The Interdependence of Stock Market among Malaysia

and Selected Middle East Countries: Financial

Innovation of Islamic Stock Index

Erlie Sharina Kamisan, Rafidah Othman, Beni Widarman Yus Kelana,

Theresa C. F. Ho, and Mohd Khairuddin Ramliy

Azman Hashim International Business School, Universiti Teknologi Malaysia, Malaysia

Abstract. This article is publish to review the interdependence of stock market

among Malaysia and selected Middle East countries (Jordan, United Arab

Emirates, Bahrain and Qatar). Throughout the year, there are many researches

and studies conducted on stock market. Majority of the studies come out with the

conclusion that most of the stock market around the world has linkages and

interdependence. However, there still lack of study in the context of Islamic stock

market interdependencies that explore the linkage between volatility of returns in

selective Middle East market. Hence, in this article, the study is to focus on the

level of international equity market interdependence between Malaysia and

selected Middle East country. The study will conduct based on the daily data of

the stock indices from January 2008 until December 2018. The results from the

study will be useful for the policy maker in regulating the market especially for

financial innovative, and to investors and speculators to beat the both markets.

Keywords: Islamic Stock Market∙Middle East Country∙Financial Stock

Innovative

1 Introduction

Malaysia is among of the top countries that fastening their economic growth through

their successful open market activities in the South East Asia. A good diplomatic

strategy and relationship with many countries around the world makes Malaysia as one

of the best country to have a good platform for an investment. There are many industries

that well develop in Malaysia, as a part of that, Malaysia stock market is one of the

industry that playing an important role in Malaysia’s financial sector which

subsequently helping in boosting the sustainability of the economy. Unfortunately, a

tough condition in 1997 Asian Financial crisis had brought Malaysia facing to the worst

recession from devalued of Ringgit currency. According to (Azman-Saini, W.N.W.

and Habibullah, M.S. and Law, Siong Hook and Dayang-Afizzah, 2007), during this

tough condition, the fall of composite index of Kuala Lumpur Stock Exchange (KLSE)

gives such impactful to financial sectors and this situation as a consequences leads to

stock return decrease. Going through the hard situation in 1997, it shows that stock

market play as an important role in boosting Malaysia’s financial sector. According to

(Nandha & Hammoudeh, 2007) , 1997 crisis had giving a worst impact to Asia Pacific

region countries and after the decades a crisis in 2008 happen again. Thus, this will be

898

Kamisan, E., Othman, R., Kelana, B., Ho, T. and Ramliy, M.

The Interdependence of Stock Market among Malaysia and Selected Middle East Countries: Financial Innovation of Islamic Stock Index.

DOI: 10.5220/0010609000002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 898-903

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

an attractive point to propose this study in order to know the situation of capital market

especially Islamic capital market from 2008 to 2018. Throughout the year, there are

many researches and studies have been conducted regarding the stock market. Majority

of the studies come out with the conclusion that most of the stock market around the

world has linkages and interdependence. However, there still less study in the context

of Islamic stock market interdependencies that explore the linkage between volatility

of returns in selective Middle East market (Bouri & Yahchouchi, 2014) Hence, in this

paper, the study is to focus on the level of international equity market interdependence

among Malaysia and selected Middle East country (Jordan, United Arab Emirates,

Bahrain and Qatar) for Islamic capital index in a decade emphasizing during recent

economic financial crisis. The interesting in study it will investigates the existence of

equity Islamic market relationship among the Middle East country, i.e. Jordan, United

Arab Emirates, Bahrain and Qatar to the Malaysia stock market in term of Islamic stock

index during a past 10 decades from 1st January 2008 until 31st December 2018. Since

these five (5) countries are Islamic countries, we expected that there will be an

association and relationship between the stock market among this countries in term of

