performance.

5 CONCLUSION AND

RECOMMENDATION

The hypothesis testing results revealed that market

attractiveness and value creation had an effect on

company performance, thus the hypothesis was

accepted. The results of statistical tests showed that

value creation had a greater influence than market

attractiveness on the achievement of company

performance in the fertilizer industry in Indonesia.

The results of this research have implications for

the management of fertilizer companies in Indonesia

that struggle to improve company performance are

based on the development of value creation which is

supported by the adaptation of market attractiveness.

Value creation development is prioritized on the

business domain aspect, followed by development in

the aspects of customer benefits and business

partners. Business domains are related to the creation

of distinctive product characteristics compared to

competitors, the creation of standards for meeting on-

time delivery, and increasing the company's

understanding of product trends in the future.

Meanwhile, market attractiveness adaptations are

prioritized on aspects of market access, followed by

adaptation to aspects of the market forces, and

competitive intensity. Adapting market access is

emphasized in aspects of customer conditions, the

extent to which customers recognize company

products, distribution channels, and the company's

understanding of product trends.

REFERENCES

Best, R. J. (2013). Market-Based Management: Strategies

for Growing Customer Value and Profitability (6th

Edition). London, England: Pearson Education.

Bowman, C., & Ambrosini, V. (2000). Value Creation

Versus Value Capture: Towards a Coherent Definition

of Value in Strategy. British Journal of Management,.

11, 1–15.

David, F. R. (2013). Strategic Management, Concepts &

Cases. London, England: Pearson Education , England.

Fonseka, M., Wang, P. & Manzoor, M. S. (2013). Impact

of human resource slacks on firm performance:

Evidence from a developing country. Zbornik Radova

Ekonomski Fakultet u Rijeka, 31(2), 279-306.

Hassabelnaby, H., Hwang, D. & Vonderembse, M. A.

(2012). The impact of ERP implementation on

organizational capabilities and firm performance.

Benchmarking: An International Journal, 19(4/5),

Hubbard, G. & Beamish, P. (2011). Strategic Management

- Thinking, Analysis, Action. Australia: Pearson, 4

th

Edition

The Effect of Market Attractiveness and Value Creation on the Performance of Fertilizer Companies in Indonesia

529

Irawan, Setyorini, D. & Rochayati, S. (n.d.). Proyeksi

Kebutuhan Pupuk Sektor Pertanian Melalui Pendekatan

Sistem Dinamis [PDF file]. Retrieved from

http://balittanah.litbang.pertanian.go.id/ind/dokumenta

si/lainnya/09%20-%20Irawan%20et%20al%20-

%20Proyeksi%20Kebutuhan%20Pupuk%20Sektor%2

0Pertanian%20Melalui%20Pendekatan%20Sistem%2

0Dinamis.pdf?secure=true

Ju, M. & Zhao, H. (2009), Behind organizational slack and

firm performance in China: The moderating roles of

ownership and competitive intensity. Asia Pacific

Journal of Management, 26(4),701-717.

Kotler, P. & Keller, K. L. (2012) Marketing Management.

14e, Global Edition, Pearson Education Limited

Kotler, P. & Keller, K. L. (2016) Marketing Management.

Global Edition, Pearson.

Malhotra, N. K. (2010). Marketing Research an Applied

Orientation. Prentice Hall.

Rodgers, D. (2010). Vision-to-value creation: A balanced

fit strategic dynamic capabilities process. ProQuest,

UMI Dissertation Publishing.

Sekaran, U., & Bougie, R. (2010). Research methods for

business A skill-building approach (5th ed.).

Haddington John Wiley & Sons.

Tenenhaus, M., Amato, S. & Vinzi, V. E. (2004) A global

Goodness-of-Fit index for PLS [PDF File]. Retrieved

from

https://pdfs.semanticscholar.org/cfdb/0d4ec08d6eb472

1787c795c092b36cb3805f.pdf

Walker, O., Mullins, J. & Boyd, H., Jr. (2011), Marketing

Strategy: A Decision-Focused Approach (8th Edition).

Business and Economics.

Wheelen, T. L. & Hunger, D. J. (2012). Strategic

Management and Business Policy, Towards Global

Sustainability (13

th

Edition). Pearson.

Wheelen, T. L., Hunger, D. J., Hoffman, A. N. & Bamford,

C. E. (2015). Strategic Management and Business

Policy: Globalization, Innovation, and Sustainability,

14

th

Edition. Global Edition, Pearson.

EBIC 2019 - Economics and Business International Conference 2019

530