Do Free Cash Flow to Firm and Relative Valuation Method Work in

Valuing Building and Construction Companies?:

A Test in IDX in 2018

Riko Hendrawan and Florent Ardhi Permadi

Telkom University, Jalan GegerkalongHilir, Bandung, Indonesia

Keywords: DCF, Relative Valuation, Building Construction Companies.

Abstract: This research aimed to take a fair valuation in estimating the stock price at the building construction

companies listed in IDX 2018 using DCF method within the FCFF approach and relative valuation methods

including PER and PBV. Three scenarios involved; pessimistic scenario (average industry condition),

moderate scenario (the most potential condition) and optimistic scenario (the condition above industry

growth). The research data were derived from historical data 2013 - 2017 which considered as the reference

for the projection years; 2018-2022. Results of this research presented that using DCF method, in the

optimistic, moderate, and pessimistic scenario, the intrinsic value of ADHI is overvalued; WSKT is

overvalued; WIKA is undervalued, and PTPP is undervalued. Furthermore, in Relative Valuation method

within PER approach, the PER value of ADHI in the optimistic, moderate and pessimistic scenario is 4.19,

3.73, and 3.32; WSKT 3.51, 3.13, and 2.38; WIKA 33.8, 33.4, and 26; PTPP 13.7, 13.7, and 13.6. In PBV

approach, the PBV value of ADHI in optimistic, moderate and pessimistic scenario is 0.76, 0.64, and 0.54;

WSKT 0.64, 0.56, and 0.42; WIKA 4.03, 3.95, and 3.04; PTPP 2.49, 2.49, and 2.47. The conclusion of this

research recommends buying ADHI, WSKT, WIKA and PTPP shares.

1 BACKGROUND

The Ministry of Finance of the Republic of

Indonesia posited that there had been an increment

in the infrastructure budget from 2014-2018 which is

accounted for 154.7 trillion to 410.7 trillion. This

significant increase illustrates the infrastructure

sector to be the main focus of the government of the

2014-2019 period. Following, the IDX gives

company update on December 31, 2017, as table 1.1.

Out of the 16 construction companies listed on

the IDX, there are four construction companies

which are state-owned enterprises (BUMN), namely

PT Waskita Karya (Persero) Tbk (WSKT), PT Adhi

Karya (Persero) Tbk (ADHI), PT Wijaya Karya

(Persero) Tbk (WIKA), and PT PP (Persero) Tbk

(PTPP). In 2017, the four companies managed to

record positive performance and control most of the

market.

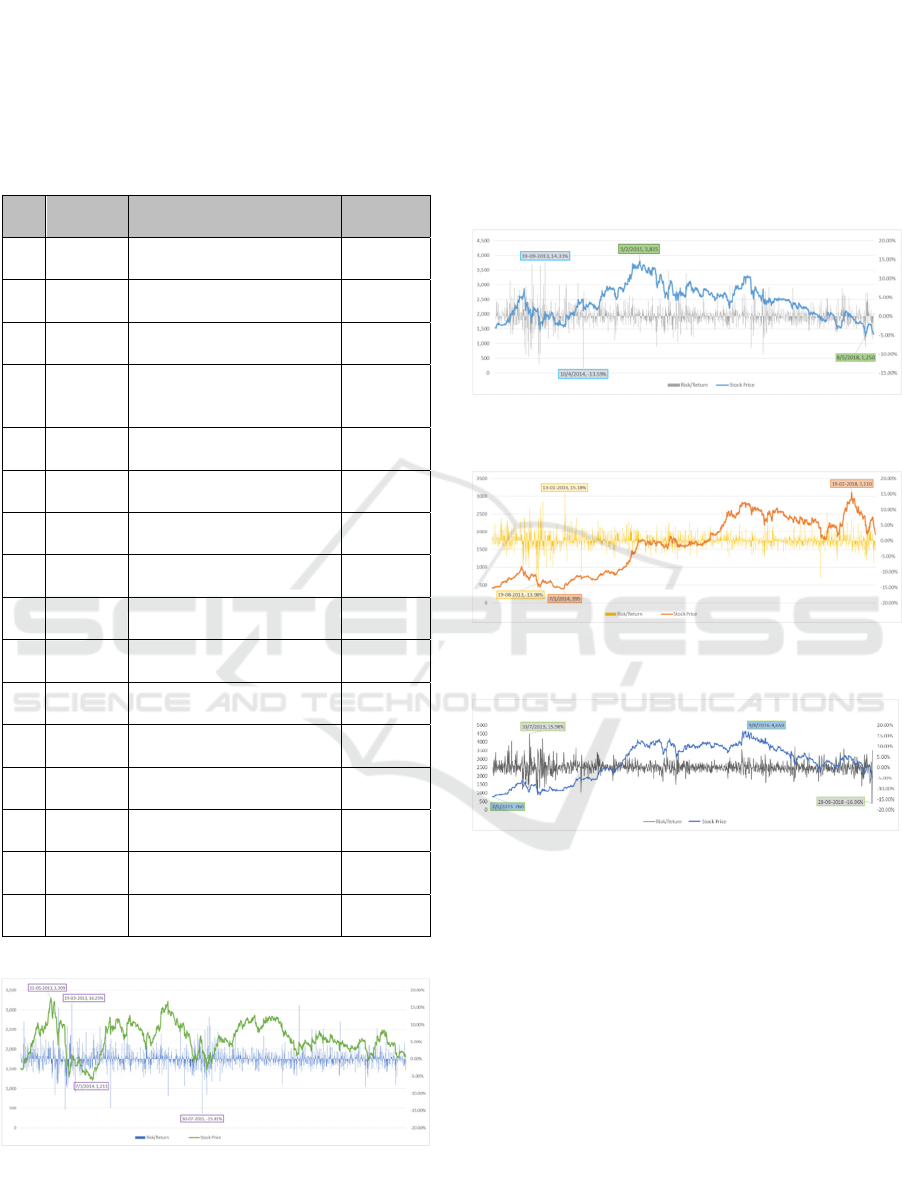

Based on Figure 1.1, it can be concluded that

there are fluctuations in the value of stock prices

and yields, both negative and positive. ADHI has

the highest share price value on May 31, 2013, with

a value of 3,309 and meets its lowest price on

January 7, 2014, with a value of 1,213. Whereas the

condition of risk and return from this company also

experienced an increase and a decrease which was

equal to 16.25% positive yield on March 19, 2013,

and experienced negative returns on July 30, 2015,

with a value of -15.81%.

