Indonesian Listed Bank Efficiency in 2008 – 2017 using

Data Envelopment Analysis (DEA)

Barkah Kristianto

and Riko Hendrawan

Telkom University, Jl. Gegerkalong Hilir No. 47, 40251, Bandung, Indonesia

Keywords: Bank Efficiency, Data Envelopment Analysis (DEA), IDX.

Abstract: These study objectives are to examine and compare the level of efficiency conventional bank listed in IDX

using Data Envelopment Analysis with Intermediation approach, Input, and Output orientation method.

Input Variables are Fixed Asset, Personal Cost, Deposit and output variables are Net Interest Income,

Investment, Loan. Observes 34 conventional banks and uses ten years period Bank's Financial Report from

2008 until 2017. Findings from this research shows that Bank Rakyat Indonesia is the most efficient bank

and furthermore state-owned banks is the most efficient with 0.966 efficiency score, followed by local

government banks, mix national and foreign private banks, and national private banks with efficiency score

of 0.956, 0.903 and 0.837 respectively and the area improvement of each group consecutively are 0.025,

0.019, 0.087 and 0.148. The result also shows from correlation analysis show that there is a weak

relationship between bank efficiency result and performance ratio (ROA, ROE, NIM, BOPO, LDR) in the

bank's financial report.

1 INTRODUCTION

The condition of the banking sector in Indonesia has

undergone many changes from time to time. This

change was caused not only by the internal

development of banking but also due to

developments in things other than banking, such as

economics, social affairs, law, and politics. Also,

with this development where deregulation and the

implementation of other policies have made

Indonesian banking as one of the essential actors in

improving macroeconomic performance in

Indonesia, it can be seen from the number of funds

channeled according to the OJK of more than 7000

trillion rupiahs.

The development of the banking world can be

seen from many banks in Indonesia where according

to Indonesia banking statistics issued by OJK in

February 2018 there were 13 Sharia Banks, 102

Conventional Commercial Banks, and 1615 Rural

Banks.

Among the 115 Commercial Banks, there are 43

banks selling securities or issuing emissions

(becoming issuers) on the Indonesia Stock

Exchange.

The banking industry is currently influenced by

digital technology which has been highly developed

in the past ten years, one of which is the

development of companies fintech which are

disruptive technologies towards the conventional

banking industry.

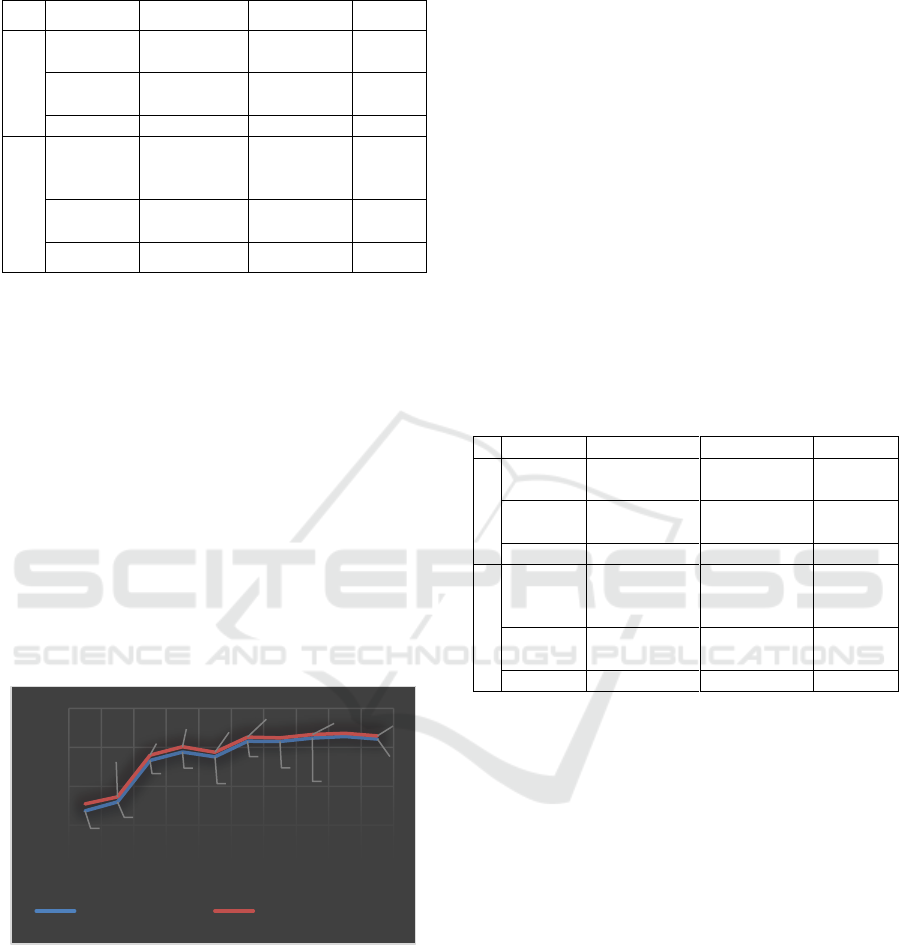

To see banking conditions can be seen from data

on profit growth and banking assets, from the table

below, it shows that there is a decrease in

Operational Profit growth in the banking industry in

5 years from 2011 to 2016. From graph 1, it shows

that in 2012 operation profit still grew by 28 percent.

Figure 1: Growth in Operational Profit of Indonesian

General Banking. Source: Indonesian Banking Statistics,

OJK, (2017).

