Long Term Financial Planning using Financial Performance Analysis

and Prospective Analysis in XYZ Workshop

Hani Novanti and Hasnul Suhaimi

Magister of Management, University of Indonesia, Salemba Raya, Jakarta, Indonesia

Keywords: Business Coaching, Financial Analysis, Financial Projection, Small and Medium Business Enterprises

(SMEs), Workshop.

Abstract: This research is in the form of business coaching conducted at SME XYZ Workshop, located in Margonda

Raya, Depok. This study aims to address the challenge in constructing financial projection for small business

based on the experience of the XYZ Workshop. A series of structured coaching and interviews with the

owner and staff with additional secondary data from the historical financial transaction of XYZ Workshop

in Depok. Subsequently, the results were analyzed with gap analysis and financial analysis. Based on the

mapping of the condition of the workshop, there is some gap between the actual conditions that occur with

the expected ideal condition. One of that is, the owner of XYZ Workshop didn't use financial analysis and

projection for investing and capital budgeting decision. The need for financial analysis and was a proposal

submitted to XYZ Workshop. This business coaching process is expected to help XYZ Workshop and other

SMEs to improve their performance.

1 INTRODUCTION

Vehicle maintenance business opportunities that meet

customer criteria are captured by XYZ Workshop

which was built in mid -1993 by the husband and wife

couple of Mr. A and Mrs. B. This business is an

expansion of his business from similar business field,

namely workshop. The establishment of XYZ

Workshop is intended to capture business

opportunities from the development and growth of the

city of Depok. XYZ Workshop was inaugurated in

May 1994, by Marketing Director of PT Bridgestone

Tire Indonesia. This inauguration also indicates that

XYZ Workshop has been considered by PT

Bridgestone Tire Indonesia as a business partner, by

making XYZ Workshop as an authorized outlet for

Bridgestone brand tire sales.

Core business XYZ Workshop is thorough

maintenance and repair of 4 wheel vehicles. With the

concept of "one stop service" - which consists of the

concept of vehicle maintenance, general repair, car

salon, the availability of tires, spare parts, lubricants,

accessories and others - XYZ Workshop is expected

to provide comprehensive service workshop in one

place. Nevertheless, the founders realized that the

workshop field is so vast that it can be very difficult

and almost impossible to fulfill all types of workshop

services. In this context, until now the XYZ

Workshop does not have any kind of repair service

body repair and painting.

One effort to empower SMEs can be done through

business coaching. Today, many business actors are

beginning to agree that coaching can be one of the

business development efforts. According to Passmore

(2010), an important part of a coaching process is to

empower people by facilitating learning for

themselves, personal growth, and performance

improvements.

Through the business coaching process conducted

by the writer and team of XYZ Workshop, several

problems were encountered, such as problems related

to the opening of new branches, loyalty program,

marketing communications, human resources, and

also problems related to financial management

systems. Based on the result of independence

assessment conducted by Yayasan Dharma Bhakti

Astra (YDBA) to XYZ Workshop as one of its partner

SMEs, from the financial aspect it is known that XYZ

Workshop does not have budgeting system for

making financial decisions. XYZ workshop has not

implemented financial management systems.

Based on the interviews of owners and

employees, direct observation, and mapping of

438

Novanti, H. and Suhaimi, H.

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop.

DOI: 10.5220/0008432304380449

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 438-449

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

conditions to the XYZ Workshop, then formulated

the priority issues in the field of financial

management facing the XYZ Workshop is “How to

create long term financial planning in XYZ

Workshop using financial performance analysis and

prospective analysis?”

Seeing the formulation of the problem in the field

of financial management, the purpose of research in

the process of business coaching implementation of

this XYZ Workshop, is “Create long term financial

planning in XYZ Workshop using financial

performance analysis and prospective analysis”

2 BUSINESS COACHING

METHODS AND DATA

ANALYSIS

2.1 SME’s Profile

XYZ Workshop was founded in 1993 by a married

couple Mr. A and Mrs. B. The couple opened the

business because of the need for workshops and there

was an increase in the number of vehicles, especially

cars in the Jalan Margonda Raya area, Depok. The

workshop was built using personal funds and

developed into a family business.

XYZ Workshop offers washing service and car

service. Car service offers a variety of regular

maintenance services, repairs, performance

improvements, and sales of car parts and accessories.

In addition to washing and car repair services, XYZ

Workshop also sells Bridgestone brand tires along

with installation, spooring and balancing services.

XYZ Workshop Building stands 1,000 square

meters on the edge of Jalan Margonda Raya, Depok.

The workshop already has a variety of facilities and

equipment that are adequate to support 2S activities,

namely Service & Spare Parts. In addition to

equipment for service and spare parts, XYZ

Workshop also has a robotic car wash machine for car

washing which is one of the excellent services offered

by the workshop.

XYZ Workshop Owners have several business

development targets for the future in the short,

medium and long term. In the short term, the expected

target is to create loyalty programs and improve

marketing communication through social media. The

medium term target is to open a new branch of XYZ

workshop in the form of own ownership or a franchise

system. Whereas in the long term, the expected target

is to maintain growth and expand the business range

of the XYZ Workshop.

The vision of the XYZ Workshop is to make the

XYZ Workshop the best general workshop by using

the work standards of the official workshops of Astra

Toyota and Daihatsu, which offer solutions, safety

and comfortability in one place. While the mission of

the XYZ Workshop is:

▪ Providing the best vehicle maintenance and repair

services by promoting consumer safety and

comfort.

▪ Using the best quality products that are tailored

to the needs and desires of consumers.

▪ Holds the principle of honesty and quality to

maintain service quality in accordance with

applicable SOPs.

▪ Building good relations with customers both

individuals and corporations and other parties

who are stakeholders.

▪ Build an organizational structure with work

culture characteristics that are disciplined and

open to employees so as to create family

cooperative relationships so that companies and

employees can prosper together.