From Figure 1.2, it is shown that from January

2013 to June 2018 there was an increase in the share

price of WIKA on February 3, 2015, amounted to

3,815 and was at its lowest point on May 8, 2018,

and was at 1,250. For the highest yield occurred on

September 19, 2013, which is getting a yield of

14.31%, while the most significant risk occurred on

April 10, 2014, which was equal to -13.59%.

The same thing happened at WSKT, this

company has the highest share value on February

19, 2018, with a value of 3.110, and has the lowest

share value on January 7, 2014, with a value of 395.

Then for risk and return, the most significant return

occurs on January 13, 2014, with an increase of

15.18% and the most significant risk occurred on

August 19, 2013, with a percentage of -13.98%.

This fluctuation also occurs in PTPP, this company

has the highest share value on August 9, 2016, with

74

Hendrawan, R. and Permadi, F.

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018.

DOI: 10.5220/0008427700740084

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 74-84

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

a value of 4.650, and has the lowest share value on

January 7, 2013, with a value of 760. Then for risk

and return, a return occurs the largest on July 10,

2013, with an increase of 15.96% and the most

significant risk occurred on June 28, 2018, with a

percentage of -16.96%.

Table 1.1: List of IDX construction companies.

No

Stock

code

Issuer

Date of

IPO

1 ACST Acset Indonusa Tbk 24-Jun-

13

2 ADHI Adhi Karya (Persero) Tbk 18-Mar-

04

3 CSIS Cahayasakti Investindo

Sukses Tb

k

10-May-

17

4 DGIK Nusa Konstruksi

Enjiniring Tbk d.h Duta

Graha Indah Tb

k

19-Dec-

07

5 IDPR Indonesia Pondasi Raya

Tbk.

10-Dec-

15

6 MTRA Mitra Pemuda Tbk. 10-Feb-

16

7 NRCA Nusa Raya Cipta Tbk 27-Jun-

13

8 PBSA Paramita Bangun

Saran Tb

k

28-Sep-

16

9 PSSI Pelita Samudera Shipping

Tb

k

5-Dec-

17

10 PTPP Pembangunan Perumahan

(

Persero

)

Tb

k

9-Feb-10

11 SSIA Surya Semesta Internusa

Tb

k

27-Mar-

97

12 TOPS Totalindo Eka Persada

Tb

k

16-Jun-

17

13 TOTL Total Bangun Persada

Tb

k

25-Jul-

06

14 WEGE Wijaya Karya Bangunan

Gedung Tb

k

30-Nov-

17

15 WIKA Wijaya Karya (Persero)

Tb

k

29-Oct-

07

16 WSKT Waskita Karya (Persero)

Tb

k

19-Dec-

12

Sources: IDX

Figure 1.1: Stock Price Trends vs. ADHI Risk / Return

January 2013 - June 2018.

However, a data trend of 2013-2017 revealed the

stock price of those companies to be quite volatile.

This condition has become uncertain and somewhat

risky for investors since the price reflects the

valuation of an asset, which might affect the returns

eventually generated. Without a fair price of shares,

it would be alarming for investors to regard a

position in investing: to buy or sell. As for owners,

valuation reflects company performance.

Figure 1.2: Stock Price Trends vs. WIKA Risk / Return

January 2013 - June 2018.

Figure 1.3: Stock Price Trends vs. WSKT Risk / Return

January 2013 - June 2018.

Figure 1.4: Stock Price Trends vs. PTPP Risk / Return

January 2013 - June 2018.

Price of a company's stock in the market might

come falsely in two directions: undervalued or

overvalued. Undervalued share indicates that the

company's stock price in the market is lower than the

intrinsic price/fair price. Otherwise, the overvalued

share implies that a company's market price is higher

than its intrinsic value.

Among many, there are two types of valuation

methods, namely (1) Discounted Cash Flow (DCF)

method with Free Cash Flow to Firm (FCFF)

approach, and (2) Relative Valuation method with

the Price Earning Ratio (PER) and Price to Book

Value (PBV) approach. FCFF method allows cash

flow to be evident to all fund providers (debt

holders, preferred shareholders, ordinary

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018

75

shareholders, convertible bond investors, etc.). This

method can also be referred to as free cash flow

without flow, and this shows the surplus cash flow

available to the business if it is debt free. The

general starting point for calculating it is Net After

Tax Operating Income (NOPAT) which can be

obtained by multiplying Pre-Interest Profit and Tax

(EBIT) by (1-Tax Rate). This method is used to

avoid overstated valuation when a company has a

relatively sizeable other income.

Relative Valuation compares companies to other

company or industry nearby. PBV has a similar

formula with PER, which is equally useful to see

the fair price of a stock. Unlike PER which focuses

on net income, PBV focuses on company equity.

PBV is a comparison between stock prices and book

value. Book Value is a comparison between the

amount of equity and the number of shares

outstanding. If the PBV value is more than 1 (one),

the stock has been traded at a price higher than its

fair value.

There are three scenarios of projection:

1) Pessimistic Scenario--uses industrial growth

projection values.

2) Moderate Scenarios--where the projected value

of industrial growth is added to the interval/delta

between the growth of the industry and the

growth of the company.

3) The Optimistic Scenario--moderate scenario

coupled with a half times the delta between the

growth of the industry and the growth of the

company.

Based on the background aforementioned, the

objectives of this study are as follows:

1. To examine the fair price of ADHI, WIKA,

WSKT, and PTPP shares using the FCFF

method; compared to the Relative Valuation

method in an optimistic scenario.

2. To examine the fair price of ADHI, WIKA,

WSKT, and PTPP shares using the FCFF

method; compared to the Relative Valuation

method in a moderate scenario

3. To examine the fair price of ADHI, WIKA,

WSKT, and PTPP shares using the FCFF

method; compared to the Relative Valuation

method in the pessimistic scenario.

4. To provide recommendations for the calculation

of the fair price of ADHI, WIKA, WSKT, and

PTPP shares calculated using the method (FCFF)

and the Relative Valuation method in the

pessimistic, moderate and optimistic scenario.

