Intellectual Capital, Disclosure and Value of Mining

Companies on IDX

Husaini

1

, Diky Pratama

Rullah

1

, Ghazali Syamni

1

, Ichsan

1

, Faisal

2

, and Mahdawi

3

1

Faculty of Economic and Business, Universitas Malikussaleh, Indonesia

2

Faculty of Economic and Business, Universitas Syiahkuala, Indonesia

3

Master of Economic, Faculty of Economic and Business, Universitas Trisakti, Indonesia

syamni_ghazali@yahoo.com,faisalekm@unsyiah.ac.id,

mahdawi1601@gmail.com

Abstract. In managing a company that is expected by the owner of the

company is increasing the value of the company. Company value is closely

associated with company managers, investors and shareholders. This paper is

conducted with the aim of analyzing the intellectual relationship of capital, its

disclosure and the value of mining companies on IDX. The data used in this

study is data from mining company financial statements 2013-2015. The results

find that value added capital employed and intellectual capital disclosure affect

the value of the company. While the value added human capital and structural

capital value added do not have a significant relationship.

Keywords: Company Value ꞏ Intellectual Capital ꞏ Disclosure ꞏ IDX

1 Introduction

Nowadays, the exist of a company depends on the ability of a company to create its

company’s value. The company’s value is a long-term contribution for company to

survive [1]. [2] state that for the public, the company’s value is reflected in the stock

price in which a company possessing a high share price means the company’s value is

high and vice versa. Even though, In the signaling theory, capital market practitioners

or investors return to participate in trading at an issuer announcing its company’s

prospect [3].

In the past, company’s managers thought that the company's prospect was only

reflected in economic or financial-based knowledge. But it is not enough today, the

company’s managers need to increase their knowledge too on a non-economic or non-

financial basis [4]. [5] state to understand asset-based knowledge for the company’s

managers is essential. In this case, it is related to intellectual capital (IC). This paper

is conducted to examine the influence of IC factor and its disclosure on company’s

value. Since the IC disclosure is a vital term too [6] and [7].

Some empirical studies that have been conducted find the importance of

understanding IC and its disclosures which influence company’s value. [8] and [9]

analyze using data in Italy in which it finds an association of IC with firm’s value.

[10] uses small company’s data using advanced technology and not using it in Italy.

916

Husaini, ., Rullah, D., Syamni, G., Ichsan, ., Faisal, . and Mahdawi, .

Intellectual Capital, Disclosure and Value of Mining Companies on IDX.

DOI: 10.5220/0010609300002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 916-920

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

It explains the is a relationship between IC and company’s performance. The

resemble case is conveyed by [11] who researches in Russia. He found there are

influence of IC on industrial performance. [12] explaine the importance of

understanding intangible assets in creating corporate value in companies in Tunisia.

While research in the Baltic countries, [13] find the IC use affects to the market value

of the company. [14]’s researches using data in India state all of IC are a vital

component in achieving the company's sustainable growth. [15], companies which

deliver a better ICD lead to better corporate value achievement.

Further, several studies in Indonesia relating to IC and ICD show various results.

[5],[16], IC has a positive impact to company’s performance but IC is not related to

market value. [3] say ICD is negatively related to firm value. In the contrary, [17]

finds that there is not related to IC and company’s performance. [1] conducts a

research in Indonesia and Malaysia in which it gives a positive impact on firm value.

According to [18], the company does not apply the IC optimally. Research conducted

by [4] reveals the ICD before the Jokowi Era is not significant even negative in the

company’s value when it is associated with a time period.

2 Data and Method

The data used in this study are secondary data on eight mining companies in

Indonesia for period of 2013-2015 accessed from the official IDX‘s site. The

company‘s data has published an annual report containing value added of capital

employed, value added of human capital, structural capital value added and

intellectual disclosure. These indicators are part of IC used as an independent variable

while the company value in this study uses book values. All of these companies did

not suffer losses in the study period.