89 259

114 715

131 555

143 761

133 198

136 311

16,8%

28,5%

14,7%

9,3%

-7,3%

2,3%

-10,0%

0,0%

10,0%

20,0%

30,0%

40,0%

-

50 000

100 000

150 000

200 000

2011 2012 2013 2014 2015 2016

Operational Profit Growth

Kristianto, B. and Hendrawan, R.

Indonesian Listed Bank Efficiency in 2008 – 2017 using Data Envelopment Analysis (DEA).

DOI: 10.5220/0008427500550064

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 55-64

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

55

Figure 2: Growth of Indonesian General Banking Assets.

Source: Indonesian Banking Statistics, OJK, (2017).

In 2013 operational profit grew 14.7 percent, not as

much as the previous year, even in subsequent years,

growth has narrowed, 2015 -7.3% and 2016 only

2.3%.

While if we look at graph two the growth of

general banking assets in Indonesia, seen from

conventional banking assets, the amount of assets

from year to year is still growing. Growth still

ranges from 8.6% to 16%. From this, it shows that

the phenomenon of assets is getting bigger, but when

compared, the operational profit does not grow in

line with the growth of assets. This phenomenon

needs to be observed, whether this is a sign of the

poor performance of banking efficiency in

Indonesia.

Because the presence and function of banking in

Indonesia both for the public, large, medium or

lower industries has a very significant role and

influence, it is essential to pay attention to bank

financial performance, where good bank

performance can lead to public trust and vice versa.

For this reason, it is necessary to research bank

performance or efficiency in Indonesia. When

efficiency measurements are taken, banks are faced

with the condition of obtaining the level of optimal

output with the existing level of input or getting a

minimum level of input with a level of certain

output. Based on ownership, banks in Indonesia can

be divided into several types, including government

/ state-owned banks such as Bank Negara Indonesia,

Bank Mandiri, Bank Rakyat Indonesia, and Bank

Tabungan Negara, regional government-owned

banks such as BPD Jawa Barat, BPD Jawa Timur,

national private-owned banks such as BCA, Bank

Bukopin, Bank Mega etc., .Also, finally the mixed-

owned national-private and foreign banks, for

example, Bank CIMB Niaga, Maybank BII Bank,

OCBC NISP, QNB Indonesia Bank, Bank UOB

Indonesia, and others. With the existence of several

types of ownership, it is also necessary to conduct

efficiency comparison research on each type of bank

ownership type and compare between them.

Based on the description of the phenomena and,

authors intend to conduct a study of how the

financial performance of the banking industry that is

listed on the Indonesia Stock Exchange, where

currently there are 43 registered banking companies

using the method Data Envelopment Analysis using

secondary data from Indonesian Banking in the

Indonesian stock market during the period of 2008-

2017. The researchers intend to use DEA as a data

analysis method to measure the performance of the

banking industry listed on the Indonesia Stock

Exchange because this method uses frontier

approach, where this approach identifies and

investigates in the area of research objects, which

objects are considered to have the best performance

in the sample studied. The best performing objects

are called frontier. Moreover, other objects that are

not on the frontier are considered relatively

inefficient compared to the best performing objects

or have efficiency equal to one (Paradi et al., 2018).

In the method, Data Envelopment Analysis need

input and output variables to measure the efficiency

of the Decision Making Unit (DMU) where in this

case each bank studied is a DMU of this study. Input

and output variables selected must have an

attachment with the phenomenon underlying this

research. The phenomenon of increasing total assets

that are not followed by the significant growth of

operating income can be further detailed to get the

variables for this study. Assets, in this case, consist

of several things including fixed assets or assets

which are long-term company properties that are

used to support the company's operations in

generating income. Other parts of a bank's assets are

current assets which include loans which in this case

are loans to borrowers who agree on returns and

interest and investment which is a long-term

investment from banks to third parties such as

securities. The amount of funding sources influences

operating income in this case, for example, deposits

which are the inclusion of funds from the

community in various types of savings, also

influenced by personal costs which include salaries

and honorariums for workers who turn the bank's

operational wheels. This operating income is also

obtained by one of them from net interest income,

which is the net income of revenue generated from

assets (loans and investments) minus the obligation

to pay interest from the deposit.

3 652 832

4 262 587

4 954 467

5 615 150

6 095 908

6 729 799

21,4%

16,7%

16,2%

13,3%

8,6%

10,4%

0,0%

5,0%

10,0%

15,0%

20,0%

25,0%

-

1 000 000

2 000 000

3 000 000

4 000 000

5 000 000

6 000 000

7 000 000

8 000 000

2011 2012 2013 2014 2015 2016

Total Asset Growth

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

56

From the description above, it can be one of the

bases for selecting the three input variables Fixed

Asset, Personal Cost, Deposit and Net Interest

Income, Investment, Loan as output variables that

will be used to calculate efficiency as a picture of

the performance of banks listed on the Indonesia

Stock Exchange. This selection also will be

strengthened by previous research which will be

described in the next section.

In the annual banking financial report, there are

reports on the performance ratio of banks, where

some of these ratios also relate to variables inputs

and outputs which will be used to calculate the value

of efficiency of Indonesian banking. Examples of

performance ratios used are Return on Assets (ROA)

where this ratio also relates to assets which are one

of the input variables, and then there are operational

costs to operating income (BOPO) where this ratio is

also related to the personal cost which is part of the

cost operational. The other ratio is a loan to deposit

(LDR) which is closely related to the input variable

deposit and output variable loan. Two other ratios

are return on equity (ROE) and net interest margin

(NIM) which are related to the output variable of net

interest income.