From the exposure of the phenomena that have

been explained above, the purpose of this research is

to look for the fair prices (intrinsic value) of the

current building construction companies listed on

the Indonesia Stock Exchange (2013-2018) using the

Discounted Cash Flow (DCF) method with the Free

Cash Flow to Firm (FCFF) approach and the

Relative Valuation method with Price to Earning

Ratio (PER) and Price Book Value (PBV)

approaches.

2 LITERATURE REVIEW

2.1 Valuation Theory

Damodaran (2006) postulated that the prerequisite

for investment decision making lays in getting well

informed of the value of the asset to be invested and

what gives value to the asset. To gain profit, an

investor buys goods if the stock price is below its

fair value.

From the managerial perspective, the purpose of

valuation is getting the right consideration,

incentives, and control processes. For a manager,

valuation is a particular concern for change

"If I choose to take action, will it increase the

company's business or it will destroy it. After making

my choice, how do I evaluate whether the financial

results produce the results that I expect for

investors?".

Valuation may cover relative value and direction

value. It is essential to distinguish which business

units add value, which parts do not have influence,

or which parts will damage the company's business,

as well as how the relationship changes with time

(Thomas & Gup, 2010).

Damodaran (2006) also asserted that the

approach to valuing an asset is generally divided

into three methods:

a. Discounted Cash Flow Valuation

Using this valuation, the value of an asset is

based on the expected cash flow

b. Relative Valuation

This valuation method values an asset by

comparing it with other similar assets.

c. Contingent Claim Valuation

This method uses option pricing models to

assess assets that have option characteristics.

2.1.1 Company Value

Company value is the investor's perception of the

level of success of a company in managing resources

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

76

that are currently associated with the company's

stock price. The price of its shares can express

company value. The stock price is determined from

the presence of requests and offers from investors.

High stock prices make the value of the company

high and can increase market confidence not only in

the company's current performance but also in the

prospects of the company. Stock prices on the

market do not necessarily reflect the right price of

the company.

2.1.2 Discounted Cash Flow

The discounted cash flow method is a stock

valuation method that utilizes the concept of the

time value of money. The postulate is that all money

flowing in the future (discount value) equals to

present value after being discounted. DCF is

obtained from company income, so DCF valuation

focuses on cash flows generated by one part of the

business, namely operating activities. The principle

is free cash flow departs from the assumption that

the company's income minus all costs is extra cash

(free cash flow). The extra cash is the right of all

parties who provide funding to companies, viz

creditors (lenders or bondholders) and shareholders.

The process of assessing a company with the

DCF method consists of several stages. Firstly, the

assumption of future free cash flow for the next five

to ten years was set. Subsequently, an appropriate

discount rate was anchored, for instance, using

WACC (determining the average capital cost to

discount all future FCFs to calculate present value).

Thirdly terminal value was determined. Terminal

value (TV) is the present value of all future cash

flows obtained after a certain projection period.

Lastly, the present value of the cash flow is summed

with the terminal value.

The DCF valuation method has three variations

of calculations that can be applied in conducting

stock valuation analysis according to the needs of

each analysis. The three variations are (1) dividend

discounted model; (2) free cash flow to equity; and

(3) free cash flow to the firm.

2.1.3 Free Cash Flow to Firm

FCFF is cash available to corporate funders, namely

shareholders and bonds after the company conducts

operations and investment activities. FCFF

calculates the value of a company without debt,

where operating costs have been excluded from

taxes and discounted using capital costs (WACC).

The calculation is as follows:

FCFF = EBIT (1-T) + D & A - CAPEX - Δ WC (1)

Determining the discount rate entails an in-depth

analysis of the company's financing structure and

current market conditions. The discount rate applied

for FCF discounts is called the weighted average

cost of capital (WACC). The formula is employed to

calculate the value of a company using FCFF whose

growth has stabilized in a given year, and after that

grows constant at the perpetual growth rate of g,

which can be expressed in Equation 2 (Damodaran,

2006)

Value of Firm =

∑

(2)

Terminal value is the present value of all future cash

flows obtained after a period determined by scenario

analysis. The formula used is as follows:

/

(3)

It is particularly challenging to estimate the exact

numbers that explicate how a company will continue

to grow in the future in the long run. Terminal

values are based on average growth expectations,

which are easier to predict. The reasoning behind

terminal values is to assume a constant growth rate

for the time after the period analyzed, where the

perpetual growth rate is symbolized by g then

WACC is symbolized by r as the discount rate used.

In most cases, the long-term and boarding growth

rates are determined by presumptions and assuming

that the economy always grows in the long run.

After determining the present value of the cash

flows obtained from the specified period and

scenario (FCFF) and also from the terminal value

discounted for the present value, then the two

present values are summed to provide the firm value

or equity value.

2.2 Cost of Capital

The cost of capital or the overall capital cost of a

company reflects the cost combination of all funding

sources used by the company. Furthermore, the

overall capital cost is called the Weighted Average

Cost of Capital (WACC). WACC is the average cost

after tax of each source of capital used by the

company to finance a project, as expressed in

Equation 4.

Weighted Average Cost of Capital = (Composition of

equity × rate of equity) + ((Composition of debt × rate of

debt) × (1 – tax))

(4)

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018

77

Factors that influence the WACC:

Cost of Equity: The rate of return expected by a

shareholder (equity) in his investment in the

company.

Cost of Debt: The interest rate due, paid by the

company for its debt or external capital.

2.3 Relative Valuation

This most commonly used valuation method applies

a comparison study of similar companies or industry

within. Relative valuation discovers the value of an

asset by comparing it with other similar assets.

1) Price earning ratio (PER) Approach

Po = Estimasi EPS × PER (5)

2) Price to Book Value (PBV) Approach

(6)

3) Multiple EBITDA Approach

(7)

2.4 Previous Studies

Previous studies supporting this research are as

follows:

Zemba & Hendrawan (2018) use financial report

data for 5 years between 2013 and 2017, and use it

as a historical aspect to produce estimates for the

next 5 years 2018-2022, states that in the health

sector with SAME, SILO, SRAJ, and MIKA

samples, which evaluate using DCF and Relative

Valuation there are 3 companies whose shares are

overvalued and only SILO whose shares are

undervalued.

