Implementing Value-at-Risk and Expected Shortfall for Real Time

Risk Monitoring

Petra Ristau

JRC Capital Management & Research GmbH, Kurfürstendamm 186, 10707 Berlin, Germany

Keywords: Cloud Appliance, Financial Risk Measures, Value-at-Risk, Expected Shortfall, Monte-Carlo Simulations.

Abstract: Regulatory standards require financial service providers and banks to calculate certain risk figures, such as

Value at Risk (VaR) and Expected Shortfall (ES). If properly calculated, their formulas are based on a

Monte-Carlo simulation, which is computationally complex. This paper describes architecture and

development considerations of a use case building a demonstrator for a big data analytics cloud platform

developed in the project CloudDBAppliance (CDBA). The chosen approach will allow for real time risk

monitoring using cloud computing and a fast analytical processing platform and data base.

1 INTRODUCTION

The way Investment Banks monitor Market Risk is

rapidly changing both for complying with regulatory

requirements and for enhancing competitiveness. In

today’s lower return / higher risk business

environment, one of the main challenges in asset

management is to provide detailed risk information

in a timely manner, i.e. in real time. The goal of the

use case described in this paper is to overcome the

current practice of leaving the operational data in

external data bases of data providers and brokers and

downloading copies on a daily basis for off-line

batch evaluations. Instead, it shall support traders,

risk managers and sales who negotiate with the

customers in doing aggregations and calculations on

the fly and let them do what-if analysis over the live

operational data.

Modern risk calculation techniques used by

banking industry operate on different kinds of

simulated scenarios together with complex

mathematical modelling to evaluate the outcome of

those scenarios. In addition to marking-to-market

current trading positions, the vast majority of the

data are pricing simulations that compute the value

and the sensitivities of financial trades to market

changes. Results are being aggregated into measures

such as Value-At-Risk (VaR) and portfolio diversity

based on market correlation. All these evaluations

depend on calculations consisting of large scale

matrix-vector operations. Using traditional

approaches such as e.g. relational databases, these

processes can be very time consuming. Usually,

processing is done once a day, and thus depending

on past data, which obviously reduces its value for

the business and increases overall risk.

In addition, regulations require banks to be able

to do back-testing analysis in a timely manner over

the whole portfolio. This requires the ability to

effectively store, retrieve and aggregate billions of

returns done for each trade historically on a large

time scale. Existing solutions cannot cope with that

without significant delays and usually require a lot

of customization in each case, while regulators

expect banks to have flexible analysis frameworks.

The remainder of the paper is structured as

follows: The next chapter briefly explains the

needed calculation, section 3 deals with

requirements analysis while section 4 introduces the

platform architecture and section 5 presents

conclusions.

2 EXPLANATION OF THE

CALCULATION

Value at risk is a risk measure, that can be calculated

for any type of financial instrument that has a liquid

enough market price. We will focus on the VaR

calculation of a portfolio of capital market products

such as stocks and bonds. VaR is determined by two

parameters, a time interval and a confidence level. A

Ristau, P.

Implementing Value-at-Risk and Expected Shortfall for Real Time Risk Monitoring.

DOI: 10.5220/0008318704590464

In Proceedings of the 8th International Conference on Data Science, Technology and Applications (DATA 2019), pages 459-464

ISBN: 978-989-758-377-3

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

459

t-day, x-per cent VaR figure would be interpreted as

the maximum loss for an x% confidence level that

will not be breached within the next t days.

Translated into regular language that would mean

that

𝑉𝑎𝑅

10𝑑,99.9%

= 72%

would be interpreted such as “I am 99.9% confident

that my portfolio will not drop more that 72% in

value within the next ten days”.

In order to calculate this figure, the risk manager

needs to calculate the multivariate distribution of the

entire portfolio’s daily returns. This is dependent on

(a) the portfolio’s instruments weight (b) their risk-

return profile (expected return and return variance)

and (c) their correlation. According to modern

portfolio theory (Elton et.al., 2014), the cross-

correlations between financial product’s prices have

a big effect on the entire portfolio value. This is why

investment professionals try to diversify risk by

including uncorrelated or even negatively correlated

instruments into their portfolio.