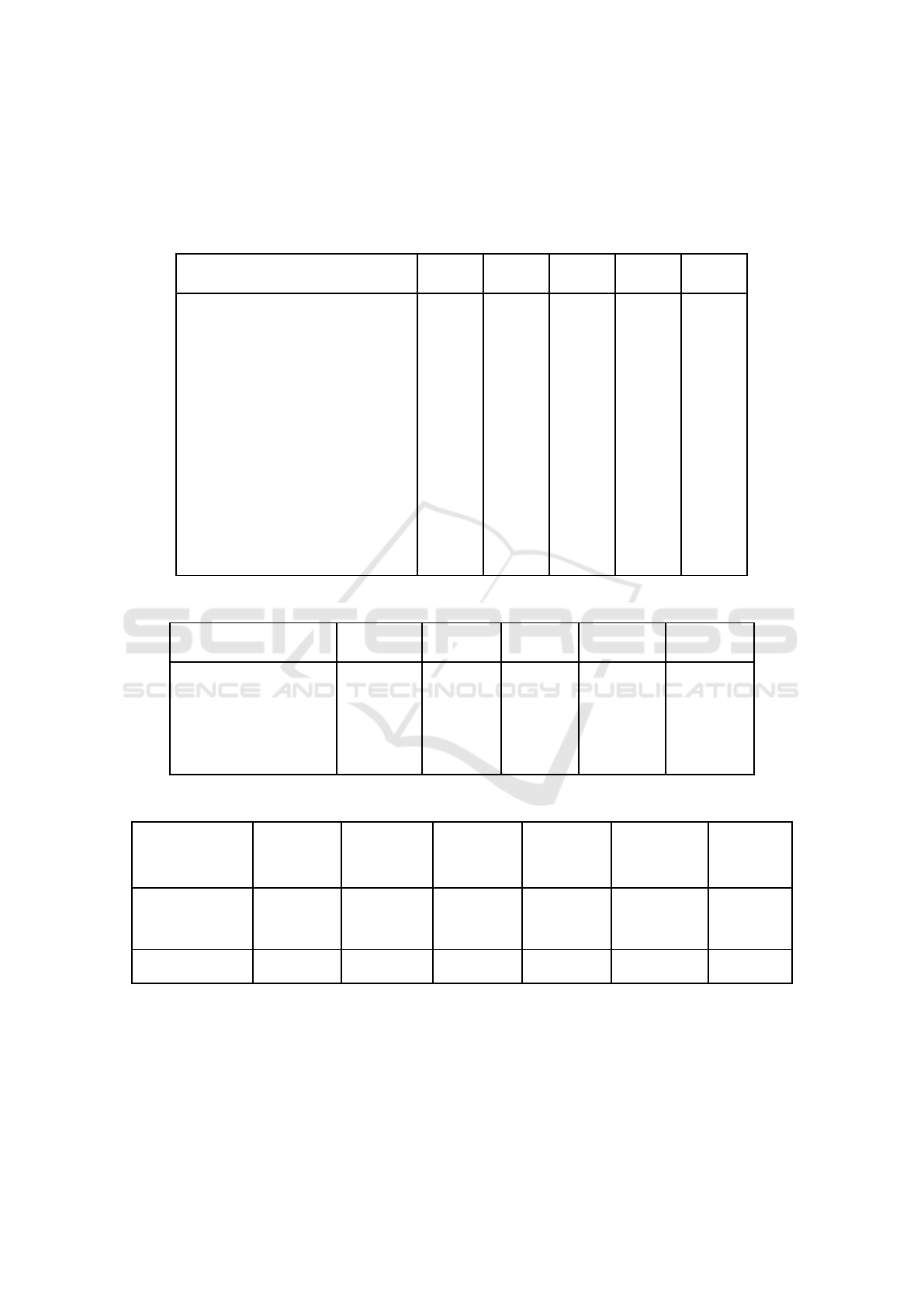

2.2 Business Model Canvas

Business model canvas of XYZ Workshop can be

seen in Table 1.

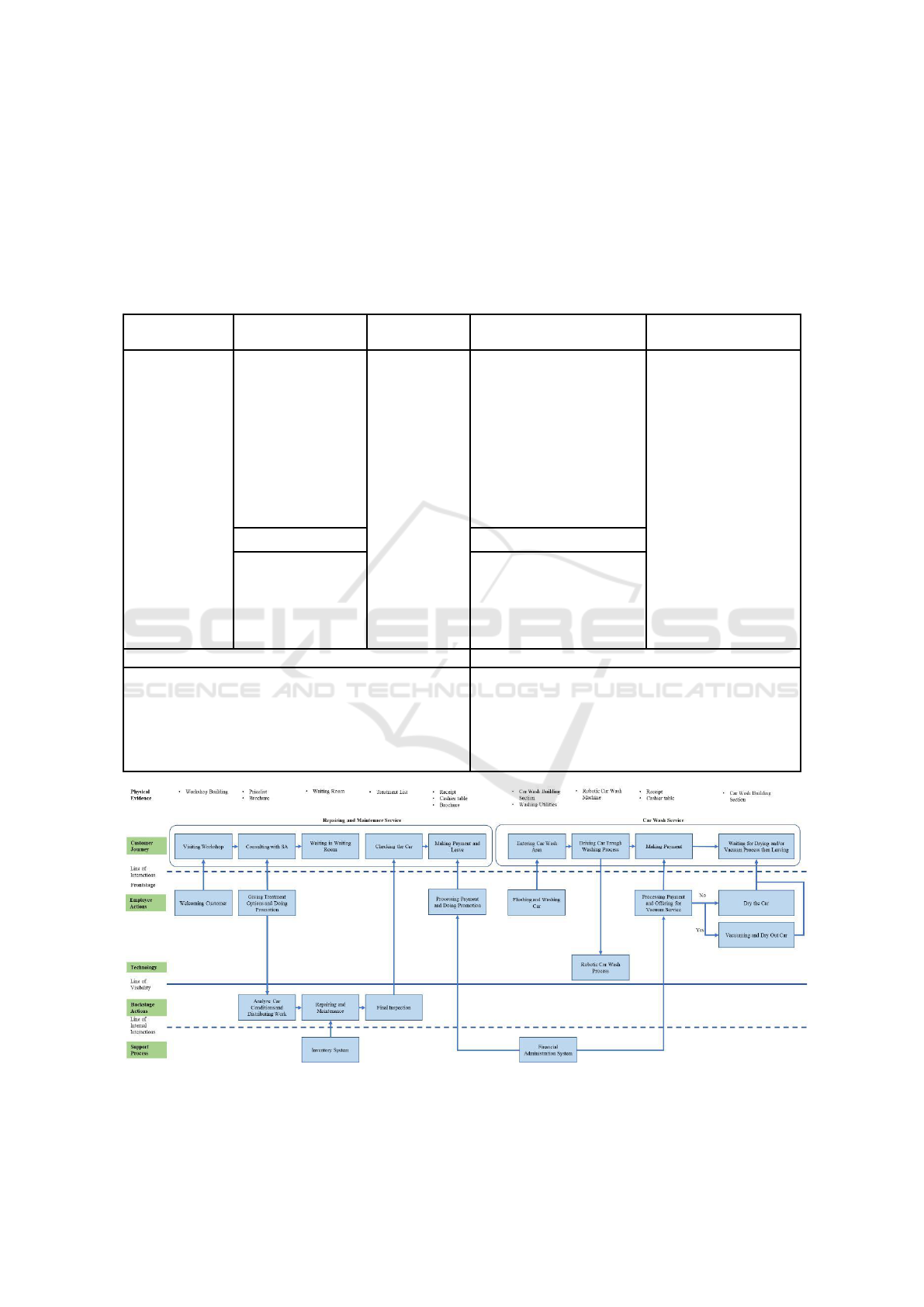

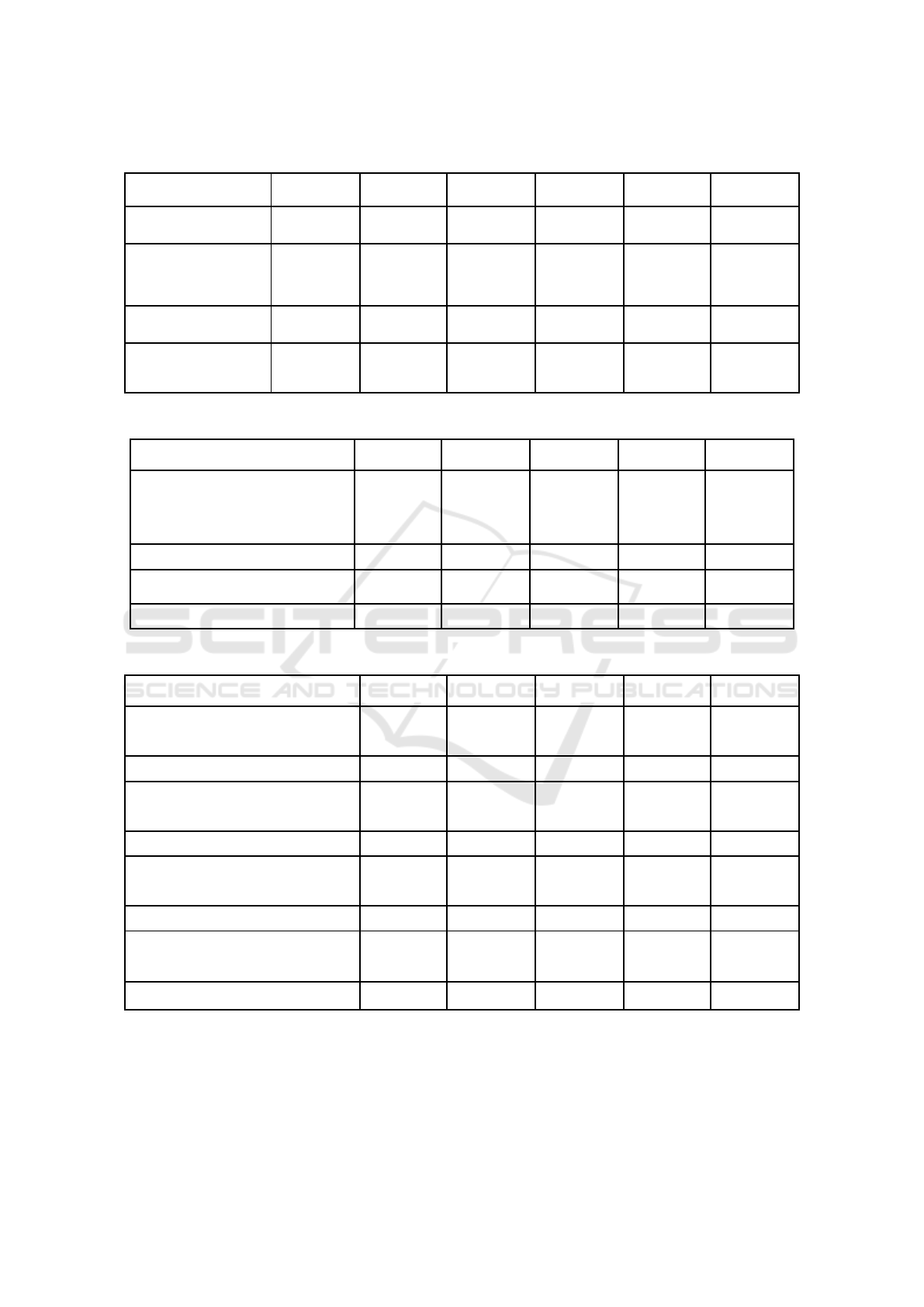

2.3 XYZ Workshop’s Business Process

Business process in XYZ Workshop is summarized

in the form of service blueprint. Service blueprint

XYZ Workshop can be seen in Figure 1.

