Integrated Reporting, Is It Really Matters?

Minda Muliana Sebayang

1

, Azhar Maksum

2

, Rina Bukit

2

, Khaira Amalia Fachrudin

2

1

Ph.D. student at Faculty of Economic and Business, Universitas Sumatera Utara

2

Lecturer at Faculty of Economic and Business, Universitas Sumatera Utara

Keywords: CSR Disclosure, Environmental Disclosure, Integrated Reporting, Stock Price

Abstract: As a new model of financial reporting in the world, the using of integrated reporting in many countries

nowadays has been expanded so do with the importance part of CSR disclosure and environmental disclosure

in annual report. This research desires to explore the scope of integrated reporting, CSR disclosure and

environmental disclosure in listed public companies in Indonesia and the enforce to company value, especially

stock price. All of the consumer goods industry listed in Indonesia Stock Exchange were be part of the

population in this study. Quantitative research method is used in this research and the result of this study

revealed that the scope of integrated reporting quality disclosure in Indonesia is getting extensive and

significantly influencing the stock price of manufacturing companies.

1 INTRODUCTION

In the new economy era, companies that were

founded should not only be solely for profit

maximization. The stock price indicates the value of

the company. The company's performance reflected

in the financial reporting will be responded by all

stakeholders in the stock market and will be used to

obtain funds or alternative financing (Tandelilin,

2010). Stock market can reflect the market response

to company financial performance published in the

annual report . The stock market price reflects the real

value of the company (Sutrisno, 2012) so that the

higher the price of shares, then it can be said that the

value of the company is also high (Husnan, 2015).

Anyhow, market member continually invest in stock

market in an endeavor to acquire profits, which can

be acomplished by utilize the abnormal returns

involvement over a period, as a result of an anomaly

market (Hirshleifer, Teoh, & Yu, 2011) and the entity

must be able to provide the information they need in

financial report or annual report.

Public companies at the present time should be

responsible to their environment and society because

they can not stand alone without the support of the

community. Changes in the new economic era also

makes the company should be clear in disclose all

financial information and non-financial. To retain

their business, companies must pay attention to the

sustainability of their business in the short, medium

and long-term sustainability, and all information must

be disclosed in company the annual reports.

Sustainability reporting is a company forms of

communication and accountability to apparent a

stakeholder with regard to the environmental

performance Good Corporate Governance. An

integrated disclosures made by the company will be

found in the annual report as a form of company

accountability and transparancy to the stakeholders

(Baiman & Verrecchia, 1996; Clarkson, et.al., 2008).

Integrated reporting is a concise and integrated

financial reporting that covering all enterprise

information either financial or non-financial

information, for example the company profile, the

management profile, good corporate governance,

corporate social responsibility and audited financial

statements.

2 LITERATURE REVIEW

Management, the owners of the company and

stakeholders have a different concern about the entity

and it makes the gap between them and boots the

agency theory. Differences in information holding on

the two parties also lead to information gaps called

information asymmetry. Either the management or

stakeholders are those who are rational and motivated

by personal interest (Jensen & Meckling, 1976).

Legitimacy Theory is a theory that focused on the

508

Sebayang, M., Maksum, A., Bukit, R. and Fachrudin, K.

Integrated Reporting, Is It Really Matters?.

DOI: 10.5220/0009308105080514

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 508-514

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

company interaction with the external parties.

Companies need legitimacy or recognition from

external stakeholders in order to maintain the

company's sustainability and to keep the public trust

so that the operation of the company should be

reciprocal to the public (Dowling & Pfeffer, 1975;

Lindblom, 1993; Deegan, et.al., 2002). As stated in

the efficient market hypothesis, new information

feasible in financial statements should be returned to

the market immediately. Therefore, this research

presents the relevance of CSR disclosure,

environmental disclosure and integrated reports

disclosure influence the company’s stock price.