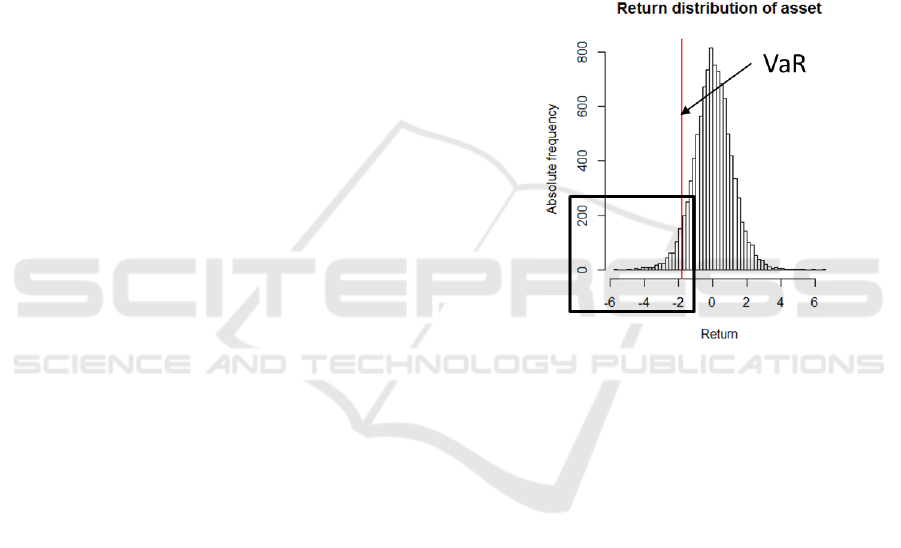

Each statistic is calculated using the standard

formula that can be found in every statistician’s

textbook. Partly represented as a number, partly

represented by a matrix, these figures are put

together so that a joint or multivariate return

distribution can be estimated. This is the return

distribution of the portfolio.

Next, the risk manager needs to proceed with the

Monte-Carlo simulation, which is a simulation of

future returns of the portfolio in this case. Deducted

from the multivariate distribution, the risk manager

randomly generates future return scenarios of length

t. These can be summed up to yield a portfolio return

over the t-day future. Repeating this simulation n-

times yields a distribution of portfolio returns after t-

days. The x% confidence level of the VaR

calculation can be deducted looking for the x% one-

sided quantile of the overall return distribution. This

return figure is the VaR figure (see figure 1). VaR is

technically a percentile of the loss distribution

(Krokhmal, Palmquist, Uryasev, 2001) of an asset.

The ES is the simple average (the expectation

value) of all simulated returns that are below the x%

quantile.

3 REQUIREMENTS ANALYSIS

The Real-time Risk Monitoring for Investment

Banking use case implements a risk assessment and

monitoring application that does, on the one hand,

comply with regulatory requirements of the financial

supervisory authorities, and on the other hand,

speeds up the risk valuation so that it can be used

intraday not only for regularly or ad-hoc queries, but

even for pre-trade analysis of potentially new trades

before the traders actually give the order.

The usage of the system is role based:

Risk Controllers have access to all use cases, i.e. the

calculation of risk measures (VaR and ES) as well as

the corresponding sensitivities. The pre-trade

analysis may be triggered by both, Risk Controllers

and Traders who just detected an investment

opportunity and have to assess portfolio risk as a

what-if scenario, as if the new trade was already

carried out.

Figure 1: VaR as a quantile of return distribution.

3.1 Input and Output Streams

The basis for every risk evaluation is the trade

history, consisting of past closed positions and

currently open positions, in combination with the

history of market price data. The result is a time

series of returns of the portfolio, the return vector (or

PnL vector), that will serve as input for the variance-

covariance matrix and finally, for the correlation

matrix.

What-if-Analysis requires as input a potential

new trade, that a trader may wish to add to the

portfolio. In order to provide also pre-trade analysis,

the trader may enter the position he/she may intend

to enter and the system will evaluate the changes of

risk measures that would be caused by this

additional trade.

On the output side we receive the risk measures

VaR and ES for the current portfolio together with

their sensitivities to a range of parameters.

In case that a pre-trade analysis was triggered,

the output will consist of the newly calculated risk

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

460

measures VaR and ES for the expanded portfolio

(what-if-scenario VaR).

The sequence of operations is rather

straightforward. From the login of the risk controller

or trader up to the calculation of the VaR and ES

risk measures as a single figure or as a diagram of

historical values.

