Behind the Surveys: Cloud Adoption at Second Glance

Damian Kutzias

1

, Mirjana Stanisic-Petrovic

2

and Claudia Dukino

2

1

University of Stuttgart IAT, Institute of Human Factors and Technology Management, Nobelstr. 12, Stuttgart, Germany

2

Fraunhofer IAO, Fraunhofer Institute for Industrial Engineering IAO, Stuttgart, Germany

{mirjana.stanisic, claudia.dukino}@iao.fraunhofer.de

Keywords:

Cloud Computing, Surveys, Cloud Adoption, Cloud Surveys, Survey Differences, Cloud, DMS, Document

Management Systems, SME, Small and Medium-sized Enterprises.

Abstract:

Cloud Computing has evolved from a trend technology to a well established part of the international market

and still has growing relevance. For strategic decisions especially of information technology providers as well

as governments, surveys can provide relevant information, but as usual in surveys, there are noteworthy differ-

ences even for the simplest questions. In this paper we give an overview of several existing cloud surveys and

compare some of the questions, particularly related to cloud adoption and scepticism. Differences are high-

lighted and a list of influencing factors as possible reasons is derived, each with some background, reference

proofs and explanation.

1 INTRODUCTION

By its essential characteristics, which are On-demand

self-service, Broad network access, Resource pool-

ing, Rapid elasticity and Measured service accord-

ing to (Mell and Grance, 2011), Cloud Computing

has many potentials for enterprises such as total cost

reduction, transforming capital expenditures to op-

erational costs, leveraging the focus on core com-

petences and huge flexibility for the consumed re-

sources and licenses (Lin et al., 2016). Cloud Com-

puting is also one of the main enabling technolo-

gies for fields like Industry 4.0 and the Internet of

Things (IoT), where even small and medium-sized en-

terprises (SME, following the definition of (European

Commission, 2003), i.e. a maximum of 50 million

euros turnover and less than 250 employees) often

have to handle huge amounts of data and need vary-

ing infrastructure resources for business intelligence

applications and machine learning approaches to op-

timise application areas such as predictive mainte-

nance and automated scheduling of workloads. Only

few technology investments are as critical to the cus-

tomer experience and competitiveness of enterprises

as Cloud Computing (O’Donnell et al., 2018). In ad-

dition, sharing the data with a cloud provider is a key

issue for many customers while using cryptography

in databases decreases performance and restricts the

ability to search (Ryan, 2013). Furthermore, while

often only the storage security and privacy is consid-

ered, also the computation security can be an issue

(Wei et al., 2014). Example software categories used

in the Cloud are Document Management Systems

(DMS) or Enterprise Content Management Systems

(ECM). DMS contains the strategies, methods, tech-

nologies and tools for company-wide capturing, cre-

ating, managing, distributing, storing archiving and

deleting documents and information. By using DMS,

organisations have the possibility to deliver relevant

documents and information to users where and when

they need it (Gartner Inc., nd). A document manage-

ment system maps all the phases of the entire docu-

ment life cycle: This cycle begins with the creation or

input of a document and ends with the archive or de-

fined disposal. Protecting outsourced data in cloud

especially when using DMS is a complex problem

which has advantages but also many disadvantages

and limitations (Wu et al., 2017).

1.1 Cloud Adoption at First Glance

The overall relevance of cloud technologies for en-

terprises as well as the general adoption of cloud

computing have vastly grown over the last years (Ill-

sley, 2017). Many current surveys show that the

predominant share of enterprises even uses Public

Clouds. Bain & Company state, that 48 of the For-

tune Global 50 companies have published their cloud

324

Kutzias, D., Stanisic-Petrovic, M. and Dukino, C.

Behind the Surveys: Cloud Adoption at Second Glance.

DOI: 10.5220/0007714303240330

In Proceedings of the 9th International Conference on Cloud Computing and Services Science (CLOSER 2019), pages 324-330

ISBN: 978-989-758-365-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

adoption plans (Brinda and Heric, 2017). According

to RightScale, the adoption of Public Clouds has in-

creased from 89 percent in 2017 to 92 percent in 2018

and even 96 percent when Private Clouds are included

(RightScale, 2018). For German enterprises, the

Cloud Monitor by KPMG and bitkom states that 29

percent of the German enterprises use Public Cloud

Solutions and 65 percent use a Public or Private Cloud

in 2016.