Therefore, based on above background and

previous research , it is necessary to do measurement

of Indonesian listed banking using DEA method and

conduct a correlation analysis between the value of

banking efficiency calculated using the DEA method

and five performance ratios that are in the banking

financial statements and the correlation between the

efficiency value and the size of the bank represented

by the total asset value.

2 PREVIOUS EFFICIENCY

RESEARCH

Previous studies supporting this research are as

follows:

A research of Indonesian Listed Banking

Efficiency using Stochastic Frontier Analysis

conducted by Hendrawan and Azhar (2018), with

ten years period between 2008 – 2017 and 21 sample

banks gave a result that Bank Rakyat Indonesia is

the most efficient bank and overall listed Indonesian

banking sector is still not efficient. This research use

price of funds-price of labor and price of physical

capital as the input variables and output variables are

total loans, net non-interest income, and securities.

Saha, and Yeok (2018) conducted a study

entitled branches of efficiency of banks branches

aimed at empirically assessing the efficiency of

major bank branches in Malaysia and the parameters

that control them, the number of branches measured

by 247 branch banks in 2014. The method used is

Data Envelopment Analysis to analyze the

efficiency of the bank branches using inputs interest

expenses, personal expenses, establishment

expenses, other operating expenses, and outputs total

deposits, total loans, wealth portfolio management,

Interest income, and non-interest income. After

conducting an efficiency analysis of branch banks

with the DEA method, followed by approach

fractional regression to access the possible factors

that control the efficiency of the branch banks. The

results of the study indicate that branch banks

operating in high concentrate branch banks

relatively more efficient, and the economic

conditions in the branch bank area are in control of

the efficiency of the branch bank. The limitations of

this study are only carried out within a period of one

year, according to researchers, further research will

provide better research if carried out within a period

of 3 to 5 years.

DEA method can be used to measure efficiency

many industry sectors not only banking, such as

research by Hendrawan and Nugroho (2018), that

measure and compare the efficiency of South East

telecommunication industry. This research measure

14 telco operators in five South East Asia countries

between 2008 until 2017 using inputs capital

expenditure, operating expenses, total asset and

outputs revenue, number of subscribers, and ARPU.

These research findings are Telkomsel was the most

efficient operator, and that annual revenue value still

grew 6.08% even with ARPU declined -4.43%.

Gulati and Kumar (2017) conducted a study

entitled Analysing banks' intermediation and

operating efficiencies using the two-stage DEA

network model: The case of India; aims to make an

approach holistic in measuring overall efficiency in

terms of intermediation and operational efficiency,

the number of banks measured is 46 banks in the

period 2011 to 2013. The method used is Data

Envelopment Analysis with input fixed assets,

number of employees, and loan funds, while

advance output and investment for stage 1 which is

the input for stage2 while stage 2 has net-interest

income and noninterest income. The results of the

study show that variations in efficiency

intermediation are influenced by bank size factors,

liquidity, loans, and intermediation cost while

differences in operation efficiency between banks

influenced by profitability and diversification of

income.

Indonesian Listed Bank Efficiency in 2008 – 2017 using Data Envelopment Analysis (DEA)

57

Khan, Samsudin, Islam (2017), conducted an

efficiency analysis of banks in Southeast Asia,

namely 61 banks in Indonesia, Malaysia, Philippines

and Thailand during the period 1998 to 2012, using

the Data Envelopment Analysis method, an

intermediation approach with input variables fixed

assets, deposits, personal expenses, and output

variables are net loans and other earnings assets. The

results of this study empirically indicate that banking

efficiency in these four countries has shown

improvement. After being hit by the global crisis in

2007 and 2008, it shows that Malaysia and Thailand

were not too affected by the crisis, and Indonesia

needed a better transformation.

Determinants of bank technical efficiency:

Evidence from rural and community banks in

Ghana, by Michael Adusei (2016), aims to calculate

Rural bank efficiency in Ghana, the number of banks

measured is 101 banks. The method used is Data

Envelopment Analysis with input Deposit and

Shareholder Equity, while output Loans, Investment,

and Profit before interest and tax. The results

showed that only 20 of the 101 rural banks in Ghana

were technically efficient, where efficiency was

influenced by bank size, profitability and the quality

of bank funding. Increasing the size and quality of

rural bank funding resulted in a technical decline in

efficiency while increasing profitability improved its

technical efficiency.

Wong and Deng (2016) with the title of their

research efficiency analysis of banks in ASEAN

countries, aims to explore various aspects of

efficiency from banks in the countries incorporated

in ASEAN, in connection with the high economic

growth in these countries at the time the research

was conducted. The numbers of banks in this study

were 39 banks in the period 2000 to 2010. The

method used was Data Envelopment Analysis with

intermediation approach where the input used was

the total cost, where the total cost included expenses

in terms of employee salaries, equipment, and

physical capital such as land, buildings, and others.

Meanwhile, the output chosen is the total loan

amount, total deposit amount, and total investment.

The results showed that first, banks in Malaysia

were more efficient than the other three ASEAN

countries studied. Second, large-scale banks in

ASEAN are less efficient. Three, state banks in

ASEAN showed increased efficiency during the

study year compared to private banks.

Shahwan and Hassan (2013) with their research

entitled Efficiency analysis of UAE banks using data

envelopment analysis, aims to measure profitability,

marketability and bank social disclosure efficiency

in the UAE, the number of banks measured by 20

banks in 2009. The method used is Data

Envelopment Analysis with the input of total

deposits, total operating expenses, and leverage and

output variables are return on assets (ROA) and

return on equity (ROE). The results also showed

additional evidence of a positive correlation between

the performance of social activities and performance

profitability.