2.1 Stock Price

The stock price is formed by supply and demand

mechanism in the capital market. If a stock

experiences excess demand, then the stock price tends

to rise. Conversely, if the excess supply then the price

of shares tends to fall (Sartono, 2010) . The price of a

legal stock that occurs on the stock market at a

particular time determined by market participants and

is determined by the demand and supply of shares in

the capital market (Jogiyanto, 2014). The main factor

that will all affect the stock price is public companies

are external and internal factors (Brigham, 2014).

2.2 Corporate Social Responsibility

(CSR) Disclosure

Corporate Social Responsibility (CSR) disclosure is

about how companies manage the business processes

to produce an overall positive impact on society

(Kusumadilaga, 2010). This definition is lifted from

the philosophy of how to manage a company well in

part or as a whole to get a positive impact on itself

and the environment. The company must be able to

manage its operating business by producing products

that are positively oriented to society and the

environment. The World Business Council for

Sustainable Development (WBCSD) which is an

international organization that stands out in 1955 and

consists of 120 multinational companies from 30

countries of the world through its publication said that

company should making a good business sense and

have a commitment to behave ethically and attribute

to economic development while improving the

quality of life of the workforce and their families as

well as the local community and social at large.

CSR disclosure goals is to empower the society

not to deceive society and the empowerment aim to

build a society autonomy. The corporate social

responsibility often interpreted as a company

generosity but the point of Company Social

Responsibilty is how to build the entrust of the

society. CSR disclosure associated with the

sustainability and acceptability. Its means the

company keep on sustaining and continuing run their

operation business in long term. So far, the term of

CSR Disclosure measured by the amount of money

spent by companies for social activities but the truth

is CSR activities is not only about spending money

for social activities but also about general public

empowerment that can not be valued in amount of

fund. It shows that Corporate Social Responsibility

disclosure is one form of action is lifted from ethical

considerations companies to increase the employees

life quality and at the same time improving the life

condition around companies community and the

disclosure of this information can increase the

company stock price (Singh, 2017; Hussaeny, et.al,

2011).

2.3 Environmental Disclosure

Environmental Disclosure is a voluntary disclosure

information both qualitative and quantitative

information made by the organization to inform or to

disclose its activities, where the disclosure contains

of financial and non-financial information (Nurdin,

2006). Environmental disclosure as a compilation of

information related to environmental management

activities by companies in the past, present and future.

This information can be obtained in many ways, such

as qualitative statements, assertions or quantitative

facts, financial statement forms or footnotes. The

field of environmental disclosure includes the

following matters, for example, expenses or operating

costs for pollution control facilities or equipment in

the past and present and the demand of this disclosure

is getting exapanded (Al-Tuwaijri & Christensen,

2004; Reinhard, 1999).

2.4 Integrated Reporting Quality

In the International Financial Reporting Standards

(IFRS) framework declared that financial statements

are a deliberated representation of the financial

position and performance of an entity and the purpose

of financial reporting is to provide financial

information about the reporting entity that is useful to

existing and potential investors, lenders and other

creditors in making decisions about providing

resources to the entity (IFRS Foundation, 2015). For

that purposes the company’s financial statement must

be reliable to stakeholders as a support information

for decision making.

Integrated Reporting, Is It Really Matters?

509

The International Integrated Reporting Council

(IIRC) describe integrated reporting as a report an

integrated report as company announcement

transparency reports to stakeholders. The reporti

contains of the organization strategy, administration,

performance and the company value creation in short,

medium and long term (IIRC, 2015). This report will

cover the lack of traditional financial reporting that

does not disclose company non-financial information

transparently to the stakeholders. The framework

developed by IIRC will be able to increase the value

of the company in the short, medium and long term

(IIRC, 2013). Integrated reporting is a new advanced

reporting about how organizations think about their

business models and how they create value (Adams,

2013). Through Integrated reporting the company not

only disclose financial information but also non-

financial information and explain the process of value

added development in the entity. The results of many

research in various countries show that the

implementation of integrated reporting can increase

share prices in the short cycle of reporting and

corporate value in the long term (Churet & Eccles,

2014; Martinez, 2016; Rivera-Arrubla, et.al., 2017;

Willows & Rockey, 2018)

