Developing New Wave Marketing Initiatives to Optimize

Bancassurance Distribution Channel: Case Study: PT ABL

Ahmad Saputra and Agung Wicaksono

School of Business and Management, Institut Teknologi Bandung, Indonesia, Gd. Graha Irama 12

th

Floor, Jl. H.R. Rasuna

Said Kav. 1-2, Kuningan Timur, Jakarta Selatan, 12950

Keywords: Bancassurance, Digitalization, Life Insurance, Marketing Initiatives, New Wave Marketing.

Abstract: Bancassurance is a business model that enables life insurance companies to sell their insurance products

through their partnered banks. As part of its strategy, PT ABL has been focusing on the development of its

bancassurance channel to help boost the company’s market share in the domestic life insurance market. The

objective of this research is to develop marketing initiatives that can help PT ABL optimize its bancassurance

channel in the current digital era. Prior to developing the proposed solution, both of the external and internal

environment of the business are analyzed using Kotler’s anatomy of change, Porter’s five forces, STP, and

marketing mix 4P’s frameworks. Purposive sampling method was used in this research. The primary data is

obtained from interviews with internal respondents and a survey to external respondents. The survey shows

that the three major factors that can positively drive the purchase decision are customer service quality, brand

image, and premium price. Using both new wave marketing and marketing 4.0 concepts, the proposed

marketing initiatives focus on improving customer experiences across the new customer path. To optimize its

bancassurance channel, PT ABL needs to increase its brand awareness and improve its customer service

quality through digitalization across its customer value chain.

1 INTRODUCTION

The demand for life insurance protection in Indonesia

has been steadily increasing in recent years, judging

from the increasing trend of the total insurance gross

premiums and the insurance density. However, since

the level of insurance penetration in the country is still

relatively low, it represents a potential future growth.

As a result, life insurance companies are developing

various innovative ways in marketing their insurance

products in order to increase their market penetration.

One of them is through the development of

bancassurance channel. Bancassurance is a business

model that enables life insurance companies to sell

their insurance products through their partnered bank

distribution channels. According to Teunissen

(2008), depending on the level of the integration

between the bank and the insurance company, there

could be four bancassurance models: pure distributor,

strategic alliance, joint venture and financial holding

company (wholly owned subsidiary).

Currently, PT ABL, as a subsidiary of one of the

state-owned banks in Indonesia, is not a dominant

player in the domestic life insurance market.

According to the data from the Financial Services

Authority, the market share of PT ABL is below two

percent of the total premium in the domestic life

insurance market in 2016 (Otoritas Jasa Keuangan,

2018). In order to increase its market share, PT ABL

focuses on the development of bancassurance

distribution channel. This is in particular because,

compared to other distribution channels, the

bancassurance distribution channel has experienced

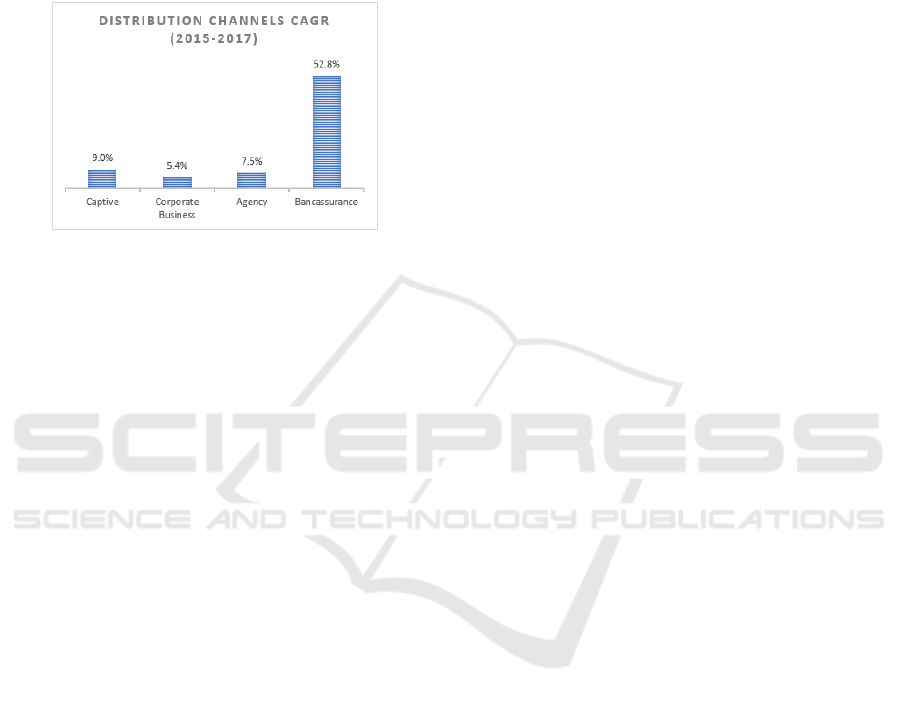

significantly higher growth, as shown in figure 1.

However, despite PT ABL has consistently

implemented both ATL and BTL marketing to

increase its brand awareness and sales, the level of

penetration of its bancassurance products to the

customer base of the parent company is still less than

five percent, according to the research interview.

Given the business condition above, the business

issue to be addressed by PT ABL is how the company

can optimize its bancassurance distribution channel,

so that it can subsequently increase its market share.

Since PT ABL is currently also adapting to the

dynamics of the digital economy and is moving

towards digitalization, therefore, the objective of this

research is to develop new marketing initiatives that

470

Saputra, A. and Wicaksono, A.

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL.

DOI: 10.5220/0008432604700481

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 470-481

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

can be implemented by PT ABL to optimize its

bancassurance distribution channel in the digital era.

This is needed because, in the current digital era, the

customer behaviour has shifted, which according to

Kotler et al. (2017), the customer path has also shifted

from 4A (Aware, Attitude, Act and Act again) to 5A

(Aware, Appeal, Ask, Act and Advocacy).

Figure 1: Compounded annual growth rate of PT ABL

distribution channels 2015-2017 (source: internal report).

2 RESEARCH METHODOLOGY

After identifying the business issue, both external and

internal environment of the business were analyzed to

understand the current business situation and the

challenges faced by the company. The external

macroeconomic and industry environment were

analyzed using Kotler's anatomy of change and

Porter's five forces framework. Subsequently, STP

analysis and Marketing Mix 4P’s framework were

used for the internal analysis. The analysis of the

current business situation would be the basis for the

formulation of the solutions.

In order to support the analysis, both primary and

secondary data were used in this research. The

primary data was obtained from survey and

interviews, while the secondary data was obtained

from literature, internal report, third-party survey, and

other publicly available information sources.