4 PLATFORM ARCHITECTURE

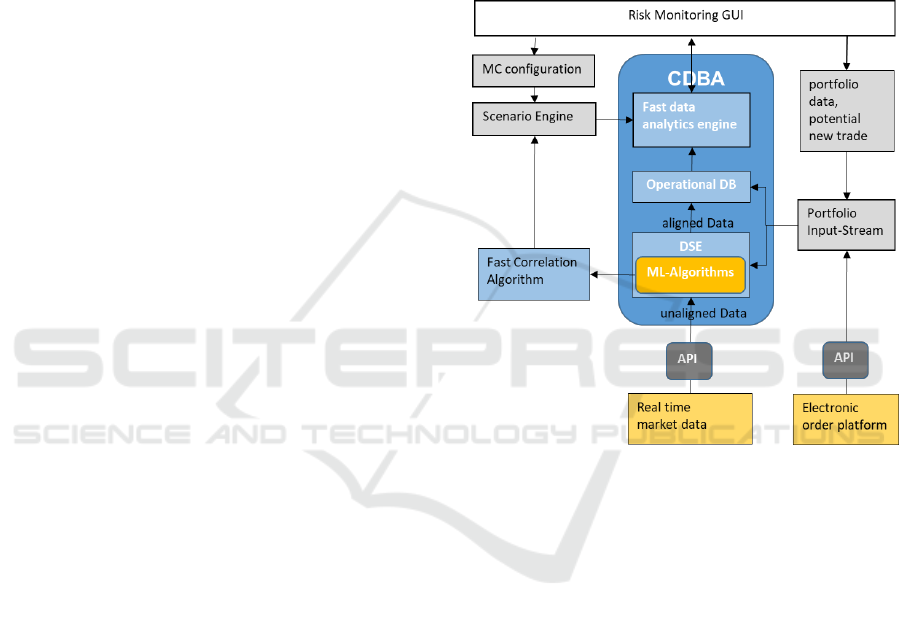

In the real-time risk monitoring use case, the aim

was to develop a solution, capable of highly non-

linear financial risk computation on large portfolios

of trades, changing in real-time (new trades coming

in, what-if scenarios, etc.). The goal is to utilize in-

memory capabilities of the solution to avoid

expensive brute-force re-computations and make it

possible to both, compute risk measures much faster

but also to allow marginal computations of risk for

new incoming transactions. The risk monitoring

application is designed to use fast analytical and

streaming processing capabilities of third-party

systems, i.e. the Big Data Analytics Engine, the

Operational DB and the Streaming Analytics Engine

shown in figure 2 below.

Two major streams of input data from external

sources supply the application with data:

Real-time market data, a high frequency data

stream of financial price data for stocks,

bonds, futures, currencies, etc. as offered by

numerous third-party data providers like

Bloomberg, ThomsonReuters, or Metastock.

Portfolio input stream, consisting of trades

list from the electronic order platform,

portfolio data and single new trades for

What-if-analysis.

Concerning the second type of input, the trade

history, we can distinguish between order data and

portfolio data. The order data consists of all trades

and can be derived via an API directly from the

electronic order platform. Each broker offers a

dedicated order platform where traders enter the new

trades that are then instantaneously forwarded to the

accounts held by the broker. The portfolio Data is

entered by the risk manager directly from the GUI

and contains information about the asset allocation

of the portfolio, but also potential new trades entered

for the pre-trade analysis. For creating the Portfolio

Input-Steam, the trades have to be evaluated and the

list of current assets contained in the portfolio is

being created and passed to both, the DSE (where it

serves for filtering only those streams related to the

current portfolio) and the Operational DB where it is

stored.

In contrast to the real-time market data

Application Programming Interface (API), the

interface to the order platform is not time critical

since the frequency with which new orders arrive

depends on the size of the institute, its number of

clients and Assets under Management (AUM).

However, the frequency is by far lower than the

market data update. Therefore, no streaming engine

support is needed here.

Figure 2: Use case architecture and data flow.

The Parameter Input-Stream is fed from the GUI

and contains all parameters for the scenario

generation that usually remain fixed, but might be

subject to change in the case that the risk controller

needs to make adjustments.