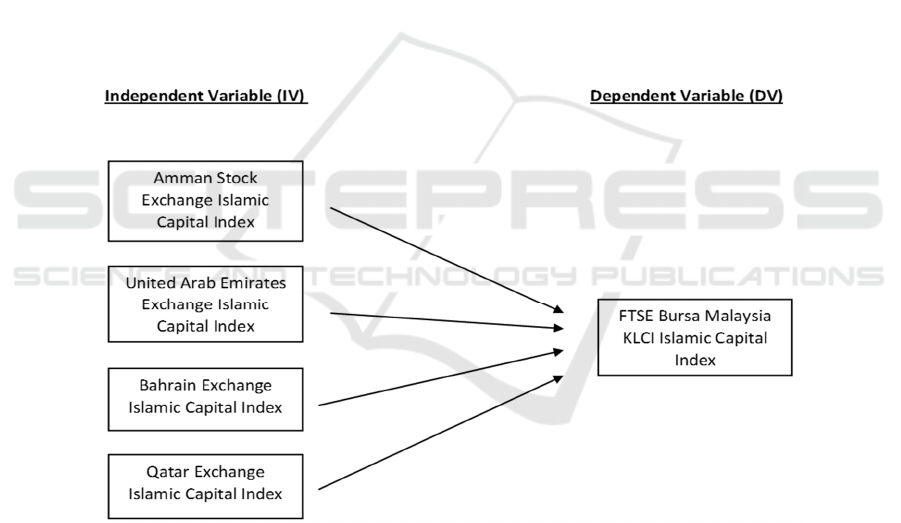

Islamic capital index as shown in the proposed research framework in Figure 1. The

findings is predicted to give a good platform for investors in order to expand their

investment especially in the Islamic stock market over the Middle East countries and

Malaysia.

Fig.1. Proposed Research Framework.

2 Institutional Background of the Islamic Stock Indices in Middle

East and South East

MENA stock market is having a small equity market and not well developed, thus need

The Interdependence of Stock Market among Malaysia and Selected Middle East Countries: Financial Innovation of Islamic Stock Index

899

their countries itself to improve their development on their stock market. A research

conducted on this market, however, the result showed this market is less liquidity than

other world financial market. In addition, the short selling was still remains illegal

(Bouri & Yahchouchi, 2014). Moreover, this market also show weak form efficiency

due to poor quality information and low competition (Lagoarde-Segot & Lucey, 2008).

Besides, MENA countries have different function than those developed counterparts.

Their market consequently have relatively common economic, institutional, regulatory,

political and cultural links which at some extent, the industrial organization found in

MENA markets is also quite different from that in developed economies (Assaf, 2009)

. Furthermore, the MENA capital markets also are less developed than the Asian or

Latin American emerging markets (Bouri & Yahchouchi, 2014) but MENA market

offer portfolio and fund managers outstanding diversification benefits (Neaime, 2012).

According to Floros, (2011), little investors know about the existing of the dynamic

relationships between the prices of Middle East stock markets although empirical

research generally suggests that national mature stock and futures markets move

together. Besides, previous research that focusing on the integration of stock markets

in MENA nations with those in the rest of the world is limited. Based on (Neaime,

2002) that using the Engle-Granger (1987) co-integration approach, test for the

integration of MENA markets with world stock markets over the period 1990 to 2000

shows there is a weak integration among the MENA markets (Morocco, Egypt, Jordan

and Turkey), however, among developed market the result reveals there is strong

integration between MENA markets and developed markets (U.S., U.K. and

France).The studies of (Paskelian, Nguyen, & Jones, 2013) also find similar results as

(Neaime, 2002). Besides, research that focuses on the integration of stock markets

within the MENA region with each other and the rest of the world is limited.

3 Gap and Issue of Islamic Stock Index

Jamaani & Roca, (2015) stated that developing market experience well growth over the

last few decades. Nikkinen, Omran, Sahlström, & Äijö, (2008) reports, incident of

September 11 that attacks New York, USA have largest impact to the world stock

market. However, Middle East and North Africa financial markets had only a minor

effect towards the incident. In the Middle East countries, the market itself can be

characterised as a market with low liquidity, small market and less information for the

investors (Haque, Hassan, Maroney, & Sackley, 2004). Based on the research and study

by Elango and Hussein (2008), there is less study conducted in the Middle East towards

the market efficiency, even it has but only produce the fragmented results. Even though

market at Middle East still not well develop compared to the other markets and regions,

but they still offer an outstanding diversification benefits to the investors (Henry &