Purposive sampling method was used in this research,

in which the respondents were selected for certain

criteria based on the research questions (CIRT, 2018).

In this research, the qualitative data was obtained by

conducting interviews with internals respondents of

the company who are involved in the development of

the bancassurance distribution channel, in order to

gain insights on the current marketing strategy and

the challenges that the company may be facing.

Questionnaires were also distributed to external

respondents to gain insights on the customer

behaviour and customer preferences when deciding to

purchase life insurance products. The target

respondents of this survey are banking customers who

have purchasing power and live in urban areas. It is

expected that the urban population would have higher

financial literacy, and thus a higher level of awareness

on insurance protection. The research questions were

designed to follow the new 5A customer path

framework, in order to understand what drives the

customers to move from one path to another.

Following the analysis, business strategy and

marketing initiatives were subsequently developed.

In developing the marketing initiatives, both new

wave marketing and marketing 4.0 frameworks were

used.

3 BUSINESS SITUATION

ANALYSIS

3.1 External Analysis

3.1.1 Kotler’s Anatomy of Change

The dynamics of business environment are always

changing. Understanding the current situation of the

business environment is of importance prior to

developing any business strategy. To analyse the

business landscape, Kotler et al. (2008) formulated an

anatomy of change framework that consists of five

elements: technology, political legal, social-cultural,

economy, and market. The changes in technology,

political-legal, social cultural and economy will

eventually affect the market dynamics, whether

creating new markets and eliminating the old ones, or

the emergence of new players and the disappearance

of the old ones.

Technology. The development of digital

technology has changed how people do things and has

become the enabler for creating new solutions. The

application of the technology can be implemented in

almost every industry, including financial services.

For example, the application of mobile banking and

mobile payments have increased the financial

inclusion, allowing a rural population to access

products and services that were previously beyond

their reach. While the emergence of FinTech has

disrupted the banking industry (by changing the

nature of lending and payment practices), it will not

be surprising that the emergence of InsurTech can

also disrupt the insurance industry (by reinventing the

way how insurance is offered and bought). However,

the insurance company can also leverage on the

development of the technology, such as data analytics

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

471

to improve the business value-chain processes. This

will require a robust digital ecosystem, not only a

user-friendly digital interface but also a reliable back-

end infrastructure.

Politic-Legal. Since 2013, the role of insurance

industry regulator in Indonesia has been assumed by

Financial Services Authority (OJK). In October 2014,

the new insurance law replaced the previous

insurance law. This regulatory change has affected

the business landscape of insurance industry in

Indonesia, where M&A and consolidation activities

are expected to continue as a result of the changes in

regulation, such as the new single presence policy, the

new capital requirement of life insurance companies,

as well as the new rule for foreign ownership of any

joint-venture insurance companies. The ASEAN

Economic Community, launched in 2015, also

represents a major opportunity for global

multinational insurance companies to enter the

domestic insurance market, which could lead to

tighter competition in the domestic market. In

addition, OJK is continuously committed to

developing the financial service sector, by developing

programs to increase the financial literacy and

financial inclusion in the country. OJK has set the

target to increase the financial literacy to 35 percent

and financial inclusion to 75 percent by 2019. This

would represent micro-insurance opportunities, since

there are still a big percentage of the population who

do not have access to financial services.

Economy. The data from Central of Statistical

Bureau of Indonesia has shown that the economic

growth of the country has been recovering since the

economic downturn in 2014/2015 (Badan Pusat

Statistik, 2018). However, despite the increasing

economic growth, it is also imperative to note that the

increasing inflation rate and the recent weakening of

Indonesian rupiah towards US dollars may also have

a negative impact on the purchasing power of the

households. In a society where price is sensitive and

it could be a determinant in making the purchase-

decision, life insurance companies will need to be

more cautious and be more innovative with their

offerings in order to develop products that are

attractive and affordable to the target customers.

Socio-Cultural. As mentioned earlier, the

development of digital technology has changed how

people live, work, and do things. It changes how

people communicate and interact with others. Over

time, it will also change the lifestyle of the society.

Kotler et al. (2017) identify that the digital revolution

has triggered the emergence of three new subcultures:

youth, women, and netizens. Managing these three

influential subcultures will be essential for a company

in order to be competitive in the era of connectivity.

The company should leverage on utilizing the digital

technology to “make friends” or collaborate with

these subcultures.

Market. Life insurance market in Indonesia still

offers an opportunity for future growth due to its low

level of insurance penetration. As mentioned earlier,

the country also represents big micro-insurance

opportunities. However, it is imperative to note that

the changes in the previous factors (technology,

politic-legal, economy, socio-culture) could also shift

the market. Therefore, the company will need to be

able to sense any changes that may occur, for example

changes in customer behaviour. Realizing the

changes after the market has actually shifted would

mean that the company will play a “catching-up”

game in the market.

3.1.2 Porter’s Five Forces

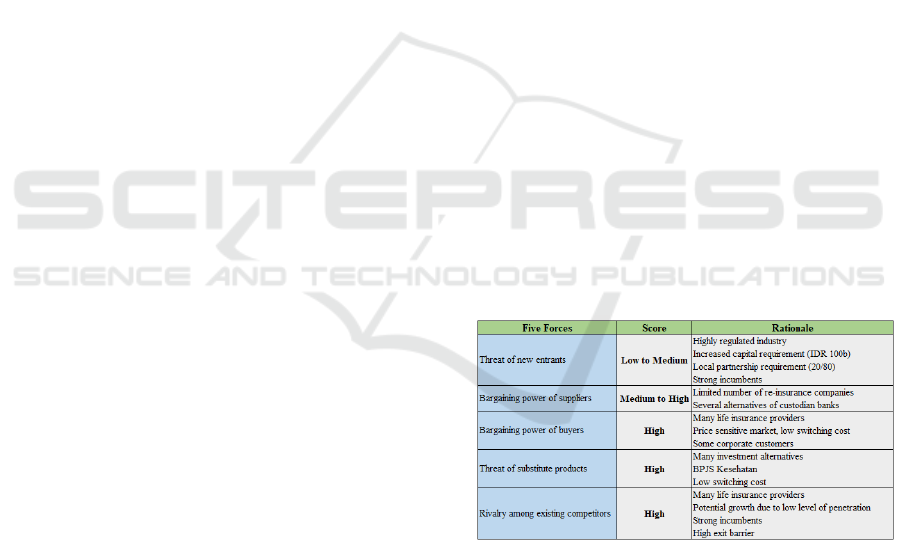

Table 1 below shows the summary of the analysis of

the life insurance industry in Indonesia using Porter's

five forces framework. The analysis shows that

despite having potential future growth, the life

insurance industry may not appear to be attractive for

new players who do not possess superior resources to

enter the industry. On the other hand, the incumbents

who aim to grow and penetrate the market further will

have to leverage on the weak forces and anticipate the

strong forces.