2 BEHIND THE SURVEYS

First, this section gives an overview of several cloud

surveys, explains their meta information, highlights

their differences and discusses them. After that, some

surveys with more background knowledge are shown

and explained and again, their differences are shown

and discussed. After that, a list of hypotheses is de-

rived and remarks for reading and writing surveys re-

lated to the meta information are given.

2.1 Adoption

When trying to answer a question based on survey re-

sults, the results usually vary. This section lists cloud

adoption results from several cloud surveys, gives an

overview and compares the results as well as inves-

tigates reasons for the differences in the topic area.

In general, the results vary heavily in the topic area of

cloud computing as it can be seen in the following. At

first, the meta information of the illustrated surveys is

given:

State of the Cloud Report. The State of the

Cloud Report is an annular Cloud survey by

RightScale. Participants of the newest version

were questioned in January 2018, range from

technical executives to managers and practition-

ers and include various enterprise sizes and indus-

tries. 19 percent of the participants are RightScale

customers and small and medium sized enter-

prises are defined as enterprises (SME) with less

than 1000 employees (RightScale, 2018).

Cloud Monitor 2018. The Cloud Monitor sur-

vey series is an annual survey by KPMG realised

by bitkom and exists since 2011. The partici-

pants are solely German IT-managers from enter-

prises with at least 20 employees and the newest

data was acquired from November to December in

2017. The enterprises are distinguished regarding

their number of employees with less than 100 and

less than and more than 2000, therefore SME are

considered to be enterprises with less than 2000

employees (Bitkom Research GmbH, 2018).

Studie IT-Trends 2017. Capgemini evaluates

current ICT-trends in German speaking countries,

i.e. Austria, Switzerland and Germany in a se-

ries of surveys called Studie IT-Trends. The con-

sidered version is from 2017 and evaluates data

from September to October 2016 (Scheid et al.,

2017). Whereas the currently newest version is

from 2018 with data from September to Novem-

ber 2017 containing the same core evaluations for

cloud computing (Scheid et al., 2018), not all the

summarised values are given in the latest version

which prevents comparability of the overall cloud

adoption. However, the difference in the share

of cloud solutions of all ICT-solutions is stated

to be nearly unchanged for the year between the

two surveys from 2017 and 2018 and the share

of cloud solutions (public and private) has only

changed from 46.8 percent in the end of 2016 to

47.3 percent in the end of 2017 (Scheid et al.,

2018). Enterprises are distinguished by revenue

whereat SME cover three classes: up to 50 mil-

lion euro, up to 500 million euro and up to 1 bil-

lion euro.

Cloud Computing Survey. The Cloud Com-

puting Survey is a cloud survey series by IDG

Communications conducted by six IDG brands

(CIO, Computerworld, CSO, InfoWorld, ITworld

and Network World) representing IT and secu-

rity decision makers across multiple industries.

This was a targeted research effort – to be con-

sidered qualified respondents must have reported

cloud utilisation was planned or currently lever-

aged at their organisation. Furthermore, respon-

dents must have reported personal involvement

in the purchase process for cloud solutions at

their organisation. The 2018 version is based on

550 participants and there is no information given

about the enterprise sizes (IDG Communications,

2018).