Al-Farisi and Hendrawan (2010) compare bank

efficiency between conventional and sharia bank in

Indonesia using sample 3 sharia banks and 102

conventional banks during 2002 – 2007 period. The

study used pooled leased square and alternative

profit efficiency model, and the findings are that

channeled credit has a positive effect, marketable

securities and labor cost have a negative effect on

efficiency. Another result also shows that the three

Islamic banks are within 21 of the most efficient

banks.

Fadzlan Sufian (2007) conducted a study entitled

Trends in the efficiency of Singapore's commercial

banking groups: A non-stochastic frontier DEA

window analysis approach, research was conducted

on nine banks in Singapore with the method

Window Analysis DEA, during the period 1993 to

2003. The results of banking efficiency are then

analyzed by the level of correlation with the

calculation of traditional banking performance such

as the Log of Total Assets, Log of Total Loans, and

Log of Total Deposits. The results of this study are

that during the overall research period Singapore's

banking efficiency experienced a downward trend in

the initial research period and increased dramatically

at the end of the study period. This study also shows

that banks with smaller assets tend to be more

efficient than banks that have significant assets.

3 DATA AND RESEARCH

METHODOLOGY

In this research, the observation period was carried

out during the years 2008 to 2017 with the number

of bank samples as many as 34 conventional banks

in Indonesia. Input variables are fixed assets,

personal cost, and deposit. While the output

variables used are net interest income, investment,

and loan.

The method used to measure the efficiency of

Indonesian banking is Data Envelopment Analysis.

The following is the general equation of the DEA

method:

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

58

=

=

=

n

j

jsjs

m

i

isis

xv

yu

hs

1

1

(1)

Where hs, it shows the bank's technical

efficiency; uis shows the weight of the output i

produced by the bank ; yis is the amount of output i

produced by the bank s; vjs is the weight of input j

given by the bank ; and xjs is the amount of input j

used by the bank s; i calculated from 1 to m and j is

calculated from 1 to n. The efficiency ratio (hs) is

then maximized with the following constraints:

1

1

1

=

=

n

j

jrj

m

i

iri

xv

yu

for r = 1,….,N ; ui and vj≥ 0 (2)

where N indicates the number of banks in the

sample. The first inequality shows that there is no

more than 1 efficiency ratio for other DMUs, while

the second inequality is positively weighted. Ratio

numbers will vary between 0 to 1, where DMU has

an efficient number 1 (100%) and if approaching 0 is

increasingly inefficient.

For the DEA model the BCC, the equation

mathematical formula:

Max.

=

=

m

i

isis yuh

1

+ U0

st.

=

m

i

iriyu

1

-

=

m

j

jrjxv

1

≤ 0 ; r = 1,….,N (3)

=

m

j

jsjxv

1

= 1

ui, vj ≥ 0

where U0 is a piece that can be positive or negative.

The results of processing the data will be

analysed to see the performance and efficiency of

the banks listed on the IDX, seen the trend and

compared between banks. The results of the

calculation of efficiency of each bank are grouped

based on the type of bank ownership and then

calculated by the average bank efficiency throughout

the period. Then the graph is made so that trend

analysis can be carried out, also comparing

efficiency between bank ownership types. From the

results of DEA calculations can also be seen the

variables that cause inefficiency by comparing the

value of inefficient bank variables with banks in the

frontier nearest efficiency, then this result is

analyzed to find which variables need to be

optimized or changed. Then the next step is measure

coefficient Pearson correlation and Spearman

correlation between each efficiency to bank

performance and size ratios. Furthermore, from the

12 pairs of correlations, the correlation strength is

observed, and calculate the value of p-value to see if

there is a correlation between the two variables.

4 RESULT AND DISCUSSION

From table 1, it shows that banks listed on the

Indonesian stock exchange which have the best

relative average efficiency value is Bank Rakyat

Indonesia (BRI) with a value of 0.991, this result

strengthens previous research finding, which was

using SFA method, by Hendrawan (2018) that BRI

is the most effective bank. After BRI another more

relatively efficient banks are Bank Victoria

International with a value of 0.990, Bank Tabungan

Negara with a value of 0.985, Bank Mestika Dharma

with a value of 0.985, Bank Nationalnobu with a

value of 0.980, BPD Jawa Timur with a value of

0.975, and the bank BTPN with a value of 0.969.

Furthermore, banks with low efficiency below 0.75

are Maspion Bank, Bank Mitraniaga, Bank Ganesha

and Bank Harda Internasional. Of the 34 banks

studied, 14 banks were below the overall efficiency

average of the bank during the 10-year study period,

and 20 banks were above the average, either using

the method input oriented or using output oriented.

With an average of 0.887 means the method input

oriented, Indonesian banks still have inefficiencies

of 11.3%, and in the method, output-oriented the

average efficiency is 0.892, which means that

Indonesian banks have 10.8% inefficiency. Area

improvement for input oriented is the highest BRI

efficiency value (0.991) minus the average value of

banking efficiency (0.887) which is equal to 0.104

while the area improvement for output oriented is

the highest BRI efficiency value (0.992) minus the

average value of banking efficiency (0.892) which is

equal to 0.1.

Indonesian Listed Bank Efficiency in 2008 – 2017 using Data Envelopment Analysis (DEA)

59

Table 1: Average Efficiency Score.