Table 1: Porter's five forces analysis.

Threat of New Entrants. Life insurance business

is highly regulated by the government in order to

protect the customers and make the business

environment healthy. While groups with big capital,

expertise, and strong brand image may not have a

significant barrier to enter the industry, the smaller

groups will certainly face some restrictions. Thus, the

threat of new entrants for life insurance industry can

be considered low to medium.

Bargaining Power of Suppliers. Bargaining

power of suppliers would normally be high when the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

472

numbers of suppliers are relatively small compared to

the numbers of players in the industry. In life

insurance industry, the suppliers are reinsurance

companies and custodian banks. The number of

reinsurance companies in Indonesia is still limited.

According to the data from OJK, there are only six

reinsurance companies in Indonesia in 2016 (Otoritas

Jasa Keuangan, 2016). Thus, life insurance

companies will have limited options of reinsurers and

will highly be dependent on few reliable reinsurers.

On the other hand, there are several alternatives for

custodian banks in Indonesia. That means life

insurance companies can select any custodian banks

that offer lower cost, more benefits, and better

services. Therefore, depending on which supplier, the

bargaining power of suppliers in life insurance

industry can be medium to high.

Bargaining Power of Buyers. The bargaining

power of buyer can be influenced by several factors

such as number of customers, switching cost,

availability of products or services, and price

sensitivity. While Indonesia has a large population, it

does not necessarily mean that the bargaining power

of insurance buyers must be low. According to the

data from OJK, there are about 55 life insurance

companies in the domestic market (Otoritas Jasa

Keuangan, 2016). This means that there are many

alternatives for the customers to choose where they

want to get their insurance protection from. The

customers in Indonesia are also price sensitive, in a

way that they will prefer insurance companies who

can offer affordable premium while still delivering

acceptable services that meet their needs. The

switching cost for the customer is also low.

Customers can easily change their insurance

providers to any providers that can meet their needs

and requirements. It is also not uncommon for

Indonesian customers to own more than one

insurance protection. As a result, the customers still

have strong bargaining power, especially those

corporate customers who seek for a group insurance

provider for their employees.

Threat of Substitute Products. Nowadays,

insurance is sold either as a protection, investment or

a combination of both. When insurance is sold as

investment, there are many alternatives of substitute

products, such as bank deposits, bonds, stocks,

mutual funds, indexes, forex, or other derivative

products. In fact, when insurance is linked to

investment products, the insurance funds are usually

invested to one or more of those investment products.

Therefore, it is not surprising if a direct investment to

those investment products would offer a more

attractive price to performance trade-off. This direct

investment will be more attractive for those

customers who are seeking for higher return of

investment and are more familiar with the investment

in the capital market. As a protection, the national

insurance protection schemes (BPJS) have become an

option for those customers looking for more

affordable protection. With low switching cost, it

means that the threat of substitute products for life

insurance protection is quite high.

Rivalry among Existing Competitors. The level

of rivalry among existing competitors can be analysed

by looking at the numbers of the players in the

industry, the status or the size of the incumbents, the

exit barrier, or even the industry growth. Since there

are many life insurance companies in Indonesia and

Indonesian are price sensitive, the life insurance

companies will have to be able to differentiate

themselves, either by being innovative in the product

development and offering, widening distribution

channels, or delivering superior services compared to

those of the competitors. Major incumbents often

possess superior brand image and reputation, wider

distribution channels, and enough capital to make

further investments. And considering the potential

future growth of the insurance industry in Indonesia,

these big incumbents are still committed to make

investments that they believe can help them penetrate

the market further. This makes the exit barrier for the

incumbents high, in addition to the amount of

obligation that they have to pay if they wish to quit.

Combination of these factors makes the level of

competition in life insurance industries is

considerably high.

3.2 Internal Analysis

3.2.1 STP Analysis

STP (Segmentation, Targeting, Positioning) is a

strategic process in modern marketing. It helps the

company explore and map the market, so that it can

design and develop an appropriate strategy according

to the selected target market. This is imperative

because of the fact that companies cannot serve all

customers, and the customers may have different

needs and may also behave and value the products or

services differently. Segmentation is a process of

dividing the market into distinct groups of customers

which could be based on geographic, demographic,

psychographic or behavioural, while targeting is a

process of selecting market segments that the

company is going to serve. PT ABL target segments

for bancassurance products are the customers of its

parent company across Indonesia, who are in their

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

473

productive years needing either insurance protection

or investment solution. The development of each

products is therefore in accordance to each target

market. For example, it develops micro-insurance

product for the micro-consumers, a unit-link product

for retail customers needs both investment and

insurance protection, or health insurance for retail

customers who only need health insurance protection.

PT ABL aims to position itself as trusted future

protection, which is in line with its vision to be a

leading and trusted life insurance company.

3.2.2 Marketing Mix 4P’s Analysis

Marketing mix is a set of tactical tools used in

marketing the product. The purpose of the marketing

mix is to engage the target customers and deliver the

proposed customer value. Marketing mix 4P's

consists of four elements: product, price, promotion,

and place. In terms of product, PT ABL currently

offers three bancassurance products, which include

health-insurance, unit link, and micro-insurance

products. In term of price, the amount of premium of

each bancassurance products will vary, depending on

which plans or riders are chosen by the customers.

According to the interview with internal respondent,

the premium of PT ABL bancassurance products is

competitively lower than those of the competitors.

For the promotion, PT ABL does both above the line

and below the line marketing communication to

increase its brand awareness and sales. For its

distribution channel, PT ABL has a wide distribution

network, especially since the distribution of its

bancassurance products is through the parent

company's branches and sub-branches. To fill the

assignments in those branches, PT ABL also

continuously recruits the required sales forces. PT

ABL currently has over 1,300 bancassurance sales

forces to cover its bancassurance distributions across

the country.

3.3 SWOT Analysis

Based on the external and internal business situation

analysis, the SWOT analysis of PTB ABL is

developed to determine the strengths, weaknesses,

opportunities, and threats of the company. The

internal insights from the interviews with internal

respondents, as well as the internal data obtained

during the research, are in particular used to identify

the strengths and the weaknesses of PT ABL. While

the analysis of macroeconomic and life insurance

industry is used as the basis in identifying the

opportunity and threats. The SWOT analysis of PT

ABL is summarized as follows:

Strengths: long experience with credit life

insurance and insurance product development

and wide distribution networks.