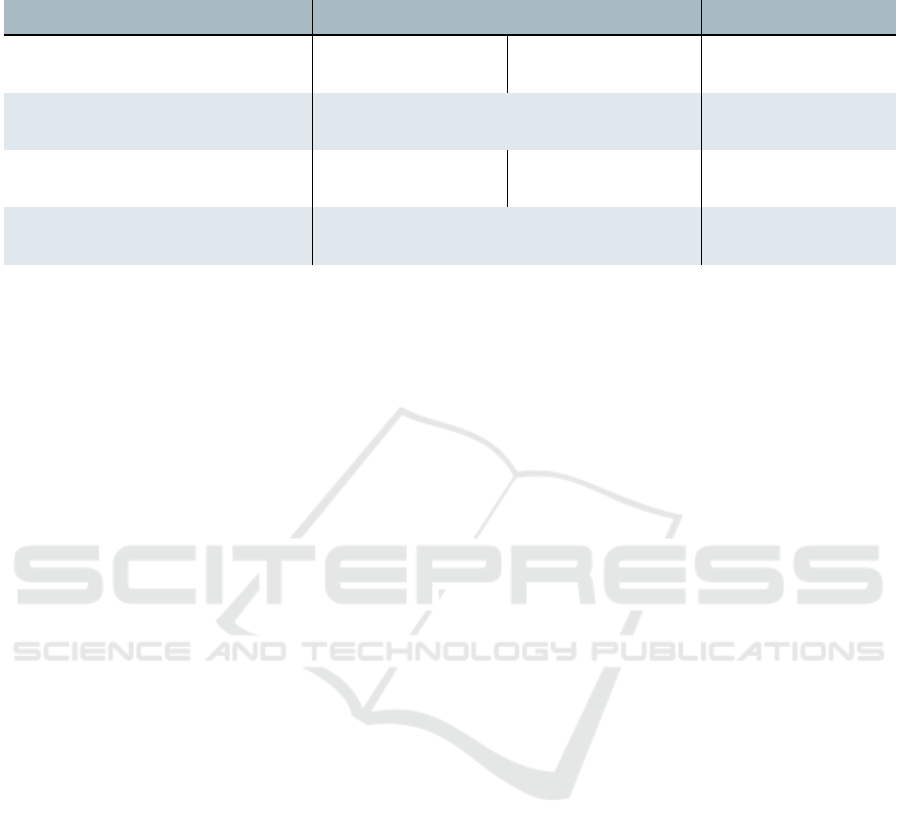

An overview of the number of participants, the share

of small and medium-sized enterprises (SME) and

the survey time is given in Table 1.

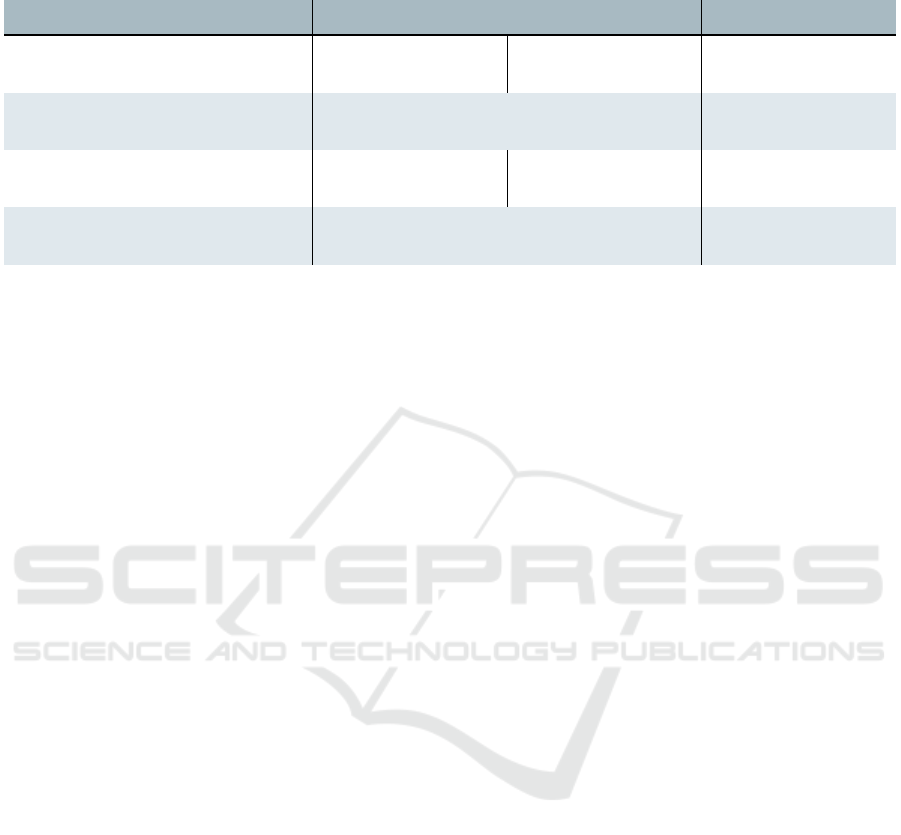

Table 2 then gives an overview of the cloud adoption

following the four considered surveys distinguished

in public cloud adoption, private cloud adoption and

the general cloud adoption (using public or private

cloud). The largest difference is the public cloud

adoption between the Cloud Monitor and the State of

the Cloud Report, whereat these two are the contin-

uous upper bound in case of the State of the Cloud

report and the continuous lower bound in case of the

Cloud Monitor. This difference is nearly a factor of

three in the double-digit percentages for the public

Behind the Surveys: Cloud Adoption at Second Glance

325

Table 1: Overview of the number of participants, the share of small and medium enterprises (SME) as well as the survey time

of the considered surveys in a tabular representation.