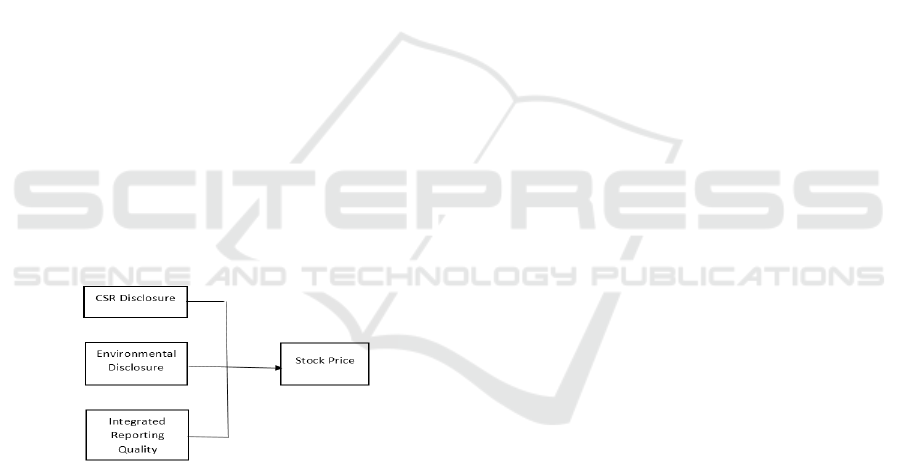

2.5 Conceptual Framework

The conceptual framework for this reserach can be

seen at figure 1.

Figure 1 Conceptual Framework

In Indonesia the disclosure of CSR,

environmental and integrated reporting is getting

expanded and will be, in long term, increase the value

of the firm, in this research is stock price. Thus, based

on the conceptual framework above, the hypotheses

in this study are:

H1: CSR disclosure has a positive effect on stock

price in public manufacturing companies in Indonesia

H2: Environmental disclosure has a positive effect on

stock price in public manufacturing companies in

Indonesia

H3: Integrated reporting quality has a positive effect

to the stock price at manufacturing in Indonesia

H4: CSR disclosure, environmental disclosure and

integrated reporting quality have a positive effect on

stock price in public manufacturing companies in

Indonesia

3 RESEARCH METHODS

This study investigates the extent and content of CSR

disclosure, environmental disclosure and integrated

reporting quality of manufacturing firms in Indonesia.

Content analysys used word count to measure the

quantity of all the disclosure. We used the IDX and

ICMD data base to test our hypotheses. Although not

all public manufacturing companies published their

annual report annually we limitation our research on

consumer goods sub-sectors listed on the Indonesia

Stock Exchange. Due to missing consience among

these firms the final sample consisted of 31 firms,

from 42 population. The hypothese were tested with

a four-year panel for 2014, 2015, 2016 and 2017,

amount to 124 firm-year observations.

3.1 Dependent and Independent

Variable

CSR disclosure is a proprietary score developed by

Rouf (2011) with 39 item to disclose in annual report.

Content analysis used to count the disclosure in every

observation, will give value 1 if the firm disclose the

information in their annual report and 0 if not. The

disclosure index of environmental will use in this

research to examines the influence of environmental

disclosure based on 10 item on list of disclosure items

developed by Bachman and Espejo (2013)

benchmark, value 1 if the firm disclose the

information in their annual report and 0 if not. The

Integrated reporting quality used the eight content

elements developed by IIRC (2013), value 1 if the

firm disclose the information in their annual report

and 0 if not.

The multiple linear regression analysis used to

measure the effect of all independent variables to

dependen variable with the following equation:

Y = a + b 1 CSRD + b 2 ED + b 3 IRQ + e

Where,

Y = Stock price

a = constanta

EBIC 2019 - Economics and Business International Conference 2019

510

b 1- b 3 = regression coefficient

CSRD = Corporate Social Responsibility

Disclosure

ED = Environmental Disclosure

IRQ = Integrated Reporting Quality

e = Standard Error

4 FINDINGS

4.1 Descriptive Statistics

This field provide a brief overview of some of the

general facts and characteristics that were identified

in this sudy. Discussion concentrates on the

minimum, average, maximum and standard deviation

values of CSR disclosure, environmental disclosure,

integrated reporting quality value and stock price.

