Market Power in Emissions Trading and Renewable Energy Policy

Mari Ito and Ryuta Takashima

Department of Industrial Administration, Tokyo University of Science, Chiba, Japan

Keywords:

Cap-and-Trade, Renewable Portfolio Standards, Market Power, Social Welfare, Electricity Price.

Abstract:

Policies for reducing greenhouse gas emissions, e.g., cap-and-trade (C&T) as emissions permits trading and

renewable portfolio standards (RPS) as renewable energy policies, have recently been introduced in various

countries. In this study, we examine market equilibria under C&T and RPS in a bi-level optimization frame-

work. For the lower level, generation of outputs of renewable and non-renewable sectors and electricity prices

are decided by maximizing their profits. For the upper level, the policy maker chooses optimal policy level in

an attempt to maximize the social welfare. Our results indicate that C&T is the best scheme for both increasing

social welfare and reducing greenhouse gas emissions.

1 INTRODUCTION

In recent years, greenhouse gas emissions (i.e., car-

bon dioxide (CO

2

) and methane) have been impli-

cated as contributing to global warming. A number

of measures to control those emissions have been pro-

posed in various countries. IEA (2018) examines the

effectiveness of policy and support scheme for renew-

able energy in various countries. The support and

target schemes have increased generation capacity of

renewables significantly: in 2010, 61 countries had

a feed-in tariff (FIT), renewable portfolio standards

(RPS) or auction system in place. Additionally, by

2017, the scheme had expanded to 121 countries, not

only in US and EU but also in Asia and Sub-Saharan

Africa.

Two commonly implemented policy instruments

are the cap-and-trade (C&T) scheme and a policy for

promoting renewable energy technologies known as

RPS. Under C&T, CO

2

emission quotas are set for

each country, region, or sector. The non-renewable

energy sectors are required to achieve CO

2

reduc-

tions. Some sectors are successful, exceeding CO

2

emission quotas. By contrast, there are unsuccess-

ful ones. C&T is a system of trading through a mar-

ket where successful and unsuccessful sectors buy

to cover shortages or sell excess capacity emissions

quotas. By contrast, RPS requires a certain percent-

age of electricity generation to originate from renew-

able energy sources. In most cases, producers are

allowed to meet RPS by self-generation, procuring

power from renewable energy sources via bi-lateral

contracts, and purchasing renewable energy certifi-

cates/credits (RECs) from secondary markets. The

REC price is endogenously determined by supply and

demand conditions in the REC market.

Some countries have introduced C&T and

RPS (ICAP, 2017; REN21, 2017). We assume that

C&T and RPS are both adequate policy schemes

viewed from the aspect of CO

2

reductions, but we do

not know which is preferable and how each one im-

pacts social welfare. Hibiki and Kurakawa (2013) dis-

cussed whether FIT or RPS as renewable energy poli-

cies is preferable from the aspect of social welfare.

Their findings indicated that governments should in-

troduce RPS when marginal damage cost is relatively

high. They did not evaluate whether C&T as emis-

sions permits trading or RPS as renewable energy

policies is preferable from the aspect of social wel-

fare.

Market power in the electricity market greatly in-

fluences electricity prices and production (Siddiqui et

al., 2016). Modeling market power in electricity mar-

kets using a Cournot oligopoly structure has already

been done. For example, Siddiqui et al. (2016) ana-

lyze market power in electricity markets under RPS.

The result of their research showed welfare losses

are actually higher when there is less potential for

exercising market power. Tanaka and Chen (2012)

analyze the impact of C&T on the electricity mar-

ket. They show the relationship between emission

cap levels and market equilibrium, however they do

not show socially optimal emission cap, to be given

exogenously as parameters.

Ito, M. and Takashima, R.

Market Power in Emissions Trading and Renewable Energy Policy.

DOI: 10.5220/0007470304290434

In Proceedings of the 8th International Conference on Operations Research and Enterprise Systems (ICORES 2019), pages 429-434

ISBN: 978-989-758-352-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

429

Our study develops an analytical model to deter-

mine an optimal policy level in a Cournot oligopoly

structure for both C&T and RPS. We extend the

model of Tanaka and Chen (2012) by considering the

optimal policy level (i.e., the rate of emission cap

and the rate of RPS). All sectors may then strategi-

cally determine output quantities to maximize prof-

its. We then apply the model to analyze a relation-

ship between market equilibria and energy and envi-

ronmental policy as C&T and RPS. Thus, the analyt-

ical model is used to generate contestable hypothe-

ses, while the numerical experiment gives us a more

meaningful and intuitive interpretation of the results.