Springborg, 2010). In this study, the main research gap is reflected with empirical

studies in terms of interdependence of Islamic stock indices around the world. Previous

researchers found there is still less study in the context of Islamic stock market

interdependencies that explore the relationship between volatility of returns in selective

Middle East market and south East Asia countries. In addition, the data used in previous

study are limited to the conventional stock markets located in US and Europe, even it

has study conducting on Islamic stock index but the empirical is more concentrating on

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

900

the post-economic crisis period analysis.Therefore, in this study we want to explore

more the association and interdependence of selected Middle East Islamic stock index

towards Kuala Lumpur FTSE Bursa Islamic stock indices focusing on global financial

crisis period. For this reason, this study examine the relationship of the Middle East

stock markets and whether these markets are weak-form efficient and have bad effect

towards Malaysian stock market especially in Islamic stock indices during 1

st

January

2008 until 31

st

December 2018. The question is about whether is there any significant

relationship between selected Middle East countries Islamic stock market to the

Malaysia Islamic stock market.

4 Conclusion

The main objective of this study is to investigate the level of international equity market

interdependence among Malaysia and selected Middle East country, i.e. Jordan, United

Arab Emirates, Bahrain and Qatar in term of Islamic stock index. Based on the previous

study by Miniaoui, Sayani, & Chaibi, (2015), which indicates the performance on the

Islamic and conventional indices of the GCC countries. The findings shows the GCC

Islamic index exhibits similar attributes of the conventional indices in all the periods of

analysis in 2008. In fact, the results show that the GCC Islamic index has similar risk

profile as its conventional counterparts. This support the findings of association

between Islamic and conventional stock index in selected Middle East stock market and

Malaysia stock market which shows the weak correlation. Research by Girard &

Hassan, (2009) found that Islamic and conventional groups of FTSE are integrated.

Research that used a multivariate co-integration analysis also emphasized that both

types of indices have similar return to risk and diversification benefits. Moreover,

Islamic indices have the same level of efficiency as conventional ones. In terms of co-

integration analysis, Islamic indices of Dow Jones and S&P have no co-integrating

relations with their respective benchmarks, which suggests the existence of long-run

diversification opportunities (El Khamlichi, Sarkar, Arouri, & Teulon, 2014). Based on

the previous study it is proven that Islamic and conventional stock indices are

interdependence and have linkage to each other. Referring to the efficient market

hypothesis (EMH) theory, information transmission in the international market

transactions can give the impact on the stock market performance especially for those

countries that is interdependent. The investor and speculator should aware of this

situation as anything happen to Qatar conventional stock exchange will affect the other

countries stock exchange. Besides, the new information that comes from Qatar will

have a linkage towards Malaysia, Jordan and UAE stock exchange. In addition,

information transmission that happen between those countries will help the speculator

to predict the market movement of the equity market to gain some profit.

5 Research Limitation and Recommendation

In order to keep the study comprehensive some limitations had to be made. First of all,

the data used in this study are limited only to the stock market of Malaysia and selected

Middle East country, i.e. Jordan, United Arab Emirates, Bahrain and Qatar in term of

The Interdependence of Stock Market among Malaysia and Selected Middle East Countries: Financial Innovation of Islamic Stock Index

901

Islamic and conventional stock index. Even though in the Middle East have many of

Islamic countries but all of them is not equally developed. Due to this problem, the

research only limit into a certain number of countries. There are also insufficient

references can be used for this study since most of the related research was been done

on Europe and US market. Since this dissertation is using stock indexes as tool to

investigate the relationship between stock market indices, a comprehensive index has

to be available. By browsing the Data stream, the study tried to find the stock markets

for each country. From this research, it is found that Islamic stock indices are quite hard

to find due to the stock market are still at the early stage. Based on the chosen markets

and the timeframe, Islamic stock index for those country in Middle East are very

limited. As consequences, the best timeframe for the data available is only for 10 years.

This limitation may be criticized, however this research have found previous research

by Miniaoui et al., (2015), that also studied the linkage between the selected countries

which we consider to strengthen our argument.