Weaknesses: brand image is not yet strong, IT

system is not yet integrated, service delivery is

not yet optimum.

Opportunities: large customer base of the parent

company, low level of life insurance penetration

in the country, micro-insurance opportunities.

Threats: AEC (foreign investments), price

sensitive market or weakening purchasing

power, national health insurance scheme

(BPJS), and the emergence of InsurTech.

4 RESULTS AND DISCUSSION

As mentioned earlier, the survey questions were

designed to follow the new 5A customer path (Aware,

Appeal, Ask, Act and Advocate), in order to

understand what drives the customers to move from

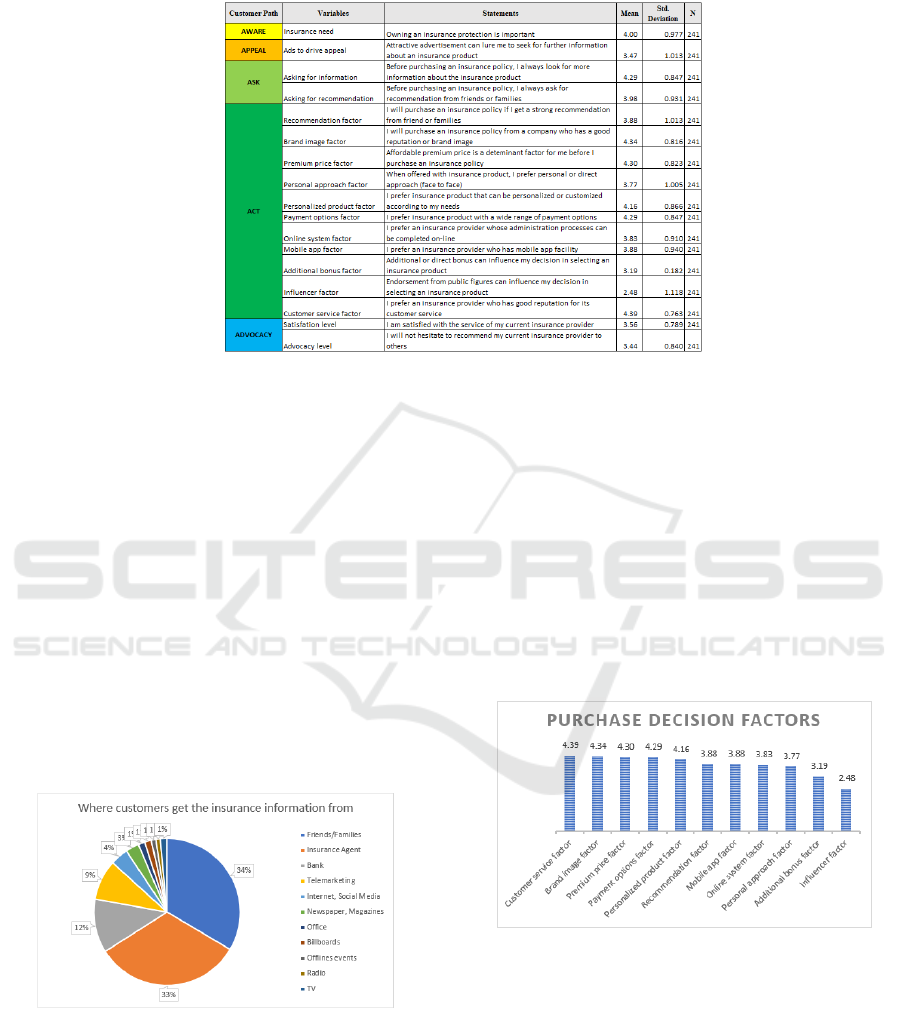

one path to another. Table 2 shows the descriptive

analysis of the survey data, presenting the mean value

of each variable, which will be used for the analysis

of each customer path.

Aware. The first step in the customer path is

aware. This could be in the form of level of awareness

to have insurance protection and the level of

awareness of the brand itself. Based on the primary

survey data, when asked about the importance of

owning insurance protection, most respondents agree

that it is important to have insurance protection (mean

score value=4.0). This implies that the urban

population already have a high level of awareness on

insurance protection. For the level of brand

awareness, according to the interview with internal

respondent, PT ABL had conducted the survey in

eight major cities in Indonesia through a consultancy

agency. The data from the survey shows that the level

of brand of awareness of PT ABL is close to 90

percent. However, it is still behind the level of brand

awareness of the market leader which is around 97

percent.

Appeal. The next path after being aware is appeal.

As shown in figure 2, the primary survey data shows

that most respondents obtain information about

insurance from direct contacts, such as friends or

families and insurance agents, or through bank

representatives and telemarketers who approach

them. Only four percent of the respondents mentioned

that they obtain information on insurance products

from internet or social media. Very few respondents

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

474

Table 2: Descriptive analysis of the survey variables (source: survey data).

gain information from traditional media, such as TV,

radio, and billboards.

It appears that the current life insurance

advertisements are not attractive enough to lure the

target customers to pay attention for the information.

However, the survey data also shows that attractive

advertisements could still arguably drive the

customers to look for further information about the

life insurance product (mean score value=3.47).

Therefore, the challenge for life insurance companies

is to find innovative ways (style) to deliver their

messages, so that it can attract the attention of the

target customers. When the attention is obtained, the

message must also contain valuable offering or

solution (substance) for the customers. Only when the

style meets substance, the target customers may be

lured.

Figure 2: The sources of information of insurance products

(source: survey data).

Ask. After being attracted to a certain life

insurance product, customers often seek for further

information and recommendation. This is expected

because there are many considerations that the

customers need to weigh prior to making the purchase

decision. This is supported by the survey data that

shows that majority of the respondents agree that they

always look for further information before making a

purchase decision on insurance products (mean score

value=4.29). Most respondents also agree that they

seek for recommendation from friend and families

about the insurance products in question (mean score

value=3.98).

Act. The survey also asks the respondents on

several factors that can affect their purchase decision

when choosing a life insurance product. The survey

results on the variables that could affect customers

purchase decision is shown in figure 3.

Figure 3: Survey results on purchase decision factors

(source: survey data).

According to the survey data, the top three

determinants that can positively affect customers

purchase decision are as follows:

Customer service quality (mean score value =

4.39). The majority of the respondents prefer

life insurance provider that owns a reputation of

having good customer services. This would be

the challenge that needs to be addressed by PT

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

475

ABL as one of the weaknesses of the company

is the customer service delivery that is still not

optimum.

Brand image or the reputation of the life

insurance company (mean score value=4.34).

This means that PT ABL will have to improve

its brand image in order to be more competitive

in the life insurance market.