We highlight the effect on electricity prices, social

welfare, and CO

2

emissions under C&T and RPS.

The following findings are provided in this pa-

per. Under C&T, the electricity price influences re-

newable energy generation. Electricity prices are high

because of low levels of non-renewable energy gener-

ation. The social surplus of C&T’s electricity market

becomes relatively large. C&T directly controls CO

2

emissions. Under RPS, renewable energy generation

decreases along with non-renewable energy genera-

tion. Electricity prices are low due to the high level of

renewable energy generation. RPS does not control

CO

2

emissions comparatively because non-renewable

energy generation also increases when renewable en-

ergy generation increases.

The remaining part of this paper is organized as

follows: Section 2 introduces one single-level model

and two bi-level models. After laying out our numer-

ical data in Section 3, we use the proposed model to

conduct experiments. Section 4 contains concluding

remarks along with suggestions for future research.

2 MODEL

In this study, we assume that there are one renewable

energy sector and two non-renewable energy sectors

possessing thermal power in the electricity industry.

We adopt a complementary approach to the mod-

els’ interaction between a deregulated electricity in-

dustry and a policymaker by assuming that the poli-

cymaker’s objective is to maximize social welfare in-

clusive of damages. In order to explore the variation

of outcomes, we allow for the following market set-

tings:

Benchmark Setting (BM). This benchmark

setting has a policymaker operating all power

plants in order to maximize social welfare,

considering damage from emissions. This

setup results in a single-level program.

C&T. The C&T is a market-based scheme for

reducing the emission of CO

2

effectively in a

region. Policymaker imposes upper-limit of

the emissions, that is, “cap” on power pro-

ducers. The power producers then trade a

difference between the upper-limit and actual

emissions in the market of the emission per-

mit. If actual emission for a power producer

is fewer (more) than upper-limit, the producer

might be able to sell (buy) the emission per-

mit. Energy sectors’ decisions at the lower

level are made by price-taking renewable and

non-renewable energy sectors that take the

rate of emission cap as given and maximize

their profits inclusive of emission revenues

or costs, the shadow price of the emission

cap constraint. At the upper level, the policy

maker decides the emission cap percentage in

order maximize social welfare constrained by

the lower level.

RPS. The RPS scheme is one for encourag-

ing power producers to supply a certain min-

imum share of their electricity from renew-

able energy sources. In countries or regions

where the RPS scheme is introduced there is

usually secondary market for REC. If the pro-

ducers can not meet the RPS target, in order

to meet the target they might be able to pur-

chase the certificates in the REC market. En-

ergy sectors’ decisions at the lower level are

made by renewable energy and non-renewable

energy sectors that take the RPS percentage

target as given and maximize their profits in-

clusive of REC revenues or costs determined

by the shadow price of the RPS constraint.

Each sector is dominant and behaves in Cournot

fashion (i.e., it is able to influence the electricity

price). Since we will examine three settings, we de-

note ·

∗

, ·

†

, and ·

⋄

as the optimal values for the decision

variables under BM, C&T, and RPS, respectively.

2.1 Notation

The parameters, and variables adopted in this study

are:

Parameters.

a: Intercept of the linear inverse demand function

(U.S. Dollars/MWh)

b: Slope of the linear inverse demand function

(U.S. Dollars/MWh

2

)

c

1

: Cost of non-renewable energy production 1

(U.S. Dollars/MWh)

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

430

c

2

: Cost of non-renewable energy production 2

(U.S. Dollars/MWh)

c

r

: Cost of renewable energy production (U.S. Dol-

lars/MWh)

r

1

: Emissions factor for non-renewable energy sector

1 (t- CO

2

)

r

2

: Emissions factor for non-renewable energy sector

2 (t- CO

2

)

e

cap

: Emission cap (t-CO

2

)

e

b

1

: Emissions for the non-renewable energy sector 1

determined in benchmark setting (t-CO

2

)

e

b

2

: Emissions for the non-renewable energy sector 2

determined in benchmark setting (t-CO

2

)

k: Rate of increase in the marginal cost of CO

2

emis-

sions (U.S. Dollars/MWh

2

)

Variables.