Acknowledgements: This article was supported by Lecturer of Faculty Business

Management, UTM and main author express her thanks for all lecturers, for all

continuous encouragement, invaluable suggestions, patient guidance and supporting

with kindness, sympathy and academic enthusiasm. All forceful comments and

meticulous directions were a constant source of inspiration to this research that

immensely improved the quality of this project paper.

References

Assaf, A. (2009). Extreme observations and risk assessment in the equity markets of MENA

region: Tail measures and Value-at-Risk. International Review of Financial Analysis.

https://doi.org/10.1016/j.irfa.2009.03.007

Azman-Saini, W.N.W. and Habibullah, M.S. and Law, Siong Hook and Dayang-Afizzah, A.

(2007). Stock prices, exchange rates and causality in Malaysia: a note. The ICFAI Journal of

Financial Economics.

Bouri, E. I., & Yahchouchi, G. (2014). Do return and volatility traverse the Middle Eastern and

North African (MENA) stock markets borders? Journal of Economic Studies.

https://doi.org/10.1108/JES-02-2012-0020

El Khamlichi, A., Sarkar, K., Arouri, M., & Teulon, F. (2014). Are Islamic equity indices more

efficient than their conventional counterparts? Evidence from major global index families.

Journal of Applied Business Research. https://doi.org/10.19030/jabr.v30i4.8660

Floros, C. (2011). Dynamic relationships between Middle East stock markets. International

Journal of Islamic and Middle Eastern Finance and Management. https://doi.org/10.1108

/17538391111166467

Girard, E. C., & Hassan, M. K. (2009). Is There a Cost to Faith-Based Investing: Evidence from

FTSE Islamic Indices . The Journal of Investing. https://doi.org/10.3905/joi.2008. 17.4.112

Haque, M., Hassan, M. K., Maroney, N., & Sackley, W. H. (2004). An empirical examination of

stability, predictability and volatility of Middle Eastern and African emerging stock markets.

Review of Middle East Economics and Finance. https://doi.org/10.1080/

14753680410001685669

Henry, C. M., & Springborg, R. (2010). Globalization and the politics of development in the

Middle East, second edition. Globalization and the Politics of Development in the Middle

East, Second Edition. https://doi.org/10.1017/CBO9780511778162

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

902

Jamaani, F., & Roca, E. (2015). Are the regional Gulf stock markets weak-form efficient as single

stock markets and as a regional stock market? Research in International Business and

Finance. https://doi.org/10.1016/j.ribaf.2014.09.001

Lagoarde-Segot, T., & Lucey, B. M. (2008). Efficiency in emerging markets-Evidence from the

MENA region. Journal of International Financial Markets, Institutions and Money.

https://doi.org/10.1016/j.intfin.2006.06.003

Miniaoui, H., Sayani, H., & Chaibi, A. (2015). The impact of financial crisis on Islamic and

conventional indices of the GCC countries. Journal of Applied Business Research.

Nandha, M., & Hammoudeh, S. (2007). Systematic risk, and oil price and exchange rate

sensitivities in Asia-Pacific stock markets. Research in International Business and Finance.

https://doi.org/10.1016/j.ribaf.2006.09.001

Neaime, S. (2002). Liberalization and Financial Integration of MENA Stock Markets * Simon

Neaime Department of Economics / Institute of Financial Economics American University

of Beirut I . Introduction. ERF’s 9th Annual Conference on Finance and Banking.

Neaime, S. (2012). The global financial crisis, financial linkages and correlations in returns and

volatilities in emerging MENA stock markets. Emerging Markets Review.

https://doi.org/10.1016/j.ememar.2012.01.006

Nikkinen, J., Omran, M. M., Sahlström, P., & Äijö, J. (2008). Stock returns and volatility

following the September 11 attacks: Evidence from 53 equity markets. International Review

of Financial Analysis. https://doi.org/10.1016/j.irfa.2006.12.002

Paskelian, O. G., Nguyen, C. V., & Jones, K. (2013). Did financial market integration really

happen in MENA region? - An analysis. Journal of Economic Cooperation and Development.

The Interdependence of Stock Market among Malaysia and Selected Middle East Countries: Financial Innovation of Islamic Stock Index

903