Neaxie & Hendrawan (2017) Stock Valuation

Using Discounted Cash Flow and Relative Valuation

Methods in Telecommunications Companies Listed

on Indonesian Stock Exchanges for Projections in

2017. This study discusses the fair valuation analysis

of shares using Discounted Cash Flow (DCF) and

Relative Valuation Methods in telecommunications

companies are listed on the Indonesia Stock

Exchange (IDX). The results show that using DCF

on an optimistic scenario, TLKM's fair value is

undervalued, ISAT's fair value is overvalued, and

EXCL's fair value is undervalued. Then using DCF

in the moderate scenario the TLKM’s fair value is

undervalued, ISAT's fair value is overvalued, and

the EXCL’s fair value is overvalued. Furthermore,

using DCF in the pessimistic scenario, TLKM’s fair

value is overvalued, the fair value of ISAT is

overvalued and the fair value of EXCL is

overvalued. Using the Relative Valuation method

with the Price Earning Ratio (PER) approach,

TLKM's fair value is undervalued, ISAT's fair value

is overvalued, and EXCL's fair value is undervalued.

Then with the Price Book Value (PBV) approach,

TLKM’s fair value is in an overvalued condition,

ISAT's fair value is in an overvalued condition, and

the EXCL’s fair value is in an undervalued

condition. Furthermore, with the approach of

EBITDA, TLKM’s fair value is overvalued, the fair

value of ISAT is in an undervalued condition, and

EXCL’s fair value is in an undervalued condition.

On their paper, Hauser & Thornton (2017) joins

measures of substantial development in a logit

relapse to characterize an exhaustive life-cycle

model of the probability of dividend payment. The

valuation of firms that conform to the model is

compared with the valuation of firms that do not fit

the model. Valuation is estimated by the market to

book (M/B) ratio. The investigation demonstrates

that dividend policy is related to firm value.

Dividend-paying firms that fit the life-cycle display

have a higher middle valuation than dividend-paying

firms that do not fit the life-cycle demonstrate.

Additionally, non-paying firms that fit the life-cycle

show have a higher middle valuation than non-

paying firms that do not fit the life-cycle model. The

outcomes likewise give proof that the vanishing

dividend phenomenon is identified with movements

in valuation.

Nissim (2013) Firm esteem is equivalent to the

present estimation of future money streams, so great

contender for value numerous valuation are basics

that are emphatically identified with future money

streams. Research in bookkeeping and account

shows that profit perform better than income in

anticipating future money streams, and, in like

manner, profit products create more accurate

valuations than income multiples. Consistent with

this proof, investigators use profit products more

frequently than income products. This is particularly

valid for safety net providers and other budgetary

administrations organizations because the money

related nature of most resources and liabilities of

these organizations makes money streams fairly self-

assertive.

Myers (2012) expressed that valuers need to

continually address the numerous issues that may

influence their risk and obligation to their customers.

Specifically, further research, vital learning

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

78

improvement and market-explicit examination are

altogether required to build up valuers' heuristics. As

the market changes and creates, valuers need to

build up their sentiments and seeing simultaneously

with the market.

Liu, et al. (2007) analysis suggests that cash flow

is not king on equity valuation. They found that

reported earnings dominate reported cash flows as

summary measures of value in the United States.

They extended the analysis to other markets and

used forecasts of operating cash flows, dividends,

and earnings. They found that, although moving

from reported numbers to forecasts improves the

performance of operating cash flows, it improves the

performance of earnings to an even greater extent.

EPS forecasts represented substantially better

summary measures of value than did OCF forecasts

in all five countries examined, and this relative

superiority was observed in most industries. When

they compared dividends rather than operating cash

flows with earnings for a sample derived from seven

countries where dividend forecasts are frequent, they

found, again, that earnings forecasts were a better

summary measure of value than dividend forecasts

in all countries and most industries. So they found

that moving from reported numbers to forecasts

improved performance more for earnings than for

dividends.

DeFond & Hung (2003) stated that cash flows

are incrementally useful because they provide

information that complements the value-relevant

information contained in earnings. Market

participants can use cash flows to interpret the

information in earnings, for example, by comparing

cash flows to net income, because cash flows are

potentially less subjective than accruals. Such

comparisons are commonly suggested in financial

statement analysis textbooks to evaluate earnings

quality. Cash flows help market participants assess

firm viability by providing information about

solvency and liquidity. Such information is

potentially useful because even firms with strong

earnings ultimately rely on cash to repay debt and

purchase assets.

On his research, Ruback (2002) presents the

Capital Cash Flow (CCF) method of valuing risky

cash flows. This method is intuitive and

straightforward. The after-tax capital cash flows are

just the before-tax cash flows to both debt and

equity, reduced by taxes including interest tax

shields. The discount rate is the same expected

return on assets that are used in the before-tax

valuation. Because the benefit of tax-deductible is

included in the cash flows, the discount rate does not

change when leverage changes. The CCF method is

algebraically equivalent to the favored method of

discounting Free Cash Flows by the after-tax

weighted average cost of capital. However, in many

instances, the Capital Cash Flow method is

substantially easier to apply and, as a result, is less

prone to error. The ease of use occurs because the

Capital Cash Flow method puts the interest tax

shields in the cash flows and discounts by a before-

tax cost of assets. The cash flow calculations can

generally rely on the projected taxes, and the cost of

assets does not generally change through time even

when the number of debt changes. When applying

the Free Cash Flow method, taxes need to be

inferred, and the cost of capital changes as the

number of debt changes. The Capital Cash Flow

method is closely related to the Adjusted Present

Value method. Adjusted Present Value is generally

calculated as the sum of operating cash flows

discounted by the cost of assets plus interest tax

shields discounted at the cost of debt. The cost of

assets discounts the interest tax shields that are

discounted by the cost of debt in the APV method in

the Capital Cash Flow method. The Adjusted

Present Value method results in a higher value than

the Capital Cash Flow method because it treats the

interest tax shields as being less risky than the firm

as a whole because the level of debt is implicitly

assumed to be a fixed dollar amount. As a result, a

tax adjustment is made when unlevering an equity

beta to calculate an asset beta. In contrast, the

Capital Cash Flow method, like the FCF method,

makes the more economically plausible assumption

that debt is proportional to value. The risk of the

interest tax shields, therefore, matches the risk of the

assets.