The XYZ Workshop is good enough in carrying

out its business processes, however, the authors find

several conditions in the field that can be improved

again. For example, financial administration systems

that have not been computerized and integrated. The

cashier at the XYZ Workshop still uses handwritten

payment receipts so that the process of recording

sales reports carried out by administrative staff is

done manually one by one into the computer.

Another condition is the stall capacity for vehicle

repair and maintenance is still not used optimally

because of the fluctuating number of customers. On

the other hand, the number of transactions for repairs

and maintenance still does not meet the target.

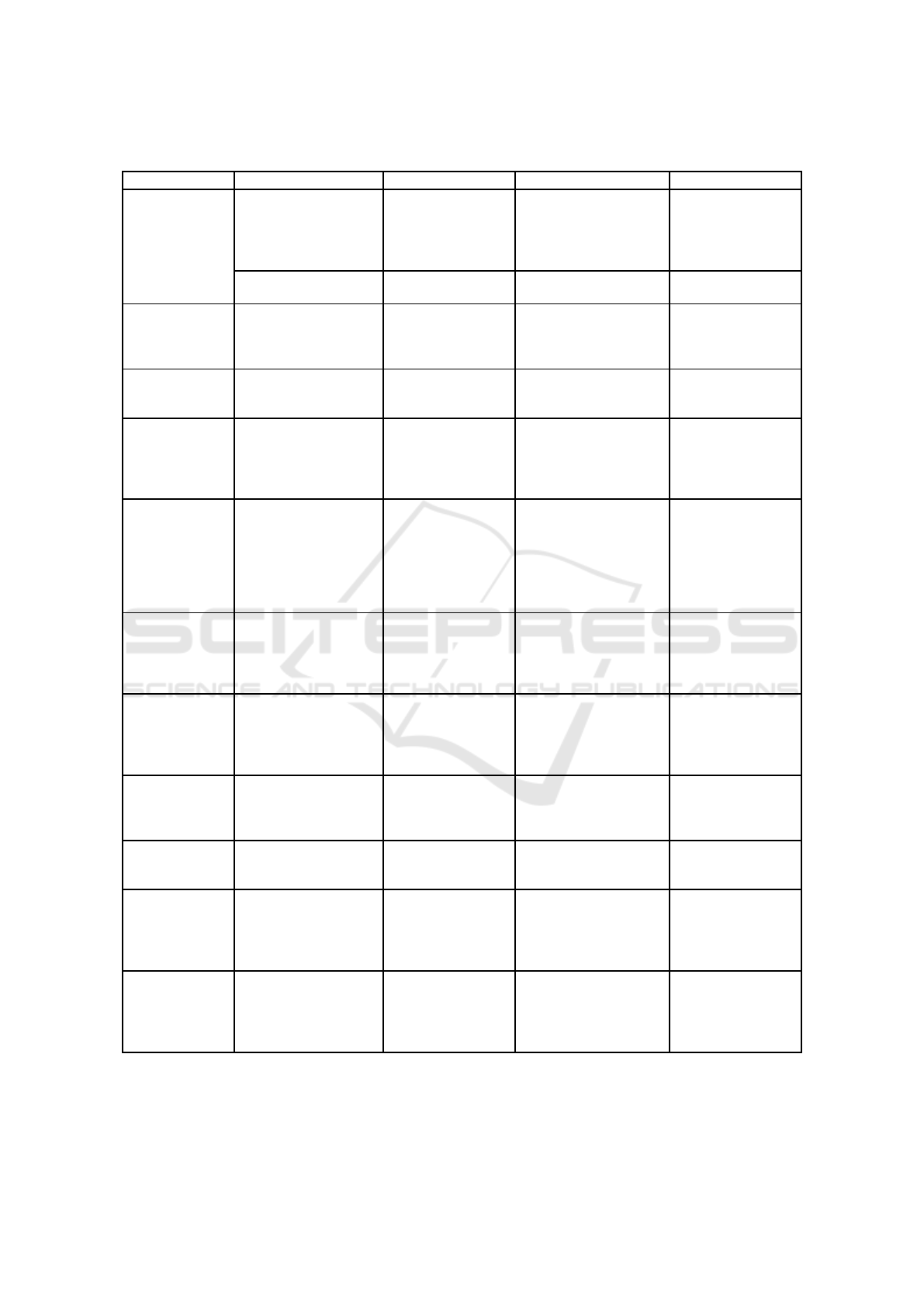

2.4 GAP Analysis

Based on the mapping of the SME's conditions

carried out on the XYZ Workshop through the results

of interviews, observations and also the identification

of the analysis of internal, external conditions and

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

439

SWOT analysis, it can be seen that the gap

between the ideal conditions and the actual

conditions that occur. Gap analysis can be seen in

Table 2.

Based on the gap analysis that has been done to the

XYZ Workshop, it can be seen that there are several

problems which then cause gaps. Therefore, Pareto

analysis will be carried out, namely a priority scale

based on the level of urgency for SMEs. Levels of

problems from the highest to the lowest will be seen

based on calculations that use values and weights on

each problem that exists. Pareto states that 80% of

disorders originate from 20% of problems

experienced.

Table 1: XYZ Workshop’s Business Model Canvas.

KEY

KEY ACTIVITIES

VALUE

CUTOMERS

CUSTOMER

PARTNERS

PROPOSITION

RELATIONSHIPS

SEGMENT

-

Car repair and

Via:

Behavioral:

e-mail, telephone, SMS,

maintenance

SA, Bridgestone official

-

Car owner with

- Bridgestone

-

Car wash

-

One stop

website, advert website

expired free service

tire’s distributor

-

Purchasing tire,

service

In a way:

period from dealer

- Lubricant’s

spare part, and

-

Nice and

-

Service time reminder

- Need to repair and

distributor

lubricants

clean

-

Ask customer

maintain car machine

- Hyundai and

-

Selling tire, spare

building

satisfaction

-

Routine chek

proton spare

part, and

-

Competitive

-

Consultation

Psycographic:

parts factory

lubricants

price

-

Offering a discount and

Not having automotive

- Spare part

-

Promotion

-

Guaranteed

souvenir

skills

agents (Toyota,

quality

Demographic:

KEY RESOURCES

CHANNEL

Honda)

-

Friendly

-

Adults age 25-50

- Yayasan

Physical:

service

-

Middle income’s man

Dharma Bakti

Land, building, and

-

Pre and after

Direct selling in workshop

and women

Astra (YDBA)

equipment

Service

Geographic:

Non Physical:

location

Depok city area radius 5-

Owners equity,

10 km from workshop

human resources

Cost

• Revenue

Variable cost: employee’s incentive, purchasing, promotion

Fixed cost: employee’s salaries, building depreciation,

electricity, tax

• General repair and car maintenance service

• Robotic car wash service

• Car tire sales

• Spare part sales

• Lubricant sales

• Businss to business partnership

Figure 1: Service Blueprint XYZ Workshop.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

440

Table 2: Gap Analysis on XYZ Workshop.