The minimum value of CSR disclosure is 0.82 and the

maximum value of CSR disclosure is 0.87. The

average of CSR disclosure in the 2014-2017 period is

0.8377 and the standard deviation of CSR Disclosure

in the 2014 during research period is 0.02133.The

minimum value of enviromental disclosure is 0.77

and the max value is 0.87. The average value of

environmental disclosure is 0.8418 with the standard

deviation value is 0.02747. Integrated reporting

disclosure has 0,71 minimum value and the maximum

value is 0.89. The average value of integrated

reporting quality is 0.8390, thus the standard

deviation is 0.05022. The minimum value of the stock

price during the research period is PT Pryidam Farma

Tbk in 2015 and the maximum value of the share

price is 390 for PT Delta Djakarta, Tbk in 2014.

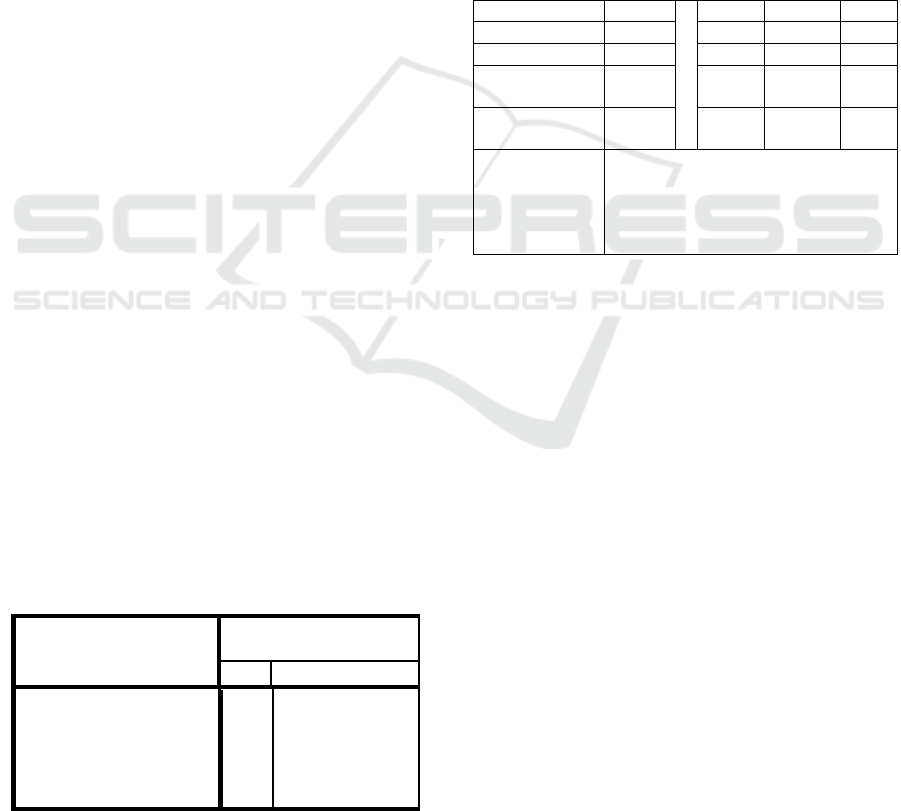

4.2 Research Data Analysis Results

Afterward we ran classical asumption test before

carrying out the multiple linear regression and the

result of multiple linear regression analysis shows on

table 1.

Table 1 Results of Multiple Linear Regression Analysis

Model Unstandardized

Coefficients

B Std. Error

1 (Constant) 13.247 1.250

CSR_Disclosure 15.166 6.739

Environmental_Disclosure 11.798 5.141

Integrated_Reporting

Qualit

y

4.283 2.751

Source: Data analysis result, 2019

Regression model was analyzed with CSR

disclosure, environmental disclosure and integrated

reporting quality as the dependent variables and stock

price as dependent variables. Based on 1 the

regression equation for this research is:

Stock Price = 13.247 + 15.166 CSR Disclosure +

11.798 Environmental Disclosure + 4.283 Integrated

Reporting Quality

It can be conclude that in every increase of CSR

disclosure, environmental disclosure and integrated

reporting quality will boost the company stock price

about the each regression cooefficient.