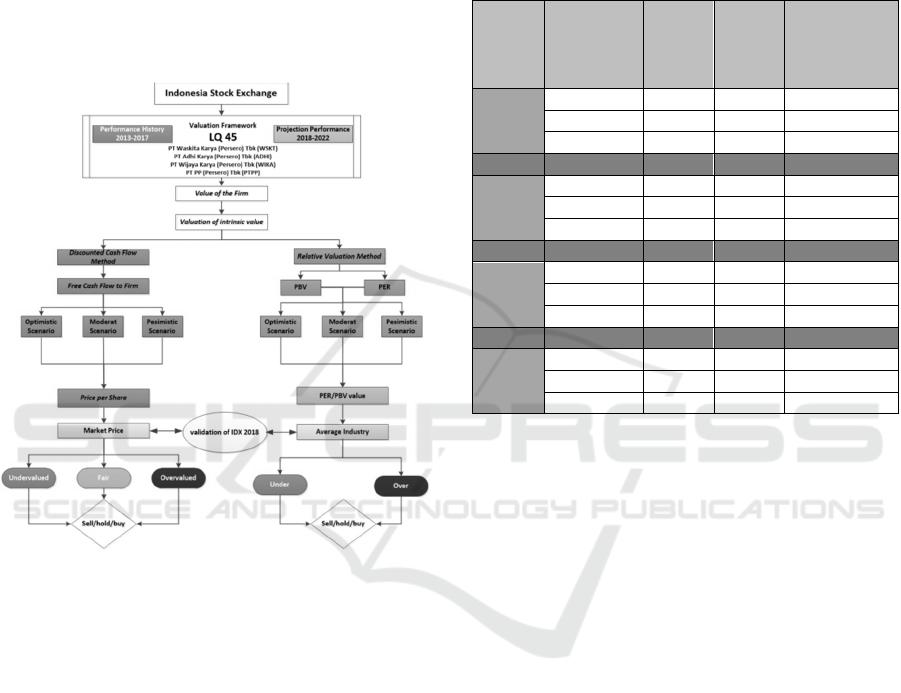

2.5 Theoretical Framework

The thinking framework of this study can be

presented as shown in Figure 2.1.

A stock price is an essential consideration when

investing in stocks. However, there are numerous

factors which cause fluctuations in stock prices--and

the trend is not robust to predict correctly.

Furthermore, there are also mispriced stocks

(wrongly priced stock: too high-priced or too cheap).

One of the best techniques to anticipate the risk of

the stock price fluctuation is to carry out a

fundamental analysis. The fundamental analysis

suggests evaluating the intrinsic value of shares.

This method proffers investors a long-term picture

of the actual value of shares which also means the

company's fundamental value.

The valuation of shares that produce information on

intrinsic value will then be compared with the stock

market price to determine the selling or buying

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018

79

position of a company's stock. The valuation of

intrinsic value is based on assumptions and the

determination of the projected fundamental value of

the company. Valuation of intrinsic value will be

calculated using the DCF method with the FCFF

approach and will be compared with the relative

valuation method with the PER and PBV

approaches. The basis of valuation is based on

assumptions and projections of company conditions.

This research is limited to using historical data from

2013-2017 as a basis for projections.

Figure 2.1: The Thinking Framework.

Succeeding the projection, the future cash flow,

and its present value is calculated. In the calculation,

three scenarios were used: optimistic, moderate and

pessimistic. The optimistic scenario runs under the

assumption that the company gains the highest

growth (as in industrial growth and the target of

company management). The moderate scenario runs

under the assumption which is most likely to occur.

Lastly, the pessimistic scenario was assumed to have

the worst conditions or circumstances under

industrial growth.

The final valuation process is obtaining equity

value or the intrinsic value of the company,

succeeded by getting intrinsic value for each share in

each condition scenario.

2.6 Discussion

2.6.1 Results of FCFF Calculation

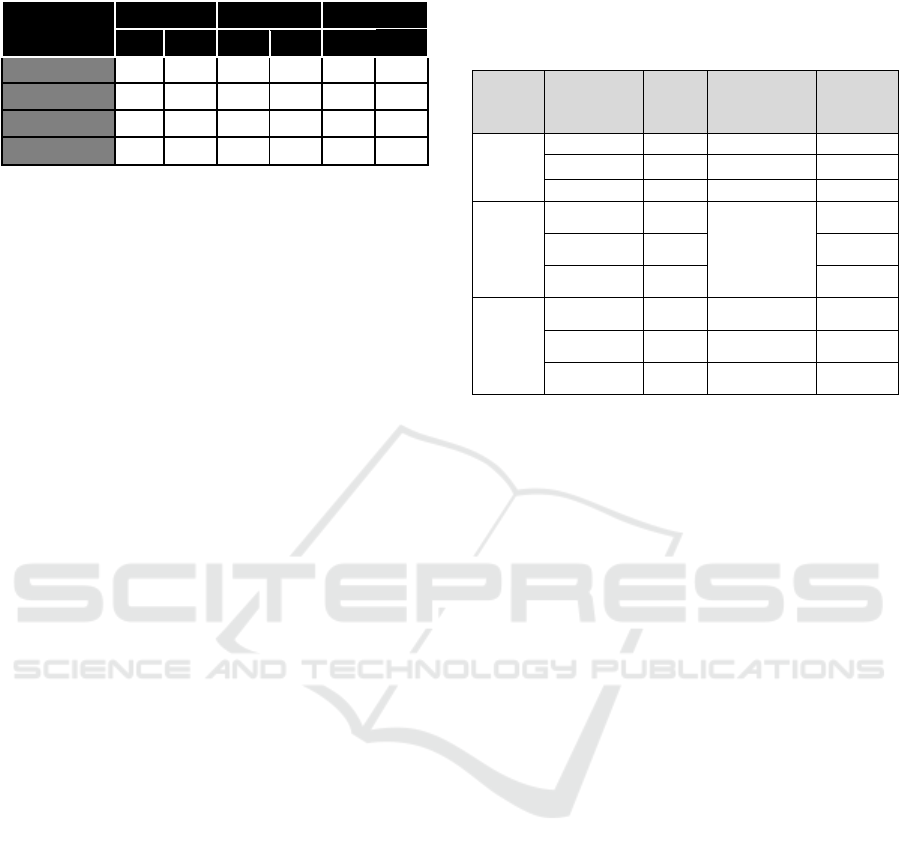

By utilizing the FCFF method, the intrinsic value of

a company is obtained, and shown in Table 2.1.

