The Effect of Implementing Internal Control System, Accounting

Standards Implementation, Management Commitment to Quality

Financial Report

Nurlinda, Erlina, Azhar Maksum, and Rina Bukit

Department of Accounting, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan, Indonesia

Keywords SPI, Accounting Standards, Management Commitments, QFR

Abstract: Government good quality financial report becomes an important indicator in assessing the financial

performance of the entity. This research was quantitative-qualitative study used primary data sourced from

the questionnaire. Data was processed using multiple linear regression. The results showed that there was a

positive and significant influence on the implementation of internal control systems, the implementation of

accounting standards and management commitments to the quality of financial statements. The quality of

financial statements showed quite good quality. The quality of finance was not maximally caused by human

resource factors, change-changing rules, intimely budgets, lack of coordination between parts and leadership

commitments that are not very good.

1 INTRODUCTION

Financial management in Indonesia, especially within

the scope of the public sector, has undergone a lot of

changes or improvements along with the spirit of

government's financial management reform. Thus,

financial statements must be prepared in accordance

with the provisions applicable in order to produce

quality financial statements, because bad financial

statements can pose negative implications such as

community confidence to fund managers public

(government) decreases, financial reporting is

unpredictable which results in increasing investment

risk so that investors will be afraid to invest, donors

will reduce or discontinue their assistance, the quality

of the decision becomes bad, financial statements

may not reflect the actual performance (Mardiasmo,

2009).

One of the indicators that can show quality

financial statements is shown in the opinion of the

auditor acquired by the entity (Mahmudi, 2016). The

less material findings of inspection results then the

entity will get a good opinion, because the quality

financial report should be free of material, accurate

and accountable (Mutiana, Diantimala, & Zuraida,

2017). A good opinion suggests that compiled

financial statements have fulfilled qualitative

characteristics consisting of relevant, reliable,

comparable and understandable. These charisma

qualities can be achieved if the financial statements

are structured according to applicable standards and

the entity implements adequate internal control. A

quality financial statement will be one of the

successful performance indicators of the financial

management of the Grant Fund. Thus, the top

management commitment is needed to encourage,

direct, influence its staff toward the achievement of

various objectives of the entity including the control

program (Pasaribu, 2009).

2 LITERATURE REVIEW

The explanation of the agency theory is related to a

contractual relationship between the principal and the

contracting agent to perform services for principal

interests including the delegation of power in decision

making (Jensen & Meckling, 1976). If it is associated

with a theory of agency in which entity management

acts as an agent having a contract on the principal to

conduct activities or represent the interests of the

principal for their benefit through the delegation of

some authorizing decisions to agents, of course

reporting is an important information for the principal

to protect the authority that has been given, and for

Nurlinda, ., Erlina, ., Maksum, A. and Bukit, R.

The Effect of Implementing Internal Control System, Accounting Standards Implementation, Management Commitment to Quality Financial Report.

DOI: 10.5220/0009215704270434

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 427-434

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

427

the entity is a tool to account for the authority

received.

The agency's problems are due to the contractual

relationship between the principla and agent. The

problem in the relationship between the principla and

agent occurs because there is an information

asymmetry where the principal will trust the

information presented in the financial statements of

the agent after being examined independently. The

management's commitment to follow up on the audit

results will result in improvements in the preparation

of good financial statements. Management's

commitment based on the thought of financial

performance in the form of quality financial

statements rests on this theory, the management of the

company is done by adherence to the prevailing rules

and regulations (Rachmad, 2011). Financial

statements are information that is a form of an agent's

responsibility for the trust given principla. Benardi,

Sutrisno, & Assih (2009) mentioned that in agency

relations, the agent is obliged to provide periodic

reports on its performance to the principal, and

further the principal will assess the performance of

the agent based on the financial statements delivered.