Premium Price (mean value=4.30). In the

market where price is sensitive, premium price

becomes one of the major purchase decision

factors. Majority of the respondents prefer

buying a life insurance policy from a life

insurance provider that can offer affordable

premium price. This could be a challenge that

needs to be addressed by life insurance

providers, because while the customers are

demanding an affordable premium price, they

also expect to have superior service quality.

Following those three major purchase-decision

factors, the respondents also prefer life insurance

providers that can offer a wide range of premium

payment options (mean score value=4.29) and a

customized or a more personalized insurance product

(mean score value=4.16). Recommendation from

friends and families can also influence the purchase

decision (mean score value=3.88). In addition, the

data also show that the respondents appreciate life

insurance provider that has an online system (mean

score value=3.83) or mobile applications (mean score

value=3.88), as these facilities would make the whole

administrative processes easier, more convenient, and

faster to complete.

However, unlike in other industries, the

endorsement or opinion from public figures and

influencers would not influence much the customers

purchase decision on insurance products (mean score

value=2.48). Additionally, those incentives or

additional bonuses that are expected to attract the

potential customers are actually not affecting much of

the customers purchase decision (mean score

value=3.19).

Advocate. When asked whether the respondents

are satisfied with the current life insurance providers,

they are arguably in a neutral position (mean score

value=3.56 on satisfaction level). As a result, they are

not in a strong position to recommend their life

insurance provider to others either (mean score

value=3.44 on advocacy level). This represents a

homework for life insurance companies that, in order

to increase the level of advocacy, they must first

ensure a high level of customer satisfaction. And to

achieve that, they must first deliver superior service

quality.

5 BUSINESS SOLUTION

FORMULATION

5.1 Business Strategy Formulation

Business strategy aims to gain and sustain

competitive advantage, which is a company’s

performance relative to the competitors. This means,

in developing the business strategy, a company needs

to compare its performance to the performance of

other companies in the same industry. Competitive

map can be used to measure the position of the

company relative to the competitors in the industry.

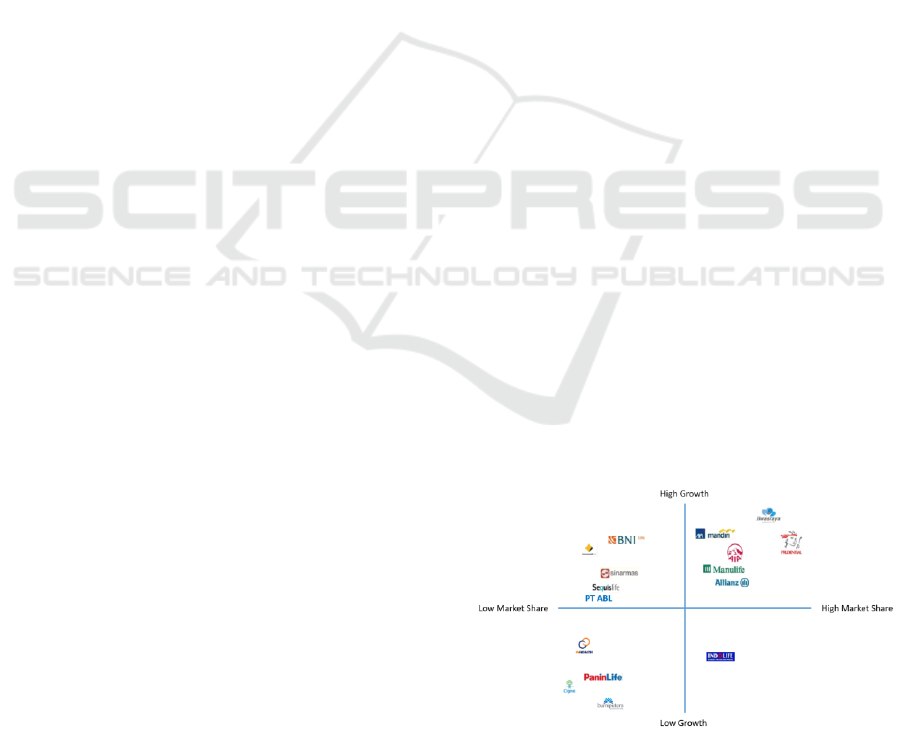

Figure 4 shows the competitive map of some life

insurance companies in Indonesia based on their

market share and growth in 2016.

The data shows that PT ABL is considered having

high growth but low market share, while the top life

insurance companies have both high growth and high

market share. This implies that, with current growth,

it might be difficult for PT ABL to "catch-up" with

the top players, because the business of top life

insurance companies is still continuously growing as

well. Therefore, in order to increase its market share,

PT ABL will need to take different approach to

penetrate the insurance market further and boost a

significant growth. This can be achieved if PT ABL

has certain uniqueness that can increase the value

creation for the customers and differentiate the

company from its competitors. Based on the

interview with internal respondent, the current

offering of bancassurance products of PT ABL is

differentiated by offering a more competitive

premium pricing or lower acquisition cost. However,

it is still not enough to increase PT ABL market share.

The data from the survey shows that the customer

quality and brand image are the two major factors that

could drive customer purchase decision, and PT ABL

still lacks on these two factors.

Figure 4: Competitive map of life insurance companies in

Indonesia in 2016 (source: OJK data).

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

476

In order to create unique differentiation, PT ABL

can focus and leverage on its strengths, which is as a

company who has long experience on life insurance

products and wide distribution networks, and also as

a subsidiary of the largest micro financing provider.

The parent company of PT ABL is known for having

a solid digital infrastructure to support its operation

and coverage in remote areas. Since the

bancassurance products of PT ABL are being

distributed through its parent company’s channels,

this represents an opportunity for PT ABL to integrate

with the digital infrastructure of the parent company

digital eco system and penetrate the micro-insurance

market. With these resources and capabilities, PT

ABL has the potential to pursue a differentiation

strategy to become the largest digital micro-insurance

provider, that is to become an insurance provider that

can deliver seamless digital customer experiences

across its customer value chain and have extended

network coverage across the country to reach those

who are not yet tapped by insurance protection.