Table 2.1: Intrinsic Value of the Company.

Scenario

Intrinsic

Value

Stock

Price

Jan 2

nd

2018

Condition

ADHI

Pessimistic 885 1,865 Overvalue

d

Moderate 1,051 1,865 Overvalue

d

O

p

timistic 1,249 1,865 Overvalue

d

WSKT

Pessimistic 699 2,190 Overvalue

d

Moderate 946 2,190 Overvalue

d

Optimistic 1,078 2,190 Overvalue

d

WIKA

Pessimistic 4,965 1,565 Undervalue

d

Moderate 6,448 1,565 Undervalue

d

Optimistic 6,565 1,565 Undervalue

d

PTPP

Pessimistic 5,667 2,620 Undervalue

d

Moderate 5,708 2,620 Undervalue

d

O

p

timistic 5,729 2,620 Undervalue

d

Sources: Author's computations

For WIKA and PTPP, in the pessimistic,

moderate and optimistic scenario, the intrinsic value

is higher than the value of shares in the market

today. On that date, the share value for WIKA was

1,565, while for PTPP it was 2,620. Using a

pessimistic scenario, WIKA's intrinsic value is 4,965

and PTPP is 5,667; thus the stock price in the market

is undervalued.

2.6.2 Calculation Results with PER and

PBV Methods

The calculation results using the Relative Evaluation

method with the PER and PBV approaches are as

table 2.2.

Under the pessimistic scenario, the ADHI PER

value is 3.32 times, WSKT 2.38 times, WIKA is

25.95 times, while PTPP is 13.60 times. In IDX

quarterly data (Q1 2018), the average PER value of

construction companies is 25.50 times, with the

lowest PER value at Surya Semesta Internusa Tbk.

(SSIA) of 2.20 times and the highest PER value in

Cahayasakti Investindo Sukses Tbk. (CSIS) of

1,612.94 times. These points explicate that the

results of research calculations are in the range of

PER in the market.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

80

Table 2.2: PER Value and PBV Calculation.

Relative

Valua-tion

Pesimistic Moderate Optimistic

PER PBV PER PBV PER PBV

ADHI 3.32 0.54 3.73 0.64 4.19 0.76

WSKT 2.38 0.42 3.13 0.56 3.51 0.64

WIKA 26 3.04 33.4 3.95 33.8 4.03

PTPP 13.6 2.47 13.7 2.49 13.7 2.49

Sources: Author's computations

The focus of this calculation is the net profit that

has been generated by the company. Kenning the

PER of an issuer, investors may find out whether the

price of a stock is reasonable or not. PER is obtained

by dividing the share price with the company's

earnings per share (EPS) displayed on the company's

financial statements. The higher the PER value of a

stock, the more expensive the stock is.

Table 2.2 explicates that WIKA has the highest

PER, accounted for 25.95 times, indicating the

intrinsic price of WIKA's shares is worth 25.95

times compared to the company's net profit per

share. Concurrently, the smallest PER is in WSKT

company which is equal to 2.38 times, which means

that the share price is worth 2.38 times per share

(EPS). For investors, a small PER value can be one

of the references in investing, because one of them

with a more massive EPS, will also increase the

possibility of being able to get higher returns.

The results of the study under pessimistic

scenario designate that the ADHI PBV value is 0.54

times, the WSKT PBV value is 2.38 times, the

WIKA PBV value is 3.04 times, and the PTPP PBV

value is 2.47 times. In quarterly IDX data (Q1 2018)

the average PBV value of construction companies is

3.35 times, with the lowest PBV value on Nusa

Konstruksi Engineering Tbk. (DGIK) of 0.47 times

and the highest PBV value in Totalindo Eka Persada

Tbk. (TOPS) of 21.00 times. This result shows that

the results of research calculations are in the PBV

range in the market.

PBV can be defined as a 'stock price compared to

the value of equity per share.' The number was

obtained by dividing the stock price by Book Value

(BV), where BV is generated from equity divided by

the average number of shares outstanding. The

concept of its application is corresponding with

PER: the higher the value of PBV, the higher the

price of the stock.

The lowest PBV value of the four companies

studied is WSKT which is 0.42 times, this signifies

that the value of the shares is smaller than 0.42 times

contrasted to the value of the book. The most

considerable PBV value of WIKA is 3.04 times; this

indicates that the intrinsic value of its shares is 3.04

times compared to its valuation book value.