Indicator

Actual Conditions

Ideal Conditions

Gap

Follow up plan

The recording of sales

Recording of

Sales receipts still use

Make a

transactions has not

computerized and

handwriting at the cashier

computerized

Business

been computerized and

integrated sales

and inputted to Ms. Excel

system for

Process, SWOT,

integrated

transactions

by admin staff

recording sales

and IFE Matrix

transactions

Stall capacity has not

Stall capacity is

The number of customers

Improve marketing

been used optimally

used optimally

is volatile

communication

Don't have a long-term

Have a long-term

Difficulty in determining

Make a long-term

VRIO, SWOT,

financial plan

financial plan

the company's strategy

financial plan

and IFE Matrix

because it does not have a

long-term financial plan

Social media has not

Social media is

Website and social media

Manage website and

PESTEL

been utilized optimally

utilized optimally

(Facebook) are not

social media

managed properly

Online taxi drivers are

Online taxi drivers

Special offers for online

Cooperate with

PESTEL,

not yet targeted

become regular

taxi drivers have not been

online taxi

SWOT, and

customers

well communicated and

cooperatives

EFE Matrix

have not cooperated with

online taxi cooperatives

Complete products and

Complete products

A slightly higher price

Service

services, with a slightly

and services, at

must be adjusted to the

development to

Marketing Mix

higher price compared

attractive prices

value given to consumers

ensure compatibility

to other general

(equal to or

between the price

workshops

cheaper) compared

and value that is to

to other general

be conveyed to

workshops

consumers

Marketing Mix,

The strategic location is

The location is

When there is a traffic

Open a new branch

easily accessible to

easily accessible to

jam in front of the

in a different

SWOT, dan

consumers when not

consumers at any

workshop, the customers

location

EFE Matrix

have traffic jam

time

reduce in number

Promotion: Still limited

Promotion: Routine

Promotional activities

Add the upselling

Marketing Mix

and less attractive

and attract

have not been managed

process to increase

consumers

properly and optimally

the number of gen.

and SWOT

repair and

maintenance sales

SWOT Analysis

Low customer loyalty

High customer

The frequency of

Creating loyalty

loyalty

fluctuating consumer

programs to

arrivals

increase customer

loyalty

SWOT Analysis

Do not have a complete

Has a complete

Consumer data collection

Creating a

consumer data

consumer data

has not been done

consumer data

collection system

collection system

optimally

collection system

SWOT Analysis

There is no individual

There are individual

Evaluation has not yet

Create an individual

and IFE Matrix

performance rating

performance rating

reached individual

KPI-based

system

systems

employees

employee

performance

appraisal system

Business Model

Key Partner:

There are other

Decreased sales of tire

Collaborating with

Canvas

Bridgestone as a

brands of tire

products

several tire

supplier becomes the

suppliers to meet

suppliers to increase

sole partner of tire

consumer needs

the variety of brands

products

and types of tires

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

441

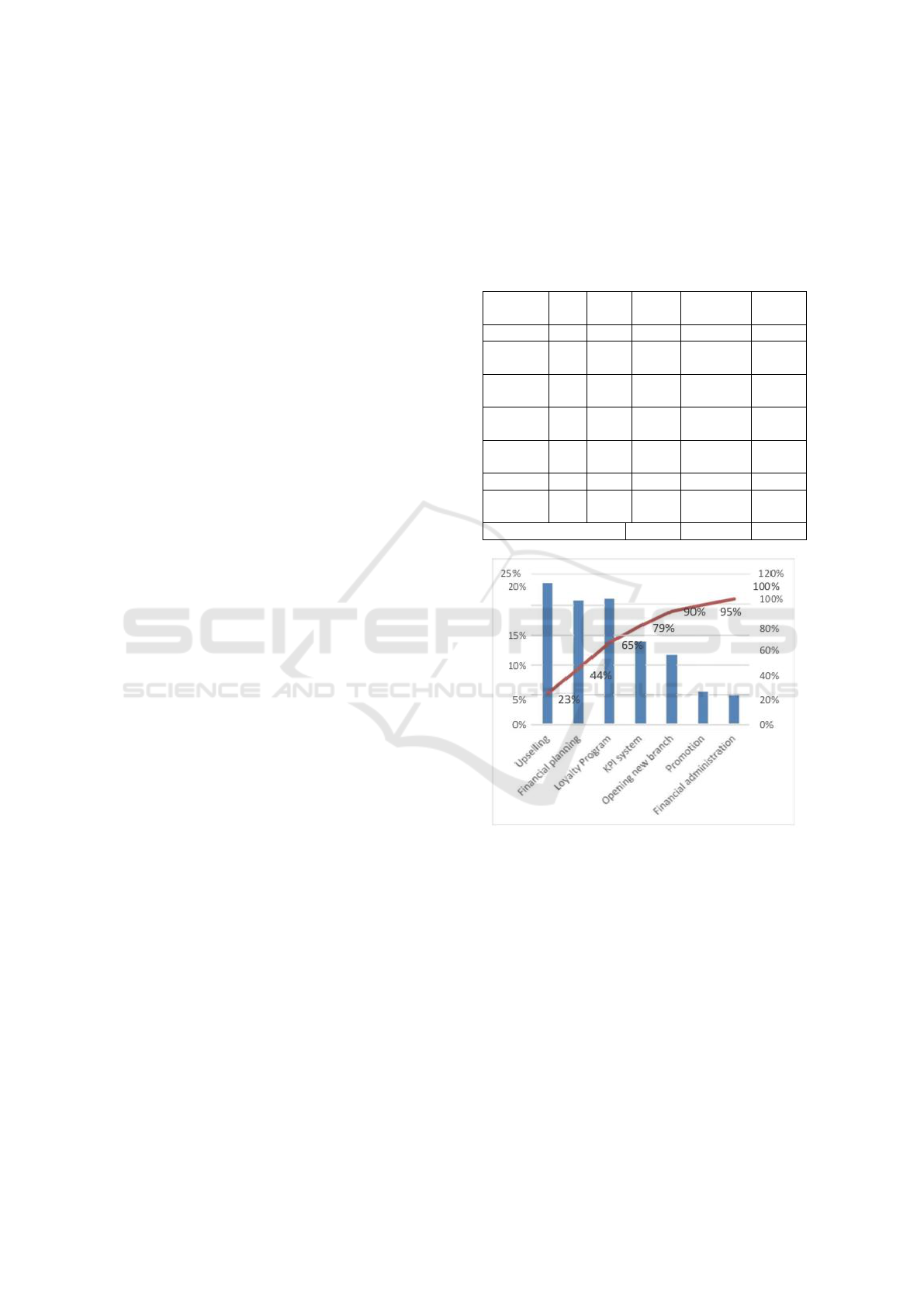

That way, this concept makes it easier for companies

to see what problems are most important to solve.

Value : 1 (most difficult to do) - 10 (easiest to do)

Weight: 1 (least significant) - 10 (Most significant)

(1)

Contributions: Value x Weight

%Distribution =

× 100%

The result of calculating the contribution of the

XYZ Workshop can be seen in Table 3.

Based on the Pareto diagram, there are four

problems that require the attention of the XYZ

workshop, namely loyalty programs, upselling, long-

term financial plans, and individual KPI systems.

Problems with loyalty programs, upselling, and

individual KPI systems will be followed up by other

coaches.

The need to make a financial plan contributes 14%

of the total problem and is one of the problems which

includes 80% of the impact. The results of the Pareto

are the basis for the writer to raise the issue that XYZ

Workshop did not have financial planning and

financial performance analysis. The financial

planning used to overcome the gaps in financial

management aspects will be discussed further in the

next chapter.

3 DISCUSSION OF THE

IMPLEMENTATION OF

BUSINESS COACHING

3.1 Business Coaching Implementation

The author focuses on the discussion of financial

management aspects when implementing business

coaching process. Based on the gap analysis on the

XYZ Workshop, the author raised the issue that was

the focus of this business coaching, namely XYZ

Workshop did not have long-term financial planning.

Based on the results of the assessment of the

independence of YDBA SME Partners, it is known

that there is no long-term financial planning in the

XYZ Workshop.

XYZ Workshop had a plan to expand its business by

opening a new branch. The plan is also based on

difficulty in accessing workshop because of traffic

congestion and a decrease in the number of customers.