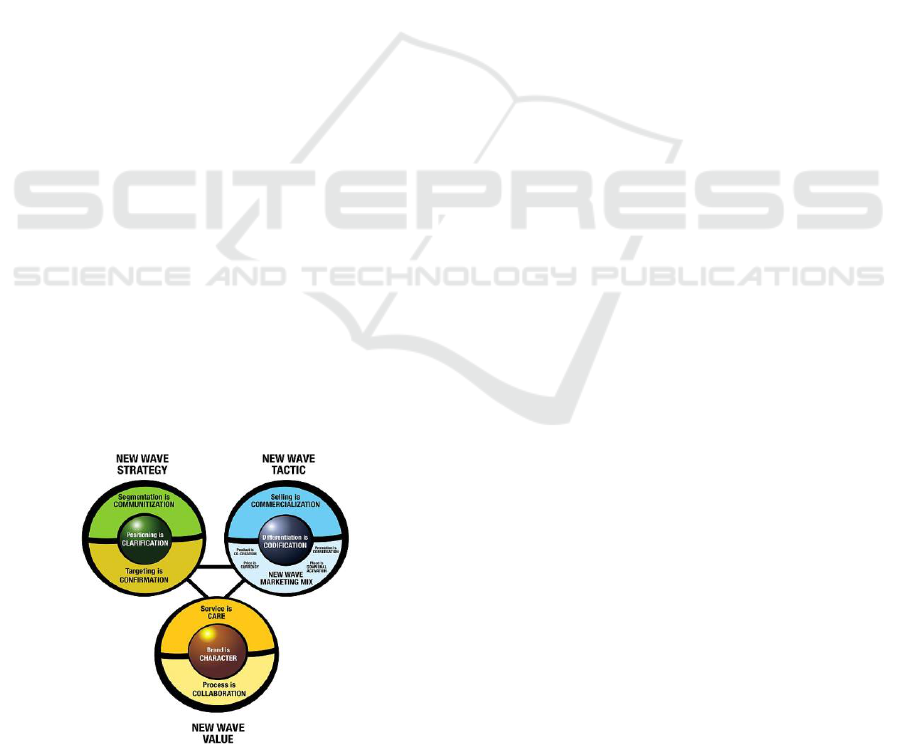

5.2 New Wave Marketing Approach

According to Kotler et al. (2017), “the business

landscape has shifted to become inclusive, horizontal,

and social”. As a result, the company should no

longer consider customers as a king, rather they

should be viewed as a friend, who demand more

participation, more collaboration and more human-

centric approach. This leads to the birth of new wave

marketing, a concept developed by Markplus Inc.,

which shifts the nine core elements of legacy

marketing to the 12C’s of new wave marketing as

shown in figure 5. This approach will be used as it fits

to address the shifts occurring the current digital

economy.

Figure 5: The 12C's of new wave marketing (source: Kotler

et al., 2017).

Communitization. In legacy marketing,

companies group their target customers through

segmentation. In the era of connectivity, the

customers are viewed as social beings who live in

certain communities. Consequently, in developing

the bancassurance distribution channel, PT ABL can

partner and synergize with its parent company to

develop their communitization strategy to engage the

existing communities or build a new community. This

is inevitable because competitors are also

approaching local communities as an entry point to

build brand awareness.

Confirmation. In legacy marketing, following the

segmentation, companies will choose the target

segment that they consider the most profitable, based

on the market size, market growth, and competitive

condition. In digital era, customers no longer want to

be considered as passive recipients. If a company

continues with the legacy marketing communication

approach, not only the customers may not pay

attention to the messages the company tries to

convey, but they may even consider the company's

attempt to reach them as spam. Therefore, after

exploring the communities that PT ABL wants to

engage, PT ABL will need to first gain permission, to

ensure that the community is willing to accept and

communicate with the company. Once the

communities accept the invitation, they become

"confirmed" communities. PT ABL will then be able

to engage further with the members of the

communities to participate in certain program or

activities.

Clarification. Positioning has also shifted to

clarification. In the legacy era, company attempts to

win the mind of the customers through frequent

communication of their value proposition or

positioning statement to the customers. However, it

does not necessarily work anymore in the current

digital era. This is because customers can now easily

access any information. They can easily clarify the

value proposition that the company offers with their

peers in the community. Kotler et al. (2017)

suggested that the approach that can be utilized in the

clarification process is by creating content that has

been adjusted according to the customer needs, in a

way that the content may not be directly related to the

products or services being offered, but it should

provide real values to the customers instead. For

example, PT ABL can create content such as tips on

how to live a healthy lifestyle, information on certain

illness, or even tutorial on personal financial

planning. This is because the main difference

between positioning and clarification is, while

positioning is about the service being offered,

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

477

clarification is all about the customer, how the

information can become useful for the customers.

When customers perceived the information is useful,

or when the service is exceeding their expectation,

they may voluntarily share the information and their

perception to their community. When communication

among the customers occurs, the community

consensus or clarification could be achieved.

Codification. In legacy era, value proposition is

delivered through differentiation. Without

differentiation, it could result in over-promise or

under-delivery of the offerings. In the digital era,

differentiation has shifted to codification.

Codification refers to a uniqueness, an authenticity of

a brand that cannot be easily imitated by the

competitors. Thus, in order to achieve a unique

differentiation, PT ABL can focus on its strength.

From the SWOT analysis, one of PT ABL strengths

lies on its wide distribution network. PT ABL can

therefore leverage this internal competitiveness with

the network and infrastructure that the parent

company has. As the largest micro-financing provider

and the bank that has largest coverage to remote areas

in the country, the parent company of PT ABL has

successfully integrated the technology and human

approach. Therefore, by integrating with the parent

company digital ecosystem and leveraging on its

extended network coverage, PT ABL can establish a

uniqueness that cannot be easily imitated by the

competitors.

Co-creation. The product development process

has shifted from company-centric to customer-

centric. The development of internet platform has

allowed the company to become more collaborative

with their customers, allowing the customers to get

involved in the product development process. This is

called co-creation. In co-creation, the company would

act more like a facilitator. By developing a platform,

PT ABL can interact and communicate actively with

customers or communities. The objective is to capture

ideas and insights directly from the customers, so that

the products or services developed can be more

personalized or customized according to customer

needs and wants. Co-creation will not only help PT

ABL make the product development process more

effective, but also help the products or services

become more acceptable when they are commercially

launched to the market.

Currency. Kotler et al. (2017) argued price has

become currency, where the advancement of

technology has enabled price customization by the

customers, in a way that the customers can determine

the price they are willing to pay based on the services

they need. Currently, PT ABL already offers

premium price flexibility depending on the type of

bancassurance products and the plans or the riders the

customers opt to have in their insurance plan. As

development of additional bancassurance products

and digital platform is inevitable in the future, PT

ABL certainly needs to make this flexible and

transparent customization of premium pricing

available in their digital platform. This would be

convenient for the customers and make the process of

customer acquisition easier and faster. The use of

data analytic will also allow advanced flexible pricing

in the future, in a way that the premium price could

be tailored based on the customer historical data.