The three pillars supporting the theory of new

institutions consist of regulative, normative and

cultural-cognitive (Scoot, 2008). This theory

describes three important mechanisms related to the

existence of institutions that are incorporated into the

environment, which compel (coersive), the process to

mimic the actions (mimetic), and the existing norms

(normative) of the environment to provide space for

In determining the policies and supporting ways to

achieve the quality of institutional performance. The

implementation of accounting standards and

implementation of internal control is a regulative

pillar aspect in the form of mandatory rules and the

terms of the coercion that must be implemented by

the entity. While the management commitment in the

effort to repair and evaluate is carried out as a follow-

up of the test results conducted by independent parties

is an aspect of the normative pillar. Management

compliance, hopes on improving the quality of

financial statements, compliance and moral burden

resulting from the audit findings are a normative

pillar aspect. Pillar cultural-cognitif is interpreted

how the action performed by the top management will

be imitated (mimetic) by the staff. The actions taken

by the top management became an example of the

persistence of its ranks. An example of the

submistibility of the staff, cultural-cognitif is

ultimately a management action that supports and

gives space to the implementation of accounting

standards and implementation of internal control

systems. It should be recognized that as good as any

standard or system in the end will not go well if there

is no support from the top management, because the

managerial factor is one of the determinants of the

quality of financial statements (Purwati, 2016). The

implementation of integrity, conducive and

disciplined leadership by the top management being

role model and exemptured by staff will be a working

culture in the entity. This culture will certainly

support the effectiveness of the implementation of

accounting standards and the implementation of

internal control systems to produce quality financial

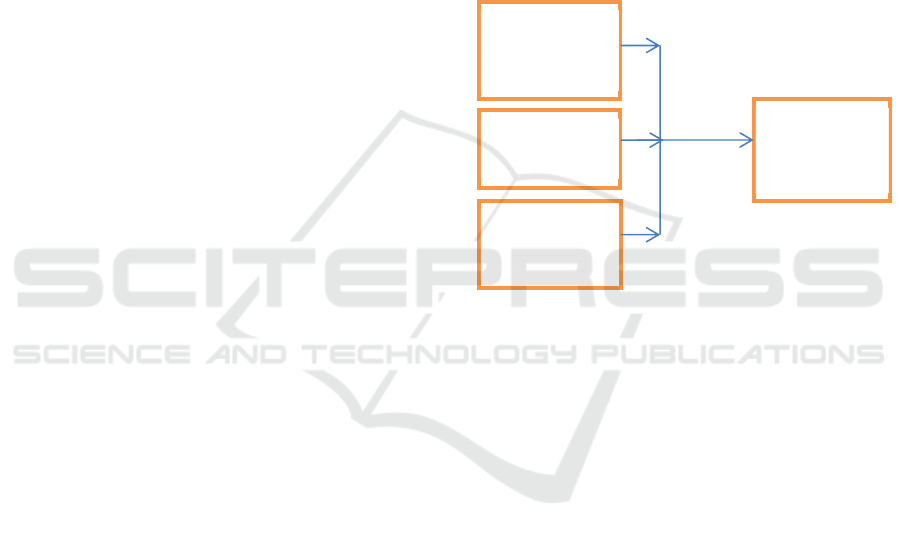

reports. Thus the framework of the research concept

can be described as follows:

Figure 1: Conceptual framework

2.1 The Effect of Implementing

Internal Control System on the

Quality of Financial Statements

Referring to the results of the examination found

several causes that are the reason the Government's

financial statements are not yet reliable and qualified

one of them is due to weak internal control, whereas

the results acknowledge that the implementation of

Internal controls play an important role in preventing

and detecting cheating on the entities (Young et al.,

2018). Some research results related to the

implementation of Internal control system (SPIP) and

quality of financial report are still found differences

in results, where there is no influence of internal

control system to the quality of financial report

(Muda et al., 2018). The results showed that the

implementation of the influential SPIP was

discovered by Julita & Susilatri (2018); Mutiana,

Diantimala, & Zuraida (2017); Yunita, Tanjung, &

Anggraini (2015); & Rahmatika, (2014); Upabayu, &

Putra (2014); Syarifudin, Surasni, & Inapty (2016);

(S, Taufik, & Hariyani, 2015). The findings show that

Financial

Reporting

Quality (KLK)

Comitment Top

Management

(KTM)

Impelementatio

n of Internal

Control System

(SPI)

Implementatio

n of Accounting

Standard (SA)

EBIC 2019 - Economics and Business International Conference 2019

428

the better the implementation of internal controls will

be the better quality of the resulting financial

statements. Significant pegaruh from the application

of SPIP to the quality of financial statements found

by Onyulo (2017); Erviana (2017); Kesuma, Anwar,

& Darmansyah (2017); Mailoor, Sondakh, &

Gamaliel (2017); Purwati (2016); Susilawati & Riana

(2014). Thus the hypothesis of this research is:

H1: Implementation of internal control system

affects positively and significantly to the quality of

financial statements

2.2 The Influence of Implementation

Accounting Standards on the

Quality of Financial Statements

The implementation of accounting standards is a

standard that binds entities to implement them in the

process of drafting financial statements. The

implementation of accounting standards is binding

and mandatory. Referring to the findings of the

auditor which causes the quality of financial

statements not yet adequate is the occurrence of

inconsistency in the implementation of accounting

standards (SA). The results of previous research

found differences in results explaining the effect of

implementing accounting standards on the quality of

financial statements. Julita & Susilatri (2018) found

that the implementation of accounting standards has

no effect on the quality of financial statements.

Wisdom, Damilola, Inemesit, & Opeyemi (2017),

Sako & Lantowa (2018) found a positive relationship

between the implementation of IPSAs-based

standards with the quality of financial statements.

Abang'a (2017); Onyulo (2017); Ijeoma &

Oghoghomeh (2014); Yusniar et al. (2016); Rahman,

Hardi, & Diyanto (2015); Nelia K (2015); Upabayu

et al. (2014); Suwanda (2015); Abdullah, (2010)

found a positive and significant influence of SAP's

application to the quality of financial statements.

Thus it can be concluded that the preparation of

financial statements in accordance with accounting

standards will improve the quality of financial

statements. Based on the conclusion, the research

hypothesis is:

H2: The implementation of Government

accounting standards has a positive and significant

effect on the quality of financial statements.

2.3 The Effect of Management

Commitment to Quality of

Financial Statements

As soon as any standard or system will eventually not

go well if there is no commitment to support from top

management, because the managerial factor is one of

the determinants of the quality of financial statements

[(Purwati, 2016); (Usman, 2010)]. According to BPK

RI, one of the factors that affects the quality of

financial statements is the commitment of leadership,

especially the commitment to present reliable

information in the financial statements of the entity

that is realized with the commitment to follow up

recommendations Inspectors and follow-up results of

the test of BKP [(Silviana, 2012). Rachmawati

(2018)]. Sutaryo & Sinaga (2018) suspect in addition

to factors such as the characteristics of internal

auditors, local external factors such as regional head

commitment as local executives are also suspected to

have influence on the maturity of implementation of

internal control system .

Management commitments in the public sector

are the commitment of regional head/head of office,

which is one of the commitments on the follow up of

examination recommendation results. (Silviana,

2012). Silviana (2012); Tambingon, Yadiati, & Kewo

(2018); Kibet (2016) found that regional head

commitments have a positive effect on the quality of

financial statements. The higher the commitment of

the management will further improve the quality of

financial statements [(Fitriani, 2017); (Tambingon et

al., 2018); Mahlil & Yahya (2017)]. Research

conducted by Rahmatika (2016) found different

results, where top management support has negative

and significant influence on fraud level, as well as

fraud level has negative and significant influence to

the quality of financial statements. The principal

element in implementing the internal control system

is one of the umbrella elements that shade the other

elements. Commitment to the leadership to be the

determinant of other internal control system elements

(Sudarno, 2018). Sudarno (2018) found that effective

internal control systems improve the quality of

financial statements if the operator has high

competence and has a strong leadership commitment.

Based on explanation above, hypotheses can be

compiled as follows:

H3: Management commitments affect the quality

of financial statements

The Effect of Implementing Internal Control System, Accounting Standards Implementation, Management Commitment to Quality

Financial Report

429

3 METHOD

This research was quantitative-qualitative study used

primary data sourced from the questionnaire using a

Likert scale of 1-5. The respondent of this research

was one of the ministries. Data was processed using

multiple linear regression. Classification criteria for

X and Y variables. The highest score (the number of

respondents in the highest score) = 47 x 5 = 235, and

the score was lower (the number of respondents were

the lowest score) = 47 X 1 = 47. Thus the score range

is as follows: Score range = (235-47) = 38

4 RESULTS AND DISCUSSION

4.1 Descriptive Analysis

Table.1 showed that the application of SPI was at a

fairly effective range for SPI Indicators 1 (130), SPI

4 (140) and SPI 5 (150). The SPI 2 (176) and SPI 3

(172) indicators demonstrate effective SPI

implementation. In total, the variable SPI shows a

percentage of 65.36%, meaning that SPI is quite

effective to improve the quality of financial

statements.