With the plan, the management of the XYZ Workshop

needs to assess the feasibility of investing by opening a

new branch that will be carried out by another coach

team. In addition to the investment feasibility,

management also requires long-term planning in the

XYZ Workshop so that it can be used as a tool to

analyze whether or not to open a new branch. The stages

in carrying out long-term financial planning will be

outlined in the next section

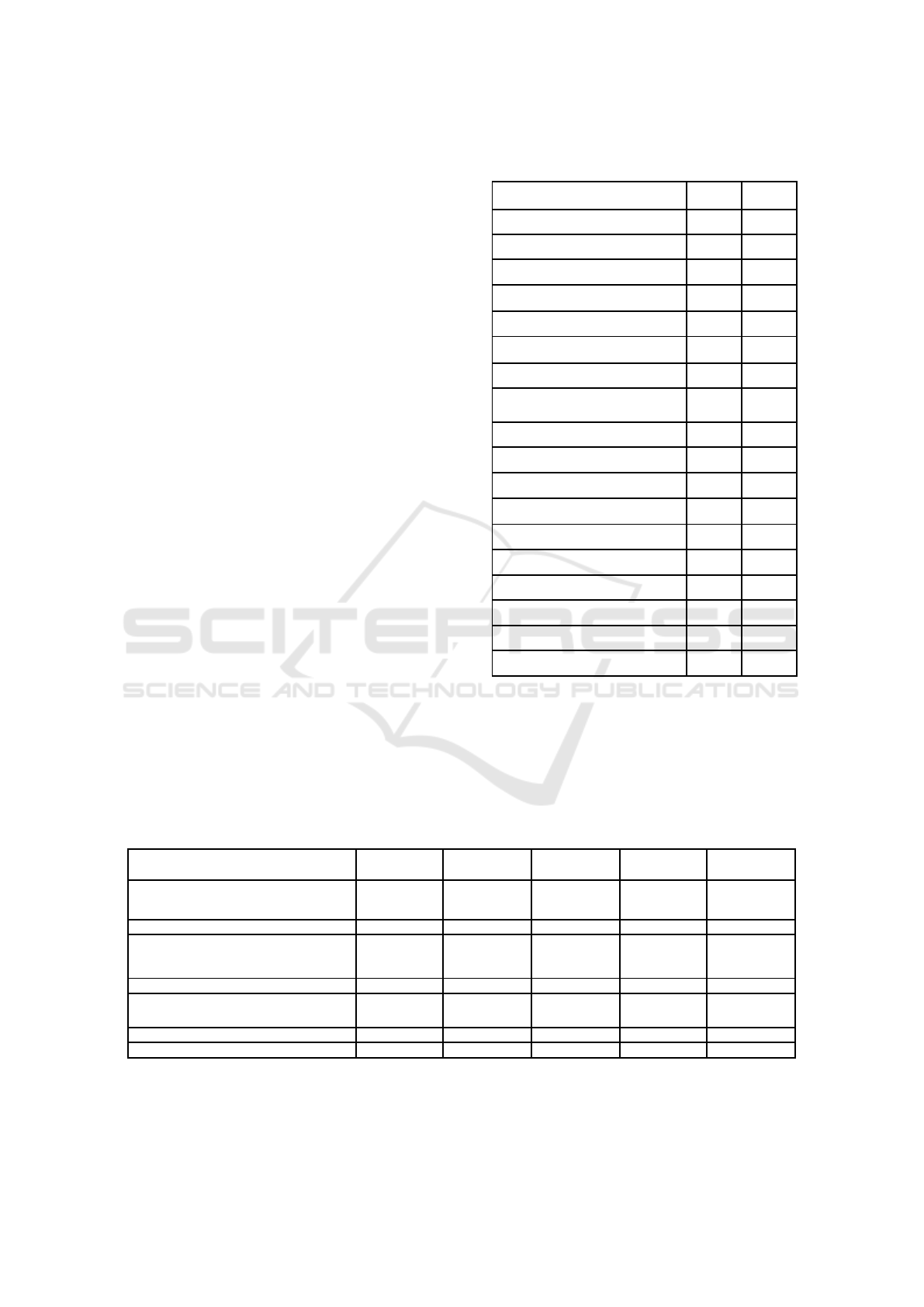

Table 3: Gap Codification and Urgency Value at XYZ

Workshop.

Codification

Value

Weight

Contribu

tion

Distribution

Accumula

tion

Upselling

8

9

72

23%

23%

Financial

Planning

9

7

63

21%

44%

Loyalty

Program

8

8

64

21%

65%

KPI

System

7

6

42

14%

79%

Open new

branch

5

7

35

11%

90%

Promotion

4

4

16

5%

95%

Financial

Admin

3

5

15

5%

100%

Total

307

100%

Figure 2: Pareto Diagram.

3.1.1 Financial Performance Analysis

Analysis of financial performance is carried out by

calculating financial ratios. These financial ratios

are divided into various analyzes, namely,

profitability, liquidity, solvency, and turnover. The

data needed in making these analyzes is the income

statement and balance sheet of the XYZ Workshop.

The obstacle faced in making an analysis of

financial performance is the collection of financial

statement data. The difficulty of collecting data

happened because the XYZ Workshop was very

private in conducting their business. The result is

that the financial statements used for analysis only

have a period of two years.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

442

3.1.2 Prospective Analysis

The process of making financial projections starts

with taking information that can be obtained from

financial statements such as the proportion of cash

compared to sales. This information can be seen in

the table below.

Table 4: Input Data for Forecasting.

2015

2016

Average

Rp ‘000

Rp ‘000

Cash

Rp

77.295

Rp

89.295

% Cash from

3,29%

3,25%

3,27%

sales

Sales

Rp 2.346.198

Rp 2.747.487

Inventory

Rp 2.046.149

Rp 2.191.254

COGS

Rp 1.283.527

Rp 1.543.879

Inventory/COG

S

159,42

%

141,93%

150,67%

Account

Receivable

(AR)

Rp

10.302

Rp

12.157

AR/Sales

0,44%

0,44%

0,44%

Purchasing

Rp 1.319.894

Rp 1.688.984

Debt

Rp

438.754

Rp

310.410

Debt/Purchasin

g

33,24%

18,38%

25,81%

Retained

earning

Rp 1.677.494

Rp 1.843.883

Net income

Rp

207.925

Rp

246.526

The average data percentage of the amount of

cash from sales and receivables is used as a

reference in conducting financial projections.

However, the reference data used to project

inventory amounts and account receivable uses the

latest year data. This is due to an increase in

performance from the previous year. XYZ

Workshop inventory decreased from 159.42% to

141.93%. Plus, the XYZ Workshop trade debt also

decreased from 33.24% to 18.38%. Therefore, it is

expected that the XYZ Workshop can maintain that

performance.

The next step is to look for information other

than those contained in financial statements, namely

data on current year's inflation rate, a number of

customers, sales price, and purchase price. In the

case of XYZ Workshop, due to the variety of

products sold in the form of spare parts, tires, and

oil, the selling price and purchase price are the

results of the average calculation. This information

can be seen in the table 5.

Table 5: Additional Data not Found in The Financial

Statements.

2015

2016

Rp ‘000

Rp ‘000

Inflation

6,38%

3,53%

Number of customers

328

367

Selling Price (Average)

Rp 7.153

Rp 7.479

Purchasing Price

Rp 3.913

Rp 4.202

(Average)