Survey Participants SME Share Survey Time

State of the Cloud Report

(RightScale, 2018)

997 47% 01/18

Cloud Monitor 2018

(Bitkom Research GmbH, 2018)

557 95% 11/17 - 12/17

Studie IT-Trends 2017

(Scheid et al., 2017)

148 56% 12.09.16 - 21.10.16

Cloud Computing Survey

(IDG Communications, 2018)

550 - -

cloud adoption.

2.2 Scepticism

In addition to the previously presented surveys and

as an additional puzzle piece for understanding dif-

ferences and influencing factors, an extract of three

more surveys is presented for which more background

knowledge exists. For the scepticism, three different

surveys from Germany are compared.

Cloud Computing im Mittelstand 2017. The

online survey (translated: Cloud Computing in

SME 2017) is a requirements analysis within the

framework of the transfer project Agentur Cloud

(Agency Cloud) in the German government pro-

gram Mittelstand Digital (Mid-sized Sector Digi-

tal). The survey was designed specifically to op-

timise support offers for the needs of influencers

and SME. Influencer such as Chambers of Com-

merce and Industry, Chambers of Crafts etc. as

well as medium-sized enterprises in Germany and

especially in Baden-W

¨

urttemberg answered ques-

tions about current trends, hurdles and other SME

related topics of cloud computing. It was an on-

line survey with 123 participants and about 90

percent influencers (108 of 123) which was con-

ducted from 27th of July 2017 to 15th of Septem-

ber 2017 (Frings et al., 2017).

Digitalisierung im Mittelstand. The document-

management-systems (DMS) for SME survey was

carried out by the Fraunhofer Institute for Indus-

trial Engineering (IAO). It investigates the devel-

opment status of the use of DMS at SME. The

content was designed for companies and organisa-

tions in German-speaking countries and was con-

ducted as an online survey with some open and

some standardised questionnaire. Two participant

groups were distinguished: those with DMS and

those without DMS in use. The questions have

been selected according to the target group. The

questionnaire for the target group with DMS had

29, the questionnaire for the target group with-

out DMS had 27 standardised questions. The

questionnaire was distributed via Fraunhofer IAO

mails predominantly to German SME and social

media platforms as well as by the Chamber of In-

dustry and Commerce Stuttgart.

The results of the survey are based on information

given by 137 respondents (60 without DMS, 77

with DMS in use), who took part between 2016

and 2017 and twenty additional interviews, which

took part during DMS projects in SME. Among

the participants, the largest group is the service

sector (36.4 percent of the respondents with DMS

and 30 percent without DMS). The second largest

group is composed of industry and retail (15.6

percent vs. 18.3 percent). 20.8 percent of the re-

spondents, using a DMS, didn’t give further infor-

mation, also 13.3 percent of the respondents, who

don’t use a DMS.

All in all, 11.7 percent of the companies, which

use a DMS have up to 9 employees, of those,

which don’t use a DMS it’s 18.3 percent. In com-

panies with up to 49 employees, 11.7 percent use

a DMS and the same percentage don’t use a DMS.

In companies with up to 250 employees 15.6 per-

cent use a DMS and 8.3 percent don’t use a DMS.

A quarter of the participants come from compa-

nies with up to 2500 employees (29.9 percent with

DMS, 20 percent without DMS). There were also

companies, which didn’t give information consid-

ering company size (27,3 percent with DMS, 26.7

percent without DMS). (Bauer et al., 2018).

Cloud Mall Baden-W

¨

urttemberg. The survey

is about the cloud adoption of SME in Baden-

W

¨

urttemberg and in addition to the adoption also

asks many details about the different kinds of so-

lutions used, plans to use cloud solutions in the

CLOSER 2019 - 9th International Conference on Cloud Computing and Services Science

326

Table 2: The Cloud Computing adoption that was shown in the four considered surveys distinguished to the adoption of

public, private and general (at least one public or private) cloud solutions.

Survey General Public Private

State of the Cloud Report

(RightScale, 2018)

96% 92% 75%

Cloud Monitor 2018

(Bitkom Research GmbH, 2018)

66% 31% 51%

Studie IT-Trends 2017

(Scheid et al., 2017)

- 79.6% 75%

Cloud Computing Survey

(IDG Communications, 2018)

73% - -

future, reasons for hesitating to or not using cloud

and also the number of used cloud solutions. It

also investigates these aspects for different indus-

try sectors. For inviting the participants, con-

tact lists from Baden-W

¨

urttemberg were used in

addition to business development enterprises and

Chambers of Industry and Commerce. The data

were collected from 21.11.2016 to 31.03.2017.