Bank Name

Owner

Average

Input

Oriented

Efficiency

Average

Output

Oriented

Efficiency

Bank Rakyat

Indonesia

State-

Owned

0.991

0.992

Bank Victoria

International

Mixed

Private

0.99

0.99

Bank Tabungan

Negara

State-

Owned

0.985

0.986

Bank Mestika

Dharma

National

Private

0.985

0.986

Bank

Nationalnobu

Mixed

Private

0.98

0.985

BPD Jatim

Regiona

l State-

Owned

0.975

0.975

Bank Tabungan

Pensiunan

Nasional

Mixed

Private

0.969

0.969

Bank Danamon

Indonesia

Mixed

Private

0.963

0.964

Bank Mandiri

State-

Owned

0.956

0.959

Bank Cimb

Niaga

Mixed

Private

0.944

0.946

BPD Jabar &

Banten

Regiona

l State-

Owned

0.938

0.939

Bank Negara

Indonesia

State-

Owned

0.933

0.935

Bank Permata

Mixed

Private

0.93

0.932

Bank OCBC

NISP

Mixed

Private

0.922

0.924

Bank Central

Asia

National

Private

0.915

0.918

Bank Ina

Perdana

Mixed

Private

0.914

0.907

Bank Capital

Indonesia

National

Private

0.905

0.911

Bank of India

Indonesia

Mixed

Private

0.905

0.907

Bank Mega

National

Private

0.899

0.903

Bank Maybank

Indonesia

Mixed

Private

0.889

0.892

Bank Agris

National

Private

0.874

0.882

Bank Bukopin

National

Private

0.873

0.875

Bank Nusantara

parahyangan

Mixed

Private

0.868

0.87

Bank Sinarmas

National

Private

0.86

0.862

Bank Mayapada

International

Mixed

Private

0.852

0.856

Bri Agroniaga

National

Private

0.852

0.861

Bank MNC

Internasional

National

Private

0.834

0.842

Bank Artha

Graha

Internasional

National

Private

0.822

0.826

Bank QNB

Indonesia

Mixed

Private

0.812

0.825

Bank Bumi

Artha

National

Private

0.79

0.803

Bank Maspion

Indonesia

National

Private

0.741

0.761

Bank Ganesha

Mixed

Private

0.708

0.739

Bank Harda

Internasional

National

Private

0.701

0.728

Bank

Mitraniaga

National

Private

0.667

0.691

Average

0.887

0.892

In the DEA method, the highest relative efficient

value is the efficiency value 1, and from the 340

DMU efficiency result, this study investigates how

consistent a bank to be efficient, that is by looking at

the frequency of the bank achieves efficiency scores

1. It appears that banks which most often get

efficiency scores 1 are Bank Rakyat Indonesia and

Bank Nationalnobu which have a maximum

efficiency score of 8 years from 10 years of

observation, so those two banks can be regarded as

the most consistent banks that operating efficiently.

The next banks that are quite consistent with

efficiency score 1 are Bank Mandiri 7 times, Bank

Tabungan Negara 6 times and two banks as much as

five times, the Bank Tabungan Pensiunan Nasional

and Bank Victoria International. From this, it shows

that 3 of the six banks that are most consistent in the

frontier efficiency are state-owned banks. The total

banks that have been at the highest efficiency value

are 21 banks (62%) of the 34 banks studied, and 13

banks never have efficiency value 1.

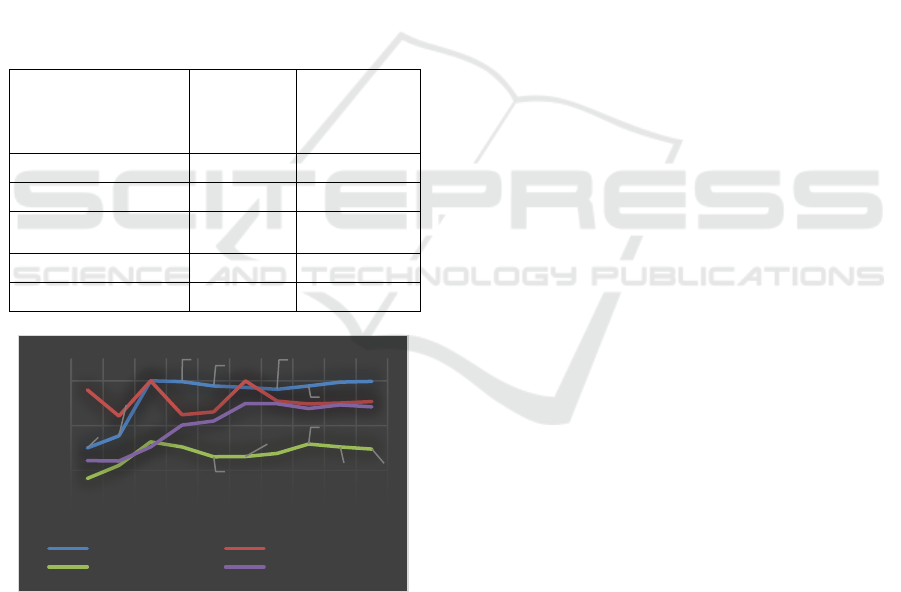

From figure 3 it shows that the average

efficiency based on input oriented and output-

oriented is not differ significantly, and in a trend, the

average Indonesian banking efficiency had grown

since 2008 from 0.818 to 0.91 in 2017. In the two

years beginning in 2008 and 2009 the efficiency of

Indonesian banking during the global crisis was seen

to be the lowest in 10 years of research, began to

increase in 2010 to 2013, and after that was quite

stable until 2017. This result shows that Indonesian

banks managed to rise from the global crisis

gradually and showed that Indonesian banking

efficiency was stable in the last five years of the

study period (2013 to by 2017).