Table 6: Estimation of Historical Nominal and Real Price

Increases

2016

Nominal increase in administrative and selling

17,53%

expenses

Real increase in administrative and selling

13,52%

expenses

Nominal increase in Selling price

4,56%

Real increase in Selling price

0,99%

Nominal increase in Purchasing price

7,40%

Real increase in Purchasing price

3,73%

Nominal increase in Sales revenues

17,10%

"Real" increase in sales revenues

13,11%

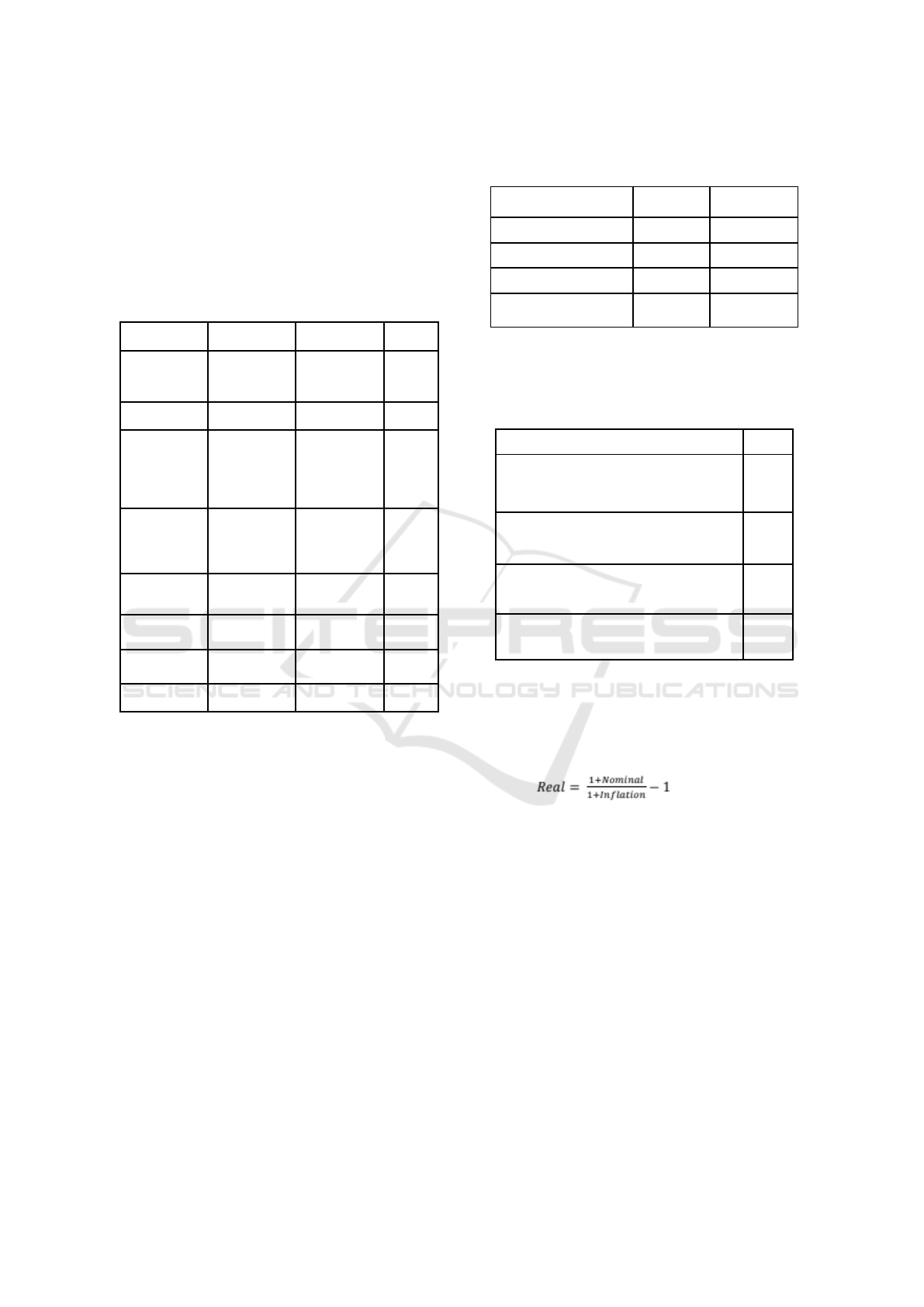

Next is calculating the increase in costs, sales,

and purchases in real terms based on the inflation

rate in the current year. These calculations use the

Fisher equation (Velez-Pareja & Tham, 2009) as

follows.

(2)

The calculation results can be seen in the table 6.

The next step is to prepare a table of prediction

data to serve as input data in making financial

projections. The data table 7 is compiled using data

from calculations that have been done before.

The inflation rate prediction is obtained from the

official website of Bank Indonesia. In addition, the

prediction of an increase in sales volume was

obtained from the management target of the XYZ

Workshop which was adjusted to the capacity of

the workshop. Based on the YDBA UKM Partner

Independence Form Assessment (2015), the capacity

of the newly used workshop is 70% of the overall

capacity of the workshop. Therefore, it is expected

that within 5 years the capacity can be used

optimally.

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

443

The next step is to calculate the nominal

predictions of sales, purchases, and salary costs based

on the previous table. Calculation of nominal

numbers is done using the Fisher equation (Velez-

Pareja & Tham, 2009) as follows. The calculation

results can be seen in Table 8.

Table 7: Input data.

2017

2018

2019

2020

2021

Inflation rate (BI Prediction)

4,00%

3,50%

3,50%

3,00%

3,00%

Real increase in selling price

0,99%

0,99%

0,99%

0,99%

0,99%

Real increase in purchase price

3,73%

3,73%

3,73%

3,73%

3,73%

Real increase in payroll expenses

18,31%

18,31%

18,31%

18,31%

18,31%

Real increase n selling and

administration expenses

13,52%

13,52%

13,52%

13,52%

13,52%

Increase in sales volume (units) (internal

estimates)

6,00%

6,00%

6,00%

6,00%

6,00%

Inventory as % of COGS

141,93%

141,93%

141,93%

141,93%

141,93%

Accounts receivable as % of sales

0,44%

0,44%

0,44%

0,44%

0,44%

Accounts payable as % of purchases

18,38%

18,38%

18,38%

18,38%

18,38%

Minimum cash required as % of sales

revenues

3,27%

3,27%

3,27%

3,27%

3,27%

Table 8: Nominal Increase in Prices and Growth in Units.

2017

2018

2019

2020

2021

Selling

5,03%

4,53%

4,53%

4,02%

4,02%

Purchase

7,88%

7,37%

7,37%

6,85%

6,85%

Payroll expenses

23,04%

22,45%

22,45%

21,86%

21,86%

Increase factor in volume

6,00%

6,00%

6,00%

6,00%

6,00%

Table 9: Sales Prediction Calculation.

2016

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Number of

Customers, Q

367

389,40

412,77

437,53

463,78

491,61

Selling price, P

Rp

7.479

Rp

7.928

Rp

8.403

Rp

8.908

Rp

9.442

Rp

10.008

Total sales, PxQ

Rp 2.747.487

Rp 3.087.080

Rp 3.468.640

Rp 3.897.363

Rp 4.379.078

Rp 4.920.331

Forecast for unit

cost

Rp

4.202

Rp

4.534

Rp

4.868

Rp

5.226

Rp

5.584

Rp

5.967

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

444

Table 10: Purchasing Prediction Calculation.

2016

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Units sold

367,36

389,40

412,77

437,53

463,78

491,61

Final inventory in units

521,40

552,68

585,85

621,00

658,26

697,75

Initial inventory in units

522,88

521,40

552,68

585,85

621,00

658,26

Purchases in units

420,69

445,93

472,68

501,04

531,11

Forecasted Unitary cost

R

p

4.203

R

p

4.534

R

p

4.868

R

p

5.226

R

p

5.584

R

p

5.967

Table 11: Cost of Goods Sold (COGS) and Overhead and Administrative and Selling Expenses Calculation.

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Initial inventory in dollars

Rp 2.191.254

Rp 2.505.855

Rp 2.851.846

Rp 3.245.609

Rp 3.675.897

Purchases in dollars

Rp 1.907.377

Rp 2.170.734

Rp 2.470.454

Rp 2.797.975

Rp 3.168.917

Final inventory in dollars

Rp 2.505.855

Rp 2.851.846

Rp 3.245.609

Rp 3.675.897

Rp 4.163.229

COGS

Rp 1.592.776

Rp 1.824.743

Rp 2.076.691

Rp 2.367.688

Rp 2.681.585

Increase in administrative and selling

expenses

18,07%

17,50%

17,50%

16,93%

16,93%

Administrative and selling expenses

Rp 1.037.891

Rp 1.219.498

Rp 1.432.881

Rp 1.675.469

Rp 1.959.126

Table 12: Purchase and Payment Prediction Calculation.

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Total sales revenues

Rp 3.087.077

Rp 3.468.640

Rp 3.897.363

Rp 4.379.078

Rp 4.920.332

Credit sales

Rp

13.607

Rp

15.289

Rp

17.179

Rp

19.302

Rp

21.688

Inflow of sales revenues for current year

Rp 3.073.470

Rp 3.453.350

Rp 3.880.184

Rp 4.359.775

Rp 4.898.644

Total purchases

Rp 1.907.377

Rp 2.170.734

Rp 2.470.454

Rp 2.797.975

Rp 3.168.917

Purchases on credit

Rp

350.548

Rp

398.949

Rp

454.033

Rp

514.226

Rp

582.400

Purchases paid the same year

Rp 1.556.829

Rp 1.771.785

Rp 2.016.421

Rp 2.283.749

Rp 2.586.517

Inflow of sales revenues for current year

Rp 3.073.470

Rp 3.453.350

Rp 3.880.184

Rp 4.359.775

Rp 4.898.644

Inflows from Accounts Receivables

Rp

12.157

Rp

13.607

Rp

15.289

Rp

17.179

Rp

19.302

Total inflows

Rp 3.085.627

Rp 3.466.958

Rp 3.895.474

Rp 4.376.954

Rp 4.917.946

Purchases paid the current year

Rp 1.556.829

Rp 1.771.785

Rp 2.016.421

Rp 2.283.749

Rp 2.586.517

Payment of Accounts Payable

Rp

310.410

Rp

350.548

Rp

398.949

Rp

454.033

Rp

514.226

Total payments for purchases

Rp 1.867.239

Rp 2.122.333

Rp 2.415.370

Rp 2.737.782

Rp 3.100.744

Nominal = ((1 + Real) × (1 + Inflation)) – 1 (3)

The making of financial projections is then carried

out by performing calculations based on input data

from the previous tables. Calculations can be seen in

Table 9, 10, 11, and 12.