There were 46 percent high-level managers, 30

percent from middle management and 24 percent

non-manager employees taking part in the survey.

From the content-related perspective, 42 percent

have an IT background, 27 percent are mainly

management, 17 percent marketing, 11 percent fi-

nance and 10 percent research and development.

58 percent of the participants already had expe-

rience with using or establishing cloud solutions.

15 percent of the represented enterprises had 1-9,

24 percent had 10-49, 23 percent had 50-249, 6

percent 250-999 and 18 percent 1000-4999 em-

ployees. Three major groups were identified:

manufacturing, IT and retail with 50 percent, 23

percent and 17 percent of the participants respec-

tively. (Falkner et al., 2018).

Table 3 shows results from the three described surveys

and emphasises the relevance of the privacy and secu-

rity concerns of German enterprises regarding cloud

computing.

2.3 Understanding the Differences

Using (Public) Cloud or cloud adoption in the context

of surveys usually means, that at least one solution is

consumed as SaaS from a Public Cloud which can be

basic software like email, collaboration tools or file

sharing. The survey of Capgemini has shown, that

the percentage of the share of the used IT solutions in

the case of Public Cloud solutions with 10.2 percent

is rather small compared to Private Cloud solutions

with 36.6 percent (Scheid et al., 2017).

Besides numbers, formulations and legal aspects,

there are also the survey participants obviously

affecting the survey results they take part in. The

following quote addresses their understanding and

preciseness:

Imagine I am participating in a cloud computing sur-

vey. When I watch Netflix at work, is my enterprise

using public cloud computing then?

J

¨

urgen Falkner

Although the statement is overblown and ironic, it

addresses some central issues with complex surveys:

the understanding and knowledge of the participants.

This ranges from understanding the question - not ev-

eryone knows the precise definitions of all the terms,

and some of them might be ambiguous in addition -

over their position within their enterprise to the for-

mulation of the question within the survey.

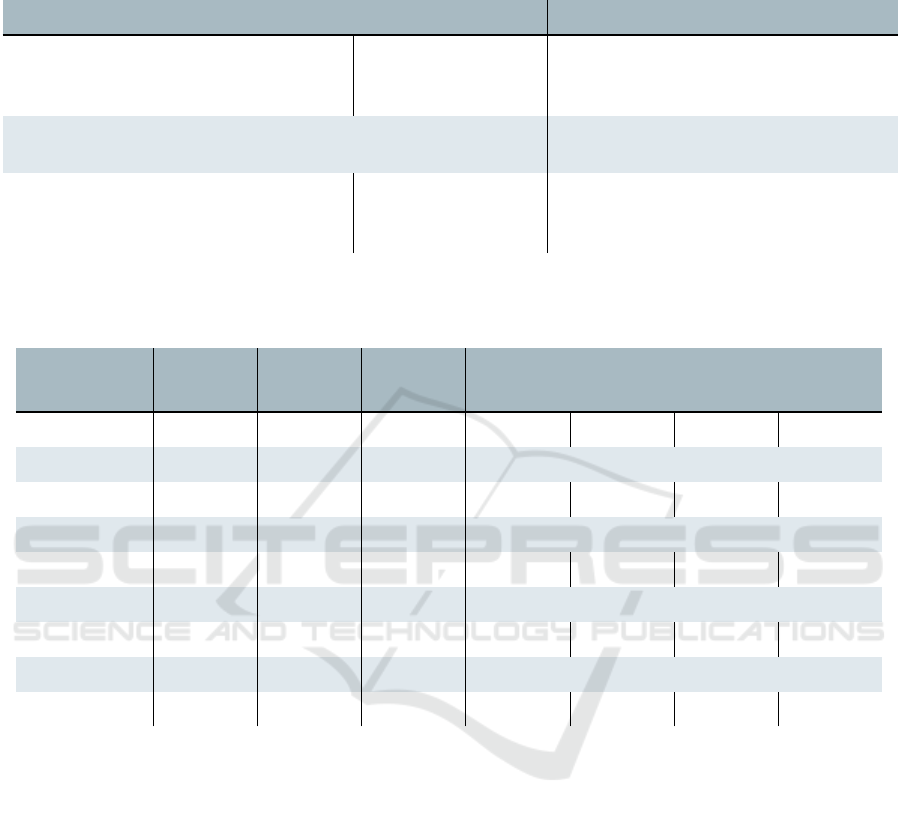

The major influencing factors to survey results we

identified during our research of surveys in the con-

text of cloud adoption are given, described and argued

in the following. An overview of the accessible meta

information of the investigated surveys for the identi-

fied influencing factors is given in Table 4.