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

60

Table 2: Summary Projection Variable Input Oriented.

From the previous results it can be seen that

there are still inefficiencies in the operation of

Indonesian banking, in order to achieve desired

efficiency values it is necessary to change variables

input or output, in the Input Oriented method, the

emphasis is prioritized to reduce inputs to obtain

efficient results. This change in input or output is

carried out by looking at the reference of an efficient

bank.

From table 3, using input-oriented, banking

sector needs to optimize the variable of fixed assets

which is quite significant, by 12.17%, besides that it

needs to decrease input the personnel cost by 5.84%

and optimization of third-party funds by 4.86%. Not

only changes in input, but also need to do a little

change in output as mentioned in table 3.

Figure 3: Average efficiency of 2008 to 2017.

Fixed assets are large enough to contribute to

inefficiencies because these inputs cannot always

contribute optimally in producing output.

Efficient banks that used as references are

different for each bank, in this input oriented, the

most widely used banks as reference are the Bank

Tabungan Negara 184 times, then Bank QNB

Indonesia 136 times, Bank Agris 132 times, Bank

Ina Perdana 119 times, Bank CIMB Niaga 97 times

and Bank Rakyat Indonesia 92 times.

Using the output-oriented method, changes

needed to achieve efficient values are emphasized by

increasing variables output, as shown in table 3

below.

From the table 3 shows that the method Output

oriented need to do a significant optimization of

fixed asset variables, by 8%, besides needing to

increase output Net Interest income by 5.44%,

investment by 5.64% and loans by 5.32%. Not only

changes in output and optimization of fixed assets

but also need to be made a little change in other

inputs mentioned in table 4. Fixed assets are large

enough to contribute to inefficiencies because these

inputs cannot always contribute optimally in

producing output.

Table 3: Summary Projection Variable Output

Oriented.

Variable

Current

Projection

Changes

Input

Fixed

Asset

874,937

768,492

-12.17%

Personn

el Cost

486,417

458,005

-5.84%

Deposit

25,440,456

24,204,164

-4.85%

Output

Net

Interest

Income

1,708,208

1,722,576

0.84%

Invest-

ment

8,783,933

8,864,670

0.92%

Loan

20,951,668

21,069,052

0.56%

Efficient banks that are used as references are

different for each bank, in this output oriented, the

most widely used bank as a reference is Bank

Tabungan Negara 188 times, then the QNB Bank

Indonesia 140 times, Bank Agris 117 times, Bank

Ina Perdana 115 times, Bank CIMB Niaga 100 times

and Bank Rakyat Indonesia 101 times.

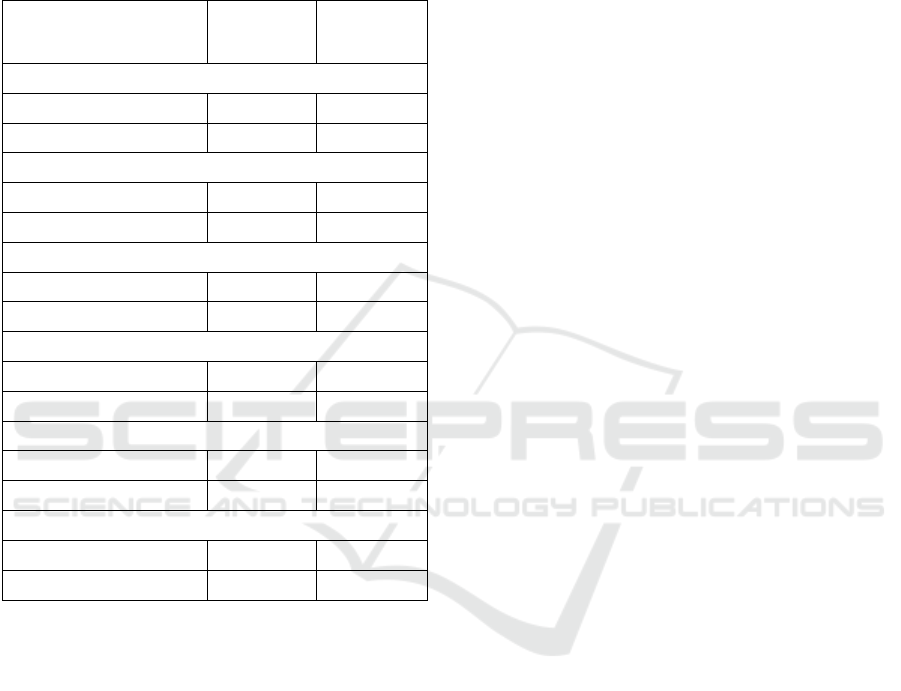

From the results of banking efficiency research

listed on the Indonesian stock exchange, then

efficiency by the groupings of ownership can be

seen in table 4. From the results of these studies, it

shows that Government Banks are relatively more

efficient than other banks. This is because the

community dominantly trusts the government banks

because they have been operating longer, have

extensive networks, supported by the government,

synergized with other BUMNs and have far greater

assets. The results of this study are aligned with the

research from Wong and Deng (2016) where the

results show that state banks in ASEAN showed

increased efficiency during the study period

0,818

0,830

0,883

0,894

0,888

0,908

0,908

0,912

0,914

0,911

0,827

0,836

0,890

0,901

0,894

0,913

0,912

0,916

0,918

0,915

0,750

0,800

0,850

0,900

0,950

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Avg Input Oriented Eff Avg Output Oriented Eff

Variable

Current

Projection

Changes

Input

Fixed

Asset

874,937

804,971

-8.00%

Personnel

Cost

486,417

478,888

-1.55%

Deposit

25,440,456

25,353,247

-0.34%

Output

Net

Interest

Income

1,708,208

1,801,138

5.44%

Invest-

ment

8,783,933

9,279,640

5.64%

Loan

20,951,668

22,066,642

5.32%

Indonesian Listed Bank Efficiency in 2008 – 2017 using Data Envelopment Analysis (DEA)

61

compared to private banks. Government banks that

have the highest efficiency value are Bank BRI with

efficiency values of oriented input 0.991 and 0.992

output oriented so that the area improvement of

government bank is 0.025 (maximum value minus

average value) for oriented inputs and 0.024 for

output oriented.