Communal Activation. Kotler et al. (2017) also

argued that not only the company needs to get the right

mix of online-offline distribution channels, once the

company identified the confirmed communities, they

also need to be able to activate those communities, by

creating a platform where the community members can

interact and share opinion with each other. Engaging

the communities will not only help PT ABL increase

its brand awareness, but it can also act as another

distribution channel through word-of-mouth.

Conversation. In legacy era, company sends a

one-way message to the target customers through

promotion. However, as the data from the survey has

previously shown, this is not always the most

effective way to convey the message to the target

customers. In the era of connectivity, it is now easy

for the customers to gain information and to get

validation from others. This communication between

customers creates conversation. This conversation

can be positive and negative. Positive conversation

can definitely have a positive impact to the brand, and

vice versa. Since conversation is more effective than

promotion, PT ABL will need to create marketing

contents that could trigger conversation, in addition

to ensuring the delivery of beyond expectation

services. This could drive the satisfying customer to

share the positive experiences with others. This

would trigger conversation. PT ABL can facilitate

this conversation through its website, social media, or

digital platform.

Commercialization. Kotler et al. (2017) define

commercialization as utilization of social networks

for new customer acquisition and old customer

retention. This can be done by utilizing both internal

and external networks. Internally, PT ABL can

leverage on its parent company extensive networks to

commercialize its products. One example is to create

a synergy with the parent company in developing a

bundled product or an insurance solution. In addition,

PT ABL can also facilitate its bancassurance sales

forces to bond with the employees of the parent

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

478

company. Once a good bonding is established, the

employees of the parent company may be able to

provide a lead for potential customers. Externally, PT

ABL can also leverage on the customer community

networks, for example by developing a “customer-

get-customer” program.

Character. Brand is a value indicator, because a

strong brand is an asset that can deliver values to both

the customers and the company. However, branding

merely with physicalities such as name, symbol,

packaging, or building is no longer enough. Brand

must also have a character. Instead of being an

institution, a brand must become more "human",

because customers now only trust human, their

friends and families. Therefore, PT ABL must

become "human", in a way that it must own human

characters of a trusted friend for the customers. PT

ABL, and its whole employees, must embrace and

apply their own corporate values, such as integrity,

professional, and customer satisfaction, in their daily

activities. They need to establish a personal

relationship with their customers, to ensure that the

interaction with the customers is not only

transactional basis.

Care. In the current era, relying only on Standard

Operating Procedures (SOP) in delivering the

services is no longer sufficient. The company must

also show genuine concerns and efforts to the

customers. Because when the customers see that the

company is indeed showing a genuine care to their

needs and anxieties, and able to provide a true

solution to them, they may not only be willing to

recommend, but also advocate the brand. This would

only happen if PT ABL can deliver outstanding

service quality in all customer touch points, by

integrating seamlessly between the technology and

the human touch.

Collaboration. In legacy era, process plays an

important factor in creating and delivering value to

the customers. The whole processes in the value chain

are normally controlled by the company, and the

success of the process is often measured by quality,

cost, and delivery. With the advancement of digital

technology, the company can now conveniently

manage and improve the processes by developing

collaboration with other parties in the value chain

process. This collaboration can be done with both

internal or external parties. In the development of

bancassurance channel, for example, PT ABL can

collaborate with its parent company to develop

seamlessly integrated system. PT ABL can also

collaborate with external parties, such as hospital

networks or health providers, to ensure they can

deliver differentiated values to their customers.

5.3 Marketing Initiatives using

Marketing 4.0 Framework

By understanding the new customer path, the

company can align its resources and implement the

appropriate tactics accordingly. Kotler et al. (2017)

argued that company could do few interventions

across the customer path to "create Attraction, trigger

Curiosity, secure Commitment, and build Affinity

(ACCA)". The proposed marketing initiatives is

developed using this framework.

Creating Attraction. Making the potential

customers aware of the brand only is not sufficient.

The brand also needs to be appealing to the potential

customers. Otherwise, the potential customers may

only know about the brand, but may not move

forward to the next step in the customer path. The

customer is aware but not appealing to the brand. If

this happens, it means that the brand has not created

enough attraction. This often results from poor

positioning or poor marketing communication. The

survey data also shows that there is a need to improve

the current marketing communication so that it can be

more appealing to the customers. The following are

some proposed marketing initiatives to increase the

brand attraction:

PT ABL can aim to develop a brand image as

the largest trusted digital micro-insurance

service provider, who is socially responsible in

contributing to the financial inclusion

development in the country. This is because the

customers are now more appealed to brands that

possess human-centric values. For example, the

parent company of PT ABL has a strong brand

image as the largest micro-financing bank who

helps to develop the country by assisting micro

and small businesses, even in some remote areas

in the country. Thus, as its subsidiary, PT ABL

can definitely follow its footstep to become the

largest micro-insurance provider in the country,

who can reach those who are previously not

tapped by insurance protection.

Improve the marketing communication, by

optimizing the use of internet and social media

to raise brand awareness. The available social

media accounts need to be more utilized to

establish valuable interaction with the

customers. Instead of only delivering one-way

product information contents, the social media

can also be used to provide useful information

for customer daily lives. The aim is to increase

brand awareness by being sociable brand.

Participate or sponsor in local community

events, such as seminar, education, sports,

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

479

social event, customer gathering, or other

events. The aim is not only to increase the brand

awareness, but also to humanly interact with the

communities for social listening.

Improve the website display and develop a

simple, attractive, friendly user interface for

digital platform. The aim is to make customer

experience when accessing the company’s

website or application seamless and easy.

PT ABL can also create a fun and catchy mascot

or jingle for the brand. The objective is to

develop a quick and easy brand association in

customer’s mind.

Triggering Curiosity. If customers are appealing

to the brand but there is low conversion rate from

Appeal to Ask, it would mean that the brand is not

able to create enough conversation. The conversation

can be created when there is curiosity. When people

are curious, they will ask around. Kotler et al. (2017)

argued that one way to trigger curiosity is through

content marketing approach, which is a process of

developing and distributing a marketing content that

is relevant for the customers. Thus, the key point in

creating a conversation lies on content marketing

creation and its distribution. Some proposed

marketing initiatives to trigger more conversation are

as follows:

Create conversation among the customers or

communities through content marketing. The

content of the marketing communication done by

PT ABL must be relevant to the customers.

When the customers are able to see the relevance

between the content and themselves, or when

they think that the content is of values and worth

sharing, they will be willingly sharing the content

with their friends or families. Conversation

among them will then be created.

Amplify the content conversation through

proper distribution channel and communities. In

addition to distributing their marketing content

through social media or traditional public

spaces, PT ABL can also place their content in

cinemas or local community events. Engaging

and involving local communities is another way

to trigger and amplify the conversation.