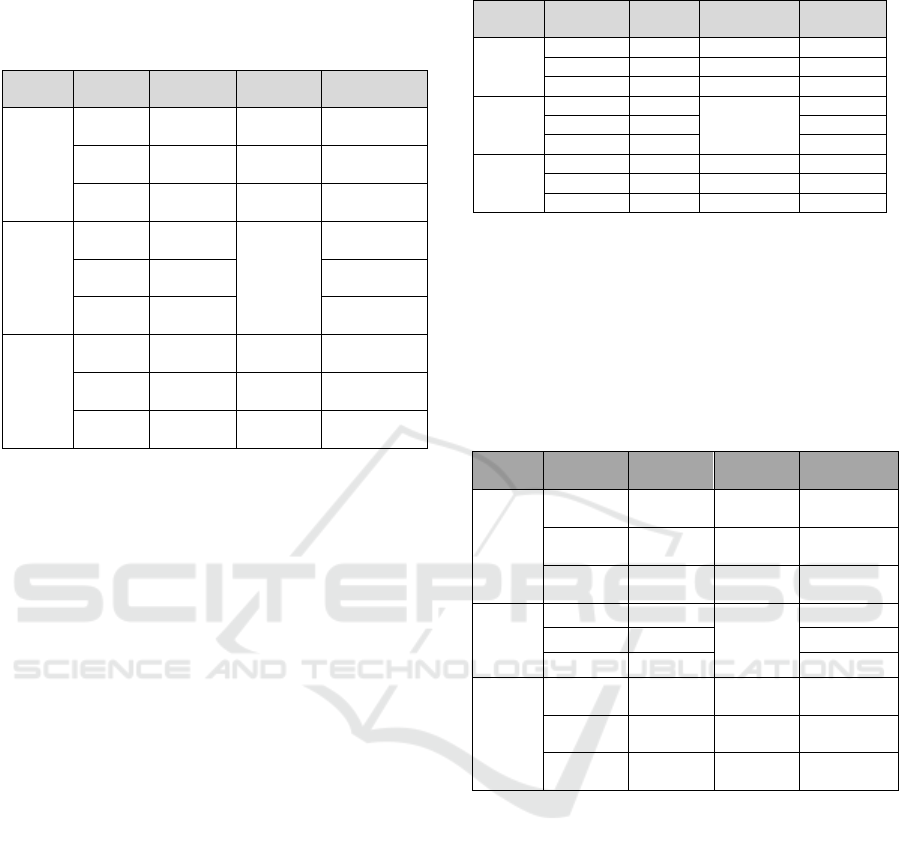

Table 3.1: Summary of ADHI Analysis.

Method Scenario

Intrinsi

c value

Evaluation

Recom-

men-

dation

DCF-

FCFF

Pessimistic 885 Overvalue

d

Sell

Moderate 1051 Overvalued Sell

Optimistic 1249 Overvalue

d

Sell

RV-

PER

Pessimistic 3.32

AVG

PER Industry

25.50

Buy

Moderate 3.73 Buy

Optimistic 4.19 Buy

RV-

PBV

Pessimistic 0.54

Undervalued

Buy

Moderate 0.64

Undervalued

Buy

Optimistic 0.76

Undervalued

Buy

Sources: Author’s computation

3 ANALYSIS

3.1 Analysis of PT Adhi Karya

(Persero) Tbk.

Using FCFF in three scenarios, "selling"

recommendations are obtained because the results of

ADHI's theoretical calculations allow overvalued

intrinsic values of stocks.

With the PER approach, the three scenarios

produce a PER value that is underneath the industry

PER average value. Industry-wise, ADHI's PER is

still a good investment. Therefore it is recommended

to "buy" those mentioned above.

The stock calculation approach with PBV

produces a value below one in all three scenarios,

which means that the value of shares in the market is

smaller than the value of the book value;

accordingly, the stock is worth buying.

It can be concluded that ADHI's shares are worth

buying or maintaining. Also, the trend of revenue

growth for this company is perfect, during the last

three years a positive trend has been obtained, for

example, in 2016-2017, the growth of the revenue

was 36.99%

3.2 Analysis of PT Waskita Karya

(Persero) Tbk.

By employing the FCFF method, it is recommended

to "sell" because the results of original calculations

exhibit the intrinsic value of stocks to be overvalued.

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018

81

By employing PER method, the PER value is

beneath the average value of the Industrial PER.

Table 3.2: Summary of WSKT Analysis.

Method Scenario

Intrinsic

value

Evaluation

Recom-

mendation

DCF-

FCFF

Pessi-

mistic

699

Over-

value

d

Sell

Mo-

derate

946

Over-

value

d

Sell

Opti-

mistic

1078

Over-

value

d

Sell

RV-PER

Pessi-

mistic

2.38

AVG PER

Industry

25.50

Buy

Mo-

derate

3.13 Buy

Opti-

mistic

3.51 Buy

RV-PBV

Pessi-

mistic

0.42

Under-

value

d

Buy

Mo-

dera

t

e

0.56

Under-

value

d

Buy

Opti-

mistic

0.64

Under-

value

d

Buy

Sources: Author's computations

Industry-wise, the PER for WSKT is still a

reliable investment, so it is recommended to "buy"

it.

By employing PER method, the PER value is

beneath the average value of the Industrial PER.

Industry-wise, the PER for WSKT is still a reliable

investment, so it is recommended to "buy" it.

By employing PBV method, PBV is produced

below one in all three scenarios, implying that the

value of shares in the market is smaller than the

value of the book value; therefore, it is

recommended to "buy" shares of WSKT.

3.3 Analysis of PT Wijaya Karya

(Persero) Tbk.

According to FCFF method, in three calculation

scenarios, it is suggested to "buy" as the calculation

exposes that the intrinsic value of the "undervalued"

stock.

The PER value for WIKA is above the industry

average, so it is recommended to "sell".

The stock calculation approach using Price Book

Value (PBV) produces a value above one in all three

scenarios, which implies that the value of shares in

the market is higher than the book value; therefore

WIKA's shares are recommended for sale.

However, WIKA's shares are worth considering

because revenue growth over the past five years has

always been positive. Based on the 2017 financial

report, WIKA's revenue in 2017 was IDR

26,176,403,026,000.00 improved from 2016 at level

Table 3.3: Summary of WIKA Analysis.

Method Scenario

Intrinsic

Value

Evaluation

Recommen

-dation

DCF-

FCFF

Pessimistic 4965 Unde

r

-valued Buy

Moderate 6448 Unde

r

-valued Buy

Optimistic 6565 Unde

r

-valued Buy

RV-PER

Pessimistic 25.95

AVG PER

Industry

25.50

Sell

Moderate 33.39 Sell

Optimistic 33.84 Sell

RV-PBV

Pessimistic 3.04 Ove

r

-valued Sell

Moderate 3.95 Ove

r

-valued Sell

Optimistic 2.49 Ove

r

-valued Sell

Sources: Author's computations

of IDR 15,668,832,513,000.00--accounted for

67.06% of increase.

Analysis of PT PP (Persero) Tbk.

By employing the FCFF method, it is recommended

to "buy" because the results of PTPP's necessary

calculations exhibit an undervalued intrinsic value.

Table 3.4: Summary of PTPP Analysis.

Method Scenario

Intrinsic

value

Evaluation

Recommen-

dation

DCF-

FCFF

Pessimistic 5667

Under-

value

d

Buy

Moderate 5708

Under-

value

d

Buy

Optimistic 5729

Under-

value

d

Buy

RV-PER

Pessimistic 13.60

AVG PER

Industry

25.50

Buy

Moderate 13.66 Buy

Optimistic 13.70 Buy

RV-PBV

Pessimistic 2.47

Over-

value

d

Sell

Moderate 2.49

Over-

value

d

Sell

Optimistic 2.49

Over-

value

d

Sell

Source: Author's computations

By applying the PER approach, PER value is

identified to be below the average industry value.