Local government banks that have an efficiency

of 0.96 are also more efficient than the average

banking efficiency listed on the exchange, which is

0.89. This is because local governments support

local government banks in synergy with other

companies belonging to the provincial government.

The regional government bank with the highest

efficiency value is BPD Jawa Timur with an

efficiency value of 0.975 for input oriented or output

oriented, the area of improvement of regional

government banks is 0.019 for input oriented and

0.018 for output oriented.

Table 4: Average efficiency based on bank ownership.

Bank Based on

Ownership

Average

efficiency

(input

oriented)

Average

efficiency

(output

oriented)

State-Owned

0.966

0.968

Local Government

0.956

0.957

National Private &

Foreign (Mixed)

0.903

0.908

National Private

0.837

0.846

Indonesian Banking

0.887

0.892

Figure 4: Average efficiency based on ownership.

Banks that are owned by National and Foreign

Private have an average efficiency of 0.9, which is

relatively higher than average and higher than

national private-owned banks, this indicates that

when foreign parties acquire private banks and there

is foreigners management interference, the tendency

to have better efficiency compared to banks that are

only owned by the national private sector. Mixed

banks of the national and foreign private sector with

the highest efficiency value are Bank Victoria

International with a value of 0.99 for input and

output oriented so that the improvement area for

national and foreign private mixed banks is 0.087 for

input oriented and 0.082 for output oriented.

National private banks are the group of banks

with the lowest average efficiency, 0.837 and 0.846

lower than the average of the Indonesian banking

industry listed on the Indonesia stock exchange

0.887 and 0.892. The national private bank with the

highest efficiency value is Mestika Dharma Bank

with a value of efficiency of oriented input 0.985

and output-oriented 0.986 so that the area of

improvement of national private banks is 0.148 for

input oriented and 0.14 for output oriented.

From Figure 4, it can be seen that in 2008 only

local government banks that had an efficiency of

close to 1, other banks were affected by the 2008

crisis, and gradually improved their efficiency. The

group of regional government banks was not too

affected by the 2008 crisis because they did not

invest much in foreign investment. In 2010, state-

owned banks became the most effective and

relatively stable bank group until the end of the

study period, which is 2017. Local government

banks appear to have fluctuating efficiency, although

always above the average, in 2008 and 2013 even

local government banks have the best efficiency

compared to other bank groups. National private

banks and foreign national private mixed banks do

not differ significantly in the value of their

efficiency from 2008 to 2010, after that the group of

foreign national private mix banks increased their

efficiency and were stable from 2013 to 2017.

Meanwhile, the national private bank group from

2011 to 2017 are in the range of average efficiency

values of 0.83 to 0.85 which is the lowest efficiency

value compared to other groups.

The results of data processing by looking for the

Pearson coefficient and Spearman coefficient

correlation between input-oriented efficiency

variables with DEA method and financial

performance ratio variables can be seen in table 5.

The p-value value of all correlation

measurements is obtained p-value <0.001, meaning

that there is a correlation between all the pairs of

variables tested. It is noticeable also that in general

there is a correlation with the level of low relation

between the efficiency of banking with a ratio of

financial performance as ROA and BOPO are using

the Pearson coefficient, ROE, NIM and LDR with

Pearson and Spearman. Only ROA and ROA using

0,850

0,877

1,000

0,998

0,989

0,986

0,981

0,988

0,997

0,999

0,782

0,812

0,864

0,853

0,831

0,831

0,838

0,859

0,853

0,848

0,700

0,800

0,900

1,000

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

State-owned Local Govenrment

National Private Mixed Private

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

62

Spearman coefficient have a moderate level of

relationship. The correlation results are low because

the financial performance ratio only uses a

comparison of variables in the bank's financial

statements, so it only compares within itself.

Table 5: Correlation coefficient between Efficiency and

Performance Ratio.

Input

Oriented

Efficiency

Output

Oriented

Efficiency

Return On Asset (ROA)

Pearson Coefficient

0.344

0.342

Spearman Coefficient

0.452

0.449

Return On Equity (ROE)

Pearson Coefficient

0.31

0.307

Spearman Coefficient

0.371

0.365

Net Interest Margin (NIM)

Pearson Coefficient

0.266

0.267

Spearman Coefficient

0.233

0.234

BOPO

Pearson Coefficient

-0.236

-0.236

Spearman Coefficient

-0.467

-0.465

Loan to Deposit Ratio (LDR)

Pearson Coefficient

0.256

0.251

Spearman Coefficient

0.261

0.26

Total Asset

Pearson Coefficient

0.338

0.341

Spearman Coefficient

0.463

0.46

While the level of efficiency using the DEA method

is a relative comparison to the efficiency of other

banks in one group of research objects. These results

reinforce the statement that DEA measures the

relative efficiency of various organizational units

that can reveal the right relationship between inputs

and outputs diverse, which previously could not

accommodate through traditional ratio analysis.