Table. 1 Review of indicators of implementation Internal

control System (SPI)

Indicators Score

Total

Score

Standart

%

SP1 1

SPI 2

SPI 3

SPI 4

SPI 5

130

176

172

140

150

235

235

235

235

235

55,32

74,89

73,19

59,57

63,83

Total 768 1175 65,36

Table 2. indicated that the implementation of

accounting standards was at the very ineffective range

for the SA indicator 8 (37.02%). Indicator SA 1

(42.55%), SA 2 (49.79%), SPA 3 (44.68%) Indicates

a less effective range. Indicator SA 4 (75.74%), SA 5

(71.06%), SA 6 (72.77%), SA 7 (78.72%) and SA 9

(71.06%) Effectively demonstrates the

implementation of SA. In total, the SA variable

showed a percentage of 60.38%. This value was good

practice that implementing SA was quite effective to

improve the quality of financial statements.

Table 2. Review of indicators of Implementation

Accounting standard Implementation (SA)

Indicators Score

Total

Score

Standart

%

SA 1

SA 2

SA 3

SA 4

SA 5

SA 6

SA 7

SA 8

SA 9

100

117

105

178

167

171

185

87

167

235

235

235

235

235

235

235

235

235

42,55

49,79

44,68

75,74

71,06

72,77

78,72

37,02

71,06

Total 1.277 2.115 60,38

Table 3. showed that the management's

commitment was at a less committed range for a KM

1 indicator (55.74%), KM 2 (47.23%), KM 3

(53.19%) and KM 5 (52.77%). Indicator only KM 4

(78.72%) Show a committed range. A total variable

management commitment showed a percentage of

57.53%. This value indicates that management was

less committed in the process of improving the

quality of financial statements.

Table 3. Review of Indicators Commitment Top

Management (KTM)

Indicators Score

Total

Score

Standart

%

KM 1

KM 2

KM 3

KM 4

KM 5

131

111

125

185

124

235

235

235

235

235

55,74

47,23

53,19

78,72

52,77

Total 676 1175 57,53

The calculated result in table 4 showed the

indicator KLK 1 (63.83%) and KLK 4 (62.98%) was

at a fairly good range, while the KLK indicator 2

(58.30) and KLK 3 (48.98%) were in less good range.

In total the KLK variable is worth 58.51%. The result

of the calculation indicates that the Y variable means

the quality of financial statements entered in the "less

good" criteria.

Table 4. Review of indicators the Financial Reporting

Quality (KLK)

Indicators Score

Total

Score

Standart

%

KLK 1

KLK 2

KLK 3

KLK 4

150

137

115

148

235

235

235

235

63,83

58,30

48,94

62,98

Total 550 940 58,51

EBIC 2019 - Economics and Business International Conference 2019

430

The results of the validity and reusability test

showed all variables and instruments of valid and

realistic statements. The quality variables of financial

statements (0.9036), internal control systems

(0.7273), accounting Standards (0.7815),

Management commitments (0.7784) have a value

greater than 0.70 (Nunnalli, 1994)., thereby inferred

variables are declared Realible. The validity test was

conducted to measure the legitimate or valid absence

of a questionnaire (Ghozali, 2016). The questionnaire

is declared valid by comparing the R count value by

R table. If the sample count (n) = 47 and the

magnitude of DF can be calculated by the formula DF

= N-2 Then, for sample 47 is diped DF = 45. By using

the Auxiliary table R count for a significant rate of

5% obtained value 0.2876. All indicators are declared

valid.

The data processing results showed the R Square

value for each variable. The internal control system

implementation (X1) variable has a value of R2 of

0.283. This result means that the internal control

system implementation variables are able to explain

the variation in the quality of the financial statements

by 28.3%, while the implementation of accounting

standards has an R2 organization of 0.283 which

means that this variable Able to explain the variation

in the quality of financial statements of 28.3% and the

management commitment variables are able to

explain the variation in the quality of financial reports

of 0268 which means that the variable management

commitments are able to explain the variation in As

much as 26.8%. Complete data processing results can

be seen in table 6.