The Business Section. When taking a deeper

look into the details of cloud adoption, it turns out

that there are huge differences depending on the

industry section of the enterprises (Candel Haug

et al., 2016). Whereas the majority of surveys

does not consider the industry sector differences,

e.g. for Baden-W

¨

urttemberg it was shown, that

especially ICT-related enterprises, the adoption

is far more advanced than in other business sec-

tions such as retail sale, logistics and craft busi-

nesses and particularly manufacturing (Falkner

et al., 2018).

The Enterprise Size. Independent from the vary-

ing definitions of SME by revenue or different

Behind the Surveys: Cloud Adoption at Second Glance

327

Table 3: The privacy and security barrier regarding the cloud adoption resulting from the three previously considered surveys.

Privacy / Security were given as a part of a set of predefined answers for all three surveys and are the largest barrier in each

case.

Survey Barrier Relevance Translated Question

Cloud Computing im Mittelstand 2017

Influencer / SME

(Frings et al., 2017)

58% / 69%

What are the major barriers of using

cloud computing?

Digitalisierung im Mittelstand

(Bauer et al., 2018)

53%

What are the backgrounds for not using

DMS cloud solutions in SME?

Cloud Mall Baden-W

¨

urttemberg

Security / Privacy

(Falkner et al., 2018)

67% / 63%

Which concrete challenges or barriers do

you see for your enterprise related to the

cloud topic?

Table 4: An overview of the meta information availability for the seven surveys previously discussed, structured by the nine

different categories of influencing factors ( extensive information available – G# partial information is available – # little

or no information available).

Influencing factors

Cloud

Computing im

Mittelstand

2017

Digitalisierung

im Mittelstand

Cloud Mall

Baden-

W

¨

urttemberg

State of the

Cloud Report

Cloud Monitor

2018

Studie

IT-Trends 2017

Cloud

Computing

Survey

Business Section

G# G#

Enterprise Size

# G#

Ambiguities and

Understanding

G# G# G# # # # #

Culture and

Legislation

#

Competence and

Knowledge

G# G# G# G# G# G# G#

Participants Role

within the Enterprise

G# G# G# G# # #

Participants of the

Same Enterprise

G# G# # G#

Kind of the Enterprise

# # # # # #

Participants

Acquisition Methods

G# # #

numbers of employees, there are noteworthy dif-

ferences such as the public cloud adoption for

which a difference from 50 percent for enterprises

with more than 2000 employees was shown in

contrast to only 29 percent for enterprises with

20 to 1999 employees (Bitkom Research GmbH,

2017).

Ambiguities and Understanding. Even for ex-

perts, some commonly used terms can be ambigu-

ous and therefore complicate the understanding of

survey questions. As an example from the cloud

context, the term Platform as a Service (PaaS) has

at least four different meanings in the literature:

PaaS as cloud IDE (integrated development envi-

ronment), PaaS as managed IaaS (Infrastructure

as a Service), PaaS with middleware and PaaS as

DevOps (Development Operations) (Kutzias and

Kett, 2018). Following the definition of the Na-

tional Institute of Standards an Technology, PaaS

is one of the fundamental three service models

and therefore a part of the definition of cloud com-

puting (Mell and Grance, 2011).

Culture and Legislation. Usually German enter-

prises are rather cautious when it comes to using

(Public) Clouds with critical data such as personal

data or documents containing crucial information

about the expertise of the enterprise or technical

processes. Germany in particular, has some of

the strictest privacy laws in the world – creating a

more restrictive environment for enterprises (Bai-

ley, 2015). After the EU General Data Protec-

tion Regulation (GDPR) taking effect this might

be even more relevant. Before taking effect, For-

rester predicted, that 80 percent of the effected en-

terprises will not comply with the EU GDPR (For-

rester, 2017). After taking effect, a survey by Tal-

end states, that 70 percent fail the EU GDPR (Tal-

end, 2018) and for Canada and the US, Miglicco

CLOSER 2019 - 9th International Conference on Cloud Computing and Services Science

328

also states, that most enterprises are most proba-

bly not compliant (Miglicco, 2018).

Competence and Knowledge. Depending on the

background and experiences, the qualification for

giving complete and correct answers to all survey

questions might differ between participants. The

Cloud Monitor states for example, that employ-

ees often do not perceive a difference between in-

tern IT solutions and cloud solutions (Bitkom Re-

search GmbH, 2018).