q

1

: Non-renewable energy 1 production (MWh)

q

2

: Non-renewable energy 2 production (MWh)

q

r

: Renewable energy production (MWh)

p: Electricity price (U.S. Dollars)

p

REC

: Market-clearing price for RECs (U.S. Dol-

lars/MWh)

p

e

: Emission price (U.S. Dollars)

α: Optimal proportion of electricity from renewable

energy (%)

β: Rate of emission cap (%)

e

1

: Emissions of non-renewable energy sector 1 (t-

CO

2

)

e

2

: Emissions of non-renewable energy sector 2 (t-

CO

2

)

For non-renewable and renewable energy sectors,

we assume the quadratic cost functions C

1

(q

1

) =

1

2

c

1

q

2

1

, C

2

(q

2

) =

1

2

c

2

q

2

2

, and C

r

(q

r

) =

1

2

c

r

q

2

r

, which

reflect not only marginal costs of production but also

amortized capital costs. As for the demand side, we

also aggregate consumers’ willingness to pay as a

linear inverse demand function, i.e., p = a − bq (in

U.S. Dollars/MWh), where q = q

1

+ q

2

+ q

r

is total

consumption. We assume that b < c

i

< c

r

< α in

order to ensure that there is an equilibrium and to

capture the general characteristic that renewable en-

ergy has a higher level of costs than non-renewable

energy sources. Here, a > 0 (in U.S. Dollars/MWh)

and b > 0 (in U.S. Dollars/MWh

2

) are the intercept

and slope of the inverse demand function, respec-

tively. The externality from emissions is included

via a damage function that is convex only in its pro-

duction from the non-renewable energy sector, i.e.,

d(q

1

, q

2

) =

1

2

k(q

1

+ q

2

)

2

for k > 0. Other types

of damage functions may be posited but increasing

marginal effects from emissions capture the fact that

atmospheric concentrations of greenhouse gases are

more difficult to reverse in greater abundance. In or-

der to facilitate comparative statics of the resulting so-

lutions, we assume that k > b.

2.2 Benchmark Setting

The benchmark setting selects generation of either

type in order to maximize sectors’ own profits by

solving the following single-level problem:

max

q

1

≥0

π

1

= pq

1

−C

1

(q

1

), (1)

max

q

2

≥0

π

2

= pq

2

−C

2

(q

2

), (2)

max

q

r

≥0

π

r

= pq

r

−C

r

(q

r

). (3)

Eqs. (1)–(3) are transformed to Karush-Kuhn-Tucker

(KKT) conditions because they are convex functions.

0 ≤ q

1

⊥ −a + bq

1

+ c

1

q

1

+ bq ≥ 0, (4)

0 ≤ q

2

⊥ −a + bq

2

+ c

2

q

2

+ bq ≥ 0, (5)

0 ≤ q

r

⊥ −a + bq

r

+ c

r

q

r

+ bq ≥ 0. (6)

We derive optimal generations q

∗

1

, q

∗

2

, and q

∗

r

by

Eqs. (4)–(6). Social welfare is thus defined as fol-

lows:

aq

∗

−

1

2

b(q

∗

)

2

−C

1

(q

∗

1

) −C

2

(q

∗

2

) −C

r

(q

∗

r

)

−d(q

∗

1

+ q

∗

2

).

(7)

We treat the emissions of non-renewable energy in the

benchmark setting e

b

1

and e

b

2

as benchmark parameters

for policies with emissions trading.

2.3 Cap-and-Trade

Lower-level Problem

At the lower level, each sector selects its production

in order to maximize its profit, which consists of rev-

enues from electricity sales minus costs.

max

q

1

,p

e

≥0

π

1

= pq

1

−C

1

(q

1

)− p

e

(r

1

q

1

−βe

b

1

), (8)

max

q

2

,p

e

≥0

π

2

= pq

2

−C

2

(q

2

)− p

e

(r

2

q

2

−βe

b

2

), (9)

max

q

r

≥0

π

r

= pq

r

−C

r

(q

r

). (10)

In Eqs. (8) and (9), non-renewable energy sectors de-

termine production to maintain emission cap (e

cap

)

based on the emissions of non-renewable energy sec-

tor determined in benchmark setting (e

b

i

) and the rate

of emissions cap (β). Eqs. (8)–(10) are transformed

Market Power in Emissions Trading and Renewable Energy Policy

431

to KKT conditions because they are convex optimiza-

tion problems. The emission cap (e

cap

) is defined as

e

cap

= βe

b

1

+ βe

b

2

. Eq. (14) provide the adjustment

conditions in the emissions trading market.