In unison R2 indicates a figure of 0374 or 37.4%,

this figure represents three independent variables

consisting of implementing an internal control

system, the implementation of accounting standards

and management commitments is able to explain the

variation The quality of the financial report is 37.4%,

while 62.6% is described by other variables outside

of this study. After obtaining the next R2 value step

is to test the data to answer the research hypothesis.

By using table 8 above, this study obtained the

following results:

From Test Anova or F test by looking at a

significant rate the value F count is 0.000 then

compared to the α value if the value of the default is

< α then the regression model can be used to predict

the dependent variable or can be said unison

dependent variables affect the dependent variable

(Ghozali, 2016). The Value F-table at significance

level 5% is calculated using the formula of degree of

freedom (df 1) = k-1 and DF 2 = n-K. With the

formula obtained the results of DF 1 = 3-1 = 2, and df

2 = 47-2 = 45, thus the value of Ftabel is 2.81. Test

result using α = 5% where F count > F table is 8,549

> 2.81 then it can be stated that the application of

accounting standards, internal control, management

commitments influence simultaneously on the quality

of financial statements.

Partial influence between dependent variables

and independent variables can use Thitung and

significance levels are smaller than α (5%). To know

the results of the hypothesis is influenced by

comparing the value of Thitung with this. The value

is obtained by using formula DF: N-k = 47-2 = 45.

Thus the test results for the one hypothesis are

"there is a positive and significant influence of

internal control system on the quality of financial

statements". The value of Thitung at a significant rate

of α 5% obtained a value of 2,014, thus if comparing

the value of Thitung with this 4,119 > 2,014 can be

interpreted that there is a positive influence

implementation of internal control system to quality

of financial statements (receive H1). Further testing

the significance value for the internal control system

implementation variables indicates the number 0.000,

hence by comparing the result to α 5% then 0.000 >

0.05 can be concluded that the implementation of

internal control system Significant impact on the

quality of financial statements.

The test result for the two hypotheses is "a

significant influence on the implementation of

accounting standards for the quality of financial

statements". Based on testing found a value of

Thitung for variables independent of the

implementation of Accounting standard 4,349 Thus if

comparing the value of Thitung with this then 4,216

> 2.014 can be interpreted that there is a positive

influence the standard implementation accounting for

the quality of financial statements (receive H2).

Further tests of significance rate with α 5%, hence the

level result of the significance of the accounting

Standards implementation variable indicate a number

0.00 < 0.05. These results indicate that the accounting

standard applicability variable significantly affects

the quality of financial statements.

The next test result for the three hypothesis is

"there is a significant influence on management

commitments to the quality of financial statements".

The result of T test obtained Thitung value for the

independent variable implementation of accounting

standard 4,060 > 2.014 can be interpreted that there is

a positive influence of management commitment to

the quality of financial report (Received H3). The test

result level significance finds the value 0.000 < 0.05.

These results indicate that a variable management

The Effect of Implementing Internal Control System, Accounting Standards Implementation, Management Commitment to Quality

Financial Report

431

commitment significantly affects the quality of

financial statements.

5 DISCUSSION

The Effect of implementing internal control

systems on the quality of financial statements

The result of the calculation showed that the internal

control system has positive and significant effect on

the quality of financial statements. Calculation results

per indicator showed at quite effective range. The

results of our interviews show data that human

resources are still an obstacle in the implementation

of effective SPI. A short time of implementation of

activities caused by long budget approved is also an

obstacle in implementing SPI. Besides, there are 2

similar activities in the budget in the end causing

confusion that impacts on the application of SPI, plus

less coordination between parts and commitment of

low leadership to the cause of the lack of

effectiveness Application of SPI.

The effect of implementing accounting standards

for quality financial statements

The calculation results showed that the

implementation of accounting standards was positive

and significant against the quality of financial

statements. Calculation results per indicator showed

at quite effective range. Our interviews showed an

understanding of the accrual base was good, and

understood the accrual-based concept. These results

indicate that the management staff is educated in

accounting so that it ultimately strengthens the

implementation of government accounting standards

on the entities. Although the results of the test showed

quite effective results, but the results of our

interviews also found that there was still confusion in

the interachievement if there are new rules that arise

given the lack of socialization of regulatory changes

the new one. This confusion eventually led to the

respondent being confused and hesitant in carrying

out the transaction, the use of standards, the rules and

format of frequently changing reports which

eventually became an obstacle in implementing a

good accounting standard.