The PER for PTPP is worthy of being an investment

target; consequently, it is recommended to "buy".

According to Price Book Value (PBV), the value

is above one in all three scenarios, indicating that the

value of shares in the market is higher than the value

of the book value; accordingly, the shares of PTPP

are recommended for sale.

Although the results of PBV analysis for PTPP

shares assert that the value of the shares is higher

than the book value, in the point of view of the

industry, the average PBV value for the construction

industry is 3.35. This number suggests PBV value

for PTPP to be still good and still quite far from the

industry average. The condition might be taken into

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

82

consideration as to retain shares previously

possessed by investors, or as one might plan to

purchase PTPP shares.

4 CONCLUSION

It can be concluded that under the optimistic

scenario and with the Discounted Cash Flow

method, ADHI and WSKT are overvalued because

the market price on January 2, 2018, is higher than

the intrinsic value. WIKA and PTPP are in an

undervalued condition because the market prices are

lower than their intrinsic value.

By using the Relative Valuation method in the

PER (Price Earning Ratio) approach, ADHI has a

value of 4.19 times, WSKT 3.51 times, WIKA 33.8

times, and PTPP 13.7 times. With the PBV (Price

Book Value) approach, ADHI has a value of 0.76

times, WSKT 0.64 times, WIKA 4.03 times and

PTPP 2.49 times. The PER and PBV values are in

the PER and PBV values in the market based on

IDX "Financial Data & Ratio" data for the 2018

quarter one period.

In the meantime, under the moderate scenario,

with the Discounted Cash Flow method, ADHI and

WSKT are overvalued. WIKA and PTPP are in an

undervalued condition. By employing Relative

Valuation method and the PER (Price Earning Ratio)

approach, ADHI has a value of 3.73 times, WSKT

3.13 times, WIKA 33.4 times and PTPP 13.7 times.

With the PBV (Price Book Value) approach, ADHI

has a value of 0.64 times, WSKT 0.56 times, WIKA

3.95 times and PTPP 2.49 times. The PER and PBV

values are in the PER and PBV values in the market

based on IDX "Financial Data & Ratio" data for the

2018 quarter one period.

As under the pessimistic scenario with the

Discounted Cash Flow method, ADHI and WSKT

are overvalued. WIKA and PTPP are in an

undervalued condition. By applying Relative

Valuation method with the PER (Price Earning

Ratio) approach, ADHI has a value of 3.32 times,

WSKT 2.38 times, WIKA 26 times and PTPP 13.6

times. With the PBV (Price Book Value) approach,

ADHI has a value of 0.54 times, WSKT 0.42 times,

WIKA 3.04 times and PTPP 2.47 times. The PER

and PBV values are in the PER and PBV values in

the market based on IDX "Financial Data & Ratio"

data for the 2018 quarter one period.

Eventually, the recommendations given under

the condition of pessimism, moderation and

optimism are shares of PT Waskita Karya (Persero)

Tbk (WSKT), PT Adhi Karya (Persero) Tbk

(ADHI), PT Wijaya Karya (Persero) Tbk. (WIKA)

also, PT PP (Persero) Tbk. (PTPP).

5 RECOMMENDATION

It is suggested that the succeeding researcher may

enhance the level of accuracy and validity of the

data by utilizing more extensive historical data, such

as history for at least ten years.

For further research, this research can be used for

reference in the use of theory and research methods

because it has been proven to get results that are in

accordance with real conditions, compared to data

from IDX.

For investors in investing, in addition to using

the results of valuation assessments as a basis for

reference in decision making, they should observe

the business, economic and social-political

conditions of the country concerned.

For companies, to maintain and increase the

value of shares in the market, in addition to

improving the performance of companies with

revenue and EAT, companies must examine the cost

& expense of the company both OPEX and CAPEX.

In this case, the company must carry out cost &

expense records that burden the company.

Companies must be able to maintain the PER and

PBV values below the industry average, individually

25.50 for PER and 3.35 for PBV.

REFERENCES

Damodaran, A., 2006. Damodaran on Valuation. United

States of America: John Wiley and Sons Inc.

DeFond, M. L. & Hung, M., 2003. An empirical analysis

of analysts’ cash flow forecasts. Journal of Accounting

and Economics, Volume 35, p. 73–100.

Hauser, R. & Thornton, J. H., 2017. Dividend policy and

corporate valuation. Managerial Finance, 43(6), pp.

663-678.

Hausman, J., 2012. Contingent Valuation: From Dubious

to Hopeless. Journal of Economic Perspectives, 26(4),

p. 43–56.

Liu, J., Nissim, D. & Thomas, J., 2007. Is Cash Flow King

in Valuations?. Financial Analysts Journal, 63(2), pp.

56-65.

Myers, G. W., 2012. The value of sustainability in real

estate: a review from a valuation perspective. Journal

of Property Investment & Finance, 30(2), pp. 115-144.

Neaxie, L. V. & Hendrawan, R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange. Journal of Economic and

Management Perspectives, 11(3).

Do Free Cash Flow to Firm and Relative Valuation Method Work in Valuing Building and Construction Companies? : A Test in IDX in 2018

83

Nissim, D., 2013. Relative Valuation of U.S. Insurance

Companies. Review of Accounting Studies, Volume

18, p. 324–359.

Penman, S., 2016. Valuation: Accounting for Risk and the

Expected Return. Abacus, 52(1), pp. 106-130.

Ruback, R. S., 2002. Capital Cash Flows: A Simple

Approach to Valuing Risky Cash Flows. Journal

Financial Managemet, 31(2), pp. 85-103.

Thomas & Gup, 2010. The Valuation Handbook,

Valuation Techniques from Today’s Top Practitioners.

United States of America: John Wiley and Sons Inc.

Zemba, S. & Hendrawan, R., 2018. Does Rapidly

Growing Revenues Always Produce An Excellent

Company’s Value? DCF & P/E Valuation Assessment

on Hospital Industry. e-Proceeding of Management,

5(2), pp. 2045-2060.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

84