0 ≤ q

1

⊥ −a + bq

1

+ c

1

q

1

+ bq + p

e

r

1

≥ 0, (11)

0 ≤ q

2

⊥ −a + bq

2

+ c

2

q

2

+ bq + p

e

r

2

≥ 0, (12)

0 ≤ q

r

⊥ −a + bq

r

+ c

r

q

r

+ bq ≥ 0, (13)

0 ≤ p

e

⊥ r

1

q

1

+ r

2

q

2

− e

cap

≥ 0. (14)

We derive optimal generation q

†

1

, q

†

2

, and q

†

r

by Eqs.

(11)–(14).

Upper-level Problem

For the upper-level problem, the policymaker selects

the optimal rate of emission cap, β

†

in order to max-

imize social welfare using q

†

1

, q

†

2

, and q

†

r

that are de-

rived at the lower level:

max

β

aq

†

−

1

2

b(q

†

)

2

−C

1

(q

†

1

) −C

2

(q

†

2

)

−C

r

(q

†

r

) − d(q

†

1

, q

†

2

).

(15)

2.4 Renewable Portfolio Standards

Lower-level Problem

At the lower level, each sector selects its production

in order to maximize its profit, which consists of rev-

enues from electricity sales minus costs.

max

q

1

≥0

π

1

= pq

1

−C

1

(q

1

) − αp

REC

q

1

, (16)

max

q

2

≥0

π

2

= pq

2

−C

2

(q

2

) − αp

REC

q

2

, (17)

max

q

r

≥0

π

r

= pq

r

−C

r

(q

r

) + (1 − α)p

REC

q

r

. (18)

In Eqs. (16) and (17), the RPS requirement results in

an extra cost resulting from the obligation to purchase

RECs at the equilibrium REC price, p

REC

(in U.S.

Dollars/MWh). In Eq. (18), the renewable energy sec-

tor earns revenues from RECs in proportion to p

REC

and the RPS constraint. Since each of these problems

is convex, it may be replaced by the KKT conditions.

Hence, the lower-level problem in Eqs. (19)–(22) con-

sists of each sector’s KKT conditions for profit maxi-

mization and the RPS constraint:

0 ≤ q

1

⊥ −a − bq

1

− c

1

q

1

− bq − p

REC

α ≥ 0, (19)

0 ≤ q

2

⊥ −a − bq

2

− c

2

q

2

− bq − p

REC

α ≥ 0, (20)

0 ≤ q

r

⊥ −a − bq

r

− c

r

q

r

− bq

+p

REC

(1 − α) ≥ 0,

(21)

0 ≤ p

REC

⊥ (1 − α)q

r

− αq

1

− αq

2

≥ 0. (22)

In Eq. (22), REC price satisfies REC market settle-

ment condition. We derive optimal generation q

⋄

1

, q

⋄

2

,

and q

⋄

r

through Eqs. (19)–(22).

Table 1: Evaluation conditions.

Intercept of inverse demand function a 100

Slope of inverse demand function b 0.01

Production cost of

non-renewable energy sector 1

c

1

0.026

Production cost of

non-renewable energy sector 2 c

2

0.024

Renewable energy production cost c

r

0.25

Emission factor of

non-renewable energy sector 1 r

1

0.5

Emission factor of

non-renewable energy sector 2 r

2

0.8

Damage cost k [0, 0.1]

Upper-level Problem

At the upper-level problem, the policymaker selects

the optimal RPS proportion, α

⋄

in order to maximize

social welfare using q

⋄

1

, q

⋄

2

, and q

⋄

r

derived at the lower

level:

max

α

aq

⋄

−

1

2

b(q

⋄

)

2

−C

1

(q

⋄

1

) −C

2

(q

⋄

2

)

−C

r

(q

⋄

r

) − d(q

⋄

1

, q

⋄

2

).

(23)

3 NUMERICAL EXAMPLES

In this section, we compare the effect of C&T and

RPS on renewable energy production, market price,

social welfare, and CO

2

emissions using the proposed

model. Table 1 shows the evaluation conditions. The

parameter values are set by reference to Siddiqui et al.

(2016) and Tanaka and Chen (2012).