Participants Role within the Enterprise. As

stated before, many employees might not realise

the difference between cloud and intern IT. While

some surveys are open to all, others require cer-

tain positions withing the enterprises, such as the

Cloud Monitor, which restricts participants to be

IT-managers (Bitkom Research GmbH, 2018). A

manager making the decisions might know more,

but time management is one of the hardest parts of

a manager’s job (Kolowich, 2015) which has been

investigated by many researchers for a long time

due to its importance (Oshagbemi, 1995). When

classifying tasks to A tasks - must be done, B tasks

- should be done, C tasks - could be done, D tasks

- delegate to somebody else and E tasks - elimi-

nate, most managers admit that 80 percent of their

time is spent on tasks of type C, D and E. Relevant

points for the quality of the survey answers are

then, how the participation in a survey is classified

for a manager and how precise the manager fills in

the answers as well as the depth of knowledge of

the manager, since especially in large enterprises,

not every manager is involved in or knows about

everything.

Participants of the Same Enterprise. Whether

the participants acquisition and data evaluation al-

low for more than one participant of the same en-

terprise can effect the results. Even though the

answers can differ, e.g. depending on knowledge

and position, strong biases on the enterprise level

are possible.

Kind of the Enterprise. In addition to the busi-

ness section, enterprises and institutions also dif-

fer in their tasks and structure. Chambers of

Industry and Commerce have the duty to assist

enterprises in using new technologies and there-

fore have a different perspective while researchers

might have an affinity for new technologies.

Participants Acquisition Methods. The meth-

ods of participant acquisition can have huge in-

fluence on the participants composition and there-

fore the survey results. For the State of the Cloud

Report from RightScale (a cloud provider), 19

percent of the participants are users of RightScale

solutions (RightScale, 2018) and for the Cloud

Computing Survey, IDG used IDG brands for par-

ticipants acquisition and to be considered quali-

fied respondents must have reported cloud utilisa-

tion was planned or currently leveraged at their or-

ganisation. Furthermore, respondents must have

reported personal involvement in the purchase

process for cloud solutions at their organisation

(IDG Communications, 2018). In contrast, the

surveys from Section 2.1 used the help of Cham-

bers of Commerce and Industry for participants

acquisition, which mainly adresses enterprises in

need for help with new technology.

Summing up, there are many different influencing

factors in addition to the variances inherent for sur-

veys. These influencing factors are not necessarily in-

dependent, e.g. it might be possible that an employee

of a small enterprise knows more or less every used

IT-system, it is unequally harder if not impossible for

an employee of a very large concern. This might also

be affected by the position, yielding a dependence of

the enterprise size, the role within the enterprise and

the knowledge of the person.

3 CONCLUSION

The cloud adoption has vastly increased over the last

years, but even if some surveys show adoption rates

with almost 100 percent, a deeper look at different

surveys and to the circumstances and the background

of the surveys show, that cloud computing is not yet

omnipresent and still several problems especially in

the areas of security and privacy have to be solved, or

at least regarding the perception of these aspects, for

many hesitating enterprises to accept the technology.

For better understanding and the derivation of in-

fluencing factors for surveys, especially in the context

of cloud computing and the cloud adoption, seven sur-

veys were investigated with special attention to their

meta information and backgrounds. Summing up,

nine main influencing factors were identified, namely:

the business section, the enterprise size, ambigui-

ties and understanding, culture and legislation, com-

petence and knowledge, the participants role within

the enterprise, participants of the same enterprise,

the kind of enterprise and the participants acquisition

methods.

Even with complete information about these in-

fluencing factors, which might be unrealistic to have

(none of the seven presented surveys has deep infor-

mation on all the identified influencing factors), also

the absence of meta information can give good expla-

Behind the Surveys: Cloud Adoption at Second Glance

329

nations for huge differences in the results such as very

high adoption rates without information about the

participants acquisition which could be solely cloud

users.

For these reasons it is strongly recommended for

survey publishers to give as much details about the

meta information as possible. For readers the influ-

encing factors provide a structured way of checking

the presence and absence of meta information for bet-

ter understanding survey results.

REFERENCES

Bailey, S. (2015). Top 3 Reasons Enterprises Hesitate to

Adopt the Cloud.

Bauer, W., Spath, D., Stanisic-Petrovic, M., and Weis-

becker, A. (2018). Digitalisierung im Mittelstand:

Dokumenten-Management-Systeme f

¨

ur KMUs.

Bitkom Research GmbH (2017). Cloud-Monitor 2017. Cy-

ber Security im Fokus: Die Mehrheit vertraut der

Cloud.