Partially, the results of hypothesis can be seen in

the following table.

Table 2.

Variable Name B t

count

t

table

Si

g

.

Constant

(

a

)

13.247 10.597 1.97993 0.000

CSR disclosure 15.166 2.250 1.97993 0.026

Environmental

disclosure

11.798 2.295 1.97993 0.023

Integrated

re

p

ortin

g

q

ualit

y

4.283 1.557 1.97993 0.022

Regression

coefficient (R) =

F

count

= 7.397

F

table

= 2.68

F

sig

= 0.000

Predictor: (Constant)

CSR disclosure, environmental

disclosure and integrated reporting

quality

De

p

endent variable: stock

p

rice

Source: Data analysis results, 2019

The table above shown that the CSR disclosure,

environmental disclosure, integrated reporting

quality variables is positively affect the stock price in

manufacturing company in Indonesia, partially and

simultaneously, because the significance value is less

than α 0.05.

The coefficient determination (R2) of this

research is 0.135 and can be concluded that the

changes variations in stock prices are influenced by

CSR Disclosure, environmental disclosure and

integrated reporting of 13.5 %, while the remaining

86.5 % influenced by other factors not concluded in

this research model.

5 DISCUSSION AND

CONCLUSION

CSR Disclosure is a form of disclosure in company

action with the public at large and can influence

stakeholder perceptions in decision making. CSR

activities must be carried out by the company as a

form of accountability for its presence in the

Integrated Reporting, Is It Really Matters?

511

community and can increase its legitimacy. The

increase in legitimacy is reflected in the company's

share price. Corporate Social Responsibility

disclosure is one form of company adaptation with

companies ethical consideration that are geared to

increase community economy, accompanied by the

increasing of the life quality of employees and their

families, as well as well as improving quality of

community more broadly.

Environmental disclosure on company’s annual

report is expected to increase the firm’s legitimacy in

society because the firms operation should be

environmental impact. This is a signal to stakeholders

that the company concentrating in company's

sustainability. Good corporate environment

performance will reduce costs to overcome future

damage and loss of the company's natural resources.

Environmental disclosure will be a goodnews for

stakeholders sehi guns can draw invest r to invest

because investors will have the assurance that the

company performing maintenance on the company's

resources in the future for doing prevention activities

and managing environmental damage so that costs for

environmental damage in the future can be diverted

to increase the company's capital in carrying out its

industrial activities in order to maximize the

company's profit and the value of the firm. The big

company is more widely disclose their environmental

information in annual report because they have more

complecated stakeholders.

One way of integrated reporting increase the

stock price by identifying risks and opportunities in

the company's financial statements, based on the

clarity of the company's commitment to increasing

the wealth of company's owner. This has been able to

be carried out optimally by the company, then

opportunities and risks can be overcome properly.

The identification of opportunities and risks is carried

out by the management of the company based on

government policies , macro and micro economic

conditions and so on.

After the issuance of Indonesian government

rules No. 47 of 2012 concerning Social and

Environmental Responsibility of Limited Liability

Companies, compulsorily companies in accordance

with those referred to in the regulation must disclose

their social responsibilities, this is expected to be

responded positively by investors and potential

investors because they believe the company has

fulfilled its obligations and in accordance with the

principles of sustainable development so that

investment risk is reduced which means investors will

be more interested in buying the company's shares.

An increase in demand for company shares will cause

stock price to rise, because stock prices are formed by

the existence of transaction mechanisms in the capital

market that are determined by stock demand and

supply. An integrated reporting can disclose all the

stakeholders information needed in one report so that

can be used in decision-making.