This study uses multiple regression models because a view number of companies

and years of research as a period of observation. Hence, the research model is: PBV =

α + β1VACA + β2VAHU + β3STVA + β4 ICD + ε. As this research is a multiple

regression research model, the process of the research method uses multiple

regression methods, such testing the classical assumptions for testing the regression

model.

3 Result and Discussion

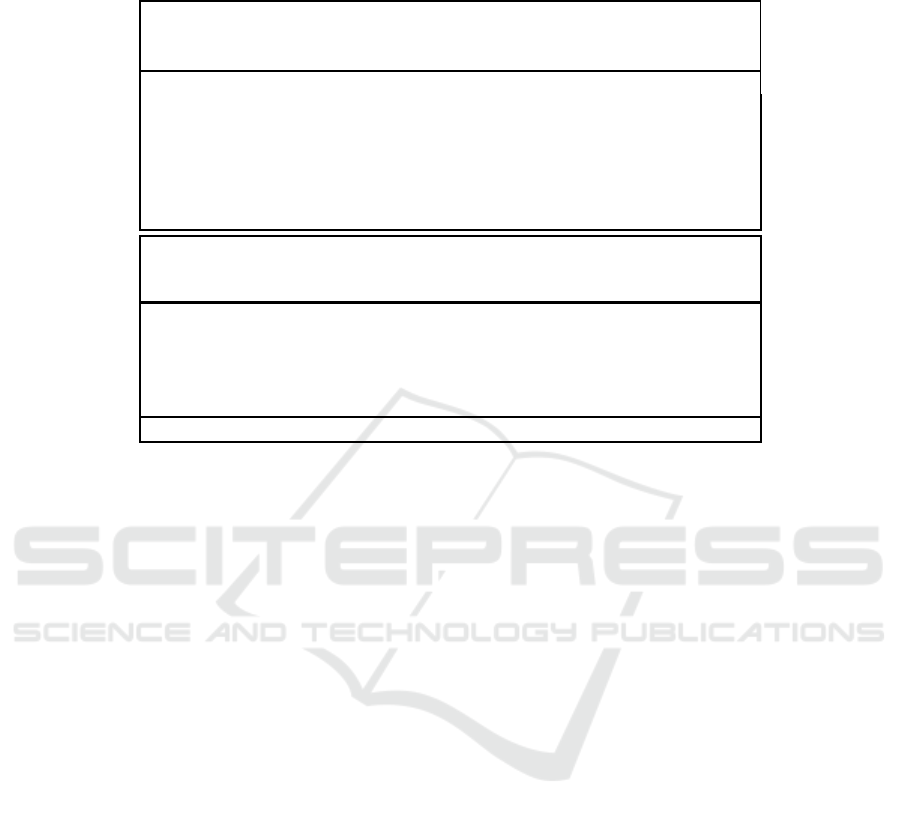

The given Table 1 depicts Jarque Berra value as many as 0.3562 with a probability of

0.8368 (not significant 5%). It means the data is normal. Furthermore, the value of the

white heteroskedasticity test is 1,378 with a probability of 0.5174 (not significant

5%). In brief, it can be interpreted that this research is free from heteroscedasticity in

other words the data has homoscedasticity. Likewise, the autocorrelation test results

tested using breusch-godfrey serial correlation lm test provides a value of 6.6756 with

a probability of 0.9181 (not significant 5%) which means that this study is free

autocorrelation.

Intellectual Capital, Disclosure and Value of Mining Companies on IDX

917

Table 1.

Jarque Berra Test : 0.3562 Prob. 0.8368

Uji White Heteroskedasticity Test: Obs*R-squared= 1.3178 Prob. 0.5174

Breusch-Godfrey Serial Correlation LM Test: 6.6756 Prob. 0.9181

Variables

Correlation

NP VACA VAHU STVA IC

NP

1.0000 -0.3162 -0.4279 -0.1261 1.0000

VACA

-0.3162 1.0000 0.6623 -0.1946 -0.3162

VAHU

-0.4279 0.6623 1.0000 0.0095 -0.4279

STVA

-0.1261 -0.1946 0.0095 1.0000 -0.1261

ICD

1.0000 -0.3162 -0.4279 -0.1261 1.0000

In addition, the same thing applies to the multicollinearity test using the correlation

between obtained variables with no correlation value between independent variables

that its value is not over 0.80. This can also be concluded that there is no relationship

between variables or there is no problem with multicollinearity.