The Influence of implementation management

commitment to the quality of financial report

The calculation results showed that the

implementation of management commitments was

positive and significant against the quality of

financial statements. Calculation results per indicator

showed at quite effective range. The results of our

interviews show that management's commitment was

not too high in the follow up on inspection results.

Constraints on human resources (human resources)

who have no understanding of how to follow up on

the inspection results become the main constraint of

the entity in the follow up of the test results plus the

more often scheduled employees. Besides, the test

result that was not coordinated with the entity was the

cause on the quality of repairs made by the entity.

6 CONCLUSIONS

The research results showed a positive and significant

influence on the implementation of internal control

systems, the implementation of accounting standards

and management commitments to the quality of

financial statements. The quality of financial

statements showed a fairly good range, caused by

human resource factors, change-changing rules,

intimely budgets, lack of coordination between parts

and not good leadership commitment.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge that the present

research is supported by Ministry of Research and

Technology and Higher Education Republic of

Indonesia. The support is under the research grant

Disertation of Year 2019.

REFERENCES

Abang’a, A. O. (2017). Determinants of quality of financial

reporting among semi -autonomous government

agencies in Kenya. Strathmore University. Retrieved

from http://su-plus.strathmore.edu/handle/11071/5581

Abdullah, M. W. (2010). Pemoderasi Kompetensi Sumber

Daya Manusia Terhadap Peningkatan Kualitas Laporan

Keuangan Daerah Kabupaten Bone. Jurnal Ilmiah

Akuntansi Peradaban, Vol. III(No. 2), 45–65.

Afiah, N. N., & Rahmatika, D. N. (2014). Factors

Influencing The Quality Of Financial Reporting And Its

Implications On Good Government Governance

(Research on Local Government Indonesia).

International Journal of Business, Economics and Law,

5(1), 111–121.

Benardi, M., Sutrisno, & Assih, P. (2009). Faktor-faktor

Yang Memengaruhi Luas Pengungkapan Dan

EBIC 2019 - Economics and Business International Conference 2019

432

Implikasinya Terhadap Asimetri Informasi (Studi Pada

Perusahaan-Perusahaan Sektor Manufaktur Yang Go

Public Di Bursa Efek Indonesia). In Simposium

Nasional Akuntansi XII. Palembang.

Erviana. (2017). Pengaruh Implementasi Sistem Informasi

Manajemen Daerah dan Kegiatan Pengendalian

Terhadap Kualitas Laporan Keuangan Pemerintah

Daerah (Survey Pada Satuan kerja Perangkat Daerah

(SKPD) Kota Palu). E Journal Katalogis, 5(4), 182–

193.

Fitriani, A. (2017). Pengaruh Komitmen Pimpinan dan

Lingkungan Pengendalian Internal Terhadap Kualitas

Laporan Keuangan (Survei Pada SKPD Provinsi

Sulawesi Tengah). E Jurnal Katalogis, 5(4), 113–122.

Retrieved from

https://media.neliti.com/media/publications/212457-

pengaruh-komitmen-pimpinan-dan-lingkunga.pdf

Ghozali, I. (2016). Aplikasi Analisis Multivariate Dengan

Program IBM SPSS 23 (VIII). Semarang: Badan

Penerbit Universitas Diponegoro.

Ijeoma, N. B., & Oghoghomeh, T. (2014). Adoption of

international public sector accounting standards in

Nigeria : Expectations , benefits and challenges.

Journal of Investment and Management, 3(1), 21–29.

https://doi.org/10.11648/j.jim.20140301.13

Jensen, & Meckling. (1976). Theory of the Firm:

Managerial Behavior, Agency Cost and Ownership

Structure. Journal of Financial Economics, 3(4), pp:

305-360.

Julita, & Susilatri. (2018). Analysis Of Factor Affecting

The Quality Of Government Financial Report

Bengkalis Regency. International Journal of Scientific

& Technology Research, 7(2), 157–164.

Kesuma, D. P., Anwar, C., & Darmansyah. (2017).