6 CONCLUSION

The conclusions in this study are:

1. From the results of the partial testing proved that

CSR Disclosure significantly affect stock prices

in companies listed on the Stock Exchange

Indonesia.

2. From the results of the partial examination it is

evident that Environmental Disclosure

significantly influences the stock price of

manufacturing companies listed on the Indonesia

Stock Exchange .

3. From the results of the partial test it is evident that

the integrated reportin g has no significant effect

on the price of p on the manufacturing companies

listed on the Indonesia Stock Exchange .

4. From the results of simultaneous testing, this

researcher was able to prove that CSR Disclosure,

Environmental Disclosure and integrated

reporting affected the stock prices of

manufacturing companies listed on the Indonesia

Stock Exchange.

7 FUTURE RESEARCH

This study uses index standards that are not

necessarily in accordance with the outward disclosure

conditions in Indonesia. So it is necessary to use a

standard that can represent the extent of corporate

disclosure in Indonesia.

Next researcher can expand the sample, more

variables and extend the observation period so that

research results can be more representative because it

can improve the data distribution.

REFERENCES

Adams, C. A. (2013). Understanding Integrated Reporting

Reporting (Greenleaf). New York.

Al-Tuwaijri , SA, TE Christensen, and KEHI (2004). The

Relations Among Environmental Disclosure,

Environmental Performance, and Economic

Performance: A Simultaneous Equations Approach.

Accounting, Organizations, and Society. 29 , 447–471.

EBIC 2019 - Economics and Business International Conference 2019

512

Baiman, S. and R. Verrecchia (1996), The Relationship of

Capital Markets, Financial Disclosure, Production

Efficiency, and Insider Trading, Journal of Accounting

Research , Vol. 34, No. 1, pp. 1 - 22.

Bachmann, R. K., Carneiro, L. M., & Espejo, M. M. dos S.

B. (2013). Evidence of environmental information:

proposal of an indicator based on the perception of

experts. Revista de Contabilidade e Organizações,

7(17), 36-47.

Brigham, Eugene F dan Joel F. Houston. 2014.

Fundamentals of Financial Management, 14th Edition.

Mason: South-Western Cengange Learning

Chariri, A. and IJ (2017). Exploration of Integrated

Reporting Elements in the Company's Annual Reports

in Indonesia. Accounting , XXI , 411–24.

Churet, C., & Eccles, RG (2014). Integrated reporting,

quality of management, and financial performance.

Journal of Applied Corporate Finance, 26 (1), 56-64.

https://doi.org/10.1111/jacf.12054 .

Clarkson, P., Y. Li, G. Richardson, and F. Vasvari (2008),

Revisiting the Relation between Environmental Pe

rformance and Environmental Disclosure: An

Empirical Analysis, Accounting, Organizations and

Society, Vol. 33, No. 4-5, pp. 303 - 27.

Deegan, Craig. (2002), Introduction The Legitimising

Effect of Social and Environmental Disclosure-A

Theoretical Foundation. Accounting, Auditing &

Accountability Journal, Vol. 15 (3), 282-311

Dowling, J and Jeffrey Pfeffer. (1975) . Organizational

Legitimacy: Social Values and Organizational

Behavior, The Pacific Sociological Review, Vol. 18,

No. 1, pp. 122-136.

Ghozali, I. (2013). Multivariate Analysis Application with

SPSS Program. Semarang: Diponegoro.

Gunawan, J. (2017). The Effect of Corporate Social

Responsibility and Corporate Governance on Tax

Aggressiveness. Accounting, XXI, 425-436.

Hirshleifer, D., Teoh, S. H., & Yu, J. J. (2011). Short

arbitrage, return asymmetry, and the accrual anomaly.

Review of Financial Studies, 24(7), 2429–2461.

https://doi.org/10.1093/rfs/hhr012

Husnan, S. (2015). Dasar-dasar Manajemen Keuangan.

Jakarta: Salemba Empat.

Hussaeny K., Elsayed M., Razik Marwa, A. (2011). Factors

Affecting Corporate Social Responsibility Disclosure

in Egypt.Corporate Ownership & Control. Volume 8,

Issue 4

IIRC (International Integrated Reporting Council). (2013).