Furthermore, the table 1 provides research results with the following equation

model: PBV = -11.1568 + 0.3190VACA - 0.0269VAHU + 0.1728 STVA +

21.1826IC. This model can be explained:

1 Negative constant 11.1568, which means if all the independent variables cash,

the value of the company remains negative 11.1568.

2 The VACA coefficient is 0.3190, which means that if a one-point VACA is

improved, it increases the value of the company's base points

3 VAHU coefficient is negative 0.0269, which means an increase in VAHU by 1

point decreases the value of the company of 0.0269 basis points.

4 STVA coefficient of 0.1728, which means an increase of 1 point for STVA

increases the value of the company as many as 0.2178 basis points.

5 IC coefficient 11.1568 meaning that if the IC values inclines by 1 point, it

increases the value of the company as much as 21.1826 basis points.

Meanwhile, if overall, F value is 3.3600 with a significant 1%, it means that all

variables used in this study affect the company’s value. However, the ability of all

independent variables used is still weak in term of explaining firm value. This can be

found from the R square value of 0.4331 or 43.31%. It means that there are other

variables which can affect the company’s value approximately over 46%.

Based on the aforementioned research results, it is found that not all IC variables

affect the company’s value partially. Only the value added of capital employed

(VACA) variabl has a significant impact to firm value. While value added of human

Variables

Result Estimation

Coefficient

Std.

Deviation

t.statistic t.tabel F. statistic F .table

C

-11.1568 3.6932 -3.0208***

VACA

0.3190 0.1301 2.4509**

VAHU

-0.0269 0.3383 -0.0433

3.6300***

STVA

0.1728 3.9851 0.0433

ICD

21.1826 7.8630 2.6939**

R-squared: 0.4331

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

918

capital, structural capital value added (VAHU and STVA) do not affect the

company’s value.

The study results indicate that in Indonesian mining companies, VACA indicators

reflecting the use of inputs and materials are vital factors in increasing company‘s

value. This is understandable because mining companies in Indonesia are more

concerned with inputs and materials in increasing company‘s value. Of course, this

needs other IC components such as VAHU and STVA. In other words, the use of IC

is not optimal yet as disclosed [18]. But overall, IC affects to the company’s value.

This result is in accordance with most previous studies such as: [10] and [1].

On the ICD side, it affects the value of mining companies in Indonesia too. This

finding indicates mining companies have revealed ICD better. This finding is shared

with [15] who finds the ICD has a positive effect on company‘s value.

4 Conclusion

This study finds that not all IC components affect to the mining company’s value in

Indonesia. Only the VACA component influences company’s value. This finding

provides an indication of mining companies in creating corporate value based on

materials and physical assets possessed. Another finding in this research finds that the

implementation of intellectual capital disclosure in mining companies has been

optimal. For future research, it needs to add other variables such as the use of Tobin's

Q as the dependent variable. In addition, research is also needed on small and medium

companies in the implementation of the IC and ICD.

References

1. Hatane, S. E., Tertiadjajadi, A., & Tarigan, J. (2017). The impact of corporate governance

on intellectual capital and firm value: Evidence from Indonesia and Malaysia consumer

goods. International Journal of Management and Applied Science (IJMAS), 3(1), 78-83.

2. Murni, S., Sabijono, H., & Tulung, J. (2019). The Role of Financial Performance in

Determining The Firm Value. Paper presented at the 5th Annual International Conference

on Accounting Research (AICAR 2018)

3. Gomes, N. G. I., Semuel, H., & Devie, D. (2019). Intellectual Capital Disclosure,

Information Asymmetry, Cost of Capital, and Firm Value: Empirical Studies on Indonesian

Manufacturers. Petra International Journal of Business Studies, 2(1), 27-35.