Bitkom Research GmbH (2018). Cloud-Monitor 2018.

Strategien f

¨

ur eine zukunftsorientierte Cloud Security

und Cloud Compliance.

Brinda, M. and Heric, M. (2017). 2017 - Bain and Company

- The Changing Faces of the Cloud.

Candel Haug, K., Kretschmer, T., and Strobel, T. (2016).

Cloud adaptiveness within industry sectors – Mea-

surement and observations. Telecommunications Pol-

icy, 40(4):291–306.

European Commission (2003). Commission Recommenda-

tion of 6 May 2003 concerning the definition of micro,

small and medium-sized enterprises (Text with EEA

relevance) (notified under document number C(2003)

1422). Official Journal of the European Union.

Falkner, J., Kutzias, D., H

¨

arle, J., and Kett, H. (2018).

Cloud Mall Baden-W

¨

urttemberg: Eine Umfrage zur

Nutzung von Cloud-L

¨

osungen bei kleinen und mit-

telst

¨

andischen Unternehmen in Baden-W

¨

urttemberg.

Fraunhofer Verlag, Stuttgart.

Forrester (2017). Predictions 2018: A Year of Reckoning.

Frings, S., Falkner, J., and Kett, H. (2017). Cloud Comput-

ing im Mittelstand 2017: Ergebnisse der Bedarfsanal-

yse der Mittelstand 4.0-Agentur Cloud.

Gartner Inc. (n.d.). IT Glossary: Enterprise Content Man-

agement (ECM).

IDG Communications (2018). Cloud Computing Survey:

Executive Summary.

Illsley, R. (2017). 2018 Trends to Watch: Cloud Computing.

Kolowich, L. (2015). How Effective Managers Organize

Their Time: 9 Pro Tips From Real HubSpot Man-

agers.

Kutzias, D. and Kett, H. (2018). Cloud Strategies for Soft-

ware Providers: Strategic Choices for SMEs in the

Context of the Cloud Platform Landscape. In Pro-

ceedings of the 14th International Conference on Web

Information Systems and Technologies, pages 207–

214. SCITEPRESS - Science and Technology Publi-

cations.

Lin, D., Armknecht, R., Zhang, W., and Cotter, B. (2016).

Cloud Adoption: Putting the Cloud at the Heart of

Business and IT Strategy.

Mell, P. and Grance, T. (2011). The NIST Definition of

Cloud Computing.

Miglicco, G. (2018). GDPR is here and it is time to get

serious. Computer Fraud & Security, 2018(9):9–12.

O’Donnell, G., Koetzle, L., McKeon-White, W., and Reese,

A. (2018). 2018 - Forrester - Cloud Services Acceler-

ate Your Pursuit Of Customer Obsession.

Oshagbemi, T. (1995). Management development and

managers0 use of their time. Journal of Management

Development, 14(8):19–34.

RightScale (2018). State of the Cloud Report - DATA TO

NAVIGATE YOUR MULTI-CLOUD STRATEGY.

Ryan, M. D. (2013). Cloud computing security: The scien-

tific challenge, and a survey of solutions. Journal of

Systems and Software, 86(9):2263–2268.

Scheid, K., Pr

¨

adel, J.-M., Emenako, D., Ogulin, G., and

Luley, T. (2017). Studie IT-Trends 2017:

¨

Uberfordert

Digitalisierung etablierte Unternehmensstrukturen.

Scheid, K., Pr

¨

adel, J.-M., Emenako, D., Ogulin, G., and Lu-

ley, T. (2018). Studie IT-Trends 2018: Digitalisierung:

Aus Ideen werden Ergebnisse.

Talend (2018). The Majority of Businesses Surveyed are

Failing to Comply with GDPR.

Wei, L., Zhu, H., Cao, Z., Dong, X., Jia, W., Chen, Y., and

Vasilakos, A. V. (2014). Security and privacy for stor-

age and computation in cloud computing. Information

Sciences, 258:371–386.

Wu, Y., Lyu, Y., Fang, Q., Zheng, G., Yin, H., and Shi,

Y. (05.06.2017 - 08.06.2017). Protecting Outsourced

Data in Semi-Trustworthy Cloud: A Hierarchical Sys-

tem. In 2017 IEEE 37th International Conference

on Distributed Computing Systems Workshops (ICD-

CSW), pages 300–305. IEEE.

CLOSER 2019 - 9th International Conference on Cloud Computing and Services Science

330