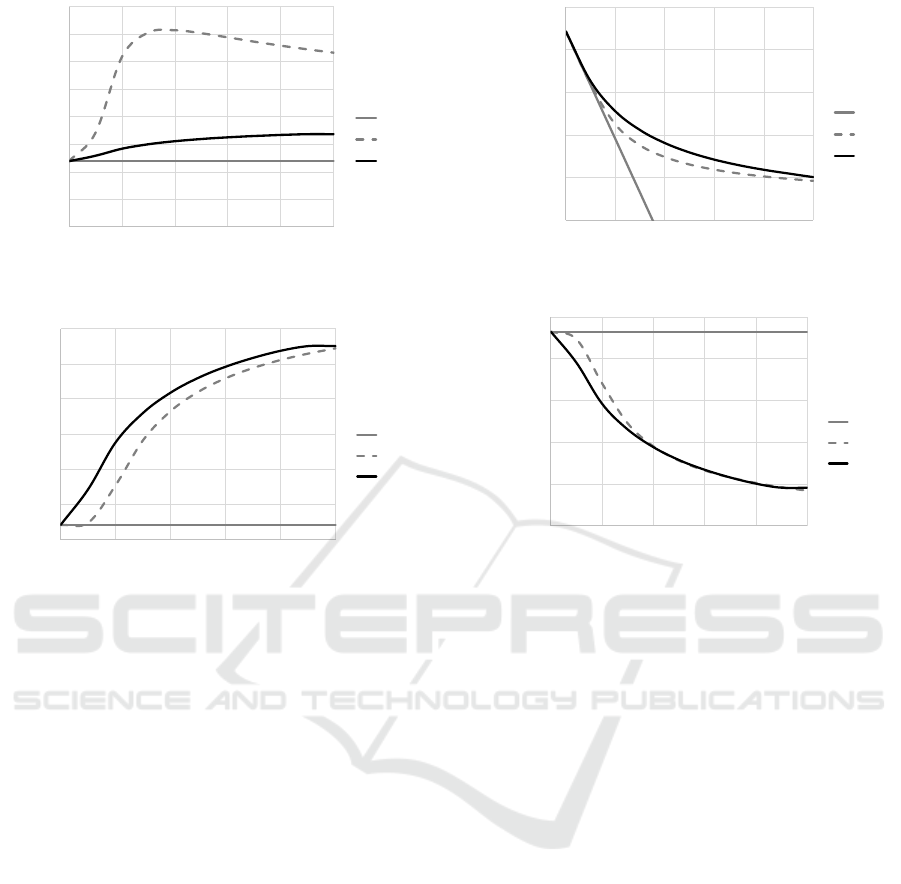

Figure 1 shows the effect of the rate of increase

in the marginal cost of CO

2

emissions, k, on renew-

able energy production, q

r

, under a benchmark set-

ting, C&T, and RPS. In the figure, the benchmark

setting, the emissions trading by cap-and-trade, and

the renewable energy policy as the renewable port-

folio standards are denoted by BM, C&T, and RPS,

respectively.

Renewable energy generation under C&T and

RPS are almost the same as that under BM when k

is low, whereas renewable energy generation under

C&T and RPS increases when k increases. C&T has

directly no influence on renewable energy generation

due to the trading scheme between non-renewable en-

ergy generation. However, renewable energy gener-

ation under C&T has a tendency to increase when k

becomes large. Renewable energy generation under

RPS also increases quickly when k increases. This

outcome might be because RPS is a direct policy of

renewable energy. However, renewable energy gen-

eration decreases after k = 0.03, approximately. In-

tuitively, non-renewable energy generation decreases

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

432

0

100

200

300

400

500

600

700

800

Ͳ

ͲǤͲʹ

ͲǤͲͶ

ͲǤͲ

ͲǤͲͺ

ͲǤͳ

q

r

[MWh]

k [U.S. Dollars/MWh

2

ሿ

BM

RPS

C&T

Figure 1: Renewable energy generation.

60

65

70

75

80

85

90

Ͳ

ͲǤͲʹ

ͲǤͲͶ

ͲǤͲ

ͲǤͲͺ

ͲǤͳ

p [U.S. Dollar/MWh]

k [U.S. Dollars/MWh

2

]

BM

RPS

C&T

Figure 2: Electricity prices.

as k becomes large. Thus the decrease causes small

generation of renewable energy due to characteristic

of RPS scheme.

Figure 2 depicts the effect of the rate of increase

in the marginal cost of CO

2

emissions, k, on electric-

ity prices, p, under BM, C&T, and RPS. Under C&T,

the electricity prices are high because of little non-

renewable energy generation. The renewable energy

sector is unaffected by k increases, using renewable

energy generation to obtain higher profits (see Fig. 1).