Pengaruh Good Governance, Penerapan Standar

Akuntansi Pemerintah, Sistem Pengendalian Internal

Pemerintah dan Kompentensi Aparatur Pemerintah

Terhadap Kualitas Laporan Keuangan Pemerintah Pada

Satuan Kerja Kementerian Pariwisata. Jurnal Ilmiah

WIDYA Ekonomika, 1(2), 141–146.

Kibet, A. J. (2016). Effects of Management Commitment

on Financial Performance of Private Schools : A Survey

of Selected Schools in Trans-Nzoia County, Kenya.

European Journal of Business and Management, 8(30),

1–5.

Mahlil, & Yahya, M. R. (2017). Pengaruh komitmen kepala

daerah dan pengetahuan akuntansi terhadap kualitas

laporan keuangan pemerintah daerah di provinsi aceh.

Jurnal Ilmiah Mahasiswa Ekonomi AKuntansi

(JIMEKA), 2(2), 21–29.

Mailoor, J. H., Sondakh, J. J., & Gamaliel, H. (2017).

Pengaruh Sistem Akuntansi Pemerintahan , Budaya

Organisasi , Kinerja Aparatur Pemerintah Daerah ,

Peran APIP , Dan Sistem Pengendalian Intern

Pemerintah Terhadap Penerapan Good Governance (

Studi Empiris Di Kabupaten Kepulauan Talaud ).

Jurnal Riset Akuntansi Dan Auditing “Goodwill,” 8(2),

82–94.

Mardiasmo. (2009). Akuntabilitas Sektor Publik

(IV).

Yogyakarta: C.V Andi Offset.

Muda, I., Harahap, A. H., Erlina, Ginting, S., Maksum, A.,

& Abubakar, E. (2018). Factors of quality of financial

report of local government in Indonesia. International

Journal for Quality Research, 8(1), 73–86.

https://doi.org/10.1088/1755-1315/

Mutiana, L., Diantimala, Y., & Zuraida. (2017). Pengaruh

sistem pengendalian intern, teknologi informasi,

kualitas sumber daya manusia dan komitmen organisasi

terhadap kualitas laporan keuangan. Jurnal Perspektif

Ekonomi Darusaslam, 3(2), 151–167.

Nelia K, M. (2015). The Effect Of Adoption Of

International Public Sector Accounting Standards On

Financial Reporting In The Public Sector In Kenya.

Onyulo, O. F. (2017). Factors Influencing Quality of

Financial Reporting in Public Sector Entities in the

Ministry of Environment and Natural Resources Kenya.

KCA UNIVERSITY.

Pasaribu, H. (2009). Pengaruh Komitmen , Persepsi dan

Penerapan Pilar Dasar Total Quality Management

terhadap Kinerja Manajerial ( Survei pada BUMN

Manufaktur di Indonesia ). Junrnal Akuntansi Dan

Keuangan, 11(2), 65–75.

Purwati, A. S. (2016). Faktor-Faktor Yang Mempengaruhi

Kualitas Laporan Keuangan Pada UMKM di

Kabupaten Banyumas. Journal & Proceeding

JPFBUNSOED, 808–818.

Rachmad, A. A. (2011). Pengaruh Penerapan Corporate

Governance Berbasis Karakteristik Manajerial pada

kinerja Perusahaan Manufaktur. E-Jurnal Akuntansi,

2(3), 678–696.

Rachmawati, R. (2018). Model Struktural Hubungan

Budaya Organisasi, Kompetensi Pengguna,

Pengendalian Internal dan Kualitas Informasi

Akuntansi Pemerintah Daerah. Jurnal Ilmiah

Manajemen, VIII(1), 136–150.

Rahman, D., Hardi, & Diyanto, V. (2015). Pengaruh

Pemanfaatan Teknologi Informasi, Penerapan Sistem

Akuntansi Keuangan Daerah, Dan Penerapan Standar

Akuntansi Pemerintahan Terhadap Kualitas Laporan

Keuangan Daerah (Studi Empiris Pada SKPD Provinsi

Riau). Jom Fekon, 2(2), 1–15.

Rahmatika, D. N. (2016). Determinant Factors Influencing

The Level Of Fraud And Implication To Quality Of

Financial Reporting (Research At Local Governments

Indonesia). J A B E R, 14(14), 861–879.