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

445

3.2 Discussion of Business Coaching

Results

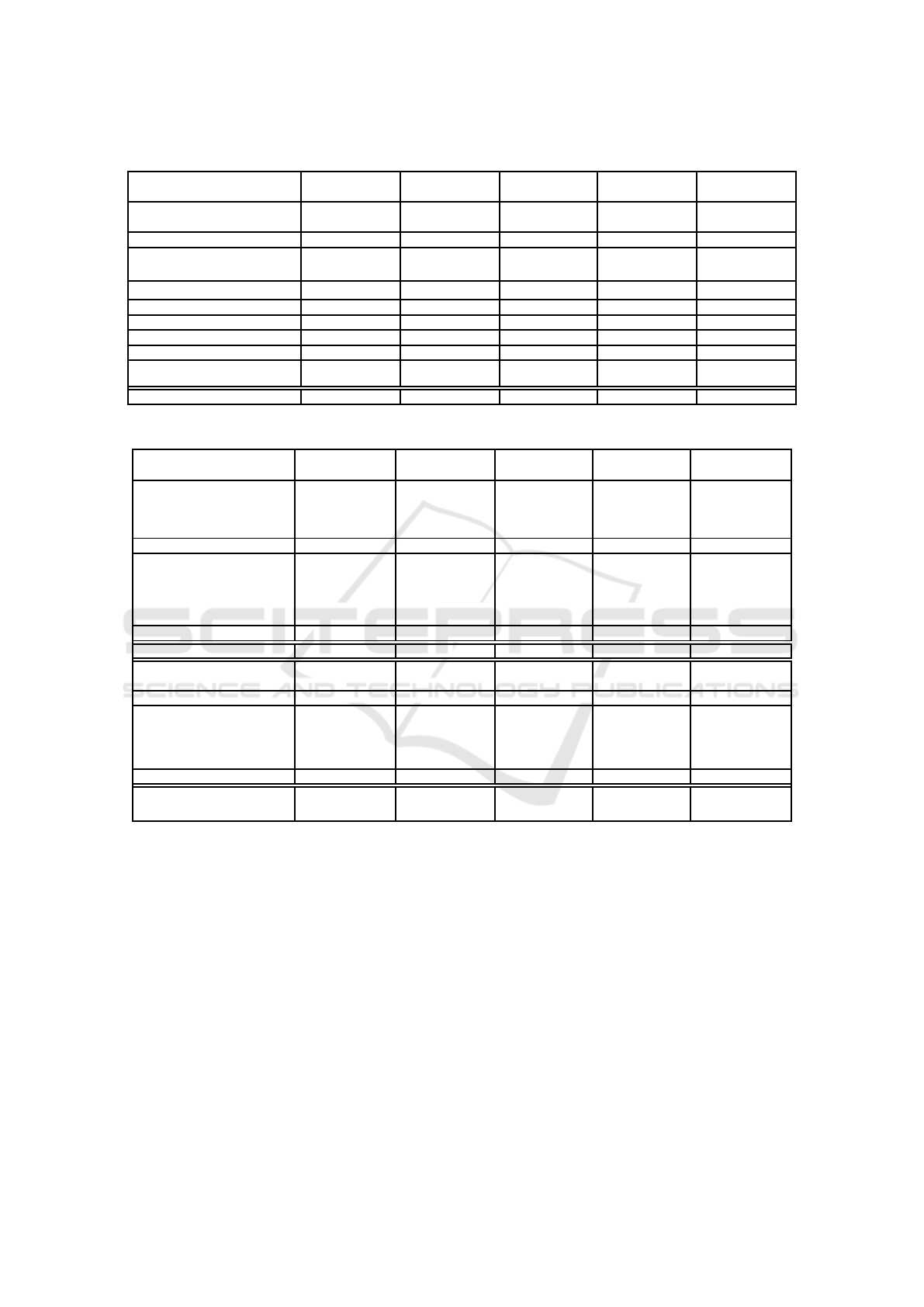

3.2.1 Financial Performance Analysis

Results

Based on the information obtained from the results of

interviews with informants and observations on the

XYZ Workshop, it is known that XYZ Workshop has

not performed financial performance analysis

regularly. Through the implementation of business

coaching, an analysis of the financial performance of

the XYZ Workshop was conducted from 2015 to

2016. There are several calculations carried out,

namely, profitability, liquidity, solvency, and

turnover. The results of these analyzes can be seen in

Table 13.

Based on the table above, the overall profitability

of the XYZ Workshop in 2016 has increased from the

previous year. The increase in profitability was

caused by an increase in sales from 2015 Rp

2,346,198.00.00 to Rp. 2,747,487,464 in 2016. On the

other hand, an increase in ROA could be caused by a

reduction in fixed assets of XYZ Workshop in 2016

6% from 2015. On the other hand, the increase in

ROE of the XYZ Workshop indicates that workshop

management is better able to utilize the equity

invested by the capital voters of the XYZ Workshop.

The table above also shows the results of calculating

the XYZ Workshop liquidity ratio.

Table 13: Analysis of Financial Performance of XYZ

Workshop.

Profitability Ratio

2015

2016

Profit Margin

0,089

0,090

ROA

0,062

0,072

ROE

0,072

0,080

Liquidity Ratio

Current Ratio

4,515

6,577

Quick Ratio

0,185

0,291

Cash Ratio

0,164

0,256

Working Capital to Total Assets

Ratio

0,495

0,565

Solvability Ratio

Total Debt Ratio

0,141

0,101

Debt to Equity Ratio

0,164

0,113

Turn Over Ratio

Total Asset TO

0,699

0,799

Fixed Asset TO

1,916

2,397

Receivable TO

227,742

226,000

Inventory TO

0,627

0,705

Average Day Inventory

582

518

Working Capital Turnover

1,412

1,413

Overall, the XYZ Workshop liquidity ratio in 2016

has increased from the previous year. This increase

was caused by short-term debt compared to the

previous year. In addition, this also shows the better

management of the company's margin of safety every

year.

Table 14: Cash Projection of XYZ Workshop.

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Cash inflows

Total AR plus sales on cash

Rp 3.085.627

Rp 3.466.958

Rp 3.895.474

Rp 4.376.954

Rp 4.917.946

Total inflows

Rp 3.085.627

Rp 3.466.958

Rp 3.895.474

Rp 4.376.954

Rp 4.917.946

Cash outflows

Total payments for purchases

Rp 1.867.239

Rp 2.122.333

Rp 2.415.370

Rp 2.737.782

Rp 3.100.744

Administrative and selling expenses

Rp 1.037.891

Rp 1.219.498

Rp 1.432.881

Rp 1.675.469

Rp 1.959.126

Total cash outflows

Rp 2.905.130

Rp 3.341.830

Rp 3.848.251

Rp 4.413.250

Rp 5.059.870

Net cash balance (NCB) before fixed assets

Rp

180.496

Rp

125.127

Rp

47.222

-Rp

36.296

-Rp

141.924

purchase

NCB

Rp

180.496

Rp

125.127

Rp

47.222

-Rp

36.296

-Rp

141.924

Cumulated NCB

Rp

269.791

Rp

394.919

Rp

442.141

Rp

405.845

Rp

263.921

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

446

Table 15: Income Statement Projection of XYZ Workshop.