Under RPS, the electricity prices are low due to the

higher usage of renewable energy generation.

Figure 3 exhibits the effect of the rate of increase

in marginal cost of CO

2

emissions, k, on social wel-

fare under BM, C&T, and RPS.

Social welfare decreases when k increases due to

the impact of damages from increased CO

2

emissions.

Comparing C&T and RPS, the social welfare attained

from C&T is higher than from RPS. The reason for

this outcome must greatly influence electricity prices

(see Fig. 2). The social surplus of C&T’s electricity

market becomes relatively large.

Figure 4 shows the effect of the rate of increase in

marginal cost of CO

2

emissions, k, on CO

2

emissions,

e, under BM, C&T, and RPS.

On the one hand, C&T and RPS control CO

2

emissions when k increases. CO

2

emissions under

Ͳ

ͷͲͲͲͲ

ͳͲͲͲͲͲ

ͳͷͲͲͲͲ

ʹͲͲͲͲͲ

ʹͷͲͲͲͲ

0 0.02 0.04 0.06 0.08 0.1

Social welfare [U.S. Dollars]

k [U.S. Dollars/MWh

2

]

Ƭ

Figure 3: Social welfare.

Ͳ

ͷͲͲ

ͳͲͲͲ

ͳͷͲͲ

ʹͲͲͲ

ʹͷͲͲ

Ͳ

ͲǤͲʹ

ͲǤͲͶ

ͲǤͲ

ͲǤͲͺ

ͲǤͳ

e

ሾ

Ǧ

ʹ

ሿ

k [U.S. Dollars/MWh

2

]

BM

RPS

C&T

Figure 4: CO

2

emissions.

C&T are lower than that of RPS because C&T is

a policy aiming to directly control CO

2

emissions.

On the other hand, CO

2

emissions under RPS is

higher than those under C&T. RPS does not con-

trol CO

2

emissions as well, by comparison, because

non-renewable energy generation also increases along

with renewable energy generation. This means that

the damage cost for RPS is larger than that for C&T.

Thus, the effects of the damage cost as well as elec-

tricity prices lead to large social welfare for C&T.

4 CONCLUDING REMARKS

In this study, we examine C&T and RPS aimed at

reducing greenhouse gas emissions that cause global

warming. We develop an analytical model for C&T

and RPS and used it to decide the optimum level of

power generation, electricity prices, rate for an emis-

sions cap, and RPS requirement percentage. We an-

alyze how the regulation level affects market equi-

librium. Furthermore, we show how policymakers

should decide the level of regulation for the purpose

of maximizing social welfare. In the end, C&T’s so-

cial welfare turns out being higher than that of the

RPS. Naturally, enforcement of C&T is effective for

controlling CO

2

emissions. From the viewpoint of

Market Power in Emissions Trading and Renewable Energy Policy

433

social welfare and CO

2

reductions, the government

enforces C&T.

We analyze the problem of a simple setting with

two non-renewable energy sectors and one renewable

energy sector in this study. In reality, the number of

sectors and the ratio of renewable energy sectors to

them, differ by country and world region. Future re-

search should extend itself to models where the num-

ber of sectors may be set. We will also extend the

model to introduce the policy mix scheme consisting

of C&T and RPS in order to investigate the interaction

between the schemes.

ACKNOWLEDGMENT

This study was supported in part by the Grant-in-Aid

for Scientific Research (B) (Grant No. 15H02975)

from the Japan Society for the Promotion of Science.

REFERENCES

Hibiki, A. and Kurakawa, Y. (2013). Which is a better sec-

ond best policy, the feed-in tariff scheme or the renew-

able portfolio standard scheme? RIETI Discussion

Paper, 13-J-070, in Japanese.

International carbon action partnership (2017). Emissions

trading worldwide: status report 2017.

International energy agency (2018). Renewables 2018:

analysis and forecasts to 2023, Paris.

Renewable energy policy network for the 21st century

(2017). Renewables 2017 global status report, Paris.

Siddiqui, A.S., Tanaka, M., and Chen, Y. (2016). Are tar-

gets for renewable portfolio standards too low?: The

impact of market structure on energy policy. European

Journal of Operational Research, 250(1), 328–341.

Tanaka, M., and Chen, Y. (2012). Market power in emis-

sions trading: Strategically manipulating permit price

through fringe firms. Applied Energy, 96, 203–211.

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

434