The first data source, the real time market data,

connect to the Data Streaming Engine (DSE) via a

dedicated API. The task of the streaming engine is to

filter only those assets that are contained in the

current portfolio and to align all incoming data into

streams with synchronous time stamps (e.g. on 1

second basis). This is a prerequisite for the

calculation of the variance-covariance matrix. The

DSE forwards the (aligned) real-time data (prices

and returns) to the Operational Database (DB) on the

one hand, where it is immediately passed through

into the Fast data Analytics Engine. The return

vectors, on the other hand, are forwarded to one of

the integrated Machine Learning Algorithms, i.e. the

fast correlation detection algorithm. The fast

Implementing Value-at-Risk and Expected Shortfall for Real Time Risk Monitoring

461

Analytics Engine can be configured via a GUI where

also the results are presented to the user.

Finally, the configuration of the scenario engine

and the data analytics engine is done via the GUI,

that also receives outputs for presenting them to the

user.

4.1 Scenario Engine

Scenario analysis is the systematic investigation of

the impact of different sets of model inputs on key

model outputs, where no analytical results are

available. The scenario engine is responsible for the

generation of parameterised simulations where each

set of input parameters defines one scenario. As

input, the scenario engine takes the correlation

matrix generated by the CDBA fast correlation

algorithm and derives from it the distributional

properties. Each scenario represents one possible

future development of market returns. Therefore, the

scenario engine uses randomly generated values for

uncertain variables and runs Monte Carlo

simulations on these values. The outputs of the

scenario engine are a huge number of return vectors,

one for each simulation run. These are loaded into

the analytics platform in order to be further

processed.

5 INTEGRATION WITH THE

CDBA PLATFORM

This section describes the usage of the core

components of the CDBA platform in the real time

risk monitoring use case.

5.1 Integration with the DSE

The usage of the DSE in this use case is threefold.

5.1.1 Data Synchronization

Since one of the main tasks of the fast correlation

detection algorithm is the generation of correlation

matrices, the input data streams of market data have

to be synchronized (aligned). We made the decision

to use a pulsing based on a one second level, but

also larger data compression intervals are possible

and usual (e.g. 1-minute, or 5-minutes). The task of

the streaming engine is to summarize several market

prices of the same time series arriving within the

same second by building an average value on the

one hand and to enter placeholder prices by

repeating the last observed data, in case there are

gaps of more than a second length.

5.1.2 Calculation of Returns

In addition to aligning the price itself, the DSE has

to calculate the returns as well, i.e. the relative

changes of two subsequent price data of the same

instrument. This is the recommended practice in

financial data analysis, i.e. correlation analysis. In

contrast to the raw market price data, return time

series have other, more desired statistical properties.

In particular, they are stationary, meaning that e.g.

their mean and variance do not depend on the

previous time series element. Therefore, the input to

the correlation detection algorithm consists of return

vectors instead of price vectors.

5.1.3 Alarm Generation

The third task of the DSE is to trigger a (complete or

incremental) recalculation of risk measures in the

case of unexpected large market moves. For this

purpose, the DSE monitors incoming market data,

whether predefined ranges are being kept and

generates an alarm in the case of breaches. However,

instead of fixed numeric values, the thresholds have

to be dynamic and they have to adapt to the

fluctuations of market prices and shall only be

triggered, if there are significant peaks or drops.

Therefore, they have to be updated in real time as

well. As a realization, we build a channel around the

market prices by adding/subtracting e.g. 2 standard

deviations.

If a price for a certain symbol arrives, that lies

outside the range, the DSE sends an alarm that is

stored in an extra table in the data base. The alarm

automatically triggers a recalculation of the risk

measures. The configuration of the thresholds in

terms of the factor of standard deviations is done via

the GUI.

In a final step, an API complying with the FIX

protocol is being built to connect a real time data

feed to the streaming engine. FIX stands for

Financial Information eXchange and is an open

standard for the exchange of information between

banks, brokers, stock exchanges and service

providers. In particular, we use the byte oriented

binary coding FAST (FIX Adapted for STreaming)

since it is more appropriate for high frequency data

streams.