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Sales

Rp 3.087.077

Rp 3.468.637

Rp 3.897.363

Rp 4.379.078

Rp 4.920.332

COGS

-Rp 1.592.776

-Rp 1.824.743

-Rp 2.076.691

-Rp 2.367.688

-Rp 2.681.585

Gross Profit

Rp 1.494.301

Rp 1.643.897

Rp 1.820.672

Rp 2.011.390

Rp 2.238.747

Administration and General

-Rp 1.037.891

-Rp 1.219.498

-Rp 1.432.881

-Rp 1.675.469

-Rp 1.959.126

Expenses

Operating Profit

Rp

456.410

Rp

424.399

Rp

387.791

Rp

335.921

Rp

279.621

Depretiation

-Rp

78.515

-Rp

78.515

-Rp

78.515

-Rp

78.515

-Rp

78.515

EBIT

Rp

377.895

Rp

345.884

Rp

309.276

Rp

257.406

Rp

201.106

Interest Expenses

Profit Before Tax

Rp

377.895

Rp

345.884

Rp

309.276

Rp

257.406

Rp

201.106

Tax

Net Income for the Year

Rp

377.895

Rp

345.884

Rp

309.276

Rp

257.406

Rp

201.106

Table 16: Balance Sheet Projection of XYZ Workshop.

2017

2018

2019

2020

2021

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Rp ‘000

Current Assets

Cash

Rp

269.791

Rp

394.919

Rp

442.141

Rp

405.845

Rp

263.921

Account Receivable

Rp

13.607

Rp

15.289

Rp

17.179

Rp

19.302

Rp

21.688

Inventory

Rp 2.505.855

Rp 2.851.846

Rp 3.245.609

Rp 3.675.897

Rp 4.163.229

Total Current Assets

Rp 2.789.254

Rp 3.262.054

Rp 3.704.930

Rp 4.101.044

Rp 4.448.839

Fixed Assets

Office Supply

Rp

1.193

Rp

1.193

Rp

1.193

Rp

1.193

Rp

1.193

Workshop Equipment’s

Rp

136.450

Rp

136.450

Rp

136.450

Rp

136.450

Rp

136.450

Building

Rp

608.662

Rp

608.662

Rp

608.662

Rp

608.662

Rp

608.662

Land

Rp

400.000

Rp

400.000

Rp

400.000

Rp

400.000

Rp

400.000

Total Fixed Assets

Rp 1.146.305

Rp 1.146.305

Rp 1.146.305

Rp 1.146.305

Rp 1.146.305

TOTAL ASSETS

Rp 3.935.559

Rp 4.408.359

Rp 4.851.235

Rp 5.247.350

Rp 5.595.144

LIABILITIES

Account Payable

Rp

350.548

Rp

398.949

Rp

454.033

Rp

514.226

Rp

582.400

TOTAL LIABILITIES

Rp

350.548

Rp

398.949

Rp

454.033

Rp

514.226

Rp

582.400

EQUITY

Paid in Capital

Rp 1.000.000

Rp 1.000.000

Rp 1.000.000

Rp 1.000.000

Rp 1.000.000

Retained Earning

Rp 1.460.811

Rp 1.917.221

Rp 2.341.621

Rp 2.729.412

Rp 3.065.333

Net Income

Rp

377.895

Rp

345.884

Rp

309.276

Rp

257.406

Rp

201.106

TOTAL EQUITY

Rp 2.838.706

Rp 3.263.105

Rp 3.650.897

Rp 3.986.818

Rp 4.266.439

TOTAL LIABILITIES AND

Rp 3.935.559

Rp 4.408.359

Rp 4.851.235

Rp 5.247.350

Rp 5.595.144

EQUITY

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

447

The solvability ratio calculation in the table above

shows that there is a decrease in the total debt ratio

and the debt to equity ratio from 2015 to 2016. This

is due to the short-term debt of the XYZ Workshop

which has also decreased. Based on the calculation

of the ratio also shows the ability of XYZ Workshop

in fulfilling its financial obligations increased in

2016.

Overall, the XYZ Workshop turnover ratio

evaluation shows an increasing trend every year,

meaning that the management of XYZ Workshop can

better manage company assets. The biggest ratio on

this turnover ratio is the receivables turnover ratio,

which indicates that the sales obtained by the

company come from sales in cash. However, the

results of calculating average day inventory show a

number that is not good because the number of days

of inventory is in the warehouse for more than one

year. This indicates that the XYZ Workshop has

more inventory than the number of sales.

The conclusion from the analysis of the financial

performance of the XYZ Workshop is the financial

performance of the XYZ Workshop during 2015 and

2016 as a whole is quite good. This is indicated by an

increase in various indicators, namely increased

profitability, ability to pay debts, and turnover of

XYZ Workshop assets.

3.2.2 Financial Projection Results

The making of long-term financial projections is

done to find out the prospect of financial benefits that

will be obtained in the future. In addition, the XYZ

Workshop has no previous long-term financial

projections. Through the business coaching process,

XYZ Workshop is expected to be able to make

financial projections independently and be carried

out routinely. In addition, the results of the financial

projections conducted are expected to provide an

overview of the development opportunities and

business continuity of the XYZ Workshop. The

results of the cash budget projection, income

statement, and financial balance of the XYZ

Workshop over the next five years can be seen in

Table 14, Table 15 and Table 16.

Based on cash budget projections, it can be seen

that the prediction of the amount of cash that will be

received by the XYZ Workshop will always decrease

from year to year. This is due to the predicted

purchase of inventory will always increase even

though supplies more warehouse than sold. These

predictions are obtained from historical purchase data

which also increased. Net income is also projected to

decline from year to year even though sales continue

to increase. This is caused by the increase in the cost

of goods sold and overall costs along with predictions

of an increase in the number of customers of XYZ

Workshop. However, the XYZ Workshop is

predicted to continue to benefit for the next five

years.

Overall, the financial projections of the XYZ

Workshop did not show encouraging results.

However, these results indicate that XYZ Workshop

needs to open a new branch to be able to develop its

business. This is due to the growth of the XYZ

Workshop which is predicted to decline even though

efforts have been made to increase sales. Long-term

financial projections can also be used as an

evaluation material for management to determine the

business strategy of XYZ Workshop in the future.

4. CONCLUSIONS

Based on the research objectives in the process of

implementing business coaching on XYZ

Workshop, conclusions can be obtained as follows:

1. Financial performance analysis can help the

management of XYZ Workshop in identifying

financial problems.

2. Long-term financial projections can provide an

overview of the prospects for future profits and

the costs needed to reach the target.

3. Financial performance of the XYZ Workshop in

2016 has increased from 2015.

4. XYZ Workshop financial projections show a

decline in net income even though sales have

increased.

The following action plan can be used as a

follow-up activity for implementing business

coaching on XYZ Workshop related to long-term

financial planning, namely:

1. Determine the strategy that will be carried out to

be able to achieve the sales targets determined by

the XYZ Workshop based on financial

projections.

2. Make a budget that is needed for each part or

department that refers to financial projections.

3. Conduct regular evaluations to be adapted to the

needs of the workshop.

4. Evaluate policies in making purchases and

improving inventory management.

Based on this study, the authors would also

recommend for further research involving more

historical data. In addition, comparison of financial

performance with other similar workshops is also

needed.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

448

ACKNOWLEDGEMENTS

Ir. Hasnul Suhaimi, MBA., Dony Abdul Chalid,

S.E.,M.M., Ph.D, Rambat Lupiyoadi, M.E., Hilda

Fachrizah, MM, Owner and employees of XYZ

Workshop.

REFERENCES

Bank Indonesia. (2018, July). Inflasi: Penetapan Target

Inflasi. December 5, 2018.

https://www.bi.go.id/id/moneter/inflasi/bi-dan-

inflasi/Contents/Penetapan.aspx

Passmore, J. (2010). Excellent in coaching: Panduan

lengkap menjadi coach profesional. Jakarta: Penerbit

PPM.

Velez-Pareja, I., & Tham, J. (2009). Prospective Analysis:

Guidelines for Forecasting Financial Statements. In R.

Vishwanath & C.

Krishnamurti (Eds.), INVESTMENT MANAGEMENT: A

MODERN GUIDE TO SECURITY ANALYSIS AND

STOCK SELECTION. https://doi.org/10.1007/s10551-

015-2769-z.For

World Bank. (2017). Middle Income Countries Overview.

Retrieved January 1, 2017, from http://www.

worldbank.org/en/country/mic/ove review

Long Term Financial Planning using Financial Performance Analysis and Prospective Analysis in XYZ Workshop

449