Create a content creation competition where

both customers and non-customers in

communities can create and share their contents

based on a certain theme. If given a theme that

is of values and relevant to the customers, they

will be willing to put their creative ideas to join

such competition. If successful, this

competition could create a strong conversation

among the communities.

Securing Commitment. The next step in the

customer path is Act. This is a point where the

customers actually buy the product. This is where the

marketing mix 4P's could be a deciding factor. The

product or service must be of good quality, the price

must be reasonable and affordable, the promotion and

the sales forces must be convincing, and the product

must be available when the customers need it.

Channel management becomes important to ensure

the availability of the product or service. The human

capital across customer touch points is also critical to

delivering excellent customer experiences. The

survey data shows that the top purchase-decision

factor is customer service quality, followed by the

brand image. The following are some proposed

marketing initiatives to secure the commitment of the

customers:

Ensure seamless integration between offline

and online channels. The aim is to create

seamless customer experiences. Both channels

must be complementing each other.

Ensure seamless integration with parent

company digital ecosystem. This is to ensure

that the bancassurance products or services can

be made available through the parent company

digital platform and all the processes can be

completed seamlessly.

Optimize channel experiences using data

analytic. Data analytics would enable the

company to get deeper insights and improve the

processes across the customer value chain.

Develop a sales force management program for

both PT ABL and parent company sales forces.

It is equally important also to ensure the

employees of the parent company understand

that it will be beneficial for both companies if

the bancassurance channel is growing. Some

additional incentives program could also be

made for parent company employees who help

to provide a lead for bancassurance customers.

Building Affinity. After securing the

commitment of the customer, the next objective is to

increase brand advocacy. According to the survey,

most respondents are not strongly willing to

recommend their current insurance provider to others.

This is arguable because their customer satisfaction

level is not spectacular either. Thus, to increase the

customer advocacy level, the company must first

deliver superior customer services. Some proposed

marketing initiatives to build affinity with the

customers are as follows:

Improve service quality through digitalization

across customer touch points to increase

customer satisfaction level. With digitalization,

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

480

PT ABL can develop self-service experiences,

make the administrative processes fast and easy,

or enable virtual customer service or chat bots to

provide real time assistance to the customer as

needed.

Develop customer service training program for

human capitals working at various customer

touch points. Automation through self-service

is great. However, it must still be combined with

a human touch. Excellent digital ecosystem can

be jeopardized if the customers are handled

poorly by the personnel at touch points. On the

other hand, exceptional human interaction can

also make the difference and amplify the

customer satisfaction.

Develop customer engagement program to

build close relationship with the customers. In

the service industry, good relationship with the

customers needs to be maintained so that the

customer satisfaction can also be managed. The

relationship with the customers cannot be

transactional only. The objective is to facilitate

the bancassurance sales forces to become

trusted friends for their respective customers

Develop a customer-get-customer program to

encourage word-of-mouth recommendation.

However, the main homework still lies on getting

very high customer satisfaction level. Any

incentive programs will not work when the

service quality is still poor, because no customers

would want to jeopardize their reputation by

providing unreliable recommendation.

6 CONCLUSIONS

The business issue in this research is for PT ABL to

increase the market share of the company by

optimizing the bancassurance distribution channel. A

survey done by a consultancy agency shows that the

brand awareness of PT ABL is still behind the leading

life insurance companies, and the primary survey data

shows that the top three factors that could drive the

customer’s purchase decision are the customer

service quality, the brand image, and the premium

price. Therefore, to optimize its bancassurance

distribution channel, PT ABL needs to increase its

brand awareness and improves its customer service

quality across its customer value chain. This can be

achieved by enhancing its marketing communication

initiatives and its customer service quality. This is

because brand image cannot be separated from

customer service quality, and a superior customer

service quality can also positively increase the brand

image of the company.

Since PT ABL is moving towards digitalization,

the proposed marketing initiatives are developed

using the new wave marketing and marketing 4.0

frameworks and are focusing to enhance the customer

experiences across its customer path through

digitalization by integrating both offline and online

channels. The customer experiences, and thus

customer satisfaction, can be improved by leveraging

on the digitalization to increase the productivity and

applying the human-centric approach to establish the

customer engagement.

REFERENCES

Badan Pusat Statistik, 2018, Statistical Yearbook of

Indonesia in Infographics 2017, February.

Center for Innovation in Research & Teaching, n.d.,

Qualitative Sampling Methods, Available from

https://cirt.gcu.edu/research/developmentresources/res

earch_ready/qualitative/sampling, Accessed on August

2018, Grand Canyon University.

Fraenkel, J. E, Wallen, N. E., Hyun, H. H, 2018, How to

Design and Evaluate Research in Education 8th Ed,

McGraw-Hill.

Kartajaya, H., Darwin, W., 2010, Connect: Surfing New

Wave Marketing, Gramedia Pustaka Utama.

Kotler, P., Armstrong, G., 2018, Principles of marketing

17ed, Pearson.

Kotler, P., Kartajaya, H., Setiawan, I., 2010, Marketing 3.0:

From products to customers in the human spirit, Wiley.

Kotler, P., Kartajaya, H, Setiawan, I., 2017, Marketing 4.0:

Moving from traditional to digital, Wiley.

Kotler, P., Kartajaya, H., Huan, H. D., 2017, Marketing for

Competitiveness: Asia to the world! In the age of digital

consumers, World Scientific.

Kotler, P., Kartajaya, H., Huan, H. D., Liu, S., 2008,

Rethinking Marketing: Sustainable Marketing

Enterprise in Asia, Pearson.

Kotler, P., Keller, K. L, Ang, S. H., Tan, C. T., Leong, S. M,

2018, Marketing management: An Asian perspective,

Pearson.

Otoritas Jasa Keuangan, 2017, Laporan Kinerja Otoritas

Jasa Keuangan.

Otoritas Jasa Keuangan, 2018, Laporan Kinerja Otoritas

Jasa Keuangan 2017, May.

Otoritas Jasa Keuangan, 2018, Statistik Perasuransian

Indonesia 2016 – Revised Version, January.

Rothaermel, F. T., 2017, Strategic Mangement 3ed,

McGraw-Hill Education.

Sekaran, U., 2003, Research Method for Business: A Skill

Building Approach, John Wiley and Sons.

Teunissen, M., 2008, Bancassurance: Tapping into the

Banking Strength, The International Association for the

Study of Insurance Economics, The Geneva Paper.

Developing New Wave Marketing Initiatives to Optimize Bancassurance Distribution Channel: Case Study: PT ABL

481