4. Hatane, S. E., Angeline, C. O., Wedysiage, M., & Saputra, V. T. (2019). Intellectual Capital

Disclosure and Firm Value: Does Jokowi’s Era Matter? Paper presented at the International

Conference on Tourism, Economics, Accounting, Management, and Social Science

(TEAMS 2018).

5. Oktari, Y., & Liugowati, L. (2019). The Effect of Intellectual Capital and Corporate Social

Responsibility on Company Performance (Empirical Study on Banking Companies Listed

on the Indonesia Stock Exchange in 2013-2017). eCo-Fin, 1(1), 34-42.

6. Belal, A. R., Mazumder, M. M. M., & Ali, M. (2019). Intellectual capital reporting

practices in an Islamic bank: A case study. Business Ethics: A European Review, 28(2),

206-220. doi: 10.1111/beer.12211

7. Birindelli, G., Ferretti, P., & Chiappini, H. (2019). Intellectual Capital Disclosure: Evidence

from the Italian Systemically Important Banks. In M. La Torre & H. Chiappini (Eds.),

Intellectual Capital, Disclosure and Value of Mining Companies on IDX

919

Socially Responsible Investments: The Crossroads Between Institutional and Retail

Investors (pp. 37-59). Cham: Springer International Publishing.

8. Angelini, M. S., Gennaro, A., & Labella, S. (2019). Disclosure on Intellectual Capital in the

Age of Industry 4.0: Evidence From Italian Capital Market. Management, 7(1), 1-14.

9. Vanini, U. (2019). Effects of voluntary intellectual capital disclosure for disclosing firms.

Journal of Applied Accounting Research, 20(3), 349-364. doi: 10.1108/JAAR-08-2018-0116

10. Xu, J. (2019). The impact of intellectual capital on SMEs’ performance in China. Journal of

Intellectual Capital, 20(4), 488-509. doi: 10.1108/JIC-04-2018-0074

11. Molodchik Mariia, A. (2019). The performance effect of intellectual capital in the Russian

context. Journal of Intellectual Capital, 20(3), 335-354. doi: 10.1108/JIC-10-2018-0190

12. Cheikh, I. B., & Noubbigh, H. (2019). The Effect of Intellectual Capital Drivers on

Performance and Value Creation: the Case of Tunisian Non-financial Listed Companies.

Journal of the Knowledge Economy, 10(1), 147-167. doi: 10.1007/s13132-016-0442-0

13. Mačerinskienė, I., & Survilaitė, S. (2019). Company’s intellectual capital impact on market

value of Baltic countries listed enterprises.

14. Mukherjee, T., & Sen, S. S. (2019). Intellectual Capital and Corporate Sustainable Growth:

The Indian Evidence. The East Asian Journal of Business Management (EAJBM), 9(2), 5-15

15. Al-Hajaya, K., Altarawneh, M. S., & Altarawneh, B. (2019). Intellectual Capital Disclosure

by Listed Companies in Jordan: A Comparative Inter-sector Analysis. International Review

of Management and Marketing, 9(1), 109-116.

16. Soetanto, T. (2019). Intellectual capital in Indonesia: dynamic panel approach. Journal of

Asia Business Studies, 13(2), 240-262. doi: 10.1108/JABS-02-2018-0059

17. Mangesti Rahayu, S. (2019). Mediation effects financial performance toward influences of

corporate growth and assets utilization. International Journal of Productivity and

Performance Management, 68(5), 981-996. doi: 10.1108/IJPPM-05-2018-0199

18. Firdaus, R. N., & Fitriasari, R. (2019). Disclosure of intellectual capital in aviation

companies in indonesia registered on the IDX. European Journal of Research and

Reflection in Management Sciences Vol, 7(2).

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

920