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

462

5.2 Integration with the Operational

Data Base

The operational data is used for storing the existing

data histories of market prices as well as the newly

incoming market data from the data feed. In

addition, it stores the return values calculated by the

DSE as the percentage change from one price value

to the next. These data are passed directly from the

DSE. Hence, each record of market data consists of

4 attributes:

(symbol_ID, time_stamp, price,

return),

where symbol_ID is the provider specific identifier

for the trading instrument, e.g. 6-letter representation

in the case of currencies (as e.g. EURUSD,

USDJPY, etc.), time_stamp is a numeric value for

Unix time, price and return are both of type double.

On the other hand, trade data are stored in the

data base. These consist of lists of order data,

indicating time stamped buy or sell information:

(symbol_ID, time_stamp, price,

amount|position size, buy|sell)

The final data to be stored are the lists of current

assets, just being the time stamped list of symbol

IDs of the assets contained in the portfolio at a

certain time.

(time_stamp, symbol_ID

1

, …

symbol_ID

n

)

5.3 Integration with ML Algorithms

The correlation discovery algorithm is being used

for building the correlation-matrix. The decisive

requirement for the CDBA project is real-time

computation. For the calculation of VaR one of the

computationally most complex steps is the

calculation of the variance-covariance matrix and/or

the correlation matrix respectively. In this use case

the time series correlation discovery algorithm will

be used to set up the correlation matrix through

pairwise measuring of correlations of all return

vectors corresponding to all assets in the portfolio.

As a precondition for the matrix setup, the time

series have to be synchronised. We agreed to

synchronise all of the time series on a 1-second

basis. This is done by the DSE as described

previously. This means, that in the most frequent

update case this computationally intensive

calculation is repeated every second, over the length

of the time window that is shifted every second by

one. This way, the window always contains the most

recent data. The sliding length is the frequency of

updates (here one second as pseudo real time).

The computational complexity, of course, will

depend on the size of the portfolio, i.e. the number

of different assets contained therein. Therefore, for

large portfolios, the preferred mode of deployment

may be based on the trigger alarm of the DSE and a

re-calculation of the correlation matrix only

performed in case of an alarm, or on user request,

e.g. for a what-if-scenario as pre-trade analysis.

5.4 Fast Analytics Engine

Since the financial sector, i.e. risk management is

one of the main application areas of the fast

analytics engine, there exists already support for this

use case on several levels. In particular, there is an

open source project available for the calculation of

VaR, that was taken and expanded to the needs of

the use case.

The VaR project receives the P&L vectors as

generated by the scenario engine and calculates the

VaR risk measure that is then returned to the GUI.

The analysis has been expanded by the ES

calculation that is based on the same set of

scenarios.

5.5 Usage

The use case application is configured and the risk

assessment run from a central GUI.

The log in dialog offers two roles for users,

distinguishing between trader and risk controller.

While the trader can only enter one or several

(potential) new trades and then push the “VaR-

button”, the risk controller is also able to enter or

change parameters such as confidence level, sliding

window length, number of scenarios to be generated,

training sample length and forecasting period length.

6 CONCLUSION

The presented risk monitoring use case is a data-

intensive application in a critical infrastructure. It

does not require many different functionalities, but

focusses on a central aspect in the daily risk

management procedures of banks and financial

institutes.

The challenge of the application lies in the

computational complexity of the calculation of the

risk measures. This is where it exploits the

Implementing Value-at-Risk and Expected Shortfall for Real Time Risk Monitoring

463

capabilities of the underlying existing big data and

streaming analytics platforms.

The chosen architecture design is kept modular

and will allow for the replacement of single

components, either on the side of data base or

analytical platform, but also with respect to the data

sources like a change of the real time market data

provider or of the electronic order platform by

simply replacing the interface. This will keep the

design sustainable and open for future extensions of

requirements and functionalities.

ACKNOWLEDGEMENTS

This project has received funding from the European

Union’s Horizon 2020 research and innovation

programme under grant agreement No. 732051. The

authors acknowledge consortium members’ support

in the described work and efforts in the

implementation of the platform components.

REFERENCES

Elton, E., Gruber, M., Brown, S., Goetzmann, W.

“Modern Portfolio Theory and Investment Analysis”,

9

th

ed., Wiley, 2014

Krokhmal, P., Palmquist, J., Uryasev, S., “Portfolio

Optimization with conditional Value-at-Risk

Objective and Constraints”, 2001

ADITCA 2019 - Special Session on Appliances for Data-Intensive and Time Critical Applications

464