The international integrated reporting framework.

Retrieved August, 2019, from

http://integratedreporting.org/wp-

content/uploads/2013/12/13-12-08-THE-

INTERNATIONAL-IR-FRAMEWORK-2-1.pdf

IFRS Foundation. (2015). A guide through IFRS standards

[downloadable PDF]. Retrieved from

https://shop.ifrs.org/productcatalog/Product.aspx?ID=

1874

Jensen, Michael and William H. Meckling (1976). Theory

Of The Firm: Managerial Behavior, Agency Costs And

Ownership Structure. Journal of Financial E conomics

3 , 305-360 .

Jogiyanto. (2014). Teori Portofolio dan Analisis Investasi.

Yogyakarta: BPFE.

Krisnamurti, A. (2016). Analysis of the Effect of Corporate

Social Responsibility Disclosures on Share Prices.

Accounting, 5 (ISSN: 2337-3806), 1–10.

Kusumadilaga, R. (2010). The Effect of Corporate Social

Responsibility on Firm Value with Profitability as a

Moderating Variable (Empirical Study of

Manufacturing Companies listed on the Indonesia

Stock Exchange). Diponegoro University .

Kustiani, NA (2014). Application of Integrated Reporting

Elements in Companies listed on the Indonesia Stock

Exchange.

Lindblom, C.K. (1993). The Implication of Organization

Legitimacy for Corporate Social Performance and

Disclosure. Paper presented at the Critical Perspective

in Accounting Conference, New York

Martinez, C. (2016). Effect of Integrated Reporting on the

Firm's Value: Voluntary Adopters of the IIRC's

Framework. USA: University of St. Gallen.

Mio, C. (2016). Integrated Reporting: A New Accounting

Disclosure.

Nurdin, E. (2006). Disclosure of Social Themes and

Environment in the Company's Annual Report on

Investor Reaction. Thesis. Universitas Padjajaran.

Pertiwi, CA (2018). The Effect of Environmental

Performance and Environmental Disclosure on

Economic Performance. JRA, 07 .

Raharjo, E. (2007). Age Theory and Stewarship Theory in

Accounting Perspectives. Scientific Economics , 2 , 37–

46.

Ramadani, S. (2015). Effects of Presentation of Integrated

Reporting Elements in Annual Reports on Information

Asymmetry. Fecon Management , 4 , 3335-3369.

Reinhardt, F. (1999). Market Failure and The

Environmental Policies of Firm: Economic Rationales

for Beyond Compliance Behavior. Journal of Industrial

Ecology, 3 (1), 9-21

Rivera-Arrubla, Y . A., Zorio-Grima, A., & García-Benau,

MA (2017). Integrated reports: disclosure levels and

explanatory factors. Social Responsibility Journal, 13

(1), 155-176. https://doi.org/10.1108/SRJ-02-2016-

0033.

Rouf A (2011) The corporate social responsibility

disclosure: A study of listed companies in Bangladesh.

Bus Econ Res J 2(3):19-32

Singh, Meera and Ahmad, Tabrez. (2017), Corporate Social

Responsibility: A Step to Bridge the Welfare Gap in

India under the Companies Act 2013, International

Journal of Legal Research & Governance, Vol -3. Issue

3 & 4

Sugiyono (2014). Business Research Methods (Alphabeta).

Bandung.

Tandelilin, E. (2010). Portfolio and Investment Theories

and Applications. Yogyakarta: Canisius.

Willows, Gizelle D. & Rockey, Jessica A. (2018) Share

price reaction to financial and integrated reports, South

Integrated Reporting, Is It Really Matters?

513

African Journal of Accounting Research, 32:2-3,

174188, DOI: 10.1080/10291954.2018.1514141

Wise V, Ali M (2009) Corporate governance and corporate

social responsibility in Bangladesh with special

reference to commercial banks (No. 2009-05).

http://ideas.repec.org/p/aiu/abewps/80.html.

EBIC 2019 - Economics and Business International Conference 2019

514