S, M. B. T., Taufik, T., & Hariyani, E. (2015). Pengaruh

Good Governance, Kompetetensi Sumber Daya

Manusia dan Sistem Pengendalian Internal Terhadap

Kualitas Informasi Laporan Keuangan. Jom Fekon,

2(2), 1–14.

Sako, U., & Lantowa, F. D. (2018). Pengaruh Penerapan

Standar Akuntansi Pemerintahan Terhadap Kualitas

Penyajian Laporan Kueangan Pada Pemerintah

Kabupaten Gorontalo.

Journal of Accounting Science,

2(1), 43–54.

Silviana. (2012). Pengaruh Komitmen Kepala Daerah

Terhadap Kualitas Laporan Keuangan Pemerintah

Daerah di Provinsi Jawa Barat. In Seminar NAsional

Akuntansi & Bisnis (SNAB) (pp. 862–869).

The Effect of Implementing Internal Control System, Accounting Standards Implementation, Management Commitment to Quality

Financial Report

433

Sudarno. (2018). Analisis Peran Karyawan dalam

Hubungan Antara Dukungan Pimpinan dengan

Efektifitas SPIP dan Kualitas Laporan Keuangan.

Jurnal Akuntansi Dan Auditing, 15(1), 115–137.

Susilawati, & Riana, D. S. (2014). Standar Akuntansi

Pemerintahan dan Sistem Pengendalian Intern Sebagai

Anteseden Kualitas Laporan Keuangan Pemerintah

Daerah. STAR – Study & Accounting Research, XI(1),

15–32.

Sutaryo, & Sinaga, D. (2018). Government Internal Control

System Maturity : The Role of Internal Guidance and

External Control of Local Government in Indonesia.

Jurnal Akuntnasi Dan Investasi, 19(1), 24–35.

https://doi.org/10.18196/jai.190189

Suwanda, D. (2015). Factors Affecting Quality of Local

Government Financial Statements to Get Unqualified

Opinion (WTP) of Audit Board of the Republic of

Indonesia (BPK). Research Journal of Finance and

Accounting, 6(4), 139–157.

Syarifudin, Surasni, N. K., & Inapty, B. A. (2016).

Determinan Kualitas Laporan Keuangan dan

Implikasinya terhadap Akuntabilitas Publik (Studi

Empiris pada Inspektorat Kab. Lombok Timur,

Kabupaten Bima dan Perwakilan BPKP Provinsi NTB).

In SNA XIX Lampung. Retrieved from https://sna-

iaikapd.or.id

Tambingon, H. N., Yadiati, W., & Kewo, C. L. (2018).

Determinant Factors Influencing the Quality of

Financial Reporting Local Government in Indonesia.

International Journal of Economics and Financial

Issues, 8(2), 262–268.

Upabayu, I. P., Mahaputra, R., & Putra, I. W. (2014).

Analisis Faktor-Faktor yang Mempengaruhi Kualitas

Informasi Pelaporan Keuangan Pemerintah Daerah. E-

Jurnal Akuntansi Universitas Udayana, 8(2), 230–244.

Usman, H. (2010). Manajemen (Teori, Praktek, dan Riset

Pendidikan). Jakarta: Bumi Aksara.

Wisdom, O., Damilola, E., Inemesit, B., & Opeyemi, A.

(2017). Public sector accounting standards and quality

of financial reporting : A case of Ogun state

government administration in Nigeria. Business and

Management Research, 7(December), 76–81.

Yunita, T. A., Tanjung, A. R., & Anggraini, L. (2015).

Pengaruh Penerapan Standar Akuntansi Pemerintahan,

Sistem Pengendalian Internal Dan Kompetensi Staf

Akuntansi Terhadap Kualitas Laporan Keuangan

Pemerintah Daerah (Studi Pada SKPD Kota Dumai).

Jom Fekon, 2(2), 1–15.

Yusniar, Darwanis, & Abdullah, S. (2016). Pengaruh

Penerapan Sistem Akuntansi Pemerintahan dan

pengendalian Intern Terhadap Good Governance dan

Dampaknya Pada Kualitas Laporan Keuangan (Studi

Pada SKPA Pemerintah Aceh). Jurnal Magister

Akuntansi Pascasarjana Universitas Syiah Kuala, 5(2),

100–115.

EBIC 2019 - Economics and Business International Conference 2019

434