From table 5 it is also seen that there is no

correlation with a high level of relationship between

total assets owned by banks with the value of

efficiency in either input oriented or output oriented.

The results of research show on the level of

efficiency that there are several banks whose asset

values are far below the average of total banking

assets but have been the most efficient banks, for

example, Bank Nationalnobu, Bank Victoria

International, Bank Ina Perdana, and Bank Mestika

Dharma. These banks have been at the frontier of

efficiency for at least four years, but in a positive

relationship, it seems that many banks with

substantial assets often have better efficiency. This

result is inversely proportional to the results of the

study from Sufian (2007) where banks in Singapore

which have smaller assets tend to be more efficient

than banks that have more considerable total assets.

5 CONCLUSIONS

Based on the data from the research and analysis of

the calculation of the efficiency value using the

DEA VRS method of input oriented and output

oriented, the conclusions that can be obtained by

researchers are as follows:

From the 34 banks listed on the Indonesia Stock

Exchange, with a period of efficiency comparison

research using the Data Envelopment Analysis

method, Variable Return to Scale, Input Oriented

and Output Oriented, it shows that Bank Rakyat

Indonesia is the most efficient bank with an average

efficiency value 0.99 using either input oriented or

output oriented. Bank Rakyat Indonesia is also the

most consistent bank, as seen from the frequent

showing of efficiency 1 with Bank Nationalnobu as

much as eight years of the observation period. In

general, Indonesian banks seem to experience

improved efficiency and show a stable value from

2013 to 2017. This result also shows that no

significant differences between input oriented or

output oriented so that the next research can choose

one of them.

In order listed Indonesian banking sector to

achieve efficient conditions, using input oriented or

output oriented, it is seen that fixed asset is the most

significant variables that need to be optimized, there

are gaps 12,17 % which is not optimal based on

input oriented and needs to be optimized by 8%

based on output oriented.

Based on the comparison of banking efficiency

grouped by type of ownership, it shows that state-

owned banks are the most efficient group of banks

followed by regional government-owned banks and

banks belonging to a mixture of national and foreign

private banks, the latter being national privately-

owned banks.

Correlation analysis results show that there is a

correlation with the level of relations that are

relatively low to moderate between the value of

banking efficiency using the DEA method and the

performance ratios contained in banking financial

statements such as ROA, ROE, NIM, BOPO, LDR,

and total assets.

Indonesian Listed Bank Efficiency in 2008 – 2017 using Data Envelopment Analysis (DEA)

63

Based on this study, advise for the banking

sector are Increasing efficiency can be done by

reducing or optimizing input variables and

increasing output variables, or a combination of

both. In order to improve its efficiency, banks can

use other banks that have maximum efficiency

values as a reference, for example, Bank Rakyat

Indonesia and Bank Tabungan Negara for large

banks or Victoria banks and QNB banks for

relatively small banks. Small-scale National Private

Banks can merge with other National Private banks

to increase efficiency, or by mergers or acquisitions

with foreign banks. Banking also needs to do a

benchmark with other banks rather than only rely on

their financial performance ratio to understand their

efficiency level.

REFERENCES

Adusei, M., 2016, Determinants of bank technical

efficiency: Evidence from rural and community banks

in Ghana, Cogent Business & Management 2016, 3

Al-Farisi, A. S., Hendrawan, R.. 2010. Measuring

Efficiency as Intermediation Approach Between

Conventional and Sharia Bank in Indonesia. Journal

of Finance and Banking, 14 (3), 501-508

Gulati, R., Kumar, S., 2017, Analysing banks’

intermediation and operating efficiencies using the

two-stage network DEA model: The case of India.

International Journal of Productivity and

Performance Management, Vol. 66 Issue: 4, pp.500-

516

Hendrawan, R., Nasution, A.A., 2018, Assessing Banking

Profit Efficiency Using Stochastic Frontier Analysis,

Journal of Finance and Banking Review, Vol. 3 Issue:

4, pp.67-66

Hendrawan, R., Nugroho, K.W.A., 2018,

Telecommunication Sector Reform in Southeast Asia:

A New Rationality, Global Journal of Business and

Social Science Review, Vol 6, Issue: 4, pp 147-154

Khan, S.J.M., Samsudin, S. and Islam, R., 2017 Efficiency

of banks in Southeast Asia: Indonesia, Malaysia,

Philippines, and Thailand. International Journal of

Social Economics, Vol. 44 Issue: 12, pp.2302-2312

Paradise, J.C., Sherman, H.D., and Tam, F.K., 2018, Data

Envelopment Analysis in the Financial Services

Industry, A guide for practitioners and analysts

working in Operations Research using DEA.: Springer

International Publishing AG. Cham, Switzerland

Saha, A., Hock-Eam, L., and Yeok, S.H., 2018,

Deciphering drivers of efficiency of bank branches,

International Journal of Emerging Markets, Vol. 13

Issue: 2, pp.391-409

Shahwan, T.M., Hassan, Y.M., 2013, Efficiency analysis

of UAE banks using data envelopment analysis,

Journal of Economic and Administrative Sciences,

Vol. 29 Issue: 1, pp.4-20

Sufian, F., 2007, Trends in the efficiency of Singapore's

commercial banking groups: A non-stochastic frontier

DEA window analysis approach. International

Journal of Productivity and Performance

Management, Vol. 56 Issue: 2, pp.99-136

Wong, W.P., Deng, Q., 2016, Efficiency analysis of banks

in ASEAN countries. Benchmarking: An International

Journal, Vol. 23 Issue: 7, pp.1798-181

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

64